Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - Zeecol International, Inc. | v458257_ex2-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2017 (February 2, 2017)

GREEN DRAGON WOOD PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

| Florida | 000-53379 | 26-1133266 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

Unit 312, 3rd Floor, New East Ocean Centre

9 Science Museum Road

Kowloon, Hong Kong

(Address of Principal Executive Offices)

Registrant’s telephone number: +852-2482-5168

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement

Item 7.01 Regulation FD

On February 2, 2017, Green Dragon Wood Products, Inc., a Florida corporation (the “ Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Zeecol Limited, a New Zealand corporation (“Zeecol”), the shareholders of Zeecol and Zeecol Acquisition Limited, a New Zealand corporation and a wholly-owned subsidiary of the Company (the “Merger Sub”), providing for the merger of Merger Sub with and into Zeecol (the “Merger”), with Zeecol surviving the Merger as a wholly-owned subsidiary of the Company. In consideration for the Merger, the Zeecol Shareholders will exchange all of the issued and outstanding shares of Zeecol to the Company, and the Company will issue 116,561,667 shares of Company common stock, par value $0.001 (“Common Stock”) to the Zeecol Shareholders. The Merger Agreement was approved by the Company’s board of directors (the “Board”) and the board of directors of Zeecol and the Merger Sub.

As a condition to closing the Merger, Kwok Leung Lee (“Mr. Lee”), the majority shareholder and Chief Executive Officer of the Company will enter into a Return Of Equity To Authorized Capital Agreement wherein he agrees to return 20,120,000 of his shares of Common Stock, representing all of his Common Stock holdings, to the Company (“Return to Treasury Agreement”).

As a condition to closing the Merger, the Company will file Articles of Amendment to its Articles of Incorporation, as amended (the “Articles of Amendment”) with the State of Florida. The Articles of Amendment will modify the rights of the holders of Series A Preferred Stock of the Company, the only holder of such shares being Mr. Lee (the “Holder”). Each share of Series A Preferred Stock shall exist until the date that is six (6) months from the date of filing the Articles of Amendment (the “Expiration Date”), unless extended in certain circumstances as set forth therein. On or prior to the Expiration Date, the Company has the option to cause the Holder to redeem all of the 2,000,000 shares of Series A Preferred Stock held by the Holder to the Company in exchange for the business (including all of the assets and the liabilities) of the Company that existed just prior to February 2, 2017, (the “Existing Green Dragon Business”) (the “Mandatory Redemption”). Additionally, on or prior to the Expiration Date, the Holder may redeem his shares of Series A Preferred Stock by redeeming all of his shares of Series A Preferred Stock to the Company in exchange for the Existing Green Dragon Business (the “Holder Optional Redemption”), or prior to the Expiration Date, the Holder has the option to convert all of the shares of Series A Preferred Stock he owns into a number of shares of Common Stock to be mutually agreed upon by and between the Holder and the Corporation at the time of conversion; provided, however, that the Holder shall be entitled to receive at least a minimum of $500,000 worth of shares of Common Stock, based on the fair market value of such Common Stock on the date of conversion.

Consummation of the Merger is subject to conditions, including without limitation: (i) the delivery to the Company of certain closing deliverables, including consents to the consummation of the Merger, the execution of the Return to Treasury Agreement, the filing of the Articles of Amendment with Florida and the execution of the Note (as defined below); and (ii) the absence of any law, injunction, judgment or ruling that prohibits, restrains or makes illegal the consummation of the Merger.

Moreover, each party’s obligation to consummate the Merger is subject to certain other conditions, including without limitation: (i) the accuracy of the other party’s representations and warranties contained in the Merger Agreement (subject to materiality qualifiers) and (ii) the other party’s performance of its obligations under the Merger Agreement in all material respects.

The representations and warranties of the Company contained in the Merger Agreement have been made solely for the benefit of the Zeecol and the Merger Sub. In addition, such representations and warranties (a) have been made only for purposes of the Merger Agreement, (b) are subject to materiality qualifications contained in the Merger Agreement which may differ from what may be viewed as material by investors, (c) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement and (d) have been included in the Merger Agreement for the purpose of allocating risk between the contracting parties rather than establishing matters as facts. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding the Company or its business. Investors should not rely on the representations and warranties or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding the Company that has been, is or will be contained in, or incorporated by reference into, the Forms 10-K, Forms 10-Q, Forms 8-K, and other documents that the Company files with the SEC.

As soon as practicable after the closing of the Merger, the Company will undertake the steps necessary to change its name to “Zeecol International, Inc.”

| -2- |

The foregoing description of the Merger Agreement is not complete and is qualified in its entirety by reference to the Merger Agreement, which is filed as Exhibit 2.1 hereto and is incorporated herein by reference.

Description of Business

Zeecol provides environmentally low-impact farming integration solutions. Zeecol’s plan is to incorporate proven farming technology with its own proprietary processes to eliminate the carbon foot-print of its client farmers, while substantially reducing its client’s operating costs and easing regulatory scrutiny.

The primary Zeecol system will take low value products derived from animals, including all waste streams on a dairy farm or feed lot, and efficiently produces/converts them into high value products such as energy and animal feed that are sold back to the farmer on long term contracts. The objective is to reduce both environmental costs and dollar costs of farming. Zeecol has not earned any revenues to date.

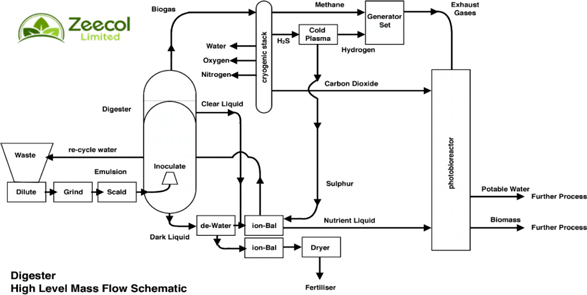

The process will utilize an anaerobic digester that makes waste suitable for use by plants, and a photo bioreactor that supports colonies of highly efficient single celled plants called micro algae. The cows and steers will essentially “feed” the digester, and the digester feeds the photo bioreactor. Finally, the photo bioreactor will feed the cows and steers in a closed cycle. Throughout the process, fuel, electricity and fertilizer will be produced as saleable byproducts. In this way, the Zeecol eliminates all waste while supercharging what happens naturally.

A High Level Mass Flow Schematic of a Zeecol Digester

| -3- |

Zeecol is Addressing an Unmet Need in the Marketplace

Zeecol is uniquely qualified to address a virtually untapped need in the dairy farming market.

| • | Dairy farms in New Zealand and in most countries are currently required to develop an acceptable sewage management plan or face shutdown. |

| • | Equipment dealers currently require farmers to arrange financing of all purchases which represents a substantial capital investment that many farmers are unable or unwilling to do. Equipment dealers are becoming increasingly receptive to alternative means for equipment financing. |

| • | Financial downturns cause a large amount of financial pressure on farms. Equipment dealers need a quick solution which Zeecol can provide. |

| • | Zeecol has a solid management team that is both knowledgeable in farm waste treatment, and also is familiar with working with distressed equipment dealers. |

| • | Through its team’s expertise, Zeecol has developed systems for purchasing, managing, and selling products from waste treatment equipment. |

| • | Zeecol has been active with various dairy groups and our management team is known in the dairy community. |

| • | Zeecol works with vendors that provide it with engineering, digesters, and a cryogenic process. |

Zeecol also intends to make acquisitions of distressed farms in 2017 that have become weakened primarily by the drop in milk solid sales, or by other inefficiencies. Management has candidates in the short term pipeline and the timing of these acquisitions will coincide with Zeecol’s ability to obtain acquisition financing.

Continuing Efforts of Zeecol with Green Dragon Wood Products

In its many discussions with Mr. Lee, Zeecol intends work closely with Mr. Lee to optimize its assets and grow its operations. A primary initiative in this regard will involve applying Zeecol’s process that builds efficiencies into dairy farming to the development of specialty wood products. The science behind such a process has been well documented, but testing must be done before mass production of any kind will be executed. The leaves of trees supply sugars to make sap that flow in the xylem, which is the region that forms rings and builds up the tree’s every cell. For many years, scientists have described how xylem cells can be grown in a test tube filled with synthetic sap and all the things that can be done with those cells.

The process being tested in this capacity would create specialty wood or veneer products by using algae instead of leaves to produce high quality tree sap to grow wood in test tubes. A culture of cells found in the tree xylem will be applied back to the trees to encourage rapid growth, and the residual substance is then mixed with natural plant hormones that cause the cells to exude lignin, thereby binding the cells of the material together. As the lignin hardens, the residual substance is formed first into fibers and then pressed into sheets, with an appropriate amount of air. The resulting products that Zeecol hopes to develop from this process will range from a fine sheet of paper, to a veneer or even a stick of lumber. Beyond mass production of quality veneers (theoretically from test tubes instead of forests) Zeecol can seek to supply the market demand for hardwoods and leave nature only as a source of natural cells for the required culture. Zeecol intends to create many variations of this “wood ink”’ of natural cells that would then be assembled by a 3D wood printer to print hardwoods on demand in any shape needed. Zeecol does not process leaves into algae. Zeecol uses algae instead of leaves to produce high quality tree sap to grow wood in test tubes. In this way Zeecol produces the wood equal to millions of trees from one tree, saving our timber for nature.

| -4- |

Management Team

William Mook Chief Executive Officer: Mr. Mook, in accordance with the Merger Agreement, will serve as Chief Executive Officer of Green Dragon Wood Products, Inc. In 2011, Mr. Mook founded Zeecol Limited and was its President and Chief Executive Officer. He has over 18 years of experience in manufacturing industry as an OEM, and technology investor. He has over 20 years of experience as President/CEO of various companies including MokEnergy, Sugico Mok and Rapi-Serv Cash Systems. He holds a number of patents in a wide range of fields. In addition to his management and motivational skills he is an accomplished speaker and team builder. Educational background: Mr. Mook served as a remote teaching associate in the Physics and Energy course taught in the physics department at Stanford in 2015. William is worked under Dr. Robert Laughlin at Stanford. Robert received a Nobel Prize in 1998 for discovery of the Fractional Quantum Hall Effect.

Tony Baxter Chief Operating Officer: At the Closing of the Merger, Mr, Baxter will become the Chief Operating Officer for Green Dragon Wood Products, Inc.. Prior to this, Mr. Baxter served in that capacity for Zeecol Limited beginning in 2016. He holds a New Zealand Certificate of Engineering in Electrical and Electronic Engineering. He has over 30 years of experience as senior executive for major electronic firms in the region such as Tait Electronics, Cray Communications, Motorola and Raytheon. His last position prior to taking early retirement six years ago was as General Manager of Alan J Brown & Associates specialized in Security & Communications Systems.

Russell Covarrubia Chief Financial Officer: At the Closing of the Merger, Mr. Covarrubia will become the Chief Financial Officer for Green Dragon Wood Products, Inc., Mr. Covarrubia served in that capacity for Zeecol Limited beginning in 2015. He specializes in financial structuring and investing, and prior to joining Zeecol Limited, Mr. Covarrubia served as Vice President of Universe Capital Partners LLC, where he helped structure and fund Turkish private and public companies, and he also served as Chief Executive Officer of UCP Holdings INC. (UCPH) structuring financial acquisitions and running day to day operations. Prior to that, from Executive Vice President AFLG Investments, at AFLG Mr. Covarrubia help structure funds and the advisory services side of AFLG, raised capital, brought in advisory clients for merger and acquisition needs. Chief Investment Officer of Universe Capital Partners LLC, advise and approved investment strategy and structure for investments made by UCP.

Kwok Leung Lee: VP of Wood Products and Director. At the Closing of the Merger, Mr. Lee will become VP of Wood Products. Prior to this, Mr. Lee served as the Company’s President/Chairman of the Board of Directors beginning in September 1998. Mr. Lee, also known as Stephen Lee, is a graduate of Michigan State University with a Bachelor Degree in Social Sciences. He received a Master of Science in Management from Shiga University in Japan in 1993 with a specialization in management and economics. Mr. Lee is fluent in Chinese, Japanese and English. Mr. Lee has traveled extensively worldwide for Green Dragon handling purchasing, negotiations with client companies, logistics, and administration and finance. He has more than thirteen (13) years of diverse product knowledge and global experience in wood products ranging from softwood to hardwood, log to lumber to veneer. His experience extends to furniture, flooring, interior decoration, musical instruments, and sports equipment.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off Balance sheet Arrangement of a Registrant

As a condition to closing the Merger , the Company will enter into a convertible promissory note (the “Note”) with Mr. Lee in the principal sum of $300,000 (the “Principal Amount”). The Note bears no interest and has a term of six (6) months (the “Termination Date”). Prior to the Termination Date, the Principal Amount is convertible into a number of shares of common stock of the Company equal to three percent (3%) of the number of shares of common stock of the Company issued and outstanding on the date of such conversion.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

|

Exhibit |

Description | |

| 2.1 | Merger Agreement between Green Dragon Wood Products, Inc., Zeecol Acquisition Limited, Zeecol Limited and the shareholders of Zeecol Limited, dated February 2, 2017 |

| -5- |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Green Dragon Wood Products, Inc. | |

| Date: February 3, 2017 | |

| /s/ Kwok Leung Lee | |

| Name: Kwok Leung Lee | |

| Title: Chief Executive Officer |

| -6- |