Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRAL VALLEY COMMUNITY BANCORP | a8-kirpresentationfigpartn.htm |

Investor Presentation

FIG Partners West Coast CEO Forum

February 2, 2017

Jim Ford President & CEO

Dave Kinross EVP CFO

Forward-Looking Statements

2

Forward-looking Statements -- Certain matters discussed constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained

herein that are not historical facts, such as statements regarding the Company's current business

strategy and the Company's plans for future development and operations, are based upon current

expectations. These statements are forward-looking in nature and involve a number of risks and

uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in

competitive pressure in the banking industry; (2) the impact of changes in interest rates, a decline in

economic conditions at the international, national or local level on the Company's results of

operations, the Company's ability to continue its internal growth at historical rates, the Company's

ability to maintain its net interest margin, and the quality of the Company's earning assets; (3)

changes in the regulatory environment; (4) fluctuations in the real estate market; (5) changes in

business conditions and inflation; (6) changes in securities markets; and (7) the other risks set forth

in the Company's reports filed with the Securities and Exchange Commission, including its Annual

Report on Form 10-K for the year ended December 31, 2015. Therefore, the information set forth in

such forward-looking statements should be carefully considered when evaluating the business

prospects of the Company.

Experienced Management Team

3

Executive Position

Years at

CVCY

Years of

Experience

James M. Ford President & CEO 3 37

David A. Kinross EVP, Chief Financial Officer 11 27

Gary D. Quisenberry EVP Commercial & Business Banking 17 32

Lydia E. Shaw EVP Community Banking 10 32

Patrick J. Carman EVP, Chief Credit Officer 8 45

Overview

4

NASDAQ Symbol CVCY

Market Capitalization $248.4 Million

Institutional Ownership 40%

Insider Ownership 14%

Total Assets $1.4 Billion

Headquarters Fresno, CA

Number of Branches 22

Year Established 1980

Strategic Footprint Bakersfield to

Sacramento

22 Branches in 9 Contiguous Counties

As of December 31, 2016

Financial Highlights

5

2016 2015

Total Average Assets $1.32 Billion $1.22 Billion

Net Income $15.18 Million $10.96 Million

Diluted EPS $1.33 $1.00

Net Interest Margin 4.09% 4.01%

ROA 1.15% 0.90%

ROE 9.84% 8.12%

Cash Dividends per share $0.24 $0.18

Total Cost of Funds 0.09% 0.09%

NPAs to Total Assets 0.18% 0.19%

Leverage Capital Ratio 8.75% 8.65%

Common Equity Tier 1 Ratio 12.48% 13.44%

Tier 1 Risk Based Capital Ratio 12.74% 13.79%

Total Risk Based Capital Ratio 13.72% 15.04%

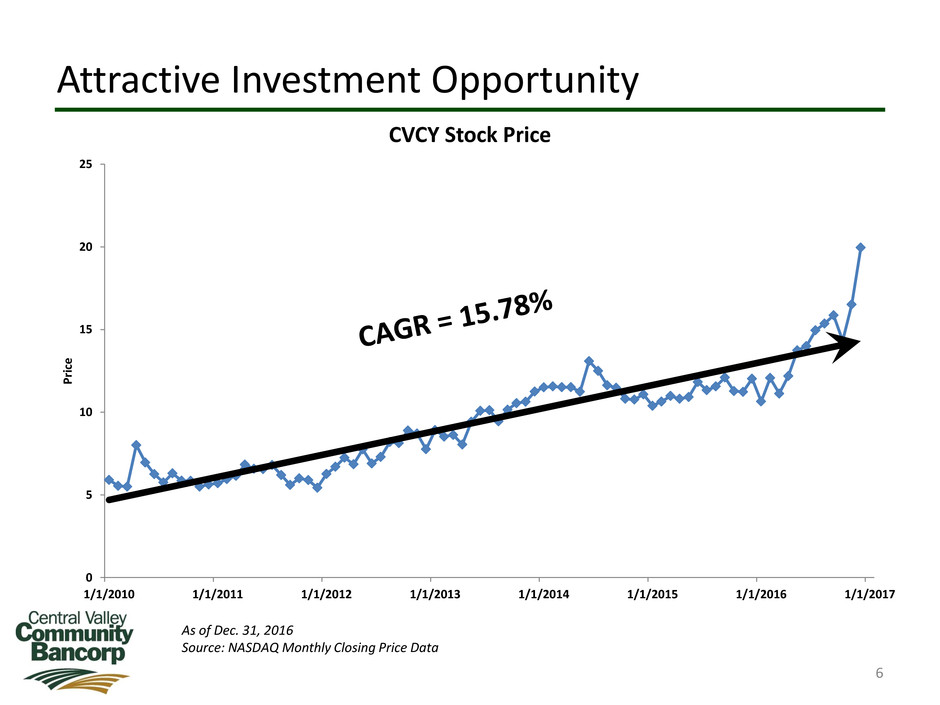

Attractive Investment Opportunity

6

As of Dec. 31, 2016

Source: NASDAQ Monthly Closing Price Data

0

5

10

15

20

25

1/1/2010 1/1/2011 1/1/2012 1/1/2013 1/1/2014 1/1/2015 1/1/2016 1/1/2017

P

ri

ce

CVCY Stock Price

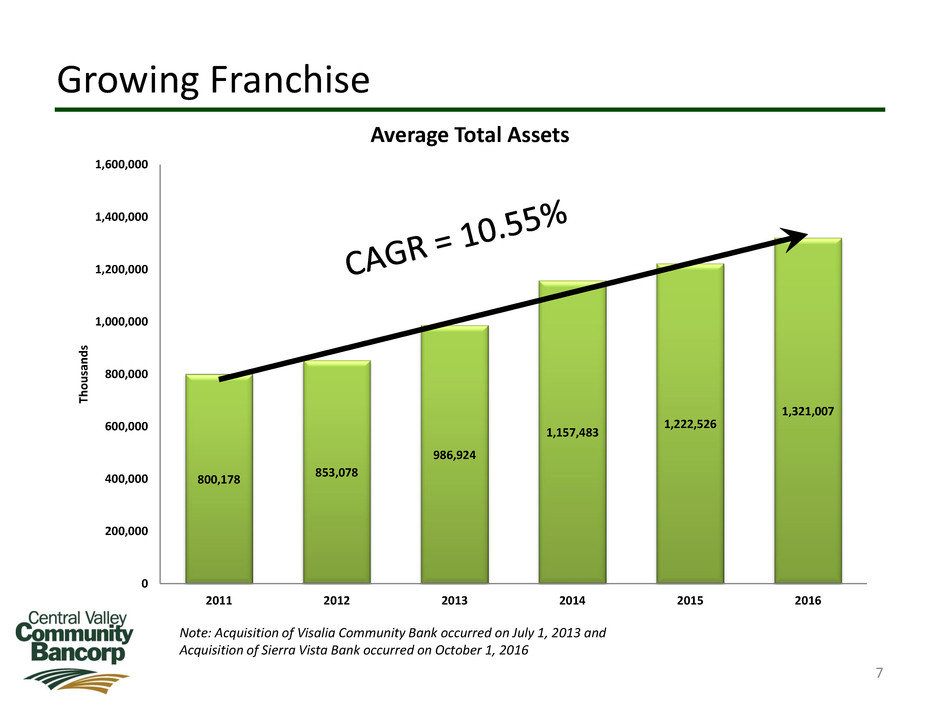

Growing Franchise

7

Note: Acquisition of Visalia Community Bank occurred on July 1, 2013 and

Acquisition of Sierra Vista Bank occurred on October 1, 2016

800,178

853,078

986,924

1,157,483

1,222,526

1,321,007

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

2011 2012 2013 2014 2015 2016

Th

o

u

sa

n

d

s

Average Total Assets

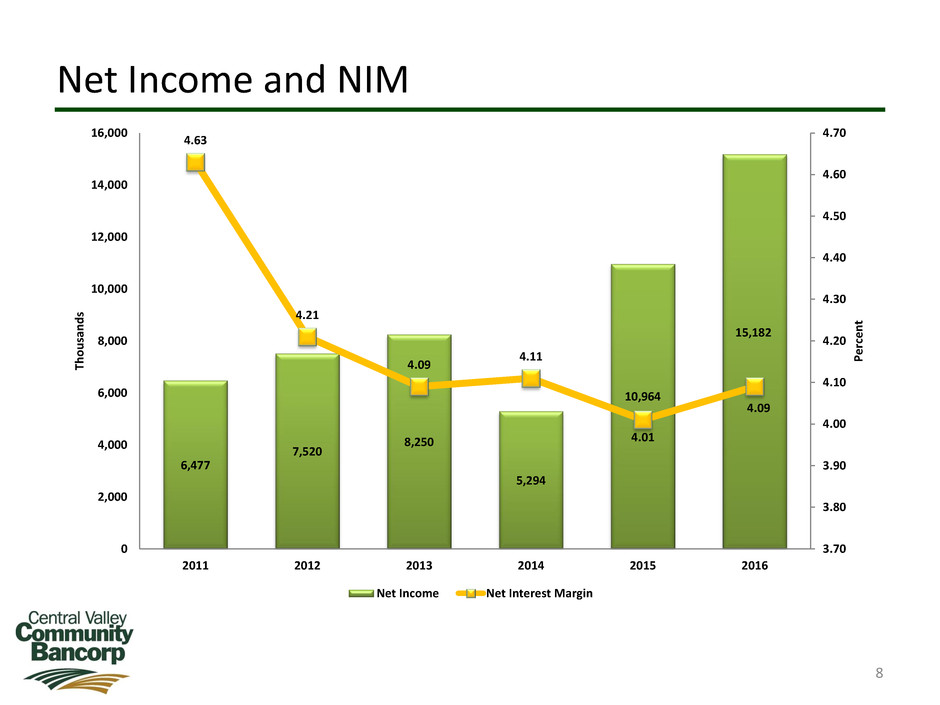

Net Income and NIM

8

6,477

7,520

8,250

5,294

10,964

15,182

4.63

4.21

4.09

4.11

4.01

4.09

3.70

3.80

3.90

4.00

4.10

4.20

4.30

4.40

4.50

4.60

4.70

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2011 2012 2013 2014 2015 2016

Pe

rc

e

n

t

Th

o

u

sa

n

d

s

Net Income Net Interest Margin

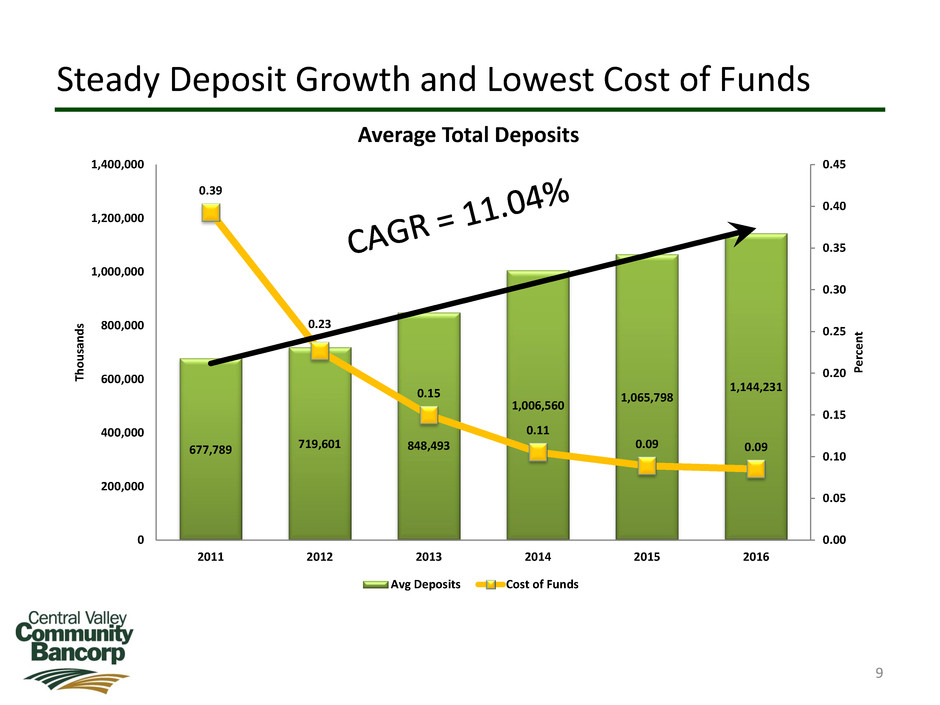

Steady Deposit Growth and Lowest Cost of Funds

9

677,789 719,601 848,493

1,006,560

1,065,798

1,144,231

0.39

0.23

0.15

0.11

0.09 0.09

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.45

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

2011 2012 2013 2014 2015 2016

Pe

rc

e

n

t

Th

o

u

sa

n

d

s

Average Total Deposits

Avg Deposits Cost of Funds

Attractive Deposit Mix

10

Non-Interest Bearing

40%

Now/Savings

28%

Money Market

20%

TCDs

12%

As of Dec. 31, 2016

Total Deposits = $1.26 Billion

Loan Totals and Yield

11

412,969 394,575

445,300

533,531

578,899

644,282

6.32

6.06

5.96

5.53

5.27 5.29

4.60

4.80

5.00

5.20

5.40

5.60

5.80

6.00

6.20

6.40

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

2011 2012 2013 2014 2015 2016

Pe

rc

e

n

t

Th

o

u

sa

n

d

s

Average Total Loans

Total Loans Loan Yield

Balanced Loan Portfolio

12

Commercial &

Industrial, 12%

Agriculture

Production & Land,

15%

Owner Occupied

Real Estate, 25%

R/E Construction &

Land, 9%

Commercial Real

Estate, 24%

Other Real Estate,

3%

Equity Loans and

Lines, 9%

Consumer &

Installment, 3%

As of Dec. 31, 2016

Excludes Deferred Loan Fees

Total Loans = $755 Million

Agricultural Loan Commitments

13

Almonds

23%

Table Grapes

12%

Open Land

12% Walnuts

11%

Wine Grapes

9%

Other

8%

Tomatoes

6%

Raisins

5%

Cherries

4%

Tree Fruit

3%

Cotton

3%

Pistachios

1%

Citrus

1%

Wheat

1%

Alfalfa

1%

As of Dec. 31, 2016

On the Horizon

14

Organic Loan Growth

Assimilate Sierra Vista Acquisition

Evaluate Merger Opportunities

Improve Efficiencies

Fee Income Improvements

Relationship Pricing & Customer

Profitability

Closely Monitor Water

Resources

15

Investing in Relationships