Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ROYAL GOLD INC | v458135_ex99-1.htm |

| 8-K - FORM 8-K - ROYAL GOLD INC | v458135_8k.htm |

Fiscal Second Quarter Results Royal Gold, Inc. February 2, 2017 Exhibit 99.2

2 February 2, 2017 Cautionary Statement NASDAQ: RGLD This presentation contains certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained herein and include, but are not limited to : scalable business model and strong margins relative to the senior gold operators and S&P 500 ; future growth from new contributions at Rainy River and Crossroads ; potential for additional reserves and ounces at no incremental capital cost from our operators’ exploration and development activity and innovation ; increased incremental stream volume and revenue from Rainy River and estimated date of commencement of production ; estimated timing and volume from the Mount Milligan gold and copper stream ; calendar year 2017 production outlook for Mount Milligan ; mine life and reserves estimates and production forecasts from the operators of our stream and royalty interests ; and the lack of near term capital commitments . Factors that could cause actual results to differ materially from these forward - looking statements include, among others : the risks inherent in the operation of mining properties ; a decreased price environment for gold and other metals on which our stream and royalty interests are paid ; performance of and production at properties, and variation of actual performance from the production estimates and forecasts made by the operators of those properties ; decisions and activities of the Company’s management affecting margins, use of capital and changes in strategy ; unexpected operating costs, decisions and activities of the operators of the Company’s royalty and stream properties ; changes in operators’ mining and processing techniques or royalty calculation methodologies ; resolution of regulatory and legal proceedings ; unanticipated grade, geological, metallurgical, environmental, processing or other problems at the properties ; revisions or inaccuracies in technical reports, reserve, resources and production estimates ; changes in project parameters as plans of the operators are refined ; the results of current or planned exploration activities ; errors or disputes in calculating royalty payments or stream deliveries, or payments or deliveries not made in accordance with royalty or stream agreements ; the liquidity and future financial needs of the Company ; economic and market conditions ; the impact of future acquisitions and royalty and stream financing transactions ; the impact of issuances of additional common stock ; and risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, environmental laws, enforcement and uncertain political and economic environments . These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission . Statements made herein are as of the date hereof and should not be relied upon as of any subsequent date . The Company’s past performance is not necessarily indicative of its future performance . The Company disclaims any obligation to update any forward - looking statements . Third - party information : Certain information provided in this presentation has been provided to the Company by the operators of those properties or is publicly available information filed by these operators with applicable securities regulatory bodies, including the Securities and Exchange Commission . The Company has not verified, and is not in a position to verify, and expressly disclaims any responsibility for the accuracy, completeness or fairness of such third - party information and refers readers to the public reports filed by the operators for information regarding those properties .

Today’s Speakers Tony Jensen President and CEO Stefan Wenger CFO and Treasurer 3 Mark Isto Vice President Operations NASDAQ: RGLD February 2, 2017

Record operating cash flow and favorable results from 38 producing interests 4 Strong Performance in Q2 FY17 1 Net GEOs: Net Gold Equivalent Ounces are calculated as revenue less stream payments, divided by the average gold price for the same period. 2 Volume in Q2FY16 positively influenced by true - up deliveries from Wassa and Prestea. 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Net GEOs in line with prior year quarter 1,2 NASDAQ: RGLD February 2, 2017 0 10 20 30 40 50 60 70 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 $USD Millions Operating Cash Flow +34% from prior year quarter 0 20 40 60 80 100 120 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 $USD Millions Revenue + 9% from prior year quarter

Impressive contributions from our recent acquisitions Future growth from new contributions from Rainy River and Crossroads Volume Growth Already Bought & Paid For Net Gold Equivalent Ounces(GEOs) 1 5 1 GEOs : Gold Equivalent Ounces, calculated as revenue, less stream payments ( COGS), divided by Royal Gold’s average realized gold price for prior fiscal years. [Future fiscal years based on operator estimated volume attributable to Royal Gold’s interest to estimate revenue, less estimated stream payments, divided by analyst consensus $120 0 p er ounce of gold.] NASDAQ: RGLD February 2, 2017 0 50,000 100,000 150,000 200,000 250,000 300,000 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 H1 FY 2017 Other Pueblo Viejo, Andacollo, Wassa, Prestea Streams

Optionality at 38 Currently Producing Interests Operators’ innovation, capital and exploration at no incremental capital cost to Royal Gold 1 Peñasquito Mount Milligan Enhancements M ount Milligan Enhancements 1 Project development as reported by the mine operators. 6 Pueblo Viejo – Potential Resource Conversion Wassa Underground Development Peñasquito Peñasquito Pyrite Leach Project NASDAQ: RGLD February 2, 2017

Rainy River will contribute incremental stream volume , with production estimated to begin in September 2017 7 Volume Growth Already Bought & Paid For New Gold’s Rainy River project is located 65 km northwest of Fort Frances, Ontario . Photo from New Gold. NASDAQ: RGLD February 2, 2017

8 Mount Milligan Gold - Copper Stream Prior stream: 52.25% of gold Amended gold - copper stream: » 35% of gold, payment - $ 435/ oz of gold delivered » 18.75% of copper, payment – 15% of prevailing copper spot price per metric tonne delivered Expected transition to gold - copper stream deliveries in April 2017 CY2017 production outlook 1 : » 91k - 101k ounces of payable gold to Royal Gold » 10 - 12Mlbs of payable copper to Royal Gold » Production ~35% weighted towards December quarter 2 » Compares favorably to ~105k ounces of gold production to Royal Gold in CY2016 on the gold - only strea m 1 Based on outlook from Centerra Gold (January 16, 2017). 2 Due to timing between production and concentrate shipments, Royal Gold expects to receive gold and copper produced in the qua r ter ended December 31, 2017 in the quarter ended June 30, 2018. NASDAQ: RGLD February 2, 2017

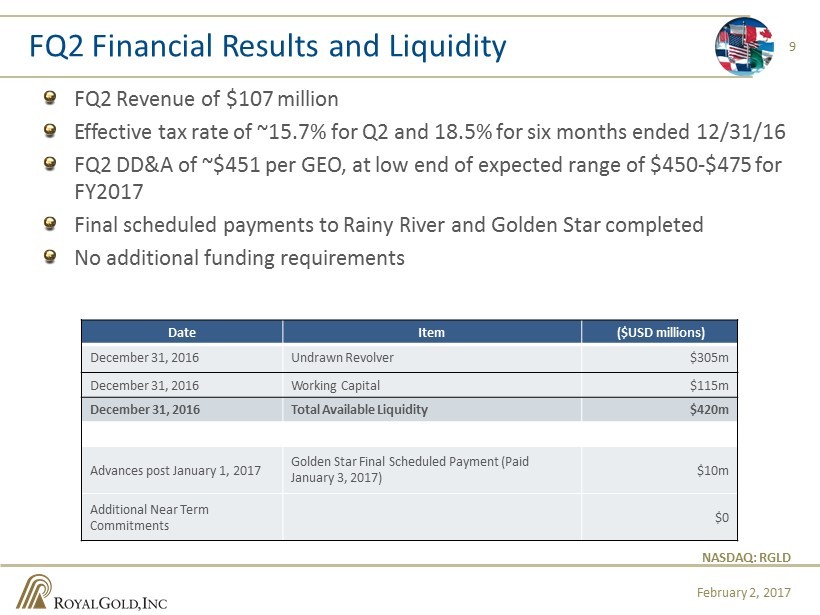

FQ2 Revenue of $107 million Effective tax rate of ~15.7% for Q2 and 18.5% for six months ended 12/31/16 FQ2 DD&A of ~$451 per GEO, at low end of expected range of $450 - $475 for FY2017 Final scheduled payments to Rainy River and Golden Star completed No additional funding requirements Date Item ($USD millions) December 31, 2016 Undrawn Revolver $305m December 31, 2016 Working Capital $115m December 31, 2016 Total Available Liquidity $420m Advances post January 1, 2017 Golden Star Final Scheduled Payment (Paid January 3, 2017) $10m Additional Near Term Commitments $0 9 FQ2 Financial Results and Liquidity NASDAQ: RGLD February 2, 2017

Margin Gross 1 With just 21 employees and a scalable business model, our margins are significantly higher than the senior gold producers and the S&P 500 2 . Growth Volume Our portfolio has embedded growth with new business already bought and paid for at Rainy River and Cortez Crossroads. Optionality E xploration and development activity adds ounces at properties such at Peñasquito at no incremental capital cost to us. Return Dividend Growth CAGR since 2001 We have increased our dividend each of the last 16 years. Producing/Total Interests A High Quality Precious Metals Investment NASDAQ: RGLD 10 1 Gross Margin is calculated as revenue less cost of goods sold as a percentage of revenue as reported for the last 12 months. Sourc e i s S&P CapitaliQ. 2 Senior producer average includes Barrick, Newmont, Goldcorp, Newcrest and Agnico - Eagle. Source for S&P 500 and Senior Producer s is S&P CapitaliQ. February 2, 2017

Board of Directors 11 NASDAQ: RGLD February 2, 2017 Jamie Sokalsky Independent Director; Former President and CEO, Barrick Gold Corporation Kevin McArthur Independent Director; Executive Chair, Tahoe Resources and Former CEO and Director, Goldcorp, Inc. Gordon Bogden Independent Director; Former Vice Chairman, Mining & Metals, Standard Chartered Bank Tony Jensen Director ; President and CEO, Royal Gold, Inc. M. Craig Haase Independent Director; Former EVP and Chief Legal Officer, Franco - Nevada Mining Corporation William Hayes Independent Director and Chairman of the Board; Former EVP, Placer Dome Inc. Ronald J. Vance Independent Director; Former SVP Corporate Development, Teck Resources Christopher M.T. Thompson Independent Director; Former Chairman and CEO, Gold Fields Limited Sybil Veenman Independent Director; Former Senior Vice President and General Counsel, Barrick Gold Corporation

1660 Wynkoop Street, #1000 Denver, CO 80202 - 1132 303.573.1660 info @royalgold.com www.royalgold.com