Attached files

| file | filename |

|---|---|

| 8-K - PRICE T ROWE GROUP INC | investordaymaterials.htm |

T. Rowe Price Investor Day • February 2, 2017 1

T. ROWE PRICE

OVERVIEW

February 2, 2017

William J. Stromberg

President and CEO

T. Rowe Price Investor Day

Welcome everyone, and thank you for coming today.

We are here to provide an update on T. Rowe Price and our strategic priorities.

̶ From August 2015 through June 2016, we conducted a thorough strategic review of our

business, and we developed a detailed plan to diversify and grow our business despite the many

headwinds that we and our industry are currently facing.

̶ We are choosing to invest in our business in three general areas to strengthen our competitive

advantages: (1) products – especially multi-asset, (2) distribution, and (3) technology.

̶ We believe that these investments are essential to our long-term success. We recognize that

they raise our expenses and impact our operating profit margins in the near term – but we think

these are the right investments to make and that the payoff will be worth it.

A second purpose of today’s meeting is to introduce you to four leaders who helped develop our plan

and who lead important businesses within T. Rowe Price. Each is an industry veteran and a strong

leader, and each is committed to our long-term business success.

A third reason for hosting this meeting today is to fulfill our commitment to you to provide more

transparency into our business. We want you to understand what we are investing in and why we

think we will be successful.

T. Rowe Price Investor Day • February 2, 2017

2

Forward-looking statements

This presentation, and other statements that T. Rowe Price may make, may contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act, with respect to T. Rowe Price’s future financial or business

performance, strategies, or expectations.

Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,”

“pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,”

“continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as

“will,” “would,” “should,” “could,” “may,” and similar expressions. Forward-looking statements in this presentation may

include, without limitation, information concerning future results of our operations, expenses, earnings, liquidity, cash flow

and capital expenditures, industry or market conditions, amount or composition of AUM, regulatory developments, demand

for and pricing of our products, and other aspects of our business or general economic conditions. T. Rowe Price cautions

that forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time.

Actual results could differ materially from those anticipated in forward-looking statements, and future results could differ

materially from historical performance. Forward-looking statements speak only as of the date they are made, and T. Rowe

Price assumes no duty to and does not undertake to update forward-looking statements.

We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks

described in our most recent Form 10-K and subsequent Forms 10-Q, filed with the Securities and Exchange Commission.

2

Important Information

This material, including any statements, information, data and content contained within it and any materials, information, images, links,

graphics or recording provided in conjunction with this material are being furnished by T. Rowe Price for general informational purposes only.

Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price. The views

contained herein are as of the date of the presentation. The information and data obtained from third-party sources which is contained in the

report were obtained from sources deemed reliable; however, its accuracy and completeness is not guaranteed.

Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as

well as up. Investors may get back less than the amount invested. Certain historical business data may include the use of estimates. This

presentation also includes non-GAAP financial measures. You can find our presentations on the most directly comparable GAAP financial

measures calculated in accordance with GAAP and our reconciliations in the appendix to this presentation and T. Rowe Price’s other periodic

reports.

The products and services discussed in this presentation are available via subsidiaries of T. Rowe Price Group as authorized in countries

through the world. The products and services are not available to all investors or in all countries. Visit troweprice.com to learn more about

the products and services available in your country and the T. Rowe Price Group subsidiary which is authorized to provide them. The

material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the

material is provided upon specific request. The material does not constitute a distribution, an offer, an invitation, recommendation or

solicitation to sell or buy any securities in any jurisdiction. The material has not been reviewed by any regulatory authority in any jurisdiction.

The material does not constitute advice of any nature and prospective investors are recommended to seek independent legal, financial and

tax advice before making any investment decision.

T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are trademarks or registered trademarks of T. Rowe Price

Group, Inc. in the United States and other countries. All other trademarks are the property of T. Rowe Price or their respective owners.

T. Rowe Price Investor Day • February 2, 2017

3

Opening and T. Rowe Price Overview

Agenda

William J. Stromberg, President and CEO

Product Overview

Multi-asset Investment Capabilities

Individual and Retirement Plan Services

Robert Higginbotham, Head of Global Investment Services

Sebastien Page, Head of Asset Allocation

Scott David, Head of Individual and Retirement Plan Services

U.S. Intermediaries

Global Investment Services

Closing and Questions

George Riedel, Head of U.S. Intermediaries

Robert Higginbotham, Head of Global Investment Services

William J. Stromberg, President and CEO

3

Agenda for today

We expect to present for about 70 minutes.

We ask that you hold your questions until we complete the presentation as there will be plenty of

time for questions.

T. Rowe Price Investor Day • February 2, 2017

4

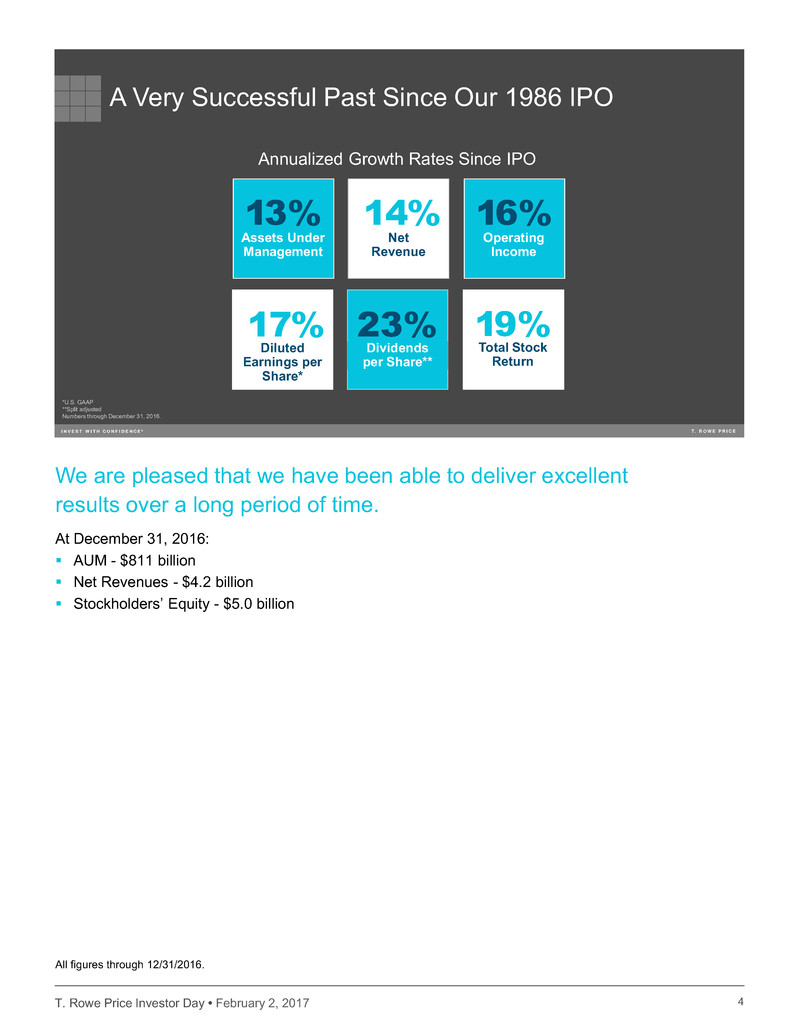

A Very Successful Past Since Our 1986 IPO

13%

Assets Under

Management

14%

Net

Revenue

17%

Diluted

Earnings per

Share*

23%

Dividends

per Share**

19%

Total Stock

Return

16%

Operating

Income

*U.S. GAAP

**Split adjusted

Numbers through December 31, 2016.

Annualized Growth Rates Since IPO

4

We are pleased that we have been able to deliver excellent

results over a long period of time.

At December 31, 2016:

AUM - $811 billion

Net Revenues - $4.2 billion

Stockholders’ Equity - $5.0 billion

All figures through 12/31/2016.

T. Rowe Price Investor Day • February 2, 2017

5

Consistently Strong

Investment

Performance

Many Factors Contributed to This Healthy Growth

New Intermediary

Distribution Practices

Early Entrant

Into Retirement

Date Funds

Our Unique

Culture

Mutual Fund

Industry Growth

Defined Contribution

Evolution

5

Consistently strong investment performance across many market cycles was critical.

Mutual fund industry growth from $500 billion to $16 trillion.

T. Rowe Price full-service recordkeeping launch in 1982, coinciding with shift to defined contribution

plans.

Intermediary migration from commission structures to asset-based fees using no-load funds.

Early entrance into the retirement date fund business with well-designed products in 2002.

Unique culture emphasizing:

— Investment excellence

— Client-first orientation

— Broadly respected brand

— Financial strength

— Durable business model

Factors contributing to growth:

T. Rowe Price Investor Day • February 2, 2017

6

Asset Class*

U.S. Equity

49%

Global Equity

7%

U.S. Fixed

Income

14%

Global Fixed

Income

1%

Asset

Allocation

29%

Diversified by Assets and by Client Type

Numbers represent percentages of total firm AUM as of December 31, 2016.

*Based on investment strategy.

Retirement –

Full-Service

Recordkeeping

13%

Individual

Investors

18%

EMEA/APAC

Intermediaries

2%

U.S.

Intermediaries

47%

Institutional

Investors

20%

Client Type

6

Diversified by…

Asset Class

Integrated global investment platform is a competitive advantage and is built for excellence at

scale.

Broad array of high-performing investment strategies has enabled growth in asset allocation

strategies.

Global capabilities in equity, fixed income, and multi-asset provide significant growth

opportunities.

Client Type

Well diversified by client type – with a heavy emphasis on retirement assets.

Meaningful growth opportunities abound across each client type.

T. Rowe Price Investor Day • February 2, 2017

7

How We Access Clients

T. Rowe Price

U.S. Plan

Sponsors

Global

Institutions

Individual Investors

U.S.

Financial

Intermediaries

EMEA & APAC

Financial

IntermediariesDirect

7

We access clients across the globe through five different channels:

Direct – 1.4+ million individual investors

U.S. Plan Sponsors – 3,600+ plans

U.S. Financial Intermediaries – 1,300+ financial institutions

EMEA & APAC Financial Intermediaries – 290+ financial institutions

Global Institutions – 640+ institutions

T. Rowe Price Investor Day • February 2, 2017

8

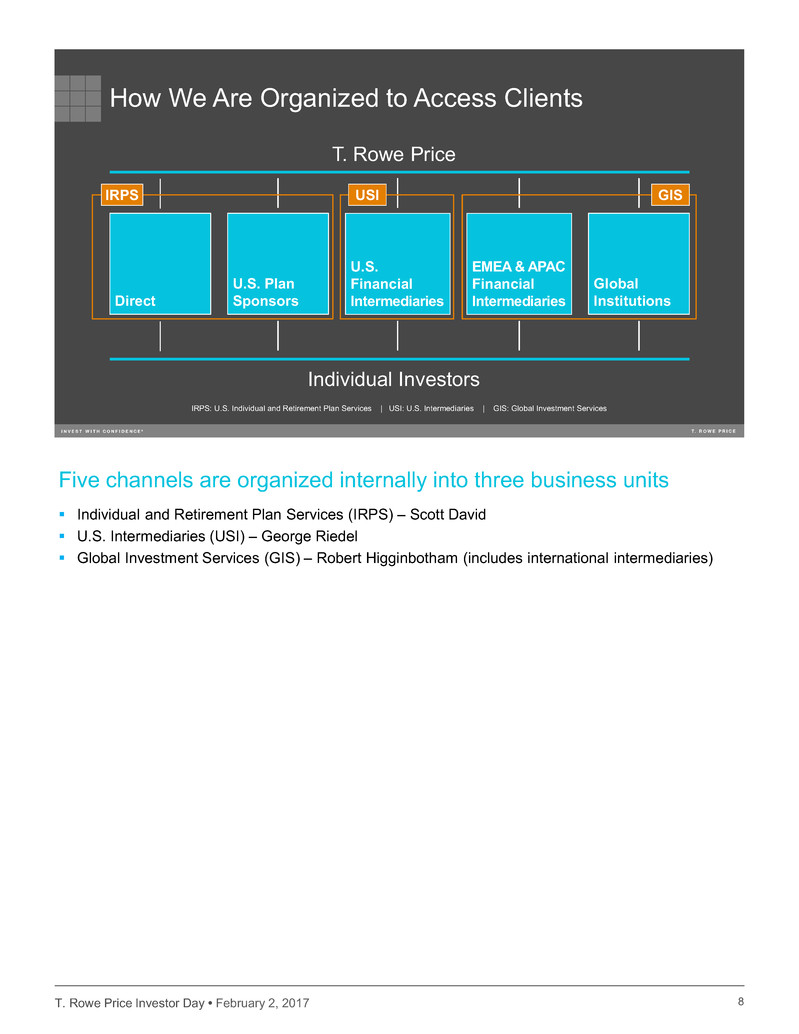

T. Rowe Price

U.S. Plan

Sponsors

Global

Institutions

Individual Investors

U.S.

Financial

Intermediaries

EMEA & APAC

Financial

IntermediariesDirect

How We Are Organized to Access Clients

GISUSIIRPS

IRPS: U.S. Individual and Retirement Plan Services | USI: U.S. Intermediaries | GIS: Global Investment Services

8

Five channels are organized internally into three business units

Individual and Retirement Plan Services (IRPS) – Scott David

U.S. Intermediaries (USI) – George Riedel

Global Investment Services (GIS) – Robert Higginbotham (includes international intermediaries)

T. Rowe Price Investor Day • February 2, 2017

9

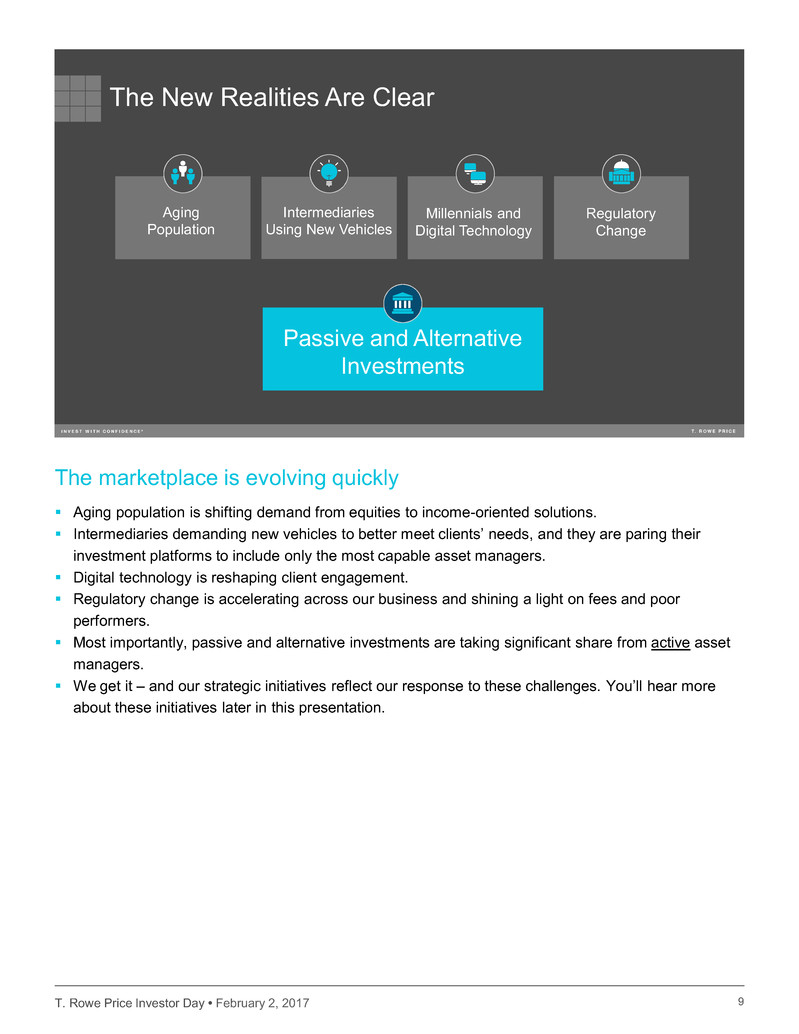

The New Realities Are Clear

Millennials and

Digital Technology

Passive and Alternative

Investments

Regulatory

Change

Intermediaries

Using New Vehicles

Aging

Population

9

The marketplace is evolving quickly

Aging population is shifting demand from equities to income-oriented solutions.

Intermediaries demanding new vehicles to better meet clients’ needs, and they are paring their

investment platforms to include only the most capable asset managers.

Digital technology is reshaping client engagement.

Regulatory change is accelerating across our business and shining a light on fees and poor

performers.

Most importantly, passive and alternative investments are taking significant share from active asset

managers.

We get it – and our strategic initiatives reflect our response to these challenges. You’ll hear more

about these initiatives later in this presentation.

T. Rowe Price Investor Day • February 2, 2017

10

T. Rowe Price Future Vision

10

We Are Executing on a Longer-Term Plan

Premier active asset manager

Integrated investment solutions provider

Global partner for retirement-oriented investors

More globally diversified asset manager

Destination of choice for top talent

More agile company

Strong financial results and balance sheet

10

Maintain our position as a premier active asset manager, creating durable value for clients.

Become more of an integrated investment solutions provider that leverages our diversified

investment management and asset allocation capabilities to meet changing client needs.

Become a more recognized global partner for retirement-oriented investors (individuals, DC plan

sponsors, or employers with DB liabilities).

Build T. Rowe Price into a more globally diversified asset manager that sources an increasing

share of AUM from outside the U.S. while still growing our U.S. franchise.

Remain a destination of choice for top talent including and beyond our investment teams, with a

culture of accountability, empowerment, and rigor.

Become a more agile company that stays ahead of and capitalizes on disruptions.

Deliver attractive financial results and balance sheet strength for our stockholders over the long-

term.

In our pursuit of our short- and long-term goals, we believe it is imperative to sustain our client-centric,

collaborative culture, and reputation for excellence and integrity.

T. Rowe Price Investor Day • February 2, 2017

11

Active Management Beliefs

We believe that active and passive will coexist and complement each

other. Given the need for returns around the world, we believe there

will always be demand for good active management.

We also believe that certain characteristics of active firms increase

their odds of outperforming passive options:

Firms with high integrity and significant financial strength

Firms with an intense focus on people, investment process, and culture

Firms with below-average fees and long-term horizons.

11

T. Rowe Price Investor Day • February 2, 2017

12

Active Management Is Hard, We’ve Consistently Done It Well

T. Rowe Price has performed consistently well versus benchmarks,

across broad product offerings, over the long term — including our

important U.S. equity and target date offerings:

U.S. Equity:

Over the last 20 years, 75% of active T. Rowe Price diversified funds (18 funds studied)

outperformed their designated benchmarks in more than 80% of the rolling 10-year periods.1

Target Date Mutual Funds:

Since inception of each Retirement Fund in the series, 100% of the funds (9 funds studied)

have outperformed their designated benchmarks in 100% of the rolling 10-year periods.2

12

Past performance is no guarantee of future results.

1For a more detailed discussion of results and methodology see, “Long-Term Benefits of the T. Rowe Price Approach to Active Management

(April 2016).” All performance is as of 12/31/2015.

2For a more detailed discussion of results and methodology see, “Target Date Strategies: The Benefits of the T. Rowe Price Approach

(January 2017).” All performance is as of 12/31/2015.

T. Rowe Price Investor Day • February 2, 2017

13

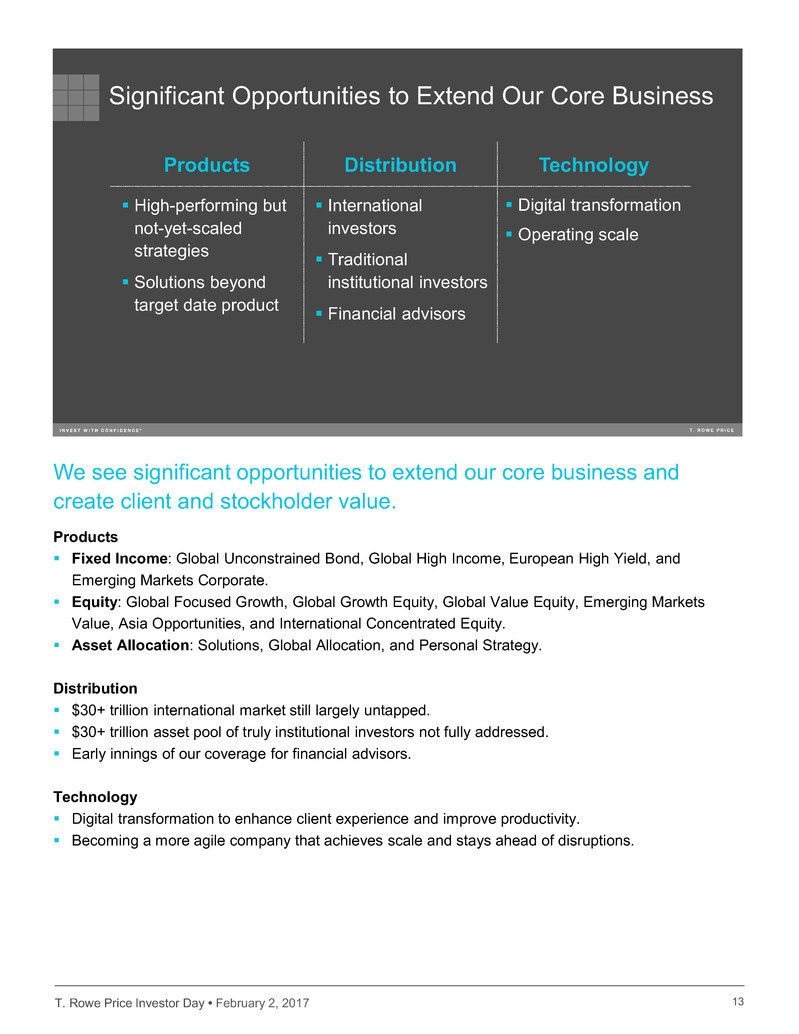

Significant Opportunities to Extend Our Core Business

Products Distribution Technology

High-performing but

not-yet-scaled

strategies

Solutions beyond

target date product

International

investors

Traditional

institutional investors

Financial advisors

Digital transformation

Operating scale

13

Products

Fixed Income: Global Unconstrained Bond, Global High Income, European High Yield, and

Emerging Markets Corporate.

Equity: Global Focused Growth, Global Growth Equity, Global Value Equity, Emerging Markets

Value, Asia Opportunities, and International Concentrated Equity.

Asset Allocation: Solutions, Global Allocation, and Personal Strategy.

Distribution

$30+ trillion international market still largely untapped.

$30+ trillion asset pool of truly institutional investors not fully addressed.

Early innings of our coverage for financial advisors.

Technology

Digital transformation to enhance client experience and improve productivity.

Becoming a more agile company that achieves scale and stays ahead of disruptions.

We see significant opportunities to extend our core business and

create client and stockholder value.

T. Rowe Price Investor Day • February 2, 2017

14

High-Performing, Not-yet-scaled Strategies

Global Unconstrained Bond

Outstanding Performance Over Two Years (Since Inception)

AUM: $1.7 Billion

Capacity: $10 Billion

Global Focused Growth Equity

Outstanding Performance Over Five Years (Since PM Inception)

AUM: $5 Billion

Capacity: $25 Billion

14

There are multiple other strategies on the previous slide that are very

similar – and more in earlier stages of operation.

T. Rowe Price Investor Day • February 2, 2017

15

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2016 2017P 2018P 2019P

Ad

ju

st

ed

O

pe

ra

tin

g

Ex

pe

ns

es

* (

$M

)

New Investment (High)

New Investment (Low)

Baseline Growth (Net 4%)

Baseline (2016)

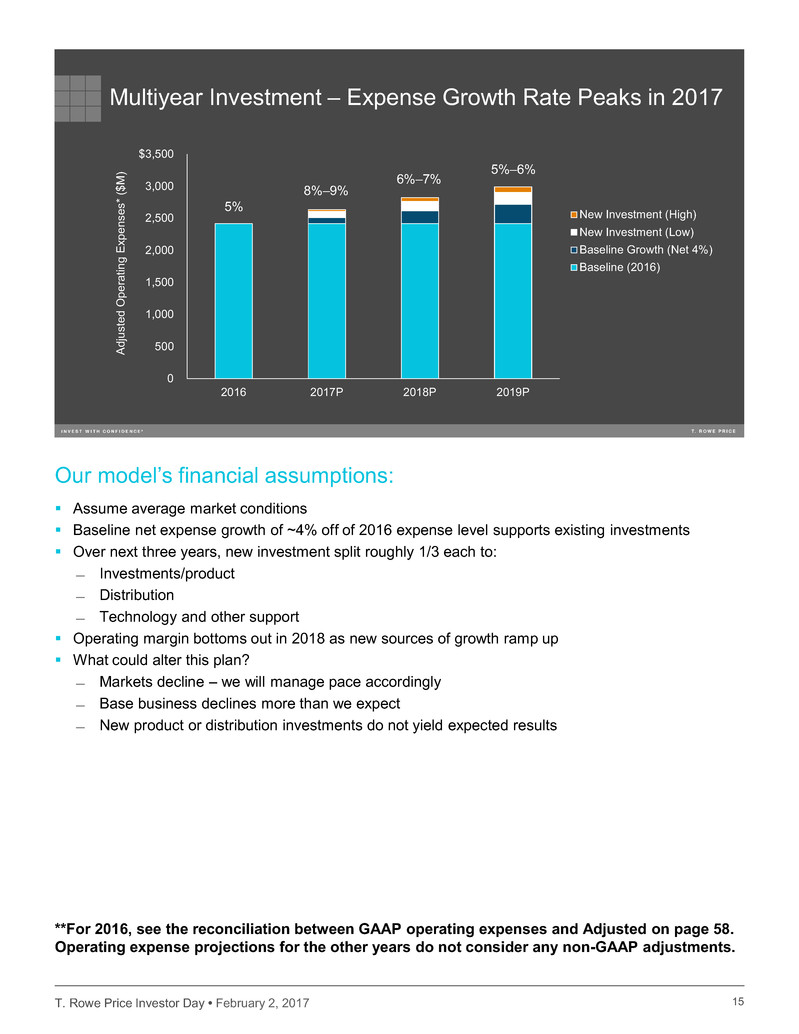

Multiyear Investment – Expense Growth Rate Peaks in 2017

5%

8%–9%

6%–7%

5%–6%

0

15

Assume average market conditions

Baseline net expense growth of ~4% off of 2016 expense level supports existing investments

Over next three years, new investment split roughly 1/3 each to:

̶ Investments/product

̶ Distribution

̶ Technology and other support

Operating margin bottoms out in 2018 as new sources of growth ramp up

What could alter this plan?

̶ Markets decline – we will manage pace accordingly

̶ Base business declines more than we expect

̶ New product or distribution investments do not yield expected results

Our model’s financial assumptions:

**For 2016, see the reconciliation between GAAP operating expenses and Adjusted on page 58.

Operating expense projections for the other years do not consider any non-GAAP adjustments.

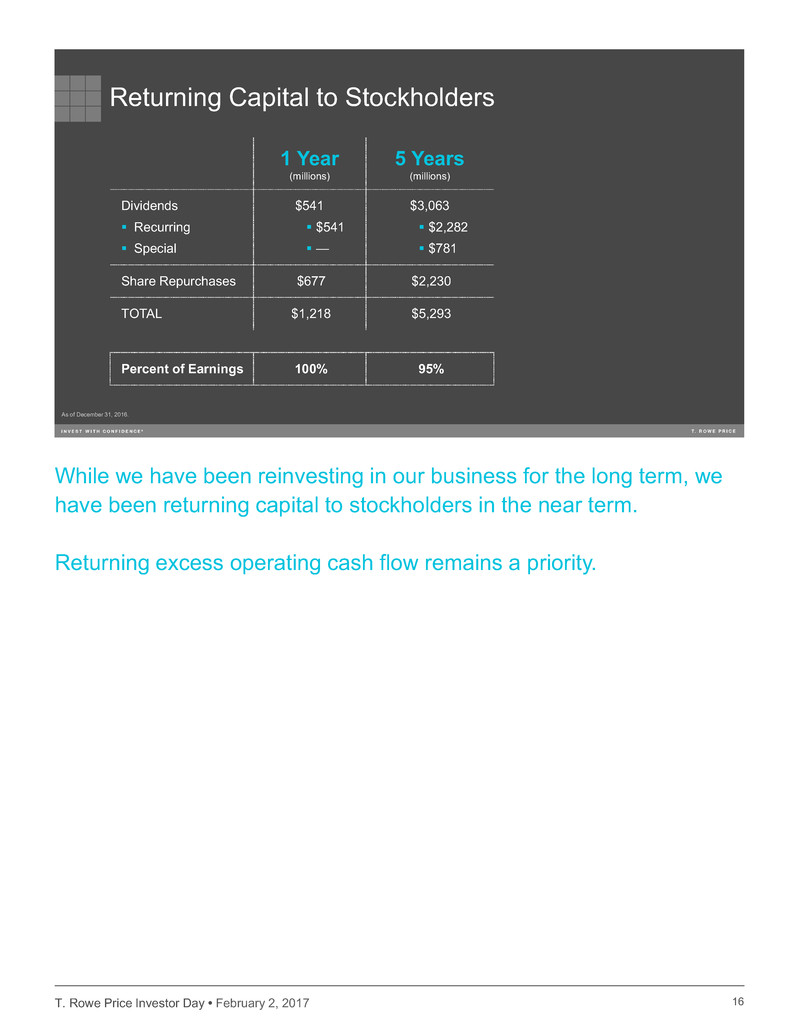

T. Rowe Price Investor Day • February 2, 2017 16

While we have been reinvesting in our business for the long term, we

have been returning capital to stockholders in the near term.

Returning excess operating cash flow remains a priority.

16

As of December 31, 2016.

Returning Capital to Stockholders

1 Year

(millions)

5 Years

(millions)

Dividends

Recurring

Special

$541

$541

—

$3,063

$2,282

$781

Share Repurchases $677 $2,230

TOTAL $1,218 $5,293

Percent of Earnings 100% 95%

T. Rowe Price Investor Day • February 2, 2017

17

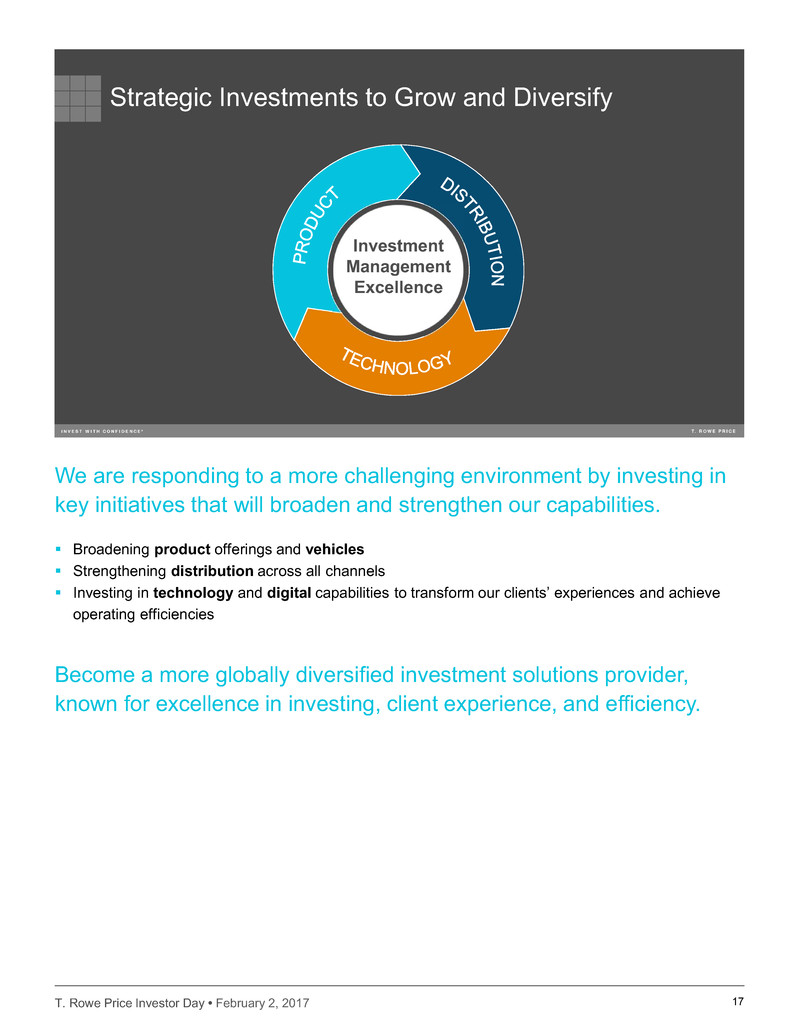

Strategic Investments to Grow and Diversify

Investment

Management

Excellence

17

Broadening product offerings and vehicles

Strengthening distribution across all channels

Investing in technology and digital capabilities to transform our clients’ experiences and achieve

operating efficiencies

We are responding to a more challenging environment by investing in

key initiatives that will broaden and strengthen our capabilities.

Become a more globally diversified investment solutions provider,

known for excellence in investing, client experience, and efficiency.

T. Rowe Price Investor Day • February 2, 2017

PRODUCT

CAPABILITIES

T. Rowe Price Investor Day

February 2, 2017

Robert Higginbotham,

Head of Global Investment Services

18

T. Rowe Price Investor Day • February 2, 2017

Key Dimensions of Product

290+

Funds

480+

Share

Classes

$1.3 b Seed Capital

10+

Vehicle

Types

Vehicle Product+ = Market RequirementsInvestment

100+

Investment

Disciplines

Equity Fixed

Income

Multi-

asset

40+

Regulators

54

Market Segments

4

Channels Countries

16

19

Product is the nexus of value creation between client needs and an asset manager’s capabilities

We have the platform in place to drive growth:

— All main asset classes covered

— More than 10 different vehicle types (U.S. mutual fund, SICAV, OEIC, separate account, sub-

advisory, etc.)

— Service clients in 54 market segments where a market segment is defined as a combination of

country (e.g., Australia) and distribution channel (e.g., institutional)

As we build a global business, we seek to create operating leverage through an efficient product

structure

Our corporate balance sheet strength is a significant competitive advantage

As of December 31, 2016.

T. Rowe Price Investor Day • February 2, 2017

0

10

20

30

40

50

60

70

-10 -8 -6 -4 -2 0 2 4 6 8 10 12 14 16

20

15

R

ev

en

ue

(b

ps

)

2015 Net Flows (%)

1 Active core equity includes U.S. large-cap equity; active core fixed income includes core, core plus, and municipal bonds; active specialty equity includes foreign, global, EM, and U.S. small-/mid-cap; active specialty fixed income includes global, EM, high yield,

TIPS, and unconstrained.

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

Market Trends in Product

North America net flow growth and revenue margin by asset class1

North America includes Canada and the United States of America

Active

Passive

Bubble size = 2015 AUM

Alternatives

Active Core

Fixed Income

Passive

Equity

Active Specialty

Fixed Income

Passive Other

Active Specialty

Equity

Active Core

Equity

Passive Fixed

Income

Alternatives

Money Market

Multi-asset

20

U.S. data – 50% total global market and in many sense U.S. leads global trends

While active as a category has seen headwinds, we continue to believe in high-quality active

management:

— We have the focus on quality and we remain dedicated to this line of business

— The revenue pools combined with the stock of assets and the replacement rate within the large

pools continues to present strong potential for commercial returns

— With the continued material funding gaps in defined benefit plans and with the under-saving in

much of the world in defined contribution and discretionary savings, the incremental return from

high-quality active management will be a vital component of successful outcomes for clients

Clients will continue to need high-quality exposure to all main asset classes, and we are well

positioned to deliver across the spectrum of equity and fixed income globally

We already have a material multi-asset solutions business, so we are well placed to benefit from

this trend in customer needs in all regions of the world

1 Active core equity includes U.S. large-cap equity; active core fixed income includes core, core plus, and municipal bonds; active specialty

equity includes foreign, global, EM, and U.S. small-/mid-cap; active specialty fixed income includes global, EM, high yield, TIPS, and

unconstrained.

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

T. Rowe Price Investor Day • February 2, 2017

Market Trends Affecting Product

Increased

Tailoring

Regulation

and Policy

PricingKey Product

Demand Drivers

21

Key Product Demand Drivers – We have existing products, recent launches, and new product plans

to continue to meet these:

— Separation of alpha and beta

— Absolute return

— Income

— Diversification

— Home market bias versus global opportunity set

Increased Tailoring – Many clients (particularly larger clients and consultants) are looking for

increased tailoring. We have the asset allocation and solutions capabilities and breadth of asset

classes to help clients in this area.

Pricing – We differentiate ourselves with our core philosophy to treat all customers fairly. We

recognize the pressures that exist in the marketplace and manage pricing discipline very carefully.

Regulation and Policy – We remain very involved in all regulatory developments and have

the scale in our business to respond to issues such as Brexit, MiFID II, money market reform, and

DOL.

T. Rowe Price Investor Day • February 2, 2017

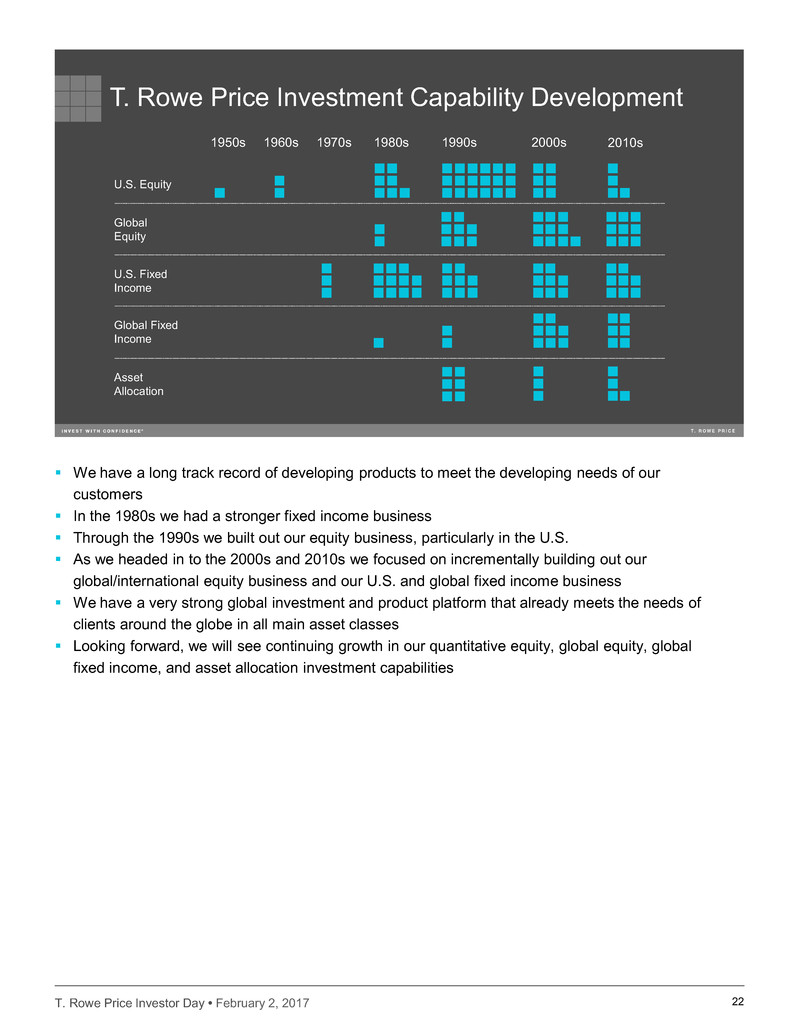

T. Rowe Price Investment Capability Development

U.S. Equity

Global

Equity

U.S. Fixed

Income

Global Fixed

Income

Asset

Allocation

1950s 1960s 1970s 2010s1980s 2000s1990s

22

We have a long track record of developing products to meet the developing needs of our

customers

In the 1980s we had a stronger fixed income business

Through the 1990s we built out our equity business, particularly in the U.S.

As we headed in to the 2000s and 2010s we focused on incrementally building out our

global/international equity business and our U.S. and global fixed income business

We have a very strong global investment and product platform that already meets the needs of

clients around the globe in all main asset classes

Looking forward, we will see continuing growth in our quantitative equity, global equity, global

fixed income, and asset allocation investment capabilities

T. Rowe Price Investor Day • February 2, 2017

Mapping Investment Capabilities to Client Needs

Client Need

Income –

All Asset

Classes

Higher-

Conviction

Strategies

Domestic

for EMEA

and APAC

Global

Fixed

Income

Absolute

Return

Solutions

and

Retirement

In

ve

st

m

en

t C

ap

ab

ili

tie

s Income

Absolute Return

Alpha and Beta Separation

Diversification

Home Market Bias

2017 developments Product ideas in R&D

23

Recent Developments

Buildout of quantitative equity product range across U.S. equity and global equity

European high yield managed income

Buy and maintain fixed income

U.S. total return fixed income

Multi-asset retirement income 2020

Income solution for UK advisory network

Global equity income

Customized retirement date solution for individual clients

Working on target date funds for South Korea

Global allocation for EMEA

T. Rowe Price Investor Day • February 2, 2017

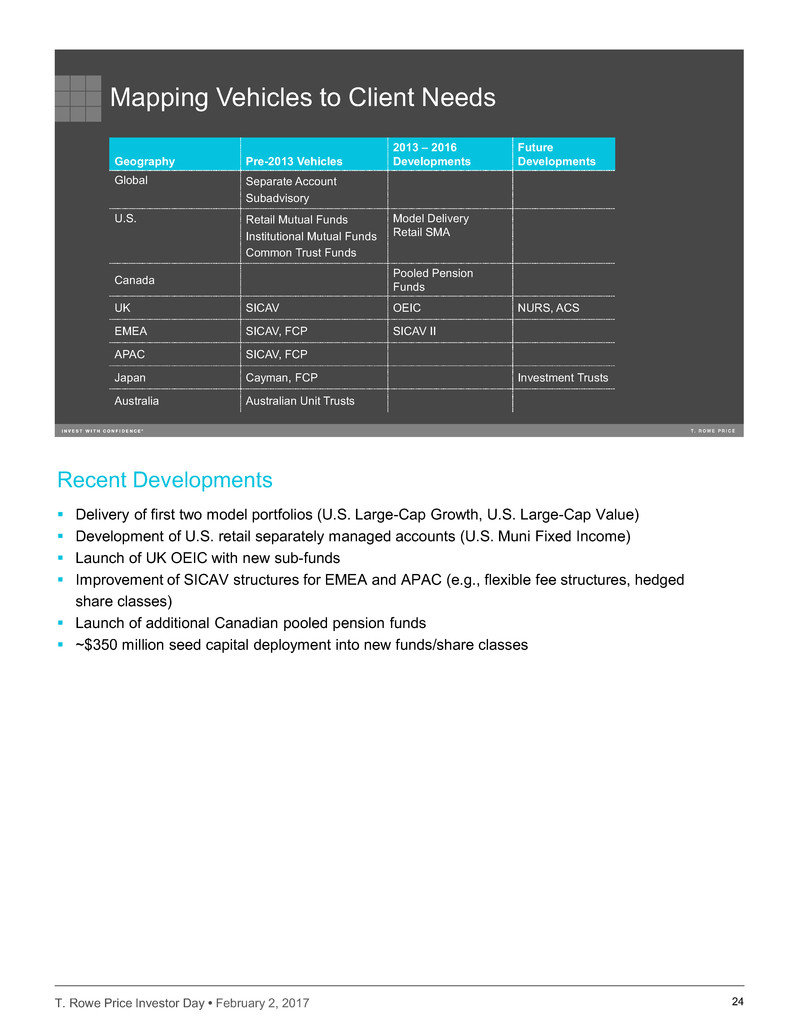

Mapping Vehicles to Client Needs

Geography Pre-2013 Vehicles

2013 – 2016

Developments

Future

Developments

Global Separate Account

Subadvisory

U.S. Retail Mutual Funds

Institutional Mutual Funds

Common Trust Funds

Model Delivery

Retail SMA

Canada Pooled PensionFunds

UK SICAV OEIC NURS, ACS

EMEA SICAV, FCP SICAV II

APAC SICAV, FCP

Japan Cayman, FCP Investment Trusts

Australia Australian Unit Trusts

24

Recent Developments

Delivery of first two model portfolios (U.S. Large-Cap Growth, U.S. Large-Cap Value)

Development of U.S. retail separately managed accounts (U.S. Muni Fixed Income)

Launch of UK OEIC with new sub-funds

Improvement of SICAV structures for EMEA and APAC (e.g., flexible fee structures, hedged

share classes)

Launch of additional Canadian pooled pension funds

~$350 million seed capital deployment into new funds/share classes

T. Rowe Price Investor Day • February 2, 2017 25

Summary

High-quality

active is a

durable theme

Future plans

aligned to

client needs

Significant

platform in

place for growth

Market trends

benefit global,

scale players

like T. Rowe Price

T. Rowe Price Investor Day • February 2, 2017 26

MULTI-ASSET

INVESTMENT

CAPABILITIES

T. Rowe Price Investor Day

February 2, 2017

Sebastien Page, CFA

Head of Asset Allocation

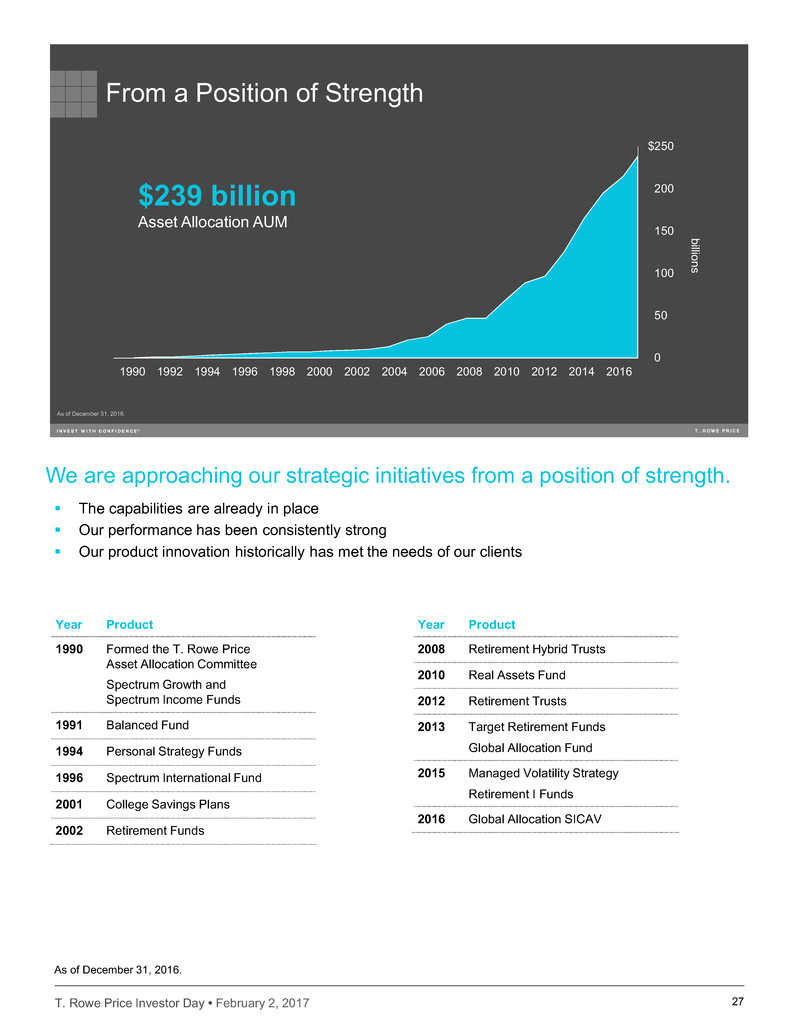

T. Rowe Price Investor Day • February 2, 2017 27

Year Product

1990 Formed the T. Rowe Price

Asset Allocation Committee

Spectrum Growth and

Spectrum Income Funds

1991 Balanced Fund

1994 Personal Strategy Funds

1996 Spectrum International Fund

2001 College Savings Plans

2002 Retirement Funds

The capabilities are already in place

Our performance has been consistently strong

Our product innovation historically has met the needs of our clients

We are approaching our strategic initiatives from a position of strength.

Year Product

2008 Retirement Hybrid Trusts

2010 Real Assets Fund

2012 Retirement Trusts

2013 Target Retirement Funds

Global Allocation Fund

2015 Managed Volatility Strategy

Retirement I Funds

2016 Global Allocation SICAV

27

As of December 31, 2016.

From a Position of Strength

$0

$50

$100

$150

$200

$250

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016

$239 billion

Asset Allocation AUM

billions

As of December 31, 2016.

T. Rowe Price Investor Day • February 2, 2017 28

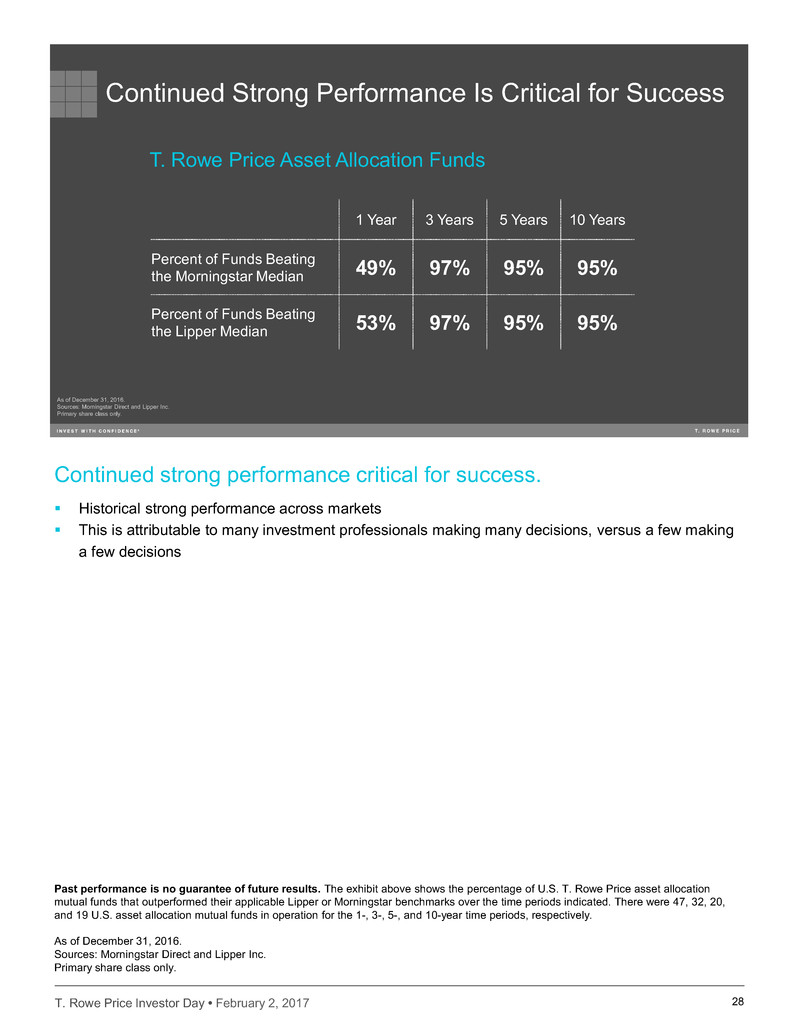

Historical strong performance across markets

This is attributable to many investment professionals making many decisions, versus a few making

a few decisions

Continued strong performance critical for success.

28

As of December 31, 2016.

Sources: Morningstar Direct and Lipper Inc.

Primary share class only.

Continued Strong Performance Is Critical for Success

T. Rowe Price Asset Allocation Funds

1 Year 3 Years 5 Years 10 Years

Percent of Funds Beating

the Morningstar Median 49% 97% 95% 95%

Percent of Funds Beating

the Lipper Median 53% 97% 95% 95%

Past performance is no guarantee of future results. The exhibit above shows the percentage of U.S. T. Rowe Price asset allocation

mutual funds that outperformed their applicable Lipper or Morningstar benchmarks over the time periods indicated. There were 47, 32, 20,

and 19 U.S. asset allocation mutual funds in operation for the 1-, 3-, 5-, and 10-year time periods, respectively.

As of December 31, 2016.

Sources: Morningstar Direct and Lipper Inc.

Primary share class only.

T. Rowe Price Investor Day • February 2, 2017 29

As of December 31, 2016.

Leveraging the investment process below, we are delivering multi-asset

advice, portfolio diagnostics, and customized investment solutions to

clients, financial advisors, and intermediaries across the globe.

29

We Have the Fundamentals in Place

Strategic

Portfolio

Design

Tactical

Asset

Allocation

Active Security

Selection

Strategic Portfolio Design

Utilize a range of analysis based

upon each strategy’s unique

objectives, targeted risk/return

profile, client guidelines, and the

range of underlying asset classes

and sectors.

Tactical Asset Allocation

Asset Allocation Committee’s

tactical decisions to overweight

or underweight asset classes and

sectors based on relative

valuation opportunities over a 6-

to 18-month outlook for global

financial markets.

Active Security Selection

Portfolio managers are

responsible for oversight and

management of each underlying

strategy through diversified

approaches, with

an emphasis on actively

managed strategies that leverage

T. Rowe Price’s global team of

more than 250 portfolio

managers and analysts.

T. Rowe Price Investor Day • February 2, 2017 30

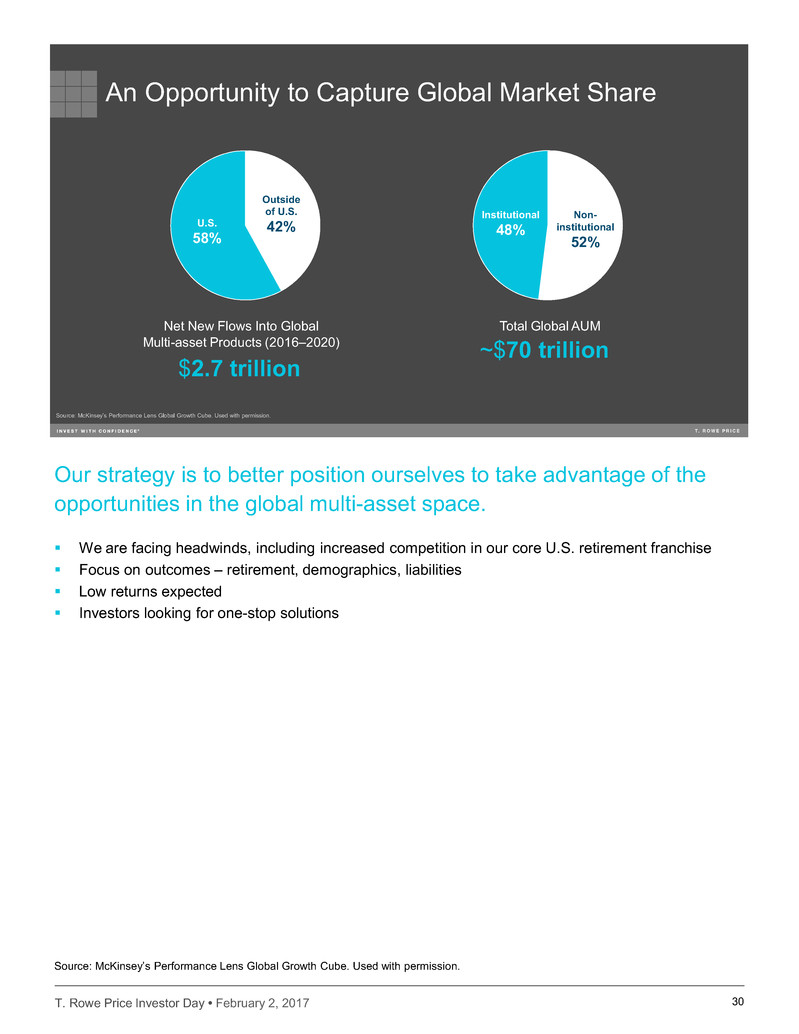

Our strategy is to better position ourselves to take advantage of the

opportunities in the global multi-asset space.

We are facing headwinds, including increased competition in our core U.S. retirement franchise

Focus on outcomes – retirement, demographics, liabilities

Low returns expected

Investors looking for one-stop solutions

30

An Opportunity to Capture Global Market Share

Net New Flows Into Global

Multi-asset Products (2016–2020)

Total Global AUM

Institutional

48%

Non-

institutional

52%

$2.7 trillion

~$70 trillion

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

U.S.

58%

Outside

of U.S.

42%

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

T. Rowe Price Investor Day • February 2, 2017 31

31

Focusing on Three Key Initiatives

Maintain

Retirement

Leadership

Expand

Global

Presence

Broaden

Solutions

Capabilities

Our overarching goals are to expand our multi-asset presence globally,

while maintaining our leadership in our retirement franchise.

Our brand is consistent with being a “trusted advisor”

Collaboration, a key element in effective solutions, is a competitive advantage of ours

T. Rowe Price Investor Day • February 2, 2017 32

Product

Delivering customized multi-asset solutions

Exploring an alternative strategies vehicle

Offering custom glide path and customer target date capabilities

Technology

Upgrading multi-asset investment platform to reduce risk, increase scale, and

enable product innovation

Upgrading our risk model system

Hiring key strategic positions to strengthen the partnership between the research

and technology teams

People

More than doubling the size of our dedicated multi-asset investment

professional staff

Adding dedicated multi-asset support staff

Building regional consultative teams in Europe and Asia

Investment in multi-asset increasing to accommodate shifting client

objectives/needs.

32

Multi-asset Investment Increasing

ProductTechnology

People

Enhanced and

Innovative Capabilities

T. Rowe Price Investor Day • February 2, 2017 33

33

Key Takeaways

Headwinds

Present

Opportunities

to Diversify

Position of

Strength

Time for

Execution

T. Rowe Price Investor Day • February 2, 2017 34

INDIVIDUAL AND

RETIREMENT

PLAN SERVICES

T. Rowe Price Investor Day

February 2, 2017

Scott David,

Head of Individual and Retirement Plan Services

T. Rowe Price Investor Day • February 2, 2017

35

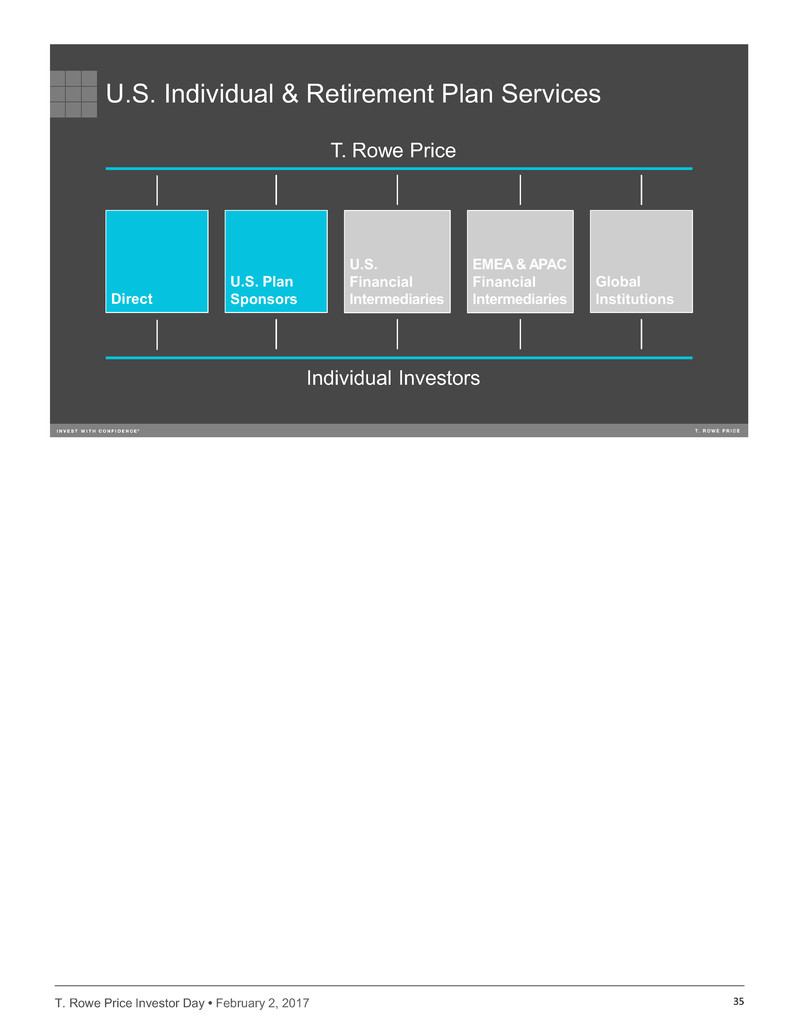

U.S. Individual & Retirement Plan Services

T. Rowe Price

U.S. Plan

Sponsors

Global

Institutions

Individual Investors

U.S.

Financial

Intermediaries

EMEA & APAC

Financial

IntermediariesDirect

35

T. Rowe Price Investor Day • February 2, 2017 36

Products

Investment capabilities

Historically strong

performance

Distribution

Client segments

Products and vehicles

Technology

Operating scale

Digital transformation

36

Investing for the Future

Products

Technology

Distribution

IRPS

Individual and Retirement Plan Services brings together:

These investments allow us to:

1. Protect and support our large existing client base

2. Take advantage of growth opportunities

3. Grow our operating scale and efficiency

T. Rowe Price Investor Day • February 2, 2017 37

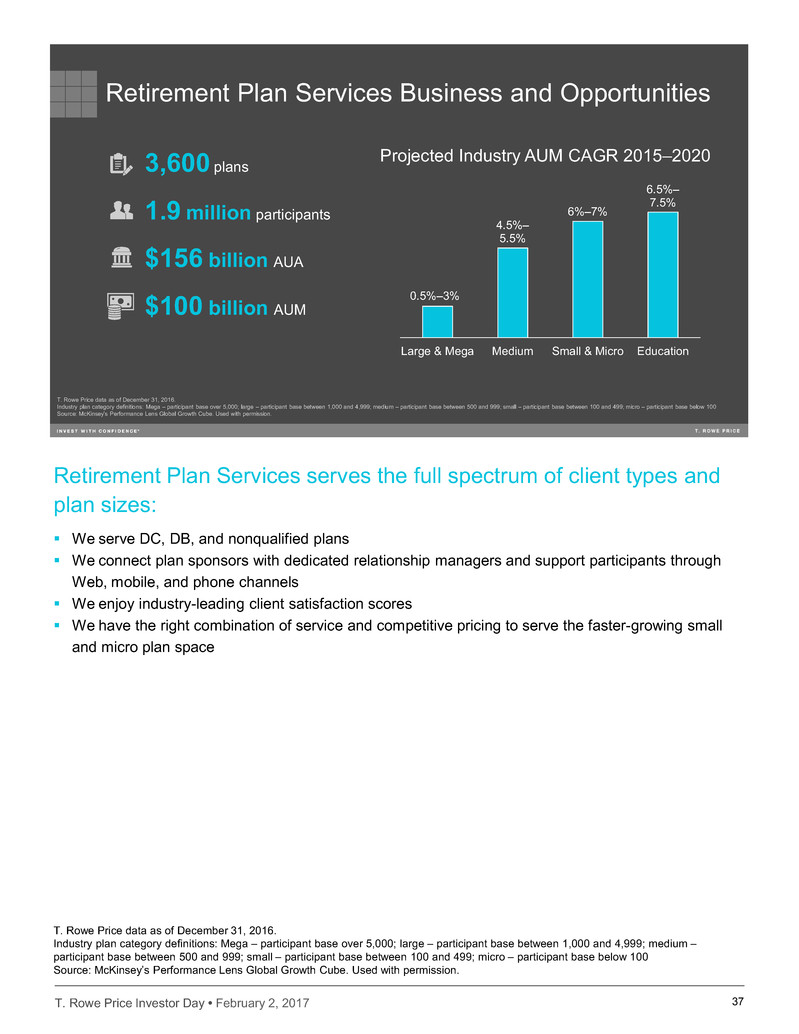

37

T. Rowe Price data as of December 31, 2016.

Industry plan category definitions: Mega – participant base over 5,000; large – participant base between 1,000 and 4,999; medium – participant base between 500 and 999; small – participant base between 100 and 499; micro – participant base below 100

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

Retirement Plan Services Business and Opportunities

0.5%–3%

4.5%–

5.5%

6%–7%

6.5%–

7.5%

Large & Mega Medium Small & Micro Education

3,600 plans

1.9 million participants

$156 billion AUA

$100 billion AUM

Projected Industry AUM CAGR 2015–2020

Retirement Plan Services serves the full spectrum of client types and

plan sizes:

We serve DC, DB, and nonqualified plans

We connect plan sponsors with dedicated relationship managers and support participants through

Web, mobile, and phone channels

We enjoy industry-leading client satisfaction scores

We have the right combination of service and competitive pricing to serve the faster-growing small

and micro plan space

T. Rowe Price data as of December 31, 2016.

Industry plan category definitions: Mega – participant base over 5,000; large – participant base between 1,000 and 4,999; medium –

participant base between 500 and 999; small – participant base between 100 and 499; micro – participant base below 100

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

T. Rowe Price Investor Day • February 2, 2017 38

We are focused on capturing the biggest opportunities:

Bring together recordkeeping, sponsor and participant support, and strong asset management

capabilities to drive better outcomes for individuals

Expand our sales teams in a targeted way

Example: We are significantly expanding our small market sales and marketing efforts, along with

targeted hiring for our large and mega plan team.

Continue our multiyear commitment to invest in our technology platform to both increase operating

efficiency and deliver better client outcomes

Deliver innovative enhancements to the client experience across channels so they can engage with

us when and how they choose

Example: Marrying client account data with animation to deliver personalized, engaging video

experiences that encourage clients to take action on areas like asset allocation or increasing

contribution rates.

38

Products

Capture the asset

management

opportunity

Capturing Opportunities in Retirement Plan Services

Distribution

Retain current

clients

Invest in talent to

accelerate growth

in key segments

Technology

Operational scale

Plan sponsor digital

experience

Participant digital

experience

T. Rowe Price Investor Day • February 2, 2017 39

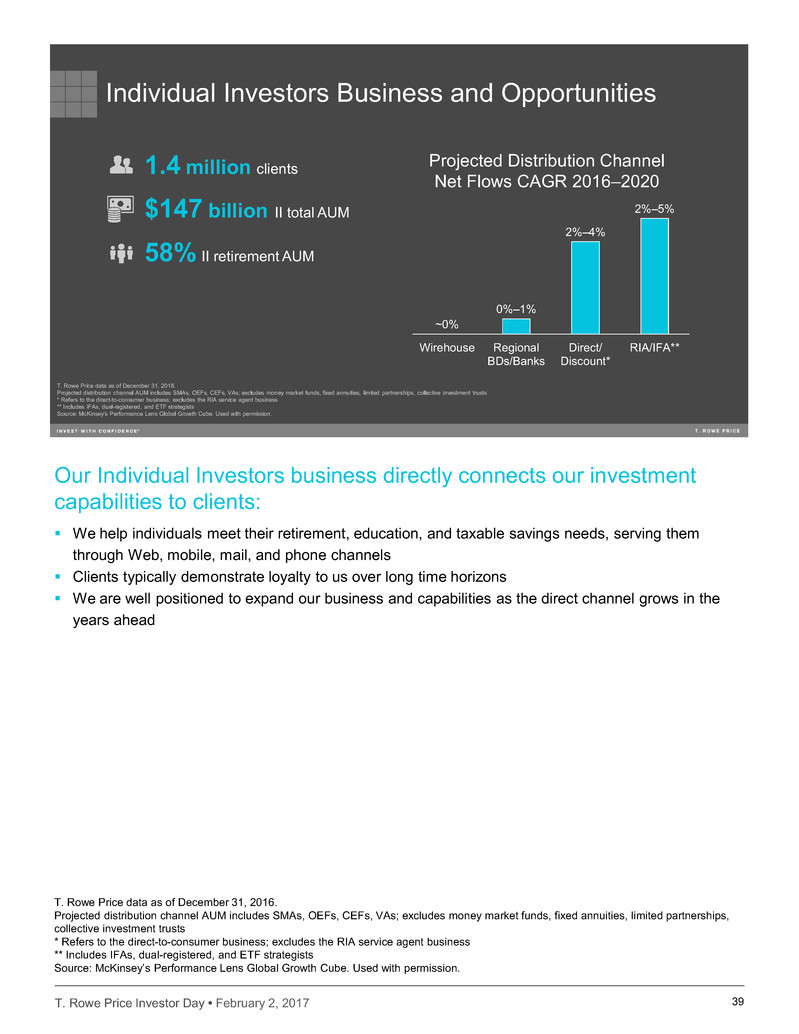

Our Individual Investors business directly connects our investment

capabilities to clients:

We help individuals meet their retirement, education, and taxable savings needs, serving them

through Web, mobile, mail, and phone channels

Clients typically demonstrate loyalty to us over long time horizons

We are well positioned to expand our business and capabilities as the direct channel grows in the

years ahead

39

T. Rowe Price data as of December 31, 2016.

Projected distribution channel AUM includes SMAs, OEFs, CEFs, VAs; excludes money market funds, fixed annuities, limited partnerships, collective investment trusts

* Refers to the direct-to-consumer business; excludes the RIA service agent business

** Includes IFAs, dual-registered, and ETF strategists

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

Individual Investors Business and Opportunities

58% II retirement AUM

1.4 million clients

$147 billion II total AUM

~0%

0%–1%

2%–4%

2%–5%

Wirehouse Regional

BDs/Banks

Direct/

Discount*

RIA/IFA**

Projected Distribution Channel

Net Flows CAGR 2016–2020

T. Rowe Price data as of December 31, 2016.

Projected distribution channel AUM includes SMAs, OEFs, CEFs, VAs; excludes money market funds, fixed annuities, limited partnerships,

collective investment trusts

* Refers to the direct-to-consumer business; excludes the RIA service agent business

** Includes IFAs, dual-registered, and ETF strategists

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

T. Rowe Price Investor Day • February 2, 2017 40

We are focused on capturing the biggest opportunities:

Expand our advice offerings to meet emerging client demand for digital advice

Example: Our T. Rowe Price® ActivePlus Portfolios brings a new, digitally enabled discretionary

advice offering to the market for portfolios with $50,000 or more – with clients only paying the

underlying management fees for the funds. The offering is currently in beta and will be rolled out

publicly in early 2017.

Strengthen our relationship management capabilities especially among high-value clients

Example: We are introducing dedicated relationship management to our high-value clients,

deepening our connection with them, and ensuring we provide the right products and services

to allow them to meet their goals and objectives.

Deliver the same high-quality experience online as we have delivered via phone for years

40

Products

No-load mutual funds

Spectrum of advice

capabilities

Launch T. Rowe

Price® ActivePlus

Portfolios

Capturing Opportunities With Individual Investors

Distribution

Expand our service

capabilities in key

segments

Technology

Operational scale

Digital experience

Launch T. Rowe

Price® ActivePlus

Portfolios

T. Rowe Price Investor Day • February 2, 2017 41

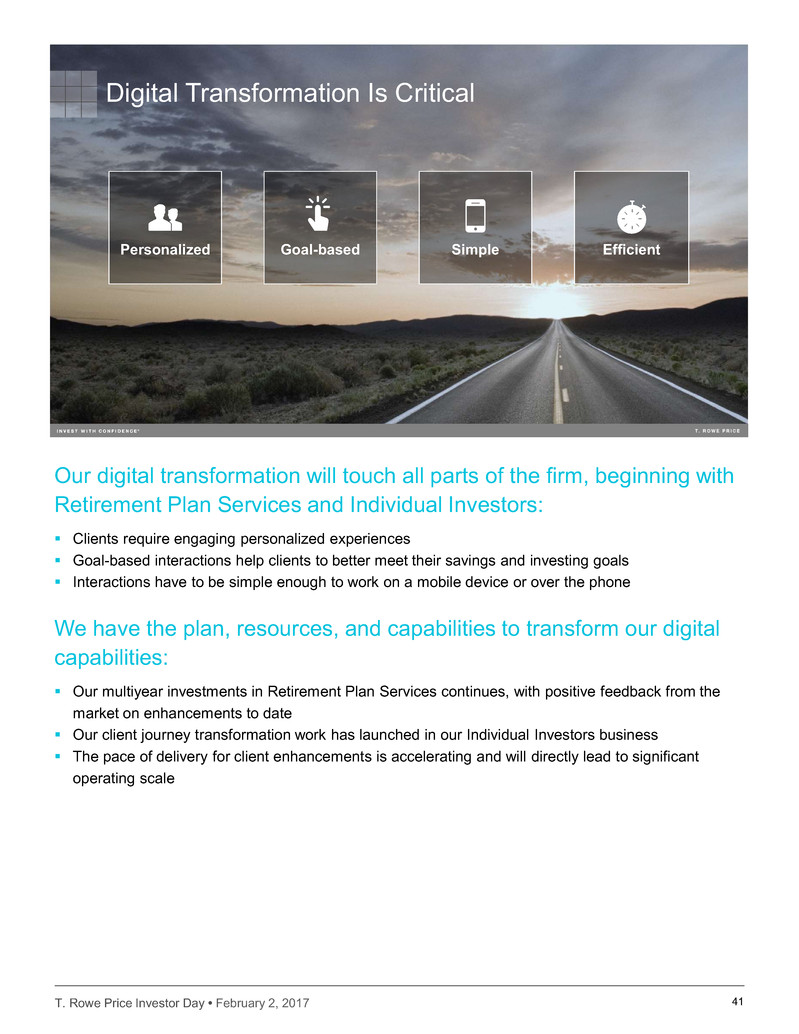

Our digital transformation will touch all parts of the firm, beginning with

Retirement Plan Services and Individual Investors:

Clients require engaging personalized experiences

Goal-based interactions help clients to better meet their savings and investing goals

Interactions have to be simple enough to work on a mobile device or over the phone

We have the plan, resources, and capabilities to transform our digital

capabilities:

Our multiyear investments in Retirement Plan Services continues, with positive feedback from the

market on enhancements to date

Our client journey transformation work has launched in our Individual Investors business

The pace of delivery for client enhancements is accelerating and will directly lead to significant

operating scale

41

Digital Transformation Is Critical

Goal-based SimplePersonalized Efficient

T. Rowe Price Investor Day • February 2, 2017

U.S.

INTERMEDIARIES

T. Rowe Price Investor Day

February 2, 2017

George Riedel,

Head of U.S. Intermediaries

42

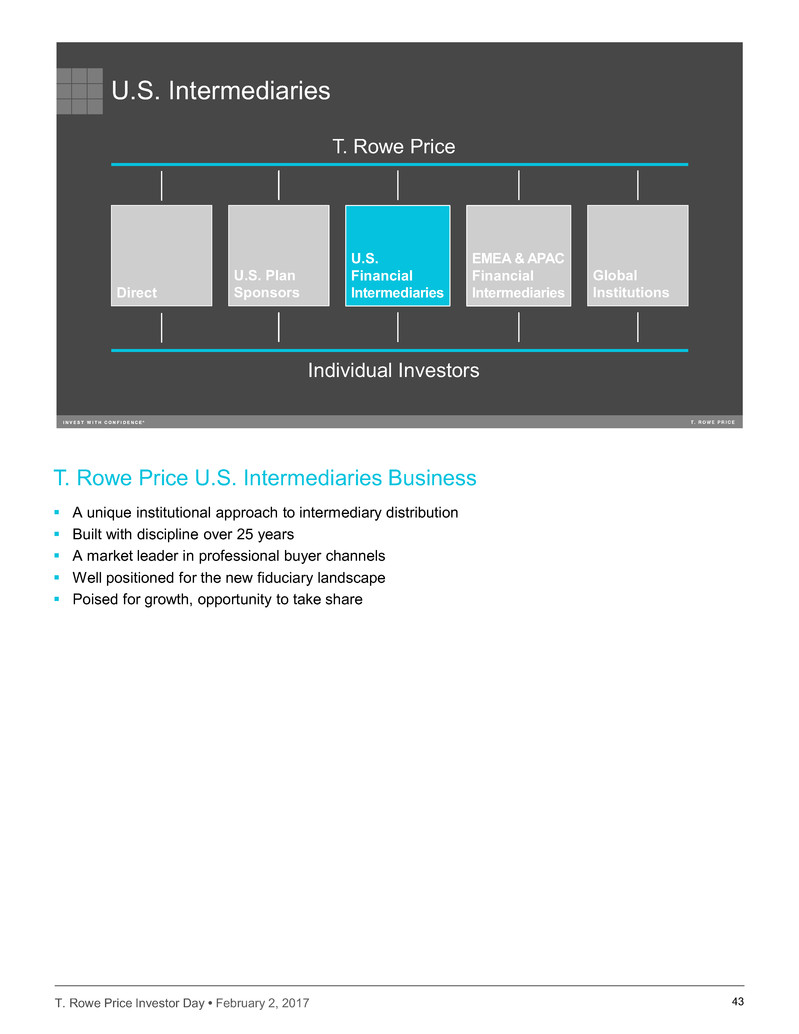

T. Rowe Price Investor Day • February 2, 2017

U.S. Intermediaries

T. Rowe Price

U.S. Plan

Sponsors

Global

Institutions

Individual Investors

U.S.

Financial

Intermediaries

EMEA & APAC

Financial

IntermediariesDirect

43

T. Rowe Price U.S. Intermediaries Business

A unique institutional approach to intermediary distribution

Built with discipline over 25 years

A market leader in professional buyer channels

Well positioned for the new fiduciary landscape

Poised for growth, opportunity to take share

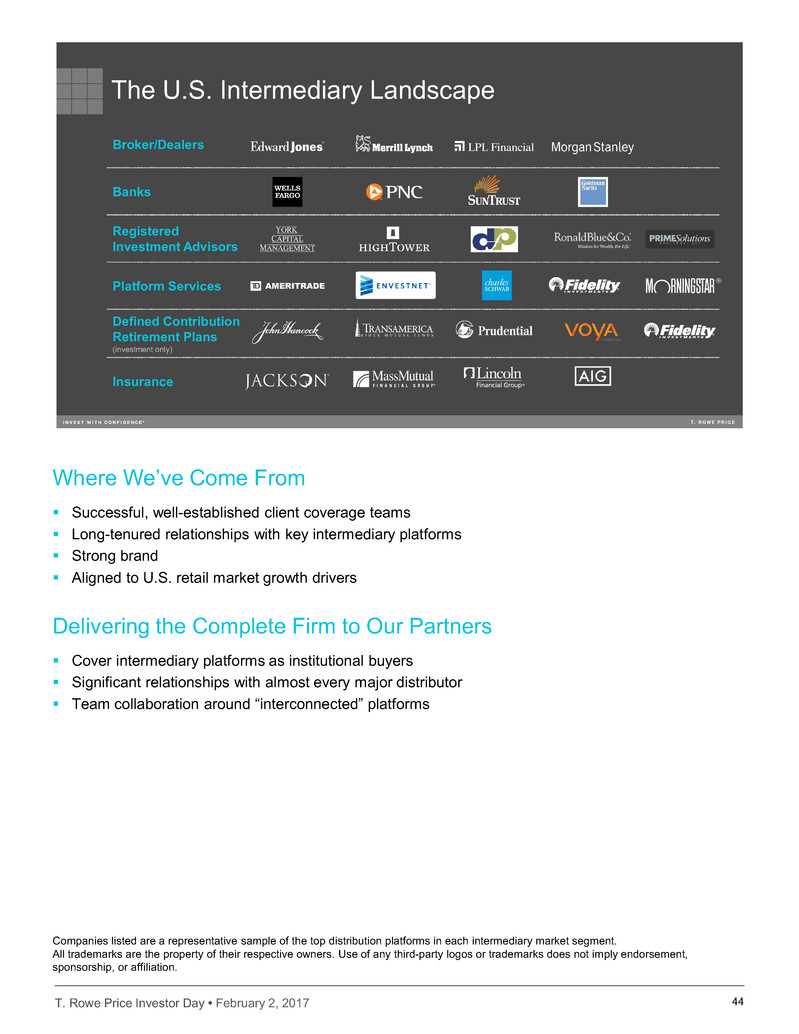

T. Rowe Price Investor Day • February 2, 2017 44

Broker/Dealers

Banks

Registered

Investment Advisors

Platform Services

Defined Contribution

Retirement Plans

(investment only)

Insurance

The U.S. Intermediary Landscape

Where We’ve Come From

Successful, well-established client coverage teams

Long-tenured relationships with key intermediary platforms

Strong brand

Aligned to U.S. retail market growth drivers

Delivering the Complete Firm to Our Partners

Cover intermediary platforms as institutional buyers

Significant relationships with almost every major distributor

Team collaboration around “interconnected” platforms

Companies listed are a representative sample of the top distribution platforms in each intermediary market segment.

All trademarks are the property of their respective owners. Use of any third-party logos or trademarks does not imply endorsement,

sponsorship, or affiliation.

T. Rowe Price Investor Day • February 2, 2017 45

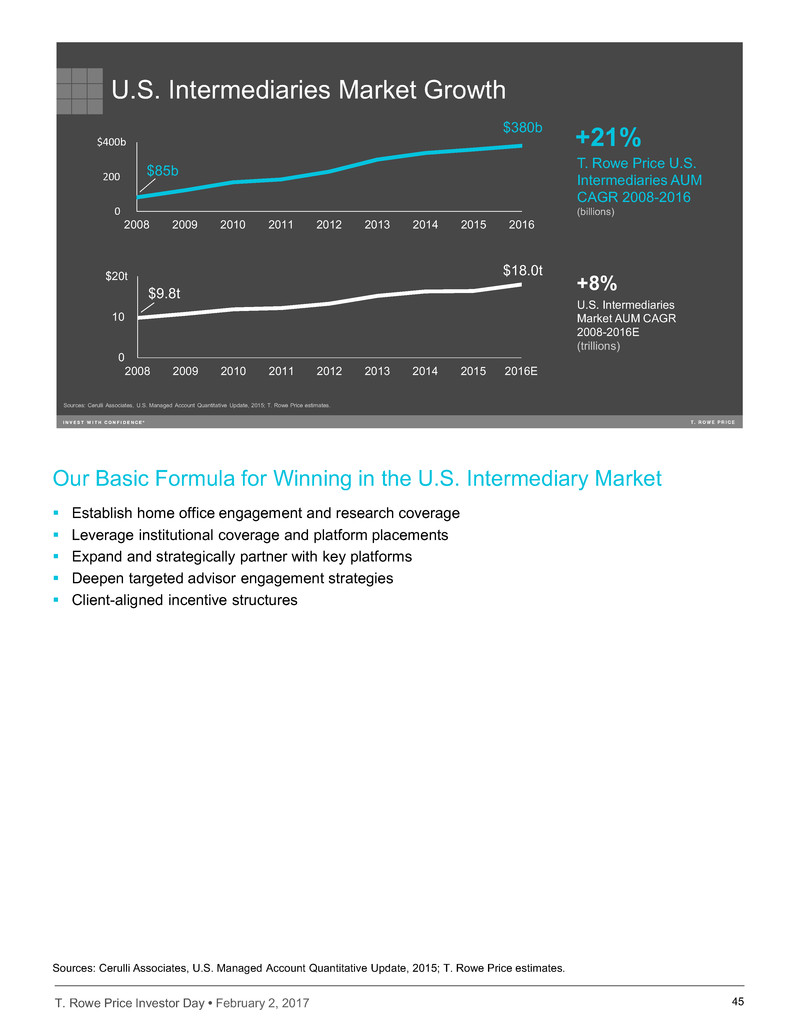

Sources: Cerulli Associates, U.S. Managed Account Quantitative Update, 2015; T. Rowe Price estimates.

U.S. Intermediaries Market Growth

$0t

$10t

$20t

2008 2009 2010 2011 2012 2013 2014 2015 2016E

+21%

+8%

U.S. Intermediaries

Market AUM CAGR

2008-2016E

(trillions)

T. Rowe Price U.S.

Intermediaries AUM

CAGR 2008-2016

(billions)$0b

$200b

$400b

2008 2009 2010 2011 2012 2013 2014 2015 2016

$380b

$85b

$18.0t

$9.8t

Our Basic Formula for Winning in the U.S. Intermediary Market

Establish home office engagement and research coverage

Leverage institutional coverage and platform placements

Expand and strategically partner with key platforms

Deepen targeted advisor engagement strategies

Client-aligned incentive structures

Sources: Cerulli Associates, U.S. Managed Account Quantitative Update, 2015; T. Rowe Price estimates.

T. Rowe Price Investor Day • February 2, 2017 46

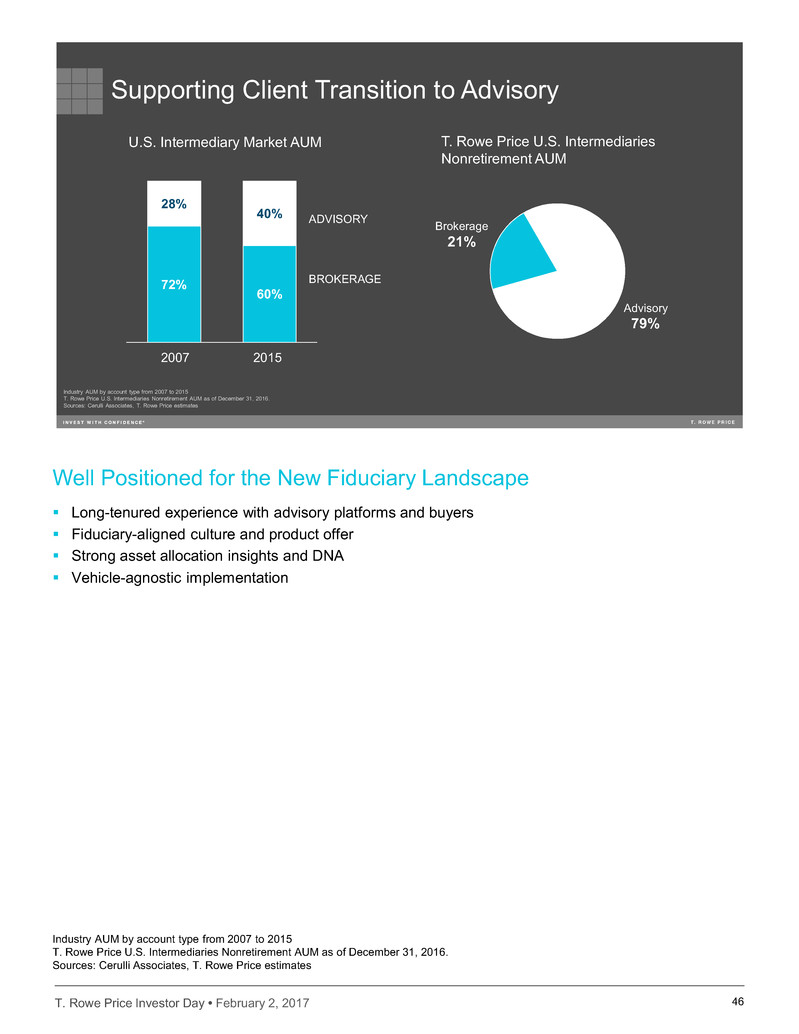

Industry AUM by account type from 2007 to 2015

T. Rowe Price U.S. Intermediaries Nonretirement AUM as of December 31, 2016.

Sources: Cerulli Associates, T. Rowe Price estimates

Supporting Client Transition to Advisory

Advisory

79%

U.S. Intermediary Market AUM

72%

60%

28%

40% ADVISORY

BROKERAGE

T. Rowe Price U.S. Intermediaries

Nonretirement AUM

Brokerage

21%

2007 2015

Well Positioned for the New Fiduciary Landscape

Long-tenured experience with advisory platforms and buyers

Fiduciary-aligned culture and product offer

Strong asset allocation insights and DNA

Vehicle-agnostic implementation

Industry AUM by account type from 2007 to 2015

T. Rowe Price U.S. Intermediaries Nonretirement AUM as of December 31, 2016.

Sources: Cerulli Associates, T. Rowe Price estimates

T. Rowe Price Investor Day • February 2, 2017

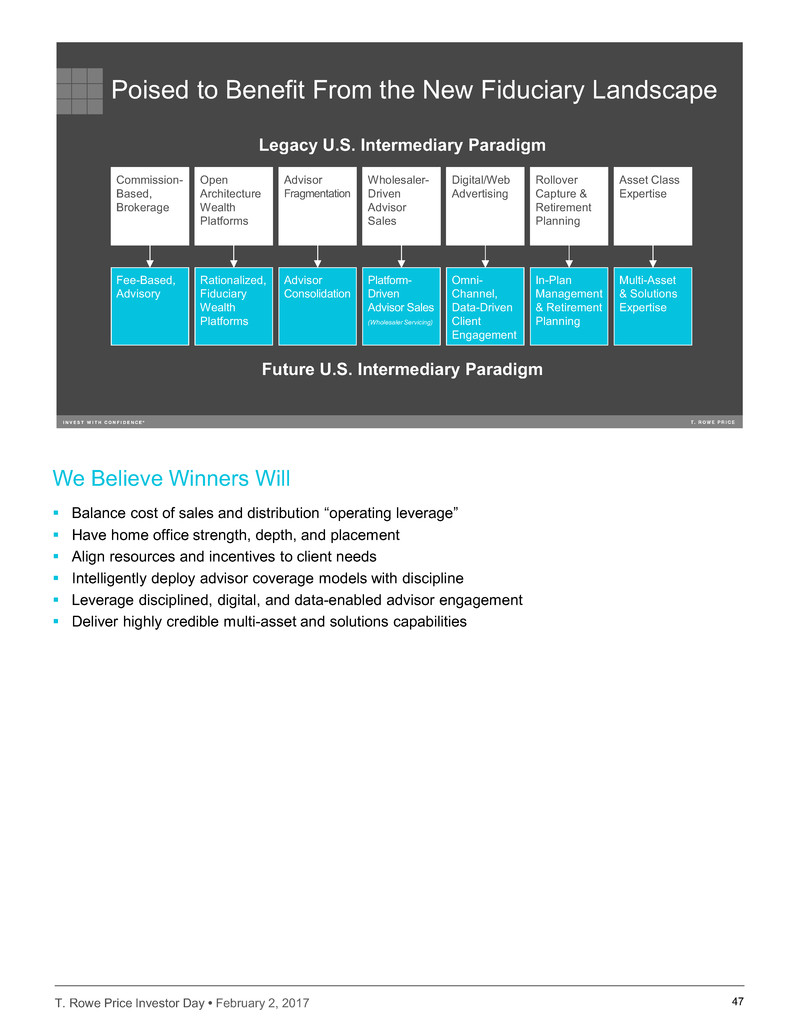

Poised to Benefit From the New Fiduciary Landscape

Fee-Based,

Advisory

Rationalized,

Fiduciary

Wealth

Platforms

Platform-

Driven

Advisor Sales

(Wholesaler Servicing)

In-Plan

Management

& Retirement

Planning

Advisor

Consolidation

Omni-

Channel,

Data-Driven

Client

Engagement

Multi-Asset

& Solutions

Expertise

Commission-

Based,

Brokerage

Open

Architecture

Wealth

Platforms

Wholesaler-

Driven

Advisor

Sales

Rollover

Capture &

Retirement

Planning

Advisor

Fragmentation

Digital/Web

Advertising

Asset Class

Expertise

Legacy U.S. Intermediary Paradigm

Future U.S. Intermediary Paradigm

47

We Believe Winners Will

Balance cost of sales and distribution “operating leverage”

Have home office strength, depth, and placement

Align resources and incentives to client needs

Intelligently deploy advisor coverage models with discipline

Leverage disciplined, digital, and data-enabled advisor engagement

Deliver highly credible multi-asset and solutions capabilities

T. Rowe Price Investor Day • February 2, 2017 48

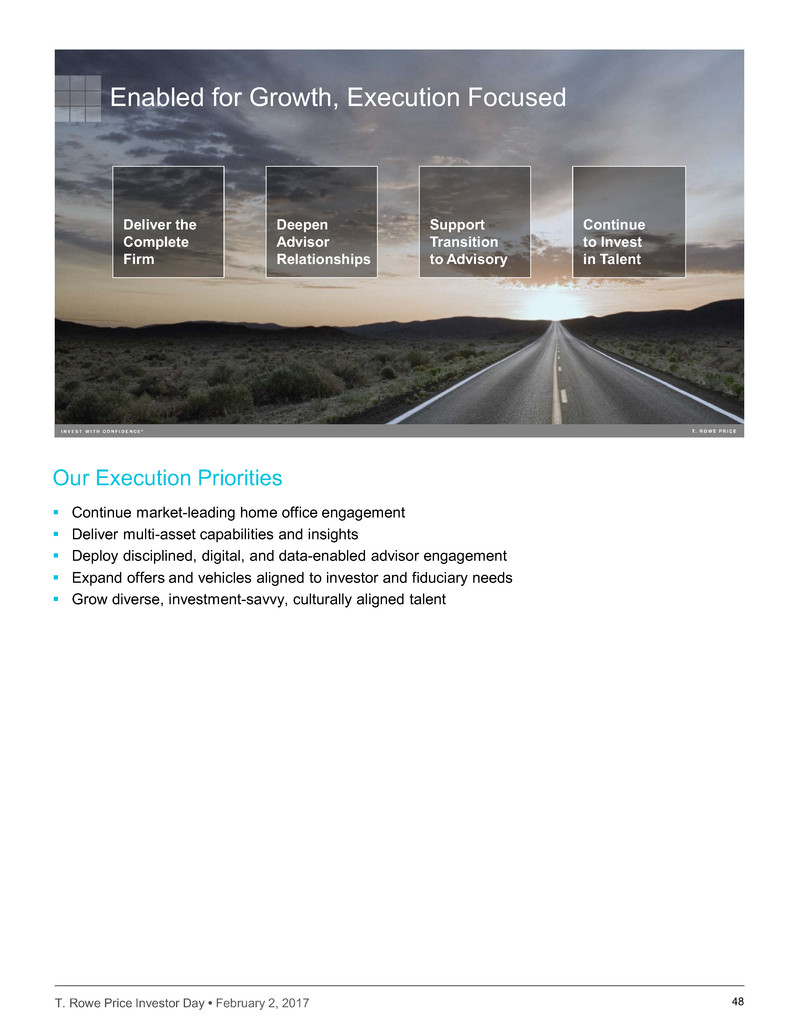

Enabled for Growth, Execution Focused

Deepen

Advisor

Relationships

Support

Transition

to Advisory

Deliver the

Complete

Firm

Continue

to Invest

in Talent

Our Execution Priorities

Continue market-leading home office engagement

Deliver multi-asset capabilities and insights

Deploy disciplined, digital, and data-enabled advisor engagement

Expand offers and vehicles aligned to investor and fiduciary needs

Grow diverse, investment-savvy, culturally aligned talent

T. Rowe Price Investor Day • February 2, 2017

GLOBAL

INVESTMENT

SERVICES

T. Rowe Price Investor Day

February 2, 2017

Robert Higginbotham,

Head of Global Investment Services

49

T. Rowe Price Investor Day • February 2, 2017

Global Investment Services

T. Rowe Price

U.S. Plan

Sponsors

Global

Institutions

Individual Investors

U.S.

Financial

Intermediaries

EMEA & APAC

Financial

IntermediariesDirect

50

T. Rowe Price Investor Day • February 2, 2017

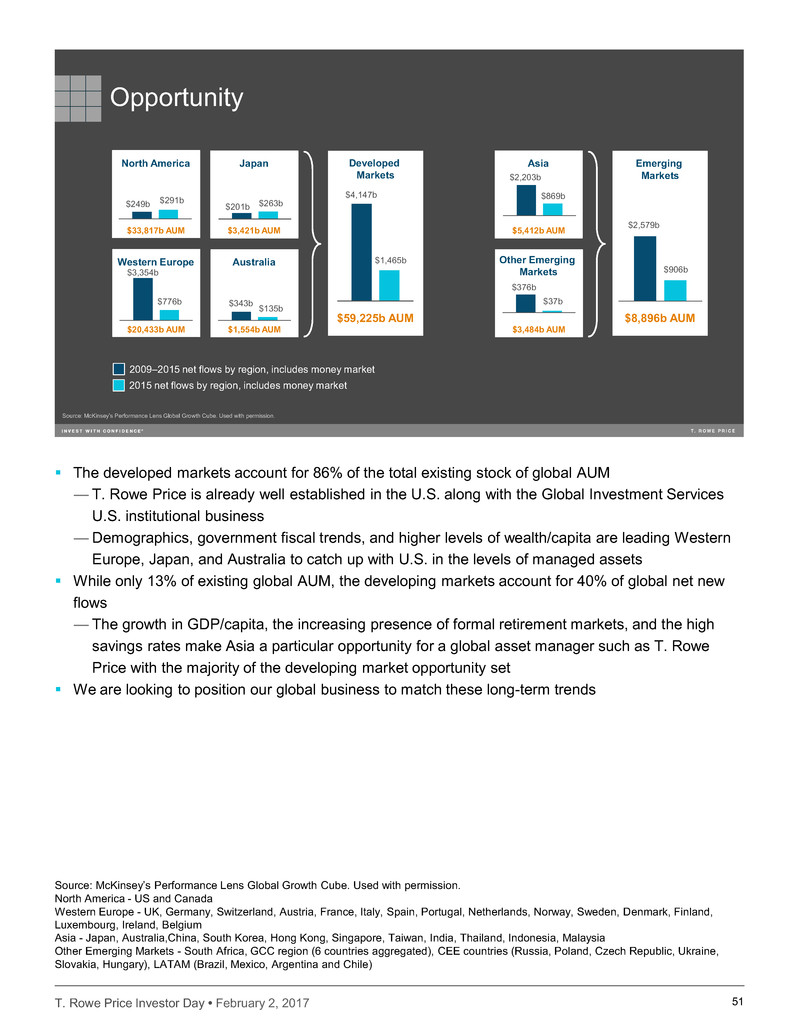

Opportunity

$4,147b

$1,465b

$59,225b AUM

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

Developed

Markets

$249b $291b

$33,817b AUM

$201b $263b

$3,421b AUM

North America Japan

$20,433b AUM $1,554b AUM

Western Europe Australia

$3,354b

$776b $343b $135b

2015 net flows by region, includes money market

2009–2015 net flows by region, includes money market

$5,412b AUM

Asia

Other Emerging

Markets

$3,484b AUM

$376b

$37b

$2,203b

$869b

$8,896b AUM

Emerging

Markets

$2,579b

$906b

51

The developed markets account for 86% of the total existing stock of global AUM

— T. Rowe Price is already well established in the U.S. along with the Global Investment Services

U.S. institutional business

— Demographics, government fiscal trends, and higher levels of wealth/capita are leading Western

Europe, Japan, and Australia to catch up with U.S. in the levels of managed assets

While only 13% of existing global AUM, the developing markets account for 40% of global net new

flows

— The growth in GDP/capita, the increasing presence of formal retirement markets, and the high

savings rates make Asia a particular opportunity for a global asset manager such as T. Rowe

Price with the majority of the developing market opportunity set

We are looking to position our global business to match these long-term trends

Source: McKinsey’s Performance Lens Global Growth Cube. Used with permission.

North America - US and Canada

Western Europe - UK, Germany, Switzerland, Austria, France, Italy, Spain, Portugal, Netherlands, Norway, Sweden, Denmark, Finland,

Luxembourg, Ireland, Belgium

Asia - Japan, Australia,China, South Korea, Hong Kong, Singapore, Taiwan, India, Thailand, Indonesia, Malaysia

Other Emerging Markets - South Africa, GCC region (6 countries aggregated), CEE countries (Russia, Poland, Czech Republic, Ukraine,

Slovakia, Hungary), LATAM (Brazil, Mexico, Argentina and Chile)

T. Rowe Price Investor Day • February 2, 2017

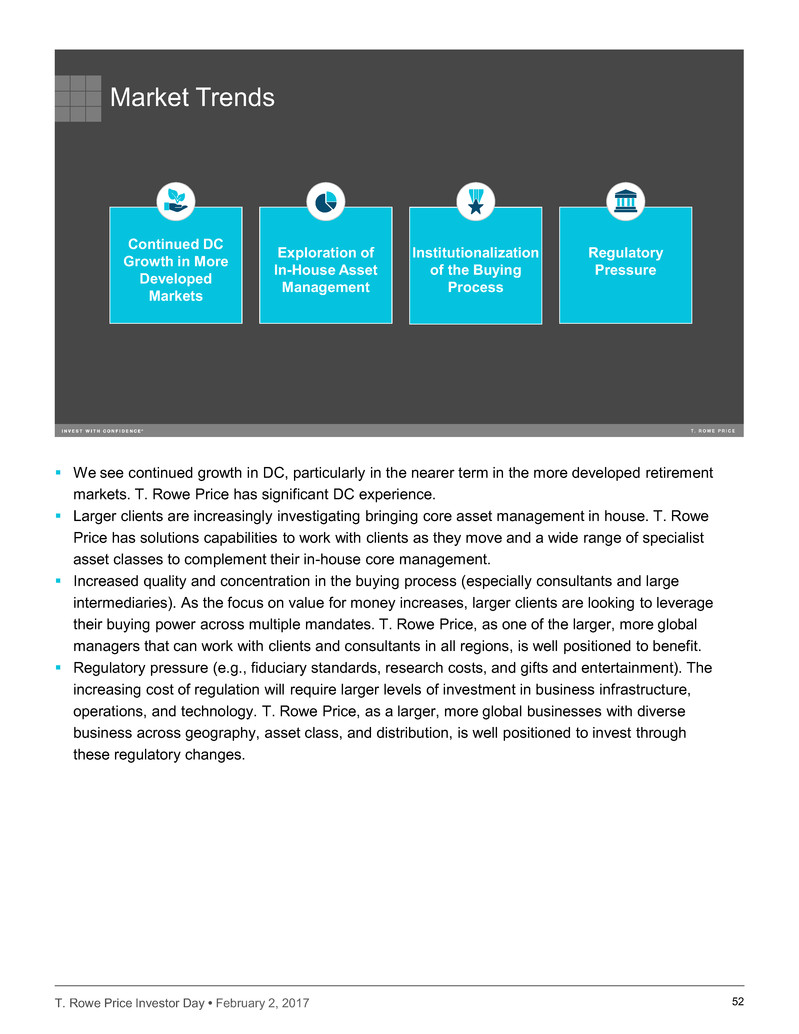

Market Trends

Continued DC

Growth in More

Developed

Markets

Exploration of

In-House Asset

Management

Institutionalization

of the Buying

Process

Regulatory

Pressure

52

We see continued growth in DC, particularly in the nearer term in the more developed retirement

markets. T. Rowe Price has significant DC experience.

Larger clients are increasingly investigating bringing core asset management in house. T. Rowe

Price has solutions capabilities to work with clients as they move and a wide range of specialist

asset classes to complement their in-house core management.

Increased quality and concentration in the buying process (especially consultants and large

intermediaries). As the focus on value for money increases, larger clients are looking to leverage

their buying power across multiple mandates. T. Rowe Price, as one of the larger, more global

managers that can work with clients and consultants in all regions, is well positioned to benefit.

Regulatory pressure (e.g., fiduciary standards, research costs, and gifts and entertainment). The

increasing cost of regulation will require larger levels of investment in business infrastructure,

operations, and technology. T. Rowe Price, as a larger, more global businesses with diverse

business across geography, asset class, and distribution, is well positioned to invest through

these regulatory changes.

T. Rowe Price Investor Day • February 2, 2017 53

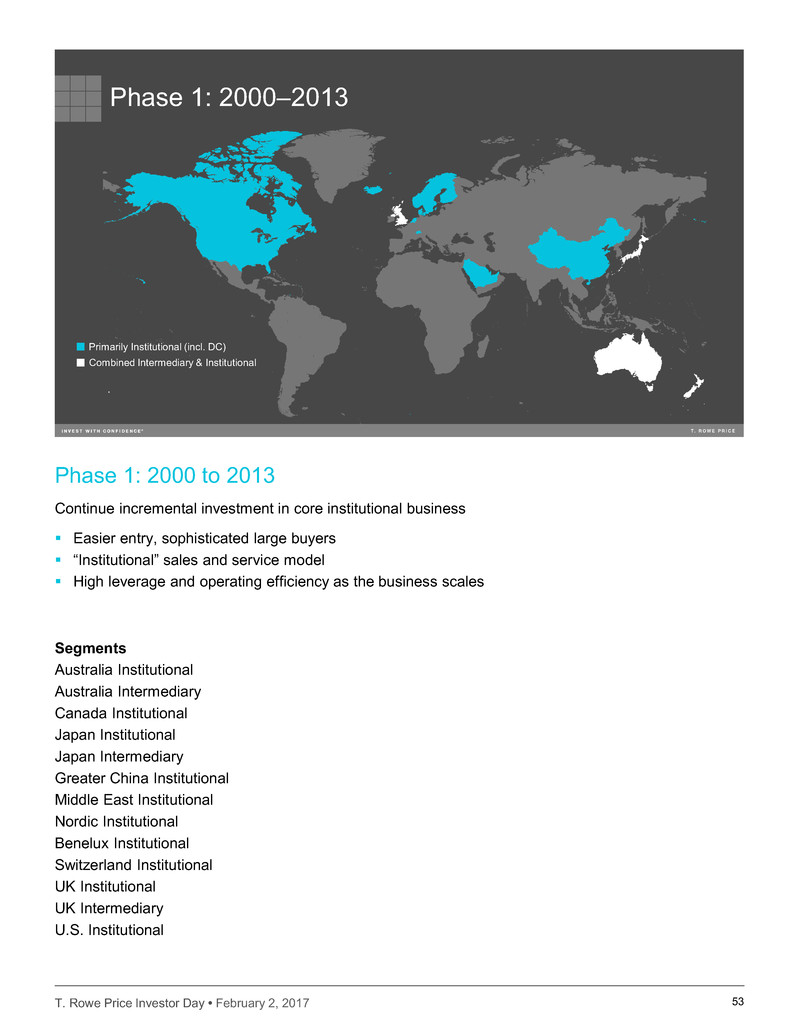

Phase 1: 2000–2013

Primarily Institutional (incl. DC)

Combined Intermediary & Institutional

Phase 1: 2000 to 2013

Continue incremental investment in core institutional business

Easier entry, sophisticated large buyers

“Institutional” sales and service model

High leverage and operating efficiency as the business scales

Segments

Australia Institutional

Australia Intermediary

Canada Institutional

Japan Institutional

Japan Intermediary

Greater China Institutional

Middle East Institutional

Nordic Institutional

Benelux Institutional

Switzerland Institutional

UK Institutional

UK Intermediary

U.S. Institutional

T. Rowe Price Investor Day • February 2, 2017 54

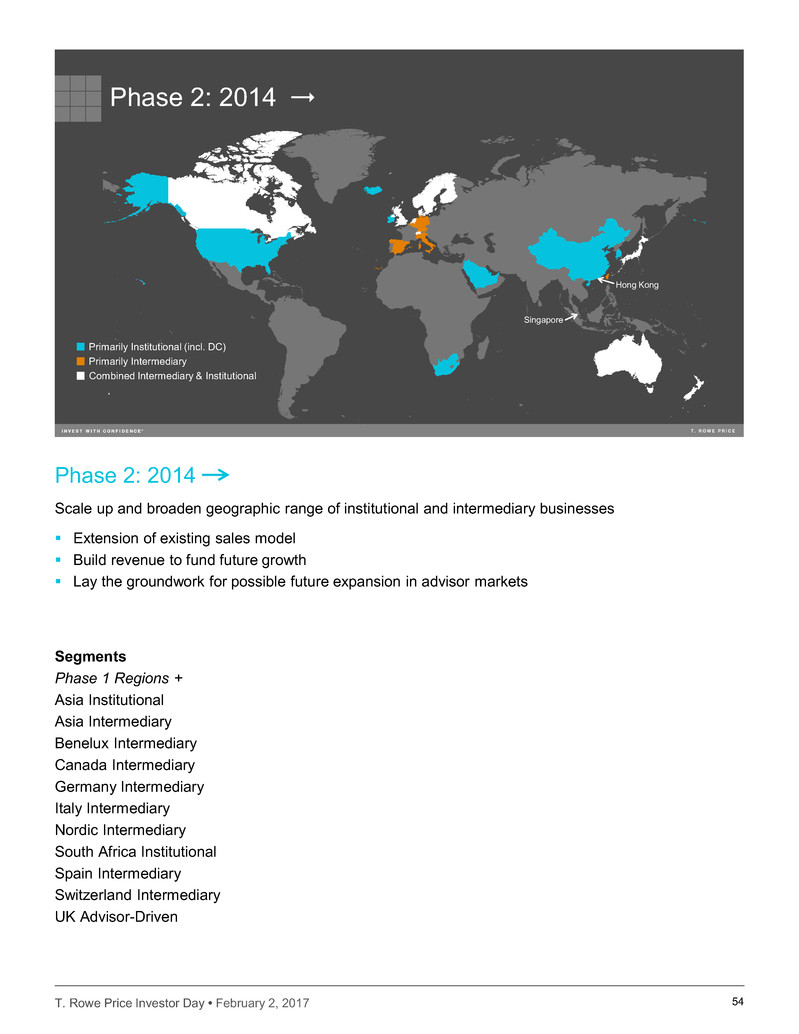

Phase 2: 2014

Hong Kong

Singapore

Primarily Intermediary

Primarily Institutional (incl. DC)

Combined Intermediary & Institutional

Phase 2: 2014

Scale up and broaden geographic range of institutional and intermediary businesses

Extension of existing sales model

Build revenue to fund future growth

Lay the groundwork for possible future expansion in advisor markets

Segments

Phase 1 Regions +

Asia Institutional

Asia Intermediary

Benelux Intermediary

Canada Intermediary

Germany Intermediary

Italy Intermediary

Nordic Intermediary

South Africa Institutional

Spain Intermediary

Switzerland Intermediary

UK Advisor-Driven

T. Rowe Price Investor Day • February 2, 2017 55

Phase 3: Future

Primarily Institutional (incl. DC)

Combined Intermediary & Institutional

Hong Kong

Singapore

Phase 3: Future

Develop capabilities to reach broader base of distribution opportunities

High-quality revenue for long-term growth

More complex infrastructure, operations, marketing

Build scale within countries

Segments

Phase 1 & 2 Regions +

Asia Advisor-Driven

Benelux Advisor-Driven

Canada Advisor-Driven

Germany Advisor-Driven

Hong Kong Defined Contribution

Italy Advisor-Driven

Local Asia: South Korea, Taiwan

Local EMEA: France, Poland

Local Latin America: Brazil, Mexico, Chile, Peru

T. Rowe Price Investor Day • February 2, 2017 56

Summary

Positive

momentum

in recent new

businesses

Core

capabilities

already in place

for growth

Disciplined

global growth

aligned to

market potential

T. Rowe Price

scale a key

competitive

advantage

T. Rowe Price Investor Day • February 2, 2017 57

The Plan The Capabilities The Resources

Execution of our plan is designed to

Enhance our ability to deliver value to clients across the globe

Allow us to grow and diversify our business

Create stockholder returns via per-share growth of revenues, earnings, and dividends

T. Rowe Price has the plan, capabilities, and resources to meet the

evolving needs of our clients and the asset management marketplace

T. Rowe Price Investor Day • February 2, 2017

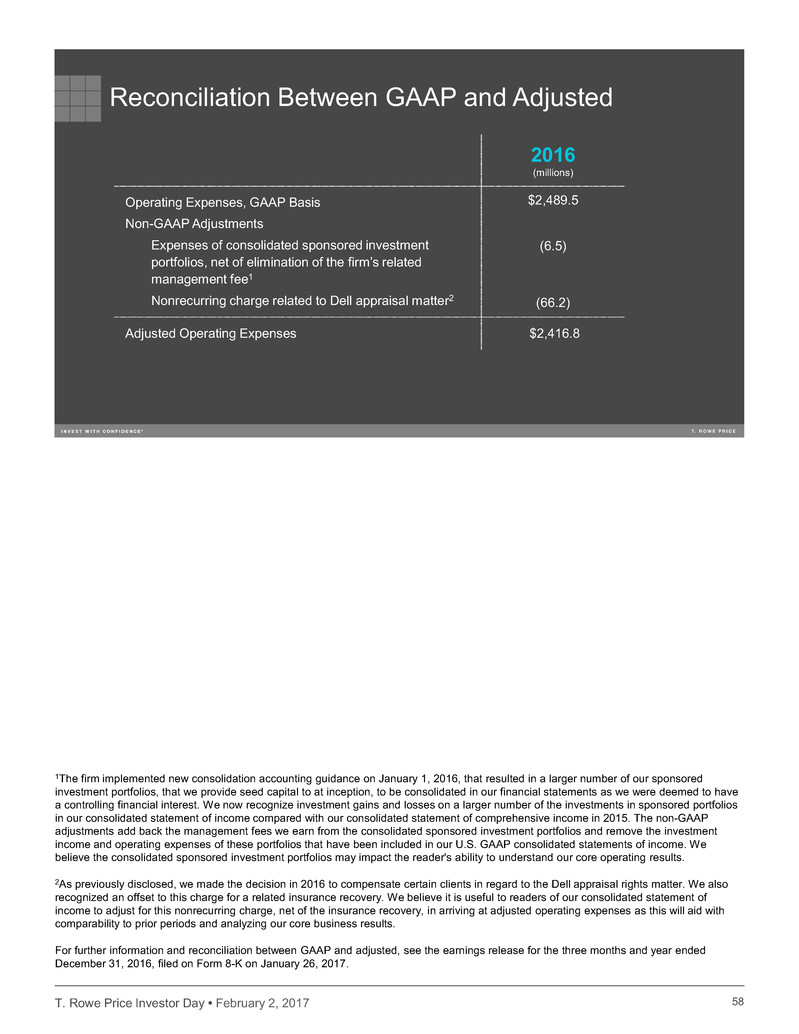

Reconciliation Between GAAP and Adjusted

2016

(millions)

Operating Expenses, GAAP Basis

Non-GAAP Adjustments

Expenses of consolidated sponsored investment

portfolios, net of elimination of the firm’s related

management fee1

Nonrecurring charge related to Dell appraisal matter2

$2,489.5

(6.5)

(66.2)

Adjusted Operating Expenses $2,416.8

58

1The firm implemented new consolidation accounting guidance on January 1, 2016, that resulted in a larger number of our sponsored

investment portfolios, that we provide seed capital to at inception, to be consolidated in our financial statements as we were deemed to have

a controlling financial interest. We now recognize investment gains and losses on a larger number of the investments in sponsored portfolios

in our consolidated statement of income compared with our consolidated statement of comprehensive income in 2015. The non-GAAP

adjustments add back the management fees we earn from the consolidated sponsored investment portfolios and remove the investment

income and operating expenses of these portfolios that have been included in our U.S. GAAP consolidated statements of income. We

believe the consolidated sponsored investment portfolios may impact the reader's ability to understand our core operating results.

2As previously disclosed, we made the decision in 2016 to compensate certain clients in regard to the Dell appraisal rights matter. We also

recognized an offset to this charge for a related insurance recovery. We believe it is useful to readers of our consolidated statement of

income to adjust for this nonrecurring charge, net of the insurance recovery, in arriving at adjusted operating expenses as this will aid with

comparability to prior periods and analyzing our core business results.

For further information and reconciliation between GAAP and adjusted, see the earnings release for the three months and year ended

December 31, 2016, filed on Form 8-K on January 26, 2017.