Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ENTEGRIS INC | entg2016ex991.htm |

| 8-K - 8-K - ENTEGRIS INC | entg2016q4.htm |

FEBRUARY 2, 2017

Earnings Summary

Fourth Quarter and Fiscal Year 2016

EXHIBIT 99.2

2

SAFE HARBOR

Certain information contained in this presentation may constitute forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve substantial risks and

uncertainties that could cause actual results to differ materially from the results expressed in, or implied by, these

forward-looking statements. Statements that include such words as “anticipate,” “believe,” “estimate,” “expect,”

“forecast,” “may,” “will,” “should” or the negative thereof and similar expressions as they relate to Entegris or our

management are intended to identify such forward-looking statements. These statements are not guarantees of future

performance and involve risks, uncertainties and assumptions that are difficult to predict. These risks include, but are

not limited to, fluctuations in the market price of Entegris’ stock, Entegris’ future operating results, other acquisition

and investment opportunities available to Entegris, general business and market conditions and other factors.

Additional information concerning these and other risk factors may be found in previous financial press releases issued

by Entegris and Entegris’ periodic public filings with the Securities and Exchange Commission, including discussions

appearing under the headings “Risks Relating to our Business and Industry,” “Risks Related to Our Indebtedness,”

“Manufacturing Risks,” “International Risks” and “Risks Related to Owning Our Common Stock” in Item 1A of our

Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange

Commission on February 29, 2016, as well as other matters and important factors disclosed previously and from time

to time in the filings of Entegris with the U.S. Securities and Exchange Commission. Except as required under the

federal securities laws and the rules and regulations of the Securities and Exchange Commission, we undertake no

obligation to update publicly any forward-looking statements contained herein.

3

4Q16 AND FY2016 HIGHLIGHTS

◦ Achieved record sales of $1.2 billion in fiscal 2016, 9% organic growth and significant outperformance of markets

◦ Generated record EPS and EBITDA for fiscal 2016, and a record EBITDA margin of 22.4 percent

◦ Growth initiatives are on track with key design wins at 10 and 7 nanometer and 3D-NAND processes

◦ Continued pay down our debt, concluding the year with a net leverage ratio of 0.7

◦ Grew our quarterly revenue by 16 percent from a year ago and achieved non-GAAP EPS of $0.24

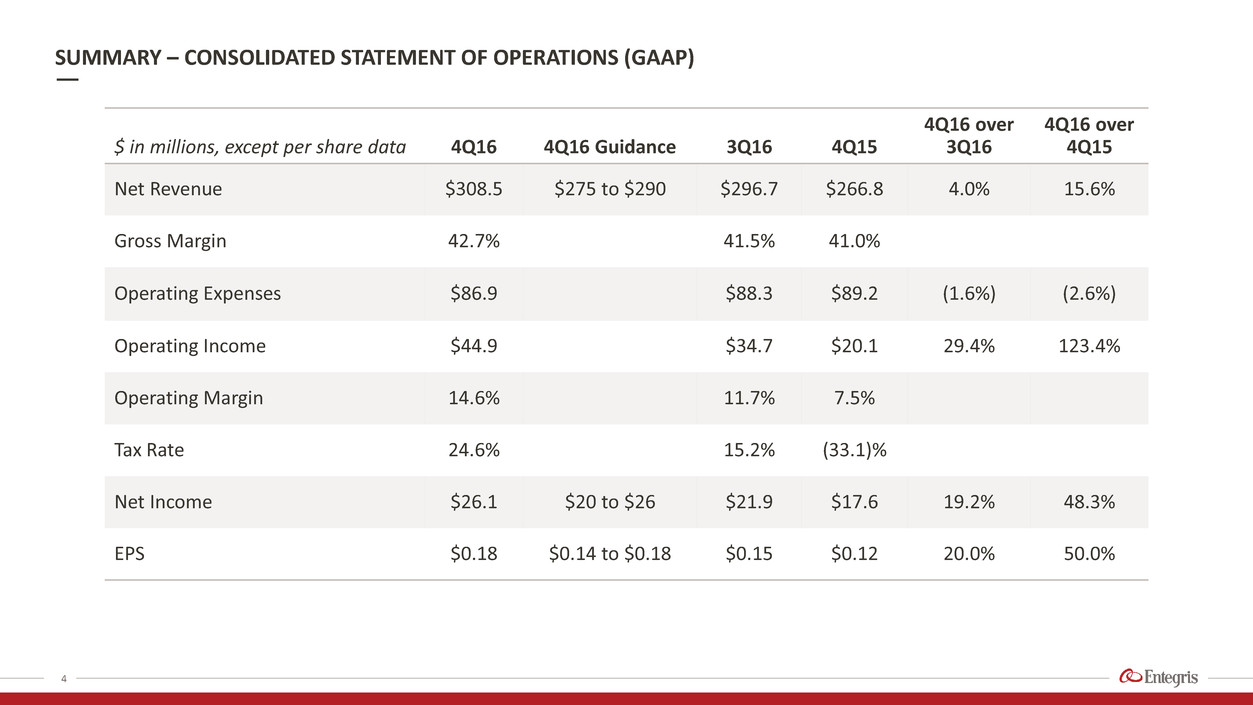

$ in millions, except per share data 4Q16 4Q16 Guidance 3Q16 4Q15

4Q16 over

3Q16

4Q16 over

4Q15

Net Revenue $308.5 $275 to $290 $296.7 $266.8 4.0% 15.6%

Gross Margin 42.7% 41.5% 41.0%

Operating Expenses $86.9 $88.3 $89.2 (1.6%) (2.6%)

Operating Income $44.9 $34.7 $20.1 29.4% 123.4%

Operating Margin 14.6% 11.7% 7.5%

Tax Rate 24.6% 15.2% (33.1)%

Net Income $26.1 $20 to $26 $21.9 $17.6 19.2% 48.3%

EPS $0.18 $0.14 to $0.18 $0.15 $0.12 20.0% 50.0%

4

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (GAAP)

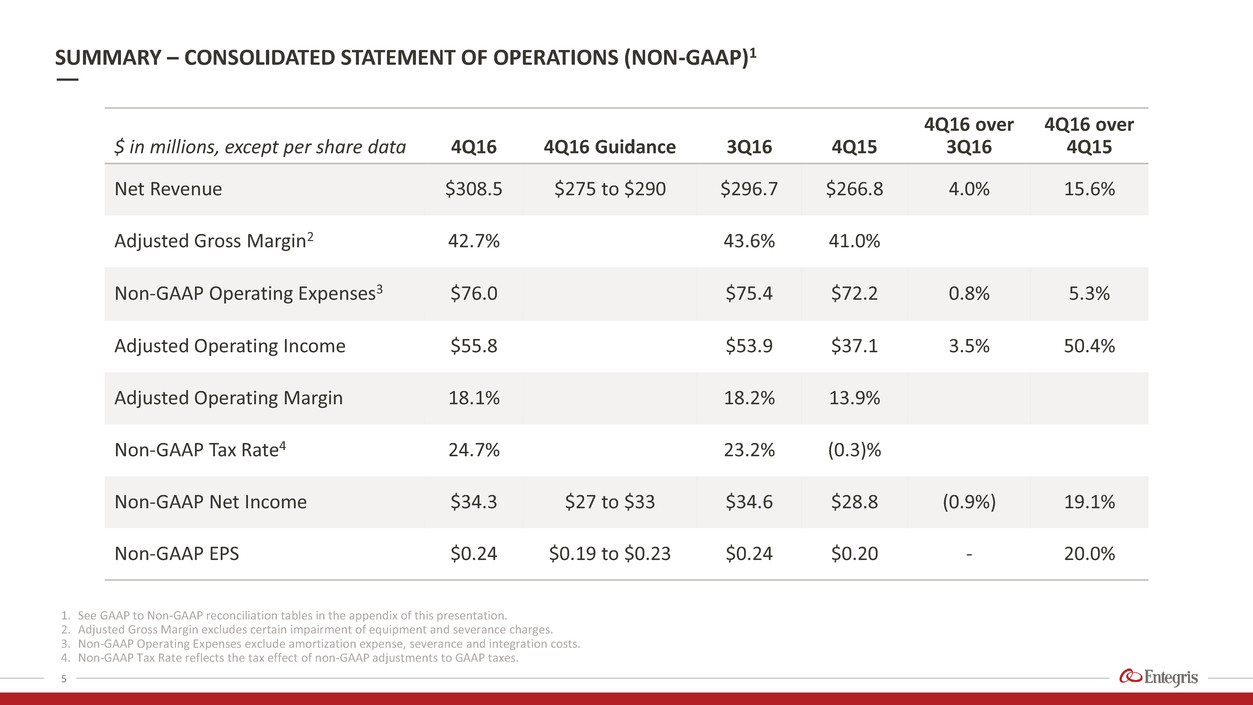

$ in millions, except per share data 4Q16 4Q16 Guidance 3Q16 4Q15

4Q16 over

3Q16

4Q16 over

4Q15

Net Revenue $308.5 $275 to $290 $296.7 $266.8 4.0% 15.6%

Adjusted Gross Margin2 42.7% 43.6% 41.0%

Non-GAAP Operating Expenses3 $76.0 $75.4 $72.2 0.8% 5.3%

Adjusted Operating Income $55.8 $53.9 $37.1 3.5% 50.4%

Adjusted Operating Margin 18.1% 18.2% 13.9%

Non-GAAP Tax Rate4 24.7% 23.2% (0.3)%

Non-GAAP Net Income $34.3 $27 to $33 $34.6 $28.8 (0.9%) 19.1%

Non-GAAP EPS $0.24 $0.19 to $0.23 $0.24 $0.20 - 20.0%

5

1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation.

2. Adjusted Gross Margin excludes certain impairment of equipment and severance charges.

3. Non-GAAP Operating Expenses exclude amortization expense, severance and integration costs.

4. Non-GAAP Tax Rate reflects the tax effect of non-GAAP adjustments to GAAP taxes.

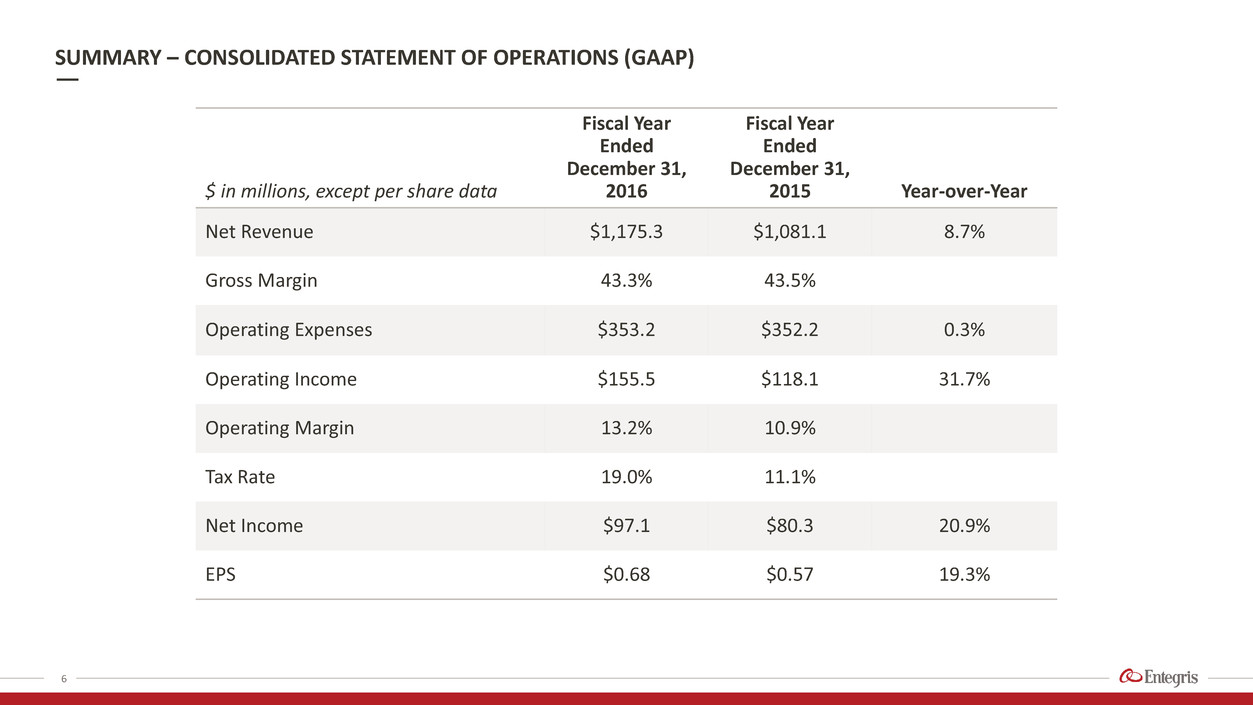

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (NON-GAAP)1

$ in millions, except per share data

Fiscal Year

Ended

December 31,

2016

Fiscal Year

Ended

December 31,

2015 Year-over-Year

Net Revenue $1,175.3 $1,081.1 8.7%

Gross Margin 43.3% 43.5%

Operating Expenses $353.2 $352.2 0.3%

Operating Income $155.5 $118.1 31.7%

Operating Margin 13.2% 10.9%

Tax Rate 19.0% 11.1%

Net Income $97.1 $80.3 20.9%

EPS $0.68 $0.57 19.3%

6

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (GAAP)

$ in millions, except per share data

Fiscal Year

Ended

December 31,

2016

Fiscal Year

Ended

December 31,

2015 Year-over-Year

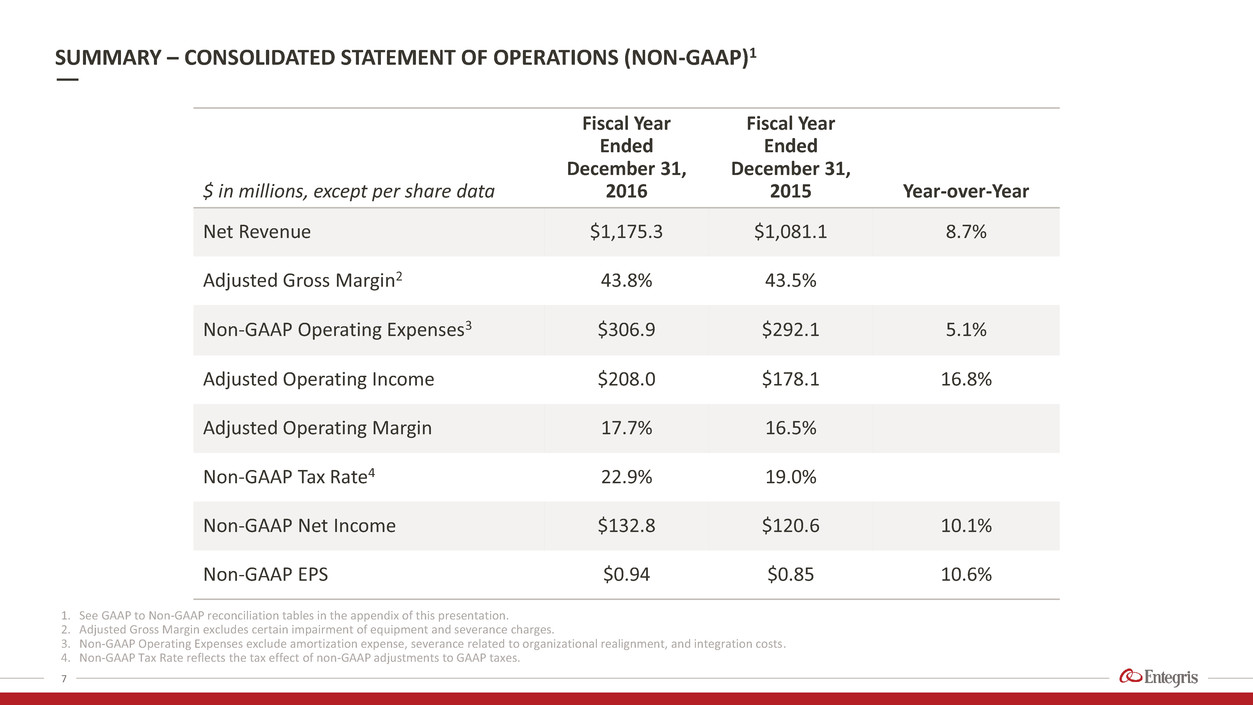

Net Revenue $1,175.3 $1,081.1 8.7%

Adjusted Gross Margin2 43.8% 43.5%

Non-GAAP Operating Expenses3 $306.9 $292.1 5.1%

Adjusted Operating Income $208.0 $178.1 16.8%

Adjusted Operating Margin 17.7% 16.5%

Non-GAAP Tax Rate4 22.9% 19.0%

Non-GAAP Net Income $132.8 $120.6 10.1%

Non-GAAP EPS $0.94 $0.85 10.6%

7

1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation.

2. Adjusted Gross Margin excludes certain impairment of equipment and severance charges.

3. Non-GAAP Operating Expenses exclude amortization expense, severance related to organizational realignment, and integration costs.

4. Non-GAAP Tax Rate reflects the tax effect of non-GAAP adjustments to GAAP taxes.

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (NON-GAAP)1

8

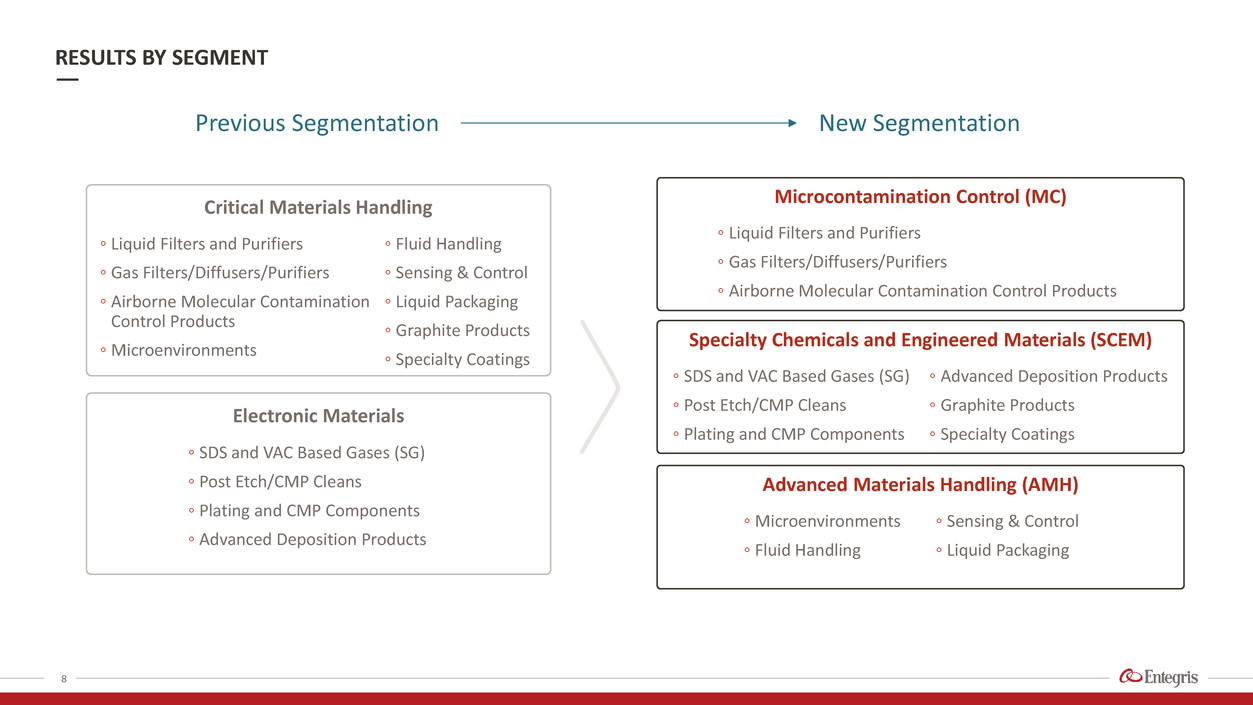

RESULTS BY SEGMENT

Critical Materials Handling

◦ Liquid Filters and Purifiers

◦ Gas Filters/Diffusers/Purifiers

◦ Airborne Molecular Contamination

Control Products

◦ Microenvironments

◦ Fluid Handling

◦ Sensing & Control

◦ Liquid Packaging

◦ Graphite Products

◦ Specialty Coatings

Electronic Materials

◦ SDS and VAC Based Gases (SG)

◦ Post Etch/CMP Cleans

◦ Plating and CMP Components

◦ Advanced Deposition Products

Previous Segmentation New Segmentation

Microcontamination Control (MC)

◦ Liquid Filters and Purifiers

◦ Gas Filters/Diffusers/Purifiers

◦ Airborne Molecular Contamination Control Products

Specialty Chemicals and Engineered Materials (SCEM)

Advanced Materials Handling (AMH)

◦ Microenvironments

◦ Fluid Handling

◦ SDS and VAC Based Gases (SG)

◦ Post Etch/CMP Cleans

◦ Plating and CMP Components

◦ Advanced Deposition Products

◦ Graphite Products

◦ Specialty Coatings

◦ Sensing & Control

◦ Liquid Packaging

$73.5

$96.1

$110.0

MC4

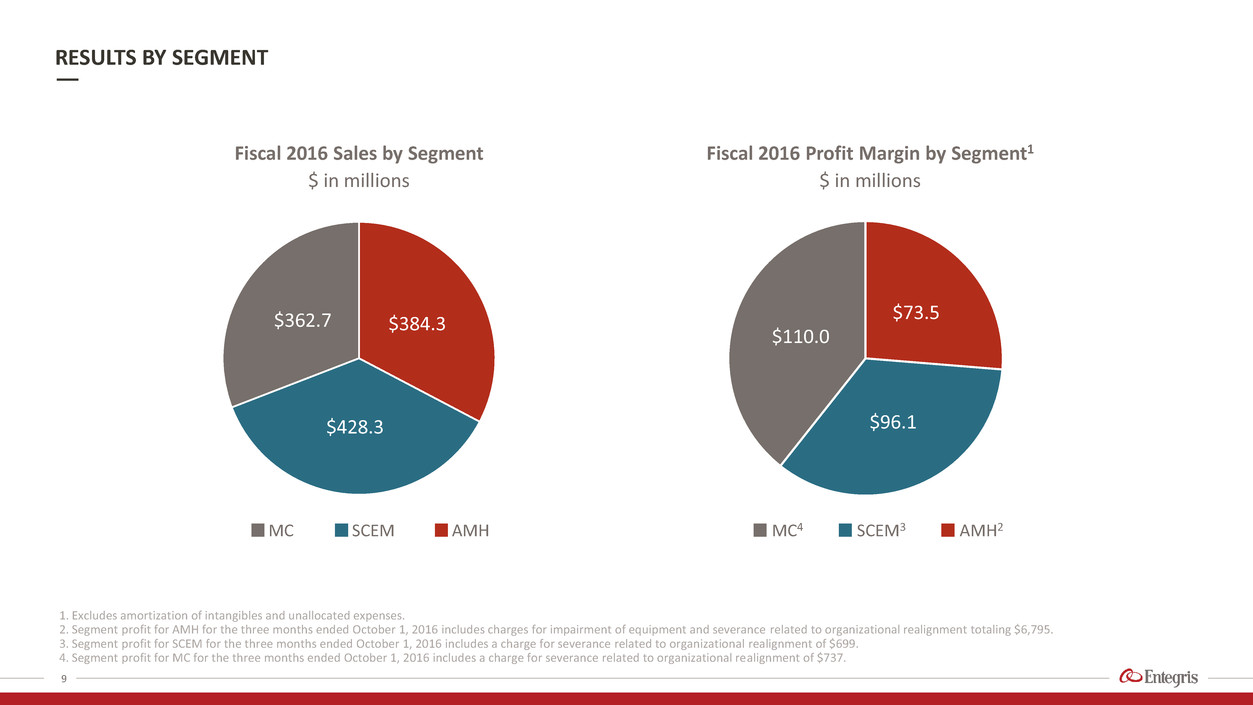

RESULTS BY SEGMENT

9

1. Excludes amortization of intangibles and unallocated expenses.

2. Segment profit for AMH for the three months ended October 1, 2016 includes charges for impairment of equipment and severance related to organizational realignment totaling $6,795.

3. Segment profit for SCEM for the three months ended October 1, 2016 includes a charge for severance related to organizational realignment of $699.

4. Segment profit for MC for the three months ended October 1, 2016 includes a charge for severance related to organizational realignment of $737.

Fiscal 2016 Sales by Segment

$384.3

$428.3

$362.7

$ in millions

Fiscal 2016 Profit Margin by Segment1

$ in millions

AMH2 SCEM3 MC AMH SCEM

22%

56%

13%

9%

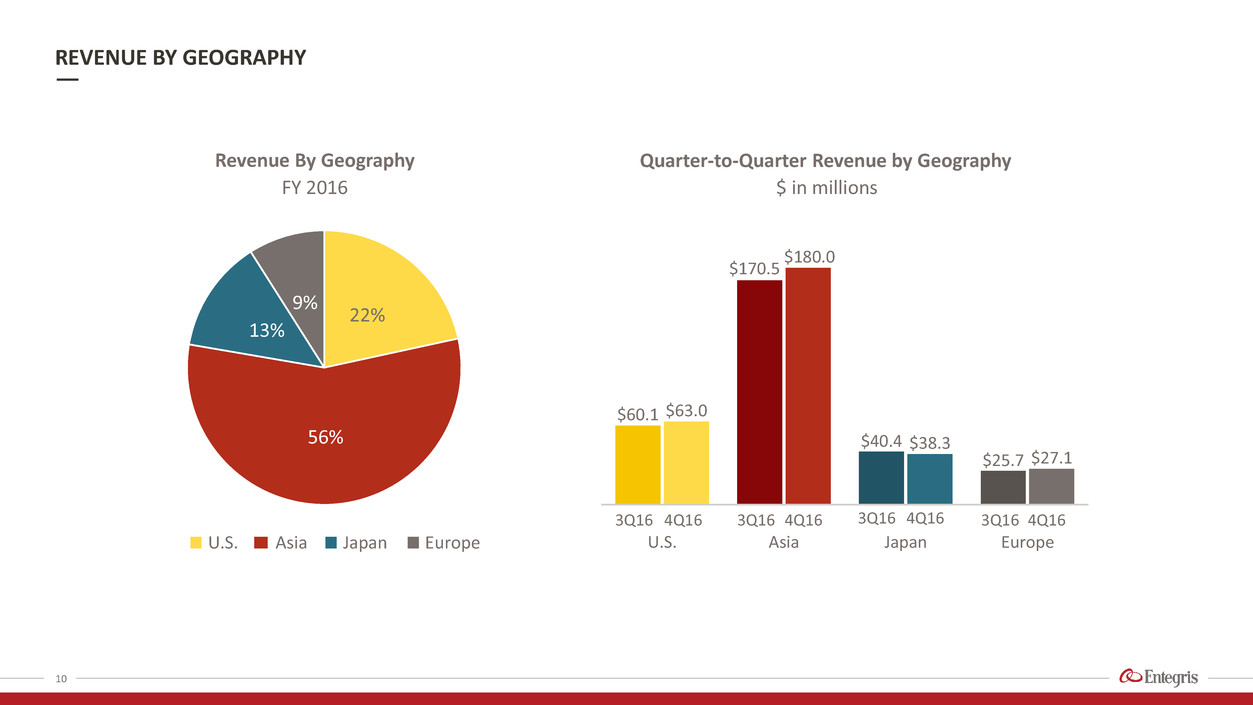

REVENUE BY GEOGRAPHY

10

Revenue By Geography

Asia Japan Europe U.S.

$60.1

$170.5

$40.4

$25.7

$63.0

$180.0

$38.3

$27.1

U.S. Asia Japan Europe

Quarter-to-Quarter Revenue by Geography

$ in millions

3Q16 4Q16 3Q16 4Q16 3Q16 4Q16

FY 2016

3Q16 4Q16

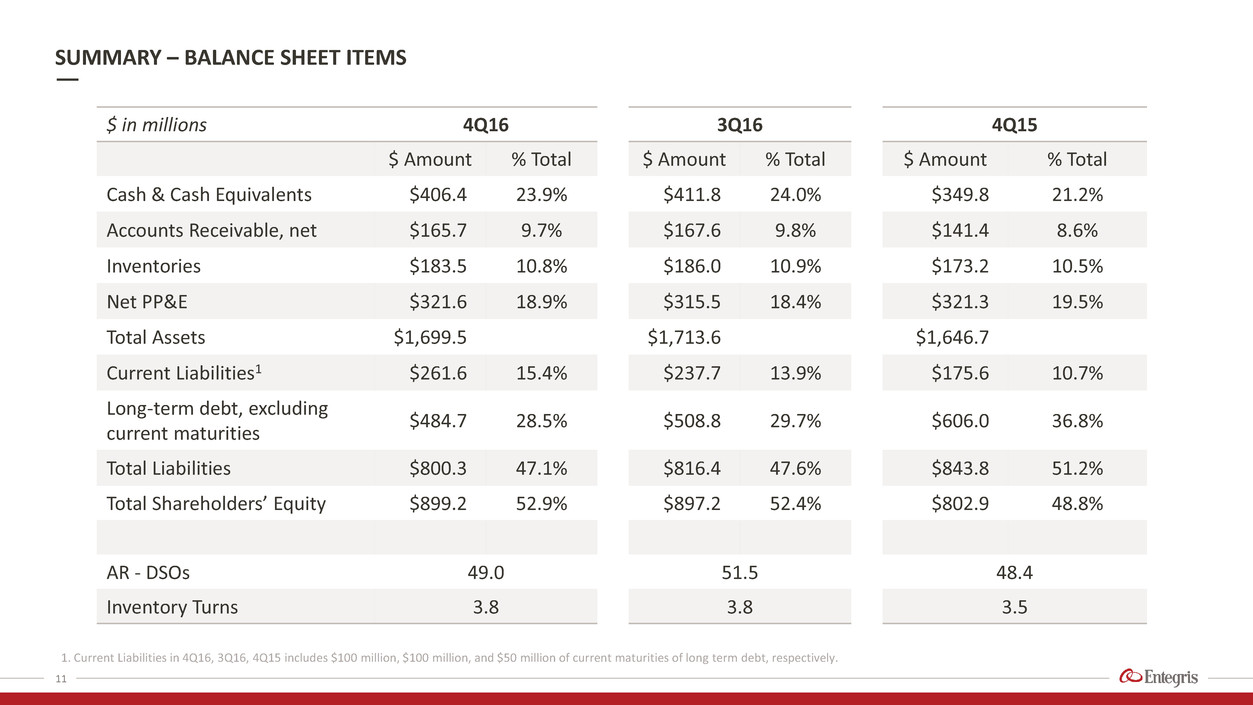

$ in millions 4Q16 3Q16 4Q15

$ Amount % Total $ Amount % Total $ Amount % Total

Cash & Cash Equivalents $406.4 23.9% $411.8 24.0% $349.8 21.2%

Accounts Receivable, net $165.7 9.7% $167.6 9.8% $141.4 8.6%

Inventories $183.5 10.8% $186.0 10.9% $173.2 10.5%

Net PP&E $321.6 18.9% $315.5 18.4% $321.3 19.5%

Total Assets $1,699.5 $1,713.6 $1,646.7

Current Liabilities1 $261.6 15.4% $237.7 13.9% $175.6 10.7%

Long-term debt, excluding

current maturities

$484.7 28.5% $508.8 29.7% $606.0 36.8%

Total Liabilities $800.3 47.1% $816.4 47.6% $843.8 51.2%

Total Shareholders’ Equity $899.2 52.9% $897.2 52.4% $802.9 48.8%

AR - DSOs 49.0 51.5 48.4

Inventory Turns 3.8 3.8 3.5

11

1. Current Liabilities in 4Q16, 3Q16, 4Q15 includes $100 million, $100 million, and $50 million of current maturities of long term debt, respectively.

SUMMARY – BALANCE SHEET ITEMS

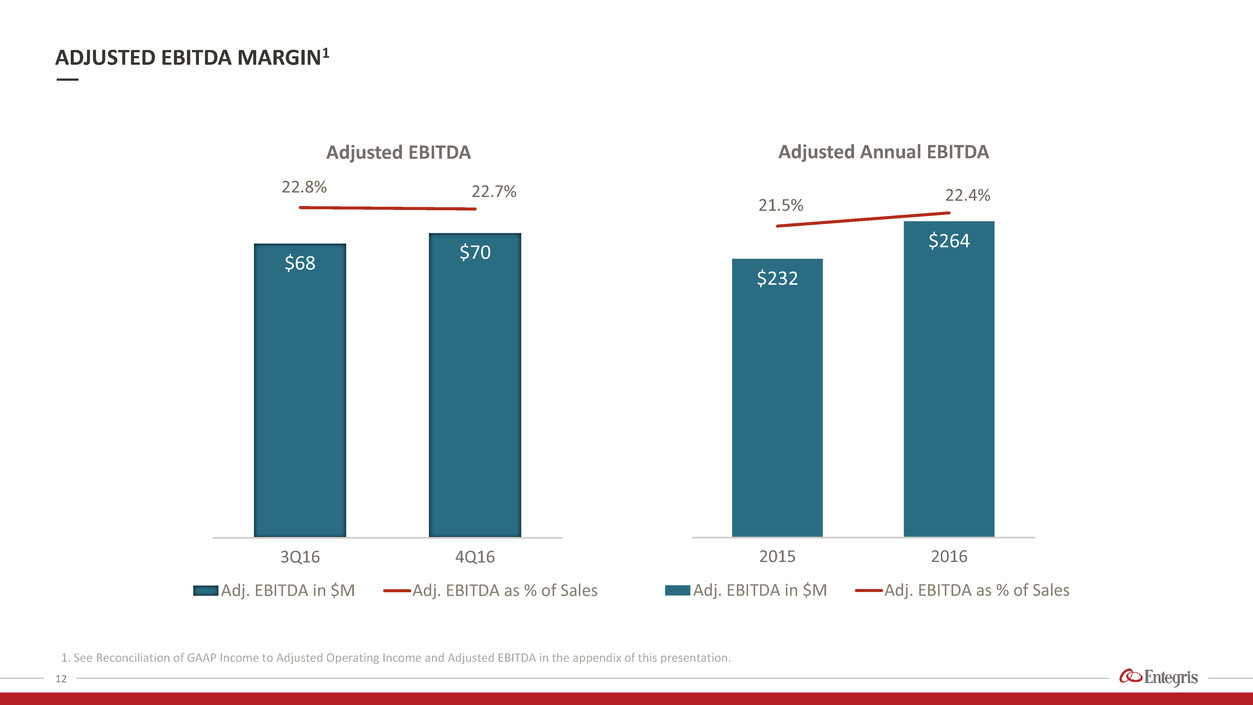

12

1. See Reconciliation of GAAP Income to Adjusted Operating Income and Adjusted EBITDA in the appendix of this presentation.

ADJUSTED EBITDA MARGIN1

$232

$264

21.5%

22.4%

0

0.05

0.1

0.15

0.2

0

50

100

150

200

250

2015 2016

Adjusted Annual EBITDA

Adj. EBITDA in $M Adj. EBITDA as % of Sales

$68

$70

22.8% 22.7%

0

0.05

0.1

0.15

0.2

0

10

20

30

40

50

60

70

80

3Q16 4Q16

Adjusted EBITDA

Adj. EBITDA in $M Adj. EBITDA as % of Sales

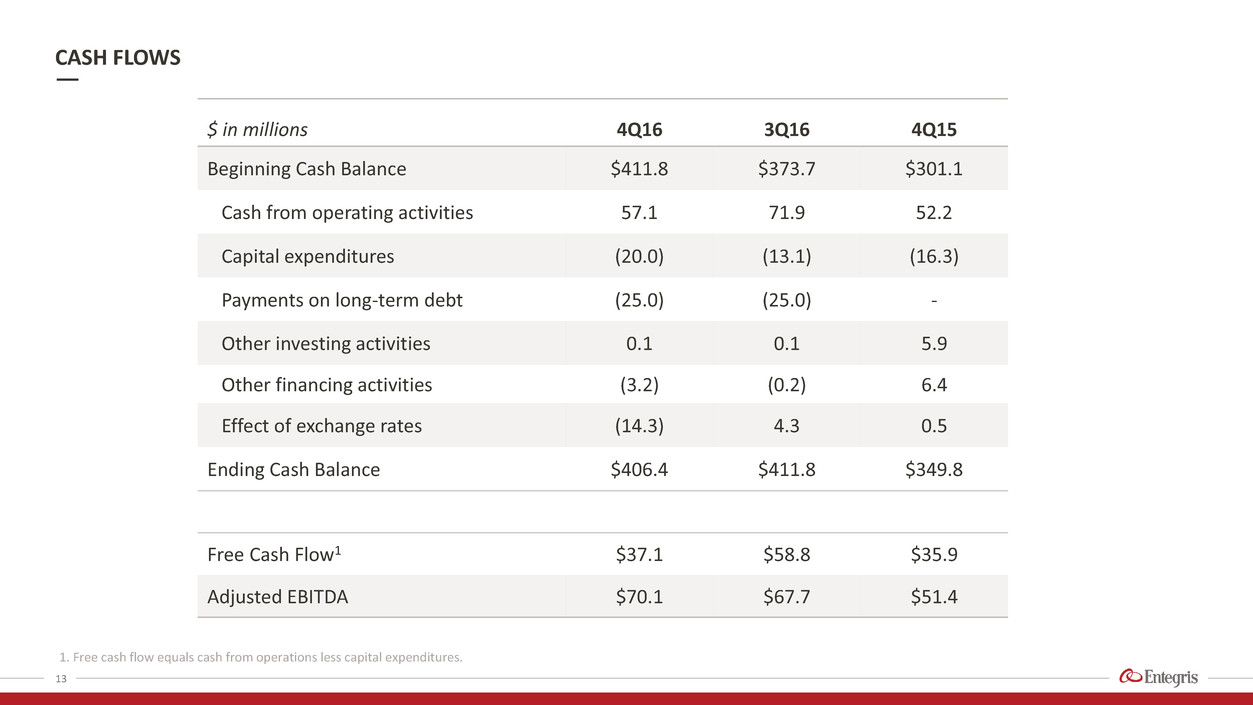

$ in millions 4Q16 3Q16 4Q15

Beginning Cash Balance $411.8 $373.7 $301.1

Cash from operating activities 57.1 71.9 52.2

Capital expenditures (20.0) (13.1) (16.3)

Payments on long-term debt (25.0) (25.0) -

Other investing activities 0.1 0.1 5.9

Other financing activities (3.2) (0.2) 6.4

Effect of exchange rates (14.3) 4.3 0.5

Ending Cash Balance $406.4 $411.8 $349.8

Free Cash Flow1 $37.1 $58.8 $35.9

Adjusted EBITDA $70.1 $67.7 $51.4

CASH FLOWS

13

1. Free cash flow equals cash from operations less capital expenditures.

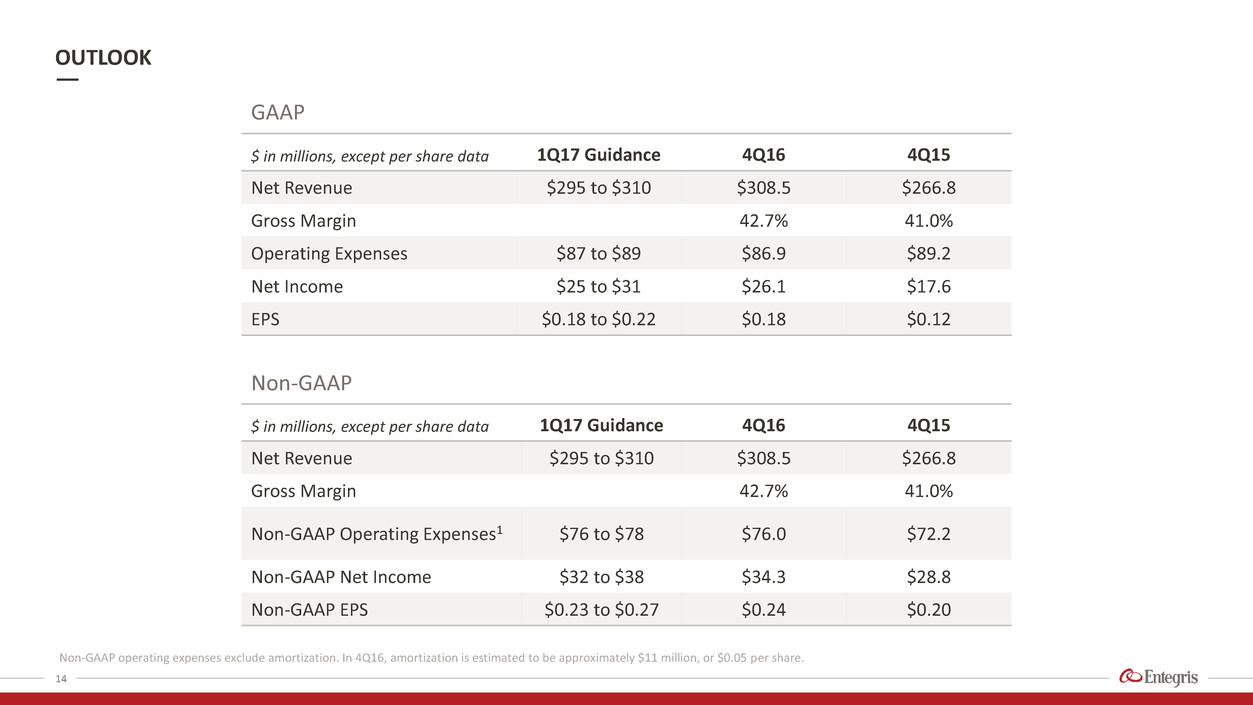

OUTLOOK

14

Non-GAAP operating expenses exclude amortization. In 4Q16, amortization is estimated to be approximately $11 million, or $0.05 per share.

$ in millions, except per share data 1Q17 Guidance 4Q16 4Q15

Net Revenue $295 to $310 $308.5 $266.8

Gross Margin 42.7% 41.0%

Operating Expenses $87 to $89 $86.9 $89.2

Net Income $25 to $31 $26.1 $17.6

EPS $0.18 to $0.22 $0.18 $0.12

$ in millions, except per share data 1Q17 Guidance 4Q16 4Q15

Net Revenue $295 to $310 $308.5 $266.8

Gross Margin 42.7% 41.0%

Non-GAAP Operating Expenses1 $76 to $78 $76.0 $72.2

Non-GAAP Net Income $32 to $38 $34.3 $28.8

Non-GAAP EPS $0.23 to $0.27 $0.24 $0.20

Non-GAAP

GAAP

Entegris®, the Entegris Rings Design™ and Pure Advantage™ are trademarks of Entegris, Inc. ©2016 Entegris, Inc. All rights reserved.

15

16

APPENDIX: NON-GAAP RECONCILIATION TABLES

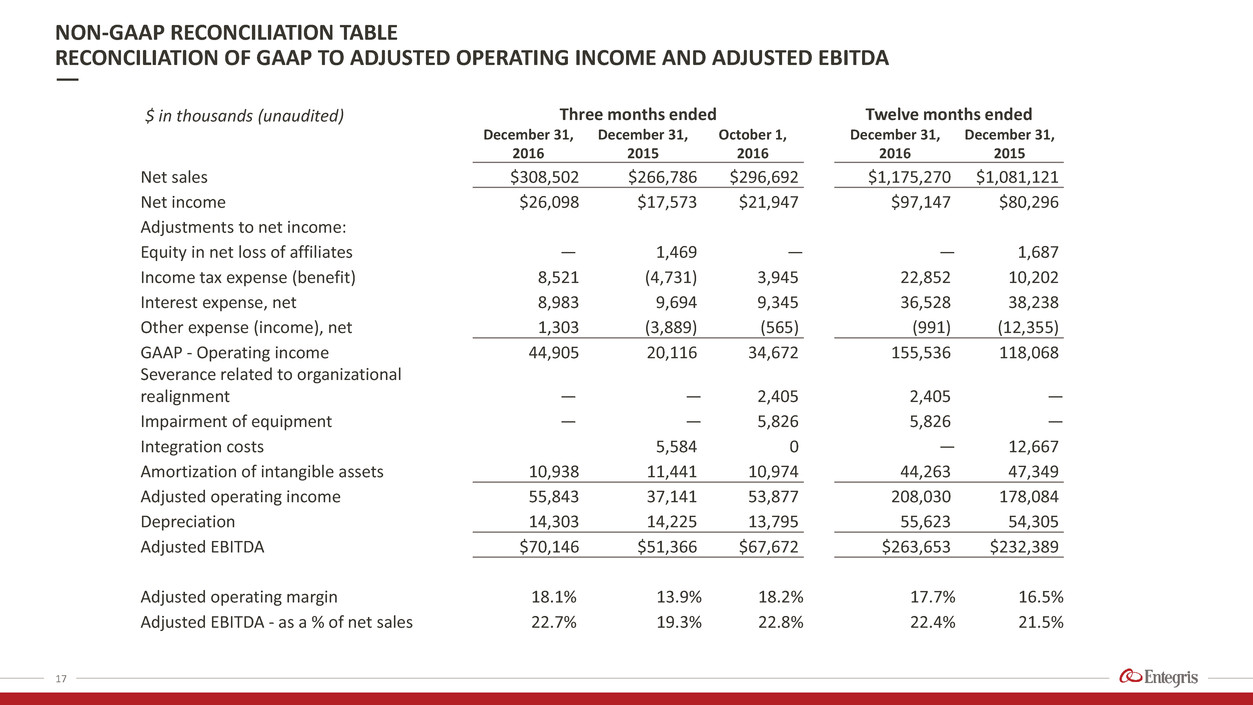

NON-GAAP RECONCILIATION TABLE

RECONCILIATION OF GAAP TO ADJUSTED OPERATING INCOME AND ADJUSTED EBITDA

17

Three months ended Twelve months ended

December 31,

2016

December 31,

2015

October 1,

2016

December 31,

2016

December 31,

2015

Net sales $308,502 $266,786 $296,692 $1,175,270 $1,081,121

Net income $26,098 $17,573 $21,947 $97,147 $80,296

Adjustments to net income:

Equity in net loss of affiliates — 1,469 — — 1,687

Income tax expense (benefit) 8,521 (4,731) 3,945 22,852 10,202

Interest expense, net 8,983 9,694 9,345 36,528 38,238

Other expense (income), net 1,303 (3,889) (565) (991) (12,355)

GAAP - Operating income 44,905 20,116 34,672 155,536 118,068

Severance related to organizational

realignment —

— 2,405 2,405 —

Impairment of equipment — — 5,826 5,826 —

Integration costs 5,584 0 — 12,667

Amortization of intangible assets 10,938 11,441 10,974 44,263 47,349

Adjusted operating income 55,843 37,141 53,877 208,030 178,084

Depreciation 14,303 14,225 13,795 55,623 54,305

Adjusted EBITDA $70,146 $51,366 $67,672 $263,653 $232,389

Adjusted operating margin 18.1% 13.9% 18.2% 17.7% 16.5%

Adjusted EBITDA - as a % of net sales 22.7% 19.3% 22.8% 22.4% 21.5%

$ in thousands (unaudited)

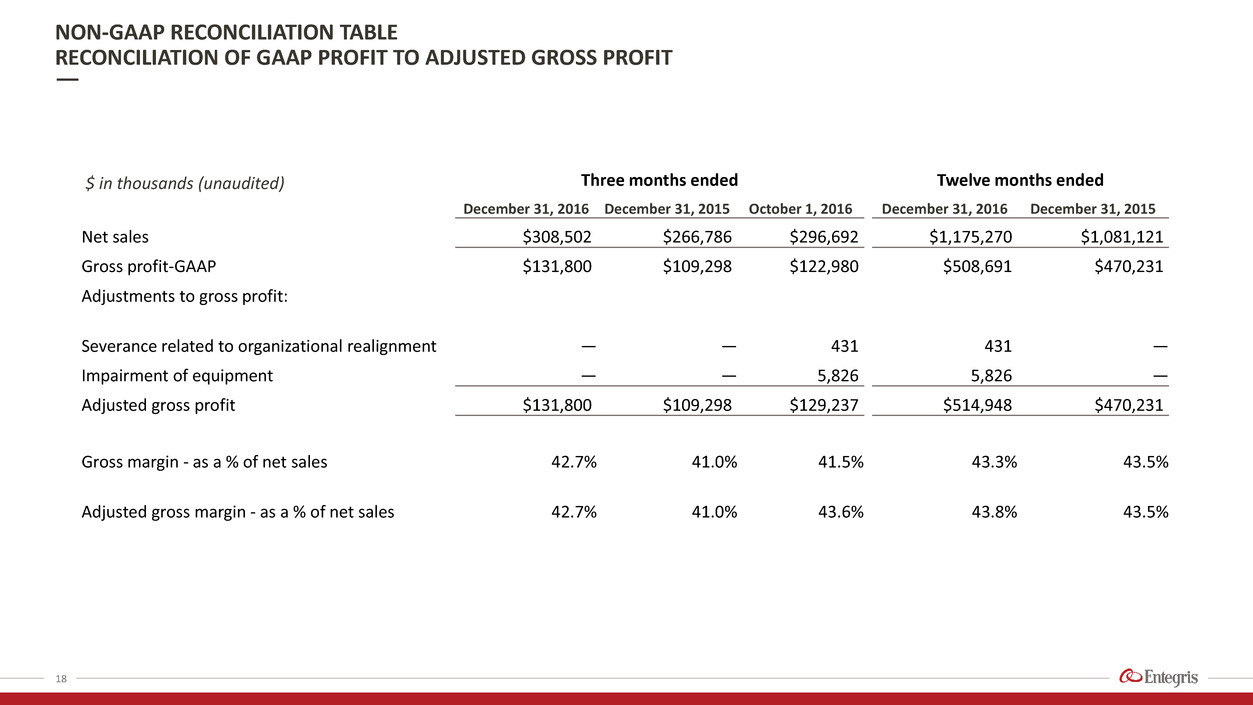

NON-GAAP RECONCILIATION TABLE

RECONCILIATION OF GAAP PROFIT TO ADJUSTED GROSS PROFIT

18

Three months ended Twelve months ended

December 31, 2016 December 31, 2015 October 1, 2016 December 31, 2016 December 31, 2015

Net sales $308,502 $266,786 $296,692 $1,175,270 $1,081,121

Gross profit-GAAP $131,800 $109,298 $122,980 $508,691 $470,231

Adjustments to gross profit:

Severance related to organizational realignment — — 431 431 —

Impairment of equipment — — 5,826 5,826 —

Adjusted gross profit $131,800 $109,298 $129,237 $514,948 $470,231

Gross margin - as a % of net sales 42.7% 41.0% 41.5% 43.3% 43.5%

Adjusted gross margin - as a % of net sales 42.7% 41.0% 43.6% 43.8% 43.5%

$ in thousands (unaudited)

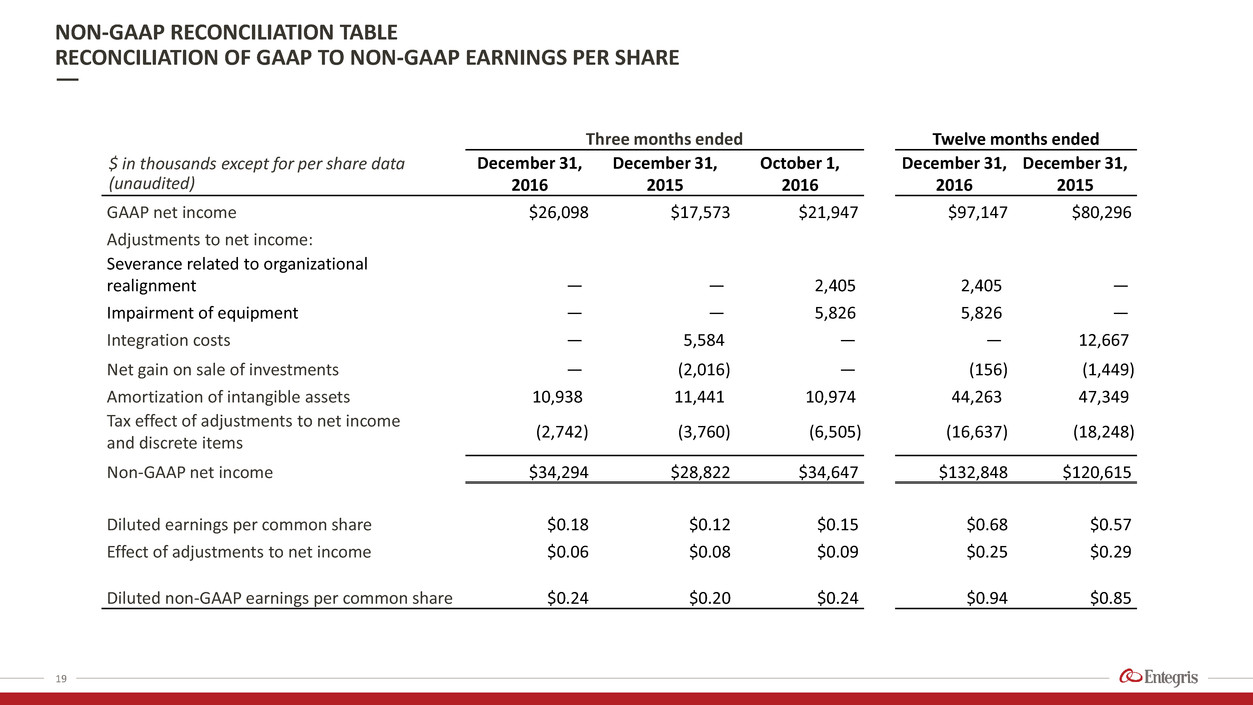

NON-GAAP RECONCILIATION TABLE

RECONCILIATION OF GAAP TO NON-GAAP EARNINGS PER SHARE

19

Three months ended Twelve months ended

December 31,

2016

December 31,

2015

October 1,

2016

December 31,

2016

December 31,

2015

GAAP net income $26,098 $17,573 $21,947 $97,147 $80,296

Adjustments to net income:

Severance related to organizational

realignment —

—

2,405

2,405

—

Impairment of equipment — — 5,826 5,826 —

Integration costs — 5,584 — — 12,667

Net gain on sale of investments — (2,016 ) — (156 ) (1,449 )

Amortization of intangible assets 10,938 11,441 10,974 44,263 47,349

Tax effect of adjustments to net income

and discrete items

(2,742 ) (3,760 ) (6,505 )

(16,637 ) (18,248 )

Non-GAAP net income $34,294 $28,822 $34,647 $132,848 $120,615

Diluted earnings per common share $0.18 $0.12 $0.15 $0.68 $0.57

Effect of adjustments to net income $0.06 $0.08 $0.09 $0.25 $0.29

Diluted non-GAAP earnings per common share $0.24 $0.20 $0.24 $0.94 $0.85

$ in thousands except for per share data

(unaudited)