Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CMS ENERGY CORP | d340860d8k.htm |

Exhibit 99.1

CMS ENERGY . . . .

CMS

LISTED

NYSE

Year-End 2016 Results & Outlook

February 2, 2017

Palisades Replacements

Gas Pipelines

CMS ENERGY

This presentation is made as of the

date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities

Exchange Act of

1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors

detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and

“RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2015 and as updated in subsequent

10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important

factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein

to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when

describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (GAAP) and adjusted (non-GAAP) basis and provides

forward-looking guidance on an adjusted basis. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, regulatory items from prior years, or other items. Management views adjusted earnings as a

key measure of the company’s present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the company uses adjusted earnings to measure and assess performance. Because

the company is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavorably, the company’s reported earnings in future periods, the company is not providing reported earnings

guidance nor is it providing a reconciliation for the comparable future period earnings. The adjusted earnings should be considered supplemental information to assist in fully understanding our business results, rather than as a substitute for the

reported earnings.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations

section, www.cmsenergy.com/investor-relations, a channel of distribution.

1

Agenda

CMS ENERGY

2016 Results and 2017 Priorities

Future Outlook

- Customer AND Investor Model

- Customer Investment Plan

Financial Results and Outlook

- Updated Sensitivities

- Potential Tax Reform

Patti Poppe

President & CEO

Tom Webb

Executive VP & CFO

2

Financial Results & Outlook . . . .

CMS

ENERGY

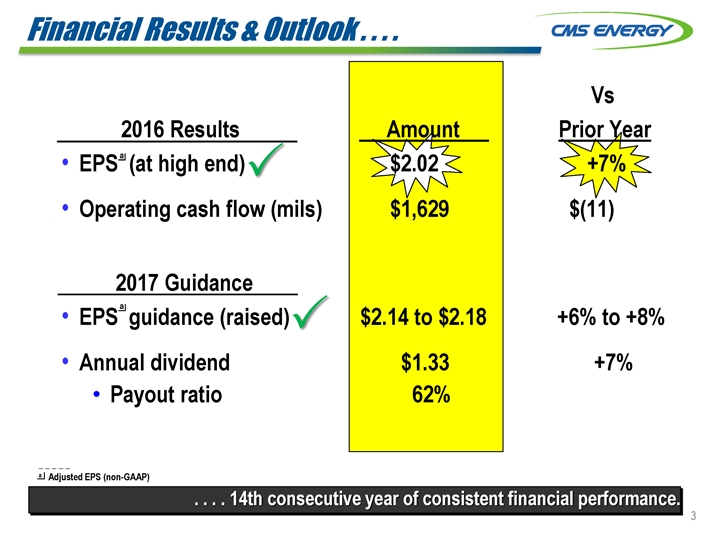

2016 Results

EPS a (at high end)

Operating cash flow (mils)

2017 Guidance

EPS a guidance (raised)

Annual dividend

Payout ratio

Amount

$2.02

$1,629

$2.14 to $2.18

$1.33

62%

Vs

Prior Year

+7%

$(11)

+6% to +8%

+7%

a Adjusted EPS (non-GAAP)

. . . . 14th consecutive year of consistent financial performance.

3

Customer-Focused Results . . . . CMS ENERGY

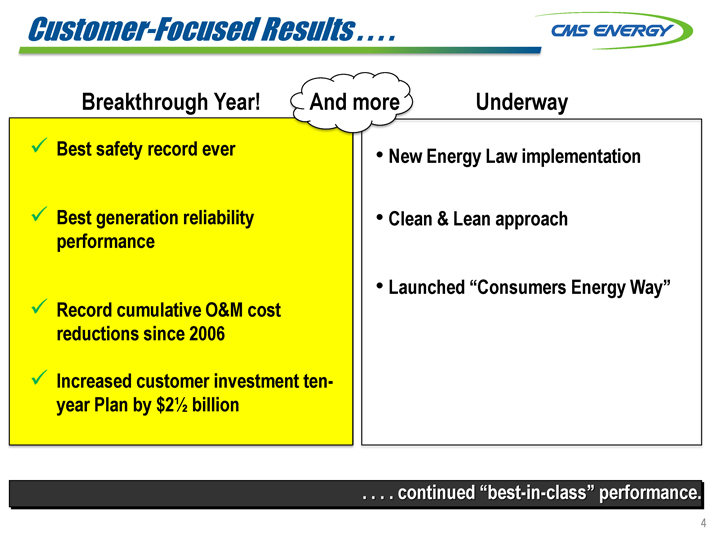

Breakthrough Year!

Best safety record ever

Best generation reliability performance

Record cumulative O&M cost reductions since 2006

Increased customer investment ten-year Plan by $2 1⁄2 billion

And more Underway

New

Energy Law implementation

Clean & Lean approach

Launched “Consumers

Energy Way”

. . . . continued “best-in-class” performance.

4

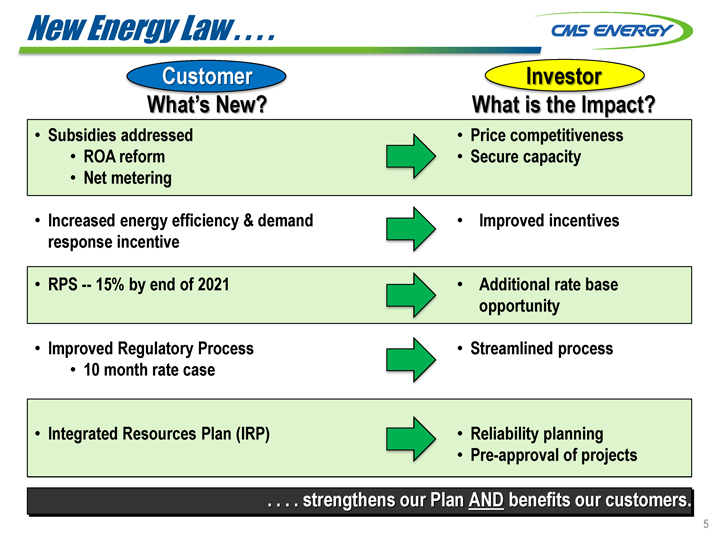

New Energy Law . . . . CMS ENERGY

Customer

What’s New?

• Subsidies addressed

• ROA reform

• Net metering

• Increased energy efficiency & demand response incentive

• RPS -- 15% by end of

2021

• Improved Regulatory Process

• 10 month rate case

• Integrated Resources Plan (IRP)

Investor What is the Impact?

• Price competitiveness

• Secure capacity

• Improved incentives

• Additional rate base opportunity

• Streamlined process

• Reliability planning

• Pre-approval of projects

. . . . strengthens

our Plan AND benefits our customers.

5

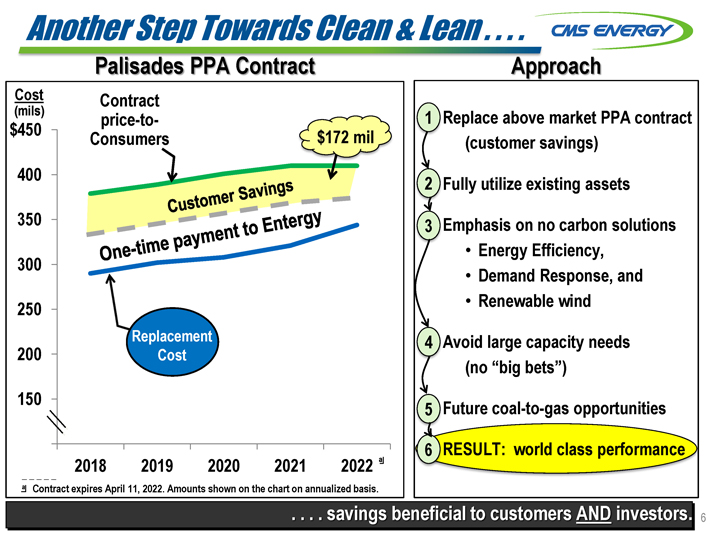

Another Step Towards Clean & Lean . . . . CMS ENERGY

Palisades PPA Contract

Cost (mils) $450 400 350 300 250 200 150

Contract price-to-Consumers $172 mil

Customer Savings

One-time payment to Entergy

Replacement Cost 2018 2019 2020 2021 2022 a

a Contract expires April 11, 2022. Amounts shown on the chart on annualized basis.

Approach

1 Replace above market PPA contract (customer savings)

2 Fully utilize

existing assets

3 Emphasis on no carbon solutions

• Energy Efficiency,

• Demand Response, and

• Renewable wind

4 Avoid large capacity needs (no “big bets”)

5 Future

coal-to-gas opportunities

6 RESULT: world class performance

. . . . savings beneficial to customers AND investors.

6

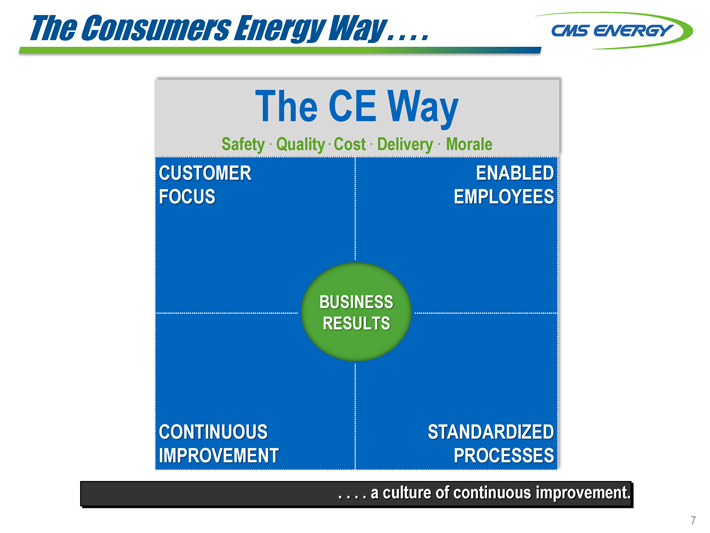

The Consumers Energy Way . . . . CMS ENERGY

The CE

Way Safety Quality Cost Delivery Morale

CUSTOMER FOCUS ENABLED EMPLOYEES BUSINESS RESULTS CONTINUOUS IMPROVEMENT STANDARDIZED PROCESSES

.. . . . a culture of continuous improvement.

7

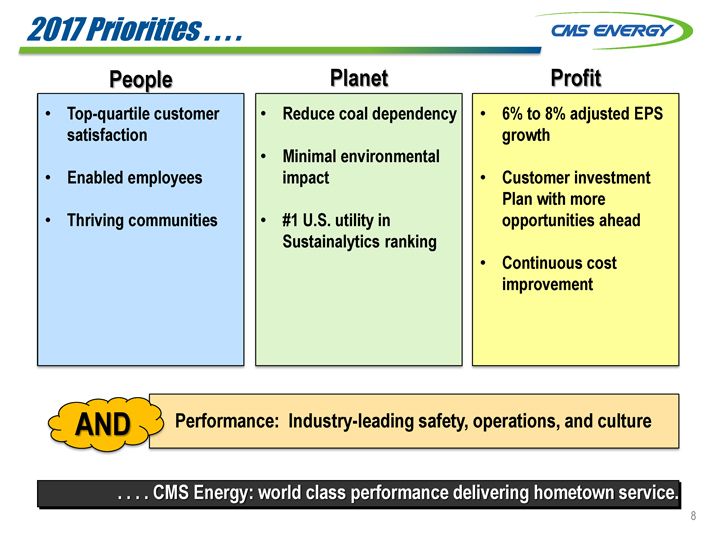

2017 Priorities . . . . CMS ENERGY

People

• Top-quartile customer satisfaction

• Enabled employees

• Thriving communities

Planet

• Reduce coal dependency

• Minimal environmental impact

• #1 U.S. utility in Sustainalytics ranking

Profit

• 6% to 8% adjusted EPS growth

• Customer investment Plan with more opportunities ahead

• Continuous cost

improvement

AND Performance: Industry-leading safety, operations, and culture

. . . . CMS Energy: world class performance delivering hometown service.

8

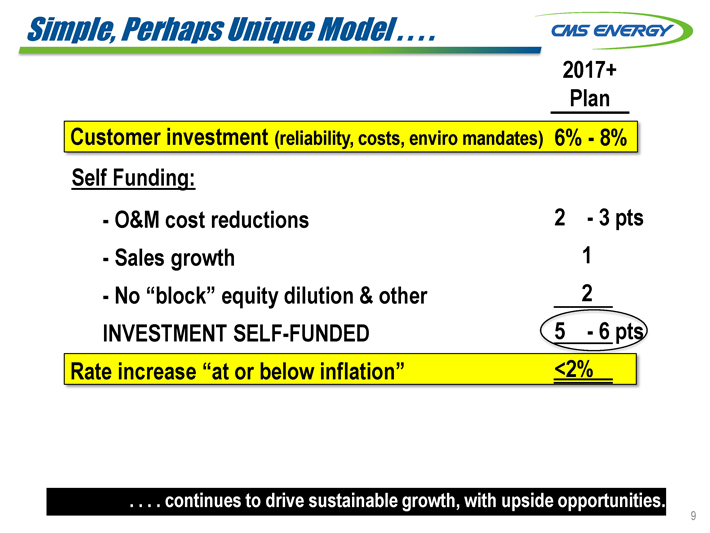

Simple, Perhaps Unique Model . . . . CMS ENERGY

2017+

Plan

Customer investment (reliability, costs, enviro mandates) 6% - 8%

Self Funding:

- O&M cost reductions 2 - 3 pts

- Sales growth 1

- No “block” equity dilution & other 2

INVESTMENT SELF-FUNDED 5 - 6 pts

Rate increase “at or below inflation” <2%

. . . . continues to

drive sustainable growth, with upside opportunities.

9

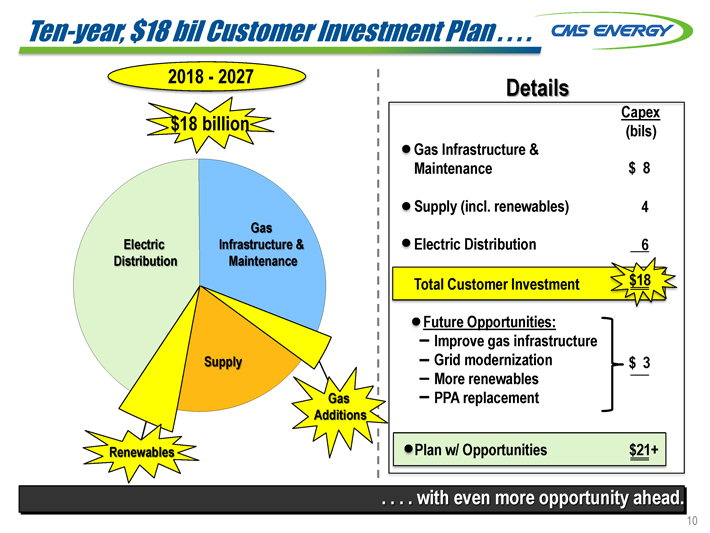

Ten-year, $18 bil Customer Investment Plan . . . . CMS ENERGY

2018 - 2027 $18 billion

Gas Infrastructure & Maintenance Electric Distribution Supply

Gas Additions Renewables

Details

Capex (bils)

• Gas Infrastructure & Maintenance $ 8

• Supply (incl. renewables) 4

• Electric Distribution 6

Total Customer Investment $18

• Future Opportunities:

- Improve gas infrastructure

- Grid modernization $ 3

- More renewables

- PPA replacement

• Plan w/ Opportunities $21+

. . . . with even more opportunity ahead.

10

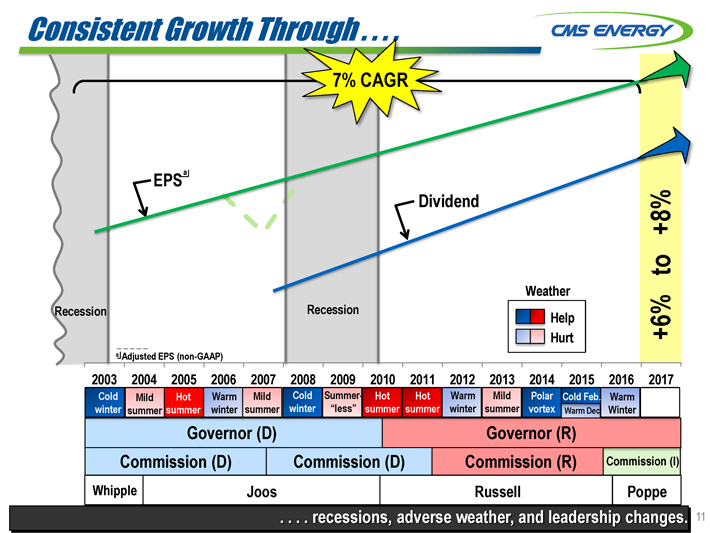

Consistent Growth Through . . . . CMS ENERGY

7%

CAGR

EPS a Dividend Recession Recession

Weather Help Hurt +6% to +8%

a Adjusted EPS (non-GAAP)

2003 2004

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Cold winter

Mild summer

Hot summer

Warm winter

Mild summer

Cold winter

Summer- “less”

Hot summer

Hot summer

Warm winter

Mild summer

Polar vortex

Cold Feb.

Warm Dec.

Warm Winter

Governor (D) Governor (R)

Commission (D) Commission (D) Commission (R) Commission (I)

Whipple Joos Russell Poppe

. . . . recessions, adverse weather, and

leadership changes. 11

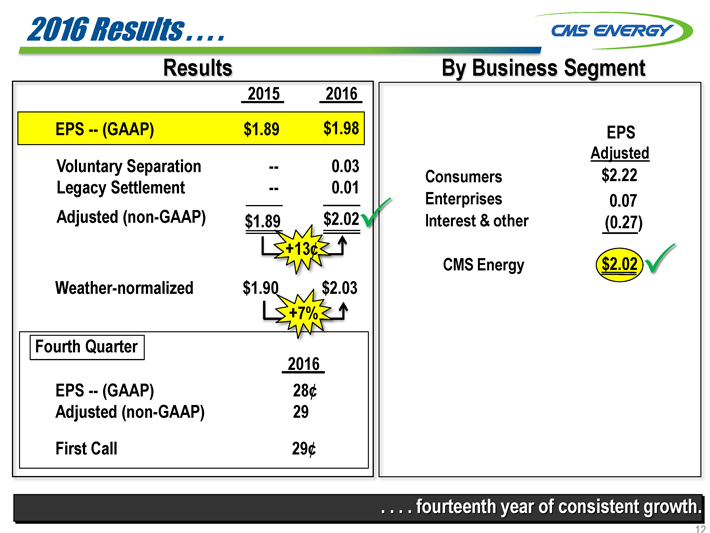

2016 Results . . . .

CMS ENERGY

Results

2015 2016

EPS -- (GAAP) $1.89 $1.98

Voluntary Separation -- 0.03

Legacy Settlement -- 0.01

Adjusted (non-GAAP) $1.89

$2.02

+13¢

Weather-normalized $1.90 $2.03

+7%

Fourth Quarter

2016

EPS -- (GAAP) 28¢

Adjusted (non-GAAP) 29

First Call 29¢

By Business Segment

EPS Adjusted

Consumers $2.22

Enterprises 0.07

Interest & Other (0.27)

CMS Energy $2.02

. . . . fourteenth year of consistent growth.

12

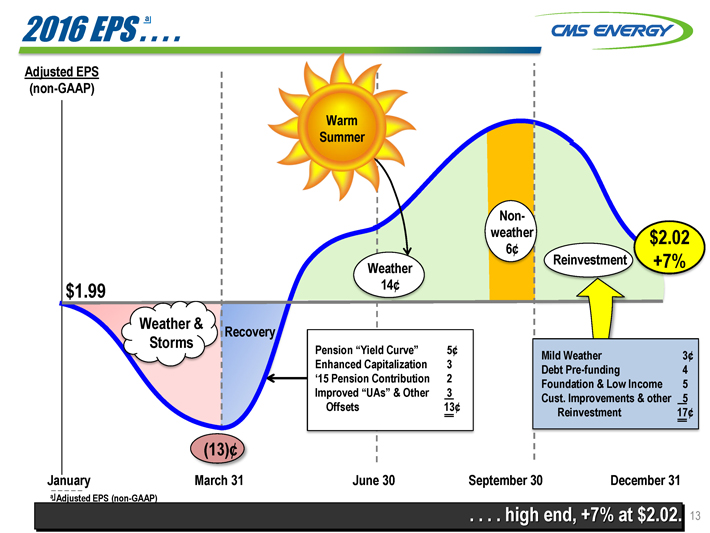

2016 EPSa . . . . CMS ENERGY

Adjusted EPS (non-GAAP)

Warm Summer

$1.99

Weather

14¢

Non-weather 6¢

Reinvestment

$2.02 +7%

Weather & Storms

Recovery

Pension “Yield Curve” 5¢

Enhanced Capitalization 3

‘15 Pension Contribution 2

Improved “UAs” & Other 3

Offsets 13¢

Mild Weather 3¢

Debt Pre-funding 4

Foundation & Low Income 5

Cust. Improvements & other 5

Reinvestment 17¢

(13)¢

January March 31 June 30 September 30 December 31

a Adjusted EPS (non-GAAP)

. . . . high end, +7% at $2.02. 13

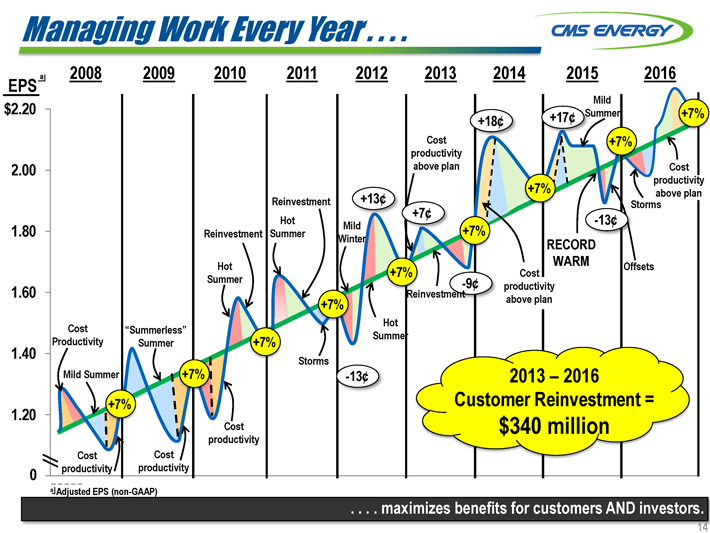

Managing Work Every Year . . . .

CMS ENERGY

2008 2009 2010 2011 2012 2013 2014 2015 2016

EPS a

$ 2.20

2.00

1.80

1.60

1.40

1.20

0

Cost Productivity

Mild Summer

“Summerless” Summer

Reinvestment

Hot Summer

Reinvestment

Hot Summer

Mild Winter

+13¢

Cost productivity above plan

+7¢

+18¢

+17¢

Mild Summer

+7%

+7%

+7%

+7%

+7%

+7%

+7%

+7%

+7%

Cost productivity

Cost productivity

Cost productivity

Storms

-13¢

Hot Summer

Reinvestment

-9¢

Cost productivity above plan

RECORD WARM

-13¢

Storms

Offsets

Cost productivity above plan

2013 – 2016

Customer Reinvestment =

$340 million

a Adjusted EPS (non-GAAP)

. . . . maximizes benefits for customers AND investors.

14

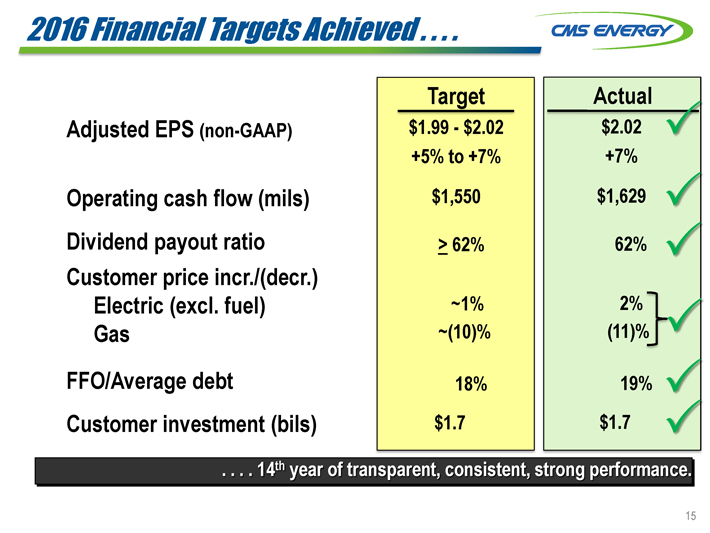

2016 Financial Targets Achieved . . . . CMS ENERGY

Target Actual

Adjusted EPS (non-GAAP)

$1.99 - $2.02 $2.02

+5% to +7% +7%

Operating cash flow (mils) $1,550 $1,629

Dividend payout ratio ³ 62% 62%

Customer price incr./(decr.)

Electric (excl. fuel) ~1% 2%

Gas ~(10)% (11)%

FFO/Average debt 18%19%

Customer investment (bils) $1.7 $1.7

. . . . 14th year of transparent, consistent, strong

performance.

15

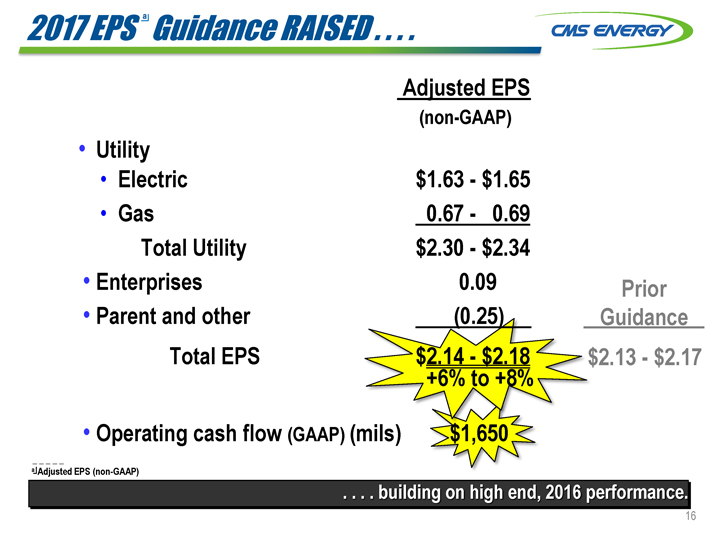

2017 EPS a Guidance RAISED . . . . CMS ENERGY

Adjusted EPS

(non-GAAP)

• Utility

• Electric

$1.63 - $ 1.65

• Gas 0.67 - 0.69

Total Utility $2.30 - $2.34

• Enterprises 0.09

Prior Guidance

• Parent and other (0.25)

Total EPS

$2.14 - $2.18

$2.13 - $2.17

+6% to +8%

• Operating cash flow (GAAP) (mils) $1,650

a Adjusted EPS

(non-GAAP)

. . . . building on high end, 2016 performance.

16

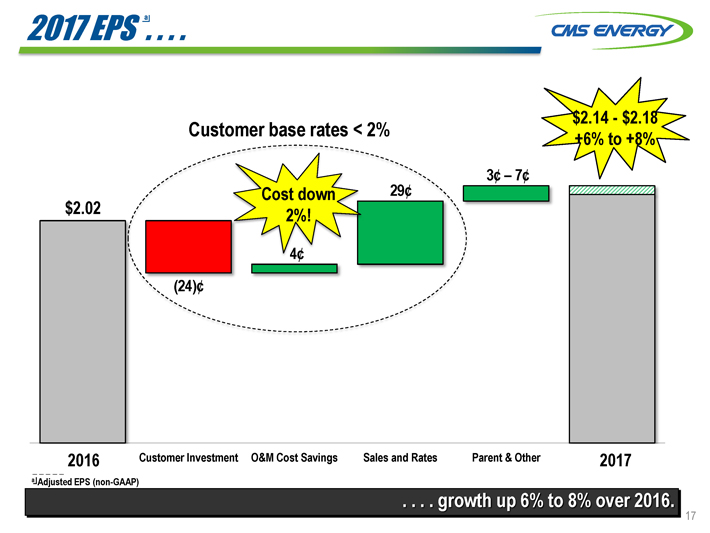

2017 EPS a . . . . CMS ENERGY

$2.02

Customer base rates < 2%

(24)¢

Cost down 2%!

4¢

29¢

3¢ - 7¢

$2.14 - $2.18

+6% to +8%

2016 Customer Investment O&M Cost Savings Sales and Rates Parent & Other 2017

a

Adjusted EPS (non-GAAP)

. . . . growth up 6% to 8% over 2016.

17

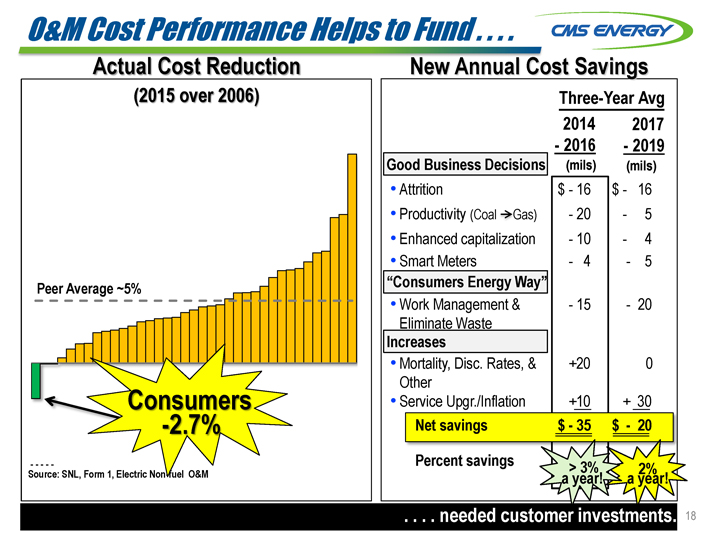

O&M Cost Performance Helps to Fund . . . . CMS ENERGY

Actual Cost Reduction

(2015 over 2006)

Peer Average ~5%

Consumers -2.7%

Source: SNL, Form 1, Electric Non-fuel O&M

New Annual Cost Savings

Three-Year Avg

2014 2017

- 2016 - 2019

Good Business Decisions (mils) (mils)

• Attrition $ - 16 $ - 16

• Productivity (Coal

g Gas) - 20 - 5

• Enhanced capitalization - 10 - 4

• Smart Meters - 4 - 5

“Consumers Energy Way”

• Work Management & - 15 - 20

Eliminate Waste

Increases

• Mortality, Disc. Rates, & Other +20 0

• Service Upgr./Inflation +10 + 30

Net savings $ - 35 $ - 20

Percent savings

> 3% a year!

2% a year!

.....

. . . . needed customer investments. 18

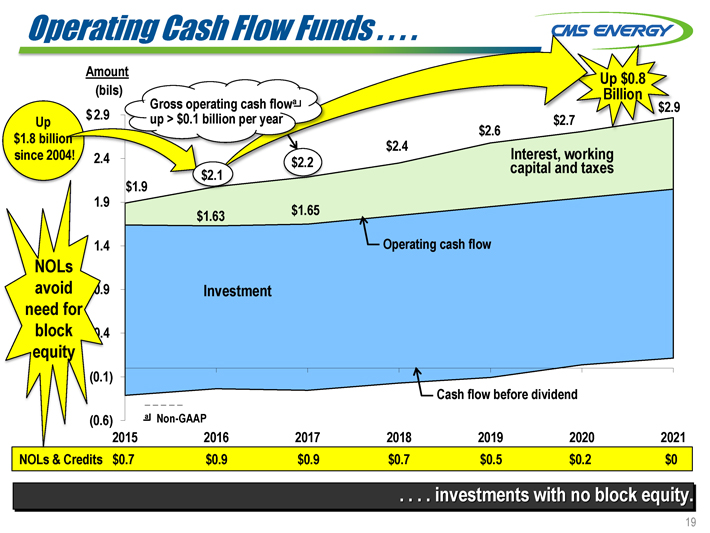

Operating Cash Flow Funds . . . . CMS ENERGY

Up

$1.8 billion

since 2004!

NOLs avoid need for block equity

Amount (bils)

$2.9

2.4

1.9

1.4

0.9

0.4

(0.1)

(0.6)

Gross operating cash flow a up > $0.1 billion per year

$1.9 $2.1 $2.2 $2.4 $2.6 $2.7 $2.9

Up $0.8 Billion

$1.63

$1.65

Interest, working capital and taxes

Investment

Operating cash flow

a Non-GAAP

Cash flow before dividend

2015 2016 2017 2018 2019 2020 2021

NOLs & Credits $0.7 $0.9 $0.9 $0.7 $0.5 $0.2 $0

. . . . investments with no block

equity.

19

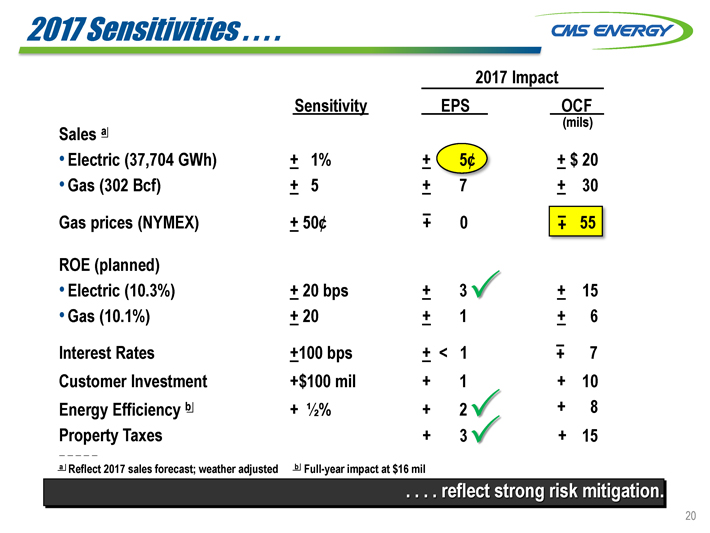

2017 Sensitivities . . . .

CMS ENERGY

2017 Impact

Sensitivity EPS OCF

(mils)

Sales a

Electric (37,704 GWh) + - 1% + - 5¢ + - $ 20

Gas (302 Bcf) + - 5 + - 7 + - 30

Gas prices (NYMEX) + - 50¢ + - 0 + - 55

ROE (planned)

Electric (10.3%) + - 20 bps + - 3 + - 15

Gas (10.1%) + - 20 + - 1 + - 6

Interest Rates + - 100 bps + - < 1 + - 7

Customer Investment +$100 mil + 1 + 10

Energy Efficiency b + 1/2% + 2 + 8

Property _ _ _ _ _ Taxes + 3 + 15

a Reflect 2017 sales forecast; weather adjusted b Full-year impact at $16 mil

. . . . reflect

strong risk mitigation.

20

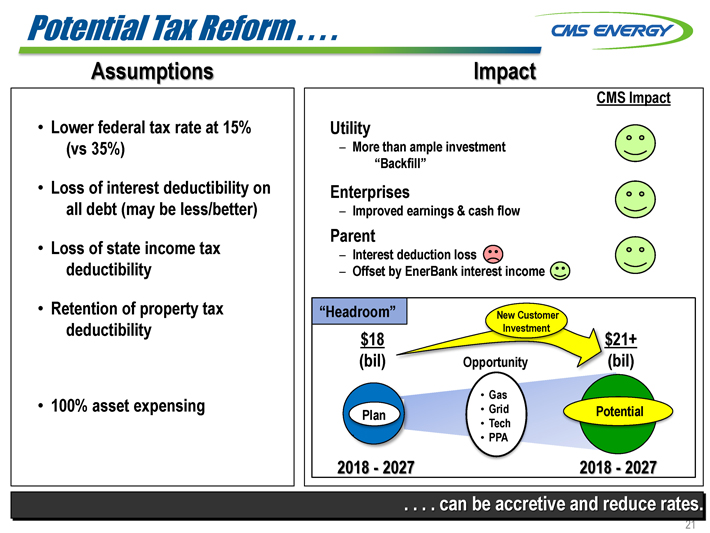

Potential Tax Reform . . . .

CMS Energy

Assumptions

Lower federal tax rate at 15% (vs 35%)

Loss of interest deductibility on all debt (may be less/better)

Loss of state income tax

deductibility

Retention of property tax deductibility

100% asset expensing

Impact

CMS Impact

Utility

– More than ample investment

“Backfill”

Enterprises

– Improved earnings & cash flow

Parent

– Interest deduction loss

– Offset by EnerBank interest income

“Headroom”

$18 (bil)

New Customer Investment

$21+ (bil)

Opportunity

Plan

Gas

Grid

Tech

PPA

Potential

2018 - 2027

2018 - 2027

. . . . can be accretive and reduce rates.

21

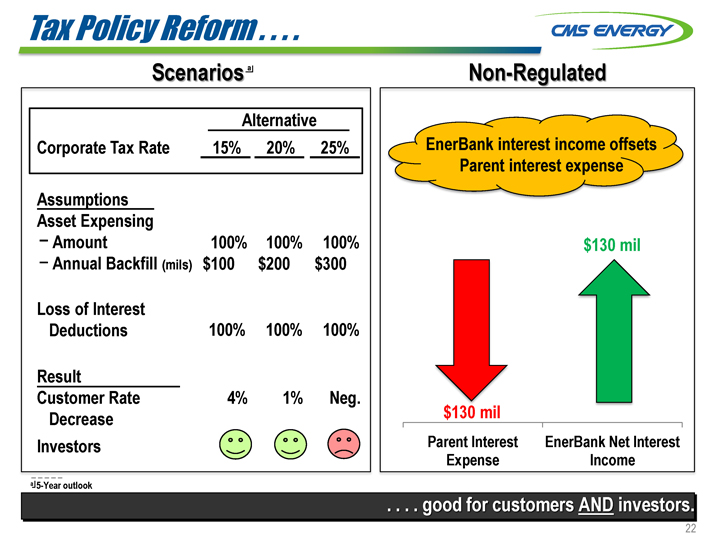

Tax Policy Reform . . . .

CMS ENERGY

Scenarios a

Alternative

Corporate Tax Rate 15% 20% 25%

Assumptions

Asset Expensing

- Amount 100% 100% 100%

- Annual Backfill (mils) $100 $200 $300

Loss of Interest

Deductions 100% 100% 100%

Result

Customer Rate 4% 1% Neg.

Decrease

Investors

Non-Regulated

EnerBank interest income offsets Parent interest expense

$130 mil

Parent Interest Expense

$130 mil

EnerBank Net Interest Income

a 5-Year outlook

. . . . good for customers AND investors.

22

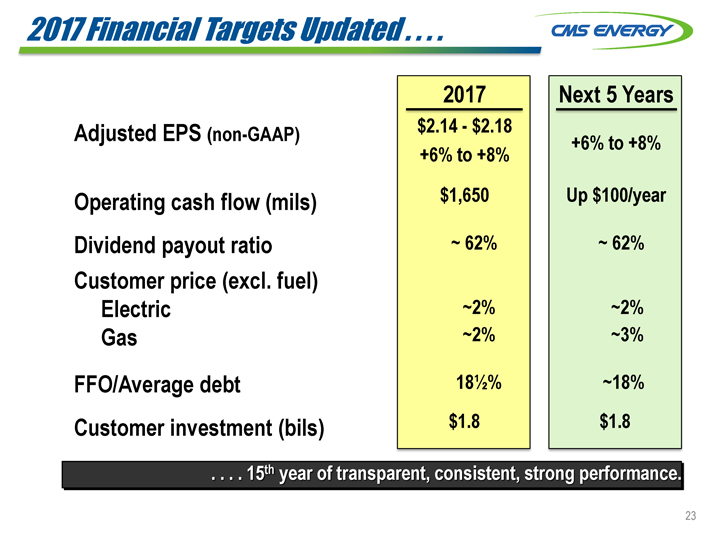

2017 Financial Targets Updated . . . .

2017 Next 5

Years

Adjusted EPS (non-GAAP) $2.14 - $2.18 +6% to +8%

+6% to +8%

Operating cash flow (mils) $1,650 Up $100/year

Dividend payout ratio ~ 62% ~ 62%

Customer price (excl. fuel)

Electric ~2% ~2%

Gas ~2% ~3%

FFO/Average debt 181/2% ~18%

Customer investment (bils) $1.8 $1.8

CMS ENERGY

. . . . 15th year of transparent, consistent, strong performance.

23

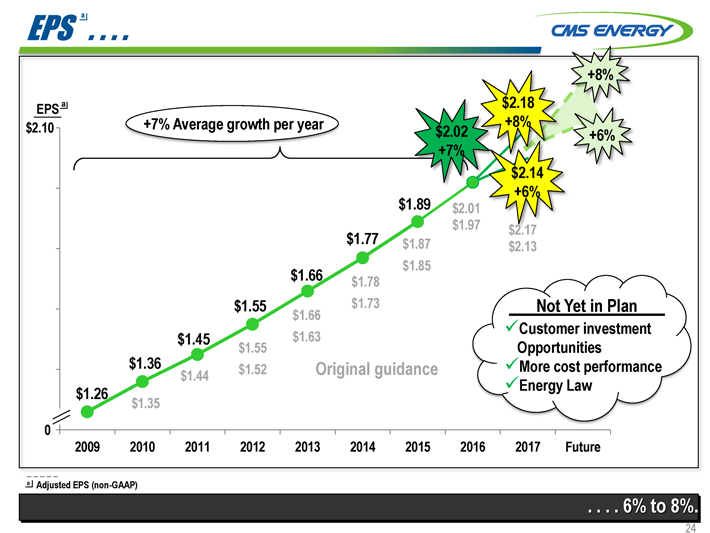

EPS a . . . .

CMS ENERGY

EPS a

$2.10

0

+7% Average growth per year

$2.02 +7%

$2.18 +8%

+8%

$2.14 +6%

+6%

$1.26

$1.36

$1.45

$1.55

$1.66

$1.77

$1.89

$1.35

$1.44

$1.55 $1.52

$1.66 $1.63

$1.78 $1.73

$1.87 $1.85

$2.01 $1.97

$2.17 $2.13

Original guidance

Not Yet in Plan

Customer investment Opportunities

More cost performance

Energy Law

2009 2010 2011 2012 2013 2014 2015 2016 2017 Future

a Adjusted EPS (non-GAAP)

. . . . 6% to 8%.

24

Q & A

Appendix

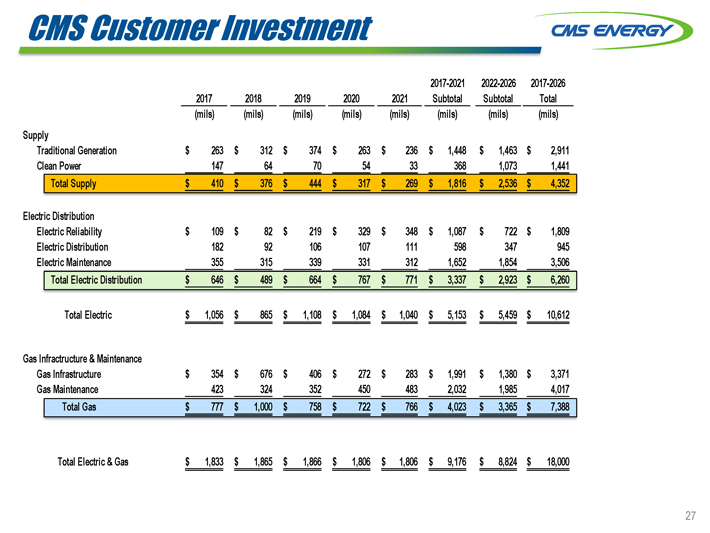

CMS Customer Investment

CMS ENERGY

2017-2021 2022-2026 2017-2026

2017 2018 2019 2020 2021 Subtotal Subtotal Total

(mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils)

Supply

Traditional Generation $ 263 $ 312 $ 374 $ 263 $ 236 $ 1,448 $ 1,463 $ 2,911

Clean Power 147

64 70 54 33 368 1,073 1,441

Total Supply $ 410 $ 376 $ 444 $ 317 $ 269 $ 1,816 $ 2,536 $ 4,352

Electric Distribution

Electric Reliability $109 $ 82 $ 219 $ 329 $ 348 $ 1,087 $ 722 $ 1,809

Electric Distribution 182 92 106 107 111 598 347 945

Electric Maintenance 355

315 339 331 312 1,652 1,854 3,506

Total Electric Distribution $ 646 $ 489 $ 664 $ 767 $ 771 $ 3,337 $ 2,923 $ 6,260

Total Electric $ 1,056 $ 865 $ 1,108 $ 1,084 $ 1,040 $ 5,153 $ 5,459 $ 10,612

Gas

Infractructure & Maintenance

Gas Infrastructure $ 354 $ 676 $ 406 $ 272 $ 283 $ 1,991 $ 1,380 $ 3,371

Gas Maintenance 423 324 352 450 483 2,032 1,985 4,017

Total Gas $ 777 $ 1,000 $ 758 $ 722 $

766 $ 4,023 $ 3,365 $ 7,388

Total Electric & Gas $ 1,833 $ 1,865 $ 1,866 $ 1,806 $ 1,806 $ 9,176 $ 8,824 $ 18,000

27

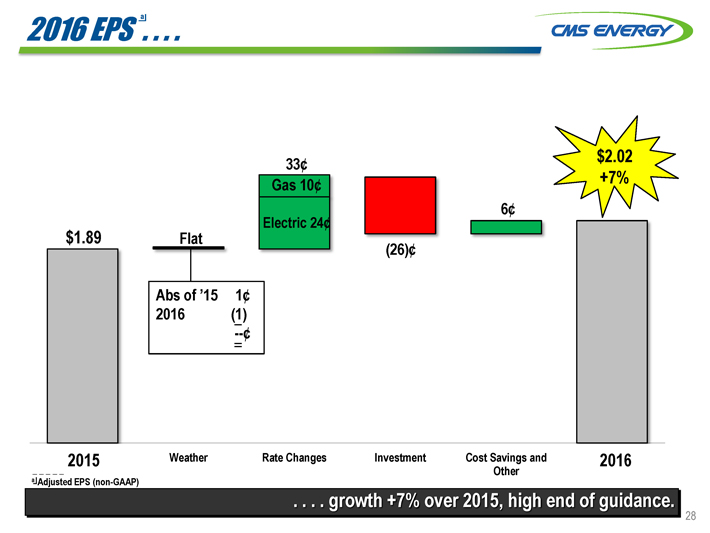

2016 EPS a . . . .

CMS ENERGY

$1.89

Flat

Abs of ’15 1¢

2016 (1)

--¢

33¢ Gas 10¢

Electric 24¢

(26)¢

6¢

$2.02 +7%

2015 Weather Rate Changes Investment Cost Savings and Other 2016

a Adjusted EPS (non-GAAP)

. . . . growth +7% over 2015, high end of guidance.

28

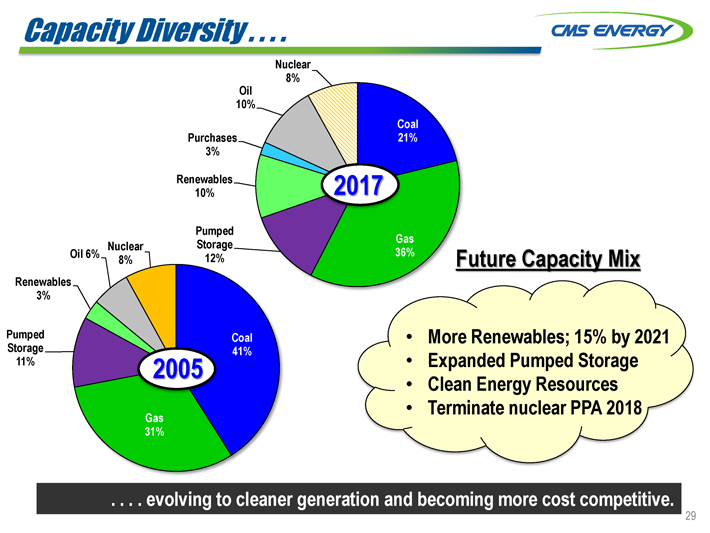

Capacity Diversity . . . .

CMS ENERGY

Pumped Storage 11%

Renewables 3%

Oil 6%

Nuclear 8%

2005

Gas 31%

Coal 41%

Pumped Storage 12%

Renewables 10%

Purchases

3%

Oil 10%

Nuclear 8%

2017

Coal 21%

Gas

36%

Future Capacity Mix

• More Renewables; 15% by 2021

• Expanded Pumped Storage

• Clean Energy Resources

• Terminate nuclear PPA 2018

. . . . evolving to cleaner generation and becoming more cost competitive.

29

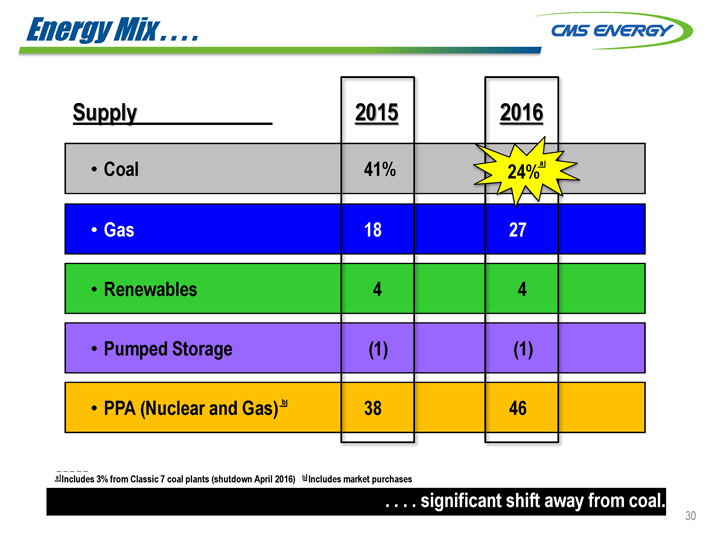

Energy Mix . . . .

CMS ENERGY

Supply 2015 2016

• Coal 41% 24%a

• Gas 18 27

• Renewables 4 4

• Pumped Storage (1) (1)

• PPA (Nuclear and Gas) b 38 46

_ _ _ _ _ a Includes 3% from Classic 7 coal plants (shutdown April 2016) b Includes market purchases

. . . . significant shift away from coal.

30

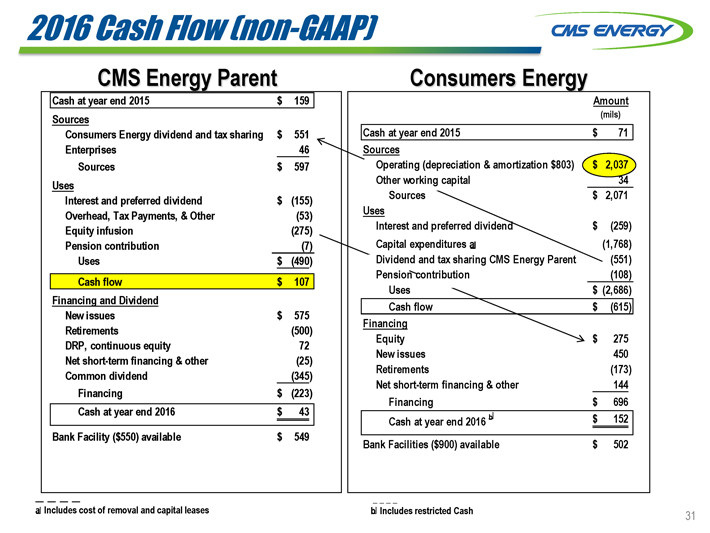

2016 Cash Flow (non-GAAP)

CMS ENERGY

CMS Energy Parent

Cash at year end 2015 $159

Sources

Consumers Energy dividend and tax sharing $551

Enterprises 46

Sources $597

Uses

Interest and preferred dividend $(155)

Overhead, Tax Payments, & Other (53)

Equity infusion (275)

Pension contribution (7)

Uses $(490)

Cash flow $107

Financing and Dividend

New issues $575

Retirements (500)

DRP, continuous equity 72

Net short-term financing & other (25)

Common dividend (345)

Financing $(223)

Cash at year end 2016 $43

Bank Facility ($550) available $549

Consumers Energy

Amount

(mils)

Cash at year end 2015 $71

Sources

Operating (depreciation & amortization $803) $2,037

Other working capital 34

Sources $2,071

Uses

Interest and preferred dividend $(259)

Capital expenditures a (1,768)

Dividend and tax sharing CMS Energy Parent (551)

Pension contribution (108)

Uses $(2,686)

Cash flow $(615)

Financing

Equity $275

New issues 450

Retirements (173)

Net short-term financing & other 144

Financing $696

Cash at year end 2016 b $152

Bank Facilities ($900) available $502

a Includes cost of removal and capital leases b Includes restricted Cash 31

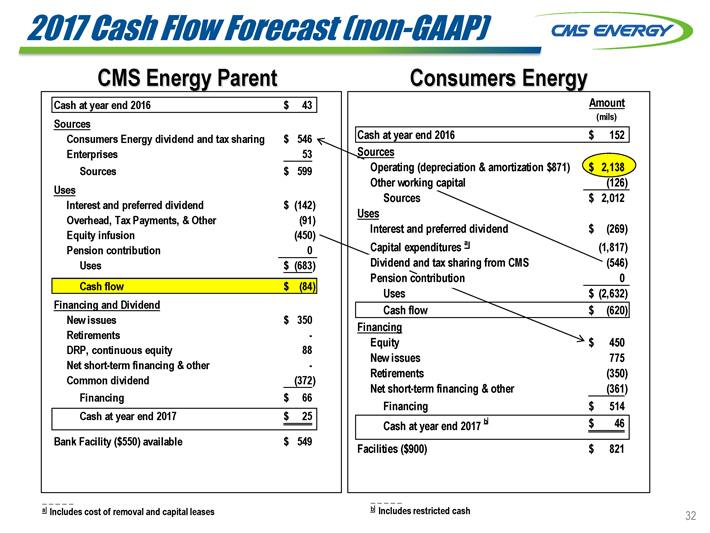

2017 Cash Flow Forecast (non-GAAP)

CMS ENERGY

CMS Energy Parent

Cash at year end 2016 $43

Sources

Consumers Energy dividend and tax sharing $546

Enterprises 53

Sources $599

Uses

Interest and preferred dividend $(142)

Overhead, Tax Payments, & Other (91)

Equity infusion (450)

Pension contribution 0

Uses $(683)

Cash flow $(84)

Financing and Dividend

New issues $350

Retirements —

DRP, continuous equity 88

Net short-term financing & other —

Common dividend (372)

Financing $66

Cash at year end 2017 $25

Bank Facility ($550) available $549

Consumers Energy

Amount

(mils)

Cash at year end 2016 $152

Sources

Operating (depreciation & amortization $871) $2,138

Other working capital (126)

Sources $2,012

Uses

Interest and preferred dividend $(269)

Capital expenditures a (1,817)

Dividend and tax sharing from CMS (546)

Pension contribution 0

Uses $(2,632)

Cash flow $(620)

Financing

Equity $450

New issues 775

Retirements (350)

Net short-term financing & other (361)

Financing $514

Cash at year end 2017 b $46

Facilities ($900) $821

a Includes cost of removal and capital leases b Includes restricted cash

32

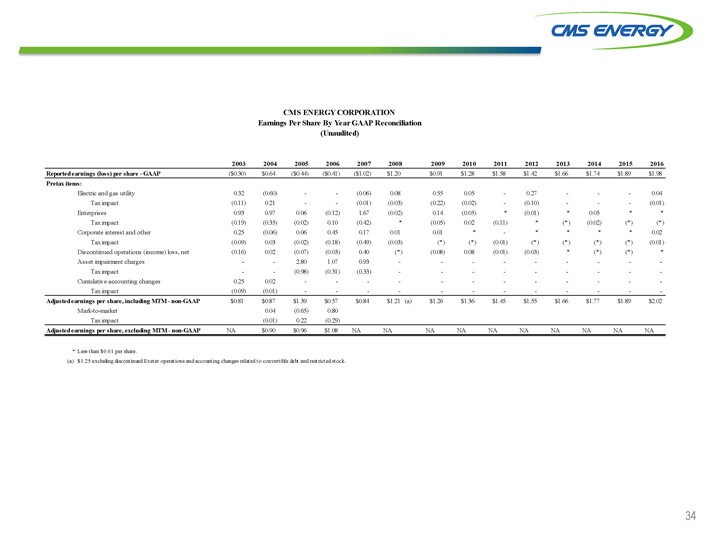

GAAP Reconciliation

CMS ENERGY

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Reported earnings (loss)

per share - GAAP ($0.30) $0.64 ($0.44) ($0.41) ($1.02) $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 $1.74 $1.89 $1.98

Pretax items:

Electric and gas utility 0.32 (0.60) — — (0.06) 0.08 0.55 0.05 — 0.27 — — — 0.04

Tax impact (0.11) 0.21 — — (0.01) (0.03) (0.22) (0.02) — (0.10) — — — (0.01)

Enterprises 0.93 0.97 0.06 (0.12) 1.67 (0.02) 0.14 (0.05)* (0.01)* 0.05* *

Tax impact (0.19)

(0.35) (0.02) 0.10 (0.42)* (0.05) 0.02 (0.11)* (*) (0.02) (*) (*)

Corporate interest and other 0.25 (0.06) 0.06 0.45 0.17 0.01 0.01* -* * * * 0.02

Tax impact (0.09) 0.03 (0.02) (0.18) (0.49) (0.03) (*) (*) (0.01) (*) (*) (*) (*) (0.01)

Discontinued operations (income) loss, net (0.16) 0.02 (0.07) (0.03) 0.40 (*) (0.08) 0.08 (0.01) (0.03)* (*) (*) *

Asset impairment charges — — 2.80 1.07 0.93 — — — — — — — — —

Tax impact — — (0.98) (0.31) (0.33) — — — — — — — — —

Cumulative accounting changes 0.25 0.02 — — — — — — — — — — — —

Tax impact (0.09) (0.01) — — — — — — — — — — — —

Adjusted earnings per share, including MTM - non-GAAP $0.81 $0.87 $1.39 $0.57 $0.84 $1.21 (a) $1.26 $1.36 $1.45 $1.55 $1.66 $1.77 $1.89

$2.02

Mark-to-market 0.04 (0.65) 0.80

Tax impact (0.01) 0.22 (0.29)

Adjusted earnings per share, excluding MTM - non-GAAP NA $0.90 $0.96 $1.08 NA NA NA NA NA NA NA NA NA NA

* Less than $0.01 per share.

(a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock.

34

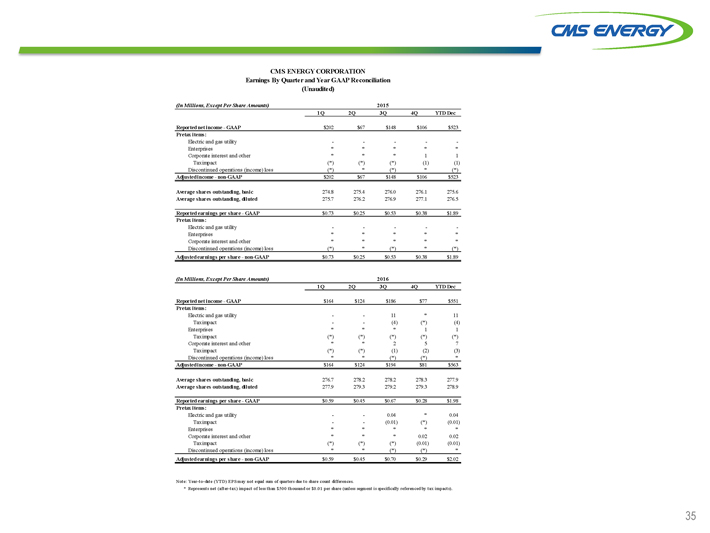

CMS ENERGY

CMS ENERGY CORPORATION

Earnings By Quarter and Year GAAP Reconciliation (Unaudited)

(In Millions, Except Per Share

Amounts) 2015

1Q 2Q 3Q 4Q YTD Dec

Reported net income - GAAP $202 $67 $148

$106 $523

Pretax items:

Electric and gas utility — — — —

—

Enterprises * * * * *

Corporate interest and other * * * 1 1

Tax impact (*) (*) (*) (1) (1)

Discontinued operations (income) loss (*) *

(*) * (*)

Adjusted income - non-GAAP $202 $67 $148 $106 $523

Average shares outstanding, basic 274.8 275.4 276.0 276.1 275.6

Average shares outstanding,

diluted 275.7 276.2 276.9 277.1 276.5

Reported earnings per share - GAAP $0.73 $0.25 $0.53 $0.38 $1.89

Pretax items:

Electric and gas utility — — — — —

Enterprises * * * * *

Corporate interest and other * * * * *

Discontinued operations (income) loss (*) * (*) * (*)

Adjusted earnings per share - non-GAAP $0.73 $0.25 $0.53 $0.38 $1.89

(In Millions, Except Per Share Amounts) 2016

1Q 2Q 3Q 4Q YTD Dec

Reported net income - GAAP $164 $124 $186 $77 $551

Pretax items:

Electric and gas utility — — 11* 11

Tax impact — — (4) (*) (4)

Enterprises * * * 1 1

Tax impact (*) (*) (*) (*) (*)

Corporate interest and other * * 2 5 7

Tax impact (*) (*) (1) (2) (3)

Discontinued operations (income) loss * * (*) (*) *

Adjusted income - non-GAAP $164 $124 $194 $81 $563

Average shares outstanding, basic 276.7 278.2 278.2 278.3 277.9

Average

shares outstanding, diluted 277.9 279.3 279.2 279.3 278.9

Reported earnings per share - GAAP $0.59 $0.45 $0.67 $0.28 $1.98

Pretax items:

Electric and gas utility — — 0.04* 0.04

Tax impact — — (0.01) (*) (0.01)

Enterprises * * * * *

Corporate interest and other * * * 0.02 0.02

Tax impact (*) (*) (*) (0.01) (0.01)

Discontinued operations (income) loss * * (*) (*) *

Adjusted earnings per share - non-GAAP $0.59 $0.45 $0.70 $0.29 $2.02

Note:

Year-to-date (YTD) EPS may not equal sum of quarters due to share count differences.

* Represents net (after-tax) impact of less than $500 thousand or $0.01 per share (unless segment is specifically

referenced by tax impacts).

35

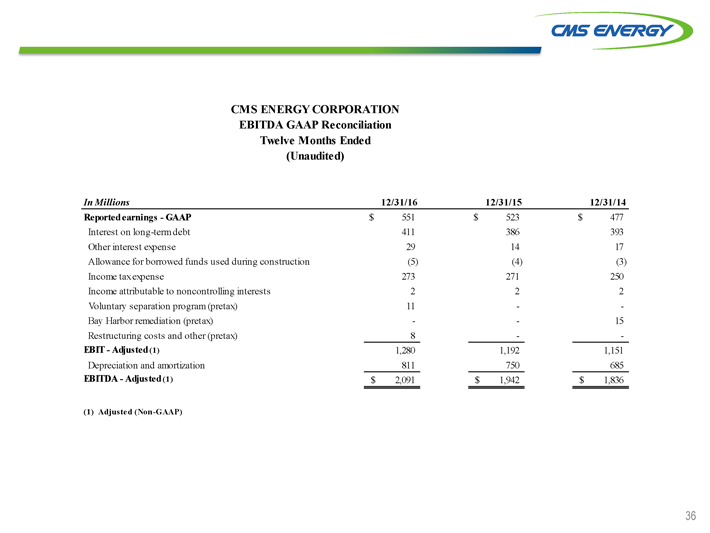

CMS ENERGY

CMS ENERGY CORPORATION

EBITDA GAAP Reconciliation

Twelve Months Ended

(Unaudited)

In Millions 12/31/16 12/31/15 12/31/14

Reported earnings - GAAP $551 $523 $477

Interest on long-term debt 411 386 393

Other interest expense 29 14 17

Allowance for borrowed funds used during construction (5) (4)

(3)

Income tax expense 273 271 250

Income attributable to noncontrolling

interests 2 2 2

Voluntary separation program (pretax) 11 — —

Bay

Harbor remediation (pretax) — — 15

Restructuring costs and other (pretax) 8 — —

EBIT - Adjusted (1) 1,280 1,192 1,151

Depreciation and amortization 811 750 685

EBITDA - Adjusted (1) $2,091 $1,942 $1,836

(1) Adjusted

(Non-GAAP)

36

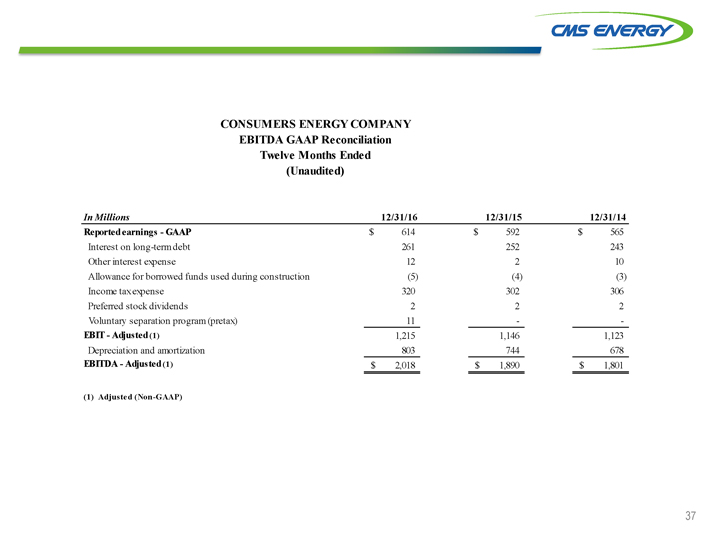

CMS ENERGY

CONSUMERS ENERGY COMPANY

EBITDA GAAP Reconciliation

Twelve Months Ended

(Unaudited)

In Millions 12/31/16 12/31/15 12/31/14

Reported earnings - GAAP $614 $592 $565

Interest on long-term debt 261 252 243

Other interest expense 12 2 10

Allowance for borrowed funds used during construction (5) (4)

(3)

Income tax expense 320 302 306

Preferred stock dividends 2 2 2

Voluntary separation program (pretax) 11 - -

EBIT - Adjusted (1) 1,215 1,146

1,123

Depreciation and amortization 803 744 678

EBITDA - Adjusted (1) $2,018

$1,890 $1,801

(1) Adjusted (Non-GAAP)

37

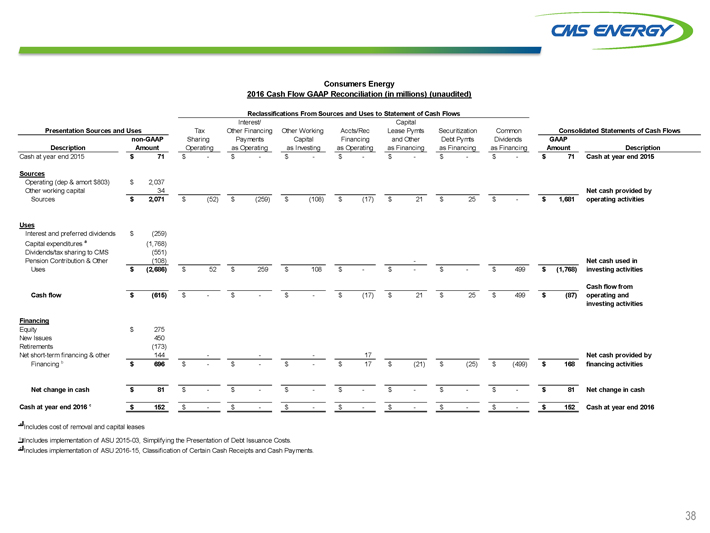

CMS ENERGY

Consumers Energy

2016 Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources

and Uses to Statement of Cash Flows

Interest/ Capital

Presentation Sources

and Uses Tax Other Financing Other Working Accts/Rec Lease Pymts Securitization Common Consolidated Statements of Cash Flows

non-GAAP Sharing Payments Capital Financing and Other Debt Pymts Dividends GAAP

Description Amount Operating as Operating as Investing as Operating as Financing as Financing as Financing Amount Description

Cash at year end 2015 $71 $ - $ - $ - $ - $ - $ - $ - $71 Cash at year end 2015

Sources

Operating (dep & amort $803) $2,037

Other working capital 34 Net

cash provided by

Sources $2,071 $(52) $(259) $(108) $(17) $21 $25 $- $1,681 operating activities

Uses

Interest and preferred dividends $(259)

Capital expenditures a (1,768)

Dividends/tax sharing to CMS (551)

Pension Contribution & Other (108) - Net cash used in

Uses $(2,686) $52 $259 $108 $-

$- $- $499 $(1,768) investing activities

Cash flow from

Cash flow $(615) $ -

$ - $ - $(17) $21 $25 $499 $(87) operating and

investing activities

Financing

Equity $275

New Issues 450

Retirements (173)

Net short-term financing & other 144 - - - 17 Net cash provided by

Financing b $696 $ - $ - $ - $17 $(21) $(25) $(499) $168 financing activities

Net change in cash $81 $ - $ - $ - $ - $ - $ - $ - $81 Net change in cash

Cash at year end 2016 c $152 $ - $ - $ - $ - $ - $ - $ - $152 Cash at year end 2016

a Includes cost of removal and capital leases b Includes implementation of ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs.

c Includes implementation of ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments.

38

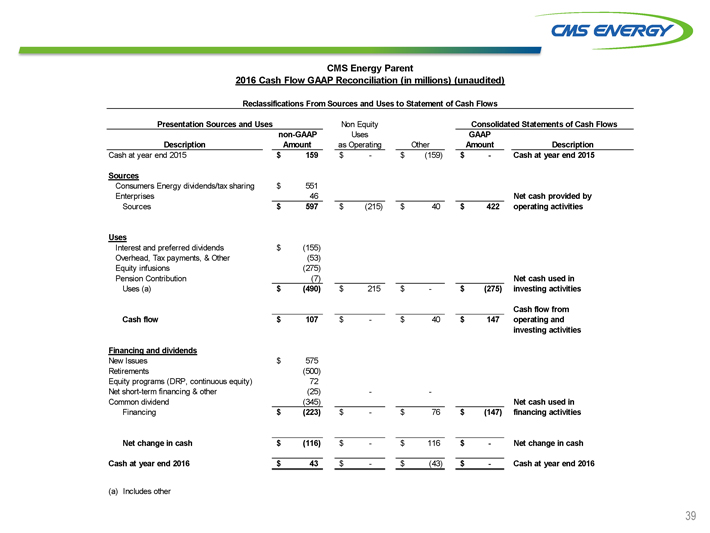

CMS ENERGY

CMS Energy Parent

2016 Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources

and Uses to Statement of Cash Flows

Presentation Sources and Uses Non Equity Consolidated Statements of Cash Flows

non-GAAP Uses GAAP

Description Amount as Operating

Other Amount Description

Cash at year end 2015 $159 $ - $(159) $ - Cash at year end 2015

Sources

Consumers Energy dividends/tax sharing $551

Enterprises 46 Net cash provided by

Sources $597 $(215) $40 $422 operating activities

Uses

Interest and preferred dividends $(155)

Overhead, Tax payments, & Other (53)

Equity infusions (275)

Pension Contribution (7) Net cash used in

Uses (a) $(490) $215 $ - $(275) investing activities

Cash flow from

Cash flow $107 $ - $40 $147 operating and

investing activities

Financing and dividends

New Issues $575

Retirements (500)

Equity programs (DRP, continuous equity) 72

Net short-term financing & other (25) - -

Common dividend (345) Net cash used in

Financing $(223) $ - $76 $(147)

financing activities

Net change in cash $(116) $ - $116 $ - Net change in cash

Cash at year end 2016 $43 $ - $(43) $ - Cash at year end 2016

(a) Includes

other

39

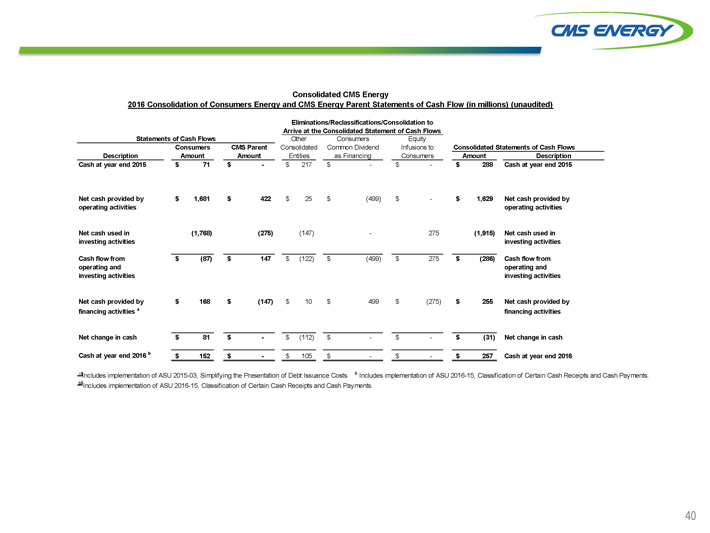

CMS ENERGY

Consolidated CMS Energy

2016 Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

Eliminations/Reclassifications/Consolidation to

Arrive at the Consolidated Statement of Cash

Flows

Statements of Cash Flows Other Consumers Equity

Consumers CMS Parent

Consolidated Common Dividend Infusions to Consolidated Statements of Cash Flows

Description Amount Amount Entities as Financing Consumers Amount Description

Cash at year end 2015 $71 $ - $217 $ - $ - $288 Cash at year end 2015

Net

cash provided by $1,681 $422 $25 $(499) $ - $1,629 Net cash provided by

operating activities operating activities

Net cash used in (1,768) (275) (147) - 275 (1,915) Net cash used in

investing activities

investing activities

Cash flow from $(87) $147 $(122) $(499) $275 $(286) Cash flow from

operating and operating and

investing activities investing activities

Net cash provided by $168 $(147) $10 $499 $(275) $255 Net cash provided by

financing

activities a financing activities

Net change in cash $81 $ - $(112) $ - $ - $(31) Net change in cash

Cash at year end 2016 b $152 $ - $105 $ - $ - $257 Cash at year end 2016

a Includes

implementation of ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs. b Includes implementation of ASU 2016-15, Classification of Certain Cash Receipts and

Cash Payments. b Includes implementation of ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments.

40

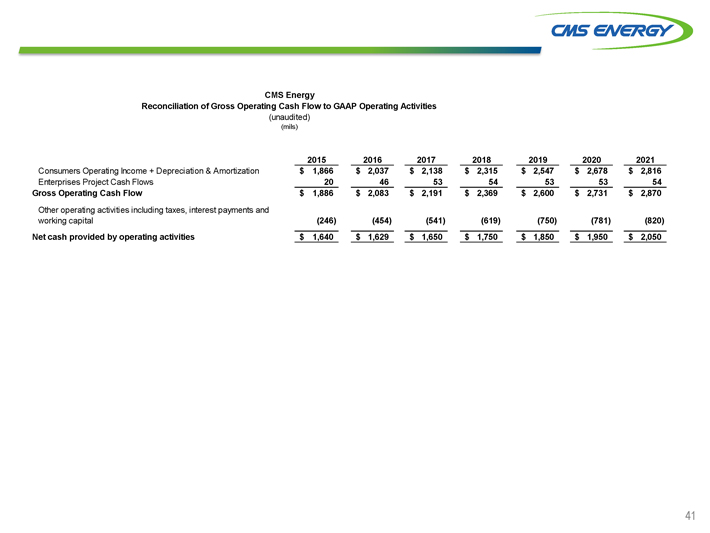

CMS ENERGY

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

2015 2016 2017 2018 2019 2020 2021

Consumers Operating Income + Depreciation & Amortization $1,866 $2,037 $2,138 $2,315 $2,547 $2,678 $2,816

Enterprises Project Cash Flows 20 46 53 54 53 53 54

Gross Operating Cash Flow $1,886 $2,083

$2,191 $2,369 $2,600 $2,731 $2,870

Other operating activities including taxes, interest payments and working capital (246) (454) (541) (619) (750) (781) (820)

Net cash provided by operating activities $1,640 $1,629 $1,650 $1,750 $1,850 $1,950 $2,050

41

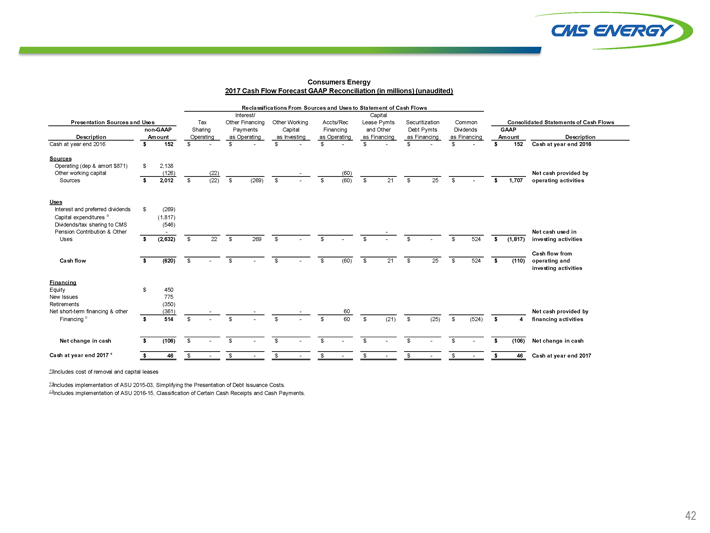

CMS ENERGY

Consumers Energy

2017 Cash Flow Forecast GAAP Reconciliation (in millions) (unaudited)

Reclassifications From

Sources and Uses to Statement of Cash Flows

Interest/ Capital

Presentation

Sources and Uses Tax Other Financing Other Working Accts/Rec Lease Pymts Securitization Common Consolidated Statements of Cash Flows

non-GAAP Sharing Payments Capital Financing and Other Debt Pymts Dividends GAAP

Description Amount Operating as Operating as Investing as Operating as Financing as Financing as Financing Amount Description

Cash at year end 2016 $152 $ - $ - $ - $ - $ - $ - $ - $152 Cash at year end 2016

Sources

Operating (dep & amort $871) $2,138

Other working capital (126) (22)

- (60) Net cash provided by

Sources $2,012 $(22) $(269) $ - $(60) $21 $25 $ - $1,707 operating activities

Uses

Interest and preferred dividends $(269)

Capital expenditures a (1,817)

Dividends/tax sharing to CMS (546)

Pension Contribution & Other - - Net cash used in

Uses $(2,632) $22 $269 $ - $ - $ -

$ - $524 $(1,817) investing activities

Cash flow from

Cash flow $(620) $ - $

- $ - $(60) $21 $25 $524 $(110) operating and

investing activities

Financing

Equity $450

New Issues 775

Retirements (350)

Net short-term financing & other (361) - - - 60 Net cash provided

by

Financing b $514 $ - $ - $ - $60 $(21) $(25) $(524) $4 financing activities

Net change in cash $(106) $ - $ - $ - $ - $ - $ - $ - $(106) Net change in cash

Cash at year end 2017 c $46 $ - $ - $ - $ - $ - $ - $ - $46 Cash at year end 2017

a Includes cost of removal and capital leases

b Includes implementation of ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs. c Includes implementation of ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments.

42

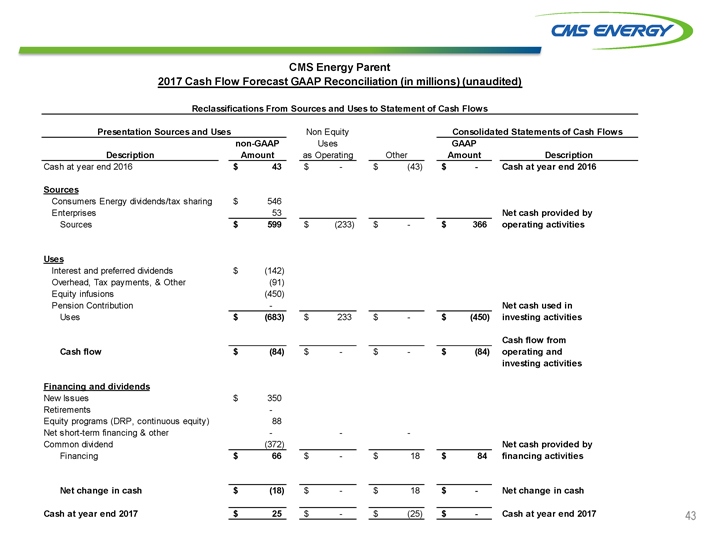

CMS ENERGY

CMS Energy Parent

2017 Cash Flow Forecast GAAP Reconciliation (in millions) (unaudited)

Reclassifications From

Sources and Uses to Statement of Cash Flows

Presentation Sources and Uses Non Equity Consolidated Statements of Cash Flows

non-GAAP Uses GAAP

Description Amount as Operating

Other Amount Description

Cash at year end 2016 $43 $ - $(43) $ - Cash at year end 2016

Sources

Consumers Energy dividends/tax sharing $546

Enterprises 53 Net cash provided by

Sources $599 $(233) $ - $366 operating activities

Uses

Interest and preferred dividends $(142)

Overhead, Tax payments, & Other (91)

Equity infusions (450)

Pension Contribution - Net cash used in

Uses $(683) $233 $ - $(450) investing activities

Cash flow from

Cash flow $(84) $ - $ - $(84) operating and

investing activities

Financing and dividends

New Issues $350

Retirements -

Equity programs (DRP, continuous equity) 88

Net short-term financing & other - - -

Common dividend (372) Net cash provided by

Financing $66 $ - $18 $84

financing activities

Net change in cash $(18) $ - $18 $ - Net change in cash

Cash at year end 2017 $25 $ - $(25) $ - Cash at year end 2017

43

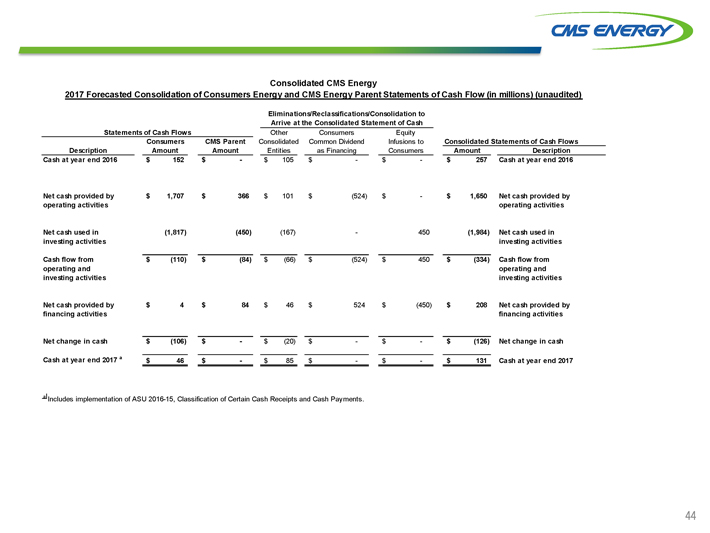

CMS ENERGY

Consolidated CMS Energy

2017 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

Eliminations/Reclassifications/Consolidation to

Arrive at the Consolidated Statement of Cash

Statements of Cash Flows Other Consumers Equity

Consumers CMS Parent

Consolidated Common Dividend Infusions to Consolidated Statements of Cash Flows

Description Amount Amount Entities as Financing Consumers Amount Description

Cash at year end 2016 $152 $ - $105 $ - $ - $257 Cash at year end 2016

Net

cash provided by $1,707 $366 $101 $(524) $ - $1,650 Net cash provided by

operating activities operating activities

Net cash used in (1,817) (450) (167) - 450 (1,984) Net cash used in

investing activities

investing activities

Cash flow from $(110) $(84) $(66) $(524) $450 $(334) Cash flow from

operating and operating and

investing activities investing activities

Net cash provided by $4 $84 $46 $524 $(450) $208 Net cash provided by

financing activities

financing activities

Net change in cash $(106) $ - $(20) $ - $ - $(126) Net change in cash

Cash at year end 2017 a $46 $ - $85 $ - $ - $131 Cash at year end 2017

a Includes

implementation of ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments.

44