Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PACWEST BANCORP | a17-3503_18k.htm |

Exhibit 99.1

2016 Fourth Quarter Results Investor Presentation

This communication contains certain “forward-looking statements” about PacWest Bancorp (the “Company”) and its subsidiaries within the meaning of the Private Securities Litigation Reform Act of 1995, including certain plans, strategies, goals, and projections and including statements about our expectations regarding our allowance for loan and lease losses, credit trends, deposit growth, profitability, capital management, including reducing excess capital, and operating expenses. All statements contained in this communication that are not clearly historical in nature are forward-looking, and the words “anticipate,” “assume,” “intend,” “believe,” “forecast,” “expect,” “estimate,” “plan,” “continue,” “will,” “should,” “look forward” and similar expressions are generally intended to identify forward-looking statements. All forward-looking statements (including statements regarding future financial and operating results and future transactions and their results) involve risks, uncertainties and contingencies, many of which are beyond our control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance or achievements. Actual results could differ materially from those contained or implied by such forward-looking statements for a variety of factors, including without limitation: higher than anticipated delinquencies, charge-offs and loan and lease losses; reduced demand for our services due to strategic or regulatory reasons; changes in economic or competitive market conditions could negatively impact investment or lending opportunities or product pricing and services; credit quality deterioration or pronounced and sustained reduction in market values or other economic factors which adversely affect our borrowers’ ability to repay loans and leases and/or require an increased provision for loan and lease losses; compression of the net interest margin due to changes in our interest rate environment, loan products, spreads on newly originated loans and leases and/or asset mix; the impact of asset/liability repricing risk and liquidity risk on net interest margin and the value of investments; higher than anticipated increases in operating expenses; increased costs to manage and sell foreclosed assets; the need to retain capital for strategic or regulatory reasons; the financial performance of the Company; increased litigation; increased asset workout or loan servicing expenses; higher compensation costs and professional fees to retain and/or incent employees; our ability to complete future acquisitions and to successfully integrate such acquired entities or achieve expected benefits, synergies and/or operating efficiencies within expected timeframes; changes in our stock price; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act on our business and business strategies; and other risk factors described in documents filed by the Company with the U.S. Securities and Exchange Commission (“SEC”). All forward-looking statements included in this communication are based on information available at the time of the communication. Pro forma, projected and estimated numbers are used for illustrative purposes only and are not forecasts, and actual results may differ materially. We are under no obligation to (and expressly disclaim any such obligation to) update or alter our forward-looking statements, whether as a result of new information, future events or otherwise except as required by law. Forward-Looking Statements

Company Overview 4 Fourth Quarter Highlights 8 Investment Securities 13 Loans and Leases 15 Credit Quality 25 Deposits 30 Net Interest Margin 33 Controlled Expenses 39 Acquisitions 42 Strong Franchise Value 45 Non-GAAP Measurements 48 Presentation Index

Company Overview

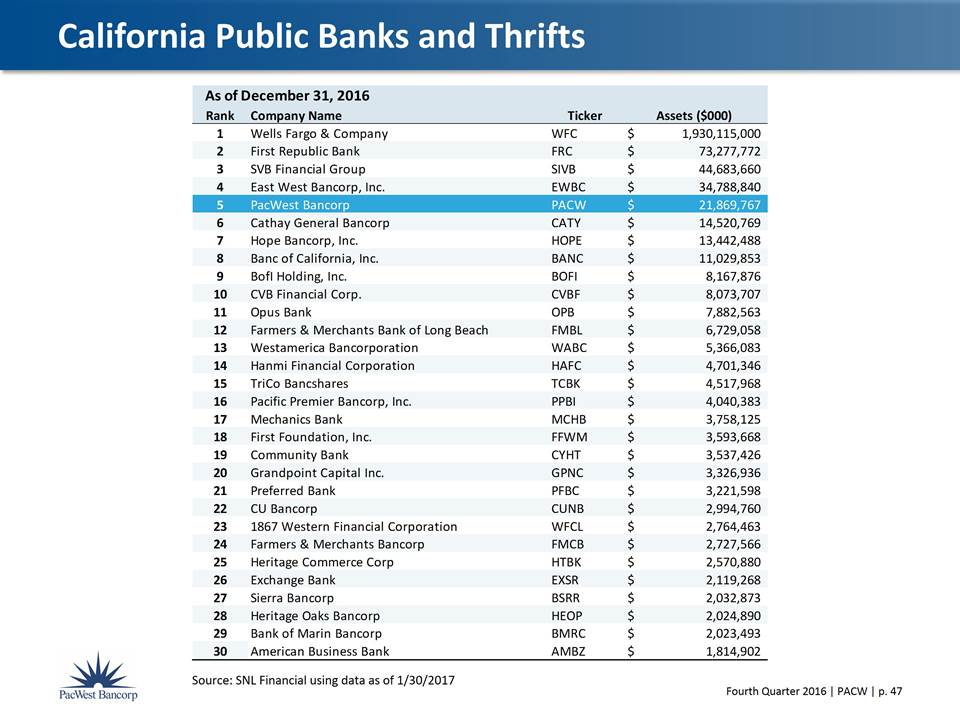

We are a commercial bank focused on core deposit growth paired with national lending and venture banking platforms NASDAQ traded (PACW) with a market capitalization of $6.9 billion (1) Average daily trading volume of 905,211 shares over the last year (1) Dividend: $2.00 per share, 3.58% yield (1) 5th largest publicly-traded bank headquartered in California with total assets of $21.9 billion, loans and leases of $15.5 billion and deposits of $15.9 billion at December 31, 2016 Profitable Growth Net earnings of $352.2 million, ROAA of 1.66% and ROATE of 15.52% for full year 2016 Industry leading tax equivalent NIM of 5.47% in 4Q16 Loan and lease production of $1.3 billion in 4Q16 ($4.1 billion FY2016) Core deposit growth of $513 million in 4Q16 ($2.0 billion FY2016) $12.5 billion of core deposits with total cost of deposits of 19 basis points for 4Q16 NPAs at 1.20% of total loans and leases and foreclosed assets Efficiency ratio of 40.1% in 4Q16 (39.8% FY2016) Experienced acquirer with 28 bank and finance company acquisitions since 2000 Analyst coverage: BMO Capital Markets, D.A. Davidson & Co., FIG Partners, FBR & Co., JMP Securities, Keefe, Bruyette & Woods, Piper Jaffray, Raymond James, Sandler O’Neill & Partners, Stephens Inc., Wells Fargo Securities (1) As of January 25, 2017 Company Overview

Business Model Community Banking National Lending Venture Banking Pacific Western Bank Attractive branch network with 77 full service branches in California Offers a full suite of deposit products and services, including on-line banking Focused on business lending products, including commercial real estate Limited consumer loan offerings Borrower relationships generally include a deposit account Efficient deposit model with average branch size of $203 million Diversified by loan and lease type, geography and industry Asset-Based Lending (ABL) Lender Finance & Timeshare, Equipment Financing, Healthcare & General ABL Cash Flow Lending Technology, Healthcare and Security Commercial Real Estate General, Multifamily, SBA, Healthcare and Construction Focus on small to middle market businesses Expertise in niche segments limits new competitors Borrower relationships may include deposit accounts and treasury services Five banking groups: Technology, Life Sciences, Equity Funds Group, Structured Finance, Specialty Finance Offices located in key innovative hubs across the United States Offers a comprehensive suite of financial services for venture-backed companies and their venture capital and private equity investors Provides comprehensive treasury management solutions, including credit cards and international-related products and services to clients Borrower relationships almost always include a deposit account Operates Square 1 Asset Management (registered investment advisor)

Source: SNL Financial and FactSet Research Systems; Market data as of 12/31/2016. Note: KBW Regional Bank Index (KRX) includes 50 institutions with a median market cap of $3.5 billion as of 12/31/2016; median weighted by market capitalization. Five Year Total Return

Fourth Quarter Highlights

See “Non-GAAP Measurements” slides beginning on page 48 Adds back the unamortized purchase discount on Non-PCI loans to the loan balance and the allowance for credit losses (see page 30 for calculation) Fourth Quarter Highlights Robust Earnings Net earnings of $85.6 million EPS of $0.71 ROAA and ROATE of 1.59% and 14.88% Industry Leading Net Interest Margin Tax equivalent (“TE”) NIM: Reported: 5.47% Core: 5.09% (1) Low Efficiency Ratio Efficiency ratio of 40.1% Average branch size of $203 million in deposits Noninterest expense to average assets of 2.20% Profitable Deposit Base Total cost of deposits of 19 bps $513 million net core deposit growth Substantial core deposit growth from Square 1 Bank Division Loan and Lease Production and Credit Quality Loan and lease production of $1.3 billion NPA to total loans and leases and foreclosed assets, excluding PCI loans, of 1.19% Non-PCI credit loss allowance of 1.05% and adjusted credit loss allowance of 1.34% (2) Non-PCI net charge-off rate of 15 bps for trailing twelve months Strong Capital Levels Tangible common equity ratio of 11.54% (1) CET1 and total capital ratios of 12.31% and 15.56% Tangible book value per share of $18.71 (1)

See “Non-GAAP Measurements” slides beginning on page 48. . Financial Highlights ? ($ in millions) 4Q16 3Q16 Q / Q Total Assets 21,870 $ 21,315 $ 3% Loans and Leases, net 15,456 $ 14,743 $ 5% Total Deposits 15,871 $ 15,646 $ 1% Core Deposits 12,524 $ 12,011 $ 4% Net Earnings 85.6 $ 93.9 $ -9% Earnings Per Share 0.71 $ 0.77 $ -8% ROAA 1.59% 1.77% -0.18 ROATE 14.88% 16.15% -1.27 Tangible Common Equity Ratio 11.54% 12.19% -0.65 Tangible Book Value Per Share 18.71 $ 19.12 $ -2% Core Net Interest Margin (TE) (1) 5.09% 5.08% 0.01 Efficiency Ratio 40.06% 40.12% -0.06

Solid Earnings Track Record ($ in millions, except EPS) 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 Net Earnings 73.1 $ 85.1 $ 69.6 $ 71.8 $ 90.5 $ 82.2 $ 93.9 $ 85.6 $ Diluted EPS 0.71 $ 0.83 $ 0.68 $ 0.60 $ 0.74 $ 0.68 $ 0.77 $ 0.71 $ $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 EPS Millions Net Earnings Diluted EPS

Source: SNL Financial using data as of 1/25/17 Solid Capital Position – 4Q16 12.01% 12.10% 12.21% 11.38% 11.87% 12.12% 12.19% 11.54% 8.44% 8.59% 8.67% 8.54% 8.77% 8.68% 8.79% 8.37% 2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 TCE / TA PACW Median Banks $15-$25B 11.74% 11.96% 12.04% 11.67% 11.51% 11.92% 12.13% 11.91% 9.42% 9.56% 9.29% 9.16% 8.99% 9.06% 9.11% 9.35% 2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 T1 Leverage PACW Median Banks $15-$25B 15.80% 16.53% 16.32% 15.65% 15.96% 16.08% 16.18% 16.08% 13.62% 13.63% 13.44% 13.20% 13.16% 13.09% 12.99% 12.49% 2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 Total Capital PACW Median Banks $15-$25B 12.27% 12.87% 12.74% 12.58% 12.63% 12.72% 12.83% 12.31% 10.93% 10.94% 10.75% 10.68% 10.64% 10.67% 10.48% 10.23% 2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 CET1 PACW Median Banks $15-$25B

Investment Securities

3.41% overall portfolio tax equivalent yield (2) (1) Fair value (2) Yield is for 4Q16 Investment Portfolio Average Life and Effective Duration Municipal Securities Composition Diversified Investment Portfolio Collateralized Loan Obligations, $156.9mm, 5% SBA Securities, $178.8mm, 6% Agency Residential MBS, $502.4mm, 16% Agency Residential CMOs, $146.3mm, 4% Agency Commercial MBS, $547.7mm, 17% Private CMOs, $125.5mm, 4% Municipal Securities, $1,456.5mm, 45% Other, $109.7mm, 3% $3.2 Billion Total Portfolio (1) S&P Ratings % Total Issue Type % Total AAA 13% G.O. Limited 6% AA 83% G.O. Unlimited 47% A 2% Revenue 47% Not rated 2% 100% 100% Municipal Securities 6.0 6.1 6.0 6.1 6.1 5.0 4.6 4.6 4.7 4.8 0 1 2 3 4 5 6 7 8 12/31/2015 3/31/2016 6/30/2016 9/30/2016 12/31/2016 Years Average Life Effective Duration

Loans and Leases

Diversified Loan and Lease Portfolio ($ in millions) $ Mix $ Mix Lender Finance & Timeshare 1,667 $ 11% 1,588 $ 11% Equipment Finance 692 4% 890 6% Healthcare Asset-Based 181 1% 228 2% Other Asset-Based 764 5% 732 5% Total Asset-Based 3,304 21% 3,438 24% Technology Cash Flow 1,048 7% 978 7% Healthcare Cash Flow 799 5% 865 6% Security Cash Flow 440 3% 451 3% General Cash Flow 564 4% 494 3% Total Cash Flow 2,851 19% 2,788 19% Commercial Real Estate 2,987 19% 2,941 20% Healthcare Real Estate 955 6% 1,247 9% Income Producing Residential 1,169 8% 1,035 7% Construction and Land 965 6% 514 4% Small Business 454 3% 474 3% Owner-Occupied Residential 145 1% 176 1% Total Real Estate 6,675 43% 6,387 44% Venture Capital 1,988 13% 1,458 10% Other 638 4% 407 3% Total Loans (1) 15,456 $ 100% 14,478 $ 100% (1) Net of deferred fees and costs 12/31/2016 12/31/2015 Lender Finance & Timeshare Equipment Finance Healthcare Asset - Based Other Asset - Based Technology Cash Flow Healthcare Cash Flow Security Cash Flow General Cash Flow Commercial Real Estate Healthcare Real Estate Income Producing Residential Construction and Land Small Business Owner - Occupied Residential Venture Capital Other As of December 31, 2016

Diversified Loan and Lease Portfolio Healthcare, $955mm, 14% SBA, $454mm, 7% Hospitality, $689mm, 10% Retail, $445mm, 7% Multifamily, $1,050mm, 16% Office, $830mm, 12% Owner - occupied, $781mm, 12% Construction, $965mm, 14% Other, $506mm, 8% Real Estate ($6.7B) Technology, $1,048mm, 37% Healthcare, $799mm, 28% Security, $440mm, 15% General, $564mm, 20% Cash Flow ($2.8B) Cash Flow, $2,851mm, 19% Real Estate, $6,675mm, 43% Asset - Based, $3,304mm, 21% Venture Capital, $1,988mm, 13% Other, $638mm, 4% Total Portfolio ($15.5B) Lender Finance & Timeshare, $1,667mm, 50% Equipment Finance, $692mm, 21% Healthcare, $181mm, 6% Other, $764mm, 23% Asset - Based ($3.3B) Later Stage, $294mm, 15% Expansion Stage, $920mm, 46% Equity Funds Group, $325mm, 16% Early Stage, $449mm, 23% Venture Capital ($2.0B)

Overview Our CapitalSource Division has dedicated groups that work with private equity sponsor firms throughout the US to provide senior debt financing to mature and profitable companies (Cash Flow lending). All Cash Flow loans are senior debt obligations (other lenders may provide subordinate or mezzanine financing) Average loan size of approximately $20 million Approximately 60% of Cash Flow loans are Shared National Credits (see page 19) Since 2010, the principal focus of Cash Flow lending has been Healthcare, Technology, and Security Monitoring; lending to industries with high historical loss experience was either discontinued entirely (Media) or substantially reduced (General). General Cash Flow lending now focuses on businesses that have substantial market share, with barriers to entry, and are supported by proven equity sponsors. * Measured on a fully-funded basis at closing and shown as a % of commitments originated. Cash Flow Loan Portfolio Overview 2001-2008 2009-2016 2001-2008 2009-2016 Healthcare 12% 31% 2.4% 0.6% Technology 5% 42% 0.2% 0.2% Security 7% 11% - - General 65% 16% 7.1% - Media 11% - 13.0% - Total Cash Flow loans 100% 100% 7.1% 0.3% Originations Aggregate Loss % Repaid w/o Loss, $235mm Upgraded, $32mm Resolved w/ Loss, $50mm ($4.7mm Loss) Still Classified, $183mm ($11.9mm Loss) Outcome or Status of Commitments that Became Classified $500 Million Became Classified, $500mm Non - classified, $5.5 Billion Leveraged Lending Commitments Originated 2010 - 2016 $6.0 Billion < 6x EBITDA, 74% ? 6x EBITDA, 26% Leveraged Lending Commitments Originated By Leverage Multiple* Non - classified, 93.7% Classified, 6.3% Total Cash Flow Portfolio By Risk Rating

SNCs are not a line of business. SNC relationships are included in business line balances. SNCs are facilities greater than $20 million with a federally supervised agent/lead bank shared by three or more federally supervised financial institutions. Approximately 116 borrowers. Adhere to same credit underwriting standards as the rest of loan portfolio. No energy-related loans. At December 31st, $13 million on nonaccrual and $70 million (3%) adversely classified. Shared National Credit (SNC) Relationships Communications, $212mm, 9% Consumer Finance, $142mm, 6% Healthcare, $777mm, 34% Management Consulting, $72mm, 3% Manufacturing, $110mm, 5% Other, $122mm, 6% Security, $152mm, 7% Technology, $569mm, 25% Transportation, $103mm, 5% $2.3B of Loans at 12/31/2016

Our CapitalSource Division has been an active, disciplined Healthcare CRE lender since 2001 From 2001 to 2016, the CapitalSource Division originated over $4.9 billion of Healthcare CRE loans with total aggregate losses of only $33.3 million (67 bps) 74% of our Healthcare CRE portfolio is secured by skilled nursing facilities Underwriting discipline includes: Lending at a conservative ratio of loan-to-value The facility-level underwritten projected “debt yield” (net operating income ÷ first lien debt) generally exceeds 15% Focus on experienced and reputable sponsors and operators On-staff licensed nursing home administrator to evaluate clinical compliance and quality of care Use of market per-bed or per-unit valuation trends and caps in conjunction with appraised values and underwritten values Analysis of payor mix and state and federal revenue sources to monitor cash flows Healthcare CRE Loans - $955 Million as of 12/31/2016 Non - classified, 94% Classified, 6% (3 loans) Total Healthcare CRE Portfolio By Risk Rating SNF, $706mm Assisted living, $133mm Continuing care, $76mm Hospital & Medical Office, $26mm Other, $14mm Total Healthcare CRE Portfolio By Property Type CA, $78mm PA, $95mm FL, $116mm NJ, $38mm VA, $76mm NV, $42mm MI, $32mm AZ, $31mm NY, $30mm Other, $168mm SNF Loans By State

CapitalSource Credit Profile: Lessons Learned and Changes Implemented CapitalSource experienced elevated losses on loans originated between 2003 and 2008. 7.5% cumulative losses on $24 billion of originations, the substantial majority from lending products which were subsequently discontinued During 2008–09, a transformative de-risking effort was launched that included executive management changes, acquired an FDIC-insured bank subsidiary and made significant adjustments to lending practices. Management changes included the promotion of Jim Pieczynski to CEO in 2010 CapitalSource Bank adopted new bank-standard lending policies appropriate for an FDIC-insured institution Lending products that comprised nearly two-thirds of the aggregate losses were discontinued, including: Other lending product standards were adjusted: Limited general cash flow lending to selected industries and borrowers with strong market share, barriers to entry and support of proven equity sponsors Focused CRE lending on stabilized cash-flowing collateral Narrowed focus of Lender Finance group Added new lower-risk lending products, including SBA, multifamily and life insurance premium finance. Of the $24 billion originated from 2003 to 2008, approximately $404 million remains outstanding with $0.3 million classified as of December 31, 2016. (1) The CapitalSource Division reintroduced this product in 2015. CapitalSource Transition from Finance Company to Bank Subprime residential mortgage Media and retail cash flow loans Resort vacation club loans Second lien/mezzanine CRE Land loans Construction loans (other than SBA)(1) Eliminated Products, 33% Adjusted Products, 34% Unchanged Products, 33% 2003 - 2008 CapitalSource Division Originations ($24 Billion) Eliminated Products, 63% Adjusted Products, 33% Unchanged Products, 4% Cumulative Losses ($1.8 Billion)

Loan and Lease Production of $1.3 Billion in 4Q16 ($ in millions) Production Payoffs Net Change Rate on Production 4Q16 1,273 $ 526 $ 747 $ 4.83% 3Q16 1,072 933 139 5.11% 2Q16 931 720 211 4.82% 1Q16 842 665 177 4.89% 4Q15 1,404 910 494 5.29% $1,404 $842 $931 $1,072 $1,273 $910 $665 $720 $933 $526 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 Q4 Q1 Q2 Q3 Q4 2015 2016 Avg. Rate on Production Billions Production Payoffs Avg Production Avg Payoffs Rate on Production

Production by Industry / Loan Type ($ in millions) 4Q16 3Q16 2Q16 1Q16 Totals Net Growth FY 2016 Healthcare Asset-Based - $ - $ - $ 5 $ 5 $ (47) $ Equipment Finance 98 96 14 80 288 (198) Lender Finance and Timeshare 146 12 87 41 286 79 Other Asset-Based 39 103 61 75 278 32 Asset-Based 283 211 162 201 857 (134) General Cash Flow 62 50 32 11 155 70 Technology Cash Flow 5 124 101 38 268 70 Healthcare Cash Flow 57 36 25 102 220 (66) Security Cash Flow 14 29 - 21 64 (11) Cash Flow 138 239 158 172 707 63 Commercial Real Estate 238 154 173 116 681 46 Income Producing and Residential Real Estate 132 163 104 100 499 103 Construction and Land 50 29 78 80 237 451 Healthcare Real Estate 88 10 19 53 170 (292) Small Business 10 17 18 7 52 (20) Real Estate 518 373 392 356 1,639 288 Venture Capital 195 154 89 85 523 530 Other 139 95 130 28 392 231 Total 1,273 $ 1,072 $ 931 $ 842 $ 4,118 $ 978 $

Impact of Rising Rates on the Loan and Lease Portfolio $823 $761 $701 $2,205 1 Year 2 Years 3 Years > 3 Years Fixed/Hybrid Years to Maturity/Repricing ($ in Millions) 8,097 2,357 292 286 Loan Rate Above Floor 1 to 25 Bps 26 to 100 Bps > 101 Bps Variable Rate Loans Lift Off of Loan Floors ($ in Millions) 1ML 3ML Prime Other Fixed Rate, 20% Variable Rate, 71% Hybrid, 9% Loan Portfolio by Repricing Type Cumulative Amount of Loans Rate Increase Needed to Reprice ($ in millions) $10,746 1 to 100 bps $10,901 101 to 200 bps $11,032 > 200 bps Repricing of Variable Rate Loans Amount % ($ in millions) 1-month LIBOR 5,450 $ 2-month LIBOR 43 3-month LIBOR 1,807 6-month LIBOR 816 12-month LIBOR 75 Total LIBOR-based Loans 8,191 66% Prime Rate 3,413 28% Other Index 755 6% Total Variable Loans 12,359 $ 100% Variable Rate and Hybrid Loans by Index

Credit Quality

Classified loans and leases are those with a credit risk rating of substandard or doubtful Allowance for credit losses includes allowance for loan and lease losses and reserve for unfunded commitments Includes the remaining unamortized discount related to acquired loans (see page 30 for calculation) Non-PCI Credit Quality ($ in thousands) 4Q16 3Q16 2Q16 1Q16 Nonaccrual Loans and Leases $ 170,599 171,085 127,655 130,418 As a % of Loans and Leases % 1.11% 1.16% 0.88% 0.91% Nonperforming Assets $ 183,575 186,198 143,836 151,266 As a % of Loans and Leases & Foreclosed Assets % 1.19% 1.27% 0.99% 1.05% Classified Loans and Leases (1) $ 409,645 417,541 441,035 384,698 As a % of Loans and Leases % 2.66% 2.84% 3.03% 2.68% Credit Loss Provision $ 21,000 8,000 12,000 20,000 As a % of Average Loans and Leases (annualized) % 0.56% 0.22% 0.34% 0.56% TTM Net Charge-offs $ 21,990 6,480 5,837 4,038 As a % of Average Loans and Leases % 0.15% 0.04% 0.04% 0.03% Allowance for Credit Losses (ACL) (2) $ 161,278 154,070 149,944 138,376 As a % of Loans and Leases % 1.05% 1.05% 1.03% 0.96% Adjusted ACL (3) $ 206,917 207,111 215,335 217,137 As a % of Adjusted Loans and Leases (3) % 1.34% 1.41% 1.47% 1.50% Adjusted ACL / Nonaccrual Loans and Leases % 121.29% 121.06% 168.69% 166.50%

Key Credit Trends 0.85% 0.96% 1.03% 1.05% 1.05% 4Q15 1Q16 2Q16 3Q16 4Q16 Non - PCI ACL / Non - PCI Loans and Leases 0.06% 0.03% 0.04% 0.04% 0.15% 4Q15 1Q16 2Q16 3Q16 4Q16 Trailing 12 Months Net Charge - Offs To Average Non - PCI Loans and Leases 0.90% 0.91% 0.88% 1.16% 1.11% 4Q15 1Q16 2Q16 3Q16 4Q16 Non - PCI Nonaccrual Loans and Leases / Non - PCI Loans and Leases 1.06% 1.05% 0.99% 1.27% 1.19% 4Q15 1Q16 2Q16 3Q16 4Q16 Non - PCI NPAs / Non - PCI Loans and Leases and Foreclosed Assets

At December 31, 2016, the Company’s ten largest Non-PCI loan relationships on nonaccrual status had an aggregate book balance of $146 million and represented 86% of total Non-PCI nonaccrual loans and leases. Non-PCI Nonaccrual Loan and Lease Detail % of Loan % of Loan 12/31/2016 9/30/2016 ($ in thousands) Balance Category Balance Category Balance Balance Real estate mortgage: Commercial 62,454 $ 1.4% 74,606 $ 1.7% 7,691 $ 2,146 $ Residential 6,881 0.5% 5,089 0.4% 5,524 - Total real estate mortgage 69,335 1.2% 79,695 1.5% 13,215 2,146 Real estate construction and land: Commercial - 0.0% 1,245 0.2% - - Residential 364 0.1% 366 0.1% - - Total R.E. construction and land 364 0.0% 1,611 0.2% - - Commercial: Cash flow 53,908 1.7% 27,831 0.9% 153 21 Asset-based 2,118 0.1% 4,044 0.2% 1,500 6,644 Venture capital 11,687 0.6% 10,782 0.6% 13,295 - Equipment finance 32,848 4.7% 46,916 7.0% 218 - Total commercial 100,561 1.2% 89,573 1.1% 15,166 6,665 Consumer 339 0.1% 206 0.1% 224 - Total 170,599 $ 1.1% 171,085 $ 1.2% 28,605 $ 8,811 $ 12/31/2016 Nonaccrual Loans and Leases 9/30/2016 Accruing and 30 -89 Days Past Due

GAAP Accounting distorts the ACL ratio. When unamortized purchase discount is added back, the adjusted Non-PCI coverage ratio is 1.34% at December 31, 2016. Unamortized purchase discount represents the acquisition date fair value adjustment based on market, liquidity and interest rate risk in addition to credit risk and is being accreted to interest income over the remaining life of the respective loans. Such discount relates to acquired loans and is assigned specifically to those loans only. Use of the interest method results in steadily declining amounts being taken to income in each reporting period. The remaining discount of $46.0 million at December 31, 2016 is expected to be substantially accreted to income by the end of 2018. Allowance for Non-PCI Credit Losses - Adjusted ($ in millions) 4Q16 3Q16 2Q16 Loan and lease balance - Non-PCI 15,412 $ 14,686 $ 14,566 $ Allowance for credit losses (ACL) 161 $ 154 $ 150 $ Reported Non-PCI ACL Ratio 1.05% 1.05% 1.03% ACL Ratio Adjusted to Add Back Unamortized Purchase Discount Loan and lease balance - Non-PCI 15,412 $ 14,686 $ 14,566 $ Add: Unamortized purchase discount (1) 46 53 65 Adjusted loan and lease balance 15,458 $ 14,739 $ 14,631 $ Allowance for credit losses 161 $ 154 $ 150 $ Add: Unamortized purchase discount (1) 46 53 65 Adjusted allowance for credit losses 207 $ 207 $ 215 $ Adjusted Non-PCI credit risk coverage ratio 1.34% 1.41% 1.47% Allowance Ratio for Originated Non-PCI Loans and Leases Originated Non-PCI loans and leases 10,999 $ 10,073 $ 9,435 $ Allowance for loan and lease losses (ALLL) 101 $ 93 $ 98 $ ALLL ratio 0.93% 0.93% 1.04%

Deposits

Does not include $1.1 billion of client investment funds held at December 31, 2016. Deposit Detail Core: 79% Core: 67% ($ in millions) Deposit Category Amount % of Total Amount % of Total Noninterest-bearing demand deposits 6,659 $ 42% 6,172 $ 39% Interest checking deposits 1,448 9% 874 5% Money market deposits 3,705 23% 2,783 18% Savings deposits 711 5% 743 5% Total core deposits 12,523 79% 10,572 67% Brokered non-maturity deposits 1,175 7% 942 6% Total non-maturity deposits 13,698 86% 11,514 73% Time deposits under $100,000 1,019 7% 1,656 11% Time deposits of $100,000 and over 1,153 7% 2,496 16% Total time deposits 2,172 14% 4,152 27% Total deposits (1) 15,870 $ 100% 15,666 $ 100% December 31, 2016 December 31, 2015 Noninterest - bearing demand deposits Interest checking deposits Money market deposits Savings deposits Brokered non - maturity deposits Time deposits under $100,000 Time deposits of $100,000 and over December 31, 2016 Noninterest - bearing demand deposits Interest checking deposits Money market deposits Savings deposits Brokered non - maturity deposits Time deposits under $100,000 Time deposits of $100,000 and over December 31, 2015

Deposit Portfolio Includes brokered deposits of $356 million with a weighted average maturity of 6 months and a weighted average cost of 0.67%. $15.7 $15.4 $15.1 $15.6 $15.9 0.10% 0.20% 0.30% 0.40% 0.50% 0.0 5.0 10.0 15.0 20.0 4Q15 1Q16 2Q16 3Q16 4Q16 Cost Balance ($ in Billions) Core Deposits Non-Core Deposits Cost of Interest-Bearing Deposits Cost of Total Deposits ($ in millions) Time Deposits Time Deposits Total Under $100,000 Time Contractual Time Deposit Maturities $100,000 Or More Deposits Rate Due in three months or less 327 $ 418 $ 745 $ 0.37% Due in over three months through six months 287 328 615 0.40% Due in over six months through twelve months 314 301 615 0.38% Due in over 12 months through 24 months 65 75 140 0.69% Due in over 24 months 26 31 57 0.67% Total 1,019 $ (1) 1,153 $ 2,172 $ 0.41% December 31, 2016

Net Interest Margin

See “Non-GAAP Measurements” slides beginning on page 48 Includes $12.1 million in Q1 2016 and $13.5 million in Q4 2016 of accelerated discount accretion from the payoff of nonaccrual PCI loans Source: SNL Financial using data as of 1/25/17 (1) Industry Leading Tax Equivalent (TE) Net Interest Margin (2) (2) 5.45% 6.00% 6.29% 5.82% 5.91% 5.95% 5.89% 5.46% 5.22% 5.53% 5.33% 5.26% 5.47% 5.35% 5.47% 5.79% 5.68% 5.57% 5.44% 5.33% 5.19% 5.10% 5.10% 5.11% 5.08% 5.09% 5.13% 5.28% 5.03% 5.10% 5.15% 5.11% 5.09% 5.00% 4.88% 4.93% 5.00% 4.95% 5.01% 3.69% 3.60% 3.64% 3.59% 3.53% 3.43% 3.43% 3.43% 3.42% 3.40% 3.38% 3.38% 3.22% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 PACW Reported NIM PACW Core NIM (Excludes accelerated loan discount accretion) PACW Adjusted NIM (Excludes all purchase accounting impacts) Banks $15-$25B Reported NIM

Effect of Purchase Accounting on NIM ($ in millions) Impact on Impact on Amount NIM Amount NIM 253.1 $ 5.47% 239.5 $ 5.26% Less: - Accelerated accretion of acquisition discounts from early payoffs of acquired loans (17.5) (0.38%) (8.2) (0.18%) - Remaining accretion of Non-PCI loan acquisition discounts (3.7) (0.08%) (6.0) (0.13%) - Amortization of TruPS discount 1.4 0.03% 1.4 0.03% - Accretion of time deposits premium (0.1) (0.00%) (0.1) (0.00%) (19.9) (0.43%) (12.9) (0.28%) 233.2 $ 5.04% 226.6 $ 4.98% Net interest income/NIM as reported (TE) Net interest income/NIM (TE) - excluding purchase accounting December 31, 2016 September 30, 2016 Three Months Ended Three Months Ended

See “Non-GAAP Measurements” slides beginning on page 48 Includes $12.1 million in Q1 2016 and $13.5 million in Q4 2016 of accelerated discount accretion from the payoff of nonaccrual PCI loans Source: SNL Financial using data as of 1/25/17 Higher Loan Yields From Disciplined & Diversified Lending Core Loan Yield(1) Excludes Accelerated Discount Accretion from Early Payoffs of Acquired Loans (2) 6.77% 7.42% 7.34% 6.68% 6.76% 6.80% 6.75% 6.34% 6.21% 6.57% 6.24% 6.17% 6.31% 6.64% 6.68% 6.76% 6.52% 6.37% 6.22% 6.11% 6.02% 6.05% 6.03% 5.97% 5.94% 5.85% 4.64% 4.49% 4.47% 4.42% 4.36% 4.23% 4.21% 4.19% 4.18% 4.14% 4.11% 4.12% 4.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Reported Loan Yield - PACW Core Loan Yield - PACW Loan Yield - Banks $15-$25B

Source: SNL Financial using data as of 1/25/17 Deposit Franchise: 4Q16 Deposit Cost of 19 Basis Points 0.11% 0.09% 0.26% 0.30% 0.34% 0.36% 0.37% 0.33% 0.24% 0.23% 0.20% 0.19% 0.19% 0.33% 0.32% 0.32% 0.32% 0.32% 0.31% 0.31% 0.31% 0.32% 0.33% 0.33% 0.35% 0.27% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 PACW Banks $15-$25B

Asset Sensitive Balance Sheet Benefits From Rising Rates 5.2% 10.2% 15.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Base Up 100 Up 200 Up 300 PacWest Bancorp IRR Model Results - % Change in NII - Year 1 Static Balance Sheet - December 31, 2016 Sudden Parallel Shocks PACW ($ in millions) Forecasted Percentage Forecasted Net Interest Income Change Net Interest Interest Rate Scenario (Tax Equivalent) From Base Margin Up 300 basis points 1,116.8 $ 15.0% 5.89% Up 200 basis points 1,070.0 10.2% 5.64% Up 100 basis points 1,022.2 5.2% 5.39% Base case 971.3 - 5.12% December 31, 2016

Controlled Expenses

Source: SNL Financial using data as of 1/25/17 Efficiency Ratio Trend 61.4% 57.1% 40.2% 40.3% 38.4% 36.9% 38.0% 39.6% 39.3% 38.5% 40.6% 40.1% 40.1% 65.1% 64.3% 63.6% 61.9% 62.4% 64.2% 63.4% 65.9% 63.2% 64.3% 62.8% 61.8% 63.5% 35.0% 40.0% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2 2016 Q3 2016 Q4 Focus and Execution Drive Efficiency PACW Efficiency Ratio Median Efficiency Ratio Banks $15-$25B

(1) Source: SNL Financial Focus and Execution Drive Efficiency 43.9% 54.2% 57.2% 55.0% 54.0% 56.4% 60.7% 41.6% 38.5% 39.8% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Efficiency Ratio (1) $54 $56 $60 $57 $60 $70 $72 $147 $193 $203 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Average Branch Size ($ - M)

Acquisitions

Acquisition Strategy In-Market Consolidation Market Expansion Asset Generation Capability Strong Core Deposit Base Sound Strategic Focus Key Drivers of Accretion Cost Savings Customer Retention Margin Improvement

Westlake Village, CA Los Angeles, CA Durham, NC Chevy Chase, MD Chicago, IL St. Louis, MO Denver, CO New York, NY Boston, MA Minneapolis, MN Austin, TX San Diego, CA Campbell, CA Menlo Park, CA San Francisco, CA Seattle, WA Atlanta, GA Market Expansion Through Acquisitions CapitalSource Square 1 2014 Merged with CapitalSource Inc. Assets added: $10.7 Billion 2015 Acquired Square 1 Financial, Inc. Assets added: $4.6 Billion

Strong Franchise Value

Attractive Footprint in Southern California Source: SNL Financial

Source: SNL Financial using data as of 1/30/2017 California Public Banks and Thrifts Rank Company Name Ticker Assets ($000) 1 Wells Fargo & Company WFC 1,930,115,000 $ 2 First Republic Bank FRC 73,277,772 $ 3 SVB Financial Group SIVB 44,683,660 $ 4 East West Bancorp, Inc. EWBC 34,788,840 $ 5 PacWest Bancorp PACW 21,869,767 $ 6 Cathay General Bancorp CATY 14,520,769 $ 7 Hope Bancorp, Inc. HOPE 13,442,488 $ 8 Banc of California, Inc. BANC 11,029,853 $ 9 BofI Holding, Inc. BOFI 8,167,876 $ 10 CVB Financial Corp. CVBF 8,073,707 $ 11 Opus Bank OPB 7,882,563 $ 12 Farmers & Merchants Bank of Long Beach FMBL 6,729,058 $ 13 Westamerica Bancorporation WABC 5,366,083 $ 14 Hanmi Financial Corporation HAFC 4,701,346 $ 15 TriCo Bancshares TCBK 4,517,968 $ 16 Pacific Premier Bancorp, Inc. PPBI 4,040,383 $ 17 Mechanics Bank MCHB 3,758,125 $ 18 First Foundation, Inc. FFWM 3,593,668 $ 19 Community Bank CYHT 3,537,426 $ 20 Grandpoint Capital Inc. GPNC 3,326,936 $ 21 Preferred Bank PFBC 3,221,598 $ 22 CU Bancorp CUNB 2,994,760 $ 23 1867 Western Financial Corporation WFCL 2,764,463 $ 24 Farmers & Merchants Bancorp FMCB 2,727,566 $ 25 Heritage Commerce Corp HTBK 2,570,880 $ 26 Exchange Bank EXSR 2,119,268 $ 27 Sierra Bancorp BSRR 2,032,873 $ 28 Heritage Oaks Bancorp HEOP 2,024,890 $ 29 Bank of Marin Bancorp BMRC 2,023,493 $ 30 American Business Bank AMBZ 1,814,902 $ As of December 31, 2016

The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. These non-GAAP financial measures are presented for supplemental informational purposes only for understanding the Company’s operating results and should not be considered a substitute for financial information presented in accordance with GAAP. These non-GAAP financial measures presented by the Company may be different from non-GAAP financial measures used by other companies. The tables on the following slides present reconciliations of non-GAAP financial measurements to the GAAP financial measurements and certain key performance ratios. Non-GAAP Measurements

Tangible Common Equity Ratio/Tangible Book Value Per Share December 31, September 30, June 30, March 31, December 31, ($ in thousands) 2016 2016 2016 2016 2015 PacWest Bancorp Consolidated: Stockholders' equity 4,479,055 $ 4,542,595 $ 4,513,304 $ 4,456,592 $ 4,397,691 $ Less: Intangible assets 2,210,315 2,213,491 2,219,557 2,223,928 2,229,511 Tangible common equity 2,268,740 $ 2,329,104 $ 2,293,747 $ 2,232,664 $ 2,168,180 $ Total assets 21,869,767 $ 21,315,291 $ 21,147,139 $ 21,031,009 $ 21,288,490 $ Less: Intangible assets 2,210,315 2,213,491 2,219,557 2,223,928 2,229,511 Tangible assets 19,659,452 $ 19,101,800 $ 18,927,582 $ 18,807,081 $ 19,058,979 $ Equity to assets ratio 20.48% 21.31% 21.34% 21.19% 20.66% Tangible common equity ratio (1) 11.54% 12.19% 12.12% 11.87% 11.38% Book value per share 36.93 $ 37.29 $ 37.05 $ 36.60 $ 36.22 $ Tangible book value per share (2) 18.71 $ 19.12 $ 18.83 $ 18.83 $ 17.86 $ Shares outstanding 121,283,669 121,817,524 121,819,849 121,771,252 121,413,727 Pacific Western Bank: Stockholders' equity 4,374,478 $ 4,416,623 $ 4,390,928 $ 4,331,841 $ 4,276,279 $ Less: Intangible assets 2,210,315 2,213,491 2,219,557 2,223,928 2,229,511 Tangible common equity 2,164,163 $ 2,203,132 $ 2,171,371 $ 2,107,913 $ 2,046,768 $ Total assets 21,848,644 $ 21,266,705 $ 21,084,950 $ 20,928,105 $ 21,180,689 $ Less: Intangible assets 2,210,315 2,213,491 2,219,557 2,223,928 2,229,511 Tangible assets 19,638,329 $ 19,053,214 $ 18,865,393 $ 18,704,177 $ 18,951,178 $ Equity to assets ratio 20.02% 20.77% 20.82% 20.70% 20.19% Tangible common equity ratio (1) 11.02% 11.56% 11.51% 11.27% 10.80% (1) Tangible common equity divided by tangible assets (2) Tangible common equity divided by shares outstanding

Core Net Interest Margin and Loan and Lease Yield December 31, 2016 September 30, 2016 June 30, 2016 March 31, 2016 December 31, 2015 Reported net interest margin (TE) 5.47% 5.26% 5.33% 5.53% 5.22% Less: Accelerated accretion of acquisition discounts from early payoffs of acquired loans (0.38)% (0.18)% (0.22)% (0.43)% (0.12)% Core net interest margin (TE) 5.09% 5.08% 5.11% 5.10% 5.10% December 31, 2016 September 30, 2016 June 30, 2016 March 31, 2016 December 30, 2015 Reported loan and lease yield 6.31% 6.17% 6.24% 6.57% 6.21% Less: Accelerated accretion of acquisition discounts from early payoffs of acquired loans (0.46)% (0.23)% (0.27)% (0.54)% (0.16)% Core loan and lease yield 5.85% 5.94% 5.97% 6.03% 6.05% Three Months Ended Three Months Ended

Net Interest Margin Excluding Purchase Accounting December 31, 2016 September 30, 2016 June 30, 2016 March 31, 2016 December 31, 2015 Reported net interest margin (TE) 5.47% 5.26% 5.33% 5.53% 5.22% Less: Accelerated accretion of acquisition discounts from early payoffs of acquired loans (0.38)% (0.18)% (0.22)% (0.43)% (0.12)% Core net interest margin (TE) 5.09% 5.08% 5.11% 5.10% 5.10% Less: Remaining accretion of Non-PCI loan acquisition discounts (0.08)% (0.13)% (0.14)% (0.19)% (0.24)% Amortization of TruPS discount 0.03% 0.03% 0.03% 0.03% 0.03% Accretion of time deposit premium 0.00% 0.00% 0.00% (0.01)% (0.01)% Net interest margin (TE) - excluding purchase accounting 5.04% 4.98% 5.00% 4.93% 4.88% Three Months Ended