Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OLIN Corp | form8kq42016earningsslides.htm |

Fourth Quarter 2016 Earnings Presentation

February 1, 2017

TM

Exhibit 99.1

Forward-Looking Statements

2

This communication includes forward-looking statements. These statements relate to analyses and other information that are

based on management’s beliefs, certain assumptions made by management, forecasts of future results, and current expectations,

estimates and projections about the markets and economy in which we and our various segments operate. These statements may

include statements regarding our recent acquisition of the U.S. chlor alkali and downstream derivatives businesses (the “Acquired

Business”), the expected benefits and synergies of the transaction, and future opportunities for the combined company following

the transaction. The statements contained in this communication that are not statements of historical fact may include forward-

looking statements that involve a number of risks and uncertainties.

We have used the words “anticipate,” “intend,” “may,” “expect,” “believe,” “should,” “plan,” “project,” “estimate,” “forecast,”

“optimistic,” and variations of such words and similar expressions in this communication to identify such forward-looking

statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions,

which are difficult to predict and many of which are beyond our control.

Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking

statements. Factors that could cause or contribute to such differences include, but are not limited to: factors relating to the

possibility that Olin may be unable to achieve expected synergies and operating efficiencies in connection with the transaction

within the expected time-frames or at all; the integration of the acquired chlorine products businesses being more difficult, time-

consuming or costly than expected; the effect of any changes resulting from the transaction in customer, supplier and other

business relationships; general market perception of the transaction; exposure to lawsuits and contingencies associated with the

acquired chlorine products business; the ability to attract and retain key personnel; prevailing market conditions; changes in

economic and financial conditions of our chlorine products business; uncertainties and matters beyond the control of

management; and the other risks detailed in Olin’s Form 10-K for the fiscal year ended December 31, 2015 and Olin’s Form 10-Q

for the quarter ended September 30, 2016. The forward-looking statements should be considered in light of these factors. In

addition, other risks and uncertainties not presently known to Olin or that Olin considers immaterial could affect the accuracy of

our forward-looking statements. The reader is cautioned not to rely unduly on these forward-looking statements. Olin undertakes

no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or

otherwise.

In addition to U.S. GAAP financial measures, this presentation includes certain non-GAAP financial measures including Adjusted

EBITDA. These non-GAAP measures are in addition to, not a substitute for or superior to, measures for financial performance

prepared in accordance with U.S. GAAP. Definitions of these measures and reconciliation of GAAP to non-GAAP measures are

provided in the appendix to this presentation.

Highlights

3

3

Achieved Adjusted EBITDA of $221.7 million in the fourth quarter, exceeding guidance1

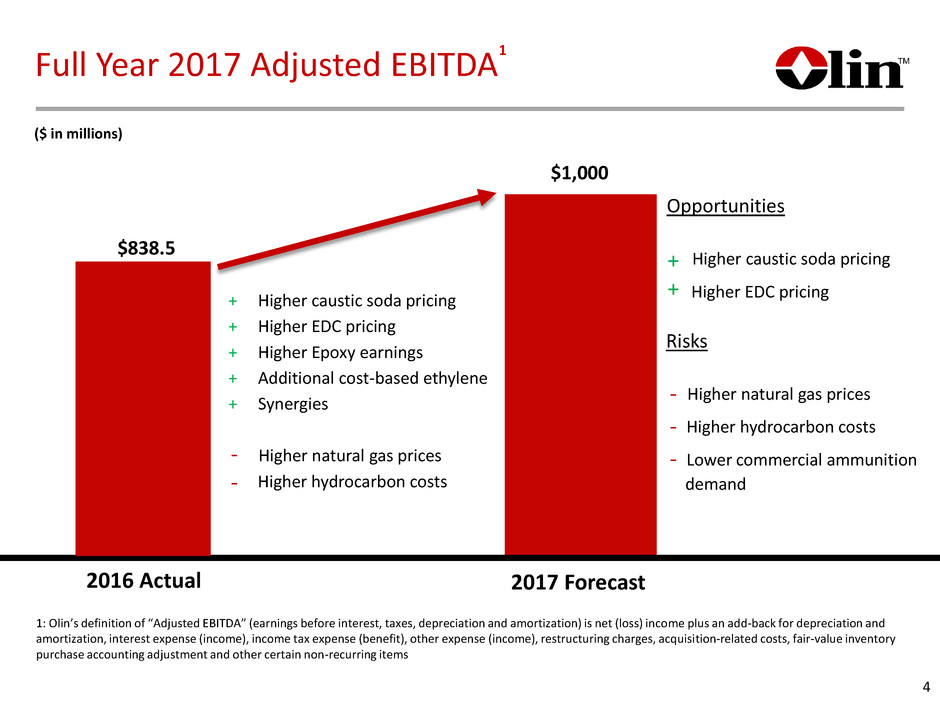

Full year 2016 Adjusted EBITDA of $838.5 million at the higher end of our guidance range2

Expect full-year 2017 cost synergy realization in the $50 million to $75 million range

Full year 2017 Adjusted EBITDA guidance range expected to be $1 billion, +/- 5%

1: Fourth quarter net income is $17.5 million

2: Full year 2016 net loss is $3.9 million

$838.5

4

Full Year 2017 Adjusted EBITDA

2016 Actual 2017 Forecast

($ in millions)

1: Olin’s definition of “Adjusted EBITDA” (earnings before interest, taxes, depreciation and amortization) is net (loss) income plus an add-back for depreciation and

amortization, interest expense (income), income tax expense (benefit), other expense (income), restructuring charges, acquisition-related costs, fair-value inventory

purchase accounting adjustment and other certain non-recurring items

1

+ Higher caustic soda pricing

+ Higher EDC pricing

+ Higher Epoxy earnings

+ Additional cost-based ethylene

+ Synergies

- Higher natural gas prices

- Higher hydrocarbon costs

-

-

$1,000

Opportunities

+ Higher caustic soda pricing

Higher EDC pricing

+

Risks

+ Higher natural gas prices

Higher hydrocarbon costs

Lower commercial ammunition

demand

-

-

-

demand

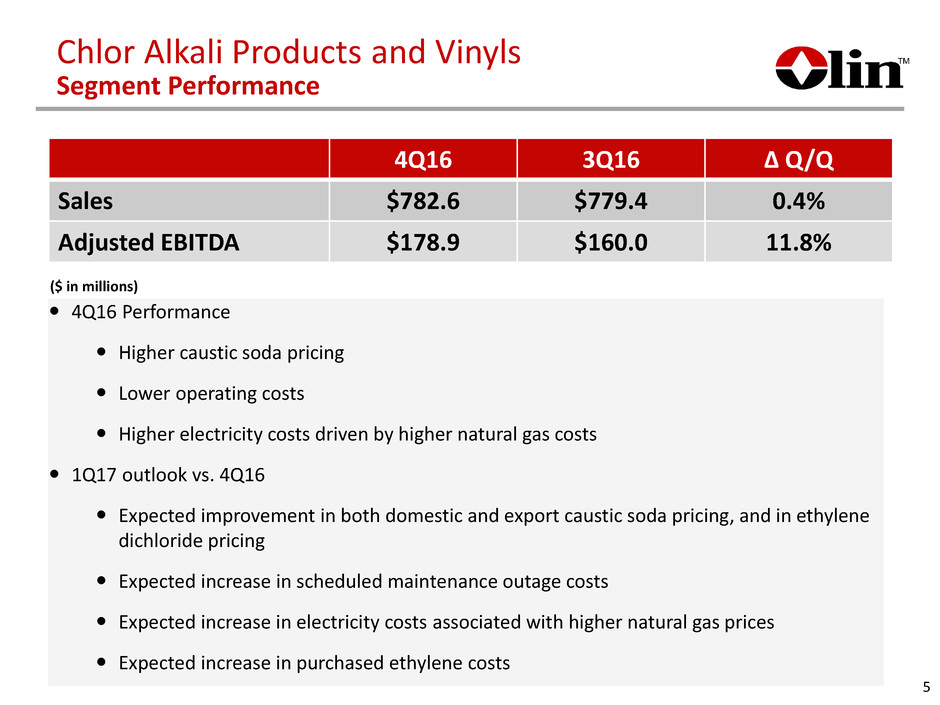

4Q16 3Q16 ∆ Q/Q

Sales $782.6 $779.4 0.4%

Adjusted EBITDA $178.9 $160.0 11.8%

4Q16 Performance

Higher caustic soda pricing

Lower operating costs

Higher electricity costs driven by higher natural gas costs

1Q17 outlook vs. 4Q16

Expected improvement in both domestic and export caustic soda pricing, and in ethylene

dichloride pricing

Expected increase in scheduled maintenance outage costs

Expected increase in electricity costs associated with higher natural gas prices

Expected increase in purchased ethylene costs

($ in millions)

Chlor Alkali Products and Vinyls

Segment Performance

5

Multi-Year View on Caustic Soda

North American chlor alkali capacity reductions, no capacity additions announced

Increasing North American caustic exports

European mercury cell chlor alkali production sunset by the end of this year

Growing internal caustic soda consumption in China coupled with lower vinyls

demand is limiting caustic soda exports from China

6

4Q16 3Q16 ∆ Q/Q

Sales $441.7 $470.1 -6.0%

Adjusted EBITDA $19.6 $32.9 -40.4%

4Q16 Performance

Lower volumes

Higher operating costs

1Q17 outlook vs. 4Q16

Expected higher pricing and higher volumes

Expected higher raw materials costs associated with benzene and propylene

Expected lower operating costs

($ in millions)

Epoxy

Segment Performance

7

4Q16 Performance

Sequentially lower volumes to commercial customers reflecting a normal seasonal

pattern

Year-over-year sales increased 3%

Adjusted EBITDA was 11.2% higher than 4Q15

1Q17 outlook vs. 4Q16

Expected sequential increase from the normal seasonally weak 4Q16

Expected customer inventory reductions

Expected higher commodity and materials costs

Winchester

Segment Performance

8

4Q16 3Q16 ∆ Q/Q

Sales $161.4 $203.2 -20.6%

Adjusted EBITDA $29.7 $40.7 -27.0%

($ in millions)

Significant Realizable Synergies

$250

Logistics & Procurement

Operational Efficiencies

Asset Optimization

Accessing New

Segments &

Customers

Capital

Investment

Actual

2016

Synergies

Breakdown

($M)

2017 2018 2019

75

Projected

Annual

Impact

125-150 180-200 250

120

Projected

Year-End

Run Rate

150-175 230-250 250

6

Projected

Annual

Impact

15-25 40-50 100

10

Projected

Year-End

Run Rate

35-50 50 100

205

Projected

CAPEX and

Investments

30 20 0

70

Projected Cash

Integration &

Restructuring

Costs

35 35 2

9

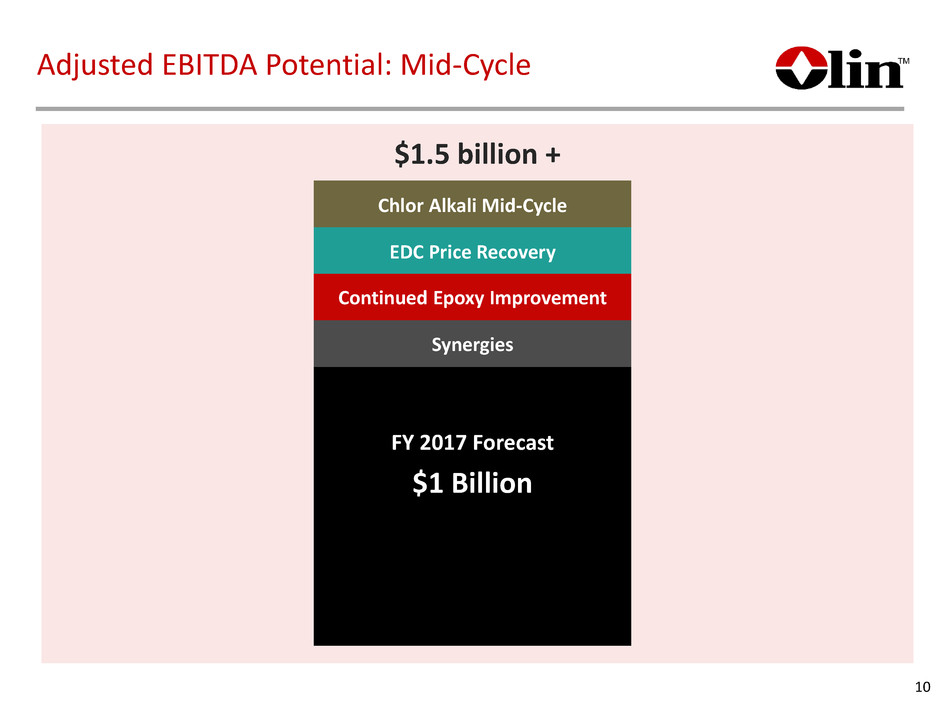

$1.5 billion +

FY 2017 Forecast

$1 Billion

Chlor Alkali Mid-Cycle

EDC Price Recovery

Continued Epoxy Improvement

Synergies

Adjusted EBITDA Potential: Mid-Cycle

10

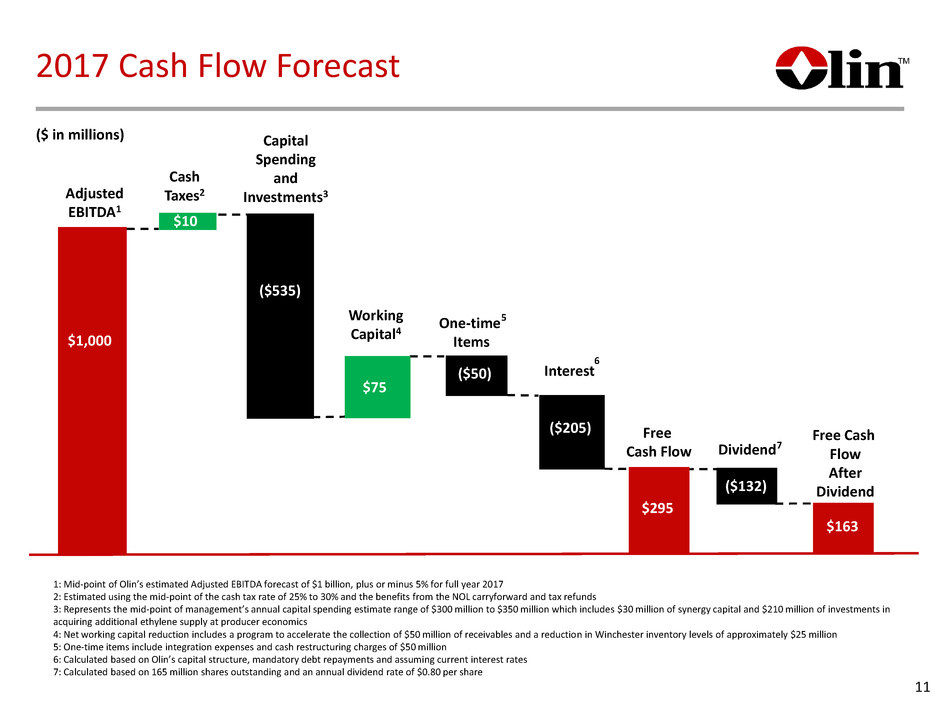

Working

Capital4

Adjusted

EBITDA1

Free Cash

Flow

After

Dividend

Cash

Taxes2

Capital

Spending

and

Investments3

Free

Cash Flow

1: Mid-point of Olin’s estimated Adjusted EBITDA forecast of $1 billion, plus or minus 5% for full year 2017

2: Estimated using the mid-point of the cash tax rate of 25% to 30% and the benefits from the NOL carryforward and tax refunds

3: Represents the mid-point of management’s annual capital spending estimate range of $300 million to $350 million which includes $30 million of synergy capital and $210 million of investments in

acquiring additional ethylene supply at producer economics

4: Net working capital reduction includes a program to accelerate the collection of $50 million of receivables and a reduction in Winchester inventory levels of approximately $25 million

5: One-time items include integration expenses and cash restructuring charges of $50 million

6: Calculated based on Olin’s capital structure, mandatory debt repayments and assuming current interest rates

7: Calculated based on 165 million shares outstanding and an annual dividend rate of $0.80 per share

2017 Cash Flow Forecast

One-time

Items

5

Dividend 7

Interest

6

($ in millions)

11

$1,000

($535)

$75

($50)

($205)

$295

($132)

$163

$10

Full Year 2017

Forecast

Key Elements

Capital Spending $300 to $350

Maintenance level of capital spending of $225M to $275M

annually, synergy capital of $30M, includes bleach capacity and

other projects

Investments $210 Includes 20 year ethylene at cost supply contract

Total $510 to $560

Depreciation & Amortization $535

Property, plant and equipment and intangible assets fair value

step up of approximately $2.5B. Includes FV step up of $160M

Pension Income $40 to $45 Lower than 2016 income levels by approximately $10M

Environmental Expense $15 to $20 Represents a more historic level of expense

Other Corporate & Unallocated Costs $110 to $115

Stock-based compensation, legal and litigation costs, and the

build out of corporate infrastructure costs

Restructuring & Acquisition Costs $50 Acquisition related integration and restructuring costs

Book Effective Tax Rate 25% to 30%

Favorable book/tax permanent differences, primarily salt

depletion

Cash Tax Rate $10 Refund

2017 cash tax benefit utilizes the benefits of NOL carry

forwards from 2015, 2016 and income tax refunds

($ in millions)

12

Guidance Assumptions

Appendix

13

Non-GAAP Financial Measures – Adjusted EBITDA (a)

(a) Unaudited.

(b) Restructuring charges were primarily associated with the closure of 433,000 tons of chlor alkali capacity across three separate Olin locations, of which $76.6 million was non-

cash impairment charges for equipment and facilities for the year ended December 31, 2016.

(c) Acquisition-related costs were associated with our acquisition of the Acquired Business.

(d) Certain non-recurring items for the year ended December 31, 2016 included an $11.0 million insurance recovery for property damage and business interruption related to a

2008 Henderson, NV chlor alkali facility incident.

14

Olin's definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net income (loss) plus an add-back for depreciation and amortization,

interest expense (income), income tax expense (benefit), other expense (income), restructuring charges, acquisition-related costs and certain other non-recurring items. Adjusted

EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors as a supplemental financial measure to assess the financial

performance of our assets without regard to financing methods, capital structures, taxes, or historical cost basis. The use of non-GAAP financial measures is not intended to

replace any measures of performance determined in accordance with GAAP and Adjusted EBITDA presented may not be comparable to similarly titled measures of other

companies. Reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are omitted from this release because Olin

is unable to provide such reconciliations without the use of unreasonable efforts. This inability results from the inherent difficulty in forecasting generally and quantifying certain

projected amounts that are necessary for such reconciliations. In particular, sufficient information is not available to calculate certain adjustments required for such

reconciliations, including interest expense (income), income tax expense (benefit), other expense (income), restructuring charges, and acquisition-related costs. Because of our

inability to calculate such adjustments, forward-looking net income guidance is also omitted from this release. We expect these adjustments to have a potentially significant

impact on our future GAAP financial results.

Year

Ended

December 31, September 30, December 31,

(In millions) 2016 2016 2016

Reconciliation of Net Income (Loss) to Adjusted EBITDA:

Net Income (Loss) 17.5$ 17.5$ (3.9)$

Add Back:

Interest Expense 48.3 47.5 191.9

Interest Income (2.1) (0.5) (3.4)

Income Tax Provision (Benefit) 6.0 3.8 (30.3)

De eciation and Amortization 136.1 135.3 533.5

EBITDA 205.8 203.6 687.8

A d B ck:

Restructuring Charges (b) 6.7 5.2 112.9

Acquisition-related Costs (c) 9.2 13.1 48.8

Certain Non-recurring Items (d) - - (11.0)

Adjusted EBITDA 221.7$ 221.9$ 838.5$

Three Months Ended

Non-GAAP Financial Measures – Net Income

(loss) from Operations per share (a)

(a) Unaudited.

(b) Restructuring charges were primarily associated with the closure of 433,000 tons of chlor alkali capacity across three separate Olin locations, of which $76.6 million was non-

cash impairment charges for equipment and facilities for the year ended December 31, 2016.

(c) Acquisition-related costs were associated with our acquisition of the Acquired Business.

(d) Certain non-recurring items for the year ended December 31, 2016 included an $11.0 million insurance recovery for property damage and business interruption related to a

2008 Henderson, NV chlor alkali facility incident.

(e) Step-up depreciation and amortization of $40.3 million for both the three months ended December 31, 2016 and September 30, 2016 and $161.4 million for the year ended

December 31, 2016 was associated with the increase to fair value of property, plant and equipment, acquired intangible assets and long-term supply contracts at the acquisition

date related to the purchase accounting of the Acquired Business.

(f) The effective tax rate on the pretax adjustments from net income (loss) per share to adjusted net income from operations per share is approximately 37%.

15

Olin's definition of adjusted net income (loss) from operations per share is net income (loss) per share plus a per dilutive share add-back for step-up depreciation and amortization

recorded in conjunction with the Acquired Business, restructuring charges, acquisition-related costs, certain other non-recurring items and the tax impact of the aforementioned

adjustments. Adjusted net income (loss) from operations per share is a non-GAAP financial measure excluding certain items that we do not consider part of ongoing operations.

Management believes that this supplemental financial measure is meaningful to investors as a financial performance metric which is useful to investors for comparative purposes.

The use of non-GAAP financial measures is not intended to replace any measures of performance determined in accordance with GAAP and adjusted net income (loss) from

operations per share presented may not be comparable to similarly titled measures of other companies.

Year

Ended

December 31, September 30, December 31,

2016 2016 2016

Reconciliation of Net Income (Loss) Per Share to Adjusted Net Income from Operations Per Share:

Net Income (Loss) Per Share 0.10$ 0.11$ (0.02)$

Add Back:

Re t ucturing Charges (b) 0.04 0.03 0.68

A q isition-related Costs (c) 0.06 0.08 0.30

Certain Non-recurring Items (d) - - (0.07)

Step-Up Depreciation and Amortization (e) 0.24 0.24 0.98

Income Tax Impact (f) (0.13) (0.13) (0.71)

Adjusted Net Income from Operations Per Share 0.31$ 0.33$ 1.16$

Three Months Ended

Non-GAAP Financial Measures by Segment

16

(In millions)

Income (loss)

before Taxes

Depreciation and

Amortization

Adjusted

EBITDA

Chlor Alkali Products and Vinyls 72.4$ 106.5$ 178.9$

Epoxy (3.1) 22.7 19.6

Winchester 25.0 4.7 29.7

(In millions)

Income (loss)

before Taxes

Depreciation and

Amortization

Adjusted

EBITDA

Chlor Alkali Products and Vinyls 53.7$ 106.3$ 160.0$

Epoxy 10.3 22.6 32.9

Winchester 36.0 4.7 40.7

Three Months Ended December 31, 2016

Three Months Ended September 30, 2016

4Q16 versus

4Q15 3Q16

Chlorine

Caustic Soda

EDC

Bleach

HCI

Chlorinated

Organics

Chlor Alkali Products and Vinyls

Pricing and Volume Comparisons

4Q16 versus

4Q15 3Q16

Chlorine

Caustic Soda

EDC

Bleach

HCI

Chlorinated

Organics

Volume Comparison Pricing Comparison

17

Product Price Change EBITDA Impact

Chlorine $10/ton $10 million

Caustic $10/ton $30 million

EDC $.01/pound $20 million

Annual EBITDA Sensitivity

18

Olin Caustic Soda Price Realization

• A $10 per ton change in Olin’s caustic soda selling price changes annual Adjusted EBITDA by

approximately $30 million

Fundamental Principle

Domestic Sales

• A significant portion of domestic sales are linked to index prices

• Index price changes typically occur 30 to 90 days post our price nomination

• Depending on market conditions 30% to 70% of index price changes are realized

• Overall price realization lags index price changes by 30 to 120 days

Export Sales

• Sold on a combination of negotiated sales and export index price

• Changes in export index prices are typically realized on a 30 to 90 day lag

• Realization of index price changes are typically 80% to 100%

19

0.00

5.00

10.00

15.00

20.00

25.00

0 25 50 75 100

EDC Pricing History 2000 – 2016

EDC Spot Export Prices

C

en

ts

P

er

P

ou

n

d

Source: IHS

EDC Pricing Distribution

Percent of Time in Price Range

• A $0.01 change in Olin’s EDC sales price changes annual Adjusted EBITDA by $20 million

• 2016 index EDC prices were in the bottom 19% of actual prices over the past 16 years

20

Average = 14 cents

4%

15%

26%

31%

14%

10%

Corporate & Other

21

4Q16 3Q16

Pension Income $13.4 $15.4

Environmental Expense $(3.7) $(0.4)

Other Corporate and

Unallocated Costs

$(18.5) $(28.2)

Restructuring Charges $(6.7) $(5.2)

Acquisition-related Costs $(9.2) $(13.1)

($ in millions)

Corporate and other unallocated costs are consistent with our full year 2016 expectations that

levels will be higher than the full year 2015 due to the build out of our corporate capabilities

since the acquisition

Corporate and other unallocated costs are lower in 4Q16 due to lower legal and litigation costs

and decreased asset retirement costs at past manufacturing locations

Restructuring charges are primarily related to the closure of 433,000 tons of chlor alkali

capacity

Acquisition-related costs are associated with our integration of the Acquired Business

End slide

TM

22