Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OCEANFIRST FINANCIAL CORP | ocfc8-kinvestorpresentatio.htm |

Investor Presentation

February 2017

OceanFirst Financial Corp.

OceanFirst Financial Corp.

Forward-Looking Statements

In addition to historical information, this news release contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and

describe future plans, strategies and expectations of the Company. These forward-looking statements are

generally identified by use of the words "believe," "expect," "intend," "anticipate," "estimate," "project," "will,"

"should," "may," "view," "opportunity," "potential," or similar expressions or expressions of confidence. The

Company's ability to predict results or the actual effect of future plans or strategies is inherently

uncertain. Factors which could have a material adverse effect on the operations of the Company and its

subsidiaries include, but are not limited to: changes in interest rates, general economic conditions, levels of

unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural

disasters and increases to flood insurance premiums, the level of prepayments on loans and mortgage-backed

securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including

policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or

composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand

for financial services in the Company's market area and accounting principles and guidelines and the Bank’s

ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2015 and subsequent securities

filings and should be considered in evaluating forward-looking statements and undue reliance should not be

placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to

publicly release the result of any revisions which may be made to any forward-looking statements to reflect

events or circumstances after the date of such statements or to reflect the occurrence of anticipated or

unanticipated events.

2

Founded,

Point Pleasant,

NJ

Branch Expansion

Into

Middlesex County

1902

1985

IPO To

Mutual

Depositors

1996

Established

Commercial

Lending

Created OceanFirst

Foundation

Established

Trust and

Asset Management

2000

2014 2015

Colonial American

Bank Acquired

Commercial LPO

Expansion into

Mercer County

Branch Expansion

Into

Monmouth County

1999

Cape Bancorp

Acquired

2016

OceanFirst

Foundation Exceeds

$25 Million In

Cumulative Grants

Ocean Shore

Holding Co.

Acquired*

2017

OceanFirst Milestones – 115 Years of Growth

3

Serving Central and Southern New Jersey Markets

• OceanFirst is the largest Bank

headquartered in Central and Southern

New Jersey

• $5.2 billion in assets

• 61 branch offices

• Market Cap $910 million

• Average Daily Share Volume of

205,000

OceanFirst Headquarters

OceanFirst Retail Branches,

Commercial Loan Production Offices,

and Wealth Management Office

30 million people, or approximately

10% of the total U.S. population,

reside within a 2-hour drive* and

7.3 million reside in market area**

4

*Includes New York – Newark NY-NJ-PA-CT CSA and

Philadelphia – Reading – Camden CSA.

**Refer to Appendix 2 for market area.

Experienced Leadership

Name

Position

# of Years

at OCFC

# of Years

In Banking

Previous

Experience

Christopher D. Maher President, Chief Executive Officer 3 28 Patriot National Bancorp; Dime Community Bancshares

Michael J. Fitzpatrick Executive Vice President, Chief Financial Officer 24 35 KPMG

Joseph R. Iantosca Executive Vice President, Chief Administrative Officer 12 38 BISYS Banking Solutions; Newtrend LLC; Brooklyn Federal Savings

Joseph J. Lebel III Executive Vice President, Chief Banking Officer 10 32

Wachovia Bank N.A.;

First Fidelity

Steven J. Tsimbinos Executive Vice President, General Counsel 6 22 Thacher Proffit & Wood; Lowenstein Sandler PC

• Substantial insider ownership of 15.3% – aligned with shareholders’ interests

OceanFirst Bank ESOP 5.0%

Directors & Senior Executive Officers 6.3%

Director and Proxy Officer Stock Ownership Guidelines

OceanFirst Foundation 4.0%

From April 26, 2016 Proxy Statement, adjusted for Cape Bancorp acquisition on May 2, 2016 and Ocean Shore

Holding Co. acquisition on November 30, 2016.

5

Strategic Focus

6

I. Organic Commercial Loan and Core Deposit Growth

• Grew commercial loans (excluding acquired loans) from $533 million at

December 31, 2012 to $911 million at December 31, 2016, 14.3% CAGR

• Grew low cost core deposits (excluding acquired deposits) from $1,493 million

(0.15% cost) at December 31, 2012 to $1,831 million (0.11% cost) at December

31, 2016

II. Opportunistic Acquisitions of Community Banks

Target Closing Date Transaction Value(1) Total Assets(1)

Colonial American Bank July 31, 2015 $ 12 million $ 142 million

Cape Bancorp May 2, 2016 $196 million $1,518 million

Ocean Shore Holding Co. November 30, 2016 $146 million $1,097 million

Weighted average(1): Price/Tangible Book Value 135%; Core Deposit Premium 4.5%

(1)At time of announcement.

Strategic Focus (Continued)

7

III. Conservative Risk Management

• Credit Risk

Reduced non-performing loans from $43.4 million (2.8% of loans) at December 31, 2012 to

$13.6 million (0.35% of total loans receivable) at December 31, 2016, a 10-year low

Strong credit culture – no non-performing commercial loans originated in the past five

years

• Interest Rate Risk

Grew core deposits (excluding acquisitions) by $170 million in 2016, or 10.2% annualized

Core deposits (all deposits except time deposits) are 84.6% of total deposits at December

31, 2016

• Regulatory/Compliance Risk

Regulatory approvals received for three acquisitions in a timely manner

Outstanding CRA rating received October 2015

Total Shareholder Return December 31, 2012 to December 31, 2016 –

145%, 25.2% CAGR

Highlights – 2016

8

Fourth Quarter

• Core EPS of $0.38(1), a 15% increase from $0.33(1) in Q4 2015

11.33% ROTE(1) & 0.92% ROA(1)

Net interest margin was 3.31% in Q4 2016, an increase from 3.25% in

Q4 2015

• Strong deposit funding with a loan to deposit ratio of 90.8% and an

average cost of deposits of just 0.26%

• Completed successful integration of Cape’s core systems providing

for realization of additional cost savings entering the first quarter of

2017

(1)Amounts and ratios exclude merger related expenses

Favorable Competitive Position

Competing Favorably Against Banking Behemoths and Local Community Banks

Source: FDIC Summary of Deposits, June 30, 2016

Note: Market area is defined as counties in Central and Southern New Jersey

*Includes the acquisitions of Cape Bank and Ocean City Home Bank

Institution

# of

Branches

Dep. In

Mkt.

($000)

TD Bank (Canada) 132 18,749,018

PNC Bank (PA) 143 17,002,556

Wells Fargo (CA) 145 15,802,079

Bank of America

(NC) 123 14,604,095

Santander Bank

(Spain) 81 6,103,973

OceanFirst Bank*

# of

Branches

Dep. In Mkt.

($000)

61 4,039,695

Institution

# of

Branches

Dep. In

Mkt.

($000)

Sun 31 1,659,983

Manasquan 8 870,556

First Choice 5 693,069

Sturdy Savings 13 668,769

OceanFirst

Competitive

Position

Responsive

Flexible

Capable

• Lending Limit

• Technology

• Trust

• Cash Management

• Consumer &

Commercial

Mega Banks Community Banks

9

Online Banking & Bill Pay

In 2015, 40% of depositors used

online banking and an average of

49,000 bills were paid with online bill

pay service each month.

Check Card

Over 11.6 million transactions processed in

2015. Rewards program promotes usage.

Launched Card Valet, a personalized

mobile card management app, in 2015.

Full Suite of Technology and Delivery Systems

10

Corporate Cash Management

Added Remote Deposit Capture

(RDC) in 2007. In 2015, 297 clients

processed over 875,000 checks

using RDC.

ATM & Interactive Teller (ITM)

Fleet of intelligent ATM terminals provide

technology for continually growing self-

service deposit option. First ITM deployed in

2014 with more added in 2015 and 2016.

Mobile Banking

Consistently adopting mobile-

centric options. Currently

offering TouchID, Apple Watch,

and Apple Pay.

Customers using self-service

channels in December 2016

• 21,000 deposits totaling

$180.1 million

• 11% of transaction volume and

23% of transaction value of

customer-presented deposits

for the Bank

Why OCFC…?

• Fundamental franchise value

• Preeminent community bank in Central and Southern New Jersey

• Superior deposit profile

• Significant commercial loan growth since December 2012; current focus on recent

portfolio integrations

• Conservative credit culture

• Solid financial performance

• Consistent attractive returns

• Strong balance sheet and capital base

• Seasoned and effective management team

• Substantial insider ownership – aligned with shareholders’ interests

• Fully capable of executing on 5-year growth plan

11

Attractive Valuation Metrics

Valuation

Price / Tang. Book Value 230% 214%

Price / Estimated 2016 EPS 17.5x 17.8x

Price / 2017 Estimated EPS 15.7x 15.2x

Core Deposit Premium 13.8% 12.9%

Cash Dividend Yield 2.0% 2.2%

OCFC Peers(1)

1) Peers include: AROW, BMTC, DCOM, FFIC, FISI, FLIC, LBAI, NFBK, ORIT, PGC, UVSP and WSFS

Note: Financial data as of the most recent period available; market data as of January 27, 2017;

OCFC stock price of $29.74.

Source: Sandler O’Neill

12

Appendix

13

OceanFirst Financial Corp. – Analyst Coverage

APPENDIX 1

Company

Analyst

Recommendation

Price

Target

Keefe Bruyette & Woods Collyn Gilbert Outperform $33.00

Sandler O’Neill & Partners Frank Schiraldi Hold $32.00

Piper Jaffray Matt Breese Overweight $31.00

FIG Partners David Bishop Outperform $34.00

Investor Relations Contacts

Christopher D. Maher

Chairman and Chief Executive Officer

732-240-4500 Ext. 7504

cmaher@oceanfirst.com

Michael Fitzpatrick

Executive Vice President and Chief Financial Officer

732-240-4500 Ext. 7506

mfitzpatrick@oceanfirst.com

Jill Hewitt

Senior Vice President/Investor Relations Officer

732-240-4500 Ext. 7513

jhewitt@oceanfirst.com

14

Market Demographics

Central

New Jersey(1)

Southern

New Jersey(2)

Philadelphia

Metro(3)

Total Bank Offices in Market 864 508 848

Total Bank Deposits in Market $87.3 billion $38.0 billion $93.7 billion

Number of OceanFirst Offices 28 22

% of OceanFirst Deposits 62 38

Market Rank 11 8

Market Share (%) 2.3 3.2

Population 2,442,000 1,838,000 3,029,000

Projected 2017-2022

Population Growth (%)

7.0 2.6 4.5

Deposit and demographic data as of June 30, 2016.

Source: SNL Financial

Notes: 1 – Includes Monmouth, Ocean, Middlesex and Mercer counties, New Jersey

2 – Includes Burlington, Atlantic, Cape May, Camden, Gloucester, Salem and Cumberland counties, New Jersey

3 – Includes Philadelphia, Bucks and Montgomery counties, Pennsylvania

APPENDIX 2

Expansion

opportunity

15

Colonial American Bank Acquisition

• 100% Stock deal, valued at $11.9 million

• In-Market acquisition supports growth objective

in towns of Middletown and Shrewsbury, NJ

• Favorable financial terms (adjusted for DTA

realization of $2.3 million)

• Price/Tangible Book Value of 104%

o Transaction neutral to OCFC book value

• Price/Core Deposit Premium of 0.4%

• Modest execution risk with conservative

assumptions

• Expected cost saves of 35%, fully realized in 2016

• Gross credit mark of $2.9 million, 2.4% of loans

• Effective execution (2015)

• Announcement – February 25

• Regulatory Approvals - June 17 (68 days following

application)

• Shareholder Approval - July 9

• Closing – July 31

• Systems Integration – October 17 (72 days following

legal closing)

APPENDIX 3

Supports

Retail

Expansion in

High Value

Communities

OceanFirst Headquarters

OceanFirst Retail Branches,

Commercial Loan Production Offices,

and Wealth Management Office

Colonial American Retail Branches

16

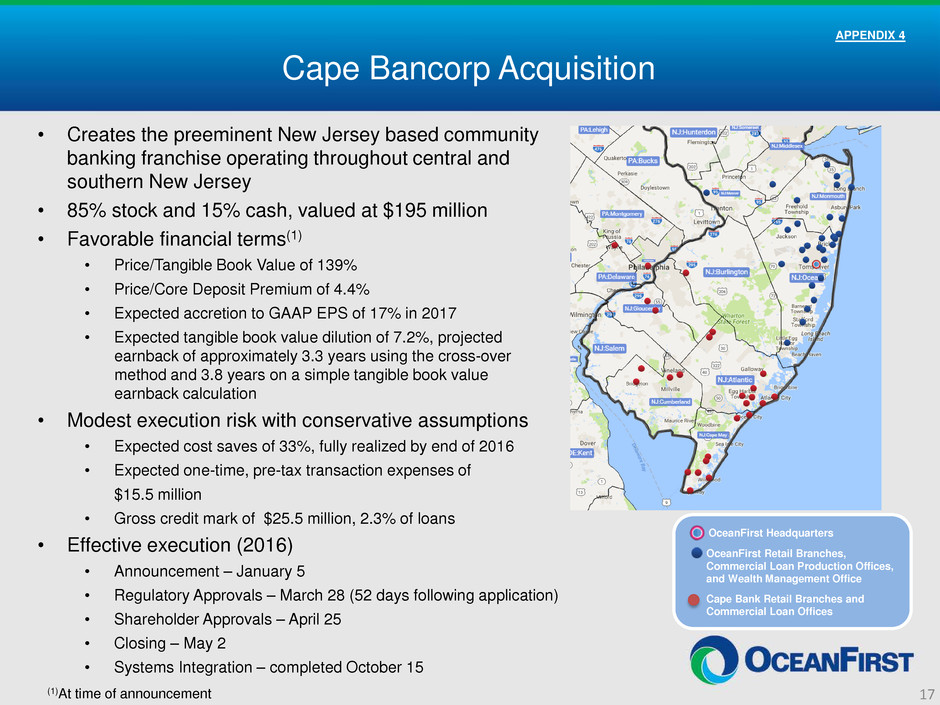

Cape Bancorp Acquisition

• Creates the preeminent New Jersey based community

banking franchise operating throughout central and

southern New Jersey

• 85% stock and 15% cash, valued at $195 million

• Favorable financial terms(1)

• Price/Tangible Book Value of 139%

• Price/Core Deposit Premium of 4.4%

• Expected accretion to GAAP EPS of 17% in 2017

• Expected tangible book value dilution of 7.2%, projected

earnback of approximately 3.3 years using the cross-over

method and 3.8 years on a simple tangible book value

earnback calculation

• Modest execution risk with conservative assumptions

• Expected cost saves of 33%, fully realized by end of 2016

• Expected one-time, pre-tax transaction expenses of

$15.5 million

• Gross credit mark of $25.5 million, 2.3% of loans

• Effective execution (2016)

• Announcement – January 5

• Regulatory Approvals – March 28 (52 days following application)

• Shareholder Approvals – April 25

• Closing – May 2

• Systems Integration – completed October 15

APPENDIX 4

17

OceanFirst Headquarters

OceanFirst Retail Branches,

Commercial Loan Production Offices,

and Wealth Management Office

Cape Bank Retail Branches and

Commercial Loan Offices

(1)At time of announcement

18

Ocean Shore Holding Co. Acquisition

- OCFC

Branches

- OSHC

Branches

APPENDIX 5

• Reinforces OceanFirst as the preeminent New Jersey

based community banking franchise operating

throughout central and southern New Jersey

• 80% stock and 20% cash, valued at $181 million

• Favorable financial terms(1)

• Price/Tangible Book Value of 132%

• Price/Core Deposit Premium of 4.9%

• Expected accretion to GAAP EPS of over 5% in 2018

• Expected tangible book value dilution of 3.1%, projected

earnback of approximately 3.7 years using the cross-over

method and 4.1 years on a simple tangible book value

earnback calculation

• Modest execution risk with conservative assumptions

• Expected cost saves of 53%, fully realized by end of 2017

• Expected one-time, pre-tax transaction expenses of $19 million

• Gross credit mark of $10.0 million, 1.25% of loans

• Effective execution

• Announcement – July 13, 2016

• Regulatory Approvals – October 27, 2016

• Shareholder Approvals – November 22, 2016

• Closing – November 30, 2016

• Systems Integration – scheduled for May 2017

(1)At time of announcement

19

Earnings Press Release

APPENDIX 6

Press Release

Company Contact:

Michael J. Fitzpatrick

Chief Financial Officer

OceanFirst Financial Corp.

Tel: (732) 240-4500, ext. 7506

Fax: (732) 349-5070

Email: Mfitzpatrick@oceanfirst.com

FOR IMMEDIATE RELEASE

OCEANFIRST FINANCIAL CORP.

ANNOUNCES QUARTERLY AND ANNUAL

FINANCIAL RESULTS

TOMS RIVER, NEW JERSEY, JANUARY 26, 2017…OceanFirst Financial Corp.

(NASDAQ:"OCFC"), (the "Company"), the holding company for OceanFirst Bank (the "Bank"), today

announced that diluted earnings per share were $0.22 for the quarter ended December 31, 2016, as

compared to $0.31 for the corresponding prior year quarter. For the year ended December 31, 2016, diluted

earnings per share were $0.98, as compared to $1.21 for the corresponding prior year period.

The results of operations for the quarter and the year ended December 31, 2016 include merger

related expenses, which decreased net income, net of tax benefit, by $4.5 million and $11.9 million,

respectively. Excluding this item, core earnings for the quarter and year ended December 31, 2016 were

$10.6 million, or $0.38 per diluted share, and $35.0 million, or $1.49 per diluted share, respectively. (Please

refer to the Non-GAAP Reconciliation table at the end of this document for details on the earnings impact

of merger related expenses, certain other expenses incurred in the second quarter of 2016, and quantification

of core earnings).

Highlights for the quarter are described below.

• On November 30, 2016, the Company completed its acquisition of Ocean Shore Holding

Company ("Ocean Shore"), which added $995.9 million to assets, $774.0 million to loans,

2

and $875.1 million to deposits. The Company anticipates full integration of Ocean Shore’s

operations and systems in May 2017.

• On October 15, 2016, the Bank completed the systems integration and rebranding effort

related to the acquisition of Cape Bancorp, Inc. ("Cape"), which had been operated as a

division of OceanFirst Bank since the closing on May 2, 2016.

• Non-performing loans decreased 25.8%, to $13.6 million, at December 31, 2016, from

$18.3 million at December 31, 2015. Non-performing loans as a percent of total loans

receivable decreased to 0.35% at December 31, 2016, from 0.91% at December 31, 2015,

the lowest level in the past 10 years.

Chairman and Chief Executive Officer Christopher D. Maher reflected on the Company's results,

"With the Ocean Shore closing on November 30th and the full systems conversion and rebranding of Cape

completed, we are pleased to include the stockholders, employees and customers of both organizations in

the OceanFirst family." Mr. Maher added, "Throughout 2017 we will be focused on effectively deploying

excess liquidity and reducing operating expenses following the two acquisitions completed in 2016."

The Company continues to focus on organic growth while actively managing expense levels.

Expense reductions associated with the successful systems integration of Cape in the fourth quarter of

2016 will be fully realized in the first quarter of 2017. Initial cost savings were realized at the time of the

Ocean Shore acquisition on November 30, 2016, with incremental savings expected after the second quarter

of 2017 due to the anticipated systems integration. The Company also expects to realize significant cost

savings from the consolidation of branches. The Company's Board of Directors has approved the

elimination of 10 such branches in the legacy Cape and Ocean Shore market area by mid-year 2017, with

an expected annualized cost savings of $3.6 million. Further, the Company expects to consolidate other

branches in its central New Jersey market area by the end of the year. These initiatives will allow the

Company to continue to invest in commercial banking and electronic delivery channels while meeting the

efficiency targets established in connection with the recent acquisitions.

3

The Company also announced that the Board of Directors declared its eightieth consecutive

quarterly cash dividend on common stock. The dividend for the quarter ended December 31, 2016 of

$0.15 per share will be paid on February 17, 2017 to stockholders of record on February 6, 2017.

Results of Operations

On July 31, 2015, the Company completed its acquisition of Colonial American Bank ("Colonial

American"), which added $142.4 million to assets, $121.2 million to loans, and $123.3 million to deposits.

Colonial American’s results of operations are included in the consolidated results for the quarter and year

ended December 31, 2016, but are only included in the results of operations for the period from August

1, 2015 through December 31, 2015.

On May 2, 2016, the Company completed its acquisition of Cape and its results of operations from

May 2, 2016 through December 31, 2016 are included in the consolidated results for the quarter and year

ended December 31, 2016, but are not included in the results of operations for the corresponding prior

year periods.

On November 30, 2016, the Company completed its acquisition of Ocean Shore and its results of

operations from December 1, 2016 through December 31, 2016 are included in the consolidated results

for the quarter and year ended December 31, 2016, but are not included in the results of operations for the

corresponding prior year periods.

Net income for the quarter ended December 31, 2016, was $6.1 million, or $0.22 per diluted share,

as compared to $5.2 million, or $0.31 per diluted share, for the corresponding prior year period. Net income

for the year ended December 31, 2016, was $23.0 million, or $0.98 per diluted share, as compared to $20.3

million, or $1.21 per diluted share, for the corresponding prior year period. Net income for the quarter

and year ended December 31, 2016 includes merger related expenses, net of tax benefit, of $4.5 million

and $11.8 million, respectively, as compared to $441,000 and $1.3 million, respectively, for the same prior

year periods. Additionally, net income for the year ended December 31, 2016, includes an FHLB advance

prepayment fee of $136,000, and a loss on the sale of investment securities available-for-sale of $12,000.

4

Excluding these items, diluted earnings per share increased over the prior year period due to higher net

interest income and other income partially offset by increases in operating expenses, provision for loan

losses, and average diluted shares outstanding.

Excluding merger related expenses, diluted earnings per share decreased $0.02 from the prior

linked quarter. Excluding the impact of Ocean Shore, net interest income decreased for the fourth quarter

of 2016, as compared to the prior linked quarter, due to a reduction in average loans receivable. This

reduction was partly offset by the overall favorable impact of the Ocean Shore acquisition for the month

of December.

Net interest income for the quarter and year ended December 31, 2016 increased to $35.8 million

and $120.3 million, respectively, as compared to $20.7 million and $76.8 million for the same prior year

periods, reflecting an increase in interest-earning assets and a higher net interest margin. Average interest-

earning assets increased $1.730 billion and $1.116 billion, respectively, for the quarter and year ended

December 31, 2016, as compared to the same prior year periods. The averages for the quarter and year

ended December 31, 2016, were favorably impacted by $1.357 billion and $900.7 million, respectively,

as a result of the interest-earning assets acquired from Ocean Shore, Cape and Colonial American

("Acquisition Transactions"). Average loans receivable, net, increased $1.323 billion and $956.7 million,

respectively, for the quarter and the year ended December 31, 2016 as compared to the same prior year

periods. The increases attributable to the Acquisition Transactions were $1.280 billion and $843.6 million

for the quarter and the year ended December 31, 2016, respectively. The net interest margin increased to

3.40% and 3.47%, respectively, for the quarter and year ended December 31, 2016, from 3.34% and 3.28%,

respectively, for the quarter and year ended December 31, 2015. The yield on average interest-earning

assets increased to 3.79% and 3.85%, respectively, for the quarter and year ended December 31, 2016,

from 3.74% and 3.66%, respectively, for the same prior year periods. The yields on average interest-

earning assets for the quarter and year ended December 31, 2016 benefited from the accretion of purchase

accounting adjustments on the Acquisition Transactions of $1.4 million and $4.5 million, respectively;

5

the higher-yielding interest-earning assets acquired from Cape; and the higher interest rate environment

in the fourth quarter of 2016. For the quarter and the year ended December 31, 2016, the cost of average

interest-bearing liabilities decreased to 0.48% and 0.47%, from 0.49% and 0.48%, respectively, in the

corresponding prior year periods. The total cost of deposits (including non-interest bearing deposits) was

0.26% and 0.25%, respectively, for the quarter and year ended December 31, 2016, as compared to 0.24%

and 0.23%, respectively, for the corresponding prior year periods.

Net interest income for the quarter ended December 31, 2016 increased $1.8 million, as compared

to the prior linked quarter, as average interest-earning assets increased $400.3 million, of which $317.8

million related to Ocean Shore. The net interest margin decreased to 3.40% for the quarter ended

December 31, 2016, from 3.56% for the prior linked quarter. The yield on average interest-earning assets

decreased to 3.79% for the quarter ended December 31, 2016, from 3.92% for the prior linked quarter due

to increased average balances in lower yielding interest-earning deposits and short-term investments. The

cost of average interest-bearing liabilities increased to 0.48% for the quarter ended December 31, 2016,

as compared to 0.43% for the prior linked quarter, due to a full quarter of interest expense on the September

2016 issuance of $35.0 million in subordinated notes at an all-in cost of 5.45% with a stated maturity of

September 30, 2026.

For the quarter and year ended December 31, 2016, the provision for loan losses was $510,000

and $2.6 million, respectively, as compared to $300,000 and $1.3 million, respectively, for the

corresponding prior year periods. Net charge-offs were $944,000 and $4.2 million, respectively, for the

quarter and the year ended December 31, 2016, as compared to $217,000 and $870,000, respectively, in

the corresponding prior year periods. The increase in net charge-offs for the quarter and the year ended

December 31, 2016, was primarily due to fourth quarter and full-year charge-offs of $535,000 and $2.1

million, respectively, on loans sold, and to a lesser extent, first quarter charge-offs of $886,000 on two

non-performing commercial loans. Excluding charge-offs attributable to the loan sale, net charge-offs for

6

the quarter totaled $409,000. Non-performing loans totaled $13.6 million at December 31, 2016, as

compared to $16.5 million at September 30, 2016, and $18.3 million at December 31, 2015.

For the quarter and the year ended December 31, 2016, other income increased to $6.3 million and

$20.4 million, respectively, as compared to $4.1 million and $16.4 million, respectively, in the same prior

year periods. The increases from the prior periods were primarily due to the impact of the Ocean Shore

and Cape acquisitions which added $1.6 million and $3.9 million to total other income for the quarter and

the year ended December 31, 2016, respectively, as compared to the same prior year periods. Excluding

Ocean Shore and Cape, other income increased $529,000 and $133,000 for the quarter and year ended

December 31, 2016, as compared to the same prior year periods. For the quarter and the year ended

December 31, 2016, other income included losses of $49,000 and $342,000, respectively, attributable to

the operations of a hotel, golf and banquet facility acquired as Other Real Estate Owned ("OREO") in the

fourth quarter of 2015. The Bank is currently engaged in a sales process with qualified buyers for this

property.

For the quarter ended December 31, 2016, other income, excluding the impact from Ocean Shore,

increased $12,000, as compared to the prior linked quarter.

Operating expenses increased to $32.5 million and $102.9 million, respectively, for the quarter

and the year ended December 31, 2016, as compared to $16.5 million and $60.8 million, respectively, in

the same prior year periods. Operating expenses for the quarter and the year ended December 31, 2016

include $6.6 million and $16.5 million, respectively, in merger related expenses, as compared to merger

related expenses of $614,000 and $1.9 million, respectively, in the same prior year periods. Excluding

merger related expenses, the increases in operating expenses over the prior year were primarily due to the

operations of Cape and Ocean Shore, which added $8.2 million and $20.5 million for the quarter and year-

to-date, respectively; the investment in commercial lending which added expenses of $15,000 and $816,000

for the quarter and year-to-date, respectively; the addition of branches (excluding those acquired in the

Acquisition Transactions) which added expenses of $176,000 and $1.2 million for the quarter and year-

7

to-date, respectively: the amortization of the core deposit intangible which added expenses of $291,000

and $602,000 for the quarter and year-to-date, respectively; and the FHLB advance prepayment fee of

$136,000.

For the quarter ended December 31, 2016, operating expenses, excluding merger related expenses,

increased $2.1 million, as compared to the prior linked quarter. The increase was primarily related to the

additional expense from the operations of Ocean Shore of $1.3 million, as well as $363,000 in costs

associated with the Bank's rebranding effort.

The provision for income taxes was $3.0 million and $12.2 million, respectively, for the quarter

and year ended ended December 31, 2016, as compared to $2.8 million and $10.9 million, respectively,

for the same prior year periods. The effective tax rate was 33.0% and 34.5%, respectively, for the quarter

and year ended December 31, 2016, as compared to 34.7% and 34.9%, respectively, for the same prior

year periods and 34.4% in the prior linked quarter. The variances in the effective tax rate were primarily

due to the timing of non-deductible merger related expenses.

Financial Condition

Total assets increased by $2.574 billion to $5.167 billion at December 31, 2016, from $2.593 billion

at December 31, 2015, primarily as a result of the acquisitions of Cape and Ocean Shore. Cash and due

from banks and interest-bearing deposits increased by $257.4 million, to $301.4 million at December 31,

2016, from $43.9 million at December 31, 2015. The increase was primarily due to cash flows from a

reduction in loans receivable (exclusive of acquired loans), deposit growth not utilized to reduce FHLB

advances (exclusive of acquired deposits), and the issuance of subordinated notes. Loans receivable, net,

increased by $1.833 billion, to $3.803 billion at December 31, 2016, from $1.971 billion at December 31,

2015, due to acquired loans of $1.931 billion. As part of the Acquisition Transactions, and the purchase

of an existing retail branch in the Toms River market in the first quarter of 2016, at December 31, 2016,

the Company had outstanding goodwill of $145.1 million and core deposit intangibles of $10.9 million.

8

Deposits increased by $2.271 billion, to $4.188 billion at December 31, 2016, from $1.917 billion

at December 31, 2015, which include deposits of $2.140 billion acquired from Ocean Shore, Cape, and

the purchase of an existing retail branch located in the Toms River market. Excluding those acquired,

deposits increased $130.7 million, while core deposits (all deposits excluding time deposits) increased

$169.7 million. The loan-to-deposit ratio at December 31, 2016 was 90.8%, as compared to 102.8% at

December 31, 2015. The deposit growth funded a decrease in FHLB advances of $73.9 million to $250.5

million at December 31, 2016 from $324.4 million at December 31, 2015. The increase in other borrowings

relates to the September 2016 issuance of $35.0 million in subordinated notes at an all-in cost of 5.45%

with a stated maturity of September 30, 2026.

Stockholders' equity increased to $572.0 million at December 31, 2016, as compared to $238.4

million at December 31, 2015. The acquisitions of Cape and Ocean Shore added $165.9 million and

$152.3 million, respectively, to stockholders' equity. At December 31, 2016, there were 154,804 shares

available for repurchase under the Company's stock repurchase program adopted in July of 2014. In the

fourth quarter, the Company repurchased 90,000 shares under this plan at an average cost of $20.86 per

share. Tangible stockholders' equity per common share decreased to $12.95 at December 31, 2016, as

compared to $13.67 at December 31, 2015, due to the addition of intangible assets in the Ocean Shore

and Cape acquisitions.

Asset Quality

The Company's non-performing loans decreased to $13.6 million at December 31, 2016, as

compared to $18.3 million at December 31, 2015, partly due to the bulk sale of non-performing and under-

performing loans in the third and fourth quarters. Non-performing loans do not include $7.6 million of

purchased credit-impaired ("PCI") loans acquired in the Acquisition Transactions. The Company's OREO

totaled $9.8 million at December 31, 2016, as compared to $8.8 million at December 31, 2015. The amount

includes $7.0 million relating to the hotel, golf and banquet facility located in New Jersey which the

Company acquired in the fourth quarter of 2015. At December 31, 2016, the Company's allowance for

9

loan losses was 0.40% of total loans, a decrease from 0.84% at December 31, 2015. These ratios exclude

existing fair value credit marks of $26.0 million at December 31, 2016 on the Ocean Shore, Cape and

Colonial American loans and $2.2 million at December 31, 2015 on the Colonial American loans. These

loans were acquired at fair value with no related allowance for loan losses. The allowance for loan losses

as a percent of total non-performing loans was 111.92% at December 31, 2016 as compared to 91.51% at

December 31, 2015.

Explanation of Non-GAAP Financial Measures

Reported amounts are presented in accordance with generally accepted accounting principles in

the United States ("GAAP"). The Company's management believes that the supplemental non-GAAP

information, which consists of reported net income excluding merger related expenses, loss on sale of

investment securities available for sale and FHLB prepayment fee, which can vary from period to period,

provides a better comparison of period to period operating performance. Additionally, the Company

believes this information is utilized by regulators and market analysts to evaluate a company's financial

condition and therefore, such information is useful to investors. These disclosures should not be viewed

as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-

GAAP performance measures which may be presented by other companies. Please refer to Non-GAAP

Reconciliation table at the end of this document for details on the earnings impact of these items.

Annual Meeting

The Company also announced today that its Annual Meeting of Stockholders will be held on Friday,

June 2, 2017 at 10:00 a.m. Eastern time, at Navesink Country Club located at 50 Luffburrow Lane,

Middletown, New Jersey. The record date for stockholders to vote at the Annual Meeting is April 11,

2017.

Conference Call

As previously announced, the Company will host an earnings conference call on Friday, January

27, 2017 at 11 a.m. Eastern time. The direct dial number for the call is (888) 338-7143. For those unable

10

to participate in the conference call, a replay will be available. To access the replay, dial (877) 344-7529,

Replay Conference Number10098553 from one hour after the end of the call until April 27, 2017. The

conference call, as well as the replay, are also available (listen-only) by internet webcast at

www.oceanfirst.com in the Investor Relations section.

* * *

OceanFirst Financial Corp.’s subsidiary, OceanFirst Bank, founded in 1902, is a $5.2 billion

community bank with branches located throughout central and southern New Jersey. OceanFirst Bank

delivers commercial and residential financing solutions, wealth management and deposit services and is

one of the largest and oldest community-based financial institutions headquartered in New Jersey.

OceanFirst Financial Corp.'s press releases are available by visiting us at www.oceanfirst.com.

Forward-Looking Statements

In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company.

These forward-looking statements are generally identified by use of the words "believe," "expect," "intend," "anticipate," "estimate," "project,"

"will," "should," "may," "view," "opportunity," "potential," or similar expressions or expressions of confidence. The Company's ability to

predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on

the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, general economic conditions,

levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases

to flood insurance premiums, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary

and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System,

the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial

services in the Company's market area, accounting principles and guidelines and the Bank's ability to successfully integrate acquired

operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December

31, 2015 and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not

be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of

any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or

to reflect the occurrence of anticipated or unanticipated events.

11

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(dollars in thousands, except per share amounts)

December 31, 2016 September 30, 2016 December 31, 2015

(unaudited) (unaudited)

Assets

Cash and due from banks $ 301,373 $ 311,583 $ 43,946

Securities available-for-sale, at estimated fair value 12,224 2,497 29,902

Securities held-to-maturity, net (estimated fair value of $596,413 at

December 31, 2016, $478,727 at September 30, 2016, and

$397,763 at December 31, 2015) 598,691 470,642 394,813

Federal Home Loan Bank of New York stock, at cost 19,313 18,289 19,978

Loans receivable, net 3,803,443 3,028,696 1,970,703

Loans held-for-sale 1,551 21,679 2,697

Interest and dividends receivable 11,989 9,396 5,860

Other real estate owned 9,803 9,107 8,827

Premises and equipment, net 71,385 51,243 28,419

Servicing asset 228 259 589

Bank Owned Life Insurance 132,172 106,433 57,549

Deferred tax asset 38,787 39,391 16,807

Other assets 10,105 11,543 10,900

Core deposit intangible 10,924 3,722 256

Goodwill 145,064 66,537 1,822

Total assets $ 5,167,052 $ 4,151,017 $ 2,593,068

Liabilities and Stockholders’ Equity

Deposits $ 4,187,750 $ 3,324,681 $ 1,916,678

Securities sold under agreements to repurchase with retail

customers 69,935 69,078 75,872

Federal Home Loan Bank advances 250,498 251,146 324,385

Other borrowings 56,559 56,399 22,500

Advances by borrowers for taxes and insurance 14,030 8,287 7,121

Other liabilities 16,242 24,182 8,066

Total liabilities 4,595,014 3,733,773 2,354,622

Stockholders’ equity:

Preferred stock, $.01 par value, $1,000 liquidation preference,

5,000,000 shares authorized, no shares issued — —

Common stock, $.01 par value, 55,000,000 shares authorized,

33,566,772 shares issued and 32,136,892, 25,850,956, and

17,286,557 shares outstanding at December 31, 2016,

September 30, 2016, and December 31, 2015, respectively 336 336 336

Additional paid-in capital 364,433 308,979 269,757

Retained earnings 238,192 236,472 229,140

Accumulated other comprehensive loss (5,614) (5,611) (6,241)

Less: Unallocated common stock held by Employee Stock

Ownership Plan (2,761) (2,832) (3,045)

Treasury stock, 1,429,880, 7,715,816, and 16,280,215

shares at December 31, 2016, September 30, 2016, and

December 31, 2015, respectively (22,548) (120,100) (251,501)

Common stock acquired by Deferred Compensation Plan (313) (310) (314)

Deferred Compensation Plan Liability 313 310 314

Total stockholders’ equity 572,038 417,244 238,446

Total liabilities and stockholders’ equity $ 5,167,052 $ 4,151,017 $ 2,593,068

12

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

For the Three Months Ended, For the Years Ended

December 31, September 30, December 31, December 31,

2016 2016 2015 2016 2015

|--------------------- (unaudited) ---------------------| (unaudited)

Interest income:

Loans $ 36,799 $ 34,607 $ 21,143 $ 122,962 $ 77,694

Mortgage-backed securities 1,874 1,700 1,449 6,697 6,051

Investment securities and other 1,231 1,000 557 3,766 2,118

Total interest income 39,904 37,307 23,149 133,425 85,863

Interest expense:

Deposits 2,392 2,083 1,217 7,517 4,301

Borrowed funds 1,758 1,289 1,244 5,646 4,733

Total interest expense 4,150 3,372 2,461 13,163 9,034

Net interest income 35,754 33,935 20,688 120,262 76,829

Provision for loan losses 510 888 300 2,623 1,275

Net interest income after provision for loan losses 35,244 33,047 20,388 117,639 75,554

Other income:

Bankcard services revenue 1,424 1,347 926 4,833 3,537

Wealth management revenue 545 608 530 2,324 2,187

Fees and services charges 3,273 2,916 2,082 10,508 8,124

Loan servicing income 73 26 82 250 268

Net gain on sale of loan servicing — — — — 111

Net gain on sales of loans available-for-sale 290 347 185 986 822

Net loss on sales of investment securities available-for-sale — — — (12) —

Net loss from other real estate operations (74) (63) (38) (856) (149)

Income from Bank Owned Life Insurance 710 659 343 2,230 1,501

Other 16 56 8 149 25

Total other income 6,257 5,896 4,118 20,412 16,426

Operating expenses:

Compensation and employee benefits 13,649 13,558 8,438 47,105 31,946

Occupancy 2,380 2,315 1,518 8,332 5,722

Equipment 1,499 1,452 1,162 5,104 3,725

Marketing 609 479 428 1,882 1,516

Federal deposit insurance 830 743 528 2,825 2,072

Data processing 2,291 2,140 1,349 7,577 4,731

Check card processing 662 623 427 2,210 1,815

Professional fees 969 681 541 2,848 1,865

Other operating expense 2,640 1,543 1,481 7,676 5,484

Amortization of core deposit intangible 304 181 13 623 21

Federal Home Loan Bank advance prepayment fee — — — 136 —

Merger related expenses 6,632 1,311 614 16,534 1,878

Total operating expenses 32,465 25,026 16,499 102,852 60,775

Income before provision for income taxes 9,036 13,917 8,007 35,199 31,205

Provision for income taxes 2,984 4,789 2,777 12,153 10,883

Net income $ 6,052 $ 9,128 $ 5,230 $ 23,046 $ 20,322

Basic earnings per share $ 0.22 $ 0.36 $ 0.31 $ 1.00 $ 1.22

Diluted earnings per share $ 0.22 $ 0.35 $ 0.31 $ 0.98 $ 1.21

Average basic shares outstanding 27,461 25,435 16,867 23,093 16,600

Average diluted shares outstanding 28,128 25,889 17,126 23,526 16,811

13

OceanFirst Financial Corp.

SELECTED LOAN AND DEPOSIT DATA

(dollars in thousands)

LOANS RECEIVABLE At

December 31,

2016

September 30,

2016

June 30,

2016

March 31,

2016

December 31,

2015

Commercial:

Commercial and industrial $ 152,810 $ 185,633 $ 222,355 $ 141,364 $ 144,788

Commercial real estate - owner-

occupied 534,365 493,157 523,662 308,666 307,509

Commercial real estate - investor 1,134,507 1,014,699 1,011,354 536,754 510,936

Total commercial 1,821,682 1,693,489 1,757,371 986,784 963,233

Consumer:

Residential mortgage 1,651,695 1,061,752 1,090,781 792,753 791,249

Residential construction 65,408 46,813 48,266 54,259 50,757

Home equity loans and lines 289,110 251,421 258,398 190,621 192,368

Other consumer 1,566 1,273 1,586 570 792

Total consumer 2,007,779 1,361,259 1,399,031 1,038,203 1,035,166

Total loans 3,829,461 3,054,748 3,156,402 2,024,987 1,998,399

Loans in process (14,249) (13,842) (13,119) (15,033) (14,206)

Deferred origination costs, net 3,414 3,407 3,441 3,253 3,232

Allowance for loan losses (15,183) (15,617) (16,678) (16,214) (16,722)

Loans receivable, net $ 3,803,443 $ 3,028,696 $ 3,130,046 $ 1,996,993 $ 1,970,703

Mortgage loans serviced for others $ 137,881 $ 143,657 $ 145,903 $ 152,653 $ 158,244

At December 31, 2016

Average Yield

Loan pipeline (1):

Commercial 4.82% $ 99,060 $ 64,976 $ 48,897 $ 57,571 $ 53,785

Residential mortgage and construction 3.91 38,486 39,252 30,520 28,528 31,860

Home equity loans and lines 4.51 6,522 5,099 5,594 8,082 5,481

Total 4.56 $ 144,068 $ 109,327 $ 85,011 $ 94,181 $ 91,126

For the Three Months Ended,

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Average Yield

Loan originations:

Commercial 4.14% $ 105,062 (4) $ 63,310 $ 59,543 $ 58,005 $ 72,534

Residential mortgage and construction 3.69 62,087 41,170 40,295 34,361 43,616

Home equity loans and lines 4.49 11,790 11,007 10,067 10,915 10,431

Total 4.00 $ 178,939 $ 115,487 $ 109,905 $ 103,281 $ 126,581

Loans sold $ 12,098 (3) $ 17,787 (2) $ 10,303 $ 8,901 $ 9,784

(1) Loan pipeline includes pending loan applications and loans approved but not funded

(2) Excludes the sale of under-performing loans of $12.8 million

(3) Excludes the sale of under-performing loans of $21.0 million

(4) Includes purchased loans totaling $24.6 million

DEPOSITS At

December 31,

2016

September 30,

2016

June 30,

2016

March 31,

2016

December 31,

2015

Type of Account

Non-interest-bearing $ 782,504 $ 512,957 $ 554,709 $ 351,743 $ 337,143

Interest-bearing checking 1,626,713 1,451,083 1,310,290 860,468 859,927

Money market deposit 458,911 400,054 366,942 163,885 153,196

Savings 672,519 489,173 489,132 327,845 310,989

Time deposits 647,103 471,414 485,189 267,420 255,423

$ 4,187,750 $ 3,324,681 $ 3,206,262 $ 1,971,361 $ 1,916,678

14

OceanFirst Financial Corp.

ASSET QUALITY

(dollars in thousands)

December 31,

2016

September 30,

2016

June 30,

2016

March 31,

2016

December 31,

2015

ASSET QUALITY

Non-performing loans:

Commercial and industrial $ 441 $ 1,152 $ 964 $ 909 $ 123

Commercial real estate - owner-occupied 2,414 5,213 4,363 4,354 7,684

Commercial real estate - investor 521 1,675 1,675 940 3,112

Residential mortgage 8,126 7,017 7,102 8,788 5,779

Home equity loans and lines 2,064 1,450 1,226 1,202 1,574

Other consumer — — — — 2

Total non-performing loans 13,566 16,507 15,330 16,193 18,274

Other real estate owned 9,803 9,107 9,791 9,029 8,827

Total non-performing assets $ 23,369 $ 25,614 $ 25,121 $ 25,222 $ 27,101

Purchased credit-impaired ("PCI") loans $ 7,575 $ 5,836 $ 9,673 $ 376 $ 461

Delinquent loans 30 to 89 days $ 22,598 $ 8,553 $ 15,643 $ 6,996 $ 9,087

Troubled debt restructurings:

Non-performing (included in total non-performing loans

above) $ 3,471 $ 3,520 $ 2,990 $ 4,775 $ 4,918

Performing 27,042 26,396 28,173 26,689 26,344

Total troubled debt restructurings $ 30,513 $ 29,916 $ 31,163 $ 31,464 $ 31,262

Allowance for loan losses $ 15,183 $ 15,617 $ 16,678 $ 16,214 $ 16,722

Allowance for loan losses as a percent of total loans receivable (1) 0.40% 0.51% 0.53% 0.80% 0.84%

Allowance for loan losses as a percent of total non-performing

loans 111.92 94.61 108.79 100.13 91.51

Non-performing loans as a percent of total loans receivable 0.35 0.54 0.48 0.80 0.91

Non-performing assets as a percent of total assets 0.45 0.62 0.62 0.97 1.05

(1) The loans acquired from Ocean Shore, Cape, and Colonial American were recorded at fair value. The net credit mark on these

loans, not reflected in the allowance for loan losses, was $25,973, $17,051, $27,281, $2,013, and $2,202 at December 31, 2016,

September 30, 2016, June 30, 2016, March 31, 2016, and December 31, 2015, respectively.

NET CHARGE-OFFS

For the three months ended

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Net Charge-offs:

Loan charge-offs $ (979) $ (2,116) $ (223) $ (1,172) $ (236)

Recoveries on loans 35 167 25 101 19

Net loan charge-offs $ (944) $ (1,949) $ (198) $ (1,071) $ (217)

Net loan charge-offs to average total loans

(annualized) 0.11% 0.25% 0.03% 0.21% 0.04%

Net charge-off detail - (loss) recovery:

Commercial $ (510) $ (1,707) $ (84) $ (1,073) $ 12

Residential mortgage and construction (233) (161) (69) (24) (117)

Home equity loans and lines (194) (83) (45) 28 (109)

Other consumer (7) 2 — (2) (3)

Net loans charged-off $ (944) $ (1,949) $ (198) $ (1,071) $ (217)

Note: Included in net loan charge-offs for the three months ended December 31, 2016 and September 30, 2016 are $535 and $1,627 relating

to under-performing loans sold or held-for-sale, respectively.

15

OceanFirst Financial Corp.

ANALYSIS OF NET INTEREST INCOME

For the Three Months Ended

December 31, 2016 September 30, 2016 December 31, 2015

(dollars in thousands)

Average

Balance Interest

Average

Yield/

Cost

Average

Balance Interest

Average

Yield/

Cost

Average

Balance Interest

Average

Yield/

Cost

Assets:

Interest-earning assets:

Interest-earning deposits and short-

term investments $ 359,804 $ 484 0.54% $ 168,045 $ 139 0.33% $ 41,227 $ 16 0.15%

Securities (1) and FHLB stock 545,302 2,621 1.91 533,809 2,561 1.91 456,486 1,990 1.73

Loans receivable, net (2)

Commercial

1,717,502 21,016 4.87 1,723,520 20,970 4.84 943,116 11,154 4.69

Residential

1,314,667 12,857 3.89 1,118,435 10,874 3.87 836,722 7,953 3.77

Home Equity 262,372 2,907 4.41 255,919 2,745 4.27 193,314 2,028 4.16

Other 1,149 19 6.58 1,163 18 6.16 544 8 5.83

Allowance for loan loss net of

deferred loan fees (12,987) — — (13,346) — — (13,597) — —

Loans Receivable, net

3,282,703 36,799 4.46 3,085,691 34,607 4.46 1,960,099 21,143 4.28

Total interest-earning assets

4,187,809 39,904 3.79 3,787,545 37,307 3.92 2,457,812 23,149 3.74

Non-interest-earning assets 368,965 316,290 129,297

Total assets $ 4,556,774 $ 4,103,835 $ 2,587,109

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest-bearing checking $ 1,538,706 723 0.19% $ 1,425,350 583 0.16% $ 909,962 278 0.12%

Money market 424,613 312 0.29 386,490 295 0.30 152,416 76 0.20

Savings 549,032 74 0.05 488,749 49 0.04 309,037 27 0.03

Time deposits 527,817 1,283 0.97 477,496 1,156 0.96 256,378 836 1.29

Total 3,040,168 2,392 0.31 2,778,085 2,083 0.30 1,627,793 1,217 0.30

Securities sold under agreements

to repurchase 72,063 24 0.13 68,540 24 0.14 78,892 29 0.15

FHLB Advances 250,829 1,120 1.78 264,213 1,067 1.61 252,812 1,041 1.63

Other borrowings 56,397 614 4.33 26,207 198 3.01 25,467 174 2.71

Total interest-bearing

liabilities 3,419,457 4,150 0.48 3,137,045 3,372 0.43 1,984,964 2,461 0.49

Non-interest-bearing deposits 622,882 521,088 349,473

Non-interest-bearing Liabilities 42,773 31,536 16,174

Total liabilities

4,085,112 3,689,669 2,350,611

Stockholders’ equity 471,662 414,166 236,498

Total liabilities and equity

$ 4,556,774 $ 4,103,835 $ 2,587,109

Net interest income $ 35,754 $ 33,935 $ 20,688

Net interest rate spread (3) 3.31% 3.49% 3.25%

Net interest margin (4) 3.40% 3.56% 3.34%

Total cost of deposits (including non-

interest-bearing deposits) 0.26% 0.25% 0.24%

(1) Amounts are recorded at average amortized cost.

(2) Amount is net of deferred loan fees, undisbursed loan funds, discounts and premiums and estimated loss allowances and includes loans held for sale

and non-performing loans.

(3) Net interest rate spread represents the difference between the yield on interest-earning assets and the cost of interest-bearing liabilities.

(4) Net interest margin represents net interest income divided by average interest-earning assets.

16

(continued)

For the Years Ended

December 31, 2016 December 31, 2015

(dollars in thousands)

Average

Balance Interest

Average

Yield/

Cost

Average

Balance Interest

Average

Yield/

Cost

Assets:

Interest-earning assets:

Interest-earning deposits and short-term investments $ 154,830 $ 693 0.45% $ 38,371 $ 44 0.11%

Securities (1) and FHLB stock 524,152 9,770 1.86 481,306 8,125 1.69

Loans receivable, net (2)

Commercial 1,472,421 70,768 4.81 840,531 38,186 4.54

Residential 1,085,991 41,996 3.87 804,404 31,423 3.91

Home Equity 236,769 10,139 4.28 194,383 8,054 4.14

Other 957 59 6.17 482 31 6.43

Allowance for loan loss net of deferred loan fees (13,280) — — (13,639) — —

Loans Receivable, net 2,782,858 122,962 4.42 1,826,161 77,694 4.25

Total interest-earning assets 3,461,840 133,425 3.85 2,345,838 85,863 3.66

Non-interest-earning assets 269,622 119,035

Total assets $ 3,731,462 $ 2,464,873

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest-bearing checking $ 1,266,135 2,114 0.17% $ 875,325 952 0.11%

Money market 316,977 858 0.27 129,775 187 0.14

Savings 447,484 191 0.04 306,151 102 0.03

Time deposits 422,026 4,354 1.03 229,786 3,060 1.33

Total 2,452,622 7,517 0.31 1,541,037 4,301 0.28

Securities sold under agreements to repurchase 75,227 102 0.14 73,029 103 0.14

FHLB Advances 266,981 4,471 1.67 253,864 3,849 1.52

Other borrowings 32,029 1,073 3.35 26,967 781 2.90

Total interest-bearing liabilities 2,826,859 13,163 0.47 1,894,897 9,034 0.48

Non-interest-bearing deposits 497,166 327,216

Non-interest-bearing Liabilities 28,454 14,851

Total liabilities 3,352,479 2,236,964

Stockholders’ equity 378,983 227,909

Total liabilities and equity $ 3,731,462 $ 2,464,873

Net interest income $ 120,262 $ 76,829

Net interest rate spread (3) 3.38% 3.18%

Net interest margin (4) 3.47% 3.28%

Total cost of deposits (including non-interest-bearing deposits) 0.25% 0.23%

(1) Amounts are recorded at average amortized cost.

(2) Amount is net of deferred loan fees, undisbursed loan funds, discounts and premiums and estimated loss allowances and includes loans held for sale

and non-performing loans.

(3) Net interest rate spread represents the difference between the yield on interest-earning assets and the cost of interest-bearing liabilities.

(4) Net interest margin represents net interest income divided by average interest-earning assets.

17

OceanFirst Financial Corp.

SELECTED QUARTERLY FINANCIAL DATA

(in thousands, except per share amounts)

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Selected Financial Condition Data:

Total assets $ 5,167,052 $ 4,151,017 $ 4,047,493 $ 2,588,447 $ 2,593,068

Securities available-for-sale, at estimated fair value 12,224 2,497 12,509 30,085 29,902

Securities held-to-maturity, net 598,691 470,642 513,721 375,616 394,813

Federal Home Loan Bank of New York stock 19,313 18,289 21,128 16,645 19,978

Loans receivable, net 3,803,443 3,028,696 3,130,046 1,996,993 1,970,703

Loans held-for-sale 1,551 21,679 5,310 3,386 2,697

Deposits 4,187,750 3,324,681 3,206,262 1,971,360 1,916,678

Federal Home Loan Bank advances 250,498 251,146 312,603 251,917 324,385

Securities sold under agreements to repurchase and other

borrowings 126,494 125,477 90,173 106,413 98,372

Stockholders' equity 572,038 417,244 409,258 241,076 238,446

For the Three Months Ended

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Selected Operating Data:

Interest income $ 39,904 $ 37,307 $ 33,141 $ 23,073 $ 23,149

Interest expense 4,150 3,372 3,127 2,514 2,461

Net interest income 35,754 33,935 30,014 20,559 20,688

Provision for loan losses 510 888 662 563 300

Net interest income after provision for loan

losses 35,244 33,047 29,352 19,996 20,388

Other income 6,257 5,896 4,883 3,376 4,118

Operating expenses 25,833 23,715 21,457 15,314 15,885

Merger related expenses 6,632 1,311 7,189 1,402 614

Income before provision for income taxes 9,036 13,917 5,589 6,656 8,007

Provision for income taxes 2,984 4,789 1,928 2,451 2,777

Net income $ 6,052 $ 9,128 $ 3,661 $ 4,205 $ 5,230

Diluted earnings per share $ 0.22 $ 0.35 $ 0.16 $ 0.25 $ 0.31

Net accretion/amortization of purchase

accounting adjustments included in net

interest income $ 1,385 $ 1,637 $ 1,267 $ 164 $ 177

18

(continued)

At or For the Three Months Ended

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Selected Financial Ratios and Other Data(1):

Performance Ratios (Annualized):

Return on average assets (2) 0.53% 0.88% 0.40% 0.65% 0.80%

Return on average stockholders' equity (2) 5.10 8.77 3.79 7.05 8.77

Return on average tangible stockholders' equity (2) (3) 6.48 10.58 4.32 7.59 8.86

Stockholders' equity to total assets 11.07 10.05 10.11 9.31 9.19

Tangible stockholders' equity to tangible assets (3) 8.30 8.50 8.51 9.23 9.12

Net interest rate spread 3.31 3.49 3.47 3.25 3.25

Net interest margin 3.40 3.56 3.57 3.34 3.35

Operating expenses to average assets (2) 2.83 2.43 3.16 2.58 2.53

Efficiency ratio (2) (4) 77.28 62.83 82.09 69.84 66.51

At or For the Years Ended December 31,

2016 2015

Performance Ratios:

Return on average assets (2) 0.62% 0.82%

Return on average stockholders' equity (2) 6.08 8.92

Return on average tangible stockholders' equity (2) (3) 7.13 8.96

Net interest rate spread 3.38 3.18

Net interest margin 3.47 3.28

Operating expenses to average assets (2) 2.76 2.47

Efficiency ratio (2) (4) 73.11 65.17

19

(continued)

At or For the Three Months Ended

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Wealth Management:

Assets under administration $ 218,336 $ 221,612 $ 221,277 $ 203,723 $ 229,039

Per Share Data:

Cash dividends per common share $ 0.15 $ 0.13 $ 0.13 $ 0.13 $ 0.13

Stockholders' equity per common share at end of period 17.80 16.14 15.89 13.89 13.79

Tangible stockholders' equity per common share at end of period (3) 12.95 13.42 13.14 13.75 13.67

Number of full-service customer facilities: 61 50 50 28 27

Quarterly Average Balances

Total securities $ 545,302 $ 533,809 $ 571,463 $ 445,696 $ 456,486

Loans, receivable, net 3,282,703 3,085,691 2,772,518 1,981,101 1,960,099

Total interest-earning assets 4,187,809 3,787,545 3,384,548 2,475,298 2,457,812

Total assets 4,556,774 4,103,835 3,647,102 2,605,017 2,587,109

Interest-bearing transaction deposits 2,512,351 2,300,589 1,899,266 1,372,357 1,371,415

Time deposits 527,817 477,496 417,301 263,722 256,378

Total borrowed funds 379,289 358,960 386,578 372,240 357,171

Total interest-bearing liabilities 3,419,457 3,137,045 2,703,145 2,008,319 1,984,964

Non-interest bearing deposits 622,882 521,088 529,230 343,371 349,473

Stockholder’s equity 471,662 414,166 388,694 239,999 236,498

Total deposits 3,663,050 3,299,173 2,845,797 1,979,450 1,977,266

Quarterly Yields

Total securities 1.91% 1.91% 1.82% 1.81% 1.73%

Loans, receivable, net 4.46 4.46 4.43 4.27 4.28

Total interest-earning assets 3.79 3.92 3.94 3.75 3.74

Interest-bearing transaction deposits 0.18 0.16 0.15 0.12 0.11

Time deposits 0.97 0.96 1.01 1.33 1.29

Borrowed funds 1.84 1.43 1.41 1.34 1.38

Total interest-bearing liabilities 0.48 0.43 0.47 0.50 0.49

Net interest spread 3.31 3.49 3.47 3.25 3.25

Net interest margin 3.40 3.56 3.57 3.34 3.34

Total deposits 0.26 0.25 0.25 0.26 0.24

(1) With the exception of end of quarter ratios, all ratios are based on average daily balances.

(2) Performance ratios for each period include merger related expenses. Refer to Other Items - Non-GAAP Reconciliation for impact

of merger related expenses.

(3) Tangible stockholders' equity and tangible assets exclude intangible assets relating to goodwill and core deposit intangible.

(4) Efficiency ratio represents the ratio of operating expenses to the aggregate of other income and net interest income.

20

OceanFirst Financial Corp.

OTHER ITEMS

(dollars in thousands, except per share amounts)

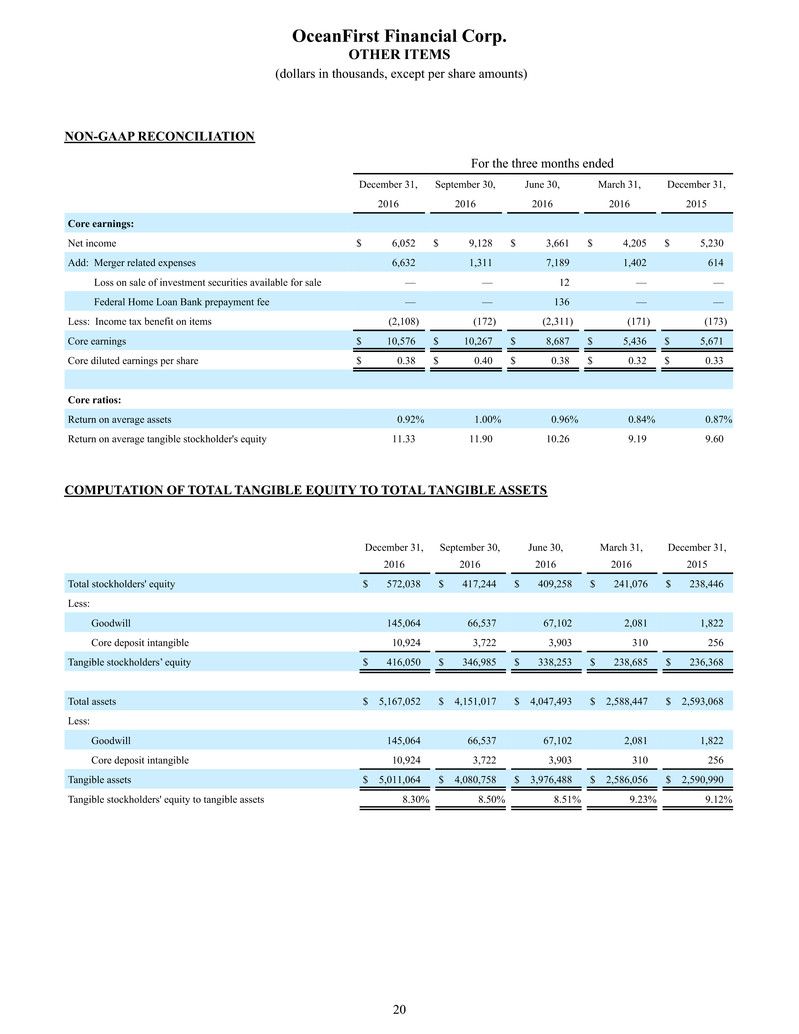

NON-GAAP RECONCILIATION

For the three months ended

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Core earnings:

Net income $ 6,052 $ 9,128 $ 3,661 $ 4,205 $ 5,230

Add: Merger related expenses 6,632 1,311 7,189 1,402 614

Loss on sale of investment securities available for sale — — 12 — —

Federal Home Loan Bank prepayment fee — — 136 — —

Less: Income tax benefit on items (2,108) (172) (2,311) (171) (173)

Core earnings $ 10,576 $ 10,267 $ 8,687 $ 5,436 $ 5,671

Core diluted earnings per share $ 0.38 $ 0.40 $ 0.38 $ 0.32 $ 0.33

Core ratios:

Return on average assets 0.92% 1.00% 0.96% 0.84% 0.87%

Return on average tangible stockholder's equity 11.33 11.90 10.26 9.19 9.60

COMPUTATION OF TOTAL TANGIBLE EQUITY TO TOTAL TANGIBLE ASSETS

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Total stockholders' equity $ 572,038 $ 417,244 $ 409,258 $ 241,076 $ 238,446

Less:

Goodwill 145,064 66,537 67,102 2,081 1,822

Core deposit intangible 10,924 3,722 3,903 310 256

Tangible stockholders’ equity $ 416,050 $ 346,985 $ 338,253 $ 238,685 $ 236,368

Total assets $ 5,167,052 $ 4,151,017 $ 4,047,493 $ 2,588,447 $ 2,593,068

Less:

Goodwill 145,064 66,537 67,102 2,081 1,822

Core deposit intangible 10,924 3,722 3,903 310 256

Tangible assets $ 5,011,064 $ 4,080,758 $ 3,976,488 $ 2,586,056 $ 2,590,990

Tangible stockholders' equity to tangible assets 8.30% 8.50% 8.51% 9.23% 9.12%

21

ACQUISITION DATE - FAIR VALUE BALANCE SHEET

The following table summarizes the estimated fair values of the assets acquired and the liabilities assumed at the date of the

acquisition for Cape, net of the total consideration paid (in thousands):

At May 2, 2016

(in thousands)

Cape

Book Value

Purchase

Accounting

Adjustments

Estimated

Fair Value

Total Purchase Price: $ 196,403

Assets acquired:

Cash and cash equivalents $ 30,025 $ — $ 30,025

Securities and Federal Home Loan Bank Stock 218,577 361 218,938

Loans: 1,169,568 1,156,807

Specific credit fair value on credit impaired loans — (5,859) —

General credit fair value — (20,545) —

Interest rate fair value — 1,888 —

Reverse allowance for loan losses — 9,931 —

Reverse net deferred fees, premiums and discounts — 1,824 —

Premises and equipment 27,972 (1,973) 25,999

Other real estate owned 2,343 (408) 1,935

Deferred tax asset 9,407 10,993 20,400

Other assets 61,793 — 61,793

Core deposit intangible 831 2,887 3,718

Total assets acquired 1,520,516 (901) 1,519,615

Liabilities assumed:

Deposits (1,247,688) (679) (1,248,367)

Borrowings (123,587) (879) (124,466)

Other liabilities (7,611) (5,398) (13,009)

Total liabilities assumed (1,378,886) (6,956) (1,385,842)

Net assets acquired $ 141,630 $ (7,857) 133,773

Goodwill recorded in the merger $ 62,630

The calculation of goodwill is subject to change for up to one year after the date of acquisition as additional information relative

to the closing date estimates and uncertainties become available. As the Company finalizes its review of the acquired assets and

liabilities, certain adjustments to the recorded carrying values may be required.

22

ACQUISITION DATE - FAIR VALUE BALANCE SHEET

The following table summarizes the estimated fair values of the assets acquired and the liabilities assumed at the date of the

acquisition for Ocean Shore, net of the total consideration paid (in thousands):

At November 30, 2016

(in thousands)

Ocean Shore

Book Value

Purchase

Accounting

Adjustments

Estimated

Fair Value

Total Purchase Price: $ 180,732

Assets acquired:

Cash and cash equivalents $ 60,871 $ — $ 60,871

Securities and Federal Home Loan Bank Stock 94,109 24 94,133

Loans: 790,396 774,046

Specific credit fair value on credit impaired loans — (2,062) —

General credit fair value — (8,127) —

Interest rate fair value — (5,779) —

Reverse allowance for loan losses — 3,265 —

Reverse net deferred fees, premiums and discounts — (3,647) —

Premises and equipment 11,696 3,372 15,068

Other real estate owned 1,090 — 1,090

Deferred tax asset 5,587 2,210 7,797

Other assets 35,369 — 35,369

Core deposit intangible 348 7,158 7,506

Total assets acquired 999,466 (3,586) 995,880

Liabilities assumed:

Deposits (874,301) (772) (875,073)

Borrowings (3,694) — (3,694)

Other liabilities (17,629) 891 (16,738)

Total liabilities assumed (895,624) 119 (895,505)

Net assets acquired $ 103,842 $ (3,467) 100,375

Goodwill recorded in the merger $ 80,357

The calculation of goodwill is subject to change for up to one year after the date of acquisition as additional information relative

to the closing date estimates and uncertainties become available. As the Company finalizes its review of the acquired assets and

liabilities, certain adjustments to the recorded carrying values may be required.