Attached files

| file | filename |

|---|---|

| 8-K - KIMBALL ELECTRONICS, INC. FORM 8-K - Kimball Electronics, Inc. | keform8-kearningsrelease12.htm |

| EX-99.1 - KIMBALL ELECTRONICS, INC. EXHIBIT 99.1 - Kimball Electronics, Inc. | a8kexhibit99112312016q210q.htm |

Lasting relationships. Global success.Lasting relationships. Global success.

Financial Results

Second Quarter Fiscal Year 2017

Quarter Ended December 31, 2016

Supplementary Information to February 2,

2017 Earnings Conference Call

Exhibit 99.2

Lasting relationships. Global success.Lasting relationships. Global success.

Safe Harbor Statement

Certain statements contained within this supplementary information and any statements made during our earnings

conference call today may be considered forward-looking under the Private Securities Litigation Reform Act of 1995

and are subject to risks and uncertainties including, but not limited to, successful integration of acquisitions and new

operations, the global economic conditions, significant volume reductions from key contract customers, loss of key

customers or suppliers, financial stability of key customers and suppliers, availability or cost of raw materials, and

increased competitive pricing pressures reflecting excess industry capacities. Additional cautionary statements

regarding other risk factors that could have an effect on the future performance of Kimball Electronics, Inc. (the

“Company”) are contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2016, our

earnings release, and other filings with the Securities and Exchange Commission (the “SEC”).

This supplementary information contains non-GAAP financial measures. A non-GAAP financial measure is a numerical

measure of a company’s financial performance that excludes or includes amounts so as to be different than the most

directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles

(GAAP) in the United States in the statement of income, statement of comprehensive income, balance sheet, statement

of cash flows, or statement of equity of the company. The non-GAAP financial measures contained herein include

Selling & Administrative Expense (%), Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, and Return

on Invested Capital (ROIC), which have been adjusted for spin-off expenses, proceeds from a lawsuit settlement, and a

bargain purchase gain. Management believes it is useful for investors to understand how its core operations performed

without the effects of incremental costs related to the spin-off, the lawsuit proceeds, and the bargain purchase gain.

Excluding these amounts allows investors to meaningfully trend, analyze, and benchmark the performance of the

Company’s core operations. Many of the Company’s internal performance measures that management uses to make

certain operating decisions use these and other non-GAAP measures to enable meaningful trending of core operating

metrics.

2

Lasting relationships. Global success.Lasting relationships. Global success.

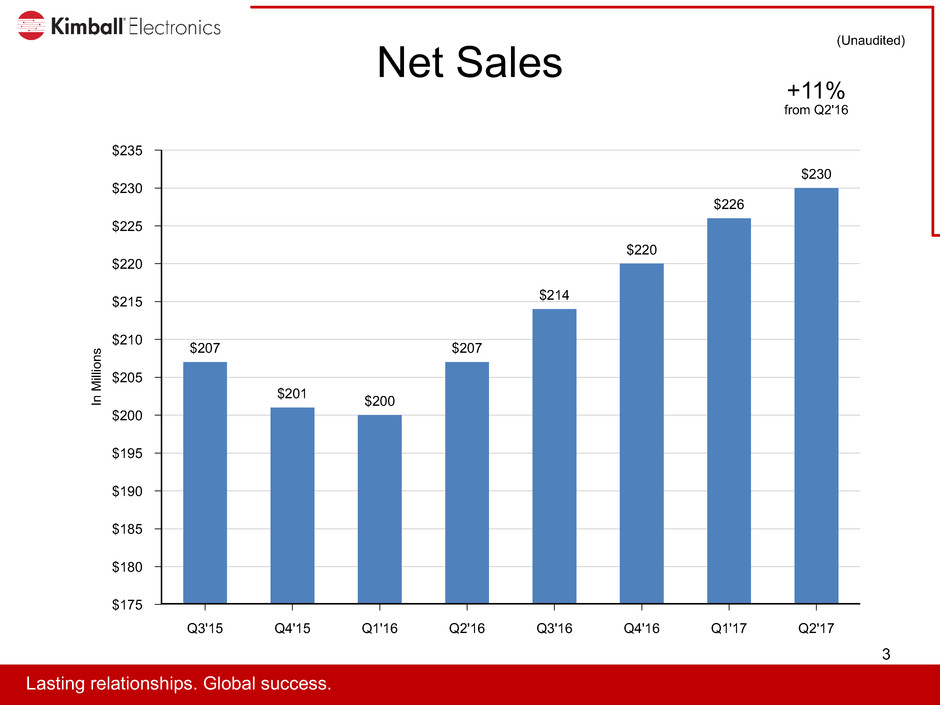

Net Sales

(Unaudited)

$235

$230

$225

$220

$215

$210

$205

$200

$195

$190

$185

$180

$175

In

M

illi

on

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

$207

$201 $200

$207

$214

$220

$226

$230

+11%

from Q2'16

3

Lasting relationships. Global success.Lasting relationships. Global success.

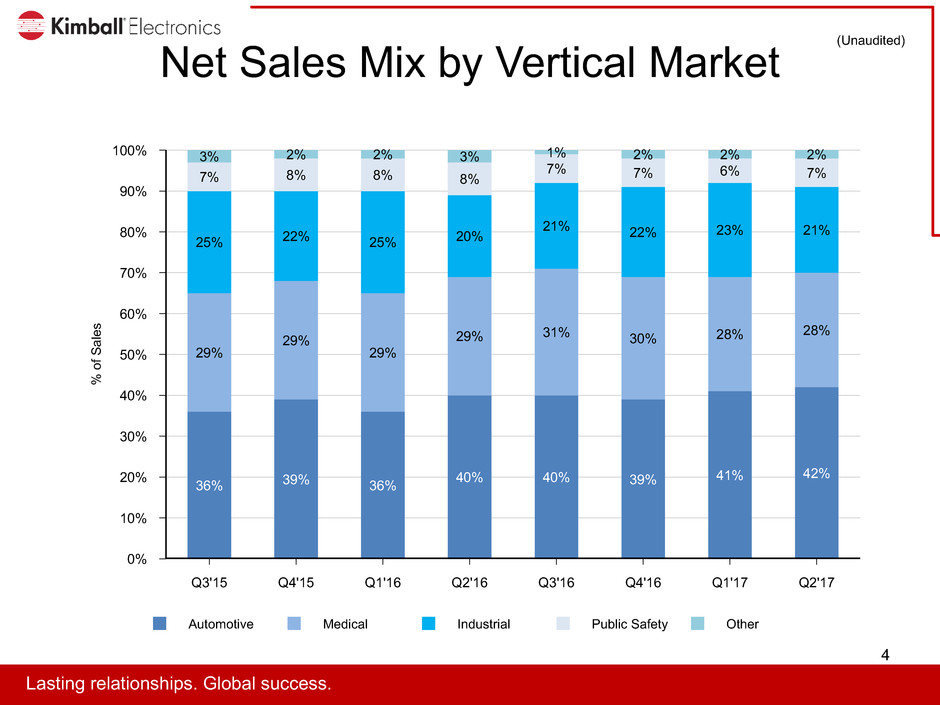

Net Sales Mix by Vertical Market

(Unaudited)

Automotive Medical Industrial Public Safety Other

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

%

of

Sa

le

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

36% 39% 36% 40% 40% 39%

41% 42%

29%

29%

29%

29% 31% 30% 28% 28%

25% 22% 25% 20%

21% 22% 23% 21%

7% 8% 8% 8%

7% 7% 6% 7%

3% 2% 2% 3% 1% 2% 2% 2%

4

Lasting relationships. Global success.Lasting relationships. Global success.

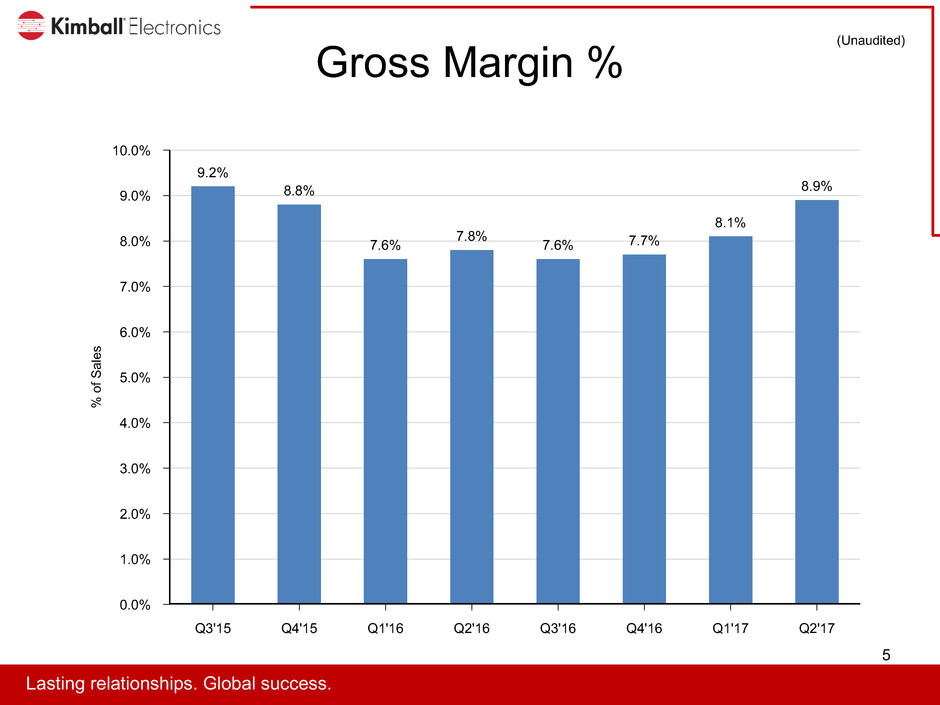

Gross Margin %

(Unaudited)

10.0%

9.0%

8.0%

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

%

of

Sa

le

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

9.2%

8.8%

7.6% 7.8% 7.6% 7.7%

8.1%

8.9%

5

Lasting relationships. Global success.Lasting relationships. Global success.

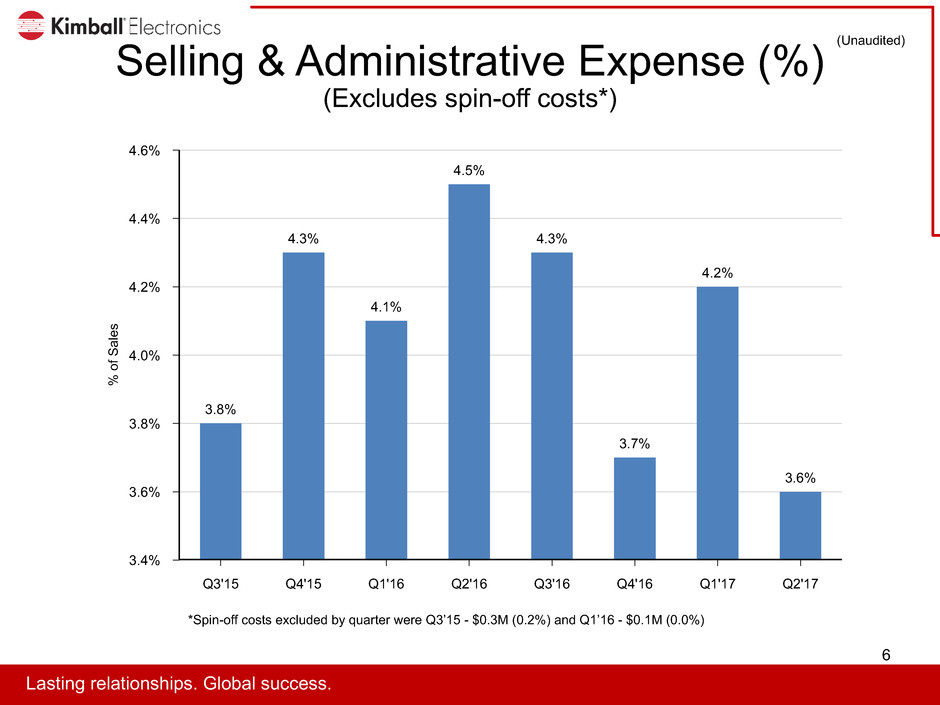

Selling & Administrative Expense (%)

(Excludes spin-off costs*)

(Unaudited)

4.6%

4.4%

4.2%

4.0%

3.8%

3.6%

3.4%

%

of

Sa

le

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

3.8%

4.3%

4.1%

4.5%

4.3%

3.7%

4.2%

3.6%

*Spin-off costs excluded by quarter were Q3’15 - $0.3M (0.2%) and Q1’16 - $0.1M (0.0%)

6

Lasting relationships. Global success.Lasting relationships. Global success.

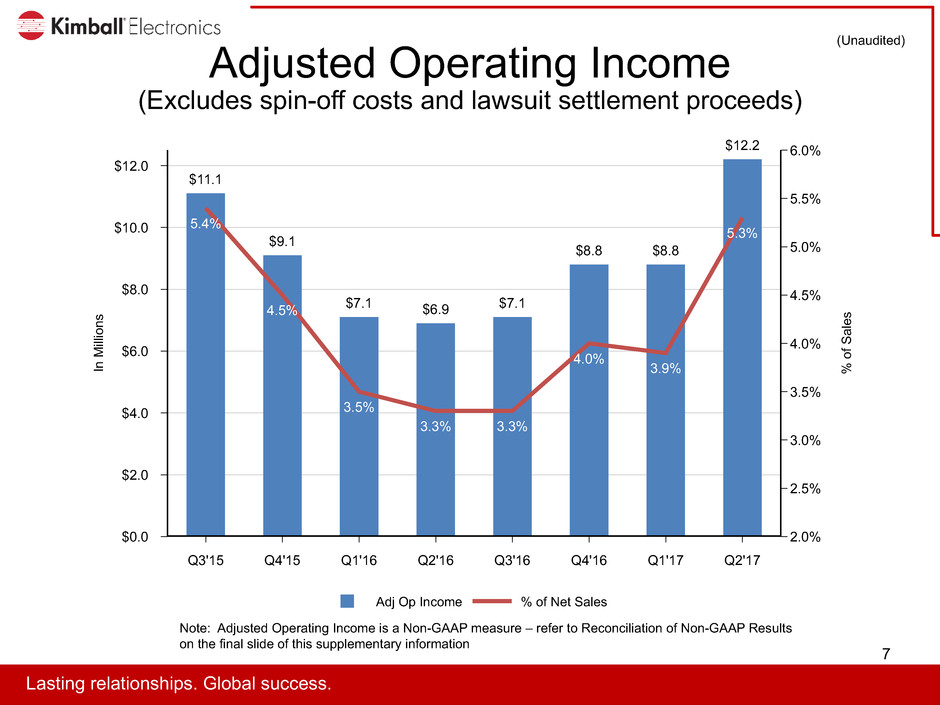

Adjusted Operating Income

(Excludes spin-off costs and lawsuit settlement proceeds)

(Unaudited)

Adj Op Income % of Net Sales

$12.0

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

In

M

illi

on

s

6.0%

5.5%

5.0%

4.5%

4.0%

3.5%

3.0%

2.5%

2.0%

%

of

Sa

le

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

$11.1

$9.1

$7.1 $6.9 $7.1

$8.8 $8.8

$12.2

5.4%

4.5%

3.5%

3.3% 3.3%

4.0% 3.9%

5.3%

Note: Adjusted Operating Income is a Non-GAAP measure – refer to Reconciliation of Non-GAAP Results

on the final slide of this supplementary information 7

Lasting relationships. Global success.Lasting relationships. Global success.

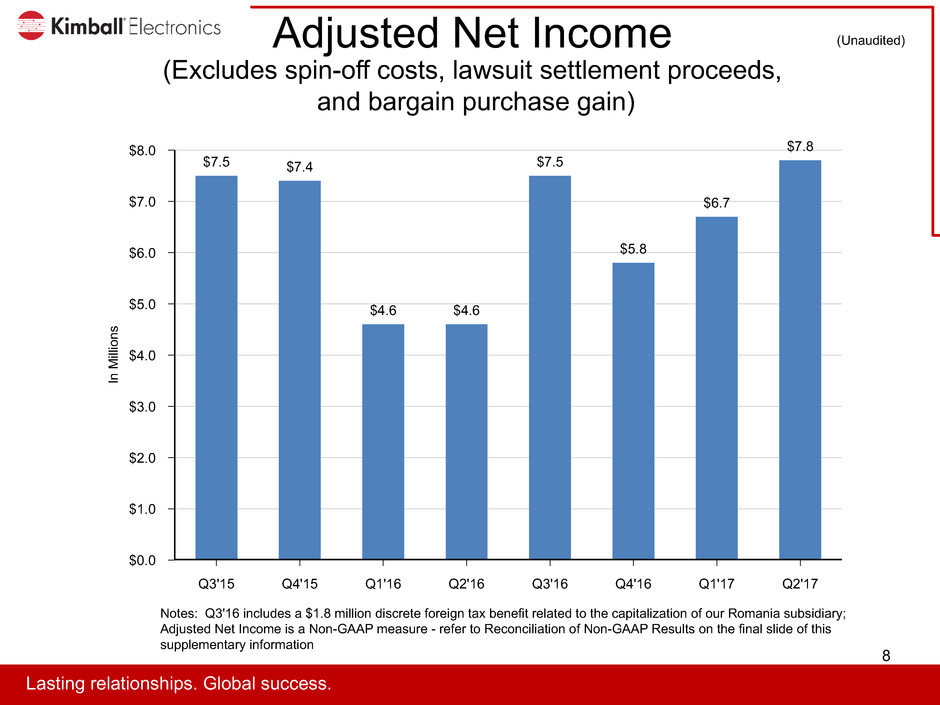

Adjusted Net Income

(Excludes spin-off costs, lawsuit settlement proceeds,

and bargain purchase gain)

(Unaudited)

$8.0

$7.0

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

$0.0

In

M

illi

on

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

$7.5 $7.4

$4.6 $4.6

$7.5

$5.8

$6.7

$7.8

Notes: Q3'16 includes a $1.8 million discrete foreign tax benefit related to the capitalization of our Romania subsidiary;

Adjusted Net Income is a Non-GAAP measure - refer to Reconciliation of Non-GAAP Results on the final slide of this

supplementary information

8

Lasting relationships. Global success.Lasting relationships. Global success.

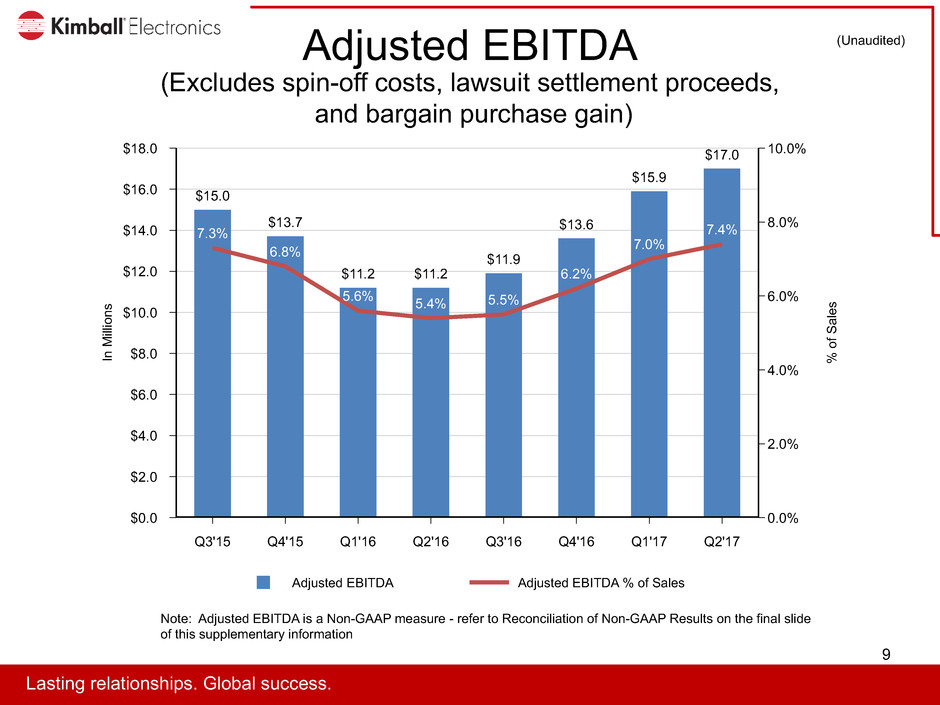

Adjusted EBITDA

(Excludes spin-off costs, lawsuit settlement proceeds,

and bargain purchase gain)

(Unaudited)

Adjusted EBITDA Adjusted EBITDA % of Sales

$18.0

$16.0

$14.0

$12.0

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

In

M

illi

on

s

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

%

of

Sa

le

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

$15.0

$13.7

$11.2 $11.2

$11.9

$13.6

$15.9

$17.0

7.3%

6.8%

5.6% 5.4% 5.5%

6.2%

7.0%

7.4%

Note: Adjusted EBITDA is a Non-GAAP measure - refer to Reconciliation of Non-GAAP Results on the final slide

of this supplementary information

9

Lasting relationships. Global success.Lasting relationships. Global success.

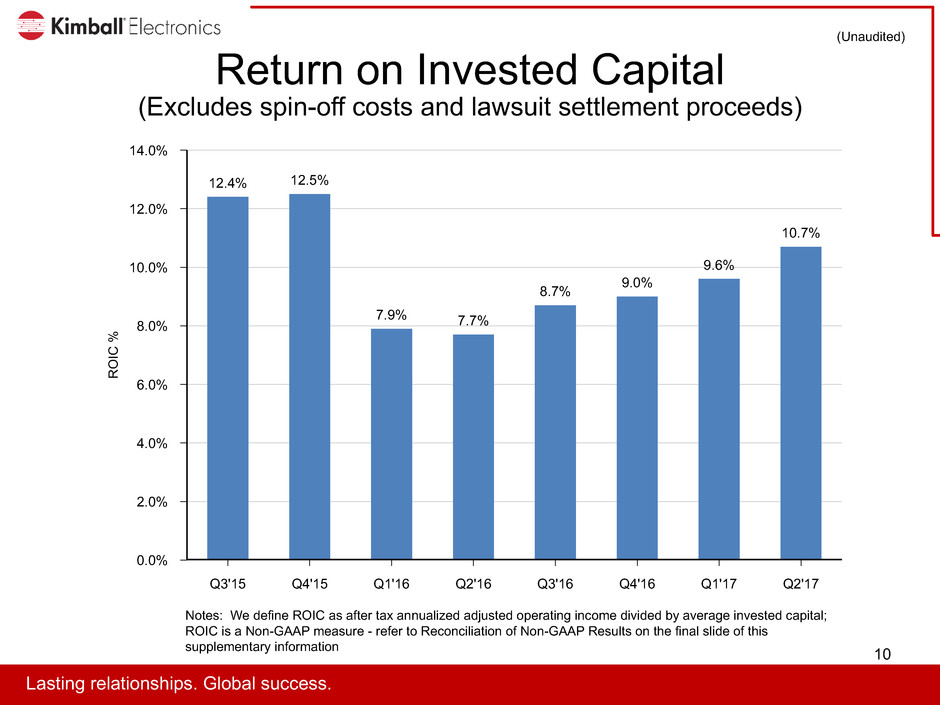

Return on Invested Capital

(Excludes spin-off costs and lawsuit settlement proceeds)

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

R

O

IC

%

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

12.4% 12.5%

7.9% 7.7%

8.7% 9.0%

9.6%

10.7%

Notes: We define ROIC as after tax annualized adjusted operating income divided by average invested capital;

ROIC is a Non-GAAP measure - refer to Reconciliation of Non-GAAP Results on the final slide of this

supplementary information

(Unaudited)

10

Lasting relationships. Global success.Lasting relationships. Global success.

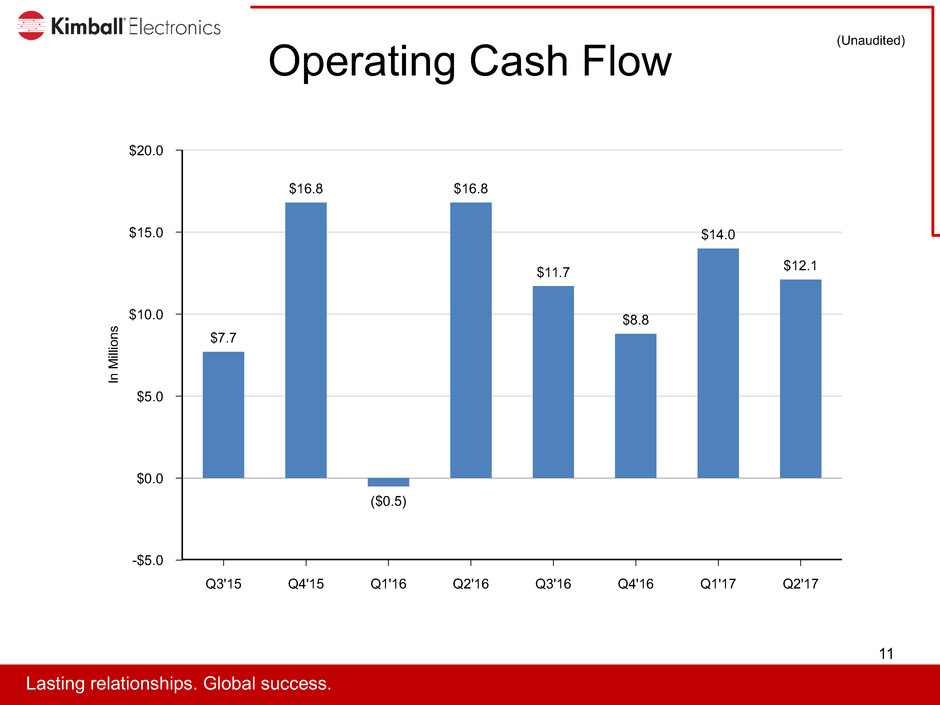

Operating Cash Flow

(Unaudited)

$20.0

$15.0

$10.0

$5.0

$0.0

-$5.0

In

M

illi

on

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

$7.7

$16.8

($0.5)

$16.8

$11.7

$8.8

$14.0

$12.1

11

Lasting relationships. Global success.Lasting relationships. Global success.

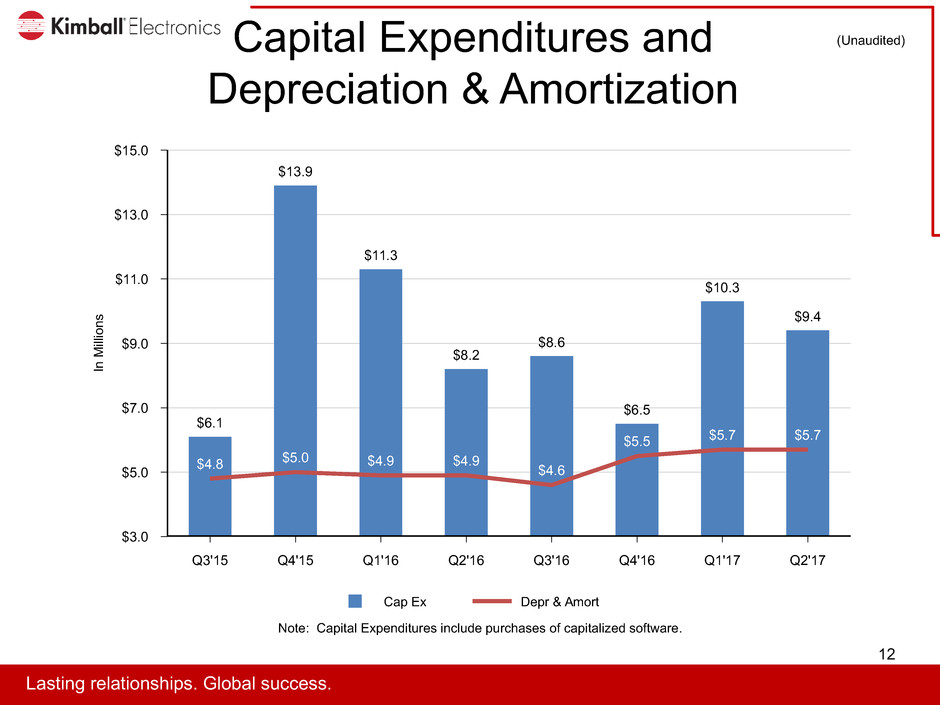

Capital Expenditures and

Depreciation & Amortization

(Unaudited)

Cap Ex Depr & Amort

$15.0

$13.0

$11.0

$9.0

$7.0

$5.0

$3.0

In

M

illi

on

s

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

$6.1

$13.9

$11.3

$8.2

$8.6

$6.5

$10.3

$9.4

$4.8 $5.0 $4.9 $4.9 $4.6

$5.5 $5.7 $5.7

Note: Capital Expenditures include purchases of capitalized software.

12

Lasting relationships. Global success.Lasting relationships. Global success.

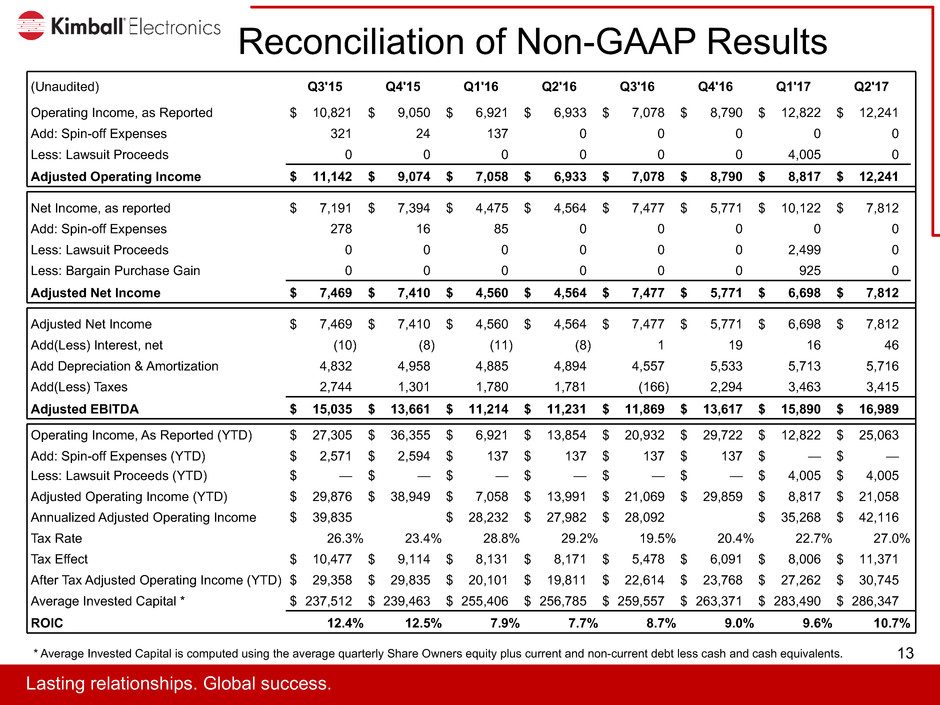

Reconciliation of Non-GAAP Results

(Unaudited) Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

Operating Income, as Reported $ 10,821 $ 9,050 $ 6,921 $ 6,933 $ 7,078 $ 8,790 $ 12,822 $ 12,241

Add: Spin-off Expenses 321 24 137 0 0 0 0 0

Less: Lawsuit Proceeds 0 0 0 0 0 0 4,005 0

Adjusted Operating Income $ 11,142 $ 9,074 $ 7,058 $ 6,933 $ 7,078 $ 8,790 $ 8,817 $ 12,241

Net Income, as reported $ 7,191 $ 7,394 $ 4,475 $ 4,564 $ 7,477 $ 5,771 $ 10,122 $ 7,812

Add: Spin-off Expenses 278 16 85 0 0 0 0 0

Less: Lawsuit Proceeds 0 0 0 0 0 0 2,499 0

Less: Bargain Purchase Gain 0 0 0 0 0 0 925 0

Adjusted Net Income $ 7,469 $ 7,410 $ 4,560 $ 4,564 $ 7,477 $ 5,771 $ 6,698 $ 7,812

Adjusted Net Income $ 7,469 $ 7,410 $ 4,560 $ 4,564 $ 7,477 $ 5,771 $ 6,698 $ 7,812

Add(Less) Interest, net (10) (8) (11) (8) 1 19 16 46

Add Depreciation & Amortization 4,832 4,958 4,885 4,894 4,557 5,533 5,713 5,716

Add(Less) Taxes 2,744 1,301 1,780 1,781 (166) 2,294 3,463 3,415

Adjusted EBITDA $ 15,035 $ 13,661 $ 11,214 $ 11,231 $ 11,869 $ 13,617 $ 15,890 $ 16,989

Operating Income, As Reported (YTD) $ 27,305 $ 36,355 $ 6,921 $ 13,854 $ 20,932 $ 29,722 $ 12,822 $ 25,063

Add: Spin-off Expenses (YTD) $ 2,571 $ 2,594 $ 137 $ 137 $ 137 $ 137 $ — $ —

Less: Lawsuit Proceeds (YTD) $ — $ — $ — $ — $ — $ — $ 4,005 $ 4,005

Adjusted Operating Income (YTD) $ 29,876 $ 38,949 $ 7,058 $ 13,991 $ 21,069 $ 29,859 $ 8,817 $ 21,058

Annualized Adjusted Operating Income $ 39,835 $ 28,232 $ 27,982 $ 28,092 $ 35,268 $ 42,116

Tax Rate 26.3% 23.4% 28.8% 29.2% 19.5% 20.4% 22.7% 27.0%

Tax Effect $ 10,477 $ 9,114 $ 8,131 $ 8,171 $ 5,478 $ 6,091 $ 8,006 $ 11,371

After Tax Adjusted Operating Income (YTD) $ 29,358 $ 29,835 $ 20,101 $ 19,811 $ 22,614 $ 23,768 $ 27,262 $ 30,745

Average Invested Capital * $ 237,512 $ 239,463 $ 255,406 $ 256,785 $ 259,557 $ 263,371 $ 283,490 $ 286,347

ROIC 12.4% 12.5% 7.9% 7.7% 8.7% 9.0% 9.6% 10.7%

13* Average Invested Capital is computed using the average quarterly Share Owners equity plus current and non-current debt less cash and cash equivalents.