Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHCARE REALTY TRUST INC | hr-2017investorpresentatio.htm |

February 2017

This presentation contains disclosures that are “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts and can be

identified by the use of words and phrases such as “can,” “may,” “payable,” “indicative,” “annualized,” “expect,” “expected,” “future cash or NOI,” “deferred revenue,” “rent

increases,” “range of expectations,” “budget,” “components of expected 2016 FFO,” and other comparable terms in this presentation. These forward-looking statements

are made as of the date of this presentation and are not guarantees of future performance. These statements are based on the current plans and expectations of

Company management and are subject to a number of unknown risks, uncertainties, assumptions and other factors that could cause actual results to differ materially

from those described in this release or implied by such forward-looking statements. Such risks and uncertainties include, among other things, the following: changes

in the economy; increases in interest rates; the availability and cost of capital at expected rates; changes to facility-related healthcare regulations; competition for

quality assets; negative developments in the operating results or financial condition of the Company's tenants, including, but not limited to, their ability to pay rent

and repay loans; the Company's ability to reposition or sell facilities with profitable results; the Company's ability to re-lease space at similar rates as vacancies occur;

the Company's ability to renew expiring long-term single-tenant net leases; the Company's ability to timely reinvest proceeds from the sale of assets at similar yields;

government regulations affecting tenants' Medicare and Medicaid reimbursement rates and operational requirements; unanticipated difficulties and/or expenditures

relating to future acquisitions and developments; changes in rules or practices governing the Company's financial reporting; the Company may be required under

purchase options to sell properties and may not be able to reinvest the proceeds from such sales at rates of return equal to the return received on the properties sold;

uninsured or underinsured losses related to casualty or liability; the incurrence of impairment charges on its real estate properties or other assets; and other legal and

operational matters. Other risks, uncertainties and factors that could cause actual results to differ materially from those projected are detailed under the heading “Risk

Factors,” in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) for the year ended December 31, 2015 and other

risks described from time to time thereafter in the Company's SEC filings. The Company undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Information as of September 30, 2016, unless otherwise disclosed.

3

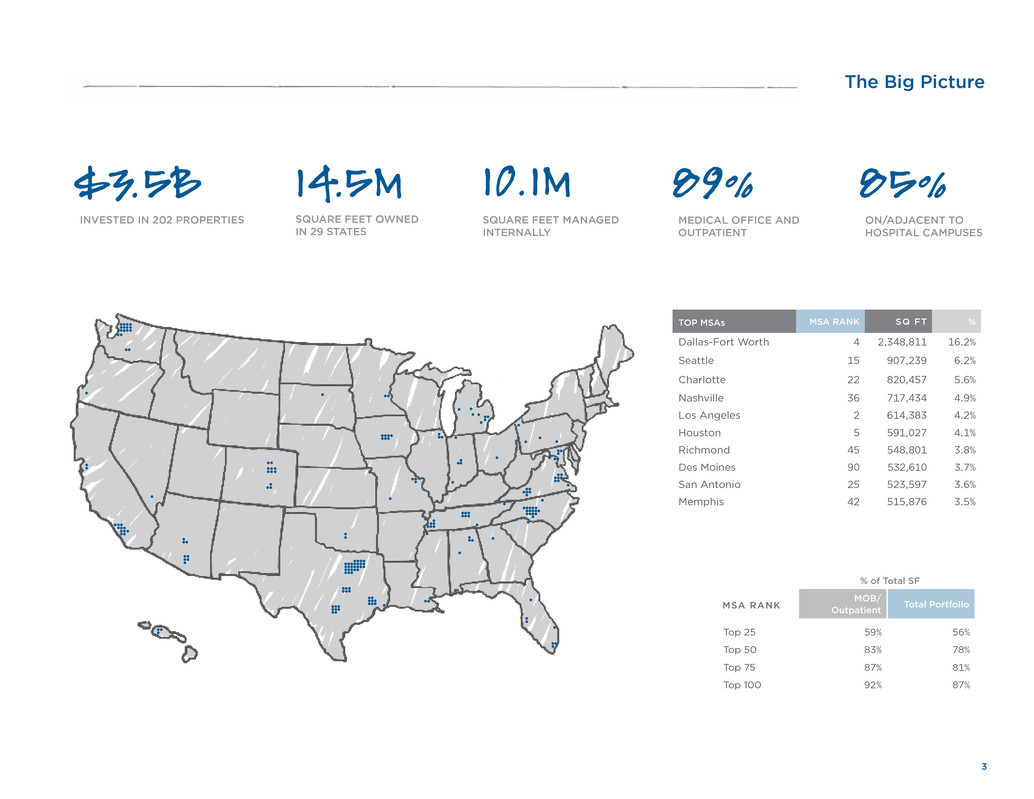

TOP MSAs MSA RANK SQ FT %

Dallas-Fort Worth 4 2,348,811 16.2%

Seattle 15 907,239 6.2%

Charlotte 22 820,457 5.6%

Nashville 36 717,434 4.9%

Los Angeles 2 614,383 4.2%

Houston 5 591,027 4.1%

Richmond 45 548,801 3.8%

Des Moines 90 532,610 3.7%

San Antonio 25 523,597 3.6%

Memphis 42 515,876 3.5%

The Big Picture

$3.5B 14.5M 10.1M

INVESTED IN 202 PROPERTIES SQUARE FEET OWNED

IN 29 STATES

SQUARE FEET MANAGED

INTERNALLY

89%

MEDICAL OFFICE AND

OUTPATIENT

85%

ON/ADJACENT TO

HOSPITAL CAMPUSES

% of Total SF

MSA RANK

MOB/

Outpatient

Total Portfolio

Top 25 59% 56%

Top 50 83% 78%

Top 75 87% 81%

Top 100 92% 87%

4

(CHI)

(Ascension)

(CHI)

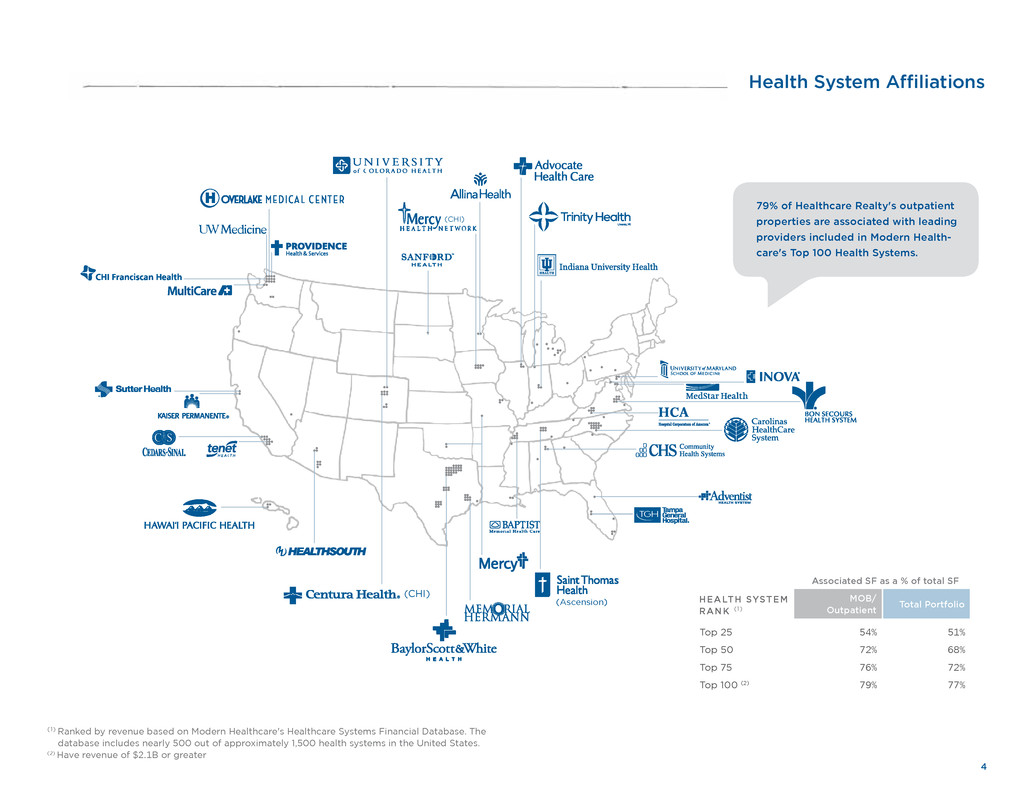

Health System Affiliations

79% of Healthcare Realty's outpatient

properties are associated with leading

providers included in Modern Health-

care's Top 100 Health Systems.

Associated SF as a % of total SF

HEALTH SYSTEM

RANK (1)

MOB/

Outpatient

Total Portfolio

Top 25 54% 51%

Top 50 72% 68%

Top 75 76% 72%

Top 100 (2) 79% 77%

(1) Ranked by revenue based on Modern Healthcare's Healthcare Systems Financial Database. The

database includes nearly 500 out of approximately 1,500 health systems in the United States.

(2) Have revenue of $2.1B or greater

5

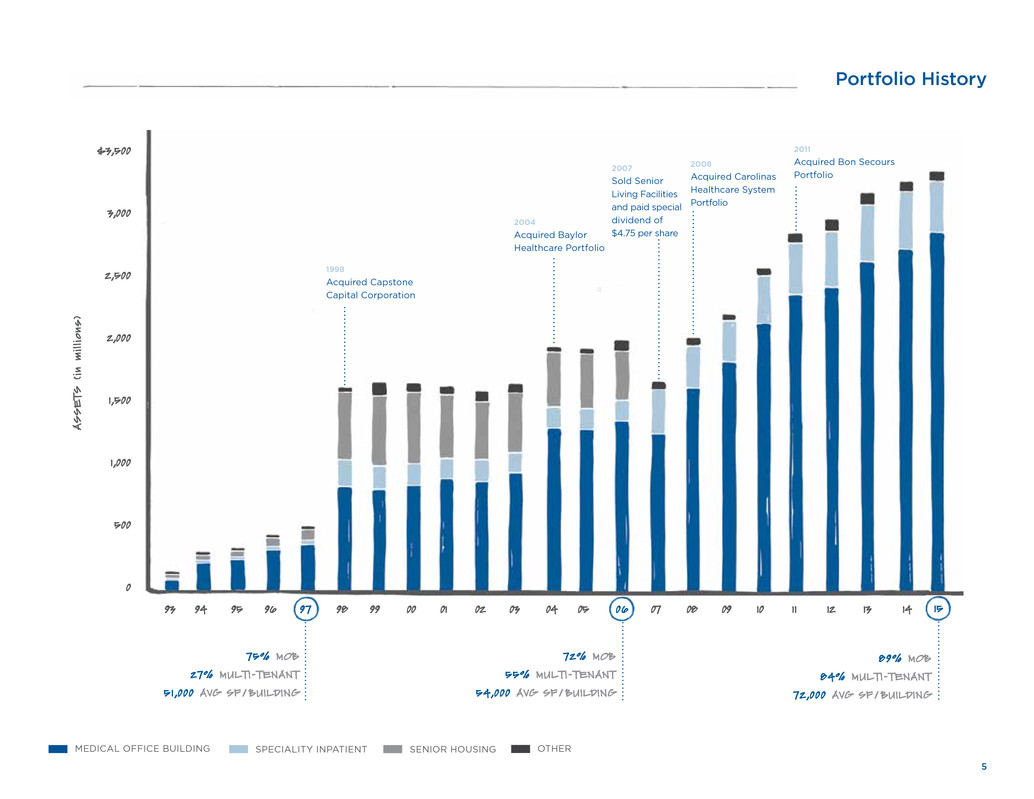

Portfolio History

93

A

S

S

E

TS

(

in

m

ill

io

ns

)

99 0596 02 0894 00 0697 03 09 10 1195 01 0798 04

2008

Acquired Carolinas

Healthcare System

Portfolio

2011

Acquired Bon Secours

Portfolio

1998

Acquired Capstone

Capital Corporation

2004

Acquired Baylor

Healthcare Portfolio

2007

Sold Senior

Living Facilities

and paid special

dividend of

$4.75 per share

3,000

1,000

2,000

0

12 13

1,500

2,500

$3,500

500

MEDICAL OFFICE BUILDING SPECIALITY INPATIENT SENIOR HOUSING OTHER

75% MOB

27% MULTI-TENANT

51 ,000 AVG SF / BUILDING

72% MOB

55% MULTI-TENANT

54,000 AVG SF / BUILDING

14 15

89% MOB

84% MULTI-TENANT

72,000 AVG SF / BUILDING

6

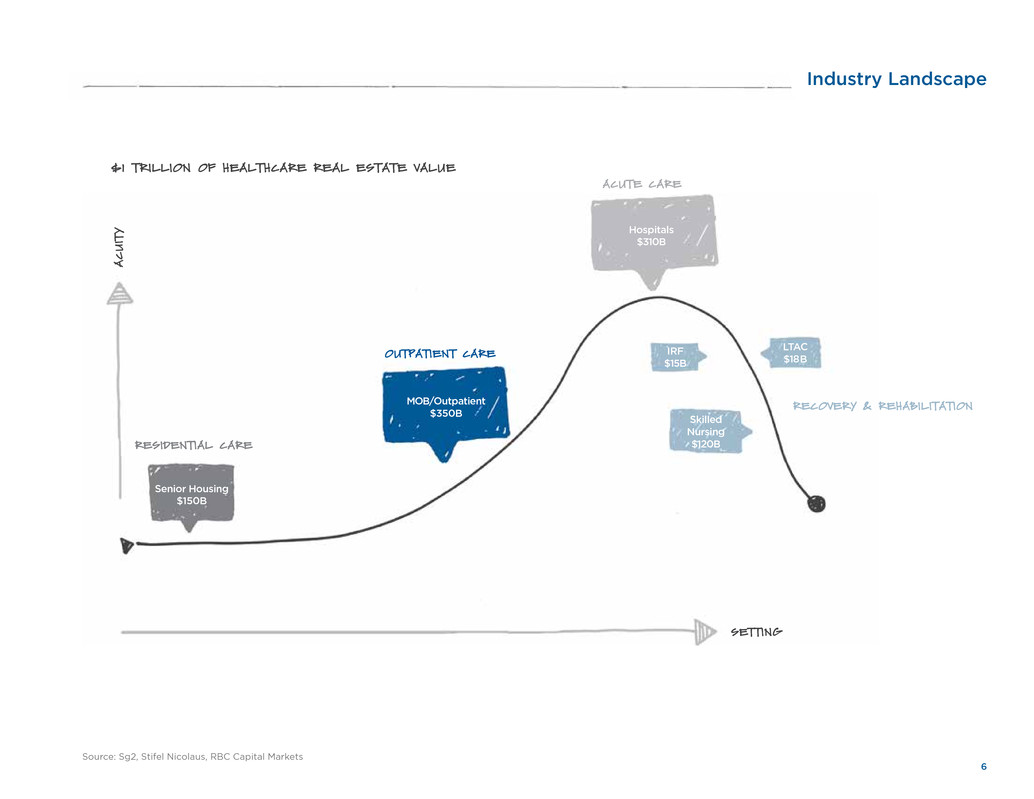

Industry Landscape

$1 TRILLION OF HEALTHCARE REAL ESTATE VALUE

Source: Sg2, Stifel Nicolaus, RBC Capital Markets

A

C

U

IT

Y

SETTING

OUTPATIENT CARE

RESIDENTIAL CARE

ACUTE CARE

RECOVERY & REHABILITATION

Senior Housing

$150B

MOB/Outpatient

$350B

Hospitals

$310B

Skilled

Nursing

$120B

LTAC

$18B

IRF

$15B

7

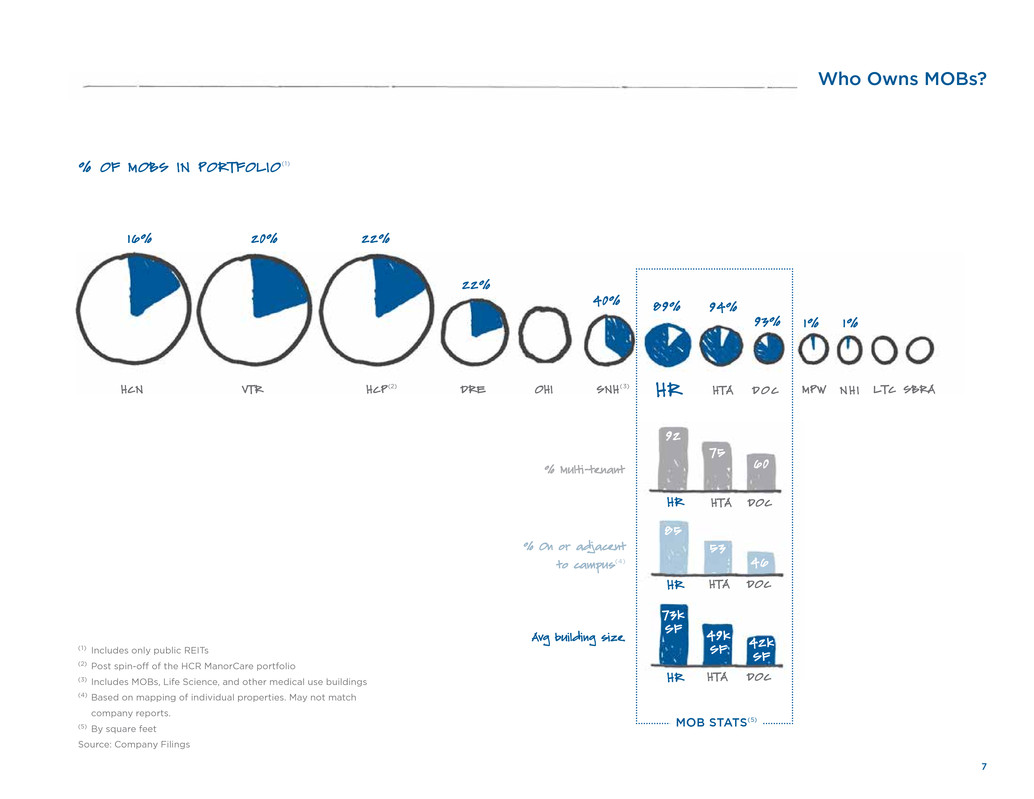

Who Owns MOBs?

HCN VTR HCP (2)

DRE OHI SNH (3) HR MPW HTA D O C LTC SBRA

16% 20% 22%

22%

40%

1% 1%

89% 94%

% Multi-tenant

% On or adjacent

to campus(4)

Avg building size

53

75

49k

SF

85

92

73k

SF

HR

HR

HR

% OF MOBS IN PORTFOLIO (1)

(1) Includes only public REITs

(2) Post spin-off of the HCR ManorCare portfolio

(3) Includes MOBs, Life Science, and other medical use buildings

(4) Based on mapping of individual properties. May not match

company reports.

(5) By square feet

Source: Company Filings

HTA

HTA

HTA

MOB STATS(5)

N H I

93%

46

60

42k

SF

DOC

DOC

DOC

8

ON -C AM PU

S

0 - 25 0 Y AR

DS25 1 YARDS - 0 . 25

M I L

ES

OFF -CAMPUS

HR

ON-C AM PU

S

0 - 25 0 Y AR

DS25 1 YARDS - 0 . 2

5

M I

LE

S

OFF -CAMPUS

HTA

SF % OF TOTAL SF % OF TOTAL SF % OF TOTAL

On-campus 8.9M 67.4% 4.5M 27.6% 2.5M 26.0%

Adjacent 2.3M 17.7% 4.1M 24.9% 1.9M 20.4%

0 - 250 yards 1.2M 9.2% 2.7M 16.4% 1.2M 12.7%

251 yards - 0.25 miles 1.1M 8.5% 1.4M 8.5% 731K 7.7%

Off-campus 2.0M 14.9% 7.8M 47.5% 5.1M 53.6%

0.25 - 0.5 miles 130K 1.0% 76K 0.5% 484K 5.1%

0.5 - 1 miles 305K 2.3% 735K 4.5% 575K 6.0%

1 - 2 miles 590K 4.4% 2.5M 15.2% 781K 8.2%

2 - 5 miles 477K 3.6% 2.5M 15.4% 1.7M 17.6%

5 - 10 miles 332K 2.5% 1.8M 10.9% 1.2M 12.3%

10 + miles 143K 1.1% 165K 1.0% 418K 4.4%

TOTAL SF 13.2M 100.0% 16.3M 100.0% 9.5M 100.0%

MOB Proximity to Hospital

OFF-CAMPUS

15.1%

ON -C AM PU

S

0 - 25 0 Y AR

DS25 1 YARDS - 0 . 25

M I L

ES

OFF -CAMPUS

DOC

Based on mapping of individual properties. May not match company reports.

Source: Company reports; S&P Global Market Intelligence; other public sources

85.1%

ON- AND ADJ

52.5% 46.4%

9

MOB Portfolio Comparison

% OF TOTAL MOB SF

Top 100

Health Systems

Top 100

MSAs

85

46

53

59

70

83

HR DOCHTAHCN VTRHCP

92

70

77

87

93

89

78

3939

49

56

79

HR DOCHTAVTRHCNHCP

66

19

27

3536

68

HR DOCHTAVTRHCNHCP

On or Adjacent

to Campus(1)

All Three

Attributes

NOT FOR PROFIT

HR DOCHTAVTRHCNHCP

(1) Based on mapping of individual properties. May not match company reports.

(2) Pro Forma for the acquisition of 51 MOBs associated with CHI

Source: Company reports; Modern Healthcare; BLS.gov; Nielsen; other public sources

%

%

%

%

ON CAMPUS

PROJECTED

POPULATION

GROWTH RATE

5.9 5.7

5.0

4.4 4.4 4.5

67

62

35

49

28

26

66

26

39 44

23

35

(1) Based on mapping of individual properties. May not match company reports. Includes properties located no more than 0.25 miles from a hospital campus.

Source: Company reports; Modern Healthcare; BLS.gov; Nielsen; other public sources

10

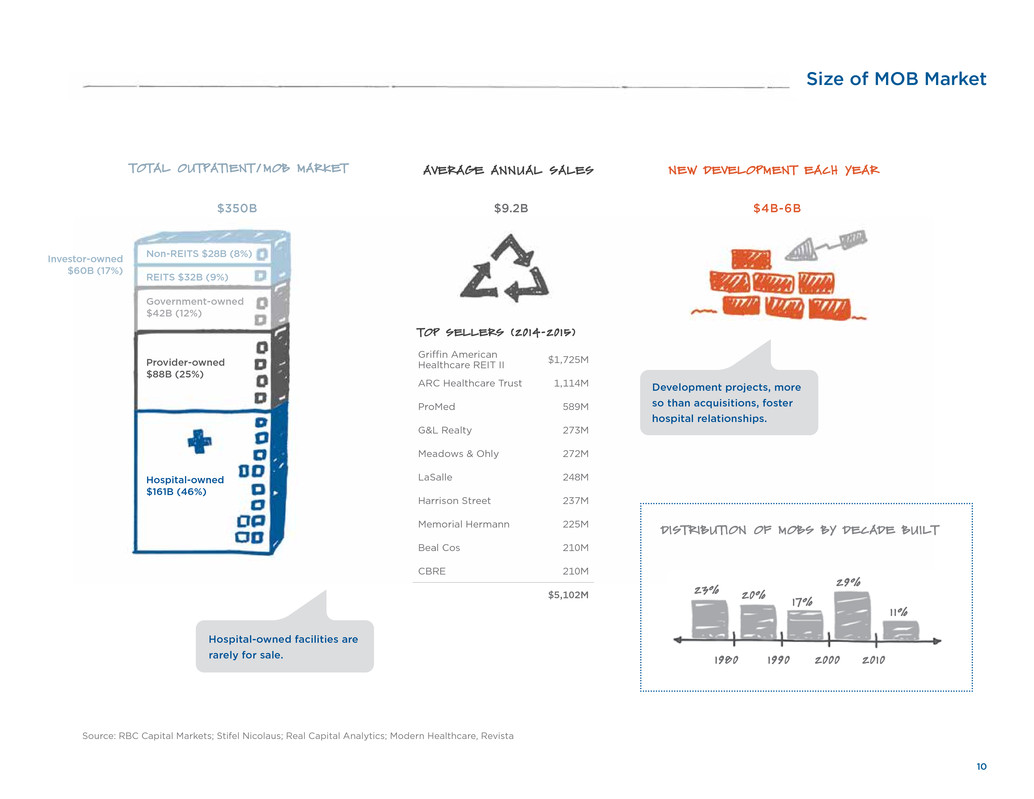

NEW DEVELOPMENT EACH YEARTOTAL OUTPATIENT / MOB MARKET AVERAGE ANNUAL SALES

Hospital-owned

$161B (46%)

Investor-owned

$60B (17%)

$9.2B $4B-6B$350B

Development projects, more

so than acquisitions, foster

hospital relationships.

Hospital-owned facilities are

rarely for sale.

TOP SELLERS (2014-2015)

Griffin American

Healthcare REIT II $1,725M

ARC Healthcare Trust 1,114M

ProMed 589M

G&L Realty 273M

Meadows & Ohly 272M

LaSalle 248M

Harrison Street 237M

Memorial Hermann 225M

Beal Cos 210M

CBRE 210M

$5,102M

Size of MOB Market

Source: RBC Capital Markets; Stifel Nicolaus; Real Capital Analytics; Modern Healthcare, Revista

DISTRIBUTION OF MOBS BY DECADE BUILT

1980

1 1%

1990 2000 2010

29%

17%20%

23%

Provider-owned

$88B (25%)

Government-owned

$42B (12%)

Non-REITS $28B (8%)

REITS $32B (9%)

11

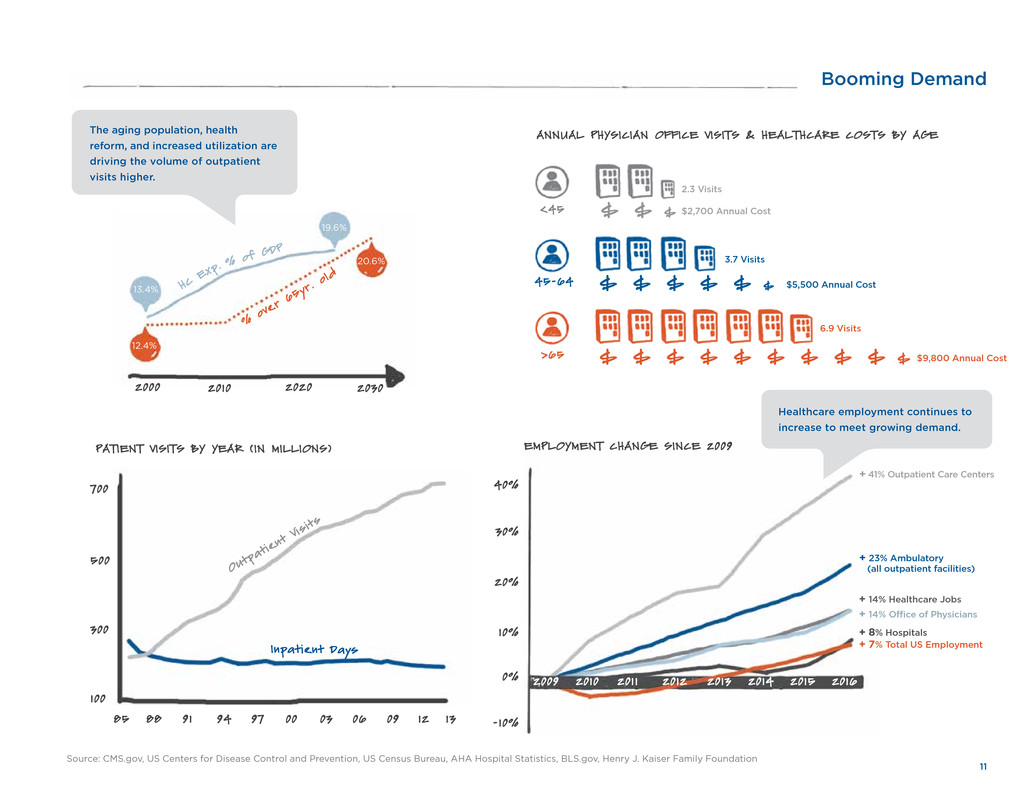

Booming Demand

ANNUAL PHYSICIAN OFFICE VISITS & HEALTHCARE COSTS BY AGE

2.3 Visits

3.7 Visits

6.9 Visits

<45

>65

45-64

2000 2020 2030

%

ove

r 6

5yr

. o

ld

13.4%

12.4%

19.6%

20.6%

Source: CMS.gov, US Centers for Disease Control and Prevention, US Census Bureau, AHA Hospital Statistics, BLS.gov, Henry J. Kaiser Family Foundation

85 88 91 94 97 00

700

500

300

100

Ou

tpa

tie

nt

Vis

its

Inpatient Days

PATIENT VISITS BY YEAR ( IN MILLIONS) EMPLOYMENT CHANGE SINCE 2009

2009 2010 201 1 2012 2013 2014

30%

20%

10%

0%

-10%

+ 41% Outpatient Care Centers

+ 23% Ambulatory

(all outpatient facilities)

+ 14% Healthcare Jobs

+ 14% Office of Physicians

+ 7% Total US Employment

The aging population, health

reform, and increased utilization are

driving the volume of outpatient

visits higher.

Healthcare employment continues to

increase to meet growing demand.

2010

03 06 09 12

HC

Ex

p. %

of G

DP

2015

$ $ $ $ $ $ $ $ $ $ $9,800 Annual Cost

$ $ $ $ $ $ $5,500 Annual Cost

$ $ $ $2,700 Annual Cost

13

2016

+ 8% Hospitals

40%

12

Source: Dixon Hughes Goodman, AHA Annual Survey data for Community hospitals, Modern Healthcare

2002 2014

100%

50%

0%

PRA

CTIC

ES

OWN

ED

BY H

OSP

ITAL

S

PRACTICES OWNED BY PHYSICIANS

Provider Trends

Inpatient vs. Outpatient

1994 2014

28% 46%

2009 2015

30%

0%

PHYSICIAN COMPENSATION GROWTH 2009–2015

10%

Pediatrics 29.6%

Internal Med. & Family Practice 20.9%

Oncology 15.6%

Cardiology 15.1%

General Surgery 14.8%

Obstetric/Gynecology 14.0%

Dermatology 13.6%

Orthopedic Surgery 10.4%

HOSPITALS' GROSS REVENUE

20%

As more of hospitals' revenue comes from

outpatient services, more physicians are em-

ployed by hospitals, and their compensation

is increasing steadily.

13

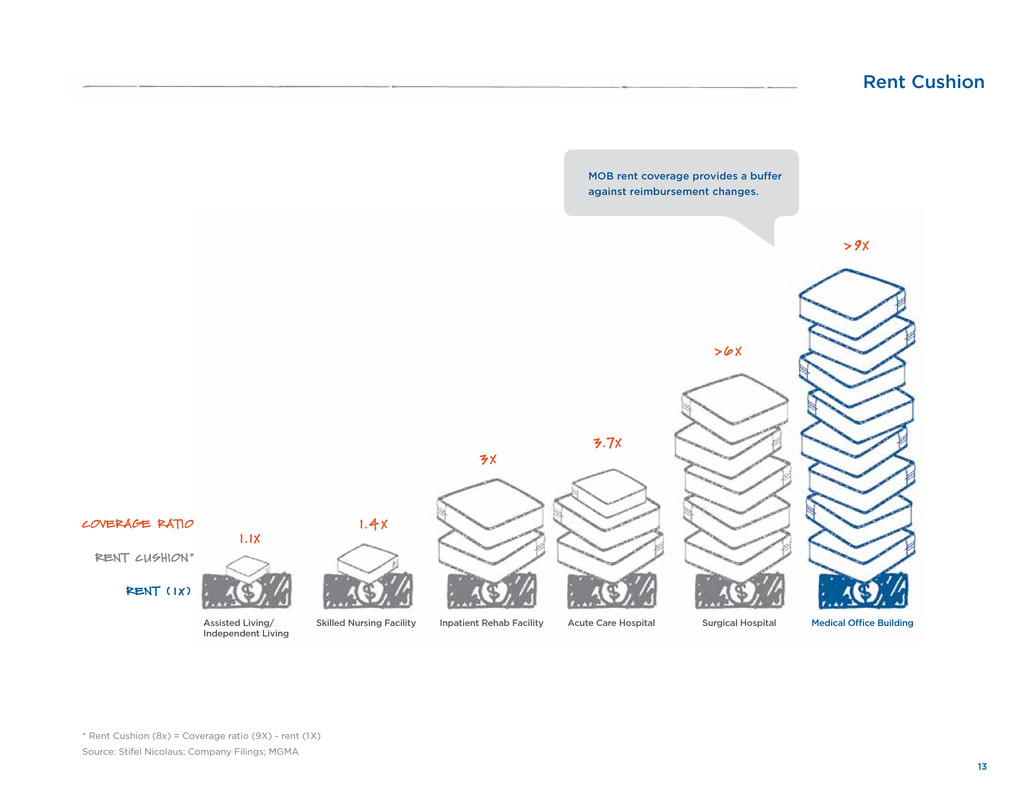

Rent Cushion

RENT ( 1 x )

RENT CUSHION*

COVERAGE RATIO

1 . 1X

1 .4 X

3 X

3.7X

> 6 X

> 9X

Assisted Living/

Independent Living

Skilled Nursing Facility Inpatient Rehab Facility Acute Care Hospital Surgical Hospital Medical Office Building

* Rent Cushion (8x) = Coverage ratio (9X) - rent (1X)

Source: Stifel Nicolaus; Company Filings; MGMA

MOB rent coverage provides a buffer

against reimbursement changes.

14

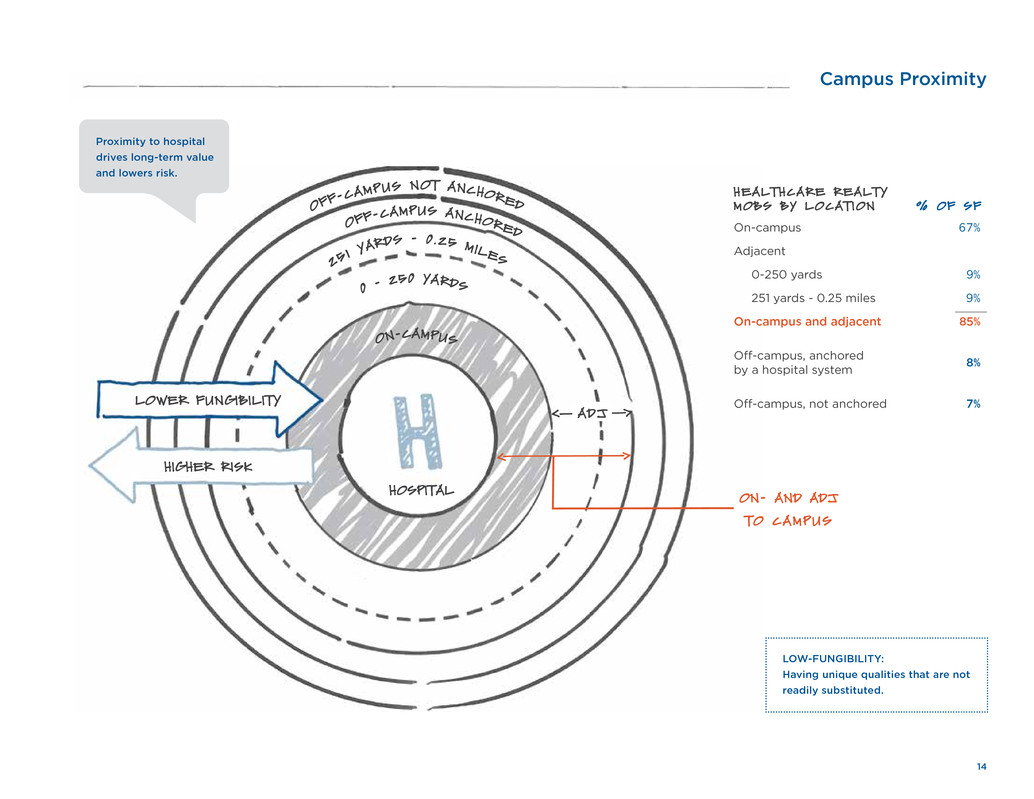

HOSPITAL

ON-CAMPUS

0 - 2

50 YARDS

25

1 YA

RDS - 0 .25 MILES

OFF-

CAMPUS ANCHORED

OFF

-CAMP

US NOT ANCHORED

< >

HIGHER RISK

LOWER FUNGIBILITY

ADJ

< >

ON- AND ADJ

TO CAMPUS

Campus Proximity

LOW-FUNGIBILITY:

Having unique qualities that are not

readily substituted.

Proximity to hospital

drives long-term value

and lowers risk.

HEALTHCARE REALTY

MOBS BY LOCAT ION % OF SF

On-campus 67%

Adjacent

0-250 yards 9%

251 yards - 0.25 miles 9%

On-campus and adjacent 85%

Off-campus, anchored

by a hospital system

8%

Off-campus, not anchored 7%

15

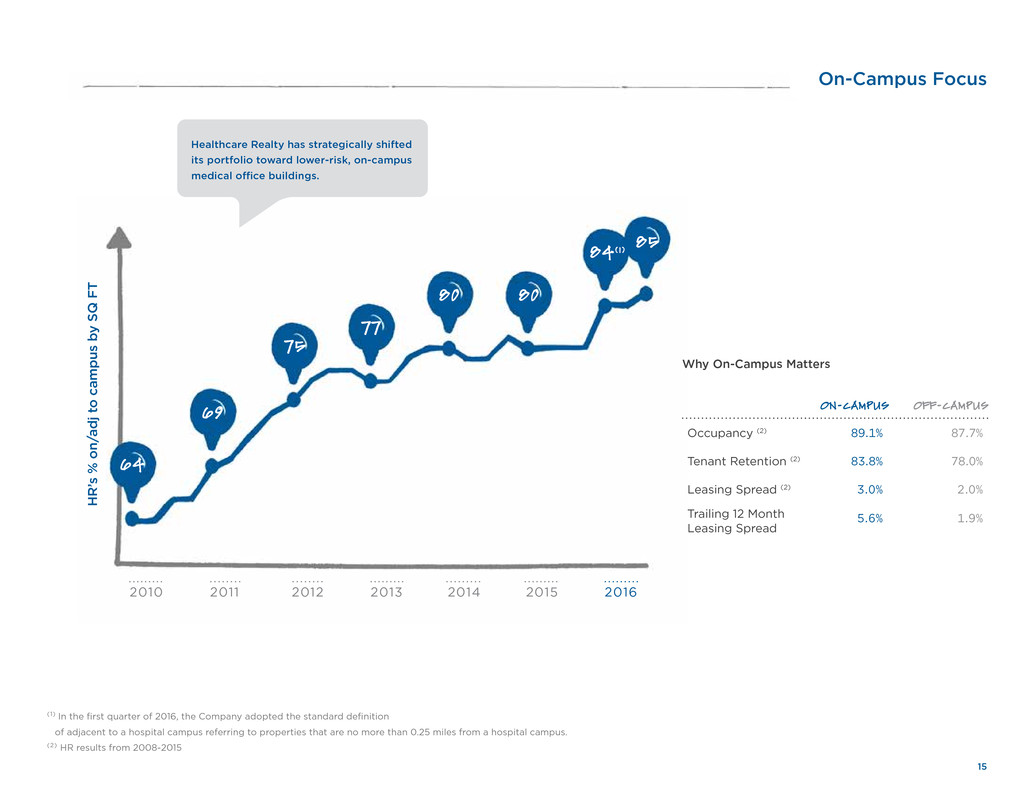

On-Campus Focus

H

R

’s

%

o

n/

ad

j t

o

c

am

p

us

b

y

S

Q

F

T 80

75

69

64

Healthcare Realty has strategically shifted

its portfolio toward lower-risk, on-campus

medical office buildings.

Why On-Campus Matters

ON-CAMPUS OFF-CAMPUS

Occupancy (2) 89.1% 87.7%

Tenant Retention (2) 83.8% 78.0%

Leasing Spread (2) 3.0% 2.0%

Trailing 12 Month

Leasing Spread

5.6% 1.9%

(1) In the first quarter of 2016, the Company adopted the standard definition

of adjacent to a hospital campus referring to properties that are no more than 0.25 miles from a hospital campus.

(2) HR results from 2008-2015

77

84(1)

2010 2011 2012 2013 2014 2015 2016

85

80

16

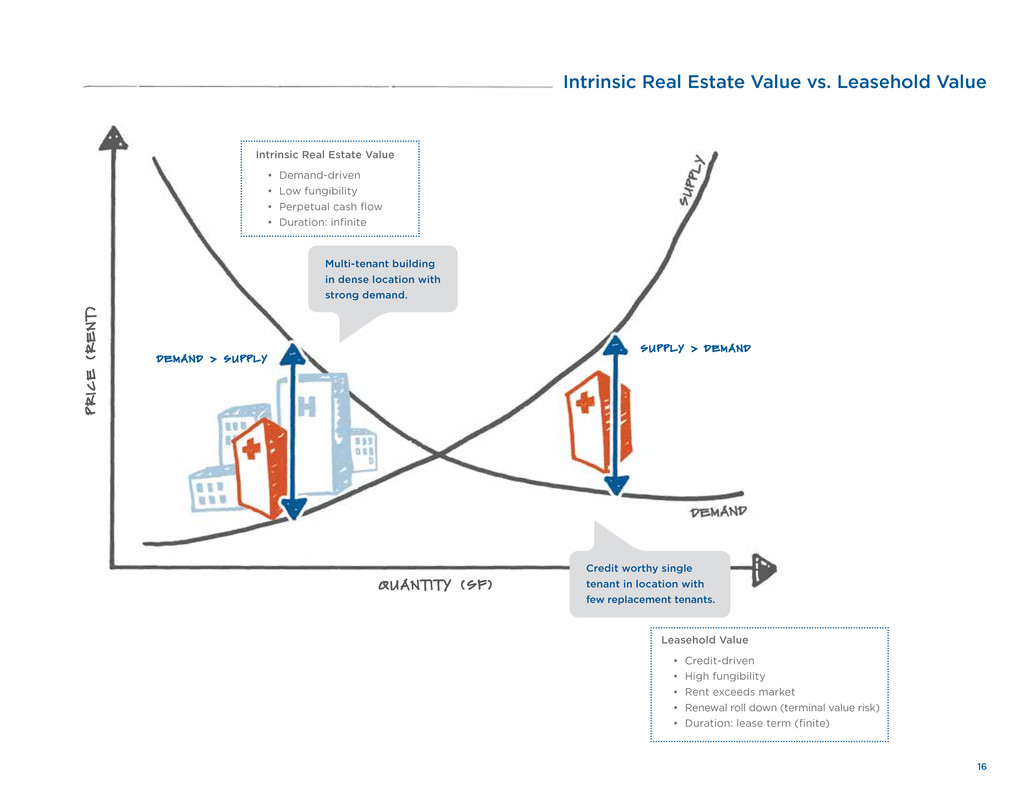

Intrinsic Real Estate Value vs. Leasehold Value

Multi-tenant building

in dense location with

strong demand.

Credit worthy single

tenant in location with

few replacement tenants.

Leasehold Value

• Credit-driven

• High fungibility

• Rent exceeds market

• Renewal roll down (terminal value risk)

• Duration: lease term (finite)

Intrinsic Real Estate Value

• Demand-driven

• Low fungibility

• Perpetual cash flow

• Duration: infinite

DEMAND > SUPPLY

SUPPLY > DEMAND

QUANT I T Y (SF )

P

R

IC

E

(

R

E

N

T)

17

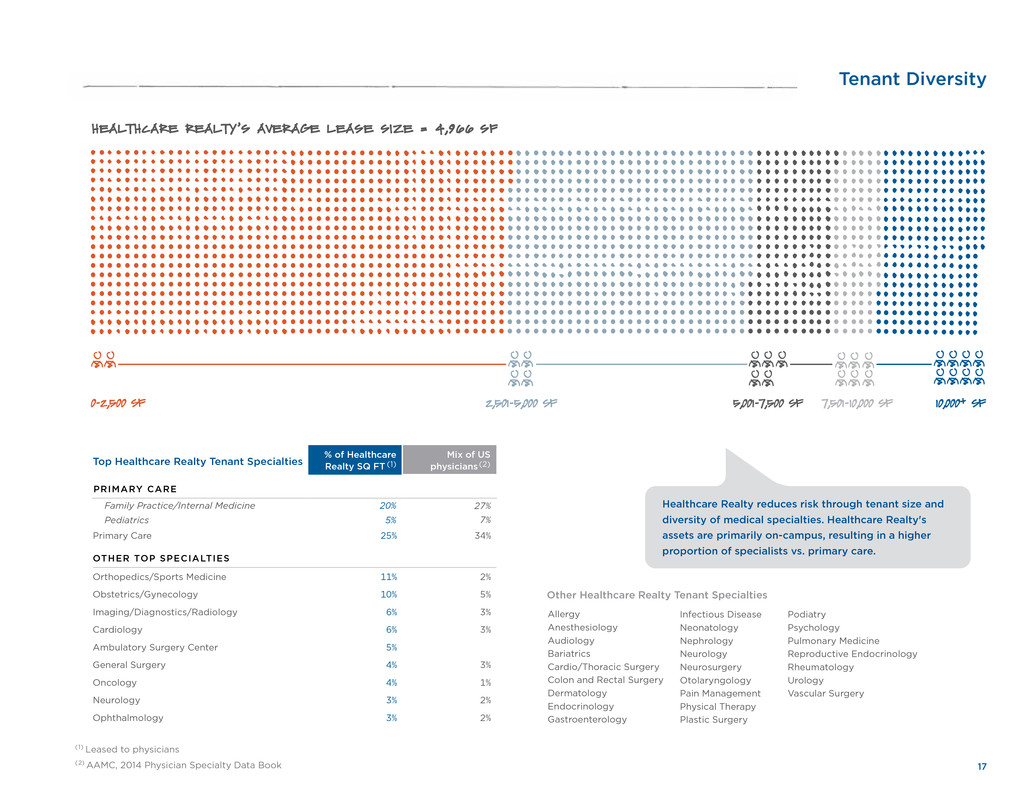

0-2,500 SF 2,501-5,000 SF 5,001-7,500 SF 7,501-10,000 SF 10,000+ SF

Tenant Diversity

Allergy

Anesthesiology

Audiology

Bariatrics

Cardio/Thoracic Surgery

Colon and Rectal Surgery

Dermatology

Endocrinology

Gastroenterology

Infectious Disease

Neonatology

Nephrology

Neurology

Neurosurgery

Otolaryngology

Pain Management

Physical Therapy

Plastic Surgery

Podiatry

Psychology

Pulmonary Medicine

Reproductive Endocrinology

Rheumatology

Urology

Vascular Surgery

Healthcare Realty reduces risk through tenant size and

diversity of medical specialties. Healthcare Realty's

assets are primarily on-campus, resulting in a higher

proportion of specialists vs. primary care.

HEALTHCARE REALTY’S AVERAGE LEASE SIZE = 4,966 SF

Top Healthcare Realty Tenant Specialties

% of Healthcare

Realty SQ FT (1)

Mix of US

physicians(2)

PRIMARY CARE

Family Practice/Internal Medicine 20% 27%

Pediatrics 5% 7%

Primary Care 25% 34%

OTHER TOP SPECIALTIES

Orthopedics/Sports Medicine 11% 2%

Obstetrics/Gynecology 10% 5%

Imaging/Diagnostics/Radiology 6% 3%

Cardiology 6% 3%

Ambulatory Surgery Center 5%

General Surgery 4% 3%

Oncology 4% 1%

Neurology 3% 2%

Ophthalmology 3% 2%

Other Healthcare Realty Tenant Specialties

(1) Leased to physicians

(2) AAMC, 2014 Physician Specialty Data Book

18

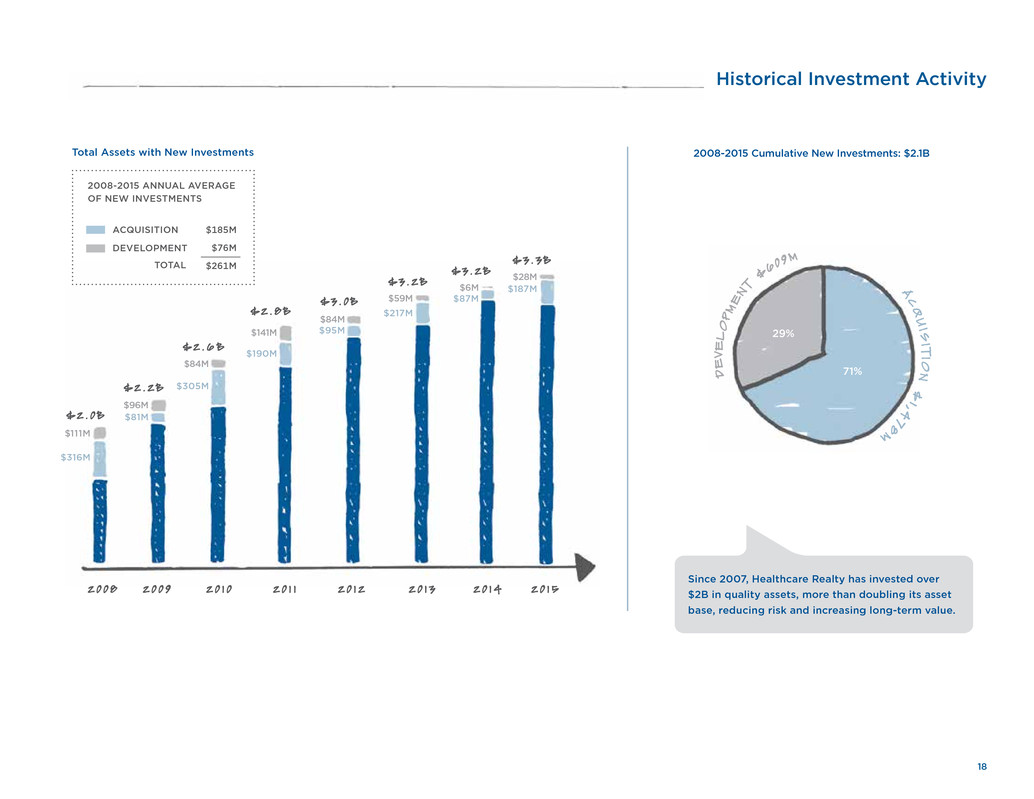

Historical Investment Activity

2008-2015 Cumulative New Investments: $2.1B

Total Assets with New Investments

Since 2007, Healthcare Realty has invested over

$2B in quality assets, more than doubling its asset

base, reducing risk and increasing long-term value.

29%

A

C

Q

U

I S

I T

IO

N

$

1,4

78M

D

E

VE

L

O

PM

E

NT

$

60

9M

71%

2 0 1 22 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1

$316M

$111M

$81M

$96M

$305M

$84M

$190M

$95M$141M

$84M

$2 . 0 B

$ 2 . 2 B

$ 2 . 6 B

$ 2 . 8 B

$ 3 . 0 B

2 0 1 3

$217M

$59M

$3 . 2 B

$87M

$6M

$3 . 2 B

2 0 1 4

$187M

$28M

$3 . 3 B

2 0 1 5

2008-2015 ANNUAL AVERAGE

OF NEW INVESTMENTS

ACQUISITION

DEVELOPMENT

$185M

$76M

$261MTOTAL

19

Recent MOB Acquisitions

MCMURRAY MEDICAL

BUILDING

Seattle 60k SQ FT

On the campus of Northwest Hospital and Medical

Center, part of AA+ rated UW Medicine

MERIDIAN MEDICAL

PAVILION

Seattle 70k SQ FT

Adjacent to Northwest Hospital and Medical

Center, part of AA+ rated UW Medicine

VALLEY PROF.

CENTER NORTH

Seattle 47k SQ FT

On the campus of Valley Medical Center, part of AA+

rated UW Medicine

TALBOT PROF.

CENTER

Seattle 87k SQ FT

On the campus of Valley Medical Center, part of AA+

rated UW Medicine

SWEDISH ORTHO.

INSTITUTE

Seattle 53k SQ FT

On the campus of Swedish Medical Center, part of

AA- rated Providence Health & Services

STEVENS HEALTH

CENTER

Seattle 30k SQ FT

On the campus of Swedish Edmonds Hospital, part of

AA- rated Providence Health

HIGHLINE MEDICAL

PAVILION

Seattle 36k SQ FT

On the campus of Highline Medical Center, part of

A- rated CHI

THREE TREE

MEDICAL ARTS

Seattle 60k SQ FT

On campus and attached to Highline Medical Center, part

of A- rated CHI

TACOMA MED CTR. Tacoma 33k SQ FT

Adjacent to Tacoma General Hospital, part of AA- rated

MultiCare Health

CIV IC CENTER PL. San Jose 111k SQ FT

Adjacent to Washington Hospital Healthcare System and

AA- rated Kaiser Permanente Hospital

BROADWAY-WEBSTER

MEDICAL PLAZA

Oakland 100k SQ FT

On the campus of Alta Bates Summit Medical Center, part

of AA- rated Sutter Health

UNION MED. PLAZA Denver 48k SQ FT

Adjacent to Healthcare Realty's MOB developments on

the campus of St. Anthony Hospital, part of A- rated CHI

WEST HILLS

MEDICAL CENTER

Los Angeles 63k SQ FT

On the campus of West Hills Hospital and Medical Center,

part of BB rated HCA

UNITY PROF.

BUILDING Minneapolis 64k SQ FT

On campus and attached to Unity Hospital, part of AA-

rated Allina Health

BEL AIR PHYSICIANS

PAVILION I&I I Baltimore 114k SQ FT

On campus and attached to Upper Chesapeake Health

Medical Center, part of A- rated University of Maryland

Medical Center

LOUDOUN I I MOB Washington, DC 104k SQ FT

On the campus of Loudoun Hospital, part of AA+ rated

Inova Health System

WEST NORMAN

PROF. BUILDING Oklahoma City 69k SQ FT

On the campus of BBB rated Norman Regional

Healthplex

Healthcare Realty targets on-cam-

pus, multi-tenant MOBs associated

with market-leading hospitals.

20

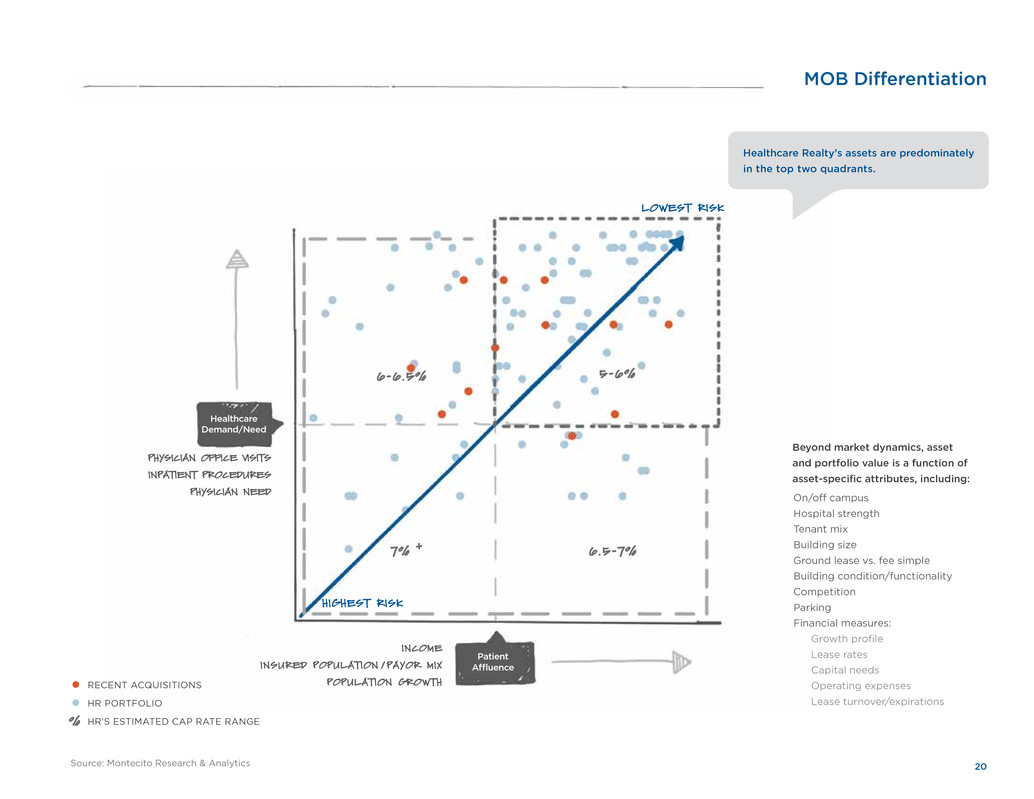

Healthcare

Demand/Need

Patient

Affluence

PHYSICIAN OFFICE VISITS

INPATIENT PROCEDURES

PHYSICIAN NEED

INCOME

INSURED POPULATION / PAYOR MIX

POPULATION GROWTH

HIGHEST RISK

LOWEST RISK

MOB Differentiation

On/off campus

Hospital strength

Tenant mix

Building size

Ground lease vs. fee simple

Building condition/functionality

Competition

Parking

Financial measures:

Growth profile

Lease rates

Capital needs

Operating expenses

Lease turnover/expirations

6-6.5%

7% +

5-6%

6.5-7%

Beyond market dynamics, asset

and portfolio value is a function of

asset-specific attributes, including:

Source: Montecito Research & Analytics

Healthcare Realty’s assets are predominately

in the top two quadrants.

RECENT ACQUISITIONS

HR PORTFOLIO

HR’S ESTIMATED CAP RATE RANGE%

21

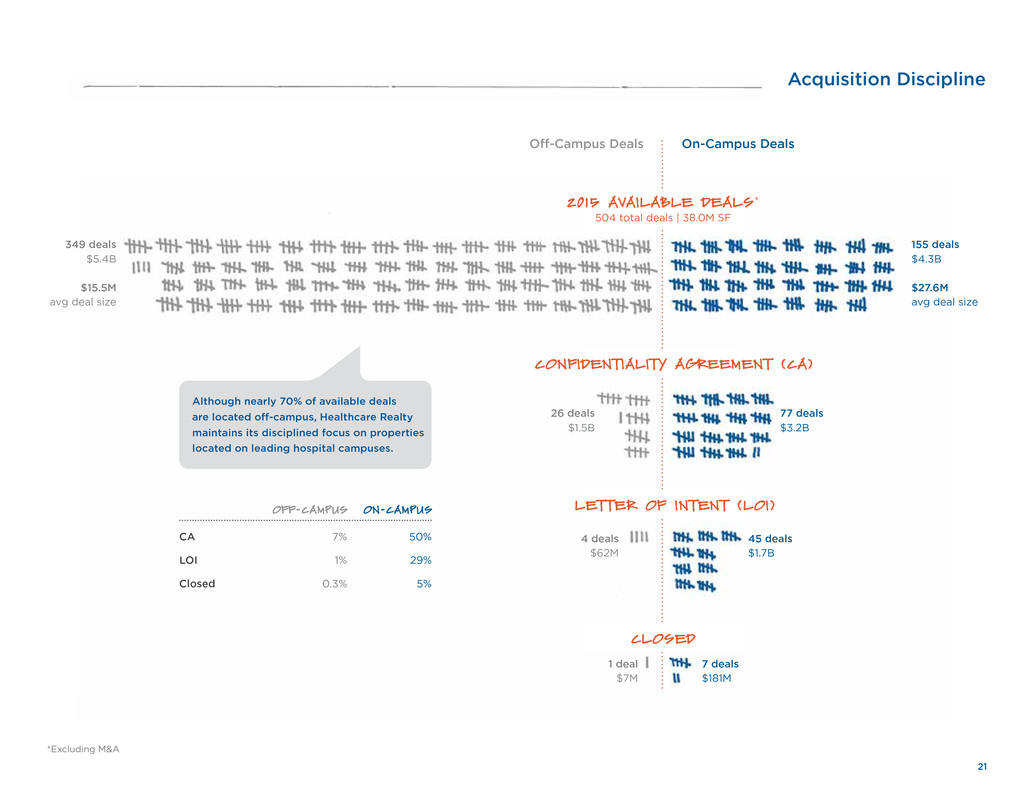

Acquisition Discipline

On-Campus Deals

2015 AVAILABLE DEALS *

504 total deals | 38.0M SF

CONFIDENTIALITY AGREEMENT (CA)

LETTER OF INTENT (LOI)

CLOSED

Off-Campus Deals

*Excluding M&A

Although nearly 70% of available deals

are located off-campus, Healthcare Realty

maintains its disciplined focus on properties

located on leading hospital campuses.

349 deals

$5.4B

$15.5M

avg deal size

155 deals

$4.3B

$27.6M

avg deal size

26 deals

$1.5B

77 deals

$3.2B

4 deals

$62M

45 deals

$1.7B

1 deal

$7M

7 deals

$181M

OFF-CAMPUS ON-CAMPUS

CA 7% 50%

LOI 1% 29%

Closed 0.3% 5%

22

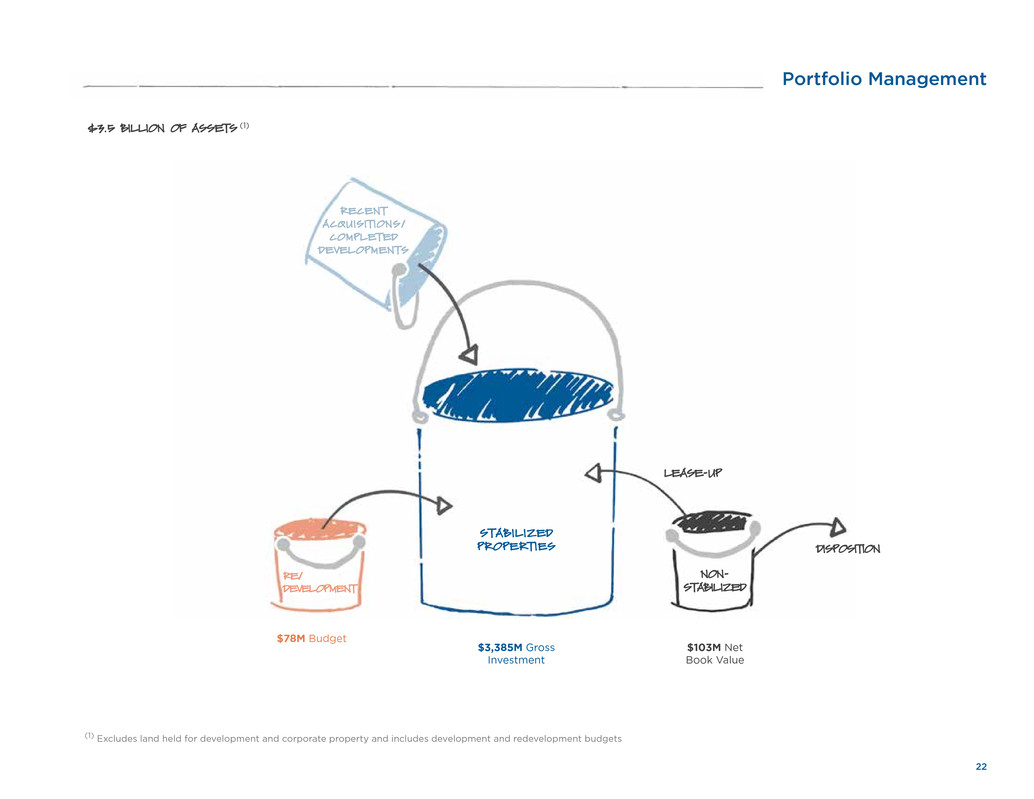

Portfolio Management

$3.5 BILLION OF ASSETS (1)

NON-

STABILIZED

STABILIZED

PROPERTIES

LEASE-UP

RECENT

ACQUISIT IONS/

COMPLETED

DEVELOPMENTS

DISPOSITION

(1) Excludes land held for development and corporate property and includes development and redevelopment budgets

$78M Budget

$3,385M Gross

Investment

$103M Net

Book Value

RE/

DEVELOPMENT

23

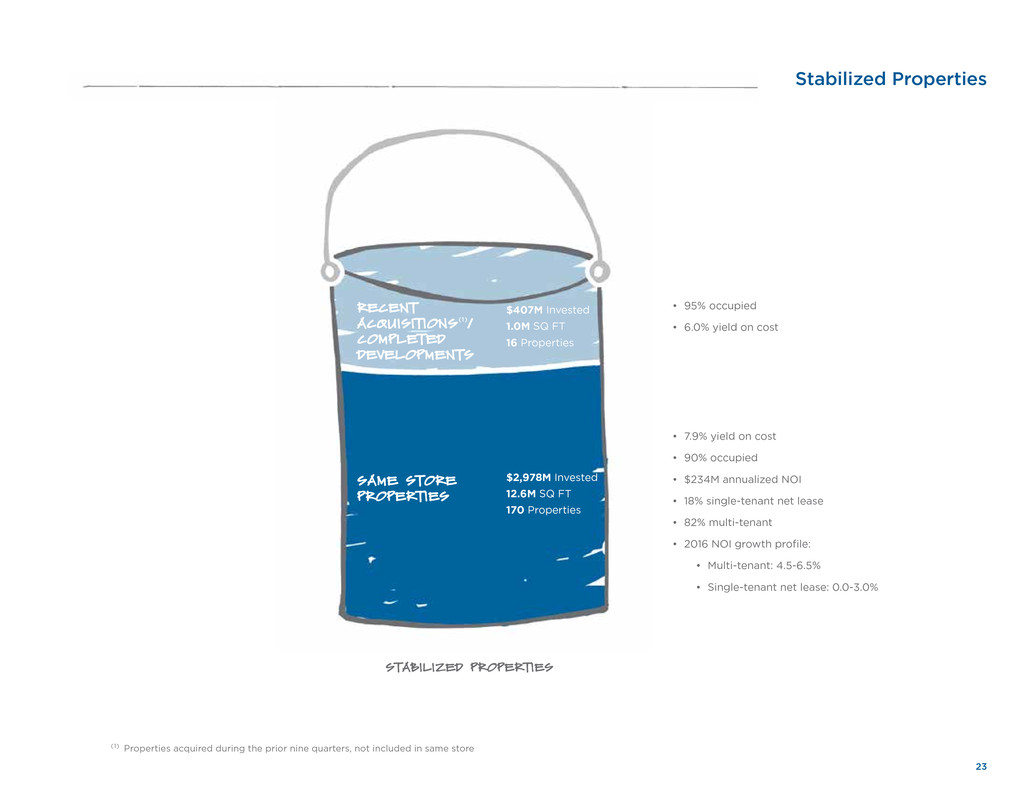

Stabilized Properties

STABILIZED PROPERTIES

• 7.9% yield on cost

• 90% occupied

• $234M annualized NOI

• 18% single-tenant net lease

• 82% multi-tenant

• 2016 NOI growth profile:

• Multi-tenant: 4.5-6.5%

• Single-tenant net lease: 0.0-3.0%

• 95% occupied

• 6.0% yield on cost

RECENT

ACQUISIT IONS (1)/

COMPLETED

DEVELOPMENTS

SAME STORE

PROPERTIES

$407M Invested

1.0M SQ FT

16 Properties

$2,978M Invested

12.6M SQ FT

170 Properties

(1) Properties acquired during the prior nine quarters, not included in same store

24

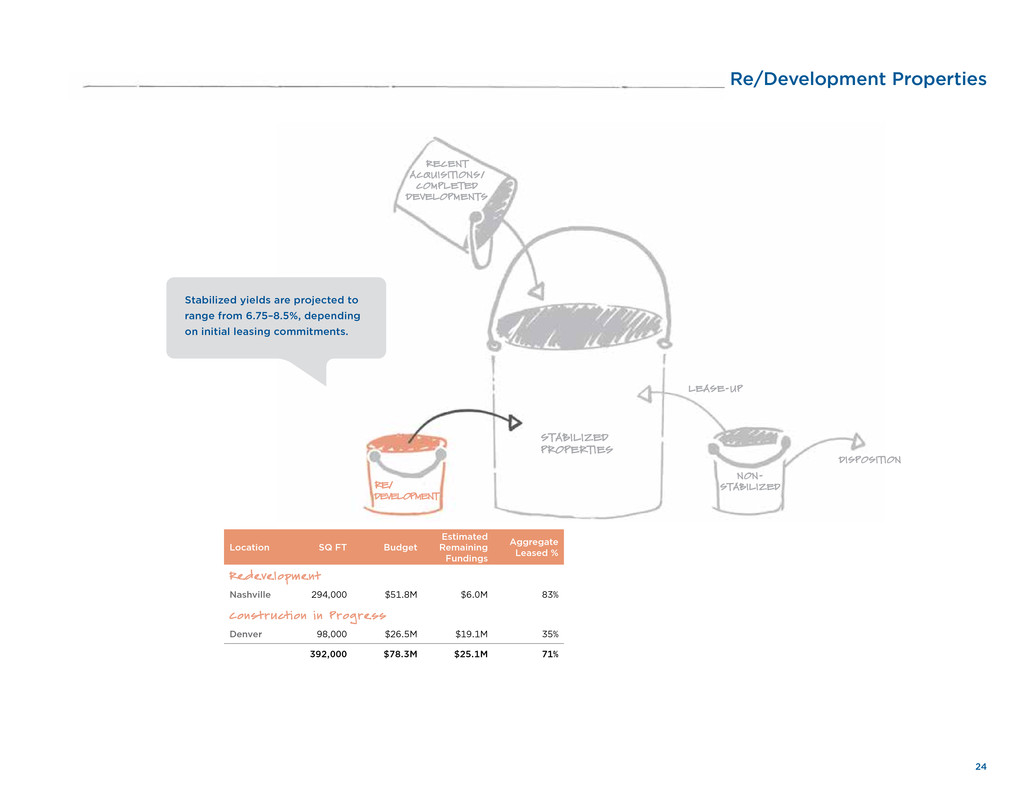

Re/Development Properties

NON-

STABILIZED

STABILIZED

PROPERTIES

LEASE-UP

RECENT

ACQUISIT IONS/

COMPLETED

DEVELOPMENTS

DISPOSIT ION

Stabilized yields are projected to

range from 6.75–8.5%, depending

on initial leasing commitments.

RE/

DEVELOPMENT

Location SQ FT Budget

Estimated

Remaining

Fundings

Aggregate

Leased %

Redevelopment

Nashville 294,000 $51.8M $6.0M 83%

Construction in Progress

Denver 98,000 $26.5M $19.1M 35%

392,000 $78.3M $25.1M 71%

25

Non-Stabilized Assets

NON-

STABILIZED

STABILIZED

PROPERTIES

LEASE-UP

RECENT

ACQUISIT IONS/

COMPLETED

DEVELOPMENTS

DISPOSITION

Through routine asset management,

Healthcare Realty recycles capital into

new assets. The Company projects

$50M–$75M in dispositions in 2016 with a

blended cap rate range of 7.5-8.5%.

RE/

DEVELOPMENT

(1) Reflects Net Book Value

REPOSITION ASSETS HELD

FOR SALE Positive NOI Negative NOI

Investment (1) $74.4M $14.4M $14.3M

Occupancy 69% 32% 88%

3Q16 NOI Annualized $4.1M ($0.7M) $2.3M

# of properties 10 6 3

SQ FT 702k 250k 128k

$23.9M sales price

116k square feet

2 properties

2016 DISPOSITIONS

26

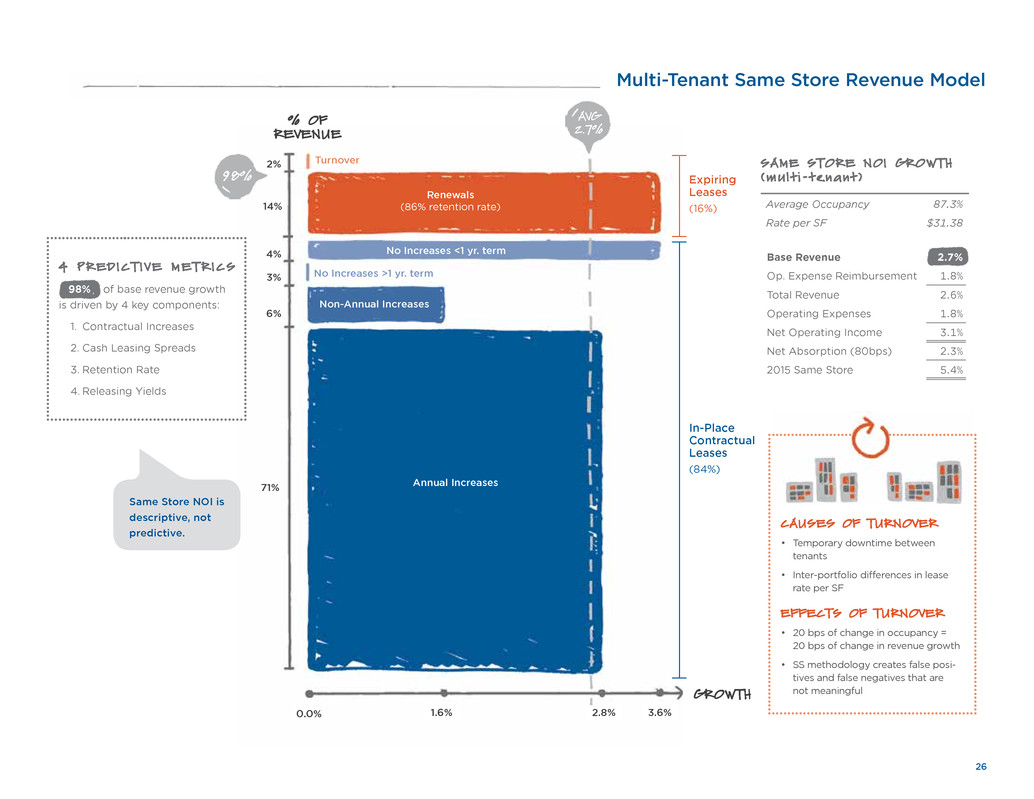

Multi-Tenant Same Store Revenue Model

CAUSES OF TURNOVER

• Temporary downtime between

tenants

• Inter-portfolio differences in lease

rate per SF

EFFECTS OF TURNOVER

• 20 bps of change in occupancy =

20 bps of change in revenue growth

• SS methodology creates false posi-

tives and false negatives that are

not meaningful

2.8%

No Increases <1 yr. term

Renewals

(86% retention rate)

Turnover

Expiring

Leases

(16%)

In-Place

Contractual

Leases

(84%)

No Increases >1 yr. term

% OF

REVENUE

Non-Annual Increases

1.6%0.0%

98%

71%

6%

3%

4%

14%

2%

AVG

2.7%

Annual Increases

3.6%

Average Occupancy 87.3%

Rate per SF $31.38

Base Revenue 2.7%

Op. Expense Reimbursement 1.8%

Total Revenue 2.6%

Operating Expenses 1.8%

Net Operating Income 3.1%

Net Absorption (80bps) 2.3%

2015 Same Store 5.4%

SAME STORE NO I GROWTH

(mu l t i - tenant )

GROWTH

98% of base revenue growth

is driven by 4 key components:

1. Contractual Increases

2. Cash Leasing Spreads

3. Retention Rate

4. Releasing Yields

4 P RE D I C T I V E ME T R I C S

Same Store NOI is

descriptive, not

predictive.

27

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2 0 1 3 2 0 1 4 2 0 1 5 2016

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2 0 1 3 2 0 1 4 2 0 1 5 2016

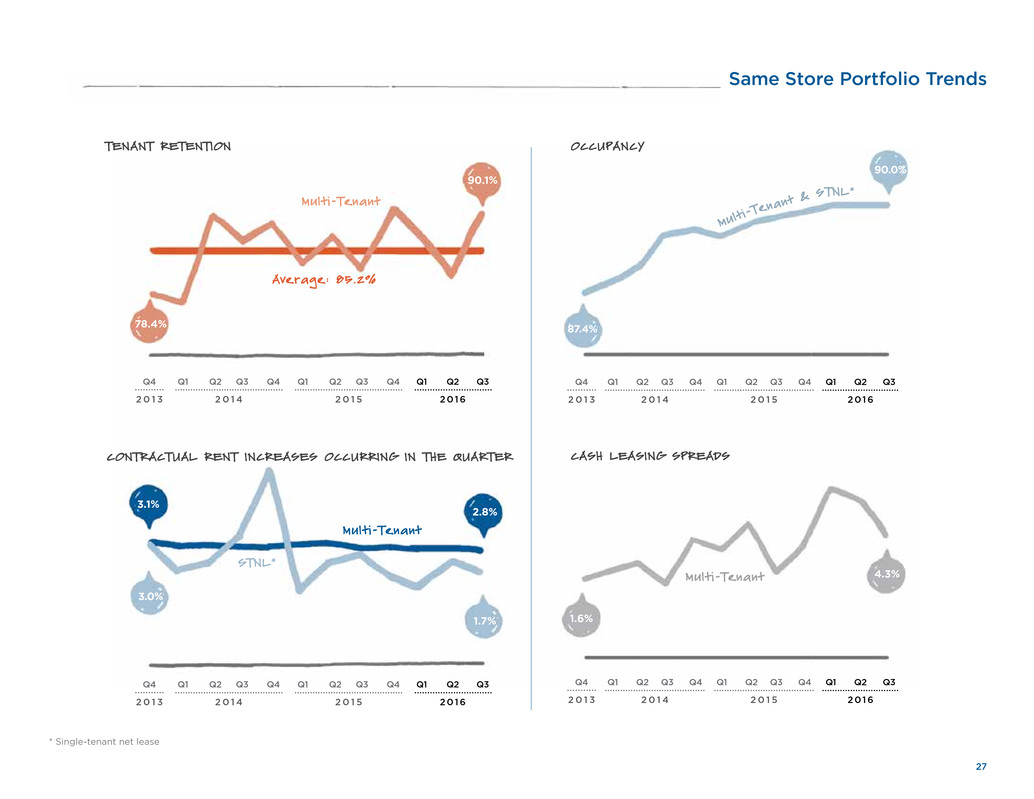

Same Store Portfolio Trends

* Single-tenant net lease

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2 0 1 3 2 0 1 4 2 0 1 5 2016

TENANT RETENTION OCCUPANCY

CONTRACTUAL RENT INCREASES OCCURRING IN THE QUARTER CASH LEASING SPREADS

3.0%

78.4%

3.1%

87.4%

90.0%

4.3%

90.1%

1.7%

Mult i-Tenant

Average: 85.2%

Mult i-Tenant

STNL*

Mult i-Tenant

2.8%

1.6%

Mult

i-Ten

ant &

STNL*

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2 0 1 3 2 0 1 4 2 0 1 5 2016

28

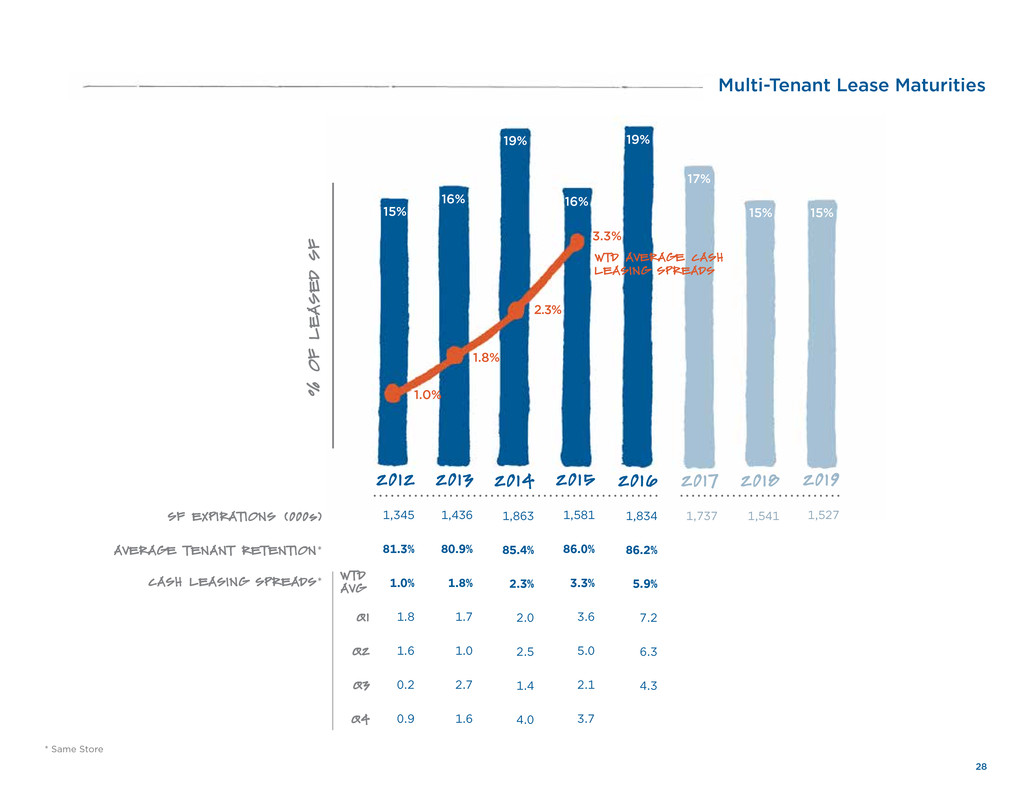

2012

1,345

81.3%

1.0%

1.8

1.6

0.2

0.9

2013

1,436

80.9%

1.8%

1.7

1.0

2.7

1.6

2014

1,863

85.4%

2.3%

2.0

2.5

1.4

4.0

2015

1,581

86.0%

3.3%

3.6

5.0

2.1

3.7

2016

1,834

86.2%

5.9%

7.2

6.3

4.3

2017

1,737

%

O

F

L

E

A

S

E

D

S

F

SF EXPIRATIONS (000s)

AVERAGE TENANT RETENTION*

CASH LEASING SPREADS*

Multi-Tenant Lease Maturities

WTD AVERAGE CASH

LEASING SPREADS

1.0%

1.8%

3.3%

2018

1,541

WTD

AVG

Q1

Q2

Q3

Q4

2019

1,527

* Same Store

2.3%

15%

16%

19%

16%

19%

17%

15% 15%

29

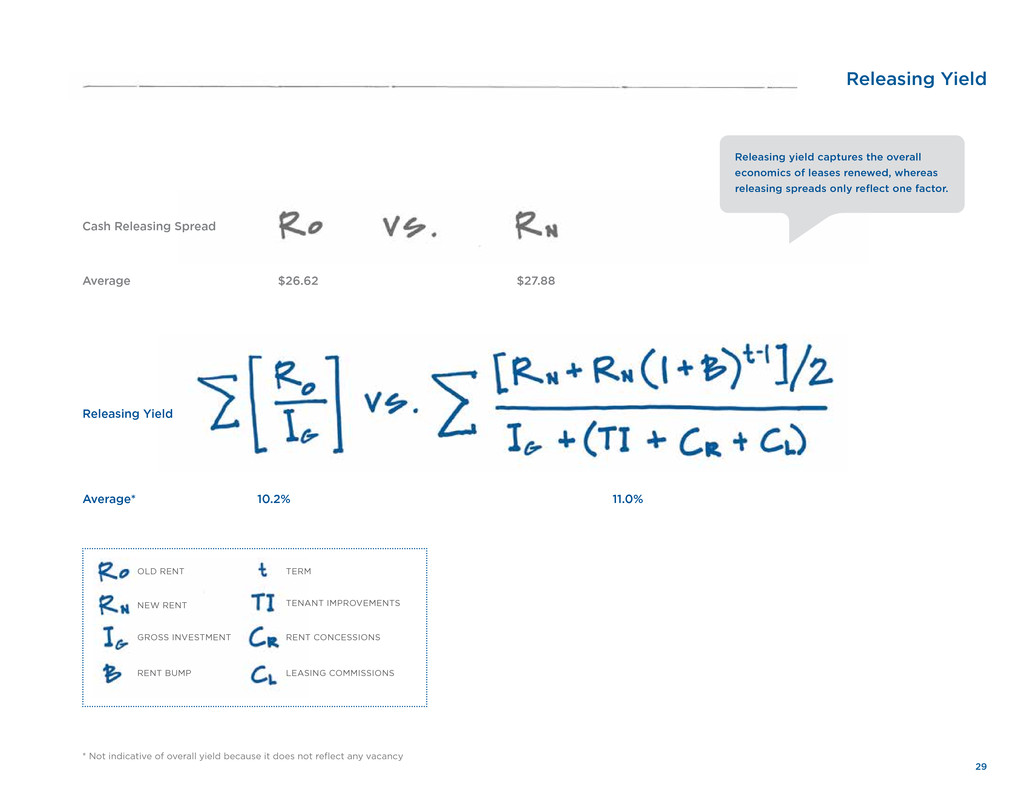

OLD RENT TERM

NEW RENT TENANT IMPROVEMENTS

GROSS INVESTMENT RENT CONCESSIONS

RENT BUMP LEASING COMMISSIONS

Cash Releasing Spread

Average

Releasing Yield

Average*

Releasing Yield

10.2% 11.0%

$26.62 $27.88

* Not indicative of overall yield because it does not reflect any vacancy

Releasing yield captures the overall

economics of leases renewed, whereas

releasing spreads only reflect one factor.

30

<0% 0%

50%

1% 2% 3% 4% 5% >6%

2012

WTD AVG

1.0%

2014

WTD AVG

2.3%

2016

WTD AVG

5.9%

0%

40%

30%

20%

10%

6%

CASH LEAS ING

SPREAD

D ISTR IBUT ION

2016 YTD

2014

2012

1%

18%

22%

13%

31%

44%

49%

30%

22%

37%

21%

12%

2012

2014

20

16

20

16

20

14

201

2

Cash Leasing Spread Distribution

31

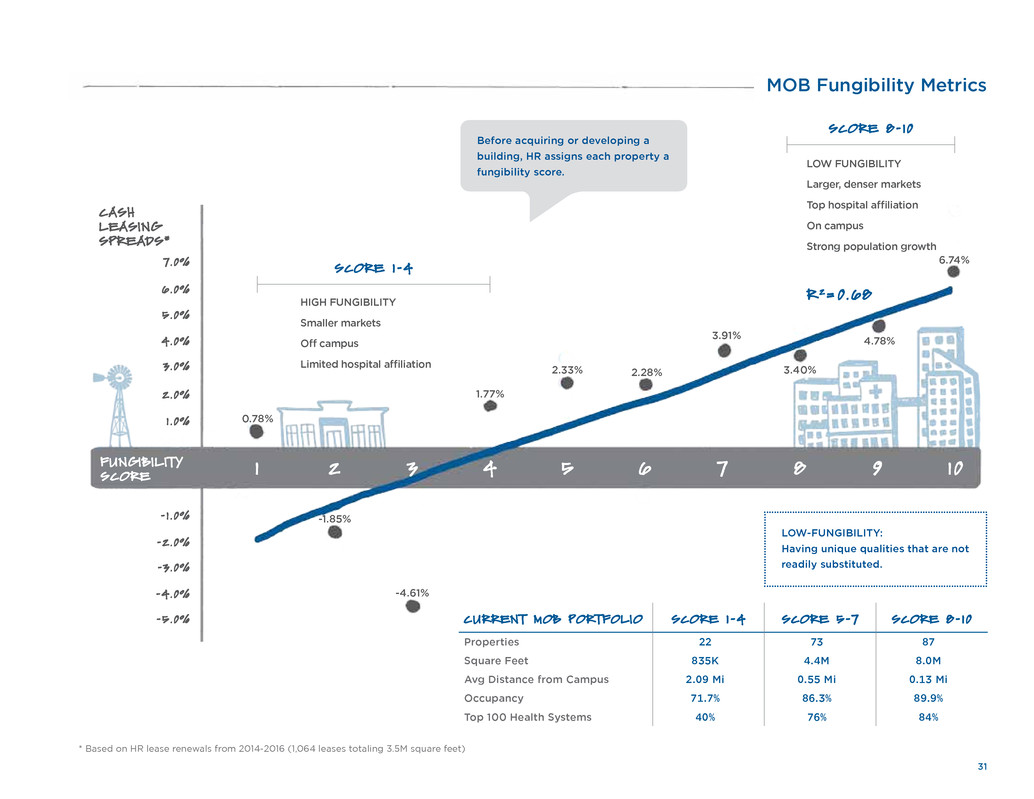

MOB Fungibility Metrics

-1 .0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

FUNGIBILITY

SCORE 1 2 3 4 5 6 7 8 9 10

CASH

LEASING

SPREADS*

* Based on HR lease renewals from 2014-2016 (1,064 leases totaling 3.5M square feet)

CURRENT MOB PORTFOLIO SCORE 1-4 SCORE 5-7 SCORE 8-10

Properties 22 73 87

Square Feet 835K 4.4M 8.0M

Avg Distance from Campus 2.09 Mi 0.55 Mi 0.13 Mi

Occupancy 71.7% 86.3% 89.9%

Top 100 Health Systems 40% 76% 84%

HIGH FUNGIBILITY

Smaller markets

Off campus

Limited hospital affiliation

SCORE 1-4

LOW FUNGIBILITY

Larger, denser markets

Top hospital affiliation

On campus

Strong population growth

SCORE 8-10

LOW-FUNGIBILITY:

Having unique qualities that are not

readily substituted.

Before acquiring or developing a

building, HR assigns each property a

fungibility score.

0.78%

-1.85%

-4.61%

1.77%

2.33% 2.28%

3.91%

3.40%

4.78%

6.74%7.0%

-2.0%

-3.0%

-4.0%

-5.0%

R 2= 0.68

32

HR MOB Portfolio Evolution

1

2

3

4

5

6

7

8

9

10

2006

F

U

N

G

IB

IL

IT

Y

S

C

O

R

E

20 1 1 2016

SF CHANGE

(2006-2016)

7.3%

24.2%

29.0%

14.2%

13.2%

5.9%

2.7%

2.1%

1.4%

0.1%

6.2%

23.0%

19.9%

9.9%

13.8%

8.6%

9.2%

5.1%

2.5%

1.7%

5.5%

22.8%

18.9%

8.4%

11.4%

12.3%

8.1%

6.7%

3.5%

2.5%

+ 497K

+ 1.3M

+ 2.2M

+ 1.2M

+ 780K

- 268K

- 336K

- 296K

- 114K

- 191K

WTD AVG

6.5

WTD AVG

6.8

WTD AVG

7.5

100% 100% 100%

8,504,364 SF 12,648,255 SF 13,244,839 SF 4,740,475 SF

33

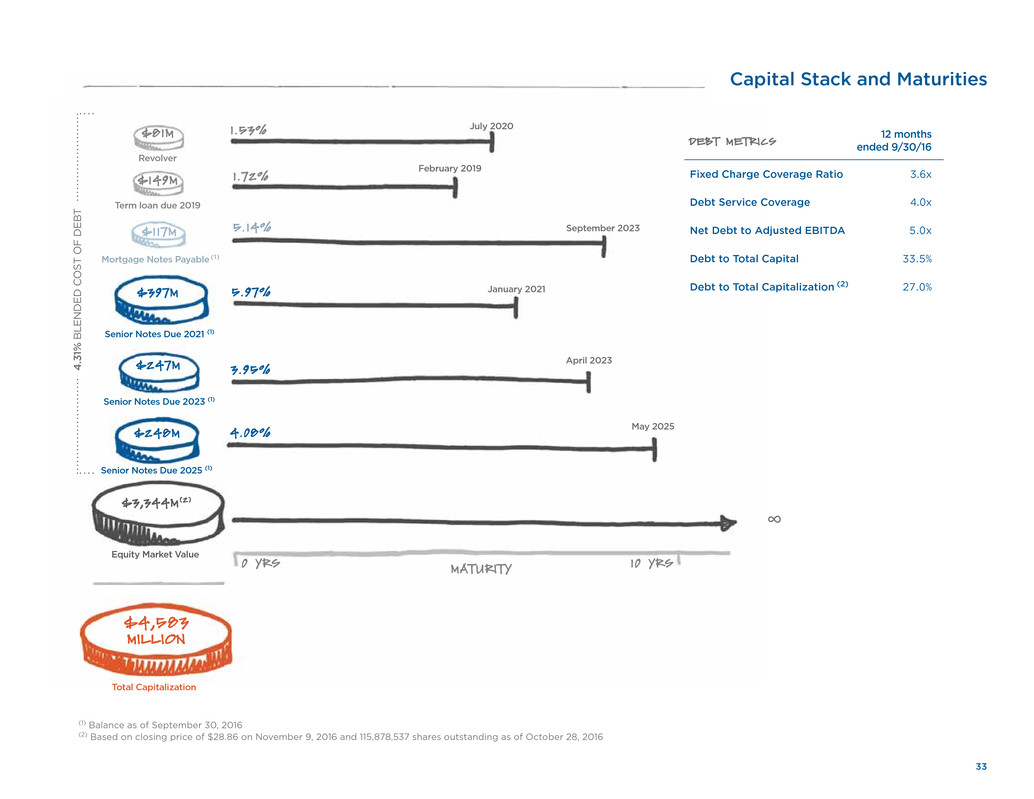

Capital Stack and Maturities

$81M

$247M

$248M

$397M

$117M

$3,344M(2)

Revolver

Senior Notes Due 2023 (1)

Senior Notes Due 2025 (1)

Senior Notes Due 2021 (1)

Mortgage Notes Payable (1)

Equity Market Value

$4,583

MILLION

July 2020

May 2025

1 .53%

January 2021

April 2023

September 2023

∞

0 YRS 10 YRS

4.08%

5.97%

3.95%

5.14%

(1) Balance as of September 30, 2016

(2) Based on closing price of $28.86 on November 9, 2016 and 115,878,537 shares outstanding as of October 28, 2016

DEBT METRICS 12 months ended 9/30/16

Fixed Charge Coverage Ratio 3.6x

Debt Service Coverage 4.0x

Net Debt to Adjusted EBITDA 5.0x

Debt to Total Capital 33.5%

Debt to Total Capitalization (2) 27.0%

MATURITY

Total Capitalization

4

.3

1%

B

LE

N

D

E

D

C

O

ST

O

F

D

E

B

T

$149M

Term loan due 2019

February 2019

1 .72%

34

Healthcare Realty

Healthcare Realty Trust is a real estate investment trust that integrates owning, managing, financing

and developing real estate properties associated primarily with the delivery of outpatient healthcare

services throughout the United States. As of September 30, 2016, the Company had investments of

approximately $3.5 billion in 202 real estate properties located in 29 states totalling approximately

14.5 million square feet. The Company provided leasing and property management services to approxi-

mately 10.1 million square feet nationwide.