Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Axos Financial, Inc. | bofi20170201.pdf |

| 8-K - 8-K - Axos Financial, Inc. | a8-k20170201februaryinvest.htm |

0 NASDAQ: BOFI

February 2017

BOFI HOLDING, INC.

Investor Presentation

1

Safe Harbor

This presentation contains forward-looking

statements within the meaning of the Private

Securities Litigation Reform Act of 1995 (the

“Reform Act”). The words “believe,” “expect,”

“anticipate,” “estimate,” “project,” or the

negation thereof or similar expressions

constitute forward-looking statements within

the meaning of the Reform Act. These

statements may include, but are not limited

to, projections of revenues, income or loss,

estimates of capital expenditures, plans for

future operations, products or services, and

financing needs or plans, as well as

assumptions relating to these matters. Such

statements involve risks, uncertainties and other factors that may cause actual results, performance or

achievements of the Company and its subsidiaries to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking statements. For a

discussion of these factors, we refer you to the Company's reports filed with the Securities and

Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2016.

In light of the significant uncertainties inherent in the forward-looking statements included herein, the

inclusion of such information should not be regarded as a representation by the Company or by any

other person or entity that the objectives and plans of the Company will be achieved. For all forward-

looking statements, the Company claims the protection of the safe-harbor for forward-looking

statements contained in the Reform Act.

2

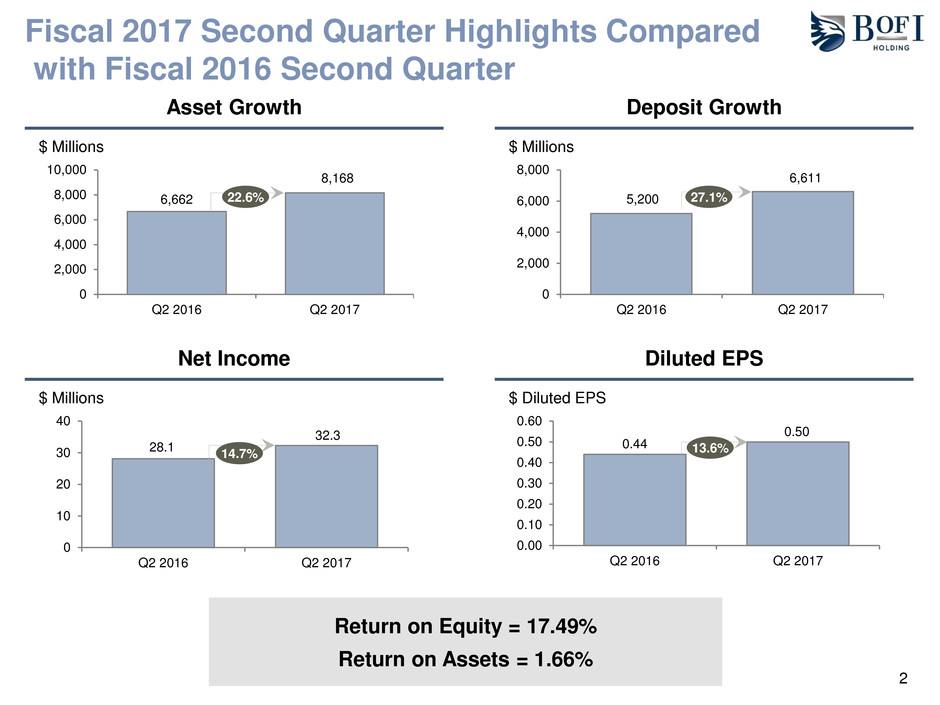

Fiscal 2017 Second Quarter Highlights Compared

with Fiscal 2016 Second Quarter

$ Millions

Asset Growth

$ Millions

Net Income

$ Millions

Deposit Growth

$ Diluted EPS

Diluted EPS

Return on Equity = 17.49%

Return on Assets = 1.66%

6,662

8,168

0

2,000

4,000

6,000

8,000

10,000

Q2 2016 Q2 2017

22.6% 5,200

6,611

0

2,000

4,000

6,000

8,000

Q2 2016 Q2 2017

27.1%

28.1

32.3

0

10

20

30

40

Q2 2016 Q2 2017

14.7%

0.44

0.50

0.00

0.10

0.20

0.30

0.40

0.50

0.60

Q2 2016 Q2 2017

13.6%

3

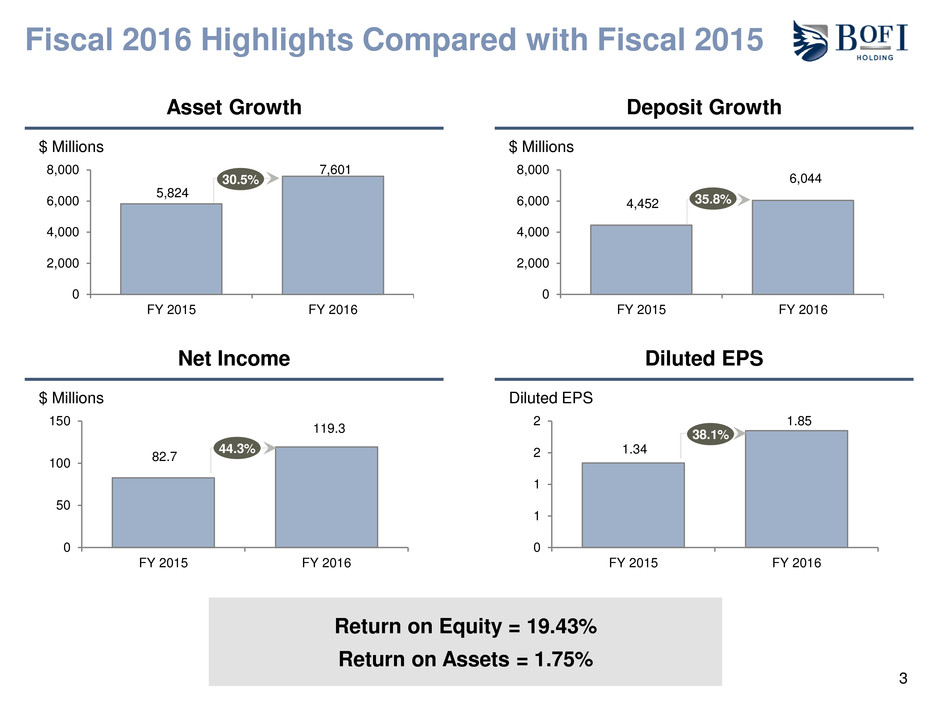

Fiscal 2016 Highlights Compared with Fiscal 2015

5,824

7,601

0

2,000

4,000

6,000

8,000

FY 2015 FY 2016

$ Millions

Asset Growth

30.5%

82.7

119.3

0

50

100

150

FY 2015 FY 2016

$ Millions

Net Income

44.3%

4,452

6,044

0

2,000

4,000

6,000

8,000

FY 2015 FY 2016

$ Millions

Deposit Growth

35.8%

1.34

1.85

0

1

1

2

2

FY 2015 FY 2016

Diluted EPS

Diluted EPS

38.1%

Return on Equity = 19.43%

Return on Assets = 1.75%

4

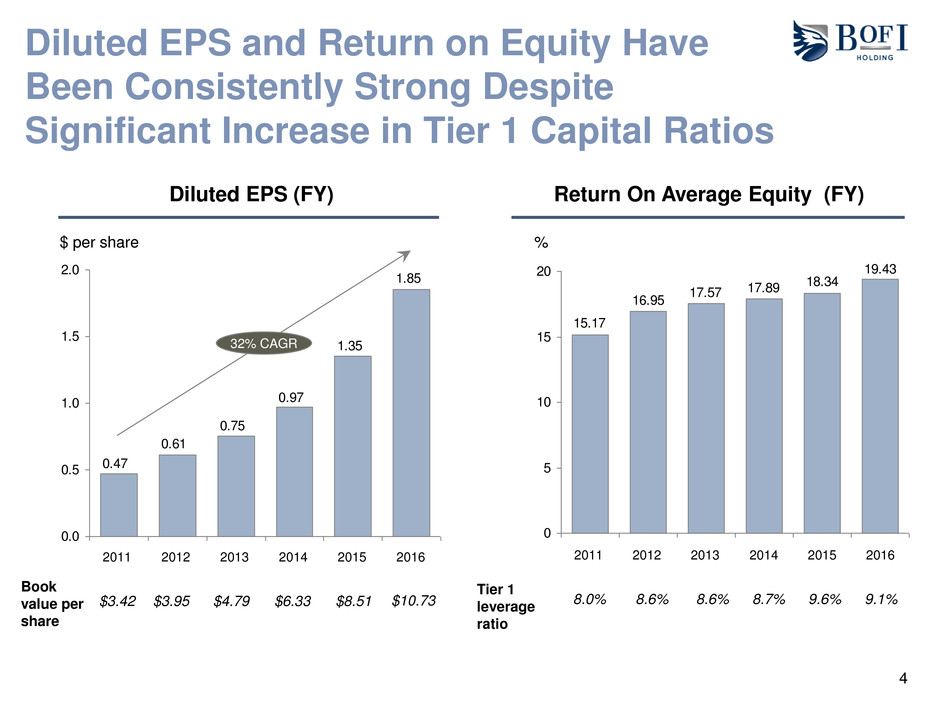

Diluted EPS and Return on Equity Have

Been Consistently Strong Despite

Significant Increase in Tier 1 Capital Ratios

Return On Average Equity (FY) Diluted EPS (FY)

1.85

1.35

0.97

0.75

0.61

0.47

0.0

0.5

1.0

1.5

2.0

2014

$ per share

2013 2011 2012 2016

32% CAGR

2015

19.43

18.3417.8917.57

16.95

15.17

0

5

10

15

20

2014

%

2013 2011 2012 2016 2015

Tier 1

leverage

ratio

8.0% 8.6% 8.6% 8.7% 9.6% 9.1%

Book

value per

share

$3.42 $3.95 $4.79 $6.33 $8.51 $10.73

5

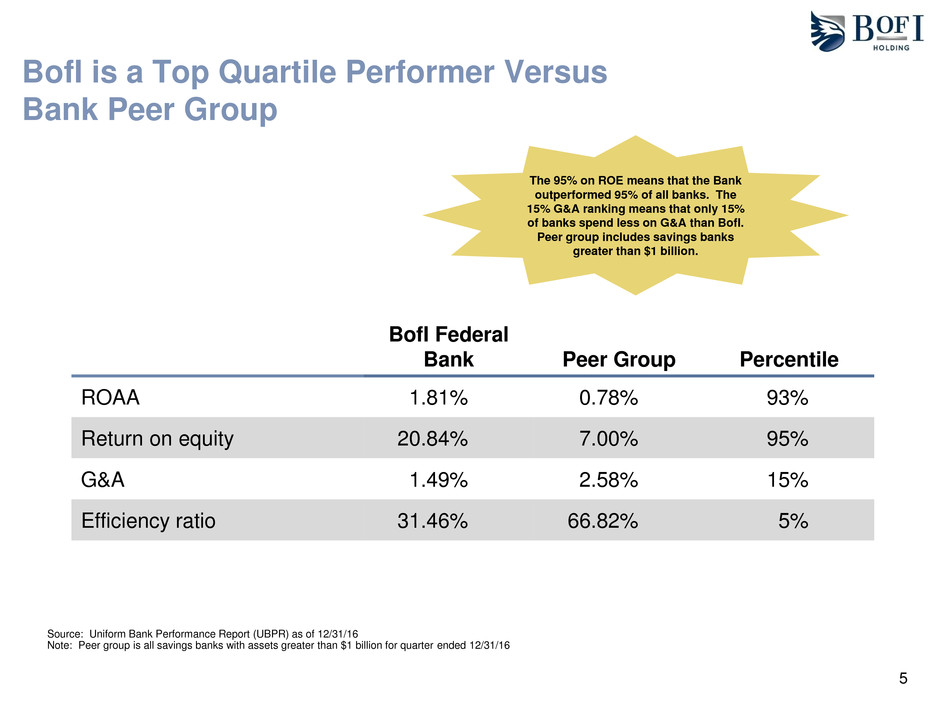

BofI is a Top Quartile Performer Versus

Bank Peer Group

BofI Federal

Bank Peer Group Percentile

ROAA 1.81% 0.78% 93%

Return on equity 20.84% 7.00% 95%

G&A 1.49% 2.58% 15%

Efficiency ratio 31.46% 66.82% 5%

Source: Uniform Bank Performance Report (UBPR) as of 12/31/16

Note: Peer group is all savings banks with assets greater than $1 billion for quarter ended 12/31/16

The 95% on ROE means that the Bank

outperformed 95% of all banks. The

15% G&A ranking means that only 15%

of banks spend less on G&A than BofI.

Peer group includes savings banks

greater than $1 billion.

6

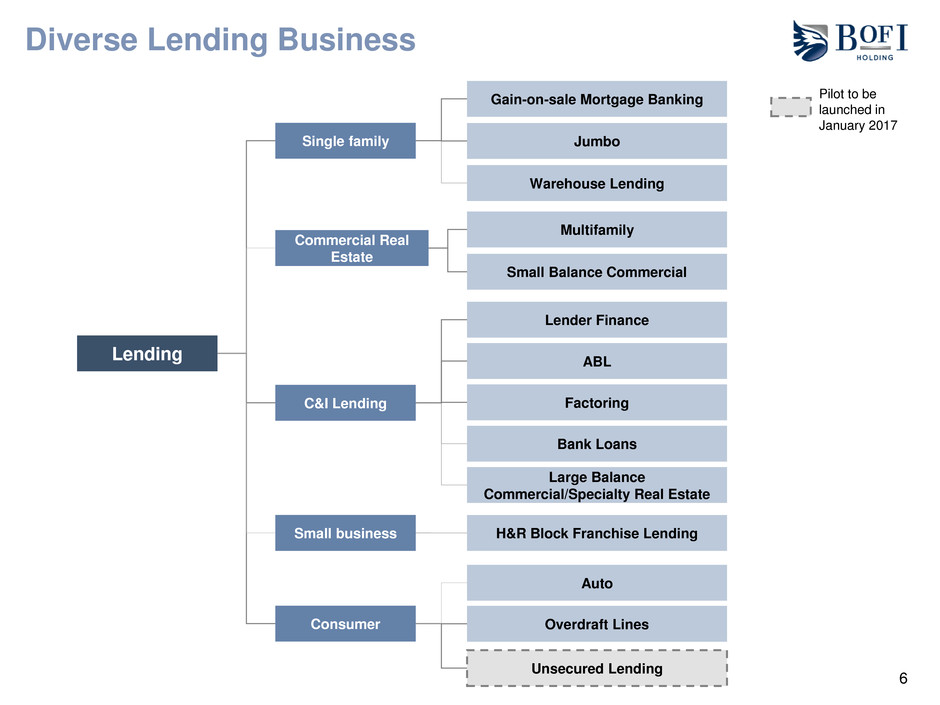

Diverse Lending Business

Lending

Single family

Commercial Real

Estate

C&I Lending

Consumer

Small business

Gain-on-sale Mortgage Banking

Jumbo

Multifamily

Small Balance Commercial

Lender Finance

ABL

Warehouse Lending

Factoring

Bank Loans

Auto

Overdraft Lines

Large Balance

Commercial/Specialty Real Estate

H&R Block Franchise Lending

Unsecured Lending

Pilot to be

launched in

January 2017

7

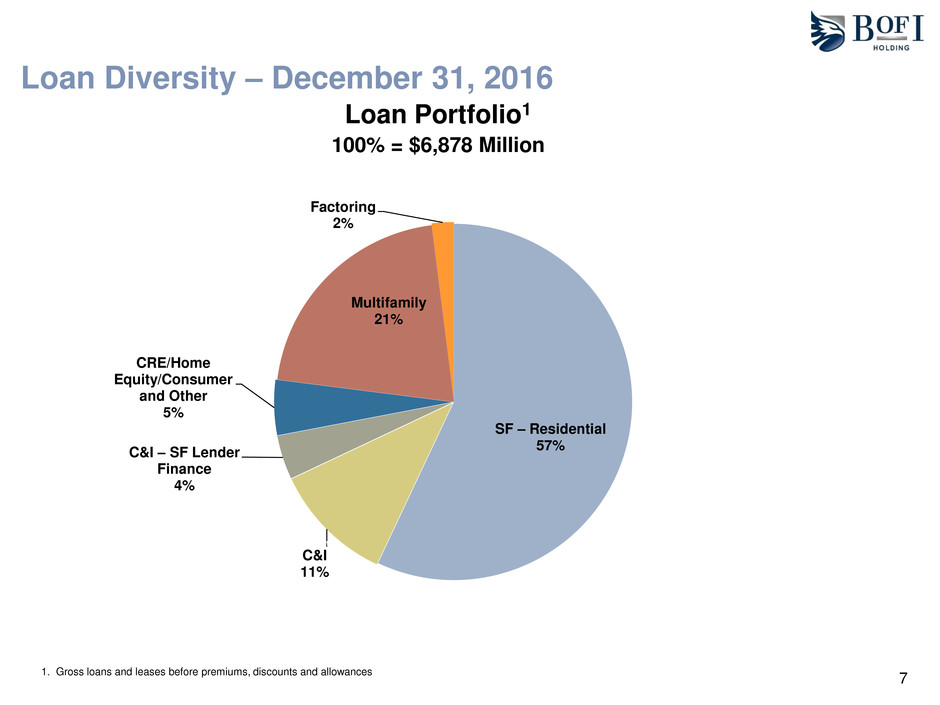

1. Gross loans and leases before premiums, discounts and allowances

Loan Portfolio1

100% = $6,878 Million

SF – Residential

57%

C&I

11%

C&I – SF Lender

Finance

4%

CRE/Home

Equity/Consumer

and Other

5%

Multifamily

21%

Factoring

2%

Loan Diversity – December 31, 2016

8

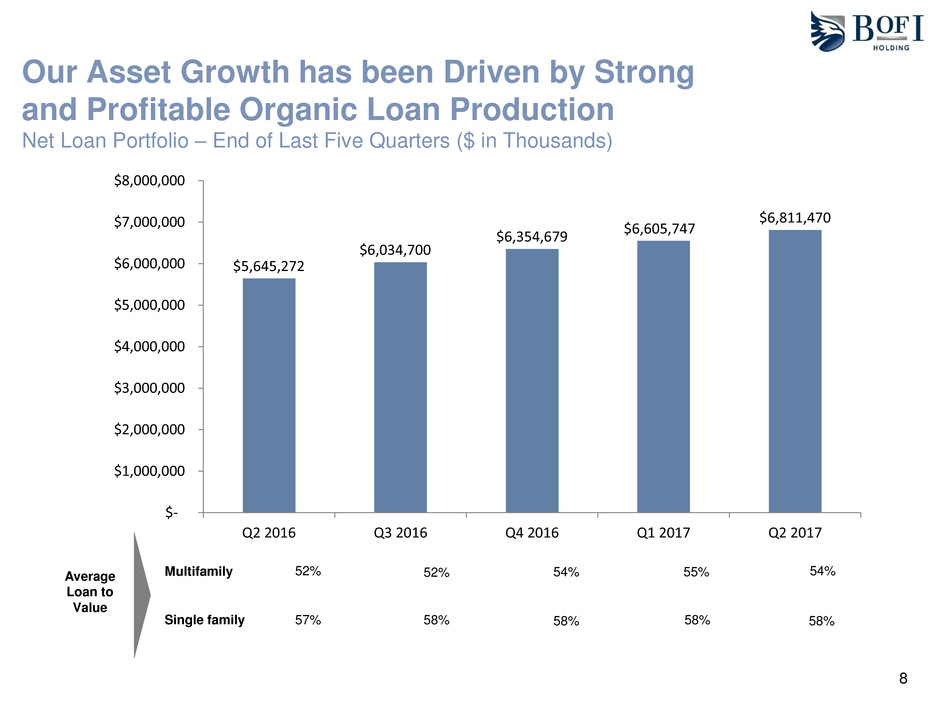

Our Asset Growth has been Driven by Strong

and Profitable Organic Loan Production

Net Loan Portfolio – End of Last Five Quarters ($ in Thousands)

Multifamily

Single family

52% 52% 54% 55% 54%

57% 58% 58% 58% 58%

Average

Loan to

Value

$5,645,272

$6,034,700

$6,354,679

$6,605,747

$6,811,470

$-

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

$8,000,000

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

9

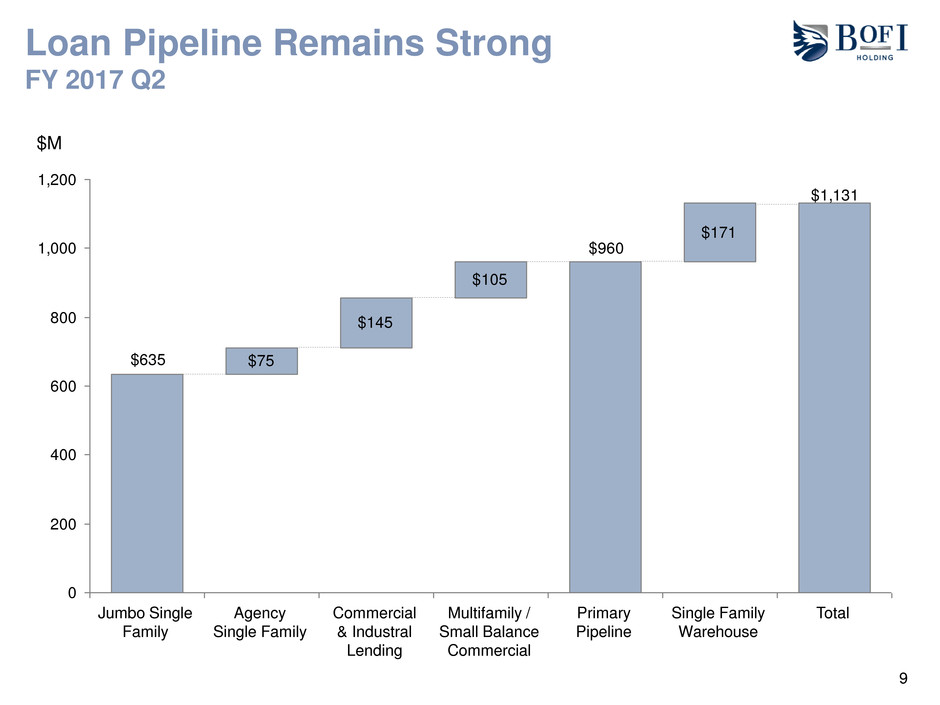

$1,131

$171

$960

$105

$145

$75$635

0

200

400

600

800

1,000

1,200

Loan Pipeline Remains Strong

FY 2017 Q2

Total Single Family

Warehouse

$M

Jumbo Single

Family

Agency

Single Family

Commercial

& Industral

Lending

Multifamily /

Small Balance

Commercial

Primary

Pipeline

10

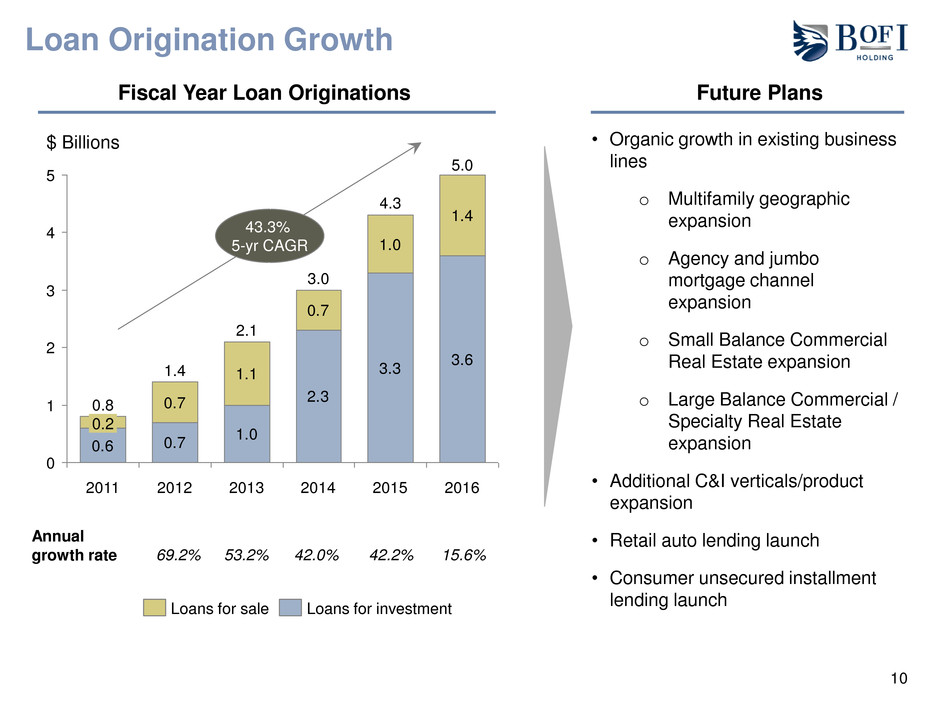

0.6 0.7

1.0

2.3

3.3

3.6

0.7

1.1

0.7

1.0

1.4

0

1

2

3

4

5

Loan Origination Growth

69.2% 53.2% 42.0% 42.2%

• Organic growth in existing business

lines

o Multifamily geographic

expansion

o Agency and jumbo

mortgage channel

expansion

o Small Balance Commercial

Real Estate expansion

o Large Balance Commercial /

Specialty Real Estate

expansion

• Additional C&I verticals/product

expansion

• Retail auto lending launch

• Consumer unsecured installment

lending launch

Annual

growth rate

Fiscal Year Loan Originations Future Plans

43.3%

5-yr CAGR

0.2

2.1

1.4

0.8

4.3

5.0

3.0

$ Billions

2011 2012 2013 2014 2015 2016

Loans for investment Loans for sale

15.6%

11

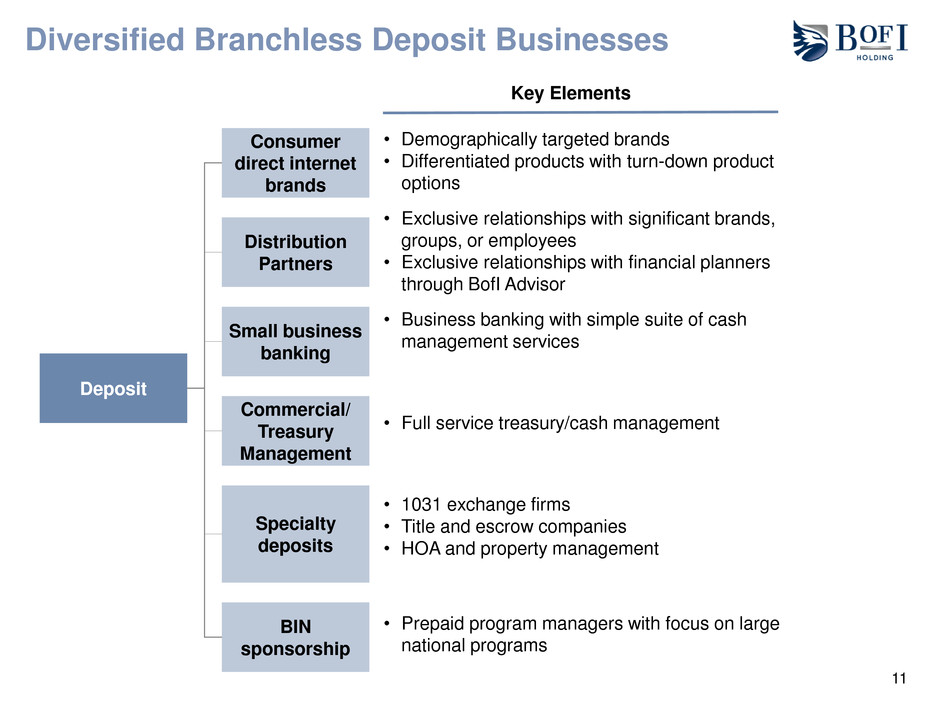

Diversified Branchless Deposit Businesses

Key Elements

Deposit

Consumer

direct internet

brands

Distribution

Partners

BIN

sponsorship

• Demographically targeted brands

• Differentiated products with turn-down product

options

Small business

banking

• Exclusive relationships with significant brands,

groups, or employees

• Exclusive relationships with financial planners

through BofI Advisor

• Business banking with simple suite of cash

management services

• Prepaid program managers with focus on large

national programs

Specialty

deposits

• 1031 exchange firms

• Title and escrow companies

• HOA and property management

Commercial/

Treasury

Management

• Full service treasury/cash management

12

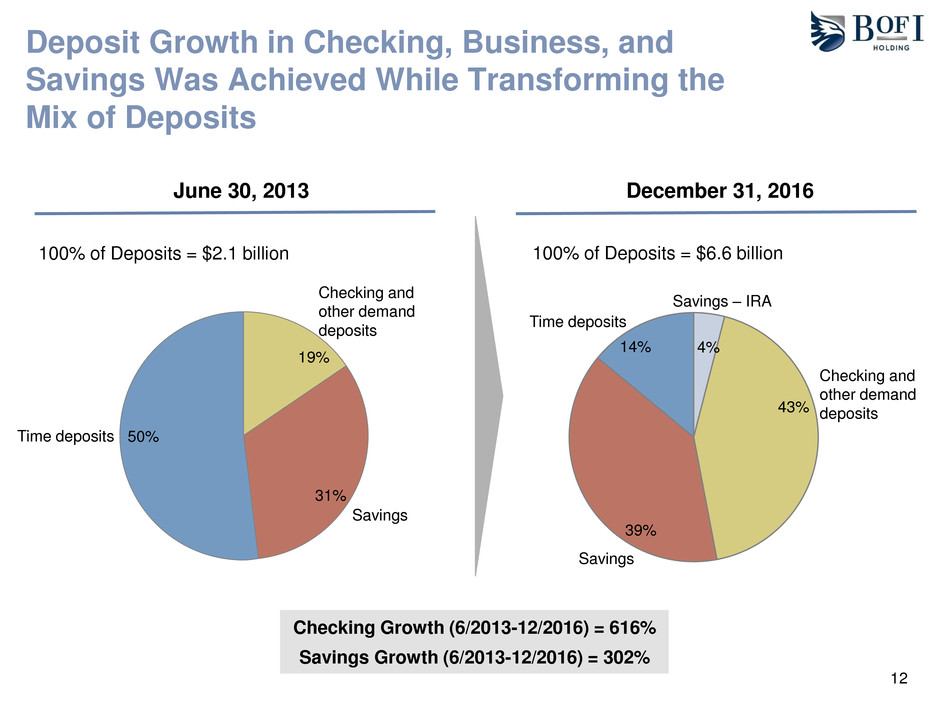

Deposit Growth in Checking, Business, and

Savings Was Achieved While Transforming the

Mix of Deposits

19%

Checking and

other demand

deposits

31%

Savings

Time deposits 50%

Checking and

other demand

deposits

Savings

Time deposits

June 30, 2013 December 31, 2016

Checking Growth (6/2013-12/2016) = 616%

Savings Growth (6/2013-12/2016) = 302%

100% of Deposits = $2.1 billion 100% of Deposits = $6.6 billion

Savings – IRA

43%

39%

14% 4%

13

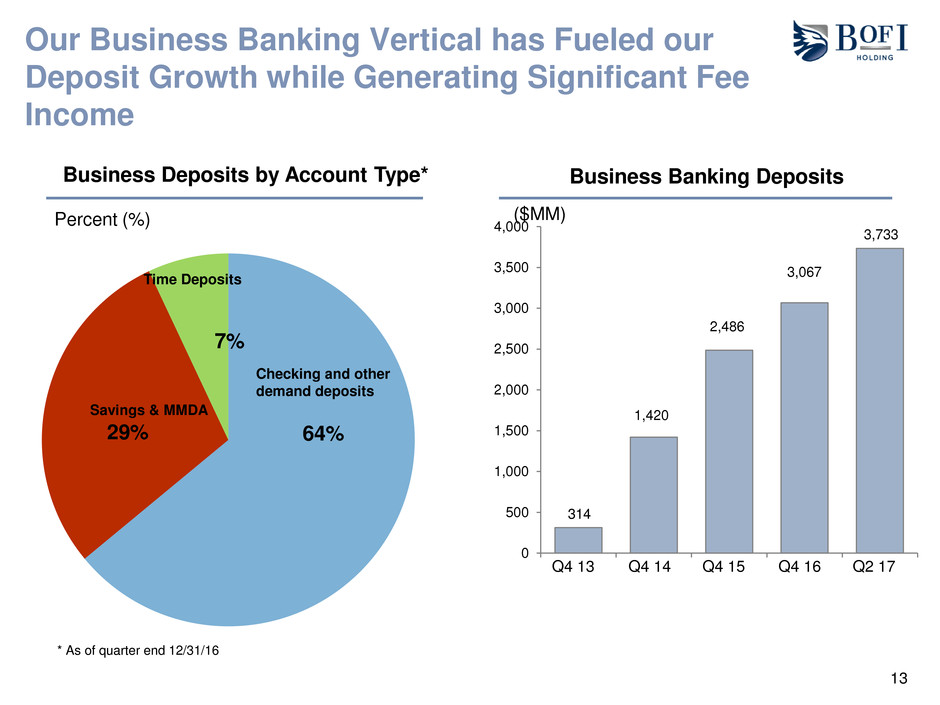

64% 29%

7%

314

1,420

2,486

3,067

3,733

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Business Deposits by Account Type* Business Banking Deposits

($MM)

Q4 13 Q4 14 Q4 15 Q4 16

Percent (%)

Q2 17

Our Business Banking Vertical has Fueled our

Deposit Growth while Generating Significant Fee

Income

Checking and other

demand deposits

Time Deposits

Savings & MMDA

* As of quarter end 12/31/16

14

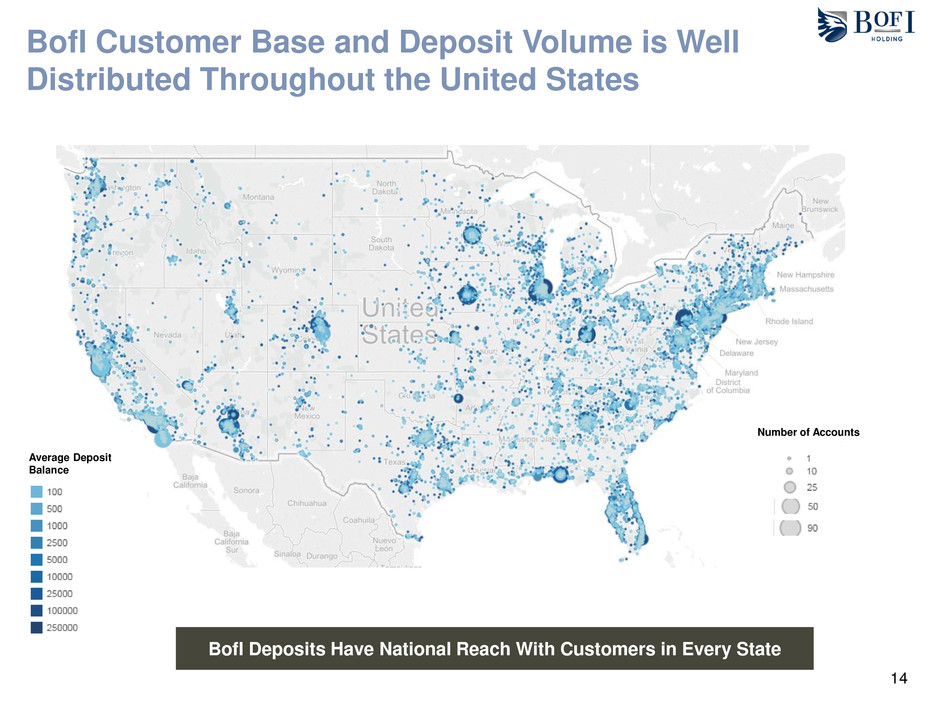

BofI Customer Base and Deposit Volume is Well

Distributed Throughout the United States

BofI Deposits Have National Reach With Customers in Every State

Average Deposit

Balance

Number of Accounts

15

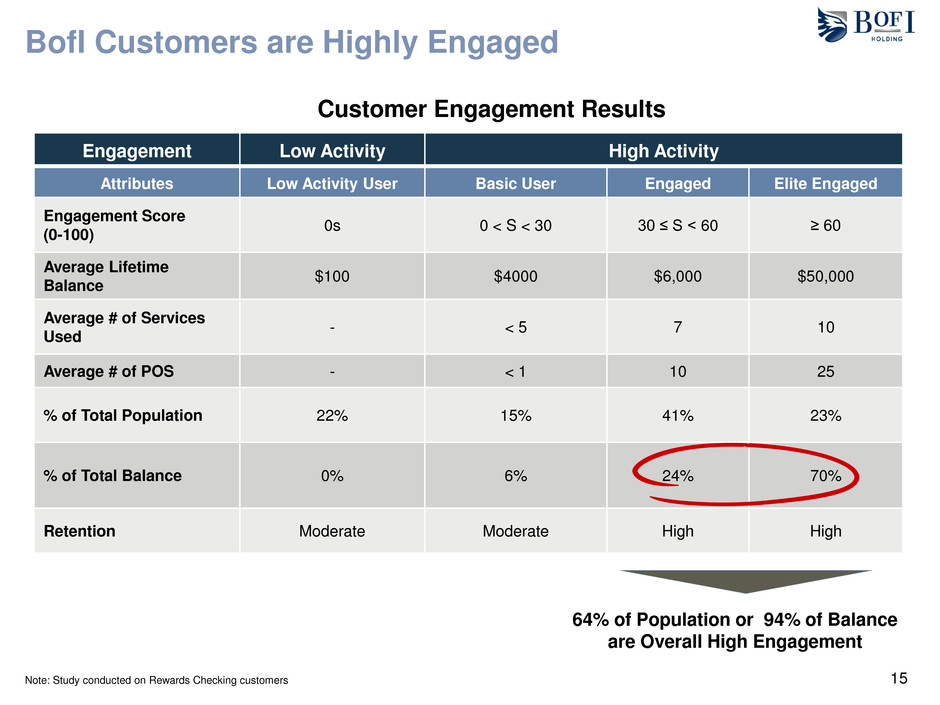

BofI Customers are Highly Engaged

Engagement Low Activity High Activity

Attributes Low Activity User Basic User Engaged Elite Engaged

Engagement Score

(0-100)

0s 0 < S < 30 30 ≤ S < 60 ≥ 60

Average Lifetime

Balance

$100 $4000 $6,000 $50,000

Average # of Services

Used

- < 5 7 10

Average # of POS - < 1 10 25

% of Total Population 22% 15% 41% 23%

% of Total Balance

0% 6% 24% 70%

Retention Moderate Moderate High High

Customer Engagement Results

Note: Study conducted on Rewards Checking customers

64% of Population or 94% of Balance

are Overall High Engagement

16

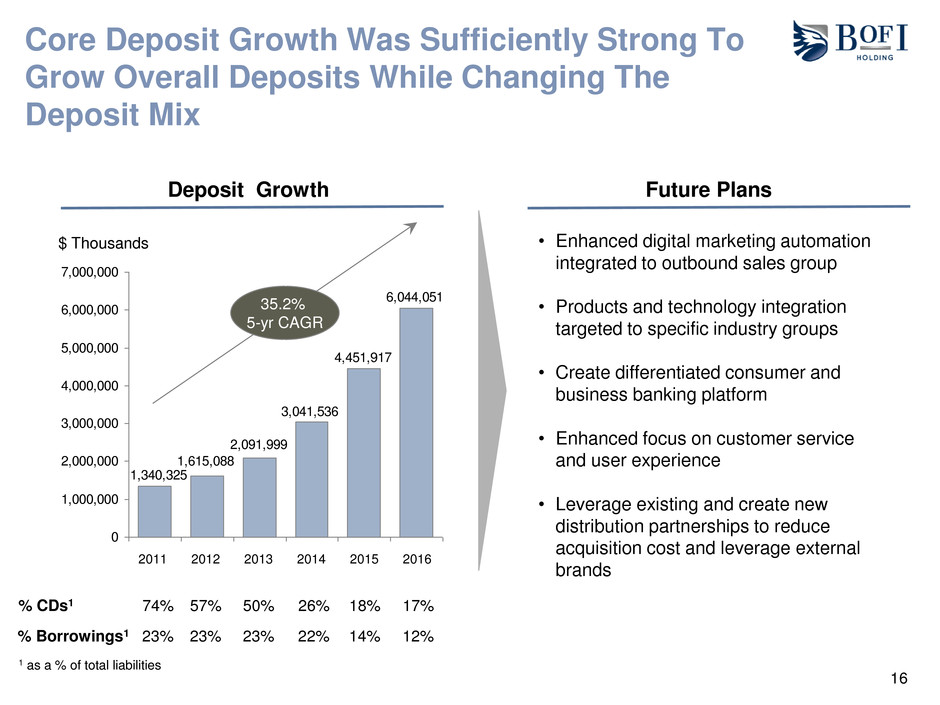

Core Deposit Growth Was Sufficiently Strong To

Grow Overall Deposits While Changing The

Deposit Mix

Deposit Growth Future Plans

• Enhanced digital marketing automation

integrated to outbound sales group

• Products and technology integration

targeted to specific industry groups

• Create differentiated consumer and

business banking platform

• Enhanced focus on customer service

and user experience

• Leverage existing and create new

distribution partnerships to reduce

acquisition cost and leverage external

brands

4,451,917

3,041,536

2,091,999

1,615,088

1,340,325

6,044,051

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

$ Thousands

2016

35.2%

5-yr CAGR

2015 2014 2013 2012 2011

% CDs1 74% 57% 50% 26% 18%

% Borrowings1 23% 23% 23% 22% 14%

17%

12%

1 as a % of total liabilities

17

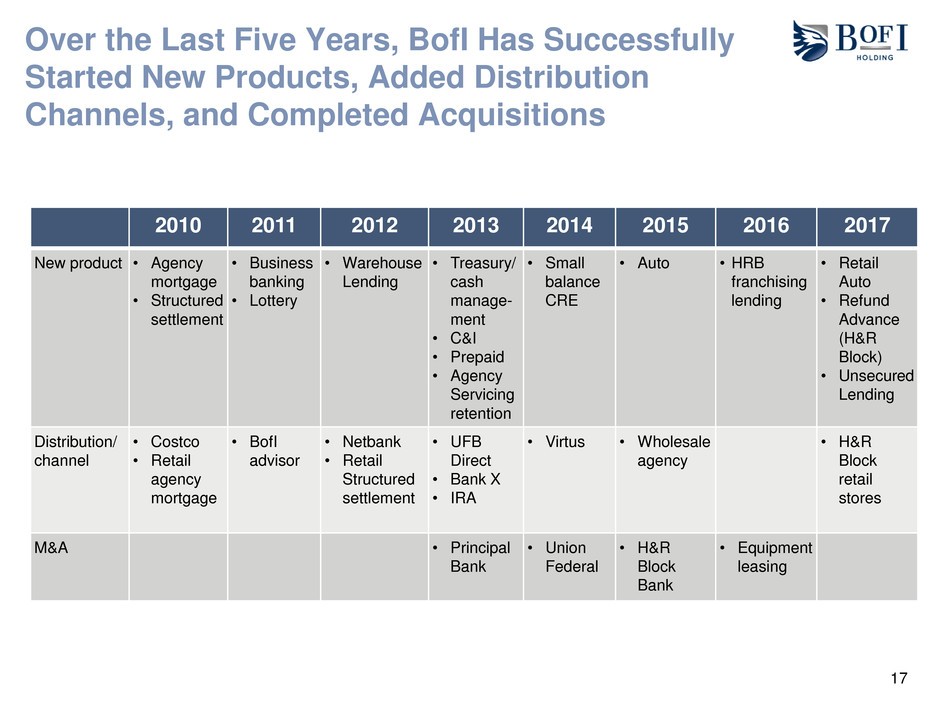

Over the Last Five Years, BofI Has Successfully

Started New Products, Added Distribution

Channels, and Completed Acquisitions

2010 2011 2012 2013 2014 2015 2016 2017

New product • Agency

mortgage

• Structured

settlement

• Business

banking

• Lottery

• Warehouse

Lending

• Treasury/

cash

manage-

ment

• C&I

• Prepaid

• Agency

Servicing

retention

• Small

balance

CRE

• Auto • HRB

franchising

lending

• Retail

Auto

• Refund

Advance

(H&R

Block)

• Unsecured

Lending

Distribution/

channel

• Costco

• Retail

agency

mortgage

• BofI

advisor

• Netbank

• Retail

Structured

settlement

• UFB

Direct

• Bank X

• IRA

• Virtus • Wholesale

agency

• H&R

Block

retail

stores

M&A • Principal

Bank

• Union

Federal

• H&R

Block

Bank

• Equipment

leasing

18

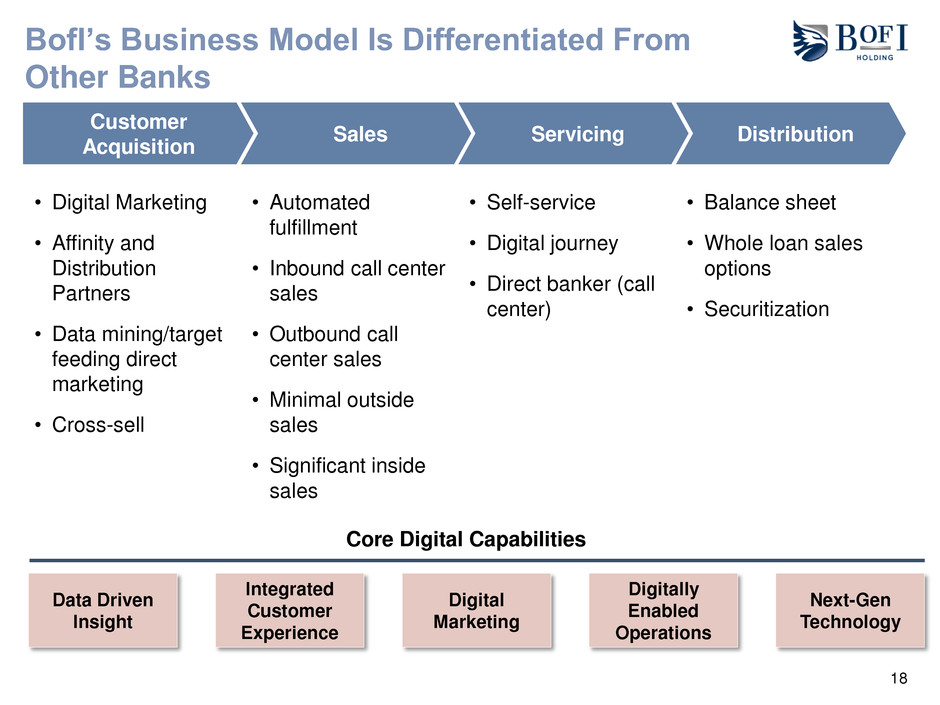

BofI’s Business Model Is Differentiated From

Other Banks

Customer

Acquisition

Sales Servicing Distribution

• Digital Marketing

• Affinity and

Distribution

Partners

• Data mining/target

feeding direct

marketing

• Cross-sell

• Automated

fulfillment

• Inbound call center

sales

• Outbound call

center sales

• Minimal outside

sales

• Significant inside

sales

• Self-service

• Digital journey

• Direct banker (call

center)

• Balance sheet

• Whole loan sales

options

• Securitization

Data Driven

Insight

Integrated

Customer

Experience

Digital

Marketing

Digitally

Enabled

Operations

Next-Gen

Technology

Core Digital Capabilities

19

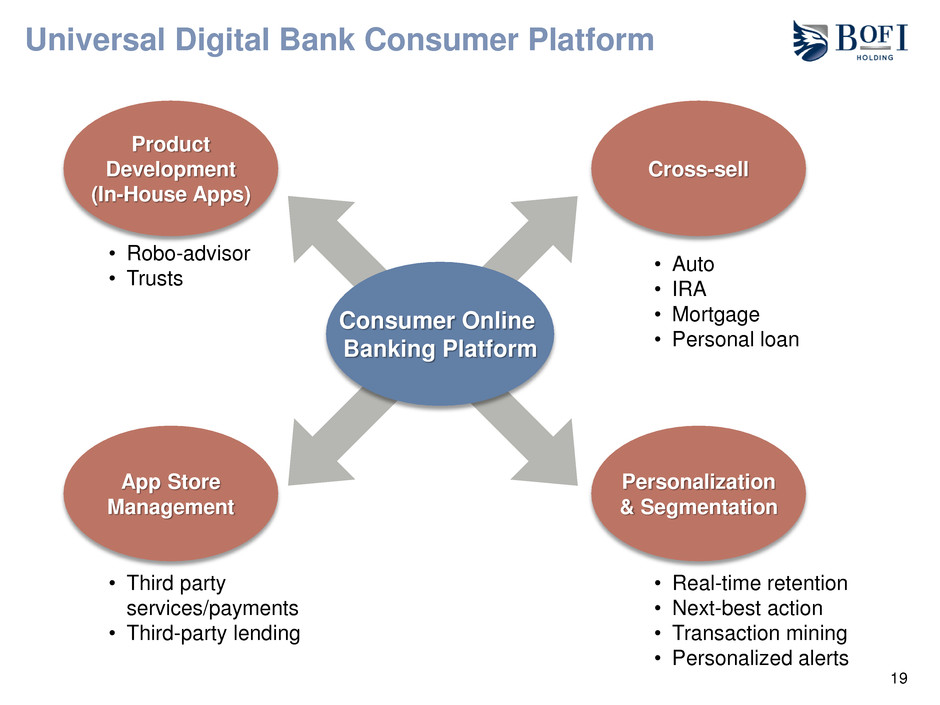

Universal Digital Bank Consumer Platform

Cross-sell

Product

Development

(In-House Apps)

Personalization

& Segmentation

App Store

Management

• Robo-advisor

• Trusts

• Third party

services/payments

• Third-party lending

• Auto

• IRA

• Mortgage

• Personal loan

• Real-time retention

• Next-best action

• Transaction mining

• Personalized alerts

Consumer Online

Banking Platform

20

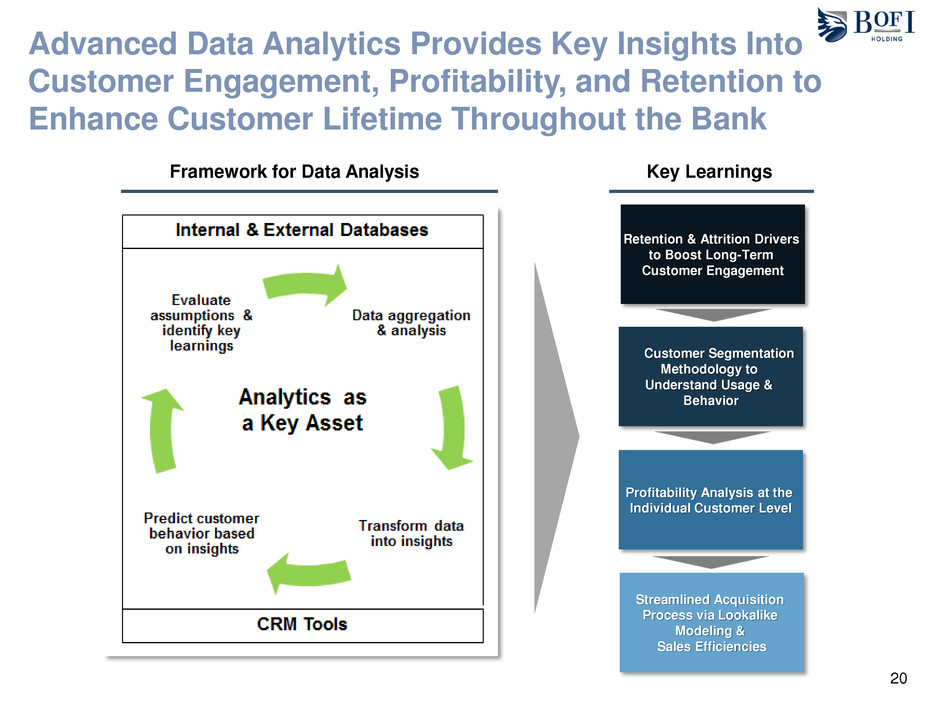

Advanced Data Analytics Provides Key Insights Into

Customer Engagement, Profitability, and Retention to

Enhance Customer Lifetime Throughout the Bank

Customer Segmentation

Methodology to

Understand Usage &

Behavior

Profitability Analysis at the

Individual Customer Level

Streamlined Acquisition

Process via Lookalike

Modeling &

Sales Efficiencies

Retention & Attrition Drivers

to Boost Long-Term

Customer Engagement

Key Learnings Framework for Data Analysis

21

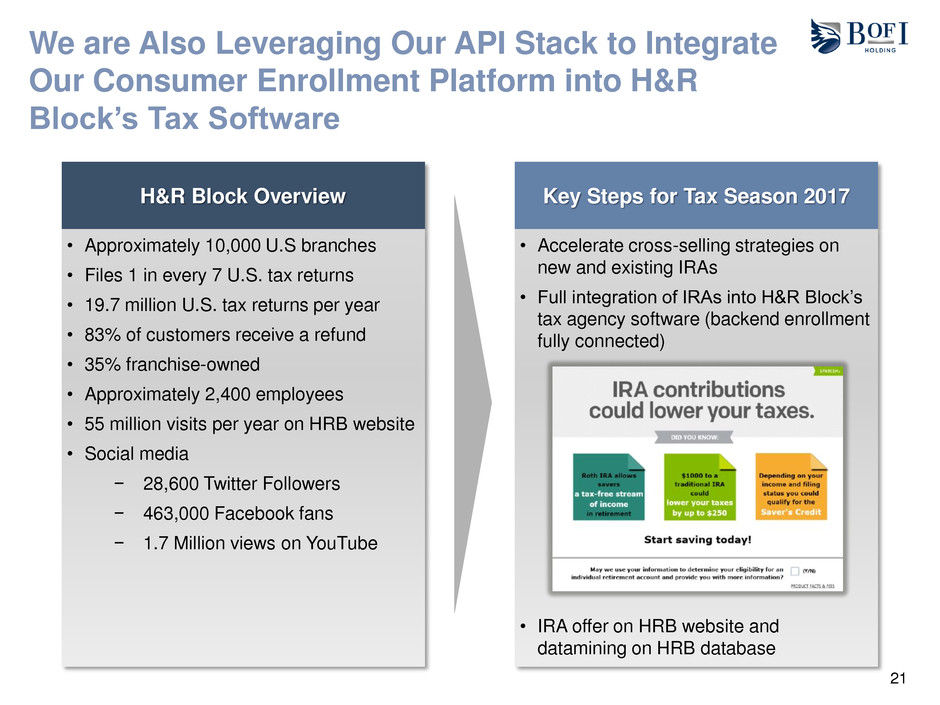

We are Also Leveraging Our API Stack to Integrate

Our Consumer Enrollment Platform into H&R

Block’s Tax Software

H&R Block Overview Key Steps for Tax Season 2017

• Approximately 10,000 U.S branches

• Files 1 in every 7 U.S. tax returns

• 19.7 million U.S. tax returns per year

• 83% of customers receive a refund

• 35% franchise-owned

• Approximately 2,400 employees

• 55 million visits per year on HRB website

• Social media

− 28,600 Twitter Followers

− 463,000 Facebook fans

− 1.7 Million views on YouTube

• Accelerate cross-selling strategies on

new and existing IRAs

• Full integration of IRAs into H&R Block’s

tax agency software (backend enrollment

fully connected)

• IRA offer on HRB website and

datamining on HRB database

22

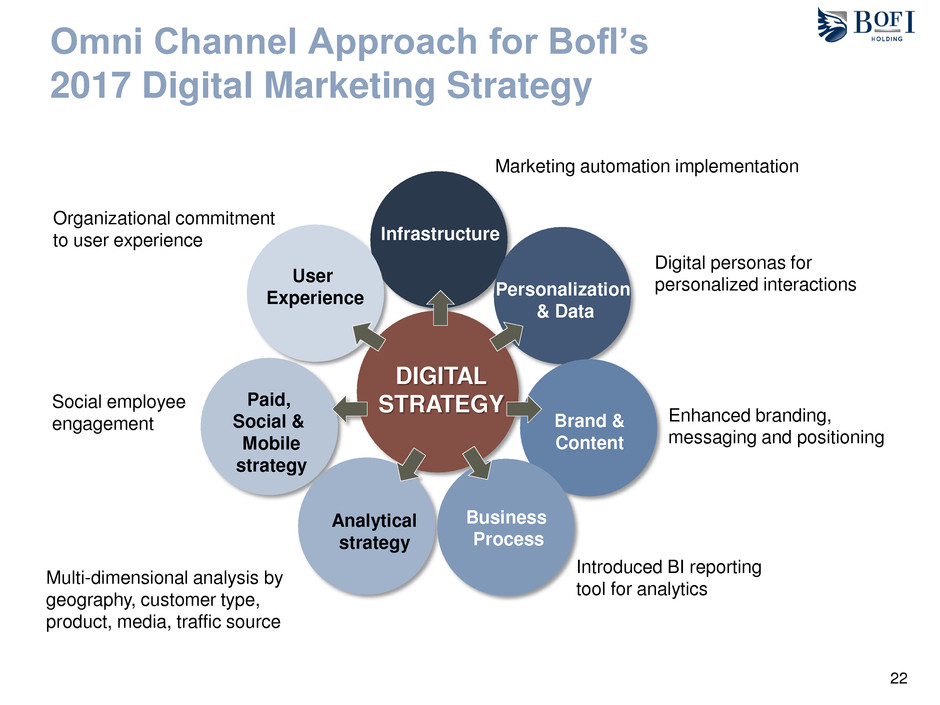

Omni Channel Approach for BofI’s

2017 Digital Marketing Strategy

Digital personas for

personalized interactions

Introduced BI reporting

tool for analytics

Enhanced branding,

messaging and positioning

Social employee

engagement

Multi-dimensional analysis by

geography, customer type,

product, media, traffic source

Organizational commitment

to user experience Infrastructure

Personalization

& Data

Brand &

Content

Business

Process

Analytical

strategy

Paid,

Social &

Mobile

strategy

User

Experience

DIGITAL

STRATEGY

Marketing automation implementation

23

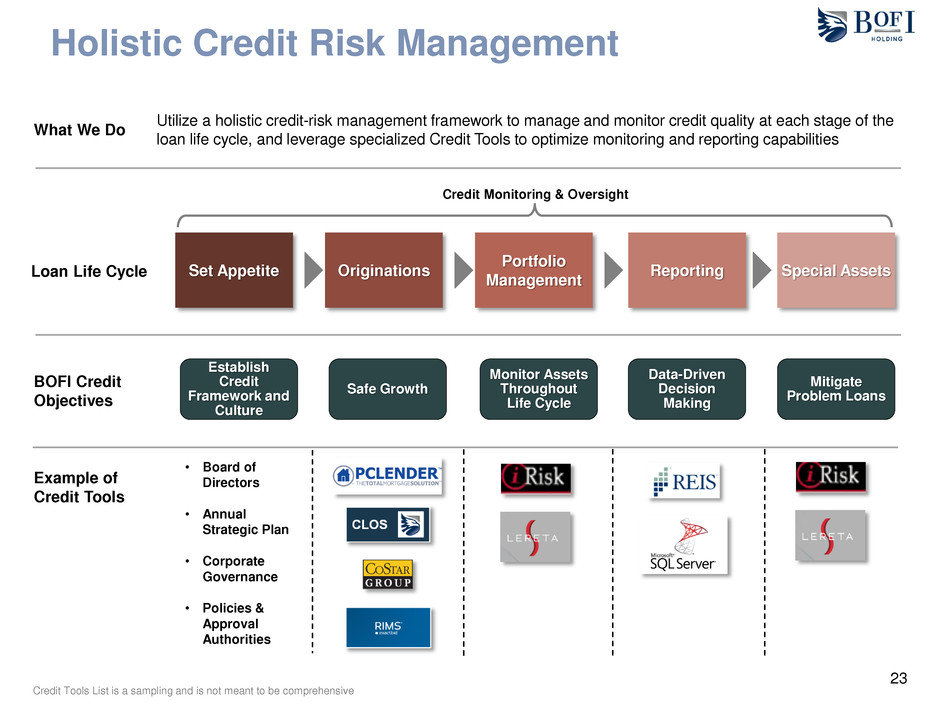

Holistic Credit Risk Management

What We Do

Loan Life Cycle

Utilize a holistic credit-risk management framework to manage and monitor credit quality at each stage of the

loan life cycle, and leverage specialized Credit Tools to optimize monitoring and reporting capabilities

Set Appetite Originations

Portfolio

Management

Reporting Special Assets

Credit Monitoring & Oversight

BOFI Credit

Objectives

Establish

Credit

Framework and

Culture

Safe Growth

Monitor Assets

Throughout

Life Cycle

Data-Driven

Decision

Making

Mitigate

Problem Loans

Example of

Credit Tools

• Board of

Directors

• Annual

Strategic Plan

• Corporate

Governance

• Policies &

Approval

Authorities

Credit Tools List is a sampling and is not meant to be comprehensive

24

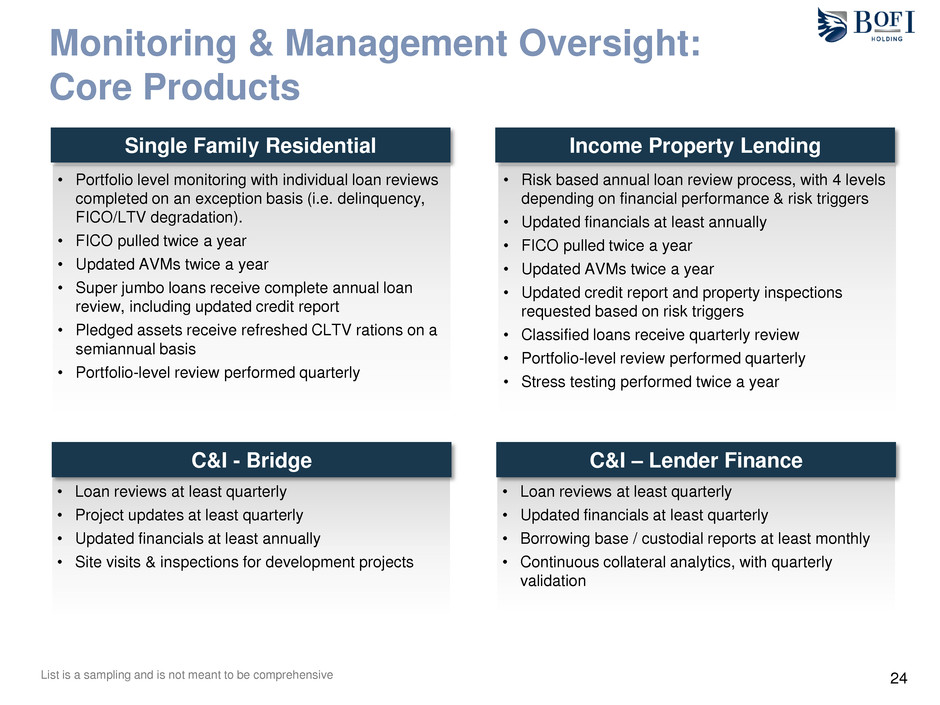

Monitoring & Management Oversight:

Core Products

• Loan reviews at least quarterly

• Project updates at least quarterly

• Updated financials at least annually

• Site visits & inspections for development projects

• Portfolio level monitoring with individual loan reviews

completed on an exception basis (i.e. delinquency,

FICO/LTV degradation).

• FICO pulled twice a year

• Updated AVMs twice a year

• Super jumbo loans receive complete annual loan

review, including updated credit report

• Pledged assets receive refreshed CLTV rations on a

semiannual basis

• Portfolio-level review performed quarterly

• Risk based annual loan review process, with 4 levels

depending on financial performance & risk triggers

• Updated financials at least annually

• FICO pulled twice a year

• Updated AVMs twice a year

• Updated credit report and property inspections

requested based on risk triggers

• Classified loans receive quarterly review

• Portfolio-level review performed quarterly

• Stress testing performed twice a year

• Loan reviews at least quarterly

• Updated financials at least quarterly

• Borrowing base / custodial reports at least monthly

• Continuous collateral analytics, with quarterly

validation

List is a sampling and is not meant to be comprehensive

Single Family Residential Income Property Lending

C&I - Bridge C&I – Lender Finance

25

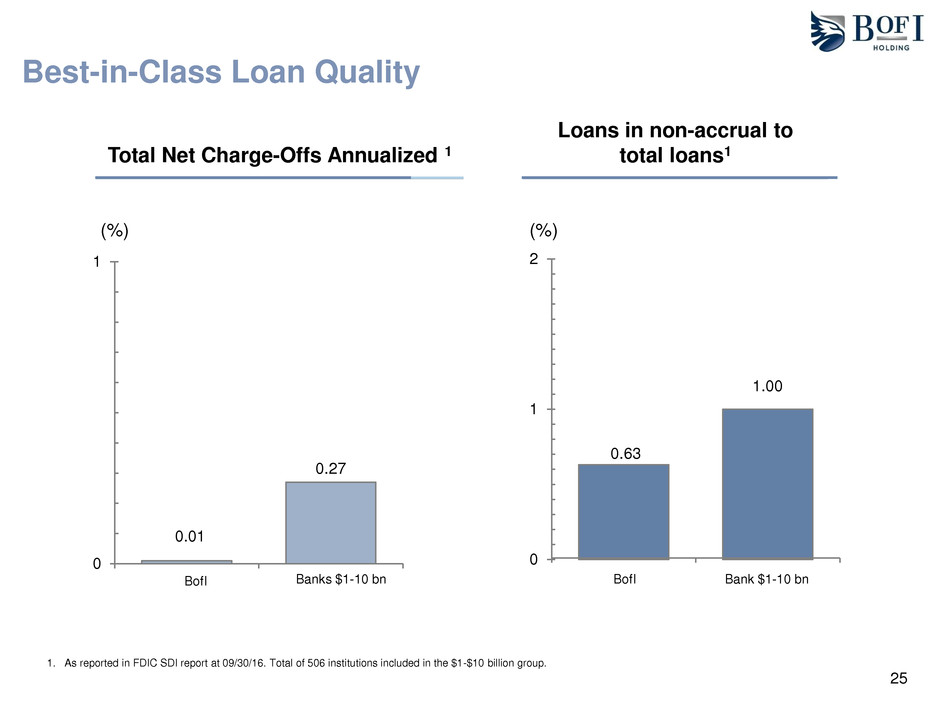

(%)

BofI Banks $1-10 bn

Total Net Charge-Offs Annualized 1

Loans in non-accrual to

total loans1

(%)

BofI Bank $1-10 bn

Best-in-Class Loan Quality

0.01

0.27

0

1

0.63

1.00

0

1

2

1. As reported in FDIC SDI report at 09/30/16. Total of 506 institutions included in the $1-$10 billion group.

26

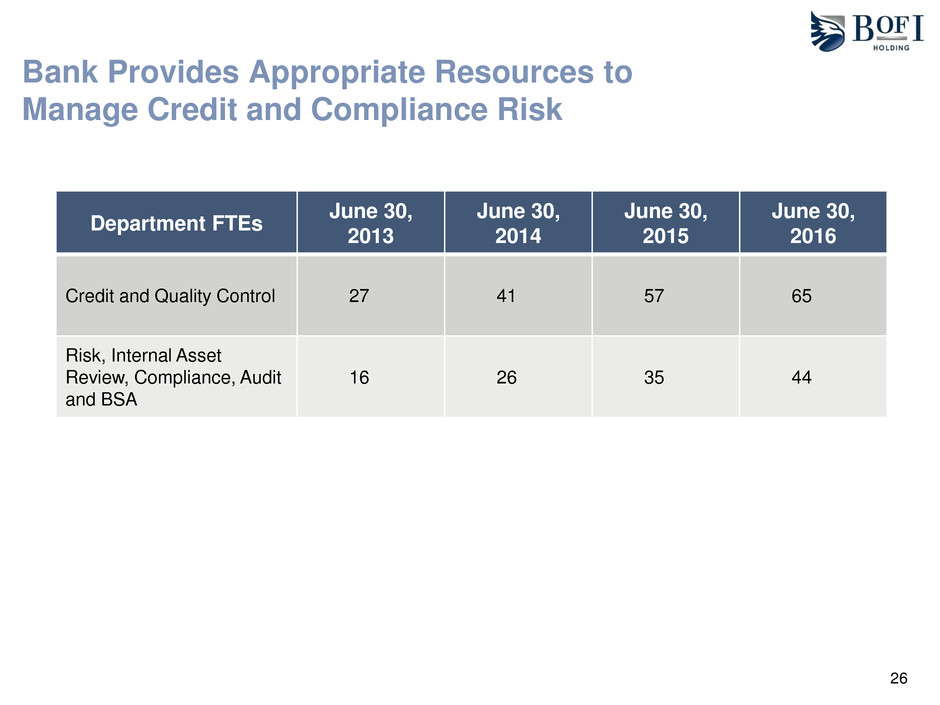

Bank Provides Appropriate Resources to

Manage Credit and Compliance Risk

Department FTEs

June 30,

2013

June 30,

2014

June 30,

2015

June 30,

2016

Credit and Quality Control 27 41 57 65

Risk, Internal Asset

Review, Compliance, Audit

and BSA

16 26 35 44

27

Full service branchless banking platform with structural

cost advantages vs. traditional banks

Superior growth and ROE relative to large and small

competitors

Solid track record of allocating capital to businesses

with best risk-adjusted returns

New business initiatives will generate incremental

growth in customers, loans and profits

Robust risk management systems and culture has

resulted in lower credit, counterparty and regulatory

risks

Investment Summary

28

Greg Garrabrants, President and CEO

Andy Micheletti, EVP/CFO

investors@bofi.com

www.bofiholding.com

Johnny Lai, VP Corporate Development and

Investor Relations

Phone: 858.649.2218

Mobile: 858.245.1442

jlai@bofi.com

Contact Information