Attached files

| file | filename |

|---|---|

| 8-K - TRINITY CAPITAL CORP | form8k_20170130.htm |

MOVING FORWARD 2016 Annual Meeting of Shareholders January 25, 2017 1

Forward Looking Statements This presentation contains forward looking statements of the Company within the meaning of the Private Securities Litigation Reform Act of 1995, with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Actual results could differ materially from the results indicated in the presentation because of risks and uncertainties, known or unknown (many of which are beyond the Company’s control), including those described in Item 1A “Risk Factors” in the Company’s Form10-K for December 31, 2015. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update or revise any statement in light of new information or future events, except as required by law. 2

Meeting Agenda Annual Meeting Business - Last Meeting on January 22, 2015 - Next Meeting Target This Summer - 2018 Meeting back on schedule2015 Review and 2016 Recent Events2017 and BeyondQuestions and Answers 3

Trinity Capital Corporation ANNUAL MEETINGBUSINESS 4

Annual Meeting Business Election of Directors- Class III to serve until 2018 annual meeting- Class I to serve until 2019 annual meetingAuthorization of Non-Voting Common StockAdvisory Vote on Executive CompensationApproval of Crowe Horwath LLP as AuditorOther Business 5

Trinity Capital Corporation (“TCC”)Los Alamos National Bank (“LANB”) 2015 REVIEW &2016 RECENT EVENTS 6

Strategic Goals & Objectives Discussed at Last Annual Meeting Achieve financial performance goalsEstablish Enterprise Risk Management (“ERM”) programIncrease return on assets and return on equityRetain, attract and develop talent- Rebuild Management TeamEnhance products and servicesMaximize operating efficiencies 7

2015 - 2016 Highlights Returned to profitability with consolidated net income of $1.9 million in 2015 and almost $4.1 million through September 30 Asset quality greatly improved – nonperforming assets / assets declined from 4.3% at 12/31/2014 to 2.2% at 9/30/2016Completed annual audits for 2014 and 2015 and settled outstanding SEC allegations & settlementRaised $52.0 million of new capital from three institutional partnersGave notice to Preferred Stock (“TARP”)* holders that all outstanding amounts will be redeemed in January 2017All delinquent amounts due on TCC debt will be paid in Q1 2017 8 *Troubled Asset Relief Program

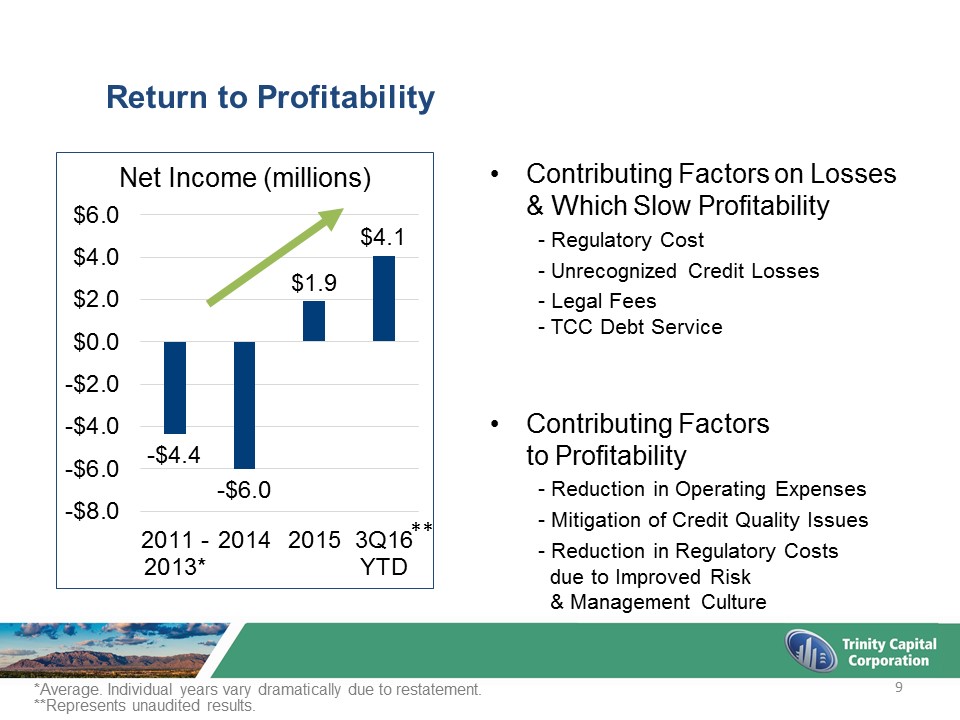

Return to Profitability Contributing Factors on Losses& Which Slow Profitability- Regulatory Cost- Unrecognized Credit Losses- Legal Fees- TCC Debt ServiceContributing Factors to Profitability - Reduction in Operating Expenses- Mitigation of Credit Quality Issues- Reduction in Regulatory Costs due to Improved Risk & Management Culture *Average. Individual years vary dramatically due to restatement. 9 ** **Represents unaudited results.

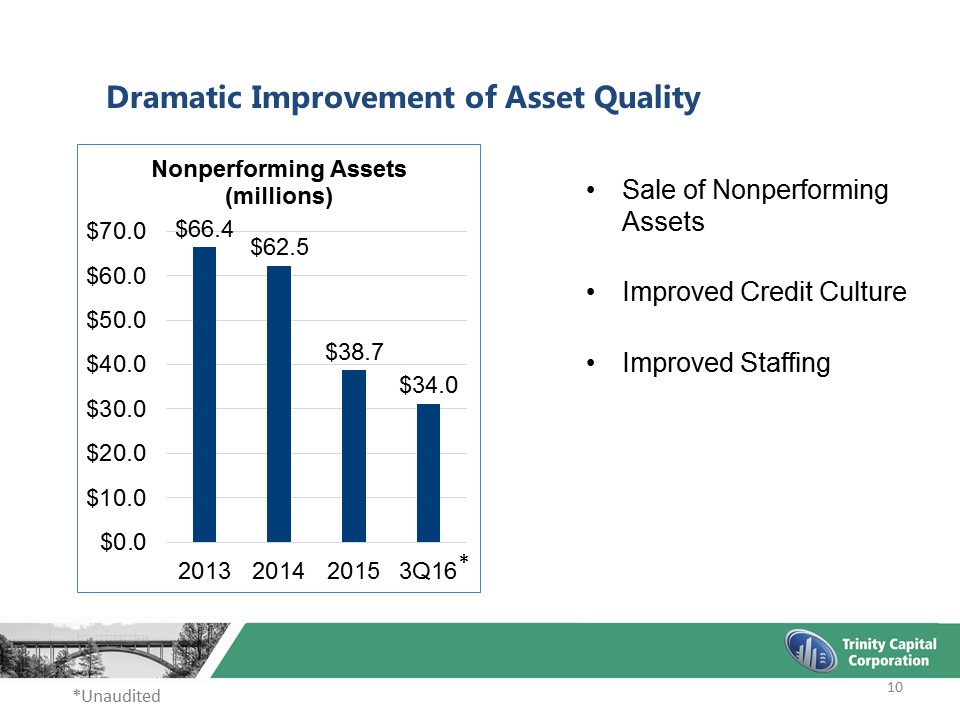

Dramatic Improvement of Asset Quality Sale of NonperformingAssetsImproved Credit CultureImproved Staffing 10 * *Unaudited

Completed Recapitalization On September 8, 2016, TCC announced the sale of $52.0 million of common and preferred stock at $4.75 per common share and $475.00 per preferred share to three highly regarded bank investorsThe use of proceeds is primarily to repay Principal and Past Due Interest on TCC Debt (extended deferral would lead to default on these obligations) Each investor agreed that they would hold no more than 9.9% of Trinity’s voting securities 11

Completed Recapitalization (Cont.) Repaying TARP now saves about $3.4 million in interest per year* (these interest payments are not tax-deductible)Consistent with regulatory order requirements, upstream of $15 million dividend from LANB to TCC as part of our Capital Plan FDIC insurance premiums have decreased $2.1 million annuallyImproves TCC’s tangible equity to tangible assetsSignificantly improves TCC’s tangible common equity to tangible assets *Does not account for the compounding of deferred interest, unaudited 12

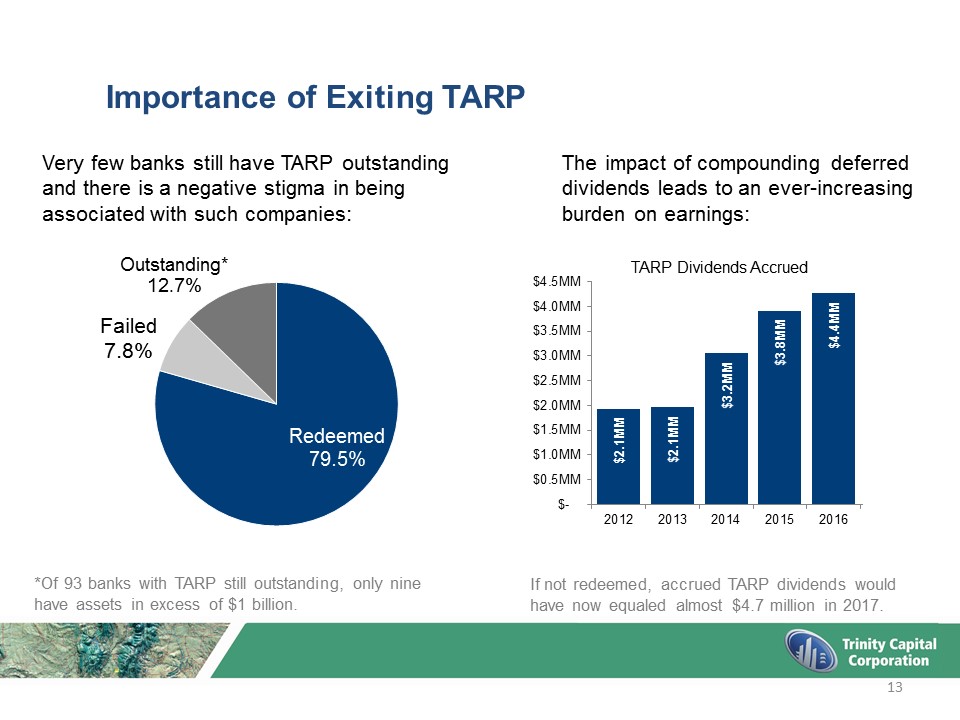

Importance of Exiting TARP Very few banks still have TARP outstanding and there is a negative stigma in being associated with such companies: The impact of compounding deferred dividends leads to an ever-increasing burden on earnings: *Of 93 banks with TARP still outstanding, only nine have assets in excess of $1 billion. If not redeemed, accrued TARP dividends would have now equaled almost $4.7 million in 2017. 13

Transaction Summary Summary of the recapitalization completed in December 2016:$12.6 million of newly-issued common equity$39.4 million of convertible preferred equity Preferred equity will convert automatically into a new class of non-voting common shares upon authorization by Trinity shareholdersTrinity is required to use its best efforts to list the common stock for quotation on a “national security exchange” within three yearsCastle Creek and Patriot Financial Partners will each appoint one director to Trinity’s and LANB’s board 14

New Members of TCC Board of Directors Jim Deutsch Mr. Deutsch is a partner at Patriot Financial Partners. He has over 35 years of banking experience and brings a breadth of knowledge to the Board in investment banking, commercial lending and corporate finance. He has experience in financial services and a perspective as both an investor and operator of banks. Mr. Deutsch currently serves on several other public company financial institution boards, including Sterling Bancorp, Cape Bancorp, Inc. and Avenue Financial Holdings, Inc. 15

New Members of TCC Board of Directors Tony Scavuzzo Mr. Scavuzzo is a principal at Castle Creek Capital. He brings extensive financial institution experience to the Board. He has led or supported investments in numerous recapitalization, distressed, and growth situations and works with executive management teams on strategic planning, operational improvements, acquisitions, and capital financings. He currently serves as a director at multiple banking institutions, including MBT Financial Corp, and serves on various board committees regarding governance, compensation and risk. 16

Trinity Capital Corporation 2017 AND BEYONDPOSITIONED FOR SUCCESS 17

Mission, Vision, Values Mission To improve the lives of our customers and employees and enhance the communities we serve by profitably providing superior banking products and trusted financial services.VisionFirst choice in achieving your financial goals.We Value - People - Service - Profits - Social Responsibility 18

Strategic Plan Differentiate ourselves from the competition through superior service and our local market presenceEstablish a risk culture and enhance controlsMaximize shareholder value- Total Return (price and dividend)- Liquidity (getting listed)Reduce credit risk profileEmerge from TCC & LANB regulatory ordersRepay converted TARP debtBring trust preferred currentIncrease earnings and capitalGain efficiencies from recent changesCommunity focus groups to discuss our brand 19 Customer Service Compliance Technology

Investment Highlights Attractive franchise, well positioned in desirable marketsImproving profitability, asset quality and operating resultsOpportunity quality loan growthStrong and experienced leadership teamEmerging from financial statement delinquencies and regulatory constraintsWhy we were able to attract strong investor interest 20

Leadership 21 John S. Gulas President & Chief Executive Officer Mr. Gulas joined TCC & LANB in 2014. He was most recently employed as President and Chief Executive Officer for Farmers National Bank in Ohio. He is a graduate of the University of Toledo College of Law, with a Juris Doctor degree in Law. Dan ThompsonChief Financial Officer Mr. Thompson joined TCC & LANB in 2015. He was most recently employed as Executive Vice President and Chief Financial Officer for Hanmi Bank in Texas. He is a graduate of the University of Oklahoma, with a Bachelor of Science degree in Business Finance.. Joe MartonyChief Risk Officer Mr. Martony joined LANB in 2016. He was most recently employed as Executive Vice President and Chief Risk Officer for SKBHC Holdings LLC, Starbuck Bancshares, Inc. and American West Bank in Washington. He is a graduate of Indiana University, with a Bachelor of Science degree in Business Finance. Tom LillyChief Loan Officer Mr. Lilly joined LANB in 2013. He was most recently employed as Senior Vice President and Chief Credit Officer for The National Bank in Iowa.

Leadership, cont. 22 Stan SluderChief Lending Officer Mr. Sluder joined LANB in 2015. He was most recently employed as Market President and Chief Lending Officer for Peoples Bank in New Mexico. He is a graduate of New Mexico State University with a Bachelor of Science in Communication Studies. Dan LeonardChief Operating Officer Mr. Leonard joined LANB in 2016. He was most recently employed as Executive Vice President of Operations and Integration for AmericanWest Bank (now Banner Bank) in Washington. He is a graduate of Portland State University, with a Bachelor of Science degree in Psychology. Eddie HoChief Information Officer Mr. Ho joined LANB in 2014. He was most recently employed as Chief Information Officer for Omni American Bank in Texas. He is a graduate of North Dakota State University, with a Master’s degree in Computer Science.

Leadership, cont. 23 Bill ZaleskiChief Wealth Strategies & Fiduciary Officer Mr. Zaleski joined LANB in 2016. He was most recently employed as Senior Managing Director and Chief Fiduciary Officer for First National Santa Fe in New Mexico. He is a graduate of American International College, with a Bachelor of Science degree in Business and English. Esther LumagueSenior Vice President, Human Resources Esther Lumague, Senior Vice President, Human Resources, joined LANB in 2015. She was most recently employed as Director, International Human Resources for Harris Corporation in New York. She is a graduate of Loyola University of Chicago, with Master degrees in Organization Development and Industrial Relations.

Market Presidents 24 Liddie Martinez, Los Alamos Liddie Martinez, Market President, Los Alamos, joined LANB in 2016. She was most recently employed as the Executive Director of the Regional Development Corporation for Northern New Mexico. She previously served as Division Director of Community & Economic Development for SOC Los Alamos National Laboratory (LANL). She and currently serves on the board of the LANL Subcontractor Consortium, Think New Mexico, New Mexico Economic Development Rural Council, Northern New Mexico College Foundation, and the Los Alamos Commerce and Development. Dion Silva, Santa Fe A. Dion Silva joined LANB in 2001. He served as the Vice President of Lending through 2016, when he became Market President for Santa Fe. He is a graduate of New Mexico State University, with a Bachelor of Science degree in Environmental Engineering and a Master of Business Administration Degree in Finance.

Market Presidents, cont. 25 Robert Gabaldon, Albuquerque Robert Gabaldon is the Albuquerque Market President, having joined LANB in the fall of 2014. He has been working in the New Mexico financial services industry for 23 years, and has held key roles at Bank of America, Bank of Albuquerque, and US Bank. An Albuquerque native, Robert currently serves on the Boards of UNM Anderson School of Management, NAIOP NM, and the Albuquerque Museum Foundation. He earned his B.B.A. in management from the University of New Mexico, R.O. Anderson School of Management.

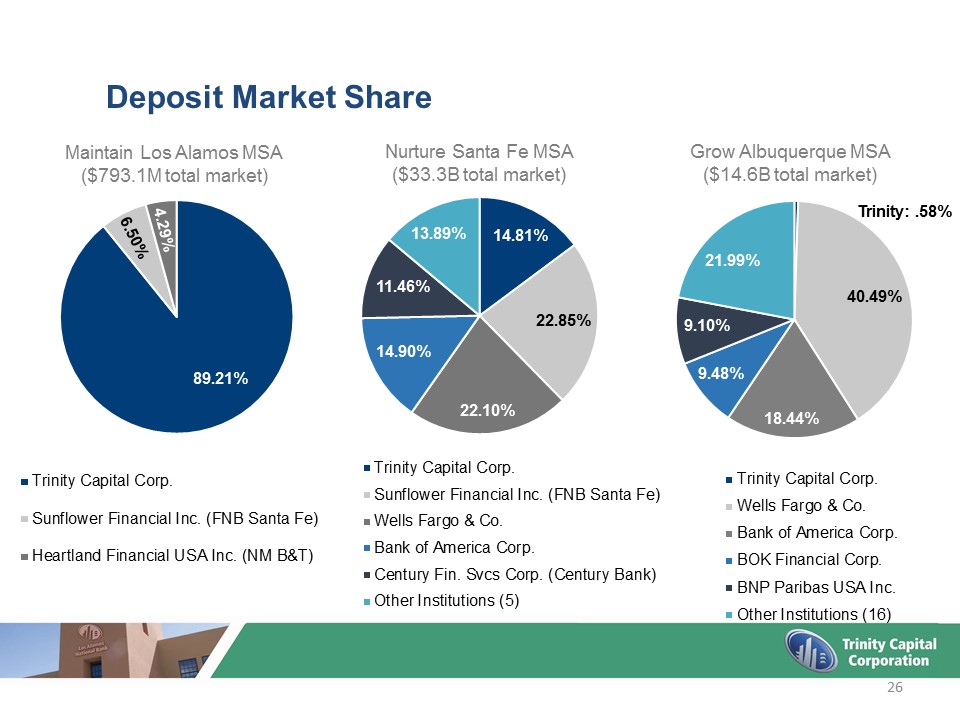

Deposit Market Share Maintain Los Alamos MSA($793.1M total market) Nurture Santa Fe MSA($33.3B total market) Grow Albuquerque MSA($14.6B total market) 26

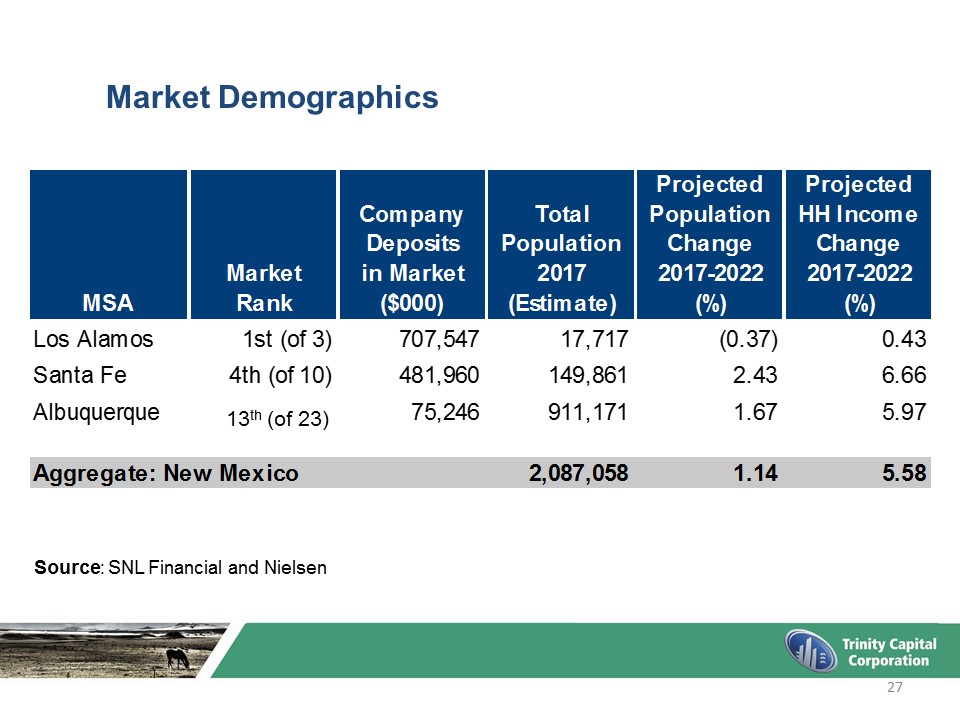

Market Demographics Source: SNL Financial and Nielsen 27 13th (of 23)

TCC Rights Offering A company offers existing shareholders the opportunity to buy additional shares of company stock in proportion to the number they already ownThe securities purchase agreement allows Trinity to subsequently conduct a rights offering to existing shareholders of up to $10.0 millionCommon Shares would be offered at the same $4.75/share priceThe three private placement investors may not participateOffering must be completed within one year of closing the private placement or by December 19, 2017Trinity has not yet filed any documents related to a potential rights offering 28

Q & A 29

Trinity Stock For questions about stock, please contact Boenning & Scattergood Inc. Nicholas P. BickingSenior Vice PresidentEquity Capital Markets(614) 408-1223nbicking@boenninginc.com Thomas L. DooleySenior Vice President Equity Capital Markets(614) 408-1224tdooley@boenninginc.com 30 To inquire about how many shares you havecontact Continental Stock Transfer & Trust: 212-509-4000

31