Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PEAPACK GLADSTONE FINANCIAL CORP | form8k-17040_pgfc.htm |

Exhibit 99.1

Strategic Update “Expanding Our Reach” Investor Presentation December 31, 2016 P EAPACK - G LADSTONE B ANK

The foregoing contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions about Management’s view of future interest income and net loans, Man agement’s confidence and strategies and Management’s expectations about new and existing programs and products, relationships, opportun iti es and market conditions. These statements may be identified by such forward - looking terminology as “expect”, “look”, “believe”, “antic ipate”, “may”, “will”, or similar statements or variations of such terms. Actual results may differ materially from such forward - looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward - looking statements include, a mong others, those risk factors identified in the Company’s Form 10 - K for the year ended December 31, 2015 , in addition to/which include the following: a) inability to successfully grow our business in line with our strategic plan; b) inability to grow deposits to fund loan growt h; c) inability to generate revenues to offset the increased personnel and other costs related to the strategic plan; d) inability to realize ex pec ted revenue synergies from the acquisition of a wealth management company in the amounts or the timeframe anticipated; e) inability to re tai n clients and employees of acquired wealth management company; f) inability to manage our growth; g) inability to successfully integrat e o ur expanded employee base; h) a further or unexpected decline in the economy, in particular in our New Jersey and New York marke t a reas; i ) declines in value in our investment portfolio; j) higher than expected increases in our allowance for loan losses; k) higher tha n expected increases in loan losses or in the level of non - performing loans; unexpected changes in interest rates; l) a continued or unexpe cted decline in real estate values within our market areas; m) legislative and regulatory actions (including the impact of the Dodd - Frank Wall S treet Reform and Consumer Protection Act, Basel III and related regulations) subject us to additional regulatory oversight which may resul t i n increased compliance costs; n) successful cyber - attacks against our IT infrastructure or that of our IT providers; o) higher than expected FDIC premiums; p) adverse weather conditions; inability to successfully generate new business in new geographic areas; q) inability to execu te upon new business initiatives; lack of liquidity to fund our various cash obligations; r) reduction in our lower - cost funding sources; s) our inability to adapt to technological changes; t) claims and litigation pertaining to fiduciary responsibility, environmental laws and other ma tters; and other unexpected material adverse changes in our operations or earnings. The Company assumes no responsibility to update such forward - looking statements in the future even if experience shows that the indicated results or events will not be realized. Although we believe that the expectations reflected in the forward - looking statements ar e reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Statement Regarding Forward - Looking Information 2

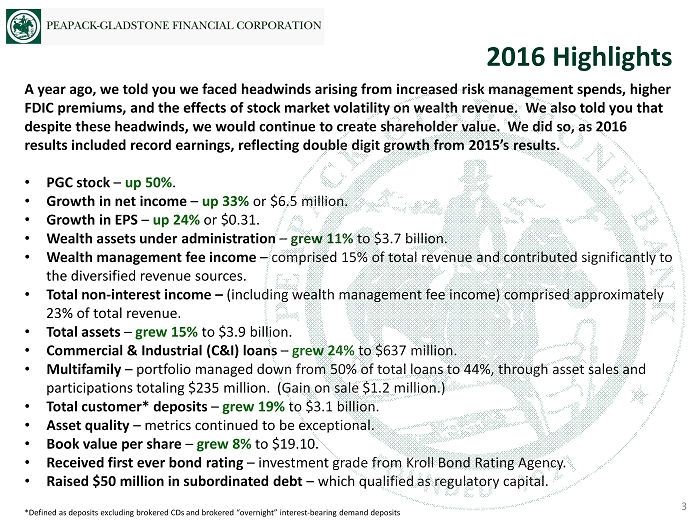

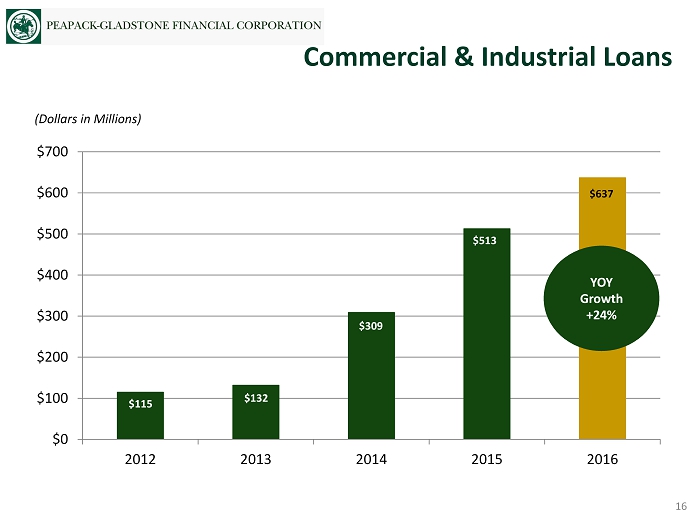

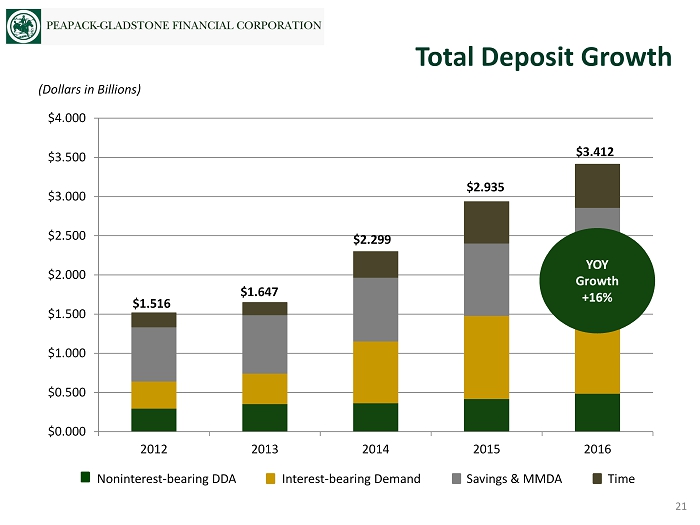

A year ago, we told you we faced headwinds arising from increased risk management spends, higher FDIC premiums, and the effects of stock market volatility on wealth revenue. We also told you that despite these headwinds, we would continue to create shareholder value. We did so, as 2016 results included record earnings, reflecting double digit growth from 2015’s results. • PGC stock – up 50% . • Growth in net income – up 33% or $6.5 million. • Growth in EPS – up 24% or $0.31. • Wealth assets under administration – grew 11% to $3.7 billion. • Wealth management fee income – comprised 15% of total revenue and contributed significantly to the diversified revenue sources. • Total non - interest income – (including wealth management fee income) comprised approximately 23% of total revenue. • Total assets – grew 15% to $3.9 billion. • Commercial & Industrial (C&I) loans – grew 24% to $637 million. • Multifamily – portfolio managed down from 50% of total loans to 44%, through asset sales and participations totaling $235 million. (Gain on sale $1.2 million.) • Total customer* deposits – grew 19% to $3.1 billion. • Asset quality – metrics continued to be exceptional. • Book value per share – grew 8% to $19.10. • Received first ever bond rating – investment grade from Kroll Bond Rating Agency. • Raised $50 million in subordinated debt – which qualified as regulatory capital. 2016 Highlights 3 *Defined as deposits excluding brokered CDs and brokered “overnight” interest - bearing demand deposits

• EPS Growth – High single digit to low double digit EPS growth. • Return on Equity – 10% target run rate by late 2017 / early to mid 2018. • Efficiency Ratio – Targeting low to mid 50’s by early to mid 2018. • Balance Sheet Growth / Loan Growth – 10% to 15% annual balance sheet growth; 12% to 18% annual loan growth. • Loan Mix – Continued diversification into Commercial & Industrial and Wealth relationship based residential lending. Portfolio targets: » C&I: 25% - 30% » CRE: 15% - 20% » Multifamily: 35% - 45% » Residential/Consumer: 15% - 25% • Revenue Mix – Non - interest income target of 30% - 40%. Organic growth, Wealth M&A plus gains in Treasury Management fees, SBA sales, back to back SWAP fees and loan sales will drive this growth. • Funding – Continued funding from diversified sources. Asset growth to be principally funded by core customer deposits. • Capital – Sufficient for current business; Shelf available for potential opportunities. Financial Targets: 2017 and Beyond 4

A high - performing boutique bank, leaders in wealth, lending and deposit solutions, known nationally for our unparalleled client service, integrity and trust. Our Foundation 5 • Professionalism • Clients First • Compete to Win • Invested in Our Community • One Team Vision Core Principles

1. See non - GAAP financial measures reconciliation on pages 32 and 33 • Headquartered in Bedminster, NJ. • Four Private Banking locations: Bedminster, Morristown, Princeton, Teaneck. • 20 Branches in four affluent New Jersey counties: Somerset, Morris, Hunterdon, Union. • Delaware Trust Subsidiary. • New York MSA offers considerable growth opportunity. Franchise Overview Our Franchise is Supporting Robust Organic Growth 6 Growth Since Launching Our Strategic Plan (Dollars in millions, except per share data) Year End Year End 12/31/12 12/31/16 Total Assets $1,668 $3,879 23% Net Loans (incl HFS) $1,153 $3,314 30% Total Deposits $1,516 $3,412 22% Total Shareholders' Equity $122 $324 28% Tangible Book Value per Share 1 $13.84 $18.91 8% Tang Common Equity / Tang Assets 1 7.29% 8.28% Total Risk-Based Capital Ratio 13.08% 13.25% For Yr Ended 2013 For Yr Ended 2016 CAGR Net Income $9,261 $26,477 42% EPS $1.01 $1.60 17% Return on Equity 7.37% 8.92% Efficiency Ratio 1 77% 61% CAGR

• Full service banking with every conversation aimed at helping clients create , grow , protect & eventually transition their wealth. • Deep understanding of our clients needs , goals, and aspirations. » It’s about the client; not about us. » Risk management tolerance, time horizon, and other traditional variables are all considered. • Our Strategy is attracting higher value clients. • A Senior Private Banker leads a TEAM to develop and deliver customized solutions. • As One Team , everyone in the Bank helps deliver an exceptional client experience . • Employees are empowered to solve any client service issue. • Our Strategy is an ongoing journey that continually focuses on: » Ensuring our Core Principles are part of our employee culture. » Listening to our clients and consistently delivering the PGB Experience. » Listening to our staff and delivering a best - in - class employee experience. » Continued innovation and differentiation through technology. The Peapack - Gladstone Private Banking Model 7

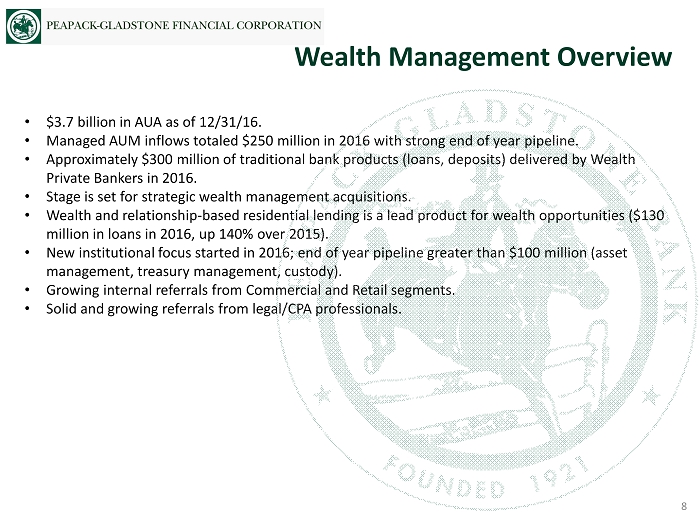

• $3.7 billion in AUA as of 12/31/16. • Managed AUM inflows totaled $250 million in 2016 with strong end of year pipeline. • Approximately $300 million of traditional bank products (loans, deposits) delivered by Wealth Private Bankers in 2016. • Stage is set for strategic wealth management acquisitions. • Wealth and relationship - based residential lending is a lead product for wealth opportunities ($130 million in loans in 2016, up 140% over 2015). • New institutional focus started in 2016; end of year pipeline greater than $100 million (asset management, treasury management, custody). • Growing internal referrals from Commercial and Retail segments. • Solid and growing referrals from legal/CPA professionals. Wealth Management Overview 8

Wealth Management Assets Under Admin Wealth Management Fee Income Wealth Management Overview $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 2012 2013 2014 2015 2016 (Dollars in Millions) $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $3.50 $3.75 2012 2013 2014 2015 2016 (Dollars in Billions) 9 $12.28 $13.84 $15.24 $17.04 $2.30 $2.69 $2.99 $3.67 $3.32 YOY Growth 7% $18.24 YOY Growth 11%

1. Revenue defined as net interest income plus all other income 2. Includes SBA Income, SWAP Income, Deposit & Loan Fees, Mortgage Banking, and BOLI Enviable Revenue Mix 76.9% 14.6% 7.4% 0.1% 1.0% For the Year Ended December 31, 2016 10 Total Non - Interest Income 23.1% of Revenue 1 Net Interest Income before Provision Wealth Fee Income Fees & Other Income Gain on Sale of Multifamily Loans Gain on Sale of Securities 2

1. Efficiency ratio is calculated as (total operating expenses, excluding provision for losses on REO) as a percentage of (ne t i nterest income plus noninterest income less, gain on securities and gain on loans held for sale at lower of cost or fair value); See non - GAAP financial measures reconciliation on page 33 2. 2015 Includes $2.5MM of non - recurring charges related to the closure of two branches Net Income / Period End FTE Efficiency Ratio 1 (Dollars in Thousands) Positive Operating Leverage 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 100% 2013 2014 2015 2016 61% $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 2013 2014 2015 2016 $28 $49 $63 $78 11 2 64% 67% 77% 2

1. 2015 reflects reported net income and EPS as per 10 - K; includes $2.50 million of pre - tax non - recurring charges related to the closure of two branches Earnings Momentum $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 2013 2014 2015 2016 1 YOY Growth +33% 12 Net Income Earnings Per Share $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 2013 2014 2015 2016 $9.26 $14.89 $19.97 $26.48 $1.01 $1.22 $1.29 $1.60 YOY Growth +24% 1 (Dollars in Millions)

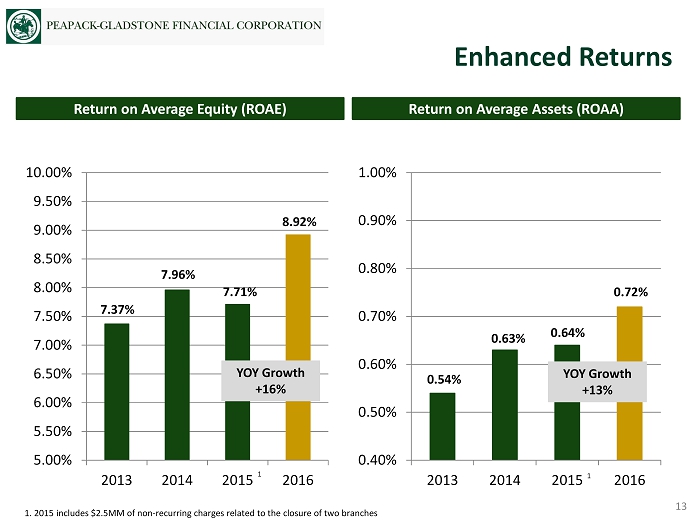

Enhanced Returns 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% 9.00% 9.50% 10.00% 2013 2014 2015 2016 YOY Growth +16% 13 Return on Average Equity (ROAE) Return on Average Assets (ROAA) 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 2013 2014 2015 2016 7.37% 7.96% 7.71% 8.92% 0.54% 0.63% 0.64% 0.72% YOY Growth +13% 1. 2015 includes $2.5MM of non - recurring charges related to the closure of two branches 1 1

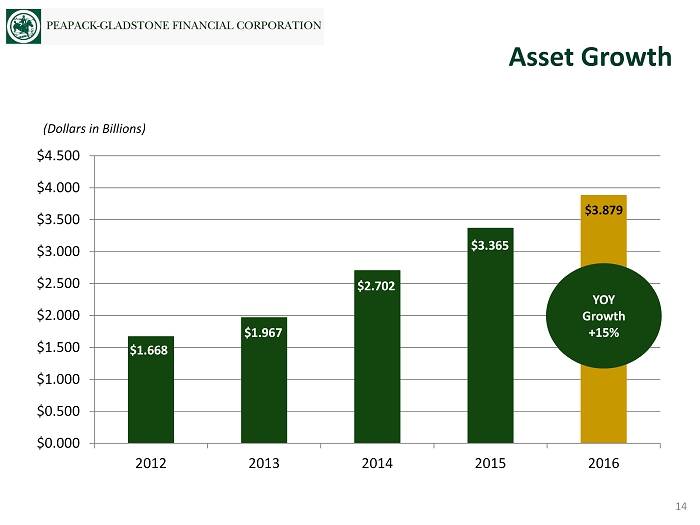

Asset Growth $0.000 $0.500 $1.000 $1.500 $2.000 $2.500 $3.000 $3.500 $4.000 $4.500 2012 2013 2014 2015 2016 (Dollars in Billions) $3.879 14 YOY Growth +15% $3.365 $2.702 $1.967 $1.668

Note: Gross loans include loans held for sale Gross Loan Growth 15 $0.000 $0.500 $1.000 $1.500 $2.000 $2.500 $3.000 $3.500 2012 2013 2014 2015 2016 $2.997 $2.251 $1.576 $1.153 $3.314 YOY Growth +11% (Dollars in Billions) Multifamily Commercial & Industrial CRE Residential, Consumer & Oth er

Commercial & Industrial Loans $0 $100 $200 $300 $400 $500 $600 $700 2012 2013 2014 2015 2016 (Dollars in Millions) $115 $132 $309 $513 $637 16 YOY Growth +24%

Multifamily Loans $100 $300 $500 $700 $900 $1,100 $1,300 $1,500 2012 2013 2014 2015 2016 (Dollars in Millions) $162 $542 $1,080 $1,499 $1,460 17 YOY Decline - 3% Note: Multifamily Loans include loans held for sale

Multifamily Loans as a Percent of Risk Based Capital 0.00% 100.00% 200.00% 300.00% 400.00% 500.00% 600.00% 2012 2013 2014 2015 2016 126% 300% 432% 504% 372% 18 Note: Multifamily Loans include loans held for sale

Proven track record of providing solid risk - adjusted returns Geographically diversified portfolio • New York – 51%; Top Markets – Bronx and Brooklyn • New Jersey – 38%; Top Markets – Hudson, Essex, & Morris/Somerset/Union Counties • Pennsylvania – 11%; Top Markets – Suburban Philadelphia and Bucks County • Current balance: $1.46 billion • Active loan participations sold and loan sales • To date, approximately $500 million sold or participated to 10 institutions • Number of multifamily loans in portfolio: 522 • Average loan size: $2.8 million • Weighted average LTV: approximately 64% • Weighted average DSCR (after underwriting stress): approximately 1.5x • No nonaccruals; no 30 day delinquencies • Generally all “workforce housing” – average rent just over $1,000 • Data warehouse captures 63 data points per loan • Recent stress test applied to Multifamily reveals considerable strength under a variety of adverse scenario’s Multifamily Portfolio Metrics 12/31/2016 19

• Portfolio stress testing performed (top down/bottom up) by an independent third party to estimate potential impact of changing market conditions on asset quality, earnings, liquidity, and capital, and forecasted over two years; Under most adverse stress model, PGB remains well capitalized. • Ongoing third party loan participations/sales to manage exposure and validate underwriting guidelines and pricing – To date, approximately $500 million sold or participated to 10 institutions • Strong Board and Management oversight, including quarterly reporting on exposure versus risk appetite limits and triggers that are revalidated quarterly through rigorous analytics – All exposures below limits and triggers. • Significant investment in 2016 to enhance analytics and risk management practices: » 65,000+ data points collected and loaded to a data warehouse; now have considerable insights to the portfolio and a better understanding of the risks associated with it. » Quarterly market analysis for various property types and geographies, including presentations to Management and the Board by a third party real estate expert to ensure there is an understanding of the macro economic factors that may affect future asset quality in the areas that the Bank lends. » Quarterly stress testing through ten different stress scenarios, including three derived from Dodd - Frank guidance. » Third party credit review firm used to monitor and evaluate overall asset quality measures to ensure an effective risk rating system and adequate reserve for loan losses maintained. Risk Management CRE Concentration 20

21 $0.000 $0.500 $1.000 $1.500 $2.000 $2.500 $3.000 $3.500 $4.000 2012 2013 2014 2015 2016 $2.935 $2.299 $1.647 $1.516 $3.412 Total Deposit Growth YOY Growth +16% (Dollars in Billions) Noninterest - bearing DDA Interest - bearing Demand Savings & MMDA Time

1. Nonperforming loans defined as nonaccrual loans plus loans 90+ days past due 2. Texas Ratio defined as nonaccrual loans plus other real estate owned and loans 90+ day past due as a percentage of the sum of tangible common equity and loan loss reserves Texas Ratio² NPLs¹ / Loans NCOs / Average Loans ALLL / Gross Loans Credit Risk Management - Metrics & Performance 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 2012 2013 2014 2015 2016 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2012 2013 2014 2015 2016 0.75% 1.00% 1.25% 1.50% 2012 2013 2014 2015 2016 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2012 2013 2014 2015 2016 0.42% 0.30% 0.23% 0.34% 1.04% 11.34% 4.62% 3.13% 2.45% 3.34% 1.12% 0.98% 0.87% 0.89% 0.97% 0.04% 0.80% 0.06% 0.03% 0.04% 22

Robust balance sheet risk management: Capital • Ratios well above well capitalized standards. • Stress test enhanced to bottom up / top down in Q1 2016. • Received first ever bond rating – investment grade from Kroll Bond Rating Agency. • Raised $50 million in subordinated debt, which qualified as regulatory capital. Liquidity • $163 million in cash and cash equivalents. • $243 million of unencumbered securities. • Over $1 billion additional borrowing capacity available at the FHLB (plus $632 million at FRB). • Quarterly stress testing. • Net Stable Funding Ratio calculation prepared as a test of the Bank’s own funding strategy and composition; it is not applicable to Bank’s under $250 billion, but if applicable, the Bank’s NSFR is 121% compared to 100% minimum requirement. Interest Rate • In an immediate and sustained 200 basis point increase in market rates at December 31, 2016 modeling results show that net interest income for year 1 would increase approximately 6%, when compared to a flat interest rate scenario. In year 2, this sensitivity improves to an expected increase in net interest income of approximately 11%. • Quarterly stress testing. Capital, Liquidity, & Interest Rate Risk Management 23

People Market Efficiency, Growth, and Profitability • Shared common vision • Very talented team with ties to the market • High levels of motivation and engagement • Act as a single team • Entrepreneurial culture • We operate in three of the top ten most affluent counties nationwide • New York MSA offers considerable growth opportunity • Large and small banks underserving the wealth related needs in this market • Improved operating leverage is delivering positive earnings momentum • People, products, market - depth and superior delivery ensure future growth • Eye toward capitalizing on emerging market opportunities • Nimble and flexible • Enviable revenue mix Unique Business Model • Holistic, “wealth centric”, advice - led approach • Private Banker acts as a lead point of contact • “Brand of One” • Fee income growth a key area of focus • Sophisticated processes to Enterprise Risk, CRE, and balance sheet management • Excellent risk leadership team • Solid governance including Firm and Board Risk Committees Risk Management How We Are Creating Value 24

PGC Comparative Stock Price Performance 1/1/2016 - 12/31/2016 25 (30%) (20%) (10%) 0% 10% 20% 30% 40% 50% 60% 01/01/16 02/11/16 03/23/16 05/03/16 06/13/16 07/24/16 09/03/16 10/14/16 11/24/16 PGC +49.8% Proxy Peers +44.1% NASDAQ Bank +35.0% KBW Nasdaq Bank +25.6%

Appendix (Including Financial Highlights) P EAPACK - G LADSTONE B ANK

Douglas L. Kennedy President & Chief Executive Officer 38 years experience; Before joining in 2012, he served as President of the NJ Market for Capital One Bank. He has held key executive level positions and had great success building formidable regional and national specialty banking business at Fleet Bank, Summit Bancorp and Bank of America. He is a current Member of the NJ Chamber of Commerce Board of Directors, Montclair State University Board of Trustees, and Sacred Heart University Board of Trustees. He has served as President of NJ After 3 and as a Board Member of the NJBankers Association. John P. Babcock Senior EVP & President of Wealth Management 35 years experience; Prior to joining, he was the managing director in charge of the Northeast Mid - Atlantic region for the HSBC Private Bank and, prior to that, he was the New York Metro Market Executive for U.S. Trust - the largest of U.S. Trust’s 53 markets in the U.S. In these and previous roles over the last 34 years, he has led commercial and wealth management/private bank businesses in New York City and regional markets through mergers, expansions, rapid growth and periods of significant organizational change. Jeffrey J. Carfora, CPA Senior EVP & Chief Financial Officer 36 years experience; Joining as Executive Vice President and CFO in March 2009, he was promoted to Senior Executive Vice President in August 2013. Previously, he was affiliated with Penn Federal Savings Bank ( where he joined as CFO and was later promoted to COO), Carteret Bank, and Marine Midland Bank. He began his career in 1980 with PriceWaterhouseCoopers . Finn M. W. Caspersen, Jr. Senior EVP, Chief Operating Officer & General Counsel 21 years experience; Before j oining in 2004, he worked as a corporate lawyer at Hale and Dorr, as an investment banker at Merrill Lynch and privately in venture capital. He has served as trustee of Cardigan Mountain School, Pomfret School, the Somerset Hills YMCA, the Willowwood Arboretum and the NJ Chapter of the Nature Conservancy. He was a two - term elected member of the Bedminster Township Committee and has also served on the Bedminster Environmental Commission and the Bedminster Land Use Board. Experienced Executive Management Team 27

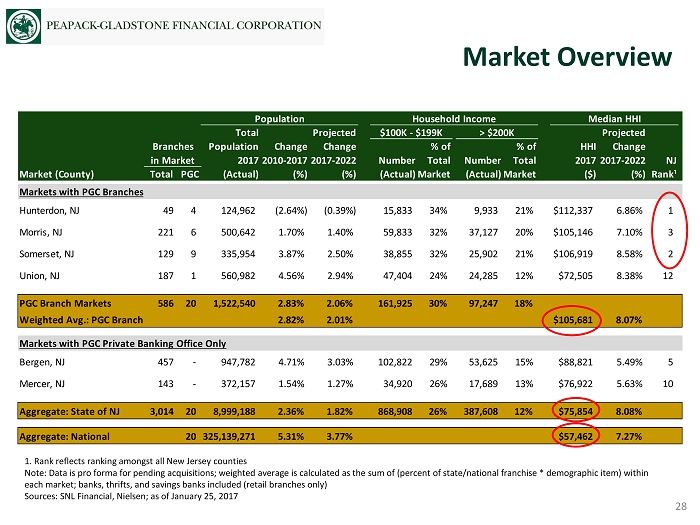

Population Household Income Median HHI Total Projected $100K - $199K > $200K Projected Branches Population Change Change % of % of HHI Change in Market 20172010-20172017-2022 Number Total Number Total 20172017-2022 NJ Market (County) Total PGC (Actual) (%) (%) (Actual)Market (Actual)Market ($) (%)Rank¹ Markets with PGC Branches Hunterdon, NJ 49 4 124,962 (2.64%) (0.39%) 15,833 34% 9,933 21% $112,337 6.86% 1 Morris, NJ 221 6 500,642 1.70% 1.40% 59,833 32% 37,127 20% $105,146 7.10% 3 Somerset, NJ 129 9 335,954 3.87% 2.50% 38,855 32% 25,902 21% $106,919 8.58% 2 Union, NJ 187 1 560,982 4.56% 2.94% 47,404 24% 24,285 12% $72,505 8.38% 12 PGC Branch Markets 586 20 1,522,540 2.83% 2.06% 161,925 30% 97,247 18% Weighted Avg.: PGC Branch Markets 2.82% 2.01% $105,681 8.07% Markets with PGC Private Banking Office Only Bergen, NJ 457 - 947,782 4.71% 3.03% 102,822 29% 53,625 15% $88,821 5.49% 5 Mercer, NJ 143 - 372,157 1.54% 1.27% 34,920 26% 17,689 13% $76,922 5.63% 10 Aggregate: State of NJ 3,014 20 8,999,188 2.36% 1.82% 868,908 26% 387,608 12% $75,854 8.08% Aggregate: National 20 325,139,271 5.31% 3.77% $57,462 7.27% 1. Rank reflects ranking amongst all New Jersey counties Note: Data is pro forma for pending acquisitions; weighted average is calculated as the sum of (percent of state/national fra nch ise * demographic item) within each market; banks, thrifts, and savings banks included (retail branches only) Sources: SNL Financial, Nielsen; as of January 25, 2017 Market Overview 28

1. 2015 includes $2.50 million of non - recurring charges related to the closure of two branch offices 2. See non - GAAP financial measures reconciliation on page 33 Historical Income Statement (as reported) 29 1 2013 2014 2015 2016 Summary Income Statement Interest Income $57,053 $75,575 $99,142 $117,048 Interest Expense 4,277 7,681 14,690 20,613 Net Interest Income 52,776 67,894 84,452 96,435 Provision for Loan Losses 3,425 4,875 7,100 7,500 Total Noninterest Income, Excl Securities Gains 19,755 20,547 23,187 28,799 Gain on Sales of Securities 840 260 527 119 Total Noninterest Expense 55,183 59,540 68,926 75,112 Income before Taxes 14,763 24,286 32,140 42,741 Provision for Income Taxes 5,502 9,396 12,168 16,264 Net Income $9,261 $14,890 $19,972 $26,477 Earnings Per Share (Diluted) $1.01 $1.22 $1.29 $1.60 Performance Ratios Return on Average Assets (ROAA) 0.54% 0.63% 0.64% 0.72% Return on Average Equity (ROAE) 7.37% 7.96% 7.71% 8.92% Net Interest Margin (Taxable Equivalent Basis) 3.26% 3.01% 2.80% 2.74% Operating Expenses/Average Assets Annualized 3.19% 2.53% 2.21% 2.06% Efficiency Ratio 76.63% 67.45% 63.80% 60.57% 2 1

Quarterly Income Statement (as reported) 30 1. December 31, 2015 includes $2.50 million of non - recurring charges related to the closure of two branch offices 2. See non - GAAP financial measures reconciliation on page 33 Dec 31, March 31, June 30, Sept 30, Dec 31, 2015 2016 2016 2016 2016 Summary Income Statement Interest Income $27,123 $27,898 $29,035 $29,844 $30,271 Interest Expense 4,304 4,488 4,859 5,575 5,691 Net Interest Income 22,819 23,410 24,176 24,269 24,580 Provision for Loan Losses 1,950 1,700 2,200 2,100 1,500 Total Noninterest Income, Excl Securities Gains 5,723 6,162 7,430 7,535 7,672 Gain on Securities Sales 0 101 18 0 0 Total Noninterest Expense 19,993 19,206 18,775 18,166 18,965 Net Income before Taxes 6,599 8,767 10,649 11,538 11,787 Income Tax Expenses 2,256 3,278 4,085 4,422 4,479 Net Income $4,343 $5,489 $6,564 $7,116 $7,308 Earnings Per Share (Diluted) $0.28 $0.34 $0.40 $0.43 $0.43 Performance Ratios Return on Average Assets (ROAA) 0.51% 0.64% 0.73% 0.77% 0.75% Return on Average Equity (ROAE) 6.37% 7.83% 9.06% 9.44% 9.27% Net Interest Margin (Taxable Equivalent Basis) 2.79% 2.82% 2.79% 2.74% 2.63% Operating Expenses/Average Assets Annualized 2.36% 2.22% 2.08% 1.98% 1.96% Efficiency Ratio 70.05% 65.22% 60.36% 57.58% 59.45% 1 2 1

Historical Balance Sheet 31 1. See non - GAAP financial measures reconciliation on page 32 2012 2013 2014 2015 2016 Cash and Equivalents $119,228 $35,147 $31,207 $70,160 $162,691 Total Securities 309,118 278,479 344,245 209,614 319,201 Total Cash & Securities 428,346 313,626 375,452 279,774 481,892 Gross Loans Held for Investment 1,132,584 1,574,201 2,250,267 2,913,242 3,312,144 Loans Held for Sale 20,210 2,001 839 83,758 1,588 Less: Allowance for Loan Losses 12,735 15,373 19,480 25,856 32,208 Total Net Loans 1,140,059 1,560,829 2,231,626 2,971,144 3,281,524 Total OREO 3,496 1,941 1,324 563 534 Goodwill 563 563 563 1,573 1,573 Other Intangibles 0 0 0 1,708 1,584 Fixed Assets 30,030 28,990 32,258 30,246 30,371 Bank-owned Life Insurance 31,088 31,882 32,634 42,885 43,806 Other Assets 34,254 29,117 28,540 36,766 37,349 Total Assets $1,667,836 $1,966,948 $2,702,397 $3,364,659 $3,878,633 Total Deposits $1,516,427 $1,647,250 $2,298,693 $2,935,470 $3,411,837 FHLB Borrowings 12,218 129,592 138,292 124,392 61,795 Capital Lease Obligations 8,971 8,754 10,712 10,222 9,693 Subordinated Debt 0 0 0 0 48,764 Total Deposits and Debt 21,189 138,346 149,004 134,614 3,532,089 Total Other Liabilities 8,163 10,695 12,433 18,899 22,334 Total Liabilities $1,545,779 $1,796,291 $2,460,130 $3,088,983 $3,554,423 Total Common Equity $122,057 $170,657 $242,267 $275,676 $324,210 Total Liabilities and Shareholders' Equity $1,667,836 $1,966,948 $2,702,397 $3,364,659 $3,878,633 Book Value Per Share $13.90 $14.79 $16.36 $17.61 $19.10 Tangible Book Value Per Share $13.84 $14.75 $16.32 $17.40 $18.91 Tangible Common Equity/Tangible Assets 7.29% 8.65% 8.95% 8.10% 8.28% Equity /Assets 7.32% 8.68% 8.96% 8.19% 8.36% Year Ended December 31, 1 1

We believe that these non - GAAP financial measures provide information that is important to investors and that is useful in under standing our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non - GAAP financ ial measures are supplemental and are not a substitute for an analysis based on GAAP measures. Non - GAAP Financial Measures Reconciliation 32 As Reported for the: 2012 2013 2014 2015 2016 Total Assets $1,667,836 $1,966,948 $2,702,397 $3,364,659 $3,878,633 Less: Goodwill 563 563 563 1,573 1,573 Less: Other Intangible Assets, net 0 0 0 1,708 1,584 Tangible Assets $1,667,273 $1,966,385 $2,701,834 $3,361,378 $3,875,476 Total Shareholder's Equity $122,057 $170,657 $242,267 $275,676 $324,210 Less: Goodwill 563 563 563 1,573 1,573 Less: Other Intangible Assets, net 0 0 0 1,708 1,584 Less: Preferred Stock 0 0 0 0 0 Tangible Common Equity $121,494 $170,094 $241,704 $272,395 $321,053 Tangible Common Equity/ Tangible Assets 7.29% 8.65% 8.95% 8.10% 8.28% Equity/Assets 7.32% 8.68% 8.96% 8.19% 8.36% Period End Shares Outstanding 8,863,690 11,788,517 15,155,717 16,068,119 17,257,995 Less: Restricted Shares Not Yet Vested 82,717 253,540 345,095 414,188 283,712 Total Outstanding Shares 8,780,973 11,534,977 14,810,622 15,653,931 16,974,283 Tangible Book Value Per Share $13.84 $14.75 $16.32 $17.40 $18.91 Book Value Per Share $13.90 $14.79 $16.36 $17.61 $19.10 Year Ended December 31,

We believe that these non - GAAP financial measures provide information that is important to investors and that is useful in under standing our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non - GAAP financ ial measures are supplemental and are not a substitute for an analysis based on GAAP measures. Non - GAAP Financial Measures Reconciliation 33 As Reported for the: Dec 31, Mar 31, June 30, Sept 30, Dec 31, 2015 2016 2016 2016 2016 Net Interest Income $22,819 $23,410 $24,176 $24,269 $24,580 Total Other Income 5,723 6,263 7,448 7,535 7,672 Less: Gain on Loans Held for Sale at lower of cost or fair value 0 124 500 256 353 Less: Securities Gains, Net 0 101 18 0 0 Total Recurring Revenue 28,542 29,448 31,106 31,548 31,899 Operating expenses 19,993 19,206 18,775 18,166 18,965 Less: ORE Provision 0 0 0 0 0 Total Operating Expenses 19,993 19,206 18,775 18,166 18,965 Efficiency Ratio 70.05% 65.22% 60.36% 57.58% 59.45% As Reported for the: 2013 2014 2015 2016 Net Interest Income $52,776 $67,894 $84,452 $96,435 Total Other Income 20,595 20,807 23,714 28,918 Less: Gain on Loans Held for Sale at lower of cost or fair value 522 166 0 1,233 Less: Securities Gains, Net 840 260 527 119 Total Recurring Revenue 72,009 88,275 107,639 124,001 Operating expenses 55,183 59,540 68,926 75,112 Less: ORE Provision 0 0 250 0 Total Operating Expenses 55,183 59,540 68,676 75,112 Efficiency Ratio 1 76.63% 67.45% 63.80% 60.57% Three Months Ended Year Ended December 31, 1. Efficiency ratio is calculated as (total operating expenses, excluding provision for losses on REO) as a percentage of (ne t i nterest income plus noninterest income less, gain on securities and gain on loans held for sale at lower of cost or fair value)

Peapack - Gladstone Financial Corporation 500 Hills Drive, Suite 300 P.O. Box 700 Bedminster, New Jersey 07921 (908) 234 - 0700 www.pgbank.com (NASDAQ Global Select Market: PGC) Douglas L. Kennedy President & Chief Executive Officer (908) 719 - 6554 dkennedy@pgbank.com John P. Babcock Senior EVP & President Private Wealth Management (908) 719 - 3301 jbabcock@pgbank.com Jeffrey J. Carfora Senior EVP & Chief Financial Officer (908) 719 - 4308 jcarfora@pgbank.com Finn M.W. Caspersen, Jr. Senior EVP, Chief Operating Officer & General Counsel (908) 719 - 6559 caspersen@pgbank.com Contacts Corporate Headquarters Contact Information 34