Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Neurotrope, Inc. | v457606_ex23-1.htm |

| EX-5.1 - EXHIBIT 5.1 - Neurotrope, Inc. | v457606_ex5-1.htm |

As filed with the Securities and Exchange Commission on January 30, 2017

Registration Statement No. 333-215159

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Neurotrope, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 2834 | 46-3522381 |

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

205 East 42nd Street – 16th Floor

New York, NY 10017

973-242-0005

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Robert Weinstein, Chief Financial Officer

Neurotrope, Inc.

205 East 42nd Street – 16th Floor

New York, NY 10017

973-242-0005

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Kenneth R. Koch, Esq.

Jeffrey P. Schultz, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky & Popeo, P.C.

666 Third Avenue

New York, New York 10017

212-935-3000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| (Check one): | |

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company þ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (3) | ||||||||||

| Common stock, par value $0.0001 per share | 8,040,395 shares | $ | 6.98 | $ | 56,121,957.10 | $ | 6,504.54 | |||||||

| (1) | Consists of (a) 3,828,754 shares of our common stock, par value $0.0001 per share, (b) 3,828,754 shares of our common stock issuable upon exercise of the outstanding Series F warrants to purchase our common stock having an exercise price of $12.80 per share and (c) 382,887 shares of our common stock issuable upon exercise of the outstanding placement agent warrants to purchase our common stock having an exercise price of $6.40 per share. Pursuant to Rule 416 under the Securities Act of 1933, as amended, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends, or similar transactions. The table above has been revised solely to give effect to the 1-for-32 reverse stock split of our common stock effected on January 11, 2017. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices of the registrant’s common stock as reported by the OTCQB marketplace (the “OTC Market”) on January 19, 2017, giving effect to the 1-for-32 reverse stock split of our common stock. The shares offered hereunder may be sold by the selling stockholders from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale or at negotiated prices. |

| (3) | $8,349.47 was previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated January 30, 2017

Neurotrope, Inc.

Prospectus

8,040,395 Shares

Common Stock

This prospectus relates to the sale of up to 8,040,395 shares of our common stock, par value $0.0001 per share, by the selling stockholders of Neurotrope, Inc., a Nevada corporation, named in this prospectus. The shares being offered consist of the following: (a) 3,828,754 shares of our common stock, (b) 3,828,754 shares of our common stock issuable upon exercise of the outstanding Series F warrants to purchase our common stock having an exercise price of $12.80 per share and (c) 382,887 shares of our common stock issuable upon exercise of the outstanding placement agent warrants to purchase our common stock having an exercise price of $6.40 per share. The shares offered by this prospectus were issued in connection with our private placement of securities, which was completed in November 2016 (the “November 2016 Private Placement”), and may be sold by the selling stockholders from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale or at negotiated prices.

Our common stock is traded on the OTCQB marketplace, or the OTC Market, under the symbol “NTRP.” On January 18, 2017, the last reported sale price for our common stock was $6.75 per share after giving effect to the 1-for-32 reverse stock split of our common stock effected on January 11, 2017. For 20 business days following the effectiveness of our reverse stock split, a “D” will be placed at the end of the symbol (“NTRPD”).

The distribution of the shares by the selling stockholders is not subject to any underwriting agreement. We will not receive any proceeds from the sale of the shares by the selling stockholders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the selling stockholders will be borne by them.

Our business and an investment in our securities involve a high degree of risk. Before making any investment in our securities, you should read and carefully consider the risks described in the “Risk Factors” section beginning on page 12 of this prospectus.

You should rely only on the information contained in this prospectus and any prospectus supplement or amendment. We have not authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus is only accurate on and as of the date of this prospectus, regardless of the time of any sale of securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2017

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell and seeking offers to buy our common stock only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction.

TABLE OF CONTENTS

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that should be considered before investing in our common stock. Potential investors should read the entire prospectus carefully, including the more detailed information regarding our business provided below in the “Description of Business” section, the risks of purchasing our common stock discussed under the “Risk Factors” section, and our consolidated financial statements and the accompanying notes to the consolidated financial statements. Unless otherwise noted, all share and per share data in this prospectus give effect to the 1-for-32 reverse stock split of our common stock that was effected on January 11, 2017. For more information about our reverse stock split, see “Recent Developments.”

Unless the context indicates otherwise, all references in this registration statement to “Neurotrope,” the “Company,” “we,” “us” and “our” refer to Neurotrope, Inc. and its wholly-owned consolidated operating subsidiary, Neurotrope BioScience, Inc. All references in this prospectus to “Neurotrope BioScience” refer solely to Neurotrope BioScience, Inc.

Overview

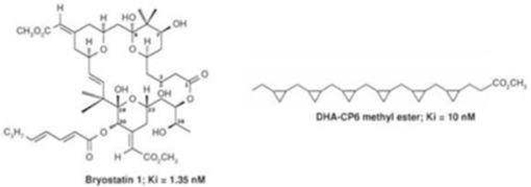

We are a biopharmaceutical company with product candidates in pre-clinical and clinical development. Neurotrope BioScience began operations in October 2012. We are principally focused on developing a product platform based upon a drug candidate called bryostatin for the treatment of Alzheimer’s disease (“AD”), which is in the clinical testing stage. We are also developing bryostatin for other neurodegenerative or cognitive diseases and dysfunctions, such as Fragile X and Niemann-Pick Type C, which are in pre-clinical testing. We have a technology license and services agreement (the “CRE License”), with Cognitive Research Enterprises, Inc. (formerly known as the Blanchette Rockefeller Neurosciences Institute, or BRNI) (“CRE”), and its affiliate NRV II, LLC, which we collectively refer to herein as “CRE,” pursuant to which we have an exclusive non-transferable license to certain patents and technologies required to develop our proposed products. Neurotrope BioScience was formed for the primary purpose of commercializing the technologies initially developed by CRE for therapeutic applications for AD or other cognitive dysfunctions. These technologies have been under development by CRE since 1999 and, up until March 2013, have been financed by CRE through funding from a variety of non-investor sources (which include not-for-profit foundations, the National Institutes of Health (which is part of the U.S. Department of Health and Human Services) and individual philanthropists). From March 2013 forward, development of the licensed technology has been funded principally through Neurotrope BioScience in collaboration with CRE.

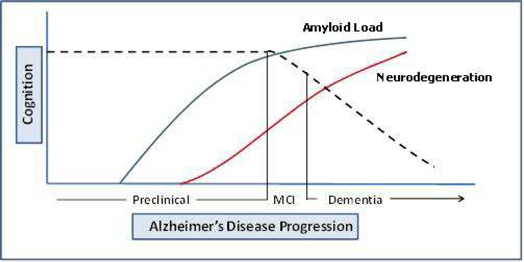

According to the Alzheimer’s Association, an estimated 36 million people worldwide had AD in 2015. The prevalence of AD is independent of race, ethnicity, geography, life style and, to a large extent, genetics. The most common cause of developing AD is old age. In developing countries, where the median age of death is less than 65 years old, AD is rarely recognized or diagnosed. In the U.S., 5.3 million people were estimated to have AD in 2015, and 96% of these people were older than 65 years of age.

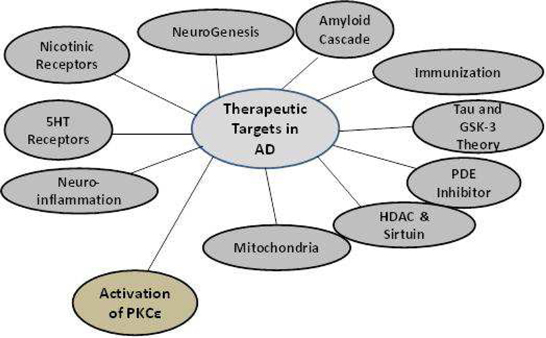

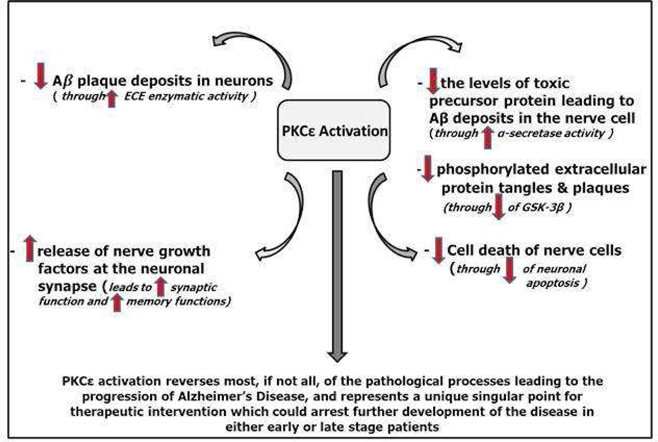

Researchers have explored and continue to explore a wide range of drug mechanisms in hopes of developing drugs to combat AD. We believe that our approach, which involves the activation of an enzyme called protein kinase C epsilon (“PKCε”), represents a novel mechanism in potential AD drug therapies.

CRE is conducting an expanded access program, formerly known as compassionate use, of Bryostatin-1 in patients with advanced AD. Thus far, five patients have been treated, four of which were treated under an Investigational New Drug Application (“IND”), cleared by the U.S. Food and Drug Administration (the “FDA”). The IND was initially held by CRE and was recently transferred to Neurotrope. One of these patients, who had familial AD, has died, but the death was not drug-related. The study for another one of these patients has concluded after almost one year on the protocol. We are providing limited funding, study drug, and personnel support under the terms of our agreement with CRE for this modest expansion of our clinical effort in AD during the 2016 timeframe.

In October 2015, we announced the initiation of a Phase 2 clinical trial to evaluate bryostatin for the treatment of patients with moderately severe to severe AD. We have completed enrollment and plan to randomize a total of up to 150 patients in this double-blind, placebo-controlled, study at approximately 30 sites. The primary objective of the clinical trial will be to assess the safety of bryostatin along with preliminary evaluation of the safety and efficacy of two doses of bryostatin in the patient population. We believe bryostatin may restore synaptic structures and functions damaged by AD, leading to improvements in cognition and memory. Beyond AD, we believe that several other neurodegenerative diseases, such as Fragile X Syndrome and Niemann Pick Type C Disease (both of which we are pursuing), ischemic stroke, traumatic brain injury, depression and aging in the brain, may be amenable to treatment with bryostatin. In August 2016, we announced that we submitted to the FDA an amended protocol for our Phase 2 clinical trial of lead candidate bryostatin-1 for the treatment of advanced AD. As planned in the original protocol, the primary efficacy outcome will occur at Week 13, and does not change with the amendment. The primary efficacy endpoint is based on the Severe Impairment Battery scale, a well-validated assessment used extensively in severe AD drug trials. Secondary efficacy endpoints include Activities of Daily Living, Neuropsychiatric Inventory and Mini-Mental State Exam. As a result of the amendment, we expect to report top line data late in the first quarter or early in the second quarter of 2017.

| 3 |

To the extent resources permit, we intend to pursue development of selected technology platforms with applications related to the treatment of AD and other neurodegenerative disorders based on our current licensed technology or technology available from third party licensors or collaborators.

Financings to Date

In February 2013, through a private placement, Neurotrope BioScience issued 9,073,300 shares of its Series A convertible preferred stock (“Neurotrope BioScience Series A Stock”), at $1.00 per share, resulting in gross proceeds of $9,073,300. In May 2013, Neurotrope BioScience issued an additional 1,313,325 shares of Neurotrope BioScience Series A Stock at $1.00 per share, resulting in gross proceeds of $1,313,325. In August 2013, Neurotrope BioScience issued 11,533,375 of Neurotrope BioScience Series A Stock at $1.00 per share, resulting in gross proceeds of $11,533,375. All of the outstanding shares of Neurotrope BioScience Series A Stock were converted on a one-for-one basis into shares of Neurotrope, Inc.’s Series A convertible preferred stock, par value $0.0001 per share (“Series A Stock”), in connection with the Reverse Merger (as defined below) in August 2013. In October 2013, we issued 1,080,000 additional shares of our Series A Stock at $1.00 per share, resulting in gross proceeds of $1,080,000, for a total of $23,000,000 of gross proceeds raised between February and October 2013.

In a November 2015 private placement, we sold units consisting of our Series B convertible preferred stock, par value $0.0001 per share (the “Series B Stock”), together with Series A warrants to purchase shares of our common stock (“Series A Warrants”), Series B warrants to purchase shares of our common stock (“Series B Warrants”), Series C warrants to purchase shares of our common stock (“Series C Warrants”), Series D warrants to purchase shares of our common stock (“Series D Warrants”) and Series E warrants to purchase shares of our common stock (“Series E Warrants” and, together with the Series A Warrants, Series B Warrants, Series C Warrants and Series D Warrants, the “Series A-E Warrants”), and certain placement agent warrants, resulting in gross proceeds of $15,640,963 (the “November 2015 Private Placement”). The private placement was completed in two closings, which took place on November 13, 2015 and November 30, 2015. In connection with this private placement, effective as of November 13, 2015, the holders of all 16,656,894 shares of our Series A Stock converted their shares into 620,781 shares of our common stock, which included 100,253 shares of our common stock issued in accordance with anti-dilution rights of the Series A Stock.

In a November 2016 private placement, we sold 3,828,754 shares of common stock and warrants to purchase an equivalent number of shares of our common stock, with an exercise price of $12.80 per share (subject to adjustment), for a period of five years from the date of issuance (the “Series F Warrants”), at a purchase price of $6.40 per share of Common Stock and Series F Warrant, resulting in gross proceeds of approximately $24.5 million (the “November 2016 Private Placement”). The private placement was completed in two closings, which took place on November 17, 2016 and November 22, 2016.

In connection with the November 2016 Private Placement, on November 17, 2016, we filed with the Secretary of State of the State of Nevada an Amendment to our Certificate of Designations, Preferences and Rights of Series B Preferred Stock (the “Series B COD Amendment”), originally filed November 13, 2015 with the Secretary of State of the State of Nevada, as corrected by the Certificate of Correction filed November 19, 2015 with the Secretary of State of the State of Nevada (as so corrected, the “Certificate of Designation”). The Series B COD Amendment (i) provided that the Company’s entry into a binding securities purchase agreement, by and among the Company and the investors signatory thereto, in connection with a private placement of the Company’s common stock and warrants, that results in at least $8,000,000 of aggregate gross proceeds to the Company (a “Private Placement”), shall result in the automatic conversion of the Company’s Series B Stock into shares of the Company’s common stock at a conversion price of $18.56 immediately prior to the initial closing of the Private Placement with aggregate gross proceeds to the Company of at least $8 million and (ii) amended the definition of “Excluded Securities” to include the issuance of the Company’s common stock and warrants issued in any Private Placement. As a result of the November 2016 Private Placement, all of the issued and outstanding shares of Series B Stock were converted into an aggregate of 825,962 shares of our common stock on November 17, 2016. The Series B COD Amendment was approved by the “Required Holders” as defined in the Certificate of Designation. As a result of the mandatory conversion of the Series B Stock, the anti-dilution protection for dilutive issuances in the Series A Warrants, the Series C Warrants and the Series E Warrants ceased to be effective pursuant to the terms of such warrants.

| 4 |

Pursuant to the purchase agreement entered into in connection with November 2016 Private Placement, we agreed to reduce the exercise prices of certain of our outstanding warrants to purchase shares of common stock that were issued in connection with the November 2015 Private Placement. Effective as of November 18, 2016, the exercise price of each of the Series A Warrants and the Series C Warrants was reduced to $0.32 per share and the exercise price of the Series E Warrants was reduced to $32.00 per share, in each case subject to adjustment as provided in such Warrants.

In connection with the Offering, pursuant to a Placement Agency Agreement, dated October 13, 2016 (the “Placement Agency Agreement”), among the Company, Katalyst Securities LLC and GP Nurmenkari Inc. (the “Placement Agents”), we agreed to pay the Placement Agents (i) a cash fee at each closing under the Purchase Agreement equal to ten percent (10%) of each closing’s gross proceeds and (ii) warrants to purchase shares of Common Stock at each closing under the Purchase Agreement equal to ten percent (10%) of the number of shares of Common Stock sold in each closing, with an exercise price of $6.40 per share and a five-year term (the “Broker Warrants”). Such Warrants shall not become exercisable until the Company’s stockholders have approved an amendment to its Articles of Incorporation to increase the number of authorized shares and such amendment is filed in Nevada.

Under the Placement Agency Agreement, we agreed to amend certain warrants previously issued to the Placement Agents. Immediately following the receipt of at least $8,000,000 of gross proceeds as part of the Offering, the exercise price of the 70,119 unexercised Placement Agent Series B Warrants and/or broker warrants issued by the Company as placement agent compensation to Katalyst Securities LLC, their registered representatives and designees, assignees or successors in interest, in connection with the Company’s completed financing in November 2015 (collectively, the “Series B Broker Warrants”), shall be reduced to $0.32 per share of Common Stock, provided that the Series B Broker Warrants that have their exercise price reduced shall not be exercisable for six months from the date of the initial closing under the Purchase Agreement. Additionally, immediately following the receipt of at least $10,000,000 of gross proceeds as part of the Offering, the exercise price of the 41,416 unexercised Placement Agent Series A Warrants and/or broker warrants issued by the Company as placement agent compensation to EDI Financial, Inc., Katalyst Securities LLC, their registered representatives and designees, assignees or successors in interest, in connection with the Company’s completed financings in 2013 (collectively, the “Series A Broker Warrants”) shall be reduced to $0.32 per share of Common Stock, provided that the Series A Broker Warrants that have their exercise price reduced shall not be exercisable for one year from the date of the initial closing under the Purchase Agreement. Accordingly, the exercise price of the Series A Broker Warrants and the Series B Broker Warrants has been reduced to $0.32 per share of Common Stock as of November 23, 2016.

Organizational History

We were incorporated as BlueFlash Communications, Inc. in Florida on January 11, 2011. Prior to the Reverse Merger (as defined below) and Split-Off (as defined below), our business was to provide software solutions to deliver geo-location targeted coupon advertising to mobile internet devices.

On August 9, 2013, we reincorporated in the State of Nevada by merging into a newly-formed special-purpose subsidiary, Neurotrope, Inc., which was incorporated on June 13, 2013 and was the surviving corporation in such reincorporation merger, or the Reincorporation Merger. As a result of the Reincorporation Merger, (i) we changed our name to Neurotrope, Inc., (ii) we changed our jurisdiction of incorporation from Florida to Nevada, (iii) we increased our authorized capital stock from 300,000,000 pre-split shares of common stock, par value $0.0001 per share, to 300,000,000 pre-split shares of common stock, par value $0.0001 per share, and 50,000,000 shares of “blank check” preferred stock, par value $0.0001 per share, (iv) each share of BlueFlash Communications, Inc. common stock outstanding at the time of the Reincorporation Merger was automatically converted into 2.242 pre-split shares of Neurotrope, Inc. common stock, our common stock, with the result being that the 10,200,000 pre-split shares of common stock of BlueFlash Communications, Inc. outstanding immediately prior to the Reincorporation Merger were converted into 22,868,400 pre-split shares of common stock of Neurotrope, Inc. outstanding immediately thereafter. All share and per share numbers in this prospectus relating to the common stock of Neurotrope, Inc., prior to the Reincorporation Merger have been adjusted to give effect to this conversion, unless otherwise stated.

| 5 |

In connection with the Reincorporation Merger, we changed our fiscal year from a fiscal year ending on January 31 of each year to one ending on December 31 of each year.

On August 23, 2013, our wholly-owned subsidiary, Neurotrope Acquisition, Inc., or Acquisition Sub, a corporation formed in the State of Nevada on August 15, 2013 merged with and into Neurotrope BioScience, a corporation incorporated in the State of Delaware on October 31, 2012. Neurotrope BioScience was the surviving corporation in the merger, or the Reverse Merger, and became our wholly-owned subsidiary. All of the outstanding shares of Neurotrope BioScience common stock, or Neurotrope BioScience Common Stock, were converted into shares of our common stock, par value $0.0001 per share, and all of the outstanding shares of Neurotrope BioScience Series A Stock were converted into shares of our Series A Stock, in each case on a one-for-one basis.

In connection with the Reverse Merger and pursuant to a split-off agreement, or Split-Off, we transferred our pre-Reverse Merger business to Marissa Watson, our pre-Reverse Merger majority stockholder, in exchange for the surrender and cancellation of 20,178,000 pre-split shares of our common stock owned by her.

As a result of the Reverse Merger and Split-Off, we discontinued our pre-Reverse Merger business and acquired the business of Neurotrope BioScience. Following the Reverse Merger and Split-off, we have undertaken the business operations of Neurotrope BioScience as a publicly-traded company under the name Neurotrope, Inc., through Neurotrope BioScience, which is now our wholly-owned subsidiary.

In accordance with “reverse merger” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Reverse Merger have been and will be replaced with the historical financial statements of Neurotrope BioScience prior to the Reverse Merger in all applicable filings with the Securities and Exchange Commission, or the SEC.

Recent Developments

On January 11, 2017, we effected a 1-for-32 reverse stock split of our shares of common stock. As a result of the reverse stock split, every thirty-two (32) shares of our pre-reverse split common stock was combined and reclassified into one share of common stock. In addition, our pre-reverse split 400,000,000 authorized shares of common stock was proportionately reduced to 12,500,000 authorized shares of common stock as a result of the reverse stock split.

About This Offering

This prospectus relates to the offering, which is not being underwritten, by the selling stockholders listed in this prospectus, of up to 8,040,395 shares of our common stock. The shares being offered consist of the following: (a) 3,828,754 shares of our common stock, (b) 3,828,754 shares of our common stock issuable upon exercise of the outstanding Series F warrants to purchase our common stock having an exercise price of $12.80 per share and (c) 382,887 shares of our common stock issuable upon exercise of the outstanding placement agent warrants to purchase our common stock having an exercise price of $6.40 per share. The shares offered by this prospectus were issued in connection with the November 2016 Private Placement, and may be sold by the selling stockholders from time to time in the open market, through negotiated transactions or otherwise at market prices prevailing at the time of sale or at negotiated prices. We will receive none of the proceeds from the sale of the shares by the selling stockholders. We are registering the shares of common stock and the warrants described above pursuant to the Registration Rights Agreement, dated as of November 17, 2016, between us and the investors in the November 2016 Private Placement. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the selling stockholders will be borne by them.

| 6 |

Selected Risks Associated with Our Business and Our Common Stock

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus, which you should review carefully. You should carefully consider these risks before making an investment. Some of these risks include the following:

| · | We may need additional financing in the future to continue our operations. If we are unable to obtain additional financing on acceptable terms, we will need to curtail or cease our development plans and operations. |

| · | We cannot guarantee that we will continue as a going concern because we have not yet been successful in establishing profitable operations. |

| · | Our ongoing viability as a company depends on our ability to successfully develop and commercialize our licensed technology. |

| · | If the CRE License were terminated, we may be required to cease operations. |

| · | We may rely on independent third-party contract research organizations to perform clinical and non-clinical studies of our drug candidate and to perform other research and development services. |

| · | We have relied on the representations and materials provided by CRE, including scientific, peer-reviewed and non-peer reviewed publications, abstracts, slides, internal documents, verbal communications, patents and related patent filings, with respect to the results of its research related to our proposed products. |

| · | We have a limited operating history upon which investors can evaluate our future prospects. |

| · | If we do not obtain the necessary regulatory approvals in the United States and/or other countries, we will not be able to sell our drug candidates. |

| · | We have not generated any revenues since our inception and we do not expect to generate revenue for the foreseeable future. If we do not generate revenues and achieve profitability, we will likely need to curtail or cease our development plans and operations. |

| · | Our commercial success will depend, in part, on our ability, and the ability of our licensors, to obtain and maintain patent protection. Our licensors’ failure to obtain and maintain patent protection for our products may have a material adverse effect on our business. |

| · | Changes in our ownership could limit our ability to utilize net operating loss carryforwards. |

| · | Our licensed patented technologies may infringe on other patents, which may expose us to costly litigation. |

| · | We may not be able to protect our trade secrets and other unpatented proprietary technologies, which could give our competitors an advantage over us. |

| · | If we are unable to hire additional qualified personnel, our business prospects may suffer. |

| · | We may not be able to in-license or acquire new development-stage products or technologies. |

| · | We are dependent upon the National Cancer Institute, or the NCI, to supply bryostatin for our clinical trials. |

| · | We expect to rely on third parties to manufacture our proposed products and, as a result, we may not be able to control our product development or commercialization. |

| · | We may rely on third parties for marketing and sales and our revenue prospects may depend on their efforts. |

| · | If our products are not accepted by patients, the medical community or health insurance companies, our business prospects will suffer. |

| · | The branded prescription segment of the pharmaceutical industry in which we operate is competitive, and we are particularly subject to the risks of such competition. |

| 7 |

| · | Our business will expose us to potential product liability risks, which could result in significant product liability exposure. |

| · | A successful clinical trial liability claim against us could have a material adverse effect on our financial condition even with such insurance coverage. |

| · | A successful liability claim against us could have a material adverse effect on our financial condition. |

| · | Reforms in the health care industry and the uncertainty associated with pharmaceutical and laboratory test pricing, reimbursement and related matters could adversely affect the marketing, pricing and demand for our products. |

| · | Consolidation in the pharmaceutical industry could materially affect our ability to operate as an independent entity. |

| · | There currently is a limited public market for our common stock. Failure to develop or maintain an active trading market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your shares. |

| · | We cannot assure you that our common stock will become liquid or that it will be listed on a securities exchange. |

| · | Our common stock may be subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in our common stock. |

| · | Volatility in the price of our common stock could lead to losses by investors and costly securities litigation. |

| · | We do not anticipate dividends to be paid on our common stock, and investors may lose the entire amount of their investment. |

| · | If securities analysts do not initiate coverage or continue to cover our common stock or if they publish unfavorable research or reports about our business, there could be a negative impact on the market price of our common stock. |

| · | Because state securities “Blue Sky” laws prohibit trading absent compliance with individual state laws, state Blue Sky registration requirements could limit resale of the shares. |

| · | You may experience significant dilution of your ownership interests because of the future issuance of additional shares of our common stock. |

| · | We may obtain additional capital through the issuance of preferred stock, which may limit your rights as a holder of our common stock. |

| · | Being a public company is expensive and administratively burdensome. |

| · | Any failure to maintain effective internal control over our financial reporting could materially adversely affect us. |

| · | There can be no assurance that the reverse stock split will achieve the desired benefits. |

| · | The reverse stock split may decrease the liquidity of the shares of our common stock. |

Corporate Information

Our principal executive offices are located at 205 East 42nd Street – 16th Floor, New York, NY 10017. Our telephone number is 1-973-242-0005. Our website address is http://www.neurotropebioscience.com. The information on, or that can be accessed through, our website is not part of this prospectus.

| 8 |

| Common stock currently outstanding | 6,987,411 shares (1) | |

| Series A, Series C, Series E and Series F Investor Warrants currently outstanding | Warrants to purchase an aggregate of 5,515,451 shares of our common stock | |

| Placement Agent Warrants currently outstanding | Warrants to purchase an aggregate of 495,999 shares of our common stock, | |

| Common stock offered by the Company | None | |

| Common stock offered by the selling stockholders | Up to 8,040,395 shares (2) | |

| Use of proceeds | We will not receive any of the proceeds from the sales of our common stock by the selling stockholders. | |

| OTC Market symbol | NTRP. For 20 business days following the effectiveness of our reverse stock split, a “D” will be placed at the end of the symbol (“NTRPD”). | |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 12 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| (1) | As of January 25, 2017, and excludes warrants to purchase 5,515,451 shares of our common stock, placement agent warrants to purchase 495,999 shares of our common stock and options to purchase 683,217 shares of our common stock (with exercise prices ranging from $10.56 to $71.04 per share). |

| (2) | Consists of (a) 3,828,754 shares of our common stock, par value $0.0001 per share, (b) 3,828,754 shares of our common stock issuable upon exercise of the outstanding Series F warrants to purchase our common stock having an exercise price of $12.80 per share and (c) 382,887 shares of our common stock issuable upon exercise of the outstanding placement agent warrants to purchase our common stock having an exercise price of $6.40 per share. |

| 9 |

Summary Financial Information

| Fiscal Year Ended December 31, 2015 | Fiscal Year Ended December 31, 2014 | Nine Months Ended September 30, 2016 | Nine Months Ended September 30, 2015 | |||||||||||||

| Statement of Operations Data | ||||||||||||||||

| Revenues | $ | — | $ | — | $ | — | $ | — | ||||||||

| Total operating expenses | $ | 9,445,757 | $ | 9,267,120 | $ | 7,918,584 | $ | 6,911,018 | ||||||||

| Net loss | $ | (9,441,535 | ) | $ | (9,253,323 | ) | $ | (7,913,134 | ) | $ | (6,908,174 | ) | ||||

| Statement of Cash Flows Data | ||||||||||||||||

| Cash used in operating activities | $ | (10,316,600 | ) | $ | (7,152,576 | ) | $ | (4,701,686 | ) | $ | (6,475,749 | ) | ||||

| Cash used in investing activities | $ | (11,827 | ) | $ | (54,943 | ) | $ | (2,947 | ) | $ | (11,827 | ) | ||||

| Cash provided by (used in) financing activities | $ | 13,548,707 | $ | 6,132 | $ | (10,237 | ) | $ | 20,756 | |||||||

| At December 31, 2015 | At December 31, 2014 | At September 30, 2016 | At September 30, 2015 | |||||||||||||

| Balance Sheet Data | ||||||||||||||||

| Total current assets | $ | 12,723,249 | $ | 8,107,430 | $ | 6,739,473 | $ | 1,891,468 | ||||||||

| Total assets | $ | 12,782,424 | $ | 8,161,048 | $ | 6,796,407 | $ | 1,952,254 | ||||||||

| Total current liabilities | $ | 990,969 | $ | 1,289,188 | $ | 1,953,034 | $ | 1,598,978 | ||||||||

| Total liabilities | $ | 990,969 | $ | 1,289,188 | $ | 1,953,034 | $ | 1,598,978 | ||||||||

| Convertible redeemable preferred stock | $ | 11,814,874 | $ | 18,524,163 | $ | 11,570,695 | $ | 14,522,010 | ||||||||

| Total stockholders’ deficit | $ | (23,419 | ) | $ | (11,652,303 | ) | $ | (6,727,322 | ) | $ | (14,168,734 | ) | ||||

| 10 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, including, without limitation, in the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere. Any and all statements contained in this prospectus that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this prospectus may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time associated with drug development and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this prospectus appears in the section captioned “Risk Factors” and elsewhere in this prospectus. Readers should carefully review this prospectus in its entirety, including, but not limited to, our financial statements and the notes thereto and the risks described herein. We advise you to carefully review the reports and documents we file from time to time with the SEC, particularly our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this prospectus to reflect any new information or future events or circumstances or otherwise.

| 11 |

An investment in shares of our common stock is highly speculative and involves a high degree of risk. We face a variety of risks that may affect our operations and financial results and many of those risks are driven by factors that we cannot control or predict. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment. Only those investors who can bear the risk of loss of their entire investment should invest in our common stock.

Risks Related to Our Business and Financial Condition

We will need additional financing to continue our operations. If we are unable to obtain additional financing on acceptable terms, we will need to curtail or cease our development plans and operations.

As of September 30, 2016, we had approximately $6.5 million of available cash and cash equivalents. We raised approximately $24.5 million of gross proceeds in the November 2016 Private Placement. We are currently reviewing our current operating plans, and we will require additional capital in the future. Additional funds may be raised through the issuance of equity securities and/or debt financing, there being no assurance that any type of financing on terms acceptable to us will be available or otherwise occur. Debt financing must be repaid regardless of whether we generate revenues or cash flows from operations and may be secured by substantially all of our assets. Any equity financing or debt financing that requires the issuance of warrants or other equity securities to the lender would cause the percentage ownership by our current stockholders to be diluted, which dilution may be substantial. Also, any additional equity securities issued may have rights, preferences or privileges senior to those of existing stockholders. If such financing is not available when required or is not available on acceptable terms, we may be required to reduce or eliminate certain product candidates and development activities, including those related to bryostatin, the “bryologs” or polyunsaturated fatty acid analogs, and it may ultimately require us to suspend or cease operations, which could cause investors to lose the entire amount of their investment.

We cannot guarantee that we will continue as a going concern because we have not yet been successful in establishing profitable operations.

We received a report from our independent registered public accounting firm on our financial statements for fiscal years ended December 31, 2015 and 2014, which contained emphasis of matter language indicating substantial doubt about the Company’s ability to continue as a going concern. In addition, and consistent with 2014, the footnotes to our financial statements contained herein list factors, including substantial losses, substantial contractual commitments, and failure to generate revenues, which raise substantial doubt about our ability to continue as a going concern.

Our ongoing viability as a company depends on our ability to successfully develop and commercialize our licensed technology.

We are principally focused on developing a drug, bryostatin, for the treatment of AD and other diseases, which is still in the clinical testing stage and has not yet been fully developed. Our potential success is highly uncertain since our principal product candidate (bryostatin to treat AD) is in Phase 2 of development. Our other product candidates (use of bryostatin to treat Niemann Pick Type-C and Fragile X Syndrome) are even earlier in their development cycles. Bryostatin is also subject to regulatory approval. Our potential success depends upon our ability to raise more capital, complete development of and successfully commercialize bryostatin in a timely manner for the treatment of AD or other diseases. We must develop bryostatin, successfully test it for safety and efficacy in the targeted patient population, and manufacture the finished dosage form on a commercial scale to meet regulatory standards and receive regulatory approvals. The development and commercialization process is both time-consuming and costly, and involves a high degree of business risk. Bryostatin is still at an early stage in its product development cycle, and any follow-on product candidates are still at the concept stage. The results of pre-clinical and clinical testing of our product candidates are uncertain and we cannot assure anybody that we will be able to obtain regulatory approvals of our product candidates. If obtained, regulatory approval may take longer or be more expensive than anticipated. Furthermore, even if regulatory approvals are obtained, our products may not perform as we expect and we may not be able to successfully and profitably produce and market any products. Delays in any part of the process or our inability to obtain regulatory approval of our products could adversely affect our future operating results by restricting (or even prohibiting) the introduction and sale of our products.

| 12 |

If the BRNI License were terminated, we may be required to cease operations.

Our rights to develop, commercialize and sell certain of our proposed products, including bryostatin, is, in part, dependent upon the CRE License. CRE has the right to terminate this agreement after 30 days prior notice in certain circumstances, including if we were to materially breach any provisions of the agreement after a 60-day cure period for breaches that are capable of being cured, in the event of certain bankruptcy or insolvency proceedings. Additionally, the CRE License provides that the license may not be assigned, including by means of a change of control of the Company, or sublicensed without the consent of CRE. For additional information regarding the CRE License, see “Business – Intellectual Property – Technology License and Services Agreement.” If the CRE License were terminated, we would lose rights to a substantial portion of the intellectual property currently being developed by us and no longer have the rights to develop, commercialize and sell some of our proposed products. As a result, we may be required to cease operations under such circumstance.

We may rely on independent third-party contract research organizations to perform clinical and non-clinical studies of our drug candidate and to perform other research and development services.

The CRE License requires us to use CRE to provide research and development services and other scientific assistance and support services, including clinical trials, under certain conditions. The CRE License limits our ability to make certain decisions, including those relating to our drug candidate, without CRE’s consent. See “Business – Intellectual Property – Technology License and Services Agreement.” Under certain conditions, we may, however, also rely on independent third-party contract research organizations, or a CRO, to perform clinical and non-clinical studies of our drug candidate. Many important aspects of the services that may be performed for us by CROs would be out of our direct control. If there were to be any dispute or disruption in our relationship with such CROs, the development of our drug candidate may be delayed. Moreover, in our regulatory submissions, we would expect to rely on the quality and validity of the clinical work performed by our CROs. If any of our CROs’ processes, methodologies or results were determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals could be materially adversely impacted.

We have relied on the representations and materials provided by CRE, including scientific, peer-reviewed and non-peer reviewed publications, abstracts, slides, internal documents, verbal communications, patents and related patent filings, with respect to the results of its research related to our proposed products.

CRE began the development of the intellectual property that forms the basis for our proposed products in 1999. We have relied on the quality and validity of the research results obtained by CRE with respect to this intellectual property, and we have conducted limited verification of the raw preclinical and clinical data produced by CRE. No independent third-party has verified any such data. If any of CRE’s basic processes, methodologies or results were determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals, could be materially adversely impacted.

We have a limited operating history upon which investors can evaluate our future prospects.

Our drug product, bryostatin, is in an early development stage and we are subject to all of the risks inherent in the establishment of a new business enterprise. While development of our product candidates was started in 1999 by CRE, Neurotrope BioScience was incorporated on October 31, 2012 and on that same date entered into the Technology License and Services Agreement with CRE and NRV II, LLC for the continuing development and commercialization of our product candidates, and, therefore, we have a limited operating history. Our proposed products are currently in the research and development stage and we have not generated any revenues, nor do we expect our products to generate revenues for the near term, if ever. As a result, any investment in our securities must be evaluated in light of the potential problems, delays, uncertainties and complications encountered in connection with a newly established pharmaceutical development business. The risks include, but are not limited to, the possibilities that any or all of our potential products will be found to be unsafe, ineffective or, that the products once developed, although effective, are not economical to market; that our competitors hold proprietary rights that preclude us from marketing such products; that our competitors market a superior or equivalent product; or the failure to receive necessary regulatory clearances for our proposed products. To achieve profitable operations, we must successfully develop, obtain regulatory approval for, introduce and successfully market, sell or license at a profit product candidates that are currently in the research and development phase. We only have one product candidate in clinical development, i.e., bryostatin to treat AD. Much of the clinical development work and testing for our product candidates remains to be completed. No assurance can be given that our research and development efforts will be successful, that required regulatory approvals will be obtained, that any of our candidates will be safe and effective, that any products, if developed and introduced, will be successfully marketed, sold or licensed or achieve market acceptance or that products will be marketed at prices necessary to generate profits. Failure to successfully develop, obtain regulatory approvals for, or introduce and market, sell or license our products would have material adverse effects on our business prospects, financial condition and results of operations.

| 13 |

If we do not obtain the necessary regulatory approvals in the United States and/or other countries, we will not be able to sell our drug candidates.

We cannot assure you that we will receive the approvals necessary to commercialize bryostatin, or any other potential drug candidates we acquire or attempt to develop in the future. We will need approval from the FDA to commercialize our drug candidates in the U.S. and approvals from similar regulatory authorities in foreign jurisdictions to commercialize our drug candidates in those jurisdictions. In order to obtain FDA approval of bryostatin or any other drug candidate for the treatment of AD, we must submit first an Investigational New Drug (“IND”) application and then a New Drug Application (“NDA”) to the FDA, demonstrating that the drug candidate is safe, pure and potent, and effective for its intended use. This demonstration requires significant research including completion of clinical trials. Satisfaction of the FDA’s regulatory requirements typically takes many years, depending upon the type, complexity and novelty of the drug candidate and requires substantial resources for research, development and testing. We cannot predict whether our clinical trials will demonstrate the safety and efficacy of our drug candidates or if the results of any clinical trials will be sufficient to advance to the next phase of development or for approval from the FDA. We also cannot predict whether our research and clinical approaches will result in drugs or therapeutics that the FDA considers safe and effective for the proposed indications. The FDA has substantial discretion in the drug approval process. The approval process may be delayed by changes in government regulation, future legislation or administrative action or changes in FDA policy that occur prior to or during our regulatory review. Delays in obtaining regulatory approvals may prevent or delay commercialization of, and our ability to derive revenues from, our drug candidates and diminish any competitive advantages that we may otherwise believe that we hold. Even if we comply with all FDA requests, the FDA may ultimately reject one or more of our applications. We may never obtain regulatory clearance for any of our drug candidates. Failure to obtain FDA approval of our drug candidates will leave us without a saleable product and therefore without any source of revenues. In addition, the FDA may require us to conduct additional clinical testing or to perform post-marketing studies, as a condition to granting marketing approval of a drug product or permit continued marketing, if previously approved. If conditional marketing approval is obtained, the results generated after approval could result in loss of marketing approval, changes in product labeling, and/or new or increased concerns about the side effects or efficacy of a product. The FDA has significant post-market authority, including the explicit authority to require post-market studies and clinical trials, labeling changes based on new safety information and compliance with FDA-approved risk evaluation and mitigation strategies. The FDA’s exercise of its authority has in some cases resulted, and in the future could result, in delays or increased costs during product development, clinical trials and regulatory review, increased costs to comply with additional post-approval regulatory requirements and potential restrictions on sales of approved drugs. In foreign jurisdictions, the regulatory approval processes generally include the same or similar risks as those associated with the FDA approval procedures described above. We cannot assure you that we will receive the approvals necessary to commercialize our drug candidates for sale either within or outside the United States.

We have not generated any revenues since our inception and we do not expect to generate revenue for the foreseeable future. If we do not generate revenues and achieve profitability, we will likely need to curtail or cease our development plans and operations.

Our ability to generate revenues depends upon many factors, including our ability to complete our currently planned clinical study and development of our proposed products, our ability to obtain necessary regulatory approvals for our proposed products and our ability to successfully commercialize market and sell our products. We have not generated any revenues since we began operations on October 31, 2012. We expect to incur significant operating losses over the next several years. If we do not generate revenues, do not achieve profitability and do not have other sources of financing for our business, we will likely need to curtail or cease our development plans and operations, which could cause investors to lose the entire amount of their investment.

| 14 |

Our commercial success will depend, in part, on our ability, and the ability of our licensors, to obtain and maintain patent protection. Our licensors’ failure to obtain and maintain patent protection for our products may have a material adverse effect on our business.

Pursuant to the CRE License, we have obtained rights to certain patents owned by CRE or licensed to NRV II, LLC by CRE as of or subsequent to October 31, 2012. For additional information regarding the CRE License, see “Business – Intellectual Property – Technology License and Services Agreement.” In the future, we may seek rights from third parties to other patents or patent applications. Our success will depend, in part, on our ability and the ability of our licensors to maintain and/or obtain and enforce patent protection for our proposed products and to preserve our trade secrets, and to operate without infringing upon the proprietary rights of third parties. Patent positions in the field of biotechnology and pharmaceuticals are generally highly uncertain and involve complex legal and scientific questions. We cannot be certain that we or our licensors were the first inventors of inventions covered by our licensed patents or that we or they were the first to file. Accordingly, the patents licensed to us may not be valid or afford us protection against competitors with similar technology. The failure to maintain and/or obtain patent protection on the technologies underlying our proposed products may have material adverse effects on our competitive position and business prospects.

Changes in our ownership could limit our ability to utilize net operating loss carryforwards.

As of September 30, 2016, we had aggregate federal and state net operating loss carryforwards of approximately $29 million, which begin to expire in fiscal 2032. Under Section 382 of the Internal Revenue Code of 1986, as amended, or the Code, changes in our ownership may limit the amount of our net operating loss carryforwards that could be utilized annually to offset our future taxable income, if any. This limitation would generally apply in the event of a cumulative change in ownership of our company of more than 50% within a three-year period. Any such limitation may significantly reduce our ability to utilize our net operating loss carryforwards and tax credit carryforwards before they expire. Any such limitation, whether as the result of future offerings, prior private placements, sales of our common stock by our existing stockholders or additional sales of our common stock by us in the future (through the conversion of preferred stock, the exercise of outstanding warrants, or otherwise), could have a material adverse effect on our results of operations in future years. We have not completed a study to assess whether an ownership change for purposes of Section 382 has occurred, or whether there have been multiple ownership changes since our inception, due to the significant costs and complexities associated with such study.

Our licensed patented technologies may infringe on other patents, which may expose us to costly litigation.

It is possible that our licensed patented technologies may infringe on patents or other rights owned by others. We may have to alter our products or processes, pay additional licensing fees, pay to defend an infringement action or challenge the validity of the patents in court or cease activities altogether because of patent rights of third parties, thereby causing additional unexpected costs and delays to us. Patent litigation is costly and time consuming, and we may not have sufficient resources to pay for such litigation. Pursuant to the CRE License, CRE has the exclusive right (but not the obligation) to apply for, file, prosecute or maintain patents and patent applications for our licensed technologies. However, in order to maintain our rights to use our licensed technologies, we must reimburse CRE for all of the attorney’s fees and other costs and expenses related to any of the foregoing. For additional information regarding the CRE License, see “Business – Intellectual Property – Technology License and Services Agreement.” If the patents licensed to us are determined to infringe a patent owned by a third party and we do not obtain a license under such third-party patents, or if we are found liable for infringement or are not able to have such third-party patents declared invalid, we may be liable for significant money damages, we may encounter significant delays in bringing products to market or we may be precluded from participating in the manufacture, use or sale of products or methods of treatment requiring such licenses.

| 15 |

We may not be able to protect our trade secrets and other unpatented proprietary technologies, which could give our competitors an advantage over us.

In addition to our reliance on patents and pending patents owned by CRE, we rely upon trade secrets and other unpatented proprietary technologies. We may not be able to adequately protect our rights with regard to such unpatented proprietary technologies or competitors may independently develop substantially equivalent technologies. We seek to protect trade secrets and proprietary knowledge, in part through confidentiality agreements with our employees, consultants, advisors and collaborators. Nevertheless, these agreements may not effectively prevent disclosure of our confidential information and may not provide us with an adequate remedy in the event of unauthorized disclosure of such information and, as a result, our competitors could gain a competitive advantage over us.

If we are unable to hire additional qualified personnel, our business prospects may suffer.

Our success and achievement of our business plans depend upon our ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among pharmaceutical and biotechnology companies is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the implementation of our business plans and activities could have a material adverse effect on us. Our inability to attract and retain the necessary technical and managerial personnel and consultants and scientific and/or regulatory consultants and advisors could have a material adverse effect on our business prospects, financial condition and results of operations.

We may not be able to in-license or acquire new development-stage products or technologies.

Our product commercialization strategy relies, to some extent, on our ability to in-license or acquire product formulation techniques, new chemical entities, or related know-how that has proprietary protection. If resources permit, we may also seek to acquire, by license or otherwise, other development stage products that are consistent with our product portfolio objectives and commercialization strategy. The acquisition of products requires the identification of appropriate candidates, negotiation of terms of acquisition, and financing for the acquisition and integration of the candidates into our portfolio. Failure to accomplish any of these tasks may diminish our growth rate and adversely alter our competitive position.

We are dependent upon the NCI to supply bryostatin for our clinical trials.

CRE has entered into a material transfer agreement with the NCI, pursuant to which the NCI has agreed to supply bryostatin required for our pre-clinical research and clinical trials. This agreement does not provide for a sufficient amount of bryostatin to support the completion of our clinical trials that we are required to conduct in order to seek FDA approval of bryostatin for the treatment of AD. Therefore, CRE or we will have to enter into one or more subsequent agreements with the NCI for the supply of additional amounts of bryostatin. If CRE or we are unable to secure such additional agreements or if the NCI otherwise discontinues for any reason supplying us with bryostatin, then we would have to either secure another source of bryostatin or discontinue our efforts to develop and commercialize bryostatin for the treatment of AD. There can be no assurance that we will be able to secure future bryostatin supplies from any source on commercially reasonable terms, if at all.

We expect to rely on third parties to manufacture our proposed products and, as a result, we may not be able to control our product development or commercialization.

We currently do not have an FDA approved manufacturing facility. We expect to rely on contract manufacturers to produce quantities of products and substances necessary for product commercialization. See also the risk factor above captioned “We are dependent upon the NCI to supply bryostatin for our clinical trials.” Contract manufacturers that we use must adhere to current good manufacturing practice regulations enforced by the FDA through its facilities inspection program. If the facilities of such manufacturers cannot pass a pre-approval plant inspection, the FDA pre-market approval of our products will not be granted. As a result:

| · | there are a limited number of manufacturers that could produce the products for us and we may not be able to identify and enter into acceptable agreements with any manufacturers; |

| · | the products may not be produced at costs or in quantities necessary to make them commercially viable; |

| 16 |

| · | the quality of the products may not be acceptable to us and/or regulatory authorities; |

| · | our manufacturing partners may go out of business or file for bankruptcy; |

| · | our manufacturing partners may decide not to manufacture our products for us; |

| · | our manufacturing partners could fail to manufacture to our specifications; |

| · | there could be delays in the delivery of quantities needed; |

| · | we could be unable to fulfill our commercial needs in the event we obtain regulatory approvals and there is strong market demand; or |

| · | ongoing inspections by the FDA or other regulatory authorities may result in suspensions, seizures, recalls, fines, injunctions, revocations and/or criminal prosecutions. |

If we are unable to engage contract manufacturers or suppliers to manufacture or package our products, or if we are unable to contract for a sufficient supply of required products and substances on acceptable terms, or if we encounter delays or difficulties in our relationships with these manufacturers, or with a regulatory agency, then the submission of products for regulatory approval and subsequent sales of such products would be delayed. Any such delay may have a material adverse effect on our business prospects, financial condition and results of operations.

We may rely on third parties for marketing and sales and our revenue prospects may depend on their efforts.

We currently have no experience in sales, marketing or distribution. We do not anticipate having the resources in the foreseeable future to allocate to the sales and marketing of our proposed products. As a result, if our product development is successful, our future success will likely depend, in part, on our ability to enter into and maintain collaborative relationships with one or more third parties for sales, marketing or distribution, on the collaborator’s strategic interest in the products we have under development and on such collaborator’s ability to successfully market and sell any such products. We intend to pursue collaborative arrangements regarding the sales and marketing of our products as appropriate. However, we may not be able to establish or maintain such collaborative arrangements or, if we are able to do so, they may not have effective sales forces. To the extent that we decide not to, or are unable to, enter into collaborative arrangements with respect to the sales and marketing of our proposed products, significant capital expenditures, management resources and time will be required to establish and develop an in-house marketing and sales force with technical expertise. To the extent that we depend on third parties for marketing and distribution, any revenues received by us will depend upon the efforts of such third parties, which may not be successful.

If our products are not accepted by patients, the medical community or health insurance companies, our business prospects will suffer.

Commercial sales of any products we successfully develop will substantially depend upon the products’ efficacy and on their acceptance by patients, the medical community, providers of comprehensive healthcare insurance, healthcare benefit plan managers, the Centers for Medicare and Medicaid Services, or CMS (which is the U.S. federal agency which administers Medicare, Medicaid and the State Children’s Health Insurance Program), and other organizations. Widespread acceptance of our products will require educating patients, the medical community and third-party payors of medical treatments as to the benefits and reliability of the products. Our proposed products may not be accepted, and, even if they are accepted, we are unable to estimate the length of time it would take to gain such acceptance.

| 17 |

The branded prescription segment of the pharmaceutical industry in which we operate is competitive, and we are particularly subject to the risks of such competition.

The branded prescription segment of the pharmaceutical industry in which we operate is competitive, in part, because the products that are sold require extensive sales and marketing resources invested in their commercialization. The increasing cost of prescription pharmaceuticals has caused providers of comprehensive healthcare insurance, healthcare benefit plan managers, CMS, as well as other organizations, collectively known as third-party payors, to tightly control and dictate their drug formulary plans to control the costs associated with the use of prescription pharmaceutical products by enrollees in these plans. Our ability to gain formulary access to drug plans supported by these third-party payors is substantially dependent on the differentiated patient benefit that our proposed products can provide, compared closely to similar products claiming the same benefits or advantages. We may not be able to differentiate our proposed products from those of our competitors, successfully develop or introduce new products that are less costly or offer better performance than those of our competitors, or offer purchasers of our proposed products payment and other commercial terms as favorable as those offered by our competitors. We expect that some of our proposed products, even if successfully developed and commercialized, will eventually face competition from a significant number of biotechnology or large pharmaceutical companies. Because most of our competitors have substantially greater financial and other resources than we have, we are particularly subject to the risks inherent in competing with them. The effects of this competition could materially adversely affect our business prospects, financial condition and results of operations.

We compete with many companies, research institutes, hospitals, governments and universities that are working to develop products and processes to treat or diagnose AD. We believe that others are doing research on Fragile X Syndrome and Niemann Pick disease. Many of these entities have substantially greater financial, technical, manufacturing, marketing, distribution and other resources than we do. However, there has been a dearth of new product introductions in the last 20 years for the treatment of AD symptoms in patients who begin exhibiting the memory and cognitive disorders associated with the disease. All of the products introduced to date for the treatment of AD have yielded negative or marginal results with little effect on the progression of AD and no improvement in the memory or cognitive performance of the patients receiving these therapies. The absolute determination of AD in patients is currently achieved only upon autopsy. We believe we are the only company currently pursuing PKCε activation as a mechanism to treat AD and neurodegenerative diseases. Although we believe that we have no direct competitors working in this same field on product candidates using the same mechanism of action, we cannot provide assurance that our competitors will not discover compounds or processes that may be competitive with our products and introduce such products or processes before us.

We are developing our product candidates to address unmet medical needs in the treatment of AD and other neurodegenerative diseases. Our competition will be determined in part by the potential indications for which drugs are developed and ultimately approved by regulatory authorities. Additionally, the timing of market introduction of some of our potential products or of competitors’ products may be an important competitive factor. Accordingly, the relative speed with which we can develop our product candidates, complete preclinical testing, clinical trials and approval processes and supply commercial quantities to market are expected to be important competitive factors. We expect that competition among products approved for sale will be based on various factors, including product efficacy, safety, reliability, availability, price and patent position.

Our business will expose us to potential product liability risks, which could result in significant product liability exposure.

Our business will expose us to potential product liability risks that are inherent in the testing, designing, manufacturing and marketing of human therapeutic products. Product liability insurance in the pharmaceutical industry is generally expensive, and we may not be able to obtain or maintain product liability insurance in the future on acceptable terms or with adequate coverage against potential liabilities, if at all. A successful products liability claim brought against us could have a material adverse effect on our business prospects, financial condition and results of operations.

A successful clinical trial liability claim against us could have a material adverse effect on our financial condition even with such insurance coverage.