Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | a2016-128kinvestorpresenta.htm |

ENTERPRISE FINANCIAL SERVICES CORP

FOURTH QUARTER 2016 INVESTOR PRESENTATION

2

FORWARD-LOOKING STATEMENT

Some of the information in this report contains “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements typically are identified with use of terms such as “may,” “might,” “will, “should,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “could,” “continue” and the negative of these terms and similar words, although some

forward-looking statements may be expressed differently. Forward-looking statements also include, but are not limited to, statements regarding plans, objectives,

expectations or consequences of announced transactions (including the Company's announced pending merger with Jefferson County Bancshares, Inc. (“JCB”)),

and statements about the future performance, operations products and services of the Company and its subsidiaries. Our ability to predict results or the actual

effect of future plans or strategies is inherently uncertain. You should be aware that our actual results could differ materially from those anticipated by the forward-

looking statements or historical performance due to a number of factors, including, but not limited to: our ability to efficiently integrate acquisitions into our

operations, retain the customers of these businesses and grow the acquired operations; reputational risks; credit risk; changes in the appraised valuation of real

estate securing impaired loans; outcomes of litigation and other contingencies; exposure to general and local economic conditions; risks associated with rapid

increases or decreases in prevailing interest rates; consolidation within the banking industry; competition from banks and other financial institutions; our ability to

attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in regulatory requirements; changes in

accounting regulation or standards applicable to banks; and other risks discussed under the caption “Risk Factors” of our most recently filed Form 10-K and in Part

II, 1A of our most recently filed Form 10-Q, all of which could cause the Company’s actual results to differ from those set forth in the forward-looking statements.

Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s analysis and expectations only as of the date of

such statements. Forward-looking statements speak only as of the date they are made, and the Company does not intend, and undertakes no obligation, to publicly

revise or update forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise, except as required by

federal securities law. You should understand that it is not possible to predict or identify all risk factors. Readers should carefully review all disclosures we file from

time to time with the Securities and Exchange Commission (the “SEC”) which are available on our website at www.enterprisebank.com under "Investor Relations."

Additional Information about the Merger and Where to Find It

In connection with the proposed merger transaction, the Company filed a Registration Statement on Form S-4 (file no. 333-214990) with the SEC that includes a Proxy

Statement of JCB, and a Prospectus of the Company, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the

Registration Statement and the Proxy Statement/Prospectus regarding the merger and any other relevant documents filed with the SEC, as well as any amendments

or supplements to those documents, because they will contain important information.

A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about the Company and JCB, may be obtained at the SEC’s website

www.sec.gov. The Company, JCB, and some of their directors and executive officers may be deemed participants in the solicitation of proxies from the shareholders

of JCB in connection with the proposed merger. Information about the directors and executive officers of the Company is set forth in the Proxy Statement for the

Company’s 2016 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 16, 2016. Additional information regarding the interests of those

participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the

proposed merger. Free copies of this document may be obtained as described in the preceding paragraph.

3

COMPANY SNAPSHOT

FDIC Data

ENTERPRISE BANK

$4.1 Billion

IN TOTAL ASSETS

ENTERPRISE TRUST

Billion

IN ASSETS UNDER

ADMINISTRATION

CONCENTRATED ON PRIVATE BUSINESSES AND

OWNER FAMILIES

RELATIONSHIP DRIVEN

ATTRACT TOP TALENT IN MARKETS

PRODUCT BREADTH

• BANKING

• TRUST & WEALTH MANAGEMENT

• TREASURY MANAGEMENT

PROVEN ABILITY TO GROW COMMERCIAL AND

INDUSTRIAL “C&I” LOANS

STRONG BALANCE SHEET WITH ATTRACTIVE RISK

PROFILE

FOCUSED BUSINESS MODEL:

Operates in

MSAs

St. Louis

Kansas City

Phoenix

$1.7

4

SOURCE: SNL FINANCIAL

ACQUISITION OF JEFFERSON COUNTY BANCSHARES, INC.

ANNOUNCED OCTOBER 11, 2016

CONSISTENT WITH M&A EXPANSION STRATEGY

MERGER PARTNER WITH EXPERIENCED BANKERS

AND PROFESSIONALS

DISCIPLINED FINANCIAL TERMS

WELL KNOWN MARKET

EXTENSIVE DUE DILIGENCE

ENHANCES EFSC’S FOOTPRINT IN THE ST.

LOUIS MSA, WHILE BUILDING TOTAL BALANCE

SHEET SIZE TO ALMOST $5 BILLION IN PRO

FORMA ASSETS

TOP FOUR DEPOSIT MARKET SHARE IN

THE ST. LOUIS MSA

EXPANDS BRANCH PRESENCE

~$3 BILLION OF DEPOSITS

STRENGTHENS & DIVERSIFIES

CORE DEPOSIT GATHERING

CAPABILITIES

ATTRACTIVE BRANCH SIZES

TRANSACTION VALUE & CONSIDERATION (1)

APPROXIMATELY $130.6 MILLION TRANSACTION VALUE

• 3.3 MILLION EFSC COMMON SHARES ISSUED TO

JEFFERSON SHAREHOLDERS

• APPROXIMATELY $26.6 MILLION IN CASH PAID, INCLUDING

CASH-OUT VALUE OF JEFFERSON STOCK OPTIONS

• CONSIDERATION MIX TO JEFFERSON SHAREHOLDERS OF ~

81.5% STOCK, ~ 18.5% CASH

PRICE / TBVPS OF 140.7%

PRICE / LTM JUNE 2016 EPS OF 19.8X

PRICE / LTM JUNE 2016 EPS INCLUDING FULLY-PHASED

COST SAVINGS OF 10.9X

(1) BASED ON JEFFERSON’S 1,472,853 COMMON SHARES OUTSTANDING, 108,295 OPTIONS OUTSTANDING WITH A WAEP OF $54.72 AND EFSC’S 15-DAY VWAP OF $31.52

AS OF OCTOBER 10, 2016; ASSUMES ALL STOCK OPTIONS ARE CASHED OUT AT CLOSING

St. Louis

MSA

EFSC (16 BRANCHES TOTAL,

6 BRANCHES IN ST. LOUIS MSA)

JEFFERSON (18 BRANCHES TOTAL,

17 BRANCHES IN ST. LOUIS MSA)

5

DIFFERENTIATED BUSINESS MODEL: BUILT

FOR QUALITY EARNINGS GROWTH

FOCUSED AND WELL-DEFINED STRATEGY AIMED AT BUSINESS

OWNERS, EXECUTIVES AND PROFESSIONALS

TARGETED ARRAY OF BANKING AND WEALTH MANAGEMENT SERVICES

TO MEET OUR CLIENTS’ NEEDS

EXPERIENCED BANKERS AND ADVISORS

Enterprise Bank

Financial & Estate Planning

Tax Credit Brokerage

Business & Succession Planning

Trust Administration

Enterprise Trust

Investment Management

Enterprise University

Treasury Management

Personal & Private Banking

Commercial & Business Banking

PRIVATE

BUSINESSES

& OWNER

FAMILIES

Mortgage Banking

6

EU is a Continuing Series of More than 30 High-Impact

Workshops for Business Owners

DESIGNED TO HELP MANAGEMENT TEAMS GROW THEIR BUSINESSES

EU IS OFFERED SEMI-ANNUALLY TO ENTERPRISE CLIENTS AND PROSPECTS ALIKE

ENTERPRISE UNIVERSITY: A KEY BRAND

DIFFERENTIATOR

EU is Unique and Highly Valued; A Clear Differentiator

MORE THAN 15,000 PARTICIPANTS TO DATE

BUILT TO ENHANCE THE SALES PROCESS, SET THE BANK APART FROM

COMPETITORS

CREATES “RAVING FANS” FOR ENTERPRISE

7

5th RANKED IN

DEPOSIT SHARE1,

LARGEST PUBLICLY

HELD BANK BASED IN

ST. LOUIS2

STRONG TRACK RECORD OF SUCCESS IN

ST. LOUIS

1 6/30/2016 FDIC data

2 Excludes Bank Unit of Stifel Nicolaus

3 Excludes specialized lending products

$1.7

BILLION WEALTH

MANAGEMENT

BUSINESS

$1.6

3

BILLION IN

LOANS

$1.7

BILLION IN

DEPOSITS

CONSISTENT ABILITY

TO PRODUCE

LOAN GROWTH –

4% CAGR3

in C&I

Loans OVER

PAST FIVE YEARS

ATTRACTING

Top

Level

BANKERS

8

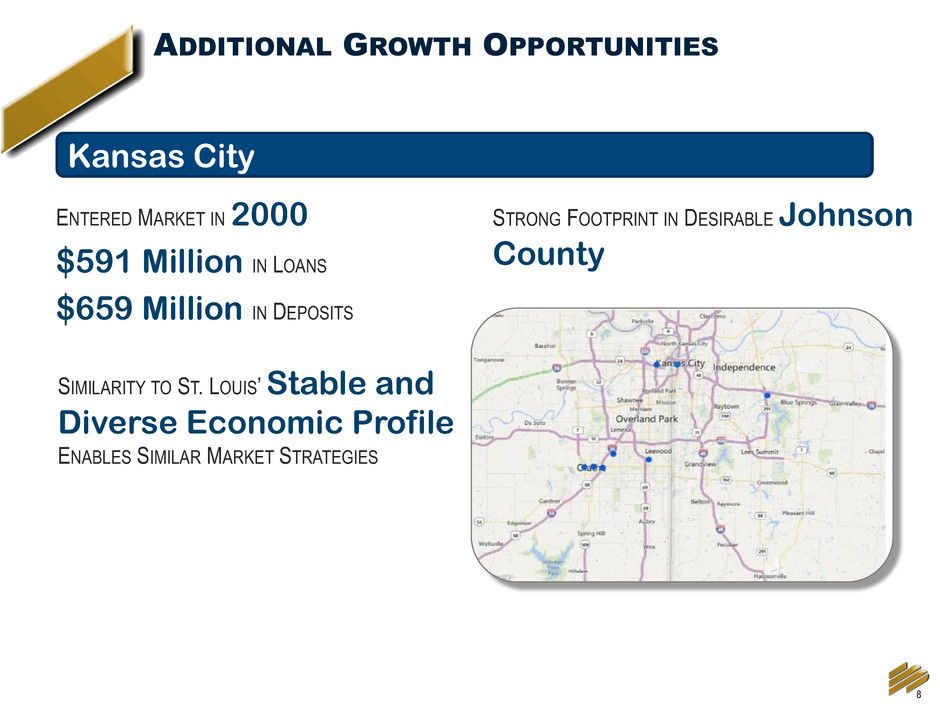

ENTERED MARKET IN 2000

$591 Million IN LOANS

$659 Million IN DEPOSITS

ADDITIONAL GROWTH OPPORTUNITIES

STRONG FOOTPRINT IN DESIRABLE Johnson

County

SIMILARITY TO ST. LOUIS’ Stable and

Diverse Economic Profile

ENABLES SIMILAR MARKET STRATEGIES

Kansas City

9

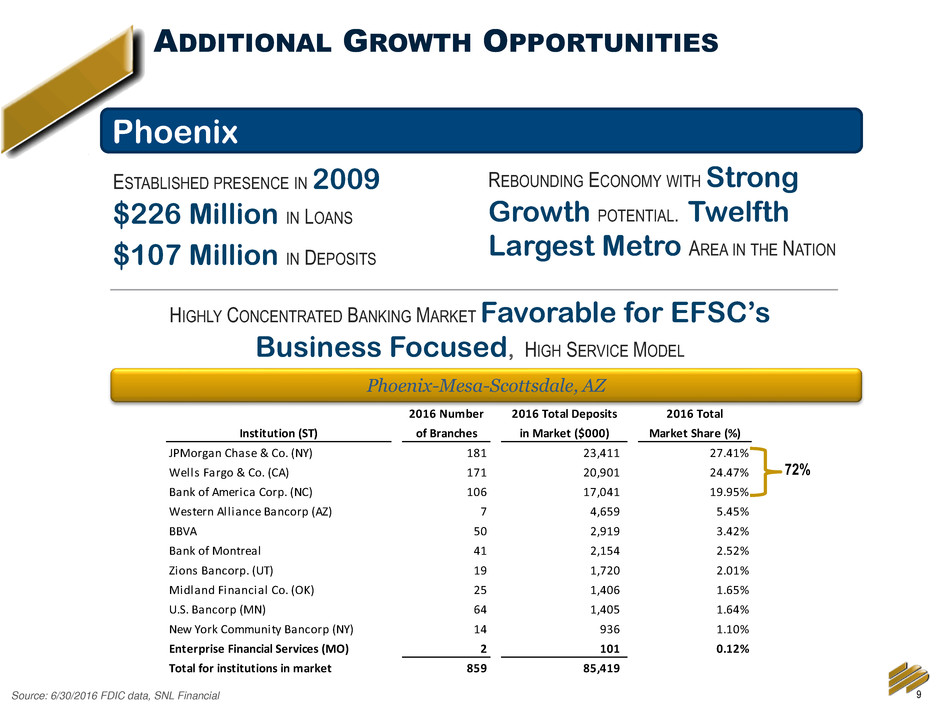

ADDITIONAL GROWTH OPPORTUNITIES

Source: 6/30/2016 FDIC data, SNL Financial

ESTABLISHED PRESENCE IN 2009

$226 Million IN LOANS

$107 Million IN DEPOSITS

Phoenix-Mesa-Scottsdale, AZ

REBOUNDING ECONOMY WITH Strong

Growth POTENTIAL. Twelfth

Largest Metro AREA IN THE NATION

HIGHLY CONCENTRATED BANKING MARKET Favorable for EFSC’s

Business Focused, HIGH SERVICE MODEL

Phoenix

72%

2016 Number 2016 Total Deposits 2016 Total

Institution (ST) of Branches in Market ($000) Market Share (%)

JPMorgan Chase & Co. (NY) 181 23,411 27.41%

Wells Fargo & Co. (CA) 171 20,901 24.47%

Bank of America Corp. (NC) 106 17,041 19.95%

Western Alliance Bancorp (AZ) 7 4,659 5.45%

BBVA 50 2,919 3.42%

Bank of Montreal 41 2,154 2.52%

Zions Bancorp. (UT) 19 1,720 2.01%

Midland Financial Co. (OK) 25 1,406 1.65%

U.S. Bancorp (MN) 64 1,405 1.64%

New York Community Bancorp (NY) 14 936 1.10%

Enterprise Financial Services (MO) 2 101 0.12%

Total for institutions in market 859 85,419

10

CONSUMER AND BUSINESS BANKING INITIATIVES

COMPLEMENT PRIMARY COMMERCIAL STRATEGY

HIGH Client Satisfaction PAVES WAY FOR ADD-ON PRODUCT SALES

Expansion of Commercial Relationships ACCOUNTED FOR

30% OF TREASURY MANAGEMENT PRODUCT IMPLEMENTATIONS YTD

Business Banking INCREMENTAL NEW NON INTEREST BEARING Deposits

REPRESENT A 40% Increase OVER THE PREVIOUS YEAR.

BRANCH ORGANIZATION MOBILIZED TO Enhance Personal Banking

Services TO COMMERCIAL AND BUSINESS BANKING CLIENTS

ESTABLISHED Distinct Sales and Relationship Management

Models TO EFFICIENTLY PENETRATE AND SERVICE THE MARKET

11

HISTORY OF STRONG C&I GROWTH

$763

$963

$1,042

$1,264

$1,484

$1,633

2011 2012 2013 2014 2015 Q4 '16

In millions

12

Tax Credit Programs. $144 MILLION IN LOANS OUTSTANDING RELATED TO FEDERAL NEW MARKETS, HISTORIC AND MISSOURI

AFFORDABLE HOUSING TAX CREDITS. $183 MILLION IN FEDERAL & STATE NEW MARKETS TAX CREDITS AWARDED TO DATE.

Enterprise Value Lending. $389 MILLION IN M&A RELATED LOANS OUTSTANDING, PARTNERING WITH PE FIRMS

Life Insurance Premium Financing. $306 MILLION IN LOANS OUTSTANDING RELATED TO HIGH NET WORTH ESTATE

PLANNING

FOCUSED LOAN GROWTH STRATEGIES

4.6%

12.5%

9.8%

Total Portfolio Loans

SPECIALIZED MARKET SEGMENTS HAVE GROWN TO 27% OF TOTAL PORTFOLIO

LOANS, OFFERING COMPETITIVE ADVANTAGES, RISK ADJUSTED PRICING AND

FEE INCOME OPPORTUNITIES.

EXPECTATIONS FOR FUTURE GROWTH

INCLUDE CONTINUED FOCUS IN THESE

SPECIALIZED MARKET SEGMENTS.

13

DRIVERS OF LOAN GROWTH

Enterprise Value

Lending

10.5%

Life Insurance

Premium Finance

11.0%

General Commercial

& Industrial

17.0%

Commercial/

Construction RE

42.8%

Residential RE

12.0%

Consumer & Other

4.8%

Tax Credits

1.9%

ENTERPRISE VALUE LENDING LIFE INSURANCE PREMIUM FINANCE

GENERAL COMMERCIAL & INDUSTRIAL COMMERCIAL/CONSTRUCTION RE

RESIDENTIAL RE CONSUMER & OTHER

TAX CREDITS

$367 MILLION

Dec 31, 2015 – Dec 31, 2016

14

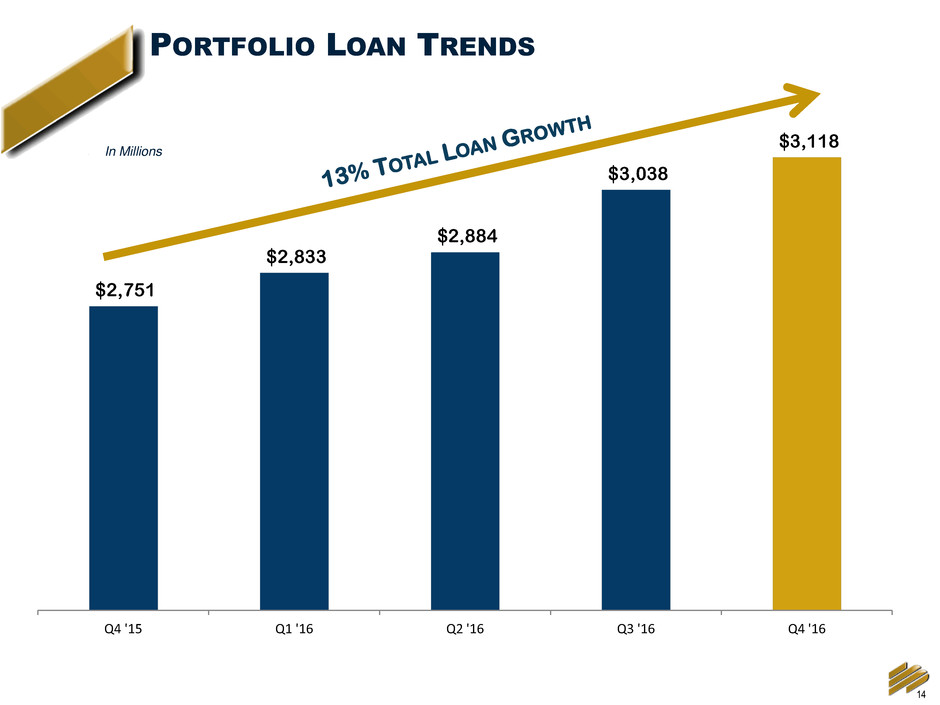

PORTFOLIO LOAN TRENDS

$2,751

$2,833

$2,884

$3,038

$3,118

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

In Millions

15

27%

36%

14%

23%

0

ATTRACTIVE DEPOSIT MIX

CD

Interest Bearing

Transaction Accts

DDA

MMA &

Savings

DEC 31, 2016

$3.2 B

Significant DDA COMPOSITION

Stable COST OF DEPOSITS

IMPROVING Core Funding

80% OF Core Deposits ARE

COMMERCIAL CUSTOMERS

$2,785

$2,932

$3,028

$3,125 $3,233

25.8% 24.5% 24.9% 24.4% 26.8%

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Deposits DDA %

Cost of Deposits 0.36%

16% DEPOSIT GROWTH

Q4 2015 – Q4 2016

In Millions

16

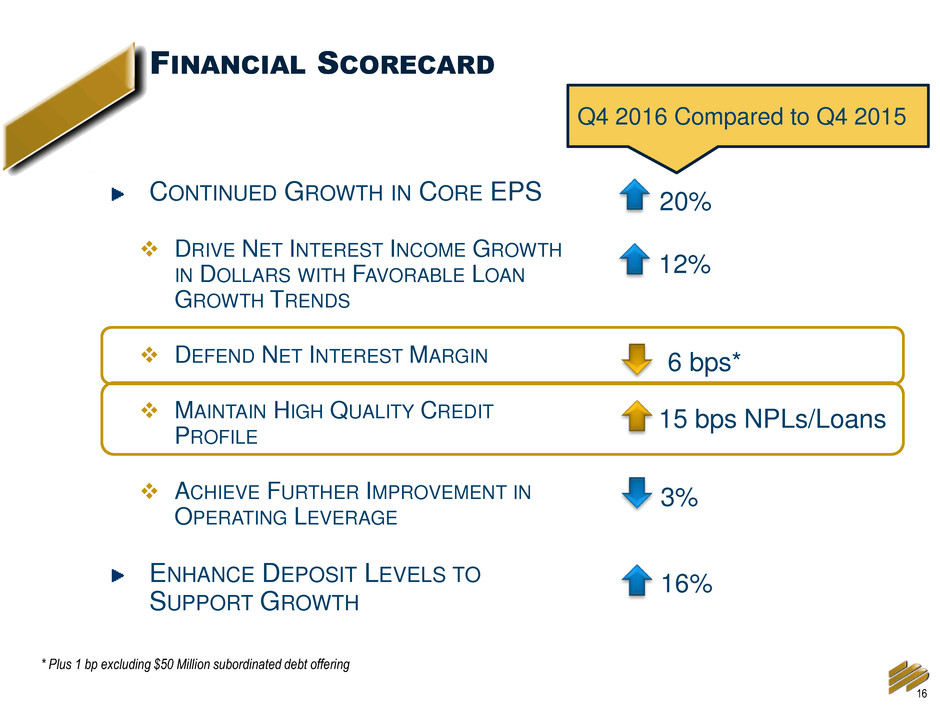

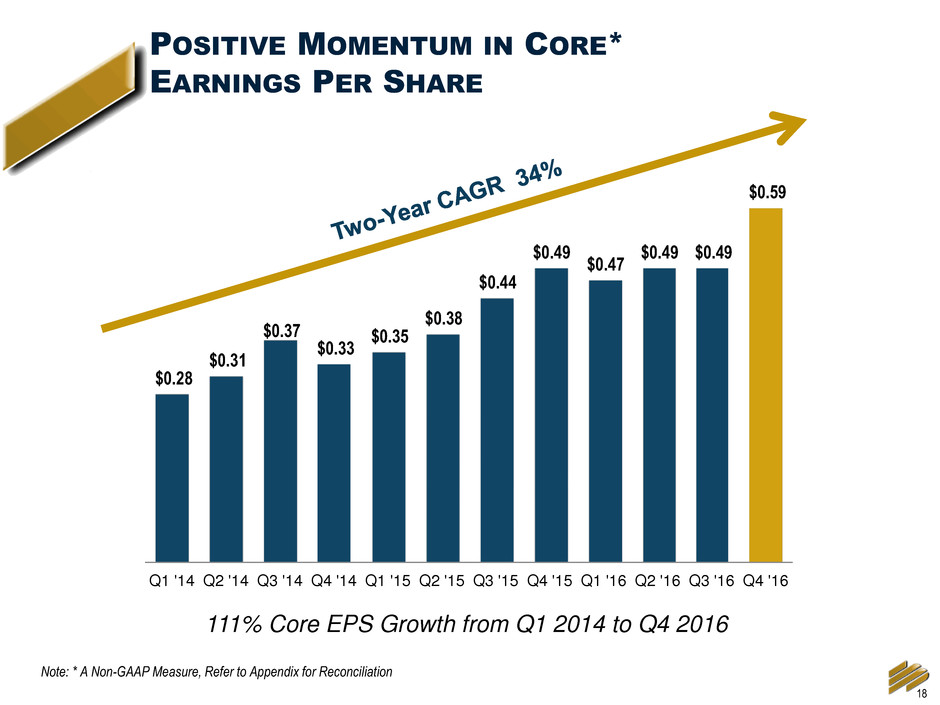

CONTINUED GROWTH IN CORE EPS

DRIVE NET INTEREST INCOME GROWTH

IN DOLLARS WITH FAVORABLE LOAN

GROWTH TRENDS

DEFEND NET INTEREST MARGIN

MAINTAIN HIGH QUALITY CREDIT

PROFILE

ACHIEVE FURTHER IMPROVEMENT IN

OPERATING LEVERAGE

ENHANCE DEPOSIT LEVELS TO

SUPPORT GROWTH

FINANCIAL SCORECARD

20%

12%

6 bps*

15 bps NPLs/Loans

3%

16%

Q4 2016 Compared to Q4 2015

* Plus 1 bp excluding $50 Million subordinated debt offering

17

FULL YEAR EARNINGS PER SHARE

$2.41 <$0.46>

$0.08 $2.03

EPS Non-Core Acquired

Assets

Other Non-Core

Expenses

Core

EPS

* A Non GAAP Measure, Refer to Appendix for Reconciliation

REPORTED VS. CORE EPS*

Q4 2016

18

POSITIVE MOMENTUM IN CORE*

EARNINGS PER SHARE

$0.28

$0.31

$0.37

$0.33

$0.35

$0.38

$0.44

$0.49

$0.47

$0.49 $0.49

$0.59

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

111% Core EPS Growth from Q1 2014 to Q4 2016

19

FULL YEAR EARNINGS PER SHARE TREND

$1.66

$0.51 < $0.02>

$0.04 <$0.16>

$2.03

2015 YTD Net Interest

Income

Portfolio Loan

Loss Provision

Non Interest

Income

Non Interest

Expense

2016 YTD

CHANGES IN CORE EPS*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

20

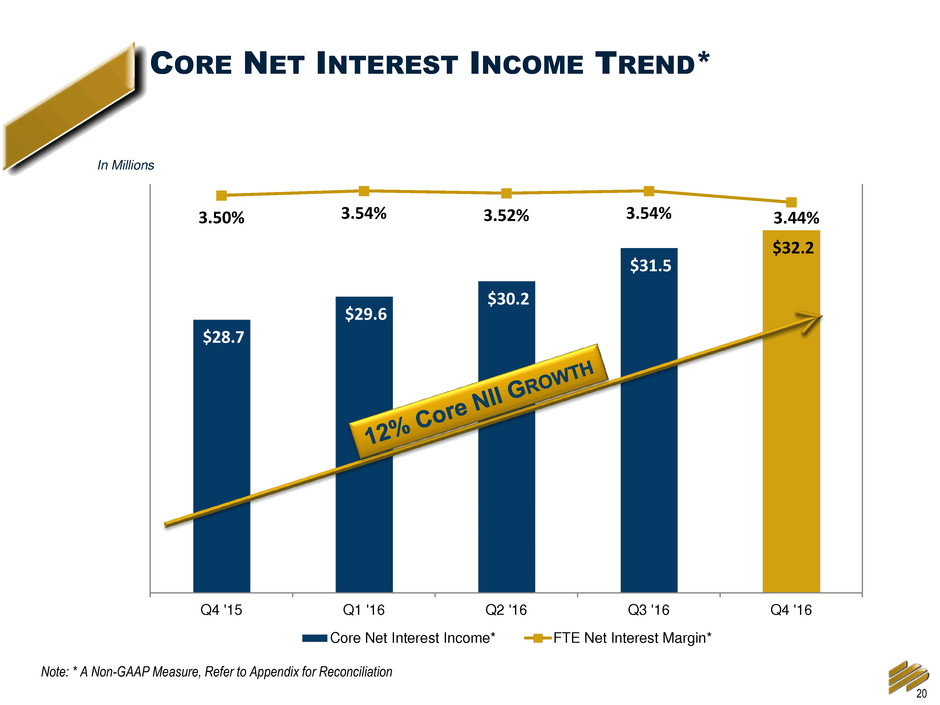

CORE NET INTEREST INCOME TREND*

In Millions

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

$28.7

$29.6

$30.2

$31.5

$32.2

3.50% 3.54% 3.52% 3.54% 3.44%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

$18.0

$19.0

$20.0

$21.0

$22.0

$23.0

$24.0

$25.0

$26.0

$27.0

$28.0

$29.0

$30.0

$31.0

$32.0

$33.0

$34.0

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Core Net Interest Income* FTE Net Interest Margin*

21

CREDIT TRENDS FOR PORTFOLIO LOANS

-10 bps

-1 bps

-6 bps

14 bps

12 bps

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Net Charge-offs (1)

(1) Portfolio loans only, excludes PCI (Purchased Credit Impaired) loans

Q4 2016 EFSC PEER(2)

NPA’S/ASSETS = 0.39% 0.51%

NPL’S/LOANS = 0.48% 0.64%

ALLL/NPL’S = 252% 138%

ALLL/LOANS = 1.20% 1.10%

(2) Peer data as of 9/30/2016 (source: SNL Financial)

In Millions

2015 NCO = 6 bps

$149

$82

$51

$154

$80

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Portfolio Loan Growth

In Millions

Net Charge-offs (1)

2016 NCO = 5 bps

$0.5

$0.8 $0.7

$3.0

$1.0

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Provision for Portfolio Loans

22

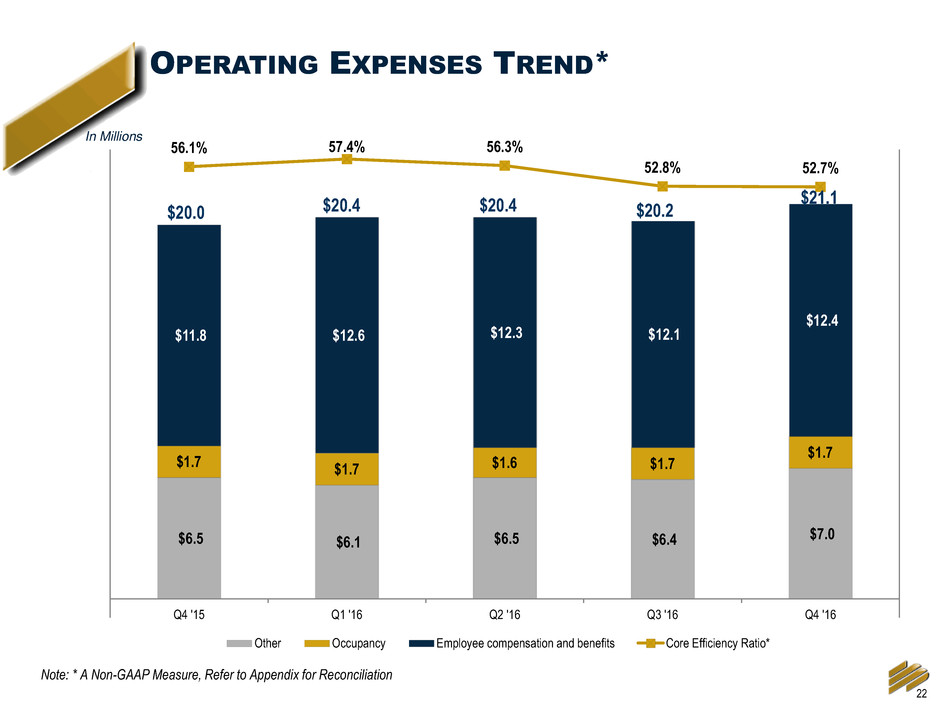

OPERATING EXPENSES TREND*

In Millions

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

$6.5 $6.1 $6.5 $6.4

$7.0

$1.7 $1.7 $1.6 $1.7

$1.7

$11.8 $12.6 $12.3 $12.1

$12.4

56.1% 57.4% 56.3%

52.8% 52.7%

-1

4

9

14

19

24

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Other Occupancy Employee compensation and benefits Core Efficiency Ratio*

$20.4 $21.1 $20.0 $20.2 $20.4

23

OPERATING EXPENSE* LOOK-BACK

In Millions

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

$7.3 $7.0

$1.5 $1.7

$11.4 $12.4

62.8%

52.7%

Q4 '14 Q4 '16

Other Occupancy Employee compensation and benefits Core Efficiency Ratio*

$20.2

$21.1

24

FIRST QUARTER 2017 DIVIDEND

OF $0.11 PER COMMON SHARE

2,000,000 SHARE COMMON

STOCK REPURCHASE PLAN

INSTITUTED

~ 10% OF EFSC OUTSTANDING

SHARES

NO SPECIFIED END DATE

DISCIPLINED, PATIENT APPROACH

BASED ON MARKET CONDITIONS

SUFFICIENT CAPITAL TO

SUPPORT GROWTH PLANS

CAPITAL LEVELS PRUDENTLY MANAGED TO FACILITATE

GROWTH AND RETURNS

4.99%

6.02%

7.78%

8.69% 8.88% 8.76%

TANGIBLE COMMON EQUITY/TANGIBLE ASSETS

25

HIGHLY FOCUSED, Proven BUSINESS MODEL

STRONG TRACK RECORD OF Commercial Loan Growth

DIFFERENTIATED COMPETITIVE Lending Expertise

Replicating ST. LOUIS MODEL IN Kansas City AND Phoenix

DEMONSTRATED PROGRESS TOWARD INCREASED

RETURNS AND Enhancing Shareholder

Value

118%

68%

EFSC Index

3-Year Total Shareholder Return

Note: Index = SNL U.S. Bank $1B - $5B, as of 12/31/2016

Source: SNL

ENTERPRISE FINANCIAL

26

APPENDIX

4Q 2016 INVESTOR PRESENTATION

27

BALANCE SHEET POSITIONED FOR GROWTH

Modest Asset Sensitivity (200 BPS RATE SHOCK INCREASES

NII BY 5.3%)

63% FLOATING RATE LOANS, WITH THREE-YEAR AVERAGE DURATION

High-quality, Cash-flowing SECURITIES PORTFOLIO WITH FOUR

YEAR AVERAGE DURATION

27% DDA TO TOTAL DEPOSITS

8.8% Tangible Common Equity/Tangible ASSETS

28

SIGNIFICANT EARNINGS CONTRIBUTION (PRE-TAX)

Significant CONTRIBUTION TO FUTURE EARNINGS

WITH ESTIMATED FUTURE ACCRETABLE YIELD

OF $13 Million

SUCCESSFUL FDIC-ASSISTED ACQUISITION

STRATEGY

TERMINATED ALL LOSS SHARE AGREEMENTS WITH THE FDIC IN

DECEMBER 2015

2014 2015 2016

$4,856 $7,529 $15,018

Dollars in Thousands

Accretable yield estimate as of 12/31/2016

COMPLETED 4 FDIC-

Assisted TRANSACTIONS

SINCE DECEMBER 2009

CONTRIBUTED $66 Million

IN Net Earnings SINCE

ACQUISITION

$66 Million OF REMAINING

CONTRACTUAL CASH FLOWS WITH

$34 Million CARRYING

VALUE

EARLY TERMINATION CHARGE FROM Q4 2015 EARNED BACK

100% IN Q1 2016

29

EARNINGS PER SHARE

$0.67 <$0.14>

$0.06 $0.59

EPS Non-Core Acquired

Assets

Other Non-Core

Expenses

Core

EPS

* A Non GAAP Measure, Refer to Appendix for Reconciliation

REPORTED VS. CORE EPS*

Q4 2016

30

EARNINGS PER SHARE TREND

$0.49

$0.02

<$0.07

$0.04 < $0.03>

$0.59

Q3 '16 Net Interest

Income

Portfolio Loan

Loss Provision

Non Interest

Income

Non Interest

Expense

Q4 '16

CHANGES IN CORE EPS*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

31

USE OF NON-GAAP FINANCIAL MEASURES

The Company's accounting and reporting policies conform to generally accepted accounting principles in the United States

(“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as

Core net interest margin and other Core performance measures, in this presentation that are considered “non-GAAP financial

measures.” Generally, a non-GAAP financial measure is a numerical measure of a company's financial performance, financial

position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable

measure calculated and presented in accordance with GAAP.

The Company considers its Core performance measures presented in this presentation as important measures of financial

performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the

impact of PCI loans and related income and expenses, the impact of nonrecurring items, and the Company's operating

performance on an ongoing basis. Core performance measures include contractual interest on PCI loans but exclude

incremental accretion on these loans. Core performance measures also exclude the Change in FDIC receivable, Gain or loss of

other real estate from PCI loans and expenses directly related to the PCI loans and other assets formerly covered under FDIC

loss share agreements. Core performance measures also exclude certain other income and expense items, such as executive

separation costs, merger related expenses, facilities charges, and gain/loss on sale of investment securities, the Company

believes to be not indicative of or useful to measure the Company's operating performance on an ongoing basis. The attached

tables contain a reconciliation of these Core performance measures to the GAAP measures.

The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and

ratios, provide meaningful supplemental information regarding the Company's performance and capital strength. The Company's

management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the

Company's operating results and related trends and when forecasting future periods. However, these non-GAAP measures and

ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP.

In the tables below, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial

measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the

financial measure for the periods indicated.

Peer group data consists of median of publicly traded banks with total assets from $1-$10 billion with commercial loans greater

than 20% and consumer loans less than 10%.

32

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, Dec 31, Dec 31,

(in thousands, except per share data) 2016 2016 2016 2016 2015 2016 2015

CORE PERFORMANCE MEASURES

Net interest income 35,454$ 33,830$ 33,783$ 32,428$ 32,079$ 135,495$ 120,410$

Less: Incremental accretion income 3,279 2,296 3,571 2,834 3,412 11,980 12,792

Core net interest income 32,175 31,534 30,212 29,594 28,667 123,515 107,618

Total noninterest income 9,029 6,976 7,049 6,005 6,557 29,059 20,675

Less: Gain (loss) on sale of other real estate from PCI loans 1,085 (225) 705 - 81 1,565 107

Less: Other income from PCI assets 95 287 239 - - 621 -

Less: Gain on sale of investment securities - 86 - - - 86 23

Less: Change in FDIC loss share receivable - - - - (580) - (5,030)

Core noninterest income 7,849 6,828 6,105 6,005 7,056 26,787 25,575

Total core revenue 40,024 38,362 36,317 35,599 35,723 150,302 133,193

Provision for portfolio loan losses 964 3,038 716 833 543 5,551 4,872

Total noninterest expense 23,181 20,814 21,353 20,762 22,886 86,110 82,226

Less: Merger related expenses 1,084 302 - - - 1,386 -

Less: Facilities disposal 1,040 - - - - 1,040 -

Less: Other expenses related to PCI loans 172 270 325 327 423 1,094 1,558

Less: Executive severance - - 332 - - 332 -

Less: FDIC loss share termination - - - - 2,436 - 2,436

Less: FDIC clawback - - - - - - 760

Less: Other non-core expenses (209) - 250 - - 41 -

Core noninterest expense 21,094 20,242 20,446 20,435 20,027 82,217 77,472

Core income before income tax expense 17,966 15,082 15,155 14,331 15,153 62,534 50,849

Core income tax expense 6,021 5,142 5,237 4,897 5,073 21,297 17,058

Core net income 11,945$ 9,940$ 9,918$ 9,434$ 10,080$ 41,237$ 33,791$

Core diluted earnings per share 0.59$ 0.49$ 0.49$ 0.47$ 0.49$ 2.03$ 1.66$

Core return on average assets 1.19% 1.04% 1.07% 1.04% 1.13% 1.09% 1.00%

Core return on average common equity 12.31% 10.47% 10.89% 10.66% 11.46% 11.10% 10.08%

Core return on average tangible common equity 13.44% 11.46% 11.98% 11.76% 12.68% 12.18% 11.22%

Core efficiency ratio 52.70% 52.77% 56.30% 57.40% 56.06% 54.70% 58.17%

NET INTEREST MARGIN TO CORE NET INTEREST MARGIN (FULLY TAX EQUIVALENT)

Net interest income 35,884$ 34,263$ 34,227$ 32,887$ 32,546$ 137,261$ 122,141$

Less: Incremental accretion income 3,279 2,296 3,571 2,834 3,412 11,980 12,792

Core net interest income 32,605$ 31,967$ 30,656$ 30,053$ 29,134$ 125,281$ 109,349$

Average earning assets 3,767,272$ 3,589,080$ 3,506,801$ 3,413,792$ 3,304,827$ 3,570,186$ 3,163,339$

Reported net interest margin 3.79% 3.80% 3.93% 3.87% 3.91% 3.84% 3.86%

Core net interest margin 3.44% 3.54% 3.52% 3.54% 3.50% 3.51% 3.46%

For the Quarter ended For the Year ended

33

Q&A

4Q 2016 INVESTOR PRESENTATION