Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Capital Bank Financial Corp. | exhibit991earningsreleasef.htm |

| 8-K - 8-K - Capital Bank Financial Corp. | a8-kx4q16earningsrelease.htm |

2016 Fourth Quarter Earnings

January 26, 2017

01/26/2017

Safe Harbor Statement

Forward-Looking Statements

Information in this press release contains forward-looking statements. Any statements about our expectations, beliefs, plans,

predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking.

These statements are often, but not always, made through the use of words or phrases such as "anticipate," "believes," "can,"

"could," "may," "predicts," "potential," "should," "will," "estimate," "plans," "projects," "continuing," "ongoing," "expects," "intends" and

similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks,

assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Our actual results

could differ materially from those anticipated in such forward-looking statements as a result of several factors more fully described

under the caption "Risk Factors" in the annual report on Form 10-K and other periodic reports filed by us with the Securities and

Exchange Commission. Any or all of our forward-looking statements in this press release may turn out to be inaccurate. The

inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future

plans, estimates or expectations contemplated by us will be achieved. We have based these forward-looking statements largely on

our current expectations and projections about future events and financial trends that we believe may affect our financial condition,

results of operations, business strategy and financial needs. There are important factors that could cause our actual results, level of

activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed

or implied by the forward looking statements including, but not limited to: (1) changes in general economic and financial market

conditions; (2) changes in the regulatory environment; (3) economic conditions generally and in the financial services industry; (4)

changes in the economy affecting real estate values; (5) our ability to achieve loan and deposit growth; (6) the completion of future

acquisitions or business combinations and our ability to integrate any acquired businesses into our business model; (7) projected

population and income growth in our targeted market areas; (8) competitive pressures in our markets and industry; (9) our ability to

attract and retain key personnel; (10) changes in accounting policies or judgments and (11) volatility and direction of market interest

rates and a weakening of the economy which could materially impact credit quality trends and the ability to generate loans. All

forward-looking statements are necessarily only estimates of future results, and actual results may differ materially from expectations.

You are, therefore, cautioned not to place undue reliance on such statements, which should be read in conjunction with the other

cautionary statements that are included elsewhere in this press release. Further, any forward-looking statement speaks only as of the

date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or

circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

2

01/26/2017

Southeastern Regional Bank in Attractive Growth Markets

Eight Acquisitions

3

One Southeastern Franchise

01/26/2017

■ Reported EPS of $0.24 and core EPS of $0.44

■ Generated ROA of 0.53%, and core ROA of 0.96%

■ Closed CommunityOne merger on October 26, 2016 and accelerated cost-

savings plan for full realization in 2Q

■ Managed balance sheet to year-end $9.9 billion in assets, in line with plan

■ Completed new payment platform roll-out, with launch of credit card and

merchant services

■ Reported efficiency ratio of 78% including merger charges, and improved

core efficiency ratio to 58%

■ Maintained conservative credit and interest-rate risk profile, leaving Capital

Bank exceptionally well-positioned for 2017

4

Fourth Quarter Highlights

Note: See reconciliation of core EPS, core ROA, and core efficiency ratio in appendix

01/26/2017

■ 4Q16 includes CommunityOne for 67 days

■ NIM benefitted from 9 bps in loan recoveries

■ Provision includes $2.6 mm for New Loans

and $0.6 mm reversal of impairment on

legacy purchased

■ Non-interest income includes $0.5 mm from

new credit card and merchant services

products

■ Efficiency ratio of 78% includes merger

charges; core efficiency ratio down y/y and

under 60% target

5

Fourth Quarter Financial Summary

Note: See reconciliation of core net income, core EPS, core fee ratio, core efficiency ratio, core ROA, and core ROTCE in appendix

($ mm's except per share data, growth rates, and metrics)

4Q16 3Q16 4Q15

Net interest income 77.8$ 24% 25%

Provision 2.0 238% 82%

Non-interest income 17.0 38% 61%

Non-interest expense 74.0 56% 55%

Pretax income 18.9 -30% -21%

Net income 12.4 -33% -17%

Per share 0.24$ -43% -29%

Non-GAAP Adjustments 9.9 NM NM

Core net income 22.3 21% 22%

Per share 0.44$ 5% 7%

Key Metrics 4Q16 3Q16 4Q15

Net interest margin (NIM) 3.67% 3.58% 3.70%

Fee ratio 17.9% 16.5% 14.6%

Efficiency ratio 78.0% 63.4% 65.7%

ROA 0.53% 0.97% 0.82%

ROE 3.8% 7.2% 6.1%

Non-GAAP Core Metrics

Core fee ratio 16.3% 16.4% 14.5%

Core efficiency ratio 58.2% 61.1% 58.9%

Core ROA 0.96% 0.97% 1.00%

Core ROTCE 8.7% 8.4% 8.7%

% change

01/26/2017

6 Note: See reconciliation of core EPS, core ROA, and core efficiency ratio in appendix

Tangible Book Value Per Share

Non-GAAP Adjustments Detail

(In thousands)

Fourth Quarter Financial Summary (continued)

■ Conversion, merger, and restructuring

expenses running in line with plan

■ OCI change due to rising interest rates

during 4Q

■ CommunityOne purchase accounting in line

with original announcement

4Q16

Conversion, merger, severance, and restructuring 18,536$

Legal settlement 1,361

Tax adjustment (1,350)

Securities gains (1,894)

Total pre-tax 16,653

Tax effect of adjustments (6,775)

Total after-tax 9,878$

3Q16 20.53$

OCI (0.39)

CommunityOne purchase accounting (0.23)

Dividends (0.12)

Buybacks (0.11)

Other 0.09

Net Income 0.24

4Q16 20.01$

Original Current

TBV dilution per share $0.19 $0.23

Cost savings 39% mid-40%

Estimated merger/conversion expenses $25 mm $27 mm

Fully phased in timing 18 months 9 months

Estimated earn-back 2.3 years 2.0 years

01/26/2017

7 Note: See reconciliation of core ROA in appendix

On Track for 1.10% ROA by Year-end 2017

■ Fully phased-in cost savings from

CommunityOne expected to be

realized during Q2 17

■ NIM will compress due to run off in

accretable yield

■ Provision will increase due to fewer

impairment reversals from legacy

acquired loans

■ Other cost savings programs in place

and under development

■ Projections do not assume higher

interest rates in 2017

ROA 0.53%

1.10%+0.16%

-0.05%

-0.03%

+0.06%

Core ROA 0.96%

4

Q

1

6

C

o

m

m

u

n

it

y

O

n

e

C

o

s

t

S

a

v

in

g

s

N

IM

C

o

m

p

re

s

s

io

n

P

ro

v

is

io

n

O

th

e

r

4

Q

1

7

T

a

rg

e

t

Well Positioned for Higher Interest Rates

Asset & Liability Durations

Earnings Sensitivity

(In millions)

Note: Base case assumes static rates and balance sheet as of 11/30/2016. +75

bps case approximates consensus outlook with 3 rate hikes in the Federal Funds

Rate (occurring in June 2017, September 2017, and December 2017), and a

+125 bps increase in the 10 yr. US Treasury yield curve.

8

■ Consensus outlook for 75 bps in rate hikes

during 2017 would boost net income by

$1.6 mm in 2017 and $8.0 mm in 2018

■ Conservative asset sensitive position reflects

short-duration loan portfolio and high

proportion of core deposit funding

Loan Maturities

Note: Effective durations estimated as of 11/30/2016. Loan maturities as of 12/31/2016.

$1.1

$1.6

$2.1

$5.3

$8.0

$10.7

-

2

4

6

8

10

12

Base +25 bps +50 bps +75 bps +100 bps

2017 2018

Se uriti s 4.0

Loans 1.4

Non-interest Checking 6.1

NOW 3.7

Money Market 2.3

Savings 3.7

Time Deposits 1.1

Borrowings 0.0

0 - 1 yr. Fixed, 4%

1 - 3 yr. Fixed, 10%

3 - 5 yr. Fixed, 17%

5 - 7 yr. Fixed, 6%

7 - 10 yr. Fixed, 3%

10+ yr. Fixed, 8%

Variable Rate, 52%

01/26/2017

9

Well-positioned for Tax Reform

Effective Tax Rate

Impact of Changes in Federal Tax Rate

■ Reduced corporate tax rates would

significantly boost net income, due to high

effective tax rate

■ BOLI/assets was 0.73% for CBF vs.

1.36% for peer median

■ Municipal holdings/assets was 0.22%

for CBF vs. 1.97% for peer median

■ DTA would be impacted by lower tax rates,

but impact on regulatory capital would be

limited

Note: CBF and peer data as of 3Q16 YTD per SNL and peer 10Q filings. Peer median is based on the peer group noted in the chart above.

34.9%

0%

5%

10%

15%

20%

25%

30%

35%

40%

CF

R

HB

HC

TR

MK

ST

BA VL

Y

PR

K

BX

S

PB

CT PB UB

SI

BK

U

PN

FP IBK

C

SS

B

CB

F

FC

B

OZ

RK

NY

CB

YD

KN

HO

MB

1. Decrease in DTA for federal tax rates at 25% and 15% is based on a 10%

and 20% reduction in the 12/31/2016 DTA balance, respectfully.

2. Decrease in Tier 1 capital for federal tax rates at 25% and 15% is equal to

20% of the corresponding decrease in DTA at the respective federal tax rate.

Tier 1 capital is preliminary.

Current

Balance 25% 15%

2017 CBF Consensus EPS $1.85 + $0.30 + $0.58

DTA1 $150.3 mm - $15.0 mm - $30.1 mm

Tier 1 Capital2 $1,101.7 mm - $3.0 mm - $6.0 mm

Federal Tax Rate at:

01/26/2017

Note: Includes loan purchases of $29 mm, $8 mm, $16 mm, $126 mm, and $32 mm in 4Q15, 1Q16, 2Q16, 3Q16, and 4Q16, respectively. 10

Consistent High-Quality Loan Production

New Loans by Product

(In millions)

New Loans by Geography

(In millions)

■ Sold $100 mm in syndicated loans and ran off indirect portfolio by $27 mm. Excluding sales/run-off

and CommunityOne acquisition, portfolio growth was 7% annualized during the quarter.

■ Carolinas loan production now includes CommunityOne

212

145

230

152 148

98

89

133

123

165

126

62

110

196 132

65

$501

$296

$473 $471

$445

4Q15 1Q16 2Q16 3Q16 4Q16

Commercial CRE Consumer Auto

145

75

139

213

116

199

141

183

138

241

157

80

151

120 88

$501

$296

$473 $471

$445

4Q15 1Q16 2Q16 3Q16 4Q16

Florida Carolinas Tennessee

01/26/2017

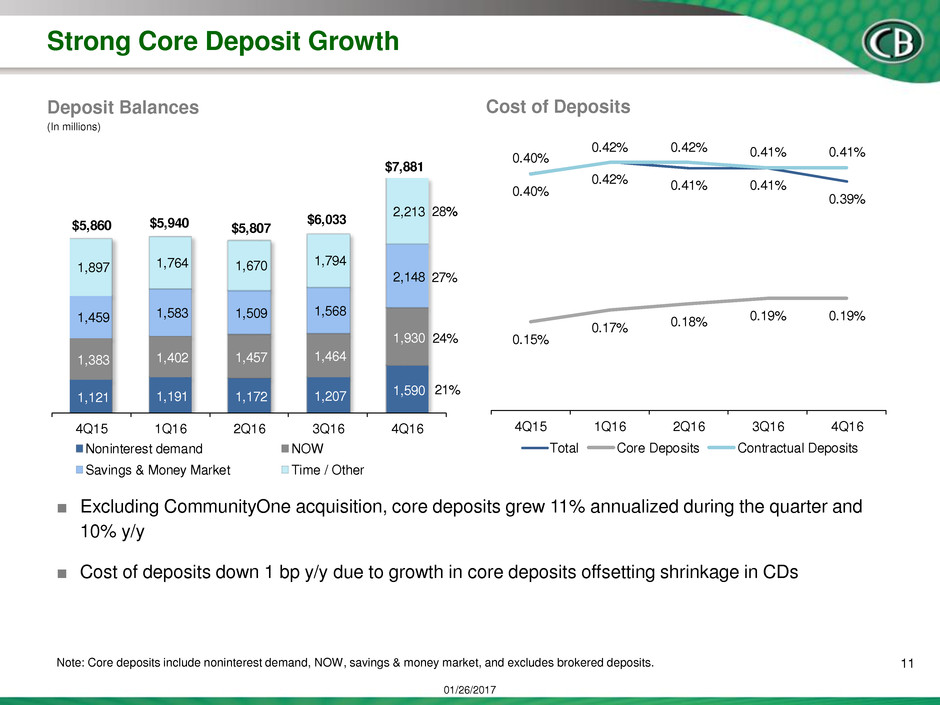

Note: Core deposits include noninterest demand, NOW, savings & money market, and excludes brokered deposits. 11

Strong Core Deposit Growth

Deposit Balances

(In millions)

Cost of Deposits

■ Excluding CommunityOne acquisition, core deposits grew 11% annualized during the quarter and

10% y/y

■ Cost of deposits down 1 bp y/y due to growth in core deposits offsetting shrinkage in CDs

1,121 1,191 1,172 1,207

1,590

1,383 1,402 1,457 1,464

1,930

1,459 1,583 1,509

1,568

2,148

1,897 1,764 1,670

1,794

2,213

4Q15 1Q16 2Q16 3Q16 4Q16

Noninterest demand NOW

Savings & Money Market Time / Other

$7,881

$5,860 $5,940 $5,807

$6,033

27%

28%

24%

21%

0.40%

0.42% .41% 0.41%

0.39%

0.15%

0.17% 0.18%

0.19% 0.19%

0.40%

0.42% 0.42% 0.41% 0.41%

4Q15 1Q16 2Q16 3Q16 4Q16

Total Core Deposits Contractual Deposits

01/26/2017

Note: See reconciliation of contractual net interest margin in appendix 12

Net Interest Margin Grows 9 bps to 3.67%

Net Interest Margin (NIM) NIM Drivers

Yields and Cost of Funds

3.70% 3.64% 3.62% 3.58% 3.67%

3.21% 3.16% 3.25% 3.11% 3.27%

4Q15 1Q16 2Q16 3Q16 4Q16

GAAP NIM Contractual NIM

0.47% 0.51% 0.50% 0.51% 0.49%

4.55% 4.52% 4.48% 4.40% 4.54%

2.25% 2.32% 2.35% 2.43% 2.39%

4Q15 1Q16 2Q16 3Q16 4Q16

Loans

Investments

Cost of

Funds

3.58%

3.67%+0.09% +0.01%

-0.01%

3Q16 Loan

Recovery

Rate

Increase

Other 4Q16

01/26/2017

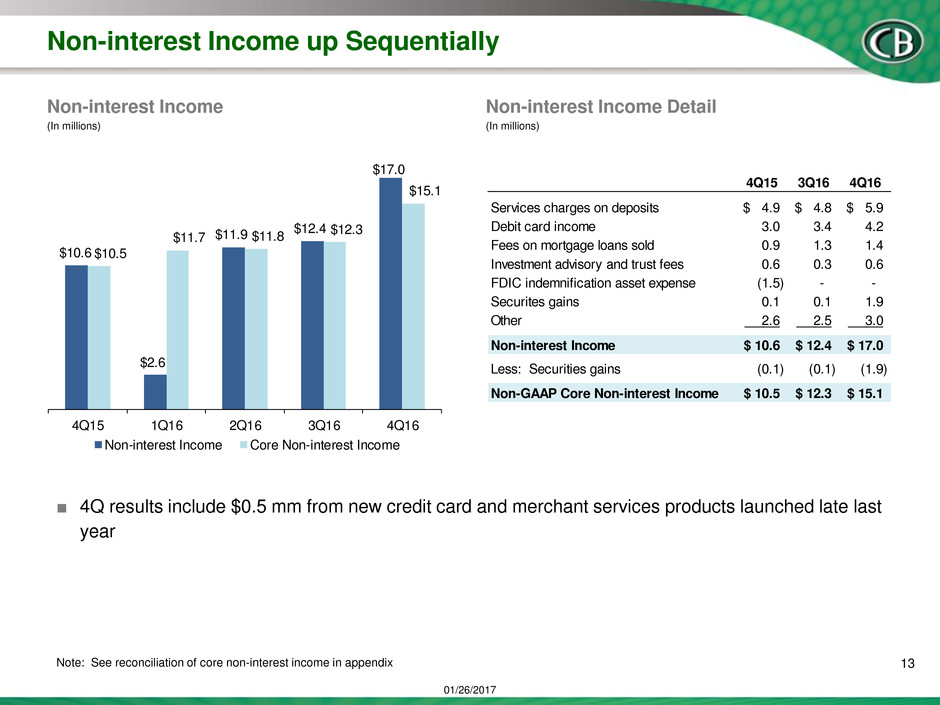

Note: See reconciliation of core non-interest income in appendix 13

Non-interest Income up Sequentially

Non-interest Income

(In millions)

Non-interest Income Detail

(In millions)

■ 4Q results include $0.5 mm from new credit card and merchant services products launched late last

year

$10.6

$2.6

$11.9 $12.4

$17.0

$10.5

$11.7 $11.8

$12.3

$15.1

4Q15 1Q16 2Q16 3Q16 4Q16

Non-interest Income Core Non-interest Income

4Q15 3Q16 4Q16

Services charges on deposits 4.9$ 4.8$ 5.9$

Debit card income 3.0 3.4 4.2

Fees on mortgage loans sold 0.9 1.3 1.4

Investment advisory and trust fees 0.6 0.3 0.6

FDIC indemnification asset expense (1.5) - -

Securites gains 0.1 0.1 1.9

Other 2.6 2.5 3.0

Non-interest Income 10.6$ 12.4$ 17.0$

Less: Securities gains (0.1) (0.1) (1.9)

Non-GAAP Core Non-interest Income 10.5$ 12.3$ 15.1$

01/26/2017

Note: See reconciliation of core efficiency ratio and core non-interest expense in appendix 14

Focused on Efficiency & Merger Cost Savings

Efficiency Ratio Non-interest Expense Detail

(In millions)

■ CommunityOne cost savings now expected to be fully realized during 2Q

42.8 45.0 43.3 45.8

54.1

$47.8 $46.9

$44.5

$47.5

$74.0

4Q15 1Q16 2Q16 3Q16 4Q16

Core Non-interest Expense Non-GAAP Adjustments

78.0%

58.2%

50%

55%

60%

65%

70%

75%

80%

85%

Efficiency Ratio Core Efficiency Ratio

Target 60%

01/26/2017

15

Liquidity and Capital Ratios Remain Strong

Tier 1 Leverage Ratio Liquidity Portfolio

Loan/Deposit Ratio

*4Q16 capital ratio is preliminary

■ Acquisition of CommunityOne reduced tier 1

leverage ratio to 12.2% and loan-to-deposit

ratio to 94.0%

■ Repurchased 0.4 mm shares following

merger closing, bringing cumulative

repurchases to 12.7 mm shares since IPO,

which represents 25% of current outstanding

shares

■ Reinvested CommunityOne securities

portfolio at closing and maintained duration

of 4.1 years at year-end

12.7%

12.5%

12.6%

12.9%

12.2%

4Q15 1Q16 2Q16 3Q16 4Q16*

Cash / Equivalents, 18.3%

U.S. Agency Securities, 0.7%

Equity Securities and Mutual

Funds, 0.2%

Corporate bonds, 7.3%

Municipal bonds,

1.2%

Industrial Revenue, 0.2%

MBS -

GSE,

72.2%

96.1%

94.9%

98.9%

98.4%

94.0%

4Q15 1Q16 2Q16 3Q16 4Q16

01/26/2017

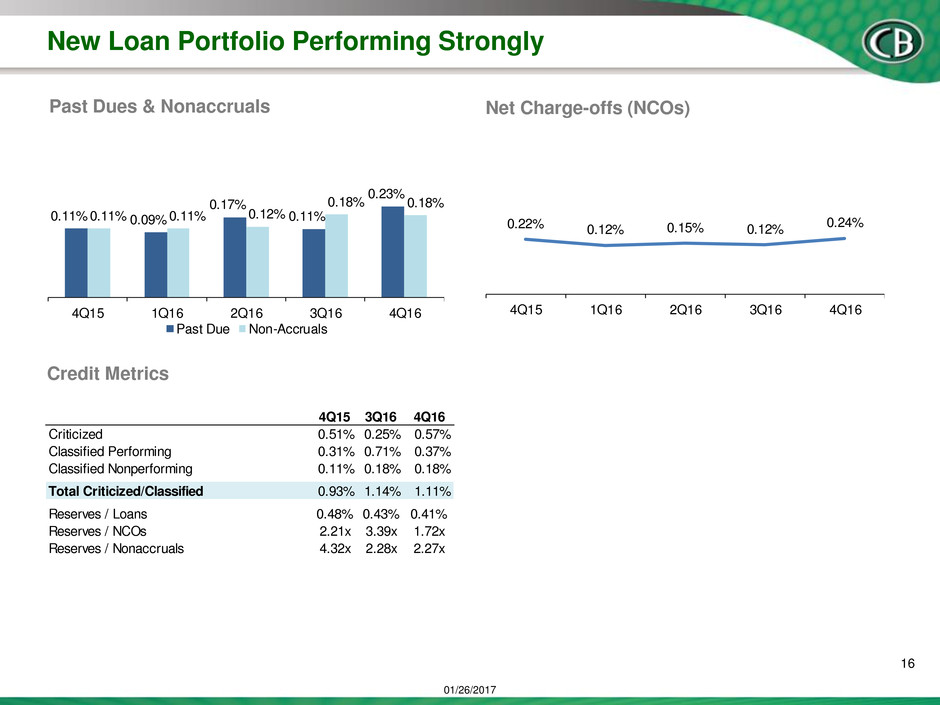

Credit Metrics

New Loan Portfolio Performing Strongly

Net Charge-offs (NCOs) Past Dues & Nonaccruals

16

0.22% 0.12% 0.15% 0.12%

0.24%

4Q15 1Q16 2Q16 3Q16 4Q16

0.11% 0.09%

0.17%

0.11%

0.23%

0.11% 0.11% 0.12%

0.18% 0.18%

4Q15 1Q16 2Q16 3Q16 4Q16

Past Due Non-Accruals4Q15 3Q16 4Q16

riticized 0.51% 0.25% 0.57%

Classified Performing 0.31% 0.71% 0.37%

Classified Nonperforming 0.11% 0.18% 0.18%

Total Criticized/Classified 0.93% 1.14% 1.11%

Reserves / Loans 0.48% 0.43% 0.41%

Reserves / NCOs 2.21x 3.39x 1.72x

Reserves / Nonaccruals 4.32x 2.28x 2.27x

01/26/2017

Legacy Credit Expenses

(In thousands)

Special Assets Remain at Low Levels

Nonperforming Loans / Total Loans

17

Special Assets

(In millions)

■ $61 mm transferred from CommunityOne to

Special Assets portfolio

2.6%

1.2% 1.2% 1.1% 1.0%

2014 2015 1Q16 2Q16 3Q16 4Q16

1.0%

349

225 201 213 195 232

78

53 49

44 46

53

$427

$278

$249 $257 $241

$285

2014 Q415 1Q16 2 6 3Q16 4Q16

Loans REO

4Q15 3 4Q16

Provision (reversal) on legacy loans (1,161)$ 48$ (638)$

FDIC indemnification asset expense 1,526 - -

OREO valuation expense 341 742 677

(Gains) losses on sales of OREO (801) (159) (150)

Foreclosed asset related expense 405 397 513

Loan workout expense 650 206 327

Salaries and employee benefits 549 511 510

Total legacy credit expense 1,509$ 1,745$ 1,239$

01/26/2017

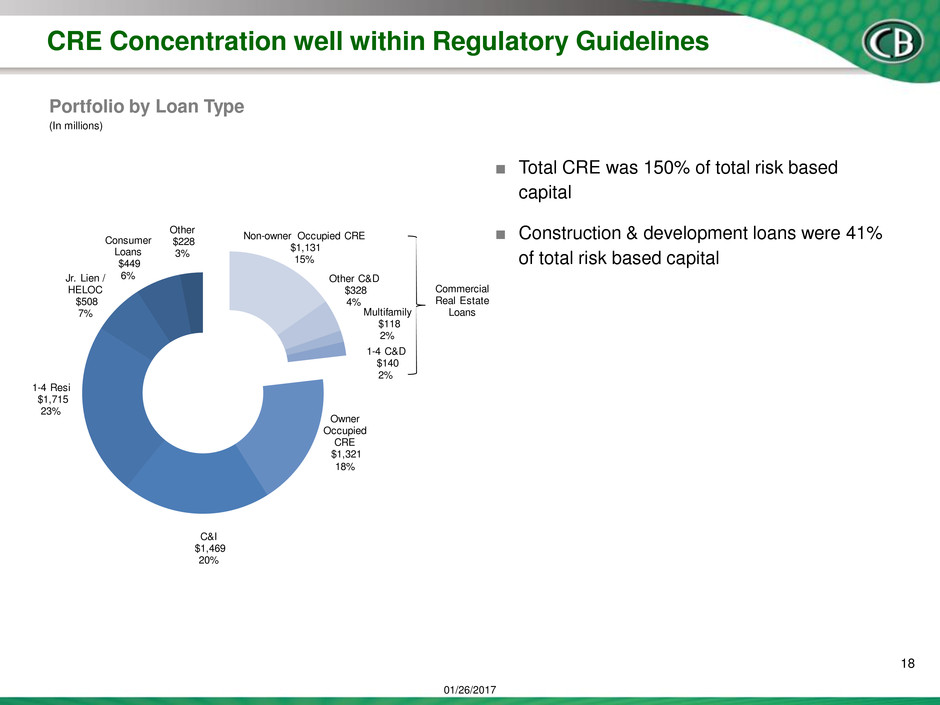

Owner

Occupied

CRE

$1,321

18%

C&I

$1,469

20%

1-4 Resi

$1,715

23%

Jr. Lien /

HELOC

$508

7%

Consumer

Loans

$449

6%

Other

$228

3%

CRE Concentration well within Regulatory Guidelines

Non-owner Occupied CRE

$1,131

15%

Other C&D

$328

4%

Multifamily

$118

2%

1-4 C&D

$140

2%

Commercial

Real Estate

Loans

18

■ Total CRE was 150% of total risk based

capital

■ Construction & development loans were 41%

of total risk based capital

Portfolio by Loan Type

(In millions)

01/26/2017

19

Appendix

01/26/2017

Use of Non-GAAP Financial Measures

Core net income, core efficiency ratio, core return-on-assets ("core ROA"), tangible book value and tangible book value per share are

each non-GAAP measures used in this report. A reconciliation to the most directly comparable GAAP financial measures - net

income in the case of core net income and core ROA, total non-interest income and total non-interest expense in the case of core

efficiency ratio, and total shareholders' equity in the case of tangible book value and tangible book value per share - appears in

tabular form at the end of this release. The Company believes core net income, the core efficiency ratio and core ROA are useful for

both investors and management to understand the effects of certain non-interest items and provide an alternative view of the

Company's performance over time and in comparison to the Company's competitors. These measures should not be viewed as a

substitute for net income. The Company believes that tangible book value and tangible book value per share are useful for both

investors and management as these are measures commonly used by financial institutions, regulators and investors to measure the

capital adequacy of financial institutions. The Company believes these measures facilitate comparison of the quality and composition

of the Company's capital over time and in comparison to its competitors. These measures should not be viewed as a substitute for

total shareholders' equity.

The Company uses these non-GAAP measures for various purposes, including measuring performance for incentive compensation

and as a basis for strategic planning and forecasting.

These non-GAAP measures have inherent limitations, are not required to be uniformly applied and are not audited. They should not

be considered in isolation or as a substitute for analysis of results reported under GAAP. These non-GAAP measures may not be

comparable to similarly titled measures reported by other companies.

20

GAAP and Non-GAAP Disclosures

01/26/2017

Diversified Loan Portfolio

Commercial Loans by Industry Commercial Real Estate Portfolio by Collateral

22

1-4 Resi

Construction,

26%

Office, 13%

Retail, 11%

Warehouse/

Industrial, 9%

Multifamily, 8%

Mixed Use,

8%

Hotel/Motel,

7%

Commercial

Land, 4%

1-4 Resi Land, 3%

Other CRE, 3%

Restaurant, 3%

Assisted Living, 2% Other, 2%

Retail

Trade,

14%

Manufacturing,

12%

Real Estate,

Rental, &

Leasing, 11%

Health Care &

Social Assistance,

8%Other Services

(except Public

Administration), 8%

Wholesale

Trade, 8%

Finance &

Insurance, 6%

Transportation &

Warehousing, 6%

Accommodation

& Food Services,

5%

Other, 5%

Professional,

Scientific, & Technical

Services, 5%

Construction, 3%

Educational

Services, 3%

Administrative, Support,

Waste Management, &

Remediation Services, 3%

Arts, Entertainment, &

Recreation, 2% Mining,

Quarrying, Oil

& Gas

Extraction, 2%

01/26/2017

23

Reconciliation of Core Noninterest Income / Expense

$ 000's

4Q16 3Q16 2Q16 1Q16 4Q15

Net interest income $77,819 $62,627 $61,515 $61,367 $62,078

Reported non-interest income 17,016 12,370 11,922 2,566 10,597

Less: Securities gains 1,894 71 117 40 54

Termination of loss share – – – (9,178) –

Core non-interest income $15,122 $12,299 $11,805 $11,704 $10,543

Reported non-interest expense $73,994 $47,530 $44,536 $46,938 $47,756

Less: Severance expense 7 – – 75 –

Conversion costs and merger 18,245 331 881 1,107 31

Legal merger non deductible 280 61 355 580 673

Restructuring expense 4 (113) 5 142 33

Contract termination – – – – 4,215

Legal settlement 1,361 1,500 – – –

Core non-interest expense $54,097 $45,751 $43,295 $45,034 $42,804

Core Fee Ratio* 16.3% 16.4% 16.1% 16.0% 14.5%

Efficiency Ratio** 78.0% 63.4% 60.6% 73.4% 65.7%

Core Efficiency Ratio*** 58.2% 61.1% 59.1% 61.6% 58.9%

* Core Fee Ratio: Core non-interest income / (Net interest income + Core non-interest income)

** Efficiency Ratio: Non-interest expense / (Net interest income + Non-interest income)

***Core Efficiency Ratio: Core non-interest expense / (Net interest income + Core non-interest income)

01/26/2017

24

Reconciliation of Core Net Income

$ 000's Quarter Quarter Quarter Quarter Quarter Quarter

Ended Ended Ended Ended Ended Ended

4Q16 4Q16 3Q16 3Q16 4Q15 4Q15

12,434$ 12,434$ 18,488$ 18,488$ 15,021$ 15,021$

Pre-Tax After-tax Pre-Tax After-tax Pre-Tax After-tax

Non-Interest Income

Security gains* (1,894) (1,170) (71) (44) (54) (33)

Non-Interest Expense

Severance expense * 7 4 - - - -

Restructuring expense* 4 3 (113) (70) 32 20 -

Conversion costs and merger tax deductible* 18,245 11,270 331 205 33 20

Legal merger non deductible 280 280 61 61 673 673

Contract Termination - - - - 4,215 2,594

Tax adjustment (1,350) (1,350) (1,067) (1,067) - -

Legal settlement* 1,361 841 1,500 927 - -

Tax effect of adjustments* (6,775) NA (629) NA (1,625) NA

22,312$ 22,312$ 18,500$ 18,500$ 18,295$ 18,295$

Diluted shares 50,387 43,909 44,550

Core Net Income per share $0.44 $0.42 $0.41

Average Assets $9,329,334 $7,592,776 $7,332,516

Tangible Common Equity $1,023,177 $883,031 $836,643

ROA** 0.53% 0.97% 0.82%

Core ROA*** 0.96% 0.97% 1.00%

Core ROTCE**** 8.7% 8.4% 8.7%

* Tax effected at an income tax rate of 38%

** ROA: Annualized net income / average assets

*** Core ROA: Annualized core net income / average assets

**** Core ROTCE: Annualized core net income / tangible common equity

Core Net Income

Net income

Adjustments

01/26/2017

25

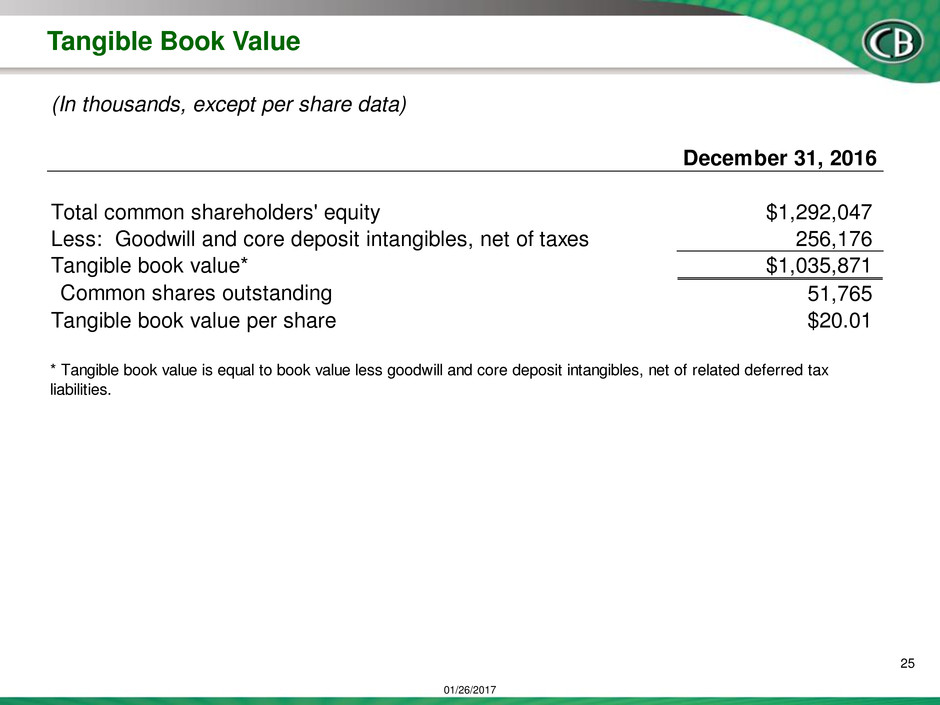

Tangible Book Value

(In thousands, except per share data)

December 31, 2016

Total common shareholders' equity $1,292,047

Less: Goodwill and core deposit intangibles, net of taxes 256,176

Tangible book value* $1,035,871

Common shares outstanding 51,765

Tangible book value per share $20.01

* Tangible book value is equal to book value less goodwill and core deposit intangibles, net of related deferred tax

liabilities.

01/26/2017

1. Includes effects of tax equivalent adjustments

2. Excludes purchase accounting adjustments

26

Contractual Net Interest Margin

$ 000's Average Earning Net Interest Net Interest

Assets Income1 Margin

December 31, 2016

Reported 8,499,594 78,376 3.67%

Purchase Accounting Impact (41,663) 8,633 0.40%

Contractual Net Interest Margin2 3.27%

September 30, 2016

Reported 7,009,363 63,083 3.58%

Purchase Accounting Impact (33,558) 8,307 0.47%

Contractual Net Interest Margin2 3.11%

June 30, 2016

Reported 6,876,936 61,950 3.62%

Purchase Accounting Impact (39,114) 6,438 0.37%

Contractual Net Interest Margin2 3.25%

March 31, 2016

Reported 6,832,335 61,786 3.64%

Purchase Accounting Impact (44,537) 8,171 0.48%

Contractual Net Interest Margin2 3.16%

December 31, 2015

Reported 6,698,720 62,491 3.70%

Purchase Accounting Impact (50,768) 8,460 0.49%

Contractual Net Interest Margin2 3.21%