Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - COLUMBUS MCKINNON CORP | exhibit9911262017.htm |

| 8-K - 8-K RESULTS OF OPERATIONS AND FINANCIAL CONDITION 01.26.17 - COLUMBUS MCKINNON CORP | a8k1262017.htm |

© 2015 Columbus McKinnon Corporation. All Rights Reserved. Confidential and Proprietary. NASDAQ: CMCO

Timothy T. Tevens

President & Chief Executive Officer

Gregory P. Rustowicz

Vice President – Finance & Chief Financial Officer

Q3 Fiscal Year 2017

Earnings Conference Call

January 26, 2017

2

© 2017 Columbus McKinnon Corporation

These slides contain (and the accompanying oral discussion will contain) “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such

statements involve known and unknown risks, uncertainties and other factors that could cause

the actual results of the Company to differ materially from the results expressed or implied by

such statements, including general economic and business conditions, conditions affecting the

industries served by the Company and its subsidiaries, conditions affecting the Company’s

customers and suppliers, competitor responses to the Company’s products and services, the

overall market acceptance of such products and services, the integration of acquisitions and

other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange

Commission. Consequently such forward looking statements should be regarded as the

Company’s current plans, estimates and beliefs. The Company does not undertake and

specifically declines any obligation to publicly release the results of any revisions to these

forward-looking statements that may be made to reflect any future events or circumstances after

the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Safe Harbor Statement

3

© 2017 Columbus McKinnon Corporation

Strong Balance Sheet and Financial

Flexibility to Execute Plans

1/3 of sales in developing

markets and 2/3 in

developed markets

Organic growth (trend line):

- U.S. & Western Europe at

GDP+

- Emerging Markets at

double digits

Acquisitions:

$200 - $300 million

Continued introduction of

new products:

20% of sales

$1B in Revenue

Operating margin:

12% - 14%

Working capital/sales:

17%

Inventory turns:

6x

DSO: < 50 days

Profitable &

Efficient

Long-Term Objectives

Debt to total Capitalization:

30%

Flex to 50% for acquisitions

Financial Flexibility

4

© 2017 Columbus McKinnon Corporation

Sales were $152.5 million; $153.9 million excluding negative FX impact

U.S. sales weaker than expected at $98.1 million; flat sequentially, but down 4.4% vs

prior year. Magnetek off of prior year due to fewer large projects.

Non-U.S. sales were $54.4 million; $55.8 million excluding negative FX impact, up

sequentially, but down 2.3% vs. prior year excluding FX. EMEA remains weak.

Gross profit of $44.8 million impacted by lower volume, higher product

liability expenses ($1.0 million) and EMEA restructuring costs ($0.3 million)

Repaid $33.3 million in debt in FY2017

Cash from operations was $22.9 million, improved working capital as a percent of sales

STAHL acquisition close planned for January 31, 2017

Expected to result in $0.34 EPS accretion in FY18, $0.51 EPS accretion in FY19, before

purchase accounting and charges

Closed debt financing for STAHL acquisition

$445 million at LIBOR +3.0%

Third Quarter Review

5

© 2017 Columbus McKinnon Corporation

U.S. Industrial Market Stabilizing

77.5%

78.1%

78.6%

78.4%

78.6%

77.3%

76.4%

76.4%

75.4%

74.9%

75.4%

75.3%

75.5%

74.0%

75.0%

76.0%

77.0%

78.0%

79.0%

80.0%

U.S. Total Industrial Capacity Utilization

Source: U.S. Board of Governors of the Federal Reserve System (FRB)

Stabilizing to up

6

© 2017 Columbus McKinnon Corporation

Sales down 3.7%, or $5.8 million, excluding FX

Up sequentially from Q2; Q3 is typically

weaker given seasonality

U.S. sales down 4.4%

Fewer large projects, weaker December

Non-U.S. sales down 2.3% excluding FX

EMEA off low-single digits, S. Africa improving

Latin America double digit growth

APAC region slowing

$159.7

$152.5

Q3 FY16 Q3 FY17

Sales

Sales up Sequentially

($ in millions)

Pricing $ 0.2 0.1%

Volume (6.0) (3.8)%

Subtotal excluding FX impact (5.8) (3.7)%

Foreign currency translation $(1.4) (0.8)%

7

© 2017 Columbus McKinnon Corporation

Gross Profit Impacted

Gross margin of 29.4%

$1.0 million unfavorable product liability includes

$0.5 million legal settlement and actuarial adjustment

Productivity net of other cost changes includes

$0.3 million of restructuring costs in EMEA

Gross margin of 30.2% excluding atypical

items

$48.3

$44.8

Q3 FY16 Q3 FY17

30.3%* 29.4%*

Gross Profit and Margin

($ in millions)

*as % of sales

Prior-year purchase accounting & restructuring costs $ 1.1

Product liability (1.0)

Productivity, net of other cost changes (1.2)

Sales volume and mix (2.0)

Subtotal excluding FX impact (3.1)

Foreign currency translation $ (0.4)

Gross Profit Bridge

8

© 2017 Columbus McKinnon Corporation

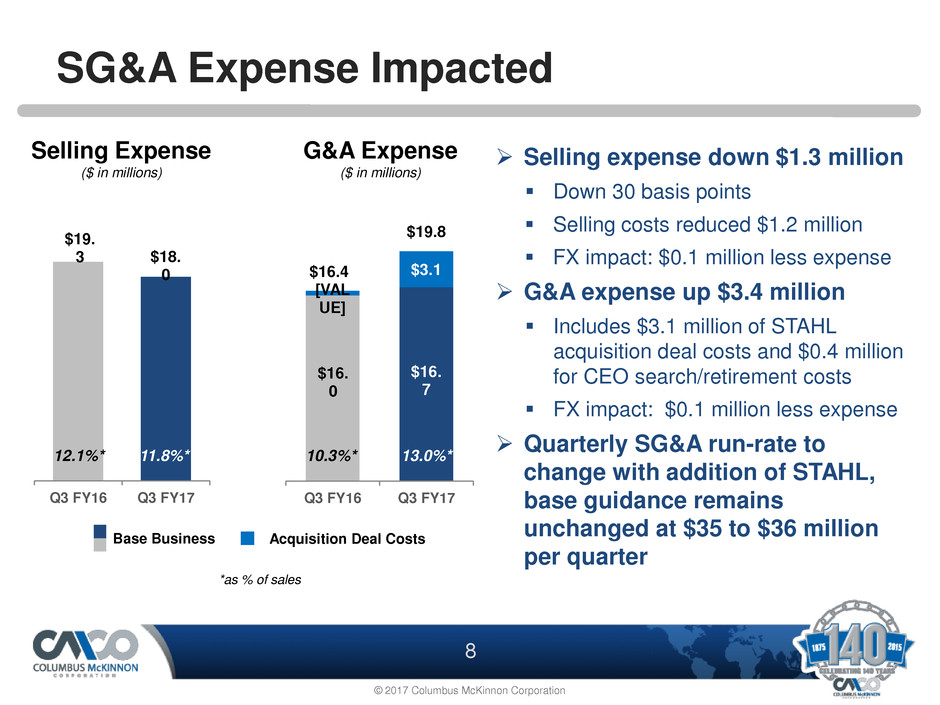

$16.

0

$16.

7

[VAL

UE]

$3.1

Q3 FY16 Q3 FY17

$16.4

$19.8 $19.

3 $18.

0

Q3 FY16 Q3 FY17

SG&A Expense Impacted

Selling expense down $1.3 million

Down 30 basis points

Selling costs reduced $1.2 million

FX impact: $0.1 million less expense

G&A expense up $3.4 million

Includes $3.1 million of STAHL

acquisition deal costs and $0.4 million

for CEO search/retirement costs

FX impact: $0.1 million less expense

Quarterly SG&A run-rate to

change with addition of STAHL,

base guidance remains

unchanged at $35 to $36 million

per quarter

Selling Expense

($ in millions)

G&A Expense

($ in millions)

12.1%* 11.8%*

*as % of sales

10.3%* 13.0%*

Base Business Acquisition Deal Costs

9

© 2017 Columbus McKinnon Corporation

Operating margin impacted by STAHL

acquisition and atypical costs

Positioned to Grow!

Income from Operations Impacted

Income from operations was $5.3 million,

or 3.5% of sales

Adjusted for STAHL acquisition deal costs,

operating margin was 5.5%

$3.1 million of STAHL acquisition deal costs

Operating margin negatively impacted by lower

volume, EMEA restructuring costs, inventory

reductions, higher product liability costs and

CEO search/retirement costs

Atypical costs had 1.2% impact

$11.0

$5.3

$1.5

$3.1

Q3 FY16 Q3 FY17

$12.5

$8.5

(1) Adjusted operating income and margin are non-GAAP financial measures. Please see supplemental slides for a reconciliation from GAAP operating income to

non-GAAP adjusted operating income and other important disclosures regarding the use of non-GAAP financial measures.

Non-GAAP

Adjustments

Income from Operations

7.8%* 5.5%*

Adjusted Income from

Operations and Margin(1)

(non-GAAP) ($ in millions)

*Non-GAAP margin as % of sales

10

© 2017 Columbus McKinnon Corporation

Diluted EPS

Earnings per Share

Net income was $0.5 million

Non-GAAP adjusted net income(1) was $4.5 million

excluding:

STAHL acquisition costs of $3.1 million

FX option revaluation loss to hedge STAHL purchase price

of $1.8 million

Adjusted to reflect normalized 30% tax rate

Adjusted diluted EPS of $0.22 impacted by atypical

costs ($0.06/share impact)

Fiscal 2017 effective tax rate of 31% to 36%

Higher than previous guidance due to non-deductible

STAHL acquisition costs

Est. quarterly average diluted shares:

22.0M (March 31, 2017) and 22.8M (June 30, 2017)

$0.34

$0.22

Q3 FY16 Q3 FY17

Adjusted Diluted EPS(1)

(non-GAAP)

(1) Adjusted net income and diluted earnings per share (EPS) are non-GAAP financial measures. Please see supplemental slides for a reconciliation from GAAP net

income and diluted EPS to non-GAAP adjusted net income and diluted EPS and other important disclosures regarding the use of non-GAAP financial measures.

$0.36

$0.02

Q3 FY16 Q3 FY17

11

© 2017 Columbus McKinnon Corporation

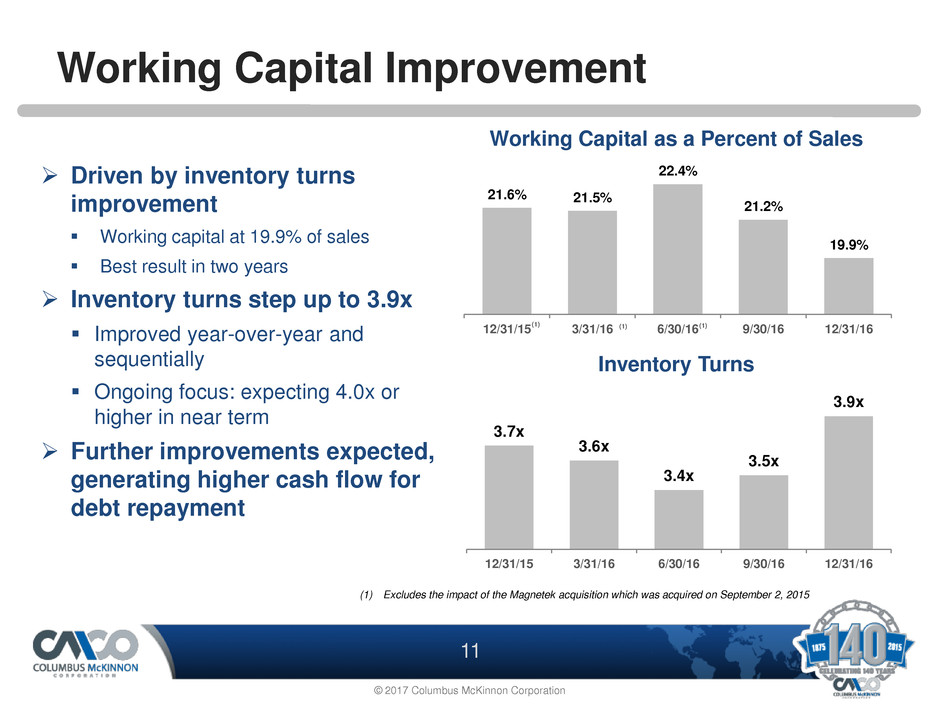

Driven by inventory turns

improvement

Working capital at 19.9% of sales

Best result in two years

Inventory turns step up to 3.9x

Improved year-over-year and

sequentially

Ongoing focus: expecting 4.0x or

higher in near term

Further improvements expected,

generating higher cash flow for

debt repayment

21.6% 21.5%

22.4%

21.2%

19.9%

12/31/15 3/31/16 6/30/16 9/30/16 12/31/16

Working Capital Improvement

3.7x

3.6x

3.4x

3.5x

3.9x

12/31/15 3/31/16 6/30/16 9/30/16 12/31/16

Working Capital as a Percent of Sales

Inventory Turns

(1) Excludes the impact of the Magnetek acquisition which was acquired on September 2, 2015

(1) (1) (1)

12

© 2017 Columbus McKinnon Corporation

Strong operating free cash flow in quarter ($20 million) and year to date

($37 million)

Year-to-date cash from operating activities increased over 45%

Capital expenditures guidance unchanged

Estimated at approximately $16 million in FY2017(1)

Strong Cash Flow

Note: Components may not add to totals due to rounding

Three Months

Ended

December 31,

Nine Months

Ended

December 31,

2016 2015 2016 2015

Net cash provided by operating activities $ 22.9 $ 28.8 $ 48.5 $ 32.9

Capital expenditures (2.8) (6.8) (11.3) (15.5)

Operating free cash flow $ 20.0 $ 22.0 $ 37.2 $ 17.4

(1) Capital expenditure guidance is as of January 26, 2017

FCF will help to

quickly de-lever

13

© 2017 Columbus McKinnon Corporation

Capital allocation priorities

De-lever balance sheet

Maintain dividend

Flexible Capital Structure Supports Growth Strategy

* Net total capitalization = total capitalization minus cash

Net debt / net total capitalization* 38.4 %

Debt / total capitalization 44.5 %

Cash

Total debt

Shareholders’ equity

Total capitalization

Net debt

($ in millions)

De-levering Balance Sheet

Debt/Total Cap Goal: 30%

Flex to ~50% for Acquisitions

$ 51.5

234.1

292.3

$ 526.4

$ 182.6

December 31,

2016

Total debt $445

Shareholders equity $339

Total capitalization $784

Net debt $410

Net debt / net total capitalization*

55%

Debt / total capitalization 57%

December 31,

2016 Pro-forma with STAHL

14

© 2017 Columbus McKinnon Corporation

Outlook

STAHL acquisition creates increased shareholder value

2nd largest hoist manufacturer in world

Strengthens position in EMEA with powered wire rope and electric chain hoists

Product development opportunities; leverage Magnetek; “Smart Hoists”

Expecting improved Q4 in U.S.

Automotive, Oil & Gas and Alternative Energy industries

Continue to take market share

Improved quotation activity, price increase, normal year-end activity

$4 million Rail & Road shipments expected

Showing signs of improvement in Latin America

Lowering quote activity, but hit rate improving in China, Rest of Asia slow

Still weak in EMEA, STAHL will enhance market presence

Backlog of $97.9 million, $107.1 million in Q2

Continue to drive customer intimacy, drive FCF and execute growth

strategy

15

© 2017 Columbus McKinnon Corporation

Replay Number: 412-317-6671 passcode: 13652416

Telephone replay available through February 2, 2017

Webcast / PowerPoint / Replay available at

www.cmworks.com/investors

Transcript, when available, at www.cmworks.com/investors

Conference Call Playback Info

© 2015 Columbus McKinnon Corporation. All Rights Reserved. Confidential and Proprietary. NASDAQ: CMCO

Supplemental

Information

17

© 2017 Columbus McKinnon Corporation

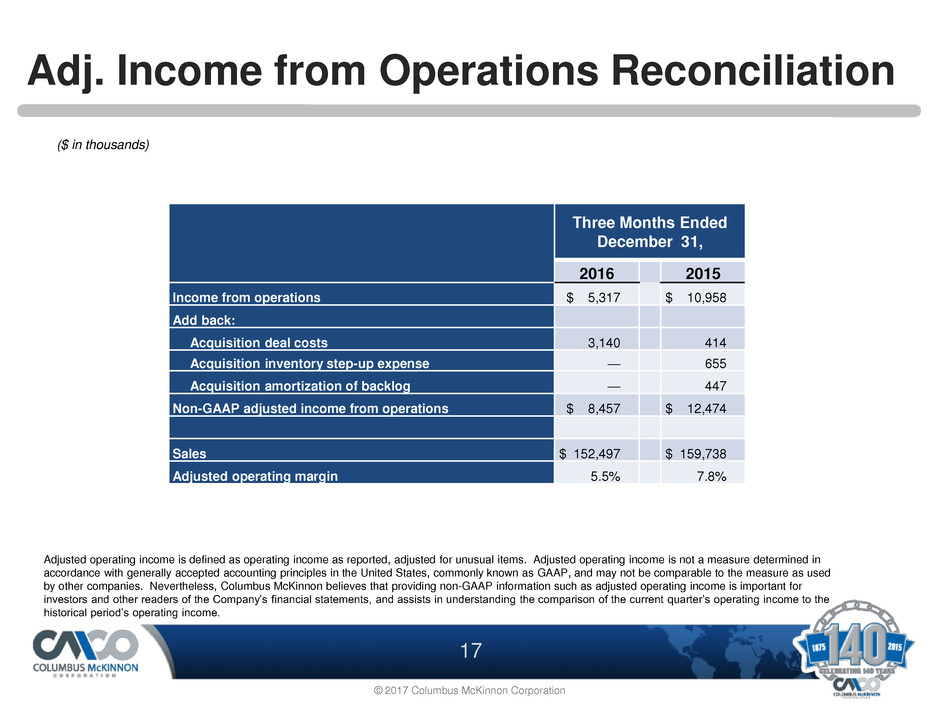

Adj. Income from Operations Reconciliation

Adjusted operating income is defined as operating income as reported, adjusted for unusual items. Adjusted operating income is not a measure determined in

accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measure as used

by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information such as adjusted operating income is important for

investors and other readers of the Company’s financial statements, and assists in understanding the comparison of the current quarter’s operating income to the

historical period’s operating income.

Three Months Ended

December 31,

2016 2015

Income from operations $ 5,317 $ 10,958

Add back:

Acquisition deal costs 3,140 414

Acquisition inventory step-up expense — 655

Acquisition amortization of backlog — 447

Non-GAAP adjusted income from operations $ 8,457 $ 12,474

Sales $ 152,497 $ 159,738

Adjusted operating margin 5.5% 7.8%

($ in thousands)

18

© 2017 Columbus McKinnon Corporation

Adjusted Diluted EPS Reconciliation

Adjusted net income and diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items and to apply a normalized tax rate. Adjusted net income and diluted

EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measure

as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted net income and diluted EPS, is important for investors and

other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year’s net income and diluted EPS to the

historical periods’ net income and diluted EPS.

(1) Applies normalized tax rate of 30% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax.

Three Months Ended

December 31,

2016 2015

Net income $ 505 $ 7,227

Add back:

Acquisition deal costs 3,140 414

Loss on revaluation of foreign exchange option 1,826 —

Acquisition inventory step-up expense — 655

Acquisition amortization of backlog — 447

Normalize tax rate to 30% (1) (934) (1,795)

Non-GAAP adjusted net income $ 4,537 $ 6,948

Average diluted shares outstanding 20,490 20,295

Diluted earnings per share - GAAP $ 0.02 $ 0.36

Diluted earnings per share - Non-GAAP $ 0.22 $ 0.34

($ in thousands, except per share data)