Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BASIC ENERGY SERVICES, INC. | a8-kforinvestorpresentatio.htm |

NYSE: BAS

Investor Presentation

January 2017

OUR LIFE’S WORK IS THE LIFE OF THE WELLTM

Forward-Looking Statements

This presentation contains forward-looking statements. Basic has based these forward-looking statements largely on its current expectations

and projections about future events and financial trends affecting the financial condition of its business. These forward-looking statements are

subject to a number of risks, uncertainties and assumptions, including, among other things, the risk factors discussed in this presentation and

other factors, most of which are beyond Basic’s control.

The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect” and similar expressions are intended to identify

forward-looking statements. All statements other than statements of current or historical fact contained in this presentation are forward-looking

statements.

Although Basic believes that the forward-looking statements contained in this presentation are based upon reasonable assumptions, the

forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially from those

anticipated or implied in the forward-looking statements.

Important factors that may affect Basic’s expectations, estimates or projections include:

a decline in or substantial volatility of oil and gas prices, and any related changes in expenditures by its customers;

the effects of future acquisitions on its business;

changes in customer requirements in markets or industries it serves;

competition within its industry;

general economic and market conditions;

its access to current or future financing arrangements;

its ability to replace or add workers at economic rates; and

environmental and other governmental regulations.

Additional important risk factors that could cause actual results to differ materially from expectations are disclosed in Item 1A of Basic’s Form

10-K for the year ended December 31, 2015 and subsequent Form 10-Q’s filed with the SEC. While Basic makes these statements and

projections in good faith, neither Basic nor its management can guarantee that the transactions will be consummated or that anticipated future

results will be achieved. Basic’s forward-looking statements speak only as of the date of this presentation. Unless otherwise required by law,

Basic undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise.

2

Proven Growth Strategy

3

Basic Energy Services supports its customers’ well site

activities from cradle to grave

Diversified service offering poised for future growth

opportunities

The right fleet, the right people and operations in the

right basins to support financial returns for the Life of

the WellTM

Our Life’s Work is the Life of the WellTM

Years

Pr

od

uc

tio

n

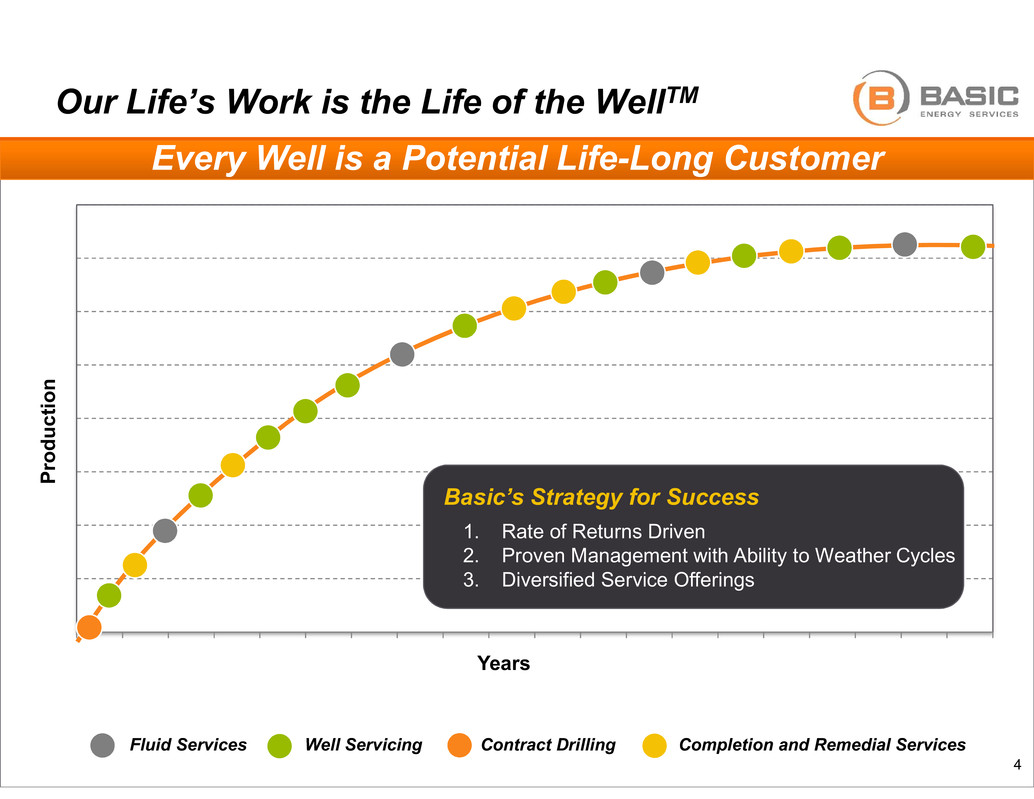

Our Life’s Work is the Life of the WellTM

4

Every Well is a Potential Life-Long Customer

Basic’s Strategy for Success

1. Rate of Returns Driven

2. Proven Management with Ability to Weather Cycles

3. Diversified Service Offerings

BAS Service Segments

Fluid Services Well Servicing Contract Drilling Completion and Remedial Services

Company Data:

NYSE Ticker: BAS

Share price (as of 01/24/17): $40.61

Market capitalization: $1.1 billion

Over 100 locations across 15 states

characterized by the most prolific basins

Website: www.basicenergyservices.com

5

Basic Energy Services Snapshot

YTD 3Q16 Revenue by Region

YTD 3Q16 Revenue by Activity

Permian Basin

46%

Mid-Continent/

Barnett/SCOOP

13%

Rocky Mountain/

Bakken/Niobrara

20%

Gulf Coast/

Eagle Ford

11%

Ark-La-

Tex/Haynesville

6%

Appalachian/

Marcellus

2%

California

2%

Fluid Services

37%

Well Servicing

30%

Contract

Drilling

1%

Cement

13%

Frac

20%

Other

62%

Acid

5%

Completion

and Remedial

Services

32%

Sizeable Footprint in the Resilient Permian Basin

Diversified Business with Majority of Revenues Tied to

Production Activities

Sources: Well count and relative percentage weighting of oil wells is from U.S. Energy Information Administration data.

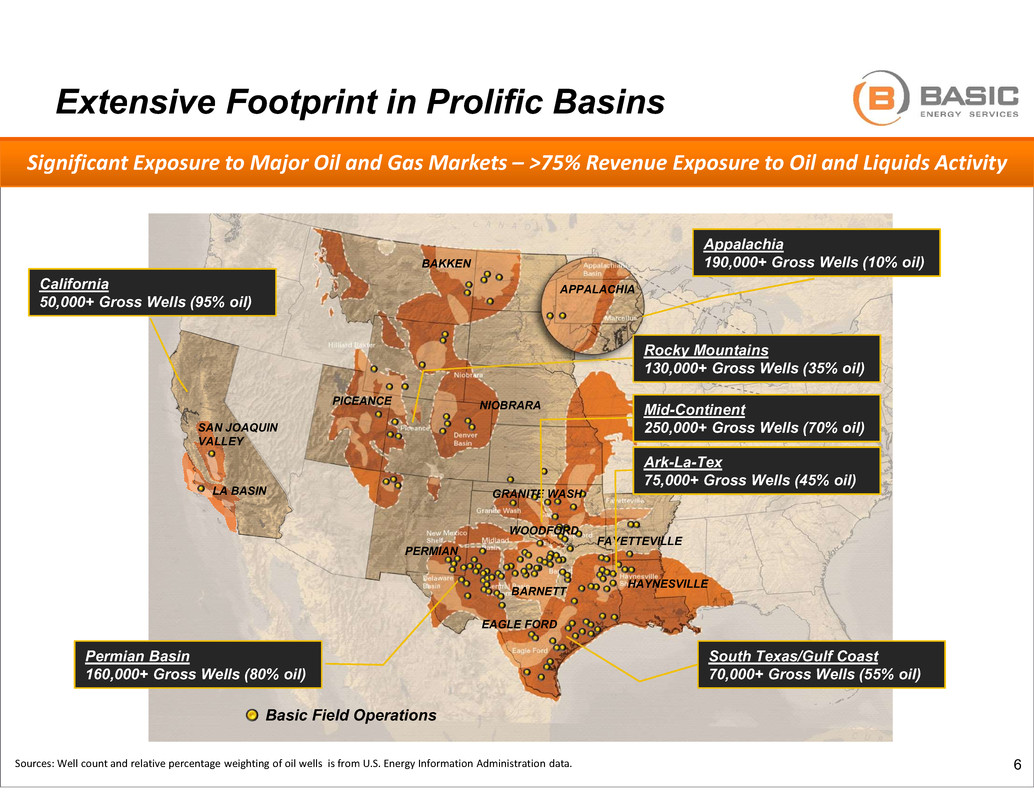

Significant Exposure to Major Oil and Gas Markets – >75% Revenue Exposure to Oil and Liquids Activity

Rocky Mountains

130,000+ Gross Wells (35% oil)

Appalachia

190,000+ Gross Wells (10% oil)

South Texas/Gulf Coast

70,000+ Gross Wells (55% oil)

Permian Basin

160,000+ Gross Wells (80% oil)

Extensive Footprint in Prolific Basins

6

BAKKEN

Basic Field Operations

NIOBRARAPICEANCE

PERMIAN

APPALACHIA

EAGLE FORD

BARNETT HAYNESVILLE

FAYETTEVILLE

GRANITE WASH

WOODFORD

Mid-Continent

250,000+ Gross Wells (70% oil)

Ark-La-Tex

75,000+ Gross Wells (45% oil)

LA BASIN

SAN JOAQUIN

VALLEY

California

50,000+ Gross Wells (95% oil)

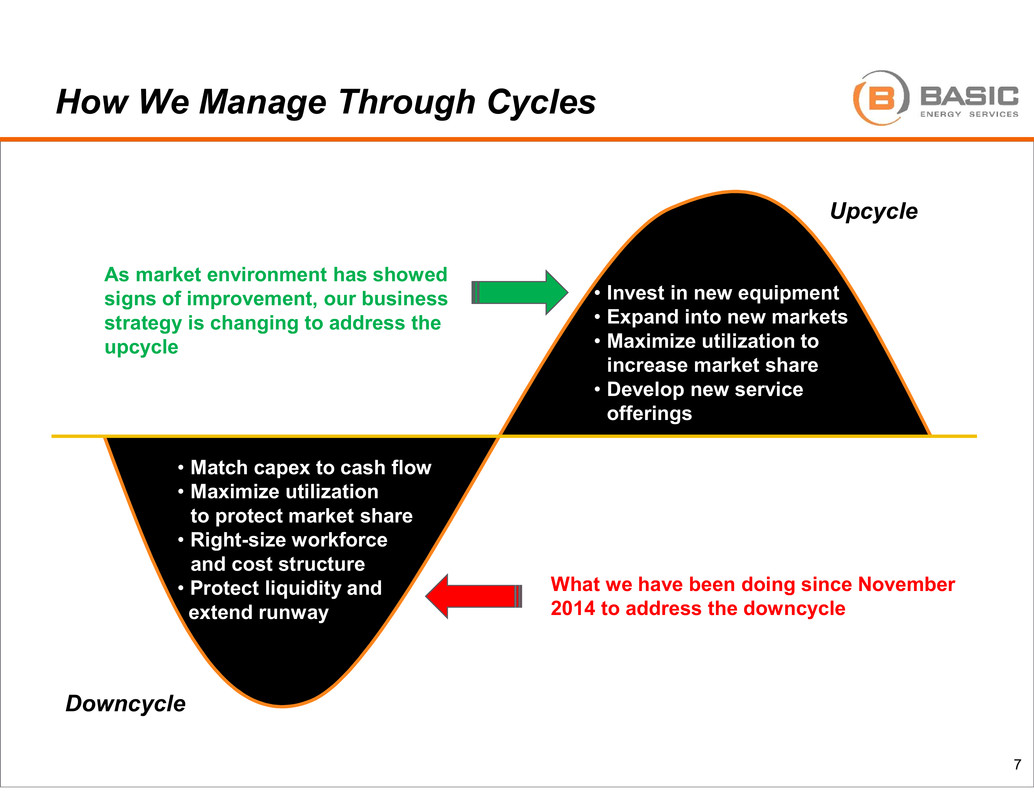

How We Manage Through Cycles

7

Upcycle

Downcycle

• Invest in new equipment

• Expand into new markets

• Maximize utilization to

increase market share

• Develop new service

offerings

• Match capex to cash flow

• Maximize utilization

to protect market share

• Right-size workforce

and cost structure

• Protect liquidity and

extend runway

What we have been doing since November

2014 to address the downcycle

As market environment has showed

signs of improvement, our business

strategy is changing to address the

upcycle

Operational Update – Equipment Counts & Utilization

8

• Invest in new equipment

• Expand into new markets

• Maximize utilization to

increase market share

• Develop new service offerings

• Match Capex to cash flow

• Maximize utilization

to protect market share

• Right-size workforce

and cost structure

• Protect liquidity and extend

runway

4Q16 3Q16

Well servicing rig hours 146,200 136,600

Well servicing utilization rate 49% 45%

Number of well servicing rigs - end of period 421 421

Fluid services truck hours 489,000 499,900

Number of fluid service trucks - end of period 941 954

Total marketed pumping HHP 327,050 271,400

Total stacked pumping HHP 116,595 172,245

Total pumping HHP - end of period 443,645 443,645

Total marketed frac HHP 256,450 201,700

Total stacked frac HHP 101,200 155,950

Total frac HHP - end of period 357,650 357,650

Note: HHP is hydraulic horsepower

Operational Update – Market Environment

9

• Invest in new equipment

• Expand into new markets

• Maximize utilization to

increase market share

• Develop new service offerings

• Match Capex to cash flow

• Maximize utilization

to protect market share

• Right-size workforce

and cost structure

• Protect liquidity and extend

runway

• We expect 4Q16 revenues to be in the range of $155 to $157 million compared to

$141 million in 3Q16

• Sequential revenue increase led by the completion and remedial segment,

particularly stimulation services

• Production oriented well servicing and fluid services lines of business

maintained or exceeded 3Q16 activity levels despite the usual seasonal

factors in the fourth quarter

• Activity levels so far in 2017 continue to improve as stable oil prices are driving an

increased U.S. Land drilling rig count and expected higher spending levels by our

customers

• We have identified several areas where expansion of our fleets are warranted

• Ordered two 2 3/8” coil tubing units for our Niobrara operations with

expected delivery dates in late 2Q or 3Q 2017

• Manufacturing two new well servicing rigs for our California operations

with expected delivery dates by mid April 2017

• Evaluating our remaining 117,000 of stacked frac HHP for refurbishment

and/or deployment as completion activity continues to grow

• We expect to release 4Q16 and full year 2016 financial results in mid March

• This is somewhat later than normal due to our fresh start accounting process

that is underway

0%

10%

20%

30%

40%

50%

60%

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

1Q

04 3Q

1Q

05 3Q

1Q

06 3Q

1Q

07 3Q

1Q

08 3Q

1Q

09 3Q

1Q

10 3Q

1Q

11 3Q

1Q

12 3Q

1Q

13 3Q

1Q

14 3Q

1Q

15 3Q

1Q

16 3Q

Segment Profits

Gross Profit Gross Margin

Specialized Completion & Remedial Services

Support drilling, workover and production

processes

Pumping services for cementing, acidizing,

squeeze-cementing (workover), fracturing and

re-fracturing activities

Fishing tools and rental equipment for drilling

and workover processes

Coil tubing and nitrogen services for

completion, remedial and P&A applications

Snubbing services to allow “live-well”

completion and workover operations

Tubular services

$0

$50

$100

$150

$200

$250

1Q

04 3Q

1Q

05 3Q

1Q

06 3Q

1Q

07 3Q

1Q

08 3Q

1Q

09 3Q

1Q

10 3Q

1Q

11 3Q

1Q

12 3Q

1Q

13 3Q

1Q

14 3Q

1Q

15 3Q

1Q

16 3Q

Revenue

10

M

illi

on

s

M

illi

on

s

Focused on Markets Traditionally Underserved by Larger Competitors

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

$0

$5

$10

$15

$20

$25

$30

$35

$40

1Q

04 3Q

1Q

05 3Q

1Q

06 3Q

1Q

07 3Q

1Q

08 3Q

1Q

09 3Q

1Q

10 3Q

1Q

11 3Q

1Q

12 3Q

1Q

13 3Q

1Q

14 3Q

1Q

15 3Q

1Q

16 3Q

Segment Profits

Gross Profit Gross Margin

Fluid Services

Transportation and disposal of salt water

produced as a by-product of oil and gas

production

Sale, transportation, storage and disposal of

fluids used in fracturing, workover and drilling

activity

Rental of portable frac and test tanks used in

fracturing, workover, drilling and industrial

applications

Oilfield wastewater (state-regulated, non-

hazardous) disposal wellsazardous) disposal

wells

$0

$20

$40

$60

$80

$100

$120

1Q

04 3Q

1Q

05 3Q

1Q

06 3Q

1Q

07 3Q

1Q

08 3Q

1Q

09 3Q

1Q

10 3Q

1Q

11 3Q

1Q

12 3Q

1Q

13 3Q

1Q

14 3Q

1Q

15 3Q

1Q

16 3Q

Revenue

Basic’s Integrated Fluid Service Business Anchored by Expansive SWD Network

11

M

illi

on

s

M

illi

on

s

Permian

Basin

48%

Rocky

Mtns.

14%

Mid-

Continent

9%

Gulf Coast

16%

Ark-La-Tex

13%

940 Trucks by Market Area

Fluid Service Truck Hours & # of SWD Wells

115,000

135,000

155,000

175,000

195,000

215,000

235,000

255,000

Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 J16

55

60

65

70

75

80

85

90

Tr

uc

k

H

ou

rs

N

um

be

r o

f S

al

t W

at

er

D

is

po

sa

l W

el

ls

Truck Hours Number of Salt Water Disposal Wells

12

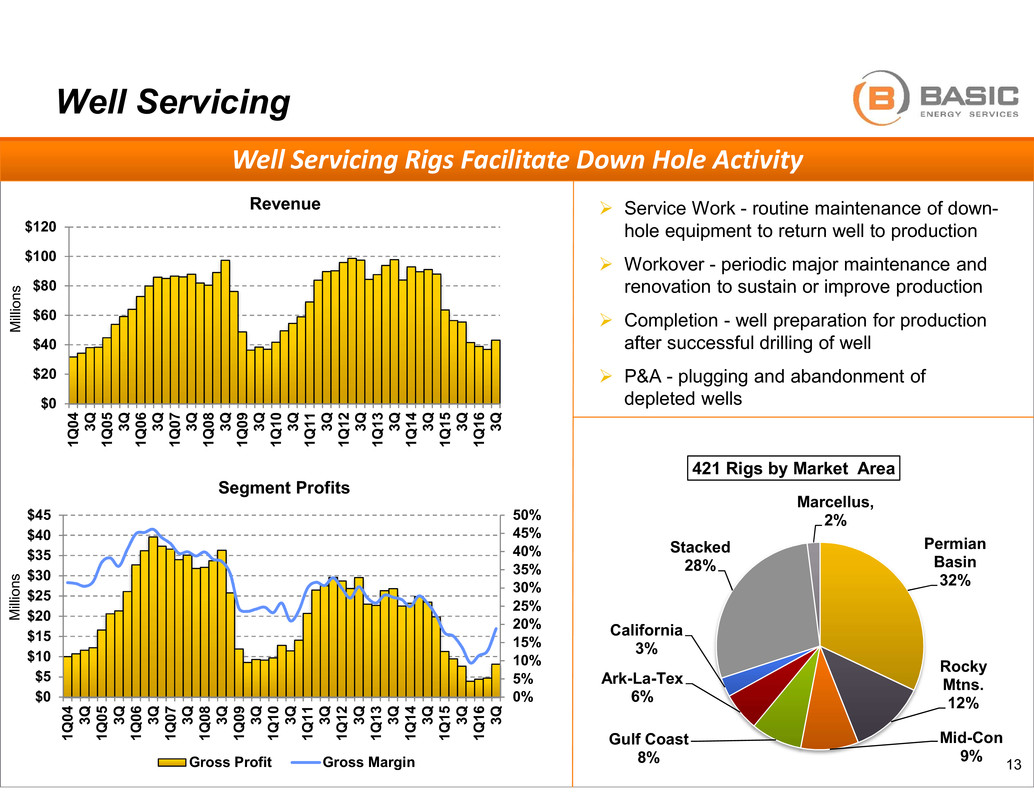

Permian

Basin

32%

Rocky

Mtns.

12%

Mid-Con

9%

Gulf Coast

8%

Ark-La-Tex

6%

California

3%

Stacked

28%

Marcellus,

2%

421 Rigs by Market Area

Well Servicing

Service Work - routine maintenance of down-

hole equipment to return well to production

Workover - periodic major maintenance and

renovation to sustain or improve production

Completion - well preparation for production

after successful drilling of well

P&A - plugging and abandonment of

depleted wells$0

$20

$40

$60

$80

$100

$120

1Q

04 3Q

1Q

05 3Q

1Q

06 3Q

1Q

07 3Q

1Q

08 3Q

1Q

09 3Q

1Q

10 3Q

1Q

11 3Q

1Q

12 3Q

1Q

13 3Q

1Q

14 3Q

1Q

15 3Q

1Q

16 3Q

Revenue

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

1Q

04 3Q

1Q

05 3Q

1Q

06 3Q

1Q

07 3Q

1Q

08 3Q

1Q

09 3Q

1Q

10 3Q

1Q

11 3Q

1Q

12 3Q

1Q

13 3Q

1Q

14 3Q

1Q

15 3Q

1Q

16 3Q

Segment Profits

Gross Profit Gross Margin

Well Servicing Rigs Facilitate Down Hole Activity

13

M

illi

on

s

M

illi

on

s

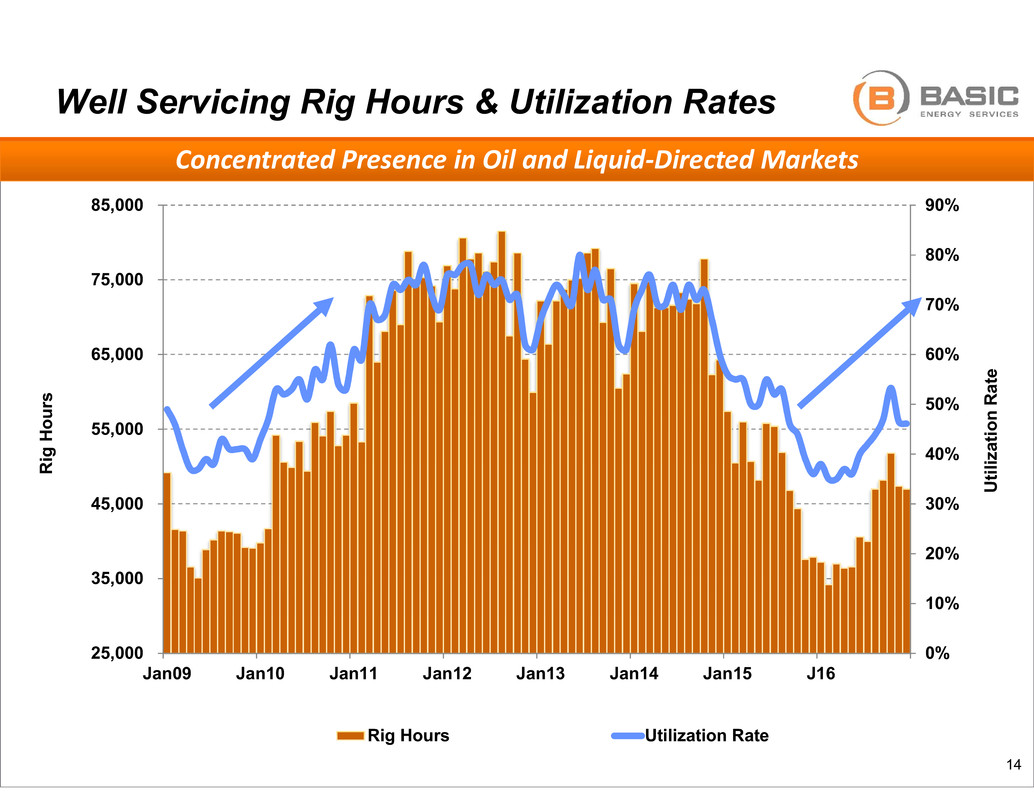

Well Servicing Rig Hours & Utilization Rates

Concentrated Presence in Oil and Liquid-Directed Markets

25,000

35,000

45,000

55,000

65,000

75,000

85,000

Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 J16

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

R

ig

H

ou

rs

U

til

iz

at

io

n

R

at

e

Rig Hours Utilization Rate

14

Pro Forma Balance Sheet

Emergence from Chapter 11 Enhances Financial Position

15

At Pro Forma

Description 9/30/2016 9/30/2016

Liquidity

ABL Credit Facility Borrowing Base 51$ 75$

Less: Letters of Credit (51) (51)

Cash 34 127

Total Liquidity 34$ 151$

Debt

Senior Notes due 2019 475,000$ -$

Senior Notes due 2022 300,000 -

Term Loan due 2021 164,588 164,588

Capital Leases 78,664 78,664

1,018,252$ 243,252$

Senior Notes due 2019 & 2022 issuance costs (7,243) -

Term Loan due 2021 discount (15,642) (15,642)

Total Debt 995,367$ 227,610$

$000s

Pro forma amounts reflect Basic's successfully emerging from pre-packaged Chapter 11 plan on December 23, 2016 where the senior

noteholders exchanged their bonds for common stock. In addition, certain bondholders participated in a rights offering of $125 million to

pay off the DIP financing and other transactions costs with the remainder added to the cash balance.

The Company’s $100 million ABL Credit Facility was amended and restated to a $75 million facility with a $25 million accordion.