Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Sprague Resources LP | srlpcapitalpr1-25x2017.htm |

| EX-2.1 - EXHIBIT 2.1 - Sprague Resources LP | srlpcapitalapa1-24x2017.htm |

| 8-K - FORM 8-K 1-25-2017 - Sprague Resources LP | form8-k.htm |

1

Sprague Resources LP

Capital Terminal Transaction

January 25, 2017

2

Safe Harbor

Forward-Looking Statements: Some of the statements in this presentation may contain forward-looking statements within

the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,”

“plan,” “estimate,” “anticipate,” “believe,” “will,” “project,” “budget,” “potential,” or “continue,” and similar references to future

periods. However, the absence of these words does not mean that a statement is not forward looking. Descriptions of our

objectives, goals, plans, projections, estimates, anticipated capital expenditures, cost savings, strategy for customer retention

and strategy for risk management and other statements of future events or conditions are also forward looking statements.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies,

projections, anticipated events and trends, the economy and other future conditions. Our actual future results and financial

condition may differ materially from those indicated in the forward-looking statements. These forward-looking statements

involve risks and uncertainties and other factors that are difficult to predict and many of which are beyond management’s

control. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our

actual results and financial condition to differ materially from those indicated in the forward-looking statements include, but are

not limited to, increased competition for our products or services; changes in supply or demand for our products; changes in

operating conditions and costs; changes in the level of environmental remediation spending; potential equipment malfunction;

potential labor issues; the legislative or regulatory environment; terminal construction repair/delays; nonperformance by major

customers or suppliers; litigation, and political, economic and capital market conditions, including the impact of potential

terrorist acts and international hostilities. For a more detailed description of these and other risks and uncertainties, please

see the “Risk Factors” section in our most recent Annual Report on Form 10-K and/or most recent Form 10-Q, Form 8-K and

other items filed with the U.S. Securities and Exchange Commission and also available in the “Investor Relations” section of

our website www.spragueenergy.com.

Any forward-looking statement made by us in this presentation is based only on information currently available to us and

speaks only as of the date of this presentation. We undertake no obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time, whether as a result of new information, future developments or

otherwise.

3

Non-GAAP Financial Measures

Non-GAAP Financial Measures: To supplement the financial information presented in accordance with United States generally accepted

accounting principles (“GAAP”), Sprague’s management uses certain non-GAAP financial measurements to evaluate its results of operations

which include EBITDA, adjusted EBITDA, adjusted gross margin and distributable cash flow. Sprague believes that investors benefit from

having access to the same financial measures that are used by its management and that these measures are useful to investors because they

aid in comparing its operating performance with that of other companies with similar operations.

As EBITDA, adjusted EBITDA, adjusted gross margin and distributable cash flow are measures not prepared in accordance with GAAP they

should not be considered as alternatives to net income (loss), or operating income or any other measure of financial performance presented in

accordance with GAAP. Additionally, Sprague's calculations of non-GAAP measures may not be comparable to similarly titled measures of

other businesses because they may be defined differently by other companies.

You can find disclosures on our use of these non-GAAP measures, as well as reconciliations between GAAP and these non-GAAP measures,

in Sprague's "Non-GAAP Measures Quarterly Supplement" located in the Investor Relations section of Sprague’s website,

www.spragueenergy.com.

EBITDA

Sprague defines EBITDA as net income (loss) before interest, income taxes, depreciation and amortization. EBITDA is used as a supplemental

financial measure by external users of Sprague’s financial statements, such as investors, trade suppliers, research analysts and commercial

banks to assess:

• The financial performance of Sprague’s assets, operations and return on capital without regard to financing methods, capital structure or

historical cost basis;

• The ability of our assets to generate sufficient revenue, that when rendered to cash, will be available to pay interest on our indebtedness

and make distributions to our equity holders;

• Repeatable operating performance that is not distorted by non-recurring items or market volatility; and

• The viability of acquisitions and capital expenditure projects.

Expansion Capital Expenditures

Expansion capital expenditures are capital expenditures made to increase the long-term operating capacity of our assets or our operating

income whether through construction or acquisition of additional assets. Examples of expansion capital expenditures include the acquisition of

equipment and the development or acquisition of additional storage capacity, to the extent such capital expenditures are expected to expand

our operating capacity or our operating income.

4

Capital Terminal - Refined Products / Materials Handling

Terms

• On 1/25/2017, Sprague Resources LP (NYSE: SRLP) announced that its operating subsidiary, Sprague Operating

Resources LLC, entered an agreement to purchase the East Providence, RI refined product terminal asset of Capital

Terminal Company

• Purchase price of $23 million in cash, to be funded with cash on hand and credit facility borrowings

• Closing expected within thirty days

Asset overview and growth capital investments

• East Providence, RI terminal – 1 million barrels of deep water distillate storage

• $8 million investment will convert 500,000 barrels of East Providence storage to gasoline and ethanol service

• Investment backed by long term gasoline storage and handling agreement with multi-national branded supplier

• Ratable fee for service contract with minimum guarantees

• $3 million Providence terminal investment to optimize distillate storage and expand materials handling capabilities

• Transaction and associated expansion capital investments expected to generate $6 million in adjusted EBITDA annually as

minimum handling volumes increase over the first five years

5

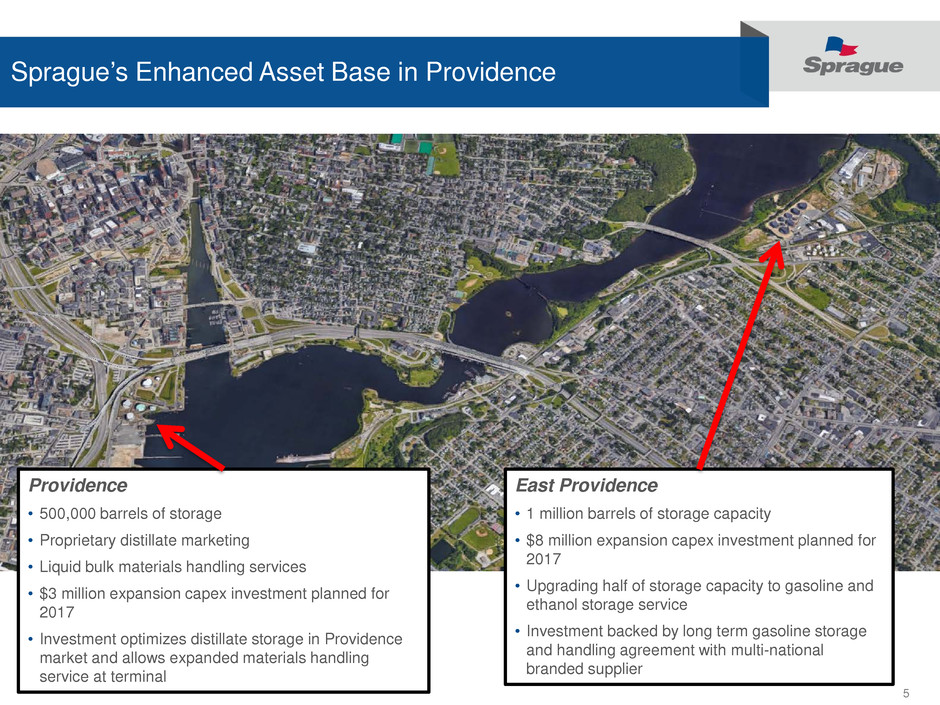

Sprague’s Enhanced Asset Base in Providence

Providence

• 500,000 barrels of storage

• Proprietary distillate marketing

• Liquid bulk materials handling services

• $3 million expansion capex investment planned for

2017

• Investment optimizes distillate storage in Providence

market and allows expanded materials handling

service at terminal

East Providence

• 1 million barrels of storage capacity

• $8 million expansion capex investment planned for

2017

• Upgrading half of storage capacity to gasoline and

ethanol storage service

• Investment backed by long term gasoline storage

and handling agreement with multi-national

branded supplier