Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SLM Corp | a01252017ip18k.htm |

| 1

SALLIE MAE

Smart Option Student Loan

Historical Performance Data

Period ended December 31, 2016

Exhibit 99.1

| 2

Forward-Looking Statements and Disclaimer

Cautionary Note Regarding Forward-Looking Statements

The following information is current as of December 31, 2016 (unless otherwise noted) and should be read in connection with the press release of SLM Corporation (the “Company”) dated January 18, 2017,

announcing its financial results for the quarter ended December 31, 2016 , and subsequent reports filed with the Securities and Exchange Commission (the “SEC”).

This Presentation contains “forward-looking” statements and information based on management’s current expectations as of the date of this presentation. Statements that are not historical facts, including

statements about the Company’s beliefs, opinions or expectations and statements that assume or are dependent upon future events, are forward-looking statements. Forward-looking statements are

subject to risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among

others, the risks and uncertainties set forth in Item 1A “Risk Factors” and elsewhere in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2015 (filed with the SEC on Feb. 26, 2016) and

subsequent filings with the SEC; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; failure to comply with consumer protection, banking

and other laws; changes in accounting standards and the impact of related changes in significant accounting estimates; any adverse outcomes in any significant litigation to which the Company is a party;

credit risk associated with the Company’s exposure to third parties, including counterparties to the Company’s derivative transactions; and changes in the terms of education loans and the educational credit

marketplace (including changes resulting from new laws and the implementation of existing laws). The Company also could be affected by, among other things: changes in its funding costs and availability;

reductions to its credit ratings; failures or breaches of its operating systems or infrastructure, including those of third-party vendors; damage to its reputation; risks associated with restructuring initiatives,

including failures to successfully implement cost-cutting programs and the adverse effects of such initiatives on the Company’s business; changes in the demand for educational financing or in financing

preferences of lenders, educational institutions, students and their families; changes in law and regulations with respect to the student lending business and financial institutions generally; changes in

banking rules and regulations, including increased capital requirements; increased competition from banks and other consumer lenders; the creditworthiness of customers; changes in the general interest

rate environment, including the rate relationships among relevant money-market instruments and those of earning assets versus funding arrangements; rates of prepayment on the loans made by the

Company and its subsidiaries; changes in general economic conditions and the Company’s ability to successfully effectuate any acquisitions; and other strategic initiatives. The preparation of the Company’s

consolidated financial statements also requires management to make certain estimates and assumptions, including estimates and assumptions about future events. These estimates or assumptions may

prove to be incorrect. All forward-looking statements contained in this presentation are qualified by these cautionary statements and are made only as of the date of this presentation. The Company does

not undertake any obligation to update or revise these forward-looking statements to conform such statements to actual results or changes in its expectations.

The Company reports financial results on a GAAP basis and also provides certain core earnings performance measures. The difference between the Company’s “Core Earnings” and GAAP results for the

periods presented were the unrealized, mark-to-market gains/losses on derivative contracts. These are recognized in GAAP, but not in “Core Earnings” results. The Company provides “Core Earnings”

measures because this is what management uses when making management decisions regarding the Company’s performance and the allocation of corporate resources. The Company’s “Core Earnings” are

not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies.

For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – GAAP Consolidated Earnings Summary-’Core Earnings’” in the Company’s Quarterly

Report on Form 10-Q for the quarter ended September 30, 2016. For a complete reconciliation between GAAP net income and “Core Earnings’’ see the “ ‘Core Earnings’ to GAAP Reconciliation” table in the

January 18, 2017 earnings press release.

Disclaimer. A significant portion of the historical data relating to historical Smart Option Student Loan performance used to prepare certain of these materials was provided to the Company by Navient

Corporation (“Navient”) pursuant to a Data Sharing Agreement executed in connection with the Spin-Off (as hereinafter defined). Under the Data Sharing Agreement, Navient makes no representations or

warranties to the Company concerning the accuracy and completeness of information that they provided. The Company and Sallie Mae Bank have not independently verified, and are not able to verify, the

accuracy or completeness of the data provided under the agreement or of Navient’s representations and warranties. Although we have no reason to believe that the data used to prepare the tabular and

graphic presentations in this document as a whole is materially inaccurate or incomplete, and have assumed that the data provided by Navient under the Data Sharing Agreement as a whole to be materially

accurate and complete, neither the Company nor any person on its behalf has independently verified the accuracy and completeness of such data.

| 3

Important Information Regarding Historical Loan Performance Data

On April 30, 2014 (the “Spin-Off Date”), the former SLM Corporation legally separated (the “Spin-Off”) into two distinct publicly traded entities: an education loan management, servicing and asset recovery business called Navient

Corporation (“Navient”), and a consumer banking business called SLM Corporation. SLM Corporation’s primary operating subsidiary is Sallie Mae Bank. We sometimes refer to SLM Corporation, together with its subsidiaries and its

affiliates, during the period prior to the Spin-Off as “legacy SLM.”

In connection with the Spin-Off, all private education loans owned by legacy SLM, other than those owned by its Sallie Mae Bank subsidiary as of the date of the Spin-Off, and all private education loan asset-backed securities (“ABS”)

trusts previously sponsored and administered by legacy SLM were transferred to Navient. As of the Spin-Off Date, Navient and its sponsored ABS trusts owned $30.8 billion of legacy SLM’s private education loan portfolio originated both

prior to and since 2009. As of the Spin-Off Date, Sallie Mae Bank owned $7.2 billion of private education loans, the vast majority of which were unencumbered Smart Option Student Loans originated since 2009.

Legacy SLM’s Private Education Loan and ABS Programs Prior to the Spin-Off

In 1989, legacy SLM began making private education loans to graduate students. In 1996, legacy SLM expanded its private education loan offerings to undergraduate students. Between 2002 and 2007, legacy SLM issued $18.6 billion of

private education loan-backed ABS in 12 separate transactions.

In 2008, in response to the financial downturn, legacy SLM revised its private education loan underwriting criteria, tightened its forbearance and collections policies, ended direct-to-consumer disbursements, and ceased lending to

students attending certain for-profit schools. Legacy SLM issued no private education loan ABS in 2008.

In 2009, legacy SLM introduced its Smart Option Student Loan product and began underwriting private education loans with a proprietary custom credit score. The custom credit score included income-based factors, which led to a

significant increase in the percentage of loans requiring a co-signer, typically a parent. The initial loans originated under the Smart Option Student Loan program (the “Interest Only SOSLs”) were variable rate loans and required interest

payments by borrowers while in school, which reduced the amounts payable over the loans’ lives and helped establish repaymen t habits among borrowers. In 2010, legacy SLM introduced a second option for its Smart Option Student

Loan customers, which required a $25 fixed monthly payment while borrowers were in school (the “Fixed Pay SOSLs”). In 2011, legacy SLM introduced another option for its Smart Option Student Loan customers, which allowed

borrowers to defer interest and principal payments until after a student graduates or separates from school (the “Deferred SOSLs”). In 2012, legacy SLM introduced a fixed rate loan option for its Interest Only, Fixed Pay and Deferred

SOSLs. Borrowers must select which of these options they prefer at the time of loan origination and are not permitted to change those options once selected.

In 2011, legacy SLM included private education loans originated under the Smart Option Student Loan program in its ABS pools for the first time. Between 2011 and 2014, the mix of Smart Option Student Loans included in legacy SLM’s

private education loan ABS steadily increased as a percentage of the collateral pools, from 10% initially to 64% in later transactions.

Sallie Mae Bank’s Private Education Loan and ABS Programs Post-Spin Off

Originations. Following the Spin-Off, Sallie Mae Bank continued to originate loans under the Smart Option Student Loan program. As of December 31, 2016, it owned $14.1 billion of private education loans, the vast majority of which were

Smart Option Student Loans originated since 2009, and over 85% of which were originated between 2013 and 2016. Navient ceased originating private education loans following the Spin-Off.

Servicing. Immediately prior to the Spin-Off, Sallie Mae Bank assumed responsibility for collections of delinquent loans on the vast majority of its Smart Option Student Loan portfolio. Following the Spin-Off Date, Navient continued to

service all private education loans owned by the two companies on its servicing platform until October 2014, when servicing for the vast majority of Sallie Mae Bank’s private education loan portfolio was transitioned to Sallie Mae Bank.

Sallie Mae Bank now services and is responsible for collecting the vast majority of the Smart Option Student Loans it owns.

Securitization and Sales. In August 2014, Sallie Mae Bank sponsored its first private education loan ABS, SMB Private Education Loan Trust 2014-A (the “SMB 2014-A transaction”). Because this transaction occurred prior to the transfer

of loan servicing from Navient to Sallie Mae Bank, Sallie Mae Bank acted as master servicer for the transaction and Navient as subservicer, and the loan pool is serviced pursuant to Navient servicing policies. In April 2015, Sallie Mae

Bank sponsored a second securitization and residual sale, SMB Private Education Loan Trust 2015-A. In July 2015, Sallie Mae Bank sponsored its first on-balance sheet term securitization, SMB Private Education Loan Trust 2015-B. In

October 2015, Sallie Mae Bank sponsored another securitization and residual sale, SMB Private Education Loan Trust 2015-C. In May 2016, Sallie Mae Bank sponsored another on-balance sheet term securitization, SMB Private

Education Loan Trust 2016-A. In July 2016, Sallie Mae Bank sponsored another on-balance sheet term securitization, SMB Private Education Loan Trust 2016-B. In October 2016, Sallie Mae Bank sponsored another on-balance sheet

term securitization, SMB Private Education Loan Trust 2016-C. Sallie Mae Bank services the loans in all of the securitizations it has sponsored following the SMB 2014-A transaction.

Additional Information. Prior to the Spin-Off, all Smart Option Student Loans were originated and initially held by Sallie Mae Bank, as a subsidiary of legacy SLM. Sallie Mae Bank typically then sold certain of the performing Smart Option

Student Loans to an affiliate of legacy SLM for securitization. Additionally, on a monthly basis Sallie Mae Bank sold all loans that were over 90 days past due, in forbearance, restructured or involved in a bankruptcy to an affiliate of legacy

SLM. As a result of this second practice, prior to the occurrence of the Spin-Off, historical performance data for Sallie Mae Bank’s Smart Option Student Loan portfolio reflected minimal later stage delinquencies, forbearance or charge-offs.

Legacy SLM collected Smart Option Student Loans pursuant to policies that required loans be charged off after 212 days of del inquency. In April 2014, Sallie Mae Bank began collecting the vast majority of its Smart Option Student Loans

pursuant to policies that required loans be charged off after 120 days of delinquency, in accordance with bank regulatory guidance. As a result of the various policies described above, it was not until recently that (a) a meaningful amount

of Smart Option Student Loan charge-offs occurred in Sallie Mae Bank’s portfolio, and (b) performance data on Sallie Mae Bank’s owned Smart Option Student Loan portfolio became useful as a basis for evaluating historical trends for

Smart Option Student Loans. For the reasons described above, much of Sallie Mae Bank’s historical performance data does not reflect current collections and charge off practices and may not be indicative of the future performance of the

Bank’s Smart Option Student Loans.

| 4

Important Information Regarding Historical Loan Performance Data (cont.)

Types of Smart Option Student Loan Portfolio Data

The portfolio data we used in this report comes from three separate sources of information:

(1) Combined Smart Option Student Loan Portfolio Data for Legacy SLM, Navient and Sallie Mae Bank. Information in this category is presented on a combined basis for loans originated under the Smart Option Student Loan program,

whether originated by Sallie Mae Bank when it was part of legacy SLM or by Sallie Mae Bank post Spin-Off, and regardless of whether the loan is currently held by an ABS trust, or held or serviced by Navient or Sallie Mae Bank. Data in

this category is used in the tables below under the following headings:

̶ “Cumulative Defaults by P&I Repayment Vintage and Years Since First P&I Repayment Period”

This combined Smart Option Student Loan portfolio data provides insight into gross defaults of all Smart Option Student Loans since 2010, regardless of ownership or servicing standard. We believe historical loan performance data since

2010 is more representative of the expected performance of Smart Option Student Loans to be included in new Sallie Mae Bank trusts than data available for earlier periods. Data available for earlier periods includes a limited number of

Smart Option Student Loan product types, a limited amount of loans in principal and interest repayment status, and limited periods of loan performance history.

Loans contained in the combined Smart Option Student Loan portfolio category were serviced by legacy SLM prior to the Spin-Off, and by either Navient or Sallie Mae Bank after the Spin-Off. As noted above, loans serviced by legacy

SLM and Navient were serviced pursuant to different policies than those loans serviced by Sallie Mae Bank after the Spin-Off. Specifically, legacy SLM charged off loans after 212 days of delinquency, and Navient has continued this

policy. Sallie Mae Bank currently charges off loans after 120 days of delinquency. All loans included in the combined Smart Option Student Loan portfolio that were serviced by legacy SLM prior to the Spin-Off were serviced pursuant to a

212-day charge off policy. Following the Spin-Off, a portion of the loans included in the combined Smart Option Student Loan portfolio data have been serviced by Navient pursuant to a 212-day charge off policy, and a portion have been

serviced by Sallie Mae Bank pursuant to a 120-day charge off policy. As a result, future performance of loans serviced by Sallie Mae Bank may differ from the historical performance of loans reflected in this combined Smart Option

Student Loan portfolio data.

(2) Legacy SLM Consolidated Smart Option Student Loan Portfolio Data prior to the Spin-Off Date, and Sallie Mae Bank-Only Smart Option Student Loan Data from and after the Spin-Off Date. Information in this category is presented (a)

prior to the Spin-Off Date for Smart Option Student Loans owned or serviced by legacy SLM prior to the Spin-Off, and (b) from and after the Spin-Off Date for Smart Option Student Loans serviced by Sallie Mae Bank from and after the

Spin-Off. Data in this category is used in the tables below under the following headings:

This consolidated Smart Option Student Loan portfolio data provides insight into historical delinquencies, forbearance, defaults and prepayment rates specifically of the Smart Option Student Loans covered, regardless of the loans’

ownership at the time, or whether the loans serve as collateral for an ABS trust. We believe this data is currently the most relevant data available for assessing historical Smart Option Student Loan performance.

Loans owned or serviced by legacy SLM and contained in this consolidated Smart Option Student Loan portfolio category were serviced pursuant to legacy SLM servicing policies prior to the Spin-Off. Loans serviced by Sallie Mae Bank

and contained in this consolidated Smart Option Student Loan portfolio were serviced pursuant to Sallie Mae Bank servicing policies since the Spin-Off. The servicing policies of legacy SLM were different than the servicing policies of

Sallie Mae Bank. Specifically, legacy SLM charged off loans after 212 days of delinquency, while Sallie Mae Bank charges off loans after 120 days of delinquency in accordance with bank regulatory guidance. As a result, future

performance of loans serviced by Sallie Mae Bank may differ from the historical performance of loans reflected in this consol idated Smart Option Student Loan portfolio data.

(3) Legacy SLM Consolidated Smart Option Student Loan Portfolio Data prior to the Spin-Off Date, and Navient-Only Smart Option Student Loan Data from and after the Spin-Off Date. Information in this category is presented (a) prior to

the Spin-Off Date for Smart Option Student Loans owned or serviced by legacy SLM prior to the Spin-Off, and (b) from and after the Spin-Off Date for Smart Option Student Loans serviced by Navient from and after the Spin-Off. Data in

this category is used in the tables below under the following headings:

Loans contained in this Smart Option Student Loan portfolio category were serviced by legacy SLM prior to the Spin-Off, and by Navient after the Spin-Off. As noted above, loans serviced by legacy SLM and Navient were serviced

pursuant to different policies than those loans serviced by Sallie Mae Bank after the Spin-Off. Specifically, legacy SLM charged off loans after 212 days of delinquency, and Navient has continued this policy. Sallie Mae Bank currently

charges off loans after 120 days of delinquency. As a result, future performance of loans serviced by Sallie Mae Bank may differ from the historical performance of loans reflected in this Smart Option Student Loan portfolio data.

Any data or other information presented in the following charts is for comparative purposes only, and is not to be deemed a part of any offering of securities.

A significant portion of the Smart Option Student Loan performance data described above is provided to Sallie Mae Bank by Navient under a data sharing agreement executed in connection with the Spin-Off. This data

sharing agreement expires in 2019. Under the data sharing agreement, Navient makes no representations or warranties to Sallie Mae Bank concerning the accuracy and completeness of information that it provided. Sallie

Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement.

̶ “31-60 Day Delinquencies as a Percentage of Loans in P&I Repayment;”

̶ “61-90 Day Delinquencies as a Percentage of Loans in P&I Repayment ;”

̶ “91-plus Day Delinquencies as a Percentage of Loans in P&I Repayment ;”

̶ “Forbearance as a Percentage of Loans in P&I Repayment and Forbearance;”

̶ “Annualized Gross Defaults as a Percentage of Loans in P&I Repayment;”

̶ “Voluntary Constant Prepayment Rates by Disbursement Vintage and Product;” and

̶ “Total Constant Prepayment Rates by Disbursement Vintage and Product.”

̶ “Smart Option Loan Cumulative Recovery Rate”

| 5

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

31-60 Day Delinquencies as a % of Loans in P&I Repayment (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

Legacy SLM: 31-60 Delinquencies as a % of P&I

SLM Bank: 31-60 Delinquencies as a % of P&I

Pre-Split Post-Split

Data as of December 31, 2016.

(1) Loans in P&I Repayment include only those loans for which scheduled principal and interest payments were due at the end of the applicable monthly reporting period.

(2) P&I Repayment Vintage is defined as the calendar year during which a borrower is first required to make full principal and interest payments on the loan.

(3) Post-split vintage performance history excludes data points for a vintage when the balance of loans in P&I Repayment outstanding in that vintage constitutes less than 1% of total balance of loans in P&I

Repayment outstanding for all vintages.

Note: Legacy SLM portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future

performance.

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

31-60 Day Delinquencies as a % of Loans in P&I Repayment (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

P&I Repayment Vintages 2010-2016 (2), (3)

Legacy SLM 2010 Vintage: 31-60 Delinquencies as a % of P&I

Legacy SLM 2011 Vintage: 31-60 Delinquencies as a % of P&I

Legacy SLM 2012 Vintage: 31-60 Delinquencies as a % of P&I

Legacy SLM 2013 Vintage: 31-60 Delinquencies as a % of P&I

Legacy SLM 2014 Vintage: 31-60 Delinquencies as a % of P&I

SLM Bank 2011 Vintage: 31-60 Delinquencies as a % of P&I

SLM Bank 2012 Vintage: 31-60 Delinquencies as a % of P&I

SLM Bank 2013 Vintage: 31-60 Delinquencies as a % of P&I

SLM Bank 2014 Vintage: 31-60 Delinquencies as a % of P&I

SLM Bank 2015 Vintage: 31-60 Delinquencies as a % of P&I

SLM Bank 2016 Vintage: 31-60 Delinquencies as a % of P&I

Pre-Split Post-Split

Smart Option Serviced Portfolio: 31-60 Day Delinquencies

| 6

Smart Option Serviced Portfolio: 61-90 Day Delinquencies

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

61-90 Day Delinquencies as a % of Loans in P&I Repayment (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

Legacy SLM: 61-90 Delinquencies as a % of P&I

SLM Bank: 61-90 Delinquencies as a % of P&I

Pre-Split Post-Split

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

61-90 Day Delinquencies as a % of Loans in P&I Repayment (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

P&I Repayment Vintages 2010-2016 (2), (3)

Legacy SLM 2010 Vintage: 61-90 Delinquencies as a % of P&I

Legacy SLM 2011 Vintage: 61-90 Delinquencies as a % of P&I

Legacy SLM 2012 Vintage: 61-90 Delinquencies as a % of P&I

Legacy SLM 2013 Vintage: 61-90 Delinquencies as a % of P&I

Legacy SLM 2014 Vintage: 61-90 Delinquencies as a % of P&I

SLM Bank 2011 Vintage: 61-90 Delinquencies as a % of P&I

SLM Bank 2012 Vintage: 61-90 Delinquencies as a % of P&I

SLM Bank 2013 Vintage: 61-90 Delinquencies as a % of P&I

SLM Bank 2014 Vintage: 61-90 Delinquencies as a % of P&I

SLM Bank 2015 Vintage: 61-90 Delinquencies as a % of P&I

SLM Bank 2016 Vintage: 61-90 Delinquencies as a % of P&I

Pre-Split Post-Split

Data as of December 31, 2016.

(1) Loans in P&I Repayment include only those loans for which scheduled principal and interest payments were due at the end of the applicable monthly reporting period.

(2) P&I Repayment Vintage is defined as the calendar year during which a borrower is first required to make full principal and interest payments on the loan.

(3) Post-split vintage performance history excludes data points for a vintage when the balance of loans in P&I Repayment outstanding in that vintage constitutes less than 1% of total balance of loans in P&I

Repayment outstanding for all vintages.

Note: Legacy SLM portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future

performance.

| 7

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

91+ Day Delinquencies as a % of Loans in P&I Repayment (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

Legacy SLM: 91+ Delinquencies as a % of P&I

SLM Bank: 91+ Delinquencies as a % of P&I

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

91+ Day Delinquencies as a % of Loans in P&I Repayment (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

P&I Repayment Vintages 2010-2016 (2), (3)

Legacy SLM 2010 Vintage: 91+ Delinquencies as a % of P&I

Legacy SLM 2011 Vintage: 91+ Delinquencies as a % of P&I

Legacy SLM 2012 Vintage: 91+ Delinquencies as a % of P&I

Legacy SLM 2013 Vintage: 91+ Delinquencies as a % of P&I

Legacy SLM 2014 Vintage: 91+ Delinquencies as a % of P&I

SLM Bank 2011 Vintage: 91+ Delinquencies as a % of P&I

SLM Bank 2012 Vintage: 91+ Delinquencies as a % of P&I

SLM Bank 2013 Vintage: 91+ Delinquencies as a % of P&I

SLM Bank 2014 Vintage: 91+ Delinquencies as a % of P&I

SLM Bank 2015 Vintage: 91+ Delinquencies as a % of P&I

SLM Bank 2016 Vintage: 91+ Delinquencies as a % of P&I

Pre-Split Post-Split

Pre-Split Post-Split

Smart Option Serviced Portfolio: 91+ Day Delinquencies

Data as of December 31, 2016.

(1) Loans in P&I Repayment include only those loans for which scheduled principal and interest payments were due at the end of each applicable monthly reporting period.

(2) P&I Repayment Vintage is defined as the calendar year during which a borrower is first required to make full principal and interest payments on the loan.

(3) Post-split vintage performance history excludes data points for a vintage when the balance of loans in P&I Repayment outstanding in that vintage constitutes less than 1% of total balance of loans in P&I

Repayment outstanding for all vintages.

Note: Legacy SLM portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future

performance.

| 8

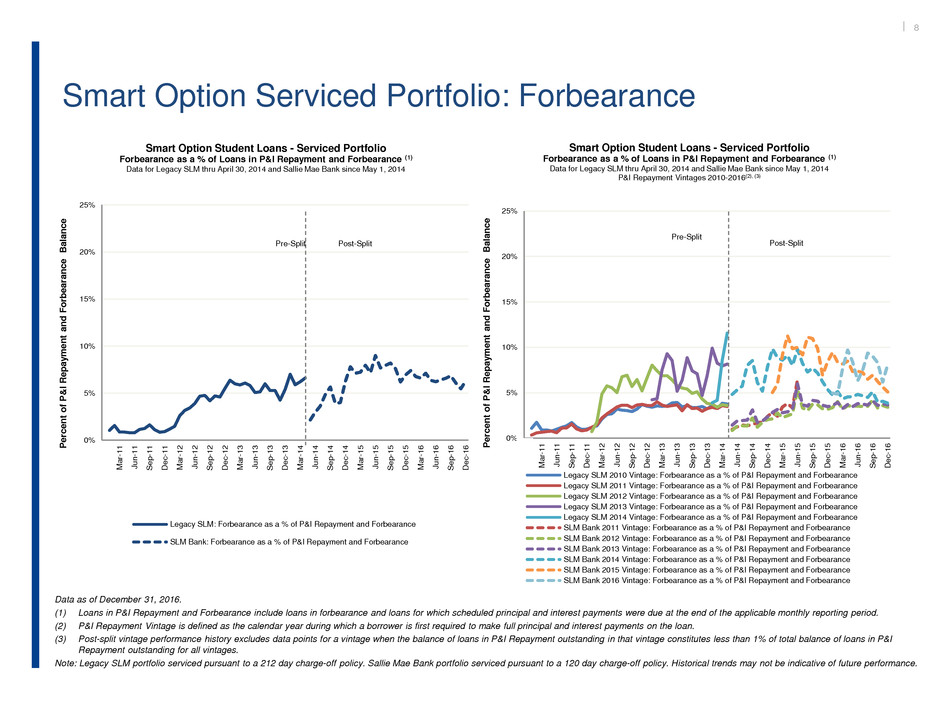

Data as of December 31, 2016.

(1) Loans in P&I Repayment and Forbearance include loans in forbearance and loans for which scheduled principal and interest payments were due at the end of the applicable monthly reporting period.

(2) P&I Repayment Vintage is defined as the calendar year during which a borrower is first required to make full principal and interest payments on the loan.

(3) Post-split vintage performance history excludes data points for a vintage when the balance of loans in P&I Repayment outstanding in that vintage constitutes less than 1% of total balance of loans in P&I

Repayment outstanding for all vintages.

Note: Legacy SLM portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

0%

5%

10%

15%

20%

25%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

a

n

d

F

o

rb

e

a

ra

n

c

e

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

Forbearance as a % of Loans in P&I Repayment and Forbearance (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

P&I Repayment Vintages 2010-2016(2), (3)

Legacy SLM 2010 Vintage: Forbearance as a % of P&I Repayment and Forbearance

Legacy SLM 2011 Vintage: Forbearance as a % of P&I Repayment and Forbearance

Legacy SLM 2012 Vintage: Forbearance as a % of P&I Repayment and Forbearance

Legacy SLM 2013 Vintage: Forbearance as a % of P&I Repayment and Forbearance

Legacy SLM 2014 Vintage: Forbearance as a % of P&I Repayment and Forbearance

SLM Bank 2011 Vintage: Forbearance as a % of P&I Repayment and Forbearance

SLM Bank 2012 Vintage: Forbearance as a % of P&I Repayment and Forbearance

SLM Bank 2013 Vintage: Forbearance as a % of P&I Repayment and Forbearance

SLM Bank 2014 Vintage: Forbearance as a % of P&I Repayment and Forbearance

SLM Bank 2015 Vintage: Forbearance as a % of P&I Repayment and Forbearance

SLM Bank 2016 Vintage: Forbearance as a % of P&I Repayment and Forbearance

Pre-Split

Post-Split

0%

5%

10%

15%

20%

25%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

a

n

d

F

o

rb

e

a

ra

n

c

e

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

Forbearance as a % of Loans in P&I Repayment and Forbearance (1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

Legacy SLM: Forbearance as a % of P&I Repayment and Forbearance

SLM Bank: Forbearance as a % of P&I Repayment and Forbearance

Pre-Split Post-Split

Smart Option Serviced Portfolio: Forbearance

| 9

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

Annualized Gross Defaults as a % of Loans in P&I Repayment(1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

P&I Repayment Vintages 2010-2016 (2), (3)

Legacy SLM 2010 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

Legacy SLM 2011 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

Legacy SLM 2012 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

Legacy SLM 2013 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

Legacy SLM 2014 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

SLM Bank 2011 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

SLM Bank 2012 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

SLM Bank 2013 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

SLM Bank 2014 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

SLM Bank 2015 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

SLM Bank 2016 Vintage: Annualized Gross Defaults as a % of Loans in P&I Repayment

Pre-Split Post-Split

0%

2%

4%

6%

8%

10%

Dec

-1

0

M

a

r-

1

1

J

u

n

-1

1

S

e

p

-1

1

Dec

-1

1

M

a

r-

1

2

J

u

n

-1

2

S

e

p

-1

2

Dec

-1

2

M

a

r-

1

3

J

u

n

-1

3

S

e

p

-1

3

Dec

-1

3

M

a

r-

1

4

J

u

n

-1

4

S

e

p

-1

4

Dec

-1

4

M

a

r-

1

5

J

u

n

-1

5

S

e

p

-1

5

Dec

-1

5

M

a

r-

1

6

J

u

n

-1

6

S

e

p

-1

6

Dec

-1

6

P

e

rc

e

n

t

o

f

P

&I

Re

p

a

y

m

e

n

t

B

a

la

n

c

e

Smart Option Student Loans - Serviced Portfolio

Annualized Gross Defaults as a % of Loans in P&I Repayment(1)

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014

Legacy SLM: Annualized Gross Defaults as a % of Loans in P&I Repayment

SLM Bank: Annualized Gross Defaults as a % of Loans in P&I Repayment

Pre-Split Post-Split

Smart Option Serviced Portfolio: Annualized Gross Defaults

Data as of December 31, 2016.

(1) Loans in P&I Repayment include only those loans for which scheduled principal and interest payments were due at the end of each applicable monthly reporting period.

(2) P&I Repayment Vintage is defined as the calendar year during which a borrower is first required to make full principal and interest payments on the loan.

(3) Post-split vintage performance history excludes data points for a vintage when the balance of loans in P&I Repayment outstanding in that vintage constitutes less than 1% of total balance of loans in P&I

Repayment outstanding for all vintages.

Note: Legacy SLM portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future

performance.

| 10

Smart Option Vintage Data: Cumulative Gross Default by

Loan Type

6.5%

5.7%

4.5%

3.7%

3.3%

1.9%

0.2%0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

0 1 2 3 4 5 6 7 8 9

C

u

m

u

la

ti

v

e

De

fa

u

lt

s

a

s

a

%

o

f

Di

s

b

u

rs

e

d

P

ri

n

c

ip

a

l

E

n

te

ri

n

g

P

&

I R

e

p

a

y

m

e

n

t

Years Since First P&I Repayment Period

Smart Option Student Loans - Serviced Portfolio: All Products

Cumulative Defaults by P&I Repayment Vintage

and Years Since First P&I Repayment Period (1)

Data for Legacy SLM, Navient and Sallie Mae Bank Combined thru Present (2)

2010

2011

2012

2013

2014

2015

2016

6.6%

5.4%

3.7%

2.7%

1.9%

1.4%

0.5%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

0 1 2 3 4 5 6 7 8 9

C

u

m

u

la

ti

v

e

De

fa

u

lt

s

a

s

a

%

o

f

Di

s

b

u

rs

e

d

P

ri

n

c

ip

a

l

E

n

te

ri

n

g

P

&

I R

e

p

a

y

m

e

n

t

Years Since First P&I Repayment Period

Smart Option Student Loans - Serviced Portfolio: Interest Only

Cumulative Defaults by P&I Repayment Vintage

and Years Since First P&I Repayment Period (1)

Data for Legacy SLM, Navient and Sallie Mae Bank Combined thru Present (2)

2010

2011

2012

2013

2014

2015

2016

6.9%

5.5%

3.7%

2.7%

1.5%

0.3%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

0 1 2 3 4 5 6 7 8 9

C

u

m

u

la

ti

v

e

De

fa

u

lt

s

a

s

a

%

o

f

Di

s

b

u

rs

e

d

P

ri

n

c

ip

a

l

E

n

te

ri

n

g

P

&

I

Re

p

a

y

m

e

n

t

Years Since First P&I Repayment Period

Smart Option Student Loans - Serviced Portfolio: Fixed Pay

Cumulative Defaults by P&I Repayment Vintage

and Years Since First P&I Repayment Period(1)

Data for Legacy SLM, Navient and Sallie Mae Bank Combined thru Present (2)

2011

2012

2013

2014

2015

2016

5.6%5.1%4.9%

2.6%

0.0%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

0 1 2 3 4 5 6 7 8 9

C

u

m

u

la

ti

v

e

De

fa

u

lt

s

a

s

a

%

o

f

Di

s

b

u

rs

e

d

P

ri

n

c

ip

a

l

E

n

te

ri

n

g

P

&

I

Re

p

a

y

m

e

n

t

Years Since First P&I Repayment Period

Smart Option Student Loans - Serviced Portfolio: Deferred

Cumulative Defaults by P&I Repayment Vintage

and Years Since First P&I Repayment Period(1)

Data for Legacy SLM, Navient and Sallie Mae Bank Combined thru Present (2)

2012

2013

2014

2015

2016

Data as of December 31, 2016.

(1) Please see page 14 for a description and explanation of the data and calculations underlying these charts.

(2) Certain data used in the charts above was provided by Navient under a data sharing agreement. Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement.

Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

| 11

Smart Option Vintage Data: Voluntary Prepayments

0%

2%

4%

6%

8%

10%

12%

14%

16%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

%

C

P

R

Quarters Since Disbursement

Smart Option Student Loans - Serviced Portfolio

Voluntary CPR by Disbursement Vintage (1)

Interest Only, Fixed Payment and Deferred Products

Data for Legacy SLM thru Apr 30, 2014 and Sallie Mae Bank since May 1, 2014 (2)

2011 Vintage 2012 Vintage

2013 Vintage 2014 Vintage

2015 Vintage

► Voluntary prepay speeds trending up as more loans enter P&I repayment

Data as of December 31, 2016.

(1) Data for all loans from initial disbursement, whether or not scheduled payments are due. Voluntary CPR includes only voluntary prepayments.

(2) Loans in a particular annual Disbursement Vintage are disbursed at different times during the Disbursement Vintage year. Prepayment data is not reported for loans in a particular annual Disbursement Vintage until all loans in that annual

Disbursement Vintage have been disbursed. Once reporting starts, data reflects prepayments that occurred in a particular period based on the number of months all loans in that annual Disbursement Vintage have been disbursed. For

example, in the charts above: (i) prepayment data reported for loans in the 2015 Disbursement Vintage represents prepayments occurring during the 12 months (i.e., first four quarters) after a loan was disbursed regardless of the month in

2015 during which such loan was disbursed; and (ii) prepayment data for loans in the 2014 Disbursement Vintage represents prepayments occurring during the first 24 months (i.e., first eight quarters) after a loan was disbursed regardless of

the month in 2014 during which such loan was disbursed.

Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

0%

2%

4%

6%

8%

10%

12%

14%

16%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

%

C

P

R

Quarters Since Disbursement

Smart Option Student Loans - Serviced Portfolio

Voluntary CPR by Disbursement Vintage and Product (1)

Interest Only, Fixed Payment and Deferred Products

Data for Legacy SLM thru Apr 30, 2014 and Sallie Mae Bank since May 1, 2014 (2)

2011 Cohort, Smart Option IO Total 2011 Cohort, Smart Option Fixed Total

2012 Cohort, Smart Option IO Total 2012 Cohort, Smart Option Fixed Total

2012 Cohort, Smart Option Deferred Total 2013 Cohort, Smart Option IO Total

2013 Cohort, Smart Option Fixed Total 2013 Cohort, Smart Option Deferred Total

2014 Cohort, Smart Option IO Total 2014 Cohort, Smart Option Fixed Total

2014 Cohort, Smart Option Deferred Total 2015 Cohort, Smart Option IO Total

2015 Cohort, Smart Option Fixed Total 2015 Cohort, Smart Option Deferred Total

| 12

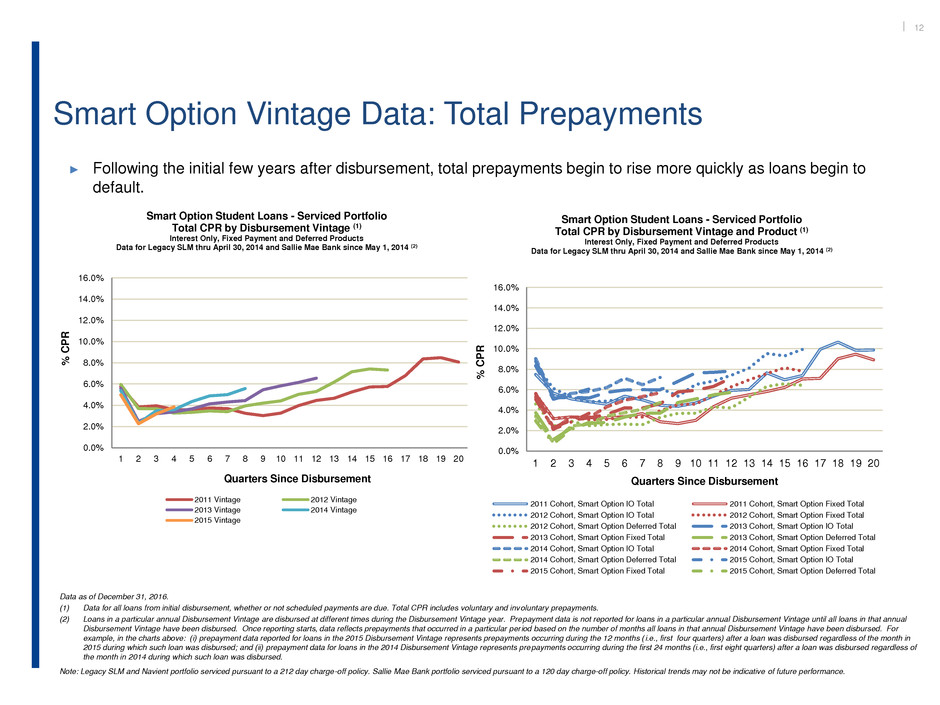

Data as of December 31, 2016.

(1) Data for all loans from initial disbursement, whether or not scheduled payments are due. Total CPR includes voluntary and involuntary prepayments.

(2) Loans in a particular annual Disbursement Vintage are disbursed at different times during the Disbursement Vintage year. Prepayment data is not reported for loans in a particular annual Disbursement Vintage until all loans in that annual

Disbursement Vintage have been disbursed. Once reporting starts, data reflects prepayments that occurred in a particular period based on the number of months all loans in that annual Disbursement Vintage have been disbursed. For

example, in the charts above: (i) prepayment data reported for loans in the 2015 Disbursement Vintage represents prepayments occurring during the 12 months ( i.e., first four quarters) after a loan was disbursed regardless of the month in

2015 during which such loan was disbursed; and (ii) prepayment data for loans in the 2014 Disbursement Vintage represents prepayments occurring during the first 24 months (i.e., first eight quarters) after a loan was disbursed regardless of

the month in 2014 during which such loan was disbursed.

Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

Smart Option Vintage Data: Total Prepayments

► Following the initial few years after disbursement, total prepayments begin to rise more quickly as loans begin to

default.

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

%

C

P

R

Quarters Since Disbursement

Smart Option Student Loans - Serviced Portfolio

Total CPR by Disbursement Vintage (1)

Interest Only, Fixed Payment and Deferred Products

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014 (2)

2011 Vintage 2012 Vintage

2013 Vintage 2014 Vintage

2015 Vintage

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

%

C

P

R

Quarters Since Disbursement

Smart Option Student Loans - Serviced Portfolio

Total CPR by Disbursement Vintage and Product (1)

Interest Only, Fixed Payment and Deferred Products

Data for Legacy SLM thru April 30, 2014 and Sallie Mae Bank since May 1, 2014 (2)

2011 Cohort, Smart Option IO Total 2011 Cohort, Smart Option Fixed Total

2012 Cohort, Smart Option IO Total 2012 Cohort, Smart Option Fixed Total

2012 Cohort, Smart Option Deferred Total 2013 Cohort, Smart Option IO Total

2013 Cohort, Smart Option Fixed Total 2013 Cohort, Smart Option Deferred Total

2014 Cohort, Smart Option IO Total 2014 Cohort, Smart Option Fixed Total

2014 Cohort, Smart Option Deferred Total 2015 Cohort, Smart Option IO Total

2015 Cohort, Smart Option Fixed Total 2015 Cohort, Smart Option Deferred Total

| 13

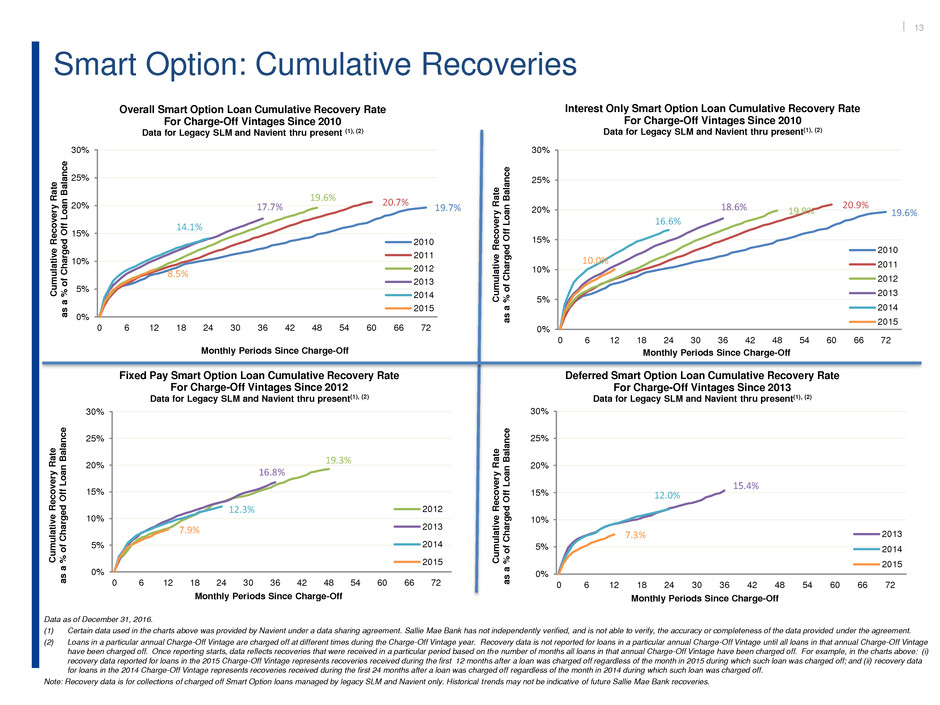

Smart Option: Cumulative Recoveries

Data as of December 31, 2016.

(1) Certain data used in the charts above was provided by Navient under a data sharing agreement. Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement.

(2) Loans in a particular annual Charge-Off Vintage are charged off at different times during the Charge-Off Vintage year. Recovery data is not reported for loans in a particular annual Charge-Off Vintage until all loans in that annual Charge-Off Vintage

have been charged off. Once reporting starts, data reflects recoveries that were received in a particular period based on the number of months all loans in that annual Charge-Off Vintage have been charged off. For example, in the charts above: (i)

recovery data reported for loans in the 2015 Charge-Off Vintage represents recoveries received during the first 12 months after a loan was charged off regardless of the month in 2015 during which such loan was charged off; and (ii) recovery data

for loans in the 2014 Charge-Off Vintage represents recoveries received during the first 24 months after a loan was charged off regardless of the month in 2014 during which such loan was charged off.

Note: Recovery data is for collections of charged off Smart Option loans managed by legacy SLM and Navient only. Historical trends may not be indicative of future Sallie Mae Bank recoveries.

19.7%

20.7%19.6%17.7%

14.1%

8.5%

0%

5%

10%

15%

20%

25%

30%

0 6 12 18 24 30 36 42 48 54 60 66 72

C

u

m

u

la

ti

v

e

Re

c

o

v

e

ry

Ra

te

a

s

a

%

o

f

C

h

a

rg

e

d

O

ff

L

o

a

n

Ba

la

n

c

e

Monthly Periods Since Charge-Off

Overall Smart Option Loan Cumulative Recovery Rate

For Charge-Off Vintages Since 2010

Data for Legacy SLM and Navient thru present (1), (2)

2010

2011

2012

2013

2014

2015

19.6%

20.9%

19.9%18.6%

16.6%

10.0%

0%

5%

10%

15%

20%

25%

30%

0 6 12 18 24 30 36 42 48 54 60 66 72

C

u

m

u

la

ti

v

e

Re

c

o

v

e

ry

Ra

te

a

s

a

%

o

f

C

h

a

rg

e

d

O

ff

L

o

a

n

Ba

la

n

c

e

Monthly Periods Since Charge-Off

Interest Only Smart Option Loan Cumulative Recovery Rate

For Charge-Off Vintages Since 2010

Data for Legacy SLM and Navient thru present(1), (2)

2010

2011

2012

2013

2014

2015

19.3%

16.8%

12.3%

7.9%

0%

5%

10%

15%

20%

25%

30%

0 6 12 18 24 30 36 42 48 54 60 66 72

C

u

m

u

la

ti

v

e

Re

c

o

v

e

ry

Ra

te

a

s

a

%

o

f

C

h

a

rg

e

d

O

ff

L

o

a

n

Ba

la

n

c

e

Monthly Periods Since Charge-Off

Fixed Pay Smart Option Loan Cumulative Recovery Rate

For Charge-Off Vintages Since 2012

Data for Legacy SLM and Navient thru present(1), (2)

2012

2013

2014

2015

15.4%

12.0%

7.3%

0%

5%

10%

15%

20%

25%

30%

0 6 12 18 24 30 36 42 48 54 60 66 72

C

u

m

u

la

ti

v

e

Re

c

o

v

e

ry

Ra

te

a

s

a

%

o

f

C

h

a

rg

e

d

O

ff

L

o

a

n

Ba

la

n

c

e

Monthly Periods Since Charge-Off

Deferred Smart Option Loan Cumulative Recovery Rate

For Charge-Off Vintages Since 2013

Data for Legacy SLM and Navient thru present(1), (2)

2013

2014

2015

| 14

Terms and calculations used in the cohort default triangles are defined below:

First P&I Repayment Period – The month during which a borrower is first required to make a full principal and interest payment on a loan.

P&I Repayment Vintage – The calendar year of a loan’s First P&I Repayment Period.

Disbursed Principal Entering P&I Repayment – The total amount of disbursed loan principal in a P&I Repayment Vintage, excluding any interest

capitalization.

Reported Default Data -

o For loans that default prior to their First P&I Repayment Period: Loans defaulting prior to their First P&I Repayment Period are included in the P&I

Repayment Vintage corresponding to the calendar year in which the default occurs, and are aggregated and reported in Year 0 of that P&I Repayment

Vintage in the relevant charts and tables. For example: (a) if a loan’s First P&I Repayment Period was scheduled for 2015, but the loan defaulted in

2014, the default amount is reflected in Year 0 of the 2014 P&I Repayment Vintage; and (b) if a loan’s First P&I Repayment Period occurred in 2015, but

the loan defaulted in 2015 before that First P&I Repayment Period, the default amount is reflected in Year 0 of the 2015 P&I Repayment Vintage.

o For loans that default after their First P&I Repayment Period: Loans enter a particular annual P&I Repayment Vintage at different times during the

P&I Repayment Vintage year. Default data is not reported for loans in a particular annual P&I Repayment Vintage until the First P&I Repayment Period

has occurred for all loans in that annual P&I Repayment Vintage. Once reporting starts, data reflects defaults that occurred in a particular period through

the number of months since December 31 of that annual P&I Repayment Vintage year. For example, in the relevant charts and tables included in this

presentation as of December 31, 2016: (i) default data reported for loans in the 2015 P&I Repayment Vintage represents defaults occurring during the

first 12 months after a loan’s First P&I Repayment Period regardless of the month in 2015 during which the first full principal and interest payment for that

loan became due; and (ii) default data for loans in the 2014 P&I Repayment Vintage represents defaults occurring during the first 24 months after a

loan’s First P&I Repayment Period regardless of the month in 2014 during which the first full principal and interest payment for that loan became due.

Periodic Defaults – For any loan in a particular P&I Repayment Vintage, the defaulted principal and interest is reflected in the year corresponding to the

number of years since the First P&I Repayment Period for that loan.

Cumulative Defaults – At any time for a particular P&I Repayment Vintage, the cumulative sum of Periodic Defaults for that vintage.

o Defaulted principal includes any interest capitalization that occurred prior to default

o Defaulted principal is not reduced by any amounts recovered after the loan defaulted

o Because the numerator includes capitalized interest while the denominator (i.e., Disbursed Principal Entering P&I Repayment) does not, default rates

are higher than they would be if the numerator and denominator both included capitalized interest

Note: Historical trends suggested by the cohort default triangles may not be indicative of future performance. Legacy SLM and Navient serviced loans were serviced pursuant to a 212 day charge off policy. Sallie

Mae Bank serviced loans were serviced pursuant to a 120 day charge off policy.

Smart Option Loan Program Cohort Default Triangles

| 15

Cohort Default Triangles – Smart Option Combined

(Interest Only, Fixed Payment & Deferred)

Data as of December 31, 2016.

(1) Numerator is the Periodic Defaults in each P&I Repayment Vintage. Denominator is the amount of Disbursed Principal for that P&I Repayment Vintage.

(2) Please see page 14 for a description and explanation of the data and calculations underlying these tables.

(3) Certain data used in the charts above was provided by Navient under a data sharing agreement. Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement.

Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

0 1 2 3 4 5 6 Total

2010 $428 1.2% 1.3% 1.2% 1.0% 0.9% 0.5% 0.4% 6.5%

2011 $999 0.8% 1.1% 1.3% 1.1% 0.8% 0.6% #N/A 5.7%

2012 $1,634 0.5% 0.9% 1.3% 1.0% 0.8% #N/A #N/A 4.5%

2013 $2,258 0.4% 1.0% 1.4% 1.0% #N/A #N/A #N/A 3.7%

2014 $2,823 0.3% 1.5% 1.4% #N/A #N/A #N/A #N/A 3.3%

2015 $3,357 0.3% 1.6% #N/A #N/A #N/A #N/A #N/A 1.9%

2016 $3,596 0.2% #N/A #N/A #N/A #N/A #N/A #N/A 0.2%

0 1 2 3 4 5 6 Total

2010 $409 1.2% 1.2% 1.1% 1.0% 0.9% 0.5% 0.4% 6.4%

2011 $917 0.7% 1.0% 1.2% 1.0% 0.8% 0.6% #N/A 5.3%

2012 $1,492 0.5% 0.7% 1.2% 0.9% 0.8% #N/A #N/A 4.0%

2013 $2,048 0.3% 0.8% 1.2% 0.9% #N/A #N/A #N/A 3.2%

2014 $2,544 0.3% 1.2% 1.3% #N/A #N/A #N/A #N/A 2.7%

2015 $3,033 0.3% 1.3% #N/A #N/A #N/A #N/A #N/A 1.6%

2016 $3,247 0.2% #N/A #N/A #N/A #N/A #N/A #N/A 0.2%

0 1 2 3 4 5 6 Total

2010 $19 1.7% 2.8% 1.7% 1.6% 0.9% 0.6% 0.2% 9.5%

2011 $82 1.8% 2.9% 2.2% 1.7% 1.1% 1.0% #N/A 10.7%

2012 $143 1.1% 2.8% 2.7% 2.0% 1.3% #N/A #N/A 10.0%

2013 $210 0.8% 2.9% 3.1% 1.8% #N/A #N/A #N/A 8.6%

2014 $279 0.9% 4.2% 3.0% #N/A #N/A #N/A #N/A 8.1%

2015 $325 1.0% 4.1% #N/A #N/A #N/A #N/A #N/A 5.1%

2016 $348 0.6% #N/A #N/A #N/A #N/A #N/A #N/A 0.6%

Smart Option Combined (P&I Repayment - Total)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Combined (P&I Repayment - No Co-signer)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Combined (P&I Repayment - Co-signer)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

| 16

Cohort Default Triangles – Smart Option Interest Only

Data as of December 31, 2016.

(1) Numerator is the Periodic Defaults in each P&I Repayment Vintage. Denominator is the amount of Disbursed Principal for that P&I Repayment Vintage.

(2) Please see page 14 for a description and explanation of the data and calculations underlying these tables.

(3) Certain data used in the charts above was provided by Navient under a data sharing agreement. Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement.

Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

0 1 2 3 4 5 6 Total

2010 $427 1.2% 1.3% 1.2% 1.0% 0.9% 0.5% 0.4% 6.6%

2011 $772 1.0% 1.1% 1.2% 1.0% 0.6% 0.5% #N/A 5.4%

2012 $855 0.7% 0.7% 1.0% 0.7% 0.6% #N/A #N/A 3.7%

2013 $891 0.5% 0.6% 0.9% 0.6% #N/A #N/A #N/A 2.7%

2014 $864 0.5% 0.7% 0.7% #N/A #N/A #N/A #N/A 1.9%

2015 $910 0.6% 0.7% #N/A #N/A #N/A #N/A #N/A 1.4%

2016 $912 0.5% #N/A #N/A #N/A #N/A #N/A #N/A 0.5%

0 1 2 3 4 5 6 Total

2010 $407 1.2% 1.2% 1.1% 1.0% 0.9% 0.5% 0.4% 6.4%

2011 $713 0.9% 1.0% 1.2% 0.9% 0.6% 0.5% #N/A 5.1%

2012 $788 0.7% 0.6% 0.9% 0.6% 0.6% #N/A #N/A 3.3%

2013 $819 0.5% 0.5% 0.8% 0.5% #N/A #N/A #N/A 2.3%

2014 $785 0.5% 0.5% 0.6% #N/A #N/A #N/A #N/A 1.6%

2015 $817 0.5% 0.6% #N/A #N/A #N/A #N/A #N/A 1.1%

2016 $811 0.4% #N/A #N/A #N/A #N/A #N/A #N/A 0.4%

0 1 2 3 4 5 6 Total

2010 $19 1.7% 2.8% 1.7% 1.6% 0.9% 0.6% 0.2% 9.5%

2011 $59 2.1% 2.5% 1.8% 1.5% 1.0% 0.8% #N/A 9.5%

2012 $67 1.4% 2.1% 2.0% 1.3% 0.8% #N/A #N/A 7.5%

2013 $72 1.4% 2.1% 2.0% 1.4% #N/A #N/A #N/A 6.9%

2014 $79 1.3% 2.1% 1.8% #N/A #N/A #N/A #N/A 5.2%

2015 $92 1.3% 1.9% #N/A #N/A #N/A #N/A #N/A 3.3%

2016 $102 1.1% #N/A #N/A #N/A #N/A #N/A #N/A 1.1%

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Interest Only (P&I Repayment - No Co-signer)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Interest Only (P&I Repayment - Total)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Interest Only (P&I Repayment - Co-signer)

| 17

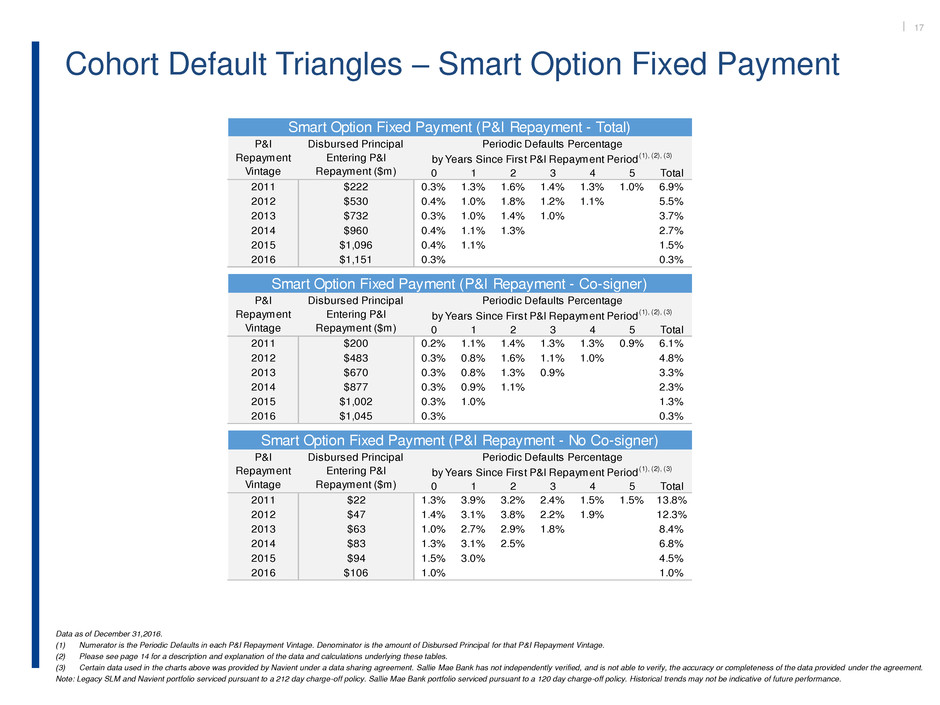

Cohort Default Triangles – Smart Option Fixed Payment

Data as of December 31,2016.

(1) Numerator is the Periodic Defaults in each P&I Repayment Vintage. Denominator is the amount of Disbursed Principal for that P&I Repayment Vintage.

(2) Please see page 14 for a description and explanation of the data and calculations underlying these tables.

(3) Certain data used in the charts above was provided by Navient under a data sharing agreement. Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement.

Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

0 1 2 3 4 5 Total

2011 $222 0.3% 1.3% 1.6% 1.4% 1.3% 1.0% 6.9%

2012 $530 0.4% 1.0% 1.8% 1.2% 1.1% #N/A 5.5%

2013 $732 0.3% 1.0% 1.4% 1.0% #N/A #N/A 3.7%

2014 $960 0.4% 1.1% 1.3% #N/A #N/A #N/A 2.7%

2015 $1,096 0.4% 1.1% #N/A #N/A #N/A #N/A 1.5%

2016 $1,151 0.3% #N/A #N/A #N/A #N/A #N/A 0.3%

0 1 2 3 4 5 Total

2011 $200 0.2% 1.1% 1.4% 1.3% 1.3% 0.9% 6.1%

2012 $483 0.3% 0.8% 1.6% 1.1% 1.0% #N/A 4.8%

2013 $670 0.3% 0.8% 1.3% 0.9% #N/A #N/A 3.3%

2014 $877 0.3% 0.9% 1.1% #N/A #N/A #N/A 2.3%

2015 $1,002 0.3% 1.0% #N/A #N/A #N/A #N/A 1.3%

2016 $1,045 0.3% #N/A #N/A #N/A #N/A #N/A 0.3%

0 1 2 3 4 5 Total

2011 $22 1.3% 3.9% 3.2% 2.4% 1.5% 1.5% 13.8%

2012 $47 1.4% 3.1% 3.8% 2.2% 1.9% #N/A 12.3%

2013 $63 1.0% 2.7% 2.9% 1.8% #N/A #N/A 8.4%

2014 $83 1.3% 3.1% 2.5% #N/A #N/A #N/A 6.8%

2015 $94 1.5% 3.0% #N/A #N/A #N/A #N/A 4.5%

2016 $106 1.0% 1.0%

Smart Option Fixed Payment (P&I Repayment - Total)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Fixed Payment (P&I Repayment - No Co-signer)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Fixed Payment (P&I Repayment - Co-signer)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

| 18

Cohort Default Triangles – Smart Option Deferred Payment

Data as of December 31, 2016.

(1) Numerator is the Periodic Defaults in each P&I Repayment Vintage. Denominator is the amount of Disbursed Principal for that P&I Repayment Vintage.

(2) Please see page 14 for a description and explanation of the data and calculations underlying tables.

(3) Certain data used in the charts above was provided by Navient under a data sharing agreement. Sallie Mae Bank has not independently verified, and is not able to verify, the accuracy or completeness of the data provided under the agreement.

Note: Legacy SLM and Navient portfolio serviced pursuant to a 212 day charge-off policy. Sallie Mae Bank portfolio serviced pursuant to a 120 day charge-off policy. Historical trends may not be indicative of future performance.

0 1 2 3 4 Total

2012 $249 0.1% 1.5% 1.4% 1.6% 1.1% 5.6%

2013 $635 0.1% 1.6% 2.1% 1.4% #N/A 5.1%

2014 $999 0.1% 2.5% 2.2% #N/A #N/A 4.9%

2015 $1,352 0.1% 2.5% #N/A #N/A #N/A 2.6%

2016 $1,532 0.0% #N/A #N/A #N/A #N/A 0.0%

0 1 2 3 4 Total

2012 $221 0.1% 1.1% 1.2% 1.4% 1.0% 4.8%

2013 $560 0.1% 1.3% 1.8% 1.2% #N/A 4.4%

2014 $881 0.1% 2.0% 2.0% #N/A #N/A 4.1%

2015 $1,213 0.0% 2.1% #N/A #N/A #N/A 2.2%

2016 $1,392 0.0% #N/A #N/A #N/A #N/A 0.0%

0 1 2 3 4 Total

2012 $28 0.0% 4.2% 2.8% 3.0% 1.8% 11.9%

2013 $75 0.1% 3.9% 4.2% 2.3% #N/A 10.4%

2014 $118 0.3% 6.4% 4.2% #N/A #N/A 10.9%

2015 $138 0.5% 6.2% #N/A #N/A #N/A 6.7%

2016 $140 0.0% 0.0%

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Deferred (P&I Repayment - No Co-signer)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Smart Option Deferred (P&I Repayment - Total)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Periodic Defaults Percentage

by Years Since First P&I Repayment Period

(1), (2), (3)

Smart Option Deferred (P&I Repayment - Co-signer)

P&I

Repayment

Vintage

Disbursed Principal

Entering P&I

Repayment ($m)