Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - GENEREX BIOTECHNOLOGY CORP | ex10_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2017

GENEREX BIOTECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 000-29169 | 98-0178636 | ||

(State or other jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S Employer Identification No.) |

10102 USA Today Way Miramar, Florida |

33025 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (416) 364-2551

4145 North Service Rd, Suite 200, Burlington, Ontario Canada L7L 6A3

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements. These statements are based on the Company’s (as hereinafter defined) current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to them. All statements, other than statements of historical fact, included herein regarding the Company’s strategy, future operations, financial position, future revenues, projected costs, plans, prospects and objectives are forward-looking statements. Words such as “expect,” “may,” “anticipate,” “intend,” “would,” “plan,” “believe,” “estimate,” “should,” and similar words and expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements. Forward-looking statements in this Current Report include express or implied statements concerning the Company’s future revenues, expenditures, capital or other funding requirements, the adequacy of the Company’s current cash and working capital to fund present and planned operations and financing needs, the growth of the Company’s business, the timing of our expansion plans, the cost of raw materials and labor, consumer preferences, the effect of government regulations on the Company’s business, the Company’s ability to compete in its industry, as well as future economic and other conditions both generally and in the Company’s specific geographic markets. These statements are based on currently available operating, financial and competitive information and are subject to various risks, uncertainties and assumptions that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements due to a number of factors including, but not limited to, those set forth below in the section entitled “Risk Factors” in this Current Report. Given those risks, uncertainties and other factors, many of which are beyond the Company’s control, you should not place undue reliance on these forward-looking statements.

Before purchasing any securities of the Company, you should carefully read and consider the risks described under the section entitled “Risk Factors.” You should be prepared to accept any and all of the risks associated with purchasing the securities, including a loss of all of your investment.

The forward-looking statements relate only to events as of the date on which the statements are made. Neither the Company nor Hema (as hereinafter defined) undertakes any obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, even if experience or future changes make it clear that any projected results or events expressed or implied therein will not be realized. You are advised, however, to consult any further disclosures the Company makes in future public filings, statements and press releases.

EXPLANATORY NOTE

On January 17, 2016, we entered into and closed Acquisition Agreement (the “Acquisition Agreement”) with the equity owners of Hema Diagnostic Systems, LLC (“Hema”) pursuant to which we acquired a majority of the equity interests in Hema in exchange for our Stock and our obligation to issue Common Stock Purchase Warrants (the “Acquisition”). We have the right to acquire the remainder of the Hema equity interests for nominal consideration provided that the stock and warrants have a specified value and we have registered for resale the Company’s shares issued to the Hema equity owners. The Acquisition is described in detail in Item 2.01 below. We intend to focus Hema’s business going forward, but do not intend to discontinue our pre-Acquisition activities.

Reference’s to Hema include its two wholly owned subsidiaries, Rapid Medical Diagnostics Corp. and Hema Diagnostic Systems Panama, S.A.. Rapid Medical Diagnostics was established to develop products and hold patents used by Hema Diagnostic Systems, LLC. Hema Diagnostic Systems Panama, S.A. was established to distribute Hema Diagnostic Systems, LLC’s products in Central and South America. Prior to the Acquisition, equity interest in Hema Diagnostic Systems Panama, S.A. and Rapid Diagnostic Systems were separately held by the equity owners of Hema, and financial statements of the three companies were prepared on a combined basis, as they were under common control and management. Immediately prior to Closing of the Acquisition, the equity owners contributed to Hema the equity of the other two companies, making them wholly owned subsidiaries of Hema.

| i |

This Current Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

| ii |

TABLE OF CONTENTS

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | ii | ||||

| EXPLANATORY NOTE | |||||

| TABLE OF CONTENTS | iii | ||||

| Item 1.01. | Entry into a Material Definitive Agreement | 1 | |||

| Item 2.01. | Completion of Acquisition or Disposition of Assets | 1 | |||

| Item 3.02. | Unregistered Sales of Equity Securities | 28 | |||

| Item 5.01. | Changes in Control of Registrant | 28 | |||

| Item 5.02. | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers | 28 | |||

| Item 9.01. | Financial Statements and Exhibits | 347 | |||

| iii |

Item 1.01. Entry into a Material Definitive Agreement.

Acquisition Agreement

On January 17, 2017, Generex Biotechnology, Inc., entered into the Acquisition Agreement with the equity owners of Hema Diagnostic Systems, LLC. The disclosures set forth in Item 2.01 below relating to the Acquisition Agreement transactions affected thereby are hereby incorporated by reference into this Item 1.01.

Item 2.01. Completion of Acquisition or Disposition of Assets.

ACQUISITION AND RELATED TRANSACTIONS

Acquisition Agreement

On January 17, 2017, we entered into and an Acquisition Agreement (the “Acquisition Agreement”) among Generex Biotechnology Corporation, Hema Diagnostic Systems, LLC, a Florida Limited Liability Company (“Hema”) and the equity owners of Hema pursuant to which we acquired a majority of the equity interests in Hema in exchange for our Stock and commitment to issue Common Stock Purchase Warrants (the “Acquisition”). Closing under the Acquisition Agreement occurred January 18.

At Closing, we acquired 4,950 of Hema’s 10,000 previously outstanding limited liability company units in exchange for 53,191,000 shares of Generex common stock, par value $.0001 per share, which had a value of $250,000, based on the closing bid price for our Common Stock on the OTCPINK marketplace on the trading day immediately preceding the Closing Date. Immediately following closing, we contributed 20,000 shares of Generex common stock to Hema, in exchange for 300 newly limited liability company units. Following these two actions, Generex holds 5,250 of Hema’s 10,300 outstanding units, or approximately 51% of Hema’s equity. The remainder of Hema’s outstanding equity will then be held by Stephen Berkman. Prior to closing, Mr. Berkman was Hema’s majority owner.

Following Closing, we intend to engage in a reverse split of our common stock. Pursuant to the Acquisition Agreement, within two trading days following the effectiveness of a planned reverse stock split, we will issue to Mr. Berkman 230,000 shares of common stock and warrants exercisable for 15,000,000 shares of our common stock at an exercise price equal to the volume weighted average price of the Company’s common stock a ten day period beginning on the day after the reverse stock split is effective.

We will have the right to purchase all of the remaining Hema equity interests form Mr. Berkman for an aggregate price of $1.00 if, at any time within three years after Closing

| • | All of the common stock issued to the Hema equity owners, as well as the common stock for which the warrants may be exercised, have been registered for resale; and |

| • | The aggregate value of all such shares, including the share underlying the Warrants, is at least $15,000,000 |

In the event the above conditions are not me, Mr. Berkman would retain his approximately 49% interest in Hema unless we negotiated a further arm’s length price with him. Pursuant to a Registration Rights Agreement entered into at Closing, we have agreed file a registration statement with respect to all of the shares, including the shares underlying the warrants, within sixty days after effectiveness of the reverse stock split.

Hema is currently indebted to Mr. Berkman in the amount of $13,260,462 for loans, advances and other consideration. This debt was secured by a security interest in Hema’s assets. At Closing. Berkman terminated his

| 1 |

security interest on the Company’s assets. At such time as the condition set forth in Section 1.1(e), above, is satisfied, the loan payable from Acquiree to Berkman shall be deemed satisfied in full.

The Acquisition Agreement contains customary representations, warranties, and covenants of the Generex, Hema and Hema’s equity. Breaches of representations and warranties are secured by customary indemnification provisions.

Hema operates both directly and through two subsidiaries. Prior to closing under the Acquisition Agreement, the two subsidiaries were separately owned by Hema’s equity owners. Immediately prior to Closing, the equity owners assigned the ownership of these two companies to Hema. One of these companies. Hema Diagnostic Systems Panama, S.A., which was organized to distributed Hema’s products in Central and South America, is organized under the laws of Panama. Record transfer of the ownership of this entity requires the consent of the Panamanian agency with authority over business organizations. We have applied for this consent and consider it to be a purely administrative issue.

DESCRIPTION OF BUSINESS

Description of Hema’s Business

As used in the remainder of this Item 2.01, “Company,” “we,” “us,” “our” and HDS refer to Hema.

OVERVIEW

Hema Diagnostic Systems (referred to as HDS or Hema) was established December 2000 as a Florida Limited Liability Company and is in the business of developing, manufacturing, and distributing of in-vitro medical diagnostics for infectious diseases administered at the point of care level with results as soon as 10-15 minutes. We manufacture and sell rapid diagnostic devices based upon our own proprietary EXPRESS technology as well as cassette devices based on customary designs used generally in the industry.

Hema’s mission is to deliver the highest standard of quality product and solutions that are accurate, reliable, and cost effective for worldwide distribution and deployment.

Since its founding, Hema has been developing and continues to develop an expanding line of Rapid Diagnostic Tests (RDTs) including those for the following infectious diseases such as Human Immunodeficiency Virus (HIV) – ½ w/p24Ab, tuberculosis-XT, malaria, hepatitis, syphilis, typhoid, dengue and other infectious diseases.

Today, we have developed a substantial line of RDT’s known as RAPID 1-2-3 HEMA® ready to “go-to-market.”

Due to the potential infectious character of the whole blood test sample, our Express series of RDTs are designed to perform and deliver test results while sealed within the Express housing, carefully controlling the potentially infectious test sample. This design helps to increase our ability to control the possibility of cross-contamination. Most of our competitors’ products, while inexpensive, are not as user-friendly allowing for increased user-error and requires substantially more training and have greater risk of cross-contamination.

We have been designing and engineering delivery systems that incorporate advanced technologies of rapid test strips for use in our Express series of devices and which yield a rapid response for point-of-care patient testing and treatment.

Each RDT incorporates an accurate test strip that has been striped with specific antigens or antibodies combined in a proprietary cocktail and then incorporated into an easy-to-use and user-friendly delivery system. The HDS delivery

| 2 |

systems include our standard “cassette” design, our patented “Express” housing device as well as our new “Express II”.

Each system delivers its own advantages which enhance the use, application and performance of each diagnostic. This ease of use in the Express delivery systems ensure that our RDTs perform efficiently and effectively providing the most accurate and repeatable test results available while, at the same time, minimizing the transference of a potentially infected blood sample.

The Company maintains a Federal Drug Administration (FDA) registered facility in Miramar, Florida and is certified under both ISO9001 and ISO13485 for the Design, Development, Production and Distribution of the in-vitro devices. Approval of our HIV rapid test has been issued by the United States Agency for International Development (USAID). Additionally, some of our products qualified for and carry the European Union “CE” Mark, which allows us to enter into CE Member countries subject to individual country requirements. Currently, we have two malaria rapid tests approved under World Health Organization (WHO) guidelines. We anticipate that a third malaria test will be approved by the end of 2016. Our HDS products have also received registrations and approvals issued by other foreign governments. HDS is currently in the planning phase for entering into the newly announced, WHO “Pre-Qualified Approval” process for other HDS tests. This process allow expedited approval of rapid tests, reducing the current 24-30 month process down to approximately 6-9 months. WHO approval is necessary for our products to be used in those countries which rely upon the expertise of the WHO, as well as for NGO funding for the purchase of diagnostic products.

We maintain current U.S. Certificates of Exportability that are issued by two FDA divisions-CBER and CDRH. CBER (Center for Biologicals Evaluation and Research) is the FDA regulatory division that oversees biological devices and which include our HIV, Hepatitis B and Hepatitis C. The other division, Center for Devices and Radiological Health (CDRH), is responsible for the oversight of other HDS devices which include Tuberculosis, Syphilis, and the remaining product line. Our HDS facility maintains FDA Establishment Registration status and is in accord with GMP (Good Manufacturing Practice) as confirmed by the FDA.

We do not currently have FDA approval to sell our products in the United States. We intend on submitting our devices to the FDA under a Pre-Market Approval Application (PMA) or through the 510K process. The 510K would require the appropriate regulatory administrative submissions as well as a limited scientific review by the FDA to determine completeness (acceptance and filing reviews); in-depth scientific, regulatory, and Quality System review by appropriate FDA personnel (substantive review); review and recommendation by the appropriate advisory committee (panel review); and final deliberations, documentation, and notification of the FDA decision. The PMA process is more extensive, requiring clinical trials to support the application. We expect to apply to FDA for approval of our first RDT for FDA 510K approval within the next 3 months. We anticipate the FDA process will be completed within 9 months after submission. During this timeline, we will be preparing documentation for additional rapid tests to undergo either the FDA PMA or 510k process including 510k de novo.

OUR PRODUCTS

While we sell “cassette” based diagnostic tests based on standard designs, we expect our success will be tied to development, manufacture and sale of products based on our proprietary Express device platform systems. Recent advances in our device platform technology can be directly applied to individual test strip which is disease specific. line. These technologies further increase the performance capabilities of each test and its’ ability to detect diseases in an efficient and cost-effective manner.

The Rapid 1-2-3 Hema® Express platform is designed to ensure ease of use, accuracy of performance, and cost-effectiveness of production. Test results of each Rapid 1-2-3 Hema Express test device are easy to read under all conditions even while conducting testing in the field. Additionally, the Rapid 1-2-3 Hema Express does not require the use of water or electricity. Testing can be conducted with the patient and test Our Malaria RDTs will be availale in our Express II platform.

| 3 |

The Express platforms are available in the following presentations:

| • | Rapid 1-2-3 Hema Express HIV 1/2 w/p24Ab |

| • | Rapid 1-2-3 Hema Express II HIV 1/2 w/p24Ab |

| • | Rapid 1-2-3 Hema Express Tuberculosis-XT |

| • | Rapid 1-2-3 Hema Express II Tuberculosis-XT |

| • | Rapid 1-2-3 Hema Express II Malaria pF |

| • | Rapid 1-2-3 Hema Express II Malaria pF/pV |

| • | Rapid 1-2-3 Hema Express II Malaria pF/Pan |

| • | Rapid 1-2-3 Hema Express Syphilis |

| • | Rapid 1-2-3 Hema Express Dengue NS1 |

| • | Rapid 1-2-3 Hema Express Dengue IgG/IgM |

HDS is also in the process of developing the platform for the qualitative testing for other infectious diseases including Typhoid, Chikungunya, Zika and other diseases. A new HDS housing, designated as the Rapid 1-2-3 Hema Express III Sepsis, is currently in the design evaluation process phase.

Our Solution

Due to the potential infectious character of the whole blood test sample, our Express series of RDTs are designed to perform and deliver test results while within the sealed Express housing. This increases our ability to control the possibility of cross-contamination.

The degree of difficulty in using a rapid test is generally determined by the delivery system/housing design itself. One of the most common reasons for rapid test failure is due to user-error which is most commonly attributed to the misuse of a rapid test or of the test sample. The greater the degree of difficulty in performing the RDT, the greater the chance for user error. The Express series of devices substantially reduces the difficulty factor through its user-friendly test process and careful controls the test sample. It should be clear that the easier and more user-friendly a rapid test is to use, the greater success in producing and delivering accurate and repeatable test results.

We believe the Express device has the potential to expand its use to include additional test samples such as urine, fecal matter and oral fluids. We need to perform additional testing to validate the use of our products with these other test media.

To expedite the training in the use of the HDS rapid tests, we have designed each Express series device to operate in the same manner thereby reducing the amount of training needed in the use of other Express series RDTs. Once trained in the use of one Express series RDT, the clinician will know and understand how to run each additional Express device regardless of the diseases being tested.

Over the past 30 years, the most common rapid test delivery systems, known as “cassettes,” has undergone very few changes in their design and operation. While the internal tests strips within the cassette have continued to evolve, the cassette design has remained static.

The popularity of the cassette is basically due to the cost of the cassette device and the fact that for years, test administrators have known of no other test platform. The cassette is considered by many, as not being user-friendly and as such, can be counter-productive to delivering an accurate and repeatable test result.

| 4 |

HDS has moved forward with the design of two patent-protected delivery systems. The Express delivery systems, which include the Express and Express II, are both user-friendly and do, to a very great degree, control the possibility of cross-contamination and loss of control of a potentially infected test sample.

The Express and the Express II both incorporate into their design, a sample take-up system that adsorbs the whole blood, serum or plasma sample directly onto the device test strip. When the test sample meets a predetermined line, sufficient sample size has been achieved. The Express or Express II is then inserted directly into a pre-filled diluent pod which contains the exact amount of diluent, creating a water tight seal. This process helps to eliminate cross-contamination from the point of sample acquisition to that of test processing. Once the test procedure is finished, the device remains sealed and can be disposed of through incineration.

Cassettes

Over the past 30 years, most administrators of RDTs have been trained on the use of cassettes. For this reason, we have maintained a line of rapid cassette tests for a number of diseases.

The cassette is a semi-complicated and low cost delivery system that has been used in the worldwide markets. The cassette is not user-friendly and substantial time is required to train the test administrator in its use.

The configuration and method of use of the cassette has not changed over time and it requires that a blood sample be taken from the fingerstick and then added into the cassette device. This method of sample transfer does not allow for control of the potentially infected test sample, nor does it deliver a consistent and reliably accurate test sample volume to run the cassette device effectively. Once the blood sample has been added into the cassette device, diluent drops are added into the cassette device using a hand held dropper bottle. The dropper bottle delivers an unreliable and a relatively inaccurate volume of diluent. The failure of having too little or too much blood sample and/or too little or too much diluent can deliver inaccurate test results know as a “false-positive” or a “false-negative” as well as in some cases a “non-flow”. Once the test process is completed, the test administrator must dispose of all of the multiple potentially infected components

The process of using a cassette device is prone to misuse -which is the core reason for most cassette test failures. Additionally, cassette test procedure offers a substantial opportunity for cross-contamination. While accepted out of tradition, the cassette is a design that requires substantial care while performing the testing procedure.

Due to the historical nature of the cassette design, we continue to offer our cassette presentation, two of which have already been approved under the World Health Organization (WHO) List of Approved Malaria Devices, and offered o those markets which require WHO approval.

HDS Express

We believe that the first major competitor to the cassette device is the HDS RAPID 1-2-3 HEMA EXPRESS system. This new technology addresses many of the problems that administrators of rapid test devices have encountered when using a cassette type of device- especially concerning ease-of-use and user-error.

The Express system is designed to substantially reduce, human error, cross-contamination and cross-infection which is achieved through its’ simplicity of design and ease of use. This contributes greatly to the delivery of more repeatable and accurate test results.

During the design phase of each new Express device, a test strip is stripped with carefully selected and specific antigens or antibodies specific to a particular diseases. It is then carefully tested and evaluated to determine its degree of “Specificity” (the ability of the test to correctly identify those without the disease) and “Sensitivity” (the ability of a test to correctly identify those with the disease). HDS strives to meet the highest possible sensitivity and specificity performance levels. Once approved, the test strip is then inserted into the previous validated Express and its performance, with each newly design strip, is evaluated. If the device meets design standards, it is validated.

We believe the EXPRESS represents a substantial improvement over the use of a CASSETTE.

| 5 |

The EXPRESS is very user-friendly. Diluent used to operate the device is premeasured and contained in a sealed plastic pod. This helps to prevent user error thereby increasing test accuracy.

The required amount of blood or serum/plasma needed to be taken-up and into the device is easily determined through the use of a visible line on the sample take-up pad. This also helps to prevent user error. The sample pad quickly and easily absorbs the test sample carefully controlling the flow of a potentially infected blood sample.

Unlike the CASSETTE, there is no external transfer of potentially infected blood/serum and unlike the cassette, there is no guess work when combining diluent with the test sample.

The EXPRESS design incorporates the sample take-up pad which absorbs the blood directly up and into the device.

This unique means of blood acquisition substantially decreases the potential transfer of disease to an uninfected person.

The Express® is a patented delivery system which integrates any HDS test strip into a single, self-contained delivery system. It is very easy to use. Each Express device is individually packaged in a foil pouch validated to withstand damaging humidity.

The process for use is very simple:

| 1) | Read the instructions on the back of the pouch. |

| 2) | Open pouch and remove the Express device, the lancet and the pre-filled diluent pod. |

| 3) | Clean the finger with alcohol and then, prick the finger with a safety lancet and allow a bead of blood to appear on the fingertip. |

| 4) | Touch the tip of the Express sample take-up pad to the drop of blood. |

| 5) | Immediately the blood sample will flow onto and up the sample take-up pad. |

| 6) | Once the blood sample reached the “sufficient sample” line. Open the pre-filled diluent pod and insert the Express into the pre-filled diluent pod, creating a water-tight seal. The diluent will immediately mix with the blood sample and flow up and onto the test strip. |

| 7) | Over the next few minutes the “Control” line will appear confirming the test is operational. If the patient is positive for the disease being tested, a second “Test” line. |

| 8) | Once the test is completed, dispose in an appropriate manner. |

HDS Express II®

The newly designed and developed RAPID 1-2-3 HEMA EXPRESS II establishes a common ground between the EXPRESS and the cassette.

This new hybrid design combines the same basic simple, easy to use system of the EXPRESS with the lower production costs of a cassette - all while maintaining same performance standards and repeatability of the EXPRESS.

With fewer components in the EXPRESS II configuration, the cost of assembly was reduced by up to 30% without any loss in performance.

Automated assembly further decreases production costs through the elimination of additional labor and the associated overhead.

| 6 |

MARKET GROWTH

In a recently released report entitled “GLOBAL MARKETS FOR RAPID MEDICAL DIAGNOSTIC KITS” from BCC Research, it stated that the global market for rapid medical diagnostic kits (RDTs) was valued at nearly $18.4 billion in 2012. BCC Research expects the market to reach more than $24.2 billion by 2017 and register a five-year compound annual growth rate (CAGR) of 5.7% for the period 2012 to 2017.

Frost and Sullivan, a multi-national research and consulting organization reported in a June 23, 2016, that the U.S. Point of Care testing market is expected to reach $4.6 billion by 2020, with the largest growth segments in Infectious Diseases, Cardiac and Coagulation PT/NR. Their report further explained that growth is driven, in part, by the following:

| • | Point of Care Testing (POC/RDT): |

“POC tests are expanding into the retail space with large consumers (CVS, Walgreens and Target) building their footprint.” This also translates into patients getting tested at their doctor's office or medical clinic and getting results for immediate diagnosis and treatment. Additionally, “new business models such as expanding into retail clinics, mobile clinics and patient self-testing -testing opens up a wide range of opportunities..."

| • | Need for Speed in Test Results: |

In-vitro diagnostics delivers results faster with minimal invasive diagnostic tools. Additionally, POCs “…reduce turn-around-time from days to minutes”.

| • | Affordable Pricing: |

“Use of cheaper disposable consumables eliminates expensive reagent costs…” The cost in providing accurate test results is always a factor. POCs when combined with accuracy, simplicity of use and a lower cost will create a greater demand, further feeding the expansion of the POC market.

The demand for affordable POCs/RDTs continues to increase driven by cost, reliability and performance. As a POC test can be administered and evaluated in a pharmacy, a clinic or a doctors’ office, the need to incur laboratory costs, including sample transport, are avoided. Cost savings when using a POC/RDT versus a laboratory process is substantial.

While we do not yet have any products approved for sale in the United States, HDS products are also designed to address the need for testing in the expanding U.S. Point of Care. As such, it is our intention to enter into the appropriate regulatory processes to achieve the sale and use of multiple HDS Express devices in the U.S. some of which are anticipated to enter into the Over-the-Counter (OTC) market.

Internationally, many countries are seeing an expanding use of POC RTDs as new tests and technologies arise to address the detection of new infectious diseases. This is especially true where laboratory testing is difficult to access or non-existent.

Additionally, POCs/RDTs can be developed and validated more easily than lab based tests, allowing for a quicker response to address new and emerging diseases.

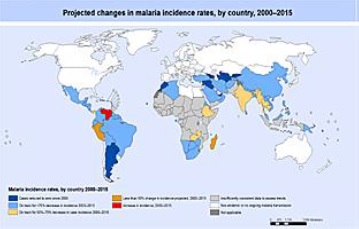

Market growth on an international basis targets three primary diseases, Malaria, HIV and Tuberculosis. In the World Malaria Day Report issued by the WHO in April 2016, it was reported that there were 214 million new cases of malaria worldwide in 2015 (range 149–303 million). The African Region accounted for most global cases of malaria (88%), followed by the South-East Asia Region (10%) and the Eastern Mediterranean Region (2%). Excluded were other parts of the world including the key markets of South America, the Caribbean and now, Western Europe. RDT sales in the WHO noted markets was approximately 314 million.

| 7 |

Human Immunodeficiency Virus (HIV) Testing Market

In 2015, the Grand View Research stated that the Global HIV Diagnostics Market is expected to reach $4.48 billion by 2022, growing at an estimated compound annual growth rate of 9.5% from 2015 to 2022.

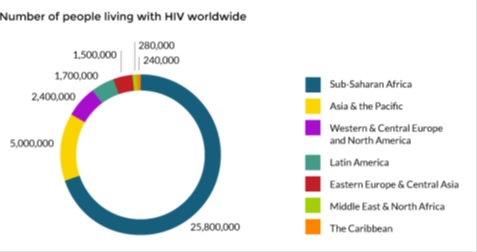

According to AVERT, there are over 36.9 million people living with HIV worldwide. It is estimated that over 2 million new cases are diagnosed each year.

The illustration below shows that the majority of the people living with HIV are in the Sub-Saharan Africa with 25.8 million people followed by Asia & the Pacific with 5.0 million and Western & Central Europe and North America with 2.4 million people.

By 2018, it is reported that the HIV rapid diagnostic test market is projected to be 162 million tests per year which is an increase from 81 million tests sold or deployed.

Our RTDs would be the first line of defense in diagnosing that would lead to mitigating the spread of the HIV disease.

Tuberculosis (TB) Testing Market

According to the US CDC, Tuberculosis (TB) is the leading infectious cause of death worldwide. TB is an airborne disease and spread by coughing or sneezing, and the most vulnerable are women, children, and those living with HIV/AIDS. It is highly contagious in closed or confined locations.

According to the WHO report reviewed in October 2016. In 2015, the WHO reported that 10.4 million were infected with TB and 1.8 million died from TB including 400,000 who were co-infected with HIV. Additionally, over 95% of TB deaths occur in low and middle-income countries, and it is among the top 5 causes of death for women between the ages of 15 to 44.

The WHO repost also estimated that 1 million children become infected and 170,000 die from TB. This number excludes those with an HIV co-infection. TB is also a leading cause of death of people living with HIV. In 2015, it is reported that 35% of HIV/TB deaths are due to TB.

The World Health Organization (WHO) estimates that two billion people—one third of the world's population—are infected with Mycobacterium tuberculosis (M.tb), the bacteria that causes TB. This includes the three tiered infections of TB: 1) M. Tuberculosis only; 2) M.TB and HIV coinfection; 3) M.TB MDR (multiple drug resistant)

| 8 |

M.TB MDR refers to the growing resistance of TB to available drugs, which means the disease is becoming more deadly and difficult to treat. It is reported that 480,000 new cases of people who are resistant to existing drugs for TB each year. A contributor to the growth of the drug resistant form of TB is the unnecessary TB treatment given to those patients who were improperly tested with an inaccurate TB test- being deemed to be positive when really being negative.

It is our hope that early detection and identification would lead to a faster treatment and care.

Malaria Testing Market

According to the World Malaria Report 2015 issued by the WHO, malaria transmission occurs in five WHO regions with 214 million cases of malaria globally.

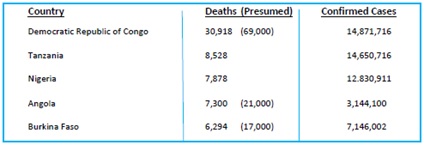

In that same report, it is reported that approximately 3.2 billion people, which is nearly half of the world's population, are at risk of malaria with 88% of malaria cases and 90% of malaria deaths occurring in Sub-Saharan Africa. Children aged under 5 years account for more than two thirds of all deaths. Additionally, in 2015, an estimated 214 million cases were reported.

Countries most affected by malaria in Africa

In the March 14, 2016 report issued by the WHO, it stated that the sale of RTDs in the endemic countries has increased from 46 million units in 2008 to 319 million units in 2013. It is projected that this volume will grow to 400 million units in 2016 and beyond.

It is our desire to be the more cost effective alternative solution.

Other Infectious Disease Test Markets

| 9 |

The Company is developing and engineering in-vitro diagnostics for the following infectious diseases. Our goal is to deliver a diagnostic that is specific for each disease, circumventing the difficulty of cross-reactivity which is especially for Vector Diseases such as Chikungunya and Zika:

| • | Typhoid | |

| • | Chikungunya | |

| • | Zika | |

| • | Anthrax | |

| • | Sepsis, among others |

Sepsis

The Company intends to devote resources to develop and engineer a new and novel rapid diagnostic test for sepsis. Sepsis is a systemic infection of the body primarily found in hospital environments and a major cause of disease and death in the United States and worldwide.

As recently reported by the Global Sepsis Alliance (GSA), it stated “In the U.S., sepsis accounts for far more deaths than the number of deaths from prostate cancer, breast cancer and AIDS combined.” “GSA is a nonprofit organization that support the efforts of more than 1 million caregivers in than 70 countries as they seek to better understand and combat what many experts believe to be the leading cause of death worldwide: Sepsis.

In

a recent PR Newswire release dated Sept. 28, 2016, it was reported that “the sepsis diagnostics market is expected to reach

USD 564.1 million by 2021, at a CAGR of 8.8% from 2016 to 2021.

The sepsis diagnostics market is primarily driven by the rising prevalence of sepsis in the neonate and adult population across

the globe. In addition, rising geriatric population, growing number of surgical procedures, high incidence of hospital-acquired

infections, and increasing number of product approvals are supporting the growth of this market. On the other hand, lack of standard

protocols and awareness as well as shortage of skilled staff are the major challenges in this market.

The Company is developing a quantitative, multiplex, rapid point-of-care diagnostic assay for direct bedside as well as for E.R. use by physicians and medical personnel to either rule in infectious sepsis or rule it out. The assay is to be configured for use with a simple volume of blood and the results will be available in 15-20 minutes.

The multiplex assay will be a rapid triage or screening tool but it will also allow the physician to monitor the progress of the patient after a definitive diagnosis has been made. As such, it is a multi-purpose diagnostic and monitoring assay.

This assay will be based on the detection of biomarkers, usually proteins, which are normally produced in the body under sepsis conditions. The detection of multiple biomarkers in sepsis patients and their quantitation will also allow the physician to closely monitor the development of the sepsis syndrome in real-time and to aid in determining the overall effects of treatment choices and to alter treatment, if necessary

PATENTS AND INTELLECTUAL PROPERTY

We hold a U.S. Patent for our sample delivery system which expires in 2026. This is the basis for our Express system platforms, as follows:

| U.S. Patent No. | Issued | Expires | Nature | Type | Description |

| 7,749,771 | 7/6/2010 | / /2026 | test device | utility | Device and methods for detecting analyte in a sample |

| 10 |

We also have received or applied for patent protection in Brazil.

We two US registered trademarks for the names Rapid 1-2-3 Hema Express® and Rapid 1-2-3®.

We believe our long-term success will substantially depend upon our ability to obtain patent protection for our technology and our ability to protect our technology from infringement, misappropriation, discovery and duplication. We cannot be sure that any future patents will be granted, or that any patents which we now own or obtain in the future will fully protect our position. Our patent rights and the patent rights of medical device companies in general, are uncertain and con include complex legal and factual issues. We believe that our existing technology and the patents which we hold or for which we have applied do not infringe anyone else's patent rights. We believe our patent rights will provide meaningful protection against others duplicating our proprietary technologies. We cannot be sure of this, however, because of the complexity of the legal and scientific issues that could arise in litigation over these issues.

REGULATORY PROCESS AND APPROVAL

Governmental Regulation

The manufacturing and marketing of the our existing and proposed diagnostic products are regulated by the United States Food and Drug Administration ( “FDA" ) and comparable regulatory bodies in other countries. Our products are also regulated by, subject to approval by, or must meet standards set by, of certain non-governmental organizations involved in the purchase and distribution of products like ours. These regulations and standards govern almost all aspects of development, production and marketing, including product testing, authorizations to market, labeling, promotion, manufacturing and record keeping.

The Company's FDA regulated products require some form of action by that agency before they can be marketed in the United States, and, after approval or clearance, the Company must continue to comply with other FDA requirements applicable to marketed products, e.g. Quality Systems (for medical devices). Failure to comply with the FDA ' s requirements can lead to significant penalties, both before and after approval or clearance.

There are two review procedures by which medical devices can receive FDA clearance or approval. Some products may qualify for clearance under Section 510(k) of the Federal Food, Drug and Cosmetic Act, in which the manufacturer provides a pre-market notification that it intends to begin marketing the product, and shows that the product is substantially equivalent to another legally marketed product (i.e., that it has the same intended use and is as safe and effective as a legally marketed device and does not raise different questions of safety and effectiveness). In some cases, the submission must include data from human clinical studies. Marketing may commence when the FDA issues a clearance letter finding such substantial equivalence.

If the medical device does not qualify for the 510(k) procedure (either because it is not substantially equivalent to a legally marketed device or because it is required by statute and the FDA ' s implementing regulations have an approved application), the FDA must approve a Pre-Marketing Application ( " PMA " ) before marketing can begin. PMA ' s must demonstrate, among other matters, that the medical device provides a reasonable assurance of safety and effectiveness. A PMA application is typically a complex submission, including the results of non-clinical and clinical studies. Preparing a PMA application is a much more expensive, detailed and time-consuming process as compared with a 510(K) pre-market notification.

In addition, the FDA regulates the export of medical devices that have not been approved for marketing in the United States. The Federal Food, Drug and Cosmetic Act contains general requirements for any medical device that may not be sold in the United States and is intended for export. Specifically, a medical device intended for export is not deemed to be adulterated or misbranded if the product: (1) complies with the specifications of the foreign purchaser; (2) is not in conflict with the laws of the country to which it is intended for export; (3) is prominently labeled on the outside of the shipping package that it is intended for export; and (4) is not sold or offered for sale in the United States. However, the Federal Food, Drug and Cosmetic Act does permit the export of devices to any country in the world, if the device complies with the laws of the importing country and has valid marketing authorization in one of several " listed " countries under the theory that these listed countries have sophisticated mechanisms for the review of medical devices for safety and effectiveness.

| 11 |

The Company is also subject to regulations in foreign countries governing products, human clinical trials and marketing, and may need to obtain approval or evaluations by international public health agencies, such as the World Health Organization, in order to sell diagnostic products in certain countries. Approval processes vary from country to country, and the length of time required for approval or to obtain other clearances may in some cases be longer than that required for United States governmental approvals. On the other hand, the fact that our HIV diagnostic tests are of value in the AIDS epidemic may lead to some government process being expedited. The extent of potentially adverse governmental regulation affecting HDS that might arise from future legislative or administrative action cannot be predicted.

Our products rely on international regulatory approvals for sale into markets outside of the USA, and, domestically, our devices would require US FDA approval and in some cases, WHO approvals. These approvals allow for passage to the Global Fund funding process.

It is our intent to focus on both the domestic and international regulatory approvals.

Domestically, we intend on submitting our devices to the FDA under a Pre-Market Approval Application (PMA) or through the 510K process. The 510K would require the appropriate regulatory administrative submissions as well as a limited scientific review by the FDA to determine completeness (acceptance and filing reviews); in-depth scientific, regulatory, and Quality System review by appropriate FDA personnel (substantive review); review and recommendation by the appropriate advisory committee (panel review); and final deliberations, documentation, and notification of the FDA decision. The PMA process is more extensive, requiring clinical trials to support the application. We expect to apply to FDA for approval of our first RDT to be submitted to the FDA for 510K approval within the next 3 months. We anticipate the FDA process will be completed within 9-12 months after submission. During this timeline we will be preparing documentation for additional rapid tests to undergo either the FDA PMA or 510k process. We have not yet competed an assessment of whether our products will qualify for approval under the 5010K process or we will be required to engage in the more cumbersome Pre-Market Approval Application.

Internationally, we intend on submitting our Express devices and cassettes to the World Health Organization (WHO) process which requires a full regulatory and quality documentation dossier, produced and compiled by the Company. WHO process requires laboratory testing and evaluation and then clinical trials for public deployment and documentation throughout the whole process.

Once the WHO process is complete and documented, there is a submission into the Global Fund, which is a partnership between governments, civil society, the private sector and people affected by infectious diseases specifically HIV/AIDs, tuberculosis, and malaria.

The Global Fund raises and invests nearly $4 billion a year to support programs run by local experts in countries that are most in need.

It is our intent to submit all of our RTDs and cassettes and Express to the FDA, WHO and the Global Fund for regulatory review and approval for HIV, TB and malaria.

Currently, both our cassette malaria pF and malaria pF/pV have been approved under the WHO process. The cassette malaria pF/Pan was submitted to the WHO in February 2015, and we anticipate final review and approval before the end of the year.

PRODUCT STRATEGY

Our product strategy is to offer RTDs and other medical devices and tests that are consistent with simplicity in design; that are cost effective; that are easy to use; deliver fast and accurate results with a substantially reduced possibility of user error.

| 12 |

All product components required to operate the RDT are contained in each individual RDT foil pouch based upon options selected by the buyer. Each pouch has written and pictorial instructions clearly illustrating product use on the back. Each is color coded for each specific diagnostic thereby making test administering easy. This minimizes cross-contamination.

Our product mix was achieved by incorporating our Express or Express II housing/delivery system with a validated test strip. This allows us to accommodate our current and future test strips into either delivery system.

COMPETITIVE ADVANTAGE

We believe our unique and simple EXPRESS product design delivers significant advantages over our competition.

Due to the potential infectious character of the whole blood test sample, our Express series of RDTs are designed to perform and deliver test results while sealed within the Express housing, carefully controlling the potentially infectious test sample. This design helps to increase our ability to control the possibility of cross-contamination. Most of our competitors’ products, while inexpensive, are not as user-friendly, require substantially more training and have greater risk of cross- contamination.

Our products are more intuitive and self-explanatory than our competitors making it easier and safer to use. Our products require less training and education. Each Express is configured to operate in the same way regardless of the type of disease being tested.

With ease of use, simple design and faster results, our products allow for more tests administered at the patient point of care level.

We will compete on the basis these advantages. Most of our competitors’ products, while inexpensive, are not as user-friendly, require substantially more training and have greater risk of cross- contamination.

COMPETITION

The diagnostics industry is a multi-billion dollar international industry and is intensely competitive. Many of our competitors are substantially larger and have greater financial, research, manufacturing and marketing resources. Industry competition in general is based on the following:

| • | Scientific and technological capability; |

| • | Proprietary know-how; |

| • | The ability to develop and market products and processes; |

| • | The ability to obtain FDA or other required regulatory approvals; |

•

|

The ability to manufacture products that meet applicable governmental and NGO requirements; |

| • | The ability to manufacture products cost-effectively; |

| • | Access to adequate capital; |

| • | The ability to attract and retain qualified personnel; and |

| • | The availability of patent protection. |

| 13 |

We believe our scientific and technological capabilities as well as our proprietary technology and know-how relating to our rapid tests, particularly for the development and manufacture of tests for the detection of antibodies to infectious diseases, are very strong.

Alere Inc.

Alere is our main competitor and one of the major player in RTDs for infectious diseases. Alere markets the Alere HIV Combo Ag/Ab test, which uses the lateral flow technology patent. Alere acquired the patent from Abbott over a decade ago. Alere subsequently acquired Standard Diagnostics of Korea and Accon of China.

In early 2016, Abbot Laboratories agreed to acquire Alere for $5.8 billion. However, Abbot recently started litigation to terminate the agreement. In the event Abbot does acquire Alere, Alere would lose the strength of Abbott, becoming as formidable competitor as it currently is.

Standard Diagnostics

Standard Diagnostics was a state funded entity in South Korea established to build and expand into the international markets under its own brand until it was acquired by Inverness, the predecessor to Alere, in 2006.

With funding from Inverness for regulatory registrations and a previously established cassette product line, Standard was able to capture a strong market share of purchased for use in Africa with funding from WHO and the Global Fund. Currently, Standard is the strongest competitor on an international basis, incorporating a cassette design into each of their products.

Chembio Diagnostic Systems, Inc.

Chembio Diagnostic Systems is a publicly traded diagnostic company that develops, manufactures and commercializes diagnostic solutions. Chembio uses its patented Next Generation DPP (Dual Path Platform) technology that makes claims of significant advantages over the Alere’s lateral-flow technology.

It has continued building its product line and entered into US FDA approval for a rapid HIV test approved for professional use only in the United States.

Other Competition

As infectious diseases are epidemic and in the minds of the public, there will be more competitors coming into the market place. However, competition will be based upon the implementation of a cassette or a “dipstick” format.

FACILITIES

The Company’s corporate office for product development and regulatory affairs is an FDA Registered Facility with a fully staffed laboratory and assembly facility in Miramar, Florida.

Based on order size, delivery requirements and current orders in process, our Miramar facility can handle up to 4 million RTD devices, all of which are currently hand assembled. We have long-standing relationships with subcontractors to handle additional production requirements. Currently, shipments have been made to agencies for regulatory approvals and for initial market entry and we are in process to apply for a US. FDA, and newly announced WHO approvals which will reduce the WHO process form 24-30 months down to approximately 6-9 months.

Cassette production is conducted through subcontractors in India and China. Each site operates under GMP (Good Manufacturing Practice) as well as being compliant with ISO 9001 and ISO13485. All HDS cassettes are included in our U.S. Certificate of Exportability and European Union CE Mark registrations. Additionally, two of our cassette malaria tests are approved by the WHO with a third approval due to be announced before the end of 2016.

| 14 |

We have established Quality and Assembly Agreements as well as Confidentiality Agreements with our subcontractors. All are subject to our inspection at a moment’s notice.

The quality of final assembly of each of our products is maintained under the strict guidelines of our internal Quality System, which forms the basis for the Company’s ISO13485 rating.

Full quality oversight is mandatory and final batch release testing is conducted on each lot of products assembled prior to shipment release.

With full automation, the Company anticipates to produce up to 10 million Express devices annually. Expanded production would allow for additional expansion beyond this volume. Additionally, subcontractors would provide approximately 60 million cassette tests per year.

SALES DEVELOPMENT

Our sales will be dependent on regulatory approvals issued by such agencies as the WHO, FDA and registration with the Global Fund. These approvals are a key element in the sales and marketing effort on an international basis.

WHO Approved

Following the successful fulfillment of previous PFSCM (Partnership for Supply Chain Management) and WHO shipments, HDS continues to participate in requests for proposals from PFSCM for our currently WHO-approved HDS Malaria test.

The Company is now awaiting the approval of an additional Malaria RDT which the WHO has stated will be announced by December 15, 2016 pending test results. This will then be the third HDS Malaria test that is approved under the WHO program.

The Company will also participate in the newly designed and recently announced WHO Pre-Qualification Program for Malaria RDTs. It is our intention to present the new Malaria Express II devices for Pf, Pf/Pv and Pf/Pan for this Pre-Qualification Program. The WHO will also extend the expedited approval process to include other diseases including HIV.

Long Term WHO Agreement

In February 2016, HDS signed a Long Term Two Year Agreement with the WHO for the supply of the first HDS Malaria tests.

Offering a highly competitive rate in close cooperation with our subcontractor, we expect to see increased sales for these products during the life of that agreement. However, the agreement with WHO allows us to compete for WHO funded projects, but does not guarantee any specific sales.

USAID

USAID has submitted to the Company a request for participation in a Long Term Agreement for the HDS Malaria Tests. The prerequisite will be the same as those requirements satisfied during the WHO evaluation process and which qualified our tests for purchase by the WHO. In FY2105, USAID purchased $24.5 million in malaria tests. USAID is the lead U.S. Government agency that works to end extreme global poverty and enable resilient, democratic societies to realize their potential and which supports the sale of RDTs to those same countries.

European Union

The European Union has also initiated the preliminary purchase process of our Express devices for Typhoid, Hepatitis-C, Hepatitis-B, Tuberculosis, Syphilis, Malaria and Dengue.

| 15 |

The requirement was made by established NGOs in Greece in cooperation with other international funding agencies.

Purchases of EXPRESS devices for Malaria and Tuberculosis ordered are to be financed by the Internal Security Fund of the European Union and details in the RFQ specifies the advanced performance specifications of the “HEMA RAPID” device.

The current requirement is for 300,000 total tests at an average of $2.10/test and is pending confirmation of funds and a renegotiation on ship schedule. Currently, due to difficulties within Greece, this requirement has been held up pending resolution.

Concurrent to this requirement is a pending order for approximately 250,000 HDS Express HIV tests. This order is being coordinated by a Netherlands NGO that has and continues to act as supply-chain management. This organization has committed to including HDS products in their current inventories and has additional requirements that span beyond the initial 250,000 devices. This includes several other RFP opportunities for other HDS testing approved products.

We have received a commitment from an NGO in Paris with sustaining ties to the country of Nigeria. The commitment signals a storing intent on the part of this NGO, but is not a binding order for products. The issuance of the order depends greatly upon the exchange rate of the target country and the US dollar. As of this date, the rate of exchange has delayed the issuance of a purchase order.

LEGAL PROCEEDINGS

Hema is not a party to any pending legal proceedings. Pursuant to the terms of the Acquisition Agreement, responsibility for any Hema liability emerging from Hema’s business prior to closing relies wholly with the pre-transaction Hema shareholders but there is no assurance they would have the assets available to pay any liability resulting from litigation.

RISK

FACTORS RELATING TO HEMA’S BUSINESS

In addition to the other information included in this Current Report on Form 8-K, you should carefully review and consider the factors discussed in Part I, Item 1A - Risk Factors of our Annual Report on Form 10-K for the year ended July 31, 2016 and our subsequent Quarterly Reports on Form 10-Q. These factors materially affect our business, financial condition or future results of operations. The risks, uncertainties and other factors described in our Annual Report on Form 10-K, our Reports on Form 10-Q and below are not the only ones facing our company. Additional risks, uncertainties and other factors not presently known to us or that we currently deem immaterial may also impair our business operations, financial condition or operating results. Any of the risks, uncertainties and other factors could cause the trading price of our common stock to decline substantially.

Risks related to our industry, business and strategy

Because we may not be able to obtain or maintain the necessary regulatory approvals for some of our products, we may not generate revenues in the amounts we expect, or in the amounts necessary to continue our business. Our existing products as well as our manufacturing facility must meet quality standards and are subject to inspection by a number of domestic regulatory and other governmental and non-governmental agencies.

All of Hema’s proposed and existing products are subject to regulation in the U.S. by the U.S. Food and Drug Administration, the U.S. Department of Agriculture and/or other domestic and international governmental, public health agencies, regulatory bodies or non-governmental organizations. In particular, we are subject to strict

| 16 |

governmental controls on the development, manufacturing, labeling, distribution and marketing of our products. The process of obtaining required approvals or clearances varies according to the nature of, and uses for, a specific product. These processes can involve lengthy and detailed laboratory testing, human or animal clinical trials, sampling activities, and other costly, time-consuming procedures. The submission of an application to a regulatory authority does not guarantee that the authority will grant an approval or clearance for that product. Each authority may impose its own requirements and can delay or refuse to grant approval or clearance, even though a product has been approved in another country.

The time taken to obtain approval or clearance varies depending on the nature of the application and may result in the passage of a significant period of time from the date of submission of the application. Delays in the approval or clearance processes increase the risk that we will not succeed in introducing or selling the subject products, and we may determine to devote our resources to different products.

Changes in government regulations could increase our costs and could require us to undergo additional trials or procedures, or could make it impractical or impossible for us to market our products for certain uses, in certain markets, or at all.

Changes in government regulations may adversely affect our financial condition and results of operations because we may have to incur additional expenses if we are required to change or implement new testing, manufacturing and control procedures. If we are required to devote resources to develop such new procedures, we may not have sufficient resources to devote to research and development, marketing, or other activities that are critical to our business.

We can manufacture and sell our products only if we comply with regulations and quality standards established by government agencies such as the FDA and the U.S. Department of Agriculture (“USDA”) as well as by non-governmental organizations such as the International Organization for Standardization (“ISO”) and WHO. We have implemented a quality control system that is intended to comply with applicable regulations. Although FDA approval is not required for the export of our products, there are export regulations promulgated by the FDA that specifically relate to the export of our products that require compliance with FDA quality system regulation and that also require meeting certain documentary requirements regarding the approval of the product in export markets. Although we believe that we meet the regulatory standards required for the export of our products, these regulations could change in a manner that could adversely impact our ability to export our products.

Our products may not be able to compete with new diagnostic products or existing products developed by well-established competitors, which would negatively affect our business.

The diagnostic industry is focused on the testing of biological specimens in a laboratory or at the point-of-care and is highly competitive and rapidly changing. Some of our principal competitors may have considerably greater financial, technical and marketing resources than we do. Several companies produce diagnostic tests that compete directly with our testing product line, including but not limited to, Chembio Diagnostics and Abbot Laboratories. Furthermore these and/or other companies have or may have products incorporating molecular and/or other advanced technologies that over time could directly compete with our testing product line. As new products incorporating new technologies enter the market, our products may become obsolete or a competitor's products may be more effective or more effectively marketed and sold.

There are competing products that could significantly reduce our U.S. sales of rapid HIV tests.

In 2006 Alere, Inc. acquired a division from Abbott Diagnostic located in Japan that manufactured and marketed a rapid HIV test product line called Determine®. The Determine® format was developed for the developing world and remote settings and, central to the needs of that market. The format is essentially a test strip that is integrated into a thin foil wrapper. When opened, the underside of the wrapper serves as the test surface for applying the blood sample and performing the test. This design reduces costs and shipping weights and volumes and provides an advantage for the developing world markets it serves. Some of the disadvantages of the platform are the amount of blood sample that is needed (50 microliters versus 2.5, 5 and 10 for our lateral flow barrel, lateral flow cassette, and DPP® products respectively), the open nature of the test surface, and the absence of a true control that differentiates biological from other kinds of samples.

| 17 |

The so-called "3rd generation" version of this product has been marketed for many years and is the leading rapid HIV test that is used in a large majority of the national algorithms of countries funded by PEPFAR and the Global Fund, as well as many other countries in the world. That product is not FDA-approved though it is CE marked. The newest Determine® HIV version, which was developed and manufactured by Alere's subsidiary in Israel, Orgenics, is the so-called "4th Generation" version Determine® test. According to its claims, this product detects HIV antibodies and P24 HIV antigens. Because the P24 antigen is known to occur in HIV-positive individuals' blood samples before antibodies do, the 4th generation Determine® test is designed to detect HIV infection earlier than tests that solely rely on antibody detection. HDS’ tests, as well as all of the other currently FDA-approved rapid HIV tests, only detect antibodies.

The initial "4th generation" Alere Determine® rapid test product that was also CE marked and that Alere launched internationally some years ago has not been successfully commercialized to the best of our knowledge and at least certain published studies were not favorable for this product. However the 4th generation product that is now FDA-approved was apparently modified as compared to the initial international version, and it may perform more satisfactorily. Alere received FDA approval of this modified product in August 2013 and CLIA waiver for it in December 2014. Alere is also aggressively pursuing development of the market for this product. Moreover there is support by a number of key opinion leaders for the public health value of such 4th generation tests, and this product represents a significant competitive threat to Chembio as well as to each of the other rapid HIV test manufacturers (OraSure and Trinity primarily).

During 2011, Biolytical, Inc. of Vancouver, Canada received FDA approval and in 2012 received CLIA waiver of a flow-through rapid HIV test called "INSTI". The flow-through technology used in the INSTI test is older than lateral flow, and requires handling of multiple components (3 vials of solution) to perform the test in multiple steps. However, these steps can be accomplished in less than ten minutes, and the actual test results occur in only one minute after those steps are completed. Therefore sample-to-result time is shorter than any of the competitive products. The product also has good performance claims. There are settings where that reduced total test time, despite the multiple steps required, may be a distinct advantage, and we believe Biolytical has made some progress in penetrating certain public health markets.

Therefore, even though our lateral flow products currently enjoy a substantial market share in the U.S. rapid HIV test market, and we have an additional rapid HIV test, the DPP® HIV 1/2 Assay, there a number of risks and uncertainties concerning current and anticipated developments in this market. Although we have no specific knowledge of any other new product that is a significant competitive threat to our products, or that will render our products obsolete, if we fail to maintain and enhance our competitive position or fail to introduce new products and product features, our customers may decide to use products developed by our competitors, which could result in a loss of revenues and cash flow.

More generally, the point-of-care diagnostics industry is undergoing rapid technological changes, with frequent introductions of new technology-driven products and services. As new technologies become introduced into the point-of-care diagnostic testing market, we may be required to commit considerable additional efforts, time and resources to enhance our current product portfolio or develop new products. We may not have the available time and resources to accomplish this, and many of our competitors have substantially greater financial and other resources to invest in technological improvements. We may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to our customers, which would materially harm our operating results.

Our use of third-party suppliers, some of which may constitute our sole supply source, for certain important product components presents a risk that could have negative consequences for other business.

A number of our components and critical raw materials are provided by third-party suppliers, some of which may be sole-source suppliers, which impacts our ability to manufacture or sell product if our suppliers cannot or will not deliver those materials in a timely fashion, or at all, due to an interruption in their supply, quality or technical issues, or any other reason. If this occurs, we could incur substantial expense and time to be able to reestablish the appropriate quality, cost, regulatory and market-acceptance circumstances needed for commercial success. Even with the needed expense and time, we may not be able to reestablish any or all of these factors. The absence of any one or more of these factors could prevent us from being able to commercially produce and market the affected product or products.

| 18 |

New developments in health treatments or new non-diagnostic products may reduce or eliminate the demand for our products.

The development and commercialization of products outside of the diagnostics industry could adversely affect sales of our products. For example, the development of a safe and effective vaccine to HIV or treatments for other diseases or conditions that our products are designed to detect, could reduce or eventually eliminate the demand for our HIV or other diagnostic products and result in a loss of revenues.

We may not have sufficient resources to effectively introduce and market our products, which could materially harm our operating results.

Introducing and achieving market acceptance for our products will require substantial marketing efforts and will require us and/or our contract partners, sales agents, and/or distributors to make significant expenditures of time and money. In some instances we will be significantly or totally reliant on the marketing efforts and expenditures of our contract partners, sales agents, and/or distributors. If they do not have or commit the expertise and resources to effectively market the products that we manufacture, our operating results will be materially harmed.

The success of our business depends on, in addition to the market success of our products, our ability to raise additional capital through the sale of debt or equity or through borrowing, and we may not be able to raise capital or borrow funds on attractive terms and/or in amounts necessary to continue our business, or at all.

Our liquidity and cash requirements will depend on several factors. These factors include, among others, (1) the level of revenues; (2) the extent to which, if any, that revenue level improves operating cash flows; (3) our investments in research and development, facilities, marketing, regulatory approvals, and other investments we may determine to make; and (4) our investment in capital equipment and the extent to which it improves cash flow through operating efficiencies. We do not expect to generate positive cash flow in next twelve months, and we cannot be sure that we will be successful in raising sufficient capital to fund our needs. If we are not able to raise additional capital from another source, we will be required to substantially reduce our operating costs, including the possibilities of suspending our unfunded research and development activities, and quickly curtailing any cash flow negative product initiatives.

Our near term sales are difficult to predict in the uncertain status of pending orders and certain regulatory approvals, and the uncertain time until we have approval to sell in the US. We believe that underlying demand for HIV rapid testing in the United States remains strong, and that the restoration of some of the funding cutbacks from sequestration and the implementation of the Affordable Care Act and of the United States Preventive Services Task Force recommendations will have a positive impact on the development of the market.

However, development of new customers with this product is costly and time-consuming.

Currently, we are dependent on international sales of our products, since we have no products approved by the FDA for US sales. The nature of international business is such that it can be volatile from period to period, depending on ordering patterns of donor-funded programs.

A number of factors can slow or prevent international sales increases or cause sales decreases, or substantially increase the cost of achieving sales assuming they are achieved. These factors include:

| • | economic conditions and the absence of or reduction in available funding sources; |

| • | regulatory requirements and customs regulations; |

| • | cultural and political differences; |

| • | foreign exchange rates, currency fluctuations and tariffs; | |

| • | dependence on and difficulties in managing international distributors or representatives; |

| • | the creditworthiness of foreign entities; |

| • | difficulties in foreign accounts receivable collection; |

| 19 |

| • | competition; |

| • | pricing; and |

| • | any inability we may have in maintaining or increasing revenues. |

If we are unable to increase our revenues from domestic and/or international customers, our operating results will be materially harmed.

Although we have an ethics and anti-corruption policy in place, and have no knowledge or reason to know of any practices by our employees, agents or distributors that could be construed as in violation of such policies, our business includes sales of products to countries where there is or may be widespread corruption.

HDS has a policy in place prohibiting its employees, distributors and agents from engaging in corrupt business practices, including activities prohibited by the United States Foreign Corrupt Practices Act (the “FCPA”). Nevertheless, because we work through independent sales agents and distributors outside the United States, we do not have control over the day-to-day activities of such independent agents and distributors. In addition, in the donor-funded markets in Africa where we sell our products, there is significant oversight from PEPFAR, the Global Fund, and advisory committees comprised of technical experts concerning the development and establishment of national testing protocols. This is a process that includes an overall assessment of a product which includes extensive product performance evaluations including five active collaborations and manufacturer’s quality systems, as well as price and delivery. In Brazil, where we have had a total of six product collaborations with FIOCRUZ, the programs through which our products may be deployed are all funded by the Brazilian Ministry of Health. Although FIOCRUZ is affiliated with the Brazilian Ministry of Health, and is its sole customer. We have no knowledge or reason to know of any activities by our employees, distributors or sales agents of any actions which could be in violation of the FCPA, although there can be no assurance of this.

To the extent that we are unable to collect our outstanding accounts receivable, our operating results could be materially harmed.

There may be circumstances and timing that require us to accept payment terms, including delayed payment terms, from distributors or customers, which, if not satisfied, could cause financial losses.

We generally accept payment terms which require us to ship product before the contract price has been paid fully, and there also are circumstances pursuant to which we may accept further delayed payment terms pursuant to which we may continue to deliver product. To the extent that these circumstances result in significant accounts receivables and those accounts receivables are not paid on a timely basis, or are not paid at all, especially if concentrated in one or two customers, we could suffer financial losses.

Item 3 Properties.