Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - TRUIST FINANCIAL CORP | exhibit992qps4q16.htm |

| EX-99.1 - EXHIBIT 99.1 - TRUIST FINANCIAL CORP | exhibit991text4q16.htm |

| 8-K - 8-K - TRUIST FINANCIAL CORP | release8kbody-4q16.htm |

• general economic or business conditions, either nationally or regionally, may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and/or a reduced demand for credit, insurance or other services;

• disruptions to the national or global financial markets, including the impact of a downgrade of U.S. government obligations by one of the credit ratings agencies, the adverse effects of economic instability and recessionary conditions or market

disruptions in Europe, China or other global markets, including, but not limited to the potential exit of the United Kingdom from the European Union;

• changes in the interest rate environment, including interest rate changes made by the Federal Reserve or the possibility of a negative interest rate scenario, as well as cash flow reassessments may reduce net interest margin and/or the volumes

and values of loans made or held as well as the value of other financial assets held;

• competitive pressures among depository and other financial institutions may increase significantly;

• legislative, regulatory or accounting changes, including changes resulting from the adoption and implementation of the Dodd-Frank Act may adversely affect the businesses in which BB&T is engaged;

• local, state or federal taxing authorities may take tax positions that are adverse to BB&T;

• a reduction may occur in BB&T's credit ratings;

• adverse changes may occur in the securities markets;

• competitors of BB&T may have greater financial resources or develop products that enable them to compete more successfully than BB&T and may be subject to different regulatory standards than BB&T;

• cybersecurity risks, including "denial of service," "hacking" and "identity theft," could adversely affect BB&T's business and financial performance or reputation, and BB&T could be liable for financial losses incurred by third parties due to

breaches of data shared between financial institutions;

• natural or other disasters, including acts of terrorism, could have an adverse effect on BB&T, materially disrupting BB&T's operations or the ability or willingness of customers to access BB&T's products and services;

• costs related to the integration of the businesses of BB&T and its merger partners may be greater than expected;

• failure to execute on strategic or operational plans, including the ability to successfully complete and/or integrate mergers and acquisitions or fully achieve expected cost savings or revenue growth associated with mergers and acquisitions within

the expected time frames could adversely impact financial condition and results of operations;

• significant litigation and regulatory proceedings could have a material adverse effect on BB&T;

• unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries could result in negative publicity, protests, fines, penalties, restrictions on BB&T's operations or ability to

expand its business and other negative consequences, all of which could cause reputational damage and adversely impact BB&T's financial conditions and results of operations;

• risks resulting from the extensive use of models;

• risk management measures may not be fully effective;

• deposit attrition, customer loss and/or revenue loss following completed mergers/acquisitions may exceed expectations;

• higher-than-expected costs related to information technology infrastructure or a failure to successfully implement future system enhancements could adversely impact BB&T's financial condition and results of operations and could result in

significant additional costs to BB&T; and

• widespread system outages, caused by the failure of critical internal systems or critical services provided by third parties, could adversely impact BB&T's financial condition and results of operations.

This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, regarding the financial condition, results of operations, business plans and the future performance of BB&T. Forward-looking statements

are not based on historical facts but instead represent management's expectations and assumptions regarding BB&T's business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances difficult to predict. BB&T's actual results may differ materially from those contemplated by the forward-looking statements. Words such as "anticipates," "believes," "estimates," "expects," "forecasts," "intends," "plans," "projects,"

"may," "will," "should," "could," and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. While there is no assurance any list

of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation:

Forward-Looking Information

• Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets and their related amortization. These measures are useful for evaluating the performance of a business consistently, whether acquired

or developed internally. The return on average risk-weighted assets is a non-GAAP measure. BB&T's management uses these measures to assess the quality of capital and returns relative to balance sheet risk and believes investors may find them

useful in their analysis of the Corporation.

• The ratio of loans greater than 90 days and still accruing interest as a percentage of loans held for investment has been adjusted to remove the impact of loans that were covered by FDIC loss sharing agreements and purchased credit impaired

("PCI") loans as well as government guaranteed loans. Management believes their inclusion may result in distortion of these ratios such that they might not be comparable to other periods presented or to other portfolios not impacted by purchase

accounting or reflective of asset collectibility.

• The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges and other selected items. BB&T's management uses this measure in their analysis of the

Corporation's performance. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and

charges.

• Core net interest margin is a non-GAAP measure that adjusts net interest margin to exclude the impact of interest income and funding costs associated with loans and securities acquired in the Colonial acquisition and PCI loans acquired from

Susquehanna and National Penn. Core net interest margin is also adjusted to remove the purchase accounting marks and related amortization for non-PCI loans, deposits and long-term debt acquired from Susquehanna and National Penn. BB&T's

management believes the adjustments to the calculation of net interest margin for certain assets and deposits acquired provide investors with useful information related to the performance of BB&T's earning assets.

Non-GAAP Information

A reconciliation of these non-GAAP measures to the most directly comparable GAAP measure is included in BB&T's Fourth Quarter 2016 Quarterly Performance Summary, which is available at BBT.com.

Capital ratios are preliminary.

This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). BB&T's management uses these "non-GAAP"

measures in their analysis of the Corporation's performance and the efficiency of its operations. Management believes these non-GAAP measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as

well as demonstrate the effects of significant gains and charges in the current period. The company believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. BB&T's management believes

investors may use these non-GAAP financial measures to analyze financial performance without the impact of unusual items that may obscure trends in the company's underlying performance. These disclosures should not be viewed as a substitute for financial

measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Below is a listing of the types of non-GAAP measures used in this news release:

3

2016 Fourth Quarter Performance Highlights1

Record annual net income totaled $2.3 billion2, up 16.7% vs. 2015

4Q16 net income totaled $592 million2, up 17.9% vs. 4Q15

Diluted EPS totaled $0.72, up 12.5% vs. 4Q15

Adjusted EPS totaled $0.73 excluding merger-related and restructuring charges

ROA, ROCE and ROTCE3 were 1.16%, 8.75% and 14.91%, respectively

Earnings

Loans &

Credit Quality

Average loans and leases held for investment totaled $142.3 billion in 4Q16, up 3.0%

compared with 3Q16

NPAs decreased 3.6% vs. 3Q16

Reserve build of $11 million (Adjusted net charge-offs were $122 million vs. provision for

loan losses of $133 million)

Strategic

Highlights

Repurchased 7.5 million shares in 4Q16

Increased total share repurchases by $200 million completed through an ASR

Total payout ratio4 was 101.9% in 4Q16

Restructured $2.9 billion in FHLB advances in 1Q17

Revenues

Taxable-equivalent revenues totaled $2.8 billion, up 8.3% vs. 4Q15

Net interest margin declined 7 bps to 3.32% vs. 3Q16

Core net interest margin was flat vs. 3Q16

Fee income ratio improved to 42.6% from 41.9% in 3Q16

Efficiency

GAAP efficiency improved to 61.1% vs. 61.7% in 3Q16

Adjusted efficiency3 was 59.5% vs. 58.7% in 3Q16

Noninterest expense was $1.7 billion, a decrease of 10.0% annualized vs. 3Q16

1 Returns and linked quarter growth rates are annualized, except credit metrics

2 Available to common shareholders

3 Refer to the Appendix for appropriate reconciliations of non-GAAP financial measures

4 Total payout ratio is calculated by dividing the sum on common stock dividends and share repurchases (excluding repurchases in connection with equity awards) by net income available to common shareholders

4

Pre-Tax After Tax1 Diluted EPS Impact

Merger-related and restructuring charges $ (13) $ (8) $ (0.01)

Securities duration adjustments and hedge

ineffectiveness

(34) (21) (0.03)

Mortgage reserve adjustment 31 19 0.02

Selected Items Affecting Earnings ($ in millions, except per share impact)

1 Income taxes were estimated using the marginal tax rate

5

Loans Reflect Portfolio Purchases, Consumer Growth and

Targeted Runoff

Average loans and leases held for investment

increased 3.0% annualized in 4Q16 vs. 3Q16

Experienced loan growth vs. 3Q16 in several

portfolios:

Grandbridge, up 28.4% annualized

Equipment Finance, up 15.2% annualized

Regional Acceptance, up 10.5% annualized

Sales finance completed a $1.9 billion portfolio

acquisition in November and a $1.0 billion

portfolio acquisition in September

1 Excludes loans held for sale

2 Other lending subsidiaries consist primarily of AFCO/CAFO/Prime Rate, BB&T Equipment Finance, Grandbridge Real Estate Capital, Sheffield Financial and Regional Acceptance

$134.8 $134.4

$141.1 $141.3 $142.3

$100.0

$110.0

$120.0

$130.0

$140.0

$150.0

4Q15 1Q16 2Q16 3Q16 4Q16

Average Loans Held for Investment

($ in billions)

C&I $ 51,306 (1.6)%

CRE – IPP 14,566 (2.7)

CRE – C&D 3,874 7.5

Dealer floor plan 1,367 31.1

Direct retail lending 12,046 1.7

Sales finance 10,599 53.7

Revolving credit 2,608 11.1

Residential mortgage 30,044 (4.1)

Other lending subsidiaries2 14,955 5.7

Acquired from FDIC and PCI 974 (29.5)

Total $ 142,339 3.0%

4Q16

Average

Balance

4Q16 v. 3Q16

Annualized

Increase

(Decrease)

Average Loans Held for Investment

($ in millions)

1Q17 management expectations

Average loans are expected to be flat to up

slightly vs. 4Q16 due largely to seasonality

6

Noninterest-Bearing Deposits Reflect Strong Growth

$148.5 $149.9

$160.3 $159.5 $160.1

0.24%

0.25%

0.23% 0.23% 0.22%

0.20%

0.25%

0.30%

0.35%

0.40%

$120.0

$130.0

$140.0

$150.0

$160.0

$170.0

4Q15 1Q16 2Q16 3Q16 4Q16

Total Interest-Bearing Deposit Cost

Total deposits averaged $160.1 billion, an increase

of $615 million vs. 3Q16

Personal, up 0.6% annualized

Business, up 4.2% annualized

Public Funds, up 10.4% annualized

Noninterest-bearing deposits increased $862 million,

or 6.8% annualized vs. 3Q16

The percentage of noninterest-bearing deposits to

total deposits improved to 32.1% compared with

31.7% in 3Q16

Average Total Deposits

($ in billions)

$45.8 $46.2

$48.8

$50.6 $51.4

$30.0

$35.0

$40.0

$45.0

$50.0

$55.0

4Q15 1Q16 2Q16 3Q16 4Q16

Average Noninterest-Bearing Deposits

($ in billions)

Noninterest-bearing deposits $ 51,421 6.8%

Interest checking 28,634 12.6

Money market & savings 63,884 (2.8)

Subtotal $ 143,939 3.6

Time deposits 15,693 (3.1)

Foreign office deposits – Interest-

bearing 486 NM

Total deposits $ 160,118 1.5%

4Q16

Average

Balance

Average Deposits

($ in millions) 4Q16 v. 3Q16

Annualized

Increase

(Decrease)

7

Credit Quality Reflects Seasonal Increase in Charge-offs;

Lower NPAs1

Credit quality results reflect expected seasonal

increase in consumer-related portfolios and

impact of loan sales

Net charge-offs totaled $151 million, up 5 bps

vs. 3Q16

- Includes $15 million related to PCI loans

- Includes $14 million related to loan sales

Loans 90 days or more past due2 increased 7.4%

vs. 3Q16

Loans 30-89 days past due2 increased 9.9%

vs. 3Q16

NPAs decreased 3.6% vs. 3Q16

Excluding energy-related loans, NPAs were

0.34% of total assets

1Q17 management expectations

Management expects 1Q17 net charge-offs to be in

the range of 35 to 45 bps

NPA levels expected to remain in a similar range in

1Q17

0.34%

0.42% 0.40% 0.38% 0.37%

0.00%

0.20%

0.40%

0.60%

4Q15 1Q16 2Q16 3Q16 4Q16

Total Nonperforming Assets as a Percentage

of Total Assets

Annualized Net Charge-offs / Average Loans

1 Includes acquired from FDIC and PCI; excludes loans held for sale

2 Excludes nonperforming loans and leases

0.38%

0.46%

0.28%

0.37%

0.42%

0.00%

0.20%

0.40%

0.60%

4Q15 1Q16 2Q16 3Q16 4Q16

8

Energy Portfolio – Stabilized in 4Q16

Outstanding balances declined 7.6% compared

with last quarter

Total commitments and nonaccruals decreased vs.

3Q16

35% Utilization rate

37% of portfolio is Criticized & Classified

Allocated reserves = 11.7%

All nonperforming borrowers are paying as agreed

Coal portfolio = $136 million outstanding, 42%

utilization with 21% Criticized & Classified

Allocated reserves = 7.2%

Support

Services

$108

9%

Oil and Gas Portfolio

$ in millions

Midstream

$492

40%

Upstream

$626

51%

Total $1.2 billion

(Less than 1% of total loans)

9

Allowance Coverage Ratios Remain Strong

2.83x

2.40x

3.88x

2.91x

2.47x 2.53x

1.89x 1.90x

2.00x 2.03x

1.00

2.00

3.00

4.00

4Q15 1Q16 2Q16 3Q16 4Q16

ALLL to Net Charge-offs ALLL to NPLs HFI

Coverage ratios remain strong at 2.47x and

2.03x for the allowance to net charge-offs and

NPLs, respectively

The ALLL to loans ratio was 1.04%, relatively

flat compared to last quarter

Excluding loans acquired from FDIC and PCI, the

provision for credit losses was $133 million vs.

adjusted net charge-offs of $122 million1

Excluding loans acquired in business acquisitions,

the ALLL to loans ratio was 1.13%, compared to

1.15% last quarter

Going forward, we continue to expect the loan

loss provision to approximate charge-offs in

addition to providing for incurred losses on

incremental loan growth

ALLL Coverage Ratios

1 Excludes $14 million of net charge-offs related to loans sold

10

Net Interest Margin Decreases to 3.32%

3.35%

3.43% 3.41% 3.39%

3.32%

3.13% 3.19% 3.17% 3.18% 3.18%

2.50%

3.00%

3.50%

4.00%

4Q15 1Q16 2Q16 3Q16 4Q16

Reported NIM Core NIM

4Q16 NIM decreased 7 bps vs. 3Q16 due to:

Securities duration adjustments, primarily

acquired securities (5 bps)

Decline in purchase accounting accretion (2 bps)

Restructured $2.9 billion of FHLB advances

in 1Q17

Recorded a pretax loss of $392 million

The debt’s average cost was 4.58%

The weighted average duration was 59 months

1Q17 management expectations

Core net interest margin expected to increase

8 – 10 bps

- Impact of FHLB restructure

- December 2016 rate increase

- Favorable asset mix changes

- Favorable funding cost and mix changes

GAAP net interest margin expected to increase

10-12 bps

Asset sensitivity decreased driven mostly

due to:

FHLB restructuring

Slower prepayment speeds in mortgage assets

Net Interest Margin

1

-0.93%

1.13%

2.14%

3.13%

-1.89%

1.96%

3.26%

4.62%

-2.00%

0.00%

2.00%

4.00%

6.00%

Down 25 Up 50 Up 100 Up 200

Sensitivities as of 12/31/16 Sensitivities as of 09/30/16

Rate Sensitivities

1 See non-GAAP reconciliations included in the attached Appendix

11

Fee Income Reflects Stronger Insurance and

Investment Banking Income

Insurance income increased $9 million, primarily due

to seasonally higher commissions

Mortgage banking income decreased $47 million

due to net mortgage servicing rights valuation

adjustments and lower production volumes

Other income increased $19 million, primarily due to

higher income from partnerships and other

investments

40.3% 39.9%

41.2% 41.9%

42.6%

35.0%

40.0%

45.0%

50.0%

4Q15 1Q16 2Q16 3Q16 4Q16

Fee Income Ratio

4Q16

4Q16 v.

3Q161

Increase

(Decrease)

4Q16 v.

4Q15

Increase

(Decrease)

Insurance income $ 419 8.7 % 10.3 %

Service charges on deposits 172 - 4.2

Mortgage banking income 107 (121.4) 2.9

Investment banking and brokerage

fees and commissions 108 27.6 18.7

Trust and investment advisory

revenues 69 5.9 7.8

Bankcard fees and merchant

discounts 60 (6.5) 7.1

Checkcard fees 50 - 6.4

Operating lease income 34 - 3.0

Income from bank-owned life

insurance 26 (102.3) (3.7)

FDIC loss share income, net - NM (100.0)

Securities gains (losses), net 1 NM NM

Other income 116 77.9 16.0

Total noninterest income $ 1,162 (0.7) % 14.5 %

Noninterest Income

($ in millions)

1 Linked quarter percentages are annualized

1Q17 management expectations

Total noninterest income expected to be relatively flat vs. 4Q16

12

Noninterest Expense Reflects Lower Loan-Related Expenses

and Merger-Related Charges

4Q16

4Q16 v.

3Q162

Increase

(Decrease)

4Q16 v.

4Q15

Increase

(Decrease)

Personnel expense $ 1,004 (0.8) % 12.4 %

Occupancy and equipment

expense 198 (9.8) 3.1

Software expense 57 (37.9) 9.6

Loan-related expense (6) NM (116.2)

Outside IT services 50 (7.8) 22.0

Professional services 27 - (6.9)

Amortization of intangibles 38 - 18.8

Regulatory charges 42 9.7 50.0

Foreclosed property expense 9 - (18.2)

Merger-related and restructuring

charges, net 13 NM (74.0)

Other expense 236 78.8 1.7

Total noninterest expense $ 1,668 (10.0) % 4.4 %

Noninterest Expense

($ in millions)

1 Refer to the Appendix for appropriate reconciliations of non-GAAP financial measures

2 Linked quarter percentages are annualized

63.4%

60.7%

65.4%

61.7% 61.1%

59.2% 58.8% 59.6% 58.7% 59.5%

50.0%

55.0%

60.0%

65.0%

70.0%

4Q15 1Q16 2Q16 3Q16 4Q16

Efficiency Ratio

GAAP Efficiency Adjusted Efficiency

Personnel expense reflects a $12 million decline in

equity-based compensation primarily due to a

decrease for retirement eligible employees

Loan-related expense decreased $39 million

compared to the prior quarter largely due to a release

of $31 million of mortgage repurchase reserves,

which is primarily driven by lower anticipated loan

repurchase requests

Other expense increased $39 million primarily due to

a net benefit of $73 million in the prior quarter related

to the settlement of certain legacy mortgage matters

involving the origination of mortgage loans insured by

the FHA

1Q17 management expectations

Excluding merger-related and restructuring charges and

the FHLB restructuring charge, expenses should be slightly

below $1.7 billion, even with seasonal headwinds in

personnel costs

1

13

Capital and Liquidity Remain Strong

10.3%

10.4%

10.0%

10.1%

10.2%

9.0%

9.5%

10.0%

10.5%

11.0%

4Q15 1Q16 2Q16 3Q16 4Q16

The common equity tier 1 ratio was 10.0% fully

phased-in

BB&T’s 12/31/16 LCR was 121%

BB&T’s 4Q16 liquid asset buffer was 12.6%

Option exercises added 0.1% to the Common

Equity Tier 1 capital ratio

4Q16 dividend payout ratio was 41.0%

4Q16 total payout ratio was 101.9%

1Q17 capital actions:

Continue share repurchase program with up to

$160 million in share repurchases in the 1st quarter

CCAR 2017

Management is currently targeting a meaningfully

significant increase in total return to shareholders

compared with CCAR 2016

1 Current quarter regulatory capital information is preliminary

Common Equity Tier 11

14

($ in millions)

Inc/(Dec)

vs 3Q16

Inc/(Dec)

vs 4Q15

4Q16 Comments5

Net Interest Income

Noninterest Income1

Provision for Credit Losses

Noninterest Expense2

Income Tax Expense

Segment Net Income

Highlighted Metrics5,6

$ 984

359

26

792

191

$ 334

$ 12

1

29

(8)

(4)

$ (4)

($ in billions)

1 Noninterest Income includes intersegment net referral fees

2 Noninterest Expense includes amortization of intangibles and allocated corporate expense

3 Linked quarter growth rates annualized except for production

4 Commercial production includes C&I, CRE and Dealer Floor Plan

4Q16 Like

Total Commercial Loans

Direct Retail Lending

Money Market & Savings

Noninterest Bearing Deposits

Link3

4.9%

8.6%

2.5%

15.2%

Change

Community Banking Segment

Commercial production4 in 4Q16 was the highest

since 2011

Increased $114 million, or 2.6%, compared to 4Q15

Increased $454 million, or 11.2%, compared to 3Q16

Direct Retail Lending production increased $156

million, or 14.9%, compared to 4Q15; increased $5

million, or 0.4%, compared with 3Q16

Operating results increased vs. 4Q15 primarily due

to the inclusion of National Penn and

Susquehanna results

Community Bank continues to execute on its

branch rationalization program

25 branch location closures completed in 4Q16

Community Bank continues to focus on improving

efficiency

Operating margin7 improved 6.3% to 41.0% in 4Q16

vs. 4Q15

Operating margin7 improved 7.8% to 39.2% for 2016

vs. 2015

Serves individual and business clients by offering a variety of loan and deposit products and other financial services

$ 50.4

$ 12.0

$ 50.1

$ 46.4

5 National Penn and Susquehanna results were included in this segment following the mid-July, 2016 conversion and the early

November, 2015 conversions, respectively

6 Balances reported and related growth metrics are based on average YTD loans and deposits

7 Operating margin is calculated as net income before taxes and provision for credit losses divided by total revenues

12.8%

18.7%

12.7%

15.2%

$ 131

28

(13)

65

35

$ 72

15

Retains and services mortgage loans originated by the Residential Mortgage Lending Division and through its referral relationship

with the Community Bank and referral partners as well as those purchased from various correspondent originators

($ in millions)

Inc/(Dec)

vs 3Q16

Inc/(Dec)

vs 4Q15

4Q16 Comments

4

Net Interest Income

Noninterest Income1

Provision for Credit Losses

Noninterest Expense2

Income Tax Expense

Segment Net Income

Highlighted Metrics

$ 109

75

15

66

39

$ 64

($ in billions)

1 Noninterest Income includes intersegment net referral fees

2 Noninterest Expense includes amortization of intangibles and allocated corporate expense

3 Credit quality metrics are based on Loans Held for Investment

4 Linked quarter growth rates annualized except for production and sales

Change

Residential Mortgage Banking Segment

$ (10)

(41)

6

28

(32)

$ (53)

Net interest income decreased vs. 3Q16 primarily

due to lower average balances and lower credit

spreads on loans

Noninterest income decreased vs. 3Q16 due to

lower net mortgage servicing rights valuation

adjustments and lower saleable loan volume and

margins

Noninterest expense increased vs. 3Q16 driven by

settlement of certain FHA-insured loan matters in

the prior quarter, partially offset by a 4Q16

decrease in repurchase reserves that reflects

lower anticipated repurchase requests

Production mix was 47% purchase / 53%

refinance in 4Q16 vs. 57% / 43% in 3Q16

Credit quality3

30+ days and still accruing delinquency of 3.51%

Nonaccruals of 0.57%

Net charge-offs of 0.13%

$ (2)

(4)

7

(37)

9

$ 15

4Q16 Link4 Like

Retail Originations $ 2.2 (8.1%) 38.8%

Correspondent Purchases $ 3.0 (22.5%) 53.8%

Total Production $ 5.2 (17.0%) 47.1%

Loan Sales $ 4.6 (6.9%) 48.5%

Loans Serviced for others (EOP) $ 90.3 0.7% (0.9%)

16

Primarily originates indirect loans to consumers on a prime and nonprime basis for the purchase of automobiles and other vehicles

through approved dealers both in BB&T’s market and nationally (through Regional Acceptance Corporation)

Comments ($ in millions)

Inc/(Dec)

vs 3Q16

Inc/(Dec)

vs 4Q15

4Q16

Net Interest Income

Noninterest Income1

Provision for Credit Losses

Noninterest Expense2

Income Tax Expense

Segment Net Income

Highlighted Metrics

4Q16 Like

$ 203

-

86

51

25

$ 41

Retail Loan Production5

Loan Yield

Operating Margin3

Net Charge-offs

$ 2.8

6.49%

74.9%

2.01%

167.9%

(0.08)%

0.4%

0.00%

1 Noninterest Income includes intersegment net referral fees

2 Noninterest Expense includes amortization of intangibles and allocated corporate expense

3 Operating margin is calculated as net income before taxes and provision for credit losses divided by total revenues

($ in billions)

Link4

29.3%

(0.14)%

1.1%

0.07%

Change

Dealer Financial Services Segment

Prime auto retail production in dealer network

increased $73 million or 14.9% over 3Q16

Prime auto enhanced by $1.9 billion portfolio

acquisition in November

Regional Acceptance generated solid loan growth

10.5% loan growth vs. 3Q164 and 10.1% vs. 4Q15

Origination terms stable, maximum term of 72 months

Program changes over last two years steadily reduced

the maximum permitted origination LTV

Regional Acceptance’s credit results continue to be

within our credit risk appetite

Default, delinquency and nonaccrual rates all declined

from 4Q15

4Q16 net charge-off rate increased due to normal

seasonality

$ 13

(1)

10

1

-

$ 1

$ 11

-

9

2

-

$ -

4 Linked quarter growth rates annualized except for production, sales and credit metrics

5 Retail loan production includes portfolio acquisitions

17

Provides specialty lending including: commercial finance, mortgage warehouse lending, tax-exempt governmental finance, equipment

leasing, commercial mortgage banking, insurance premium finance, dealer-based equipment financing, and direct consumer finance

Comments ($ in millions)

Inc/(Dec)

vs 3Q16

Inc/(Dec)

vs 4Q15

4Q16

Net Interest Income

Noninterest Income1

Provision for Credit Losses

Noninterest Expense2

Income Tax Expense

Segment Net Income

Highlighted Metrics

4Q16 Like

$ 120

76

12

113

16

$ 55

$ (2)

(7)

(11)

16

(5)

$ (9)

$ 7

5

-

25

(5)

$ (8)

($ in billions)

Loan Originations

Loan Yield

Operating Margin3

Net Charge-offs

$ 4.8

4.53%

42.4%

0.33%

2.9%

(0.32%)

(9.8%)

0.03%

1 Noninterest Income includes intersegment net referral fees

2 Noninterest Expense includes amortization of intangibles and allocated corporate expense

3 Operating margin is calculated as net income before taxes and provision for credit losses divided by total revenues

4 Linked quarter growth rates annualized except for production, sales and credit metrics

(8.7%)

(0.07%)

(10.3%)

(0.10%)

Link4

Change5

Specialized Lending Segment

5 During the first quarter of 2016, the Asset-Based Lending Group was moved to Community Banking, and Supply-Chain

Lending was moved to the Financial Services segment. Prior period amounts have been retrospectively adjusted for

these transfers

Specialized Lending continues to benefit from

strong seasonal loan growth and production.

Average loans up 5.4% compared to 3Q164 and

up 16.1% compared to 4Q15

Premium Finance

- 10.8% loan growth vs. 4Q15

- 13.4% production growth vs. 4Q15

Sheffield

- 12.1% loan growth vs. 4Q15

- 5.4% production growth vs. 4Q15

Equipment Finance

- 12.7% loan growth vs. 4Q15

- 10.4% production growth vs. 4Q15

Noninterest expense increase over Q316 driven

primarily by asset write downs in the Equipment

Finance operating lease portfolio

Grandbridge realized strong mortgage banking

income

4Q16 up 21.5% compared to 4Q15

18

Comments ($ in millions)

Inc/(Dec)

vs 3Q16

Inc/(Dec)

4Q15

4Q16

Net Interest Income

Noninterest Income1

Provision for Credit Losses

Noninterest Expense2

Income Tax Expense

Segment Net Income

Highlighted Metrics

Noninterest Income

Total Agencies3

EBITDA Margin5

4Q16 Like

Provides property and casualty, life, and health insurance to business and individual clients. It also provides workers compensation

and professional liability, as well as surety coverage and title insurance

$ 2

428

-

374

22

$ 34

$ -

16

-

(1)

6

$11

$ -

40

-

43

(1)

$ (2)

$ 428

224

17.7%

10.3%

27

(1.5%)

Change

15.4%

-

3.7%

Link4

($ in millions)

Insurance Holdings Segment

4 Linked quarter growth rates annualized except for production and sales

5 EBITDA margin is a measurement of operating profitability calculated by dividing pre-tax

net income adjusted to add back interest, depreciation, intangible amortization and merger-related

charges by total revenue

Commission and fee revenue growth of 10.9% vs.

4Q15:

1.2% for Retail Segment

21.2% for Wholesale Segment

Higher noninterest income and noninterest expense

vs. 4Q15 was primarily due to the addition of Swett

& Crawford

Higher noninterest income vs. 3Q16 primarily

reflects seasonality in commercial property and

casualty insurance

Year-to-date organic growth in commission and fee

revenue of 0.6% vs prior year

Experienced strong quarter over quarter and year-

to-date growth in Employee Benefits sales.

1 Noninterest Income includes intersegment net referral fees

2 Noninterest Expense includes amortization of intangibles, allocated corporate expense, and merger related charges

3 U.S. Locations; count includes shared locations

19

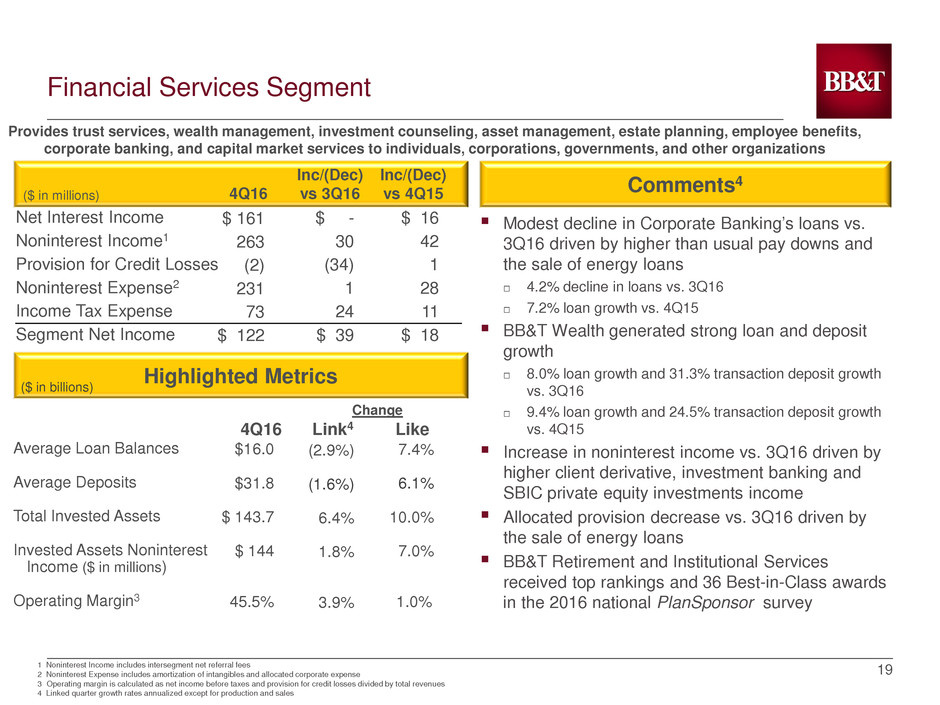

Provides trust services, wealth management, investment counseling, asset management, estate planning, employee benefits,

corporate banking, and capital market services to individuals, corporations, governments, and other organizations

Comments4 ($ in millions)

Inc/(Dec)

vs 3Q16

Inc/(Dec)

vs 4Q15

4Q16

Net Interest Income

Noninterest Income1

Provision for Credit Losses

Noninterest Expense2

Income Tax Expense

Segment Net Income

Highlighted Metrics

Average Loan Balances

Average Deposits

Total Invested Assets

Invested Assets Noninterest

Income ($ in millions)

Operating Margin3

4Q16 Like

$ 161

263

(2)

231

73

$ 122

$ -

30

(34)

1

24

$ 39

$ 16

42

1

28

11

$ 18

$16.0

$31.8

$ 143.7

$ 144

45.5%

1 Noninterest Income includes intersegment net referral fees

2 Noninterest Expense includes amortization of intangibles and allocated corporate expense

3 Operating margin is calculated as net income before taxes and provision for credit losses divided by total revenues

4 Linked quarter growth rates annualized except for production and sales

($ in billions)

Link4

(2.9%)

(1.6%)

6.4%

1.8%

3.9%

Change

7.4%

6.1%

10.0%

7.0%

1.0%

Financial Services Segment

Modest decline in Corporate Banking’s loans vs.

3Q16 driven by higher than usual pay downs and

the sale of energy loans

4.2% decline in loans vs. 3Q16

7.2% loan growth vs. 4Q15

BB&T Wealth generated strong loan and deposit

growth

8.0% loan growth and 31.3% transaction deposit growth

vs. 3Q16

9.4% loan growth and 24.5% transaction deposit growth

vs. 4Q15

Increase in noninterest income vs. 3Q16 driven by

higher client derivative, investment banking and

SBIC private equity investments income

Allocated provision decrease vs. 3Q16 driven by

the sale of energy loans

BB&T Retirement and Institutional Services

received top rankings and 36 Best-in-Class awards

in the 2016 national PlanSponsor survey

20

21

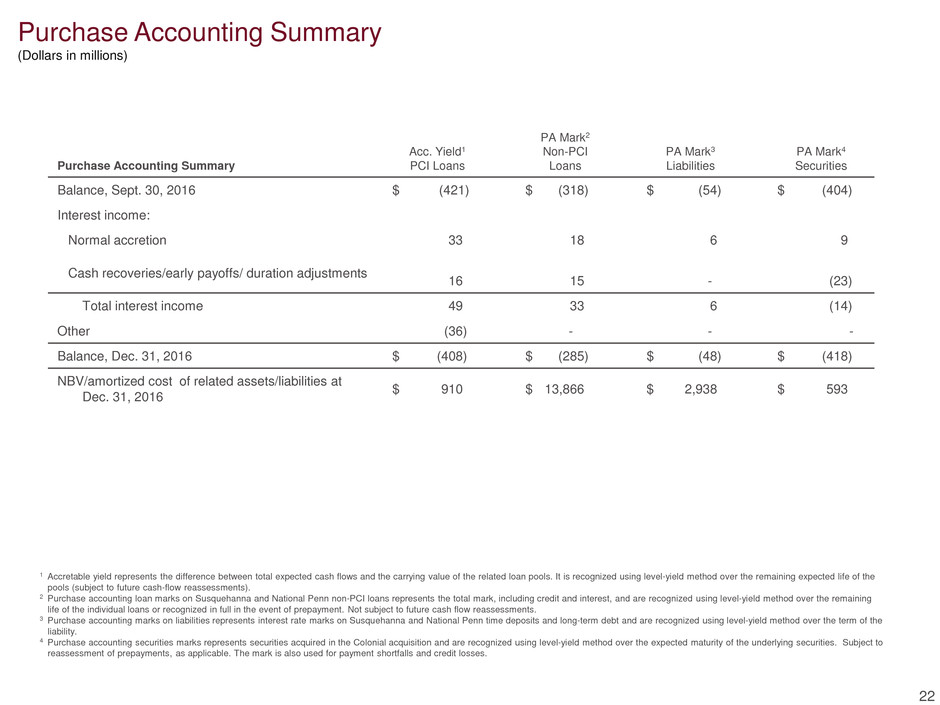

Purchase Accounting Summary

Acc. Yield1

PCI Loans

PA Mark2

Non-PCI

Loans

PA Mark3

Liabilities

PA Mark4

Securities

Balance, Sept. 30, 2016 $ (421) $ (318) $ (54) $ (404)

Interest income:

Normal accretion 33 18 6 9

Cash recoveries/early payoffs/ duration adjustments 16

15

-

(23)

Total interest income 49 33 6 (14)

Other (36) - - -

Balance, Dec. 31, 2016 $ (408) $ (285) $ (48) $ (418)

NBV/amortized cost of related assets/liabilities at

Dec. 31, 2016 $ 910 $ 13,866 $ 2,938 $ 593

1 Accretable yield represents the difference between total expected cash flows and the carrying value of the related loan pools. It is recognized using level-yield method over the remaining expected life of the

pools (subject to future cash-flow reassessments).

2 Purchase accounting loan marks on Susquehanna and National Penn non-PCI loans represents the total mark, including credit and interest, and are recognized using level-yield method over the remaining

life of the individual loans or recognized in full in the event of prepayment. Not subject to future cash flow reassessments.

3 Purchase accounting marks on liabilities represents interest rate marks on Susquehanna and National Penn time deposits and long-term debt and are recognized using level-yield method over the term of the

liability.

4 Purchase accounting securities marks represents securities acquired in the Colonial acquisition and are recognized using level-yield method over the expected maturity of the underlying securities. Subject to

reassessment of prepayments, as applicable. The mark is also used for payment shortfalls and credit losses.

Purchase Accounting Summary

(Dollars in millions)

22

Capital Measures1

(Dollars in millions, except per share data)

1 Current quarter regulatory capital is preliminary

23

As of / Quarter Ended

Dec. 31 Sept. 30 June 30 March 31 Dec. 31

2016 2016 2016 2016 2015

Selected Capital Information

Risk-based capital:

Common equity tier 1 $ 18,050 $ 17,824 $ 17,568 $ 17,320 $ 17,081

Tier 1 21,102 20,876 20,620 20,373 19,682

Total 24,873 24,793 24,525 24,355 23,753

Risk-weighted assets 176,217 176,739 176,021 166,781 166,611

Average quarterly tangible assets 211,392 212,816 214,235 202,200 201,541

Risk-based capital ratios:

Common equity tier 1 10.2% 10.1% 10.0% 10.4% 10.3%

Tier 1 12.0 11.8 11.7 12.2 11.8

Total 14.1 14.0 13.9 14.6 14.3

Leverage capital ratio 10.0 9.8 9.6 10.1 9.8

Equity as a percentage of total assets 13.6 13.5 13.4 13.3 13.0

Common equity per common share $ 33.14 $ 33.27 $ 32.72 $ 32.14 $ 31.66

Non-GAAP Reconciliations

24

(Dollars in millions, except per share data)

1

Tangible common equity is a non-GAAP measure. BB&T's management uses these measures to assess the quality of capital and believes that investors may find them useful in their analysis of the Corporation.

These capital measures are not necessarily comparable to similar capital measures that may be presented by other companies.

Calculations of tangible common equity and related measures1:

Total shareholders' equity $ 29,926 $ 30,091 $ 29,743 $ 28,239 $ 27,340

Less:

Preferred stock 3,053 3,053 3,053 3,054 2,603

Noncontrolling interests 45 39 39 39 34

Intangible assets 10,492 10,519 10,567 9,215 9,234

Tangible common equity $ 16,336 $ 16,480 $ 16,084 $ 15,931 $ 15,469

Outstanding shares at end of period (in thousands) 809,475 811,424 814,500 782,379 780,337

Tangible common equity per common share $ 20.18 $ 20.31 $ 19.75 $ 20.36 $ 19.82

As of / Quarter Ended

Dec. 31 Sept. 30 June 30 March 31 Dec. 31

2016 2016 2016 2016 2015

Non-GAAP Reconciliations1

25

1 BB&T’s management uses these measures in their analysis of the Corporation’s performance and believes these measures provide a greater understanding of ongoing operations and enhance

comparability of results with prior periods, as well as demonstrating the effects of significant gains and charges.

2 Revenue is defined as net interest income plus noninterest income

Quarter Ended

Dec. 31 Sept. 30 June 30 March 31 Dec. 31

Efficiency Ratio (1) 2016 2016 2016 2016 2015

Efficiency Ratio Numerator - Noninterest Expense - GAAP $ 1,668 $ 1,711

$ 1,797 $ 1,545 $ 1,597

Amortization of intangibles (38) (38) (42) (32) (32)

Merger-related and restructuring charges, net (13) (43) (92) (23) (50)

Gain (loss) on early extinguishment of debt - -

- 1 -

Mortgage reserve adjustments 31 - - - -

Charitable contribution - (50) - - -

Settlement of FHA-insured loan matters and related recovery - 73

- - -

Efficiency Ratio Numerator - Adjusted $ 1,648 $ 1,653

$ 1,663 $ 1,491 $ 1,515

Efficiency Ratio Denominator – Revenue2 – GAAP $ 2,727 $ 2,774

$ 2,747 $ 2,545 $ 2,519

Taxable equivalent adjustment 41 40

40 39 38

Securities (gains) losses, net (1) -

- (45) -

Efficiency Ratio Denominator - Adjusted $ 2,767 $ 2,814

$ 2,787

$ 2,539

$ 2,557

Efficiency Ratio - GAAP 61.1 % 61.7 % 65.4 % 60.7 % 63.4 %

Efficiency Ratio - Adjusted 59.5 58.7 59.6 58.8 59.2

(Dollars in millions)

26

1 BB&T’s management believes investors use this measure to evaluate the return on average common shareholders’ equity without the impact of intangible assets and their related amortization.

Non-GAAP Reconciliations1

(Dollars in millions)

Quarter Ended

Dec. 31 Sept. 30 June 30 March 31 Dec. 31

Return on Average Tangible Common Shareholders' Equity 2016 2016 2016 2016 2015

Net income available to common shareholders $ 592 $ 599 $ 541 $ 527 $ 502

Plus:

Amortization of intangibles, net of tax 24 24 26 20 21

Tangible net income available to common shareholders $ 616 $ 623 $ 567 $ 547 $ 523

Average common shareholders' equity $ 26,962 $ 26,824 $ 26,519 $ 25,076 $ 24,736

Less:

Average intangible assets 10,508 10,545 10,574 9,226 9,224

Average tangible common shareholders' equity $ 16,454 $ 16,279 $ 15,945 $ 15,850 $ 15,512

Return on Average Tangible Common Shareholders' Equity 14.91% 15.20% 14.33% 13.87% 13.37%

Dec. 31 Sept. 31 June 30 March 31 Dec. 31

2016 2016 2016 2016 2015

Net interest income - GAAP $ 1,565 $ 1,610 $ 1,617 $ 1,529 $ 1,504

Taxable-equivalent adjustment

41

40

40

39

38

Net interest income - taxable-equivalent $ 1,606 $ 1,650 $ 1,657 $ 1,568 $ 1,542

Interest income - PCI loans (49) (52) (48) (59) (56)

Accretion of mark on Susquehanna and National Penn non-PCI loans (33) (40) (42) (28) (30)

Accretion of mark on Susquehanna and National Penn liabilities (6) (7) (9) (8) (9)

Accretion of mark on securities acquired from FDIC 14 (8) (21) (18) (7)

Net interest income - Core $ 1,532 $ 1,543 $ 1,538 $ 1,455 $ 1,439

Earning assets - GAAP 192,574 193,909 194,822 183,612 183,151

Average balance - PCI loans (974) (1,052) (1,130) (1,098) (1,070)

Average balance of mark on Susquehanna and National Penn non-PCI loans 300 335 345 274 437

Average balance of mark on securities acquired from FDIC 402 408 424 441 448

Earning assets - Core $ 192,302 $ 193,601 $ 94,461 $183,230 $ 182,967

Annualized net interest margin

Reported 3.32% 3.39% 3.41% 3.43% 3.35%

Core 3.18 3.18 3.17 3.19 3.13

Non-GAAP Reconciliations1,2

Core net interest margin is a non-GAAP measure that adjusts net interest margin to exclude the impact of interest income and funding costs associated with loans and securities acquired in the Colonial acquisition and

PCI loans acquired from Susquehanna and National Penn. Core net interest margin is also adjusted to remove the purchase accounting marks and related amortization for non-PCI loans, deposits and long-term debt

acquired from Susquehanna and National Penn. BB&T's management believes that the adjustments to the calculation of net interest margin for certain assets and deposits acquired provide investors with useful

information related to the performance of BB&T's earning assets.

Amounts may not sum due to rounding

1

Quarter Ended

27

(Dollars in millions)

2