Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ERICKSON INC. | novmorsubmission.htm |

Monthly Operating Report

JUDGE:

UNITED STATES BANKRUPTCY COURT

NORTHERN & EASTERN DISTRICTS OF TEXAS

REGION 6

MONTHLY OPERATING REPORT

MONTH ENDING: November 2016

MONTH YEAR

IN ACCORDANCE WITH TITLE 28, SECTION 1746, OF THE UNITED STATES CODE, I DECLARE UNDER

PENALTY OF PERJURY THAT I HAVE EXAMINED THE FOLLOWING MONTHLY OPERATING REPORT

(ACCRUAL BASIS-1 THROUGH ACCRUAL BASIS-7) AND THE ACCOMPANYING ATTACHMENTS AND,

TO THE BEST OF MY KNOWLEDGE, THESE DOCUMENTS ARE TRUE, CORRECT, AND COMPLETE.

DECLARATION OF THE PREPARER (OTHER THAN RESPONSIBLE PARTY) IS BASED ON ALL

INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

RESPONSIBLE PARTY:

ORIGINAL SIGNATURE OF RESPONSIBLE PARTY

PRINTED NAME OF RESPONSIBLE PARTY

PREPARER:

ORIGINAL SIGNATURE OF PREPARER

PRINTED NAME OF PREPARER

Harlin D. Hale

ACCRUAL BASIS

CASE NAME: Erickson Incorporated

CASE NUMBER: 16-34393

DATE

/s/ David Lancelot Chief Restructuring Officer

TITLE

David Lancelot 12/30/2016

DATE

/s/ Craig Eastwood Controller

TITLE

Craig Eastwood 12/30/2016

GENERAL NOTES:

• This Monthly Operating Report (the “MOR”) has been filed on a deconsolidated basis for Erickson

Incorporated (7561); EAC Acquisition Corporation (3733); Erickson Helicopters, Inc. (5052);

Erickson Transport, Inc. (9162); Evergreen Helicopters International, Inc. (1311); Evergreen Equity,

Inc. (9209); and Evergreen Unmanned Systems, Inc. (3961) (collectively, the “Debtors”). The

Debtors do not maintain separate financial books and records for Debtors EAC Acquisition

Corporation, Erickson Transport, Inc., Evergreen Helicopters International, Inc., Evergreen Equity,

Inc., and Evergreen Unmanned Systems, Inc. Financial activity for all Debtors, including all

disbursements made by the Debtors, is aggregated and reported in the books and records of Erickson

Incorporated and Erickson Helicopters, Inc. The Debtors have reported information in the MOR as it

is maintained in their books and records. On November 8, 2016, each of the Debtors filed a voluntary

petition with the United States Bankruptcy Court for the Northern District of Texas for reorganization

relief under chapter 11 of title 11 of the United States Code. The cases were consolidated for

procedural purposes only under Case No. 16-34393.

• The Company cautions investors and potential investors not to place undue reliance upon the

information contained in the Monthly Operating Report which was not prepared for the purpose of

providing the basis for an investment decision relating to any of the securities of the Company. The

Monthly Operating Report is limited in scope, covers limited time periods, and has been prepared

solely for the purpose of complying with the monthly reporting requirements of the Bankruptcy

Court. The Monthly Operating Report was not audited or reviewed by independent accountants, was

not prepared in accordance with U.S. generally accepted accounting principles, is in a format

prescribed by applicable bankruptcy laws, and is subject to future adjustment and reconciliation.

There can be no assurance that, from the perspective of an investor or potential investor in the

Company’s securities, the Monthly Operating Report is complete. The Monthly Operating Report

also contains information for periods which are shorter and otherwise different from those required in

the Company’s periodic reports pursuant to the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and such information might not be indicative of the Company’s financial condition

or operating results for a period that would be reflected in the Company’s financial statements or in

its report pursuant to the Exchange Act. Information set forth in the Monthly Operating Report should

not be viewed as indicative of future results.

• The Debtors use a centralized cash management system. See the Cash Management motion filed on

November 9, 2016 [Docket No. 008] for a full description of the Debtors’ cash management system.

• For financial reporting purposes, the Debtors generally prepare consolidated financial statements. On

December 14, 2016, the Debtors filed their Schedules of Assets and Liabilities and the Statement of

Financial Affairs (the “Statements and Schedules”). As described in the global notes to the

Statements and Schedules and above, the Debtors do not maintain separate financial books and

records for certain Debtors. Information is reported in the MOR as it is maintained in the Debtors’

books and records, consistent with the Statements and Schedules.

• As noted in the global notes to the Statements and Schedules, Schedule AB information is based

largely on the Debtors’ October 31, 2016 trial balance. The Debtors have reported the ‘Schedule

Amount’ in the MOR based on the Debtors’ October 31, 2016 trial balance, however variances

between the Statements and Schedules and the MOR may exist. These variances are on account of,

among other things: recategorization of certain assets to more closely match Schedule AB questions,

and listing of certain values as ‘undetermined’ in Schedule AB and at book value in the MOR (e.g. IP,

Goodwill, etc).

• The MOR is not meant to be relied upon as a complete description of the Debtors, their businesses or

condition (financial or otherwise), or their results of operations, prospects, assets or liabilities. The

Debtors reserve all rights to revise this MOR. This MOR is not prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”). This MOR should be read in conjunction with

the previously filed financial statements and accompanying notes in the Company’s annual and

quarterly reports that are filed with the United States Securities and Exchange Commission. Certain

exceptions as listed below are not exhaustive of all non-GAAP compliance:

o The financial statements are unaudited and will not be subject to audit or review by the

Debtors’ external auditors at any time in the future and are subject to change.

o The MOR does not reflect all normal quarterly adjustments that are generally recorded by the

Debtor upon review of major accounts period to the end of each quarterly accounting period.

o Certain items presented in this MOR are not fully known or under research and may be

accounted for differently in future monthly reports. Please note:

Prepetition liabilities could materially increase in the future, on account of, among

others, potential rejection of certain aircraft and non-craft leases.

As previously disclosed in an 8-K filed on November 9th, 2016, the Company

advised investors not to rely on previously issued consolidated financial statements

for the years ended December 31, 2015 and 2014 and its quarterly financial

information for each of the quarterly and year-to-date periods ended March 31, June

30, and September 30, for the years 2015 and 2014, and the quarterly and year-to-

date periods ended March 31 and June 30, 2016, because of certain errors within the

financial statements. In the 8-K, the Company disclosed that it had discovered an

estimated $13.8 million understatement of current liabilities and return-to-service

expense as the net cumulative effect of these errors through June 30, 2016. The

Monthly Operating Reports being filed during bankruptcy will not include the full

amount of the Company’s Return-to-Service liability, primarily due to changes in the

status of many of the leases and related leased aircraft in question.

o The MOR does not include explanatory footnotes such as disclosures required under GAAP.

o The MOR is not presented in GAAP-based SEC reporting format.

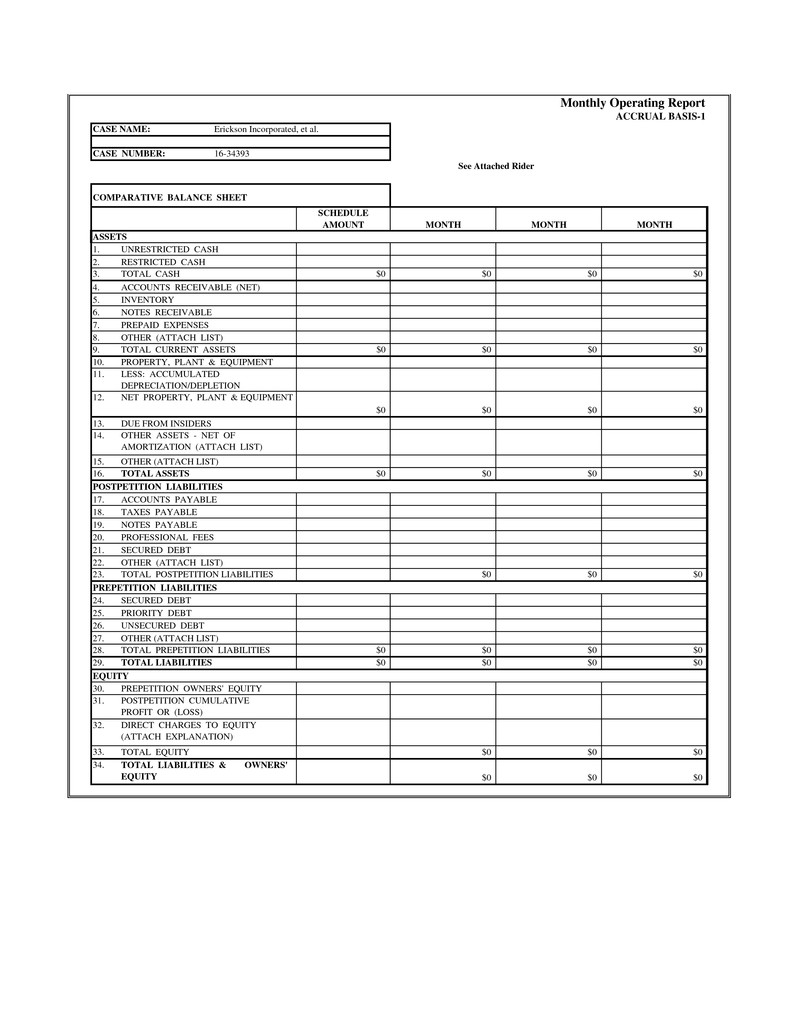

Monthly Operating Report

ACCRUAL BASIS-1

CASE NAME:

CASE NUMBER:

COMPARATIVE BALANCE SHEET

ASSETS

1.

2.

3. $0 $0 $0 $0

4.

5.

6.

7.

8.

9. TOTAL CURRENT ASSETS $0 $0 $0 $0

10. PROPERTY, PLANT & EQUIPMENT

11.

12.

$0 $0 $0 $0

13.

14.

15. OTHER (ATTACH LIST)

16. $0 $0 $0 $0

POSTPETITION LIABILITIES

17. ACCOUNTS PAYABLE

18.

19.

20.

21.

22.

23. TOTAL POSTPETITION LIABILITIES $0 $0 $0

PREPETITION LIABILITIES

24.

25.

26.

27. OTHER (ATTACH LIST)

28. TOTAL PREPETITION LIABILITIES $0 $0 $0 $0

29. TOTAL LIABILITIES $0 $0 $0 $0

EQUITY

30. PREPETITION OWNERS' EQUITY

31.

32.

33. $0 $0 $0

34.

$0 $0 $0

MONTH

Erickson Incorporated, et al.

16-34393

SCHEDULE

AMOUNT MONTH MONTH

LESS: ACCUMULATED

DEPRECIATION/DEPLETION

NET PROPERTY, PLANT & EQUIPMENT

DUE FROM INSIDERS

OTHER ASSETS - NET OF

AMORTIZATION (ATTACH LIST)

UNRESTRICTED CASH

RESTRICTED CASH

TOTAL CASH

ACCOUNTS RECEIVABLE (NET)

INVENTORY

NOTES RECEIVABLE

TOTAL LIABILITIES & OWNERS'

EQUITY

See Attached Rider

SECURED DEBT

PRIORITY DEBT

UNSECURED DEBT

POSTPETITION CUMULATIVE

PROFIT OR (LOSS)

DIRECT CHARGES TO EQUITY

(ATTACH EXPLANATION)

TOTAL EQUITY

TOTAL ASSETS

TAXES PAYABLE

NOTES PAYABLE

PROFESSIONAL FEES

SECURED DEBT

OTHER (ATTACH LIST)

PREPAID EXPENSES

OTHER (ATTACH LIST)

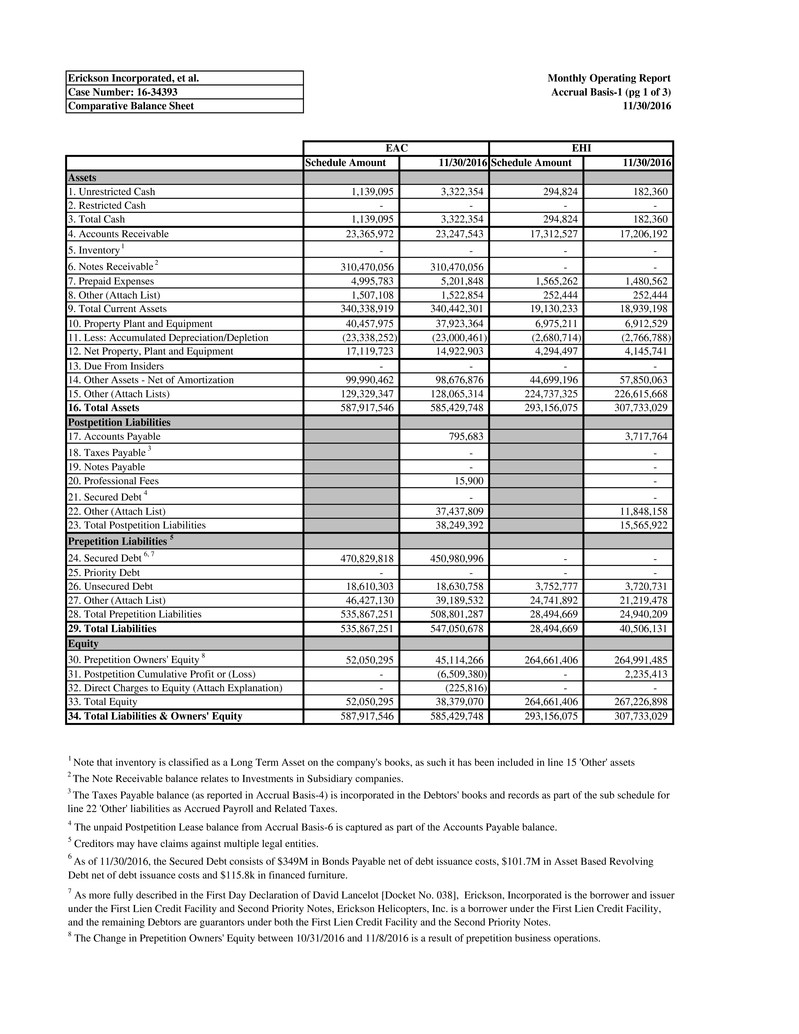

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-1 (pg 1 of 3)

Comparative Balance Sheet 11/30/2016

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Assets

1. Unrestricted Cash 1,139,095 3,322,354 294,824 182,360

2. Restricted Cash - - - -

3. Total Cash 1,139,095 3,322,354 294,824 182,360

4. Accounts Receivable 23,365,972 23,247,543 17,312,527 17,206,192

5. Inventory 1 - - - -

6. Notes Receivable 2 310,470,056 310,470,056 - -

7. Prepaid Expenses 4,995,783 5,201,848 1,565,262 1,480,562

8. Other (Attach List) 1,507,108 1,522,854 252,444 252,444

9. Total Current Assets 340,338,919 340,442,301 19,130,233 18,939,198

10. Property Plant and Equipment 40,457,975 37,923,364 6,975,211 6,912,529

11. Less: Accumulated Depreciation/Depletion (23,338,252) (23,000,461) (2,680,714) (2,766,788)

12. Net Property, Plant and Equipment 17,119,723 14,922,903 4,294,497 4,145,741

13. Due From Insiders - - - -

14. Other Assets - Net of Amortization 99,990,462 98,676,876 44,699,196 57,850,063

15. Other (Attach Lists) 129,329,347 128,065,314 224,737,325 226,615,668

16. Total Assets 587,917,546 585,429,748 293,156,075 307,733,029

Postpetition Liabilities

17. Accounts Payable 795,683 3,717,764

18. Taxes Payable 3 - -

19. Notes Payable - -

20. Professional Fees 15,900 -

21. Secured Debt 4 - -

22. Other (Attach List) 37,437,809 11,848,158

23. Total Postpetition Liabilities 38,249,392 15,565,922

Prepetition Liabilities 5

24. Secured Debt 6, 7 470,829,818 450,980,996 - -

25. Priority Debt - - - -

26. Unsecured Debt 18,610,303 18,630,758 3,752,777 3,720,731

27. Other (Attach List) 46,427,130 39,189,532 24,741,892 21,219,478

28. Total Prepetition Liabilities 535,867,251 508,801,287 28,494,669 24,940,209

29. Total Liabilities 535,867,251 547,050,678 28,494,669 40,506,131

Equity

30. Prepetition Owners' Equity 8 52,050,295 45,114,266 264,661,406 264,991,485

31. Postpetition Cumulative Profit or (Loss) - (6,509,380) - 2,235,413

32. Direct Charges to Equity (Attach Explanation) - (225,816) - -

33. Total Equity 52,050,295 38,379,070 264,661,406 267,226,898

34. Total Liabilities & Owners' Equity 587,917,546 585,429,748 293,156,075 307,733,029

2 The Note Receivable balance relates to Investments in Subsidiary companies.

4 The unpaid Postpetition Lease balance from Accrual Basis-6 is captured as part of the Accounts Payable balance.

5 Creditors may have claims against multiple legal entities.

8 The Change in Prepetition Owners' Equity between 10/31/2016 and 11/8/2016 is a result of prepetition business operations.

3 The Taxes Payable balance (as reported in Accrual Basis-4) is incorporated in the Debtors' books and records as part of the sub schedule for

line 22 'Other' liabilities as Accrued Payroll and Related Taxes.

7 As more fully described in the First Day Declaration of David Lancelot [Docket No. 038], Erickson, Incorporated is the borrower and issuer

under the First Lien Credit Facility and Second Priority Notes, Erickson Helicopters, Inc. is a borrower under the First Lien Credit Facility,

and the remaining Debtors are guarantors under both the First Lien Credit Facility and the Second Priority Notes.

EAC EHI

1 Note that inventory is classified as a Long Term Asset on the company's books, as such it has been included in line 15 'Other' assets

6 As of 11/30/2016, the Secured Debt consists of $349M in Bonds Payable net of debt issuance costs, $101.7M in Asset Based Revolving

Debt net of debt issuance costs and $115.8k in financed furniture.

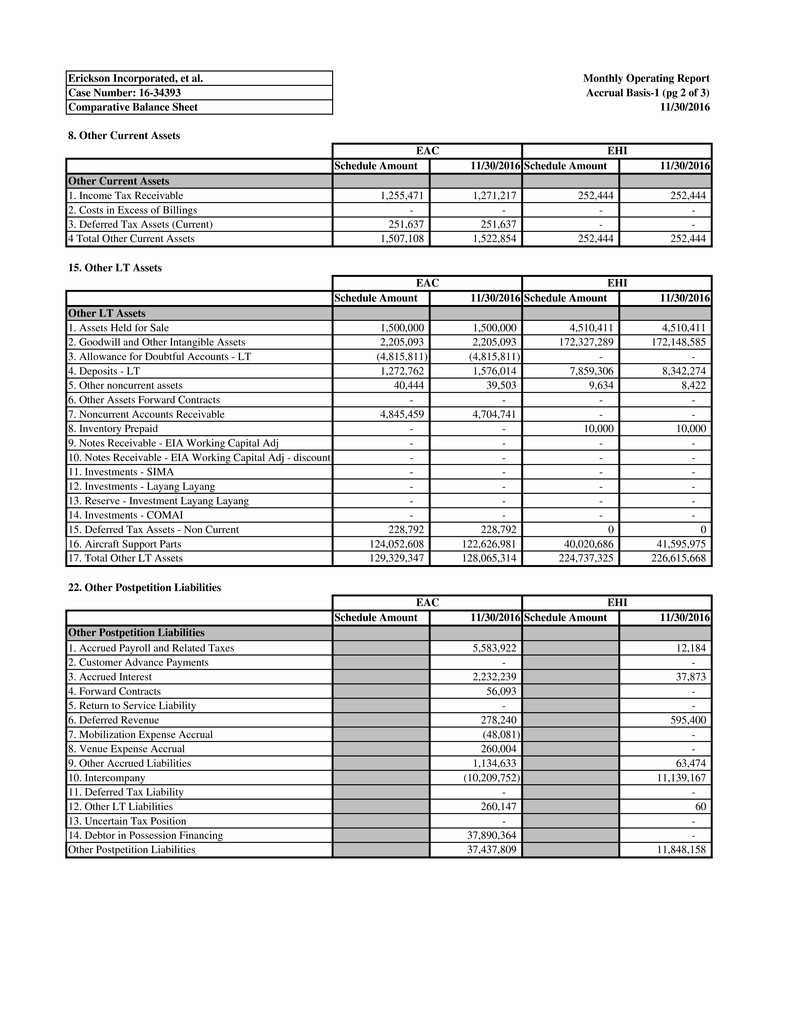

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-1 (pg 2 of 3)

Comparative Balance Sheet 11/30/2016

8. Other Current Assets

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Current Assets

1. Income Tax Receivable 1,255,471 1,271,217 252,444 252,444

2. Costs in Excess of Billings - - - -

3. Deferred Tax Assets (Current) 251,637 251,637 - -

4 Total Other Current Assets 1,507,108 1,522,854 252,444 252,444

15. Other LT Assets

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other LT Assets

1. Assets Held for Sale 1,500,000 1,500,000 4,510,411 4,510,411

2. Goodwill and Other Intangible Assets 2,205,093 2,205,093 172,327,289 172,148,585

3. Allowance for Doubtful Accounts - LT (4,815,811) (4,815,811) - -

4. Deposits - LT 1,272,762 1,576,014 7,859,306 8,342,274

5. Other noncurrent assets 40,444 39,503 9,634 8,422

6. Other Assets Forward Contracts - - - -

7. Noncurrent Accounts Receivable 4,845,459 4,704,741 - -

8. Inventory Prepaid - - 10,000 10,000

9. Notes Receivable - EIA Working Capital Adj - - - -

10. Notes Receivable - EIA Working Capital Adj - discount - - - -

11. Investments - SIMA - - - -

12. Investments - Layang Layang - - - -

13. Reserve - Investment Layang Layang - - - -

14. Investments - COMAI - - - -

15. Deferred Tax Assets - Non Current 228,792 228,792 0 0

16. Aircraft Support Parts 124,052,608 122,626,981 40,020,686 41,595,975

17. Total Other LT Assets 129,329,347 128,065,314 224,737,325 226,615,668

22. Other Postpetition Liabilities

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Postpetition Liabilities

1. Accrued Payroll and Related Taxes 5,099.36 5,583,922 10.17 12,184

2. Customer Advance Payments - - - -

3. Accrued Interest 15,934.65 2,232,239 47.75 37,873

4. Forward Contracts 112.52 56,093 - -

5. Return to Service Liability - - 900.00 -

6. Deferred Revenue 627.27 278,240 - 595,400

7. Mobilization Expense Accrual 1,520.65 (48,081) 75.00 -

8. Venue Expense Accrual 88.20 260,004 - -

9. Other Accrued Liabilities 10,621.81 1,134,633 4,860.60 63,474

10. Intercompany (14,368.65) (10,209,752) (4,636.14) 11,139,167

11. Deferred Tax Liability 2,024.46 - - -

12. Other LT Liabilities 10,454.53 260,147 7,275.12 60

13. Uncertain Tax Position 1,171.99 - - -

14. Debtor in Possession Financing 37,890,364 - -

Other Postpetition Liabilities 33,286.79 37,437,809 8,532.50 11,848,158

EAC EHI

EAC EHI

EAC EHI

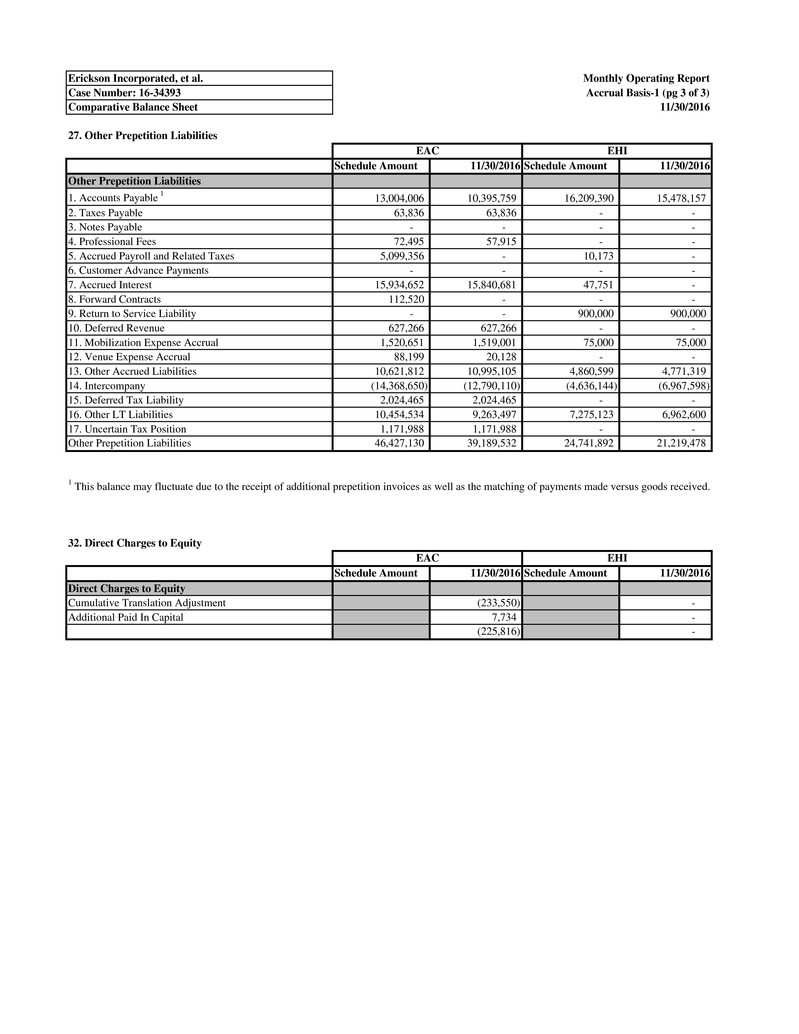

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-1 (pg 3 of 3)

Comparative Balance Sheet 11/30/2016

27. Other Prepetition Liabilities

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Prepetition Liabilities

1. Accounts Payable 1 13,004,006 10,395,759 16,209,390 15,478,157

2. Taxes Payable 63,836 63,836 - -

3. Notes Payable - - - -

4. Professional Fees 72,495 57,915 - -

5. Accrued Payroll and Related Taxes 5,099,356 - 10,173 -

6. Customer Advance Payments - - - -

7. Accrued Interest 15,934,652 15,840,681 47,751 -

8. Forward Contracts 112,520 - - -

9. Return to Service Liability - - 900,000 900,000

10. Deferred Revenue 627,266 627,266 - -

11. Mobilization Expense Accrual 1,520,651 1,519,001 75,000 75,000

12. Venue Expense Accrual 88,199 20,128 - -

13. Other Accrued Liabilities 10,621,812 10,995,105 4,860,599 4,771,319

14. Intercompany (14,368,650) (12,790,110) (4,636,144) (6,967,598)

15. Deferred Tax Liability 2,024,465 2,024,465 - -

16. Other LT Liabilities 10,454,534 9,263,497 7,275,123 6,962,600

17. Uncertain Tax Position 1,171,988 1,171,988 - -

Other Prepetition Liabilities 46,427,130 39,189,532 24,741,892 21,219,478

32. Direct Charges to Equity

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Direct Charges to Equity

Cumulative Translation Adjustment (233,550) -

Additional Paid In Capital 7,734 -

0 (225,816) 0 -

EAC EHI

1 This balance may fluctuate due to the receipt of additional prepetition invoices as well as the matching of payments made versus goods received.

EAC EHI

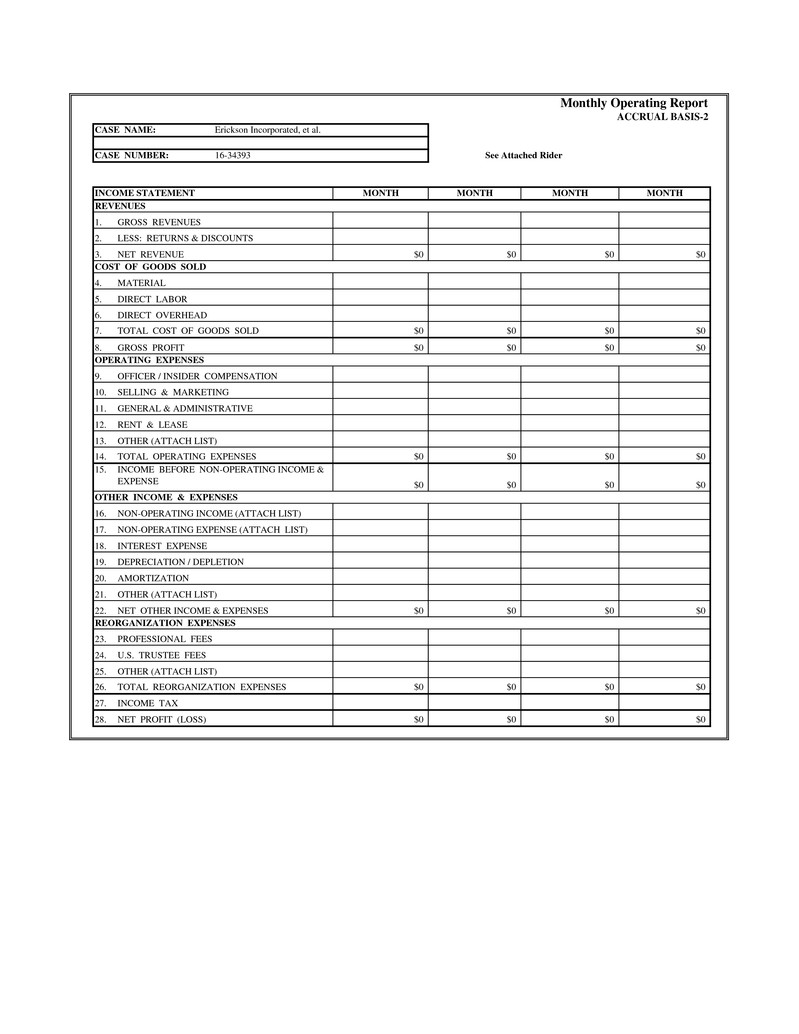

Monthly Operating Report

ACCRUAL BASIS-2

CASE NAME:

CASE NUMBER:

INCOME STATEMENT MONTH MONTH MONTH MONTH

REVENUES

1.

2.

3. $0 $0 $0 $0

COST OF GOODS SOLD

4.

5.

6.

7. $0 $0 $0 $0

8. $0 $0 $0 $0

OPERATING EXPENSES

9.

10.

11.

12.

13.

14. $0 $0 $0 $0

15.

$0 $0 $0 $0

OTHER INCOME & EXPENSES

16.

17. NON-OPERATING EXPENSE (ATTACH LIST)

18.

19.

20.

21.

22. $0 $0 $0 $0

REORGANIZATION EXPENSES

23.

24.

25.

26. $0 $0 $0 $0

27.

28. $0 $0 $0 $0

Erickson Incorporated, et al.

16-34393

GROSS REVENUES

LESS: RETURNS & DISCOUNTS

NET REVENUE

NET OTHER INCOME & EXPENSES

PROFESSIONAL FEES

GENERAL & ADMINISTRATIVE

RENT & LEASE

OTHER (ATTACH LIST)

TOTAL OPERATING EXPENSES

INCOME BEFORE NON-OPERATING INCOME &

EXPENSE

NON-OPERATING INCOME (ATTACH LIST)

See Attached Rider

INTEREST EXPENSE

DEPRECIATION / DEPLETION

AMORTIZATION

OTHER (ATTACH LIST)

DIRECT LABOR

DIRECT OVERHEAD

TOTAL COST OF GOODS SOLD

GROSS PROFIT

OFFICER / INSIDER COMPENSATION

SELLING & MARKETING

MATERIAL

U.S. TRUSTEE FEES

OTHER (ATTACH LIST)

TOTAL REORGANIZATION EXPENSES

INCOME TAX

NET PROFIT (LOSS)

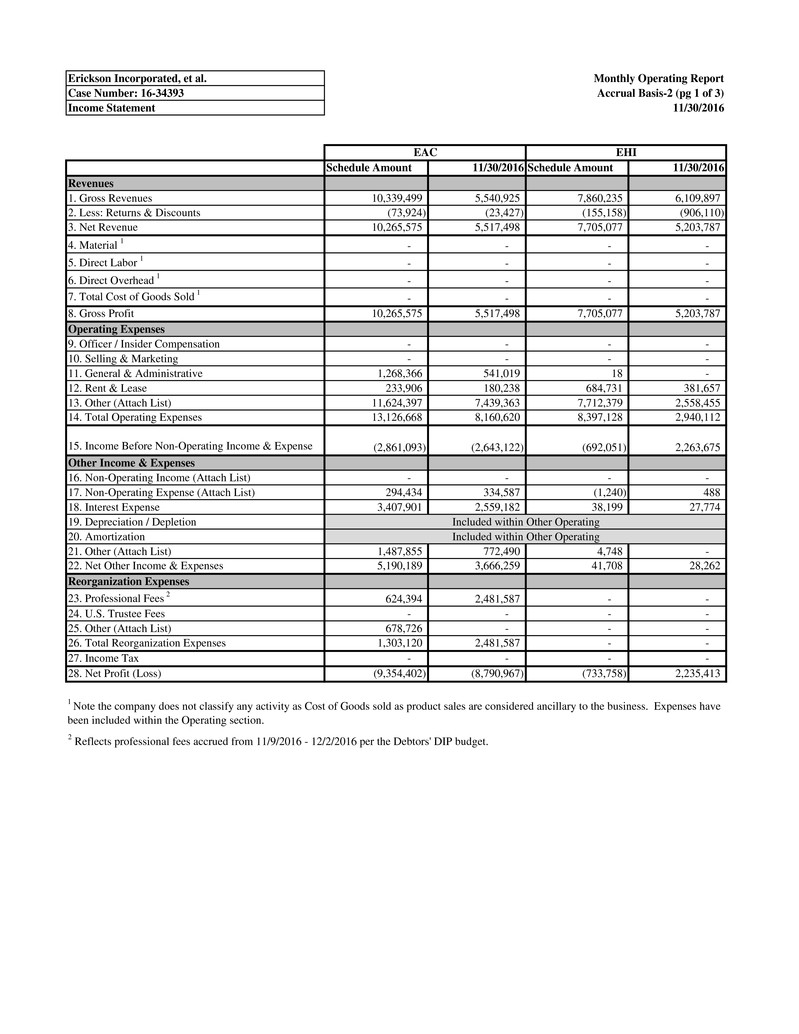

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-2 (pg 1 of 3)

Income Statement 11/30/2016

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Revenues

1. Gross Revenues 10,339,499 5,540,925 7,860,235 6,109,897

2. Less: Returns & Discounts (73,924) (23,427) (155,158) (906,110)

3. Net Revenue 10,265,575 5,517,498 7,705,077 5,203,787

4. Material 1 - - - -

5. Direct Labor 1 - - - -

6. Direct Overhead 1 - - - -

7. Total Cost of Goods Sold 1 - - - -

8. Gross Profit 10,265,575 5,517,498 7,705,077 5,203,787

Operating Expenses

9. Officer / Insider Compensation - - - -

10. Selling & Marketing - - - -

11. General & Administrative 1,268,366 541,019 18 -

12. Rent & Lease 233,906 180,238 684,731 381,657

13. Other (Attach List) 11,624,397 7,439,363 7,712,379 2,558,455

14. Total Operating Expenses 13,126,668 8,160,620 8,397,128 2,940,112

15. Income Before Non-Operating Income & Expense (2,861,093) (2,643,122) (692,051) 2,263,675

Other Income & Expenses

16. Non-Operating Income (Attach List) - - - -

17. Non-Operating Expense (Attach List) 294,434 334,587 (1,240) 488

18. Interest Expense 3,407,901 2,559,182 38,199 27,774

19. Depreciation / Depletion

20. Amortization

21. Other (Attach List) 1,487,855 772,490 4,748 -

22. Net Other Income & Expenses 5,190,189 3,666,259 41,708 28,262

Reorganization Expenses

23. Professional Fees 2 624,394 2,481,587 - -

24. U.S. Trustee Fees - - - -

25. Other (Attach List) 678,726 - - -

26. Total Reorganization Expenses 1,303,120 2,481,587 - -

27. Income Tax - - - -

28. Net Profit (Loss) (9,354,402) (8,790,967) (733,758) 2,235,413

2 Reflects professional fees accrued from 11/9/2016 - 12/2/2016 per the Debtors' DIP budget.

EAC EHI

Included within Other Operating

Included within Other Operating

1 Note the company does not classify any activity as Cost of Goods sold as product sales are considered ancillary to the business. Expenses have

been included within the Operating section.

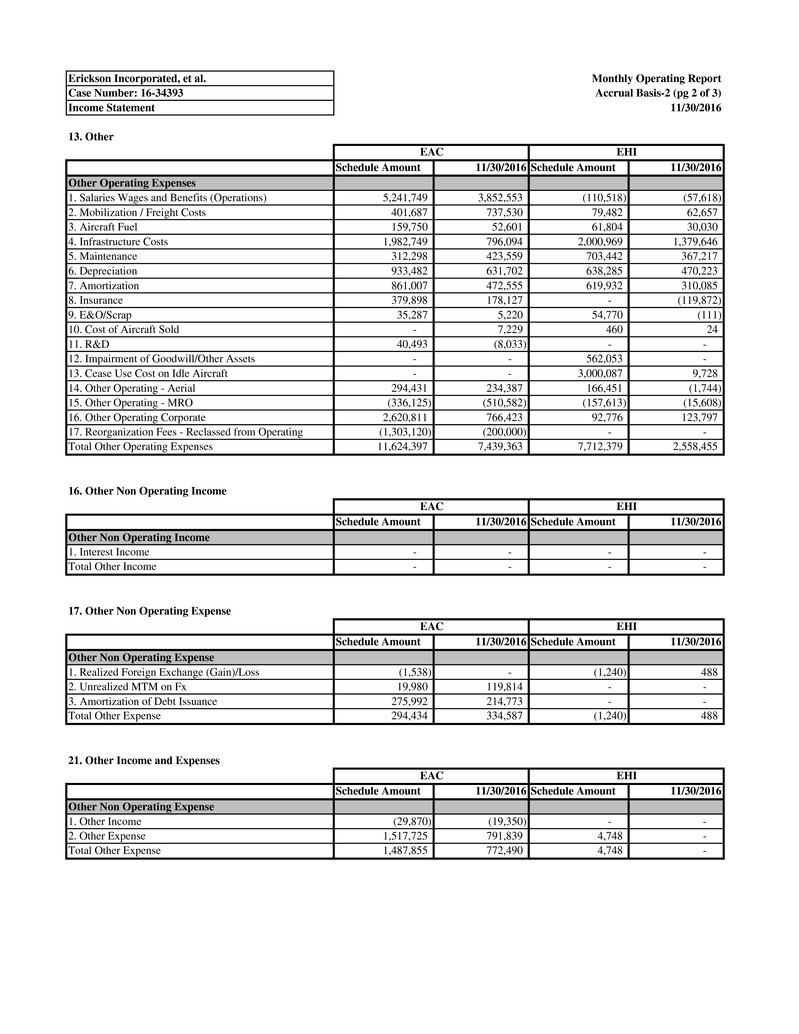

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-2 (pg 2 of 3)

Income Statement 11/30/2016

13. Other

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Operating Expenses

1. Salaries Wages and Benefits (Operations) 5,241,749 3,852,553 (110,518) (57,618)

2. Mobilization / Freight Costs 401,687 737,530 79,482 62,657

3. Aircraft Fuel 159,750 52,601 61,804 30,030

4. Infrastructure Costs 1,982,749 796,094 2,000,969 1,379,646

5. Maintenance 312,298 423,559 703,442 367,217

6. Depreciation 933,482 631,702 638,285 470,223

7. Amortization 861,007 472,555 619,932 310,085

8. Insurance 379,898 178,127 - (119,872)

9. E&O/Scrap 35,287 5,220 54,770 (111)

10. Cost of Aircraft Sold - 7,229 460 24

11. R&D 40,493 (8,033) - -

12. Impairment of Goodwill/Other Assets - - 562,053 -

13. Cease Use Cost on Idle Aircraft - - 3,000,087 9,728

14. Other Operating - Aerial 294,431 234,387 166,451 (1,744)

15. Other Operating - MRO (336,125) (510,582) (157,613) (15,608)

16. Other Operating Corporate 2,620,811 766,423 92,776 123,797

17. Reorganization Fees - Reclassed from Operating (1,303,120) (200,000) - -

Total Other Operating Expenses 11,624,397 7,439,363 7,712,379 2,558,455

16. Other Non Operating Income

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Non Operating Income

1. Interest Income - - - -

Total Other Income - - - -

17. Other Non Operating Expense

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Non Operating Expense

1. Realized Foreign Exchange (Gain)/Loss (1,538) - (1,240) 488

2. Unrealized MTM on Fx 19,980 119,814 - -

3. Amortization of Debt Issuance 275,992 214,773 - -

Total Other Expense 294,434 334,587 (1,240) 488

21. Other Income and Expenses

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Non Operating Expense

1. Other Income (29,870) (19,350) - -

2. Other Expense 1,517,725 791,839 4,748 -

Total Other Expense 1,487,855 772,490 4,748 -

EAC EHI

EAC EHI

EAC EHI

EAC EHI

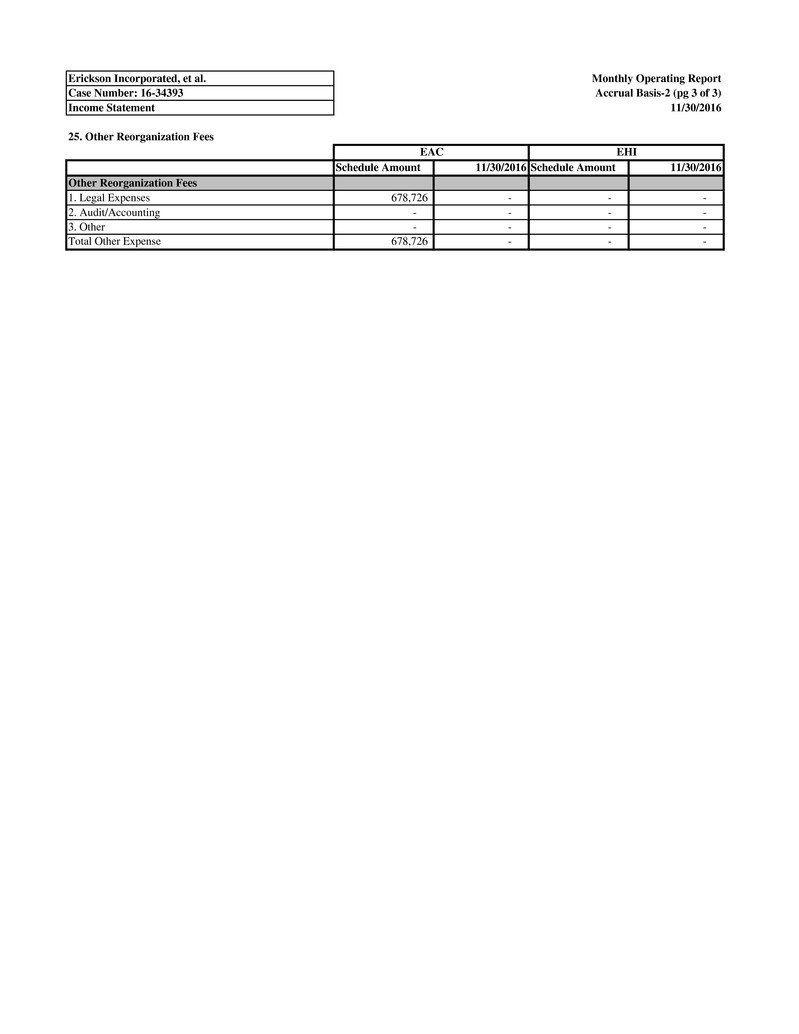

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-2 (pg 3 of 3)

Income Statement 11/30/2016

25. Other Reorganization Fees

Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

Other Reorganization Fees

1. Legal Expenses 678,726 - - -

2. Audit/Accounting - - - -

3. Other - - - -

Total Other Expense 678,726 - - -

EAC EHI

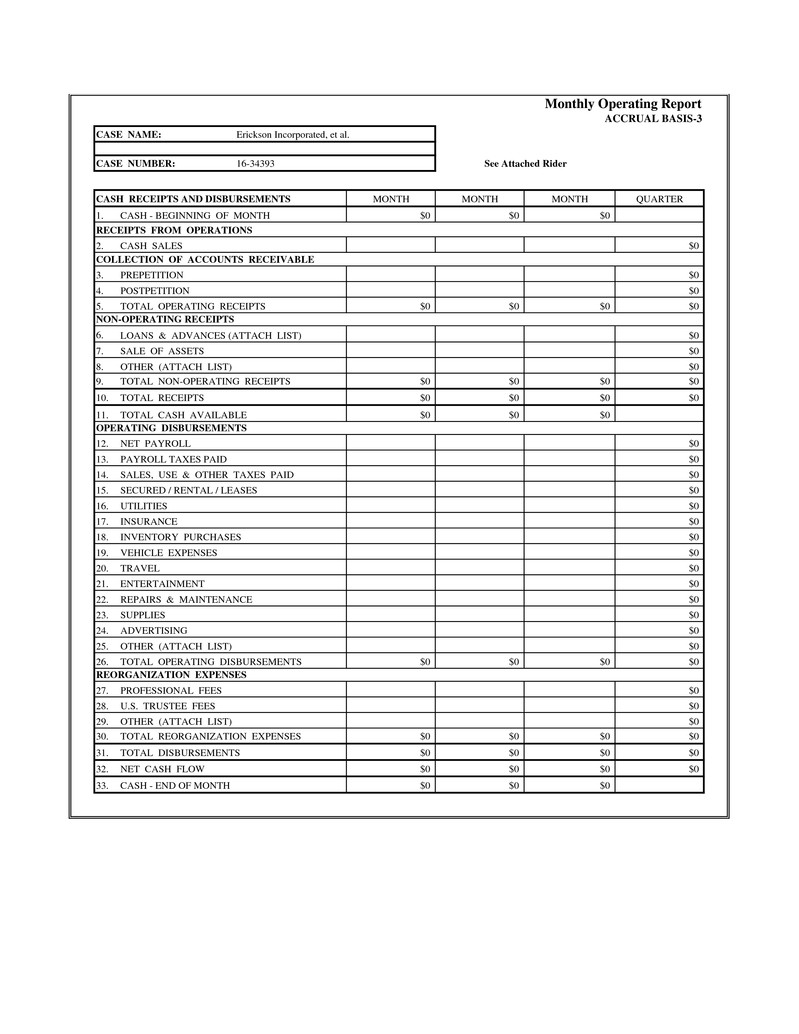

Monthly Operating Report

ACCRUAL BASIS-3

CASE NAME:

CASE NUMBER:

CASH RECEIPTS AND DISBURSEMENTS MONTH MONTH MONTH QUARTER

1. $0 $0 $0

RECEIPTS FROM OPERATIONS

2. $0

3. $0

4. $0

5. $0 $0 $0 $0

NON-OPERATING RECEIPTS

6. $0

7. $0

8. $0

9. $0 $0 $0 $0

10. $0 $0 $0 $0

11. $0 $0 $0

OPERATING DISBURSEMENTS

12. $0

13. $0

14. $0

15. $0

16. $0

17. $0

18. $0

19. $0

20. $0

21. $0

22. $0

23. $0

24. $0

25. $0

26. $0 $0 $0 $0

REORGANIZATION EXPENSES

27. $0

28. $0

29. $0

30. $0 $0 $0 $0

31. $0 $0 $0 $0

32. $0 $0 $0 $0

33. $0 $0 $0

PREPETITION

Erickson Incorporated, et al.

16-34393

CASH - BEGINNING OF MONTH

CASH SALES

COLLECTION OF ACCOUNTS RECEIVABLE

SECURED / RENTAL / LEASES

POSTPETITION

TOTAL OPERATING RECEIPTS

LOANS & ADVANCES (ATTACH LIST)

SALE OF ASSETS

OTHER (ATTACH LIST)

TOTAL NON-OPERATING RECEIPTS

NET CASH FLOW

CASH - END OF MONTH

REPAIRS & MAINTENANCE

SUPPLIES

ADVERTISING

OTHER (ATTACH LIST)

TOTAL OPERATING DISBURSEMENTS

PROFESSIONAL FEES

See Attached Rider

U.S. TRUSTEE FEES

OTHER (ATTACH LIST)

TOTAL REORGANIZATION EXPENSES

TOTAL DISBURSEMENTS

UTILITIES

INSURANCE

INVENTORY PURCHASES

VEHICLE EXPENSES

TRAVEL

ENTERTAINMENT

TOTAL RECEIPTS

TOTAL CASH AVAILABLE

NET PAYROLL

PAYROLL TAXES PAID

SALES, USE & OTHER TAXES PAID

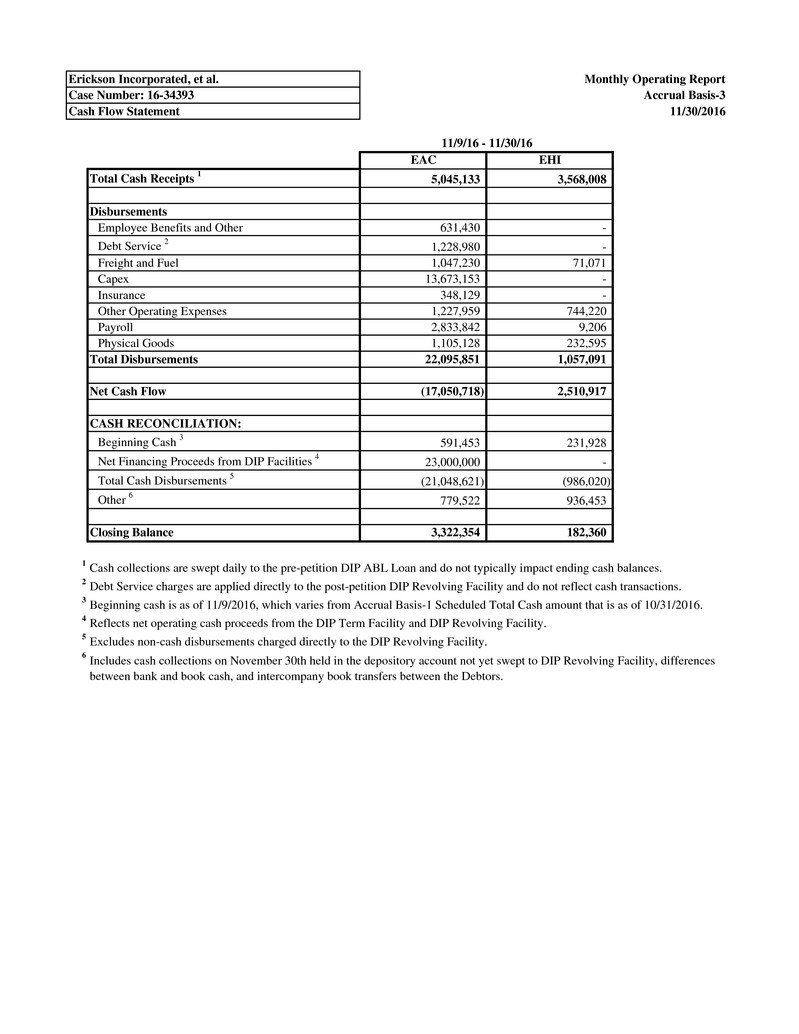

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-3

Cash Flow Statement 11/30/2016

EAC EHI

Total Cash Receipts 1 5,045,133 3,568,008

Disbursements

Employee Benefits and Other 631,430 -

Debt Service 2 1,228,980 -

Freight and Fuel 1,047,230 71,071

Capex 13,673,153 -

Insurance 348,129 -

Other Operating Expenses 1,227,959 744,220

Payroll 2,833,842 9,206

Physical Goods 1,105,128 232,595

Total Disbursements 22,095,851 1,057,091

Net Cash Flow (17,050,718) 2,510,917

CASH RECONCILIATION:

Beginning Cash 3 591,453 231,928

Net Financing Proceeds from DIP Facilities 4 23,000,000 -

Total Cash Disbursements 5 (21,048,621) (986,020)

Other 6 779,522 936,453

Closing Balance 3,322,354 182,360

1 Cash collections are swept daily to the pre-petition DIP ABL Loan and do not typically impact ending cash balances.

2 Debt Service charges are applied directly to the post-petition DIP Revolving Facility and do not reflect cash transactions.

3 Beginning cash is as of 11/9/2016, which varies from Accrual Basis-1 Scheduled Total Cash amount that is as of 10/31/2016.

4 Reflects net operating cash proceeds from the DIP Term Facility and DIP Revolving Facility.

5 Excludes non-cash disbursements charged directly to the DIP Revolving Facility.

6

11/9/16 - 11/30/16

Includes cash collections on November 30th held in the depository account not yet swept to DIP Revolving Facility, differences

between bank and book cash, and intercompany book transfers between the Debtors.

Monthly Operating Report

ACCRUAL BASIS-4

CASE NAME:

CASE NUMBER:

ACCOUNTS RECEIVABLE AGING

1. 0-30

2. 31-60

3. 61-90

4. 91+

5. $0 $0 $0 $0

6.

7. $0 $0 $0 $0

AGING OF POSTPETITION TAXES AND PAYABLES MONTH: November 2016

0-30 31-60 61-90 91+

TAXES PAYABLE DAYS DAYS DAYS DAYS TOTAL

1. FEDERAL $0

2. STATE $0

3. LOCAL $0

4. OTHER (ATTACH LIST) $0

5. TOTAL TAXES PAYABLE $0 $0 $0 $0 $0

6. ACCOUNTS PAYABLE $0

STATUS OF POSTPETITION TAXES MONTH: November 2016

BEGINNING AMOUNT ENDING

TAX WITHHELD AND/ AMOUNT TAX

FEDERAL LIABILITY 0R ACCRUED PAID LIABILITY

1. WITHHOLDING $0

2. FICA-EMPLOYEE $0

3. FICA-EMPLOYER $0

4. UNEMPLOYMENT $0

5. INCOME $0

6. OTHER (ATTACH LIST) $0

7. TOTAL FEDERAL TAXES $0 $0 $0 $0

STATE AND LOCAL

8. WITHHOLDING $0

9. SALES $0

10. EXCISE $0

11. UNEMPLOYMENT $0

12. REAL PROPERTY $0

13. PERSONAL PROPERTY $0

14. OTHER (ATTACH LIST) $0

15. TOTAL STATE & LOCAL $0 $0 $0 $0

16. TOTAL TAXES $0 $0 $0 $0

MONTH

TOTAL ACCOUNTS RECEIVABLE

AMOUNT CONSIDERED UNCOLLECTIBLE

ACCOUNTS RECEIVABLE (NET)

See Attached Rider

Erickson Incorporated, et al.

16-34393

SCHEDULE

AMOUNT MONTH MONTH

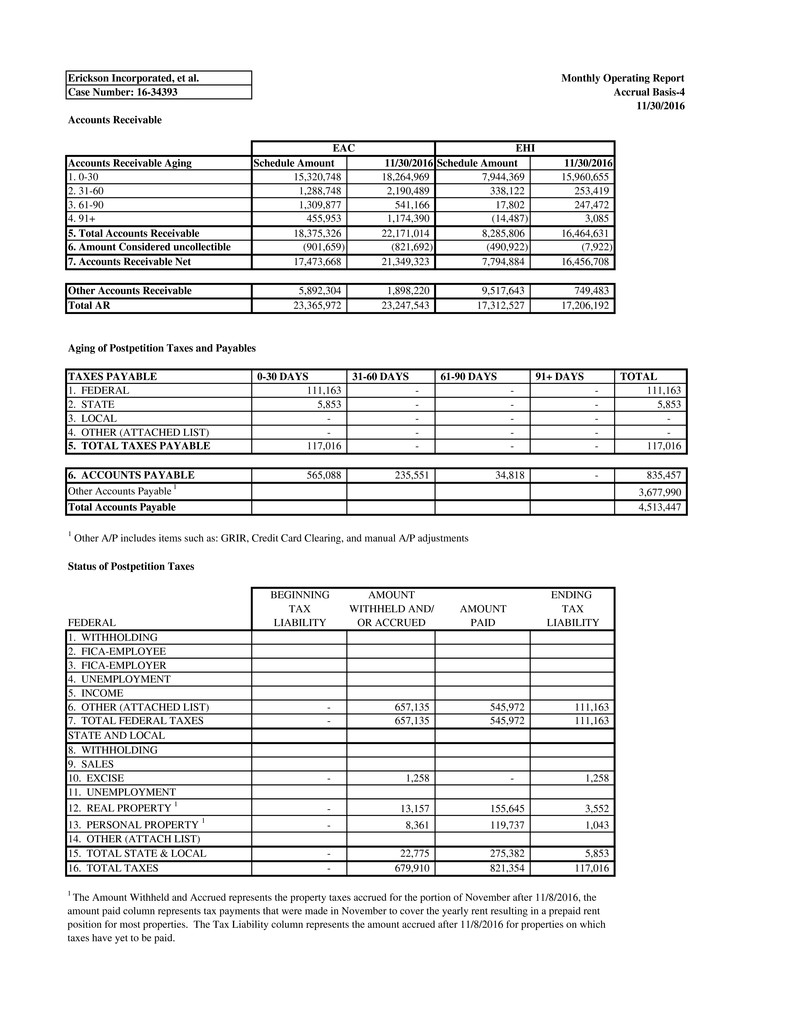

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-4

11/30/2016

Accounts Receivable

Accounts Receivable Aging Schedule Amount 11/30/2016 Schedule Amount 11/30/2016

1. 0-30 15,320,748 18,264,969 7,944,369 15,960,655

2. 31-60 1,288,748 2,190,489 338,122 253,419

3. 61-90 1,309,877 541,166 17,802 247,472

4. 91+ 455,953 1,174,390 (14,487) 3,085

5. Total Accounts Receivable 18,375,326 22,171,014 8,285,806 16,464,631

6. Amount Considered uncollectible (901,659) (821,692) (490,922) (7,922)

7. Accounts Receivable Net 17,473,668 21,349,323 7,794,884 16,456,708

Other Accounts Receivable 5,892,304 1,898,220 9,517,643 749,483

Total AR 23,365,972 23,247,543 17,312,527 17,206,192

Aging of Postpetition Taxes and Payables

TAXES PAYABLE 0-30 DAYS 31-60 DAYS 61-90 DAYS 91+ DAYS TOTAL

1. FEDERAL 111,163 - - - 111,163

2. STATE 5,853 - - - 5,853

3. LOCAL - - - - -

4. OTHER (ATTACHED LIST) - - - - -

5. TOTAL TAXES PAYABLE 117,016 - - - 117,016

6. ACCOUNTS PAYABLE 565,088 235,551 34,818 - 835,457

Other Accounts Payable 1 3,677,990

Total Accounts Payable 4,513,447

1 Other A/P includes items such as: GRIR, Credit Card Clearing, and manual A/P adjustments

Status of Postpetition Taxes

BEGINNING AMOUNT ENDING

TAX WITHHELD AND/ AMOUNT TAX

FEDERAL LIABILITY OR ACCRUED PAID LIABILITY

1. WITHHOLDING

2. FICA-EMPLOYEE

3. FICA-EMPLOYER

4. UNEMPLOYMENT

5. INCOME

6. OTHER (ATTACHED LIST) - 657,135 545,972 111,163

7. TOTAL FEDERAL TAXES - 657,135 545,972 111,163

STATE AND LOCAL

8. WITHHOLDING

9. SALES

10. EXCISE - 1,258 - 1,258

11. UNEMPLOYMENT

12. REAL PROPERTY 1 - 13,157 155,645 3,552

13. PERSONAL PROPERTY 1 - 8,361 119,737 1,043

14. OTHER (ATTACH LIST)

15. TOTAL STATE & LOCAL - 22,775 275,382 5,853

16. TOTAL TAXES - 679,910 821,354 117,016

EAC EHI

1 The Amount Withheld and Accrued represents the property taxes accrued for the portion of November after 11/8/2016, the

amount paid column represents tax payments that were made in November to cover the yearly rent resulting in a prepaid rent

position for most properties. The Tax Liability column represents the amount accrued after 11/8/2016 for properties on which

taxes have yet to be paid.

Monthly Operating Report

ACCRUAL BASIS-5

CASE NAME:

CASE NUMBER:

MONTH: November 2016

BANK RECONCILIATIONS

Account #1 Account #2 Account #3

A. BANK:

B. ACCOUNT NUMBER: TOTAL

C. PURPOSE (TYPE):

1. BALANCE PER BANK STATEMENT $0

2. ADD: TOTAL DEPOSITS NOT CREDITED $0

3. SUBTRACT: OUTSTANDING CHECKS $0

4. OTHER RECONCILING ITEMS $0

5. MONTH END BALANCE PER BOOKS $0 $0 $0 $0

6. NUMBER OF LAST CHECK WRITTEN

INVESTMENT ACCOUNTS

DATE OF TYPE OF PURCHASE CURRENT

BANK, ACCOUNT NAME & NUMBER PURCHASE INSTRUMENT PRICE VALUE

7.

8.

9.

10.

11. TOTAL INVESTMENTS $0 $0

CASH

12. CURRENCY ON HAND $0

13. TOTAL CASH - END OF MONTH $0

See Attached Rider

Erickson Incorporated, et al.

16-34393

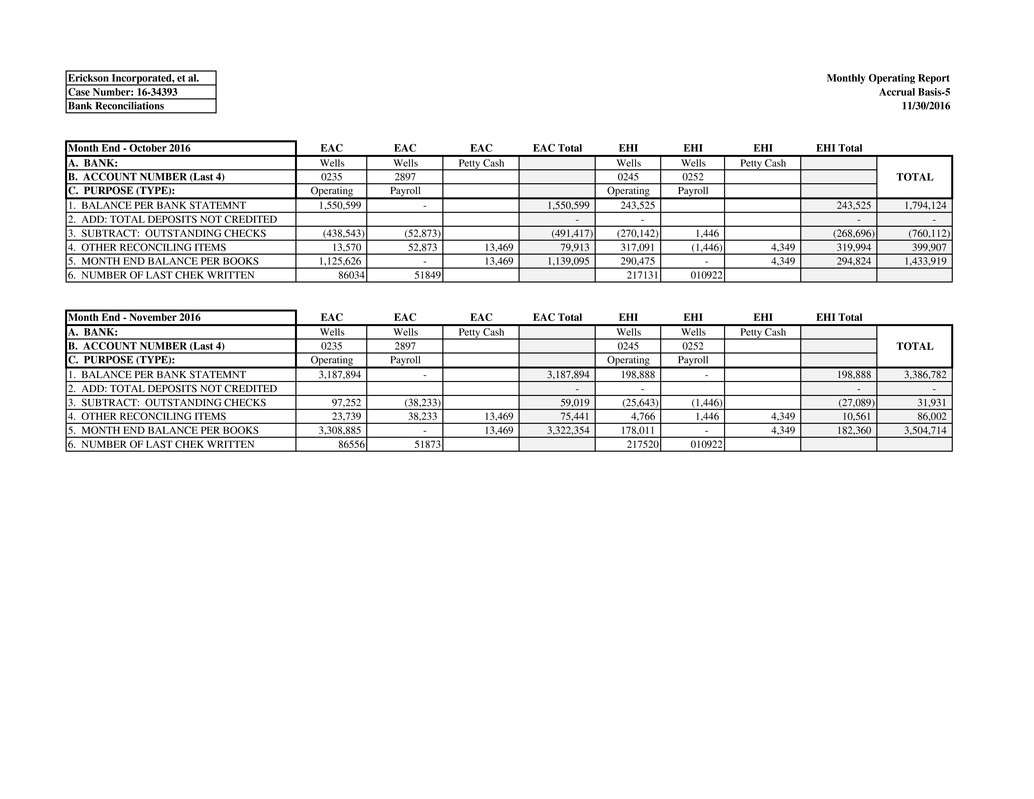

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-5

Bank Reconciliations 11/30/2016

Month End - October 2016 EAC EAC EAC EAC Total EHI EHI EHI EHI Total

A. BANK: Wells Wells Petty Cash Wells Wells Petty Cash

B. ACCOUNT NUMBER (Last 4) 0235 2897 0245 0252

C. PURPOSE (TYPE): Operating Payroll Operating Payroll

1. BALANCE PER BANK STATEMNT 1,550,599 - 1,550,599 243,525 243,525 1,794,124

2. ADD: TOTAL DEPOSITS NOT CREDITED - - - -

3. SUBTRACT: OUTSTANDING CHECKS (438,543) (52,873) (491,417) (270,142) 1,446 (268,696) (760,112)

4. OTHER RECONCILING ITEMS 13,570 52,873 13,469 79,913 317,091 (1,446) 4,349 319,994 399,907

5. MONTH END BALANCE PER BOOKS 1,125,626 - 13,469 1,139,095 290,475 - 4,349 294,824 1,433,919

6. NUMBER OF LAST CHEK WRITTEN 86034 51849 217131 010922

Month End - November 2016 EAC EAC EAC EAC Total EHI EHI EHI EHI Total

A. BANK: Wells Wells Petty Cash Wells Wells Petty Cash

B. ACCOUNT NUMBER (Last 4) 0235 2897 0245 0252

C. PURPOSE (TYPE): Operating Payroll Operating Payroll

1. BALANCE PER BANK STATEMNT 3,187,894 - 3,187,894 198,888 - 198,888 3,386,782

2. ADD: TOTAL DEPOSITS NOT CREDITED - - - -

3. SUBTRACT: OUTSTANDING CHECKS 97,252 (38,233) 59,019 (25,643) (1,446) (27,089) 31,931

4. OTHER RECONCILING ITEMS 23,739 38,233 13,469 75,441 4,766 1,446 4,349 10,561 86,002

5. MONTH END BALANCE PER BOOKS 3,308,885 - 13,469 3,322,354 178,011 - 4,349 182,360 3,504,714

6. NUMBER OF LAST CHEK WRITTEN 86556 51873 217520 010922

TOTAL

TOTAL

Monthly Operating Report

ACCRUAL BASIS-6

CASE NAME:

CASE NUMBER:

MONTH: November 2016

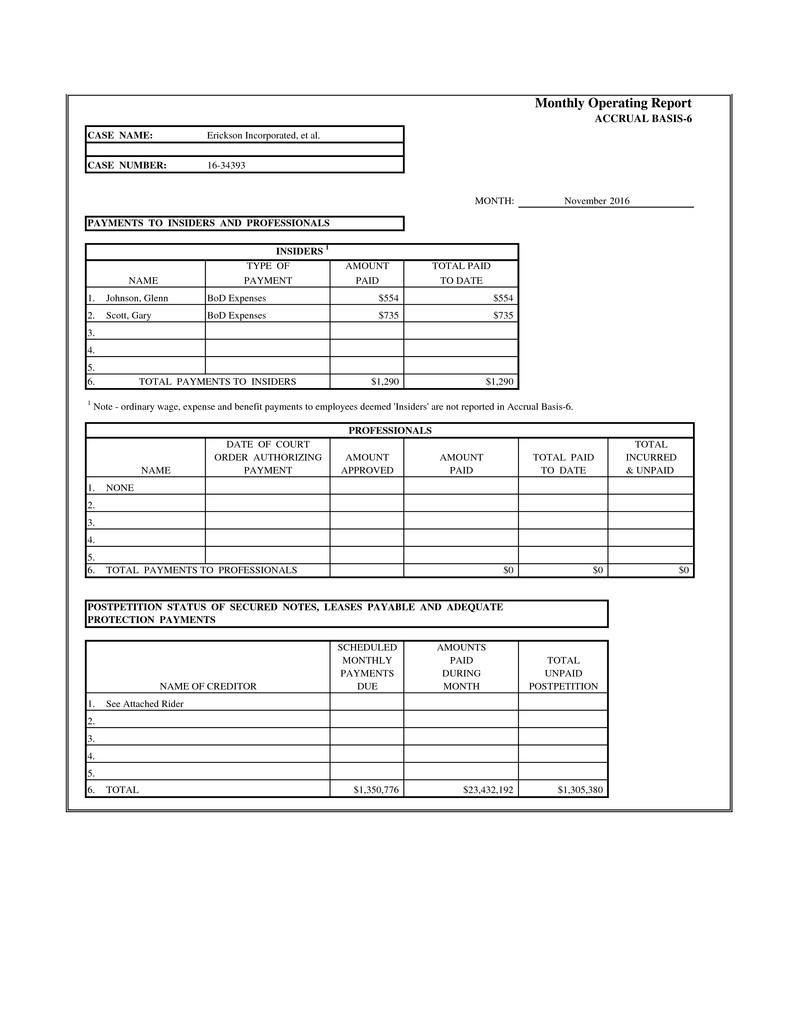

PAYMENTS TO INSIDERS AND PROFESSIONALS

INSIDERS 1

TYPE OF AMOUNT TOTAL PAID

NAME PAYMENT PAID TO DATE

1. Johnson, Glenn BoD Expenses $554 $554

2. Scott, Gary BoD Expenses $735 $735

3.

4.

5.

6. $1,290 $1,290

1 Note - ordinary wage, expense and benefit payments to employees deemed 'Insiders' are not reported in Accrual Basis-6.

PROFESSIONALS

DATE OF COURT TOTAL

ORDER AUTHORIZING AMOUNT AMOUNT TOTAL PAID INCURRED

NAME PAYMENT APPROVED PAID TO DATE & UNPAID

1. NONE

2.

3.

4.

5.

6. TOTAL PAYMENTS TO PROFESSIONALS $0 $0 $0

POSTPETITION STATUS OF SECURED NOTES, LEASES PAYABLE AND ADEQUATE

PROTECTION PAYMENTS

SCHEDULED AMOUNTS

MONTHLY PAID TOTAL

PAYMENTS DURING UNPAID

NAME OF CREDITOR DUE MONTH POSTPETITION

1.

2.

3.

4.

5.

6. TOTAL $1,350,776 $23,432,192 $1,305,380

Erickson Incorporated, et al.

16-34393

TOTAL PAYMENTS TO INSIDERS

See Attached Rider

Erickson Incorporated, et al. Monthly Operating Report

Case Number: 16-34393 Accrual Basis-6

11/30/2016

Name of Creditor

Scheduled Monthly

Payments Due 1

Amounts Paid

During Month 2

Total Unpaid Post

Petition

1 EAGLE COPTERS MAINTENANCE LTD 18,000 - 18,000

2 EAGLE COPTERS MAINTENANCE LTD 18,000 - 18,000

3 HELIFLEET 2013-01, LLC N300EV 32,000 - 32,000

4 HELIFLEET 2013-01, LLC N367EV 25,000 - 25,000

5 HELIFLEET 2013-01, LLC N787SR 20,000 - 20,000

6 HELIFLEET 2013-01, LLC N814EH 9,000 - 9,000

7 HELIFLEET 2013-01, LLC N8227J 8,000 - 8,000

8 HELIFLEET 2013-01, LLC N366EV 31,000 - 31,000

9 HELIFLEET 2013-01, LLC N415EV 87,104 - 87,104

10

MILESTONE AVIATION ASSET HOLDING GROUP

NO 1 68,500 - 68,500

11

MILESTONE AVIATION ASSET HOLDING GROUP

NO 1 67,931 - 67,931

12 THE MILESTONE AVIATION GROUP LIMITED 290,245 - 290,245

13 SQN HELO, LLC 48,885 - 48,885

14 SQN HELO, LLC 56,217 - 56,217

15 SQN HELO, LLC 51,811 - 51,811

16 SQN HELO, LLC 51,811 - 51,811

17 SQN HELO, LLC 39,960 - 39,960

18 ITC LEASING N708H 60,417 - 60,417

19 ITC LEASING N745H 15,019 - 15,019

20 ITC LEASING N746H 30,576 - 30,576

21 SENTRY AIRCRAFT LEASING 8 105 EV 27,362 - 27,362

22 SENTRY AIRCRAFT LEASING #171CJ 26,931 - 26,931

23 SENTRY CAPITAL CORP #368EV 70,653 - 70,653

24 SENTRY CAPITAL CORP #393AL 27,477 - 27,477

25 SENTRY AIRCRAFT LEASING #N437CA 32,915 - 32,915

26 SENTRY AIRCRAFT LEASING #N502FS 29,330 - 29,330

27 VARIANT AIRCRAFT FUND 28198 LLC 47,855 - 47,855

28 AMERICAN MULTIPLEX LLC 1,150 - 1,150

29 KING ISLAND NATIVE CORPORATION 2,200 - 2,200

30 MUNICIPALITY OF ANCHORAGE 1,912 - 1,912

31 PARK PLAZA II APARTMENTS

32 ROGERS PARK 900 - 900

33 BURRILL REAL ESTATE INC

34 JACKSON COUNTY AIRPORT AUTHORITY 2,181 - 2,181

35 JACKSON COUNTY AIRPORT AUTHORITY 434 - 434

36 SRI EIGHT MACADAM LLC

37 WEST CASCADE PROPERTIES

38 WESTERN EQUIPMENT FINANCE

39 ACME SUITES/AYALA PROPERTIES LLC 2,000 1,467 533

40 ROBERT F GREENWELL CO LLP 43,929

41 SMITH RANCHES

42 T&D FAMILY TRUST (TIM & DENISE SMITH)

43 J&H CP, LLC

44 ENTERPRISE FM TRUST 4,072 4,072

45 WELLS FARGO REVOLVER 3 23,430,726

Total 1,350,776 23,432,192 1,305,380

1

2 Payments on post petition rent/leases in November.

3

Amounts scheduled reflect November Rent payments for the full month and have not been prorated to reflect solely postpetition

amounts.

The Pre-Petition ABL Loan reflects both post-petition payments from collection of receivables as well as the First Lien Repayment

as described in the final DIP Order [Docket No. 133, entered on 12/2/2016]. As the pre-petition facility continues to collect

proceeds and pay down its principal balance, the DIP Revolving Facility allows the Debtors to advance funds on a post-petition

basis. Please reference the final DIP Order [Docket No. 133] for further information.

Postpetition Status of Secured Notes, Leases Payable and Adequate Protection Payments

Monthly Operating Report

ACCRUAL BASIS-7

CASE NAME:

CASE NUMBER:

MONTH: November 2016

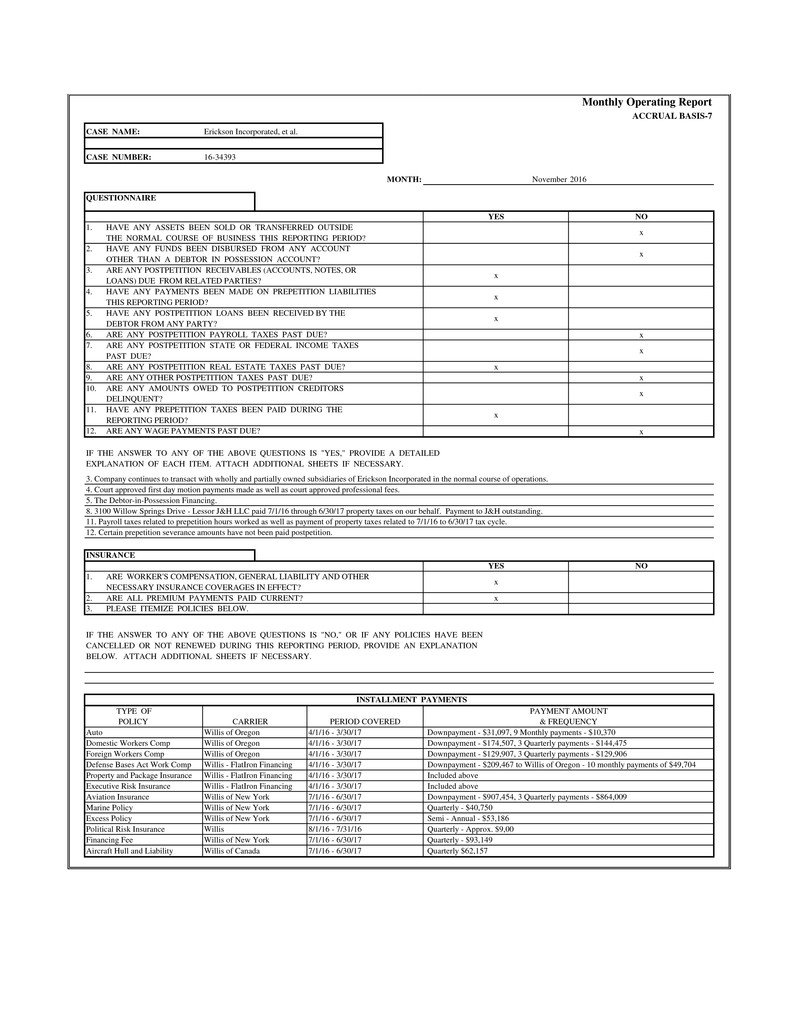

QUESTIONNAIRE

YES NO

1. HAVE ANY ASSETS BEEN SOLD OR TRANSFERRED OUTSIDE

THE NORMAL COURSE OF BUSINESS THIS REPORTING PERIOD?

2. HAVE ANY FUNDS BEEN DISBURSED FROM ANY ACCOUNT

OTHER THAN A DEBTOR IN POSSESSION ACCOUNT?

3. ARE ANY POSTPETITION RECEIVABLES (ACCOUNTS, NOTES, OR

LOANS) DUE FROM RELATED PARTIES?

4. HAVE ANY PAYMENTS BEEN MADE ON PREPETITION LIABILITIES

THIS REPORTING PERIOD?

5. HAVE ANY POSTPETITION LOANS BEEN RECEIVED BY THE

DEBTOR FROM ANY PARTY?

6. ARE ANY POSTPETITION PAYROLL TAXES PAST DUE? x

7. ARE ANY POSTPETITION STATE OR FEDERAL INCOME TAXES

PAST DUE?

8. ARE ANY POSTPETITION REAL ESTATE TAXES PAST DUE? x

9. ARE ANY OTHER POSTPETITION TAXES PAST DUE? x

10. ARE ANY AMOUNTS OWED TO POSTPETITION CREDITORS

DELINQUENT?

11. HAVE ANY PREPETITION TAXES BEEN PAID DURING THE

REPORTING PERIOD?

12. ARE ANY WAGE PAYMENTS PAST DUE? x

IF THE ANSWER TO ANY OF THE ABOVE QUESTIONS IS "YES," PROVIDE A DETAILED

EXPLANATION OF EACH ITEM. ATTACH ADDITIONAL SHEETS IF NECESSARY.

3. Company continues to transact with wholly and partially owned subsidiaries of Erickson Incorporated in the normal course of operations.

4. Court approved first day motion payments made as well as court approved professional fees.

5. The Debtor-in-Possession Financing.

8. 3100 Willow Springs Drive - Lessor J&H LLC paid 7/1/16 through 6/30/17 property taxes on our behalf. Payment to J&H outstanding.

11. Payroll taxes related to prepetition hours worked as well as payment of property taxes related to 7/1/16 to 6/30/17 tax cycle.

12. Certain prepetition severance amounts have not been paid postpetition.

INSURANCE

YES NO

1. ARE WORKER'S COMPENSATION, GENERAL LIABILITY AND OTHER

NECESSARY INSURANCE COVERAGES IN EFFECT?

2. ARE ALL PREMIUM PAYMENTS PAID CURRENT? x

3. PLEASE ITEMIZE POLICIES BELOW.

IF THE ANSWER TO ANY OF THE ABOVE QUESTIONS IS "NO," OR IF ANY POLICIES HAVE BEEN

CANCELLED OR NOT RENEWED DURING THIS REPORTING PERIOD, PROVIDE AN EXPLANATION

BELOW. ATTACH ADDITIONAL SHEETS IF NECESSARY.

TYPE OF PAYMENT AMOUNT

POLICY CARRIER PERIOD COVERED & FREQUENCY

Auto Willis of Oregon 4/1/16 - 3/30/17 Downpayment - $31,097, 9 Monthly payments - $10,370

Domestic Workers Comp Willis of Oregon 4/1/16 - 3/30/17 Downpayment - $174,507, 3 Quarterly payments - $144,475

Foreign Workers Comp Willis of Oregon 4/1/16 - 3/30/17 Downpayment - $129,907, 3 Quarterly payments - $129,906

Defense Bases Act Work Comp Willis - FlatIron Financing 4/1/16 - 3/30/17 Downpayment - $209,467 to Willis of Oregon - 10 monthly payments of $49,704

Property and Package Insurance Willis - FlatIron Financing 4/1/16 - 3/30/17 Included above

Executive Risk Insurance Willis - FlatIron Financing 4/1/16 - 3/30/17 Included above

Aviation Insurance Willis of New York 7/1/16 - 6/30/17 Downpayment - $907,454, 3 Quarterly payments - $864,009

Marine Policy Willis of New York 7/1/16 - 6/30/17 Quarterly - $40,750

Excess Policy Willis of New York 7/1/16 - 6/30/17 Semi - Annual - $53,186

Political Risk Insurance Willis 8/1/16 - 7/31/16 Quarterly - Approx. $9,00

Financing Fee Willis of New York 7/1/16 - 6/30/17 Quarterly - $93,149

Aircraft Hull and Liability Willis of Canada 7/1/16 - 6/30/17 Quarterly $62,157

Erickson Incorporated, et al.

16-34393

x

x

x

x

x

x

INSTALLMENT PAYMENTS

x

x

x