Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - COHERENT INC | rofin8kaexhibit993.htm |

| EX-99.2 - EXHIBIT 99.2 - COHERENT INC | rofin8kaexhibit992.htm |

| EX-23.1 - EXHIBIT 23.1 - COHERENT INC | rofin8kaexhibit231.htm |

| 8-K/A - 8-K/A - COHERENT INC | rofin8-ka.htm |

1

ROFIN-SINAR TECHNOLOGIES INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except share data)

September 30,

2016 2015

ASSETS

Current assets:

Cash and cash equivalents $ 177,743 $ 169,729

Short-term investments 9,191 5,833

Accounts receivable, trade 110,664 99,372

Less allowance for doubtful accounts (4,752 ) (3,279 )

Trade accounts receivable, net 105,912 96,093

Other accounts receivable 5,952 3,258

Inventories, net (note 3) 183,825 181,025

Prepaid expenses 6,186 6,920

Deferred income tax assets (note 10) 25,780 25,718

Total current assets 514,589 488,576

Property and equipment, at cost (note 4) 202,980 191,828

Less accumulated depreciation (105,665 ) (99,255 )

Property and equipment, net 97,315 92,573

Deferred income tax assets (note 10) 17,055 15,528

Goodwill (note 5) 92,759 93,541

Other intangibles, net (note 5) 12,803 14,767

Other assets 1,294 1,506

Total assets $ 735,815 $ 706,491

LIABILITIES AND EQUITY

Current liabilities:

Line of credit and short-term borrowings (note 7 and 8) $ 9,064 $ 5,226

Accounts payable, trade 23,307 23,443

Accounts payable to related party (note 15) 283 299

Income taxes payable (note 10) 7,485 7,998

Deferred income tax liabilities (note 10) 2,524 2,666

Accrued liabilities (note 6) 62,323 69,986

Total current liabilities 104,986 109,618

Long-term debt (note 8) 12,610 18,085

Pension obligations (note 11) 32,596 25,439

Deferred income tax liabilities (note 10) 7,855 6,452

Other long-term liabilities 4,235 4,288

Total liabilities 162,282 163,882

Commitments and contingencies (note 9)

2

Stockholders’ equity:

Preferred stock, 5,000,000 shares authorized, none issued or outstanding — —

Common stock, $0.01 par value, 50,000,000 shares authorized, 33,681,537 shares issued at

September 30, 2016 (33,053,687 shares issued at September 30, 2015) 337

331

Additional paid-in capital 259,159 239,333

Retained earnings 556,646 529,234

Accumulated other comprehensive income (loss) (65,843 ) (57,517 )

Treasury shares, at cost, 5,256,584 at September 30, 2016 and 4,871,884 shares at

September 30, 2015 (177,264 ) (169,262 )

Total ROFIN-SINAR Technologies Inc. stockholders’ equity 573,035 542,119

Noncontrolling interest in subsidiaries 498 490

Total equity 573,533 542,609

Total liabilities and equity $ 735,815 $ 706,491

See accompanying notes to consolidated financial statements

3

ROFIN-SINAR TECHNOLOGIES INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

YEARS ENDED SEPTEMBER 30, 2016, 2015 AND 2014

(dollars in thousands, except share and per share amounts)

Years ended September 30,

2016 2015 2014

Net sales $ 485,651 $ 519,643 $ 530,117

Cost of goods sold 308,127 323,165 341,202

Gross profit 177,524 196,478 188,915

Selling, general and administrative expenses 97,642 97,405 106,051

Research and development expenses 36,046 39,987 45,900

Amortization expense 2,678 3,057 2,906

Income from operations 41,158 56,029 34,058

Other expense (income):

Interest income (431 ) (418 ) (485 )

Interest expense 357 409 719

Foreign currency losses (gains) 1,196 (1,680 ) (1,425 )

Miscellaneous (173 ) 750 (1,431 )

Total other expense (income), net 949 (939 ) (2,622 )

Income before income taxes 40,209 56,968 36,680

Income tax expense (note 10) 12,789 15,747 11,528

Net income 27,420 41,221 25,152

Less: net income (loss) attributable to the non-controlling interest 8 (37 ) (16 )

Net income attributable to RSTI $ 27,412 $ 41,258 $ 25,168

Net income attributable to RSTI per share (note 12):

Per share of common stock basic $ 0.97 $ 1.47 $ 0.90

Per share of common stock diluted $ 0.96 $ 1.46 $ 0.89

Weighted average shares used in computing earnings per share (note 12):

Basic 28,356,877 28,127,733 28,073,081

Diluted 28,542,641 28,270,944 28,222,191

See accompanying notes to consolidated financial statements

4

ROFIN-SINAR TECHNOLOGIES INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

YEARS ENDED SEPTEMBER 30, 2016, 2015 AND 2014

(dollars in thousands)

Years ended September 30,

2016 2015 2014

Net income $ 27,420 $ 41,221 $ 25,152

Other comprehensive income (loss):

Fair value of interest rate swap agreements, net of tax expense of $ 0, $11 and

$15 24

38

47

Foreign currency translation adjustments (4,227 ) (43,137 ) (24,850 )

Defined benefit pension plans, net of tax benefit of $1,914, $309 and $391

(note 11) (4,123 ) (346 ) (802 )

Other comprehensive income (loss), net of tax $ (8,326 ) $ (43,445 ) $ (25,605 )

Total comprehensive income (loss) $ 19,094 $ (2,224 ) $ (453 )

Less: Total comprehensive income (loss) attributable to the

non-controlling interest 8

(37 ) (16 )

Total comprehensive income (loss) attributable to RSTI $ 19,086 $ (2,187 ) $ (437 )

See accompanying notes to consolidated financial statements

5

ROFIN-SINAR TECHNOLOGIES INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

YEARS ENDED SEPTEMBER 30, 2016, 2015 AND 2014

(dollars in thousands, except share data)

Number of

Common

Shares

Outstanding

Common

Stock

Par Value

Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Treasury

Stock

ROFIN-SINAR

Technologies

Stockholders’

Equity

Non-

Controlling

Interests

Total

Equity

BALANCES at September 30, 2013 28,124,269 $ 327 $ 228,124 $ 462,808 $ 11,533 $ (163,026 ) $ 539,766 $ 3,652 $ 543,418

Total comprehensive income (loss) 25,168 (25,605 ) — (437 ) (16 ) (453 )

Purchase of non-controlling interest — — (2,302 ) — — — (2,302 ) (2,730 ) (5,032 )

Common stock issued in connection with

stock incentive plans 158,050

2

7,010

—

—

—

7,012

—

7,012

Purchases of treasury stock (270,203 ) — — — — (6,236 ) (6,236 ) — (6,236 )

BALANCES at September 30, 2014 28,012,116 $ 329 $ 232,832 $ 487,976 $ (14,072 ) $ (169,262 ) $ 537,803 $ 906 $ 538,709

Total comprehensive income (loss) 41,258 (43,445 ) — (2,187 ) (37 ) (2,224 )

Purchase of non-controlling interest — — (69 ) — — — (69 ) (379 ) (448 )

Common stock issued in connection with

stock incentive plans 169,687

2

6,570

—

—

—

6,572

—

6,572

Purchases of treasury stock — — — — — — — — —

BALANCES at September 30, 2015 28,181,803 $ 331 $ 239,333 $ 529,234 $ (57,517 ) $ (169,262 ) $ 542,119 $ 490 $ 542,609

Total comprehensive income (loss) 27,412 (8,326 ) — 19,086 8 19,094

Purchase of non-controlling interest — — — — — — — — —

Common stock issued in connection with

stock incentive plans 627,850

6

19,826

—

—

—

19,832

—

19,832

Purchases of treasury stock (384,700 ) — — — — (8,002 ) (8,002 ) — (8,002 )

BALANCES at September 30, 2016 28,424,953 $ 337 $ 259,159 $ 556,646 $ (65,843 ) $ (177,264 ) $ 573,035 $ 498 $ 573,533

See accompanying notes to consolidated financial statements

6

ROFIN-SINAR TECHNOLOGIES INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED SEPTEMBER 30, 2016, 2015 AND 2014

(dollars in thousands)

Years ended September 30,

2016 2015 2014

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 27,420 $ 41,221 $ 25,152

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 15,819 16,190 17,312

Issuance of restricted stock 386 275 292

Provision for doubtful accounts 1,879 552 889

Exchange rate (gains) losses 1,205 (1,062 ) (837 )

Loss (gains) on disposal of property and equipment 6 566 (55 )

Stock-based compensation expenses 3,980 4,189 4,282

Deferred income taxes 1,416 (3,396 ) (2,178 )

Other non-cash income — — (1,000 )

Change in operating assets and liabilities:

Accounts receivable, trade (12,215 ) 2,701 (3,560 )

Other accounts receivable (2,699 ) 1,394 2,866

Inventories (4,513 ) (7,421 ) (1,972 )

Prepaid expenses and other 150 (3,970 ) (2,316 )

Accounts payable 309 2,509 (653 )

Income taxes payable (190 ) 1,865 1,221

Accrued liabilities and pension obligations (4,065 ) 12,966 (3,899 )

Net cash provided by operating activities 28,888 68,579 35,544

CASH FLOWS FROM INVESTING ACTIVITIES:

Additions to property and equipment (20,772 ) (33,998 ) (10,389 )

Proceeds from the sale of property and equipment 176 527 231

Purchases of short-term investments (10,740 ) (9,327 ) (38,671 )

Proceeds from the sale of short-term and long-term investments 6,210 15,860 30,499

Acquisitions — — (5,891 )

Net cash used in investing activities (25,126 ) (26,938 ) (24,221 )

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from the issuance of debt 24,230 34,260 39,726

Repayments to bank (26,291 ) (23,436 ) (41,677 )

Purchase of treasury stock (8,002 ) — (6,236 )

Issuance of common stock 15,466 2,109 2,389

Excess tax benefit from stock options — — 48

Payment of contingent acquisition-related obligations (1,093 ) (800 ) —

Payments to subsidiary’s minority shareholders — (410 ) (4,911 )

Net cash provided by (used in) financing activities 4,310 11,723 (10,661 )

Effect of foreign currency translation on cash (58 ) (12,172 ) (5,858 )

Net increase (decrease) in cash and cash equivalents 8,014 41,192 (5,196 )

Cash and cash equivalents at beginning of year 169,729 128,537 133,733

Cash and cash equivalents at end of year $ 177,743 $ 169,729 $ 128,537

Cash paid during the year for interest $ 292 $ 277 $ 355

Cash paid during the year for income taxes $ 12,487 $ 16,082 $ 10,716

See accompanying notes to consolidated financial statements

7

ROFIN-SINAR TECHNOLOGIES INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2016, 2015, and 2014

(dollars in thousands, except per share amounts)

1. SUMMARY OF ACCOUNTING POLICIES

Description of the Company and Business

The primary business of ROFIN-SINAR Technologies Inc. (“ROFIN” or “RSTI” or “the Company”) is to develop,

manufacture, and market industrial lasers and supplies used for material processing applications. The majority of the

Company’s customers are in the machine tool, automotive, semiconductor, and electronics industries and are located in the

United States, Europe, and Asia/Pacific. For the years ended September 30, 2016, 2015 and 2014, ROFIN generated

approximately 54%, 58% and 58%, respectively, of its revenues from the sale of lasers and laser systems. For the years ended

September 30, 2016, 2015 and 2014, approximately 46%, 42% and 42%, respectively, of its revenues were generated from

sales of after-sales services, replacement parts and components for laser products.

On March 16, 2016, the Company entered into a Merger Agreement with Coherent, Inc. ("Coherent") and Rembrandt Merger

Sub Corp., a wholly-owned subsidiary of Coherent ("Merger Sub"), providing for, subject to the terms and conditions of the

Merger Agreement, the acquisition of the Company by Coherent at a price of $32.50 per share, without interest (the "Merger

Consideration"), through the Merger of Merger Sub with and into the Company (the "Merger"), with the Company surviving the

Merger as a wholly-owned subsidiary of Coherent.

Subsequent Events

The Company has evaluated subsequent events through January 17, 2017, which is the date consolidated financial

statements were available to be issued.

On November 7, 2016, the transaction was completed and as a consequence of the effectiveness of the transaction, Coherent

has become the sole shareholder of ROFIN-SINAR Technologies Inc.

Principles of Consolidation and Basis of Presentation

The accompanying consolidated financial statements of RSTI and its subsidiaries were prepared in accordance with accounting

principles generally accepted in the United State of America ("U.S. GAAP") and include the assets, liabilities, revenues and

expenses of all majority-owned subsidiaries over which the Company exercises control and, when applicable, for which the

Company has a controlling financial interest or is the primary beneficiary.

All intercompany balances and transactions have been eliminated in consolidation.

Acquisitions

The Company uses the acquisition method of accounting for its acquisitions with the respective results of operations included

in the consolidated results from the date of acquisition.

• Effective June 12, 2014, the Company acquired the remaining 5% of the common stock of DILAS Diodenlaser GmbH

(“DILAS”) through its wholly-owned subsidiary ROFIN-SINAR Technologies Europe S.L.U. (“RSTE”). The

Company currently holds 100% of the share capital of DILAS.

8

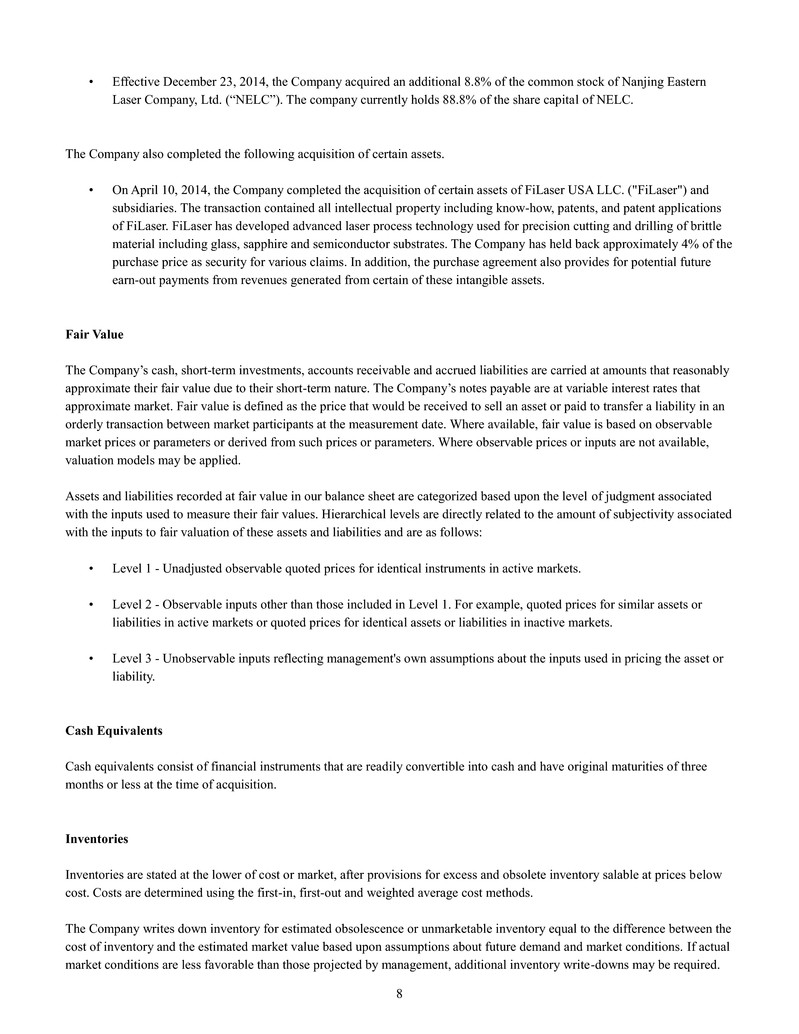

• Effective December 23, 2014, the Company acquired an additional 8.8% of the common stock of Nanjing Eastern

Laser Company, Ltd. (“NELC”). The company currently holds 88.8% of the share capital of NELC.

The Company also completed the following acquisition of certain assets.

• On April 10, 2014, the Company completed the acquisition of certain assets of FiLaser USA LLC. ("FiLaser") and

subsidiaries. The transaction contained all intellectual property including know-how, patents, and patent applications

of FiLaser. FiLaser has developed advanced laser process technology used for precision cutting and drilling of brittle

material including glass, sapphire and semiconductor substrates. The Company has held back approximately 4% of the

purchase price as security for various claims. In addition, the purchase agreement also provides for potential future

earn-out payments from revenues generated from certain of these intangible assets.

Fair Value

The Company’s cash, short-term investments, accounts receivable and accrued liabilities are carried at amounts that reasonably

approximate their fair value due to their short-term nature. The Company’s notes payable are at variable interest rates that

approximate market. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. Where available, fair value is based on observable

market prices or parameters or derived from such prices or parameters. Where observable prices or inputs are not available,

valuation models may be applied.

Assets and liabilities recorded at fair value in our balance sheet are categorized based upon the level of judgment associated

with the inputs used to measure their fair values. Hierarchical levels are directly related to the amount of subjectivity associated

with the inputs to fair valuation of these assets and liabilities and are as follows:

• Level 1 - Unadjusted observable quoted prices for identical instruments in active markets.

• Level 2 - Observable inputs other than those included in Level 1. For example, quoted prices for similar assets or

liabilities in active markets or quoted prices for identical assets or liabilities in inactive markets.

• Level 3 - Unobservable inputs reflecting management's own assumptions about the inputs used in pricing the asset or

liability.

Cash Equivalents

Cash equivalents consist of financial instruments that are readily convertible into cash and have original maturities of three

months or less at the time of acquisition.

Inventories

Inventories are stated at the lower of cost or market, after provisions for excess and obsolete inventory salable at prices below

cost. Costs are determined using the first-in, first-out and weighted average cost methods.

The Company writes down inventory for estimated obsolescence or unmarketable inventory equal to the difference between the

cost of inventory and the estimated market value based upon assumptions about future demand and market conditions. If actual

market conditions are less favorable than those projected by management, additional inventory write-downs may be required.

9

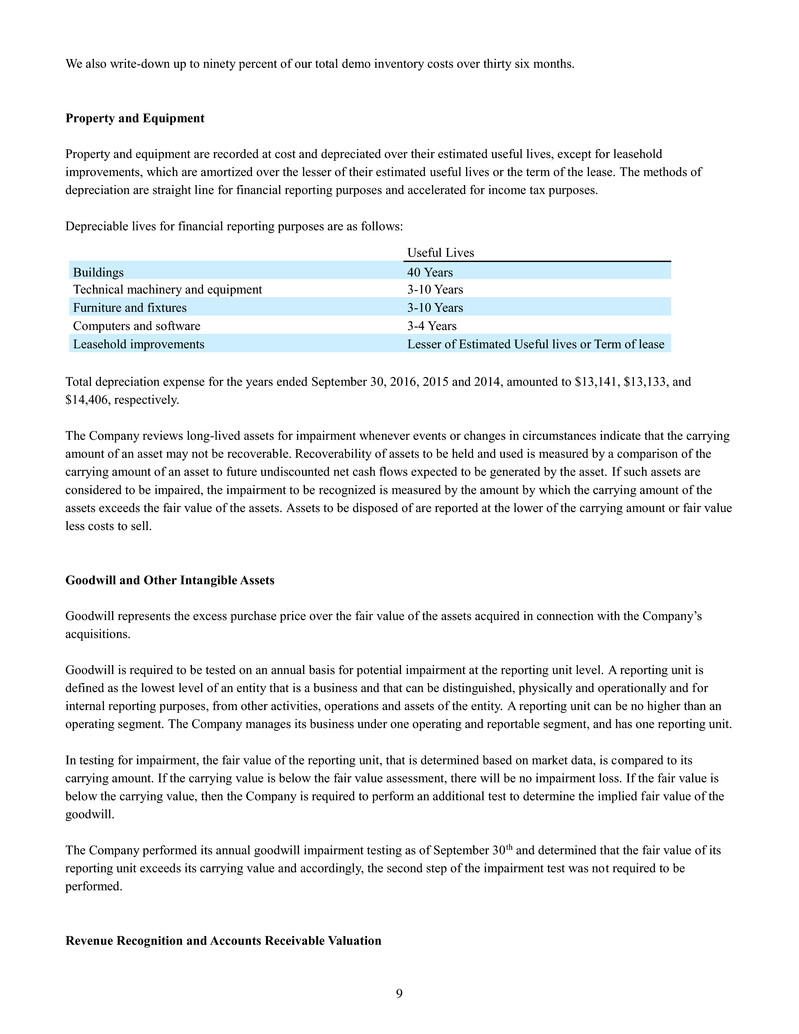

We also write-down up to ninety percent of our total demo inventory costs over thirty six months.

Property and Equipment

Property and equipment are recorded at cost and depreciated over their estimated useful lives, except for leasehold

improvements, which are amortized over the lesser of their estimated useful lives or the term of the lease. The methods of

depreciation are straight line for financial reporting purposes and accelerated for income tax purposes.

Depreciable lives for financial reporting purposes are as follows:

Useful Lives

Buildings 40 Years

Technical machinery and equipment 3-10 Years

Furniture and fixtures 3-10 Years

Computers and software 3-4 Years

Leasehold improvements Lesser of Estimated Useful lives or Term of lease

Total depreciation expense for the years ended September 30, 2016, 2015 and 2014, amounted to $13,141, $13,133, and

$14,406, respectively.

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the

carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. If such assets are

considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the

assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value

less costs to sell.

Goodwill and Other Intangible Assets

Goodwill represents the excess purchase price over the fair value of the assets acquired in connection with the Company’s

acquisitions.

Goodwill is required to be tested on an annual basis for potential impairment at the reporting unit level. A reporting unit is

defined as the lowest level of an entity that is a business and that can be distinguished, physically and operationally and for

internal reporting purposes, from other activities, operations and assets of the entity. A reporting unit can be no higher than an

operating segment. The Company manages its business under one operating and reportable segment, and has one reporting unit.

In testing for impairment, the fair value of the reporting unit, that is determined based on market data, is compared to its

carrying amount. If the carrying value is below the fair value assessment, there will be no impairment loss. If the fair value is

below the carrying value, then the Company is required to perform an additional test to determine the implied fair value of the

goodwill.

The Company performed its annual goodwill impairment testing as of September 30th and determined that the fair value of its

reporting unit exceeds its carrying value and accordingly, the second step of the impairment test was not required to be

performed.

Revenue Recognition and Accounts Receivable Valuation

10

Revenue is recognized when persuasive evidence of an arrangement exists, the product has been delivered, the price is fixed or

determinable and collection is reasonably assured. Terms under these arrangements are generally free on board (“FOB”)

shipping point, or ex works factory (“EXW”), at which time legal title passes from the Company to the customer. Therefore,

delivery is generally considered to have occurred upon shipment. In certain circumstances customers may negotiate different

terms. In these situations, delivery is considered to have occurred once legal title has passed from the Company to the

customer. This may be at delivery to the customer’s destination or acceptance by the Company’s customer.

Sales to end-user customers and resellers typically do not have customer acceptance provisions and only certain of the original

equipment manufacturer (“OEM”) customer sales have customer acceptance provisions. Customer acceptance is generally

limited to performance under published product specifications. For the few product sales that have customer acceptance

provisions because of higher than published specifications, (1) the products are tested and accepted by the customer at a

company site or by the customer’s acceptance of the results of a testing program prior to shipment to the customer, or (2) the

revenue is deferred until customer acceptance occurs. The Company records revenues net of volume discount rebates that are

earned by certain OEM customers, based on sales levels, pursuant to contractual agreements.

The vast majority of our sales are made to OEMs, resellers, and end users in the industrial market. Sales made to OEMs and

resellers in the industrial market do not require installation of the products by the Company, as installation is performed by the

customer and are not subject to other post-delivery obligations. The Company may enter into multiple-deliverable arrangements

which include the delivery of lasers, laser systems, installation, and training. Revenue from these arrangements is allocated to

separate units of accounting if certain criteria are met. The allocation of the arrangement consideration to the separate units of

accounting is based on vendor-specific objective evidence or third-party evidence of selling price. If such evidence is not

available, the Company uses best estimate of selling price. Revenue related to installation and training is recognized when

installation is completed or training is provided which usually takes place up to three months after the delivery of the laser or

the laser system.

The Company records allowances for uncollectible customer accounts receivable based on historical experience. Additionally,

an allowance is made based on an assessment of specific customers’ financial condition and liquidity. If the financial condition

of the Company’s customers were to deteriorate, additional allowances may be required.

Income and Other Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the

future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and

liabilities and their respective tax bases and operating loss tax carryforwards. Deferred tax assets and liabilities are measured

using enacted tax rates that apply to taxable income in the years in which those temporary differences are expected to be

recovered or settled. The effect on deferred taxes of a change in tax rates is recognized in income in the period that includes the

enactment date. In assessing the realizability of deferred tax assets, management considers whether it is more likely than not

that some portion or all of the deferred tax assets will not be realized.

The Company recognizes certain tax liabilities for anticipated tax audit findings in the U.S. and other tax jurisdictions based on

its estimate of whether, and to the extent to which additional taxes would be due. If the audit finding results in actual taxes

owed more or less than what the Company anticipated, its income tax expense would increase or decrease in the period of

determination.

Revenue and expenses are presented net of any country-specific taxes.

Accounting for Warranties

11

The Company issues a standard warranty of one to two years for parts and labor on lasers that are sold. Additionally, extended

warranties are negotiated on a contract-by-contract basis. The Company provides for estimated warranty costs as products are

shipped.

The Company’s estimate of costs to fulfill its warranty obligations is based on historical experience and expectation of future

conditions. To the extent the Company experiences increased warranty claim activity or increased costs associated with

servicing those claims, revisions to the estimated warranty liability would be required.

Foreign Currency Translation

The assets and liabilities of the Company’s operations outside the United States are translated into U.S. dollars at exchange

rates in effect on the balance sheet date, and revenues and expenses are translated using a weighted average exchange rate

during the period. Gains or losses resulting from the translation of foreign currency financial statements are recorded as a

separate component of stockholders’ equity. Gains and losses resulting from the re-measurement of foreign currency

transactions are reported as a component of “Other expense (income), net”.

Earnings per Share (“EPS”)

Basic EPS is computed by dividing “Net Income attributable to RSTI” by the weighted average number of common shares

outstanding during the period. Diluted EPS reflects the potential dilution from common stock equivalents (stock options).

Comprehensive Income

Comprehensive income consists of net income, foreign currency translation adjustments, pension liability adjustments and

changes in the fair value of interest rate swap agreements, and is presented in the consolidated statements of stockholders’

equity and comprehensive income.

Research and Development Expenses

Research and development costs are expensed when incurred and are net of primarily German and other European governments

and European Union grants of $707, $691 and $1,555, received for the years ended September 30, 2016, 2015 and 2014,

respectively. The Company has no future obligations under such grants.

Derivative Financial Instruments

The Company uses derivative financial instruments to manage funding costs and exposures arising from fluctuations in interest

rates. These derivative financial instruments consist primarily of interest rate swaps. The Company does not use derivative

financial instruments for trading purposes.

On the date the derivative contract is entered into, the Company designates the derivative as a hedge of the variability of cash

flows to be paid related to a recognized liability (“cash flow” hedge). Changes in the fair value of a derivative that is highly

effective and that is designated and qualifies as a cash flow hedge are recorded in other comprehensive income, until earnings

are affected by the variability in cash flows of the designated hedged item.

12

Interest rate swap agreements designated as hedges of the Company’s financial liabilities are recorded in the consolidated

balance sheet at fair value. Adjustments to the fair value of the derivative asset or liability are recorded as an adjustment to

other comprehensive income. At September 30, 2016, the Company did not hold any interest rate swaps.

From time to time, the Company enters into foreign currency forward contracts and forward exchange options generally of less

than one year duration to hedge a portion of its sales transactions denominated in foreign currencies. The gains and losses from

these foreign currency forward contracts and forward exchange options are reflected in the consolidated statement of

operations. At September 30, 2016, the Company held Japanese yen forward exchange contracts with notional amounts of Euro

2.3 million.

Operating Leases

The Company leases facilities under operating leases. Building lease agreements generally include rent escalation clauses. Most

of the Company’s lease agreements include renewal periods at the Company’s option. The Company recognizes scheduled rent

increases on a straight-line basis over the lease term beginning with the date the Company takes possession of the leased space.

Use of Estimates

Management of the Company makes a number of estimates and assumptions relating to the reporting of assets and liabilities,

the disclosure of contingent assets and liabilities and the reporting of revenues and expenses, to prepare these financial

statements in conformity with accounting principles generally accepted in the United States of America. Significant items

subject to such estimates and assumptions include the valuation allowance for receivables, inventory valuation, warranty

liabilities, the valuation allowance for deferred tax assets, assets and obligations related to employee benefits, and share-based

payment awards. Actual results could differ from these estimates.

Stock Incentive Plans

The Company measures share-based payments to employees, including grants of employee stock options, at fair value and

expenses them in the consolidated statement of operations over the service period (generally the vesting period) of the grant.

Shipping and Handling Costs

The Company accounts for shipping and handling fees and costs by recording revenue from shipping and handling fees in net

sales and shipping and handling costs in cost of sales.

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU No. 2014-09, "Revenue from Contracts with Customers (Topic 606)." ASU 2014-09

provides guidance on revenue from contracts with customers, which implements a five step process of how an entity should

recognize revenue in order to depict the transfer of promised goods or services to customers in an amount that reflects the

consideration to which the entity expects to be entitled in exchange for those goods or services. This standard was initially

released as effective for fiscal years beginning after December 15, 2016. In August 2015, the FASB issued ASU No. 2015-14

which defers the effective date of ASU 2014-09 by one year, with a new effective date for fiscal years beginning after

December 15, 2017 (fiscal year 2019 for the Company). The new guidelines can be implemented using either of the following

transition methods: (i) a full retrospective approach reflecting the application of the standard in each prior reporting period with

the option to elect certain practical expedients, or (ii) a retrospective approach with the cumulative effect of initially adopting

13

ASU 2014-09 recognized at the date of adoption. In May 2016, accounting guidance was issued to clarify the not yet effective

revenue recognition guidance issued in May 2014. This additional guidance does not change the core principle of the revenue

recognition guidance issued in May 2014, rather, it provides clarification of accounting for collections of sales taxes as well as

recognition of revenue (i) associated with contract modifications, (ii) for noncash consideration, and (iii) based on the

collectability of the consideration from the customer. The guidance also specifies when a contract should be considered

“completed” for purposes of applying the transition guidance. The effective date and transition requirements for this guidance

are the same as the effective date and transition requirements for the guidance previously issued in 2014, which is effective for

our fiscal year 2019.

In August 2014, the FASB issued No. ASU 2014-15, "Presentation of Financial Statements - Going Concern (Subtopic 205-40):

Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern". ASU 2014-15 requires management to

assess an entity’s ability to continue as a going concern by incorporating and expanding upon certain principles that are

currently in U.S. auditing standards. Specifically, ASU 2014-15 (1) provides a definition of the term substantial doubt, (2)

requires an evaluation every reporting period including interim periods, (3) provides principles for considering the mitigating

effect of management’s plans, (4) requires certain disclosures when substantial doubt is alleviated as a result of consideration of

management’s plans, (5) requires an express statement and other disclosures when substantial doubt is not alleviated, and (6)

requires an assessment for a period of one year after the date that the financial statements are issued (or are available to be

issued). The standard will be effective for the first interim period within annual reporting periods beginning after December 15,

2016. Early application is permitted. The Company does not believe the adoption of this guidance will have a material impact

on our consolidated financial statements.

In April 2015, the FASB issued ASU No. 2015-05, "Customer's Accounting for Fees Paid in a Cloud Computing Arrangement".

ASU 2015-05 provides guidance to customers about whether a cloud computing arrangement includes a software license. If the

arrangement includes a software license, the customer should account for the software license element in a manner consistent

with the acquisition of other software licenses. If the arrangement does not include a software license, the customer should

account for the arrangement as a service contract. This guidance will be effective for annual periods, including interim periods

within those annual periods, beginning after December 15, 2015 (fiscal year 2017 for the Company). The Company does not

believe the pronouncement will have a material impact on the Company’s consolidated financial statements.

In April 2015, the FASB issued ASU No. 2015-03, “Simplifying the Presentation of Debt Issuance Costs”. This standard

amends existing guidance to require the presentation of debt issuance cost in the balance sheet as a deduction from the carrying

amount of the related debt liability instead of a deferred charge. It is effective for annual reporting periods beginning after

December 15, 2015, but early adoption is permitted. The Company does not believe the pronouncement will have a material

impact on the Company’s financial statements and will implement the pronouncement in fiscal year 2017.

In July 2015, the FASB issued ASU No. 2015-11, "Simplifying the Measurement of Inventory". The new guidance does not

apply to inventory that is measured using last-in, first-out or the retail inventory method. The guidance applies to all other

inventory, which includes inventory that is measured using first-in, first-out or average cost and requires that inventory should

be measured at the lower of cost and net realizable value. These amendments are effective for fiscal years beginning after

December 15, 2016 (fiscal year 2018 for the Company). The Company is currently evaluating the impact of the new guidance

on its consolidated financial statements, and will implement the guidance in fiscal year 2018.

On November 20, 2015, the FASB issued ASU No. 2015-17, "Balance Sheet Classification of Deferred Assets". The new

guidance will require entities to present deferred tax assets and deferred tax liabilities as noncurrent in a classified balance

sheet. This amendment is effective for fiscal years beginning after December 15, 2016, and interim periods within those years.

Early adoption is allowed and entities are permitted to apply the amendments either prospectively or retrospectively. The

Company will adopt the guidance in fiscal year 2018.

In January 2016, the FASB issued ASU No. 2016-01, Recognition and Measurement of Financial Assets and Liabilities. The

guidance requires equity investments, except those accounted for under the equity method of accounting, to be measured at fair

value with changes in fair value recognized in net income. Companies may elect to measure equity instruments that do not

14

have readily determinable fair values at cost, less impairment (if any), plus or minus changes resulting from observable price

changes. If a company has elected to measure a liability at fair value, the changes in fair value resulting from instrument

specific credit risk are required to be recorded through other comprehensive income. Companies are also required to separately

present financial assets and financial liabilities, by measurement category and form of financial asset, on the balance sheet or in

the notes to the financial statements. ASU No. 2016-01 will be effective for fiscal years and interim periods beginning after

December 15, 2017 (fiscal year 2019 for the Company) and is required to be applied prospectively with a cumulative effect

adjustment to the balance sheet as of the beginning of the fiscal year of adoption. Early adoption is not permitted, except for

recognition of changes in fair value of a liability resulting from a change in instrument specific credit risk through other

comprehensive income. The Company does not believe the pronouncement will have a material impact on the Company’s

financial statements and will implement the pronouncement in fiscal year 2019.

In February 2016, the FASB issued ASU No. 2016-02, "Leases". This guidance requires lessees to record the assets and

liabilities arising from all leases in the statement of financial position. Under ASU No, 2016-02, lessees will recognize a

liability for lease payments and right-of-use asset. When measuring asset and liabilities, a lessee should include amounts

related to option terms, such as an option of extending or terminating the lease or purchasing the underlying asset, that are

reasonably certain to be exercised. For leases with a term of 12 months or less, lessees are permitted to make an accounting

policy election to not recognize lease assets and liabilities. ASU No. 2016-02 retains the distinction between finance leases and

operating leases and the classification criteria remains similar. For financing leases, a lessee will recognize the interest on a

lease liability separate from amortization of the right-to-use asset. In addition, repayments of principal will be presented within

financing activities and interest payments will be presented within operating activities in the statement of cash flows. For

operating leases, a lessee will recognize a single lease cost on a straight-line basis and classify all cash payments within

operating activities in the statement of cash flows. ASU No. 2016-02 will be effective for years and interim periods beginning

after December 15, 2018 and is required to be applied using a modified retrospective approach. Early adoption is permitted but

has not been elected. The Company has not yet evaluated the expected impact ASU No. 2016-02 will have on its financial

position and results of operations and will adopt the guidance in fiscal year 2020.

In March 2016, the FASB issued amended guidance that simplifies several aspects of the accounting for employee share based

payment transactions, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as

well as classification in the statement of cash flows. Under the new guidance, an entity recognizes all excess tax benefits and

tax deficiencies as income tax expense or benefit in the income statement. This change eliminates the notion of the APIC pool

and significantly reduces the complexity and cost of accounting for excess tax benefits and tax deficiencies. The new standard

will become effective for our fiscal year beginning October 1, 2017. We are currently assessing the impact of this amended

guidance and the timing of adoption.

In October 2016, the FASB issued amended guidance that improves the accounting for the income tax consequences of intra-

entity transfers of assets other than inventory. Under the new guidance, an entity should recognize the income tax consequences

of an intra-entity transfer of an asset other than inventory when the transfer occurs. The new standard will become effective for

our fiscal year beginning October 1, 2018. We are currently assessing the impact of this amended guidance and the timing of

adoption.

Other accounting standards that have been issued by the FASB or other standards-setting bodies that do not require adoption

until a future date are not expected to have a material impact on the Company's financial statements upon adoption.

15

2. FAIR VALUE MEASUREMENTS

Financial assets and liabilities, measured at fair value on a recurring basis, are classified on the valuation hierarchy in the table

below:

September 30, 2016

Total Level 1 Level 2 Level 3

Cash and cash equivalents $ 177,743 $ 177,743 $ — $ —

Short-term investments 9,191 9,191 — —

Derivatives (169 ) — (169 ) —

Other long-term assets 550 — 550 —

Total assets and liabilities at fair value $ 187,315 $ 186,934 $ 381 $ —

September 30, 2015

Total Level 1 Level 2 Level 3

Cash and cash equivalents $ 169,729 $ 169,729 $ — $ —

Short-term investments 5,833 5,833 — —

Derivatives (51 ) — (51 ) —

Other long-term assets 550 — 550 —

Total assets and liabilities at fair value $ 176,061 $ 175,562 $ 499 $ —

3. INVENTORIES

Inventories, net of obsolescence and lower of cost or market reserves, are summarized as follows:

September 30,

2016 2015

Finished goods $ 31,921 $ 29,720

Work in progress 42,732 38,602

Raw materials and supplies 62,882 67,434

Demo inventory 12,960 13,655

Service parts 33,330 31,614

Total inventories $ 183,825 $ 181,025

4. PROPERTY AND EQUIPMENT

Property and equipment include the following:

September 30,

2016 2015

Land and buildings $ 61,786 $ 63,302

Technical machinery and equipment 68,921 63,764

Construction in progress 10,907 1,461

Furniture and fixtures 30,767 28,461

Computers and software 7,786 8,022

Leasehold improvements 22,813 26,818

Total property and equipment, at cost $ 202,980 $ 191,828

16

5. GOODWILL AND OTHER INTANGIBLE ASSETS

The changes in the carrying amount of goodwill for the years ended September 30, 2016 and 2015, are as follows:

Germany

United

States

Rest of

World Total

Balance as of September 30, 2014 $ 40,938 $ 13,091 $ 46,326 $ 100,355

Additional goodwill from acquisitions — — — —

Currency exchange differences (4,326 ) (325 ) (2,163 ) (6,814 )

Balance as of September 30, 2015 $ 36,612 $ 12,766 $ 44,163 $ 93,541

Additional goodwill from acquisitions — — — —

Currency exchange differences 45 3 (830 ) (782 )

Balance as of September 30, 2016 $ 36,657 $ 12,769 $ 43,333 $ 92,759

The carrying values of other intangible assets are as follows:

September 30, 2016 September 30, 2015

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Amortized intangible assets:

Patents $ 16,970 $ 9,938 $ 16,985 $ 9,151

Customer base 17,545 17,115 17,220 16,451

Other 23,869 18,528 23,527 17,363

Total $ 58,384 $ 45,581 $ 57,732 $ 42,965

Patents are amortized on a straight-line basis over the life of the patent which ranges from 1 to 20 years. Customer base is

amortized on a straight-line basis over seven years. Other intangible assets, mainly comprised of software and unpatented

technology, are amortized on a straight-line basis between 1 and 16 years. Amortization expense for the years ended

September 30, 2016, 2015 and 2014, was $2,678, $3,057 and $2,906, respectively.

At September 30, 2016, estimated amortization expense of existing intangible assets for the next five fiscal years and thereafter,

based on the average exchange rates as of September 30, 2016, is as follows:

Amortization Expense

2017 $ 2,700

2018 2,100

2019 1,400

2020 1,100

2021 and thereafter 5,500

17

6. ACCRUED LIABILITIES

Accrued liabilities are comprised of the following:

September 30,

2016 2015

Employee compensation $ 20,845 $ 24,314

Warranty reserves 10,849 10,913

Invoices to be received 3,319 4,343

Customer deposits 13,906 16,188

Deferred income 3,287 3,362

Other 10,117 10,866

Total accrued liabilities $ 62,323 $ 69,986

The Company provides for the estimated costs of product warranties when revenue is recognized. The estimate of costs to

fulfill warranty obligations is based on historical experience and expectation of future conditions.

The change in warranty reserves for the years ended September 30, 2016 and 2015, are as follows:

Balance as of September 30, 2014 $ 10,778

Additional accruals for warranties during the period 3,365

Usage during the period (2,351 )

Currency translation (879 )

Balance as of September 30, 2015 $ 10,913

Additional accruals for warranties during the period 4,261

Usage during the period (4,261 )

Currency translation (64 )

Balance as of September 30, 2016 $ 10,849

7. LINES OF CREDIT

The Company maintains $20,000 in short-term lines of credit in the U.S. As of September 30, 2016 and 2015, $20,000

remained unused and available for future use.

In addition, the Company’s non-U.S. subsidiaries have short-term credit lines amounting to $40,532, which allow them to

borrow in the applicable local currency. At September 30, 2016 and 2015, direct borrowings under these agreements totaled

$3,569 and $3,932, respectively. Additionally, $1,552 and $2,244 were used for bank guarantees under those lines of credit as

of September 30, 2016 and 2015, respectively. The remaining unused portion of the lines of credit at September 30, 2016, was

$35,411, in aggregate. Interest rates vary from 0.43% to 1.35%, depending upon the country and the usage made of the

available credit.

Furthermore, the Company also maintains credit lines specific to bank guarantees amounting to $12,924 and $12,180 as of

September 30, 2016 and 2015, respectively, of which $3,141 and $4,656 was used as of September 30, 2016 and 2015,

respectively.

The Company is subject to financial covenants under some of these lines of credit, which could restrict the Company from

drawing money under them. The Company was in compliance with all covenants as of September 30, 2016.

18

8. LONG-TERM DEBT

Long-term debt included in the consolidated balance sheets is comprised of the following:

September 30,

Description 2016 2015

1.85% Term loan due 2018 1,632 2,561

1.7% Term loan due 2017 2,797 2,794

1.0% State of Connecticut Term loan due 2023 2,487 2,850

1.3% Term loan due 2024 11,189 11,174

Total long-term debt facilities 18,106 19,379

Current portion of long-term debt included in line of credit and

short-term borrowings 5,496

1,294

Total long-term debt $ 12,610 $ 18,085

Future contractual principal payments of long-term debt as of September 30, 2016, are as follows:

Fiscal year ending September 30, Total

2018 2,469

2019 1,773

2020 1,777

2021 1,781

2022 and thereafter 4,810

$ 12,610

9. COMMITMENTS

The Company leases operating facilities and equipment under various operating leases. The lease agreements require payment

of real estate taxes, insurance, and maintenance expenses by the Company.

Minimum lease payments for future fiscal years under non-cancellable operating leases as of September 30, 2016, are:

Fiscal year ending September 30, Total

2017 $ 6,528

2018 3,913

2019 2,575

2020 1,485

2021 550

2022 and thereafter 2,186

Rent expense charged to operations for the years ended September 30, 2016, 2015 and 2014, approximated $9,247, $10,728

and $10,786, respectively.

Purchase obligations for payments due under various types of agreements to purchase raw materials, services and other goods

as of September 30, 2016, are:

Less than 1 year 71,797

1 - 3 Years 11,843

3 - 5 Years 33

More than 5 years 115

19

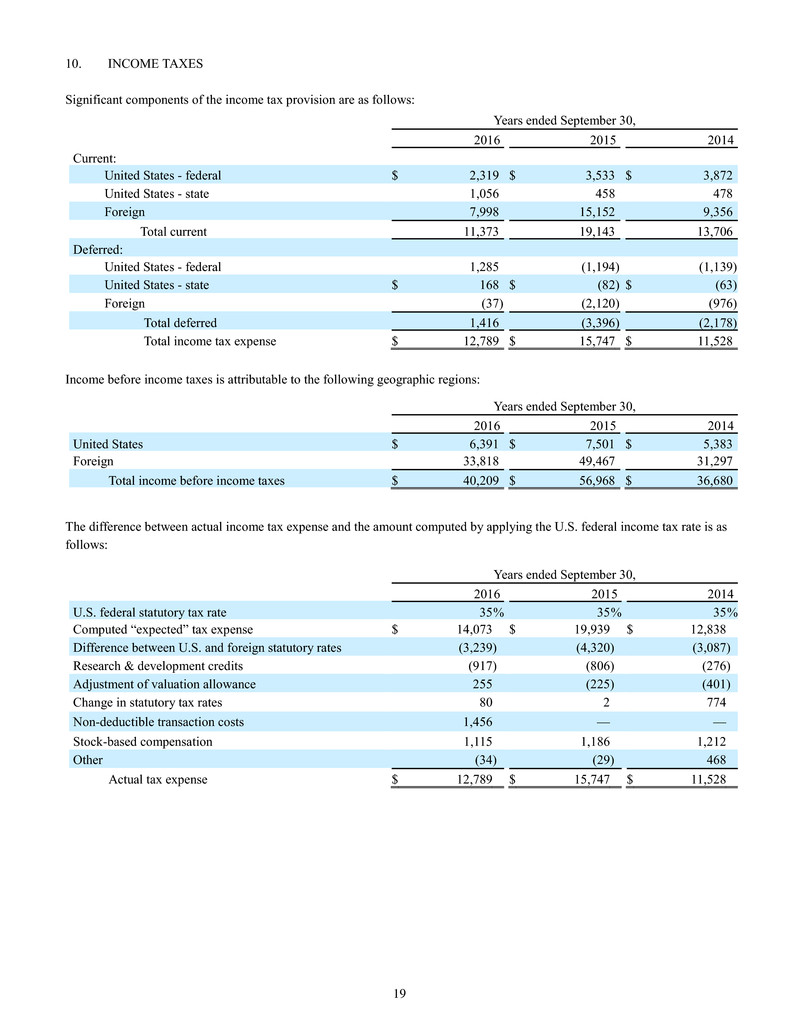

10. INCOME TAXES

Significant components of the income tax provision are as follows:

Years ended September 30,

2016 2015 2014

Current:

United States - federal $ 2,319 $ 3,533 $ 3,872

United States - state 1,056 458 478

Foreign 7,998 15,152 9,356

Total current 11,373 19,143 13,706

Deferred:

United States - federal 1,285 (1,194 ) (1,139 )

United States - state $ 168 $ (82 ) $ (63 )

Foreign (37 ) (2,120 ) (976 )

Total deferred 1,416 (3,396 ) (2,178 )

Total income tax expense $ 12,789 $ 15,747 $ 11,528

Income before income taxes is attributable to the following geographic regions:

Years ended September 30,

2016 2015 2014

United States $ 6,391 $ 7,501 $ 5,383

Foreign 33,818 49,467 31,297

Total income before income taxes $ 40,209 $ 56,968 $ 36,680

The difference between actual income tax expense and the amount computed by applying the U.S. federal income tax rate is as

follows:

Years ended September 30,

2016 2015 2014

U.S. federal statutory tax rate 35 % 35 % 35 %

Computed “expected” tax expense $ 14,073 $ 19,939 $ 12,838

Difference between U.S. and foreign statutory rates (3,239 ) (4,320 ) (3,087 )

Research & development credits (917 ) (806 ) (276 )

Adjustment of valuation allowance 255 (225 ) (401 )

Change in statutory tax rates 80 2 774

Non-deductible transaction costs 1,456 — —

Stock-based compensation 1,115 1,186 1,212

Other (34 ) (29 ) 468

Actual tax expense $ 12,789 $ 15,747 $ 11,528

20

Total income taxes for the years ended September 30, 2016, 2015 and 2014, were allocated as follows:

Years ended September 30,

2016 2015 2014

Income taxes from operations $ 12,789 $ 15,747 $ 11,528

Stockholders’ equity:

Tax benefit applicable to the exercise of stock options — — (48 )

Tax (benefit) expense applicable to defined benefit pension plan (1,914 ) (309 ) (391 )

Tax (benefit) expense applicable to the fair value of interest swap

agreements —

11

15

Total income tax $ 10,875 $ 15,449 $ 11,104

21

Deferred income taxes result from temporary differences between the amount of assets and liabilities recognized for financial

reporting and tax purposes. The components of net deferred income taxes are as follows:

September 30,

2016 2015

Deferred income tax assets:

Foreign

Net operating loss carryforwards $ 3,781 $ 5,122

Inventories 6,973 6,912

Pension obligations 4,185 2,676

Accounts payable 303 85

Accounts receivable 876 —

Other 679 627

Total Foreign 16,797 15,422

United States:

Net operating loss carryforwards 5,745 6,425

Tax credits 439 576

Warranty reserve 940 858

Inventories 8,052 8,121

Allowance for doubtful accounts 316 297

Accrued liabilities 916 783

Pension obligations 2,824 2,109

Property & equipment — 278

Accounts receivable 370 355

Stock-based compensation expense 2,591 2,682

Other 141 216

Total United States 22,334 22,700

Gross deferred income tax assets 39,131 38,122

Less: Valuation allowance (2,717 ) (2,463 )

Net deferred income tax assets $ 36,414 $ 35,659

Deferred income tax liabilities:

Foreign:

Property & equipment (357 ) (174 )

Intangibles (3,056 ) (2,784 )

Accounts receivable — (244 )

Other (357 ) (259 )

Total Foreign (3,770 ) (3,461 )

United States:

Other non-current assets (73 ) (70 )

Property & equipment (75 ) —

Other intangibles (40 ) —

Total United States (188 ) (70 )

Gross deferred income tax liabilities (3,958 ) (3,531 )

Net deferred income tax assets $ 32,456 $ 32,128

22

The total deferred income tax assets (liabilities) are included in the accompanying consolidated balance sheet as follows:

September 30,

2016 2015

Deferred income tax assets – current $ 25,780 $ 25,718

Deferred income tax assets – non-current 17,055 15,528

Deferred income tax liabilities – current (2,524 ) (2,666 )

Deferred income tax liabilities – non-current (7,855 ) (6,452 )

Net deferred income tax assets $ 32,456 $ 32,128

In assessing the realizability of deferred tax assets, management considers whether it is more likely than not that some portion

or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the

generation of future taxable income during the periods in which those temporary differences become deductible, as well as

limitations imposed by the relevant taxing jurisdictions on the future benefits of those deductions. Management considers the

scheduled reversal of deferred tax liabilities, projected future taxable income, the relevant statutory and regulatory limitations,

and tax planning strategies in making this assessment. Based upon the level of historical taxable income and projections for

future taxable income over the periods in which the deferred tax assets are deductible, management believes it is more likely

than not that the Company will realize the benefits of these deductible differences.

At September 30, 2016, the Company had state net operating tax loss carryforwards available of $30,611 in the United States

(which start to expire in 2023). Additionally, the Company had federal net operating tax loss carryforwards available of

$10,143 in the United States, $5,214 in Germany and $10,032 in other European/Asian countries (which start to expire in

2017). As of September 30, 2016, deferred tax assets, net of valuation allowances related to these operating tax losses and tax

credits, amounted to $6,809.

We have accumulated undistributed earnings of foreign subsidiaries aggregating approximately $460 million at September 30,

2016. These earnings are expected to be indefinitely reinvested outside of the United States. If those earnings were distributed

in the form of dividends or otherwise, they would be subject to United States federal income taxes (subject to an adjustment for

foreign tax credits), state income taxes and withholding taxes payable to the various foreign countries. It is not currently

practicable to estimate the tax liability that might be payable on the repatriation of these foreign earnings.

The Company's policy is to recognize interest and penalties accrued on any unrecognized tax benefits as interest expense and

selling, general and administrative expenses, respectively. The Company classified the unrecognized tax benefit as non-current

because payment is not anticipated within one year of the balance sheet date. As of September 30, 2016, the Company's gross

unrecognized tax benefits totaled $581, which includes $160 interest and penalties. Approximately $421 of unrecognized tax

benefits would impact the effective tax rate, if recognized. The Company estimates that the unrecognized tax benefits will not

change significantly within the next year.

23

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits, excluding the related accrual for

interest, is as follows:

Balance at September 30, 2013 $ 440

Decreases in tax positions for prior years (69 )

Increases in tax positions for current year 194

Settlements with taxing authorities —

Balance at September 30, 2014 $ 565

Decreases in tax positions for prior years (185 )

Increases in tax positions for current year —

Settlements with taxing authorities (146 )

Balance at September 30, 2015 $ 234

Decreases in tax positions for prior years (3 )

Increases in tax positions for current year 91

Increases in tax positions for prior years 259

Settlements with taxing authorities —

Balance at September 30, 2016 $ 581

The Company files federal and state income tax returns in several domestic and foreign jurisdictions. In most tax jurisdictions,

returns are subject to examination by the relevant tax authorities for a number of years after the returns have been filed. With

limited exceptions, the Company is no longer subject to examination by the United States Internal Revenue Service for years

through 2011. With respect to state and local tax jurisdictions and countries outside the United States, with limited exceptions,

the Company is no longer subject to income tax audits for years before 2010.

11. EMPLOYEE BENEFIT PLANS

The Company has defined benefit pension plans for the RSL and Rofin-Sinar Inc. (RS Inc.) employees. The Company’s U.S.

plan began in fiscal year 1995 and is funded. Any new employees hired after January 1, 2007, are not eligible for the RS Inc.

pension plan. As is the normal practice with German companies, the German pension plan is unfunded. Any new employees,

hired after the acquisition of RBL in 2000, are not eligible for the RSL pension plan. The measurement date of the Company’s

pension plans is September 30.

Effective January 1, 2012, the RS Inc. defined benefit pension plan was amended to exclude highly compensated employees, as

defined by the Internal Revenue Service, from receiving future years of service under the RS Inc. pension plan. A non-qualified

defined benefit pension plan was created to replace the benefits lost by the employees that were otherwise excluded from the

qualified pension plan.

The determination of the Company’s obligation and expense for pension is dependent on the selection of certain actuarial

assumptions in calculating those amounts. Assumptions are made about interest rates, expected investment return on plan

assets, total turnover rates, and rates of future compensation increases. In addition, the Company’s actuarial consultants use

subjective factors such as withdrawal rates and mortality rates to develop their calculations of these amounts. The Company

generally reviews these assumptions at the beginning of each fiscal year. The Company is required to consider current market

conditions, including changes in interest rates, in making these assumptions. The actuarial assumptions that the Company uses

may differ materially from actual results due to changing market and economic conditions, higher or lower withdrawal rates or

longer or shorter life spans of participants. These differences may result in a significant impact on the amount of pension

benefits expense the Company has recorded or may record.

Another key assumption in determining the net pension expense is the assumed discount rate to be used to discount plan

obligations. The Company's U.S. plan uses a cash flow matching approach, which uses projected cash flows matched to spot

24

rates along a high-quality corporate yield curve to determine the present value of cash flows to calculate a single equivalent

discount rate. A lower discount rate increases the present value of benefit obligations and increases pension expense.

To determine the expected long-term rate of return on plan assets, the Company considers the current and expected asset

allocations, as well as historical and expected returns on various categories of plan assets.

The following table sets forth the funded status of the plans at the balance sheet dates:

September 30,

2016 2015

Change in benefit obligation:

Projected benefit obligation at beginning of year $ 35,988 $ 36,441

Service cost 880 928

Interest cost 1,159 1,062

Actuarial losses (gains) 6,838 259

Foreign exchange rate impacts 20 (1,898 )

Benefits paid – total (707 ) (804 )

Projected benefit obligation at end of year 44,178 35,988

Projected benefit obligation at end of year:

U.S. plans 18,836 15,810

Foreign plans 25,342 20,178

Projected benefit obligation at end of year 44,178 35,988

Change in plan assets:

Fair value of plan assets at beginning of year 10,095 10,276

Actual return on plan assets 788 (163 )

Employer contributions 550 422

Benefits paid – funded plans (312 ) (440 )

Fair value of plan assets at end of year 11,121 10,095

Fair value of plan assets at end of year:

U.S. plans 11,121 10,095

Foreign plans — —

Fair value of plan assets at end of year 11,121 10,095

Funded status at end of year $ (33,057 ) * $ (25,893 ) *

Amounts recognized in the consolidated balance sheet

Accrued benefit liability $ (33,057 ) $ (25,893 )

Accumulated other comprehensive loss (pre-tax) 15,948 9,911

Net amount recognized $ (17,109 ) $ (15,982 )

*$461 and $454 relate to expected payments in the following twelve months for the Company’s unfunded non-US plans and are

therefore classified in current “Accrued liabilities” in the consolidated balance sheets as of September 30, 2016 and 2015,

respectively.

The following table sets forth information for pension plans with an accumulated benefit obligation in excess of plan assets:

September 30,

2016 2015

Projected benefit obligation $ 44,178 $ 35,988

Accumulated benefit obligation 40,396 33,383

Fair value of plan assets 11,121 10,095

25

The components of net periodic benefit cost and other changes recognized in other comprehensive income:

September 30,

2016 2015

Net periodic benefit cost

Service Cost $ 880 $ 928

Interest Cost 1,159 1,062

Expected return on plan assets (659 ) (700 )

Amortization of net loss 628 405

Amortization of prior service cost 75 75

Effect of settlement — (13 )

Net periodic benefit cost $ 2,083 $ 1,757

Other changes recognized in other comprehensive income

Net loss (gain) 6,112 730

Amortization of prior service cost (75 ) (75 )

Total recognized in other comprehensive income $ 6,037 $ 655

Total recognized in net periodic benefit cost and other comprehensive income $ 8,120 $ 2,412

The weighted average assumptions used in the valuation of the plan are as follows:

September 30,

2016 2015

Discount rate to determine benefit obligations:

United States 3.66 % 4.33 %

Foreign 1.33 % 2.42 %

Discount rate to determine net periodic benefit cost:

United States 4.33 % 4.22 %

Foreign 2.42 % 2.40 %

Expected return on plan assets

United States 6.75 % 7.00 %

Foreign — % — %

Rate of compensation increase

United States 3.0 % 3.0 %

Foreign 3.0 % 3.0 %

The Company recognizes the over (under) funded status of the defined benefit plans in the statement of financial position. The

Company also recognizes, in other comprehensive income, certain gains and losses that arise during the period but are deferred

under current pension accounting rules. A one percent change in the discount rate or the rate of return on plan assets would

have a de minimis impact on the projected benefit obligation and the net periodic benefit cost.

Expected benefit payments for each of the next five fiscal years and for the five years aggregated thereafter is as follows: $901

in 2017, $1,401 in 2018, $1,127 in 2019, $1,203 in 2020, $1,941 in 2021 and $8,571 thereafter.

The Company’s pension plan asset allocations at September 30, 2016 and 2015, by asset category are as follows:

2016 2015

Target

Allocation Percentage Percentage

Equity Securities 50 % 50 % 49 %

Debt Securities 50 % 50 % 51 %

Total Plan Assets 100 % 100 % 100 %

26

The Company employs a total return investment approach whereby a mix of equity, debt securities and government securities

are used to maximize the long-term return of plan assets for a prudent level of risk. The intent of this strategy is to minimize

plan expenses by maximizing investment returns within that prudent level of risk. Furthermore, equity investments are

diversified across U.S. and non-U.S. stocks as well as growth, value and small and large capitalizations. Additionally, cash

balances are maintained at levels adequate to meet near-term plan expenses and benefit payments. Investment risk is measured

and monitored on an ongoing basis through semi-annual investment portfolio reviews.

Investments in our defined benefit plan are stated at fair value. Level 1 assets are valued using quoted market prices that

represent the asset value of the shares held by the trusts. The level 2 assets are investments in pooled funds, which are valued

using a model to reflect the valuation of their underlying assets that are publicly traded with observable values. The fair value

of our level 3 pension plan assets are measured by compiling the portfolio holdings and independently valuing the securities in

those portfolios.

The fair values of our pension plan assets, by level within the fair value hierarchy, are as follows:

September 30, 2016

Asset Categories Level 1 Level 2 Level 3 Total

Equity Securities

Small Cap $ — $ 255 $ — $ 255

Mid Cap — 531 — 531

Large Cap — 2,000 — 2,000

Total Market Stock — 935 — 935

International — 1,605 — 1,605

Emerging Markets — 272 — 272

Debt Securities

Bonds & Mortgages — 4,142 — 4,142

Inflation Protected — 563 — 563

High Yield — 580 — 580

Money Market — 238 — 238

Total Plan Assets $ — $ 11,121 $ — $ 11,121

September 30, 2015

Asset Categories Level 1 Level 2 Level 3 Total

Equity Securities

Small Cap $ — $ 217 $ — $ 217

Mid Cap — 474 — 474

Large Cap — 1,770 — 1,770

Total Market Stock — 808 — 808

International — 1,444 — 1,444

Emerging Markets — 230 — 230

Debt Securities

Bonds & Mortgages — 4,082 — 4,082

Inflation Protected — 520 — 520

High Yield — 510 — 510

Money Market — 40 — 40

Total Plan Assets $ — $ 10,095 $ — $ 10,095

27

RS Inc., RB Inc., PRC, Lee Laser, ROFIN-BAASEL Canada Ltd., DILAS Diode Laser, Inc. and Nufern have 401(k) plans for

the benefit of all eligible U.S. employees, as defined by the plan. Participating employees may contribute up to 16% of their

qualified annual compensation. Those subsidiaries match 50% of the first 5 to 6% of the employees’ compensation contributed

as a salary deferral. Company contributions for the years ended September 30, 2016, 2015 and 2014, were $719, $736 and

$701, respectively.

12. EARNINGS PER COMMON SHARE

The basic earnings per common share (EPS) calculation is computed by dividing net income attributable to holders of RSTI

common stock by the weighted average number of shares outstanding during the period. Diluted earnings per common share

reflect the potential dilution from common stock equivalents (stock options).

The calculation of the weighted average number of common shares outstanding for each period is as follows:

Years ended September 30,

2016 2015 2014

Weighted number of shares for basic earnings per common share 28,356,877 28,127,733 28,073,081

Potential additional shares due to outstanding dilutive stock options 185,764 143,211 149,110

Weighted number of shares for diluted earnings per common share 28,542,641 28,270,944 28,222,191

The weighted-average diluted shares outstanding for the years ended September 30, 2016, 2015 and 2014, excludes the dilutive

effect of approximately 1,491 thousand, 2,414 thousand and 2,927 thousand stock options, respectively, since the impact of

including these options in diluted earnings per share for these years was antidilutive.

13. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Accumulated other comprehensive income is comprised of the following:

September 30,

2016 2015 2014

Foreign currency translation adjustment $ (55,123 ) $ (50,896 ) $ (7,759 )

Defined benefit pension plans (net of taxes of $5,228 in 2016, $3,315 in 2015 and

$3,006 in 2014) (10,720 ) (6,597 ) (6,251 )

Fair value of interest swap agreements (net of taxes of $0 in 2016, $7 in 2015 and

$18 in 2014) —

(24 ) (62 )

Total accumulated other comprehensive income (loss) $ (65,843 ) $ (57,517 ) $ (14,072 )

The changes in accumulated other comprehensive income (loss) by component, net of tax, during the years ended

September 30, 2016 and 2015, are as follows:

Defined Benefit

Plans

Foreign Currency

Translation

Adjustments

Fair Value of

Interest Swap

Agreements Total

Balance at September 30, 2015 $ (6,597 ) $ (50,896 ) $ (24 ) $ (57,517 )

Other comprehensive income before

reclassifications —

(4,227 ) 24

(4,203 )

Amounts reclassified from accumulated other

comprehensive income (4,123 ) —

—

(4,123 )

Balance at September 30, 2016 $ (10,720 ) $ (55,123 ) $ — $ (65,843 )

28

Defined Benefit

Plans

Foreign Currency

Translation

Adjustments

Fair Value of

Interest Swap

Agreements Total

Balance at September 30, 2014 $ (6,251 ) $ (7,759 ) $ (62 ) $ (14,072 )

Other comprehensive income before

reclassifications —

(43,137 ) 38

(43,099 )

Amounts reclassified from accumulated other

comprehensive income (346 ) —

—

(346 )

Balance at September 30, 2015 $ (6,597 ) $ (50,896 ) $ (24 ) $ (57,517 )

The reclassifications out of accumulated other comprehensive income (loss) for the years ended September 30, 2016 and 2015,

are as follows:

September 30, 2016 September 30, 2015

Unamortized loss on defined benefit pension plans

Amortization $ (6,037 ) $ (655 )

Tax effects 1,914 309

Total reclassification for the period $ (4,123 ) $ (346 )

14. TREASURY STOCK

On November 11, 2015, the Board of Directors authorized the Company to initiate a share buyback of up to $50.0 million of

the Company’s common stock over the next eighteen months to be made from time to time in the open market or in privately

negotiated transactions at the Company’s discretion. During the year ended September 30, 2016, the Company repurchased

approximately 0.4 million shares of common stock, at an average price of $20.80, under the stock buyback program for a total

price of $8.0 million.

15. RELATED PARTY TRANSACTIONS

The Company maintains other accounts payable to a related party in China amounting to $283 and $299 and as of September 30,

2016 and 2015, respectively. Effective December 23, 2014, the Company acquired an additional 8.8% of the common stock of

NELC. The Company currently holds 88.8% of the share capital of NELC as of September 30, 2016 and 2015, respectively.

The main facility in Starnberg is rented under a 25-year operating lease from the former minority shareholder of RBL, Mr.

Baasel, who is also a member of the Board of Directors of the Company. That lease will terminate by end of December 2016.

The Company paid expenses, mainly for rental expense of $704, $735 and $883 to Mr. Baasel during fiscal years 2016, 2015

and 2014, respectively.

16. GEOGRAPHIC INFORMATION

Assets, revenues and income before taxes, by geographic region attributed based on the geographic location of the RSTI

entities are summarized below:

29

ASSETS September 30,

2016 2015

North America $ 265,838 $ 258,424

Germany 448,010 433,435

Other 362,387 343,072

Intercompany eliminations (340,420 ) (328,440 )

Total assets $ 735,815 $ 706,491

PROPERTY AND EQUIPMENT, NET September 30,

2016 2015

North America $ 16,898 $ 16,128

Germany 57,283 51,124

Other 23,295 25,560

Intercompany eliminations (161 ) (239 )

Total long-lived assets $ 97,315 $ 92,573

REVENUES - TOTAL BUSINESS Years ended September 30,

2016 2015 2014

North America $ 154,128 $ 151,835 $ 146,053

Germany 301,239 320,557 330,485

Other 244,958 274,431 276,832

Intercompany eliminations (214,674 ) (227,180 ) (223,253 )

$ 485,651 $ 519,643 $ 530,117

INTERCOMPANY REVENUES Years ended September 30,

2016 2015 2014

North America $ 9,656 $ 14,191 $ 12,602

Germany 156,035 159,601 148,441

Other 48,983 53,388 62,210

Intercompany eliminations (214,674 ) (227,180 ) (223,253 )

$ — $ — $ —

EXTERNAL REVENUES Years ended September 30,

2016 2015 2014

North America $ 144,472 $ 137,643 $ 133,450

Germany 145,204 160,957 182,045

Other 195,975 221,043 214,622

$ 485,651 $ 519,643 $ 530,117

INCOME BEFORE INCOME TAXES Years ended September 30,

2016 2015 2014

North America $ 6,412 $ 7,809 $ 5,490

Germany 17,825 22,780 5,000

Other 15,972 26,379 26,190

$ 40,209 $ 56,968 $ 36,680

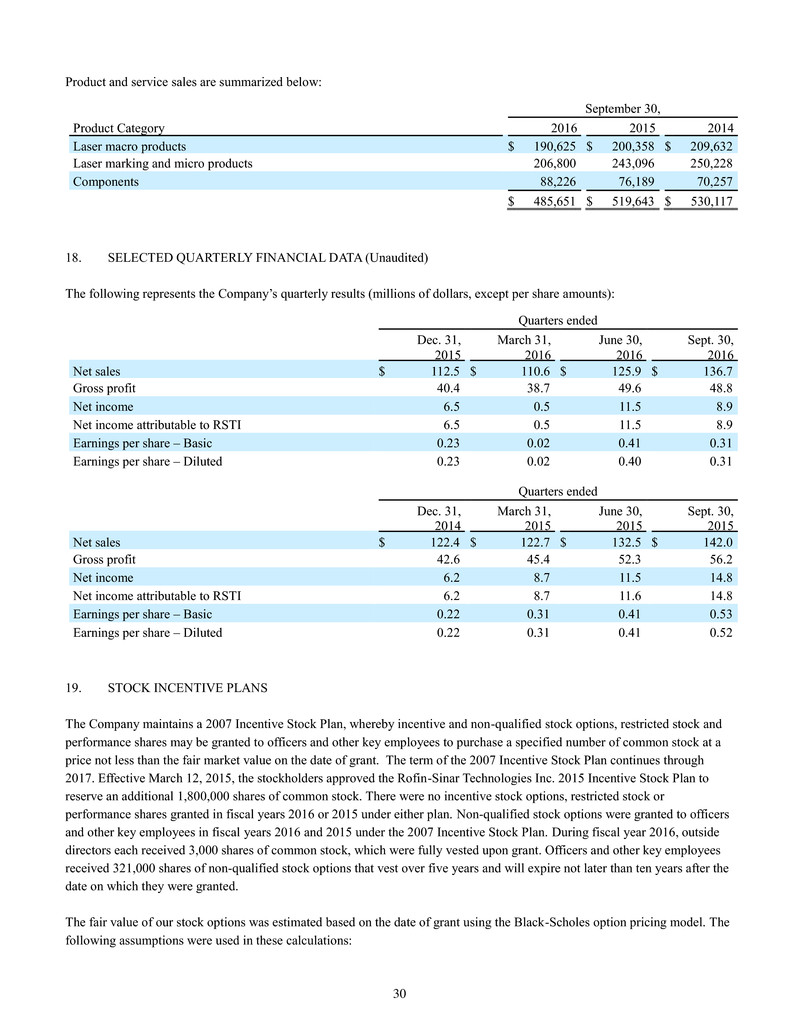

17. ENTERPRISE WIDE INFORMATION

The Company derives revenues from the sale and servicing of laser products used for macro applications, from the sale and

servicing of laser products for marking and micro applications, and from the sale of components products.

30

Product and service sales are summarized below:

September 30,

Product Category 2016 2015 2014

Laser macro products $ 190,625 $ 200,358 $ 209,632

Laser marking and micro products 206,800 243,096 250,228

Components 88,226 76,189 70,257

$ 485,651 $ 519,643 $ 530,117

18. SELECTED QUARTERLY FINANCIAL DATA (Unaudited)

The following represents the Company’s quarterly results (millions of dollars, except per share amounts):

Quarters ended

Dec. 31,

2015

March 31,

2016

June 30,

2016

Sept. 30,

2016

Net sales $ 112.5 $ 110.6 $ 125.9 $ 136.7

Gross profit 40.4 38.7 49.6 48.8

Net income 6.5 0.5 11.5 8.9

Net income attributable to RSTI 6.5 0.5 11.5 8.9

Earnings per share – Basic 0.23 0.02 0.41 0.31

Earnings per share – Diluted 0.23 0.02 0.40 0.31

Quarters ended

Dec. 31,

2014

March 31,

2015

June 30,

2015

Sept. 30,

2015

Net sales $ 122.4 $ 122.7 $ 132.5 $ 142.0

Gross profit 42.6 45.4 52.3 56.2

Net income 6.2 8.7 11.5 14.8

Net income attributable to RSTI 6.2 8.7 11.6 14.8

Earnings per share – Basic 0.22 0.31 0.41 0.53

Earnings per share – Diluted 0.22 0.31 0.41 0.52

19. STOCK INCENTIVE PLANS

The Company maintains a 2007 Incentive Stock Plan, whereby incentive and non-qualified stock options, restricted stock and

performance shares may be granted to officers and other key employees to purchase a specified number of common stock at a

price not less than the fair market value on the date of grant. The term of the 2007 Incentive Stock Plan continues through

2017. Effective March 12, 2015, the stockholders approved the Rofin-Sinar Technologies Inc. 2015 Incentive Stock Plan to

reserve an additional 1,800,000 shares of common stock. There were no incentive stock options, restricted stock or

performance shares granted in fiscal years 2016 or 2015 under either plan. Non-qualified stock options were granted to officers

and other key employees in fiscal years 2016 and 2015 under the 2007 Incentive Stock Plan. During fiscal year 2016, outside

directors each received 3,000 shares of common stock, which were fully vested upon grant. Officers and other key employees

received 321,000 shares of non-qualified stock options that vest over five years and will expire not later than ten years after the

date on which they were granted.

The fair value of our stock options was estimated based on the date of grant using the Black-Scholes option pricing model. The

following assumptions were used in these calculations:

31

September 30,

2016

Grants

2015

Grants

2014

Grants

Weighted average grant date fair value $ 11.75 $ 8.55 $ 11.72

Expected life 6.40 Years 5.46 Years 5.40 Years

Volatility 36.41 % 37.57 % 50.55 %

Risk-free interest rate 1.97 % 1.74 % 1.48 %

Dividend yield — % — % — %

For purposes of the Black-Scholes model, the Company uses historical data to estimate the expected life, volatility, and

estimated forfeitures of an option. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of

grant.

The balance of outstanding stock options and all options activity for the year ended September 30, 2016, is as follows:

Number of

Shares

Weighted

Average

Exercise Price

Weighted Average

Remaining

Contractual Term

(Years)

Aggregate

Intrinsic

Value

(Millions)