Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Hospitality Investors Trust, Inc. | v457064_ex99-2.htm |

| 8-K - FORM 8-K - Hospitality Investors Trust, Inc. | v457064_8k.htm |

Exhibit 99.1

American Realty Capital Hospitality Trust Announces $400 Million Commitment from Brookfield REIT to Become Self - Managed Upon Closing of the Transaction

American Realty Capital Hospitality Trust, Inc. 2 Risk Factors Investing in our common stock involves a degree of risk . See the section entitled “Risk Factors” in the most recent Annual Report on Form 10 - K of American Realty Capital Hospitality Trust, Inc . (“ARC Hospitality,” the “Company” or “we”) for a discussion of the risks which should be considered in connection with the Company . In addition to those risks , please be advised that the Company’s transaction with an affiliate of a fund managed by affiliates of Brookfield Asset Management, Inc . is subject to conditions, and there can be no assurance that such transaction will be consummated on its current terms, or at all . Further, any transition to self - management is conditioned on the consummation of the first tranche of the Brookfield convertible preferred equity investment . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review Risk Factors at the end of this presentation for a discussion of risks and uncertainties that could cause actual results to differ materially from our forward - looking statements. Important Information

American Realty Capital Hospitality Trust, Inc. 3 Brookfield Transaction ▪ ARC Hospitalit y has entered into a strategic transaction with an affiliate of a real estate private equity fund managed by affiliates of Brookfield Asset Management, Inc. (“Brookfield”), a global asset manager with over $250 billion of assets under management ▪ Brookfield will invest up to $400 million of convertible preferred equity (“Brookfield Transaction” or “Transaction”), which is anticipated to: ▪ Enable us to meet our near - term capital objectives ▪ Enhance our ability to execute our investment strategy ▪ Optimize the long - term value of our hotel portfolio ▪ Advance our long - term objective of providing liquidity for shareholders Uses of Brookfield’s Investment Proceeds ▪ $290.2 million: Redemption of preferred equity interests held by affiliates of the Whitehall real estate private equity funds sponsored by Goldman Sachs (“Whitehall”) ▪ $59.2 million: Funding of Property Improvement Plans (“PIPs”), transaction costs, working capital and general corporate purposes ▪ $26.9 million: Acquisition of portfolio of seven hotels from Summit Hotel Properties, Inc. (“Summit”) (1) ▪ $23.7 million: Repayment of our debt to affiliates of Summit Our Transition to Self - Management ▪ At closing, anticipated in March 2017, w e will become self - managed and change our name to Hospitality Investors Trust, Inc. ▪ We expect to realize meaningful annual cost savings (2) resulting from: ▪ Termination of our advisory agreement with AR Global ▪ Modification of existing property management agreements ▪ The current management team will remain unchanged (1) Assumes successful procurement of mortgage debt financing at approximately 50% LTV (2) Savings reflect Company estimates and assumptions which are subject to change, and there can be no assurance the cost savings wi ll ultimately be achieved Strategic Transaction

American Realty Capital Hospitality Trust, Inc. 4 Retail (1) $51.4B 170 Properties 151 million sf $1.0B Re - development Pipeline Hospitality ($9.8B) & Other ($10.4B) $18.2B 19 Hospitality Properties with ~14,000 Rooms 330 properties leased to automotive dealerships on a triple net basis Over 160 self - storage properties with approximately 98,000 units Industrial $4.1B 185 Properties 46 million sf Development Potential 42 million sf Multifamily (3) $9.4B ~32,000 Owned Apartments ~50,000 Managed Apartments Development Potential ~13,000 Apartments Office (1) $61.4B 259 Properties 125 million sf Development Potential 33 million sf (2) (4) 4 (1) Includes both core and opportunistic investments (2) General Growth Properties is a non - controlled affiliate; Brookfield owns a 33% interest on a fully - diluted basis including outst anding options (3) Includes multifamily developments owned by Brookfield Office Properties and Canary Wharf Group (4) Atlantis is managed by a Brookfield affiliate overseen by Brookfield Real Estate Financial Partners; Hard Rock Hotel & Casino is managed by a third - party overseen by Brookfield Real Estate Financial Partners; Brookfield’s interests in those parties is held by Brookfield Property Partners, which is a capital source for BPG’s investment activities Who is Brookfield? ▪ Global asset manager with over $250 billion of assets under management across real estate, renewable energy, infrastructure and private equity in over 30 countries; 100+ year history ▪ The investment will be provided by an affiliate of Brookfield Real Estate Partners II, which is managed by Brookfield Property Group (“BPG ”); BPG is Brookfield’s real estate division and the firm’s largest business with $145 billion of AUM, including $9.8 billion dedicated to the hospitality sector across North America and the U.K.

American Realty Capital Hospitality Trust, Inc. 5 Portfolio Development and Outlook December 2016 Portfolio consists of 141 hotels totaling 17,193 rooms in 32 states and a purchase price of $2.3 billion January 2014 Initial escrow break and share issuance February 2015 Equity Inns Portfolio acquired from Whitehall for $1.8 billion November 2015 Equity raise terminated having raised ~$900 million of anticipated $2 billion April and July 2016 Cash distributions suspended and annual stock distributions of $1.46 per share declared x Enables us to execute our investment strategy and maximize portfolio value x Expected to create meaningful annual savings (1) x Addresses near - term capital objectives x Advances our long - term objective of delivering liquidity for investors January 2017 $ 400 million strategic investment from Brookfield and self - management initiative announced (1) Savings reflect Company estimates and assumptions which are subject to change, and there can be no assurance the cost savings wi ll ultimately be achieved

American Realty Capital Hospitality Trust, Inc. 6 ▪ We own select - service and full - service hotels that are: ▪ Affiliated with premium national brands such as Hilton, Marriott and Hyatt ▪ Operated by highly - ranked and experienced management companies ▪ Located in strong U.S. markets with diverse demand generators ▪ Well - maintained, with brand - mandated reinvestment expected to further drive hotel performance ▪ Positioned as market leaders with attractive rates, occupancies and cash flows ▪ Purchased at a discount to replacement cost Capital Preservation Capital Appreciation ARC Hospitality seeks to provide: Consistent Investment Strategy

American Realty Capital Hospitality Trust, Inc. 7 Brookfield Transaction Transition to Self - Management x Creates partnership with leading global real estate asset manager ($250 billion of AUM) x Signals institutional affirmation of our investment strategy and opportunities in the select - service REIT sector x Addresses near - term capital requirements and financing needs, creating: ₋ A more sustainable capital structure ₋ An improved debt maturity profile x Provides liquidity to complete renovations in a timely and efficient manner, thus maximizing property performance and asset values x Allows for closing of the Summit Acquisition (1) x Advances our long - term plan for a potential listing or sale x Results in meaningful estimated annual savings (2) from: ₋ Elimination of asset management fees ₋ Reduction of property management fees x Cost savings support our long - term plan for a potential listing or sale by: ₋ Improving our liquidity profile ₋ Enabling us to potentially further deleverage our balance sheet ₋ Establishing a more efficient cost structure in line with publicly - traded peers x Allows for c ontinuity of existing management team and other employees Transaction and Transition to Self - Management Benefit Shareholders (1) Assumes successful procurement of mortgage debt financing at approximately 50% LTV (2) Savings reflect Company estimates and assumptions which are subject to change, and there can be no assurance the cost savings wi ll ultimately be achieved

American Realty Capital Hospitality Trust, Inc. 8 Suspension of Stock D istributions ▪ In connection with the Brookfield Transaction, our Board has suspended payment of our monthly distribution to stockholders payable in shares of common stock, effective as of January 14, 2017 ▪ Our Board believes suspending stock distributions is in the best long - term interest of our stockholders ▪ There can be no assurance that we will resume payment of distributions at any time in the future

American Realty Capital Hospitality Trust, Inc. 9 Management Continuity Hospitality Investors Trust, Inc. will be led by our existing management team, which has overseen our operations and the execution of our investment strategy since inception. Jonathan P. Mehlman President & Chief Executive Officer Paul Hughes Senior Vice President & Counsel Edward T. Hoganson Chief Financial Officer ▪ 25+ years of experience in real estate investment banking and capital markets with significant focus in the hospitality sector ▪ Acted as an M&A advisor, investment banker and lender in over $300 billion of lodging transactions ▪ Previously Head or Co - Head of real estate/lodging advisory at Deutsche Bank, Citigroup and Citadel Securities ▪ Significant legal experience in all practice areas impacting public real estate investment trusts, including corporate and corporate governance, federal securities laws, real estate acquisition and finance ▪ Spent 10 years as general counsel of a $2 billion public REIT listed on NYSE and 10 years in private practice ▪ Also is a CPA with significant financial accounting experience ▪ 15+ years of experience in the hospitality industry focused on the financial and capital markets ▪ Former CFO and EVP of Crestline Hotels & Resorts ▪ Former Senior Vice President of acquisitions for Sunrise Senior Living ▪ Former Head of Asset Management at Highland Hospitality Corporation (NYSE: HIH)

American Realty Capital Hospitality Trust, Inc. 10 Investment Size & Type ▪ Up to $ 400 million of Convertible Preferred Equity (“Convertible Preferred Units”) Distribution Rate ▪ 7.5% per annum paid in cash (1) ▪ 5.0% per annum paid in Convertible Preferred Units on an accrual basis Conversion Price ▪ Convertible Preferred Units will be convertible based on an initial conversion price of $14.75 per unit into OP Units, which are in turn redeemable for shares of our common stock on a one - for - one basis (2) Board Representation ▪ Brookfield will have the right to elect two members to ARC Hospitality’s Board of Directors (including the Board’s Chairman) , which will be increased from four to seven members upon the consummation of the initial closing of the investment Closing Conditions ▪ Closing of initial funding of $135 million is subject to lender and franchisor approvals as well as other closing conditions Transaction Summary Brookfield Transaction Note: Additional details regarding the material terms related to the Brookfield Transaction are available in our Form 8 - K that w as filed with the Securities and Exchange Commission (“SEC”) on January 13, 2017, as amended January 17, 2017 (1) Distribution rate could be increased to 7.75% per annum under certain circumstances (2) Initial conversion price of $14.75 subject to anti - dilution protection

American Realty Capital Hospitality Trust, Inc. 11 Termination of External Manager ▪ Pursuant to a separate agreement between us and American Realty Capital Hospitality Advisors, LLC (the “Advisor”), we will become self - managed and our existing advisory agreement will be terminated Property Management Agreement Modifications ▪ We will modify property management agreements to reduce property management fees and the contract length, in the case of certain sale events Name Change ▪ We intend to change our name to Hospitality Investors Trust, Inc. Management Team & Other Employees ▪ All of our executive officers and certain other employees of AR Global or its affiliates currently involved in the day - to - day management of ARC Hospitality are expected to become employees of Hospitality Investors Trust, Inc. Consideration to Property Manager ▪ In consideration of the changes to the property management agreements, our property manager, an affiliate of the Advisor, will receive certain consideration in cash and shares of our common stock Our Transition to Self - Management Note: Additional details regarding the material terms related to our transition to self - management are available in our Form 8 - K that was filed with the SEC on January 13, 2017, as amended January 17, 2017 Transaction Summary

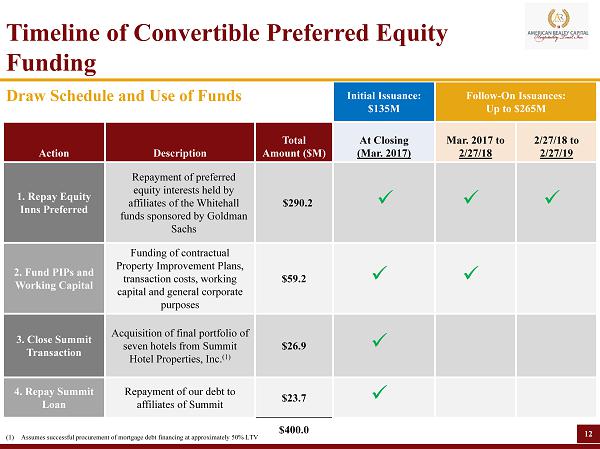

American Realty Capital Hospitality Trust, Inc. 12 Initial Issuance: $ 135 M Follow - On Issuances: Up to $ 265M Action Description Total Amount ($M) At Closing (Mar. 2017) Mar. 2017 to 2/27/18 2/27/18 to 2/27/19 1. Repay Equity Inns Preferred Repayment of preferred equity interests held by affiliates of the Whitehall funds sponsored by Goldman Sachs $ 290.2 x ` x X x X 2. Fund PIPs and Working Capital Funding of contractual Property Improvement Plans , transaction costs, working capital and general corporate purposes $ 59.2 x X x X 3. Close Summit Transaction Acquisition of final portfolio of seven hotels from Summit Hotel Properties, Inc. (1) $ 26.9 x X 4. Repay Summit Loan Repayment of our debt to affiliates of Summit $ 23.7 x X $ 400.0 (1) Assumes successful procurement of mortgage debt financing at approximately 50% LTV Draw Schedule and Use of Funds Timeline of Convertible Preferred Equity Funding

American Realty Capital Hospitality Trust, Inc. 13 Pending Summit T ransaction Portfolio Summary (1) Closing Date 4/27/17 Hotels 7 Keys 651 Purchase Price $66.8M Price Per Key $102.6K Brands (1) Assumes sale to a third party of the eighth hotel we are obligated to purchase under the Summit Agreement, Courtyard El Paso, TX, prior to closing; this hotel is currently under contract to be sold by Summit to another third party, but there can be no assurance that the sale will be completed Courtyard Germantown, TN Fairfield Inn & Suites Germantown, TN Residence Inn Germantown, TN Homewood Suites Ridgeland, MS Courtyard Jackson, MS Residence Inn Jackson, MS Staybridge Suites Jackson, MS

American Realty Capital Hospitality Trust, Inc. 14 Hotel Portfolio Summary Hotels Keys % NOI Summary by Brand 66 8,374 44.8% 62 6,831 44.3% 17 2,229 9.3% Independent 1 252 0.9% 2 158 0.7% Total 148 17,844 100.0% Hotels Keys % NOI Top 5 Flags 47 5,684 26.9% 23 2,796 18.2% 19 1,751 14.1% 11 1,493 10.3% 16 2,080 8.3% Top 5 MSAs Hotels Keys % NOI Miami / W. Palm 7 780 5.2% Chicago 5 763 4.0% Seattle 2 305 4.0% Orlando 3 610 3.9% San Diego 3 377 2.9% Portfolio Composition Geography (148 Hotels, 33 States) Top Hotels by State 22 14 12 10 6 6 5 5 5 5 5 FL TN TX GA KY IL OH MI LA CA CO Pro Forma for Pending Summit Transaction

American Realty Capital Hospitality Trust, Inc. 15 See ‘‘Risk Factors’’ beginning on page 7 of the Company’s 2015 Form 10 - K for a discussion of the risks that should be considered in connection with your investment in our common stock, including : • All of our executive officers are also officers, managers and/or holders of a direct or indirect controlling interest in American Realty Capital Hospitality Advisors, LLC (the "Advisor") or other entities affiliated with AR Capital, LLC (“AR Capital”), the parent of our sponsor, American Realty Capital IX, LLC (the "Sponsor"), and AR Global Investments, LLC, the successor to AR Capital’s business (“AR Global”) . As a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us . These conflicts could result in unanticipated actions . • There are risks associated with the Company’s proposed transition to self - management, which is conditioned on the consummation of the first tranche of the Brookfield convertible preferred equity investment . • We suspended our initial public offering of common stock (our "IPO" or our "Offering") on November 15 , 2015 , effective as of December 31 , 2015 . Prior to the suspension of our IPO, we depended, and expected to continue to depend, in substantial part on proceeds from our IPO to meet our major capital requirements . As of September 30 , 2016 , we are required to redeem 50 . 0 % of our mandatorily redeemable preferred securities originally issued, or an additional $ 68 . 8 million by February 27 , 2018 , and we are required to redeem the remaining $ 223 . 5 million by February 27 , 2019 . Because we do not expect we will resume our IPO, we will require funds in addition to operating cash flow and cash on hand to meet our capital requirements, including payments due on our outstanding indebtedness . • Our ability to complete the transactions whereby Brookfield would make a convertible preferred equity investment in our operating partnership is subject to conditions, and we may be unable to complete these transactions on their current terms, or at all . • Because we require funds in addition to our operating cash flow and cash on hand to meet our capital requirements, beginning with distributions payable with respect to April 2016 we began paying distributions to our stockholders in shares of common stock instead of cash and we suspended paying distributions to stockholders entirely in January 2017 . There can be no assurance that we will resume paying distributions in cash or shares of common stock in the future . Our ability to make future cash distributions will depend on our future cash flows and may be dependent on our ability to obtain additional liquidity on favorable terms . • There can be no assurance that we will be successful in obtaining sufficient proceeds from the pending transaction with Brookfield, which is subject to conditions, or from any other alternative for obtaining liquidity to meet our capital requirements . Risk Factors

American Realty Capital Hospitality Trust, Inc. 16 • All of the properties we own are hotels, and we are subject to risks inherent in the hospitality industry . • Even if the initial closing of the transaction with Brookfield is consummated, we will require additional debt or equity financing to complete our pending acquisition of eight hotels for an aggregate purchase price of $ 77 . 2 million (the “Pending Acquisition”) from Summit Hotel OP, LP, the operating partnership of Summit Hotel Properties, Inc . (collectively, “Summit”), and there can be no assurance that such additional capital will be available on favorable terms, or at all . Any failure to complete our Pending Acquisition could cause us to default under the agreement and forfeit a $ 10 . 5 million deposit . • Because our IPO has raised substantially less proceeds than expected and Brookfield’s rights under our agreements with them, we will not be able to make additional investments unless we are able to identify additional debt or equity capital on favorable terms and subject to Brookfield’s approval . • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . • Increases in interest rates could increase the amount of our debt payments . • We have incurred substantial indebtedness, which may limit our future operational and financial flexibility . • We are obligated to pay fees to our Advisor and its affiliates, which may be substantial . • We may fail to realize the expected benefits of our acquisitions of hotels within the anticipated timeframe or at all and we may incur unexpected costs . • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit markets of the United States from time to time . • Our failure to qualify or to continue to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes ("REIT") which would result in higher taxes, may adversely affect operations and cash available for distributions . Risk Factors

ARCHospitalityReit.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com