Attached files

| file | filename |

|---|---|

| EX-23.4 - EX-23.4 - NEXTIER OILFIELD SOLUTIONS INC. | d256111dex234.htm |

| EX-23.3 - EX-23.3 - NEXTIER OILFIELD SOLUTIONS INC. | d256111dex233.htm |

| EX-23.2 - EX-23.2 - NEXTIER OILFIELD SOLUTIONS INC. | d256111dex232.htm |

| EX-5.1 - EX-5.1 - NEXTIER OILFIELD SOLUTIONS INC. | d256111dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 17, 2017

Registration No. 333-215079

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Keane Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1389 | 38-4016639 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2121 Sage Road

Houston, TX 77056

(713) 960-0381

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gregory L. Powell

President and Chief Financial Officer

Keane Group, Inc.

2121 Sage Road

Houston, TX 77056

(713) 960-0381

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Stuart D. Freedman, Esq. Antonio L. Diaz-Albertini, Esq. Schulte Roth & Zabel LLP 919 Third Avenue New York, NY 10022 Phone: (212) 756-2000 Fax: (212) 593-5955 |

William J. Miller, Esq. Cahill Gordon & Reindel LLP 80 Pine Street New York, NY 10005 Phone: (212) 701-3000 Fax: (212) 378-2500 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effectiveness of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(1)(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount Of Registration Fee(3) | ||||

| Common Stock |

25,645,000 |

$19.00 | $487,255,000 |

$56,473(4) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares of common stock issuable upon exercise of an over-allotment option to purchase additional shares granted to the underwriters. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 of the Securities Act. |

| (3) | Calculated pursuant to Rule 457(a) under the Securities Act. |

| (4) | The Registrant previously paid $42,292 of this amount. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 17, 2017

22,300,000 Shares

Keane Group, Inc.

Common Stock

This is an initial public offering of our common stock. We are offering 15,700,000 shares of our common stock and the selling stockholder is offering 6,600,000 shares of common stock.

We expect the initial public offering price to be between $17.00 and $19.00 per share. Currently, no public market exists for our common stock. The selling stockholder has granted to the underwriters an over-allotment option to purchase up to 3,345,000 additional shares of common stock at the initial public offering price, less the underwriting discount and commissions, within 30 days from the date of this prospectus. We have been approved to list our common stock on the New York Stock Exchange (“NYSE”) under the symbol “FRAC.”

We are an “emerging growth company,” as that term is defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 22 of this prospectus to read the factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds to selling stockholder(2) |

$ | $ | ||||||

| (1) | The underwriters will also be reimbursed for certain expenses incurred in the offering. See “Underwriting” for additional information regarding underwriting compensation. |

| (2) | We have agreed to pay all underwriting discounts and commissions and other offering expenses for the selling stockholder incurred in connection with the sale. |

The underwriters expect to deliver the shares of our common stock to investors against payment on or about , 2017.

Joint Book-Running Managers

| Citigroup | Morgan Stanley | BofA Merrill Lynch |

J.P. Morgan |

Senior Co-Managers

| Wells Fargo Securities | Simmons & Company International Energy Specialists of Piper Jaffray |

Houlihan Lokey | ||

Co-Managers

| Guggenheim Securities | Scotia Howard Weil | Stephens Inc. |

The date of this prospectus is , 2017.

Table of Contents

Table of Contents

Prospectus

| Page | ||||

| 1 | ||||

| 22 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| Unaudited Pro Forma Condensed Combined and Consolidated Financial Information |

55 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations of Keane |

65 | |||

| 79 | ||||

| 98 | ||||

| 105 | ||||

| 116 | ||||

| 123 | ||||

| 125 | ||||

| 131 | ||||

| 134 | ||||

| Certain U.S. Federal Income and Estate Tax Considerations to Non-U.S. Holders |

138 | |||

| 141 | ||||

| 147 | ||||

| 147 | ||||

| 147 | ||||

| F-1 | ||||

Until , 2017 (25 days after the date of this prospectus), all dealers that buy, sell or trade shares of our common stock, whether or not participating in our initial public offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Unless indicated otherwise, the information included in this prospectus assumes that (i) the shares of common stock to be sold in this offering are sold at $18.00 per share, which is the midpoint of the estimated offering range set forth on the cover page of this prospectus and (ii) all shares offered by us and the selling stockholder in this offering are sold (other than pursuant to the over-allotment option described herein).

We and the underwriters have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

i

Table of Contents

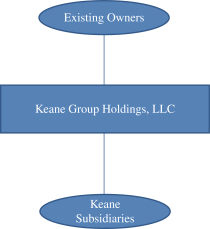

EXPLANATORY NOTE

Keane Group, Inc., the registrant whose name appears on the cover of this registration statement, is a newly formed Delaware corporation. Shares of common stock of Keane Group, Inc. are being offered by the prospectus that forms a part of this registration statement. Keane Group Holdings, LLC (“Keane”) is a Delaware limited liability company. Keane Group, Inc. was formed solely for the purpose of reorganizing the organizational structure of Keane and its direct and indirect consolidated subsidiaries in order for the registrant to be a corporation rather than a limited liability company. In connection with, and prior to and/or concurrently with the closing of, this offering, each member of Keane will directly or indirectly contribute all of its equity interests in Keane to Keane Group, Inc. in exchange for shares of common stock of Keane Group, Inc. As a result, Keane and its direct and indirect consolidated subsidiaries will become wholly-owned subsidiaries of Keane Group, Inc. See “IPO-Related Transactions and Organizational Structure” for additional information.

As used in this prospectus, unless the context otherwise requires, references to (i) the terms “company,” “Keane,” “we,” “us” and “our” refer to Keane Group Holdings, LLC and its consolidated subsidiaries for periods prior to the consummation of the IPO-Related Transactions (as defined herein), and, for periods as of and following the consummation of the IPO-Related Transactions, to Keane Group, Inc. and its consolidated subsidiaries; (ii) the term “Trican Parent” refers to Trican Well Service Ltd. and, where appropriate, its subsidiaries; (iii) the term “Trican U.S.” refers to Trican Well Service L.P.; (iv) the term “Trican” refers to Trican Parent and Trican U.S., collectively; and (v) references to our “Sponsor” refers to Cerberus Capital Management, L.P. (“Cerberus”) and its respective controlled affiliates and investment funds. For the convenience of the reader, except as the context otherwise requires, all information included in this prospectus is presented giving effect to the consummation of the IPO-Related Transactions.

BASIS OF PRESENTATION

Prior to or concurrently with this offering, we will effect the IPO-Related Transactions described under “IPO-Related Transactions and Organizational Structure.” The consolidated financial statements and consolidated financial data included in the prospectus are those of Keane and its consolidated subsidiaries and do not give effect to the IPO-Related Transactions. Other than the audited balance sheet, dated as of October 31, 2016, the historical financial information of Keane Group, Inc. has not been included in this prospectus as it is a newly incorporated entity, has had no business transactions or activities to date and had no assets or liabilities during the periods presented in this prospectus.

We completed the Trican transaction (as described herein in “Certain Relationships and Related Party Transactions—Trican Transaction”) on March 16, 2016. Accordingly, this prospectus also includes the audited balance sheets of Trican U.S. as of December 31, 2015 and 2014 and the related statements of operations, partners’ capital and cash flows for the years then ended.

PRO FORMA INFORMATION

This prospectus contains unaudited pro forma financial information prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma condensed combined and consolidated statement of operations for 2015 gives pro forma effect to:

| • | our acquisition of the Acquired Trican Operations (as defined herein) and the transactions related thereto; |

| • | the IPO-Related Transactions; |

ii

Table of Contents

| • | the issuance of 15,700,000 shares of common stock in this offering and the application of the estimated net proceeds from the sale of such shares to repay certain existing debt and to pay fees and expenses related to this offering, as described in “Use of Proceeds;” and |

| • | the sale of 6,600,000 shares of common stock in this offering by our selling stockholder and the payment by us of fees and expenses related to the sale of such shares, |

in each case as if such transactions had been consummated on January 1, 2015, the first day of 2015. The unaudited pro forma condensed combined and consolidated statement of operations for the first nine months of fiscal 2015 and the first nine months of fiscal 2016 gives pro forma effect to our acquisition of the Acquired Trican Operations and the transactions related thereto, the IPO-Related Transactions and this offering and the related use of proceeds as if such transactions had occurred on January 1, 2015. The unaudited pro forma condensed combined and consolidated balance sheet as of September 30, 2016 gives pro forma effect to the IPO-Related Transactions and this offering and the related use of proceeds as if such transactions had occurred on September 30, 2016. See “Unaudited Pro Forma Condensed Combined and Consolidated Financial Information.”

MARKET, INDUSTRY AND OTHER DATA

This prospectus includes market and industry data and certain other statistical information based on third-party sources including independent industry publications, government publications and other published independent sources, such as the “Drilling and Production Outlook—December 2016” and “NAM Activity by Region_Dec_2016” reports prepared by Spears & Associates. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. Some data is also based on our own good faith estimates which are supported by our management’s knowledge of and experience in the markets and businesses in which we operate.

While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the sections entitled “Special Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus.

This prospectus includes references to utilization of hydraulic fracturing assets. Utilization for our own fleets, as used in this prospectus, is defined as the ratio of the number of deployed fleets to the number of total fleets. For the purposes of this prospectus, we consider one of our fleets deployed if the fleet has been put in service at least one day during the period for which we calculate utilization. As a result, as additional fleets are incrementally deployed, our utilization rate increases.

We define industry utilization as the ratio of the total industry demand of hydraulic horsepower to the total available capacity of hydraulic horsepower, in each case as reported by an independent industry source. Our method for calculating the utilization rate for our own fleets or the industry may differ from the method used by other companies or industry sources which could, for example, be based off a ratio of the total number of days a fleet is put in service to the total number of days in the relevant period.

As used in this prospectus, capacity in the hydraulic fracturing business refers to the total number of hydraulic horsepower, regardless of whether such hydraulic horsepower is active and deployed, active and not deployed or inactive. While the equipment and amount of hydraulic horsepower required for a customer project varies, we calculate our total number of fleets, as used in this prospectus, by dividing our total hydraulic horsepower by 40,000 hydraulic horsepower.

We believe that our measures of utilization, based on the amount of deployed fleets, provide an accurate representation of existing, available capacity for additional revenue generating activity.

As used in this prospectus, references to cannibalization of parked equipment refer to the removal of parts and components (such as the engine or transmission of a fracturing pump) from an idle hydraulic fracturing fleet in order to service an active hydraulic fracturing fleet.

iii

Table of Contents

TRADEMARKS AND TRADE NAMES

This prospectus contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply, a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

NON-GAAP FINANCIAL MEASURES

We define EBITDA as generally accepted accounting principles (“GAAP”) earnings (net income (loss)) before interest, income taxes, depreciation and amortization. We define Adjusted EBITDA as earnings (net income (loss)) before interest, income taxes, depreciation and amortization, further adjusted to eliminate the effects of items management does not consider in assessing our ongoing performance. See “Prospectus Summary—Summary Consolidated Historical and Pro Forma Financial and Other Data” for further discussion and a reconciliation of Adjusted EBITDA.

EBITDA and Adjusted EBITDA (together, the “Non-GAAP Measures”) are performance measures that provide supplemental information we believe is useful to analysts and investors to evaluate our ongoing results of operations, when considered alongside other GAAP measures such as net income, operating income and gross profit. These Non-GAAP Measures exclude the financial impact of items management does not consider in assessing our ongoing operating performance, and thereby facilitate review of our operating performance on a period-to-period basis. Other companies may have different capital structures or different lease terms, and comparability to our results of operations may be impacted by the effects of acquisition accounting on our depreciation and amortization. As a result of the effects of these factors and factors specific to other companies, we believe EBITDA and Adjusted EBITDA provide helpful information to analysts and investors to facilitate a comparison of our operating performance to that of other companies. Our presentation of Non-GAAP Measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

Non-GAAP Measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our operating results or cash flows as reported under GAAP. Some of these limitations are:

| • | Non-GAAP Measures do not reflect changes in, or cash requirements for, our working capital needs; |

| • | EBITDA and Adjusted EBITDA do not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on our debt; |

| • | Although depreciation and amortization are non-cash charges, the assets being depreciated or amortized may have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; |

| • | Non-GAAP Measures are adjusted for certain non-recurring and non-cash income or expense items that are reflected in our statements of operations; |

| • | Non-GAAP Measures do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; and |

| • | Other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures. |

iv

Table of Contents

Because of these limitations, Non-GAAP Measures should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Non-GAAP Measures only for supplemental purposes. Please see our consolidated financial statements contained in this prospectus.

Pro Forma EBITDA and Adjusted EBITDA, as presented in this prospectus, are also supplemental measures of our performance that are not required by or presented in accordance with GAAP. Pro Forma EBITDA includes the historical actual results of Trican U.S. prior to Keane’s ownership and assumption of specific assets and liabilities as defined in the asset purchase agreement dated January 25, 2016 (the “Trican APA”), and adjustments required to conform Trican U.S.’s accounting policies to Keane’s accounting policies, but does not reflect any realized or anticipated cost savings in connection with the Trican transaction. Our historical Pro Forma EBITDA is not necessarily indicative of any actual results had we owned the Acquired Trican Operations prior to the consummation of the Trican transaction. See “Prospectus Summary—Summary Consolidated Historical and Pro Forma Financial and Other Data” for additional information.

v

Table of Contents

This summary highlights the information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you or that you should consider before investing in shares of our common stock. You should read the entire prospectus carefully before making an investment decision. The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. In particular, you should read the sections entitled “Risk Factors,” “Unaudited Pro Forma Condensed Combined and Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Keane” included elsewhere in this prospectus and our consolidated financial statements and the related notes attached hereto.

Our Company

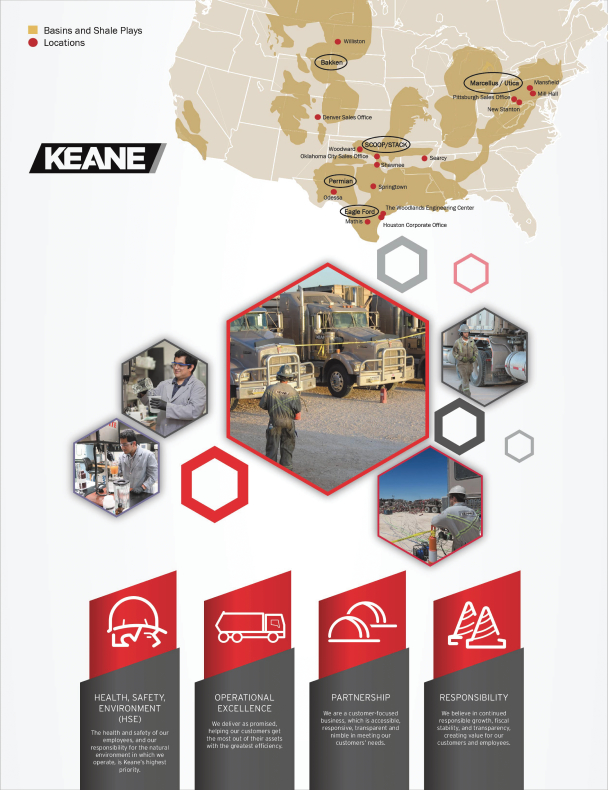

We are one of the largest pure-play providers of integrated well completion services in the U.S., with a focus on complex, technically demanding completion solutions. Our primary service offerings include horizontal and vertical fracturing, wireline perforation and logging and engineered solutions, as well as other value-added service offerings. With approximately 944,250 hydraulic horsepower spread across 23 hydraulic fracturing fleets and 23 wireline trucks located in the Permian Basin, the Marcellus Shale/Utica Shale, the SCOOP/STACK Formation, the Bakken Formation and other active oil and gas basins, we provide industry-leading completion services with a strict focus on health, safety and environmental stewardship and cost-effective customer-centric solutions. Our company prides itself on our outstanding employee culture, our efficiency and our ability to meet and exceed the expectations of our customers and communities in which we operate.

We provide our services in conjunction with onshore well development, in addition to stimulation operations on existing wells, to exploration and production (“E&P”) customers with some of the highest quality and safety standards in the industry. We believe our proven capabilities enable us to deliver cost-effective solutions for increasingly complex and technically demanding well completion requirements, which include longer lateral segments, higher pressure rates and proppant intensity, and multiple fracturing stages in challenging high-pressure formations.

As of November 30, 2016, we had 13 hydraulic fracturing fleets and eight wireline trucks operating in the most active unconventional oil and natural gas basins in the U.S., including the Permian Basin, the Marcellus Shale/Utica Shale, the SCOOP/STACK Formation and the Bakken Formation. We are one of the largest providers of hydraulic fracturing services in the Permian Basin, the Marcellus Shale/Utica Shale and the Bakken Formation by total hydraulic horsepower deployed.

Our completion services are designed in partnership with our customers to enhance both initial production rates and estimated ultimate recovery from new and existing wells. We seek to deploy our assets with well-capitalized customers that have long-term development programs that enable us to maximize operational efficiencies and the return on our assets. We believe our integrated approach increases efficiencies and provides potential cost savings for our customers, allowing us to broaden our relationships with existing customers and attract new ones. In addition, our technical team and engineering center, which is located in The Woodlands, Texas, provides us the ability to supplement our service offerings with engineered solutions specifically tailored to address their completion requirements and challenges.

We believe the demand for our services will increase over the medium and long-term as a result of a number of favorable industry trends. While drilling and completion activity has improved along with a rebound in commodity prices from their lows in early 2016 of $26.21 per barrel (based on the Cushing WTI Spot Oil Price (“WTI”)) and

1

Table of Contents

$1.64 per million British Thermal Units (“mmBtu”) for natural gas, we believe there are long-term fundamental demand and supply trends that will benefit our company. We believe demand for our services will grow from:

| • | Increases in customer drilling budgets focused in our core service areas; |

| • | Increases in the percentage of rigs that are drilling horizontal wells; |

| • | Increases in the length of the typical horizontal wellbore; |

| • | Increases in the number of fracture stages in a typical horizontal wellbore; and |

| • | Increases in pad drilling and simultaneous fracturing/wireline operations. |

We believe demand and pricing for our services will be further enhanced by a reduction in available hydraulic fracturing equipment as a result of:

| • | Cannibalization of parked equipment and increased maintenance costs; |

| • | Aging of existing fleets given the limited investment since the industry downturn in late 2014; |

| • | Increased customer focus on well-capitalized, safe and efficient service providers that can meet or exceed their requirements; and |

| • | Reduced access to capital for fleet acquisition, maintenance and deployment. |

Pricing levels for our industry’s services are driven primarily by asset utilization. With the downturn in commodity prices from late 2014 into early 2016, asset utilization across the hydraulic fracturing industry has been reported at approximately 37%. Of our total 23 hydraulic fracturing fleets, 13 fleets, or 57% of our total fleets, were deployed as of November 30, 2016. We believe our deployment rate reflects the quality of our assets and services. Due to lack of investment in maintenance and aging equipment, we believe that approximately 70% of active industry equipment is currently deployed. We have 15 active hydraulic fracturing fleets, of which 13 fleets, or 87% of our active fleets, were deployed as of November 30, 2016. Based on current pricing for component parts and labor, we believe our remaining eight inactive fleets can be made operational at a cost of approximately $1.5 million per fleet.

Our History

Our company was founded in 1973 by the Keane family in Lewis Run, Pennsylvania. We have been well regarded as a customer-focused operator that prioritizes safety, the environment and our relationship with the communities in which we operate. We are committed to maintaining conservative financial policies and a disciplined approach to asset deployment, adding new capacity with customers with significant capital budgets and steady development programs rather than on a speculative basis.

We have developed what we believe is an industry-leading, completions-focused platform by emphasizing health, safety and environmental stewardship as our highest priority, implementing an efficient cost structure focused on disciplined cost controls, establishing a sophisticated supply chain and investing in state-of-the-art systems, technology and infrastructure to support our growth. Through these initiatives, our platform has demonstrated the ability to scale with an increase in activity. For example, in 2013, we organically entered into the Bakken Formation, where we remain one of the most active service providers, and, in 2014, we successfully recruited and integrated over 450 employees into our business, resulting in a 74% increase in our employee base.

We believe that our ability to identify, execute and integrate acquisitions is a competitive advantage. We have demonstrated the ability to grow both organically and through opportunistic acquisitions. From 2010 to 2014, we organically added seven hydraulic fracturing fleets deployed across the Marcellus Shale/Utica Shale, the Bakken Formation and the Permian Basin. We have also completed three acquisitions that have diversified

2

Table of Contents

our geographic presence and service line capabilities. In April 2013, we acquired the wireline technologies division of Calmena Energy Services, which provided us with wireline operations capabilities in the U.S. In December 2013, we acquired the assets of Ultra Tech Frac Services to establish a presence in the Permian Basin. In March 2016, we completed the opportunistic acquisition of Trican’s U.S. oilfield service operations resulting in the expansion of our hydraulic fracturing operations to the current 23 fleets and establishing Keane as one of the largest pure-play providers of integrated well completion services in the U.S. with approximately 944,250 hydraulic horsepower. This acquisition added high quality equipment, provided increased scale in key operating basins, expanded our customer base, and offered significant cost reduction opportunities. To date we have identified and implemented a plan to achieve over $80 million of annualized cost savings as a result of facility consolidations, head count rationalization and procurement savings. The Trican transaction also enhanced our access to proprietary technology and engineering capabilities that have improved our ability to provide integrated services solutions. We intend to continue to evaluate potential acquisitions on an opportunistic basis that would complement our existing service offerings or expand our geographic capabilities.

Our Competitive Strengths

We believe that technical expertise, fleet capability, equipment quality and robust preventive maintenance programs, integrated solutions, experience, scale in leading basins and health, safety and environmental (“HSE”) performance are the primary differentiating factors within the industry. We specialize in providing customized completion solutions to our customers that increase efficiency, improve safety and lower their overall cost.

Accordingly, we believe the following strengths differentiate us from many of our competitors and contribute to our ongoing success:

Multi-Basin Service Provider with Close Proximity to Our Customers.

We provide our services in several of the most active basins in the U.S., including the Permian Basin, the Marcellus Shale/Utica Shale, the SCOOP/STACK Formation, the Bakken Formation and the Eagle Ford Shale. These regions are expected to account for approximately 87% of all new horizontal wells anticipated to be drilled between 2016 and 2020. In addition, the high-density of our operations in the basins in which we are most active provides us the opportunity to leverage our fixed costs and to quickly respond with what we believe are highly efficient, integrated solutions that are best suited to address customer requirements.

In particular, we are one of the largest providers in the Permian Basin and the Marcellus Shale/Utica Shale, the most prolific and cost-competitive oil and natural gas basins in the United States, respectively. According to Spears & Associates, the Permian Basin and the Marcellus Shale/Utica Shale are expected to account for the greatest crude oil and natural gas production growth in the U.S. through 2020 based on forecasted rig counts. These basins have experienced a recovery in activity since the spring of 2016, representing approximately 62% of the increase in U.S. rig count from its May 2016 low of 404 to 597 as of December 2016.

Our Houston, Texas-based headquarters, eight field offices and numerous management and sales offices are in close proximity to unconventional resource plays which allows us to take a hands-on approach to customer relationships at multiple levels within our organization, anticipate our customers’ needs and efficiently deploy our assets.

3

Table of Contents

The below map represents our areas of operation:

Customer-Tailored Approach.

We seek to develop long-term partnerships with our customers by investing significant time and effort educating them on our value proposition and maintaining a continuous dialogue as we deliver ongoing service. We believe our direct line of communication with our customers at the senior management level as well as with key operational managers in the field provides us with the ability to address issues quickly and efficiently and is highly valued by our customers. In November 2016, we received Shell Global Solutions International’s annual Well Services Performance Award in recognition of our Permian Basin team’s exceptional 2016 performance and customer service in hydraulic fracturing and wireline services.

In connection with the Trican transaction, we acquired our Engineered Solutions Center, comprised of a dedicated team of engineers and a network of field labs, which we believe provides value-added capabilities to both our new and existing customers. We believe our Engineered Solutions Center enables us to support our customers’ technical specifications with a focus on reducing costs and increasing production. As pressure pumping complexity increases and the need for comprehensive, solution-driven approaches grows, our Engineered Solutions Center is able to meet our customers’ business objectives cost-effectively by offering flexible design solutions that package our services with new and existing product offerings. Our Engineered Solutions Center is focused on providing (1) economical and effective fracture designs, (2) enhanced fracture stimulation methods, (3) next-generation fluids and technologically advanced diverting agents, such as MVP Frac™ and TriVert™, which we received the right to use as part of the Trican transaction, (4) dust control technologies and (5) customized solutions to individual customer and reservoir requirements.

Track Record of Providing Safe and Reliable Solutions.

Safety is our highest priority and we believe we are among the safest service providers in the industry. For example, we achieved a total recordable incident rate (“TRIR”), which we believe is a reliable measure of safety performance, that is less than half of the industry average from 2013 to 2015. We believe we have an industry leading behavior-based safety program to ensure each employee understands the importance of safety.

4

Table of Contents

Depending on job requirements, each new employee goes through a rigorous on-boarding and training program, is assigned a dedicated mentor, is routinely subject to our “Fit for Duty” verification program and periodically attends safety and technical certification programs. Our customers seek to protect their field employees, contractors and communities in which they serve as well as minimize the risk of disproportionately high costs that can result from an HSE incident. As a result, our customers demand robust HSE programs from their service providers and view safety records as a key criterion for vendor selection. We believe our safety and training record creates a competitive advantage by enhancing our ability to develop long-term relationships with our customers, allowing us to qualify to tender bids on more projects than many of our competitors and enabling us to attract and retain employees.

Modern, High-Quality Asset Base and Robust Maintenance Program.

We have invested in modern equipment, including dual-fuel fracturing pumps, Tier IV engines, stainless steel fluid ends, dry friction reducer and dry guar, to enhance our efficiency and safety. In addition, our high-quality, heavy-duty hydraulic fracturing and wireline fleets reduce operational downtime and maintenance costs while enhancing our ability to provide reliable, safe and consistent service to our customers. We have approximately 944,250 total hydraulic horsepower and can deploy up to 23 hydraulic fracturing fleets. As of November 30, 2016, we had 13 hydraulic fracturing fleets and eight wireline trucks deployed. We believe we have a robust preventative maintenance program for both our active and inactive fleets which allows us to respond to customer demand in a timely, safe and cost-efficient manner, and we continue to invest in and stock critical parts and components.

Since April 1, 2016, we have deployed 5 hydraulic fracturing fleets to service customers at a total cost to deploy of approximately $8 million. In addition, based on current pricing for component parts and labor, we believe our remaining inactive hydraulic fracturing fleets can be made operational at a cost of approximately $1.5 million per fleet. Based upon our recent deployment experience, we believe it takes approximately 45 days to activate and staff a single hydraulic fracturing fleet, allowing us to quickly and cost-effectively respond to an increase in customer demand. We also believe we can deploy each of our wireline trucks in less than 30 days at a nominal cost. Our conservative financial profile and continued investment in our assets and fleets should enable us to maintain an efficient operating cost structure as we begin to redeploy assets, ensuring our operators have safe, well-maintained equipment to service our customers.

Flexible Supply Chain Management Capabilities.

Our sophisticated logistics network is comprised of strategically-located field offices, proppant storage facilities and proprietary last-mile transportation solutions. We have a dedicated supply chain team that manages sourcing and logistics to ensure flexibility and continuity of supply in a cost-effective manner across all areas of operation. We maintain multi-year relationships with industry-leading suppliers of proppant and have contracted secure supply at pricing reflecting current market conditions for over 80% of our expected demand through 2020, based on existing job designs. We currently have a network of 1,050 modern railcars, which are being leased to us on a multi-year basis, and which provides us with valuable and flexible logistical support for our operations. Our logistics infrastructure also includes access to eight third-party unit train facilities, which improve railcar turn times and reduce transit costs, and approximately 50 transload facilities. In addition, we own over 120 pneumatic sand-hauling trucks for last-mile transportation to the well site, which gives us the ability to access and deliver proppant where and when needed. We believe our supply chain and logistics network provide us with a competitive advantage by allowing us to quickly respond during periods of increased demand for our services.

5

Table of Contents

Strong Balance Sheet and Disciplined Use of Capital.

We believe our balance sheet strength represents a significant competitive advantage, allowing us to pro-actively maintain our fleet while also pursuing opportunistic initiatives to further grow and expand our base business with new and existing customers. Our customers seek to employ well-capitalized service providers that are in the best position to meet their service requirements and their financial obligations, and, as a result, we intend to continue to maintain a strong balance sheet.

We adjust our capital expenditures based on prevailing industry conditions, the availability of capital and other factors as needed. Throughout the industry downturn that began in 2014, we have prioritized continued investment in our robust maintenance program to ensure our fleet of equipment can be deployed efficiently as demand recovers. At September 30, 2016, we had $62.4 million and $147.5 million of cash on hand on an actual basis and on a pro forma basis after giving effect to the sale of our common stock and the use of net proceeds as described herein, respectively, and $33.5 million of availability under our Existing ABL Facility on both an actual and pro forma basis, providing us with the means to fund deployment of fleets and grow our operations. We intend to continue to prioritize maintenance, upgrades, refurbishments and acquisitions, in a disciplined and diligent manner, carefully evaluating these investments based on their ability to maintain or improve our competitive position and strengthen our financial profile while creating value for our shareholders.

Best-in-Class Management Team with Extensive Industry Experience.

The members of our management team are seasoned operating, financial and administrative executives with extensive experience in and knowledge of the oilfield services industry. Our management team is led by our Chairman and Chief Executive Officer, James C. Stewart, who has over 30 years of industry experience. Each member of our management team brings significant leadership and operational experience with long tenures in the industry and respective careers at highly regarded companies, including Schlumberger Limited, Halliburton, Baker Hughes, Weatherford International and General Electric. The members of our executive management team provide us with valuable insight into our industry and a thorough understanding of customer requirements.

Our Strategy

Our principal business objective is to increase shareholder value by profitably growing our business while safely providing best-in-class completion services. We expect to achieve this objective through:

Efficiently Capitalizing on Industry Recovery.

Hydraulic fracturing represents the largest cost of completing a shale oil or gas well and is a mission-critical service required for the continued development of U.S. shale resources. Upon a recovery in demand for oilfield services in the U.S., the hydraulic fracturing sector is expected to have among the highest growth rates among oilfield service providers. Industry reports have forecasted that the North American onshore stimulation sector, which includes hydraulic fracturing, will increase at a compound annual growth rate (“CAGR”), a measure of growth rate for selected points in time, of 10% from 2006 to 2020, and 30% from 2016 through 2020. As a well-capitalized provider operating in the most active unconventional oil and natural gas basins in the U.S., we believe that our business is well positioned to capitalize efficiently on an industry recovery. We have invested significant resources and capital to develop a market leading platform with demonstrated capabilities and technical skills that is well equipped to address increased demand from our customers. We believe that our rigorous preventative maintenance program provides us with a well-maintained hydraulic fracturing fleet and the ability to deploy inactive fleets efficiently. Based upon our recent experience and current pricing for components and labor, we believe it will take approximately 45 days to activate a single hydraulic fracturing fleet, allowing us to quickly and cost-effectively respond to an increase in customer demand at a cost of approximately $1.5 million per fleet. We also believe we can incrementally deploy each of our wireline trucks in less than 30 days at a nominal cost.

6

Table of Contents

Developing and Expanding Relationships with Existing and New Customers.

We target well-capitalized customers that we believe will be long-term participants in the development of conventional and unconventional resources in the U.S., value safe and efficient operations, have the financial stability and flexibility to weather industry cycles and seek to develop a long-term relationship with us. We believe our high-quality fleets, diverse completion service offerings, engineering and technology solutions and geographic footprint with basin density in some of the most active basins position us well to expand and develop relationships with our existing and new customers. These qualities, combined with our past performance, have resulted in the renewal and new award of service contracts by our customers and by an expansion of the basins in which we operate for these customers. We believe these arrangements will provide us an attractive revenue stream while leaving us the ability to deploy our remaining fleets as industry demand and pricing continue to recover. We have invested in our sales organization, nearly tripling its headcount over the past two years. Together with our sales team, our Chief Executive Officer and our President and Chief Financial Officer are deeply involved with our commercial sales effort, fostering connectivity throughout a customer’s organization to further develop the relationship. We believe this level of senior management engagement differentiates us from many of our larger integrated peers.

Continuing Our Industry Leading Safety Performance and Focus on the Environment.

We are committed to maintaining and improving the safety, reliability, efficiency and environmental impact of our operations, which we believe is key to attracting new customers and maintaining relationships with our current customers, regulators and the communities in which we operate. As a result of our strong emphasis on training and safety protocols, we have one of the best safety records and reputations in the industry which helps us to attract and retain employees. We have maintained a strong safety record even as our employee base increased by 137% over the past three years. From the beginning of 2013 to 2015, our TRIR and lost time incident rate (“LTIR”) dropped by approximately 30% and 50%, respectively, and, for the year ended December 31, 2015, our TRIR and LTIR statistics were 0.50 and 0.12, respectively. We believe we are among the safest service providers in the industry. For example, we achieved a TRIR, which we believe is a reliable measure of safety performance, that is less than half of the industry average from 2013 to 2015. In addition, all of our field-based management are provided financial incentives to satisfy safety standards and customer expectations, which we believe motivates them to continually maintain a focus on quality and safety. We work diligently to meet or exceed applicable safety and environmental requirements from our customers and regulatory agencies, and we intend to continue to enhance our safety monitoring function as our business grows and operating conditions change. For example, we have made investments in more efficient engines and dual-fuel kits to comply with customer requirements to reduce emissions and noise at the well site. In addition, we have also invested in spill prevention equipment and remediation systems and dust control technology, which we believe allows us to meet or exceed the latest Occupational Safety and Health Administration (“OSHA”) requirements and standards. We have also deployed high-grade cameras to remotely monitor high-risk zones in our field operations, which we believe helps reduce safety risks to our employees. We believe that our commitment to maintaining a culture that prioritizes safety and the environment is critical to the long-term success and growth of our business.

Investing Further in Our Robust Maintenance Program.

We have in place a rigorous preventative maintenance program to continuously maintain our fleets, resulting in less downtime, reduced equipment failure in demanding conditions, lower operating costs and overall safer and more reliable operations. Due to our strong balance sheet, we have been able to sustain investment in maintenance, including preemptive purchases of key components and upgrades to our fleets throughout the downturn. We believe that the quality of our fleets and our maintenance program enhance our ability to both secure contracts with new customers and to service our existing customers reliably and efficiently. Our active fleet uptime is reinforced by preventive maintenance on our equipment, allowing us to minimize the negative

7

Table of Contents

impact to our customers from equipment failure. In addition, we continue to monitor advances in hydraulic fracturing and wireline technology and make strategic purchases to enhance our existing capabilities.

Maintaining a Conservative Balance Sheet to Preserve Operational and Strategic Flexibility.

We carefully manage our liquidity by continuously monitoring cash flow, capital spending and debt capacity. Our focus on maintaining our financial strength and flexibility provides us with the ability to execute our strategy through industry volatility and commodity price cycles, as evidenced by our recent completion of the Trican transaction and continued investment in our robust maintenance program. We intend to maintain a conservative approach to managing our balance sheet to preserve operational and strategic flexibility. At September 30, 2016, we had $62.4 million and $147.5 million of cash on hand on an actual basis and on a pro forma basis after giving effect to the sale of our common stock and the use of net proceeds as described herein, respectively, and $33.5 million of availability under our Existing ABL Facility on both an actual and pro forma basis, providing us with the means to fund deployment of fleets and grow our operations.

Continued Evaluation of Consolidation Opportunities that Strengthen Capabilities and Create Value.

We believe that our ability to identify, execute and integrate acquisitions is a competitive advantage. Since 2011, we have completed three acquisitions that have diversified our geographic presence and service line capabilities. In April 2013, we acquired the wireline technologies division of Calmena Energy Services to expand our wireline operations capabilities in the U.S. In December 2013, we acquired the assets of Ultra Tech Frac Services to establish a presence in the Permian Basin. In March 2016, we completed the Trican transaction, creating a leading independent provider of hydraulic fracturing services in the United States. This acquisition added high quality equipment, provided increased scale in key operating basins, expanded our customer base and offered significant cost reduction opportunities. To date we have identified and implemented a plan to achieve over $80 million of annualized cost savings as a result of facility consolidations, head count rationalization and procurement savings. The Trican transaction also provided us access to proprietary technology and engineering capabilities that have enhanced our ability to provide integrated services solutions. We intend to continue to evaluate potential acquisitions on an opportunistic basis that would complement our existing service offerings or expand our geographic capabilities and allow us to earn an appropriate return on invested capital.

Risks Related to Our Business and This Offering

An investment in shares of our common stock involves a high degree of risk, including the speculative nature of oil and natural gas development and production, competition, volatile oil and natural gas prices and other material factors. You should carefully read and consider the section entitled “Risk Factors” following this prospectus summary before making an investment decision. The following considerations, among others, may offset our competitive strengths or have a negative effect on our strategy or operating activities, which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

| • | We do not anticipate available cash for quarterly distribution on our common stock. |

| • | Oil and natural gas prices are volatile. A sustained decline in oil and natural gas prices could adversely affect our business, financial condition and results of operations and our ability to meet our capital expenditure obligations and financial commitments. |

| • | We depend upon several significant customers within the E&P industry for most of our revenue. The loss of one or more of these customers could adversely affect our revenues. |

| • | Our operations are subject to operational hazards for which we may not be adequately insured. |

| • | Difficulties managing the growth of our business may adversely affect our financial condition, results of operations and cash available for distribution. |

8

Table of Contents

| • | Competition within our industry may adversely affect the price for our services. |

| • | We rely on a number of third parties to provide raw materials and equipment in order to offer our services, and the termination of our relationship with one or more of these third parties could adversely affect our operations. |

| • | Our operations are subject to various governmental regulations that require compliance that can be burdensome and expensive and adversely affect the feasibility of conducting our operations. |

| • | Any failure by us to comply with applicable environmental laws and regulations, including those relating to hydraulic fracturing, could result in governmental authorities taking actions that adversely affect our operations and financial condition. |

| • | Our failure to successfully identify, complete and integrate future acquisitions of assets or businesses could reduce our earnings and cash available for distribution and slow our growth. |

| • | Our failure to successfully complete the Anticipated Refinancing Transactions could adversely affect our operations and financial condition. |

| • | We expect to be a “controlled company” within the meaning of the rules of the NYSE and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. |

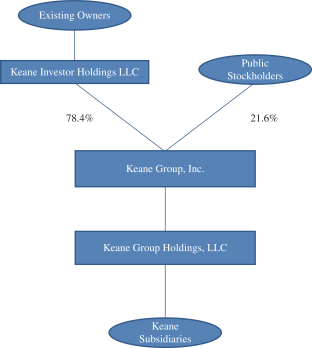

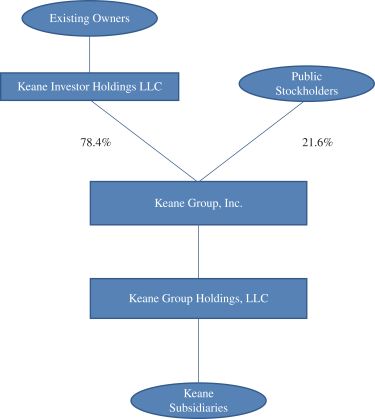

Our Corporate Structure

Our business is currently conducted through our operating subsidiaries, which are wholly-owned by Keane. The equity interests of Keane immediately prior to the IPO-Related Transactions were owned (directly and indirectly) by entities affiliated with our Sponsor, certain members of the Keane family, Trican and certain current members of our management, whom we refer to as our “Existing Owners,” as well as our independent directors. Keane Group, Inc. is a newly formed entity.

In order to effectuate this offering, we expect to effect the following series of transactions prior to and/or concurrently with the closing of this offering that will result in the reorganization of our business so that it is owned by Keane Group, Inc. Specifically, (i) our Existing Owners will contribute all of their direct and indirect equity interests in Keane to Keane Investor Holdings LLC (“Keane Investor”); (ii) Keane Investor will contribute all of its equity interests in Keane to Keane Group, Inc. in exchange for common stock of Keane Group, Inc; and our independent directors will receive grants of restricted common stock of Keane Group, Inc. in substitution for their interests in Keane. As a result of the foregoing transactions and this offering, an aggregate of 80,828,019 shares of our common stock will be owned by Keane Investor (assuming that the underwriters’ over-allotment option to purchase additional shares from the selling stockholder is not exercised) and our independent directors. In addition, all of our existing Class B and Class C Units will be exchanged for Class B and Class C Units in Keane Investor.

9

Table of Contents

The chart below summarizes our corporate structure after giving effect to this offering and the IPO-Related Transactions, assuming that the underwriters’ over-allotment option to purchase shares from the selling stockholder is not exercised and excluding the 98,015 shares of restricted stock held by our independent directors:

For a further discussion of the IPO-Related Transactions, see “IPO-Related Transactions and Organizational Structure.”

Preliminary Results For The Three-Months Ended December 31, 2016

Although our results of operations for the three-months ended December 31, 2016 are not yet final, the following unaudited information reflects our preliminary expectations with respect to such results based on information currently available to management. The financial information for the three-months ended December 31, 2016 does not reflect a breakdown of segment revenues and cost of services, as this information is not yet derivable and is subject to the completion of our normal closing procedures and a review by our independent auditors. The financial information for the three-months ended December 31, 2015 does not give pro forma effect to the acquisition of the Acquired Trican Operations.

Based on the preliminary results, we estimate that revenue, on an actual basis, will be within a range of $149 million to $151 million for the three months ended December 31, 2016 as compared to $54 million for the same period of 2015. This increase was primarily attributable to the additional number of hydraulic fracturing fleets deployed reflecting the inclusion of the acquired Trican assets and the increased utilization of the combined asset base, partially off-set by lower revenue per deployed hydraulic fracturing fleet as a result of competitive pricing due to current market conditions.

Based on the preliminary results, we estimate that cost of services will be within a range of $137 million to $139 million for the three-months ended December 31, 2016 as compared to $50 million for the same period of

10

Table of Contents

2015. The increase in cost of services was primarily driven by higher activity of our hydraulic fracturing fleets and the commissioning costs associated with deploying such fleets.

Based on the preliminary results, we estimate that selling, general and administrative expense, which represents costs associated with managing and supporting our operations, will be within a range of $11 million to $12 million for the three-months ended December 31, 2016 as compared to $7 million for the same period of 2015. The increase in selling, general and administrative expense is related to increased headcount, property taxes and insurance associated with a larger asset base as a result of the Acquired Trican Operations.

Based on the preliminary results, we estimate that depreciation and amortization expense will be approximately $29 million for the three-months ended December 31, 2016 as compared to $17 million for the same period of 2015. This increase is primarily attributable to additional depreciation and amortization expense related to the property and equipment included in the Acquired Trican Operations. This increase was partially offset by a decrease in depreciation expense of Keane’s existing equipment as some assets became fully depreciated and reduced capital expenditures in 2016.

Based on the preliminary results, we estimate that interest expense will be approximately $9 million for the three-months ended December 31, 2016 as compared to $6 million for the same period of 2015. This increase was primarily attributable to an increase in the interest rate in accordance with the modified terms of the NPA (as defined herein), interest expense incurred on the Existing Term Loan Facility (as defined herein) and higher commitment fees incurred on the Existing ABL Facility (as defined herein).

Based on the preliminary results, we estimate that net loss will be within a range of $36 million to $38 million for the three-months ended December 31, 2016 as compared to a net loss of $26 million for the same period of 2015. This increase in net loss is primarily driven by the factors discussed above.

Based on the preliminary results, we estimate that Adjusted EBITDA will be within a range of $5 million to $7 million for the three-months ended December 31, 2016 as compared to $0.4 million for the same period of 2015. The increase was driven by higher revenue due to increased fleet utilization and cost saving initiatives.

EBITDA and Adjusted EBITDA Description and Reconciliation

Adjusted EBITDA is a Non-GAAP Measure defined as earnings (net income (loss)) before interest, income taxes, depreciation and amortization, further adjusted to eliminate the effects of items management does not consider in assessing ongoing performance.

Adjusted EBITDA is a Non-GAAP Measure that provides supplemental information we believe is useful to analysts and investors to evaluate our ongoing results of operations, when considered alongside other GAAP measures such as net income, operating income and gross profit. This Non-GAAP Measure excludes the financial impact of items management does not consider in assessing our ongoing operating performance, and thereby facilitates review of our operating performance on a period-to-period basis. Other companies may have different capital structures, and comparability to our results of operations may be impacted by the effects of acquisition accounting on our depreciation and amortization. As a result of the effects of these factors and factors specific to other companies, we believe Adjusted EBITDA provides helpful information to analysts and investors to facilitate a comparison of our operating performance to that of other companies.

11

Table of Contents

The table set forth below is a reconciliation of net loss to Adjusted EBITDA (in millions) for the three-months ended 2016 (estimated) and 2015 (actual):

| Three-Months Ended | ||||||||||||

| (in millions, unaudited) | December

31, 2016 (Low) |

December

31, 2016 (High) |

December 31, 2015 (Actual) |

|||||||||

| Net income (loss) |

(38.4 | ) | (36.4 | ) | (25.7 | ) | ||||||

| Depreciation and amortization |

28.5 | 28.5 | 16.5 | |||||||||

| Interest expense, net |

9.2 | 9.2 | 5.8 | |||||||||

| Income tax expense |

0.0 | 0.0 | 0.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

(0.7 | ) | 1.3 | (2.7 | ) | |||||||

| Acquisition, integration and divestiture costs |

2.7 | 2.7 | 2.3 | |||||||||

| Fleet commissioning costs |

2.8 | 2.8 | 0.0 | |||||||||

| Unit-based compensation |

0.1 | 0.1 | 0.2 | |||||||||

| Other |

0.1 | 0.1 | 0.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 5.0 | $ | 7.0 | $ | 0.4 | ||||||

|

|

|

|

|

|

|

|||||||

The preliminary financial information included in this prospectus reflects management’s estimates based solely upon information available to us as of the date of this prospectus and is the responsibility of management. The preliminary financial results presented above are not a comprehensive statement of our financial results for the three-months ended December 31, 2016. In addition, the preliminary financial results presented above have not been audited, reviewed, or compiled by our independent registered public accounting firm, KPMG LLP. Accordingly, KPMG LLP does not express an opinion or any other form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information. The preliminary financial results presented above are subject to the completion of our financial closing procedures, which have not yet been completed. Our actual results for the three-months ended December 31, 2016 will not be available until after this offering is completed and may differ materially from these estimates. Therefore, you should not place undue reliance upon these preliminary financial results. For instance, during the course of the preparation of the respective financial statements and related notes, additional items that would require material adjustments to be made to the preliminary estimated financial results presented above may be identified. There can be no assurance that these estimates will be realized, and estimates are subject to risks and uncertainties, many of which are not within our control. Accordingly, the revenues and income before tax in any particular period may not be indicative of future results. See “Special Note Regarding Forward-Looking Statements.”

Anticipated Refinancing Transactions

We have had preliminary discussions with potential lenders, financial intermediaries and advisors and following the consummation of this offering, subject to market conditions, we intend to enter into new financing facilities, consisting of a new asset-based revolving facility and a new term loan facility (such new facilities, the “New Credit Facilities”). If we enter into the New Credit Facilities, we intend to use the proceeds thereof to repay all amounts outstanding under, and to terminate, the Existing ABL Facility and our Notes (as defined herein) under the NPA. We refer to these refinancings as the “Anticipated Refinancing Transactions.” The Anticipated Refinancing Transactions are expected to extend the weighted average maturity of our indebtedness and provide us with more flexibility to pursue various transactions than we have under the restrictive covenants in our existing indebtedness. The terms of the Anticipated Refinancing Transactions may be adversely affected by economic, market, geopolitical and other conditions prevailing at the time we propose to consummate such transactions, most of which are beyond our control. There can be no assurance that we will be able to complete

12

Table of Contents

the Anticipated Refinancing Transactions on terms favorable to us, or at all. This offering is not contingent upon our entering into the New Credit Facilities, and there can be no assurance that we will enter into the New Credit Facilities and terminate the Existing ABL Facility and NPA following the consummation of this offering, or at all, and we may elect not to proceed with the Anticipated Refinancing. See “Description of Indebtedness—Anticipated Refinancing Facilities” and “Risk Factors—Risks Relating to Our Indebtedness—We may be unable to complete the Anticipated Refinancing Transactions, or we may decide not to pursue the Anticipated Refinancing Transactions.

Corporate Information

Keane Group, Inc. is a Delaware corporation that was incorporated on October 13, 2016 to undertake this offering. Our principal executive offices are located at 2121 Sage Road, Suite 370, Houston, TX 77056. Our telephone number is (713) 960-0381 and our internet address is www.keanegrp.com. Our website and the information contained thereon and accessible therefrom are not part of this prospectus and should not be relied upon by prospective investors in connection with any decision to purchase our common shares.

Our Equity Sponsor

We believe that one of our strengths is our relationship with our Sponsor. We believe we will benefit from our Sponsor’s investment experience in the energy sector, its expertise in mergers and acquisitions and its support on various near-term and long-term strategic initiatives.

Established in 1992, Cerberus and its affiliated group of funds and companies comprise one of the world’s leading private investment firms with approximately $32 billion of capital under management in four primary strategies: control and non-control private equity investments, distressed securities and assets, commercial mid-market lending and real estate-related investments. In addition to its New York headquarters, Cerberus has offices throughout the United States, Europe and Asia.

Our Sponsor will indirectly control us through its ownership of Keane Investor and will continue to be able to control the election of our directors, determine our corporate and management policies and determine, without the consent of our other stockholders, the outcome of any corporate transaction or other matter submitted to our stockholders for approval, including potential mergers or acquisitions, asset sales and other significant corporate transactions. Following the completion of the IPO-Related Transactions and this offering, Keane Investor will own approximately 78% of our common stock, or 75% if the underwriters exercise their over-allotment option to purchase additional shares in full. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the NYSE on which we have been approved to list our shares and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. As a result, our stockholders will not have the same protections afforded to stockholders of companies that are subject to such requirements. Following the completion of the IPO-Related Transactions and this offering, we will be required to appoint to our board of directors individuals designated by Keane Investor. Furthermore, if we cease to be a controlled company under the applicable rules of the NYSE, but Keane Investor collectively owns at least 35% of our then-outstanding common stock, Keane Investor shall have the right to designate a number of members of our board of directors equal to one director fewer than 50% of our board of directors and Keane Investor shall cause its directors appointed to our board of directors to vote in favor of maintaining an 11-person board. In connection with this offering, Keane Group, Inc. will enter into a stockholders agreement with Keane Investor (the “Stockholders’ Agreement”), and if a permitted transferee or assignee of such party that succeeds to such party’s rights under the Stockholders’ Agreement (each transferee or assignee, a “Holder” and, collectively, the “Holders”) has beneficial ownership of less than 35% but at least 20% of our then-outstanding common stock, such Holder shall have the right to designate a number of members of our board of directors equal to the

13

Table of Contents

greater of (a) three or (b) 25% of the size of our board of directors (rounded up to the next whole number). If a Holder has beneficial ownership of less than 20% but at least 15% of our then-outstanding common stock, such Holder shall have the right to designate a number of directors equal to the greater of (a) two or (b) 15% of the size of our board of directors (rounded up to the next whole number). If a Holder has beneficial ownership of less than 15% but at least 10% of our then-outstanding common stock, such Holder shall have the right to designate one director to our board of directors.

The interests of our Sponsor may not coincide with the interests of other holders of our common stock. Additionally, our Sponsor is in the business of making investments in companies and may, from time to time, acquire and hold interests in businesses that compete directly or indirectly with us. Our Sponsor may also pursue acquisition opportunities that may be complementary to our business, and as a result, those acquisition opportunities may not be available to us. So long as Cerberus continues to own a significant amount of the outstanding shares of our common stock through Keane Investor, Cerberus will continue to be able to strongly influence or effectively control our decisions, including potential mergers or acquisitions, asset sales and other significant transactions.

See “Risk Factors—Risks Related to This Offering and Owning Our Common Stock.”

Implications of being An Emerging Growth Company

We qualify as an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | a requirement to have only two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure; |

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| • | an exemption from new or revised financial accounting standards until they would apply to private companies and from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation; |

| • | reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| • | no requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements. |

The JOBS Act permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to “opt out” of this provision, and as a result, we plan to comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period is irrevocable.

We have elected to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of these elections, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. In addition, it is possible that some investors will find our common stock less attractive as a result of our elections, which may result in a less active trading market for our common stock and more volatility in our stock price.

14

Table of Contents

We may take advantage of these provisions for up to five years or until such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, are deemed to be a large accelerated filer (as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) or issue more than $1.0 billion of non-convertible debt securities over a three-year period.

15

Table of Contents

The Offering

| Issuer |

Keane Group, Inc. |

| Selling stockholder |

Keane Investor Holdings LLC |

| Common stock outstanding immediately before this offering |

87,428,019 shares. |

| Common stock offered by us |

15,700,000 shares. |

| Common stock offered by selling stockholder |

6,600,000 shares. |

| Common stock to be outstanding immediately after this offering |

103,128,019 shares. |

| Option to purchase additional shares |

The selling stockholder has granted to the underwriters a 30-day over-allotment option to purchase up to 3,345,000 additional shares of our common stock at the initial public offering price less the underwriting discount and commissions. |

| Use of proceeds |

We estimate that our net proceeds from this offering, after deducting underwriting discounts and approximately $6.0 million of estimated offering expenses, will be approximately $250.5 million if the over-allotment option is not exercised and $246.6 million if the over-allotment option is exercised, assuming the shares are offered at $18.00 per share, which is the midpoint of the estimated offering range set forth on the cover page of this prospectus. |

| We intend to use the net proceeds from this offering to fully repay our existing balance of approximately $99 million under our Existing Term Loan Facility (and, in addition, approximately $16 million of prepayment premium related to such repayment), repay approximately $50 million of our Notes and to pay fees and expenses related to this offering. We intend to use any remaining proceeds for general corporate purposes, which may include the repayment of indebtedness, capital expenditures, working capital and potential acquisitions and strategic transactions. |

| We will not receive any of the proceeds from the sale of shares of common stock sold by the selling stockholder. |

| See “Use of Proceeds.” |

| Dividend policy |