Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMERICA INC /NEW/ | cma-20161231form8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - COMERICA INC /NEW/ | cma-20161231ex991.htm |

Comerica Incorporated

Fourth Quarter 2016Financial Review

January 17, 2017

Safe Harbor Statement

Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on course,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, including the GEAR Up initiative, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of the economic benefits of the GEAR Up initiative, estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes in monetary and fiscal policies, including changes in interest rates; changes in regulation or oversight; Comerica's ability to maintain adequate sources of funding and liquidity; the effects of more stringent capital or liquidity requirements; declines or other changes in the businesses or industries of Comerica's customers, in particular the energy industry; unfavorable developments concerning credit quality; operational difficulties, failure of technology infrastructure or information security incidents; reliance on other companies to provide certain key components of business infrastructure; factors impacting noninterest expenses which are beyond Comerica's control; changes in the financial markets, including fluctuations in interest rates and their impact on deposit pricing; reductions in Comerica's credit rating; whether Comerica may achieve opportunities for revenue enhancements and efficiency improvements under the GEAR Up initiative, or changes in the scope or assumptions underlying the GEAR Up initiative; the interdependence of financial service companies; the implementation of Comerica's strategies and business initiatives; damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; changes in customer behavior; any future strategic acquisitions or divestitures; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; the impact of legal and regulatory proceedings or determinations; the effectiveness of methods of reducing risk exposures; the effects of terrorist activities and other hostilities; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; changes in accounting standards and the critical nature of Comerica's accounting policies. Comerica cautions that the foregoing list of factors is not exclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of the Corporation's Annual Report on Form 10-K for the year ended December 31, 2015 and “Item 1A. Risk Factors” beginning on page 62 of the Corporation’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2016. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

Financial Summary

4Q16 3Q16 2016 2015

Diluted income per common share $0.92 $0.84 $2.68 $2.84

Net interest income $455 $450 $1,797 $1,689

Net interest margin 2.65% 2.66% 2.71% 2.60%

Provision for credit losses 35 16 248 147

Net credit-related charge-offs to average loans 0.29% 0.13% 0.32% 0.21%

Noninterest income 267 272 1,051 1,035

Noninterest expenses 461 493 1,930 1,827

Restructuring expenses 20 20 93 -

Net income 164 149 477 521

Average loans $48,915 $49,206 $48,996 $48,628

Average deposits 59,645 58,065 57,741 58,326

Common equity Tier 1 capital ratio 11.07%1 10.69% 11.07%1 10.54%

Average diluted shares (millions)2 177 176 177 181

Efficiency Ratio3 63.58% 68.15%

$ in millions, except per share data ● 1Estimated ● 2Average diluted shares for 4Q16 included an increase of 1MM shares as a result of the impact of increased share price on common stock equivalents ● 3Noninterest expenses as a percentage of the sum of net interest income (FTE) and noninterest income excluding net securities gains (losses). 3

Full-Year 2016 Results

$ in millions, except per share data ● 2016 compared to 2015 ● 1Included restructuring charges of $93MM in 2016

● 2EPS based on diluted income per share ● 32016 repurchases under the equity repurchase program

2016 From FY15Chg $ Chg %Average loans $48,996 $368 1%

Average deposits 57,741 (585) (1)%

Net interest income 1,797 108 6%

Provision for credit losses 248 101 70%

Net credit-related charge-offs 157 46 46%

Noninterest income 1,051 16 2%

Noninterest expenses1 1,930 103 6%

Net income 477 (44) (8)%

Earnings per share (EPS)2 2.68 (0.16) (6)%

Equity repurchases3 6.6MM shares or $303MM

Key YoY Performance Drivers

Average Loans up 1% (or 2%, ex $641MM decline in Energy)

Deposits down 1% with LCR adjustments early in 2016

Net interest income grew due to rise in interest rates & earning asset growth

Provision increased due to 1Q16 reserve build for Energy loans

Noninterest income reflects growth in customer-driven fees (particularly card) partially offset by decline in non-fee categories

Expenses included $93MM in restructuring charges

Share repurchases plus dividends returned $458MM to shareholders

4

Fourth Quarter 2016 Results

$ in millions, except per share data ● n/m = not meaningful ● 4Q16 compared to 3Q16 ● 1Included restructuring charges of $20MM in 3Q16 & 4Q16 ● 2EPS based on diluted income per share ● 34Q16 repurchases under the equity repurchase program

4Q16 Change From3Q16 4Q15Average loans $48,915 $(291) (1)%

Average deposits 59,645 1,580 3%

Net interest income 455 5 1%

Provision for credit losses 35 19 n/m

Net credit-related charge-offs 36 20 n/m

Noninterest income 267 (5) (2)%

Noninterest expenses1 461 (32) (6)%

Net income 164 15 10%

Earnings per share (EPS)2 0.92 0.08 10%

Equity repurchases3 1.8MM shares or $99MM

Key QoQ Performance Drivers

Average loans relatively stable, reflects seasonality & Energy portfolio reduction

Deposit growth strong with increases in nearly all lines of business

Net interest income benefitted from increase in interest rates

Provision & net charge-offs increased from low level

Noninterest income decreased with decline in commercial lending fees

Lower expenses mainly resulting from GEAR Up initiative (lower salaries & benefits)

Taxes benefitted from early termination of certain leveraged lease transactions

Active capital management continued

5

Loans Relatively StableTypical seasonality & Energy portfolio reduction

4Q16 compared to 3Q16 ● 1Utilization of commercial commitments as a percentage of total commercial commitments at period-end

Total Loans($ in billions)

48.5 48.4 49.5 49.2 48.9 49.3 49.1

3.24 3.38 3.31 3.33 3.36

4Q15 1Q16 2Q16 3Q16 4Q16 3Q16 4Q16

Loan Yields

Average Balances Period-end

Average loans decreased $291MM

- Mortgage Banker Finance- Energy- General Middle Market- Environmental Services+ National Dealer Services

Loan yields +3 bps + Increase in rates - Lease residual value adjustment

Commitments $52.5B

Declined 1% due to reduction in Energy & seasonal decline in Mortgage Banker

Line utilization1 remained stable at 51%

Loan pipeline remains strong

6

4Q16 compared to 3Q16 ● 1Interest costs on interest-bearing deposits ● 2At 12/31/16

Average Balances Period-end

Total Deposits($ in billions)

59.7

56.7 56.5 58.1

59.6 59.3 59.0

0.14 0.14 0.14 0.14 0.14

4Q15 1Q16 2Q16 3Q16 4Q16 3Q16 4Q16

Deposit Rates1

7

Average deposits increased $1.6B

+ Corporate Banking+ Energy+ General Middle Market + Retail Bank- Technology & Life Sciences

Noninterest-bearing grew $1.6B

Interest-bearing declined $57MM

Loan to Deposit Ratio2 of 83%

Strong Deposit GrowthDriven by increase in noninterest-bearing deposits

Securities Portfolio($ in billions)

8

Securities Portfolio StableAverage yield unchanged

9.2 9.4 9.3 9.4 9.4 9.5 9.5

10.9

12.4 12.3 12.4 12.3 12.5 12.4

2.11 2.05 2.03 2.01 2.01

4Q15 1Q16 2Q16 3Q16 4Q16 3Q16 4Q16

Treasury Securities & OtherMortgage-backed Securities (MBS)Securities Yields

Average Balances Period-end

Securities portfolio

Duration of 3.5 years1• Extends to 3.9 years under a 200 bps instantaneous rate increase1

Net unrealized pre-tax loss of $42MM2

Net unamortized premium of $29MM3

GNMA ~49% of MBS portfolio

12/31/16 ● 1Estimated as of 12/31/16. Excludes auction rate securities (ARS). ● 2Net unrealized pre-tax gain on the available-for-sale (AFS) portfolio ● 3Net unamortized premium on the MBS portfolio

Net Interest Income($ in millions)

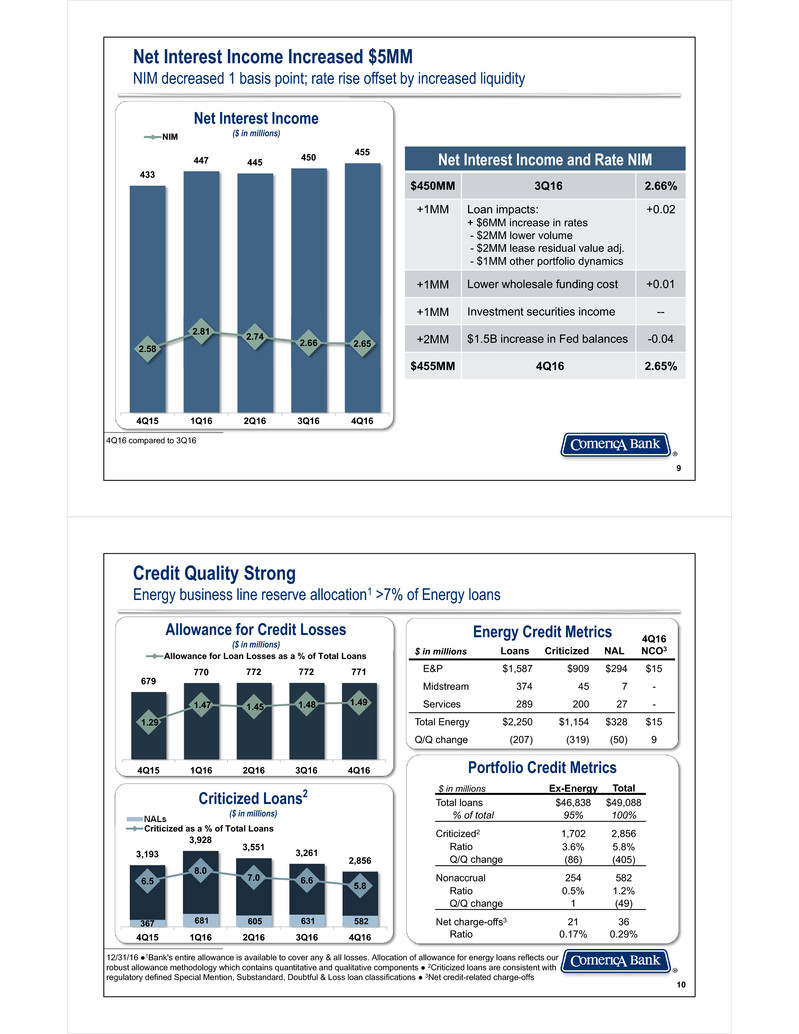

Net Interest Income Increased $5MMNIM decreased 1 basis point; rate rise offset by increased liquidity

4Q16 compared to 3Q16

433 447 445

450 455

2.58

2.81 2.74 2.66 2.65

4Q15 1Q16 2Q16 3Q16 4Q16

NIM Net Interest Income and Rate NIM

$450MM 3Q16 2.66%

+1MM Loan impacts:+ $6MM increase in rates- $2MM lower volume- $2MM lease residual value adj.- $1MM other portfolio dynamics

+0.02

+1MM Lower wholesale funding cost +0.01

+1MM Investment securities income --

+2MM $1.5B increase in Fed balances -0.04

$455MM 4Q16 2.65%

9

367 681 605 631 582

3,193 3,928 3,551 3,261 2,856

6.5 8.0 7.0 6.6 5.8

4Q15 1Q16 2Q16 3Q16 4Q16

NALsCriticized as a % of Total Loans

Criticized Loans2($ in millions)

Credit Quality StrongEnergy business line reserve allocation1 >7% of Energy loans

12/31/16 ●1Bank's entire allowance is available to cover any & all losses. Allocation of allowance for energy loans reflects ourrobust allowance methodology which contains quantitative and qualitative components ● 2Criticized loans are consistent withregulatory defined Special Mention, Substandard, Doubtful & Loss loan classifications ● 3Net credit-related charge-offs

Allowance for Credit Losses($ in millions)

679 770 772 772 771

1.29

1.47 1.45 1.48 1.49

4Q15 1Q16 2Q16 3Q16 4Q16

Allowance for Loan Losses as a % of Total Loans

$ in millions Ex-Energy TotalTotal loans $46,838 $49,088% of total 95% 100%

Criticized2 1,702 2,856Ratio 3.6% 5.8%Q/Q change (86) (405)

Nonaccrual 254 582Ratio 0.5% 1.2%Q/Q change 1 (49)

Net charge-offs3 21 36Ratio 0.17% 0.29%

$ in millions Loans Criticized NAL 4Q16 NCO3

E&P $1,587 $909 $294 $15

Midstream 374 45 7 -

Services 289 200 27 -

Total Energy $2,250 $1,154 $328 $15

Q/Q change (207) (319) (50) 9

Energy Credit Metrics

Portfolio Credit Metrics

10

Noninterest Income Decreased from Record 3Q16 LevelNon-fee income decreased $4MM

4Q16 compared to 3Q16

266

244

268 272 267

4Q15 1Q16 2Q16 3Q16 4Q16

Noninterest Income ($ in millions)

11

Noninterest income decreased $5MM

+ $3MM Card fees- $5MM Commercial Lending fees

- $2MM Net securities loss (related to Visa derivative) - $2MM Deferred comp (offset in noninterest expense)

Noninterest Expenses Decreased 6%Restructuring costs of $20MM included in 4Q16

4Q16 compared to 3Q16

Noninterest expenses down $32MM

- $28MM Salaries & Benefits- $ 4MM Consulting Fees- $ 3MM Gain on early termination of certain leased assets+ $ 3MM Outside processing

Noninterest Expenses($ in millions)

12

53 20

20

482

458

518

493

461

4Q15 1Q16 2Q16 3Q16 4Q16

Restructuring >$25MM in GEAR Up savings realized thus far

Active Capital ManagementContinued to return excess capital to shareholders

12/31/16 ● 1Shares repurchased under equity repurchase program

2016 CCAR Capital Plan

Equity repurchases up to $440 million (3Q16-2Q17)

Pace of buyback linked to capital position, financial performance & market conditionsEquity repurchases1

1.8MM shares for $99MM in 4Q16

2.1MM shares for $97MM in 3Q16

5MM shares issued in 4Q16 for warrants & employee options exercised

Dividends Per Share Growth

0.55

0.68 0.79

0.83 0.89

2012 2013 2014 2015 2016

13

Shareholder Payout($ in millions)

65 42 65

97 99

37

37

38

40 40 102 79

103

137 139

4Q15 1Q16 2Q16 3Q16 4Q16

Equity RepurchasesDividends

Share Count(in millions)

188 182 179 176 175

192 187 185 181 177

2012 2013 2014 2015 2016

Common Shares Outstanding Average Diluted Shares

12/31/16 ● Outlook as of 1/17/17 ● 1Based on immediate parallel shock. Calculations derived from sensitivity results shown on slide 22.

Potential Future Upside Significant upside from recent rate increase

14

Other Potential Upsides

Well Positioned for Potential Tax Changes 2016 Tax Reconciliation

($ in millions) Amount RateTax based on federal statutory rate $235 35.0%State income taxes 8 1.2 Affordable housing and historic credits (22) (3.3)Bank-owned life insurance (15) (2.3)Lease termination transactions (15) (2.2)Tax-related interest and penalties 3 0.5Other (1) (0.1)Provision for income taxes 193 28.8%

Regulatory relief on expenses & capital management

Fiscal stimulus driving economic growth & loan demand

Additional Annual Net Interest Income1 Estimated increase from interest rate movement

25 bps 50 bps 75 bps

~$50MM to~$85MM

~$95MM to~$155MM

~$120MM to~$235MM

Range is driven by deposit betas, deposit reduction & incremental funding needs

12/31/16 ● 1Relative to when we began the initiative in June 2016 ● 2Count of total U.S. banking centers ● 3Includes Pension, Postretirement & Retirement Account Plan costs ● Estimates & outlook as of 1/1717

8,948 8,876 8,880 7,960 ~8,000

2013 2014 2015 2016 Proj2017

Achieved FY16 Workforce Reduction(# of employees – full time equivalent) 482 480 476 457 438

2013 2014 2015 2016 Proj2017

19 Banking Centers Consolidated in FY162 95

50 58

16

~(17)

2013 2014 2015 2016 Proj2017

Revised Retirement Plan Reducing Expense3($ in millions)

15

~270MM additional annual pre-tax income1 Double-digit ROE ≤ 60% Efficiency Ratio

On Track to Reach FY18 Financial Targets

GEAR Up: Growth in Efficiency And RevenueGoal: Enhance shareholder value through increased profitability

Expense Achievements & Opportunities

Outlook as of 1/17/17

GEAR Up initiative incorporated into this Outlook

Average loans Higher • In line with growth in real GDP• Increases in most lines of business & reduced headwind from declining Energy loans

Net interest income Higher

• December rise in short-term rates expected to contribute approx. $70MM (assuming a 25% deposit beta)• Contribution from loan growth • Partly offset by higher funding costs & minor loan yield compression

Provision Lower • Provision & net charge-offs in-line with historical normal levels of 30-40 basis points• Continued solid performance of the overall portfolio

Noninterest income Higher

• Execution of GEAR Up opportunities of ~$30MM• Modest growth in treasury management & card fees, as well as wealth management products such as fiduciary & brokerage services• Increase 4-6%

Noninterest expenses Lower

• Restructuring expenses of about $25MM-$50MM (2016 $93MM)• Remaining noninterest expense decline 1-2% • GEAR Up savings: additional $125MM relative to 2016 savings (2016 >$25MM)• Increased outside processing in line with growing revenue, continued increases in technology costs, higher FDIC insurance expense & typical inflationary pressures • No repeat of gain on leveraged lease terminations (2016 $13MM) • Decrease 4-5% including restructuring charges

Income Taxes Higher • ~33% of pre-tax income

Management Outlook FY17 compared to FY16Assuming continuation of current economic & low rate environment

16

Appendix

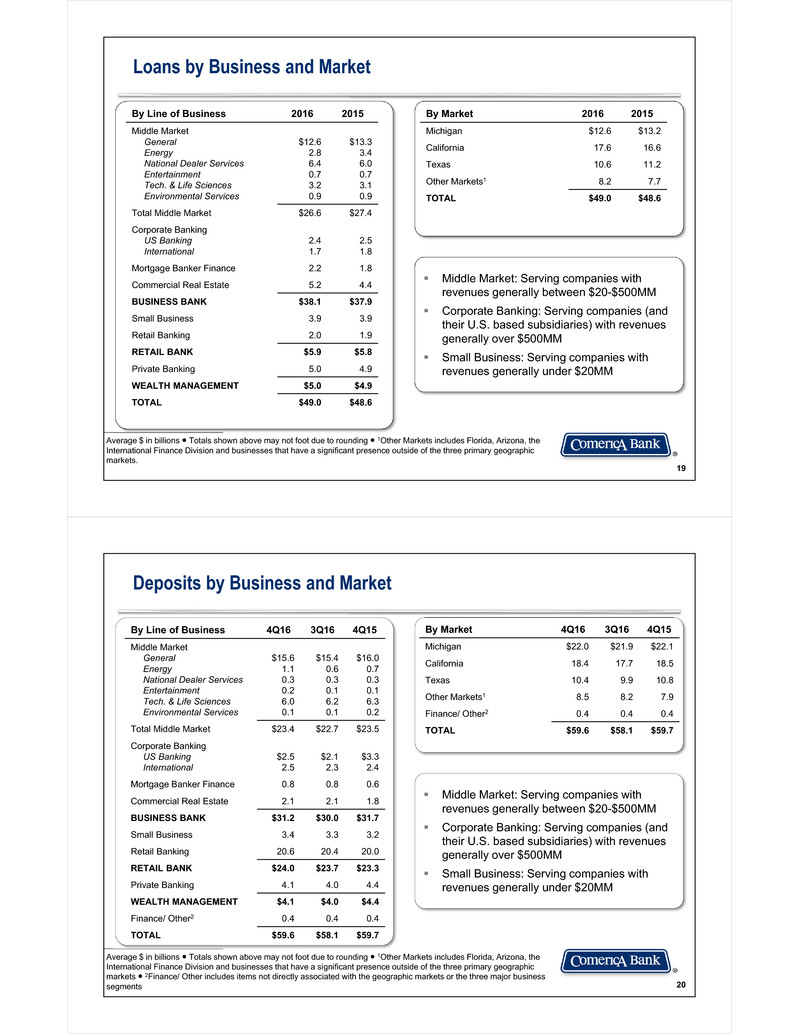

Loans by Business and Market

Average $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets

Middle Market: Serving companies with revenues generally between $20-$500MM

Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM

Small Business: Serving companies with revenues generally under $20MM

By Line of Business 4Q16 3Q16 4Q15

Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services

$12.42.46.60.73.20.8

$12.52.66.30.73.10.9

$13.03.26.20.73.30.9

Total Middle Market $26.2 $26.2 $27.3

Corporate BankingUS BankingInternational 2.41.6 2.31.7 2.41.7

Mortgage Banker Finance 2.4 2.5 1.7

Commercial Real Estate 5.4 5.5 4.6

BUSINESS BANK $37.9 $38.2 $37.7

Small Business 3.9 3.9 3.9

Retail Banking 2.0 2.0 1.9

RETAIL BANK $5.9 $5.9 $5.9

Private Banking 5.1 5.1 5.0

WEALTH MANAGEMENT 5.1 5.1 5.0

TOTAL $48.9 $49.2 $48.5

By Market 4Q16 3Q16 4Q15

Michigan $12.5 $12.5 $13.0

California 17.7 17.6 17.0

Texas 10.4 10.6 10.9

Other Markets1 8.3 8.5 7.6

TOTAL $48.9 $49.2 $48.5

18

Loans by Business and Market

Average $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets.

Middle Market: Serving companies with revenues generally between $20-$500MM

Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM

Small Business: Serving companies with revenues generally under $20MM

By Line of Business 2016 2015

Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services

$12.62.86.40.73.20.9

$13.33.46.00.73.10.9

Total Middle Market $26.6 $27.4

Corporate BankingUS BankingInternational 2.41.7 2.51.8

Mortgage Banker Finance 2.2 1.8

Commercial Real Estate 5.2 4.4

BUSINESS BANK $38.1 $37.9

Small Business 3.9 3.9

Retail Banking 2.0 1.9

RETAIL BANK $5.9 $5.8

Private Banking 5.0 4.9

WEALTH MANAGEMENT $5.0 $4.9

TOTAL $49.0 $48.6

By Market 2016 2015

Michigan $12.6 $13.2

California 17.6 16.6

Texas 10.6 11.2

Other Markets1 8.2 7.7

TOTAL $49.0 $48.6

19

Deposits by Business and Market

Average $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets ● 2Finance/ Other includes items not directly associated with the geographic markets or the three major business segments

Middle Market: Serving companies with revenues generally between $20-$500MM

Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM

Small Business: Serving companies with revenues generally under $20MM

By Line of Business 4Q16 3Q16 4Q15

Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services

$15.61.10.30.26.00.1

$15.40.60.30.16.20.1

$16.00.70.30.16.30.2

Total Middle Market $23.4 $22.7 $23.5

Corporate BankingUS BankingInternational $2.52.5 $2.12.3 $3.32.4

Mortgage Banker Finance 0.8 0.8 0.6

Commercial Real Estate 2.1 2.1 1.8

BUSINESS BANK $31.2 $30.0 $31.7

Small Business 3.4 3.3 3.2

Retail Banking 20.6 20.4 20.0

RETAIL BANK $24.0 $23.7 $23.3

Private Banking 4.1 4.0 4.4

WEALTH MANAGEMENT $4.1 $4.0 $4.4

Finance/ Other2 0.4 0.4 0.4

TOTAL $59.6 $58.1 $59.7

By Market 4Q16 3Q16 4Q15

Michigan $22.0 $21.9 $22.1

California 18.4 17.7 18.5

Texas 10.4 9.9 10.8

Other Markets1 8.5 8.2 7.9

Finance/ Other2 0.4 0.4 0.4

TOTAL $59.6 $58.1 $59.7

20

Deposits by Business and Market

Average $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets. ● 2Finance/ Other includes items not directly associated with the geographic markets or the three major business segments.

Middle Market: Serving companies with revenues generally between $20-$500MM

Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM

Small Business: Serving companies with revenues generally under $20MM

By Line of Business 2016 2015

Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services

$15.10.80.30.26.10.1

$15.90.70.20.16.30.2

Total Middle Market $22.6 $23.4

Corporate BankingUS BankingInternational 2.22.3 2.82.2

Mortgage Banker Finance 0.7 0.6

Commercial Real Estate 1.9 1.9

BUSINESS BANK $29.7 $30.9

Small Business 3.2 3.1

Retail Banking 20.3 19.8

RETAIL BANK $23.5 $22.9

Private Banking 4.1 4.1

WEALTH MANAGEMENT $4.1 $4.1

Finance/ Other2 0.4 0.4

TOTAL $57.7 $58.3

By Market 2016 2015

Michigan $21.8 $21.9

California 17.4 17.8

Texas 10.2 10.9

Other Markets1 8.0 7.3

Finance/ Other2 0.3 0.4

TOTAL $57.7 $58.3

21

Interest Rate SensitivityRemain well positioned for rising rates

12/31/16 ● For methodology see the Company’s Form 10-Q, as filed with the SEC. Estimates are based on simulation modeling analysis.

Estimated Net Interest Income: Annual (12 month) SensitivitiesBased on Various AssumptionsAdditional Scenarios are Relative to 4Q16 Standard Model($ in millions)

0.1

Interest Rates 200 bps gradual, non-parallel rise

Loan Balances Modest increase

Deposit Balances Moderate decrease

Deposit Pricing (Beta)

Historical price movements with short-term rates

Securities Portfolio Held flat with prepayment reinvestment

Loan Spreads Held at current levels

MBS Prepayments Third-party projections and historical experience

Hedging (Swaps) No additions modeled

Standard Model Assumptions

22

~95

~140

~190 ~190 ~210

~250

~325

Up 100bps Addl.$3BDepositDecline

Addl.20%Increasein Beta

Addl.$1BDepositDecline

StandardModel Addl.~3%LoanGrowth

Up 300bps

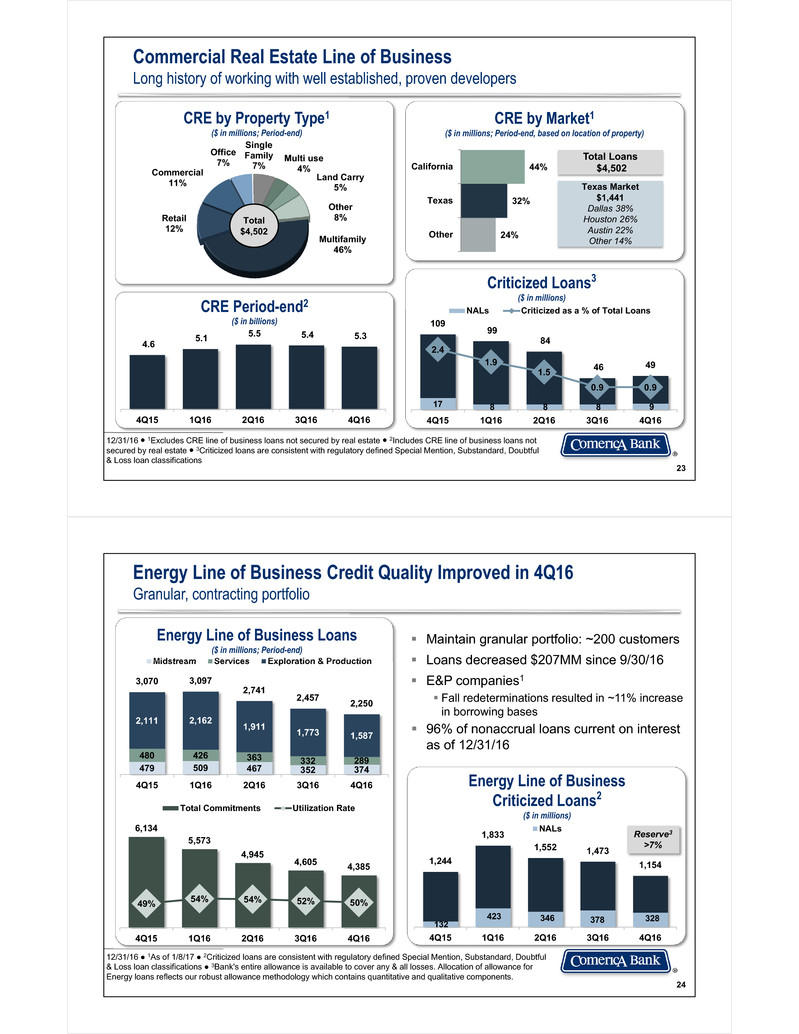

CRE by Property Type1($ in millions; Period-end)

24%

32%

44%

Other

Texas

California

CRE by Market1($ in millions; Period-end, based on location of property)

Commercial Real Estate Line of BusinessLong history of working with well established, proven developers

12/31/16 ● 1Excludes CRE line of business loans not secured by real estate ● 2Includes CRE line of business loans not secured by real estate ● 3Criticized loans are consistent with regulatory defined Special Mention, Substandard, Doubtful & Loss loan classifications 23

CRE Period-end2($ in billions)

Total Loans$4,502

Texas Market $1,441Dallas 38%Houston 26%Austin 22%Other 14%

Criticized Loans3($ in millions)

17 8 8 8 9

109 99 84

46 49

2.4 1.9 1.5

0.9 0.9

4Q15 1Q16 2Q16 3Q16 4Q16

NALs Criticized as a % of Total Loans

4.6 5.1 5.5 5.4 5.3

4Q15 1Q16 2Q16 3Q16 4Q16

Multifamily46%

Retail12%

Commercial11%

Office7%

Single Family7% Multi use4% Land Carry5%

Other8%Total$4,502

Energy Line of BusinessCriticized Loans2($ in millions)

479 509 467 352 374

480 426 363 332 289

2,111 2,162 1,911 1,773 1,587

3,070 3,097 2,741 2,457 2,250

4Q15 1Q16 2Q16 3Q16 4Q16

Midstream Services Exploration & Production

Energy Line of Business Loans ($ in millions; Period-end)

132 423 346 378 328

1,244

1,833 1,552 1,473 1,154

4Q15 1Q16 2Q16 3Q16 4Q16

NALs

Energy Line of Business Credit Quality Improved in 4Q16Granular, contracting portfolio

12/31/16 ● 1As of 1/8/17 ● 2Criticized loans are consistent with regulatory defined Special Mention, Substandard, Doubtful & Loss loan classifications ● 3Bank's entire allowance is available to cover any & all losses. Allocation of allowance for Energy loans reflects our robust allowance methodology which contains quantitative and qualitative components.

Natural Gas 13% Oil40%

Mixed18%

6,134 5,573 4,945 4,605 4,385

49% 54% 54% 52% 50%

4Q15 1Q16 2Q16 3Q16 4Q16

Total Commitments Utilization Rate

Maintain granular portfolio: ~200 customers

Loans decreased $207MM since 9/30/16

E&P companies1

Fall redeterminations resulted in ~11% increase in borrowing bases

96% of nonaccrual loans current on interest as of 12/31/16

24

Reserve3>7%

923 1,53

5

1,48

3

1,50

7 1,99

6

2,09

4

1,73

7

1,81

5

1,60

5

1,10

9

886 1,

319 1,59

5

1,39

7

1,39

9 2,0

89 2,13

6

1,74

2

1,67

4 2,14

5 2,54

4

2,35

2

200300

400500

600700

800900

3Q1

1

4Q1

1

1Q1

2

2Q1

2

3Q1

2

4Q1

2

1Q1

3

2Q1

3

3Q1

3

4Q1

3

1Q1

4

2Q1

4

3Q1

4

4Q1

4

1Q1

5

2Q1

5

3Q1

5

4Q1

5

1Q1

6

2Q1

6

3Q1

6

4Q1

6

Actual MBAMortgageOriginationVolumes

12/31/16 ● 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 12/14/16; 4Q16 estimated ●2$ in billions

Average Loans($ in millions)

Mortgage Banker Finance50 Years experience with reputation for consistent, reliable approach

MBA Mortgage Originations Forecast1($ in billions)

470

352 430 437 352 345 445 443

4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18

Purchase Refinance

1,2

Provide warehouse financing: bridge from residential mortgage origination to sale to end market

Extensive backroom provides collateral monitoring and customer service

Focus on full banking relationships

Granular portfolio with 100+ relationships

Underlying mortgages are typically related to home purchases as opposed to refinancesAs of 4Q16: • Comerica: ~67% purchase • Industry: 49% purchase1

Strong credit quality• No charge-offs since 2010

25

National Dealer Services65+ years of floor plan lending

Toyota/Lexus16%

Honda/Acura 15%

Ford 9%

GM 9%

Fiat/Chrysler 10%Mercedes 3%

Nissan/ Infiniti 6%

Other European 11%

Other Asian 11%

Other110%

Franchise Distribution(Based on period-end loan outstandings)

Geographic DispersionCalifornia 64% Texas 6%Michigan 19% Other 11%

Average Loans($ in billions)

Top tier strategy

Focus on “Mega Dealer” (five or more dealerships in group)

Strong credit quality

Robust monitoring of company inventory and performance

1.5 1.9 2.3 2.3 2.5 2.8 3.1 2.9 3.2 3.2 3.5 3.2 3.4 3.5 3.6 3.5 3.7 3.8 4.0 3.8 4.0

3.4

3.8 4.

3 4.3 4.6

4.9 5.1

4.9 5.

3 5.3 5.7

5.5 5.7

5.9 6.0

6.0 6.2

6.2 6.5

6.3 6.6

4Q1

1

1Q1

2

2Q1

2

3Q1

2

4Q1

2

1Q1

3

2Q1

3

3Q1

3

4Q1

3

1Q1

4

2Q1

4

3Q1

4

4Q1

4

1Q1

5

2Q1

5

3Q1

5

4Q1

5

1Q1

6

2Q1

6

3Q1

6

4Q1

6

Floor Plan

Total $6.9B

12/31/16 ● 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans)

26

Early Stage~14%

Growth~27%

Late Stage~9%

Equity Fund Services~46%

Leveraged Finance~4%

Technology and Life Sciences20+ Years experience provides competitive advantage

Technology & Life Sciences Avg. Loans($ in billions)

Customer Segment Overview(based on period-end loans)

Strong relationships with top-tier investors

Granular portfolio: ~810 customers (including ~220 customers in Equity Fund Services)

Manage concentration to numerous verticals to ensure widely diversified portfolio

Closely monitor cash balances and maintain robust backroom operation

Net Charge-off Ratio1(In basis points)

Total $3.3B 57 61

89 108

51

2012 2013 2014 2015 2016

l .1

12/31/16 ● 1TLS net charge-offs to avg. TLS loans

27

0.3 0.4 0.6 1.1 1.4

1.8 2.0

2.5 3.1

3.2

2012 2013 2014 2015 2016

Equity Fund Services

Funding ProfileAt December 31, 2016($ in billions)

Equity$7.8 11%

Interest-Bearing Deposits$27.4 38%

Noninterest-Bearing Deposits$31.5 44%

Wholesale Debt$5.2 7%

Funding and Maturity Profile

12/31/16 ● 12026 maturity ● 2Face value at maturity

Wholesale debt markets

Federal Home Loan Bank of Dallas• $2.8B outstanding1• $3.9B remaining borrowing capacity

Brokered deposits

Fed funds/ Repo markets

Multiple Funding Sources

Debt Profile by Maturity2($ in millions)

500 350

4,225

2017 2019 2020+

Subordinated NotesSenior NotesFHLB Advance1

28

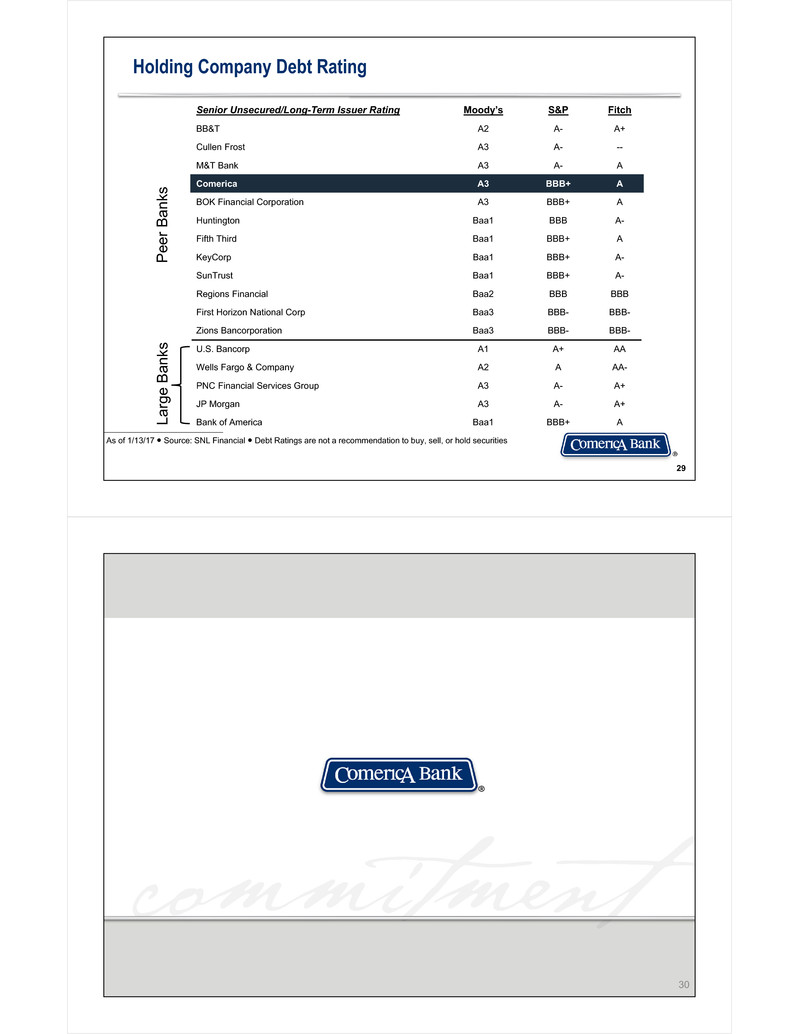

Senior Unsecured/Long-Term Issuer Rating Moody’s S&P Fitch

BB&T A2 A- A+

Cullen Frost A3 A- --

M&T Bank A3 A- A

Comerica A3 BBB+ A

BOK Financial Corporation A3 BBB+ A

Huntington Baa1 BBB A-

Fifth Third Baa1 BBB+ A

KeyCorp Baa1 BBB+ A-

SunTrust Baa1 BBB+ A-

Regions Financial Baa2 BBB BBB

First Horizon National Corp Baa3 BBB- BBB-

Zions Bancorporation Baa3 BBB- BBB-

U.S. Bancorp A1 A+ AA

Wells Fargo & Company A2 A AA-

PNC Financial Services Group A3 A- A+

JP Morgan A3 A- A+

Bank of America Baa1 BBB+ A

Holding Company Debt Rating

As of 1/13/17 ● Source: SNL Financial ● Debt Ratings are not a recommendation to buy, sell, or hold securities

Pee

r Ba

nks

Larg

e Ba

nks

29

30