Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - British Cambridge, Inc. | ex32.htm |

| EX-31 - EX-31 - British Cambridge, Inc. | ex31.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2016

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 333-207947

British Cambridge, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 37-1801552 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| Ground Floor, Unit D, Belvedere Tower San Miguel Avenue, Ortigas Center Pasig City, Philippines | 1605 | |

| (Address of principal executive offices) | (Zip Code) | |

N/A

(Former name, former address and former fiscal year, if changed since last report)

Issuer's telephone number: (+63) 2 650 6565

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Exchange Act:

| Title of each class |

Name of each exchange on which registered |

|||

| Common Stock, $.0001 | None at this time |

-1-

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a small reporting company. See definition of large accelerated filer, accelerated filer and small reporting company in Rule 12b-2 of the Securities Exchange Act of 1934.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[X] Yes [ ] No

As of September 30, 2016, there were approximately 241,042,000 shares of common stock and 3,000,000 shares of preferred stock issued and outstanding.

-2-

Explanatory Note: This 10-K/A is being filed to amend a clerical error in the Report of the Independent Registered Public Accounting Firm on page F2. The date of the report was incorrectly dated 1/13/16 in the previous filing and is herein amended to the appropriate date (1/13/17).

FORWARD-LOOKING STATEMENTS

Subject to Section 21 E, of the Exchange Act, this Form 10-K contains forward-looking statements. The forward-looking statements are based on our current goals, plans, expectations, assumptions, estimates and predictions regarding the Company.

When used in this Annual Report, the words “plan”, “believes,” “continues,” “expects,” “anticipates,” “estimates,” “intends”, “should,” “would,” “could,” or “may,” and similar expressions are intended to identify forward looking statements.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, events or growths to be materially different from any future results, events or growths expressed or implied in this Annual Report.

In this Annual Report on Form 10-K, “British Cambridge,” “the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to British Cambridge, Inc., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending September 30th. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

-3-

British Cambridge, Inc.

-4-

PART I

Corporate History

British Cambridge, Inc., a Delaware corporation (“the Company”) was incorporated under the laws of the State of Delaware on June 24, 2015.

On July 30, 2015 Hatadi Shapiro Supaat was appointed President and Chairman of our Board of Directors. Simultaneously, Teodoro G. Bondoc Jr. was appointed Chief Executive Officer and Director and Leslie Ann C. Galano was appointed Chief Financial Officer. Also on July 30, 2015 Dr. Aurora L. Jalacon was appointed Chief Operations Officer and Strazzi R. Revil was appointed Chief Accounting Officer. Simultaneously, Dr. Eduardo Cabantog and Dr. And Julie D. Rosal were each appointed as a Director.

On July 30, 2015 Hatadi Shapiro Supaat was issued 200,000,000 shares of restricted common stock and 3,000,000 shares of preferred stock all with a par value of .0001. Simultaneously, Teodoro G. Bondoc Jr. was issued 17,000,000 shares of restricted common stock with a par value of .0001. Michael Angelo F. Balagtas was issued 1,000,000 shares of restricted common stock, John N. Bautista was issued 1,000,000 shares of restricted common stock and Meugene M. Guiterrez was issued 1,000,000 shares of restricted common stock, all of which had a par value of .0001. Also on July 30, 2015 Dr. Eduardo Cabantog was issued 20,000,000 shares of restricted common stock with a par value of .0001.

The above stock issuances were issued in exchange for services rendered to developing the Company’s business plan.

Information regarding the above share issuances:

* Hatadi Shapiro Supaat is our President and Chairman of the Board of Directors.

* Dr. Eduardo Cabantog is a member of our Board of Directors.

* Teodoro Garcia Bondoc Jr. is our Chief Executive Officer and a member of our Board of Directors.

* Michael Angelo F. Balagtas is an employee of the Company.

* John N. Bautista is an employee of the Company.

* Meugene M. Guiterrez is an employee of the Company.

On September 29, 2015 we purchased the comprehensive rights to an online platform that streamlines online education from British Cambridge College, Inc. in exchange for 1,000,000 shares of restricted common stock in our Company.

On September 29, 2015 we executed a lease agreement with British Cambridge College, a Philippines Company in which they would, every three months, pay a fee of $10,000 to us in exchange for the license to use our platform. See note immediately following:

On April 1, 2016 a new lease agreement was made between the Company and British Cambridge College Inc. whereby British Cambridge College Inc. would lease the online platform from the Company for $100,000 per year for ten years beginning 10/1/15. As a result of the new agreement both parties agreed to cancel the previous agreement in which British Cambridge College, Inc. was to pay $10,000 to the Company each quarter.

On August 1, 2016 the active agreement between British Cambridge, Inc. and British Cambridge College, executed on April 1, 2016 was revised to include more specific payment terms. The agreement was edited so that it specifically states the following: “The Lessee agrees to pay the Lessor the amount of $100,000 U.S. Dollars every year. If agreed upon by both parties the funds may be paid in another currency. The $100,000 payment is to be made yearly. It can be made in installments at any time throughout the course of the year so long as the full amount has been paid by the year end September 31.”

On September 30, 2015 the Company issued 1,000,000 shares of restricted common stock at par value ($.0001) to British Cambridge College, Inc.

On October 13, 2015 Ms. Leslie Ann C. Galano resigned from the Company as Chief Financial Officer and Mr. Strazzi R. Revil resigned from the Company as Chief Accounting Officer. The previous resignations were not as a result of any disagreements with the Company.

On October 13, 2015 the Company appointed Joseph Lemuel L. Manzano as Chief Accounting Officer and Abdon P. Manaois as Chief Financial Officer.

On September 2, 2016 at a meeting of our majority shareholders and board of directors a motion was presented and resolved to sell the comprehensive rights to the Company’s online education platform to British Cambridge College, including any propriety code. British Cambridge College is considered a related party and is in part owned by both our CEO Teodoro G. Bondoc Jr. and President Hatadi Shapiro Supaat. The consideration British Cambridge College paid for the platform to the Company was $35,000.

During the three month period ended June 30, 2016 British Cambridge College paid us $35,000 in advance payments to be put toward the lease of our online education platform. Because we have sold the online education platform to them we have agreed that the advance payments will be considered as the monetary consideration in the above transaction. As a result there was no physical exchange of cash regarding the above transaction.

The lease agreement executed between the two aforementioned parties is now cancelled and terminated.

On September 2, 2016, we changed the nature of our business and operations from marketing our online education platform ‘British Cambridge College’ to business consulting. Specifically, we aim to provide small businesses with consulting services relating to going public on the Over-the-Counter (OTC) Marketplace, a United States Financial Listing Platform, and may evaluate assisting companies to go public on other, as of this time, unidentified exchanges.

-5-

Industry Overview

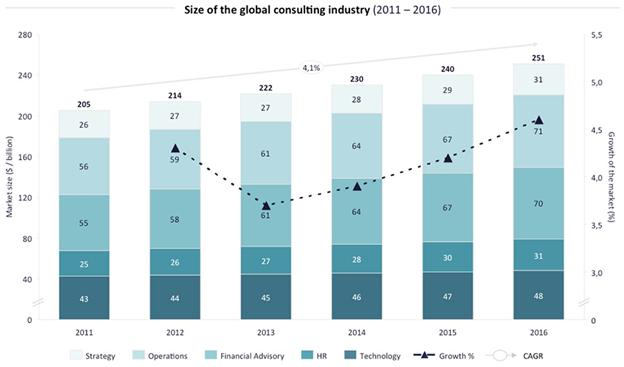

The global consulting industry has a total value of around $250 billion and is one of the most substantial markets within the larger professional services industry. As the global economy fluctuates, so too does the consulting industry. In any economy experiencing growth, higher revenues and budgets, this creates a setting in which companies are more willing to spend their revenue on consultation services. Of course that also means that when countries experience and economic downturn this alters their spending behavior and typically results in cutting down on their consultation budgets.

Despite the close link between the consulting industry and a country’s economy, it is notable that between the 1970s up to the 1990s the global consulting market grew every single year, despite two recession periods. However, in 2002 and later between 2009 and 2011 the consultation industry contracted due to global financial crises.

According to http://www.consultancy.uk/consulting-industry/global the consulting industry was valued at around $205 billion in 2011, and since then the market has grown with an average Compound Annual Growth Rate (CAGR) of 4.1% to a value of $251 billion in 2016. For many years globalization, consolidation, developments in laws and legislation, efficiency and technology have acted as the main growth drivers of the global consulting industry. More recently, digital and business model disruption has surfaced as the driving factor behind growth, in particular in the more mature markets.

Relevant data regarding how many consulting firms offer comparable services, I.E., assist in taking a Company public onto a recognized exchange, are incredibly difficult to come by because the range of services consultants offer can vary so broadly and can fluctuate on a case by case basis. Many consultants tailor their services to each individual client and thereby if going public is ideal for their client then they will attempt to assist in that process. However, in addition to general consulting there are certain subsections of the industry which are noteworthy.

The five main branches of the consulting industry are: strategy, operations, financial advisory, human resources, and technology. Strategy consulting, also termed boardroom consulting, focuses on ‘big picture’ consultation services which are typically provided to executives, members of the board of directors, etc. Operations relates to the day to day running and operations of a company, and human resources relates directly to its namesake. Financial consulting is built on an analytic foundation and can cover a wide range of topics relating to a company’s finances. Technology consulting is increasingly important as technology continues to evolve and industry professionals find their skills in higher demand.

General consulting can cover some of, or all, of the branches of consultation and is rather difficult to quantify. While we believe that our services can fit into several of the aforementioned branches it may be more accurate to state that we provide general consultation services. This puts us directly into competition with tens of thousands of other companies, and as the industry continues to evolve and grow the competition for the growing market share will only become stronger.

-6-

Business Information

British Cambridge, Inc. is a business consulting company specifically focused on providing small businesses with consulting services relating to going public on the Over-the-Counter (OTC) Marketplace, a United States Financial Listing Platform, and may evaluate assisting companies to go public on other, as of this time, unidentified exchanges. From time to time, upon request, we may also assist our clients in becoming SEC Reporting via a Form 10, an S-1 Registration Statement or other comparable Registration Statement.

To date, subsequent to the adoption of our current business plan, our activities have been limited to securing contracts for our consulting services. As such, all of the information below detailing our plan of operations for when we acquire clients is based upon the plans of our company which have been determined arbitrarily by our management. Our course of action may change in various ways, when we secure consulting contracts, which we cannot fully anticipate at this point in time.

We will charge a flat fee for our business consulting services depending upon the consulting service that is being requested. As of this point in time, the fees we intend to charge prospective clients are undecided, however they will likely be determined on a case by case basis. The determination of our fees can vary based on a number of factors including, but not limited to, the size of the client’s Company, the amount of time each project is likely to take, the difficulty inherent in every project, etc.

We will not be offering our clients investment or legal advice, nor do we anticipate that we will be conducting any SEC filings on behalf of our clients. Our primary focus is on connecting our clients to reputable service providers in the United States that can assist our client’s in going public, becoming SEC Reporting, or assisting with other related services. Upon connecting our clients with these service providers we will oversee their operations in order to ensure that they are carrying out their tasks in a reasonable amount of time and providing work that lives up to our standards.

We anticipate that our services will extend to assisting our clients by providing the communication link between their company and the U.S. Service providers. As an example, we may provide services relating to bettering our clients’ business plans and other material necessary for a U.S. service provider in order to complete their services.

Additionally, we may offer advice and consultation to any of our clients who are seeking to conduct mergers and acquisitions. As before, our advisory and consultancy services should not be misconstrued as providing legal or investment advice to our clients.

Subsequent to the adoption of our current business strategy we have held meetings with several companies seeking listing on the OTC, however, at this point in time, none of these meetings have resulted in a signed consulting contract. Although speculative in nature, the Company anticipates securing a minimum of two consulting contracts within the first quarter of 2017. We will attempt to acquire more, and anticipate we will have additional contracts in subsequent quarters, but we cannot guarantee that our expectations regarding forthcoming contracts will be realized in any capacity.

Our marketing plans are not fully developed at this point in time, however we have taken several steps to market our company while we are in the process of finalizing our marketing plans. We have conducted free seminars for company executives and owners aimed towards educating them on what we, as a company, view as the benefits of listing on the OTC. Additionally our management has held personal meetings with several company executives to discuss related topics. Our company also has a website that is in development which will showcase the services we will offer to our clients. We believe that the website will be completed in the next few months.

Going forward we will use Company revenue and available cash to fund our operations. We may also seek to acquire and maintain equity in some of our clients’ companies seeking to go public on various exchanges in lieu of full cash payments. Our initial focus will be on businesses located in the Philippines, where our Company is currently located, however we do have future unidentified plans to expand into other areas in Asia.

-7-

Employees

As of September 30, 2016, and the date of this report, we had/have ten-part time employees, of which seven are our Officers and Directors.

Currently, each of our employees works on our business up to 25 to 30 hours per week, but each is prepared to devote more time if necessary. The exact time allocation each employee works on our business each week varies.

We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers/or directors and or employees.

The following risk factors and other information included in this Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we presently deem less significant may also impair our business operations. If any of the events or circumstances described in the following risk factors actually occurs, our business, operating results and financial condition could be materially adversely affected.

At present we have not finalized the pricing for our services, and as such our revenue may differ from what we anticipate.

Given the fact that we do not have any definitive prices set for our services it is difficult to evaluate exactly how much revenue we can expect. Additionally, we plan to price our services on a case by case scenario based upon the clients we begin to work with. Until we have commenced our operations for at least several months it will be difficult for us to evaluate or predict any generated revenue accurately.

We do not currently have a fully developed marketing plan, and as such we may not generate as much revenue as we anticipate.

Presently, we do not have a definitive marketing plan to acquire clients. We may initially utilize personal connections of our Officers and Directors to generate leads, but we cannot guarantee that will result in anything. It will take us time to develop a concrete marketing plan, and in the interim we will likely not be generating significant revenue or, in a worst case scenario, any revenue at all.

Due to the fact that we have entered into a highly competitive industry, and we will be competing against companies with greater resources and an established network, we may have a difficult time penetrating the market.

Our new competitors have been in the consultation business for far longer than we have. They also have an existing client base, relevant company history, greater capital resources, an established brand, and any number of other factors. We may have a difficult time gaining the market share we are seeking. We will need to devote significant effort in the future to ensure that we can compete with established competitors successfully, and that we can generate and retain clients when competing against these other companies. In the event that we are not able to compete successfully, we may be forced to change our business plan and or scale down our operations.

We rely on third parties to fully take our future clients public onto the OTC Marketplace, or to potentially provide other services, and if there is any issue at all with the services these third parties provide then we may be adversely effected.

There are aspects of the process of getting trading on the OTC Marketplace that we do not have the applicable licenses/certifications to carry out, and additionally we may seek third party assistance for some, or all, of the parts of the process. As a result, this will make it more difficult for us to monitor and control all aspects of the process. While we have every intention to monitor these third parties, who we do not yet have any solid relationships with, we cannot guarantee with absolute certainty that the quality of their work, their timeline, or any number of other factors will live up to our expectations. In the event that thee third parties produce substandard work we may be forced to identify alternative third parties or, in a worst case scenario in which we cannot find any third parties to work with, we may be forced to alter our business strategy or cease operations entirely.

While we will make every effort to assist our future clients there may be some situations in which a project will become untenable due to a refusal to provide required information.

In the event that we have a client in the future who refuses to provide us, or a service provider we connect them with, the material needed to add certain disclosures into a document, we may be forced to suspend or cease the project entirely. There are aspects of going public that require certain filings with particular disclosures that are derived from information provided by the client (Company), and if they are unwilling or unable to provide this information this could hinder or halt the process from moving forward.

-8-

In the event that a client is performing any unlawful actions, such as fraud, theft, etc. we will be unable to work with them and complete their project.

As part of the process to go public certain information, such as financial information, is required in order to provide a factual analysis of the company in question. In the event that it comes to light that a future client of ours is conducting any kind of unlawful behavior we will be forced to cease all work for the client and may be required to contact the appropriate third parties. This would, of course, render us unable to complete our intended project on behalf of that particular client.

Our Officers and Directors have limited experience working with clients and service providers in an effort to assist a client in becoming trading on the OTC Marketplace or any other US trading platform.

Our Officers and Directors have limited experience relating to taking a company public on the OTC Marketplace, or any US Stock Exchange for that matter. Due to this fact, they may be forced to rely on outside industry professionals in order to assist them in learning all of the information required in order to take a company public. While our Officers and Directors fully believe they have the capability to carry out our new business activities, we understand that there can be no guarantees based on their history. In the event that our Officers and Directors find themselves unable to complete the services described in our new business plan then we may be forced to change our business plan and or scale down our operations.

Our Professional reputation is critical to our business, and any harm to our reputation could decrease the amount of business we can acquire, which could have a material adverse effect on our future revenue and growth prospects.

Our reputation and our relationships with our future clients is a key factor in growing our revenue and increasing the number of consulting contracts we can consummate. Negative press reports regarding poor contract performance, employee misconduct, dissatisfied clients, or any number of negative events could substantially harm our reputation and make it more difficult for us to acquire future clients. Due to the ease of acquiring information provided by the internet this risk is particularly pertinent, as negative client feedback could be posted online and available to anyone who researches our Company. In the event that our reputation is substantially harmed we may acquire less revenue than we anticipate and in a worst case scenario may be forced to cease operations entirely.

We may fail to attract, train and retain skilled and qualified employees, which may impair our ability to generate revenue, effectively serve our clients, and execute our growth strategy.

Our business depends in large part upon our ability to attract and retain sufficient numbers of highly qualified individuals. If we are unable to recruit and retain a sufficient number of qualified employees our ability to maintain and grow our business and to effectively serve our clients could be limited and our future revenue and results of operations could be materially and adversely affected. Furthermore, to the extent that we are unable to make necessary permanent hires to appropriately serve our clients, we could be required to engage larger numbers of contracted personnel, which could reduce our profit margins.

The results of our business operations could be negatively affected by global markets.

In our opinion, during economic downturns companies around the globe are generally less inclined to take their companies public on the OTC or on any other exchange. Economic conditions can vary from one country to another, or a sizeable downturn could effect a large portion of the globe. In the event that an economy is thriving we may see an increase in clients, however if an economy is struggling we may consummate fewer contracts than we anticipate, and in that event the results of our operations and our revenues could be adversely effected. This is particularly true if the Philippines is experiencing economic turmoil due to the fact that our management team is located in the Philippines and will primarily be attempting to acquire future clients locally before expanding in the future.

Item 1B. Unresolved Staff Comments.

None.

As of the date of this report we do not own any properties.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

-9-

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

We are not currently listed on any exchange however, in the future we intend to list on the OTC Marketplace.

Stockholders of Our Common Shares

As of September 30, 2016, we had 241,042,000 shares of common stock issued and outstanding.

Stockholders of Our Preferred Shares

As of September 30, 2016, we had 3,000,000 shares of preferred stock issued and outstanding. Every one share of preferred stock has voting rights equivalent to 100 shares of common stock.

Recent Sales of Unregistered Securities

On July 30, 2015 Hatadi Shapiro Supaat was appointed President and Chairman of our Board of Directors. Simultaneously, Teodoro G. Bondoc Jr. was appointed Chief Executive Officer and Director and Leslie Ann C. Galano was appointed Chief Financial Officer. Also on July 30, 2015 Dr. Aurora L. Jalacon was appointed Chief Operations Officer and Strazzi R. Revil was appointed Chief Accounting Officer. Simultaneously, Dr. Eduardo Cabantog and Dr. And Julie D. Rosal were each appointed as a Director.

On July 30, 2015 Hatadi Shapiro Supaat was issued 200,000,000 shares of restricted common stock and 3,000,000 shares of preferred stock all with a par value of .0001. Simultaneously, Teodoro G. Bondoc Jr. was issued 17,000,000 shares of restricted common stock with a par value of .0001. Michael Angelo F. Balagtas was issued 1,000,000 shares of restricted common stock, John N. Bautista was issued 1,000,000 shares of restricted common stock and Meugene M. Guiterrez was issued 1,000,000 shares of restricted common stock, all of which had a par value of .0001. Also on July 30, 2015 Dr. Eduardo Cabantog was issued 20,000,000 shares of restricted common stock with a par value of .0001.

The above stock issuances were issued in exchange for services rendered to developing the Company’s business plan.

Information regarding the above share issuances:

* Hatadi Shapiro Supaat is our President and Chairman of the Board of Directors.

* Dr. Eduardo Cabantog is a member of our Board of Directors.

* Teodoro Garcia Bondoc Jr. is our Chief Executive Officer and a member of our Board of Directors.

* Michael Angelo F. Balagtas is an employee of the Company.

* John N. Bautista is an employee of the Company.

* Meugene M. Guiterrez is an employee of the Company.

On September 30, 2015 the Company issued 1,000,000 shares of restricted common stock at par value ($.0001) to British Cambridge College, Inc.

Recent Sales of Securities Registered through Form S-1 Deemed Effective 12/30/15

On March 21, 2016 the Company sold 13,000 shares of common stock at $1.00 per share to thirteen investors.

On March 22, 2016 the Company sold 22,000 shares of common stock at $1.00 per share to twenty-two investors.

Of the 35,000 shares of common stock sold 1,000 shares were sold at $1.00 to our Director And Julie Rosal, 1,000 shares were sold at $1.00 to our Chief Operating Officer Dr. Aurora L. Jalocon, and 1,000 shares were sold at $1.00 to our Chief Accounting Officer Joseph L. Manzano.

On April 22, 2016 the Company sold 7,000 shares of common stock at $1.00 per share to seven investors.

-10-

Item 6. Selected Financial Data.

The tables and information below are derived from our financial statements.

BRITISH CAMBRIDGE, INC.

BALANCE SHEETS

| September 30, 2016 |

September 30, 2015 | ||||||

| ASSETS | |||||||

| Current Assets | |||||||

| Cash | 137,533 | - | |||||

| Total Current Assets | 137,533 | - | |||||

| TOTAL ASSETS | $ | 137,533 | $ | - | |||

| LIABILITIES & STOCKHOLDERS’ DEFICIT | |||||||

| Current Liabilities | |||||||

| Tax Accrual | 20,232 | - | |||||

| Total Current Liabilities | 20,232 | - | |||||

| TOTAL LIABILITIES | 20,232 | - | |||||

| Stockholders’ Deficit | |||||||

| Preferred stock, $.0001 par value, 100,000,000 shares authorized; 3,000,000 issued and outstanding as of September 30, 2016 and 2015 | 300 | 300 | |||||

| Common stock , $.0001 par value, 1,000,000,000 shares authorized, 241,042,000 shares issued and outstanding as of September 30, 2016 and 241,000,000 shares issued and outstanding as of September 2015 | 24,104 | 24,100 | |||||

| Additional Paid in Capital | 79,829 | 105 | |||||

| Accumulated Equity/(Deficit) | 13,068 | (24,505) | |||||

| Total Stockholders’ Equity/(Deficit) | $ | 117,301 | $ | - | |||

| TOTAL LIABILITIES & STOCKHOLDERS’ DEFICIT | $ | 137,533 | $ | - | |||

BRITISH CAMBRIDGE, INC.

STATEMENTS OF OPERATIONS

| Year Ended September 30, 2016 | For the Period from June 24, 2015 (Inception) to September 30, 2015 | ||||||

| Operating Expenses | |||||||

| Organization and Related Expenses | 8,295 | 24,505 | |||||

| Professional Fees | 43,900 | - | |||||

| Total Operating Expenses | 52,195 | 24,505 | |||||

| Income (Loss) From Continuing Operations | (52,195) | (24,505) | |||||

| Gain (Loss) From Discontinued Operations | 35,000 | - | |||||

| Revenue From Discontinued Operations | 75,000 | - | |||||

| Income Tax From Discontinued Operations | 20,232 | ||||||

| Income From Discontinued Operations | 89,768 | ||||||

| Net Income/(loss) | 37,573 | (24,505) | |||||

| Basic and Diluted Income (Loss) Per Share | |||||||

| Income (Loss) Continuing Operations | (0.00) | (0.00) | |||||

| Income (Loss) Discontinued Operations | 0.00 | - | |||||

| Net Income (Loss) | 0.00 | (0.00) | |||||

| Basic and Diluted Weighted average number of shares outstanding | 241,021,475 | 151,847,000 |

The accompanying notes are an integral part of these financial statements.

-11-

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Our cash balance is $137,533 as of September 30, 2016 . We have generated $110,000 in the past fiscal year ending September 30, 2016. Our cash balance was $0 at the end of the September 30, 2015 fiscal year end. The increased revenue was due to the commencement of our operations throughout the 2016 fiscal year.

In the fiscal year ending September 30, 2015 our net loss was $24,505, and in the fiscal year ended September 30, 2016 we achieved a net income of $57,805. The shift from loss to profit was a result of the commencement of our business operations and our increased revenue generation.

Any capital that may be necessary to fund our future operations will be provided by the Company. In the event that the cost of our future operations exceeds our cash balance we may be required to utilize funds from our officers and directors. However, it is important to note that our officers and directors are under no legal obligation to provide us with funds, and may be unwilling or unable to do so in the event that we require additional capital to progress our operations.

On September 2, 2016 we formally changed the nature of our business from marketing the online British Cambridge platform to providing consulting services specifically relating to taking companies public on the OTC marketplace or similar exchanges. We will not be providing our clients investment or legal advice, nor do we anticipate that we will be conducting any SEC filings on behalf of our clients. Our primary focus is on connecting our clients to reputable service providers in the United States that can assist our client’s in going public, becoming SEC Reporting, or assisting with other related services. Upon connecting our clients with these service providers we will oversee their operations in order to ensure that they are carrying out their tasks in a reasonable amount of time and providing work that lives up to our standards.

To date, since the change in our operations on September 2, 2016, our operations have been limited to attempting to consummate consultation agreements with various potential clients. We have provided free informative seminars relating to our services, our management has met with officers and directors of target companies, and we have begun the planning stages of the development of a company website. We anticipate the website will be completed in the coming months, but do not have a definitive timeline in place.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

-12-

Item 8. Financial Statements and Supplementary Data.

British Cambridge, Inc.

FINANCIAL STATEMENTS

INDEX TO FINANCIAL STATEMENTS

| Pages | ||

| Report of Independent Registered Public Accounting Firm | F2 | |

| Balance Sheets | F3 | |

| Statements of Operations | F4 | |

| Statements of Changes in Stockholders’ Deficit | F5 | |

| Statements of Cash Flows | F6 | |

| Notes to Financial Statements | F7-F8 |

-F1-

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Stockholders

British Cambridge, Inc.

We have audited the accompanying balance sheets of British Cambridge, Inc. (the “Company”) as of September 30, 2016 and 2015, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the year ended September 30, 2016 and for the period from June 24, 2015 (Inception) to September 30, 2015. These financial statements are the responsibility of the entity’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of British Cambridge, Inc. as of September 30, 2016 and 2015, and the results of its operations and its cash flows for the year ended September 30, 2016 and for the period from June 24, 2015 (Inception) to September 30, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has no current revenue sources which raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

January 13, 2017

-F2-

BRITISH CAMBRIDGE, INC.

BALANCE SHEETS

| September 30, 2016 |

September 30, 2015 | ||||||

| ASSETS | |||||||

| Current Assets | |||||||

| Cash | 137,533 | - | |||||

| Total Current Assets | 137,533 | - | |||||

| TOTAL ASSETS | $ | 137,533 | $ | - | |||

| LIABILITIES & STOCKHOLDERS’ DEFICIT | |||||||

| Current Liabilities | |||||||

| Tax Accrual | 20,232 | - | |||||

| Total Current Liabilities | 20,232 | - | |||||

| TOTAL LIABILITIES | 20,232 | - | |||||

| Stockholders’ Deficit | |||||||

| Preferred stock, $.0001 par value, 100,000,000 shares authorized; 3,000,000 issued and outstanding as of September 30, 2016 and 2015 | 300 | 300 | |||||

| Common stock , $.0001 par value, 1,000,000,000 shares authorized, 241,042,000 shares issued and outstanding as of September 30, 2016 and 241,000,000 shares issued and outstanding as of September 30, 2015 | 24,104 | 24,100 | |||||

| Additional Paid in Capital | 79,829 | 105 | |||||

| Accumulated Equity/(Deficit) | 13,068 | (24,505) | |||||

| Total Stockholders’ Equity/(Deficit) | $ | 117,301 | $ | - | |||

| TOTAL LIABILITIES & STOCKHOLDERS’ DEFICIT | $ | 137,533 | $ | - | |||

The accompanying notes are an integral part of these financial statements.

-F3-

BRITISH CAMBRIDGE, INC.

STATEMENTS OF OPERATIONS

| Year Ended September 30, 2016 | For the Period from June 24, 2015 (Inception) to September 30, 2015 | ||||||

| Operating Expenses | |||||||

| Organization and Related Expenses | $ | 8,295 | $ | 24,505 | |||

| Professional Fees | 43,900 | - | |||||

| Total Expenses | $ | 52,195 | $ | 24,505 | |||

| Income (Loss) From Continuing Operations | (52,195) | (24,505) | |||||

| Gain (Loss) From Discontinued Operations | 35,000 | - | |||||

| Income From Discontinued Operations, net of tax | 54,768 | - | |||||

| Income From Discontinued Operations | 89,768 | - | |||||

| Net Income/(loss) | $ | 37,573 | $ | (24,505) | |||

| Basic and Diluted Income (Loss) Per Share | |||||||

| Income (Loss) Continuing Operations | (0.00) | (0.00) | |||||

| Income (Loss) Discontinued Operations | 0.00 | - | |||||

| Net Income (Loss) | 0.00 | (0.00) | |||||

| Basic and Diluted Weighted average number of shares outstanding | 241,021,475 | 151,847,000 |

The accompanying notes are an integral part of these financial statements.

-F4-

|

BRITISH CAMBRIDGE, INC. STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT) FOR THE YEARS ENDED SEPTEMBER 30, 2016 AND 2015 AND THE PERIOD FROM JUNE 24, 2015 (INCEPTION) TO SEPTEMBER 30, 2015 |

|||||||

| Shares | Par | Additional Paid-in Capital | Accumulated Deficit | Total | |||

| Common | Preferred | ||||||

| Balances, June 24, 2015 | - | - | $ | - | - | - | - |

| Issuance of shares for services: | |||||||

| Common stock, par value $.0001 | 240,000,000 | - | 24,000 | - | - | 24,000 | |

| Preferred stock, par value $.0001 | - | 3,000,000 | 300 | - | - | 300 | |

| Issuance of shares for online platform | 1,000,000 | - | 100 | - | - | 100 | |

| Contributed expenses | - | - | - | 105 | - | 105 | |

| Net loss | - | - | - | - | (24,505) | (24,505) | |

| Balances, September 30, 2015 | 241,000,000 | 3,000,000 | $ | 24,400 | 105 | (24,505) | - |

| Common shares sold for cash | 42,000 | - | 4 | 41,996 | - | 42,000 | |

| Contributed expenses | - | - | - | 37,728 | - | 37,728 | |

| Net income | - | - | - | - | 37,573 | 37,573 | |

| Balances, September 30, 2016 | 241,042,000 | 3,000,000 | $ | 24,404 | 79,829 | 13,068 | 117,301 |

The accompanying notes are an integral part of these financial statements.

-F5-

BRITISH CAMBRIDGE, INC.

STATEMENTS OF CASH FLOWS

| Year

Ended September 30, 2016 |

For

the period from June 24, 2015 (Inception) to September 30, |

||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||

| Net income/(loss) | $ | 37,573 | $ | (24,505) | |

| Adjustment to reconcile net loss to net cash used in operating activities: | |||||

| Shares issues for services | - | 24,400 | |||

| Expenses contributed to capital | 37,728 | 105 | |||

| Changes in current assets and liabilities: | |||||

| Accrued income tax | 20,232 | - | |||

| Net cash used in operating activities | 95,533 | 0 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||

| Proceeds from sale of common stock | 42,000 | - | |||

| Net cash provided by financing activities | 42,000 | - | |||

| Net increase in cash and cash equivalents | 137,533 | - | |||

| Cash and cash equivalents at beginning of year | - | - | |||

| Cash and cash equivalents at end of year | 137,533 | - | |||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |||||

| Cash paid for: | |||||

| Interest | $ | - | $ | - | |

| Income taxes | $ | - | $ | - | |

The accompanying notes are an integral part of these financial statements.

-F6-

BRITISH CAMBRIDGE, INC.

NOTES TO FINANCIAL STATEMENTS

FOR YEAR ENDED SEPTEMBER 30, 2016 and 2015

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

British Cambridge, Inc. (the Company) was incorporated under the laws of the State of Delaware on June 24, 2015.

On September 2, 2016, we changed the nature of our business and operations from marketing our online education platform ‘British Cambridge College’ to business consulting. Specifically, we aim to provide small businesses with consulting services relating to going public on the Over-the-Counter (OTC) Marketplace, a United States Financial Listing Platform, and may evaluate assisting companies to go public on other, as of this time, unidentified exchanges.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

USE OF ESTIMATES.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported amount of revenues and expenses during the reporting period. Actual results could differ from these estimates. Due to the limited level of operations, the Company has not had to make material assumptions or estimates other than the assumption that the Company is a going concern.

FISCAL YEAR END.

The Company elected September 30th as its fiscal year ending date.

CASH AND CASH EQUIVALENTS.

For the purpose of the financial statements cash equivalents include all highly liquid investments with original maturity of three months or less.

COMMITMENTS AND CONTINGENCIES.

The Company follows ASC 450-20, Loss Contingencies, to report accounting for contingencies. Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it

is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

BASIC AND DILUTED EARNINGS PER SHARE

The Company computes basic and diluted earnings per share amounts in accordance with ASC Topic 260, Earnings per Share. Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted average number of shares of common stock and potentially outstanding shares of common stock during each period. There were no potentially dilutive shares outstanding as of September 30, 2016.

FINANCIAL INSTRUMENTS.

ASC 820, Fair Value Measurements and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| · | Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities |

| · | Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| · | Level 3 - Inputs that are both significant to the fair value measurement and unobservable. |

The Company’s balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

INCOME TAXES.

The Company accounts for income taxes under ASC 740, Income Taxes. Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations.

RELATED PARTY TRANSACTIONS.

The Company follows ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

DISCONTINUED OPERATIONS

The company has formally changed its business plan from marketing and services related to the online British Cambridge College platform to business consultation with an emphasis on taking Companies public on various exchanges. Operations relating to the previous activities of the Company have been discontinued.

We have generated related party revenue in the amount of $110,000 in the year ended September 30, 2016. The $110,000 was received from British Cambridge College, a Philippine University which is in part owned by both our CEO Teodoro G. Bondoc Jr. and President Hatadi Shapiro Supaat, as part of our discontinued operations. The $110,000 was comprised of $75,000 generated from our discontinued operations and when the online platform was sold a gain of $35,000 was recognized. The purchase was transacted September 2, 2016.

-F7-

SHARE-BASED EXPENSE.

ASC 718, Compensation – Stock Compensation, prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, Equity – Based Payments to Non-Employees. Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

RECENTLY ISSUED ACCOUNTING- PRONOUNCEMENTS.

Management has considered all recent accounting pronouncements issued since the last audit of our financial statements. The Company's management believes that these recent pronouncements will not have a material effect on the Company's financial statements.

NOTE 3 - GOING CONCERN

The accompanying financial statements are prepared on a basis of accounting assuming that the Company is a going concern that contemplates realization of assets and satisfaction of liabilities in the normal course of business. The Company has no current revenue sources. This condition raises substantial doubt about the Company’s ability to continue as a going concern. The Company’s Management plans to engage in very limited activities without incurring any liabilities that must be satisfied in cash until a source of funding is secured. The Company will offer noncash consideration and seek equity lines as a means of financing its operations. If the Company is unable to obtain revenue - producing contracts or financing or if the revenue or financing it does obtain is insufficient to cover any operating losses it may incur, it may substantially curtail or terminate its operations or seek other business opportunities through strategic alliances, acquisitions or other arrangements that may dilute the interests of existing stockholders.

The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 4 - RELATED-PARTY TRANSACTIONS

Income from Discontinued Operations and Gain from Discontinued Operations

We have generated related party revenue in the amount of $110,000 in the year ended September 30, 2016. The $110,000 was received from British Cambridge College, a Philippine University which is in part owned by both our CEO Teodoro G. Bondoc Jr. and President Hatadi Shapiro Supaat, as part of our discontinued operations. The $110,000 was comprised of $75,000 generated from our discontinued operations and when the online platform was sold a gain of $35,000 was recognized. The purchase was transacted September 2, 2016.

On April 1, 2016 a new lease agreement was made between the Company and British Cambridge College Inc. whereby British Cambridge College Inc. would lease the online platform from the Company for $100,000 per year for ten years beginning October 1, 2015. As a result of the new agreement both parties agreed to cancel the previous agreement in which British Cambridge College, Inc. was to pay $10,000 to the Company each quarter. Any monies paid have been agreed to be credited towards the terms of the new agreement.

On August 1, 2016 the active agreement between British Cambridge, Inc. and British Cambridge College, executed on April 1, 2016 was revised to include more specific payment terms. The agreement was edited so that it specifically states the following: “The Lessee agrees to pay the Lessor the amount of $100,000 U.S. Dollars every year. If agreed upon by both parties the funds may be paid in another currency. The $100,000 payment is to be made yearly. It can be made in installments at any time throughout the course of the year so long as the full amount has been paid by the year end September 30.”

On September 2, 2016 the Company and British Cambridge College Inc. entered into a purchase agreement whereby the rights and ownership of the online education platform were purchased from the Company by British Cambridge College Inc. for $35,000. This amount had already been paid to the Company as a customer advance by British Cambridge College Inc. under the previous lease agreement. At the time of the purchase and sales agreement, the previous lease was canceled.

On October 29, 2016 the Company and British Cambridge College Inc. entered into a consulting agreement whereby British Cambridge College, Inc. will provide consulting services for the Company for a period of four months from December 1, 206 to March 31, 2017 in exchange for $30,000. Additionally, British Cambridge College Inc. will conduct market research for the Company for a period of two months from December 1, 2016 to January 31, 2017 in exchange for an additional $10,000.

Monetary Contributions

During the year ending September 30, 2016, $37,728 in expenses were paid by our President and principal shareholder and are considered contributions to capital. The expenses consisted mostly of professional fees.

NOTE 5 - EQUITY

Preferred Stock

The authorized preferred stock of the Company consists of 100,000,000 shares with a par value of $0.0001. The Company has issued 3,000,000 shares as of September 30, 2015.

On July 30, 2015 the company issued 3,000,000 shares of its .0001 par value preferred stock totaling $300 to the President of the Company as compensation for developing the Company’s business concept and plan.

Common Stock

The authorized common stock of the Company consists of 1,000,000,000 shares with a par value of $0.0001. There were 241,000,000 shares of common stock issued and outstanding as of September 30, 2015.

The Company does not have any potentially dilutive instruments as of September 30, 2016 and, thus, anti-dilution issues are not applicable.

On July 30, 2015 the Company issued 200,000,000 of its $0.0001 par value common stock totaling $20,000 to the President of the Company and issued 40,000,000 of its $0.0001 par value common stock totaling $4,000 to other officers and directors of the Company in exchange for developing the Company’s business concept and plan.

On September 29, 2015 the Company issued 1,000,000 of its $0.0001 par value common stock totaling $100 to British Cambridge College, Inc, a Philippine Company, in exchange for the comprehensive rights to a custom-designed online education platform.

On March 21, 2016 the Company sold 13,000 shares of common stock at $1.00 per share to thirteen investors.

On March 22, 2016 the Company sold 22,000 shares of common stock at $1.00 per share to twenty-two investors.

Of the 35,000 shares of common stock sold 1,000 shares were sold at $1.00 to our Director And Julie Rosal, 1,000 shares were sold at $1.00 to our Chief Operating Officer Dr. Aurora L. Jalocon, and 1,000 shares were sold at $1.00 to our Chief Accounting Officer Joseph L. Manzano.

On April 22, 2016 the Company sold 7,000 shares of common stock at $1.00 per share to seven investors.

Pertinent Rights and Privileges

Holders of shares of common stock are entitled to one vote for each share held to be used at all stockholders meetings and for all purposes including the election of directors. The common stock does not have cumulative voting rights. Nor does it have preemptive or preferential rights to acquire or subscribe for any unissued shares of any class of stock.

Holders of shares of preferred stock are entitled to voting rights where every one share of preferred stock has voting rights equal to one hundred shares of common stock.

Additional Paid In Capital

During the period end September 30, 2015 our President paid operating expenses in the amount of $105 which is recorded as additional paid in capital.

NOTE 6 - INCOME TAXES

The Company has not recognized an income tax benefit for its operating losses generated based on uncertainties concerning its ability to generate taxable income in future periods. The tax benefit for the periods presented is offset by a valuation allowance established against deferred tax assets arising from the net operating losses and other temporary differences, the realization of which could not be considered more likely than not. In future periods, tax benefits and related deferred tax assets will be recognized when management considers realization of such amounts to be more likely than not. Section 382 of the Internal Revenue Code generally requires us to limit the amount of its income in future years that can be offset by historic losses, i.e. net operating loss (NOL) carryforwards and certain built-in losses, after a corporation has undergone an ownership change.

There was no NOL for the fiscal year ended September 30, 2015 and September 30, 2016. British Cambridge Inc. has recognized net income in the amount of $57,805 prior to any adjustment. The current net income is $35,573 after tax income was applied at a rate of 35%, with tax expenses at $20,232. The $20,232 is shown as tax accrual on the balance sheet as of September 30, 2016.

| September 30, | |||||||

| 2016 | 2015 | ||||||

| Deferred tax asset, generated from net operating loss at statutory rates | $ | - | $ | 105 | |||

| Valuation allowance | - | (105) | |||||

| $ | — | $ | — | ||||

The reconciliation of the effective income tax rate to the federal statutory rate is as follows:

| Federal income tax rate | 34.0 | % | ||

| Increase in valuation allowance | (34.0 | %) | ||

| Effective income tax rate | 0.0 | % |

NOTE 7 - SUBSEQUENT EVENTS

On November 14, 2016 the Board of Directors took the following actions: In response to the Company’s change in operations the Company conducted a buy-back program, whereupon the shareholders who had invested in the Company under its previous operations were refunded their investment and given the option to repurchase those same shares for the amount of $1.00 per share.

-F8-

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None

Item 9A. Controls and Procedures.

Management’s Report on Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934 , as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer and our chief financial officer (who is acting as our principal executive officer, principal financial officer and principle accounting officer) to allow for timely decisions regarding required disclosure.

As of September 30, 2016, the end of the fiscal period covered by this report, we carried out an evaluation, under the supervision of our chief executive officer, with the participation of our chief financial officer, of the effectiveness of the design and the operation of our disclosure controls and procedures. The officers concluded that the disclosure controls and procedures are not effective as of the end of the period covered by this report. There are two pertinent material weaknesses to our disclosure controls: limited segregation of duties and lack of policies and procedures that provide multiple levels of supervision and review.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Responsibility, estimates and judgments by management are required to assess the expected benefits and related costs of control procedures. The objectives of internal control include providing management with reasonable, but not absolute, assurance that assets are safeguarded against loss from unauthorized use or disposition, and that transactions are executed in accordance with management’s authorization and recorded properly to permit the preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States. Our management assessed the effectiveness of our internal control over financial reporting as of September 30, 2016. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework. Our management has concluded that, as of September 30, 2016, our internal control over financial reporting are not effective as of the end of the period. There are two pertinent material weaknesses to our disclosure controls: limited segregation of duties and lack of policies and procedures that provide multiple levels of supervision and review.

This annual report does not include an attestation report of our company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our Company’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit our company to provide only management’s report in this annual report.

Inherent limitations on effectiveness of controls

Internal control over financial reporting has inherent limitations which include but is not limited to the use of independent professionals for advice and guidance, interpretation of existing and/or changing rules and principles, segregation of management duties, scale of organization, and personnel factors. Internal control over financial reporting is a process which involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management override. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis, however these inherent limitations are known features of the financial reporting process and it is possible to design into the process safeguards to reduce, though not eliminate, this risk. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

None.

-13-

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Biographical information regarding the officers and Directors of the Company, who will continue to serve as officers and Directors of the Company are provided below:

| NAME | AGE | POSITION | |||||

| Hatadi Shapiro Supaat | 52 | President, and Chairman of the Board of Directors | |||||

| Teodoro G. Bondoc Jr. | 51 | Chief Executive Officer and Director | |||||

| Abdon P. Manaois | 55 | Chief Financial Officer | |||||

| Dr. Aurora L. Jalacon | 63 | Chief Operations Officer | |||||

| Joseph Lemuel L. Manzano | 26 | Chief Accounting Officer | |||||

| Dr. And Julie Rosal | 39 | Director | |||||

| Dr. Eduardo Cabantog | 43 | Director | |||||

Hatadi Shapiro Supaat

Mr. Supaat is the President and Chairman of the Board of Directors of British Cambridge, Inc. Mr. Supaat is responsible for spearheading the growth and development of the company, identifying and developing potential new markets, mergers and acquisitions and strategic partnerships across Asia and Africa. Mr. Supaat graduated with a degree in Bible Counseling from Christian Bible College and with a Diploma in Business Administration from Cambridge College. From 1994 to 2001 he served as Chief Executive Officer of First World Technologies and from 2008 to 2014 he was the Chief Executive Officer of British Academics. From 2011 to Present he has also served as Chairman of British Cambridge College, Inc.

Teodoro G. Bondoc Jr.

Mr. Bondoc is the Chief Executive Officer (CEO) and a Director of British Cambridge, Inc. Mr. Bondoc is responsible for overseeing the general day to day operations of the company and liaising with all key executives of the company. He also serves as a national and international ambassador for British Cambridge College, Inc. Mr. Bondoc received a Degree in Civil Engineering from University of Luzon, a Degree in Electrical Engineering from University of Perpetual Help DALTA and a MBA in International Business from MDC. From 2003 to 2011 Mr. Bondoc served as President of AIE College from 2003 to 2011 and from 2011 to Present he has served as Chief Executive Officer of British Cambridge College, Inc.

Abdon P. Manaois

Mr. Manaois is the Chief Financial Officer (CFO) of British Cambridge, Inc. Mr. Manaois is responsible for overseeing the finances of the Company. Mr. Manaios received a Degree in Accountancy October 1983 as Cumlaude from the University of Pangasinan and is also a Certified Public Accountant. He is also currently independently affiliated with Manaois Accounting Office in the Philippines.

Dr. Aurora L. Jalocon

Dr. Jalacon is the Chief Operations Officer (COO) of British Cambridge, Inc. Dr. Jalacon is responsible for evaluating the operations of the Company. Dr. Jalacon received a Doctorate in Humanities from the Far East Advent School of Theology International and a Trainer Certificate in Methodology from TESDA. Dr. Jalocon served as a Manufacturing Manager of PSI Technologies, Campus Director of AIE College from 2010 to 2011 and from 2011 to Present Dr. Jalacon has served as Chief Operations Officer of British Cambridge College, Inc.

Joseph L. Lemuel Manzano

Mr. Manzano is the Chief Accounting Officer (CAO) of British Cambridge, Inc. Mr. Manzano is responsible for overseeing the accounting policies and practices of the Company. Mr. Manzano received a Degree in Accountancy from the University of the East, is a Member of the Philippines Institute of Certified Public Accountants and is also a Certified Public Accountant. He is currently independently affiliated with San Miguel Holdings Corp., one of the top corporations in the Philippines.

Dr. And Julie Rosal

Dr. And Julie Rosal is a Director of British Cambridge, Inc. Dr. Rosal received a Bachelor of Science in Education from AMA University, a Master of Information Technology from Colegio de Dagupan and a Doctorate in Business Administration from Lyceum Northwestern University. Dr. Rosal served as Campus Director of AIE College from 2007 to 2009 and has been the Dean of AMA University from 2009 to Present.

Dr. Eduardo Cabantog

Dr. Eduardo Cabantog is a Director of British Cambridge, Inc. Dr. Cabantog received a Doctor of Medicine from the University of the City of Manila. Dr. Cabantog was a resident Doctor at Makati Medical Center from 1999 to 2002, has served as Chief Executive Officer of Alliance in Motion Global from 2005 to Present, and Chief Executive Officer of AIM Cambridge from 2015 to Present.

Corporate governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors reviews the Company's internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our sole Director believes that it is not necessary to have such committees, at this time, because the Director(s) can adequately perform the functions of such committees.

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an “audit committee financial expert” as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as “independent” as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our Director and our executive officers have not been involved in or a party in any of the following events or actions during the past ten years:

| 1. | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| 5. | Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| 6. | Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| 7. | Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:(i) Any Federal or State securities or commodities law or regulation; or(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 8. | Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

-14-

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our Chief Executive Officer, at the address appearing on the first page of this report.

Item 11. Executive Compensation.