Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - AdvancePierre Foods Holdings, Inc. | d304963dex231.htm |

| EX-5.1 - EX-5.1 - AdvancePierre Foods Holdings, Inc. | d304963dex51.htm |

| EX-1.1 - EX-1.1 - AdvancePierre Foods Holdings, Inc. | d304963dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 17, 2017

Registration No. 333- 215441

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AdvancePierre Foods Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2000 | 26-3712208 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

9987 Carver Road

Blue Ash, Ohio 45242

(800) 969-2747

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael B. Sims

Senior Vice President, Chief Financial Officer and Treasurer

9987 Carver Road

Blue Ash, Ohio 45242

(800) 969-2747

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| With copies to:

| ||

| Gregg A. Noel, Esq. Jeffrey H. Cohen, Esq. Jonathan Ko, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 300 South Grand Avenue, Suite 3400 Los Angeles, California 90071 (213) 687-5000 |

Merritt Johnson, Esq. Shearman & Sterling LLP 599 Lexington Avenue New York, New York 10022-6069 (212) 848-4000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered(1) |

Proposed maximum offering price |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee(3) | ||||

| Common stock, par value $0.01 per share |

14,375,000 | $29.43 | $423,056,250 | $49,032.22 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes offering price of shares of common stock that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and the low price of the Registrant’s common stock on January 3, 2017, as reported on The New York Stock Exchange. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated January 17, 2017

PRELIMINARY PROSPECTUS

12,500,000 Shares

AdvancePierre Foods Holdings, Inc.

Common Stock

The selling stockholders identified in this prospectus, including funds managed by Oaktree Capital Management, L.P. (“Oaktree”) and members of our management, are selling 12,500,000 shares of our common stock. See “Principal and Selling Stockholders.” We will not be selling any shares of our common stock in this offering and will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Our common stock is listed on The New York Stock Exchange (the “NYSE”) under the symbol “APFH.” The last reported sale price of our common stock as reported on the NYSE on January 13, 2017 was $28.03 per share.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 22 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

||||||||

| Underwriting discounts and commissions(1) |

||||||||

| Proceeds, before expenses, to the selling stockholders |

||||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

To the extent that the underwriters sell more than 12,500,000 shares of our common stock, the underwriters have the option to purchase up to an additional 1,875,000 shares from certain of the selling stockholders at the public offering price, less the underwriting discounts and commissions, within 30 days of the date of this prospectus. We will not receive any proceeds from the exercise of the underwriters’ option to purchase additional shares from certain of the selling stockholders.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2017.

| Morgan Stanley | Credit Suisse | Barclays | ||||

| BMO Capital Markets | Deutsche Bank Securities | Goldman, Sachs & Co. | Wells Fargo Securities | |||

Prospectus dated , 2017.

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by or on behalf of us. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. Neither we, the selling stockholders nor the underwriters are making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus or such other date stated in this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 22 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

51 | |||

| 83 | ||||

| 84 | ||||

| 99 | ||||

| 125 | ||||

| 128 | ||||

| 133 | ||||

| 137 | ||||

| 144 | ||||

| UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

147 | |||

| 150 | ||||

| 157 | ||||

| 157 | ||||

| 157 | ||||

| F-1 | ||||

i

Table of Contents

We obtained the industry, market and competitive position data used throughout this prospectus from internal company surveys and management estimates as well as from industry and general publications and research, surveys and studies conducted by third parties. We believe these internal company surveys and management estimates are reliable; however, no independent sources have verified such surveys and estimates. Third-party industry and general publications, research, studies and surveys generally state that the information contained therein has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, neither we nor the selling stockholders have independently verified any of the data from third-party sources and cannot guarantee its accuracy and completeness.

Forecasts and other forward-looking information obtained from these sources involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. In addition, our name, logo and website name and address are our service marks or trademarks. Some of the more important registered U.S. trademarks and trade names are AdvancePierre Foods®, Barber Foods®, Better Bakery®, Big AZ®, Drive Thru®, Fast Classics®, Fast Fixin’®, Hot ‘n’ Ready®, Landshire®, Pierre™, Pierre Signatures®, PB Jamwich®, The Pub®, Smart Picks® and Steak EZE®. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective holders.

As used in this prospectus, unless otherwise noted or the context otherwise requires, (1) references to the “company,” “we,” “our,” or “us” are to AdvancePierre Foods Holdings, Inc. and its consolidated subsidiaries, (2) references to “AdvancePierre” are to AdvancePierre Foods Holdings, Inc. exclusive of its subsidiaries, (3) references to “APF Holdco” are to Pierre Holdco, Inc., a direct wholly-owned subsidiary of AdvancePierre, and (4) references to “APF” are to AdvancePierre Foods, Inc., an indirect wholly-owned subsidiary of AdvancePierre and a direct subsidiary of APF Holdco.

References to “fiscal 2016” are to the 52-week period ended December 31, 2016, “fiscal 2015” are to the 52-week period ended January 2, 2016, references to “fiscal 2014” are to the 53-week period ended January 3, 2015, references to “fiscal 2013” are to the 52-week period ended December 28, 2013, references to “fiscal 2012” are to the 52-week period ended December 29, 2012 and references to “fiscal 2011” are to the 52-week period ended December 31, 2011. References to “Q4 2016” are to the 13-week period ended December 31, 2016 and references to “Q4 2015” are to the 13-week period ended January 2, 2016. References to “Q3 2016” are to the 13-week period ended October 1, 2016 and references to “Q3 2015” are to the 13-week period ended October 3, 2015. References to the “2016 YTD period” are to the fiscal year to date period ended October 1, 2016 and references to “2015 YTD period” are to the fiscal year to date period ended October 3, 2015. Both the 2016 YTD period and the 2015 YTD period consisted of 39 weeks. In this prospectus, (1) financial data for fiscal 2015, fiscal 2014 and fiscal 2013, and balance sheet data as of January 2, 2016 and January 3, 2015, is derived from our audited consolidated financial statements included elsewhere in this prospectus, (2) financial data for fiscal 2012 and fiscal 2011, and balance sheet data as of December 28, 2013, December 29, 2012 and December 31, 2011, is derived from our unaudited consolidated financial statements that are not included in this prospectus and (3) financial data for Q3 2016, Q3 2015, the 2016 YTD period, the 2015 YTD period and balance sheet data as of October 1, 2016, is derived from our unaudited consolidated interim financial statements included elsewhere in this prospectus.

ii

Table of Contents

References to “ready-to-eat sandwiches” means bun based sandwiches, breakfast sandwiches, stuffed pockets and sliced meat deli sandwiches and excludes hot dogs and wrap-based sandwiches.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements and the related notes thereto included elsewhere in this prospectus. Certain other amounts that appear in this prospectus may not sum due to rounding.

iii

Table of Contents

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including the information presented under the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before making a decision to invest in our common stock. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of certain factors such as those set forth in the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” When making an investment decision, you should also read the discussion under “Basis of Presentation” for the definition of certain terms used in this prospectus and other matters described in this prospectus.

Who We Are

We are a leading national producer and distributor of value-added, convenient, ready-to-eat sandwiches, sandwich components and other entrées and snacks. We hold the number one or number two market share position by sales or volume in nearly all our major product categories, with net sales of $1.5 billion in the twelve months ended October 1, 2016 and $1.6 billion in fiscal 2015. We offer a differentiated value proposition to our customers due to our scale, broad product portfolio, customization capabilities, national distribution and food safety track record.

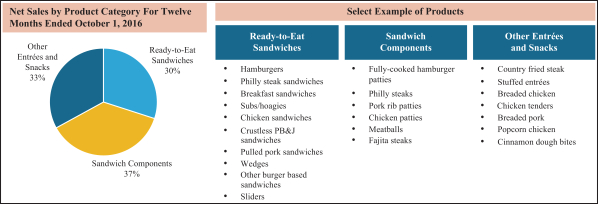

We market and distribute approximately 2,600 stock keeping units (“SKUs”) across all day parts in multiple product categories, including: (1) ready-to-eat sandwiches, such as breakfast sandwiches, peanut butter and jelly (“PB&J”) sandwiches and hamburgers; (2) sandwich components, such as fully-cooked hamburger and chicken patties and Philly steaks; and (3) other entrées and snacks, such as country fried steak, stuffed entrées, chicken tenders and cinnamon dough bites. In the twelve months ended October 1, 2016, 67.5% of our net sales were attributable to the fast-growing ready-to-eat sandwiches and sandwich components categories. Our products are shipped frozen to our customers and sold under our commercial and retail brands, as well as private label and licensed brands.

We control more steps within the production process than most of our competitors. This integrated approach allows us to add value throughout our processes, generate attractive margins and provides us with a significant competitive advantage. Our value-added processes include recipe formulation, pre-preparation by chopping, breading, seasoning and marinating, food preparation by baking, charring, frying and grilling, assembly and packaging. Our integrated bread and biscuit production capabilities are a key differentiator due to proprietary formulations that we believe produce superior tasting sandwiches.

We sell to a diverse set of over 3,000 customers and have an average relationship tenure of approximately 20 years with our top 20 customers. We employ a customer-centric approach, which is rooted in market-leading research and development (“R&D”) capabilities, product quality and customer service. We have dedicated marketing and sales teams for each of our channels to serve the specific needs of our customers. We enjoy “category captain” status in many of our product categories with our largest foodservice customers. In many cases, we collaborate with our customers to develop new products, customizing recipes and flavors in a cost efficient manner. We believe our customer-centric approach is a competitive advantage that helps our customers grow their businesses and, in turn, accelerates our organic growth and profitability.

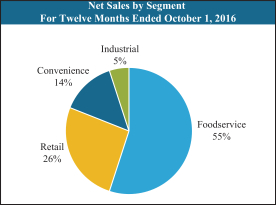

We sell our value-added products to the foodservice, retail and convenience channels, which correspond to our three core segments. We also sell our products in the industrial channel. We believe our diversification across

1

Table of Contents

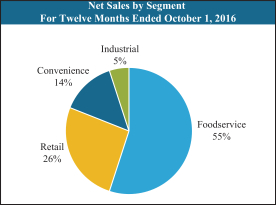

these channels provides us with a stable revenue base through economic cycles. In the twelve months ended October 1, 2016, 54.7% of our net sales were generated from our Foodservice segment, where our commercial brands are highly sought-after and trusted by chefs, cooks and other purchasers. In our Retail segment, in addition to selling our branded products, we also leverage our R&D capabilities to co-create exclusive products and packaging designs with our customers under their private label brands. In our Convenience segment, we are a leading supplier of ready-to-eat sandwiches and sandwich components to national and regional convenience chains and vending providers.

We have an attractive financial profile with steady, organic volume growth, healthy margins, modest capital expenditures and limited working capital requirements. These characteristics enable our business to generate strong cash flows. Our earnings profile also benefits from a lean selling, general and administrative (“SG&A”) cost structure and a scaled, efficient supply chain network. We intend to use these attributes to enhance stockholder value by paying regular dividends, reducing our indebtedness, strategically deploying our capital to fund organic growth opportunities and financing value-enhancing acquisitions.

In the twelve months ended October 1, 2016, we generated $1.5 billion in net sales, $114.8 million in net income, $97.8 million in Adjusted Net Income and $287.9 million in Adjusted EBITDA. In fiscal 2015, we generated $1.6 billion in net sales, $37.1 million in net income, $66.8 million in Adjusted Net Income and $260.2 million in Adjusted EBITDA. Our net sales, Adjusted Net Income and Adjusted EBITDA in the twelve months ended October 1, 2016 reflect a compound annual growth rate (“CAGR”) of 1.2%, 337.1% and 20.8%, respectively, since fiscal 2013. In the twelve months ended October 1, 2016 and fiscal 2015, we also generated $186.6 million and $157.2 million, respectively, of cash flow from operating activities. See “—Summary Historical Consolidated Financial Data” for reconciliations of Adjusted Net Income and Adjusted EBITDA to net income.

Our Recent Performance and the APF Way

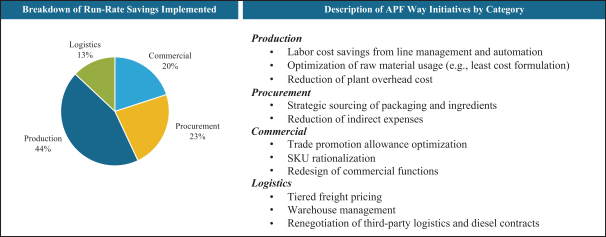

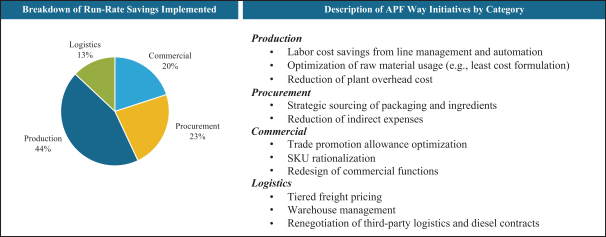

During 2013 and 2014, our board of directors transformed our senior management by hiring John Simons and four of the ten other members of our current executive team. This new team revamped our cost structure, budgeting tools and pricing methodology by implementing a continuous improvement program that we call the “APF Way.” The APF Way uses a data-driven analytical framework to drive growth and profitability through improved commercial decision-making, excellence in sales and marketing and productivity in procurement, logistics and production.

2

Table of Contents

We believe the APF Way has fundamentally changed the cost structure of our business and has been a major factor in our recent volume, sales and profitability growth. Initially, we focused on reducing our cost structure by executing on productivity initiatives and re-aligning trade promotion allowances, resulting in approximately $155.0 million in implemented annualized savings from 2013 to October 1, 2016. In addition, we eliminated approximately $155.0 million of sales associated with lower margin contracts. We have invested in new systems and processes that enable us to deliver continuous productivity savings and effectively manage margins and profitability. Our Adjusted EBITDA margin, which we calculate as Adjusted EBITDA divided by net sales, expanded from 10.9% in fiscal 2013 to 18.6% in the twelve months ended October 1, 2016, even as our raw material costs increased. Our net sales and volume grew at a CAGR of 2.7% and 5.2%, respectively, in our three core segments from fiscal 2013 to the twelve months ended October 1, 2016. Going forward, we expect these investments and discipline will allow us to continue to deliver overall growth and attractive margins.

Our Segments

We manage and report our operations in four segments with Foodservice, Retail and Convenience representing our core segments. Our fourth segment, Industrial, consists of sales to other food producers under short-term co-manufacturing agreements.

3

Table of Contents

Foodservice. The foodservice industry supplies the diverse U.S. “food-away-from-home” industry. The foodservice industry had $232 billion of sales in 2015 and is expected to have 2.3% annual growth over the next five years, according to Technomic Inc. (“Technomic”) data prepared in 2016. Our Foodservice customers include leading national and regional distributors, who then sell our products to end-customers such as restaurant operators, schools, healthcare providers, hospitality providers, the U.S. military and grocery deli counters. We supply 95 of the largest 100 school districts in the United States, directly and through distributors, and work closely with school districts to develop nutritious meal options with good quality and value. We also directly supply many national restaurant chains. We sell a diverse portfolio of products into the foodservice channel, including ready-to-eat sandwiches, such as breakfast sandwiches, PB&J sandwiches and hamburgers, sandwich components, such as fully-cooked hamburger and chicken patties and Philly steaks, and other entrées and snacks, such as country fried steak, stuffed entrées, chicken tenders and cinnamon dough bites. We primarily sell our products under our own commercial brands, which are highly sought-after and trusted by chefs, cooks and other purchasers. Commercial and private label brands accounted for 71.5% and 28.5%, respectively, of our Foodservice net sales for fiscal 2015.

Retail. Frozen and refrigerated handhelds, which includes ready-to-eat sandwiches, accounted for $4.1 billion of industry-wide retail sales in 2015, with 5.3% annual growth since 2010, according to Information Resources, Inc. (“IRI”) data prepared in 2016. Within frozen and refrigerated handhelds, breakfast handhelds accounted for $1.2 billion of industry-wide retail sales in 2015, with 14.6% annual growth since 2010, according to IRI data prepared in 2016. We serve a wide array of retail customers including national and regional grocery chains, major warehouse club stores, mass retailers and dollar stores. Key products that we sell into the retail channel include ready-to-eat sandwiches, such as breakfast sandwiches, grilled chicken sandwiches and stuffed pockets, sandwich components, such as chicken patties and Philly steaks, and other entrées and snacks, such as stuffed chicken breasts. In addition to selling our branded products, we also leverage our R&D capabilities to co-create exclusive products and packaging designs with our Retail customers under their private label brands. For fiscal 2015, 69.4% of our Retail net sales were attributable to our retail brands, such as Barber, Pierre and Fast Fixin’, 29.8% to private label brands and the rest to licensed brands.

Convenience. Industry-wide prepared food sales in the convenience channel were $46.8 billion in 2015, with approximately 9.3% annual growth since 2012, according to National Association of Convenience Stores (“NACS”) data prepared in 2016. Our Convenience customers include national and regional convenience chains and vending providers. We partner with our Convenience customers to develop customized, ready-to-eat sandwiches, such as breakfast sandwiches and hamburgers, sandwich components, such as chicken patties, and other entrées and snacks, such as cinnamon dough bites. For fiscal 2015, 77.6% of our Convenience net sales were attributable to our retail brands, such as Big AZ, 21.6% to private label brands and the rest to licensed brands.

Industrial. In order to optimize capacity utilization across our production network, we opportunistically enter into short-term co-manufacturing agreements with other food producers, such as packaged food companies. Due to the lower margin nature of this business, we have strategically reduced our percentage of net sales generated by this segment from 15.7% in fiscal 2013 to 5.1% in the twelve months ended October 1, 2016.

Our Strengths

We believe the following strengths differentiate us from our competitors and will contribute to our ongoing success:

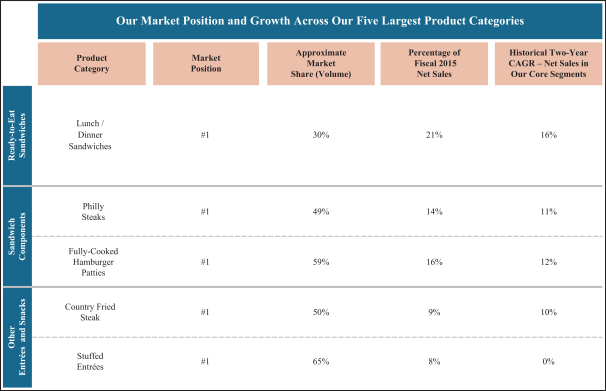

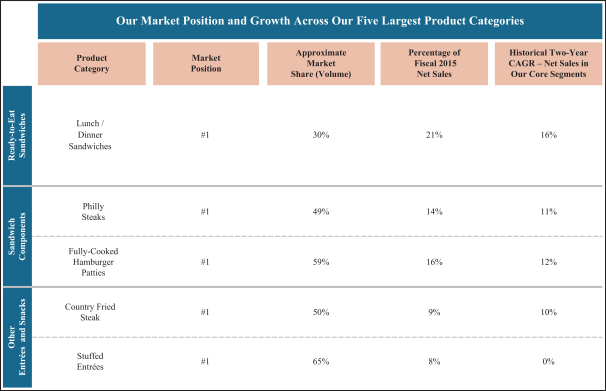

Leading Market Positions in Attractive, Growing Categories

We hold the number one or number two market share position by volume in nearly all of our major product categories and are well positioned to capitalize on growth in our markets. We are the number one player with

4

Table of Contents

market shares ranging from approximately 30% to 65% in our top five product categories, which represent 68% of our net sales in fiscal 2015. Within most of our major product categories, we are the only full-service operator of scale and compete against smaller, regional players with limited product breadth, production capacity and capabilities. We typically do not compete against large packaged food companies given our foodservice focus and the customization requirements of our customers.

We produce over 600 million sandwiches per year and 67.5% of our net sales in the twelve months ended October 1, 2016 were related to ready-to-eat sandwiches and sandwich components. We are a leading provider of lunch and dinner sandwiches to the foodservice, retail and convenience channels. Our superior bread quality is an important purchase driver for our sandwiches.

Long-Standing, Collaborative Customer Relationships Create a High Barrier to Entry

Our strong customer relationships across a diverse set of customers provide a significant competitive advantage and create a high barrier to entry. For fiscal 2015, our top ten customers accounted for 53.4% of our net sales, with our two largest customers, Sysco Corporation and U.S. Foods, Inc., accounting for 13.6% and 12.0%, respectively, of our net sales in fiscal 2015. Our two largest customers collectively source over 1,700 SKUs from our portfolio and buy across multiple contracts for a diverse set of end-customers, making us an important supplier and giving us a stable and consistent revenue base.

We have deep and collaborative relationships with an average tenure of approximately 20 years with our top 20 customers. We maintain our relationships through our segment-focused marketing teams and an experienced sales force of approximately 100 associates who work closely with customers to meet their needs. Our foodservice commercial brands are highly sought-after and trusted by chefs, cooks and other purchasers for their consistent food safety, premium quality and taste profile. Given our track record, we enjoy “category captain”

5

Table of Contents

status in many of our product categories. We produce approximately 2,600 SKUs for our customers, who source a high volume and a variety of products from us, making us an important supplier and partner. We expect to continue to have a competitive advantage as our customers focus on large scale suppliers in order to streamline and optimize their supply chains.

We offer a differentiated value proposition to our customers due to our scale, broad product portfolio, customization capabilities, national distribution and food safety track record.

Leader in On-Trend, Fast-to-Market New Product Development

We believe our customer-centric approach, which is rooted in market-leading R&D capabilities, product quality and customer service, differentiates us from our competitors and has allowed us to accelerate our organic growth and improve our profitability. Our product innovation and R&D expertise span areas such as flavor development, recipe formulation, nutrition science, bakery science and food safety. In recent years, we have enhanced our new product development and customer insight capabilities, and, in 2015, we opened a state-of-the-art 3,200 square foot R&D facility in West Chester, Ohio.

The food industry today is characterized by rapidly changing menus and evolving consumer taste profiles. In this environment, our customers value our ability to co-create new products with flavor profiles that differentiate their offerings and successfully commercialize new products with speed and efficiency. We launched 600 new SKUs in the last three years, accounting for 12.7% of our net sales in fiscal 2015. Our innovation, sales force and marketing teams collaborate with customers to co-create highly customized products and are able to mobilize quickly to respond to customer requests.

Scale and Production Efficiency with a National Distribution Footprint

We benefit from a national, scaled production, procurement and logistics network with low production, freight and warehousing costs. We believe our efficient cost structure provides a sustainable competitive advantage and enables us to offer a customized and varied set of products to our customers at competitive prices.

We have two integrated bakery facilities which allow us to source approximately 65% of our bread in-house (excluding bread for our PB&J sandwiches). Our eleven production facilities benefit from economies of scale, which when combined with our national distribution capabilities, differentiate us from our competitors and make us a valuable supplier for both national and regional customers. Except for the production facility previously owned by Allied Specialty Foods, Inc. (“Allied”), which we acquired in October 2016 and are in the process of improving, all of our facilities have achieved Safe Quality Food (“SQF”) Level 3 food safety certification, the highest level of such certification from the Global Food Safety Initiative (“GFSI”).

Attractive Financial Profile

We have an attractive financial profile with steady, organic volume growth in our core segments, healthy Adjusted EBITDA margins, modest capital expenditures and limited working capital requirements.

We are able to deliver attractive Adjusted EBITDA margins due to the high value-added nature of our products. Our margin profile is well protected given our ability to proactively adjust pricing frequently to reflect input cost movements with minimal lag time. Only 16.2% of our net sales in fiscal 2015 were subject to fixed price arrangements. We also have a lean and scalable cost structure. We plan to continue leveraging the APF Way to deliver operational productivity savings, improve our business mix and increase the effectiveness of our trade promotion allowances. Our business has relatively low capital expenditure requirements, with maintenance expenditures typically averaging approximately 1% of our net sales.

6

Table of Contents

Proven Acquisition Expertise

We have a successful track record of sourcing, executing and integrating acquisitions, beginning with the combination of Pierre Foods, Inc., APF’s predecessor, with Advance Food Company, Inc. and Advance Brands, LLC in 2010. Given our scale and breadth of capabilities, we believe we are well positioned to consolidate the fragmented industry in which we operate. We maintain a highly disciplined approach to acquisitions, focusing on opportunities that diversify our products, add production capabilities, expand production capacity and allow for meaningful synergy realization. In addition to realizing cost synergies, we leverage our sales teams to expand distribution of newly acquired brands and products and cross-sell across our channels to drive sales synergies.

Since 2011, we have completed four accretive acquisitions. In June 2011, we acquired Barber Foods, LLC (“Barber Foods”), a producer of premium stuffed entrées, which strengthened our retail presence and expanded our chicken-based product offering. In January 2015, we acquired the wholesale business and production assets of Landshire, Inc. (“Landshire”), which broadened our portfolio of premium sandwiches to include sliced meat sandwiches and added incremental, margin-enhancing baking and assembly production capabilities. In April 2015, we acquired the business and production assets of Better Bakery, LLC (“Better Bakery”) to expand into stuffed sandwiches, one of the largest ready-to-eat sandwich categories. Our acquisitions of Barber Foods, Landshire and Better Bakery contributed $166.4 million of incremental net sales in fiscal 2015. In October 2016, we acquired Allied, a producer of beef and chicken Philly steak products, which we expect will expand our market position in Philly steaks by adding fully cooked product offerings, expand our geographic reach and increase our sandwich component production capacity.

Talented Management Team with a Track Record of Driving Growth and Reducing Costs

Since 2013, we have assembled an experienced management team through strategic hiring of key leaders and expanded organizational capabilities in R&D, sales and marketing. Our management team has an average of 25 years of expertise in the foodservice, retail and convenience industries and has demonstrated its ability to deliver on key strategic initiatives, which have transformed business performance. In the last two years, our management team’s key accomplishments include implementation of the APF Way, successful integration of two value-enhancing acquisitions and significant margin improvement.

Our management team had been led by our President and Chief Executive Officer John Simons since October 2013. On November 9, 2016, in response to Mr. Simons’ planned retirement in 2017, we announced a succession and transition plan for our President and Chief Executive Officer positions. As a part of the plan, Christopher Sliva, who has over a decade of experience as a public food company executive, became our President and a member of our board of directors. It is anticipated that Mr. Simons will remain as our Chief Executive Officer until March 31, 2017, when he will retire and be succeeded by Mr. Sliva as our President and Chief Executive Officer.

Our Strategy

Expand Our Market Leading Positions in Growing Channels and Categories

We are focused on expanding our leadership position within our core segments of Foodservice, Retail and Convenience.

We believe the ready-to-eat breakfast sandwich category is a key growth opportunity for us. We hold the number one position with a 64% market share in breakfast sandwiches sold in the convenience channel. We are also the largest supplier of private label breakfast sandwiches in the retail channel, with a 56% market share, according to IRI data prepared in 2016. Private label sales of retail frozen breakfast sandwiches are underpenetrated compared

7

Table of Contents

to the frozen food market and therefore we believe poised for significant growth. We will continue to leverage our sandwich expertise and customer relationships to grow our share in breakfast sandwiches in the retail channel and with foodservice distributors and schools.

We believe we have multiple growth opportunities across our core segments. In Foodservice, we plan to expand distribution of our products to new customers, such as coffee shops, theaters, grocery deli counters and hospitality providers. In Retail, in addition to growing our sandwich business, we are launching product extensions for Barber Foods and Better Bakery and expanding distribution within rapidly growing dollar stores. In Convenience, we are expanding our breakfast product portfolio and launching Better Bakery products.

We are also expanding our lineup of products to take advantage of recent consumer trends. We have successfully launched snacking-oriented products, such as popcorn chicken, PB&J snack bars and cinnamon dough bites, and better-for-you products, such as antibiotic, hormone-free fully-cooked burgers.

Drive Growth Through Focus on Innovation

Our product categories offer potential for value-added product innovation. We believe our innovation capabilities, combined with our investments in consumer insights and our ability to partner with customers to co-create products, will enable us to continue to introduce successful new products to drive sales growth and margin improvement across our portfolio.

Our R&D team is focused on developing products in line with key consumer trends, such as breakfast sandwiches, better-for-you products and snacking-oriented products. Examples of products in our innovation pipeline include ready-to-eat breakfast sandwiches that meet the new K-12 nutrition guidelines, premium offerings for club stores and new limited time offers for key convenience store chain customers. We are also partnering with various customers to develop on-trend, protein-based snacks.

Deliver Attractive Margins through Dynamic Pricing and Leveraging the APF Way

We believe we are well positioned to deliver attractive margins given the high value-added nature of our products, our dynamic pricing model and our ability to generate ongoing productivity savings by leveraging the APF Way. In addition, our focus on improving our product mix, leveraging our scalable organization structure and realizing synergies from acquisitions supports our margin profile. Under the APF Way, we are implementing multiple initiatives across the areas of production, procurement, commercial and logistics that we expect will deliver ongoing productivity savings and help offset potential operational headwinds and cost inflation.

Acquire Value-Enhancing Businesses

We believe our scale and integration expertise allow us to make value-enhancing acquisitions. We operate in a highly fragmented industry with many opportunities to execute accretive transactions. For example, in October 2016, we acquired Allied, a producer of beef and chicken Philly steak products, which we expect will expand our market position in Philly steaks by adding fully cooked product offerings, expand our geographic reach and increase our sandwich component production capacity. Our integration expertise allows us to rapidly capture cost synergies and we are able to generate revenue synergies by leveraging existing customer relationships and marketing expertise to cross-sell products across channels. Our management team has an active pipeline of acquisition opportunities and maintains a regular dialogue with potential targets.

Return Capital and Reduce Debt

We believe our capital structure enables us to invest in our business and reduce our indebtedness, creating value for our stockholders. We also expect to return capital to our stockholders through regular dividend payments. We paid a regular quarterly cash dividend of $0.14 per share on September 28, 2016 and December 6, 2016. In addition, on December 16, 2016, we announced that our board of directors intends to increase the

8

Table of Contents

regular quarterly dividend from $0.14 per share to $0.16 per share, an increase of approximately 14.3%. We expect to pay a regular quarterly cash dividend of $0.16 per share beginning in the first quarter of fiscal 2017, subject to declaration by our board of directors. See “Dividend Policy” for additional details.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | The food industry in which we operate is highly competitive. |

| • | Disruption of our supply chain could adversely affect our business, financial condition and operating results. |

| • | Our top ten customers have historically accounted for a significant portion of our net sales. |

| • | Most of our customers are not obligated to continue purchasing products from us. |

| • | Increases in the prices of raw materials, particularly beef, poultry and pork, could reduce our operating margins. |

| • | Changes in consumer eating habits could adversely affect our business, financial condition and operating results. |

| • | If our products become contaminated or are mislabeled, we may be subject to product liability claims, product recalls and increased scrutiny by regulators, any of which could adversely affect our business. |

| • | We are subject to extensive governmental regulations, which require significant compliance expenditures. |

| • | We sell a large percentage of our products to schools, directly and through distributors, which subjects our sales volumes and, thus, our operating results, to seasonal variations. |

| • | We may be unsuccessful at identifying, acquiring or integrating future acquisitions. |

| • | Our high level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, expose us to interest rate risk to the extent of our floating-rate indebtedness and prevent us from meeting our obligations under our indebtedness. |

| • | Oaktree will continue to have significant influence over us after this offering, which could limit your ability to influence the outcome of key transactions, including a change of control. |

| • | Upon completion of this offering, we will no longer be a “controlled company” within the meaning of the NYSE. However, we will continue to qualify for, and may rely on, exemptions from certain corporate governance requirements that would otherwise provide protection to stockholders of other companies during a one-year transition period. |

Corporate Information

AdvancePierre was incorporated in Delaware on December 5, 2008 as Pierre Foods Holding Corporation and changed its name to AdvancePierre Foods Holdings, Inc. on March 16, 2016. On July 20, 2016, we completed our initial public offering of 21,390,000 shares of our common stock, which included the full exercise of the underwriters’ option to purchase additional shares, at a price of $21.00. Upon completion of our initial public offering, our common stock was listed on the NYSE under the symbol “APFH.”

Our executive offices are located at 9987 Carver Road, Blue Ash, Ohio 45242, and our telephone number at that location is (800) 969-2747. We maintain a website at www.advancepierre.com. The information contained

9

Table of Contents

on or accessible through our corporate website or any other website that we may maintain is not part of this prospectus or the registration statement of which this prospectus is a part.

Our Principal Stockholders

Prior to the completion of this offering, funds managed by Oaktree (our “principal stockholders”) beneficially owned 57.2% of our common stock. Oaktree is a leader among global investment managers specializing in alternative investments, with $99.8 billion in assets under management as of September 30, 2016. The firm emphasizes an opportunistic, value-oriented and risk-controlled approach to investments in distressed debt, corporate debt (including high yield debt and senior loans), control investing, convertible securities, real estate and listed equities. Headquartered in Los Angeles, the firm has over 900 employees and offices in 18 cities worldwide.

After the completion of this offering, our principal stockholders will beneficially own 44.0% of our common stock, or 41.9% of our common stock if the underwriters exercise in full their option to purchase additional shares from certain of the selling stockholders. As a result, Oaktree will continue to have significant influence over us and decisions made by our stockholders and may have interests that differ from yours. See “Risk factors—Risks Related to this Offering and Ownership of Our Common Stock—Oaktree will continue to have significant influence over us after this offering, which could limit your ability to influence the outcome of key transactions, including a change of control.” We also entered into a new stockholders agreement and an amended and restated registration rights agreement with our principal stockholders in connection with our initial public offering. For more information regarding these agreements, see “Certain Relationships and Related Party Transactions—Stockholders Agreement” and “—Registration Rights Agreement.”

Oaktree currently owns a majority of the voting power of all outstanding shares of our common stock. As a result, we currently are a “controlled company” within the meaning of the rules of the NYSE. Upon completion of this offering, we will no longer be a “controlled company” within the meaning of the corporate governance standards of the NYSE. See “Principal and Selling Stockholders” and “Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock—Upon completion of this offering, we will no longer be a “controlled company” within the meaning of the NYSE. However, we will continue to qualify for, and may rely on, exemptions from certain corporate governance requirements that would otherwise provide protection to stockholders of other companies during a one-year transition period.”

Recent Developments

Allied Acquisition

On October 7, 2016, we acquired all of the outstanding voting interests of Allied, a producer of beef and chicken Philly steak products, for $60.0 million in cash, subject to a post-closing adjustment estimated to be approximately $2.5 million. We expect this acquisition will expand our market position in Philly steaks by adding fully cooked product offerings, expand our geographic reach and increase our sandwich component production capacity. The acquisition is also expected to provide cost synergies.

Succession and Transition Plan for Our President and Chief Executive Officer Positions

On November 9, 2016, we announced that our board of directors approved a succession and transition plan for our President and Chief Executive Officer positions. As a part of the plan, Mr. Sliva became our President and a member of our board of directors on November 14, 2016. It is anticipated that Mr. Simons will remain as our Chief Executive Officer until March 31, 2017, when he will retire and be succeeded by Mr. Sliva as our President and Chief Executive Officer. Mr. Simons will remain a member of our board of directors until the date of the 2017 annual meeting of our stockholders.

10

Table of Contents

Notes Offering

On December 7, 2016, we issued $400 million aggregate principal amount of our 5.50% senior notes due 2024 (the “notes”) in a private placement to “qualified institutional buyers” as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and outside the United States to non-U.S. persons pursuant to Regulation S under the Securities Act. The notes mature on December 15, 2024 and bear interest at a rate of 5.50% per annum, payable semi-annually on June 15 and December 15 of each year, commencing on June 15, 2017. On December 7, 2016, we used the net proceeds of the offering, together with cash on hand, to repay $400 million of outstanding borrowings under our first lien term loan and to pay estimated fees and expenses of $5 million. In connection with the repayment of $400 million of outstanding borrowings under our first lien term loan, we estimate that we will expense $6.3 million of unamortized loan origination fees and original issue discount.

Repricing of Our First Lien Term Loan

On December 7, 2016, we entered into a repricing amendment to the credit agreement governing our first lien term loan. The amendment reduced the margins applicable to our first lien term loan from 2.75% per annum (subject to a leverage-based step-down to 2.50%) to 2.00% per annum in the case of base rate loans, and from 3.75% per annum (subject to a leverage-based step-down to 3.50%) to 3.00% per annum in the case of LIBOR loans (subject to a 1.00% floor on LIBOR loans). The amendment also provides that a 1.0% mandatory prepayment premium applies to certain repricing transactions occurring prior to the six-month anniversary of execution of the amendment. We estimate that we incurred $2.6 million of fees and expenses in connection with the repricing of our first lien term loan, of which $1.9 million is expected to be expensed in fiscal year 2016 and $0.7 million is expected to be deferred.

Dividend Increase

On December 16, 2016, we announced that our board of directors intends to increase our regular quarterly dividend from $0.14 per share to $0.16 per share, an increase of approximately 14.3%. We intend to pay a regular quarterly dividend of $0.16 per share in the first quarter of fiscal 2017, subject to declaration by our board of directors.

Preliminary Results for Q4 2016 and Fiscal 2016

We have prepared preliminary estimated unaudited selected financial results for Q4 2016 and fiscal 2016. Based on information that is currently available, we are reporting the following estimated ranges:

| • | Q4 2016 net sales are expected to be in the range of $408 million to $411 million, including volume growth in our three core segments (excluding volume attributable to our acquisition of Allied) of 5.7%. We expect fiscal 2016 net sales of $1.566 billion to $1.569 billion, including volume growth in our three core segments (excluding volume attributable to our acquisition of Allied) of 2.8%. |

| • | Q4 2016 net income is expected to be in the range of $30 million to $34 million, or diluted net income per share of $0.38 to $0.43. We expect fiscal 2016 net income to be in the range of $133 million to $137 million, or diluted net income per share of $1.85 to $1.90. |

| • | Q4 2016 Adjusted Net Income is expected to be in the range of $40 million to $44 million, or Adjusted Diluted Net Income Per Share of $0.51 to $0.55. We expect fiscal 2016 Adjusted Net Income to be in the range of $122 million to $126 million, or Adjusted Diluted Net Income Per Share of $1.69 to $1.74. |

| • | Q4 2016 Adjusted EBITDA is expected to be in the range of $77 million to $81 million and fiscal 2016 Adjusted EBITDA is expected to be in the range of $296 million to $300 million. |

11

Table of Contents

In Q4 2016, we continued to organically grow core volume, implement productivity initiatives as part of the APF Way, generate strong cash flow and successfully execute our acquisition strategy.

Adjusted Net Income, Adjusted Diluted Net Income Per Share and Adjusted EBITDA are not financial measures calculated under U.S. generally accepted accounting principles (“GAAP”). See “—Summary Historical Consolidated Financial Data” for additional information and the tables below for a reconciliation of such non-GAAP financial measures to the most directly comparable GAAP measures.

We have presented preliminary estimated unaudited financial data in this prospectus because our closing procedures for Q4 2016 and fiscal 2016 are not yet complete, and these estimates are subject to the completion of financial closing procedures, final adjustments and other developments that may arise between now and the time these results are finalized. The ranges presented herein are based upon the most current information available to management and assumptions we believe to be reasonable, but include information that is subject to further review, verification and adjustment. The preliminary estimated unaudited financial data presented herein should not be considered a substitute for the financial information to be filed with the SEC in our Annual Report on Form 10-K for fiscal 2016 once it becomes available and we have no intention or obligation to update the preliminary estimated unaudited financial data presented herein prior to filing our Annual Report on Form 10-K for fiscal 2016. The preliminary estimated unaudited financial data presented herein was prepared by, and is the responsibility of, our management. Our independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to the preliminary estimated unaudited financial data, and accordingly does not express an opinion or any other form of assurance with respect thereto. It is possible that our final reported results for Q4 2016 and fiscal 2016 may not be within the ranges presented herein and the differences may be material, including from developments of which we are currently unaware. Accordingly, investors are cautioned not to place undue reliance on the preliminary estimated unaudited financial data presented herein. Please refer to “Special Note Regarding Forward-Looking Statements” and “Risk Factors” for additional information. The preliminary estimated unaudited financial data presented herein should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

The following table shows the reconciliation of Adjusted Net Income from net income:

| Q4 2016 (Estimated) |

Fiscal 2016 (Estimated) |

|||||||||||||||||||||||

| (in millions) | Low | High | Q4 2015 (Actual) |

Low | High | Fiscal 2015 (Actual) |

||||||||||||||||||

| Net income |

$ | 30 | $ | 34 | $ | 12 | $ | 133 | $ | 137 | $ | 37 | ||||||||||||

| Reversal of deferred tax asset valuation allowance |

— | — | — | (58 | ) | (58 | ) | — | ||||||||||||||||

| Charges related to refinancing of credit facilities |

9 | 9 | — | 28 | 28 | — | ||||||||||||||||||

| Restructuring expenses |

— | — | 1 | — | — | 5 | ||||||||||||||||||

| Sponsor fees and expenses |

— | — | 1 | 14 | 14 | 12 | ||||||||||||||||||

| Merger and acquisition expenses and public filing expenses |

— | — | 1 | 4 | 4 | 6 | ||||||||||||||||||

| Other |

1 | 1 | 1 | 1 | 1 | 7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Net Income(a) |

$ | 40 | $ | 44 | $ | 15 | $ | 122 | $ | 126 | $ | 67 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Diluted net income share |

$ | 0.38 | $ | 0.43 | $ | 0.18 | $ | 1.85 | $ | 1.90 | $ | 0.56 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Diluted Net Income Per Share |

$ | 0.51 | $ | 0.55 | $ | 0.23 | $ | 1.69 | $ | 1.74 | $ | 1.01 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | The estimated tax effects of the adjustments “Charges related to refinancing of credit facilities” and “Other” noted above were determined to be de minimus, based on a comparison of the expected tax liability with and without such items. |

12

Table of Contents

The following table shows the reconciliation of Adjusted EBITDA from net income:

| (in millions) | Q4 2016 (Estimated) |

Fiscal 2016 (Estimated) |

||||||||||||||||||||||

| Low | High | Q4 2015 (Actual) |

Low | High | Fiscal 2015 (Actual) |

|||||||||||||||||||

| Net income |

$ | 30 | $ | 34 | $ | 12 | $ | 133 | $ | 137 | $ | 37 | ||||||||||||

| Interest expense |

22 | 22 | 26 | 105 | 105 | 104 | ||||||||||||||||||

| Provision for income taxes |

— | — | 3 | (58 | ) | (58 | ) | 9 | ||||||||||||||||

| Depreciation and amortization expense |

17 | 17 | 17 | 65 | 65 | 63 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

$ | 69 | $ | 73 | $ | 57 | $ | 245 | $ | 249 | $ | 213 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Restructuring expenses |

— | — | 1 | — | — | 5 | ||||||||||||||||||

| Non-cash stock based compensation expense |

6 | 6 | 9 | 32 | 32 | 17 | ||||||||||||||||||

| Sponsor fees and expenses |

— | — | 1 | 14 | 14 | 12 | ||||||||||||||||||

| Merger and acquisition expenses and public filing expenses |

1 | 1 | 1 | 5 | 5 | 6 | ||||||||||||||||||

| Product recalls |

— | — | 1 | — | — | 4 | ||||||||||||||||||

| Inventory step-up amortization |

— | — | — | — | — | 1 | ||||||||||||||||||

| Fair value adjustment to USDA commodity liability |

— | — | — | (1 | ) | (1 | ) | — | ||||||||||||||||

| Other |

1 | 1 | — | 1 | 1 | 1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 77 | $ | 81 | $ | 69 | $ | 296 | $ | 300 | $ | 260 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

13

Table of Contents

The Offering

| Common stock offered by the selling stockholders |

12,500,000 shares |

| Underwriters’ option to purchase additional shares of common stock from certain of the selling stockholders |

1,875,000 shares |

| Common stock to be outstanding immediately after this offering |

78,607,804 shares |

| Use of proceeds |

We will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders in this offering. However, we will bear all costs, fees and expenses in connection with this offering, except that the selling stockholders will pay the underwriting discounts and commissions. See “Use of Proceeds.” |

| Risk factors |

See “Risk Factors” beginning on page 20 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Dividend policy |

We paid a regular quarterly cash dividend of $0.14 per share on September 28, 2016 and December 6, 2016. In addition, on December 16, 2016, we announced that our board of directors intends to increase the regular quarterly dividend from $0.14 per share to $0.16 per share, an increase of approximately 14.3%. We expect to pay a regular quarterly cash dividend of $0.16 per share beginning in the first quarter of fiscal 2017, subject to declaration by our board of directors, the discretion of our board of directors to increase, decrease or eliminate the dividend in the future, and compliance with applicable law, and depending on, among other things, our results of operations, financial condition, level of indebtedness, capital requirements, contractual restrictions, restrictions in our debt agreements and in any preferred stock, business prospects and other factors that our board of directors may deem relevant. In particular, our ability to pay dividends on our common stock is limited by covenants in our credit facilities and the indenture governing the notes, and may be further restricted by the terms of any future debt or preferred securities. We do not currently believe that the restrictions contained in our credit facilities or the indenture governing the notes will impair our ability to pay regular quarterly cash dividends as described above. Because we are a holding company, our ability to pay dividends also depends on our receipt of cash dividends from our operating subsidiaries, which may be restricted in their ability to pay dividends as a result of the laws of their jurisdiction of organization, agreements of our subsidiaries or covenants under any existing and future outstanding indebtedness we or our subsidiaries incur. See “Dividend Policy” and “Description of Certain Indebtedness.” |

| NYSE ticker symbol |

“APFH” |

14

Table of Contents

The number of shares of our common stock to be outstanding immediately after the consummation of this offering presented in this prospectus (unless we indicate otherwise or the context otherwise requires) is based on 78,607,804 shares of common stock outstanding as of October 1, 2016, including 1,319,905 shares of issued and unvested restricted stock as of October 1, 2016.

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| • | assumes no exercise of the underwriters’ option to purchase additional shares of our common stock from certain of the selling stockholders; and |

| • | does not reflect (1) 883,488 shares of common stock that may be issued pursuant to outstanding options and restricted stock units as of October 1, 2016 and (2) 5,628,690 shares of common stock that are reserved for future issuance under our 2009 Omnibus Equity Incentive Plan. |

15

Table of Contents

Summary Historical Consolidated Financial Data

The following table summarizes our historical consolidated financial and other data for the periods and at the dates indicated. Our fiscal year is based on either a 52-week or 53-week period ending on the Saturday closest to each December 31.

We have derived the summary historical consolidated financial data for the fiscal years ended January 2, 2016, January 3, 2015 and December 28, 2013, and the summary balance sheet data as of January 2, 2016 and January 3, 2015, from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary balance sheet data as of December 28, 2013 from our unaudited consolidated financial statements that are not included in this prospectus. We have derived the summary historical consolidated financial data for the 39 weeks ended October 1, 2016 and October 3, 2015, and the summary balance sheet data as of October 1, 2016, from our unaudited consolidated interim financial statements included elsewhere in this prospectus. Our unaudited consolidated interim financial statements were prepared on a basis consistent with our audited consolidated financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of the financial information. We have derived the summary historical consolidated financial data for the twelve months ended October 1, 2016 by adding the summary historical consolidated financial data for the 39 weeks ended October 1, 2016 to the summary historical consolidated financial data for the fiscal year ended January 2, 2016, and subtracting the summary historical consolidated financial data for the 39 weeks ended October 3, 2015. We believe that presentation of the summary historical consolidated financial data for the twelve months ended October 1, 2016 is useful to investors because it presents information about how our business has performed in the twelve month period immediately preceding the date of our most recent interim financial statements, which allows investors to review our current performance trends over a full year period, and presenting results for four consecutive quarters compensates for seasonal factors that might influence results in a particular quarter within the year. The results of operations of the assets of Landshire, which we acquired in January 2015, and of Better Bakery, which we acquired in April 2015, are reflected in our results as of and from the date of such transactions. The results of operations of Allied, which we acquired in October 2016, are not reflected in our results below.

16

Table of Contents

Our historical results are not necessarily indicative of future operating results, and the results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year. Because the data in this table is only a summary and does not provide all of the data contained in our consolidated financial statements, the information should be read in conjunction with “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| (in millions, except per share data) | YTD 2016 Period |

YTD 2015 Period |

Fiscal 2015 |

Fiscal 2014 |

Fiscal 2013 |

Twelve Months Ended October 1, 2016 |

||||||||||||||||||

| Statement of Operations: |

||||||||||||||||||||||||

| Net sales |

$ | 1,158.8 | $ | 1,225.6 | $ | 1,611.6 | $ | 1,577.6 | $ | 1,492.0 | $ | 1,544.8 | ||||||||||||

| Cost of goods sold |

783.5 | 891.5 | 1,158.2 | 1,227.1 | 1,144.3 | 1,050.2 | ||||||||||||||||||

| Distribution expenses |

68.7 | 73.1 | 96.5 | 99.3 | 95.3 | 92.1 | ||||||||||||||||||

| Restructuring expenses |

— | 2.4 | 2.5 | 2.0 | 21.5 | 0.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

306.6 | 258.7 | 354.4 | 249.2 | 230.9 | 402.3 | ||||||||||||||||||

| Selling, general and administrative expenses |

165.4 | 142.4 | 196.2 | 167.6 | 160.5 | 219.2 | ||||||||||||||||||

| Impairment charges |

— | — | — | — | 5.5 | — | ||||||||||||||||||

| Restructuring expenses |

0.1 | 1.4 | 2.2 | 5.3 | 10.2 | 0.9 | ||||||||||||||||||

| Other expense, net |

13.6 | 4.7 | 5.6 | 0.2 | 0.8 | 14.5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income |

127.4 | 110.1 | 150.4 | 76.1 | 53.9 | 167.7 | ||||||||||||||||||

| Interest expense |

82.5 | 78.6 | 104.4 | 105.6 | 104.6 | 108.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) before income taxes |

45.0 | 31.5 | 46.0 | (29.5 | ) | (50.7 | ) | 59.5 | ||||||||||||||||

| Income tax (benefit) provision |

(58.2 | ) | 6.1 | 8.9 | 8.4 | 6.3 | (55.4 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | 103.1 | $ | 25.4 | $ | 37.1 | $ | (37.9 | ) | $ | (57.0 | ) | $ | 114.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Per Share Data: |

||||||||||||||||||||||||

| Net income (loss) per share(1): |

||||||||||||||||||||||||

| Basic |

$ | 1.47 | $ | 0.39 | $ | 0.57 | $ | (0.59 | ) | $ | (0.90 | ) | $ | 1.66 | ||||||||||

| Diluted |

$ | 1.47 | $ | 0.38 | $ | 0.56 | $ | (0.59 | ) | $ | (0.90 | ) | $ | 1.66 | ||||||||||

| Statement of Cash Flows: |

||||||||||||||||||||||||

| Cash flows provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | 118.1 | $ | 88.7 | $ | 157.2 | $ | 22.9 | $ | 34.4 | $ | 186.6 | ||||||||||||

| Investing activities |

(26.5 | ) | (102.0 | ) | (108.3 | ) | (20.9 | ) | (11.8 | ) | (32.8 | ) | ||||||||||||

| Financing activities |

19.8 | 15.2 | (44.5 | ) | (2.1 | ) | (22.5 | ) | (39.9 | ) | ||||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 115.9 | $ | 4.5 | $ | 0.1 | $ | 0.3 | ||||||||||||||||

| Working capital(2) |

138.8 | 127.4 | 158.7 | 142.9 | ||||||||||||||||||||

| Total assets(2)(3) |

1,210.5 | 1,096.2 | 1,048.8 | 1,049.7 | ||||||||||||||||||||

| Total debt(3) |

1,077.8 | 1,258.6 | 1,287.5 | 1,274.8 | ||||||||||||||||||||

| Total stockholders’ deficit |

(329.7 | ) | (427.2 | ) | (467.0 | ) | (427.4 | ) | ||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Adjusted Net Income(4) |

$ | 82.5 | $ | 51.6 | $ | 66.8 | $ | (4.3 | ) | $ | (7.3 | ) | $ | 97.8 | ||||||||||

| Adjusted Diluted Net Income Per Share(4) |

$ | 1.17 | $ | 0.77 | $ | 1.01 | $ | (0.07 | ) | $ | (0.12 | ) | $ | 1.40 | ||||||||||

| Adjusted EBITDA(5) |

$ | 219.0 | $ | 191.3 | $ | 260.2 | $ | 170.5 | $ | 163.3 | $ | 287.9 | ||||||||||||

| (1) | Basic net income (loss) per share is calculated based upon the weighted average number of outstanding shares of common stock for the period, plus the effect of vested restricted shares. Diluted net income (loss) |

17

Table of Contents

| per share is calculated consistent with the calculation of basic net income (loss) per share, plus the effect of dilutive unissued common shares related to stock-based employee compensation programs. All of our unvested restricted stock awards were excluded from the computation of diluted net income (loss) per share for fiscal 2014 and fiscal 2013 because including them would have had an anti-dilutive effect due to our net loss position. There were no awards that could have diluted basic net income (loss) per share in the future that were not included in the computation of diluted net income (loss) per share in the 2016 YTD period, the 2015 YTD period or fiscal 2015 as all awards were dilutive. |

All per share amounts have been retroactively restated to reflect the 49.313-for-one stock split effective June 21, 2016.

| (2) | Working capital is defined as current assets (excluding cash) minus current liabilities (excluding the current portion of debt). We retrospectively adopted the guidance under the Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) No. 2015-17 “Balance Sheet Classification of Deferred Taxes” to simplify the classification of deferred taxes into non-current amounts. At January 3, 2015, we had a current deferred tax liability of $0.2 million that was reclassified as non-current. At December 28, 2013, we had a current deferred tax asset of $0.6 million that was reclassified as non-current. |

| (3) | We retrospectively adopted the guidance under FASB ASU No. 2015-03 “Simplifying the Presentation of Debt Issuance Costs” to deduct deferred loan origination fees from long-term debt, net of current maturities. This adoption resulted in reductions of deferred loan origination fees and long-term debt, net of current maturities of $11.1 million, $17.7 million and $24.1 million as of January 2, 2016, January 3, 2015 and December 28, 2013, respectively. |

| (4) | Adjusted Net Income represents net income (loss) before interest expense, income tax expense, depreciation and amortization and certain non-cash and other adjustment items. Adjusted Diluted Net Income Per Share represents the diluted per share value of Adjusted Net Income. Adjusted Net Income and Adjusted Diluted Net Income Per Share are not financial measures calculated under GAAP and do not comply with GAAP because they are adjusted to exclude certain cash and non-cash expenses. |

We present Adjusted Net Income and Adjusted Diluted Net Income Per Share as performance measures because we believe they facilitate a comparison of our operating performance on a consistent basis from period-to-period and provide for a more complete understanding of factors and trends affecting our business than measures under GAAP can provide alone. We also believe Adjusted Net Income and Adjusted Diluted Net Income Per Share are useful to investors because they are frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. However, our definitions of Adjusted Net Income and Adjusted Diluted Net Income Per Share may not be the same as similarly titled measures used by other companies.

Adjusted Net Income and Adjusted Diluted Net Income Per Share have limitations as an analytical tool and should not be considered in isolation from, or as an alternative to, or more meaningful than, net income as determined in accordance with GAAP. Some of these limitations are:

| • | Adjusted Net Income and Adjusted Diluted Net Income Per Share do not reflect reversals of deferred tax benefits; |

| • | Adjusted Net Income and Adjusted Diluted Net Income Per Share do not reflect refinancing charges, including write-offs of deferred loan fees and original issue discounts, payments of loan origination fees and prepayment penalties; |

| • | Adjusted Net Income and Adjusted Net Income Per Share exclude certain costs associated with reorganization and restructuring activities, business acquisitions and integration of acquired businesses; |

| • | Adjusted Net Income and Adjusted Diluted Net Income Per Share exclude public filing expenses; and |

| • | Adjusted Net Income and Adjusted Diluted Net Income Per Share do not reflect management fees and expense reimbursements paid to certain of our pre-initial public offering stockholders. |

18

Table of Contents

Because of these limitations, you should rely primarily on net income as determined in accordance with GAAP and use Adjusted Net Income and Adjusted Diluted Net Income Per Share only as supplements. In evaluating Adjusted Net Income and Adjusted Diluted Net Income Per Share, you should be aware that in the future we may incur expenses similar to those for which adjustments are made in calculating Adjusted Net Income and Adjusted Diluted Net Income Per Share. Adjusted Net Income and Adjusted Diluted Net Income Per Share should not be considered as measures of discretionary cash available to us to invest in the growth of our business.

The following table shows the reconciliation of Adjusted Net Income from the most directly comparable GAAP measure, net income (loss):

| (in millions) | 2016 YTD Period |

2015 YTD Period |

Fiscal 2015 |

Fiscal 2014 |

Fiscal 2013 |

Twelve Months Ended October 1, 2016 |

||||||||||||||||||

| Net income (loss) |

$ | 103.1 | $ | 25.4 | $ | 37.1 | $ | (37.9 | ) | $ | (57.0 | ) | $ | 114.8 | ||||||||||

| Reversal of deferred tax asset valuation allowance(a) |

(58.2 | ) | — | — | — | — | (58.2 | ) | ||||||||||||||||

| Charges related to refinancing of credit facilities(b) |

19.0 | — | — | — | — | 19.0 | ||||||||||||||||||

| Impairment charges |

— | — | — | — | 5.5 | — | ||||||||||||||||||

| Restructuring expenses(c) |

0.1 | 3.8 | 4.7 | 7.3 | 31.7 | 1.0 | ||||||||||||||||||

| Sponsor fees and expenses(d) |

14.2 | 11.1 | 11.9 | 16.0 | 8.5 | 15.0 | ||||||||||||||||||

| Merger and acquisition expenses and public filing expenses(e) |

4.2 | 5.0 | 6.2 | 0.7 | 0.7 | 5.4 | ||||||||||||||||||

| Other(f) |

(0.1 | ) | 6.3 | 6.9 | 9.6 | 3.3 | 0.5 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Net Income(g) |

$ | 82.5 | $ | 51.6 | $ | 66.8 | $ | (4.3 | ) | $ | (7.3 | ) | $ | 97.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Diluted Net Income Per Share |

$ | 1.17 | $ | 0.77 | $ | 1.01 | $ | (0.07 | ) | $ | (0.12 | ) | $ | 1.40 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Represents reversal of a portion of existing valuation allowances on net operating loss and other deferred tax benefits. |

| (b) | Represents (1) charges related to refinancing of our credit facilities in June 2016, including write-off of deferred loan fees and original issue discounts, payments of debt issuance costs and prepayment penalties, and (2) write-offs of deferred loan fees and original issue discounts in connection with the partial prepayment of our first lien term loan in July 2016. |

| (c) | Represents costs associated with reorganization and restructuring activities, business acquisitions, integration of acquired businesses and the implementation of the APF Way. Restructuring expenses primarily relate to costs associated with the restructure of the management team and consolidation of business unit operations in fiscal 2014. |