Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Essential Utilities, Inc. | d327302dex992.htm |

| 8-K - FORM 8-K - Essential Utilities, Inc. | d327302d8k.htm |

Exhibit 99.1

2017 Earnings

Guidance

Call

AQUASM

NYSE: WTR

January 17, 2017

Forward Looking Statement

This presentation contains in addition to historical information, forward looking statements based on assumptions made by management regarding future circumstances

over which the company may have little or no control, that involve risks, uncertainties and other factors that may cause actual results to be materially different from any future results expressed or implied by such forward-looking statements. These

factors include, among others, the following: general economic and business conditions; weather conditions affecting customers’ water usage or the company’s cost of operations; costs arising from changes in regulations; regulatory

treatment of rate increase requests; changes in the valuation of our investment in our joint venture in the Marcellus shale region; availability and cost of capital; the success of growth initiatives, including pending acquisitions; the ability to

generate earnings from capital investment; and other factors discussed in our Form 10-K for the fiscal year ended December 31, 2015, which is on file with the SEC. We undertake no obligation to publicly

update or revise any forward-looking statement.

Non-GAAP Reconciliation

For reconciliation of non-GAAP financial measures, see the Investor Relations section of the company’s Web site at www.aquaamerica.com

NYSE: WTR AQUASM 2

Today’s Presenters

Christopher Franklin

President & Chief Executive Officer

Dave Smeltzer

Executive Vice President & Chief Financial Officer

Brian Dingerdissen

Vice President, Chief of Staff & Investor Relations

NYSE: WTR AQUASM 3

Introduction

Christopher

Franklin

President and Chief Executive Officer

AQUASM

NYSE: WTR

Today’s Agenda

• 2016 Guidance

• Corporate Update

• Introduce 2017 Guidance

• Q&A Session

NYSE: WTR AQUASM 5

2016 Guidance

Dave

Smeltzer

Executive Vice President & Chief Financial Officer

AQUASM

NYSE: WTR

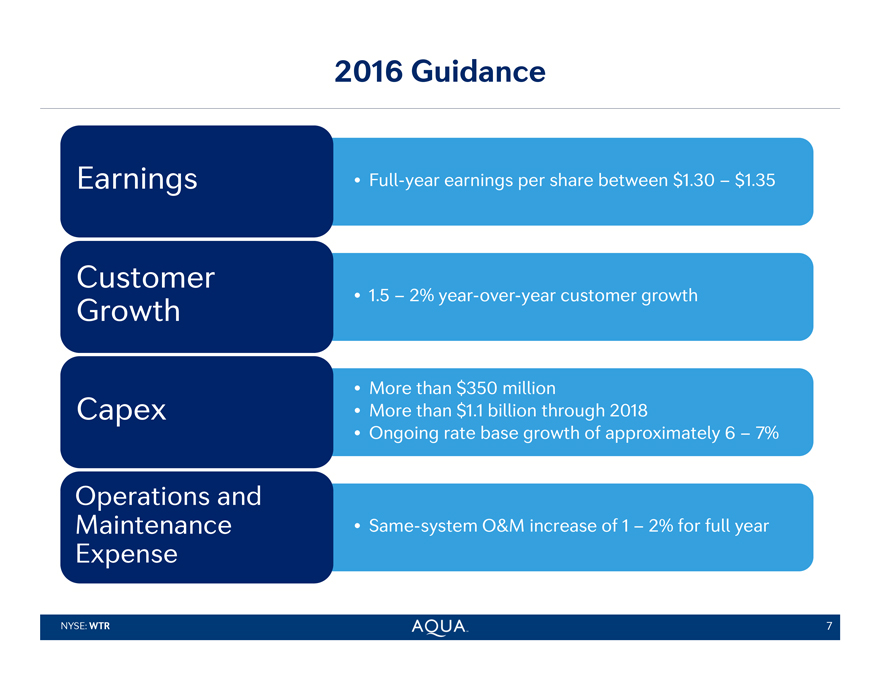

2016 Guidance

Earnings

Customer Growth

Capex

Operations and Maintenance Expense

• Full-year earnings per share between $1.30 –

$1.35

• 1.5 – 2% year-over-year customer growth

• More than

$350 million

• More than $1.1 billion through 2018

•

Ongoing rate base growth of approximately 6 – 7%

• Same-system O&M increase of 1 – 2% for full year

NYSE: WTR AQUASM 7

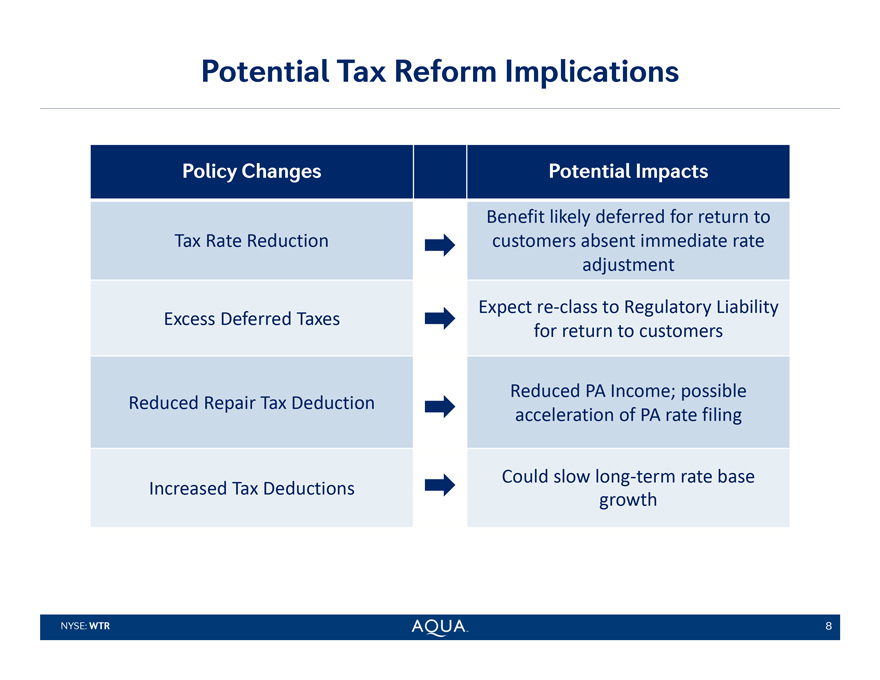

Potential Tax Reform Implications

Policy Changes

Tax Rate Reduction

Excess Deferred Taxes

Reduced Repair Tax Deduction

Increased Tax Deductions

Potential Impacts

Benefit likely deferred for return to customers absent immediate rate adjustment

Expect

re-class to Regulatory Liability for return to customers

Reduced PA Income; possible acceleration of PA rate filing

Could slow long-term rate base growth

NYSE: WTR AQUASM 8

Corporate Update

Christopher Franklin

President and Chief Executive Officer

AQUASM

NYSE: WTR

Current Market-Based Activities

Decisions by Segment

Segment

Transportation Services

Construction

Tri-State Grouting

Field Services

Cross-connection

Consulting/Training

Limited O&M

Home Services

Outcome

Divested

Contract Ended

Divested

Exiting in 2017

Divesting in February 2017

Divesting in February 2017

Maintain

Maintain

$35M of Revenue in 2015 vs. $4M Expected in 2017, with a Positive Contribution to Net

Income

NYSE: WTR AQUASM 10

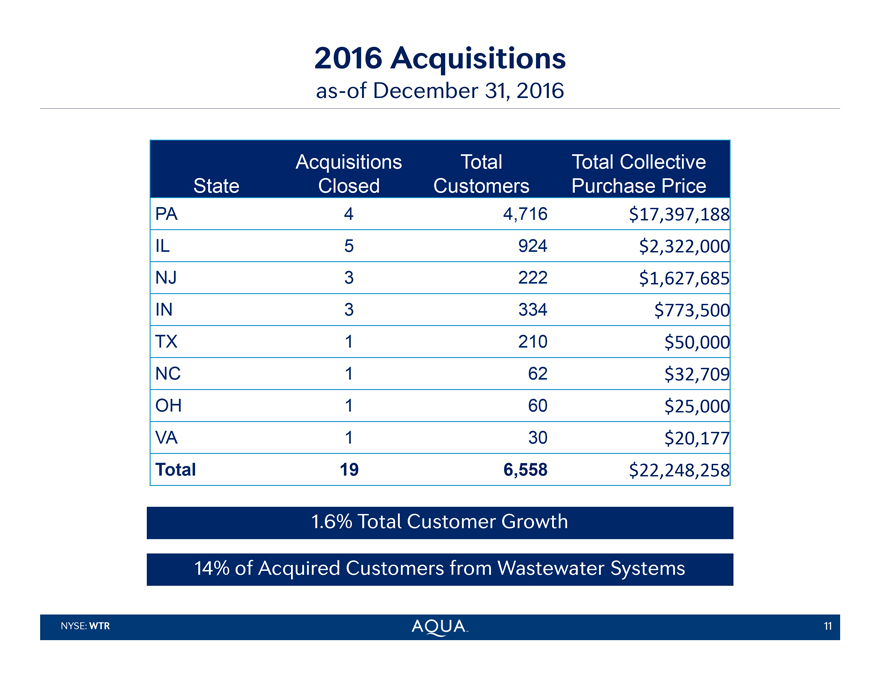

2016 Acquisitions

as-of December 31, 2016

State

Acquisitions Closed

Total Customers

Total Collective Purchase Price

PA 4 4,716 $17,397,188

IL 5 924 $2,322,000

NJ 3 222 $1,627,685

IN 3 334 $773,500

TX 1 210 $50,000

NC 1 62 $32,709

OH 1 60 $25,000

VA 1 30 $20,177

Total 19 6,558 $22,248,258

1.6% Total Customer Growth

14% of Acquired Customers from Wastewater Systems

NYSE: WTR AQUASM 11

2017 Guidance

Christopher

Franklin

President and Chief Executive Officer

AQUASM NYSE: WTR

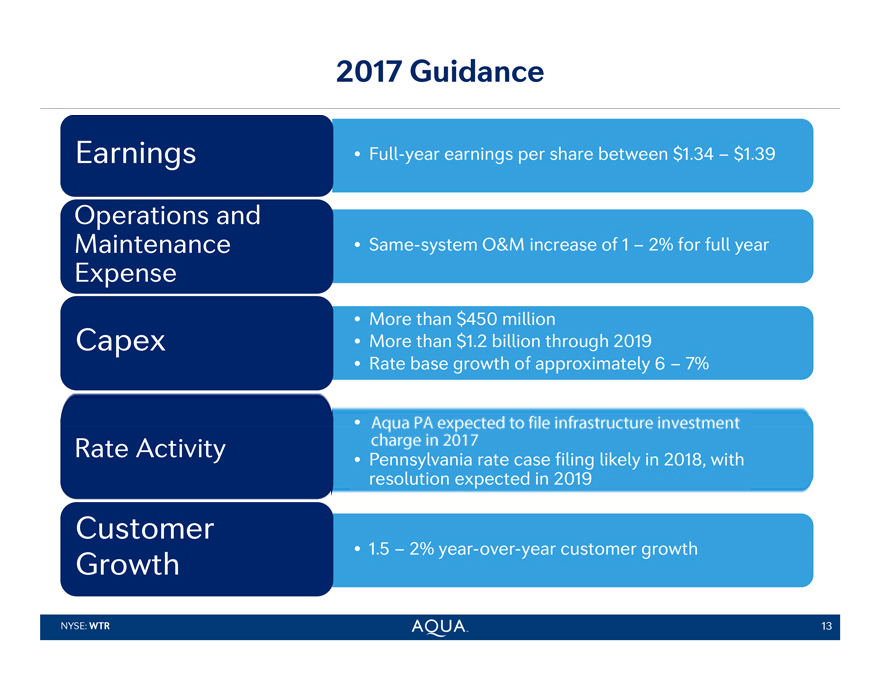

2017 Guidance

Earnings

Full-year earnings per share between $1.34 – $1.39

Operations and

Maintenance Expense

Same-system O&M increase of 1 – 2% for full year

Capex

More than $450 million

More than $1.2 billion through 2019

Rate base growth of approximately 6 – 7%

Aqua PA expected to file infrastructure investment charge in 2017

Rate

Activity

Pennsylvania rate case filing likely in 2018, with resolution expected in 2019

Customer Growth

1.5 – 2% year-over-year customer growth

NYSE: WTR AQUASM 13

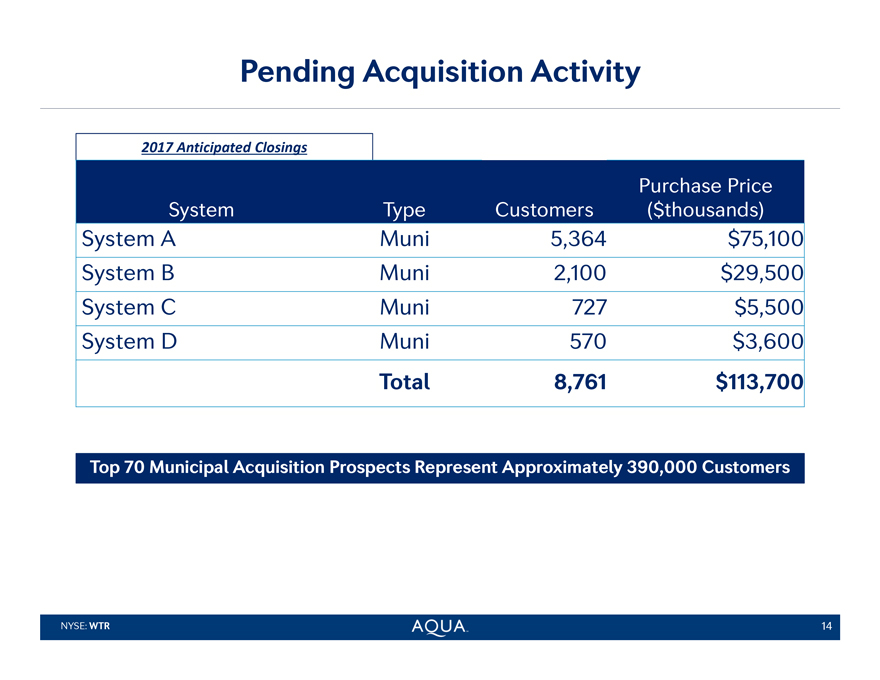

Pending Acquisition Activity

2017 Anticipated Closings System Type Customers Purchase Price ($thousands)

System A

Muni 5,364 $75,100

System B Muni 2,100 $29,500

System C Muni 727 $5,500

System D Muni 570 $3,600

Total 8,761 $113,700

Top 70 Municipal Acquisition Prospects Represent Approximately 390,000 Customers

NYSE: WTR

AQUASM 14

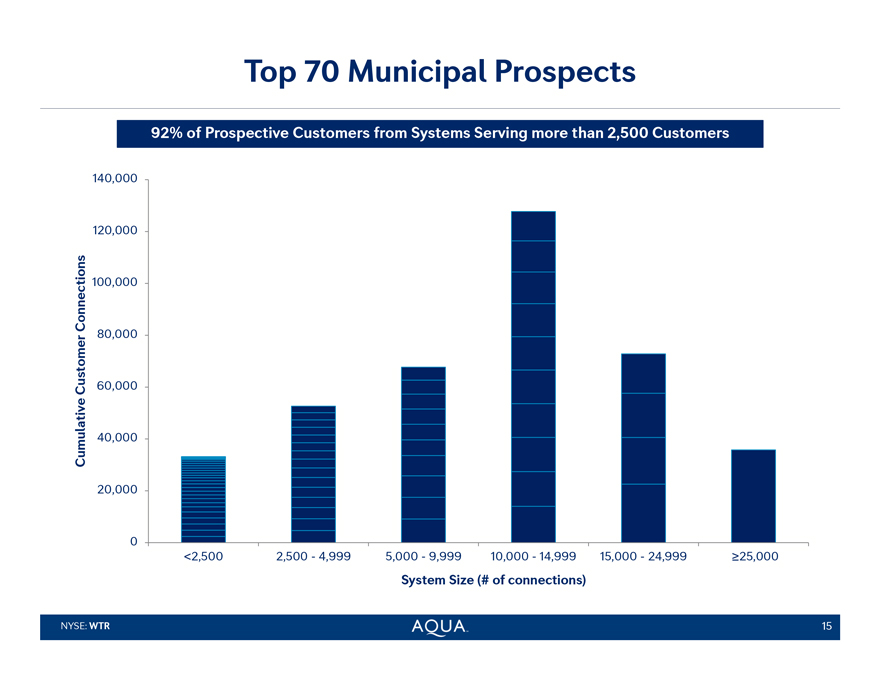

Top 70 Municipal Prospects

92% of Prospective Customers from Systems Serving more than 2,500 Customers

Cumulative Customer Connections

140,000

120,000

100,000

80,000

60,000

40,000

20,000

0

<2,500 2,500 - 4,999 5,000 - 9,999 10,000 - 14,999 15,000 - 24,999 ³25,000

System Size (# of connections)

NYSE: WTR AQUASM 15

Q&A Session

AQUASM

NYSE: WTR

Thank You for Attending Aqua America’s 2017 Earnings Guidance Call

2016 Full-year and Fourth Quarter Earnings

Conference Call and Webcast

Thursday, February 23, 2017

For more information contact:

Brian Dingerdissen

Vice President, Chief of Staff and Investor Relations

610.645.1191

NYSE: WTR AQUASM 17

Appendix

AQUASM

NYSE: WTR

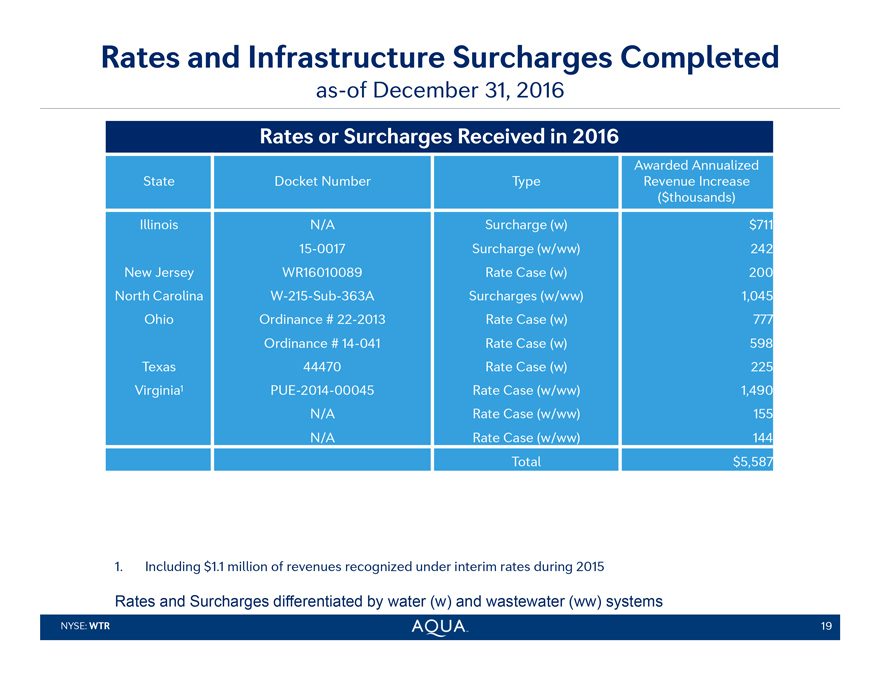

Rates and Infrastructure Surcharges Completed

as-of December 31, 2016

Rates or Surcharges

Received in 2016

State Docket Number Type

Awarded Annualized

Revenue Increase

($thousands)

Illinois N/A Surcharge (w) $711

15-0017 Surcharge

(w/ww) 242

New Jersey WR16010089 Rate Case (w) 200

North Carolina W-215-Sub-363A Surcharges (w/ww) 1,045

Ohio

Ordinance # 22-2013 Rate Case (w) 777

Ordinance # 14-041 Rate Case (w) 598

Texas 44470 Rate Case (w) 225

Virginia1

PUE-2014-00045 Rate Case (w/ww) 1,490

N/A Rate Case (w/ww) 155

N/A Rate Case (w/ww) 144

Total $5,587

1. Including $1.1 million of revenues recognized under interim rates during 2015

Rates

and Surcharges differentiated by water (w) and wastewater (ww) systems

NYSE: WTR AQUASM 19

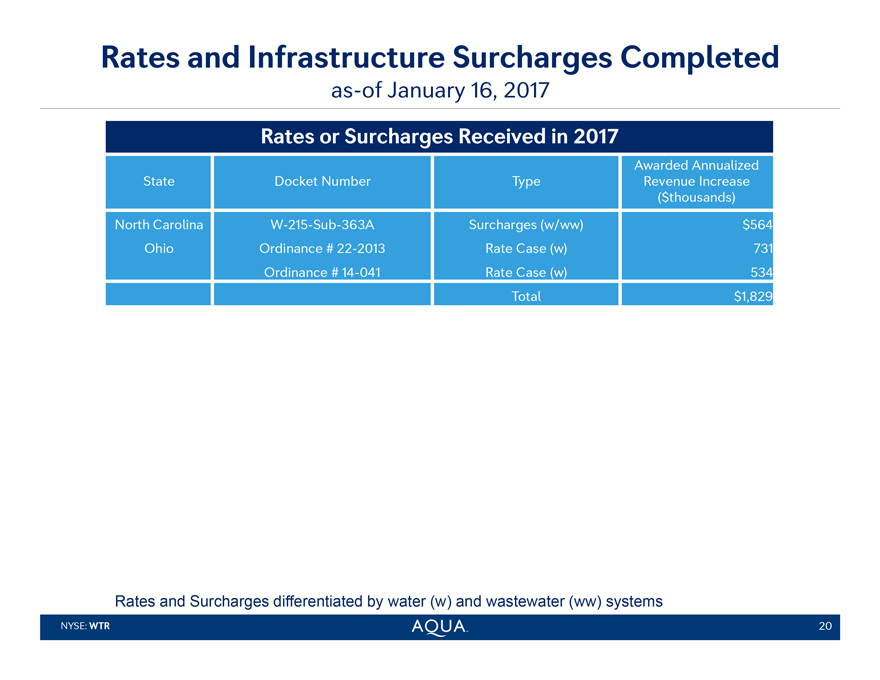

Rates and Infrastructure Surcharges Completed

as-of January 16, 2017

Rates or Surcharges

Received in 2017

State Docket Number Type

Awarded Annualized

Revenue Increase

($thousands)

North Carolina W-215-Sub-363A Surcharges (w/ww) $564

Ohio Ordinance # 22-2013 Rate Case (w) 731

Ordinance # 14-041 Rate Case (w) 534

Total $1,829

Rates and Surcharges differentiated by water (w) and wastewater (ww) systems

NYSE: WTR AQUASM 20

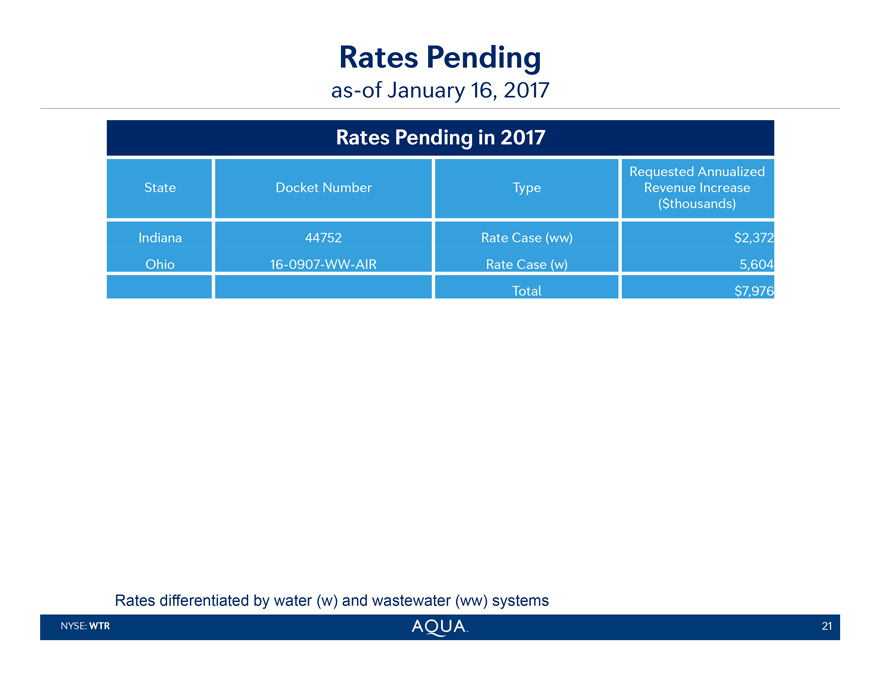

Rates Pending

as-of January 16, 2017

Rates Pending in 2017

State Docket Number Type

Requested Annualized

Revenue Increase

($thousands)

Indiana 44752 Rate Case (ww) $2,372

Ohio 16-0907-WW-AIR Rate Case (w) 5,604

Total $7,976

Rates differentiated by water (w) and wastewater (ww) systems

NYSE: WTR AQUASM 21

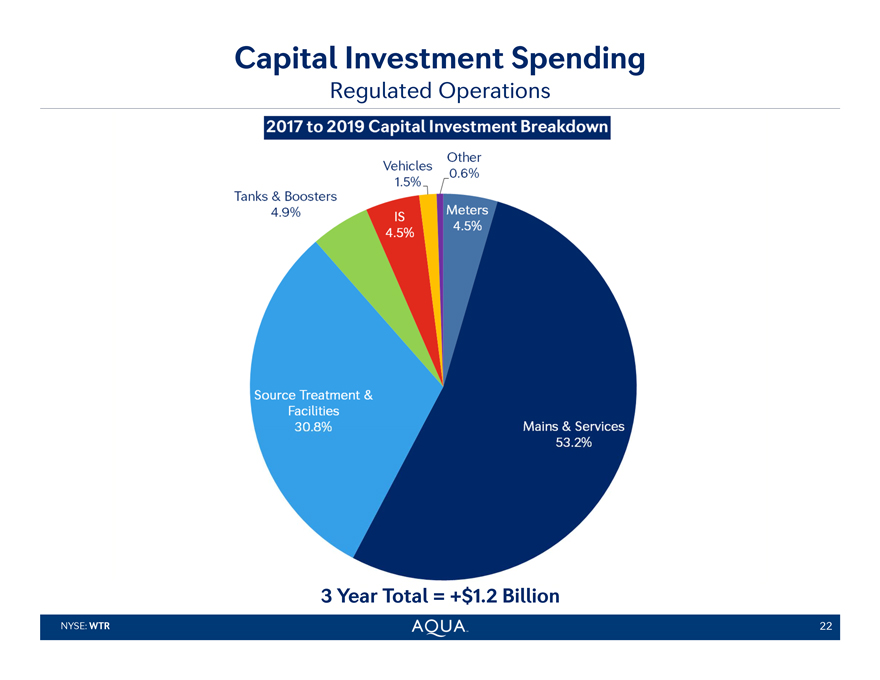

Capital Investment Spending

Regulated Operations

2017 to 2019 Capital Investment Breakdown

Tanks & Boosters 4.9%

Vehicles 1.5%

Other 0.6%

IS 4.5%

Meters 4.5%

Source Treatment & Facilities 30.8%

Mains & Services 53.2%

3 Year Total = +$1.2 Billion

NYSE: WTR AQUASM 22