Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - INTEGRA LIFESCIENCES HOLDINGS CORP | d316863dex991.htm |

| EX-2.1 - EX-2.1 - INTEGRA LIFESCIENCES HOLDINGS CORP | d316863dex21.htm |

| 8-K - 8-K - INTEGRA LIFESCIENCES HOLDINGS CORP | d316863d8k.htm |

Integra LifeSciences Acquisition of Derma Sciences January 11, 2017 Ex99.2

Safe Harbor / Non-GAAP Financial Measures This presentation contains “forward-looking statements”, including statements regarding the proposed transaction and the ability to consummate the proposed transaction. Statements in this document may contain, in addition to historical information, certain forward-looking statements. Some of these forward-looking statements may contain words like “believe,” “may,” “could,” “would,” “might,” “possible,” “should,” “expect,” “intend,” “plan,” “anticipate,” or “continue,” the negative of these words, other terms of similar meaning or they may use future dates. Forward-looking statements in this document include without limitation statements regarding the planned completion of the transaction. These statements are subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including, but not limited to, risks and uncertainties related to the following: statements regarding the anticipated benefits of the proposed transactions contemplated by the definitive agreement by and among Integra, Integra Derma, Inc., a wholly owned subsidiary of Integra (“Integra Derma”) and Derma Sciences (the “Proposed Transactions”); statements regarding the anticipated timing of filings and approvals relating to the Proposed Transactions; statements regarding the expected timing of the completion of the Proposed Transactions; the percentage of Derma’s stockholders tendering their shares in the Offer; the possibility that competing offers will be made; the possibility that various closing conditions for the Proposed Transactions may not be satisfied or waived; the effects of disruption caused by the Proposed Transactions making it more difficult to maintain relationships with employees, vendors and other business partners; stockholder litigation in connection with the Proposed Transactions; and other risks and uncertainties discussed in the Company’s filings with the SEC, including the “Risk Factors” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 and subsequent quarterly reports on Form 10-Q, as well as the Schedule TO and related tender offer documents to be filed by Parent and Merger Sub and the Solicitation/Recommendation Statement to be filed by the Company. The Company undertakes no obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as expressly required by law. All forward-looking statements in this document are qualified in their entirety by this cautionary statement. Certain non-GAAP financial measures are disclosed in this presentation. Unless otherwise noted, all references to gross margin, SG&A, EBITDA and EPS refer to adjusted measures. A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided in the appendix of the Third Quarter 2016 Earnings Call Presentation and in the Investor Day Presentation, dated November 2015, available on our website, www.integralife.com. This presentation is neither an offer to purchase nor a solicitation of an offer to sell securities. The tender offer for the outstanding shares of Derma Sciences common stock and preferred stock described in this presentation has not commenced. At the time the tender offer is commenced, Integra and Integra Derma will file a Tender Offer Statement on Schedule TO with the SEC and Derma Sciences will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to Derma Sciences’ security holders at no expense to them. In addition, all of those materials (and all other offer documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

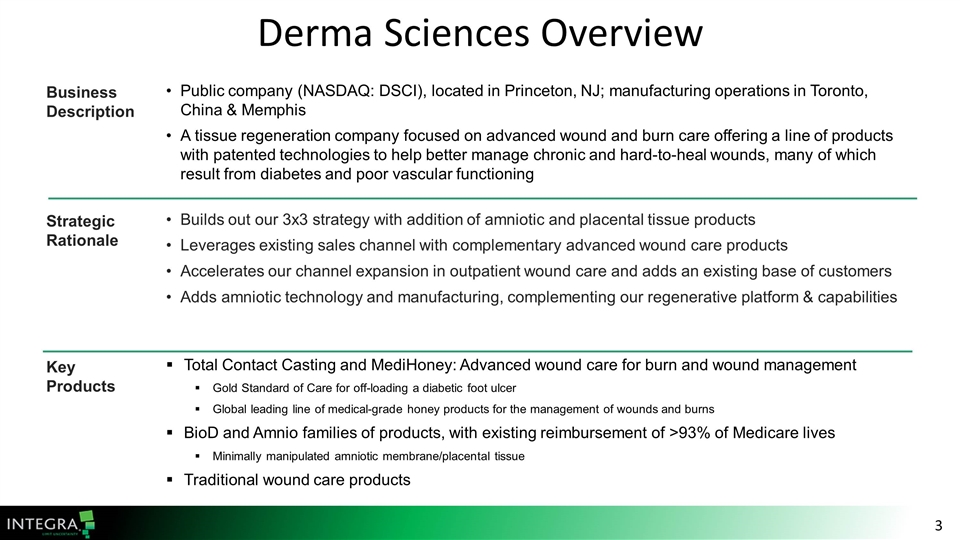

Derma Sciences Overview Business Description Key Products Strategic Rationale Public company (NASDAQ: DSCI), located in Princeton, NJ; manufacturing operations in Toronto, China & Memphis A tissue regeneration company focused on advanced wound and burn care offering a line of products with patented technologies to help better manage chronic and hard-to-heal wounds, many of which result from diabetes and poor vascular functioning Builds out our 3x3 strategy with addition of amniotic and placental tissue products Leverages existing sales channel with complementary advanced wound care products Accelerates our channel expansion in outpatient wound care and adds an existing base of customers Adds amniotic technology and manufacturing, complementing our regenerative platform & capabilities Total Contact Casting and MediHoney: Advanced wound care for burn and wound management Gold Standard of Care for off-loading a diabetic foot ulcer Global leading line of medical-grade honey products for the management of wounds and burns BioD and Amnio families of products, with existing reimbursement of >93% of Medicare lives Minimally manipulated amniotic membrane/placental tissue Traditional wound care products

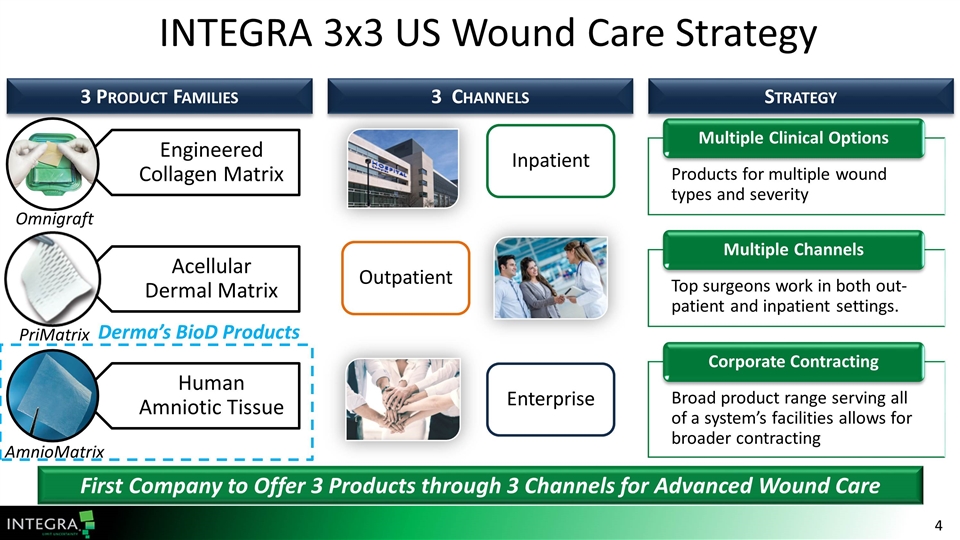

INTEGRA 3x3 US Wound Care Strategy 3 Product Families First Company to Offer 3 Products through 3 Channels for Advanced Wound Care 3 Channels Strategy Products for multiple wound types and severity Multiple Clinical Options Inpatient Broad product range serving all of a system’s facilities allows for broader contracting Corporate Contracting Enterprise Top surgeons work in both out-patient and inpatient settings. Multiple Channels Outpatient Omnigraft PriMatrix AmnioMatrix Derma’s BioD Products Engineered Collagen Matrix Acellular Dermal Matrix Human Amniotic Tissue

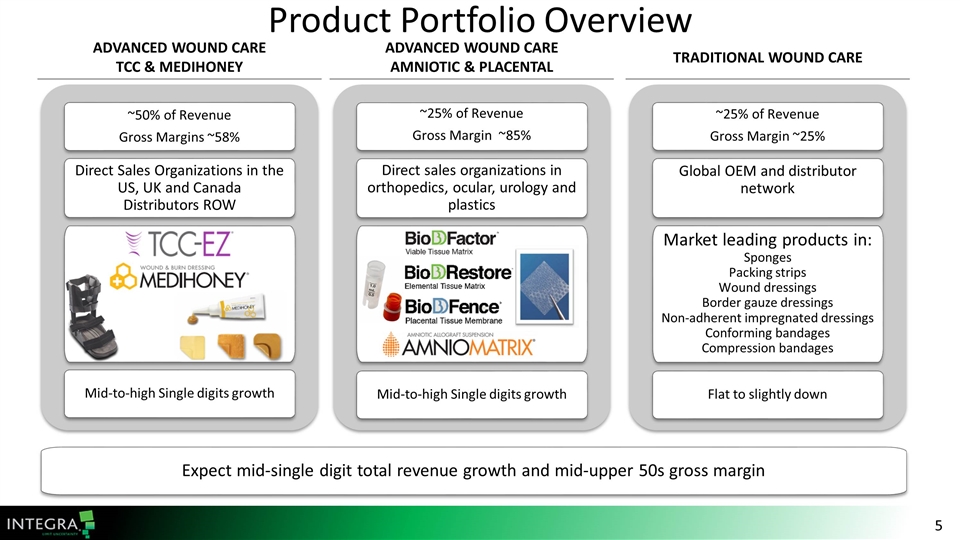

Advanced Wound Care TCC & MediHoney Traditional Wound Care Advanced Wound Care Amniotic & Placental Product Portfolio Overview ~50% of Revenue Gross Margins ~58% Direct Sales Organizations in the US, UK and Canada Distributors ROW Mid-to-high Single digits growth ~25% of Revenue Gross Margin ~85% Direct sales organizations in orthopedics, ocular, urology and plastics Mid-to-high Single digits growth ~25% of Revenue Gross Margin ~25% Global OEM and distributor network Market leading products in: Sponges Packing strips Wound dressings Border gauze dressings Non-adherent impregnated dressings Conforming bandages Compression bandages Flat to slightly down Expect mid-single digit total revenue growth and mid-upper 50s gross margin

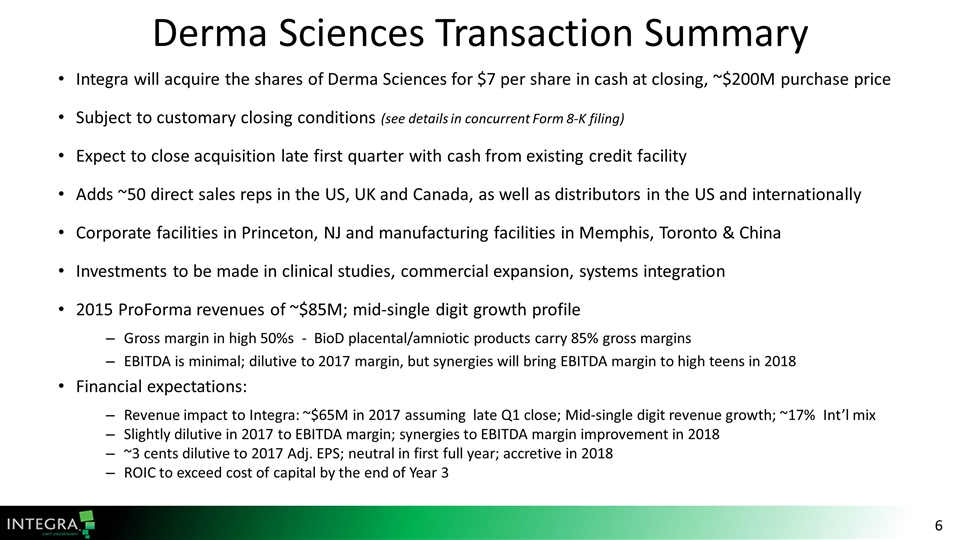

Derma Sciences Transaction Summary Integra will acquire the shares of Derma Sciences for $7 per share in cash at closing, ~$200M purchase price Subject to customary closing conditions (see details in concurrent Form 8-K filing) Expect to close acquisition late first quarter with cash from existing credit facility Adds ~50 direct sales reps in the US, UK and Canada, as well as distributors in the US and internationally Corporate facilities in Princeton, NJ and manufacturing facilities in Memphis, Toronto & China Investments to be made in clinical studies, commercial expansion, systems integration 2015 ProForma revenues of ~$85M; mid-single digit growth profile Gross margin in high 50%s - BioD placental/amniotic products carry 85% gross margins EBITDA is minimal; dilutive to 2017 margin, but synergies will bring EBITDA margin to high teens in 2018 Financial expectations: Revenue impact to Integra: ~$65M in 2017 assuming late Q1 close; Mid-single digit revenue growth; ~17% Int’l mix Slightly dilutive in 2017 to EBITDA margin; synergies to EBITDA margin improvement in 2018 ~3 cents dilutive to 2017 Adj. EPS; neutral in first full year; accretive in 2018 ROIC to exceed cost of capital by the end of Year 3

Acquisition Summary Acquisition of Derma Sciences is a strong strategic fit Builds out our 3x3 strategy with addition of amniotic and placental tissue products Leverages existing sales channel with complementary advanced wound care products Accelerates our channel expansion in outpatient wound care and adds an existing base of customers Adds amniotic technology and manufacturing, complementing our regenerative platform & capabilities Opportunity to Invest in Leadership with Differentiated Regenerative Technology Portfolio Investments in expanding commercial channel for inpatient and outpatient advanced wound care Investments in clinical evidence to support health economics and clinical outcomes for additional indications and reimbursement coverage