Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OPKO HEALTH, INC. | d315559d8k.htm |

Exhibit 99.1

|

|

Diagnostics & Pharmaceuticals for Large Markets with Unmet Needs

January 2017 NASDAQ: OPK

|

|

FORWARD-LOOKING STATEMENTS

This presentation contains “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipates,” “believes,” “should,” “intends,” “estimates,” “potential,” and other words of similar meaning, including statements regarding our estimated revenues and financial projections, expected milestones and royalties from the outlicense of our products, our ability to achieve high levels of growth, the potential for our products under development, the potential of the 4Kscore® to influence 89% of biopsy decisions and predict the risk of aggressive prostate cancer, our ability to develop, test and launch new products, the expected timing of the clinical studies and regulatory approval for our products under development, the outcome of our clinical trials and validation studies and that such outcomes will support marketing approval or commercialization, the expected market penetration and size of the market for our products, including without limitation, Rolapitant, Rayaldee®, hGH-CTP, the 4Kscore, Factor VIIa-CTP, oxyntomodulin the SARM candidate, and our point-of-care diagnostic products, the potential benefits of our products under development, including whether the 4Kscore will predict the risk of distant metastases and result in 40-55% cost savings, the expected submission dates for the PMA for PSA and 510k for testosterone and expected launch date for each, that oxyntomodulin will provide superior long-term therapy for obesity and Type II diabetes patients, our ability to successfully commercialize our product candidates such as Rolapitant, the 4Kscore, hGH-CTP and Rayaldee and whether Rayaldee will take significant market share in stage 3 and 4 CKD patients with SHPT, whether Rayaldee will raise serum total 25-hydroxyvitamin D (25D) more effectively than any over-the-counter (OTC) or prescription (Rx) products currently marketed without the risk of hypercalcemia, our ability to double our sales force and the timeline for doing so, our ability to obtain commercial and Part D coverage for 70-80% of U.S. covered lives by mid-2017, our ability to develop Rayaldee for new indications including stage 5 CKD and the timeline for doing so, expectations surrounding the sensitivity analysis for primary and secondary endpoints for the adult hGH-CTP study, whether the results of the analysis and any post-hoc efficacy analysis will be positive, whether the FDA would consider the analysis and whether the drug will be approvable, whether we will be required to make any changes to our development plans for hGH-CTP, expectations regarding patent coverage, the expected timing for commencing, completing and announcing results for our clinical trials, the timing for release of trial data and seeking and obtaining FDA and European regulatory approvals as well as reimbursement coverage for our products, our ability to obtain Medicare coverage for the 4Kscore and whether we have enough scientific and clinical data to justify a positive coverage determination, expectations about our animal health business and the introduction of several OTC and prescription products for the animal market, and the timing of commercial launch of our product candidates. These forward-looking statements are only predictions and reflect our views as of the date they were made, and we undertake no obligation to update such statements. Such statements are subject to many risks and uncertainties that could cause our activities or actual results to differ materially from the activities and results anticipated in forward looking statements, including integration challenges with Bio-Reference and other acquired businesses, risks inherent in funding, developing and obtaining regulatory approvals of new, commercially viable and competitive products and treatments, the success of our collaboration with Pfizer, general market factors, competitive product development, product availability, federal and state regulations and legislation, delays associated with development of novel technologies, unexpected difficulties and delays in validating and testing product candidates, the regulatory process for new products and indications, manufacturing issues that may arise, the cost of funding lengthy research programs, the need for and availability of additional capital, the possibility of infringing a third party’s patents or other intellectual property rights, the uncertainty of obtaining patents covering our products and processes and in successfully enforcing them against third parties, and the possibility of litigation, among other factors, including all of the risks identified under the heading Risk Factors in our Annual Report on Form 10-K and other filings with the Securities and Exchange Commission.

2

|

|

A multinational biopharmaceutical and diagnostics company establishing important positions in large markets by leveraging its extensive health care industry, expertise and experience.

3

|

|

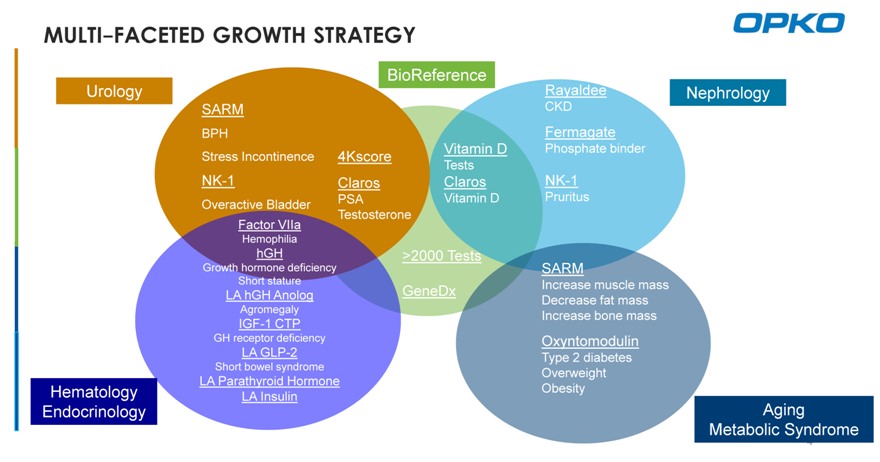

MULTI-FACETED GROWTH STRATEGY

Urology BioReference Rayaldee

Nephrology

SARM CKD BPH Fermagate Vitamin D Phosphate binder Stress Incontinence 4Kscore Tests

NK-1 Claros Claros NK-1

PSA Vitamin D Pruritus Overactive Bladder Testosterone Factor VIIa

Hemophilia

hGH >2000 Tests

Growth hormone deficiency SARM

Short stature Increase muscle mass LA hGH Anolog GeneDx Decrease fat mass Agromegaly Increase bone mass IGF-1 CTP

GH receptor deficiency Oxyntomodulin

LA GLP-2 Type 2 diabetes

Short bowel syndrome Overweight

LA Parathyroid Hormone

Hematology Obesity

LA Insulin

Endocrinology Aging Metabolic Syndrome

4

|

|

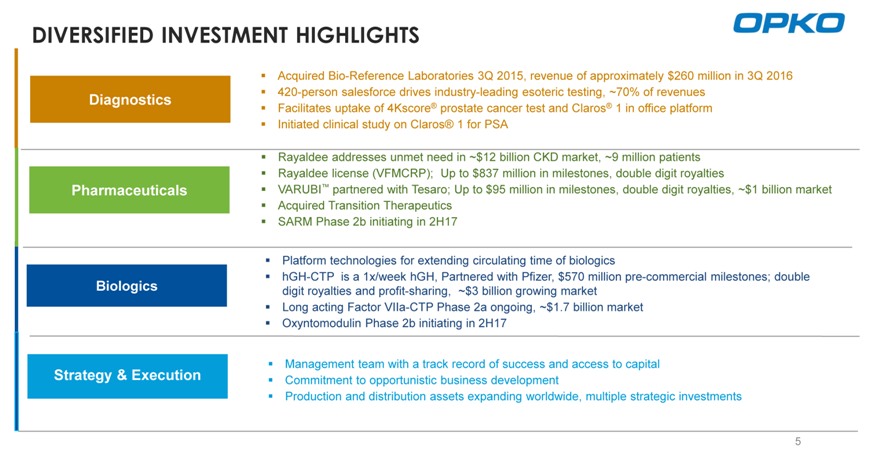

DIVERSIFIED INVESTMENT HIGHLIGHTS

Acquired Bio-Reference Laboratories 3Q 2015, revenue of approximately $260 million in 3Q 2016 420-person salesforce drives industry-leading esoteric testing, ~70% of revenues Facilitates uptake of 4Kscore® prostate cancer test and Claros® 1 in office platform Initiated clinical study on Claros® 1 for PSA

Rayaldee addresses unmet need in ~$12 billion CKD market, ~9 million patients Rayaldee license (VFMCRP); Up to $837 million in milestones, double digit royalties

VARUBI™ partnered with Tesaro; Up to $95 million in milestones, double digit royalties, ~$1 billion market Acquired Transition Therapeutics SARM Phase 2b initiating in 2H17

Platform technologies for extending circulating time of biologics hGH-CTP is a 1x/week hGH, Partnered with Pfizer, $570 million pre-commercial milestones; double digit royalties and profit-sharing, ~$3 billion growing market Long acting Factor VIIa-CTP Phase 2a ongoing, ~$1.7 billion market Oxyntomodulin Phase 2b initiating in 2H17

Management team with a track record of success and access to capital Commitment to opportunistic business development

Production and distribution assets expanding worldwide, multiple strategic investments

5

|

|

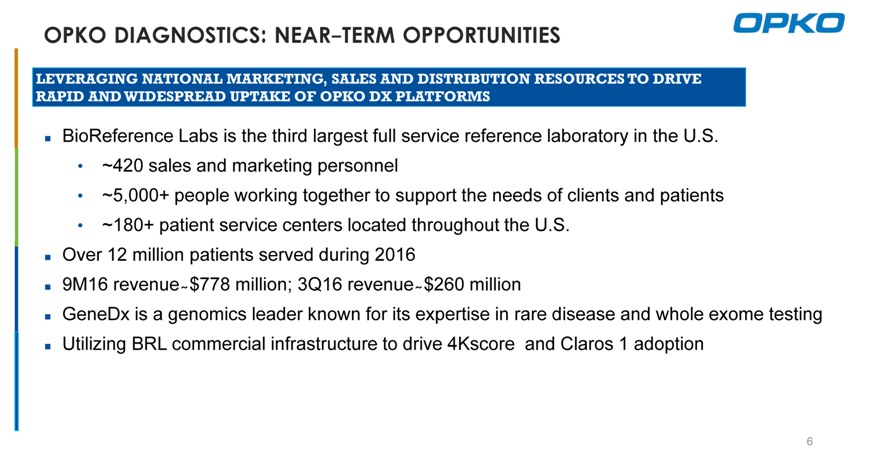

OPKO DIAGNOSTICS: NEAR-TERM OPPORTUNITIES

LEVERAGING NATIONAL MARKETING, SALES AND DISTRIBUTION RESOURCES TO DRIVE RAPID AND WIDESPREAD UPTAKE OF OPKO DX PLATFORMS

BioReference Labs is the third largest full service reference laboratory in the U.S.

~420 sales and marketing personnel

~5,000+ people working together to support the needs of clients and patients

~180+ patient service centers located throughout the U.S.

Over 12 million patients served during 2016

9M16 revenue ? $778 million; 3Q16 revenue ? $260 million

GeneDx is a genomics leader known for its expertise in rare disease and whole exome testing? Utilizing BRL commercial infrastructure to drive 4Kscore and Claros 1 adoption

6

|

|

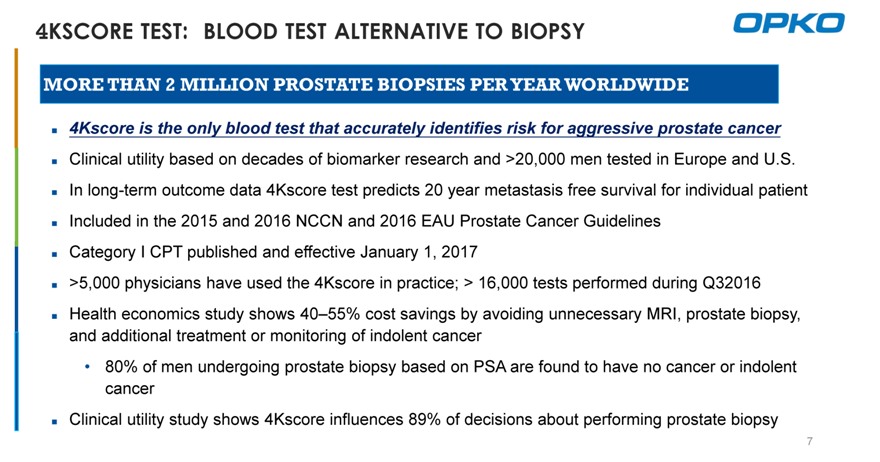

4KSCORE TEST: BLOOD TEST ALTERNATIVE TO BIOPSY

MORE THAN 2 MILLION PROSTATE BIOPSIES PER YEAR WORLDWIDE

4Kscore is the only blood test that accurately identifies risk for aggressive prostate cancer

Clinical utility based on decades of biomarker research and >20,000 men tested in Europe and U.S. In long-term outcome data 4Kscore test predicts 20 year metastasis free survival for individual patient Included in the 2015 and 2016 NCCN and 2016 EAU Prostate Cancer Guidelines Category I CPT published and effective January 1, 2017 >5,000 physicians have used the 4Kscore in practice; > 16,000 tests performed during Q32016 Health economics study shows 40–55% cost savings by avoiding unnecessary MRI, prostate biopsy, and additional treatment or monitoring of indolent cancer

80% of men undergoing prostate biopsy based on PSA are found to have no cancer or indolent cancer Clinical utility study shows 4Kscore influences 89% of decisions about performing prostate biopsy

7

|

|

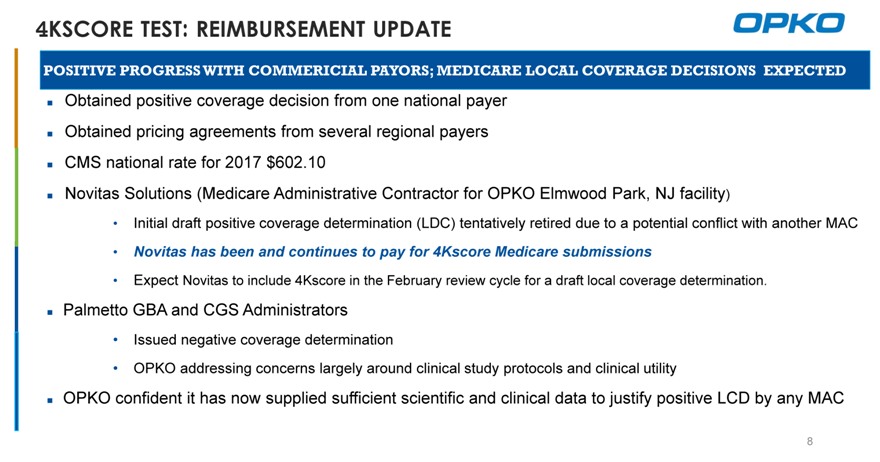

4KSCORE TEST: REIMBURSEMENT UPDATE

POSITIVE PROGRESS WITH COMMERICIAL PAYORS; MEDICARE LOCAL COVERAGE DECISIONS EXPECTED

Obtained positive coverage decision from one national payer? Obtained pricing agreements from several regional payers? CMS national rate for 2017 $602.10

Novitas Solutions (Medicare Administrative Contractor for OPKO Elmwood Park, NJ facility)

Initial draft positive coverage determination (LDC) tentatively retired due to a potential conflict with another MAC

Novitas has been and continues to pay for 4Kscore Medicare submissions

Expect Novitas to include 4Kscore in the February review cycle for a draft local coverage determination.

Palmetto GBA and CGS Administrators

Issued negative coverage determination

OPKO addressing concerns largely around clinical study protocols and clinical utility

OPKO confident it has now supplied sufficient scientific and clinical data to justify positive LCD by any MAC

8

|

|

CLAROS 1 PLATFORM ADDRESSES LARGE POINT OF CARE TEST MARKET

25M PSA TESTS IN THE US ANNUALLY; $625M MARKET OPPORTUNITY

Initiated clinical study for PSA test in January 2017

Filing modular PMA with FDA for PSA test expected in 1H2017 and expect testosterone 510(k) filing 2H2017 Claros 1 point of care platform will leverage BioReference Labs distribution and marketing Menu expansion following initial FDA filings

9

|

|

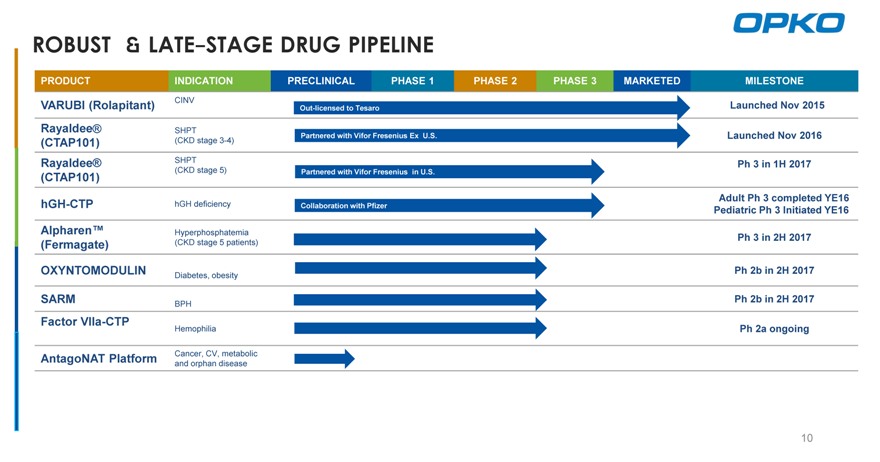

ROBUST & LATE-STAGE DRUG PIPELINE

PRODUCT INDICATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 MARKETED MILESTONE

VARUBI (Rolapitant) CINV Out-licensed to Tesaro Launched Nov 2015

Rayaldee® SHPT

Partnered with Vifor Fresenius Ex U.S. Launched Nov 2016

(CTAP101) (CKD stage 3-4)

Rayaldee® SHPT Ph 3 in 1H 2017

(CKD stage 5) Partnered with Vifor Fresenius in U.S.

(CTAP101)

Adult Ph 3 completed YE16

hGH-CTP hGH deficiency Collaboration with Pfizer

Pediatric Ph 3 Initiated YE16

Alpharen™ Hyperphosphatemia

Ph 3 in 2H 2017

(Fermagate) (CKD stage 5 patients)

OXYNTOMODULIN Ph 2b in 2H 2017

Diabetes, obesity

SARM Ph 2b in 2H 2017

BPH

Factor VIIa-CTP

Hemophilia Ph 2a ongoing

AntagoNAT Platform Cancer, CV, metabolic and orphan disease

10

|

|

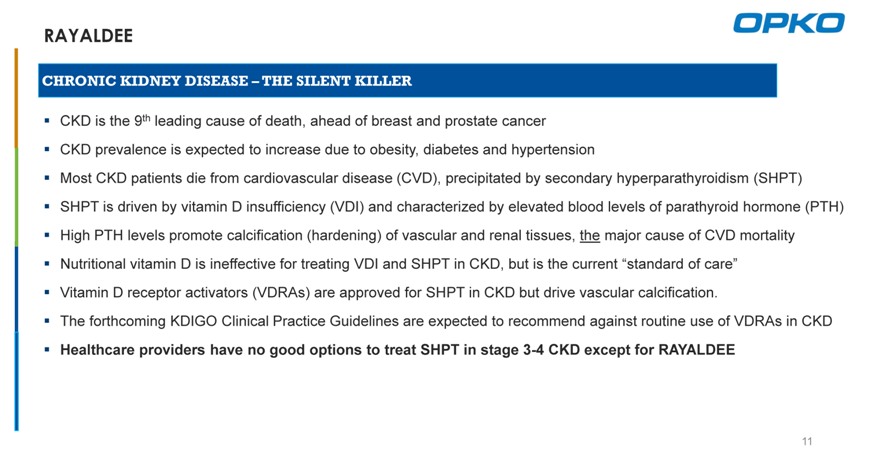

RAYALDEE

CHRONIC KIDNEY DISEASE – THE SILENT KILLER

CKD is the 9th leading cause of death, ahead of breast and prostate cancer CKD prevalence is expected to increase due to obesity, diabetes and hypertension

Most CKD patients die from cardiovascular disease (CVD), precipitated by secondary hyperparathyroidism (SHPT) SHPT is driven by vitamin D insufficiency (VDI) and characterized by elevated blood levels of parathyroid hormone (PTH) High PTH levels promote calcification (hardening) of vascular and renal tissues, the major cause of CVD mortality Nutritional vitamin D is ineffective for treating VDI and SHPT in CKD, but is the current “standard of care” Vitamin D receptor activators (VDRAs) are approved for SHPT in CKD but drive vascular calcification.

The forthcoming KDIGO Clinical Practice Guidelines are expected to recommend against routine use of VDRAs in CKD

Healthcare providers have no good options to treat SHPT in stage 3-4 CKD except for RAYALDEE

11

|

|

RAYALDEE OVERVIEW

PRODUCT LAUNCHED NOVEMBER 29, 2016

Extended-Release (1x daily) oral formulation of 25D * addresses significant unmet need

3

FDA-approved for SHPT (elevated PTH) in patients with stage 3-4 CKD and VDI Reduces plasma PTH and increases serum 25D with a safety profile similar to placebo Minimal effects on serum calcium or phosphorus (key drivers of vascular calcification)

Expected to take significant market share in stage 3-4 CKD patients with SHPT & VDI (~12M patients in US)

Potential for new indications including stage 5 CKD, institutionalized elderly, osteoporosis and cancer

* 25-Hydroxyvitamin D3 or Calcifediol

12

|

|

RAYALDEE: SIMPLE POSITIONING

13

|

|

RAYALDEE COMMERCIALIZATION

70-person sales and marketing team launched Rayaldee in November 2016

Plans to nearly double the sales and marketing team in 2H17

Comprehensive ongoing market education campaign highlighting the unmet need re: SHPT

Leveraging KOL advocates in community outreach (i.e., Speaker Bureaus and Patient Advocacy)

Commercial and Part D insurance under contract for >50% of U.S. covered lives

Growing to 70-80% by mid-2017

Initial line extension plans

Clinical trials for stage 5 CKD to begin 1H17

CKD to begin 1H17

14

|

|

SARM–SELECTIVE ANDROGEN RECEPTOR MODULATOR TT701 -BENIGN PROSTATIC HYPERTROPHY (BPH)

ONCE DAILY ORAL TABLET

Phase 2 study of 350 male subjects for another indication showed significantly increased lean body mass and muscle strength and significant fat mass reduction with no change or lower prostate specific antigen (PSA) levels Animal studies resulted in decreased size of prostate Currently in Phase 2 study in prostate cancer patients who have undergone radical prostatectomy

NEXT STEP:

Begin Ph 2b trial to determine optimal dose to treat BPH

15

|

|

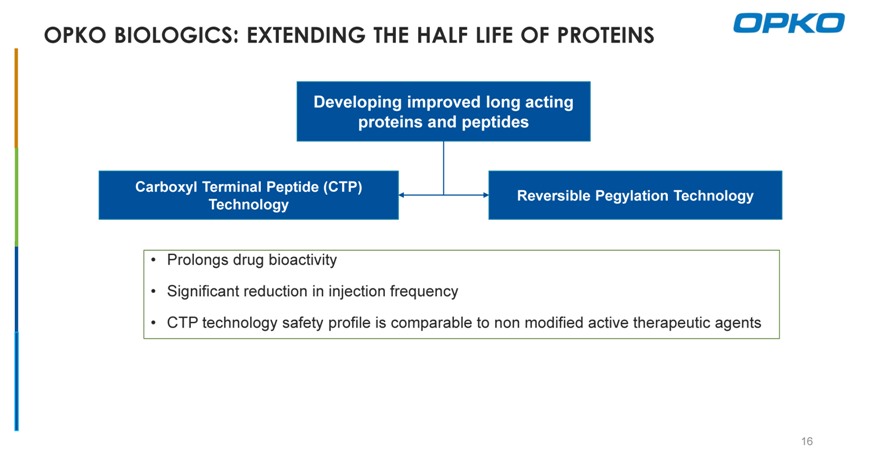

OPKO BIOLOGICS: EXTENDING THE HALF LIFE OF PROTEINS

Developing improved long acting proteins and peptides

Carboxyl Terminal Peptide (CTP)

Reversible Pegylation Technology Technology

Prolongs drug bioactivity

Significant reduction in injection frequency

CTP technology safety profile is comparable to non modified active therapeutic agents

16

|

|

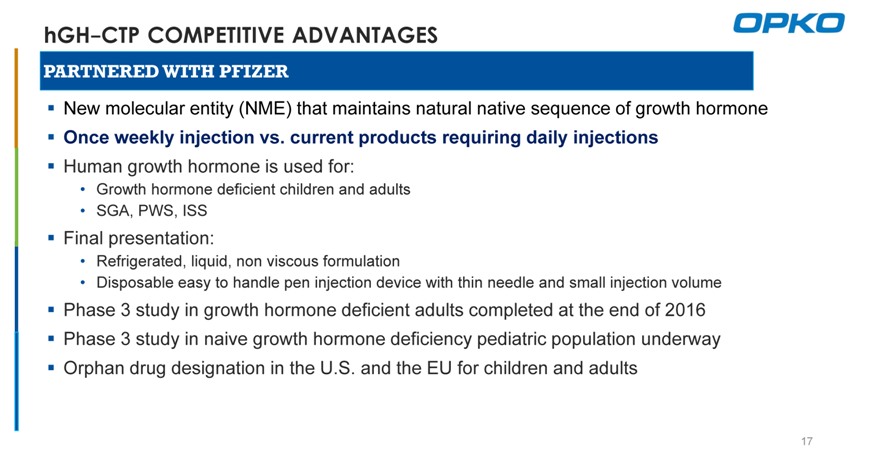

hGH-CTP COMPETITIVE ADVANTAGES

PARTNERED WITH PFIZER

New molecular entity (NME) that maintains natural native sequence of growth hormone

Once weekly injection vs. current products requiring daily injections

Human growth hormone is used for:

Growth hormone deficient children and adults

SGA, PWS, ISS

Final presentation:

Refrigerated, liquid, non viscous formulation

Disposable easy to handle pen injection device with thin needle and small injection volume

Phase 3 study in growth hormone deficient adults completed at the end of 2016 Phase 3 study in naive growth hormone deficiency pediatric population underway Orphan drug designation in the U.S. and the EU for children and adults

17

|

|

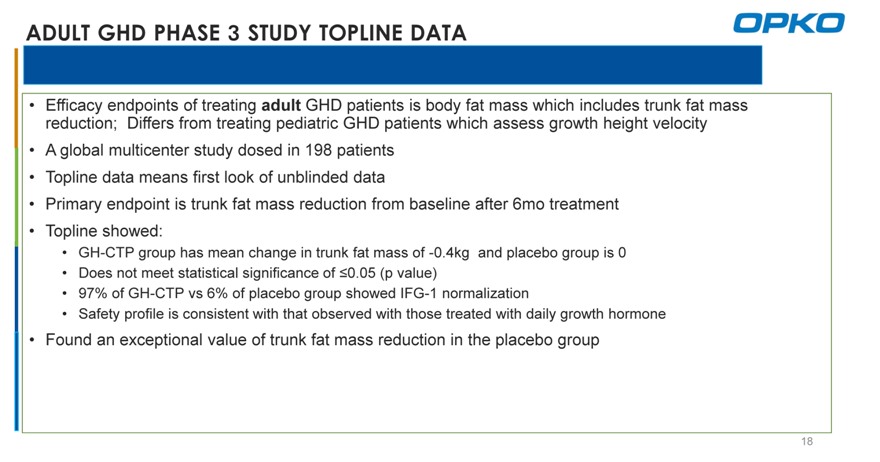

ADULT GHD PHASE 3 STUDY TOPLINE DATA

Efficacy endpoints of treating adult GHD patients is body fat mass which includes trunk fat mass reduction; Differs from treating pediatric GHD patients which assess growth height velocity

A global multicenter study dosed in 198 patients

Topline data means first look of unblinded data

Primary endpoint is trunk fat mass reduction from baseline after 6mo treatment

Topline showed:

GH-CTP group has mean change in trunk fat mass of -0.4kg and placebo group is 0

Does not meet statistical significance of ?0.05 (p value)

97% of GH-CTP vs 6% of placebo group showed IFG-1 normalization

Safety profile is consistent with that observed with those treated with daily growth hormone

Found an exceptional value of trunk fat mass reduction in the placebo group

18

|

|

NEXT STEP

Phase 3 adult GHD study

The exceptional data point warrants an outlier sensitivity analysis of the primary endpoint and related secondary endpoints

Developed a statistical plan for data sensitivity analysis to identify any outlier from the entire data set

Proceed with analysis; discuss with regulatory authorities

Communicated to all investigators and CROs involved in all on-going and newly initiated adult and pediatric GHD studies

19

|

|

GH-CTP PROGRAM STATUS

Initiated phase 3 pediatric GHD study in December 2016

220 patients, non-inferiority comparison of weekly GH-CTP to daily growth hormone

Global study CROs selected; sites initiated in December

Easy to use, disposable, refrigerated pen device

Phase 3 adult GHD and phase 2 pediatric GHD open label extension studies continue without interruption

No safety concerns

Switching to pen device in open label extensions

Initiating Pediatric GHD registration study in Japan

44 patients, comparison of weekly GH-CTP to daily growth hormone

Same pen device, dosage and formulation used in global study

Plan to commence global SGA study

20

|

|

LONG-ACTING FACTOR VIIA-CTP FOR HEMOPHILIA A & B

PHASE 2a STUDY UNDERWAY- $1.7 BILLION MARKET

Market growing 7% annually and only 25% of patients are treated

Current product (NovoSeven®) requires frequent IV doses

3-4 times a day during bleeding episodes

1-2 times a day for prophylactic treatment

In pharmacological studies in hemophilic mice and dogs, Factor VIIa-CTP:

Demonstrated potential for subcutaneous administration

Reduced frequency of injection during on-demand therapy

Enabled prophylactic treatment while reducing the injection frequency to 2-3 times a week

Orphan drug designation in the U.S. and the EU

21

|

|

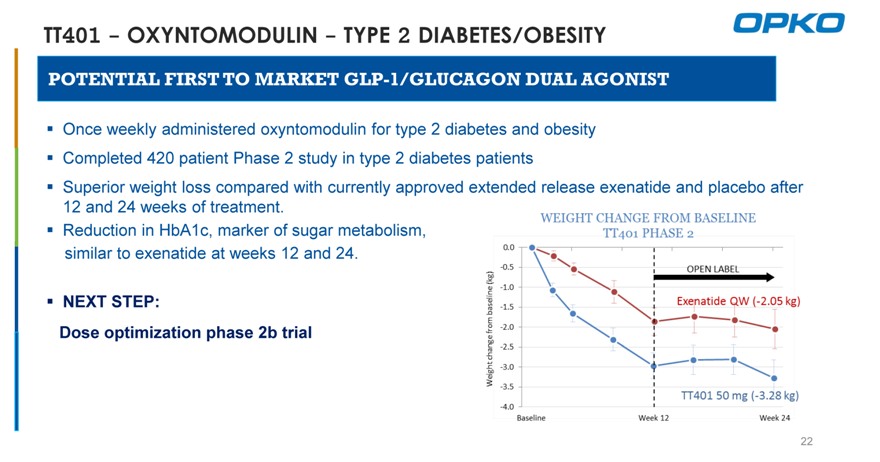

TT401—OXYNTOMODULIN—TYPE 2 DIABETES/OBESITY

POTENTIAL FIRST TO MARKET GLP-1/GLUCAGON DUAL AGONIST

Once weekly administered oxyntomodulin for type 2 diabetes and obesity? Completed 420 patient Phase 2 study in type 2 diabetes patients

Superior weight loss compared with currently approved extended release exenatide and placebo after 12 and 24 weeks of treatment.

Reduction in HbA1c, marker of sugar metabolism, similar to exenatide at weeks 12 and 24.

NEXT STEP:

Dose optimization phase 2b trial

22

|

|

OPKO ANIMAL HEALTH

UNIQUELY POSITIONED TO OFFER PRODUCTS FOR COMPANION ANIMALS; $60 BILLION U.S.MARKET

Minimal investment by utilizing existing product and manufacturing resources

Plans to introduce several OTC products 1Q17 and select prescription products in 4Q17 Oncology products being developed with OPKO Ireland for treatment of common cancers in pets

>6 million dogs and >6 million cats in the U.S. are diagnosed with cancer annually

Developed pet friendly formulations and packaging with specific labeling for different species Marketed through a logistics partner and select national and regional distributors Executive team has significant experience and success in developing and marketing animal health products (DVM Pharmaceuticals division of IVAX Corp.)

23

|

|

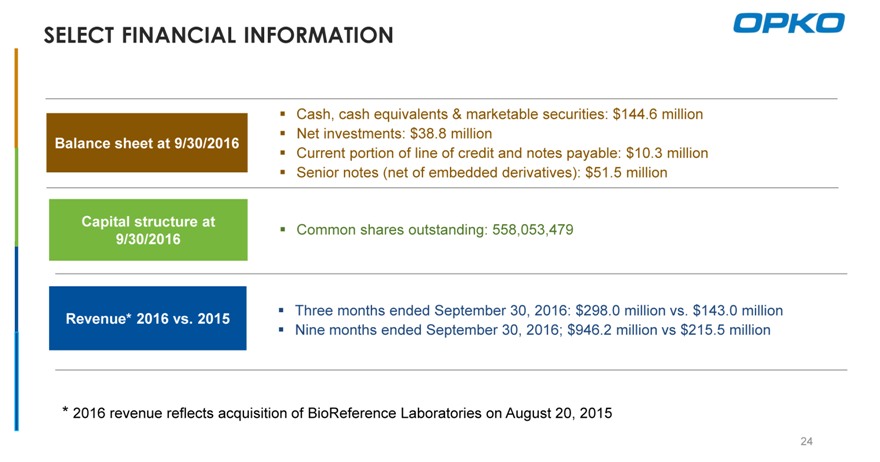

SELECT FINANCIAL INFORMATION

Cash, cash equivalents & marketable securities: $144.6 million? Net investments: $38.8 million

Balance sheet at 9/30/2016

Current portion of line of credit and notes payable: $10.3 million ? Senior notes (net of embedded derivatives): $51.5 million

Capital structure at

Common shares outstanding: 558,053,479

9/30/2016

Three months ended September 30, 2016: $298.0 million vs. $143.0 million

Revenue* 2016 vs. 2015

Nine months ended September 30, 2016; $946.2 million vs $215.5 million

* 2016 revenue reflects acquisition of BioReference Laboratories on August 20, 2015

24

|

|

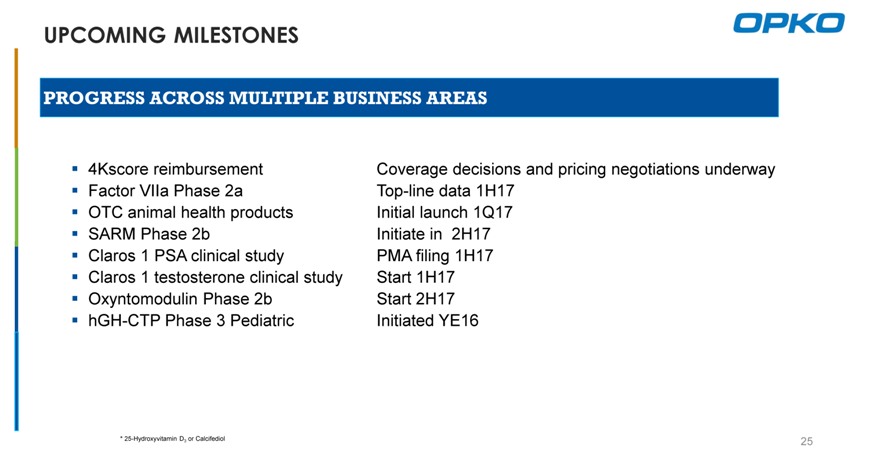

UPCOMING MILESTONES

PROGRESS ACROSS MULTIPLE BUSINESS AREAS

4Kscore reimbursement Coverage decisions and pricing negotiations underway Factor VIIa Phase 2a Top-line data 1H17 OTC animal health products Initial launch 1Q17 SARM Phase 2b Initiate in 2H17 Claros 1 PSA clinical study PMA filing 1H17 Claros 1 testosterone clinical study Start 1H17 Oxyntomodulin Phase 2b Start 2H17 hGH-CTP Phase 3 Pediatric Initiated YE16

* 25-Hydroxyvitamin D3 or Calcifediol

25

|

|

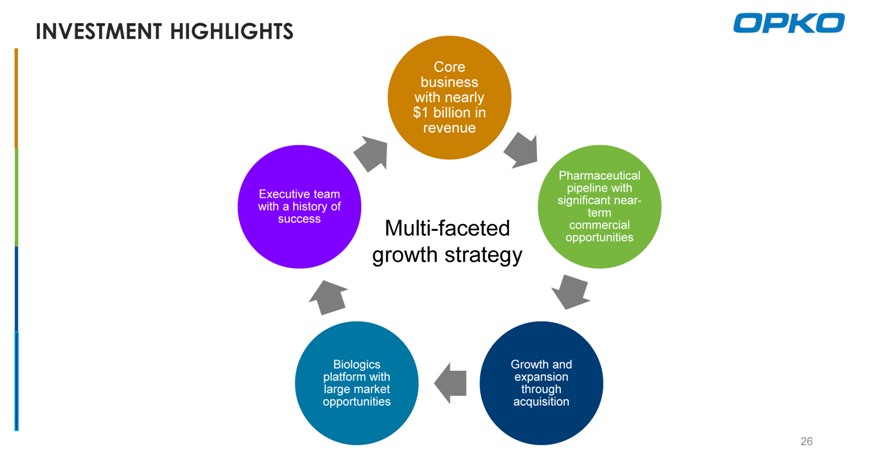

INVESTMENT HIGHLIGHTS

Core business with nearly $1 billion in revenue

Pharmaceutical pipeline with Executive team significant near-with a history of term success Multi-faceted opportunities commercial

growth strategy

platform Biologics with Growth expansion and large market through opportunities acquisition

26

|

|

THANK YOU