Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - MAGNACHIP SEMICONDUCTOR Corp | d293753dex993.htm |

| EX-99.1 - EX-99.1 - MAGNACHIP SEMICONDUCTOR Corp | d293753dex991.htm |

| 8-K - 8-K - MAGNACHIP SEMICONDUCTOR Corp | d293753d8k.htm |

Exhibit 99.2

Recent Developments

Fourth Quarter 2016 Preliminary Financial Results

As of January 10, 2017, we estimate revenue for the quarter ended December 31, 2016 to be approximately $180 million, and we estimate gross margin for the quarter ended December 31, 2016 to be approximately 25%. In addition, we estimate Adjusted EBITDA for the quarter ended December 31, 2016 to be higher than Adjusted EBITDA for the quarter ended September 30, 2016.

The Company’s preliminary financial results in the fourth quarter of 2016 benefited primarily from a richer-than-expected product mix and a larger-than-expected increase in foundry revenue. Gross profit margin in both the Foundry Services Group and the Standard Products Group improved sequentially in the fourth quarter of 2016, and gross profit margin for the AMOLED product line continued to exceed the corporate average in the fourth quarter of 2016.

These preliminary estimates are not a comprehensive statement of our financial results for the quarter or year ended December 31, 2016. These preliminary estimates have been prepared by, and are the responsibility of our management. Our independent registered public accounting firm, Samil PricewaterhouseCoopers has not audited, reviewed or compiled, examined or performed any procedures with respect to the estimated results, and has not expressed any opinion or any other form of assurance on the preliminary estimated financial results. Our actual results may differ materially from these estimates due to the completion of our accounting closing procedures, final adjustments and other developments that may arise between now and the time the financial results for the year ended December 31, 2016 are finalized. See “Safe Harbor for Forward-Looking Statements” in this Current Report.

We do not expect to disclose publicly whether or not our expectations have changed or to update our expectations, other than through the release of actual results in the ordinary course of business. These preliminary results should be read in conjunction with MagnaChip’s historical consolidated financial statements, including related notes, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our 2015 Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the nine months ended September 30, 2016.

2017 Cost Reduction Program

We plan to use approximately $30-40 million of the net proceeds of the offering for a cost reduction program to be implemented during the first half of 2017 (the “2017 Cost Reduction Program”). We believe that a headcount reduction will reduce operating costs and improve gross profit, while still preserving the Company’s ability to grow and serve customer needs.

The 2017 Cost Reduction Program is part of an ongoing and comprehensive, multi-phase turnaround strategy instituted by our management in mid-2015, intended to increase revenue, engage with global IC customers, increase our fabrication facility utilization rates, reduce costs and improve profit margins. The Company previously closed a legacy 6” fabrication facility in Cheongju, Korea in the first quarter of 2016 and commenced a voluntary resignation program (the “2016 Program”) in the second quarter of 2016, which was available to certain manufacturing employees. Under the 2016 Program, 169 manufacturing employees elected to resign, which is expected to save the

Company approximately $8 million in spending per year with a payback period of approximately 1.5 years. We anticipate that the mix of employees participating in the 2017 Cost Reduction Program will include senior-level employees in both manufacturing and non-manufacturing roles, including those in general and administrative functions, which we expect will ultimately result in greater cost savings per employee. We anticipate that the Company’s workforce reduction related to the 2017 Cost Reduction Program will be two to three times larger than the 2016 Program with an expected payback period of approximately 1.5 years.

Any cost savings and payback period associated with the 2017 Cost Reduction Program are subject to numerous variables and uncertainties, many of which are outside of our control. As a result, there is a possibility that actual cost savings and the payback period associated with the 2017 Cost Reduction Program will vary materially from our current expectations.

Stock Repurchase Program

On January 10, 2016, our board of directors (the “Board”) authorized a $10 million stock repurchase program covering the purchase of shares of our common stock in open market, privately negotiated or other transactions (our “Stock Repurchase Program”). There can be no guarantee as to the exact number of shares or value that will be repurchased under the Stock Repurchase Program, and we may discontinue purchases at any time. Whether we make any repurchases will depend on many factors, including but not limited to our business and financial performance, the business and market conditions at the time, including the price of our shares, and other factors that management considers relevant.

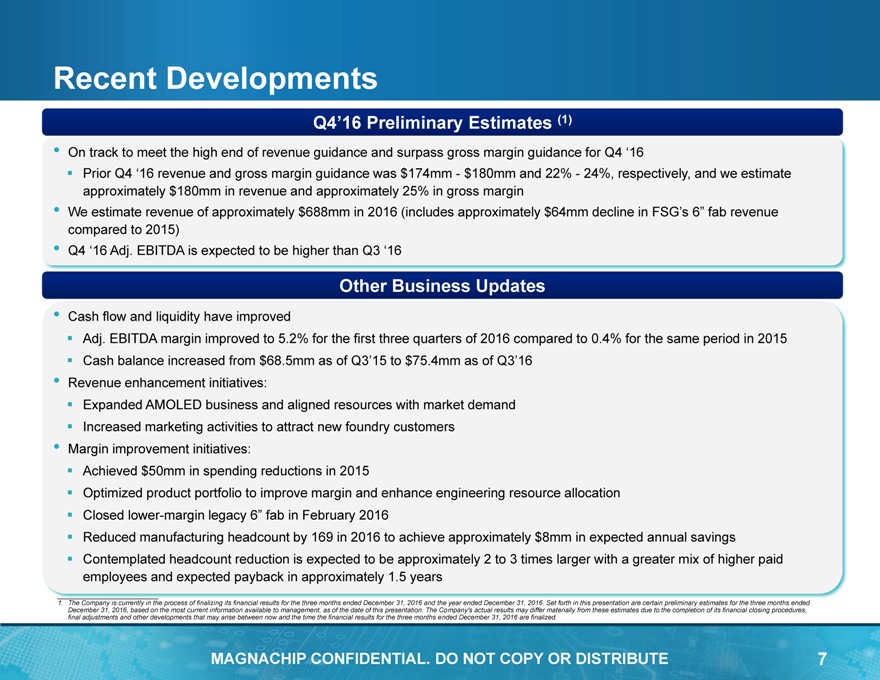

Recent Developments

Q4’16 Preliminary Estimates (1)

On track to meet the high end of revenue

guidance and surpass gross margin guidance for Q4 ‘16

Prior Q4 ‘16 revenue and gross margin guidance was $174mm - $180mm and 22% - 24%, respectively, and

we estimate approximately $180mm in revenue and approximately 25% in gross margin

We estimate revenue of approximately $688mm in 2016 (includes approximately $64mm

decline in FSG’s 6” fab revenue compared to 2015)

Q4 ‘16 Adj. EBITDA is expected to be higher than Q3 ‘16

Other Business Updates

Cash flow and liquidity have improved

Adj. EBITDA margin improved to 5.2% for the first three quarters of 2016 compared to 0.4% for the same period in 2015

Cash balance increased from $68.5mm as of Q3’15 to $75.4mm as of Q3’16

Revenue

enhancement initiatives:

Expanded AMOLED business and aligned resources with market demand Increased marketing activities to attract new foundry customers

Margin improvement initiatives:

Achieved $50mm in spending reductions in 2015

Optimized product portfolio to improve margin and enhance engineering resource allocation

Closed lower-margin legacy 6” fab in February 2016

Reduced manufacturing headcount by 169

in 2016 to achieve approximately $8mm in expected annual savings

Contemplated headcount reduction is expected to be approximately 2 to 3 times larger with a

greater mix of higher paid employees and expected payback in approximately 1.5 years

The Company is currently in the process of finalizing its financial results

for the three months ended December 31, 2016 and the year ended December 31, 2016. Set forth in this presentation are certain preliminary estimates for the three months ended December 31, 2016, based on the most current information available to

management, as of the date of this presentation. The Company’s actual results may differ materially from these estimates due to the completion of its financial closing procedures, final adjustments and other developments that may arise between

now and the time the financial results for the three months ended December 31, 2016 are finalized.