Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-k11017jpmppt.htm |

J.P. MORGAN

HEALTHCARE CONFERENCE

JANUARY 10, 2017 | SAN FRANCISCO, CA

1

FORWARD LOOKING STATEMENT

Cautionary Statement Regarding Forward Looking Statements

This presentation contains forward-looking statements including with respect to estimated 2016 results and

guidance and the impact of various factors on operating results. Each of the forward-looking statements is subject

to change based on various important factors, including without limitation, competitive actions in the marketplace,

adverse actions of governmental and other third-party payers and the results from the Company’s acquisition of

Covance. Actual results could differ materially from those suggested by these forward-looking statements. Further

information on potential factors that could affect LabCorp’s operating and financial results is included in the

Company’s Form 10-K for the year ended December 31, 2015, including in each case under the heading risk factors,

and in the Company’s other filings with the SEC, as well as in the risk factors included in Covance’s filings with the

SEC. The information in this presentation should be read in conjunction with a review of the Company’s filings with

the SEC including the information in the Company’s Form 10-K for the year ended December 31, 2015, under the

heading MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The Company assumes no obligation to update any forward-looking information included in this presentation.

2

AGENDA

Company Overview

Update on “Wave One” Initiatives

2016 Highlights

Financial Strength

2017 Priorities

3

WHO WE ARE

Our

Mission

is to

improve

health and

improve lives

LabCorp is

a world-leading

life sciences company

that is deeply integrated

in guiding patient care

4

LABCORP OVERVIEW

1. Based on the midpoint of guidance issued on October 26, 2016

• Provides diagnostic, drug development

and technology-enabled solutions for

>110 million patient encounters per year

• Operates in two segments – LabCorp Diagnostics

and Covance Drug Development

• ~$9.4B revenue expected in 20161

• >50,000 mission-driven employees worldwide

• Leadership in large, growing, fragmented global markets

• Experienced management team

A World-Leading Life Sciences Company

5

LABCORP DIAGNOSTICS OVERVIEW

• ~$6.6B revenue expected in 20161

• National network of 41 primary clinical laboratories

and approximately 1,750 patient service centers

• Offers broad range of 4,800+ clinical, anatomic

pathology, genetic and genomic tests

• Processes ~500,000 patient specimens daily

• >150 million unique patients seen over past 5 years

• Serves hundreds of thousands of customers,

including physicians, government agencies,

managed care organizations, hospitals and

health systems, patients and consumers

1. Based on the midpoint of guidance issued on October 26, 2016

2. Presented on a pro forma basis as if the acquisition of Covance closed on January 1, 2015.

Adjusted operating income and margin exclude unallocated corporate expenses, amortization, restructuring and other special items

Leading National Clinical Laboratory

Pro Forma Segment Financial Summary2

Constant

Nine Months Ended Currency

9/30/2016 9/30/2015 Change Change

Revenue 4,922$ 4,659$ 5.6% 5.9%

Adj. O.I. 1,005$ 942$ 6.7%

Adj. O.I. % 20.4% 20.2% 20 bps

6

Pro Forma Segment Financial Summary2

Constant

Nine Months Ended Currency

9/30/2016 9/30/2015 Change Change

Revenue 2,127$ 1,937$ 9.8% 11.0%

Adj. O.I. 306$ 261$ 17.4%

Adj. O.I. % 14.4% 13.5% 90 bps

COVANCE DRUG DEVELOPMENT OVERVIEW

• ~$2.8B revenue expected in 20161

• Market leader in early development, central

laboratory, and Phase I-IV clinical trial management

services

• Collaborated on 87% of the 45 new drugs approved by

FDA in 2015, including all 14 approved oncology

drugs, and 20 of 21 drugs treating rare and orphan

diseases

• Xcellerate® is the world’s most comprehensive

investigator performance database

1. Based on the midpoint of guidance issued on October 26, 2016

2. Presented on a pro forma basis as if the acquisition of Covance closed on January 1, 2015.

Adjusted operating income and margin exclude unallocated corporate expenses, amortization, restructuring and other special items

Leading CRO / Drug Development Services Provider

7

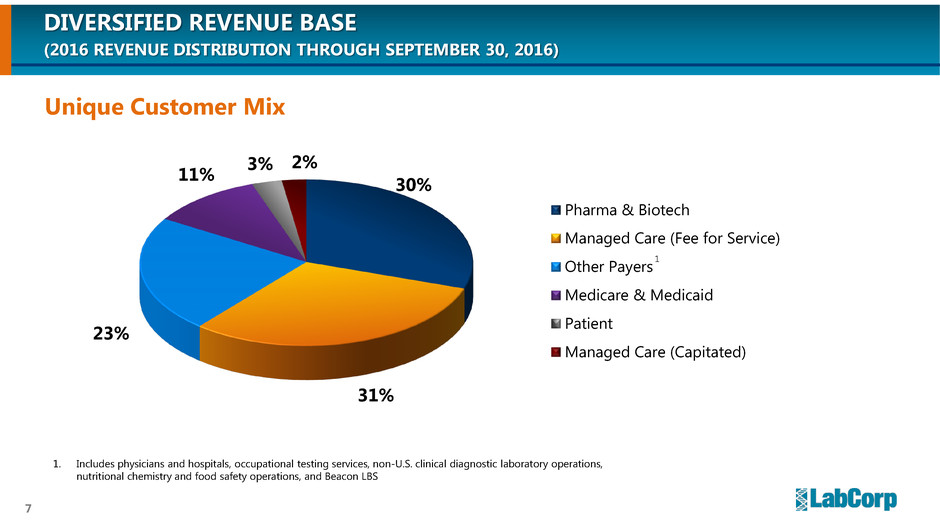

DIVERSIFIED REVENUE BASE

(2016 REVENUE DISTRIBUTION THROUGH SEPTEMBER 30, 2016)

Unique Customer Mix

30%

31%

23%

11%

3% 2%

Pharma & Biotech

Managed Care (Fee for Service)

Other Payers

Medicare & Medicaid

Patient

Managed Care (Capitated)

1. Includes physicians and hospitals, occupational testing services, non-U.S. clinical diagnostic laboratory operations,

nutritional chemistry and food safety operations, and Beacon LBS

1

8

EXPANDED GROWTH OPPORTUNITIES WITH INCREASED GLOBAL PRESENCE

1. 2014 revenue excludes Covance. 2016 revenue from January 1st through September 30th

2. Based on industry publications and company estimates

3. Over 30 currencies in 2016 and no single currency (other than US dollar) accounts for more than 10% of 2016 revenue

2014 Revenue Distribution1

>$70 billion

addressable

market2

2016 Revenue Distribution1

0%

25%

50%

75%

100%

USA Rest of World

92.7%

80.9%

7.3%

19.1%

0%

25%

50%

75%

100%

USA Rest of World

92.7%

Markets Served

North American

Clinical Reference Laboratory

Central Laboratory

Market Opportunities

Global Clinical Reference Laboratory Drug Development

Central Laboratory Market Access

Food Safety and Chemistry

>$200 billion

addressable

market2

3

9

OUR MISSION: IMPROVE HEALTH AND IMPROVE LIVES

Build / Acquire

Complementary Capabilities

Organic Growth Through

New Tests, Customers and

Markets

Integrate Diagnostic

Information and Content

Build / Acquire

Complementary Capabilities

Use Tools and Technology to

Improve Success, and Reduce

Time and Cost, of Trials

Commercialize

Technology-Enabled

Solutions

Develop Scalable Platforms

and Applications for

Customers

Delivering

World Class Diagnostics

Bringing Innovative

Medicines to Patients Faster

Using Technology

to Provide Better Care

10

AGENDA

Company Overview

Update on “Wave One” Initiatives

2016 Highlights

Financial Strength

2017 Priorities

11

2015 JP MORGAN CONFERENCE:

COMBINATION PROVIDES SIGNIFICANT NEW GROWTH AVENUES

Prioritized top 3 opportunities based on

materiality, feasibility, and strategic fit

Deliver faster clinical

trial enrollment

1

Partner of choice to

develop and commercialize

companion diagnostics

2

Enhance Phase IV trial experience

and post-market surveillance

3

Wave One

12

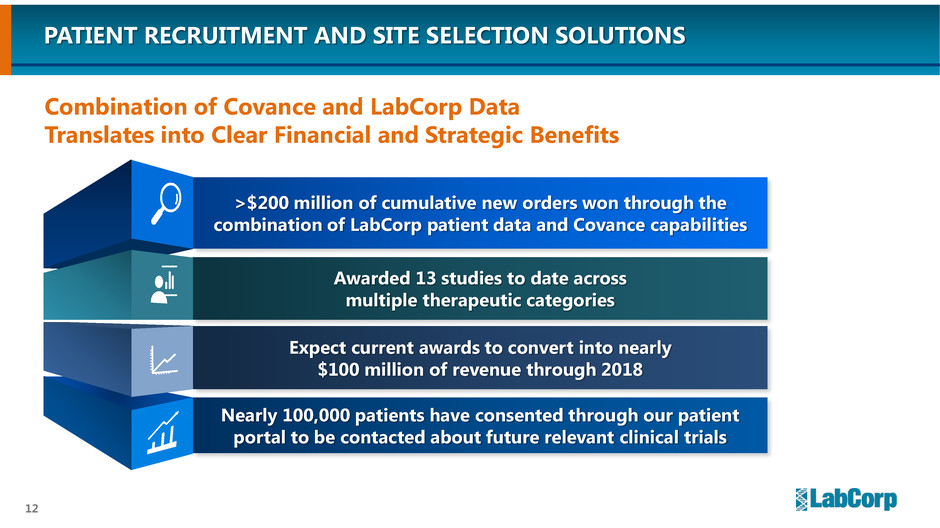

>$200 million of cumulative new orders won through the

combination of LabCorp patient data and Covance capabilities

Awarded 13 studies to date across

multiple therapeutic categories

Expect current awards to convert into nearly

$100 million of revenue through 2018

Nearly 100,000 patients have consented through our patient

portal to be contacted about future relevant clinical trials

PATIENT RECRUITMENT AND SITE SELECTION SOLUTIONS

Combination of Covance and LabCorp Data

Translates into Clear Financial and Strategic Benefits

13

Keytruda is a registered trademark of Merck Sharp & Dohme Corp.,

a subsidiary of Merck & Co., Inc.

OPDIVO is a registered trademark of Bristol-Myers Squibb Company.

cobas is a registered trademark of Roche.

TAGRISSO is a trademark of the AstraZeneca group of companies.

Tarceva is a registered trademark of OSI Pharmaceuticals.

TECENTRIQ is a registered trademark of Genentech, Inc. 1. 2016 full year revenue is estimated based on run-rate through September 30th, 2016

COMPANION AND COMPLEMENTARY DIAGNOSTICS (CDX)

Unmatched CDx Franchise Providing End-to-End Clinical Development

and Commercial Lab Testing Solutions

• Dedicated global CDx team and laboratories

• Worked on 60+ CDx programs supporting

145+ clinical protocols in 2016

• 33% increase in revenue across drug

development and commercial clinical

laboratory testing since 20141

• CDx collaborations with 13 of top 20

pharmaceutical companies

• Only CRO awarded a podium presentation at

World Companion Diagnostics Conference

• PD-L1 IHC 22C3 pharmDx

(Merck’s Keytruda®)

• PD-L1 IHC 28-8 pharmDx

(Bristol-Myers Squibb’s OPDIVO®)

• cobas® EGFR Mutation Test v2

(AstraZeneca’s TAGRISSO™ and

Roche’s Tarceva®)

• Ventana PD-L1 (SP142)

(Genentech’s TECENTRIQ®)

Notable CDx Tests from LabCorp

14

UNIQUELY POSITIONED FOR PARTNERSHIPS

IN REAL-WORLD EVIDENCE AND POST-MARKET SURVEILLANCE

Delivering Integrated Solutions for Commercially-Approved Products

in “Real-World” Setting

• Lab Assist Program with Top 20 pharmaceutical

partner to facilitate required monthly liver testing

• Patient and provider support through

program enrollment, monthly test scheduling,

and follow up on missed appointments

• Convenient access to LabCorp’s Patient Service

Center network for specimen collections or

drop-offs

• Customized informatics enable electronic

delivery of results to providers and patients

• Coordination between Covance Market Access

and LabCorp Diagnostics

• Program Coordinator calls

the patient to schedule

monthly testing

• Sample is collected and

submitted to LabCorp

• Results are delivered to the

provider’s office

15

AGENDA

Company Overview

Update on “Wave One” Initiatives

2016 Highlights

Financial Strength

2017 Priorities

16

ENTERPRISE HIGHLIGHT

Trial Data / Capability Outcome

Prevention of upper

respiratory tract infections

with seasonal incidence

LabCorp-generated data enables Covance to flexibly open

and close sites based on timely insights into viruses of

interest circulating in a particular community

All Studies

Awarded to

Non-alcoholic

steatohepatitis (NASH)

Leveraged the LabCorp database of physicians ordering Fibrosure,

a non-invasive biomarker of fibrosis, in client proposals

Rare genetic disorder Director in Biochemical & Molecular Genetics at LabCorp will serve

as “Geneticist Expert,” and LabCorp team will conduct review,

validation and classification of mutation types

Cardiopulmonary bypass

surgery involving use of

frozen platelets

LabCorp’s Chief Medical Officer served as in-house consultant

for transfusion medicine for RFP

Innovative Use Cases for LabCorp Data and Technical Expertise

Contribute to New Study Awards

17

ENTERPRISE HIGHLIGHT

Integrated “Research Hub” Model for Hospitals and Health Systems,

Adding Value for All Key Stakeholders

• Expand patient

recruitment

• Enhance site

identification

• Greater access to clinical trials

• Improve patient care and

outcomes

• Grow reference testing

• Cultivate long-term,

comprehensive

partnerships

• Collaboration and

medical institution

growth

• Access to new revenue stream

• Differentiate from competitors

• Enhance academic reputation

• Reduce costs under value-based

reimbursement framework

Integrated

“Research Hub”

Model

LabCorp

Diagnostics

Covance Drug

Development

Hospitals, Health

Systems & Large

Provider Networks

Patients

18

ENTERPRISE HIGHLIGHT

Combined Expertise in Oncology Drives Growth

• Utilized LabCorp data and Covance informatics to secure

Phase III study in Acute Myeloid Leukemia

• Heat map highlighted U.S. physicians with high volume of AML

patients; 50,000+ patients represented in this dataset from LabCorp

• Physicians in LabCorp database evaluated for clinical trial experience

and categorized by expertise and practice type

• Integrated, end-to-end development and commercialization

capabilities in immuno-oncology

• Doubled the number of immuno-oncology study awards

and related backlog year on year

• Performed thousands of PD-L1 tests through Diagnostic and

Drug Development segments

• Published real world utilization data at ASCO

Acute myeloid leukemia cells

19

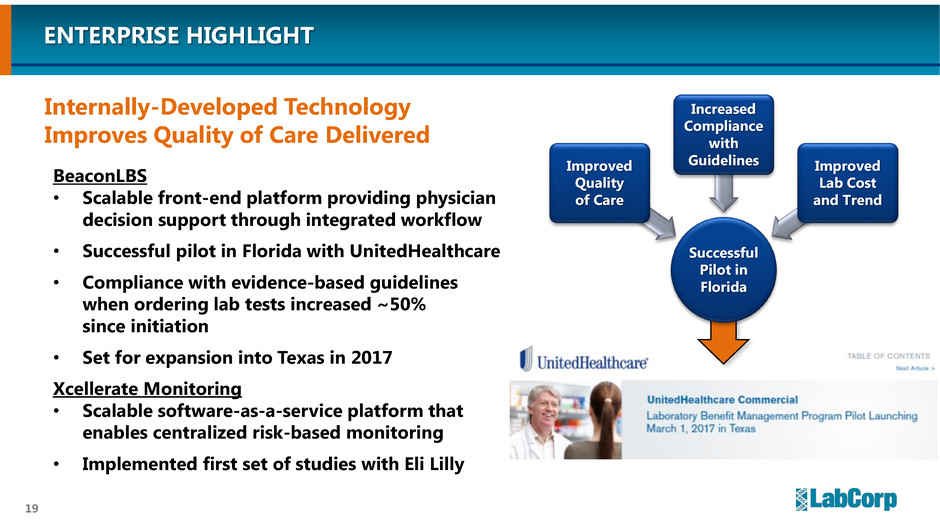

BeaconLBS

• Scalable front-end platform providing physician

decision support through integrated workflow

• Successful pilot in Florida with UnitedHealthcare

• Compliance with evidence-based guidelines

when ordering lab tests increased ~50%

since initiation

• Set for expansion into Texas in 2017

Xcellerate Monitoring

• Scalable software-as-a-service platform that

enables centralized risk-based monitoring

• Implemented first set of studies with Eli Lilly

Internally-Developed Technology

Improves Quality of Care Delivered

ENTERPRISE HIGHLIGHT

Successful

Pilot in

Florida

Improved

Quality

of Care

Increased

Compliance

with

Guidelines Improved

Lab Cost

and Trend

20

LABCORP DIAGNOSTICS HIGHLIGHT

Broad and Flexible Health System and Large Provider Collaborations

Have Been a Successful Model for Over Three Decades

Reference

Testing

Lab Optimization

(incl. Outreach Business)

Research

Hub Model

• 1,800+ hospital clients, and 200+ partnerships

• Average partnership length of ~6 years

• Significant progress on multiple strategic

health system initiatives in 2016

• Enhanced executive leadership focused on

comprehensive partnerships

21

Acquiring Assets of Mount Sinai Health System Clinical Outreach Laboratories

LABCORP DIAGNOSTICS HIGHLIGHT

• LabCorp will provide comprehensive

laboratory services

• Exploring opportunities to collaborate on

companion diagnostics, clinical trials and

medical education

• LabCorp’s differentiators include:

• Access to clinical trials and research

through Covance Drug Development

• Enhanced IT and data analytics

• Standardized testing platforms

• Meets stated financial criteria

“[LabCorp’s] unparalleled reputation and

success ensure our patients will continue to

have access to high-quality, high-value and

convenient testing services.” 1

“LabCorp’s proven track record of service

excellence, breadth of diagnostic capabilities,

and cost-efficiency will benefit our community

now and in years to come.” 2

“We are confident this transaction will provide

great benefits for our patients and physicians

and allow Mount Sinai to continue to invest in

our core strategic programs.” 2

1. Quote attributed to Carlos Cordon-Cardo, MD, PhD, Irene Heinz Given and John LaPorte

Given Professor and Chairman, Department of Pathology, Mount Sinai Health System

2. Quote attributed to Donald Scanlon, Chief Financial Officer and Chief of Corporate Services,

Mount Sinai Health System

22

• Increased Patient Engagement

• Mobile-Friendly Patient Portal

• Clinical Trial Patient Consents

• Self Service Registration in 2017

(opportunity for clinical trial opt-ins)

• Integrated Clinical Decision Support Capabilities

• LabCorp Link

• LithoLink CDS Platform and Reports

• UpToDate® Advisor

• Enhanced Revenue Cycle Management Tools

• Nationwide Real-Time Eligibility Verification

• Introduced Patient Responsibility Estimate

(Price Transparency)

Continued Commitment to Technology Innovation

to Deliver Improved Patient Care

LABCORP DIAGNOSTICS HIGHLIGHT

23

COVANCE DRUG DEVELOPMENT HIGHLIGHT

Novel Drug Development Solutions Drive Growth and Loyalty

Lab Optimization

(incl. Outreach Business)

Research

Hub Model • Integrated LabCorp Diagnostics’ specialty

test menu into global central laboratory services

• Leveraged the Xcellerate informatics platform to

optimize and execute an enrollment strategy for

12,000-patient Cardiovascular Outcomes trial

• Developed a “One Stop” laboratory solution that

manages all internal and external lab vendors

• Early Phase Development Solutions (EPDS) available

from pre-Clinical Lead Optimization through Clinical

Proof of Concept with consistent and focused

project team

• Nearly 10x increase in number of complex

tests referred from Covance to LabCorp

• Enrollment for this 600 site, 37 country study was

completed 5 months ahead of original

stretch goal

• Executed two multi-year sole source

agreements with top 20 pharmaceutical companies

• Through EPDS, worked with over 50 companies

worldwide in pre-clinical, early clinical or both stages of

development

Solution Result

24

AGENDA

Company Overview

Update on “Wave One” Initiatives

2016 Highlights

Financial Strength

2017 Priorities

25

LONG-TERM REVENUE GROWTH1

$3.3

$3.6

$4.1

$4.5 $4.7

$5.0

$5.5 $5.7

$5.8

$8.5

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E

$6.0

~$9.4

CAGR 9%

41%

1. 2005-2014 revenue excludes Covance results. 2008 revenue includes a $7.5 million adjustment relating to certain historic

overpayments made by Medicare for claims submitted by a subsidiary of the Company

2. Guidance issued on October 26, 2016

($ Billions)

Covance

Drug

Development

LabCorp

Diagnostics

Midpoint of Guidance2

~10.5%

26

LONG-TERM ADJUSTED EPS GROWTH1,2

$3.01

$3.53

$4.45

$4.91

$5.24

$5.98

$6.37

$6.82 $6.95 $6.80

$7.91

$8.80

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E

CAGR 2%

1. EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special

charges). Diluted EPS, as reported in the Company’s Annual Report were: $2.71 in 2005; $3.24 in 2006; $3.93 in 2007; $4.16 in

2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; $5.99 in 2012; $6.25 in 2013; $5.91 in 2014; and $4.34 in 2015

2. 2005-2014 figures exclude Covance results, and other items discussed in the Appendix

3. Guidance issued on October 26, 2016

Midpoint of

Guidance3

CAGR 13%

16%

27

FREE CASH FLOW1,2

$516

$567

$624

$748

$758 $759

$668

$617

$536

$727

$860

$0

$200

$400

$600

$800

$1,000

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E

1. 2006-2014 figures exclude Covance results

2. Operating Cash Flow and Free Cash Flow in 2011 excludes the $49.5 million Hunter Labs settlement

3. Guidance issued on October 26, 2016

($ Millions) 2006 – 2015 Average Free Cash Flow: $652 million

Midpoint of

Guidance3

28

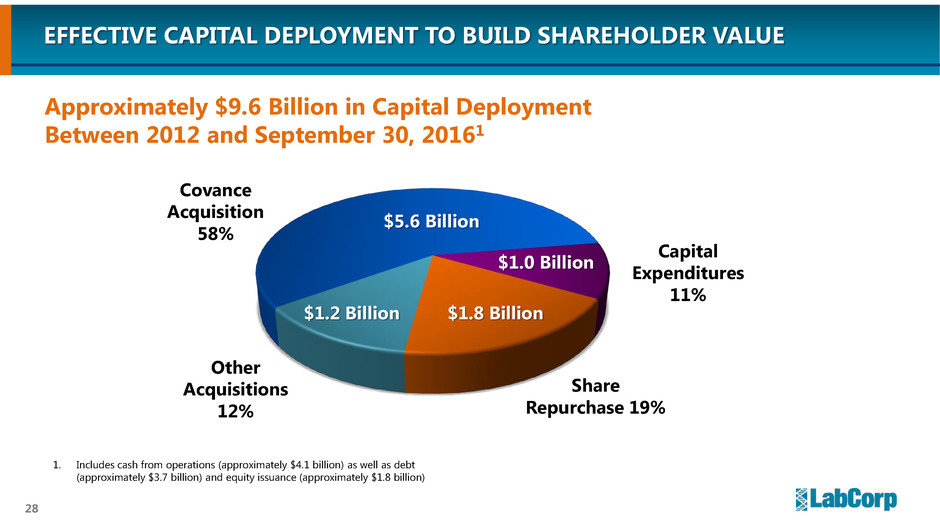

EFFECTIVE CAPITAL DEPLOYMENT TO BUILD SHAREHOLDER VALUE

Capital

Expenditures

11%

$1.8 Billion

Share

Repurchase 19%

Other

Acquisitions

12%

$5.6 Billion

$1.0 Billion

1. Includes cash from operations (approximately $4.1 billion) as well as debt

(approximately $3.7 billion) and equity issuance (approximately $1.8 billion)

Covance

Acquisition

58%

$1.2 Billion

Approximately $9.6 Billion in Capital Deployment

Between 2012 and September 30, 20161

29

AGENDA

Company Overview

Update on “Wave One” Initiatives

2016 Highlights

Financial Strength

2017 Priorities

30

2017 STRATEGIC PRIORITIES

Solution

Focus Fully-

Integrated

Organization

Return of Capital

to Shareholders -

Reinitiated Share

Repurchases

31

The Combination of Covance and LabCorp will:

OUR PURPOSE FOR CREATING

A WORLD LEADING LIFE SCIENCES COMPANY

• Accelerate long-term profitable growth through expanded

market opportunities

• Commercialize new business models in clinical care and

research settings

• Increase shareholder value, including return of capital

• Continue to enhance capabilities that guide patient care,

fulfilling our mission of improving health and improving lives

J.P. MORGAN

HEALTHCARE CONFERENCE

JANUARY 10, 2017 | SAN FRANCISCO, CA

33

APPENDIX

34

YEAR-TO-DATE PRO FORMA SEGMENT RESULTS1

(DOLLARS IN MILLIONS)

Pro forma results assume that the acquisition of Covance closed on January 1, 2015

Nine Months Nine Months

Ended 9/30/16 Ended 9/30/15 % Change

Net Revenue

LabCorp Diagnostics $4,922.1 $4,659.2 5.6%

Covance Drug Development $2,126.6 $1,937.3 9.8%

Total Net Revenue $7,048.2 $6,596.5 6.8%

Adjusted Operating Income2, 3

LabCorp Diagnostics $1,005.1 $942.0 6.7%

Adjusted Operating Margin 20.4% 20.2% 20 bps

Covance Drug Development $306.2 $260.9 17.4%

Adjusted Operating Margin 14.4% 13.5% 90 bps

Unallocated Corporate Expense ($108.9) ($98.5) (10.6%)

Total Adjusted Operating Income $1,202.4 $1,104.4 8.9%

Total Adjusted Operating Margin 17.1% 16.7% 40 bps

(1) The consolidated net revenue and adjusted operating income are presented net of inter-segment transaction eliminations

(2) Adjusted Operating Income excludes amortization, restructuring and special items

(3) See Reconciliation of non-GAAP Financial Measures in Appendix

35

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

The following consolidated results include Covance as of February 19, 2015;

prior to February 19, 2015, all consolidated results exclude Covance

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions, except per share data)

Adjusted Operating Income 2016 2015

Operating Income 989.0$ 760.3$

Acquisition-related costs 15.1 118.0

Restructuring and other special charges 48.6 59.9

Consulting fees and executive transition expenses 7.9 15.2

Wind-down of minimum volume contract operations 4.0 -

LaunchPad system implementation costs 7.1 -

Amortization of intangibles and other assets 130.7 120.6

Adjusted operating income 1,202.4$ 1,074.0$

A justed EPS

Diluted earnings per common share 5.25$ 3.29$

Restructuring and special items 0.56 1.83

Amortization expense 0.86 0.82

Adjusted EPS 6.67$ 5.94$

Nine Months Ended

September 30,

36

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions, except per share data)

Free Cash Flow: 2016 2015

Net cash provided by operating activities 727.0$ 597.8$

Less: Capital expenditures (204.6) (170.7)

Free cash flow 522.4$ 427.1$

Free Cash Flow, Excluding Acquisition Related Charges:

Net cash provided by operating activities 727.0$ 597.8$

Add back: Acquisition related charges - 153.5

Net cash provided by operating activities, excluding

acquisition related charges 727.0$ 751.3$

Less: Capital expenditures (204.6) (170.7)

Free cash flow, excluding acquisition related charges 522.4$ 580.6$

Nine Months Ended

September 30,

The following consolidated results include Covance as of February 19, 2015;

prior to February 19, 2015, all consolidated results exclude Covance

37

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

1) During the third quarter of 2016, the Company recorded net restructuring and special items of $22.8 million. The charges included $14.1 million in severance

and other personnel costs along with $9.1 million in facility-related costs associated with facility closures and general integration initiatives. The Company

reversed previously established reserves of $0.2 million in unused facility-related costs and $0.2 million in unused personnel costs. The Company incurred

$5.9 million in fees and expenses associated with acquisitions completed during the quarter and incurred additional legal and other costs of $1.3 million

relating to the wind-down of its minimum volume contract operations. The Company also recorded $1.4 million in consulting expenses relating to fees

incurred as part of its Covance integration costs and compensation analysis, along with $0.5 million in short-term equity retention arrangements relating to

the acquisition of Covance and $3.4 million of accelerated equity and other final compensation relating to executive transition announced during the third

quarter and incurred $3.7 million of non-capitalized costs associated with the implementation of a major system as part of its LaunchPad business process

improvement initiative (all recorded in selling, general and administrative expenses). The Company also incurred $5.6 million of interest expense relating to

the early retirement of subsidiary indebtedness acquired as part of its recent acquisition of Sequenom. The after tax impact of these charges decreased net

earnings for the quarter ended September 30, 2016, by $28.5 million and diluted earnings per share by $0.27 ($28.5 million divided by 104.9 million shares).

During the first two quarters of 2016, the Company recorded net restructuring and other special charges of $25.8 million. The charges included $9.0 million

in severance and other personnel costs along with $21.6 million in facility-related costs associated with facility closures and general integration initiatives.

The Company reversed previously established reserves of $2.2 million in unused facility-related costs and $2.6 million in unused severance reserves. The

Company incurred $1.5 million in fees and expenses associated with completed acquisitions and incurred additional legal and other costs of $2.7 million

relating to the wind-down of its minimum volume contract operations. The Company also recorded $3.0 million in consulting expenses relating to fees

incurred as part of its Covance integration costs and compensation analysis, along with $1.8 million in short-term equity retention arrangements relating to

the acquisition of Covance and $4.1 million of accelerated equity compensation relating to the announced retirement of a Company executive and incurred

$4.8 million of non-capitalized costs associated with the implementation of a major system as part of its LaunchPad business process improvement initiative

(all recorded in selling, general and administrative expenses). In conjunction with certain international legal entity tax structuring, the Company recorded a

one-time tax liability of $1.1 million.

The after tax impact of these charges decreased net earnings for the nine months ended September 30, 2016, by $58.1 million and diluted earnings per share

by $0.56 ($58.1 million divided by 104.2 million shares).

38

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

2) During the third quarter of 2015, the Company recorded net restructuring and special items of $26.3 million. The charges included $24.4 million in severance

and other personnel costs along with $2.2 million in facility-related costs associated with facility closures and general integration initiatives. The Company

reversed previously established reserves of $0.3 million in unused facility-related costs. The Company also recorded $3.5 million in consulting expenses

relating to fees incurred as part of its Covance integration costs, along with $1.4 million in short-term equity retention arrangements relating to the

acquisition of Covance (all recorded in selling, general and administrative expenses). In addition, the Company recorded a non-cash loss of $2.3 million, upon

the dissolution of one of its equity investments (recorded in other, net in the accompanying Consolidated Statements of Operations). The after tax impact of

these charges decreased net earnings for the quarter ended September 30, 2015, by $27.7 million and diluted earnings per share by $0.27 ($27.7 million

divided by 102.9 million shares).

During the first two quarters of 2015, the Company recorded net restructuring and other special charges of $33.5 million. The charges included $9.5 million

in severance and other personnel costs along with $9.8 million in costs associated with facility closures and general integration initiatives. The Company

reversed previously established reserves of $0.6 million in unused facility-related costs. In addition, the Company recorded asset impairments of $14.8 million

relating to lab and customer service applications that will no longer be used. The Company also recorded $11.6 million of consulting expenses relating to fees

incurred as part of its LaunchPad business process improvement initiative as well as Covance integration costs. In addition, the Company also expensed $2.9

million in short-term equity retention arrangements relating to the acquisition of Covance.

During the first quarter of 2015, the Company recorded $166.0 million of one-time costs associated with its acquisition of Covance. The costs included $79.5

million of Covance employee equity awards, change in control payments and short-term retention arrangements that were accelerated or triggered by the

acquisition transaction (recorded in selling, general and administrative expenses in the accompanying Consolidated Statements of Operations). The

acquisition costs also included advisor and legal fees of $33.9 million (recorded in selling, general and administrative expenses in the accompanying

Consolidated Statements of Operations), $15.2 million of deferred financing fees associated with the Company’s bridge loan facility as well as a make-whole

payment of $37.4 million paid to call Covance’s private placement debt outstanding at the purchase date (both amounts recorded in interest expense in the

accompanying Consolidated Statements of Operations).

The after tax impact of these charges decreased net earnings for the nine months ended September 30, 2015, by $182.5 million and diluted earnings per

share by $1.83 ($182.5 million divided by 99.7 million shares).

39

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

3) The Company continues to grow the business through acquisitions and uses Adjusted EPS excluding amortization as a measure of operational

performance, growth and shareholder returns. The Company believes adjusting EPS for amortization provides investors with better insight

into the operating performance of the business. For the quarters ended September 30, 2016 and 2015, intangible amortization was $41.1

million and $44.9 million, respectively ($28.4 million and $31.3 million net of tax, respectively) and decreased EPS by $0.27 ($28.4 million

divided by 104.9 million shares) and $0.30 ($30.8 million divided by 102.9 million shares), respectively. For the nine months ended September

30, 2016 and 2015, intangible amortization was $130.7 million and $120.6 million, respectively ($89.4 million and $81.9 million net of tax,

respectively) and decreased EPS by $0.86 ($89.4 million divided by 104.2 million shares) and $0.82 ($81.9 million divided by 99.7 million

shares), respectively.

4) During the first quarter of 2015, the Company's operating cash flows were reduced due to payment of $153.5 million in acquisition-related

charges. These payments were comprised of $75.5 million in legal and advisor fees, $40.6 million in accelerated Covance employee equity

awards, and $37.4 million in make-whole payments triggered by calling Covance private placement notes outstanding at the time of the

transaction.

40

FOOTNOTES TO “LONG-TERM ADJUSTED EPS GROWTH” SLIDE

(1) EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special charges).

Diluted EPS, as reported in the Company’s Annual Report were: $2.71 in 2005; $3.24 in 2006; $3.93 in 2007; $4.16 in 2008; $4.98 in 2009;

$5.29 in 2010; $5.11 in 2011; $5.99 in 2012; $6.25 in 2013; $5.91 in 2014; and $4.34 in 2015.

(2) 2005-2014 figures exclude Covance results. Excluding the $0.09 per diluted share impact of restructuring and other special charges and the

$0.21 per diluted share impact from amortization in 2005; excluding the $0.06 per diluted share impact of restructuring and other special

charges and the $0.23 per diluted share impact from amortization in 2006; excluding the $0.25 per diluted share impact of restructuring and

other special charges and the $0.27 per diluted share impact from amortization in 2007; excluding the $0.44 per diluted share impact of

restructuring and other special charges and the $0.31 per diluted share impact from amortization in 2008; excluding the ($0.09) per diluted

share impact of restructuring and other special charges and the $0.35 per diluted share impact from amortization in 2009; excluding the

$0.26 per diluted share impact of restructuring and other special charges and the $0.43 per diluted share impact from amortization in 2010;

excluding the $0.72 per diluted share impact of restructuring and other special charges, the $0.03 per diluted share impact from a loss on the

divestiture of assets and the $0.51 per diluted share impact from amortization in 2011; excluding the $0.29 per diluted share impact of

restructuring and other special charges and the $0.54 per diluted share impact from amortization in 2012; excluding the $0.15 per diluted

share impact of restructuring and other special charges and the $0.55 per diluted share impact from amortization in 2013; excluding the

$0.34 per diluted share impact of restructuring and other special charges and the $0.55 per diluted share impact from amortization in 2014;

and excluding the $2.44 per diluted share impact of restructuring and other special charges and the $1.13 per diluted share impact from

amortization in 2015.

(3) Guidance issued on October 26, 2016.