Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MERRIMACK PHARMACEUTICALS INC | d310422dex991.htm |

| EX-2.1 - EX-2.1 - MERRIMACK PHARMACEUTICALS INC | d310422dex21.htm |

| 8-K - FORM 8-K - MERRIMACK PHARMACEUTICALS INC | d310422d8k.htm |

Merrimack Pharmaceuticals: A Refocused R&D Company January 2017 Exhibit 99.2

This presentation contains forward-looking statements of the Company that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation are forward-looking statements. Forward looking statements can be identified by the use of the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions. The Company’s forward-looking statements include, among others, statements about the expected dividend, potential milestone payments, and Merrimack’s expectations with respect to the consummation of the proposed transaction and its ability to fund its operations, including continued investment in its research and development pipeline. Actual events or results may differ materially from those described in this presentation due to a number of risks and uncertainties. Risks and uncertainties include, among other things, risks related to the satisfaction of the conditions to closing the asset sale (including the failure to obtain necessary approvals) in the anticipated timeframe or at all; whether stockholders approve the deal; whether any legal action is brought that results in a delay in or prohibition of the consummation of the transaction; whether the Company receives payments related to the milestone events under its contract with Shire, when expected or at all, or under the asset purchase agreement; whether the Company’s expenses are as predicted; the amount of any working capital adjustment in the transaction; whether the Company is able to satisfy the necessary legal tests required to make the anticipated dividend; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of this announcement or the consummation of the proposed transaction on the market price of the Company’s common stock; significant transaction costs; unknown liabilities; other business effects, including the effects of industry, market, economic, political or regulatory conditions; and those risk factors discussed in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2016 filed with the Securities and Exchange Commission (“SEC”) on November 9, 2016 and its other filings with the SEC. The forward-looking statements in this presentation represent the Company’s views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause its views to change. However, while it may elect to update these forward-looking statements at some point in the future, it has no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing the Company’s views as of any date subsequent to the date of this presentation. Additional Information about the Transaction and Where to Find It This disclosure is being made in respect of the asset sale contemplated by the Asset Sale Agreement. The proposed asset sale will be submitted to the Company’s stockholders for their consideration. In connection with the proposed asset sale, the Company will file a proxy statement with the SEC. This presentation does not constitute a solicitation of any vote or proxy from any stockholder of Merrimack’s. INVESTORS ARE URGED TO READ THE PROXY STATEMENT CAREFULLY AND IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS OR MATERIALS FILED OR TO BE FILED WITH THE SEC OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ASSET SALE. The final proxy statement will be mailed to the Company’s stockholders. In addition, the proxy statement and other documents will be available free of charge at the SEC’s internet website, www.sec.gov. When available, the proxy statement and other pertinent documents also may be obtained free of charge at the Merrimack’s website, www.merrimack.com, or by directing a written request to Merrimack Pharmaceuticals, Inc., One Kendall Square, Suite B7201, Cambridge, Massachusetts 02139, telephone number 617-441-1000. Participants in the Solicitation Merrimack and its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed asset sale. Information about Merrimack’s directors and executive officers is included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 filed with the SEC on February 26, 2016 and the proxy statement for Merrimack’s 2016 annual meeting of stockholders filed with the SEC on April 25, 2016. Additional information regarding these persons and their interests in the transaction will be included in the proxy statement relating to the proposed asset sale when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated above. Forward Looking Statements

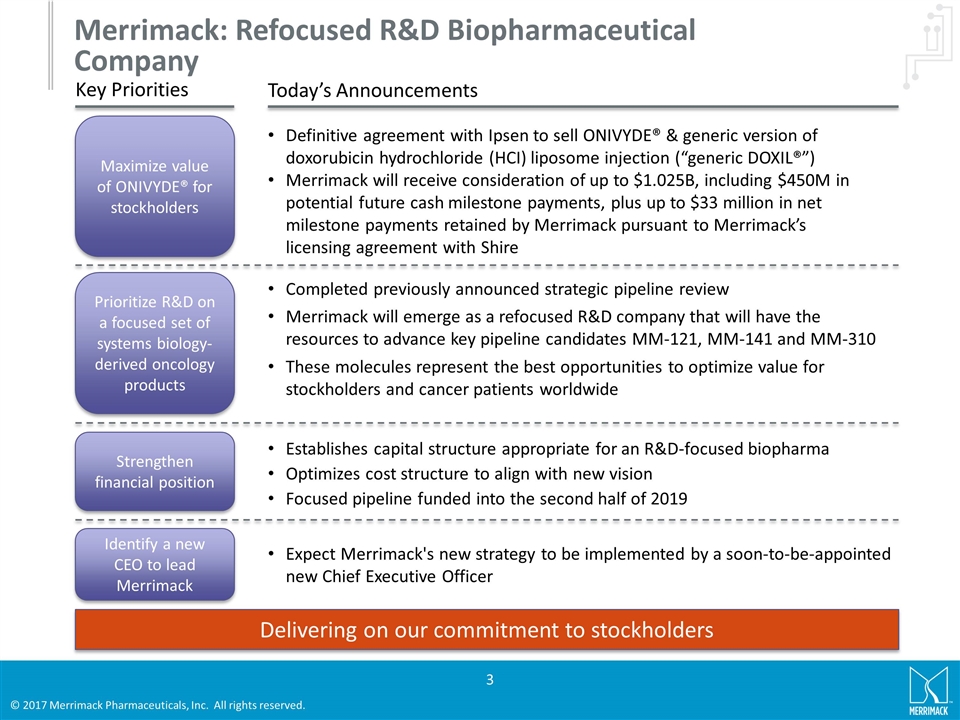

Merrimack: Refocused R&D Biopharmaceutical Company Definitive agreement with Ipsen to sell ONIVYDE® & generic version of doxorubicin hydrochloride (HCI) liposome injection (“generic DOXIL®”) Merrimack will receive consideration of up to $1.025B, including $450M in potential future cash milestone payments, plus up to $33 million in net milestone payments retained by Merrimack pursuant to Merrimack’s licensing agreement with Shire Key Priorities Today’s Announcements Maximize value of ONIVYDE® for stockholders Completed previously announced strategic pipeline review Merrimack will emerge as a refocused R&D company that will have the resources to advance key pipeline candidates MM-121, MM-141 and MM-310 These molecules represent the best opportunities to optimize value for stockholders and cancer patients worldwide Establishes capital structure appropriate for an R&D-focused biopharma Optimizes cost structure to align with new vision Focused pipeline funded into the second half of 2019 Expect Merrimack's new strategy to be implemented by a soon-to-be-appointed new Chief Executive Officer Delivering on our commitment to stockholders Prioritize R&D on a focused set of systems biology-derived oncology products Strengthen financial position Identify a new CEO to lead Merrimack

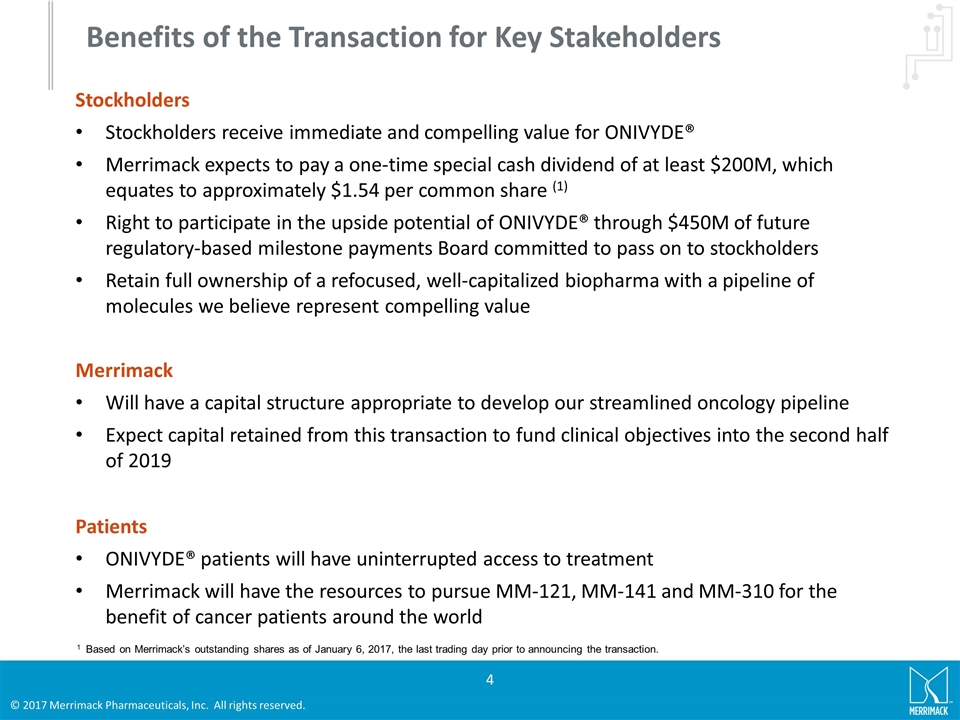

Benefits of the Transaction for Key Stakeholders Stockholders Stockholders receive immediate and compelling value for ONIVYDE® Merrimack expects to pay a one-time special cash dividend of at least $200M, which equates to approximately $1.54 per common share (1) Right to participate in the upside potential of ONIVYDE® through $450M of future regulatory-based milestone payments Board committed to pass on to stockholders Retain full ownership of a refocused, well-capitalized biopharma with a pipeline of molecules we believe represent compelling value Merrimack Will have a capital structure appropriate to develop our streamlined oncology pipeline Expect capital retained from this transaction to fund clinical objectives into the second half of 2019 Patients ONIVYDE® patients will have uninterrupted access to treatment Merrimack will have the resources to pursue MM-121, MM-141 and MM-310 for the benefit of cancer patients around the world 1 Based on Merrimack’s outstanding shares as of January 6, 2017, the last trading day prior to announcing the transaction.

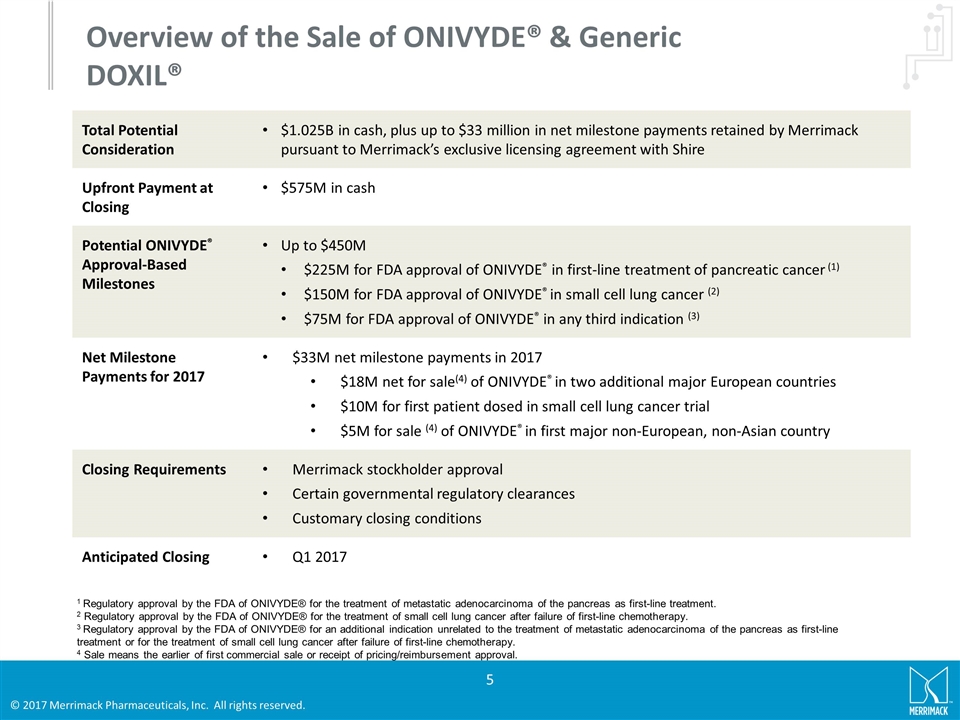

Overview of the Sale of ONIVYDE® & Generic DOXIL® Total Potential Consideration $1.025B in cash, plus up to $33 million in net milestone payments retained by Merrimack pursuant to Merrimack’s exclusive licensing agreement with Shire Upfront Payment at Closing $575M in cash Potential ONIVYDE® Approval-Based Milestones Up to $450M $225M for FDA approval of ONIVYDE® in first-line treatment of pancreatic cancer (1) $150M for FDA approval of ONIVYDE® in small cell lung cancer (2) $75M for FDA approval of ONIVYDE® in any third indication (3) Net Milestone Payments for 2017 $33M net milestone payments in 2017 $18M net for sale(4) of ONIVYDE® in two additional major European countries $10M for first patient dosed in small cell lung cancer trial $5M for sale (4) of ONIVYDE® in first major non-European, non-Asian country Closing Requirements Merrimack stockholder approval Certain governmental regulatory clearances Customary closing conditions Anticipated Closing Q1 2017 1 Regulatory approval by the FDA of ONIVYDE® for the treatment of metastatic adenocarcinoma of the pancreas as first-line treatment. 2 Regulatory approval by the FDA of ONIVYDE® for the treatment of small cell lung cancer after failure of first-line chemotherapy. 3 Regulatory approval by the FDA of ONIVYDE® for an additional indication unrelated to the treatment of metastatic adenocarcinoma of the pancreas as first-line treatment or for the treatment of small cell lung cancer after failure of first-line chemotherapy. 4 Sale means the earlier of first commercial sale or receipt of pricing/reimbursement approval.

Strengthening Our Financial Position Capital structure appropriate for an R&D-focused biopharmaceutical company Invest $125 million to develop the Company’s streamlined oncology pipeline, such that Merrimack will be funded into the second half of 2019 Plan to extinguish $175M in outstanding Senior Secured Notes due in 2022, plus approximately $20M of costs associated with early redemption Following completion of the transaction with Ipsen, Merrimack will have a cost structure aligned with the scope of our planned R&D activities Significantly reduced cash burn Expect Merrimack to have ~80 employees post-closing

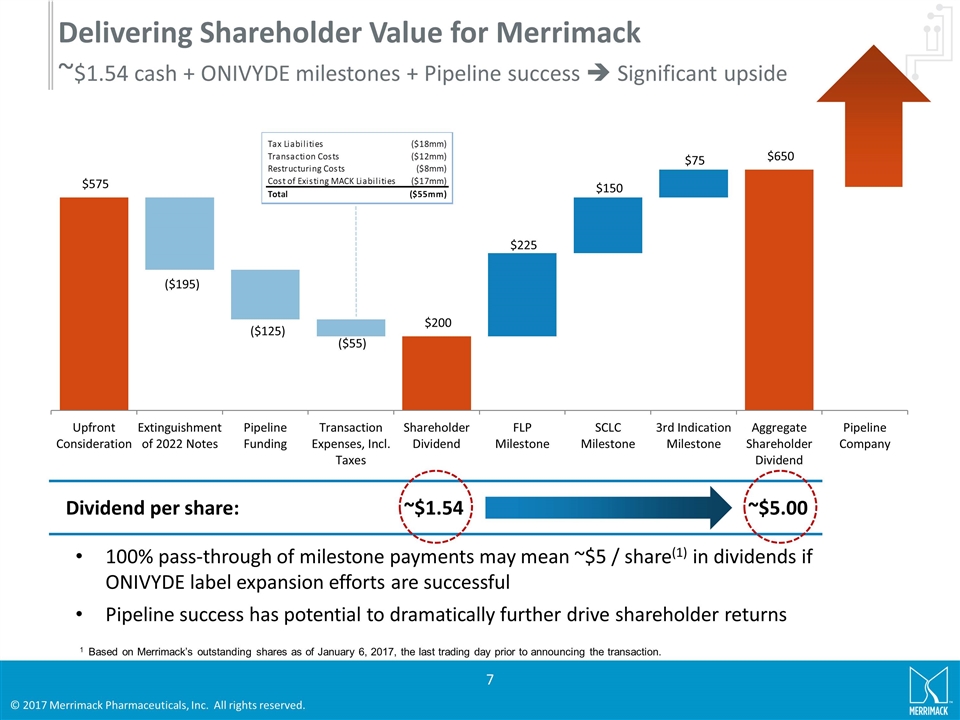

Delivering Shareholder Value for Merrimack ~$1.54 cash + ONIVYDE milestones + Pipeline success è Significant upside 100% pass-through of milestone payments may mean ~$5 / share(1) in dividends if ONIVYDE label expansion efforts are successful Pipeline success has potential to dramatically further drive shareholder returns Dividend per share: ~$5.00 ~$1.54 1 Based on Merrimack’s outstanding shares as of January 6, 2017, the last trading day prior to announcing the transaction.

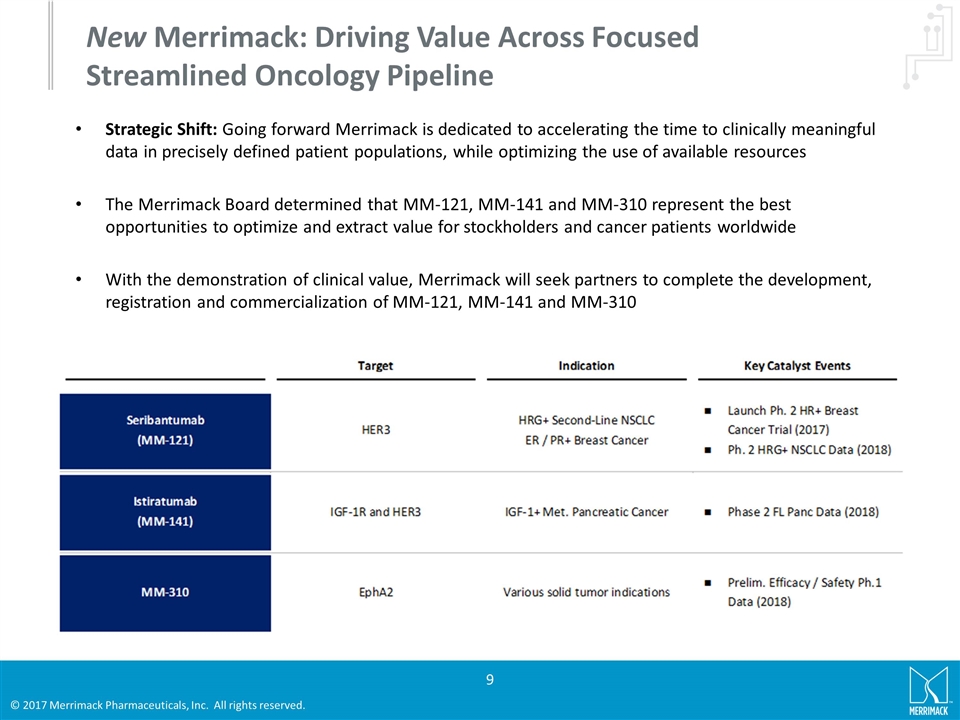

New Merrimack: Driving Value Across Focused Streamlined Oncology Pipeline

New Merrimack: Driving Value Across Focused Streamlined Oncology Pipeline Strategic Shift: Going forward Merrimack is dedicated to accelerating the time to clinically meaningful data in precisely defined patient populations, while optimizing the use of available resources The Merrimack Board determined that MM-121, MM-141 and MM-310 represent the best opportunities to optimize and extract value for stockholders and cancer patients worldwide With the demonstration of clinical value, Merrimack will seek partners to complete the development, registration and commercialization of MM-121, MM-141 and MM-310

Seribantumab (MM-121) Seribantumab is a first-in class monoclonal antibody targeting HER3 Seribantumab has the potential to transform patient care in heregulin positive patients backed by the extensive clinical data package and by the strong biomarker hypothesis

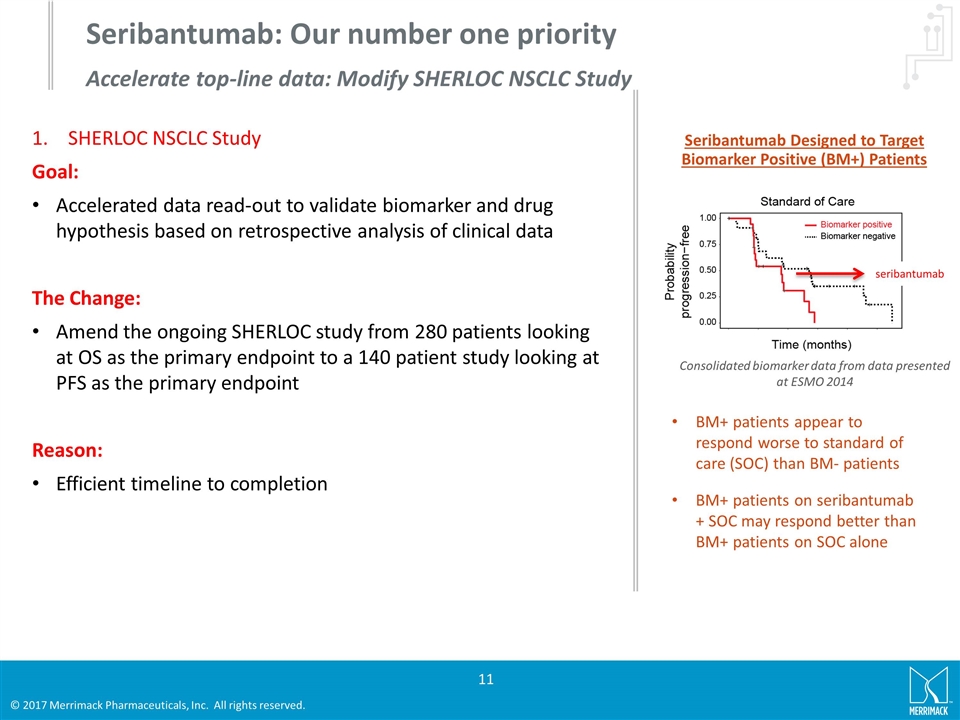

Seribantumab Designed to Target Biomarker Positive (BM+) Patients SHERLOC NSCLC Study Goal: Accelerated data read-out to validate biomarker and drug hypothesis based on retrospective analysis of clinical data The Change: Amend the ongoing SHERLOC study from 280 patients looking at OS as the primary endpoint to a 140 patient study looking at PFS as the primary endpoint Reason: Efficient timeline to completion seribantumab Consolidated biomarker data from data presented at ESMO 2014 BM+ patients appear to respond worse to standard of care (SOC) than BM- patients BM+ patients on seribantumab + SOC may respond better than BM+ patients on SOC alone Seribantumab: Our number one priority Accelerate top-line data: Modify SHERLOC NSCLC Study

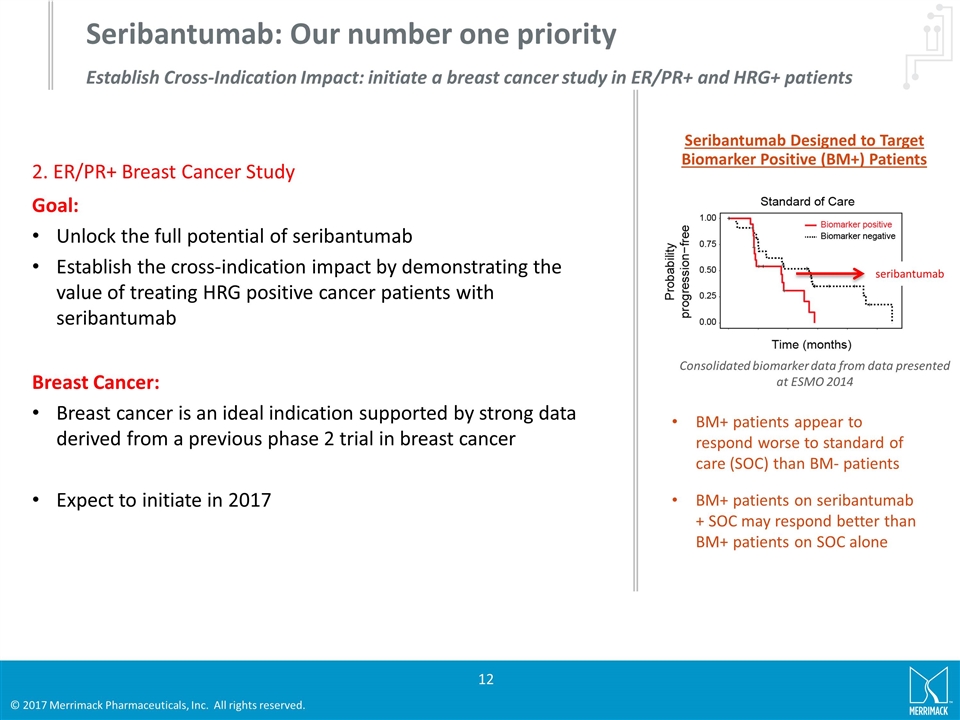

Seribantumab Designed to Target Biomarker Positive (BM+) Patients 2. ER/PR+ Breast Cancer Study Goal: Unlock the full potential of seribantumab Establish the cross-indication impact by demonstrating the value of treating HRG positive cancer patients with seribantumab Breast Cancer: Breast cancer is an ideal indication supported by strong data derived from a previous phase 2 trial in breast cancer Expect to initiate in 2017 seribantumab Consolidated biomarker data from data presented at ESMO 2014 BM+ patients appear to respond worse to standard of care (SOC) than BM- patients BM+ patients on seribantumab + SOC may respond better than BM+ patients on SOC alone Seribantumab: Our number one priority Establish Cross-Indication Impact: initiate a breast cancer study in ER/PR+ and HRG+ patients

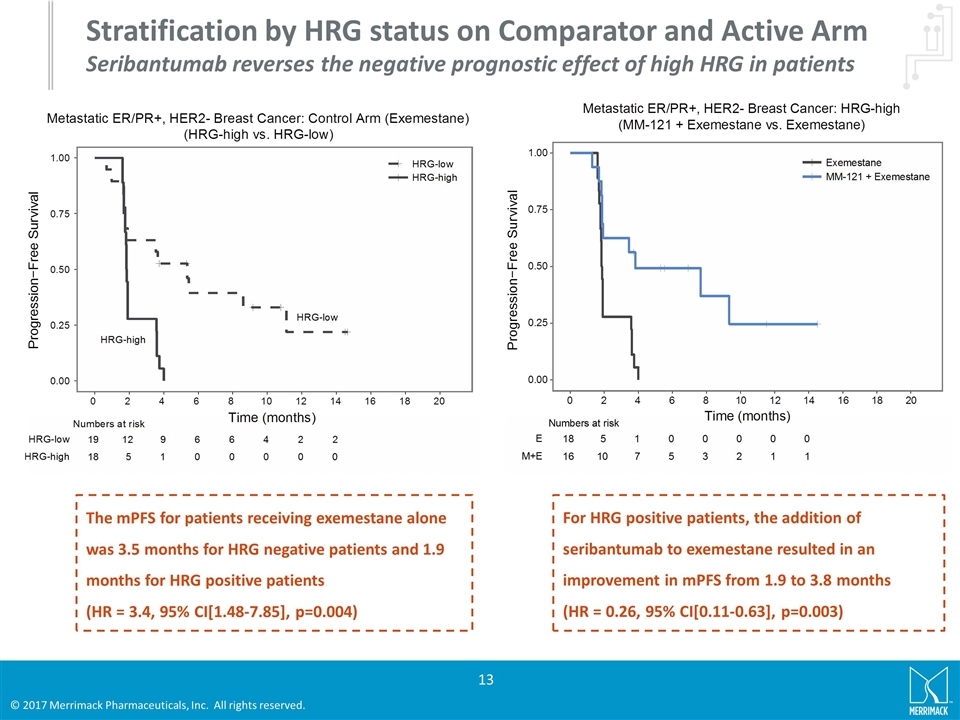

Stratification by HRG status on Comparator and Active Arm Seribantumab reverses the negative prognostic effect of high HRG in patients The mPFS for patients receiving exemestane alone was 3.5 months for HRG negative patients and 1.9 months for HRG positive patients (HR = 3.4, 95% CI[1.48-7.85], p=0.004) For HRG positive patients, the addition of seribantumab to exemestane resulted in an improvement in mPFS from 1.9 to 3.8 months (HR = 0.26, 95% CI[0.11-0.63], p=0.003)

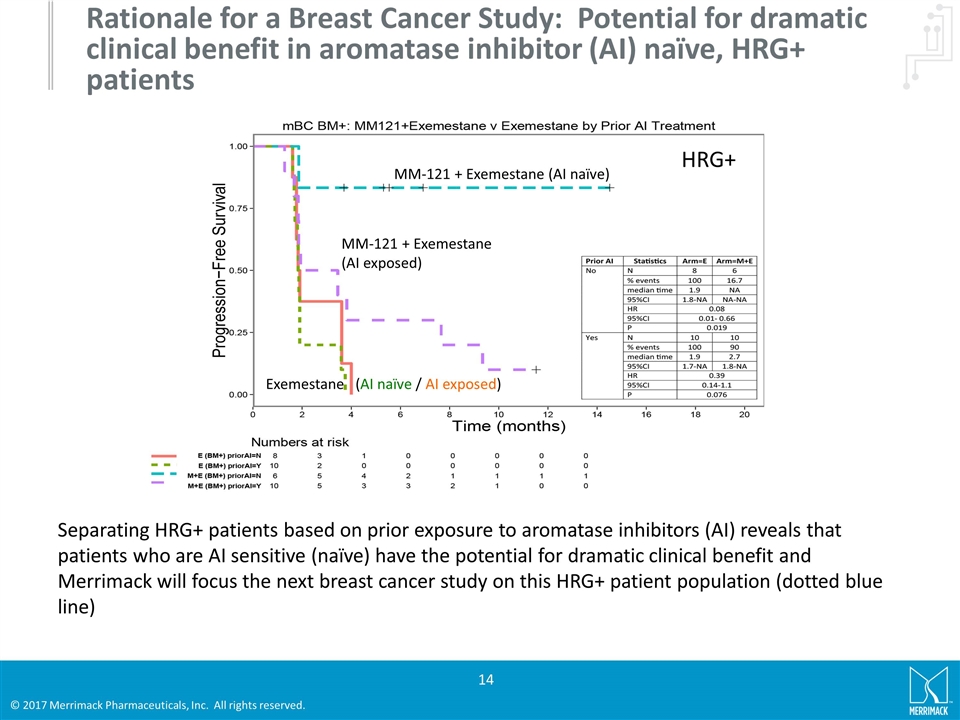

Rationale for a Breast Cancer Study: Potential for dramatic clinical benefit in aromatase inhibitor (AI) naïve, HRG+ patients Separating HRG+ patients based on prior exposure to aromatase inhibitors (AI) reveals that patients who are AI sensitive (naïve) have the potential for dramatic clinical benefit and Merrimack will focus the next breast cancer study on this HRG+ patient population (dotted blue line) MM-121 + Exemestane (AI naïve) MM-121 + Exemestane (AI exposed) Exemestane (AI naïve / AI exposed) HRG+

Istiratumab (MM-141) Istiratumab is a bispecific tetravalent antibody and a potent inhibitor of the PI3K/AKT/mTOR pathway by targeting IGF1-R and HER3

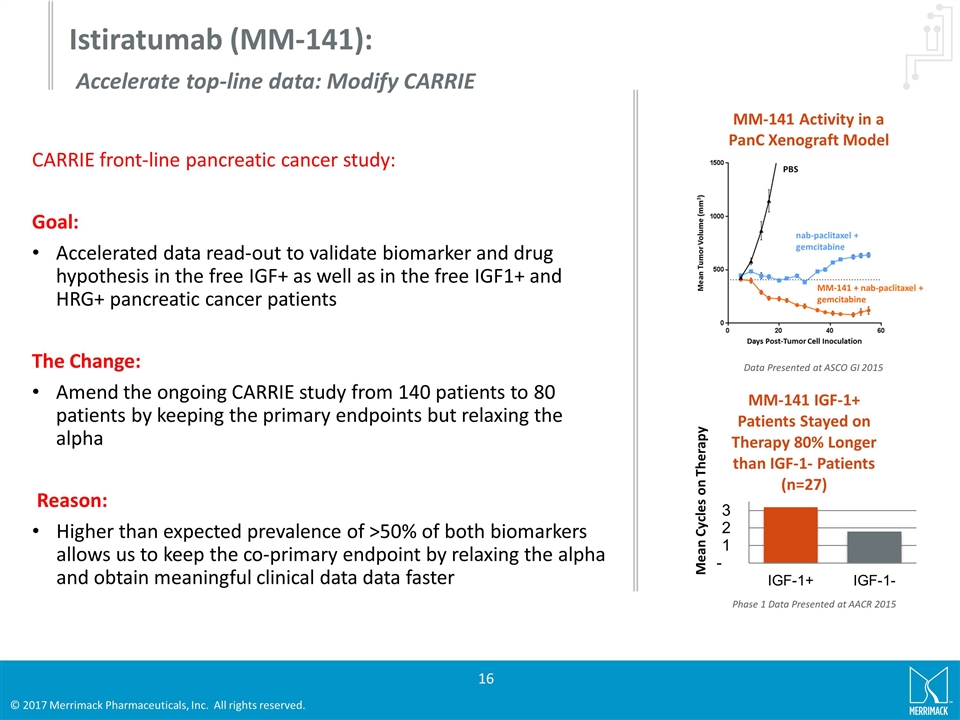

MM-141 Activity in a PanC Xenograft Model Mean Cycles on Therapy Phase 1 Data Presented at AACR 2015 Istiratumab (MM-141): Accelerate top-line data: Modify CARRIE Data Presented at ASCO GI 2015 CARRIE front-line pancreatic cancer study: Goal: Accelerated data read-out to validate biomarker and drug hypothesis in the free IGF+ as well as in the free IGF1+ and HRG+ pancreatic cancer patients The Change: Amend the ongoing CARRIE study from 140 patients to 80 patients by keeping the primary endpoints but relaxing the alpha Reason: Higher than expected prevalence of >50% of both biomarkers allows us to keep the co-primary endpoint by relaxing the alpha and obtain meaningful clinical data data faster

MM-310 A novel antibody directed nanotherapeutic (ADN) that contains a prodrug of docetaxel and targets the EphA2 receptor MM-310 utilizes the same proprietary nano-liposomal technology as ONIVYDE® Launching a Phase 1 study with MM-310 enrolling prostate, ovarian, bladder, gastric and lung cancer patients the first quarter of 2017

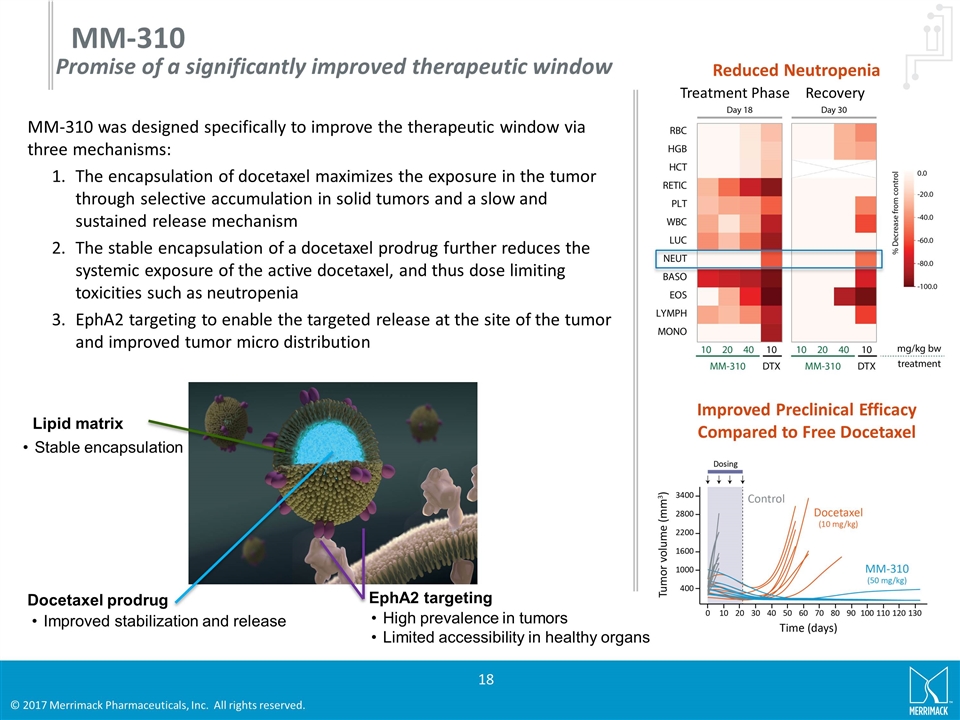

MM-310 was designed specifically to improve the therapeutic window via three mechanisms: The encapsulation of docetaxel maximizes the exposure in the tumor through selective accumulation in solid tumors and a slow and sustained release mechanism The stable encapsulation of a docetaxel prodrug further reduces the systemic exposure of the active docetaxel, and thus dose limiting toxicities such as neutropenia EphA2 targeting to enable the targeted release at the site of the tumor and improved tumor micro distribution MM-310 Reduced Neutropenia Improved Preclinical Efficacy Compared to Free Docetaxel Treatment Phase Recovery Promise of a significantly improved therapeutic window Lipid matrix Stable encapsulation Docetaxel prodrug Improved stabilization and release EphA2 targeting High prevalence in tumors Limited accessibility in healthy organs

Summary

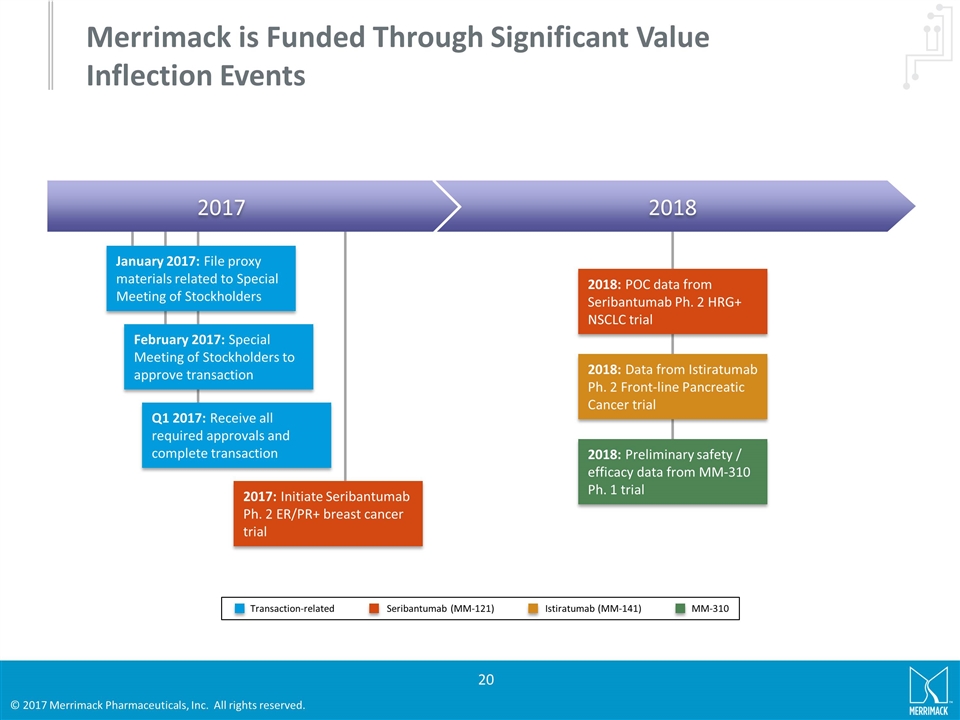

Merrimack is Funded Through Significant Value Inflection Events 2017 2018 January 2017: File proxy materials related to Special Meeting of Stockholders February 2017: Special Meeting of Stockholders to approve transaction Q1 2017: Receive all required approvals and complete transaction 2017: Initiate Seribantumab Ph. 2 ER/PR+ breast cancer trial 2018: POC data from Seribantumab Ph. 2 HRG+ NSCLC trial 2018: Preliminary safety / efficacy data from MM-310 Ph. 1 trial 2018: Data from Istiratumab Ph. 2 Front-line Pancreatic Cancer trial Istiratumab (MM-141) Transaction-related Seribantumab (MM-121) MM-310

The New Merrimack Opportunity Focused on three leading product candidates Committed to delivering innovative oncology treatments for cancer patients, while creating value for stockholders Capital structure to support and sustain strategic shift to earlier-stage, R&D-focused biopharmaceutical company Fully funded into the second half of 2019 Potential for near-term value events and positioned for long-term value creation

Appendix: Supporting Information on Development Stage Assets

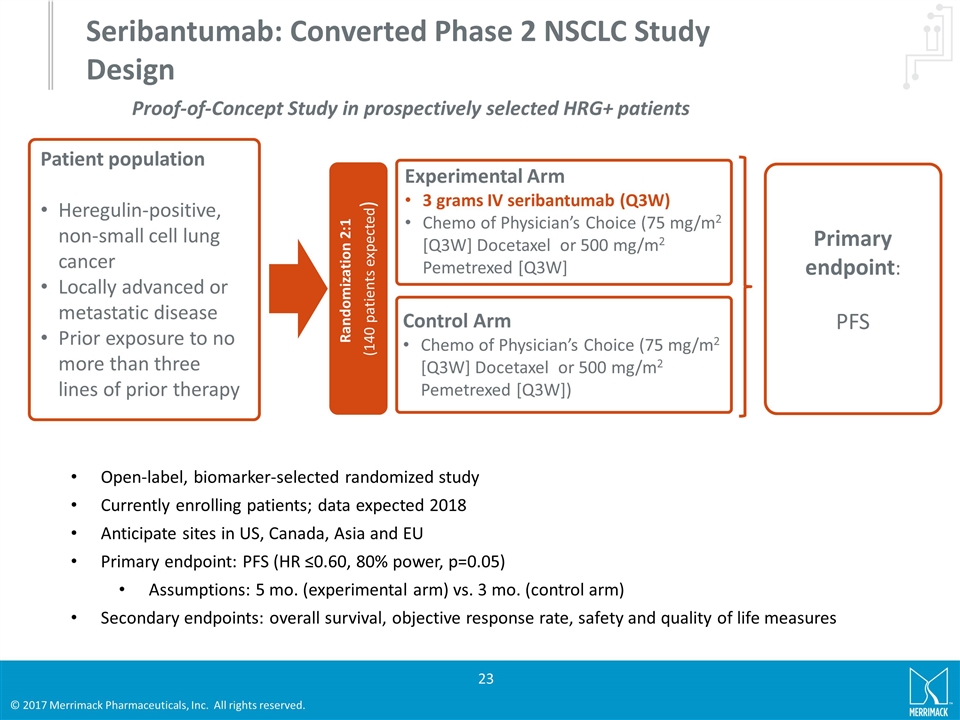

Seribantumab: Converted Phase 2 NSCLC Study Design Patient population Heregulin-positive, non-small cell lung cancer Locally advanced or metastatic disease Prior exposure to no more than three lines of prior therapy Primary endpoint: PFS Randomization 2:1 (140 patients expected) Experimental Arm 3 grams IV seribantumab (Q3W) Chemo of Physician’s Choice (75 mg/m2 [Q3W] Docetaxel or 500 mg/m2 Pemetrexed [Q3W] Control Arm Chemo of Physician’s Choice (75 mg/m2 [Q3W] Docetaxel or 500 mg/m2 Pemetrexed [Q3W]) Open-label, biomarker-selected randomized study Currently enrolling patients; data expected 2018 Anticipate sites in US, Canada, Asia and EU Primary endpoint: PFS (HR ≤0.60, 80% power, p=0.05) Assumptions: 5 mo. (experimental arm) vs. 3 mo. (control arm) Secondary endpoints: overall survival, objective response rate, safety and quality of life measures Proof-of-Concept Study in prospectively selected HRG+ patients

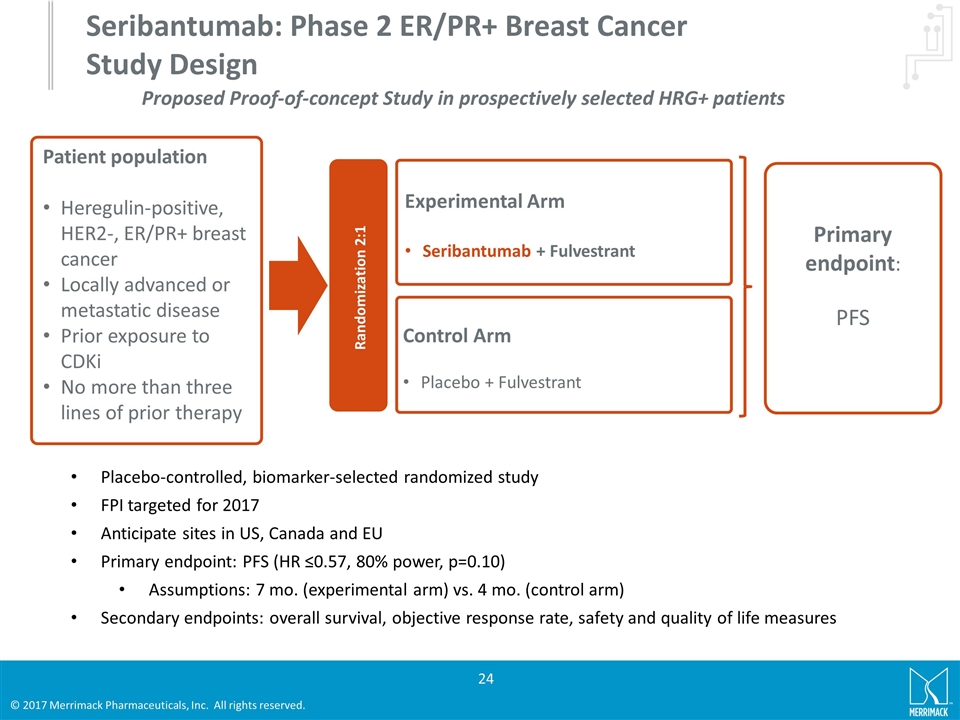

Seribantumab: Phase 2 ER/PR+ Breast Cancer Study Design Patient population Heregulin-positive, HER2-, ER/PR+ breast cancer Locally advanced or metastatic disease Prior exposure to CDKi No more than three lines of prior therapy Primary endpoint: PFS Randomization 2:1 Experimental Arm Seribantumab + Fulvestrant Control Arm Placebo + Fulvestrant Placebo-controlled, biomarker-selected randomized study FPI targeted for 2017 Anticipate sites in US, Canada and EU Primary endpoint: PFS (HR ≤0.57, 80% power, p=0.10) Assumptions: 7 mo. (experimental arm) vs. 4 mo. (control arm) Secondary endpoints: overall survival, objective response rate, safety and quality of life measures Proposed Proof-of-concept Study in prospectively selected HRG+ patients

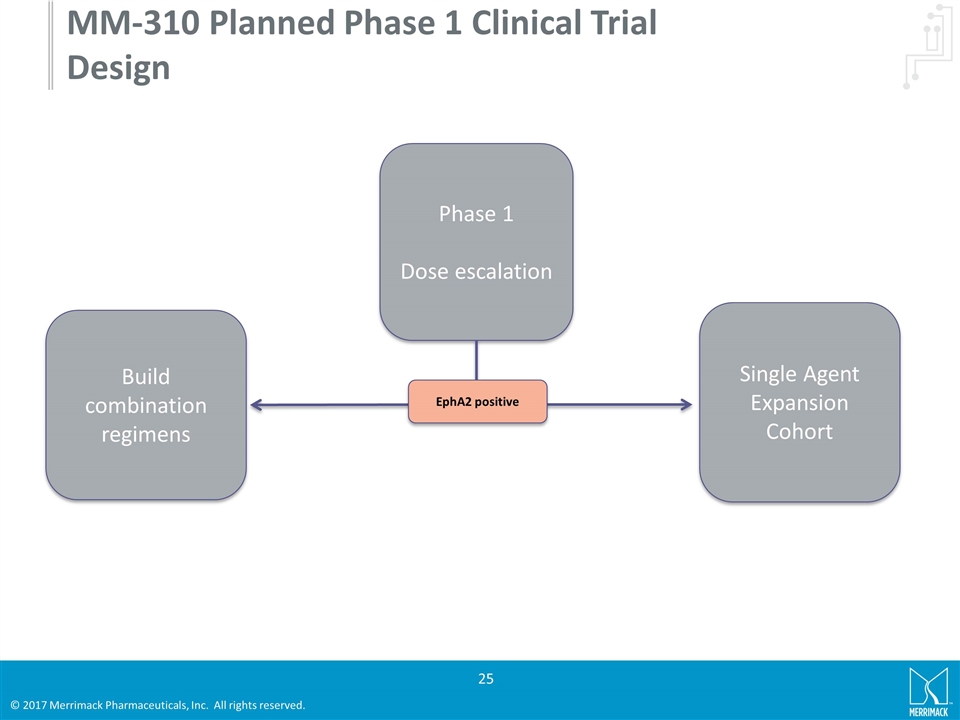

MM-310 Planned Phase 1 Clinical Trial Design Phase 1 Dose escalation Build combination regimens Single Agent Expansion Cohort EphA2 positive

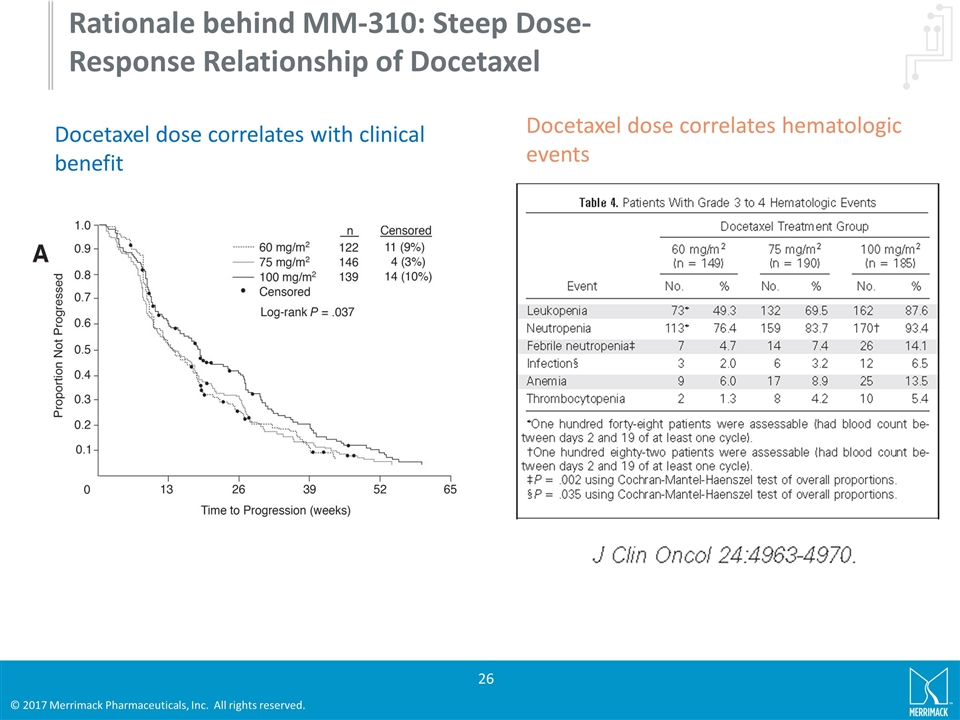

Rationale behind MM-310: Steep Dose-Response Relationship of Docetaxel Docetaxel dose correlates with clinical benefit Docetaxel dose correlates hematologic events