Attached files

| file | filename |

|---|---|

| 8-K - 8K INVESTOR PRESENTATION JANUARY 2017 AND HOLIDAY SALES PRESS RELEASE - DESTINATION XL GROUP, INC. | dxlg-8k_20170109.htm |

| EX-99.1 - EX-99.1 - DESTINATION XL GROUP, INC. | dxlg-ex991_14.htm |

ICR Conference January 10, 2017

Forward-Looking Statements and Non-GAAP Measures Forward-Looking Statements: Certain information contained in this presentation constitute forward-looking statements under the federal securities laws and include statements regarding the Company’s expectations on strategic opportunities, sales, gross margin, free cash flows, EBITDA, projected 5-year IRR, capital expenditures and store counts for fiscal 2016 and beyond. The discussion of forward-looking information requires management of the Company to make certain estimates and assumptions regarding the Company's strategic direction and the effect of such plans on the Company's financial results. Such forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from those indicated. Such risks and uncertainties may include, but are not limited to: the failure to execute the Company's DXL strategy and grow market share, failure to compete successfully with our competitors, failure to predict fashion trends, extreme or unseasonable weather conditions, economic downturns, a weakness in overall consumer demand, trade and security restrictions and political or financial instability in countries where goods are manufactured, fluctuations in price, availability and quality of raw material, the interruption of merchandise flow from the Company's distribution facility, and the adverse effects of general economic conditions, political issues abroad, natural disasters, war and acts of terrorism on the United States and international economies. These, and other risks and uncertainties, are detailed in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission for the fiscal year ended January 30, 2016 filed on March 18, 2016 and other Company filings with the Securities and Exchange Commission. The Company assumes no duty to update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. Non-GAAP Measures: Adjusted Net Loss, Adjusted Net Loss Per Diluted Share, EBITDA, Free Cash Flow and Free Cash Flow before DXL expenditures are non-GAAP measures. The Company believes that these non-GAAP measures are useful as additional means for investors to evaluate the Company's operating results, when reviewed in conjunction with the Company's GAAP financial statements. Please see Appendix B for additional information concerning these non-GAAP measures and a reconciliation to their respective GAAP measures, as applicable.

Agenda DXL Today Our Strategy Our Opportunity Key Financial Metrics Key Investment Takeaways

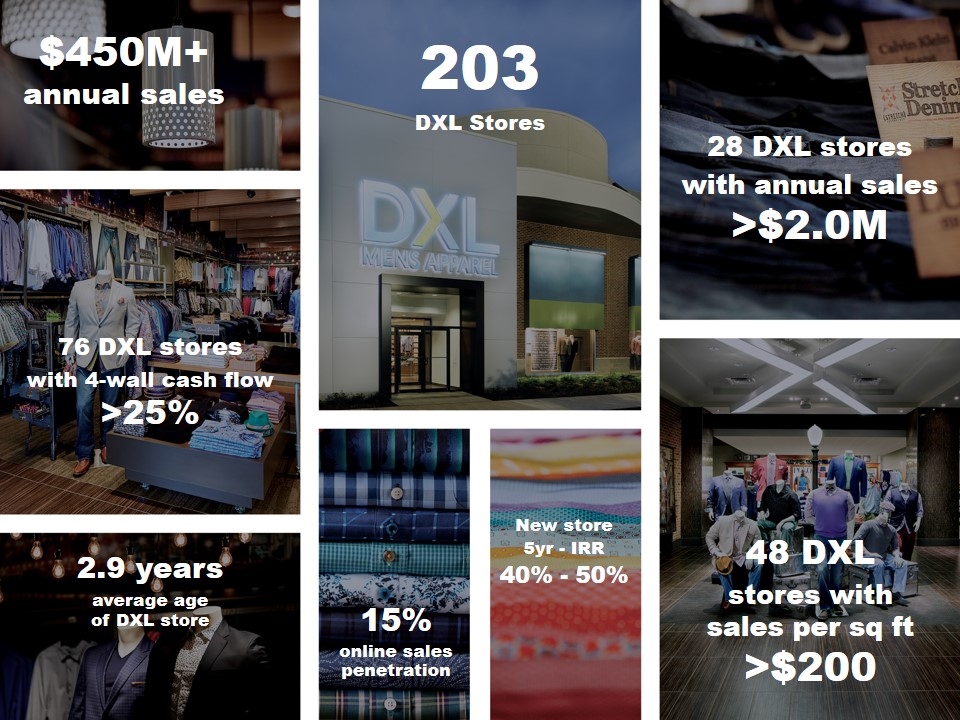

DXL Today

$450M+ annual sales 203 DXL Stores 48 DXL stores with sales per sq ft >$200 2.9 years average age of DXL store New store 5yr - IRR 40% - 50% 15% online sales penetration 76 DXL stores with 4-wall cash flow >25% 28 DXL stores with annual sales >$2.0M

Strategy

Strategy: Differentiated Assortment & Experience CONVENIENCE AND EASE Convenient head-to-toe shopping all under one roof; casual to dress to athletic styles. THE PERFECT FIT We ARE the fit experts with technical designs to precisely fit and complement the body proportions of our guy. Sizes start at XL, waist 38, and shoes 10W & up. THE FINEST QUALITY & PERSONALIZED SERVICE Whether it’s a top designer or a value-priced private label, we offer only the finest in quality and craftsmanship; and our service is unparalleled. BEST SELECTION OF STYLES & BRANDS Over 100 brands and 1,000s of styles – from top designers and exclusive private labels. MODERN, UNIQUE SHOPPING ENVIRONMENT A store environment that offers the ultimate “WOW” factor, featuring spacious aisles and fitting rooms, plus an easy-to-shop layout.

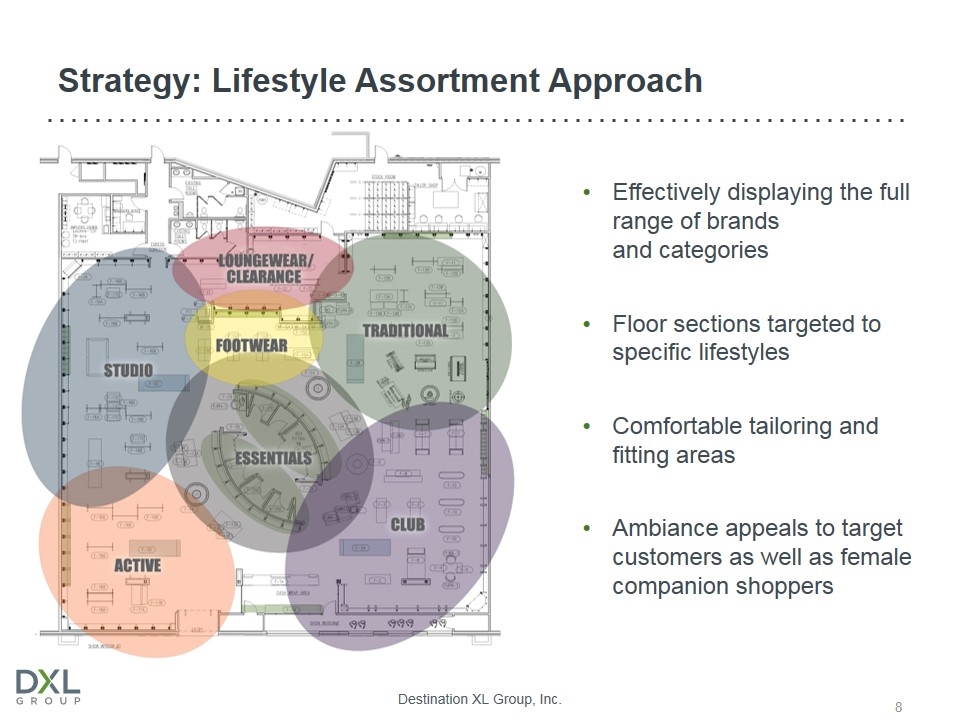

Strategy: Lifestyle Assortment Approach Effectively displaying the full range of brands and categories Floor sections targeted to specific lifestyles Comfortable tailoring and fitting areas Ambiance appeals to target customers as well as female companion shoppers

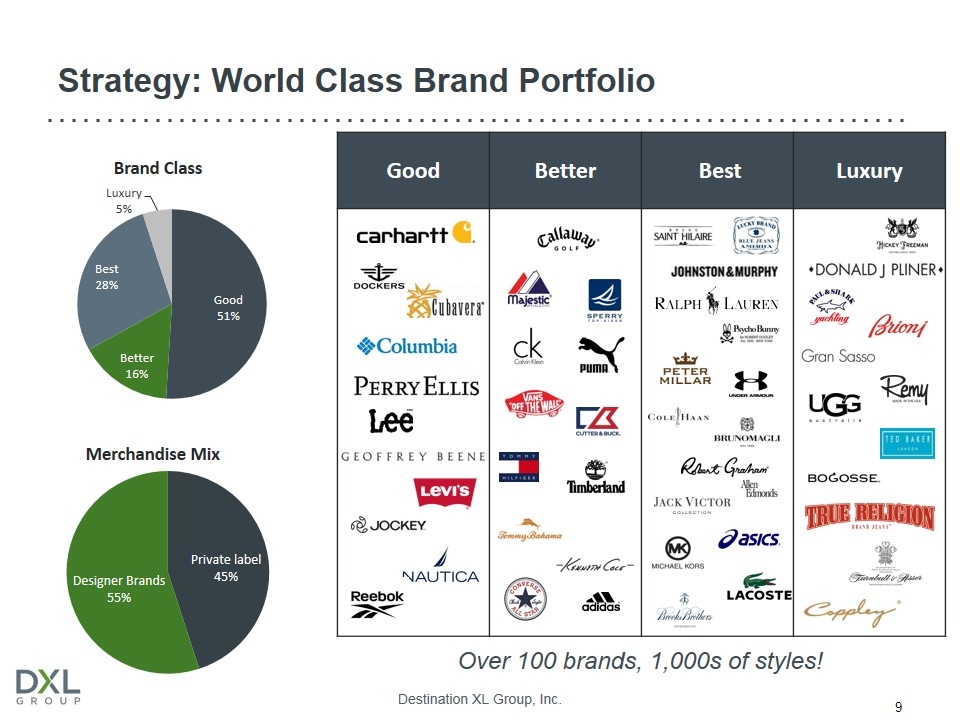

Strategy: World Class Brand Portfolio Good Better Best Luxury Brand Class Over 100 brands, 1,000s of styles!

Strategy: Destination Model vs. Mall Model Destination model acquires customers over time resulting in strong year-over-year comps as the store matures as opposed to Mall model Located in high traffic locations with convenient access

This slide represents a one-minute video that provides a tour of the DXL stores as well as a representation of merchandise sold by the Company.

Opportunity

Opportunity: Awareness 6 out of 10 Big and Tall Guys don’t know who we are!

Opportunity: End-of-Rack Customer (waist size 38”- 46”) End-of-Rack Improves Quality of Sale Spends 120% more than 48”+ customers Visits 52% more often than 48”+ customers In Q3 2016, End-of-Rack was 44.5% of bottoms business compared to 42.9% in prior year quarter.

Opportunity: eCommerce Mobile Experience Personalization Digital Prospecting Digital Offers/Free Shipping

Selected Primary Expansion Opportunities Opportunity: International 2 DXL stores opening in Toronto in Spring 2017 International franchising / licensing model

Key Financial Metrics

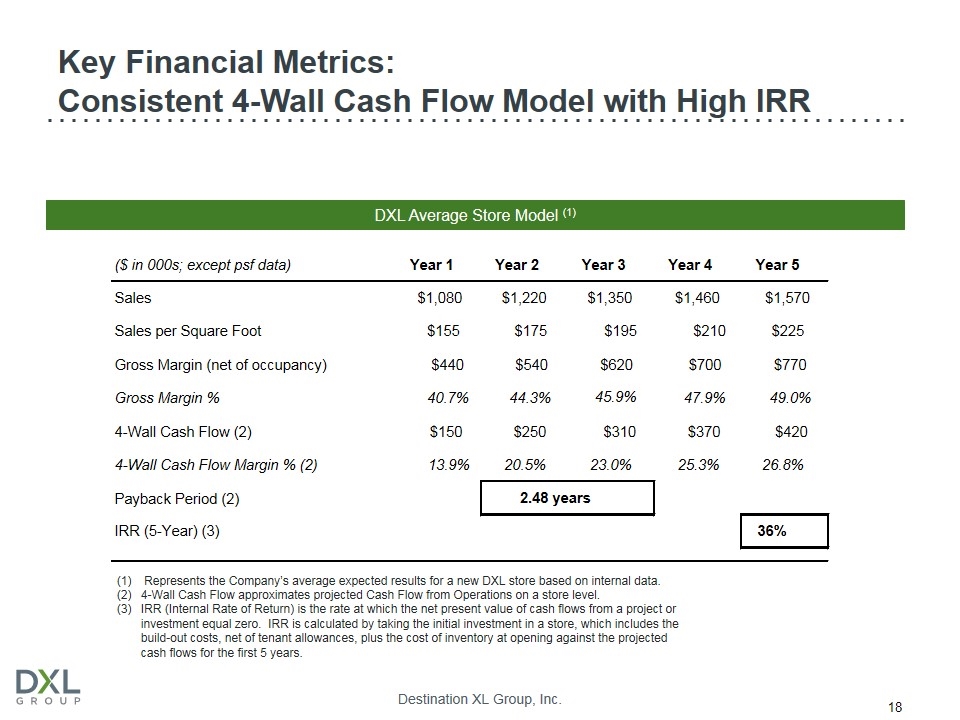

Key Financial Metrics: Consistent 4-Wall Cash Flow Model with High IRR DXL Average Store Model (1) ($ in 000s; except psf data) Year 1 Year 2 Year 3 Year 4 Year 5 Sales $1,080 $1,220 $1,350 $1,460 $1,570 Sales per Square Foot $155 $175 $195 $210 $225 Gross Margin (net of occupancy) $440 $540 $620 $700 $770 Gross Margin % 40.7% 44.3% 45.9% 47.9% 49.0% 4-Wall Cash Flow (2) $150 $250 $310 $370 $420 4-Wall Cash Flow Margin % (2) 13.9% 20.5% 23.0% 25.3% 26.8% Payback Period (2) 2.48 years IRR (5-Year) (3) 36% Represents the Company’s average expected results for a new DXL store based on internal data. 4-Wall Cash Flow approximates projected Cash Flow from Operations on a store level. IRR (Internal Rate of Return) is the rate at which the net present value of cash flows from a project or investment equal zero. IRR is calculated by taking the initial investment in a store, which includes the build-out costs, net of tenant allowances, plus the cost of inventory at opening against the projected cash flows for the first 5 years.

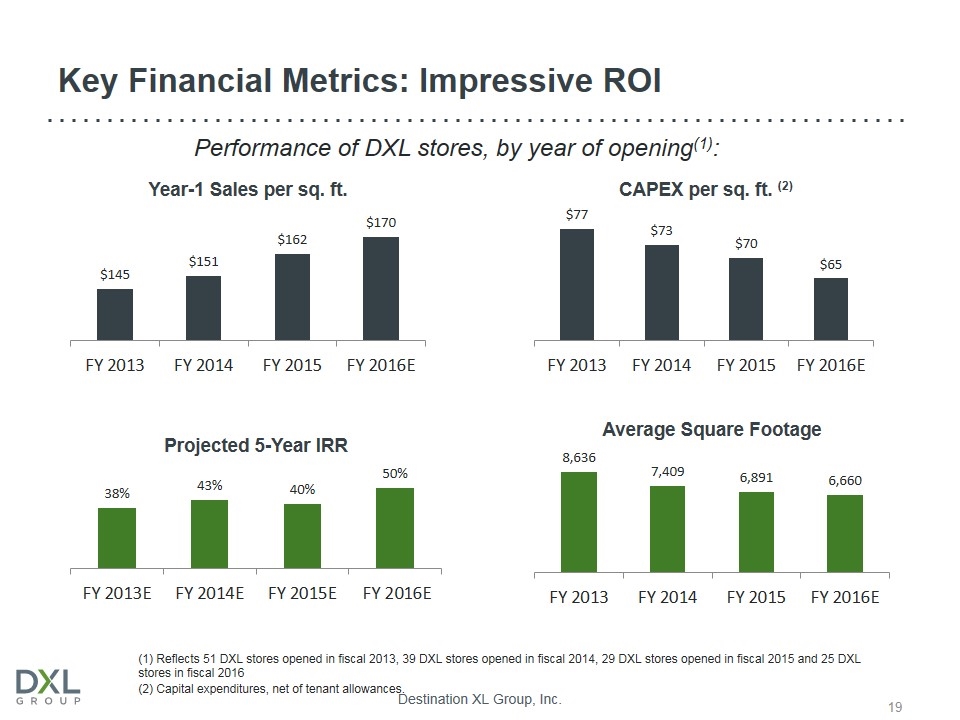

Key Financial Metrics: Impressive ROI (1) Reflects 51 DXL stores opened in fiscal 2013, 39 DXL stores opened in fiscal 2014, 29 DXL stores opened in fiscal 2015 and 25 DXL stores in fiscal 2016 (2) Capital expenditures, net of tenant allowances. Performance of DXL stores, by year of opening(1):

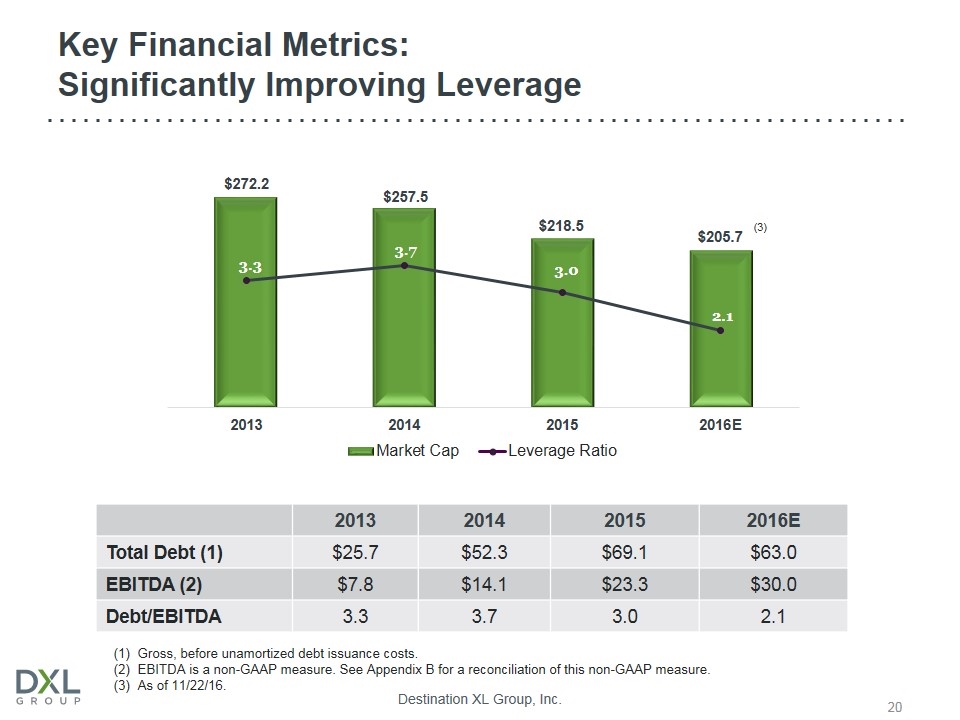

Key Financial Metrics: Significantly Improving Leverage 2013 2014 2015 2016E Total Debt (1) $25.7 $52.3 $69.1 $63.0 EBITDA (2) $7.8 $14.1 $23.3 $30.0 Debt/EBITDA 3.3 3.7 3.0 2.1 Gross, before unamortized debt issuance costs. EBITDA is a non-GAAP measure. See Appendix B for a reconciliation of this non-GAAP measure. As of 11/22/16. (3)

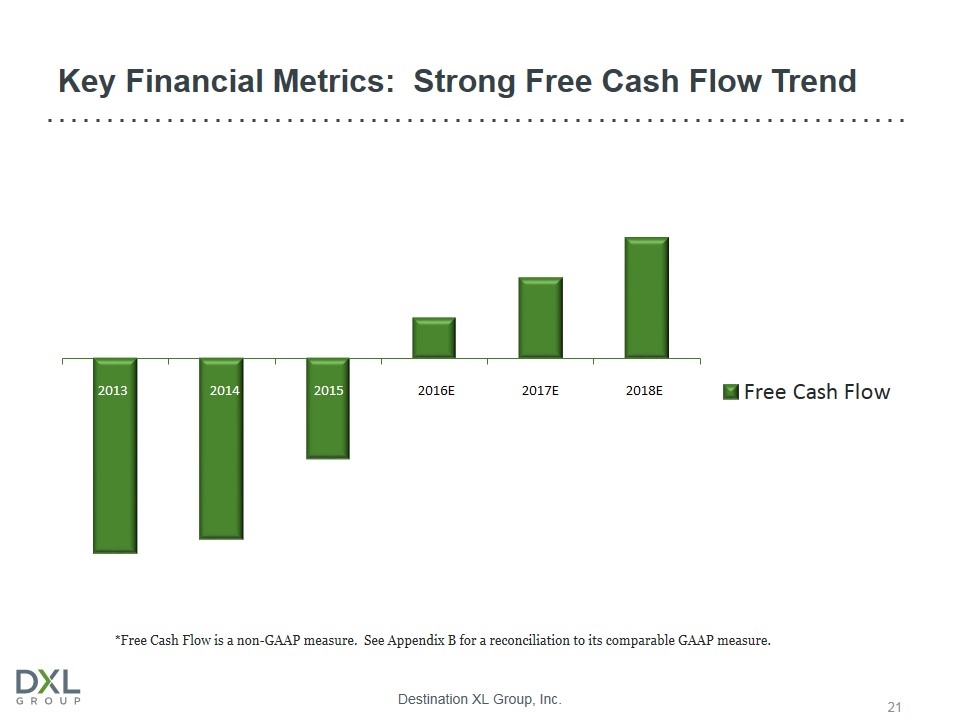

Key Financial Metrics: Strong Free Cash Flow Trend *Free Cash Flow is a non-GAAP measure. See Appendix B for a reconciliation to its comparable GAAP measure.

Key Investment Takeaways

Key Investment Takeaways: Quality, Service, Selection World Class Brand portfolio Customer Awareness End-of-Rack Customer eCommerce International

ICR Conference January 10, 2017

Q3 Financial Results Appendix A

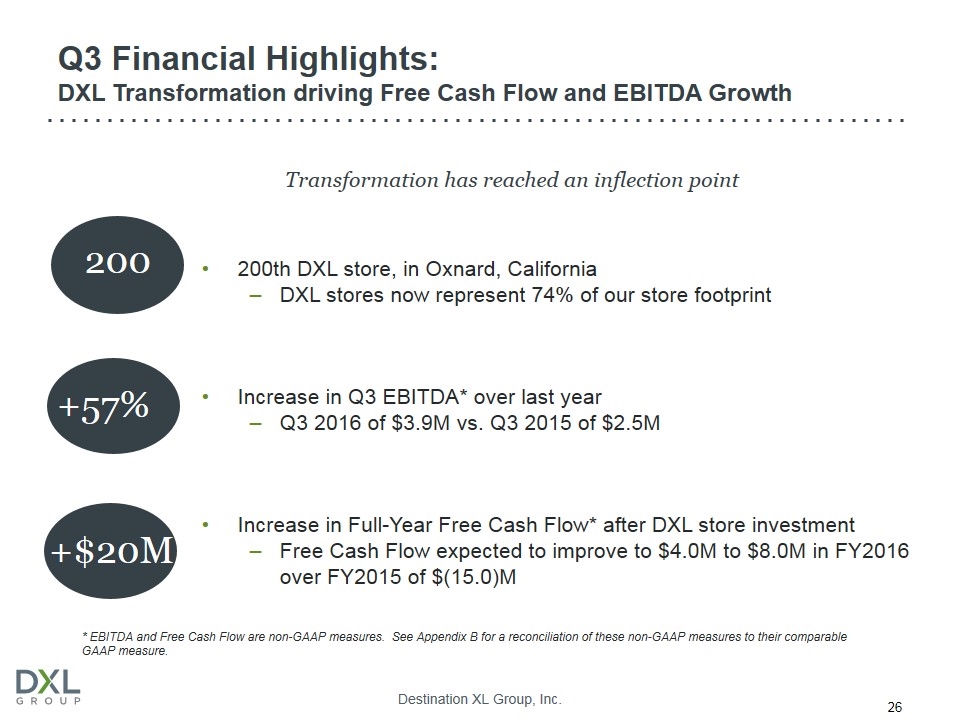

Q3 Financial Highlights: DXL Transformation driving Free Cash Flow and EBITDA Growth 200th DXL store, in Oxnard, California DXL stores now represent 74% of our store footprint Increase in Q3 EBITDA* over last year Q3 2016 of $3.9M vs. Q3 2015 of $2.5M Increase in Full-Year Free Cash Flow* after DXL store investment Free Cash Flow expected to improve to $4.0M to $8.0M in FY2016 over FY2015 of $(15.0)M 200 +57% +$20M Transformation has reached an inflection point * EBITDA and Free Cash Flow are non-GAAP measures. See Appendix B for a reconciliation of these non-GAAP measures to their comparable GAAP measure.

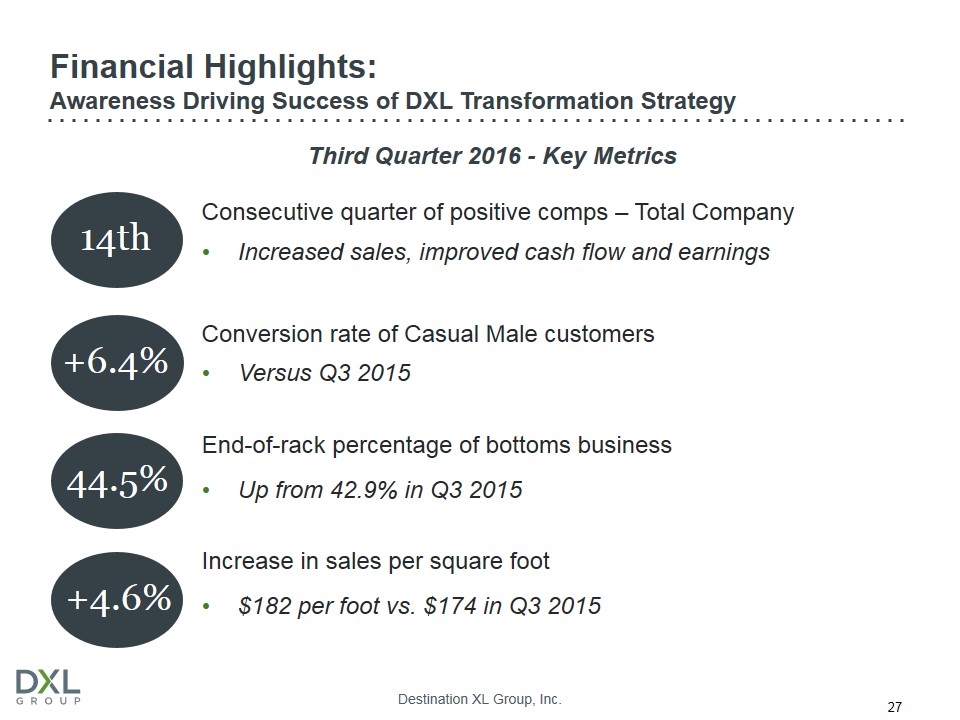

2013 Financial Highlights: Awareness Driving Success of DXL Transformation Strategy Third Quarter 2016 - Key Metrics Consecutive quarter of positive comps – Total Company Increased sales, improved cash flow and earnings Conversion rate of Casual Male customers Versus Q3 2015 End-of-rack percentage of bottoms business Up from 42.9% in Q3 2015 Increase in sales per square foot $182 per foot vs. $174 in Q3 2015 38% +6.4% 44.5% +4.6% 14th

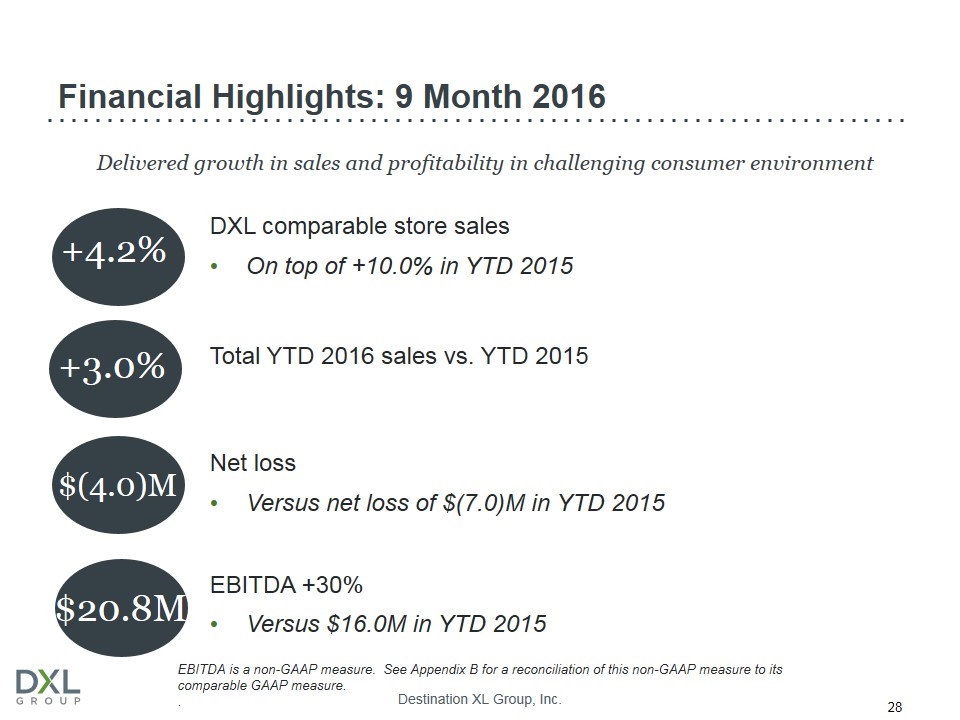

Financial Highlights: 9 Month 2016 DXL comparable store sales On top of +10.0% in YTD 2015 Total YTD 2016 sales vs. YTD 2015 Net loss Versus net loss of $(7.0)M in YTD 2015 EBITDA +30% Versus $16.0M in YTD 2015 +4.2% +3.0% $20.8M Delivered growth in sales and profitability in challenging consumer environment $(4.0)M EBITDA is a non-GAAP measure. See Appendix B for a reconciliation of this non-GAAP measure to its comparable GAAP measure. .

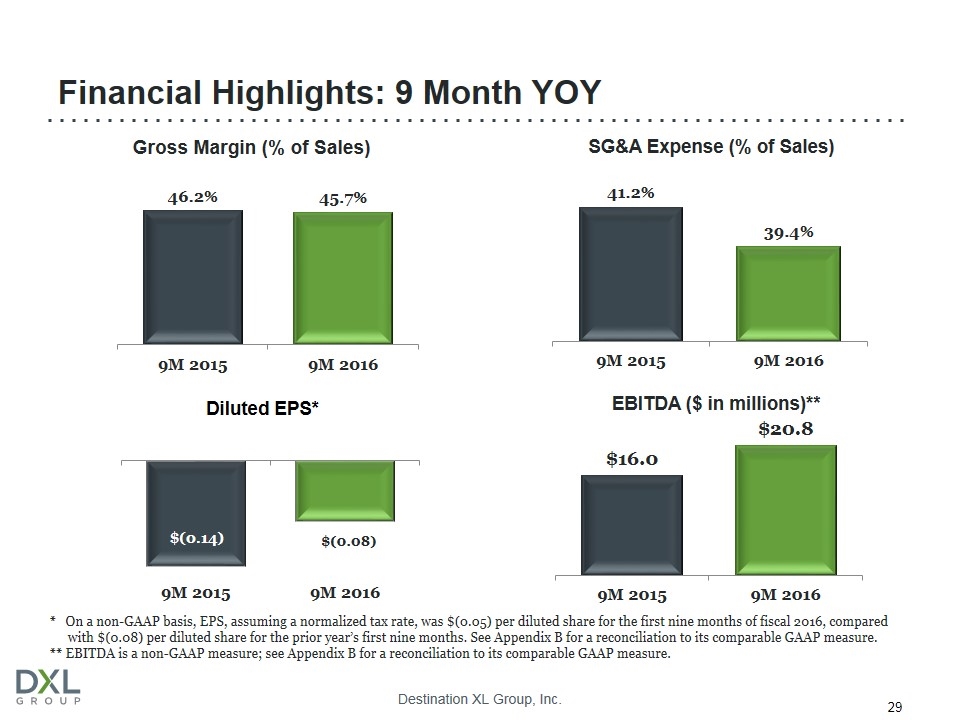

Financial Highlights: 9 Month YOY * On a non-GAAP basis, EPS, assuming a normalized tax rate, was $(0.05) per diluted share for the first nine months of fiscal 2016, compared with $(0.08) per diluted share for the prior year’s first nine months. See Appendix B for a reconciliation to its comparable GAAP measure. ** EBITDA is a non-GAAP measure; see Appendix B for a reconciliation to its comparable GAAP measure.

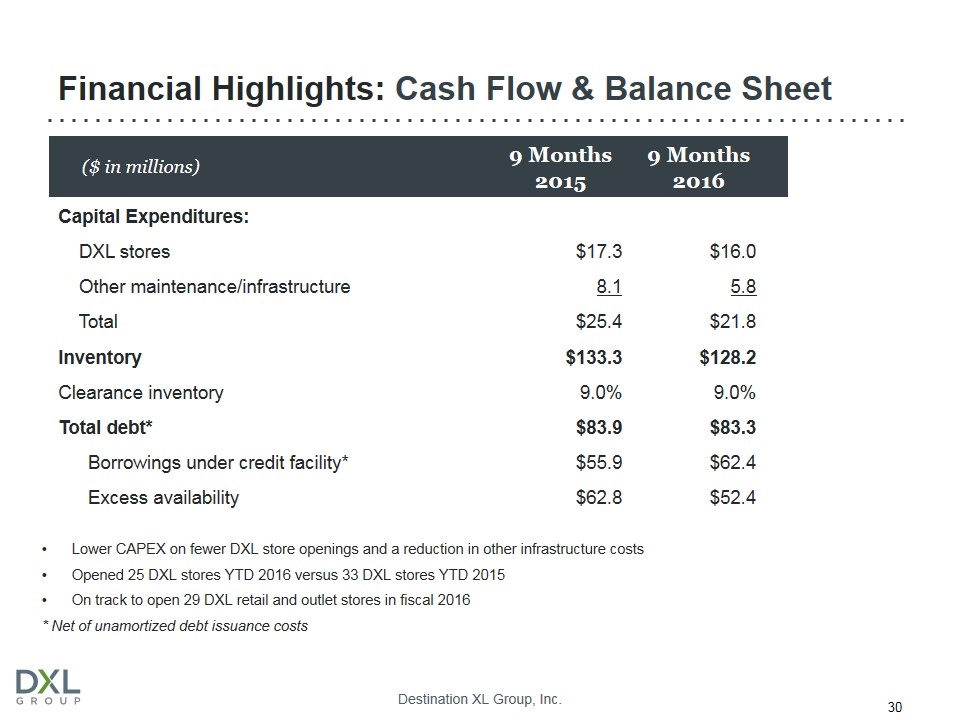

Financial Highlights: Cash Flow & Balance Sheet 9 Months 2015 9 Months 2016 Capital Expenditures: DXL stores $17.3 $16.0 Other maintenance/infrastructure 8.1 5.8 Total $25.4 $21.8 Inventory $133.3 $128.2 Clearance inventory 9.0% 9.0% Total debt* $83.9 $83.3 Borrowings under credit facility* $55.9 $62.4 Excess availability $62.8 $52.4 ($ in millions) Lower CAPEX on fewer DXL store openings and a reduction in other infrastructure costs Opened 25 DXL stores YTD 2016 versus 33 DXL stores YTD 2015 On track to open 29 DXL retail and outlet stores in fiscal 2016 * Net of unamortized debt issuance costs

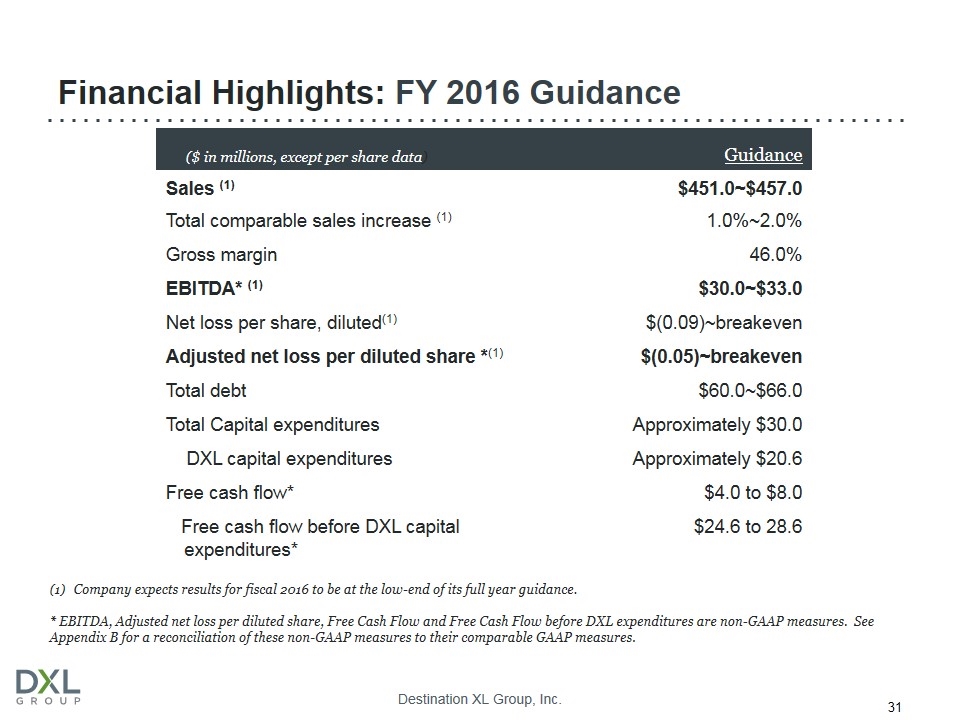

Financial Highlights: FY 2016 Guidance Guidance Sales (1) $451.0~$457.0 Total comparable sales increase (1) 1.0%~2.0% Gross margin 46.0% EBITDA* (1) $30.0~$33.0 Net loss per share, diluted(1) $(0.09)~breakeven Adjusted net loss per diluted share *(1) $(0.05)~breakeven Total debt $60.0~$66.0 Total Capital expenditures Approximately $30.0 DXL capital expenditures Approximately $20.6 Free cash flow* $4.0 to $8.0 Free cash flow before DXL capital expenditures* $24.6 to 28.6 ($ in millions, except per share data) Company expects results for fiscal 2016 to be at the low-end of its full year guidance. * EBITDA, Adjusted net loss per diluted share, Free Cash Flow and Free Cash Flow before DXL expenditures are non-GAAP measures. See Appendix B for a reconciliation of these non-GAAP measures to their comparable GAAP measures.

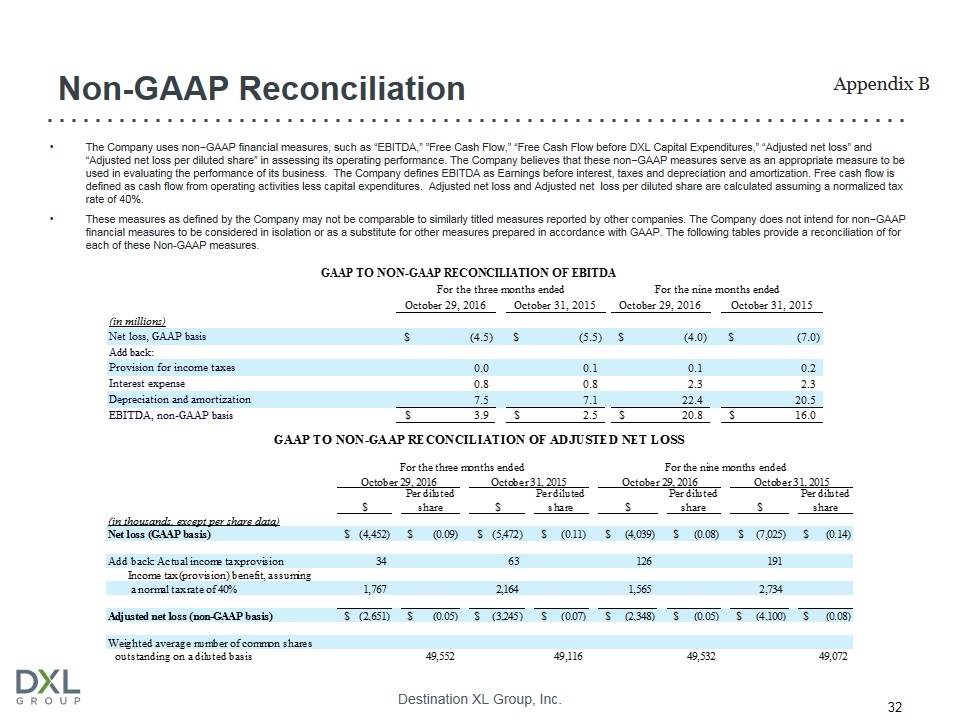

Non-GAAP Reconciliation The Company uses non−GAAP financial measures, such as “EBITDA,” ”Free Cash Flow,” “Free Cash Flow before DXL Capital Expenditures,” “Adjusted net loss” and “Adjusted net loss per diluted share” in assessing its operating performance. The Company believes that these non−GAAP measures serve as an appropriate measure to be used in evaluating the performance of its business. The Company defines EBITDA as Earnings before interest, taxes and depreciation and amortization. Free cash flow is defined as cash flow from operating activities less capital expenditures. Adjusted net loss and Adjusted net loss per diluted share are calculated assuming a normalized tax rate of 40%. These measures as defined by the Company may not be comparable to similarly titled measures reported by other companies. The Company does not intend for non−GAAP financial measures to be considered in isolation or as a substitute for other measures prepared in accordance with GAAP. The following tables provide a reconciliation of for each of these Non-GAAP measures. Appendix B MDA_EPS_SUMMARY For the three months ended For the nine months ended October 29, 2016 October 31, 2015 October 29, 2016 October 31, 2015 (in millions, except per share data) Net loss $-4.4530000000000003 $-5.4720000000000004 $-4.04 $-7.0250000000000004 EBITDA (Non-GAAP basis) $3.855 $2.4500000000000002 $20.795999999999999 $15.981999999999999 Per diluted share: Net loss $-8.9865192121407811E-2 $-0.1114097239188859 $-8.1563433739804569E-2 $-0.1431569938050212 NonGaap_EBITDA For the three months ended For the nine months ended October 29, 2016 October 31, 2015 October 29, 2016 October 31, 2015 (in millions) Net loss (GAAP basis) $-4.4530000000000003 $-5.4720000000000004 $-4.04 $-7.0250000000000004 Add back: Provision for income taxes 3.5000000000000003E-2 6.3E-2 0.127 0.191 Interest expense 0.77900000000000003 0.78300000000000003 2.3460000000000001 2.29 Depreciation and amortization 7.4939999999999998 7.0759999999999996 22.363 20.526 EBITDA (non-GAAP basis) $3.8549999999999995 $2.4499999999999993 $20.795999999999999 $15.981999999999999 $1.4050000000000002 0.57346938775510226 + For press release GAAP TO NON-GAAP RECONCILIATION OF EBITDA For the three months ended For the nine months ended October 29, 2016 October 31, 2015 October 29, 2016 October 31, 2015 (in millions) Net loss, GAAP basis $-4.4530000000000003 $-5.4720000000000004 $-4.04 $-7.0250000000000004 Add back: Provision for income taxes 3.5000000000000003E-2 6.3E-2 0.127 0.191 Interest expense 0.77900000000000003 0.78300000000000003 2.3460000000000001 2.29 Depreciation and amortization 7.4939999999999998 7.0759999999999996 22.363 20.526 EBITDA, non-GAAP basis $3.8549999999999995 $2.4499999999999993 $20.795999999999999 $15.981999999999999 Projected Fiscal 2016 (in millions, except per share data) per diluted share Net income (loss), GAAP basis $(4.4)-$0.0 -4.4000000000000004 0 Add back: 0.2 0.2 Provision for income taxes 0.2 3.3 2.9 Interest expense 2.9-3.3 31.9 31.9 Depreciation and amortization 31.9 31 35 EBITDA, non-GAAP basis $31.0-$35.0 Net income (loss), GAAP basis $(4.4)-$0.0 $(0.09)-$0.00 Income tax benefit, assuming 40% rate $(1.8)-$0.0 $(0.04)-$0.00 4.4000000000000004 50 $8.8000000000000009E-2 Adjusted net income (loss), non-GAAP basis $(2.6)-$0.0 $(0.05)-$0.00 1.7600000000000002 50 $3.5200000000000002E-2 Weighted average common shares outstanding - diluted 49.9 2.64 50 $5.28E-2 Cash flow from operating activities, GAAP basis $35.0-$40.0 Capital expenditures, infrastructure projects (9.4) Free Cash Flow, before DXL capital expenditures $25.6-$30.6 Capital expenditures for DXL stores (20.6) Free Cash Flow, non-GAAP basis $5.0-$10.0

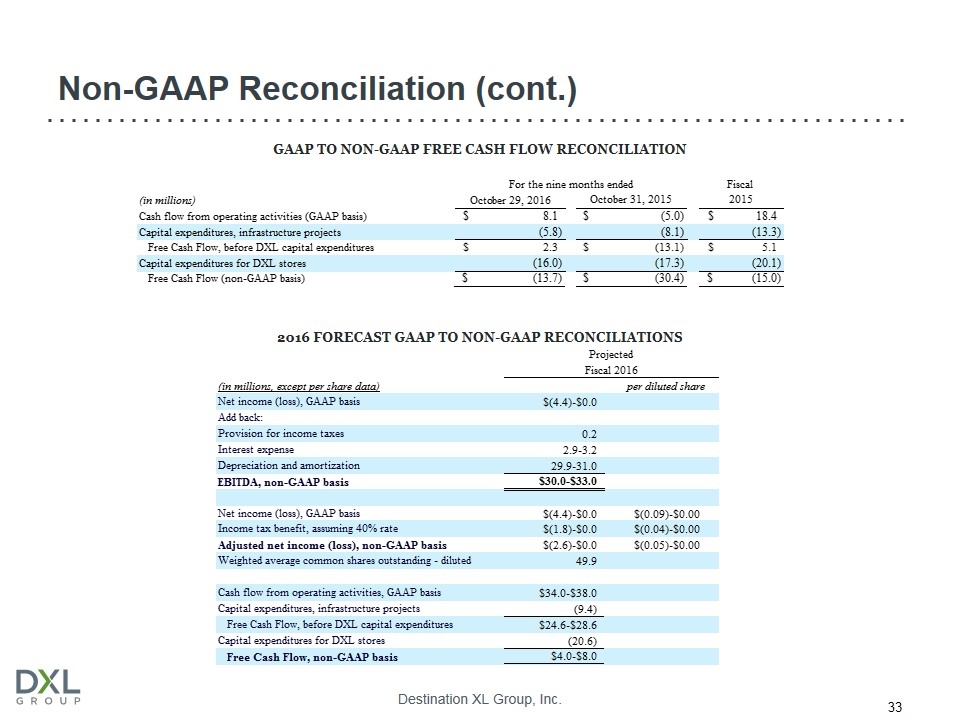

Non-GAAP Reconciliation (cont.) GAAP TO NON-GAAP FREE CASH FLOW RECONCILIATION 2016 FORECAST GAAP TO NON-GAAP RECONCILIATIONS

Investor Contact Tom Filandro Managing Director, ICR 646-277-1235 (D) Tom.Filandro@icrinc.com www.DestinationXL.com