Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MELINTA THERAPEUTICS, INC. /NEW/ | d285921d8k.htm |

January 2017 David Moore President and Chief Commercial Officer Developing Well-Differentiated Antibiotics Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements regarding future events. These statements are just predictions and are subject to risks and uncertainties that could cause the actual events or results to differ materially. These risks and uncertainties include, among others: our ability to address the issues identified by the FDA in the complete response letter relating to our new drug applications for solithromycin as a treatment for community acquired bacterial pneumonia; our ability to obtain FDA and foreign regulatory approval of solithromycin for community acquired bacterial pneumonia; our ability to identify and contract with regulatory-approved manufacturers for clinical and commercial supplies of our active pharmaceutical ingredients and product candidates; the impact of the recently announced changes in our senior management and our ability to retain and hire necessary employees and to staff our operations appropriately; our anticipated capital expenditures and our estimates regarding our capital requirements, including the costs of addressing the complete response letter; our dependence on the success of solithromycin and fusidic acid; results of our and our strategic commercial partners' pre-clinical studies and clinical trials are not predictive of results from subsequent clinical trials for any possible therapy; risks related to the costs, sources of funding, timing, regulatory review and results of our studies, clinical trials and regulatory applications, including activities to address the complete response letter, and those of our strategic partners; our strategic commercial partners’ ability to obtain FDA and foreign regulatory approval of our product candidates; our need to obtain additional funding and our ability to obtain future funding on acceptable terms; our ability to commercialize and launch whether on our own or with a strategic partner any product candidate that receives regulatory approval; the unpredictability of the size of the markets for, and market acceptance of, any of our products, including solithromycin and fusidic acid; our ability to produce and sell any approved products and the price we are able to realize for those products; the possible impairment of, or inability to obtain, intellectual property rights and the costs of obtaining such rights from third parties; our ability to compete in our industry; innovation by our competitors; and our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business. Please refer to the documents that we file from time to time with the Securities and Exchange Commission.

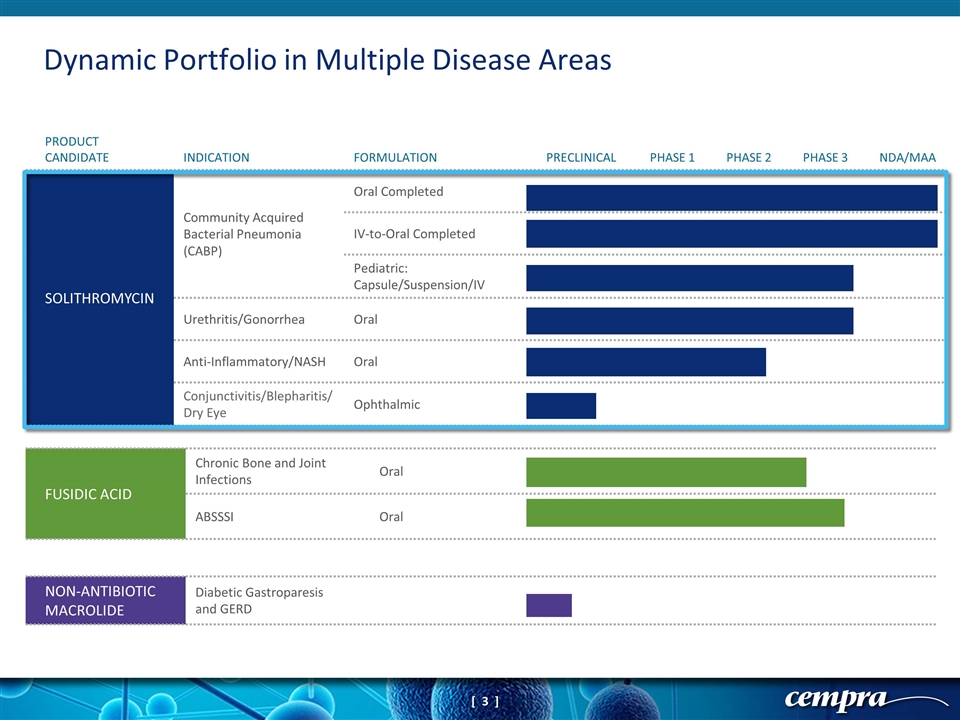

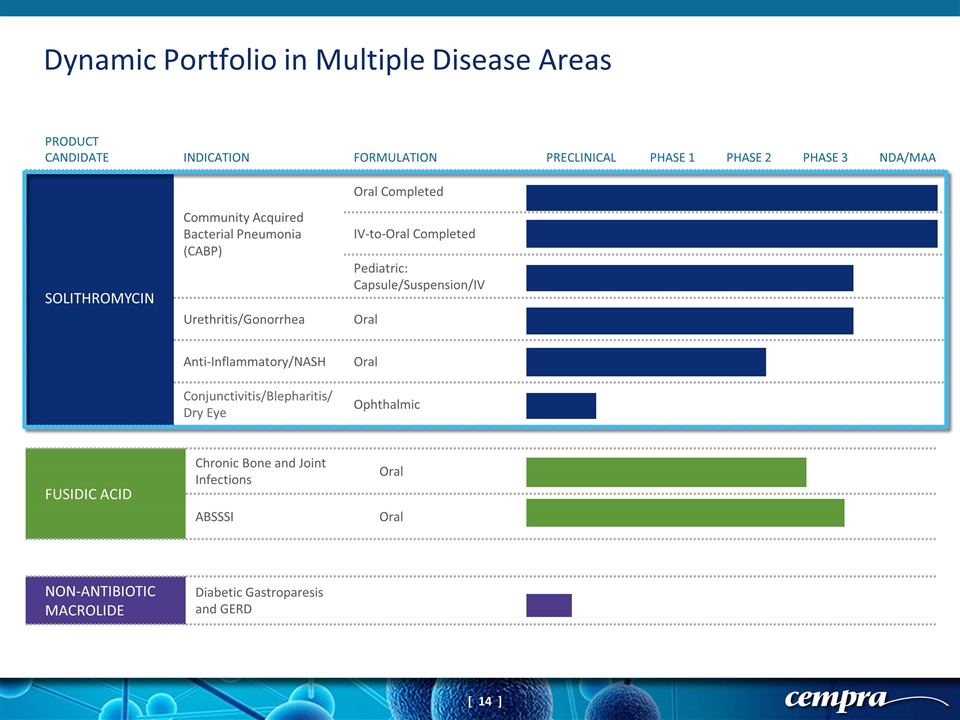

FUSIDIC ACID Chronic Bone and Joint Infections Oral ABSSSI Oral NON-ANTIBIOTIC MACROLIDE Diabetic Gastroparesis and GERD Dynamic Portfolio in Multiple Disease Areas PRODUCT CANDIDATE INDICATION FORMULATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 NDA/MAA SOLITHROMYCIN Community Acquired Bacterial Pneumonia (CABP) Oral Completed IV-to-Oral Completed Pediatric: Capsule/Suspension/IV Urethritis/Gonorrhea Oral Anti-Inflammatory/NASH Oral Conjunctivitis/Blepharitis/ Dry Eye Ophthalmic

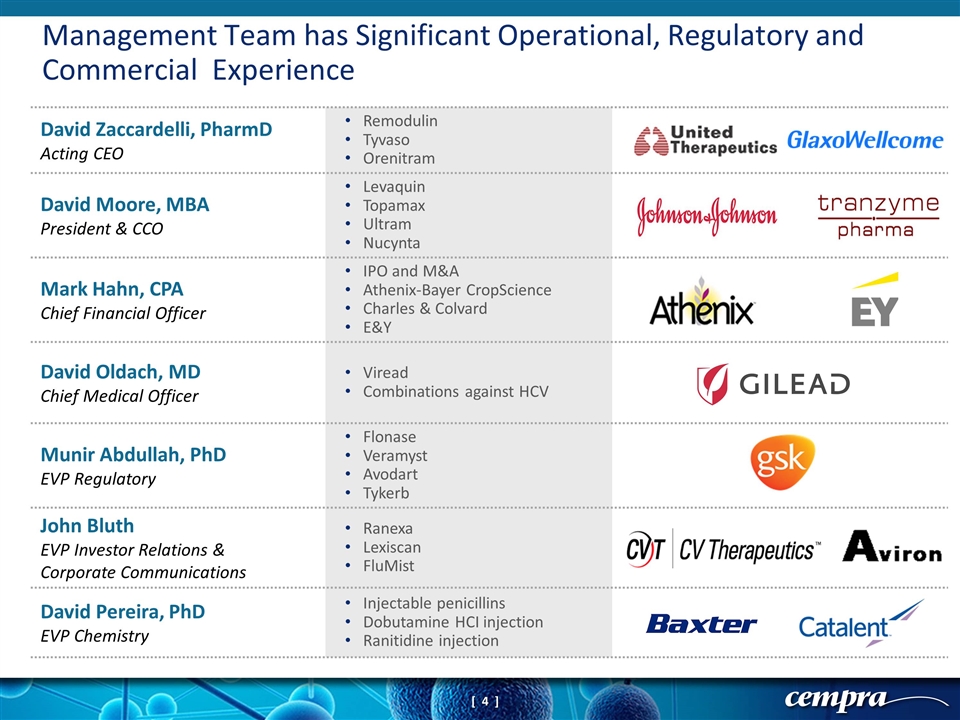

Management Team has Significant Operational, Regulatory and Commercial Experience David Zaccardelli, PharmD Acting CEO Remodulin Tyvaso Orenitram David Moore, MBA President & CCO Levaquin Topamax Ultram Nucynta Mark Hahn, CPA Chief Financial Officer IPO and M&A Athenix-Bayer CropScience Charles & Colvard E&Y David Oldach, MD Chief Medical Officer Viread Combinations against HCV Munir Abdullah, PhD EVP Regulatory Flonase Veramyst Avodart Tykerb John Bluth EVP Investor Relations & Corporate Communications Ranexa Lexiscan FluMist David Pereira, PhD EVP Chemistry Injectable penicillins Dobutamine HCI injection Ranitidine injection

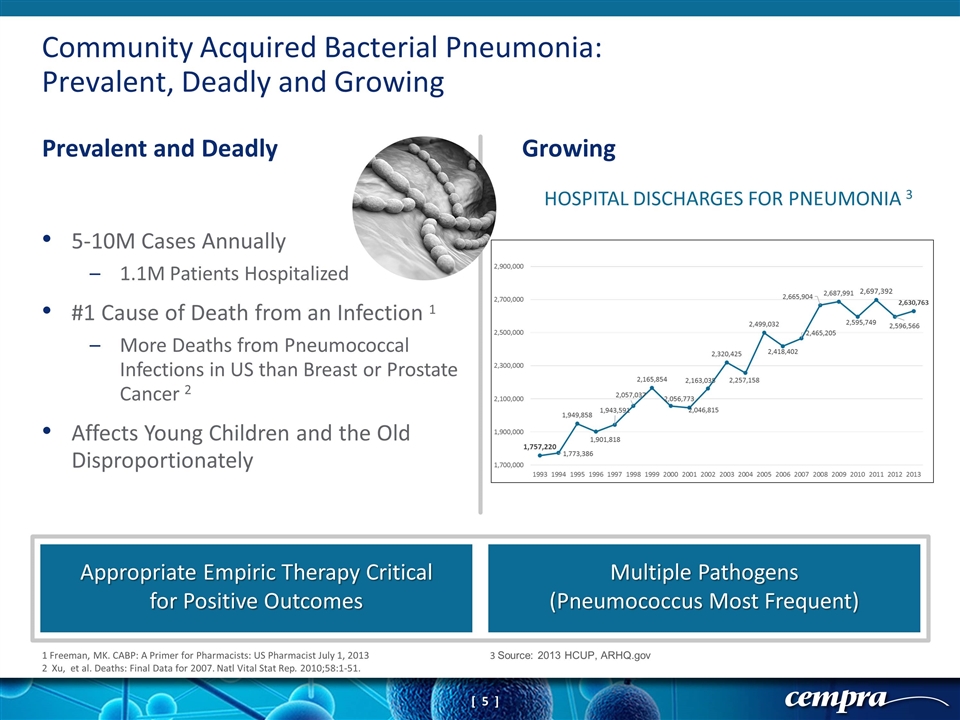

Community Acquired Bacterial Pneumonia: Prevalent, Deadly and Growing Prevalent and Deadly Growing Appropriate Empiric Therapy Critical for Positive Outcomes Multiple Pathogens (Pneumococcus Most Frequent) 1 Freeman, MK. CABP: A Primer for Pharmacists: US Pharmacist July 1, 2013 2 Xu, et al. Deaths: Final Data for 2007. Natl Vital Stat Rep. 2010;58:1-51. 3 Source: 2013 HCUP, ARHQ.gov 5-10M Cases Annually 1.1M Patients Hospitalized #1 Cause of Death from an Infection 1 More Deaths from Pneumococcal Infections in US than Breast or Prostate Cancer 2 Affects Young Children and the Old Disproportionately HOSPITAL DISCHARGES FOR PNEUMONIA 3

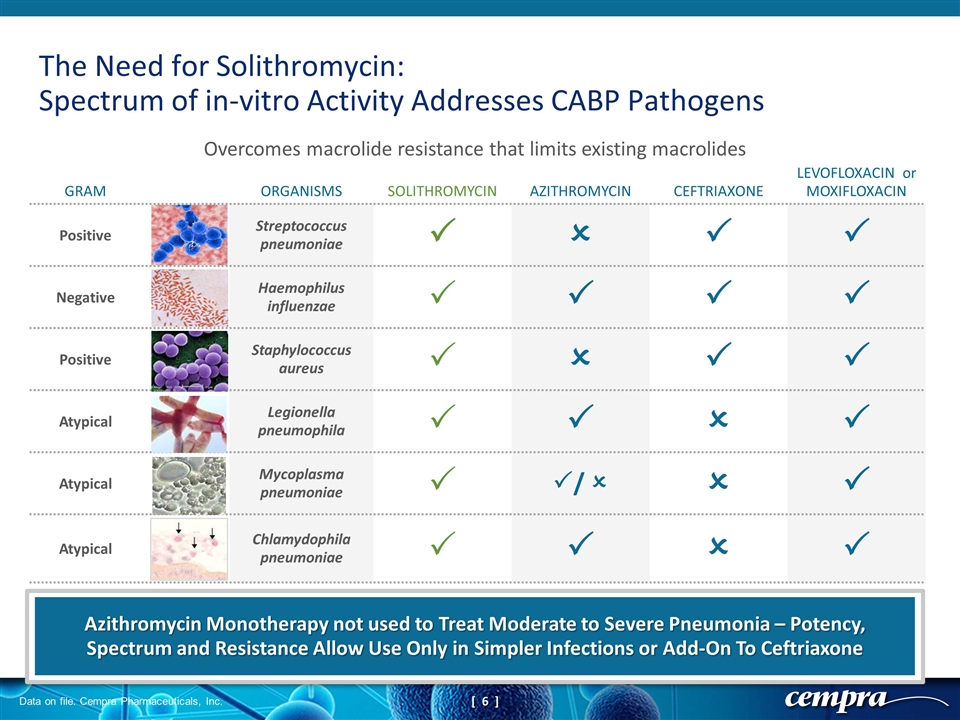

The Need for Solithromycin: Spectrum of in-vitro Activity Addresses CABP Pathogens GRAM ORGANISMS SOLITHROMYCIN AZITHROMYCIN CEFTRIAXONE LEVOFLOXACIN or MOXIFLOXACIN Positive Streptococcus pneumoniae P O P P Negative Haemophilus influenzae P P P P Positive Staphylococcus aureus P O P P Atypical Legionella pneumophila P P O P Atypical Mycoplasma pneumoniae P P/ O O P Atypical Chlamydophila pneumoniae P P O P Overcomes macrolide resistance that limits existing macrolides Azithromycin Monotherapy not used to Treat Moderate to Severe Pneumonia – Potency, Spectrum and Resistance Allow Use Only in Simpler Infections or Add-On To Ceftriaxone Data on file. Cempra Pharmaceuticals, Inc.

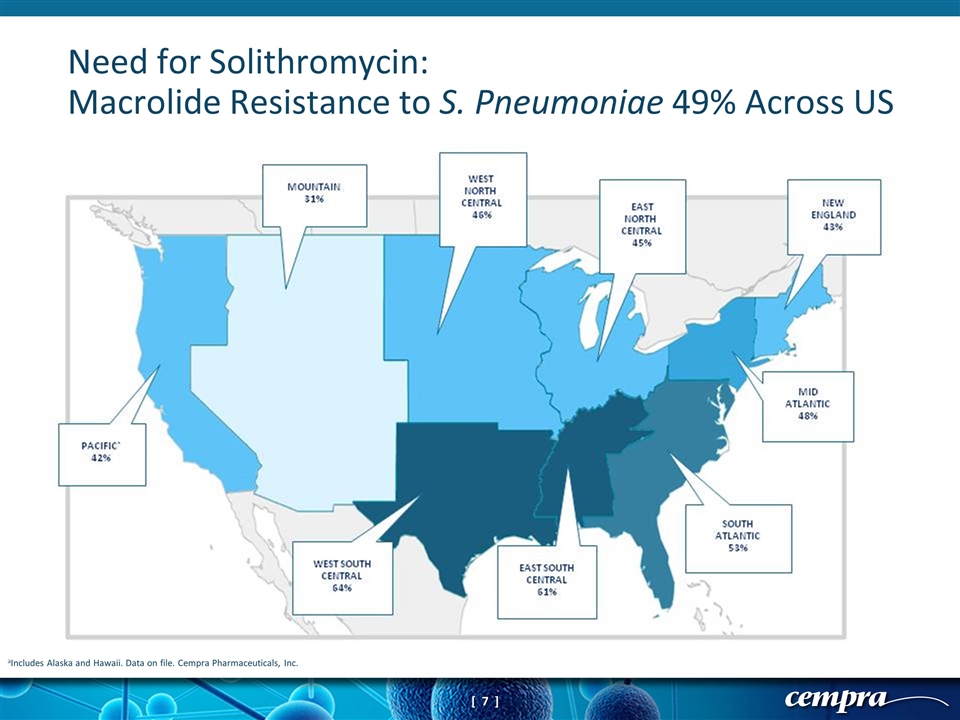

aIncludes Alaska and Hawaii. Data on file. Cempra Pharmaceuticals, Inc. Need for Solithromycin: Macrolide Resistance to S. Pneumoniae 49% Across US

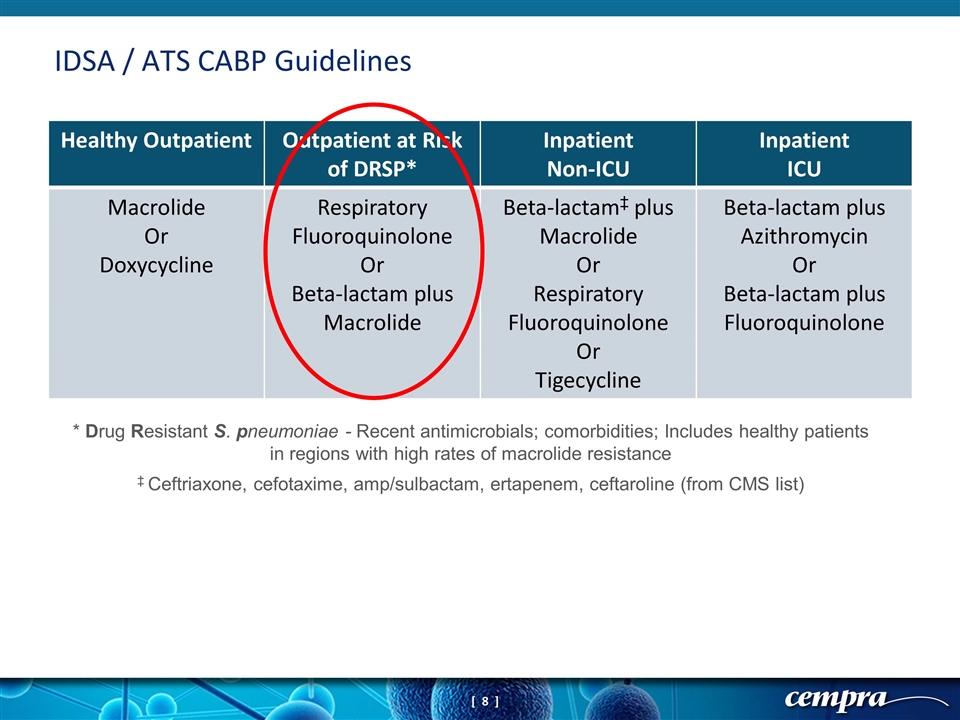

IDSA / ATS CABP Guidelines Healthy Outpatient Outpatient at Risk of DRSP* Inpatient Non-ICU Inpatient ICU Macrolide Or Doxycycline Respiratory Fluoroquinolone Or Beta-lactam plus Macrolide Beta-lactam‡ plus Macrolide Or Respiratory Fluoroquinolone Or Tigecycline Beta-lactam plus Azithromycin Or Beta-lactam plus Fluoroquinolone * Drug Resistant S. pneumoniae - Recent antimicrobials; comorbidities; Includes healthy patients in regions with high rates of macrolide resistance ‡ Ceftriaxone, cefotaxime, amp/sulbactam, ertapenem, ceftaroline (from CMS list)

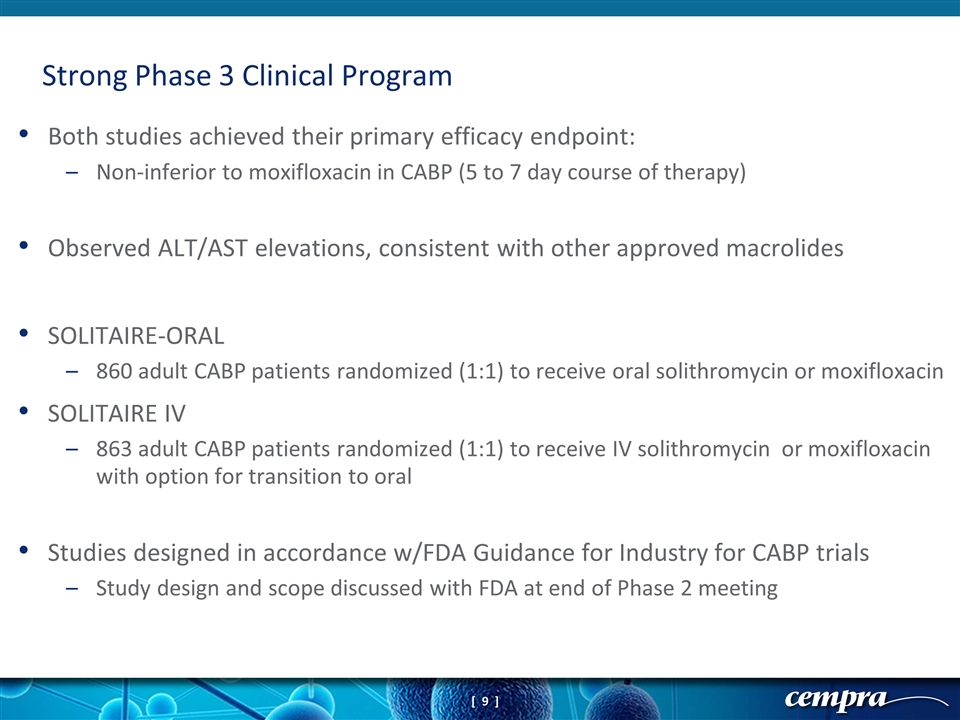

Both studies achieved their primary efficacy endpoint: Non-inferior to moxifloxacin in CABP (5 to 7 day course of therapy) Observed ALT/AST elevations, consistent with other approved macrolides SOLITAIRE-ORAL 860 adult CABP patients randomized (1:1) to receive oral solithromycin or moxifloxacin SOLITAIRE IV 863 adult CABP patients randomized (1:1) to receive IV solithromycin or moxifloxacin with option for transition to oral Studies designed in accordance w/FDA Guidance for Industry for CABP trials Study design and scope discussed with FDA at end of Phase 2 meeting Strong Phase 3 Clinical Program

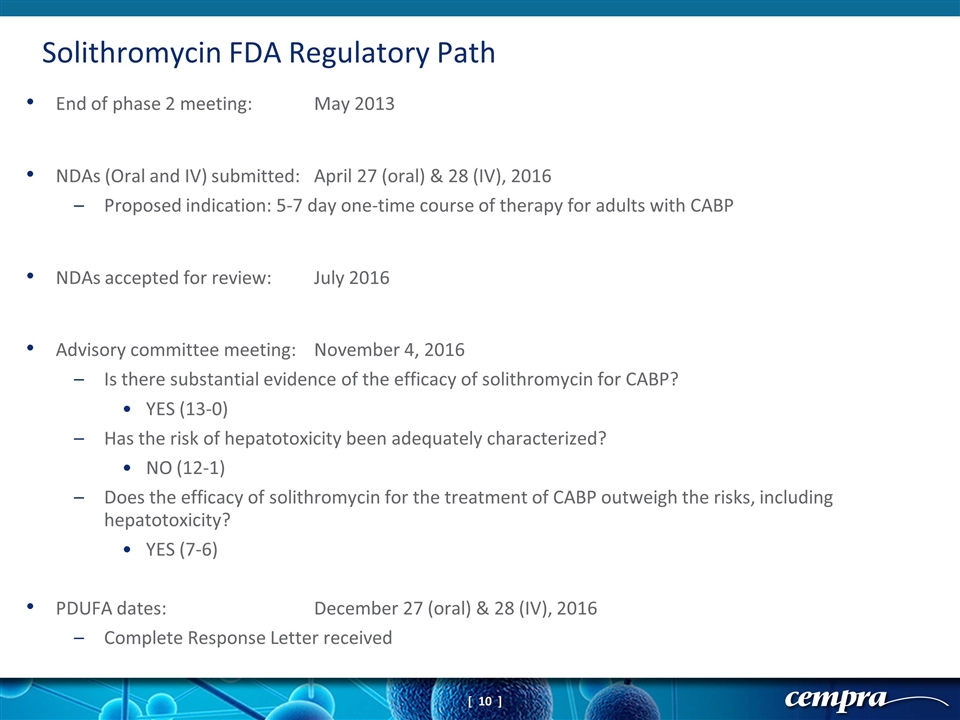

End of phase 2 meeting:May 2013 NDAs (Oral and IV) submitted:April 27 (oral) & 28 (IV), 2016 Proposed indication: 5-7 day one-time course of therapy for adults with CABP NDAs accepted for review:July 2016 Advisory committee meeting: November 4, 2016 Is there substantial evidence of the efficacy of solithromycin for CABP? YES (13-0) Has the risk of hepatotoxicity been adequately characterized? NO (12-1) Does the efficacy of solithromycin for the treatment of CABP outweigh the risks, including hepatotoxicity? YES (7-6) PDUFA dates:December 27 (oral) & 28 (IV), 2016 Complete Response Letter received Solithromycin FDA Regulatory Path

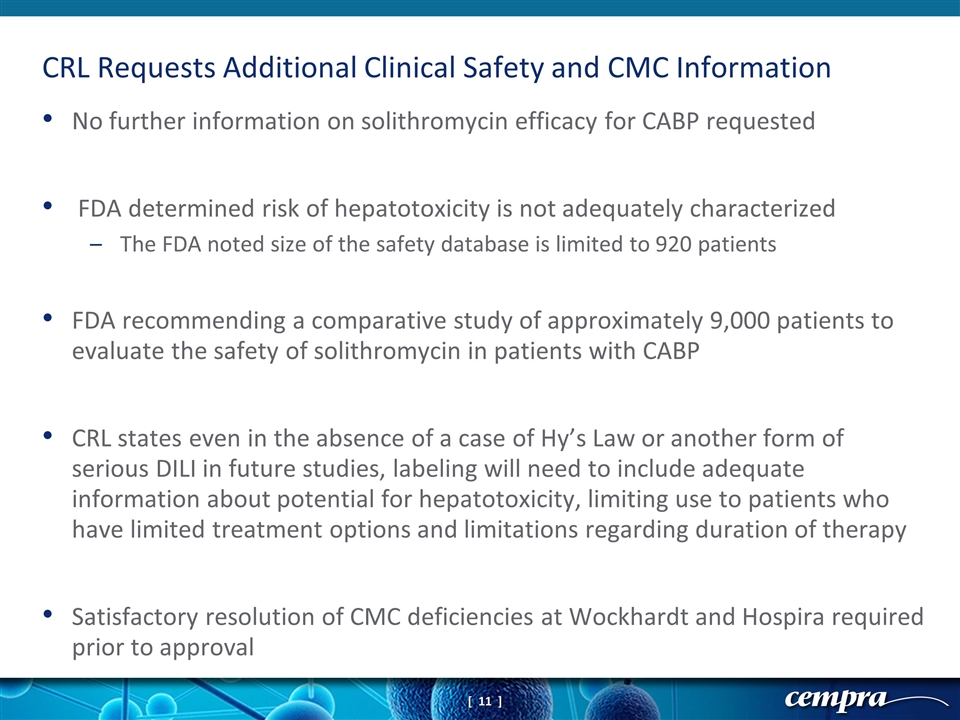

No further information on solithromycin efficacy for CABP requested FDA determined risk of hepatotoxicity is not adequately characterized The FDA noted size of the safety database is limited to 920 patients FDA recommending a comparative study of approximately 9,000 patients to evaluate the safety of solithromycin in patients with CABP CRL states even in the absence of a case of Hy’s Law or another form of serious DILI in future studies, labeling will need to include adequate information about potential for hepatotoxicity, limiting use to patients who have limited treatment options and limitations regarding duration of therapy Satisfactory resolution of CMC deficiencies at Wockhardt and Hospira required prior to approval CRL Requests Additional Clinical Safety and CMC Information

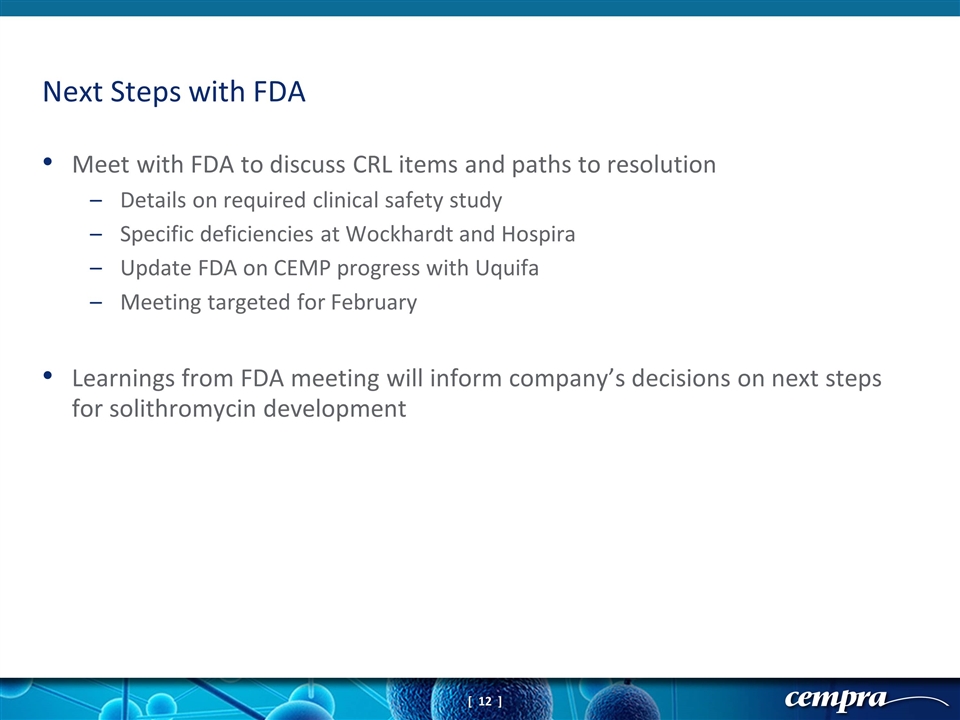

Meet with FDA to discuss CRL items and paths to resolution Details on required clinical safety study Specific deficiencies at Wockhardt and Hospira Update FDA on CEMP progress with Uquifa Meeting targeted for February Learnings from FDA meeting will inform company’s decisions on next steps for solithromycin development Next Steps with FDA

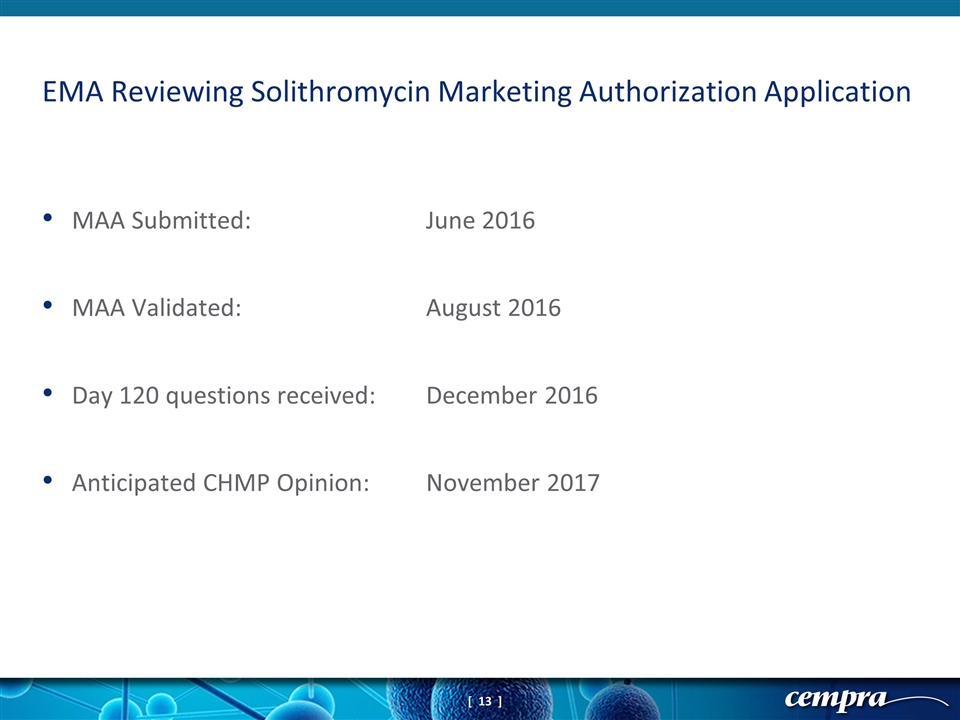

MAA Submitted: June 2016 MAA Validated: August 2016 Day 120 questions received: December 2016 Anticipated CHMP Opinion: November 2017 EMA Reviewing Solithromycin Marketing Authorization Application

FUSIDIC ACID Chronic Bone and Joint Infections Oral ABSSSI Oral NON-ANTIBIOTIC MACROLIDE Diabetic Gastroparesis and GERD Dynamic Portfolio in Multiple Disease Areas PRODUCT CANDIDATE INDICATION FORMULATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 NDA/MAA SOLITHROMYCIN Community Acquired Bacterial Pneumonia (CABP) Oral Completed IV-to-Oral Completed Pediatric: Capsule/Suspension/IV Urethritis/Gonorrhea Oral Anti-Inflammatory/NASH Oral Conjunctivitis/Blepharitis/ Dry Eye Ophthalmic

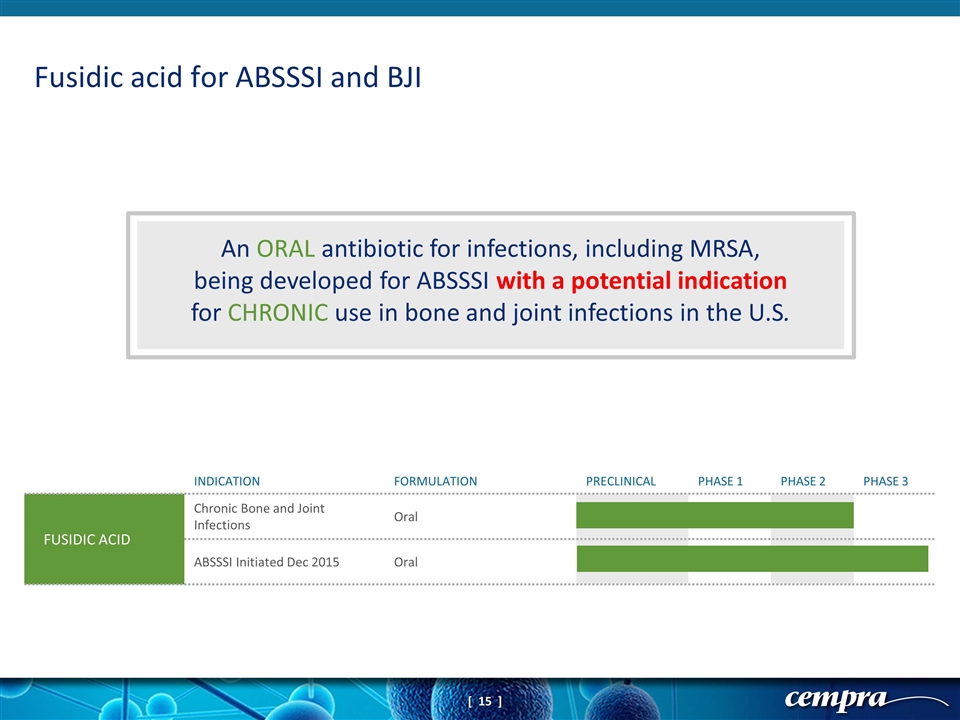

An ORAL antibiotic for infections, including MRSA, being developed for ABSSSI with a potential indication for CHRONIC use in bone and joint infections in the U.S. Fusidic acid for ABSSSI and BJI INDICATION FORMULATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 FUSIDIC ACID Chronic Bone and Joint Infections Oral ABSSSI Initiated Dec 2015 Oral

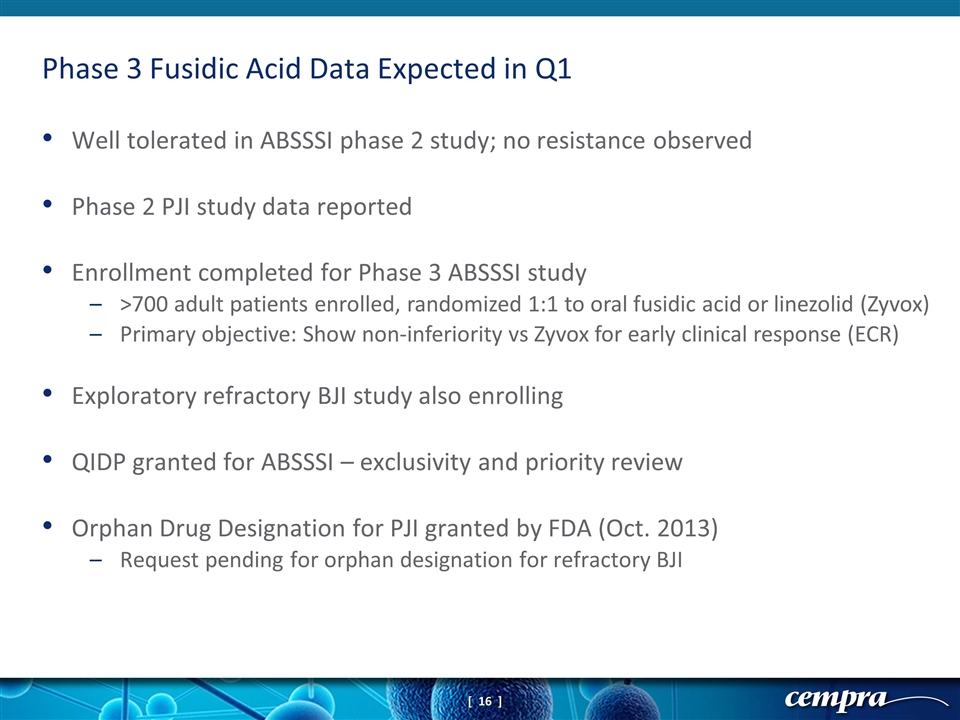

Well tolerated in ABSSSI phase 2 study; no resistance observed Phase 2 PJI study data reported Enrollment completed for Phase 3 ABSSSI study >700 adult patients enrolled, randomized 1:1 to oral fusidic acid or linezolid (Zyvox) Primary objective: Show non-inferiority vs Zyvox for early clinical response (ECR) Exploratory refractory BJI study also enrolling QIDP granted for ABSSSI – exclusivity and priority review Orphan Drug Designation for PJI granted by FDA (Oct. 2013) Request pending for orphan designation for refractory BJI Phase 3 Fusidic Acid Data Expected in Q1

BARDA funding recently initiated Phase 2/3 pediatric trial Current treatment options for children even more limited Enrolling 400 children age two months to 17 years 16 currently enrolled Patients receive IV, oral suspension or oral capsule formulations of solithromycin Active comparator: standard of care therapy Significant Pediatric CABP Opportunity for Solithromycin

CDC has identified drug-resistant gonorrhea (GC) as an urgent threat, noting that GC has developed resistance to nearly every drug used for treatment Single dose (1000 or 1200 mg) of solithromycin achieved 100% efficacy in Phase 2 study of male and female gonorrhea patients Open label Phase 3 study comparing single dose solithromycin to standard of care enrolled 262 patients (only 16 women) NIAID funding Phase 3 extension to enroll an additional 76 female and adolescent patients (with target of 50 evaluable patients) Extension study enrollment has been much slower than anticipated CEMPRA discussing with NIAID best approach to accelerate the program Solithromycin for Gonorrhea: Ongoing NIAID Study Exploring Urgently Needed New Option

NASH Expanding NASH patient population with significant unmet need NIH: Up to 16 million Americans (2-5% percent of the U.S. population) has NASH No approved drugs Likely combo drug market Why solithromycin for NASH? Anti-inflammatory properties observed with macrolides, including solithromycin Liver is a target organ for solithromycin Different doses lead to different safety outcomes Exploring lower solithromycin doses in our pilot NASH trial NASH study has completed enrollment of 10 patient cohort Follow-up on all 10 patients expected to be completed in Q1 2017 Data expected to be presented at upcoming medical conference COPD Cempra has discontinued clinical trial of solithromycin for COPD Exploratory Studies Evaluating Chronic Dosing for NASH & COPD

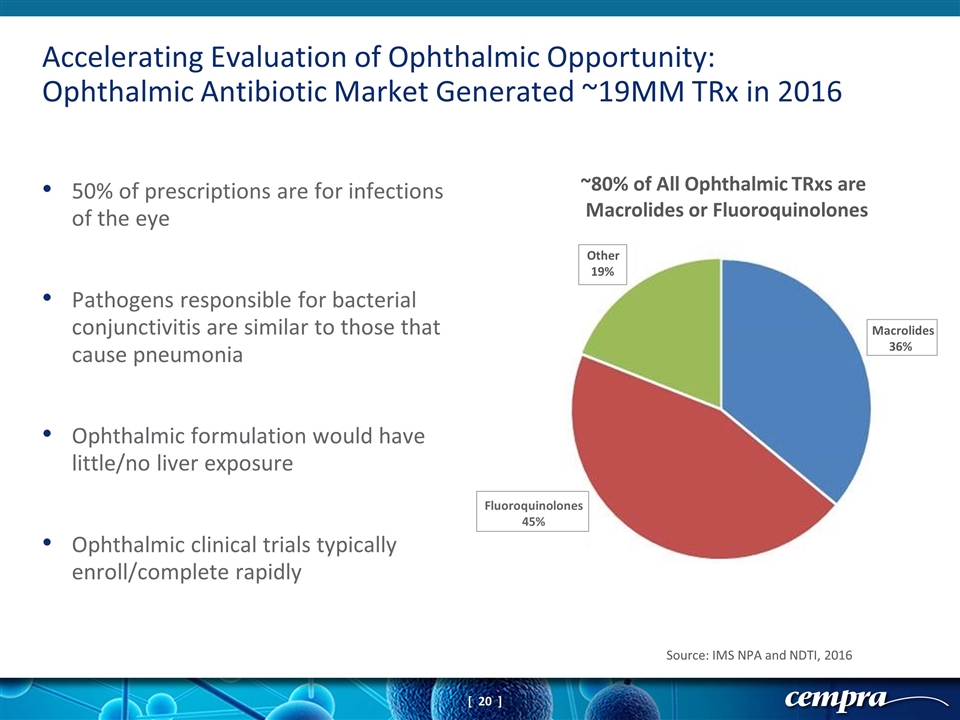

50% of prescriptions are for infections of the eye Pathogens responsible for bacterial conjunctivitis are similar to those that cause pneumonia Ophthalmic formulation would have little/no liver exposure Ophthalmic clinical trials typically enroll/complete rapidly Accelerating Evaluation of Ophthalmic Opportunity: Ophthalmic Antibiotic Market Generated ~19MM TRx in 2016 Source: IMS NPA and NDTI, 2016 Macrolides 36% Other 19% ~80% of All Ophthalmic TRxs are Macrolides or Fluoroquinolones Fluoroquinolones 45%

Learnings from FDA meeting will inform company’s decisions on next steps for solithromycin development Taksta Phase 3 data expected 1Q Cash on hand at 12/31/16: ~$225 million Solithromycin patent life in U.S extends to 2032 Accelerating ophthalmic program + ongoing studies in GC, NASH, pediatrics Actively evaluating business development opportunities Focused on delivering value to patients and shareholders Resources Provide Flexibility for Decisions

January 2017 David Moore President and Chief Commercial Officer Developing Well-Differentiated Antibiotics