Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TEAM HEALTH HOLDINGS INC. | d267388d8k.htm |

Exhibit 99.1

Non-GAAP Financial Measures Reconciliations

In this document, we refer to Adjusted EBITDA and Adjusted EBITDA margin which are financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Adjusted EBITDA is defined as net earnings attributable to Team Health Holdings, Inc. before interest expense, taxes, depreciation and amortization, as further adjusted to exclude the non-cash items and the other adjustments shown in the table under “Reconciliation from 2016 audited financials to Pro Forma Normalized EBITDA” on pages 67 and 68. Adjusted EBITDA margin represents Adjusted EBITDA divided by net revenue. For a reconciliation of each of Adjusted EBITDA to the most directly comparable GAAP measure, we refer you to the table under “Adjusted EBITDA”, contained in the Appendix.

5

| 3. | Executive summary |

Unless otherwise indicated, or the context requires, in this Confidential Information Memorandum (“CIM”), the terms “Company”, and “TeamHealth” refer to TeamHealth Holdings, Inc. and its subsidiaries. TeamHealth’s fiscal year ends on December 31st of each year. References to “LTM” mean the last twelve month period. References to “YTD” mean year to date. Throughout this CIM, some tables or charts might not add up due to rounding.

Company overview

TeamHealth is one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States. TeamHealth provides comprehensive programs for emergency medicine, anesthesiology, inpatient services (hospitalists comprising the specialties of internal medicine, orthopedic surgery, general surgery and OB/GYN), scribes, ambulatory care, pediatrics, post-acute care and other healthcare services, by providing permanent staffing that enables the management teams of hospitals and other healthcare facilities to outsource certain management, recruiting, hiring, payroll, billing and collection and benefits functions. The Company’s range of services it provides to its clients includes the following:

| • | Recruiting, schedule and credential coordination for clinical and non-clinical medical professionals |

| • | Coding, billing and collection of fees for services provided by medical professionals |

| • | Provision of experienced medical directors |

| • | Administrative support services, such as payroll and professional liability insurance coverage |

| • | Claims and risk management services |

| • | Standardized procedures and operational consulting |

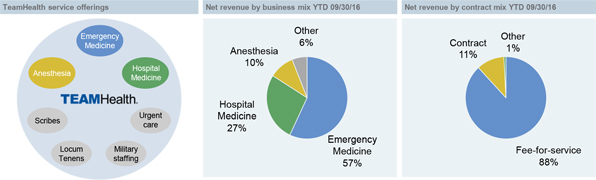

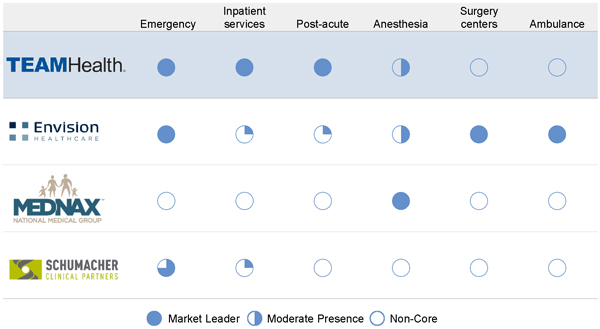

Diverse service offering with particular strength in the emergency department

Source: Company filings

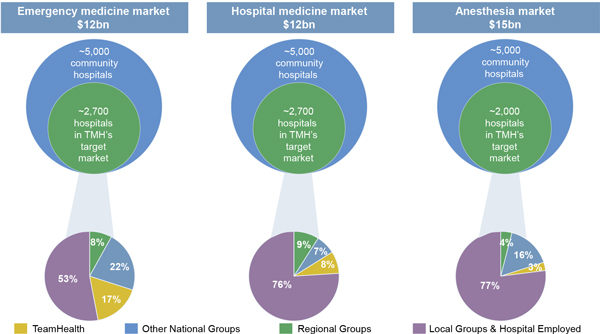

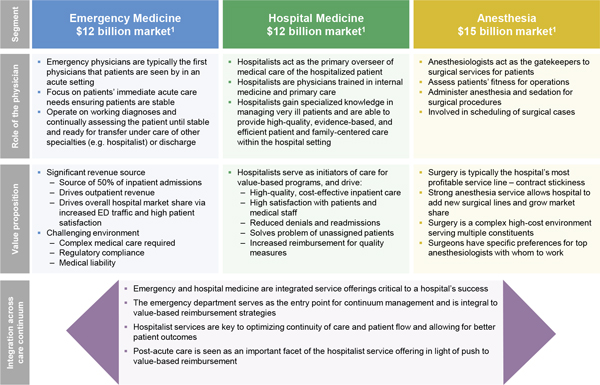

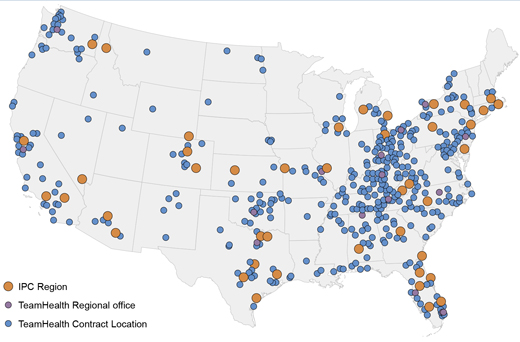

TeamHealth’s reach spans 47 states and approximately 3,300 acute and post-acute facilities and physician groups nationwide. The Company’s national scale enables it to maintain and expand its foothold in the highly fragmented emergency medicine, hospital medicine, and anesthesia markets. TeamHealth estimates that the annual sizes of each market are $12 billion, $12 billion, and $15 billion, respectively. According to the American Hospital Association, there were more than 5,000 community hospitals in the United States in 2016, and approximately 92% of those operated EDs. Of those 5,000 hospitals, 2,700 are in the Company’s target market for emergency medicine and hospital medicine, and 2,000 are in TeamHealth’s target market for anesthesia. Within the Company’s target markets for emergency medicine, hospital medicine, and anesthesia, TeamHealth estimates that it commands a 17%, 8% and 3% share, respectively.

14

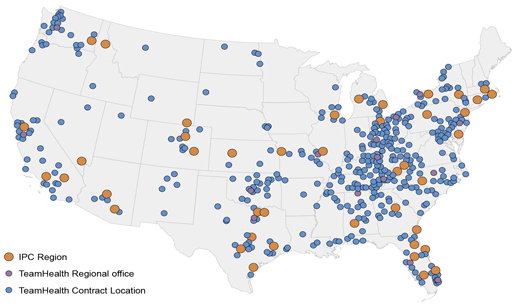

Unmatched national platform of provider services

Source: TeamHealth management

15

Summary of service lines

| Emergency medicine | • | One of the largest providers of outsourced clinical staffing and administrative services for hospital-based and free standing EDs in the US | ||||

| • | Core services: contract management, recruiting, credentials coordination, staffing and scheduling | |||||

| • | Enhanced services: programs improving efficiency, productivity, effectiveness and quality of patient care in EDs | |||||

| Hospital medicine and post-acute (Legacy and IPC) |

• | Acquisition of IPC has significantly expanded hospital medicine service line for both acute and post-acute care facilities | ||||

|

• |

Assists hospitals, post-acute care facilities and payors in improving quality of care, increasing operating efficiencies and reducing costs | |||||

|

• |

Clinical services are focused on providing, managing and coordinating the entire episode of care of inpatients | |||||

| Anesthesiology | • | Provides outsourced anesthesiology and pain management solutions to hospitals and ambulatory surgery centers on a ‘turn-key’ basis for the full range of surgical subspecialties as well as interventional pain management | ||||

| • | Also provides comprehensive administrative oversight and business management of services including processes designed to improve the efficiency and effectiveness of the anesthesiology department and the hospital’s surgical services | |||||

| Other services | • | Temporary staffing (Locum Tenens) | ||||

| • | Pediatrics | |||||

| • | Scribes | |||||

| • | Ambulatory care | |||||

| • | Medical call center services | |||||

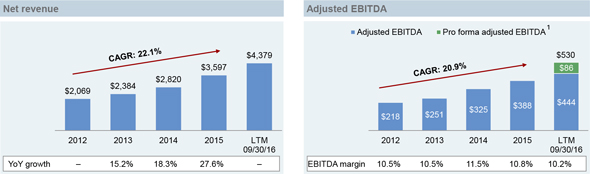

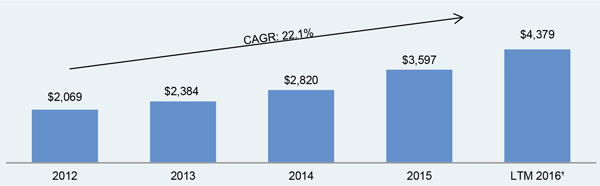

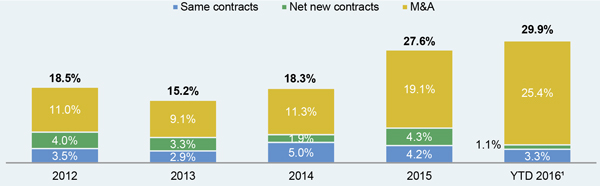

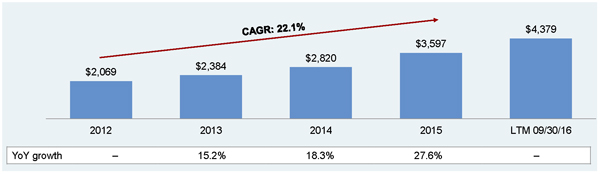

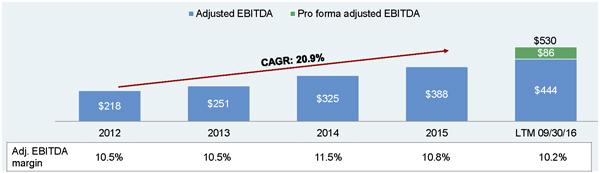

TeamHealth’s dynamic growth opportunities both organically and via acquisitions have enabled the Company to generate top-line growth of 22.1% per annum (2012 – LTM 2016), translating to adjusted EBITDA growth of 20.9% per annum during the same period. From 2012 to 2015, the Company’s revenue growth from existing contracts ranged from 4 – 6%, revenue growth from net new contracts ranged from 2 – 4%, with the remaining growth attributable to strategic acquisitions. The Company has completed 22 acquisitions in 2015 and 2016, including IPC. During the twelve months ended September 30, 2016, the Company generated net revenues of $4.4 billion and PF adjusted EBITDA of $530 million.

Summary financials ($mm)

| 1 | Pro forma adjusted EBITDA margin of 12.1% |

Source: Company filings and TeamHealth management

16

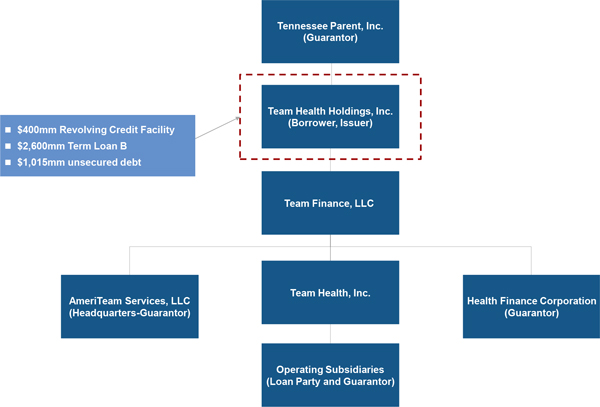

Transaction overview

On October 31, 2016, TeamHealth Holdings, Inc. entered into a definitive agreement to be acquired by funds affiliated with Blackstone in a transaction valued at approximately $6.1 billion (before transaction fees) or $43.50 per share in cash. Funds affiliated with Blackstone will contribute $2.8 billion of new equity1, or approximately 43% of the pro forma capitalization. Blackstone previously purchased the Company in 2005 and completed an IPO in 2009 before fully exiting the business in 2013.

The transaction will be financed through:

| • | $400mm 5-year senior secured revolving credit facility |

| • | $2,600mm 7-year senior secured Term Loan B |

| • | $1,015mm senior unsecured debt |

| • | $2,751mm of equity1 |

J.P. Morgan will act as Lead Left Bookrunner for the Senior Secured Credit Facilities and Barclays will act as Lead Left Bookrunner for the unsecured debt.

Pro forma for the transaction, leverage will be 4.9x on a senior secured basis and 6.8x on a total basis (based on LTM 9/30/16 Pro Forma Adj. EBITDA of $529.8 million).

The estimated sources and uses of funds for the transaction are as follows:

Sources & uses

Sources & uses ($mm)

| 1 | Figure as of 09/30/16; actual amount will reflect cash generated between 09/30/16 and closing |

17

Pro forma capitalization

Pro forma capitalization

| Pro Forma LTM 09/30/16 | ||||||||

| ($ in millions) |

Amount | xEBITDA1 | ||||||

| New $400mm RC Facility due 2022 |

— | |||||||

| New Term Loan B due 2024 |

2,600 | |||||||

| Total Senior Secured Debt |

$ | 2,600 | 4.9x | |||||

| New unsecured debt |

1,015 | |||||||

| Total Debt |

$ | 3,615 | 6.8x | |||||

| 1 | LTM 09/30/16 pro forma adjusted EBITDA of $530mm |

Pro forma corporate structure

TMH Corporate Legal Structure1

| 1 | Team Health Holdings, Inc. will be the financial reporting entity post-close |

18

Blackstone’s equity sponsorship

Blackstone (NYSE: BX) is one of the world’s leading investment firms. Blackstone’s alternative asset management businesses include the management of corporate private equity funds, real estate funds, hedge fund solutions, credit-oriented funds and closed-end mutual funds. Through its different businesses, Blackstone had total assets under management of approximately $361 billion as of September 30, 2016. Blackstone seeks to create positive economic impact and long-term value for its investors, the companies it invests in, and the communities in which it works. The firm was founded in 1985 by Stephen A. Schwarzman and Peter G. Peterson and has more than 2,200 employees in more than 20 offices worldwide. Blackstone portfolio companies employ more than 560,000 people across the globe.

Blackstone has significant experience in the healthcare sector with current and prior investments including Change Healthcare, Apria Healthcare, Stiefel, Biomet, DJO Global, Catalent, Vanguard and Independent Clinical Services.

Strong track record in the healthcare sector

Blackstone previously owned TeamHealth when it acquired the firm from Madison Dearborn Partners in 2005. During Blackstone’s prior ownership, the key strategic initiatives in partnership with management centered around a rigorous focus on productivity and quality metrics to ensure high patient and physician satisfaction and enhanced hospital relationships, building a sales force to win new hospital contracts, and the creation of a business development team to acquire accretive tuck-in physician group targets. The company de-levered from 5.9x to 3.5x on a net leverage basis until the IPO in 2009 and EBITDA doubled during Blackstone’s ownership period. In September 2009, Blackstone took TeamHealth public, selling 13.3 million primary shares at $12.00 per share on the New York Stock Exchange. Blackstone initially sold a portion of its investment in TeamHealth in a 2011 secondary offering then fully monetized its investment via follow-on offerings in 2012 and 2013. During the term of the prior Blackstone investment, TeamHealth paid no dividends nor made any other equity distributions.

Several highlights of TeamHealth’s business drove Blackstone’s decision to re-invest. These include:

| • | Company’s leading position in attractive physician outsourcing market, providing a cost-effective, high-quality, essential service to hospitals |

| • | Long-term and sticky hospital relationships with 90%+ client and physician retention rates over the long term |

| • | Demonstrated history of strong organic growth through consistent same-contract growth and net new contract wins |

| • | Scale platform in a highly fragmented industry, with track record of executing on tuck-in M&A of local physician groups |

| • | Continued realization of synergies with IPC |

| • | Near-term cost reduction opportunities |

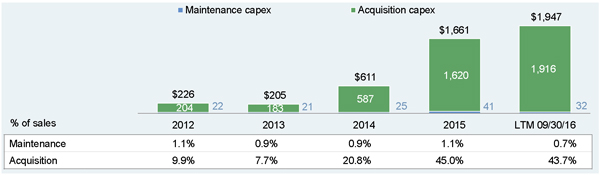

| • | Strong free cash flow generation given asset-light model and minimal capex |

Blackstone welcomes the opportunity to once again partner with TeamHealth’s management to continue to drive growth and value within the company. Blackstone believes it can leverage its

20

existing knowledge of the asset and sector expertise to optimize the business strategy and capitalize on evolving care and payment models. Under Blackstone’s ownership, TeamHealth will continue to focus on driving steady organic growth coupled with pursuing accretive acquisitions in a price disciplined fashion to gain further scale and capabilities.

21

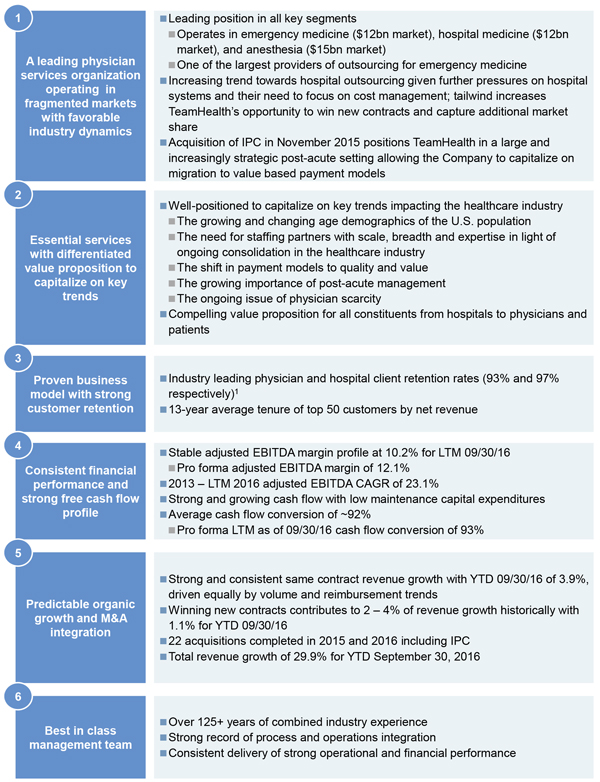

| 4. | Key investment highlights |

| 1 | Calculated on a preceding 12 months basis as of 09/30/16 for ED operations, calculated as full year 2015 minus the nine months ended 09/30/15 plus the nine months ended 09/30/16 |

22

|

A leading physician services organization operating in fragmented markets with favorable industry dynamics |

TeamHealth is one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States, based upon revenues, patient visits, and number of clients. The Company believes its operating model, providing a localized presence combined with the benefits of scale as a large, national staffing provider, has made and will continue to make it an attractive partner for physicians and service provider for clients in addition to providing operating leverage to drive economies of scale.

The Company plays within highly fragmented markets across its service lines and maintains market leading positions. Within the emergency medicine (ED) segment, the Company has a market leading position servicing 17% of the 2,700 hospitals comprising its target market in 2016. The Company also enjoys a strong position in the hospital medicine and anesthesia markets, servicing 8% of the 2,700 target hospitals and 3% of the 2,000 target hospitals, respectively.

Leading market positions in highly fragmented markets

Source: TeamHealth management

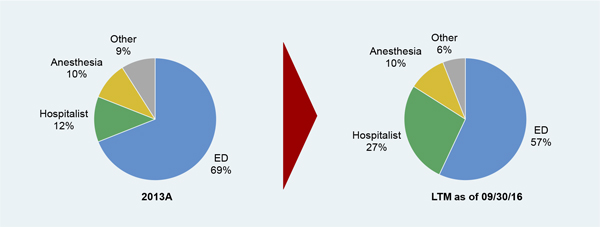

TeamHealth benefits from a highly diversified revenue base. In 2013, the Company’s segment mix was comprised of emergency medicine at 69%, hospital medicine at 12% and anesthesia at 10%. Over the last 3 years, the Company’s revenue base has diversified further through organic growth and strategic acquisitions. The acquisition of IPC in November 2015 broadened the Company’s service offering in hospital medicine and the post-acute segment, providing a powerful capability to manage patient care and influence outcomes while lowering costs in light of the transition to value based care. Additionally, this broadened service offering positions TeamHealth to be a bundled service provider across the care continuum from emergency medicine to inpatient hospitalist care to the post-acute setting. Capturing the entirety of this care continuum further embeds TeamHealth into the operations of the providers, making the Company’s service highly sticky. For LTM September 30, 2016, the Company’s business mix comprises of 57% for emergency medicine, 27% for hospital medicine and 10% for anesthesia, illustrating how the Company continues to diversify its service mix.

23

Business mix development 2013A vs. LTM as of 09/30/16

Source: Company filings

In addition to segment diversification, TeamHealth believes its geographic diversification provides it with a strong competitive position within the highly fragmented markets that it serves, utilizing its presence to extend services and grow organically while also being a partner of choice for physicians and hospitals seeking to enhance operational sophistication. The Company’s scalable national infrastructure also drives value for customers and is a significant competitive advantage.

| • | 15 regional offices throughout the United States allow for local client facing support and market knowledge, fostering community based relationships with healthcare facilities as well as ability to serve large hospital systems on a broader, national basis |

| • | 7 billing centers offer national managed care contracting that works in tandem with regional operators and processes approximately 17 million patient claims per year across a single IT platform |

| • | Centralized risk and claims management and professional liability insurance support an aggressive claims management process and captive professional liability insurance program |

| • | A centralized and well-funded administrative unit supports accounting, payroll, human resources, legal and compliance needs |

Finally, TeamHealth also benefits from a highly diversified revenue base. For 2015, no single contract represented more than 1.2% of total net revenue, and the top 10 and top 20 contracts represented 4.6% and 7.0% of net revenue, respectively. Additionally, no single hospital system represented more than 7% of total net revenue, while the top 10 and top 20 hospital systems represented 36% and 48% of net revenue respectively.

24

|

Essential services with differentiated value proposition to capitalize on key trends |

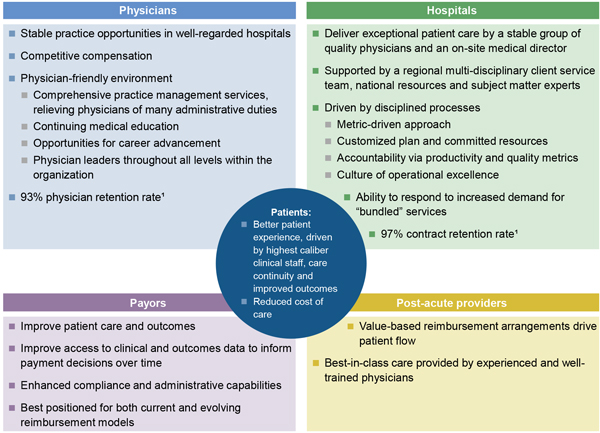

TeamHealth’s differentiated and market leading service offerings across the care continuum, from emergency medicine to post-acute care, position the Company well to capitalize on key trends impacting the healthcare industry and drive value for all stakeholders:

|

The growing and changing age demographics of the U.S. population |

|

The need for staffing partners with scale, breadth and expertise in light of ongoing consolidation in the healthcare industry |

|

The shift in payment models to quality and value |

|

The growing importance of post-acute management |

|

The ongoing issue of physician scarcity |

Value proposition

| 1 | Calculated on a preceding 12 months basis as of 09/30/16 for ED operations, calculated as full year 2015 minus the nine months ended 09/30/15 plus the nine months ended 09/30/16 |

|

The growing and changing age demographics of the U.S. population |

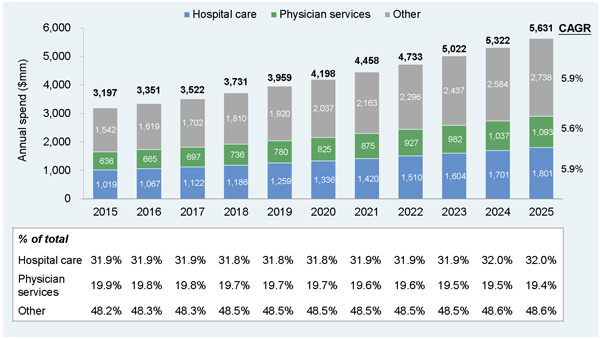

According to the U.S. Census Bureau, the number of Americans aged 65 and over will increase 36% to approximately 65 million by 2025. With almost 2 out of 3 older Americans burdened with multiple chronic conditions, resulting in higher ED utilization and a higher rate of surgical procedures requiring anesthesia, the demand by hospital systems for staffing needs continues to increase in critical services that manage these patients. TeamHealth’s diversified service offering across the care continuum from emergency medicine through to the increasingly important post-acute setting positions the Company well to support health systems in managing the increasing demands this patient population will present.

25

|

The need for staffing partners with scale, breadth and expertise in light of ongoing consolidation in the healthcare industry |

With multiple large, pending mergers in the managed care sector, the potential exists for increased pressure on provider reimbursement from larger, more powerful commercial payors across numerous markets. Increasing scale and market relevance are among the key strategies for providers to employ to best balance the potential impact of the wave of consolidation currently contemplated by the largest health insurers in the United States. The breadth and scale of services provided by TeamHealth positions the Company to broaden its relevance in key markets through the expansion of service offerings, providing the Company with a stronger position from which to negotiate compensation for its high quality services. TeamHealth’s deep experience in emergency medicine, anesthesia, and hospital medicine also makes it the partner of choice for hospitals when they decide they need to outsource certain departments to drive greater efficiency and cost management while still maintaining best-in-class patient care. In addition, the complementary nature of the leading emergency medicine and hospitalist medicine programs, particularly when coupled with post-acute expertise, has the potential to significantly impact cost of care while maintaining superior clinical outcomes. That dynamic, coupled with TeamHealth’s favorable and deep business relationships with several large hospital systems, makes the Company a powerful partner to payors seeking to steer patients towards providers with expertise across those critical clinical services.

|

The shift in payment models to quality and value |

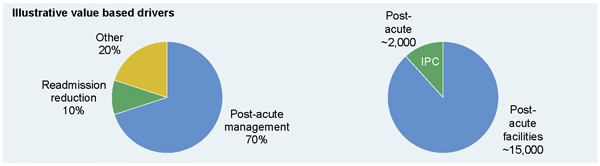

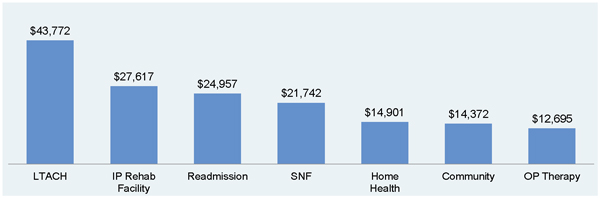

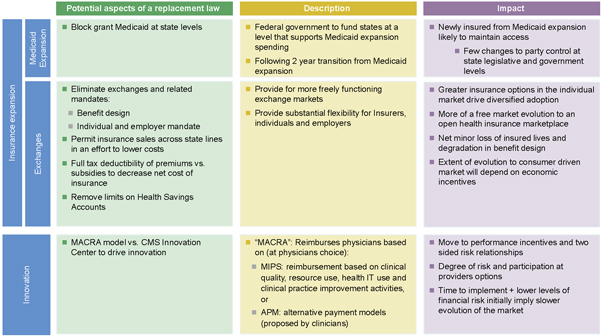

Both commercial and government payors have articulated plans to increase the percentage of annual reimbursement paid through value based programs in the coming years. Under such payment models, there is a growing opportunity for providers who can efficiently and effectively coordinate patient care both within and beyond the hospital setting.

Current fee-for-service reimbursement models reward physicians and hospitals for delivering more care, with little regard for the effectiveness of care delivered. While many types of value based care models exist, all work to establish and align incentives among care providers with a focus on quality and accountability. The premise behind such programs is not only to drive better and more holistic care for patients from admission through to the post-acute setting but to also generate system level cost savings through population based health rather than individual based care. In some value based models, payors would consolidate all payments for a hospitalization episode and pay a flat fee, including post-discharge care of up to a certain time period. Payments may be consolidated to a single provider entity (such as a physician or hospital) with the goal of improving care coordination resulting in better outcomes and lower costs. In a bundled payment arrangement, savings are generated when actual expenditures are reconciled against a target price for an episode of care. Providers and other entities are then incentivized through a gain sharing construct where a portion of total savings generated for specific patient encounters is distributed.

Such programs represent a unique opportunity for TeamHealth, particularly in the context of its broad and highly synergistic service offering following the acquisition of IPC. Additionally, the Company has a demonstrated track record of being at the forefront of evolving care models and expects to continue to utilize these capabilities to its advantage. TeamHealth’s scale and niche focus on certain hospital departments enables it to deliver high quality care on-site in a highly cost effective manner, often with greater resource efficiency than hospitals and many regional players are able to achieve, and will serve to position the Company well during the transition to value based care.

26

|

Growing importance of post-acute management |

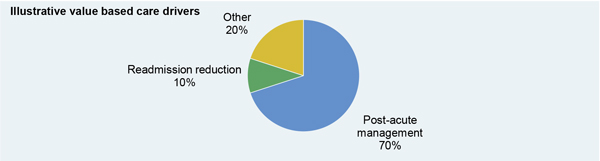

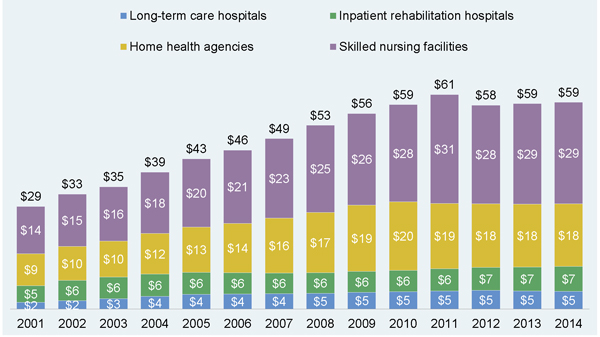

According to the Centers for Medicare and Medicaid (CMS), the post-acute setting represents the most impactable and expensive part of healthcare delivery at an estimated market size greater than $300 billion. With approximately 44% of Medicare patients discharged from acute care facilities to post-acute settings, a substantial portion of overall Medicare spend is generated in post-acute facilities today (MedPac). That spend is expected to continue to grow as the portion of elderly chronic disease patients increase. As the figure below demonstrates, TeamHealth anticipates the primary driver of savings under value based programs will be post-acute management. These savings are expected to be achieved by a combination of care coordination initiatives, including procedural containment efforts, focus on clinically appropriate discharge timing and locations, reduction in average length of stay in post-acute facilities and a focus on reduction in readmission rates.

Increasing strategic importance of post-acute services

Source: TeamHealth management estimates

|

The ongoing issue of physician scarcity |

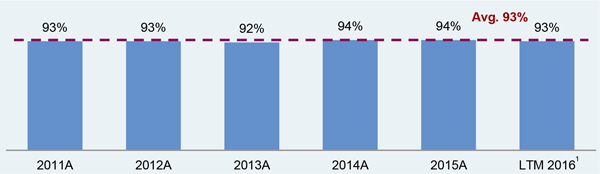

The population and demographic issues mentioned earlier have also contributed to increased competition for physician services. According to a 2016 study by the Association of American Medical Colleges (AAMC), the U.S. is experiencing a physician shortage that is expected to grow to more than 95,000 doctors by 2025. In primary care, the shortage is more acute with the demand outpacing supply by approximately 9% in 2025. In such an environment, hospital systems and other healthcare providers are focused on recruiting, training and retaining top physician talent to ensure consistent and high quality service provision. With a physician-centric model that allows physicians to focus on delivering care rather than administrative duties coupled with highly competitive compensation, TeamHealth has been able to attract the highest quality physicians and achieve consistently high physician retention rates for ED operations averaging at 93% for the last 6 years. Physicians are compelled by the Company’s large national scale and strong capabilities in recruiting, credentialing, billing, collection and other administrative functions.

27

|

Proven business model with strong customer retention rates |

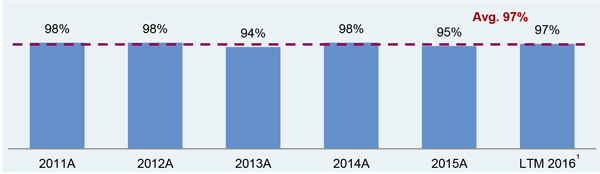

A key to TeamHealth’s success has been its attractive value proposition to both physicians and hospitals/facilities as demonstrated by its consistent high retention rates, averaging at approximately 93% and 97% respectively over the last 6 years within its core ED operations.

Hospital retention rates

| 1 | Calculated on a preceding 12 months basis as of 09/30/16 for ED operations, calculated as full year 2015 minus the nine months ended 09/30/15 plus the nine months ended 09/30/16 |

Source: TeamHealth management

A critical factor of this business model is TeamHealth’s ability to deliver a locally focused service combined with the resources and sophistication of a national organization. TeamHealth’s local presence helps the Company to foster community-based relationships with healthcare facilities, which results in a responsive service as well as high physician retention rates. The Company’s strong relationships in local markets enables it to market its services effectively to both local hospital and military treatment facility administrators, who generally are involved in making decisions regarding contract awards and renewals. As EDs generate 50% of inpatient admissions, these administrators are looking for staffing partners such as TeamHealth who provide high quality patient care and productivity. Additionally, with a centralized national infrastructure, which includes integrated information systems and standardized procedures, the Company believes it is able to efficiently manage the operations as well as billing and collections processes. The Company also provides each of the regional operational sites with centralized staffing support, purchasing economies of scale, payroll administration, coordinated marketing efforts, and risk management. Such a local presence supported by a national infrastructure not only improves productivity and quality of care while reducing the cost of care, but also offers operating leverage to drive economies of scale as TeamHealth continues to grow.

Physician retention rates

| 1 | Calculated on a preceding 12 months basis as of 09/30/16 for ED operations, calculated as full year 2015 minus the nine months ended 09/30/15 plus the nine months ended 09/30/16 |

Source: TeamHealth management

TeamHealth has consistently been able to recruit and retain high quality physicians to service its contracts. The Company’s local presence gives it the knowledge to optimally match physicians with hospitals and their affiliated clinics while its national presence and centralized infrastructure provides physicians with a variety of attractive client locations, operating flexibility, advanced information and reimbursement systems and standardized procedures. Furthermore,

28

the Company offers physicians substantial flexibility in terms of geographic location, type of facility, scheduling of work hours, benefit packages and opportunities for relocation and career development. TeamHealth’s business model allows for considerable clinical autonomy within a large national practice group, relieving physicians of the administrative burden, strained resources and risk of job security associated with smaller practices while offering competitive, performance based compensation to drive results and loyalty to the Company.

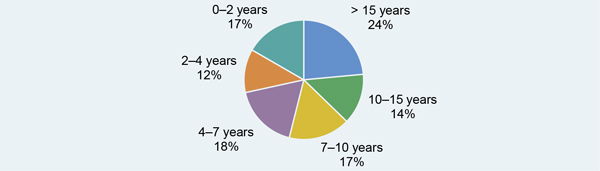

TeamHealth believes its experience and expertise in managing the complexities of high-volume EDs are competitive advantages and enable its hospital customers to provide higher quality and more efficient patient care. These competitive advantages, coupled with TeamHealth’s long history of demonstrated expertise, commitment to clinical excellence, superior customer service and focus on physician satisfaction, have enabled the Company to maintain long-standing relationships with many of its customers. The average ED contract length of TeamHealth’s top 50 customers by net revenue is approximately 13 years with many spanning over 25 years. The Company continues to retain its first two clients who it began serving at the time of the Company’s inception in 1979. Such long-term relationships have allowed the Company to generate recurring revenue streams.

ED contract longevity – 534 contracts as of 09/30/16

Source: TeamHealth management

Additionally, TeamHealth believes its service offering in anesthesia positions it to be a critical partner to hospitals given the necessity of a successful surgery unit for a hospital’s profitability. TeamHealth’s ability to help coordinate surgery, reduce costs, and increase quality continue to differentiate the Company’s among its competitors.

Following the acquisition of IPC, TeamHealth’s value proposition to hospitals has become increasingly relevant in light of the drive towards lower readmission rates, appropriate lengths of stay and improved outcomes, all facets of value based care models. As the shift to value continues, the necessity of competent hospitalists and a robust post-acute service offering is becoming more apparent. Hospitals and facilities are looking for low cost turn-key solution providers of these services, who in addition to staffing their facilities, can remove the administrative burden of billing, collecting and ongoing training for which a facility would otherwise bear responsibility. TeamHealth’s significant scale and resources allows for assured, consistent solutions and bundled arrangements across multiple facilities within this new healthcare environment.

29

|

Consistent financial performance and strong free cash flow profile |

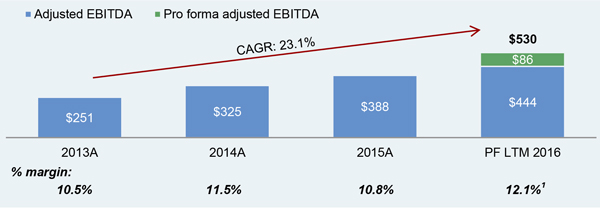

TeamHealth’s long term and contractual relationships with customers coupled with its scale and ability to leverage its administrative and support infrastructure allow for stable and predictable profitability metrics. The Company has been able to demonstrate consistent adjusted EBITDA margins between 10.5% and 11.5% as well as a CAGR of 24.3% for the fiscal years between 2013 and 2015. For the preceding 12 months as of September 30, 2016, the Company’s pro forma adjusted EBITDA margin was 12.1%.

Adjusted EBITDA ($mm)

Source: TeamHealth management; 1 Based on LTM 9/30/16 pro forma adjusted EBITDA of $529.8mm

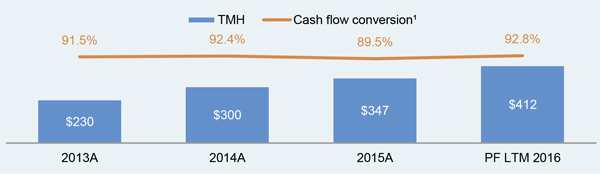

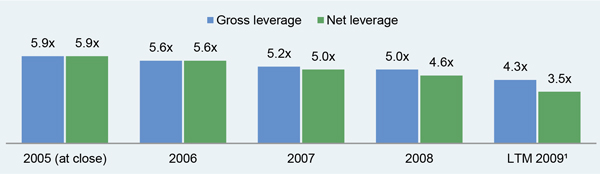

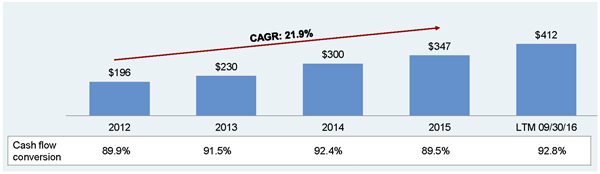

With robust EBITDA margins along with an asset-lite operating model (maintenance capex has consistently been at or below 1% of net revenues), the Company is able to produce an attractive cash flow conversion profile, averaging at 92% over the last 4 years. This further enhances TeamHealth’s operational flexibility and provides considerable cushion to service debt. The Company’s ability to de-lever was demonstrated during Blackstone’s prior ownership in 2005, decreasing from 5.9x in 2005 to 3.5x at the IPO on a net leverage basis.

Adjusted EBITDA – Maintenance capex ($mm)

| 1 | Defined as (Adjusted EBITDA less maintenance capex) / Adjusted EBITDA |

Source: TeamHealth management

30

De-leveraging under Blackstone ownership (2005 to IPO)

| 1 | As of September 30, 2009 |

Source: TeamHealth management

Regional operating units supported by TeamHealth’s centralized national infrastructure are designed to continually drive operating leverage, improve efficiencies and align employee incentives to drive growth. Information systems and economies of scale allow the Company to enhance profitability and revenue growth without compromising the quality of operations or clinical care. Furthermore, TeamHealth believes its consolidated revenue platform and standardized processes related to managed care contracting, billing, coding, collection and compliance have driven a track record of strong revenue cycle management. The Company also believes its innovative patient safety and risk management initiatives and robust claims management processes have delivered favorable loss trends.

In May 2016, TeamHealth engaged highly regarded consulting firm AlixPartners to conduct a focused review of total SG&A spend. The initiative is still ongoing, however preliminary results indicate potential annual savings between approximately $30 – 45mm, with a more meaningful impact expected to be realized at the beginning of 2017.

Profit improvement

| $mm |

Annualized impact1 | Full potential | ||||||

| 1) Centralization of payroll, talent acquisition, benefits, AP |

$ | 7 | $ | 7-9 | ||||

| 2) Regional management restructuring |

8 | 8 | ||||||

| 3) Third party spend on locums tenens, print, other |

10 | 10-12 | ||||||

| 4) IT cloud migration, outsourcing, consolidation |

2 | 4-7 | ||||||

| 5) Network consolidation of regional offices |

1 | 1 | ||||||

| 6) Service center consolidation |

0 | 7-9 | ||||||

| Total profit improvement EBITDA impact |

$ | 28 | $ | 34-45 | ||||

| 1 | YE 2017 |

The Company believes that one of the most important factors potential customers, such as hospitals and other healthcare facilities, evaluate when considering a staffing partner is financial stability. TeamHealth’s historically strong financial performance continues to serve as competitive advantage in winning new contracts, renewing existing contracts and establishing and maintaining relationships with physicians and hospitals.

31

|

Predictable organic growth and M&A integration |

TeamHealth’s overall net revenue growth increased at a 22.1% compound annual growth rate from 2012 to 2015. The Company has continued to utilize its competitive strengths to capitalize on favorable industry trends and drive growth by:

|

Driving same contract revenue growth |

|

Capitalizing on outsourcing opportunities to win new contracts |

|

Executing a disciplined M&A strategy |

Net revenue ($mm)

| 1 | As of September 30, 2016 |

Source: Company filings

Revenue growth contribution

| 1 | As of September 30, 2016 |

Source: TeamHealth management

32

|

Driving same contract revenue growth |

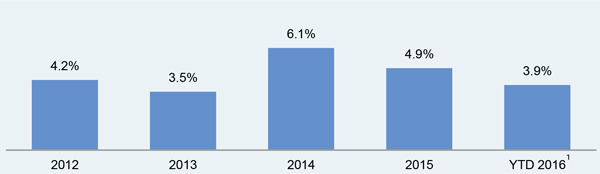

TeamHealth has a strong record of achieving growth in revenues from its existing customer base. In 2014 and 2015, same contract revenue grew by approximately 6.1% and 4.9% respectively on a year-over-year basis. As of September 30 2016, same contract revenue increased by 3.9% over the same period last year. Roughly half of the growth in same contract revenue over the last 6 years can be attributed to volume growth and the other half reimbursement growth. While volume fluctuations from flu and macro trends can drive year to year volatility, same contract revenue growth has typically reverted to the 4% to 6% range over the longer term.

Same-contract revenue growth

| 1 | As of September 30, 2016 |

Source: TeamHealth management

The Company plans to continue to increase revenues from existing customers by:

| • | Capitalizing on increasing patient volumes |

| • | Implementing enhanced point of service capture of non-clinical patient data, resulting in improved billing and collection for services rendered |

| • | Continuing to improve documentation of clinical care delivered, thereby capturing appropriate reimbursement for services provided |

| • | Negotiating and implementing fee schedule increases, where appropriate |

| • | Cross-selling additional services within contracted healthcare facilities |

| • | Increasing staffing levels and expanding services at current military sites of service to retain patients who might otherwise receive services off-base |

| • | Participating in value based care programs |

|

Capitalizing on Outsourcing Opportunities to Win New Contracts |

As hospitals and other healthcare providers continue to experience pressure from managed care companies and other payors to reduce costs while maintaining or improving their quality of service, TeamHealth believes hospitals and other contracting parties will increasingly turn to a single source with an established track record of success for outsourced physician staffing and administrative services. The Company believes it is well-positioned to capitalize on the growth in emergency medicine and other target outsourcing markets due to its:

| • | Demonstrated ability to improve productivity, patient satisfaction and quality of care while reducing overall cost to the healthcare facility |

| • | Successful record of recruiting and retaining high quality physicians and other healthcare professionals |

| • | Ability to further expand offerings in hospitals and providers the Company already serves |

| • | National presence |

| • | Sophisticated information systems and standardized procedures that enable the Company to efficiently manage its core staffing and administrative services as well as the complexities of the billing and collections process |

| • | Financial strength and resources |

33

Furthermore, the Company seeks to obtain new contracts that meet its financial targets by:

| • | Replacing competitors at hospitals that currently outsource their services |

| • | Obtaining new contracts from healthcare facilities that do not currently outsource |

| • | Expanding its present base of military treatment facility contracts by successfully competing for new staffing contracts |

|

Executing a disciplined M&A strategy |

Although TeamHealth is one of the largest providers of outsourced physician staffing and administrative services in the US, based on revenues and patient visits, its current ED and hospital medicine market shares are less than 20%. With the market still highly fragmented and approximately 61% of ED outsourcing serviced by local and regional groups, TeamHealth believes this dynamic represents an attractive opportunity for further consolidation. As reimbursement models change and require greater regulatory and compliance reporting requirements, a further tailwind exists driving smaller physician groups to sell to larger, scale platforms such as TeamHealth who have the resources and expertise to navigate the evolving regulatory landscape.

TeamHealth has had a long and successful record of efficiently executing on M&A opportunities. For fiscal year 2015 and YTD 2016, the company has executed 22 successful acquisitions – all at highly attractive multiples for TeamHealth. The Company is a partner of choice and uses experienced teams of operations and financial personnel to conduct thorough diligence on potential targets as well as dedicated teams responsible for the integration of acquired centers and practices. The Company considers physician group integration as a core competency and intends to continue using some of its robust internally generated cash flows selectively for smaller tuck-in acquisitions at attractive multiples to enhance both its strategic and competitive positions.

34

Acquisitions for 2015 and YTD 2016

| Company |

Date |

Business | ||

| Florida Emergency Physicians (FEP) | 10/16 | ED | ||

| Evergreen Emergency Services | 10/16 | ED | ||

| EmMed, PC | 9/16 | ED | ||

| Grossmont Emergency Medical Group | 8/16 | ED | ||

| Anesthesia Associates of Cincinnati and Pain Management Associates | 8/16 | Anesthesia | ||

| Signature Healthcare Solutions | 8/16 | Hospital Medicine / Post-Acute | ||

| North Florida Hospital Group | 7/16 | Anesthesia | ||

| Lake County Anesthesia Associates | 7/16 | Anesthesia | ||

| Tri City Emergency Medical Group | 6/16 | ED | ||

| Children’s Emergency Services | 4/16 | ED | ||

| Emergency Physicians of Connecticut, Emergency Care Services of New England | 3/16 | ED | ||

| Geriatric Essentials | 12/15 | Post-Acute Provider Services | ||

| Everest Inpatient Services | 12/15 | Hospital Medicine | ||

| South Atlantic Division Physician Group | 12/15 | ED | ||

| IPC Healthcare, Inc. | 11/15 | Hospital Medicine / Post-Acute Provider Services | ||

| Freemont Emergency Services, Advanced Care Emergency Services, Advanced Care Emergency Specialists | 10/15 | ED | ||

| Brookhaven Anesthesia Associates | 7/15 | Anesthesia | ||

| Princeton Emergency Physicians | 5/15 | ED | ||

| Professional Anesthesia Service | 5/15 | Anesthesia | ||

| Ruby Crest Emergency Medicine | 2/15 | ED | ||

| Capital Emergency Associates | 2/15 | ED / Hospital Medicine | ||

| EOS Medical Group | 1/15 | ED | ||

35

|

Best in class management team |

TeamHealth has been able to consistently deliver strong operational and financial performance due to its highly experienced management team. One of TeamHealth’s original co-founders, Executive Chairman H. Lynn Massingale, M.D., has continued to serve in various capacities at the Company since its inception in 1979. Collectively, management has more than 125 years of industry experience, leading to unrivalled knowledge and insights into the outsourced physician staffing and administrative services industry. Furthermore, the management team has built a highly regarded reputation throughout the industry, synonymous with high quality patient care, strong execution and consistency. The Company has one of the most established and recognizable brands within the industry.

Management has devised a winning growth strategy that has served and positioned the Company well to capitalize on evolving industry trends. This strategy emerged from the Company’s core as a leading provider of outsourced emergency medicine staffing and services to a more holistic physician services offering that integrated the full continuum of care. Supporting this transformation has been management’s unique ability to identify opportunities and acquire assets that supplement the Company’s growth trajectory and core competencies.

The Company has added to the depth of its management team, hiring a new Chief Executive Officer, Leif Murphy, who brings with him 22 years of experience and industry knowledge, most recently acting as Chief Financial Officer of LifePoint Health, Inc. Additionally, TeamHealth’s senior corporate and regional management team reflects a mix of both physician and non-physician leaders with an average of more than 27 years in the healthcare industry and more than 14 years of experience with TeamHealth.

Highly experienced management team

| Team member |

Title |

Total years of industry experience | ||

| Dr. Lynn Massingale, M.D. | Co-Founder / Executive Chairman | 38 years | ||

| Leif Murphy | Chief Executive Officer | 22 years | ||

| David Jones | Chief Financial Officer | 24 years | ||

| Oliver Rogers | Chief Operating Officer | 42 years | ||

36

| 5. | Company overview |

TeamHealth is one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States based upon revenues, patient visits, and number of clients. Since TeamHealth’s inception in 1979, the Company has provided outsourced services in emergency medicine (EDs). TeamHealth also provides anesthesiology, inpatient services (hospitalists comprising the specialties of internal medicine, orthopedic surgery, general surgery and OB/GYN), scribes, ambulatory care, pediatrics, post-acute care and other healthcare services comprehensive programs that allow facilities to be more cost-effective and focus attention elsewhere. For the preceding 12 months as of September 30, 2016, the Company generated net revenues of $4.4 billion and pro forma adjusted EBITDA of $530 million.

Diverse service offering with particular strength in the emergency medicine

| 1 | Management estimates |

TeamHealth serves approximately 3,300 civilian and military hospitals, clinics and physician groups in 47 states with a team of more than 20,000 affiliated healthcare professionals, including physicians, physician assistants, nurse practitioners, and nurses. Its facilities served consist of approximately 685 hospital based locations, 220 Spectrum Health Resources (military staffing division) locations, 95 occupational medicine locations, and more than 2,460 IPC-staffed hospitals and post-acute facilities.

Under TeamHealth’s primary business model, the Company signs exclusive contracts with hospitals that retain it to provide clinical staffing services. Once a relationship with a hospital has been formed, TeamHealth assigns affiliated physicians from its network of high-quality local physician groups to work with the hospital staff and to provide patient care. In addition, TeamHealth works to recruit and maintain a network of top-notch local physician groups across the country. The range of physician and non-physician staffing and administrative services that TeamHealth provides to its clients include the following:

| • | Recruiting, schedule and credential coordination for clinical and non-clinical medical professionals |

37

| • | Coding, billing and collection of fees for services provided by medical professionals |

| • | Provision of experienced medical directors |

| • | Administrative support services, such as payroll and professional liability insurance coverage |

| • | Claims and risk management services |

| • | Standardized procedures and operational consulting |

With respect to physicians, TeamHealth eases the administrative burdens associated with practice management while also providing physicians stable practice opportunities in well-regarded hospitals with competitive compensation. Furthermore, TeamHealth has demonstrated its commitment to building a strong physician-centric culture by employing physician leaders throughout all levels of its organization and by providing its physicians with continuing medical education and other opportunities for career advancement. For hospitals, TeamHealth delivers mission critical results via a robust operating platform. Supported by the resources of a national organization and 15 regional client service teams, the Company’s physicians offer hospitals customizable patient care and the option to “bundle” services. This compelling value proposition is further evidenced by a 93% physician retention rate and a 97% contract retention rate with affiliated hospitals (calculated on a preceding 12 month basis as of September 30, 2016 for ED operations).

TeamHealth is a national company delivering services through its regional operating units located in key geographic markets. This operating model enables the Company to provide a localized presence combined with the benefits of scale in centralized administrative and other back office functions that accrue to a larger, national company. The teams in TeamHealth’s regional offices are responsible for managing client relationships and for providing healthcare administrative services.

Unmatched national platform of provider services

Source: TeamHealth management

38

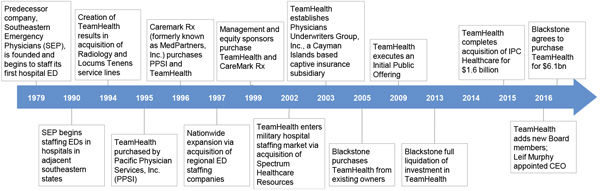

Company history

Segment overview

TeamHealth provides a full range of outsourced physician staffing and administrative services in emergency medicine, hospital medicine, anesthesiology, inpatient services (hospitalists comprising the specialties of internal medicine, critical care, orthopedic surgery, general surgery, and OB/GYN), scribes, ambulatory care, pediatrics, post-acute care and other healthcare services. The Company also provides a full range of healthcare management services to military treatment and government facilities.

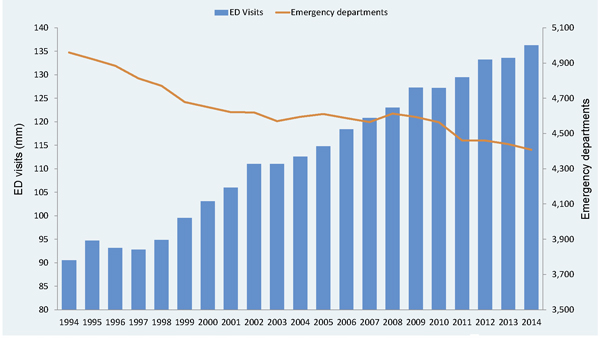

Emergency medicine (57% of LTM 09/30/16 revenues)

TeamHealth is one of the largest providers of outsourced clinical staffing and administrative services for EDs in the United States based upon revenues and patient visits. EDs are a significant source of hospital inpatient admissions with a majority of admissions for key medical service lines starting in EDs, making successful management of this department critical to a hospital’s patient satisfaction rates and overall success. This dynamic, combined with the challenges involved in billing and collections and physician recruiting and retention, is a primary driver for hospitals to outsource their clinical staffing and management services to companies such as TeamHealth. As of December 31, 2015, the Company independently contracted with or employed approximately 4,900 hospital-based emergency physicians. Net revenues derived from TeamHealth ED service line were 67% and 68% of the Company’s consolidated net revenues in 2013 and 2014 and 57% of 2015 and LTM 09/30/16 respectively.

The Company contracts with hospitals to provide qualified emergency physicians, physician assistants and nurse practitioners for their EDs. In addition to the core services of contract management, recruiting, credentials coordination, staffing and scheduling, TeamHealth provides client hospitals with enhanced services designed to improve the efficiency and effectiveness of their EDs. The Company has specific programs that apply proven process improvement methodologies to departmental operations. By providing these enhanced services, TeamHealth believes it increases the value of services provided to clients and improves client relations. Additionally, TeamHealth believes these enhanced services also differentiate the Company from the competition in sales situations and improve the Company’s chances of being selected in a competitive bidding process.

The EDs that TeamHealth staffs are generally located in mid-sized to larger hospitals. The Company believes that its experience and expertise in managing the complexities of these high-volume EDs enables its hospital clients to provide higher quality and more efficient physician and administrative services. In this type of setting, TeamHealth can establish stable long-term relationships, recruit and retain high quality physicians and other providers and staff, and obtain attractive payor mixes and stable margins.

39

Hospital medicine (27% of LTM 09/30/16 revenues)

TeamHealth provides physician staffing and administrative functions for inpatient services, which include hospital medicine, intensivist and house coverage services (Hospitalists comprising the specialties of Internal Medicine, Critical Care, Orthopedic Surgery, General Surgery and OB/GYN). Inpatient contracts with hospitals are generally on a cost-plus or flat rate basis. The Company also contracts directly with health plans.

Following the acquisition of IPC in November 2015, TeamHealth significantly expanded its Hospital Medicine service line for both acute and post-acute care facilities. IPC is the leading national acute hospitalist and post-acute provider group practice in the United States based on revenues, patient encounters and number of affiliated clinicians.

TeamHealth’s clinicians assume the inpatient care responsibilities that are otherwise provided by the primary care physician or attending physician and are reimbursed by third parties using the same fee-for-service visit-based or procedural billing codes as would be used by the primary care physician or attending physician. The Company assists hospitals, post-acute care facilities and payors in improving quality of care, increasing operating efficiencies and reducing costs. Through TeamHealth’s affiliated clinicians, the Company provides, manages and coordinates the care of hospitalized patients and serves as the inpatient partner of primary care physicians and specialists, allowing them to focus their time and resources on their office based practices or their specialties. By practicing each day in the same facility, the Company’s clinicians perform consistent functions, interact regularly with the same healthcare professionals and become highly accustomed to specific facility processes, which can result in greater efficiency, less process variability and better patient outcomes. TeamHealth believes the Company’s hospitalists and post-acute clinicians are better able to achieve these results because of their exclusive focus on inpatient care without the inherent distraction of balancing both inpatient and outpatient care responsibilities.

Likewise, TeamHealth believes the Company’s clinicians generate operating and cost efficiencies by managing the treatment of a large number of patients with similar clinical needs. For the year ended December 31, 2015, on a pro forma basis assuming the IPC Transaction had been completed on January 1, 2015, approximately 27% of the Company’s consolidated revenues were generated by the hospital medicine and post-acute service line. For LTM 09/30/16, legacy and IPC comprised 27% of consolidated revenues.

Anesthesia (10% of LTM 09/30/16 revenues)

TeamHealth provides outsourced anesthesiology and pain management solutions to hospitals and ambulatory surgery centers on a ‘turn-key’ basis. Anesthesiologists act as the gatekeepers to surgical services for patients, assessing patients’ fitness for operations, administering anesthesia and sedation for surgical procedures and scheduling surgical cases. Many surgeons have strong preferences for anesthesiologists they work with and hence access to quality physicians in this regard is important. As one of the hospital’s most profitable service lines, providers are looking for staffing partners like TeamHealth that have the ability to help coordinate surgeries, reduce costs and increase quality.

The services provided by anesthesiologists, certified registered nurse anesthetists (CRNAs), and anesthesiologist assistants include anesthesia for the full range of surgical subspecialties, including cardiac, pediatric, trauma, ambulatory, orthopedic, obstetrical, general and ear, nose and throat, as well as interventional pain management. The Company also provides comprehensive administrative oversight and business management of these services, including processes designed to improve the efficiency and effectiveness of the anesthesiology department and the hospital’s surgical services. This, along with TeamHealth’s industry reputation and focus on high levels of customer service, provide the Company with key market differentiation. As of December 31, 2015, the Company independently contracted with or employed approximately 400 anesthesiologists. Net revenues derived from the anesthesiology service line were 10% and 11% of consolidated net revenues in 2013, 2014 respectively and 10% for 2015 and LTM 09/30/16.

40

Other (6% of LTM 09/30/16 revenues)

In addition, TeamHealth operates in the following service lines:

Military staffing. TeamHealth provides through its Spectrum Health Resources division physician and other non-physician staffing services, including such services as nursing, specialty technician and administrative staffing, primarily in military treatment and outpatient clinical facilities within the United States. These services are generally provided on an hourly contract basis. Net revenues derived from TeamHealth military staffing services line were 5%, 4%, and 3% of the Company’s consolidated net revenues in 2013 and 2014 and 2015, respectively.

Temporary staffing. TeamHealth provides temporary staffing (locum tenens) of physicians and advanced practice clinicians to hospitals and other healthcare organizations through the Company’s subsidiary, D&Y. TeamHealth also uses D&Y to provide locum tenens staffing to the Company’s internal operations when such opportunities are available. Temporary staffing specialties placed include anesthesiology, hospitalists, primary care, radiology, psychiatry and emergency medicine, among others. Revenues from these services are generally derived from a standard contract rate based upon the type of service provided. Customers include hospitals, military treatment facilities and medical groups.

Pediatrics. TeamHealth provides outsourced pediatric physician staffing and administrative services for general and pediatric hospitals on a fee-for-service basis. These services include pediatric emergency medicine, neonatal intensive care, pediatric intensive care, urgent care centers, primary care centers, observation units and inpatient services. TeamHealth also operates after-hours pediatric urgent care centers in Florida.

Scribes. Through the Company’s medical scribes company, PhysAssist, TeamHealth provides documentation services to physicians and other medical personnel in a variety of healthcare environments. PhysAssist also provides scribes to TeamHealth’s internal operations in certain locations.

Ambulatory care. TeamHealth provides cost-effective, high quality primary care physician staffing and administrative services in stand- alone urgent care clinics and in clinics located on the work-site of industrial clients. Urgent care is an emerging area that is an important part of the continuum of care and not only serves as a portal on the initial or front end of care but also as a site for the delivery of follow up post discharge care to patients. The Company believes that there will be a need for increased urgent care capacity as a result of an expansion in the number of individuals with health insurance under the Patient Protection and Affordable Care Act (PPACA) and the reemergence of cost-based initiatives will increase pressure to drive care to the lowest cost setting. As opportunities present themselves, the Company will look to develop urgent care clinics in attractive markets including working in concert with the Company’s hospital partners in various arrangements including potential joint ventures or staffing hospital owned facilities.

Medical call center services. Through the Company’s subsidiary, TeamHealth provides medical call center services to hospitals, physician groups and managed care organizations. The Company’s 24-hour medical call center is staffed by registered nurses and specially trained telephone representatives with consultation available from practicing physicians. The services provided include:

| • | Physician after-hours call coverage |

| • | Community nurse lines |

| • | ED advice calls |

| • | Physician referral |

| • | Class scheduling |

| • | Appointment scheduling |

| • | Web response |

41

In addition, TeamHealth can provide ED clients with outbound follow-up calls to patients who have been discharged from an ED. The Company believes this service results in increased patient satisfaction and decreased liability for the hospital. TeamHealth’s medical call center is one of the few call centers nationwide that is accredited by the Utilization Review Accreditation Committee, an independent nonprofit organization that provides accreditation and certification programs for call centers.

42

Contractual arrangements

Fundamentals of TeamHealth’s business model

| Hospitals | Contracts with hospitals are typically: | |||||

|

• |

Three years in length | |||||

|

• |

Automatically renew | |||||

|

• |

Take the form of fee-for-service, flat-rate or cost-plus | |||||

|

Military and government facilities |

Contracts with military and government facilities are typically: | |||||

|

• |

One year in length | |||||

|

• |

Automatically renew | |||||

|

• |

Based on an hourly or contracted fee basis | |||||

|

Physicians |

Contracts with independent contractors or employees are typically: | |||||

|

• |

Automatically renew | |||||

|

• |

Pay is based on base rate process, productivity-based process or a combination of both | |||||

|

• |

Contracts generally contain non-compete / non-solicit clauses when practices are acquired | |||||

|

Other healthcare professionals |

Utilizes and provides other advanced practice clinicians, such as: | |||||

|

• |

Physician assistants, nurse practitioners, certified registered nurse anesthetists, anesthesiologist assistants and administrative support staff to assist physicians | |||||

Sign exclusive contract with hospital to provide clinical staffing

Recruit and maintain a high-quality local physician group

TeamHealth earns revenues from both fee-for-service arrangements and from flat-rate or hourly contracts. Neither form of contract requires any significant financial outlay, investment obligation or equipment purchase by TeamHealth other than the professional expenses and administrative support costs associated with obtaining and staffing the contracts and the associated cost of working capital for such investments.

43

The Company’s contracts with hospitals generally have terms of three years. Present contracts with military treatment and government facilities are generally for one year. Both types of contracts often include automatic renewal options under similar terms and conditions unless either party gives notice to the other of an intent not to renew. Despite the fact that most contracts can be terminated by either party upon notice of as little as 90 days, the average tenure of the Company’s existing ED contracts is approximately thirteen years. The termination of a contract is usually due to either an award of the contract to another staffing provider as a result of a competitive bidding process or the termination of the contract by TeamHealth due to a lack of an acceptable profit margin on fee-for-service patient volumes coupled with inadequate contract subsidies. Contracts may also be terminated as a result of a hospital facility closing due to facility mergers or a hospital attempting to insource the services being provided by TeamHealth.

Hospitals

TeamHealth provides outsourced physician staffing and administrative services to hospitals under fee-for-service contracts, flat-rate contracts and cost-plus contracts. Hospitals entering into fee-for-service contracts agree, in exchange for granting exclusivity to the Company for such services, to authorize TeamHealth to bill and collect the professional component of the charges for such professional services. Under the fee-for-service arrangements, the Company bills patients and third-party payors for services rendered, making up the majority of its revenue in this instance. Depending on the underlying economics of the services provided to the hospital, including its payor mix, TeamHealth may also receive supplemental revenue from the hospital however this is generally less than 4% of total revenue for the Company. In a fee-for-service arrangement, the Company accepts responsibility for billing and collections.

Under flat-rate contracts, the hospital usually performs the billing and collection services of the professional component and assumes the risk of collectability. In return for providing the physician staffing and administrative services, the hospital pays the Company a contractually negotiated fee, often on an hourly basis. Under cost-plus contracts, the hospital typically reimburses for the amount of the total costs incurred in providing physicians and mid-level practitioners to perform the professional services, plus an agreed upon administrative management fee, less the Company billings and collections of the professional component of the charges for such professional services.

Hospitalist clinicians are credentialed and maintain privileges at the hospitals they serve. Patients are referred to TeamHealth affiliated clinicians through their community medical providers, emergency departments, payors and hospitals, in the same manner as many other medical professionals receive referrals. Third party payors and patients pay for TeamHealth services in the same manner as they would pay the primary care physicians and other medical professionals who otherwise would be furnishing this direct patient care. Patient encounters are obtained through a network of more than 48,000 referring physicians and 3,500 health plans. TeamHealth’s hospitalist programs are structured to provide acute care hospitals with a consistent on-site physician presence that typically results in fewer admitting physicians overseeing patients in the hospital, thereby reducing process variability and enhancing the ability to implement standardized practices. The Company believes the affiliated clinicians’ consistent presence in the facilities leads to more efficient processes within the acute care hospitals, which can improve clinical outcomes, decrease average length of inpatient stay and lower costs per day. By concentrating the care of more patients with relatively fewer physicians, hospitals can more easily implement new initiatives and enhance compliance with protocols.

Alternative sites of inpatient and post-acute care facilities

Alternative sites of inpatient and post-acute care facilities such as long-term acute care facilities, specialty hospitals, psychiatric facilities, rehabilitation hospitals and skilled nursing

44

facilities face many of the same challenges as acute care hospitals. There is increasing demand for facility-based care in the post-acute setting, and these facilities face challenges related to the narrow breadth of physician coverage that is typically available at such sites. TeamHealth’s affiliated clinicians provide alternative sites of inpatient care in the post-acute setting with consistent on-site physician availability and experience. The Company believes this benefits inpatient care in post-acute care facilities by providing a single point of contact and regular communication with other healthcare constituents outside the site of care. The Company’s clinicians in both post-acute and acute care facilities may coordinate patient care with each other, thereby providing a continuum of care which improves quality of care while enhancing the patient experience. By coordinating inpatient care at such facilities, TeamHealth believes the affiliated clinicians manage the appropriate utilization of patient care to the benefit of both the patients and the facility.

Military treatment and government facilities

TeamHealth’s present contracts to provide staffing for military treatment and government facilities generally provide such staffing on an hourly or contracted fee basis.

Physicians

The Company contracts with physicians as independent contractors or employees to provide the professional services necessary to fulfill the contractual obligations to the Company’s hospital clients. The Company typically pay physicians: (1) a base rate (generally for emergency physicians an hourly rate for each hour of coverage and a base salary for other physician specialties) provided at rates comparable to the market in which they work; (2) a productivity-based payment such as a relative value unit (RVU) based payment or (3) a combination of both a fixed rate and a productivity-based payment. The hourly rate varies depending on whether the physician is independently contracted or an employee. Independently contracted physicians are required to pay self-employment tax, social security, and workers’ compensation insurance premiums. By contrast, the Company pay these taxes and expenses for employed physicians.

The Company’s contracts with physicians generally have automatic renewal provisions and can be terminated at any time under certain circumstances by either party without cause, typically upon 90 to 180 days’ notice. TeamHealth’s physician contracts may also be terminated immediately for cause by the Company under certain circumstances. In addition, the Company has generally required physicians to sign non-competition and non-solicitation agreements. Although the terms of TeamHealth’s non-competition and non-solicitation agreements vary from physician to physician, they generally restrict the physician for two years after termination from divulging confidential information, soliciting or hiring employees and physicians, inducing termination of TeamHealth agreements, competing for and/or soliciting TeamHealth clients and, in limited cases, providing services in a particular geographic region. As of November 30, 2016, the Company had working relationships with approximately 9,400 physicians, of which approximately 4,100 were independently contracted.

Other healthcare professionals

TeamHealth utilizes other advanced practice clinicians, such as physician assistants, nurse practitioners, certified registered nurse anesthetists, anesthesiologist assistants and administrative support staff to assist physicians when staffing TeamHealth’s hospital-based facilities. The Company also provides other healthcare professionals such as nurses, specialty technicians and administrative support staff on a contractual basis to military treatment and government facilities. As of November 30, 2016, TeamHealth employed or contracted with approximately 10,700 other healthcare professionals.

45

Sales and Marketing

Contracts for outsourced physician staffing and administrative services are generally obtained either through direct selling efforts or requests for proposals. TeamHealth has a team of sales professionals located throughout the country. Each sales professional is responsible for developing sales opportunities for the operating unit in their territory. In addition to direct selling, the sales professionals are responsible for working in concert with the regional operating unit president and corporate development personnel to respond to requests for proposals or to take other steps to develop new business relationships. Although practices vary, healthcare facilities generally issue a request for proposal with demographic information of the facility department, a list of services to be performed, the length of the contract, the minimum qualifications of bidders, the selection criteria and the format to be followed in the bid. Supporting the sales professionals is a fully integrated marketing campaign comprised of an inside sales program, an internet website, journal advertising, direct mail, conventions/trade shows, online campaigns, social media and a lead referral program.

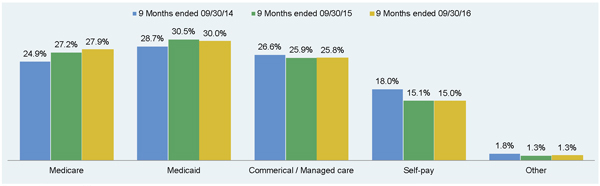

Payor mix

Payor mix has remained stable over a long period of time and is comprised of 57.9% government, 25.8% commercial and 15.0% self-pay, based on a percentage of consolidated fee-for-service volume for the nine months ended September 30, 2016. Given TeamHealth’s focus in emergency medicine and the existing requirements to treat all patients irrespective of insurance coverage, the implementation of the Affordable Care Act (ACA) and the subsequent expansion in covered lives did not impact the Company’s patient volumes significantly. However, the Company did experience an improvement in reimbursement and collections resulting from a shift of previously uninsured patients to Medicaid.

The chart below summarizes TeamHealth’s approximate payor mix as a percentage of consolidated fee-for-service patient volume for the periods indicated:

Nine months ended September 30, 2014, 2015 and 2016

Source: Company filings

46

Services overview

Contract management

The Company’s delivery of services for a clinical area of a healthcare facility is led by an experienced contract management team of clinical and other healthcare professionals. The team usually includes a regional medical director, an on-site medical director and a client services manager. The on-site medical director is a physician with the primary responsibility of coordinating the physician component of a clinical area of the facility. The medical director works with the team, in conjunction with the nursing staff and private medical staff, to improve clinical quality and operational effectiveness. Additionally, the medical director works closely with the regional operating unit’s operations staff to meet the client’s ongoing recruiting and staffing needs.

Credentials coordination

The Company gathers primary source information regarding physicians to facilitate the review and evaluation of physicians’ credentials by the healthcare facility.

Information systems

The Company has invested in advanced information systems and proprietary software packages designed to assist hospitals in lowering administrative costs while improving the efficiency and productivity of a clinical area. These systems include TeamWorks, the Company’s national physician database and software package that facilitates the recruitment and retention of physicians and supports the contract requisition, credentials coordination, automated application generation, scheduling and payroll operations.

The strength of the Company’s electronic billing system and other information systems has enhanced the Company’s ability to properly collect patient payments and reimbursements in an orderly and timely fashion and has increased the billing and collections productivity. As a result of TeamHealth’s investments in information systems and the company-wide application of operational best practices policies, TeamHealth believes the Company’s average cost per patient billed and average recruiting cost per clinician are among the lowest in the industry.

TeamHealth provides the Company’s affiliated hospital medicine clinicians with access to IPC-Link ® and other third party applications (collectively IPC-Link ®) through TeamHealth web-based “Virtual Office” portal to support their clinical, administrative and communications needs. IPCLink ® is distinctive in its ability to capture the results of each doctor-patient encounter and organize these results into a searchable database. IPC-Link ® enables TeamHealth affiliated clinicians to view and record important patient data, and allows clinicians in a practice group to share patient information as needed. Additionally, the technology enables TeamHealth affiliated clinicians to communicate directly and securely to the clinical call center and the Company’s risk management and compliance departments. IPC-Link ® includes a secure, HIPAA-compliant web interface, which allows TeamHealth to assume responsibility for billing, collection and reimbursement for services rendered by TeamHealth affiliated clinicians.

Within IPC, the Company use IPC-Link ® to create customized surveys for patients who are discharged to home from an inpatient facility. To assist in monitoring and documenting the patient’s discharge or transition to outpatient care, IPC-Link ® provides TeamHealth’s call center with patient information and follow-up instructions. TeamHealth’s system provides for the Company’s dedicated call center staff of patient representatives and nurses to contact the discharged patient, usually within 48 hours of discharge, to discuss the patient’s ability to understand post-discharge instructions, obtain prescribed medication, schedule an appointment with a primary care physician and fulfill other health-related post-discharge needs. TeamHealth’s system enables the Company to identify a patient’s post-discharge medical issues on a near real-time basis, coordinate care with the appropriate care provider, improve outcomes, lower the readmission rate into inpatient facilities, and decrease TeamHealth medical malpractice risk.

47

Operational consulting

The Company assists the Company’s clients in achieving or exceeding their clinical, operational and financial goals through operational consulting. TeamHealth’s focus is on improving patient satisfaction, reducing patient throughput times, managing resource utilization, ensuring integration among multiple service lines, improving clinical outcomes, and overall enhancing efficiency and quality of patient care. TeamHealth utilizes physician and nurse coaches in providing this consulting service.

Scheduling

The Company scheduling department assists the on-site medical directors in scheduling physicians and other healthcare professionals within the clinical area on a monthly basis.

Billing and collections

The Company billing and collection services are a critical component of the Company’s business. TeamHealth’s fee-for-service billing and collection internal operations are primarily conducted at one of seven billing locations. TeamHealth’s emergency medicine, acute-care, and anesthesia services operate on a uniform billing system using a state of the art billing and accounts receivable software package with comprehensive reporting capabilities. The Company is able to maintain fee schedules that vary for the level of care rendered and to apply contractually agreed upon allowances (in the case of commercial and managed care insurance payors) and reimbursement policy parameters (in the case of governmental payors) to allow the Company to process payor reimbursements at levels that are less than the gross charges resulting from the Company’s fee schedules. TeamHealth’s billing system calculates the contractual allowances at the time of processing of third-party payor remittances. The contractual allowance calculation is used principally to determine the propriety of subsequent third-party payor payments. The nature of emergency care services and the requirement to treat all patients in need of such care and often times under circumstances where complete and accurate billing information is not readily available at the time of discharge, precludes the use of the Company billing system to accurately determine contractual allowances on an individual patient basis for financial reporting purposes. As a result, management estimates net revenues, which is the Company revenue estimated to be collected after considering the contractual allowance obligations and the Company’s estimates of doubtful accounts.