Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - PRICESMART INC | c803-20161130xex32_2.htm |

| EX-32.1 - EX-32.1 - PRICESMART INC | c803-20161130xex32_1.htm |

| EX-31.2 - EX-31.2 - PRICESMART INC | c803-20161130xex31_2.htm |

| EX-31.1 - EX-31.1 - PRICESMART INC | c803-20161130xex31_1.htm |

| EX-10.2 - EX-10.2 - PRICESMART INC | c803-20161130xex10_2.htm |

| 10-Q - 10-Q - PRICESMART INC | c803-20161130x10q.htm |

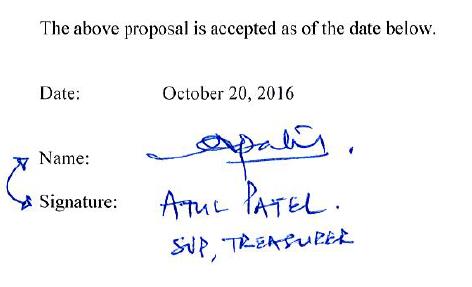

October 20, 2016

Mr. Atul Patel

PriceSmart, Inc.

9740 Scranton Rd Ste 125

San Diego, CA92121

RE: PROPOSAL TO PROVIDE CREDIT

Dear Atul,

MUFG Union Bank, N.A. (“Bank”) is pleased to present you (“Borrower”) with this proposal concerning a possible real estate secured loan (“Loan”) on the terms and conditions described below. Please understand that this letter is not a commitment or agreement to make a Loan; rather, it is intended to set forth some, but not all, of the terms the Bank would consider in making a loan.

|

I. Permanent Term Loan |

||

|

|

||

|

Borrower: |

PriceSmart, Inc. |

|

|

|

||

|

Loan Amount: |

The principal amount of the Loan shall not exceed the lesser of 75% of Bank approved concluded value, or cost. |

|

|

|

||

|

Term: |

10 years |

|

|

|

||

|

Amortization: |

Interest only first two years followed by 28 year amortization |

|

|

|

||

|

Collateral: |

A first priority deed of trust on the real property and improvements located at Building #9, Flagler Station Phase III, Miami, Florida. |

|

|

|

||

|

Guarantor(s): |

None |

|

|

|

||

|

Interest Rate: |

Variable Interest Rate: A variable interest rate based on 1.70% per annum (the "Spread") in excess of the LIBOR Rate. The interest would be adjusted at the end of each interest period to the then current one month LIBOR Rate plus the Spread. Upon each adjustment in the interest rate, the amount of the monthly installments of principal and interest would be adjusted to an amount sufficient to fully amortize the Loan over the remaining amortization term at the then prevailing interest rate. |

|

|

|

||

|

Swap Rate Option: |

Borrower may enter into an interest rate derivative contract for the life of the permanent loan. |

|

|

|

||

|

Upon Default: |

The interest rate on the Loan would be subject to increase upon a default by Borrower, and late payment charges would be assessed as provided in the loan documents. Interest will be calculated based upon a 360-day year. |

|

|

|

||

|

Prepayment Fee: |

Borrower will be required to pay to Bank a prepayment fee in accordance with the loan documents and swap documents. |

|

|

|

||

|

Recourse: |

Full recourse to Borrower. |

|

|

|

||

|

Loan Fee: |

The loan fee will equal 0.25% of the Loan Amount, payable upon funding of Loan. |

|

|

|

||

|

Covenants: |

Final covenants are to be determined, and will include, but not be limited to, the following: |

II. Other Terms and Conditions

|

1) Appraisal acceptable to Bank; |

|

2) Environmental review acceptable to Bank; |

|

3) Certificate of Occupancy; |

|

4) Title insurance issued by a title insurance company acceptable to Bank with all appropriate endorsements; |

|

5) Receipt, review and acceptance of financial and other documents which may be needed for the approval of described real estate loan. |

Loan Documents: All loan documents will be prepared by Bank or outside counsel chosen by Bank, in form and substance satisfactory in all respects to Bank and will contain standard representations and warranties, financial information and covenants and events of default for financing arrangements of the type described in this letter.

Expenses and Charges: Borrower will pay all expenses and charges incurred by Bank in connection with Bank's due diligence, including, but not limited to: a) appraisal, b) environmental review, c) title insurance, and d) costs of loan documentation.

This letter is only a proposal on behalf of Bank, and nothing herein shall be deemed to constitute a commitment or agreement, or otherwise obligate Bank in any way to make available or offer the financing described above. It is intended that any legal rights or obligations between us will come into existence only if comprehensive loan documents are executed and delivered. Such legal rights and obligations shall be only those set forth in such loan documents. In addition, the contemplated credit facility is subject to credit approval by the Bank and no adverse change in the Borrower's financial condition, assets, liabilities, business or prospects.

Please indicate your acceptance of this letter, and the terms hereof, by signing and returning the enclosed counterpart hereof, together with the deposit referred to above. If this letter is not accepted and returned to Bank on or before October 31, 2016, then, at the option of Bank, this letter shall be null and void and of no further force or effect. This letter shall be governed by California law.

We appreciate the opportunity to provide you with this letter confirming our interest in considering a possible Loan to Borrower on the terms set forth above. Should you have any questions concerning this letter, please do not hesitate to call me at 858/812-3661.

Sincerely,

ATTACHMENT TO PROPOSAL LE TTER

Please complete and provide the information requested below with the executed proposal letter.

|

1. TITLE |

We will require a preliminary title report or existing owner’s policy with copies of all exceptions and plotted easements. If you do not furnish a report, please authorize Bank to order a title report on its behalf. Please complete information below. If no preference is stated, Bank will select a title company in its sole discretion.

Preferred Title Company:___________________________________________________________________________

Contact Name:_____________________________________________________________________________________

Phone number Fax number:_____________________________

If a purchase, please enclose a copy of the purchase/sale agreement and certified escrow instructions.

If a refinance of existing debt other that debt to Union Bank, please provide:

I) Person to contact at lender/servicer for ordering payoff/demand statement:

Loan Name:_______________________________________________________________________________

Loan Number:_____________________________________________________________________________

Financial Institution Name:_________________________________________________________________

Phone Number:___________________________________________________________________________

Please make sure you have provided authorization to your financial institution to release a demand to Bank and/or Title Company.

|

2. INSURANCE (all information below, required 5 days prior to closing) |

Name of insurance carrier for property

insurance:_________________________________________________________________________________

Agent Name:___ Agent phone #

Agent Fax#_______ Agent E-mail

Name of insurance carrier for liability

insurance:_________________________________________________________________________________

Agent Name:___ Agent phone #

Agent Fax#_______ Agent E-mail