Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE - DELTA AIR LINES, INC. | dal_8k-ex9902.htm |

| 8-K - CURRENT REPORT ON FORM 8-K - DELTA AIR LINES, INC. | dal_8k.htm |

Exhibit 99.1

1 Overall Commentary • Delta expects a December quarter operating margin of 10.5 - 11.0%, consistent with the updated guidance provided at Investor Day in mid - December. – Results for the quarter include the full 2016 impact of Delta’s new pilot contract, totaling $475 million of expense. Excluding the portion of this expense not related to the December quarter, Delta’s normalized operating margin is expected to be in the 14.5 - 15.0% range. • Consolidated passenger unit revenue (PRASM) for the month of December was flat year over year, driven by strong demand trends and improving close - in domestic yields as Delta’s capacity actions and revenue management strategies continue to benefit results. – For the December quarter, Delta expects unit revenue to decline 2.5 - 3.0%, which compares favorably to the initial guidance range of down 3 - 5% given in October. • Non - fuel unit costs including profit sharing for the December quarter are expected to be up approximately 10% versus the prior year, with ~8 points of the increase related to the new pilot contract. Excluding the portion of the contract expense not related to the December quarter, Delta’s normalized non - fuel unit costs are expected to be up roughly 4%. • Delta returned ~$450 million to shareholders through dividends and share repurchases in the quarter for a total of more than $3 billion for 2016. December Quarter 2016 Operating margin 10.5 - 11.0% Cargo and other revenue $1.4 - $1.5 billion Average fuel price per gallon $1.57 - $1.62 Profit sharing expense ~$190 million Non - operating expense $75 - 100 million December Quarter 2016 vs. December Quarter 2015 Passenger unit revenue Down 2.5 - 3.0% CASM - Ex including Profit Sharing Up ~10% System capacity Up ~1% January 4, 2017 • Note: Information for the December quarter 2016 in this investor update is adjusted for the reconciliations below. Fuel Delta’s expected fuel price of $1.57 - $1.62 includes taxes, transportation, and refinery results. CASM - Ex Delta excludes fuel and certain other expenses from its unit cost guidance. Other expenses include the costs associated with third - party Maintenance Repair and Overhaul, Delta Global Services, Delta Vacations, Delta Private Jets, and refinery cost of sales to third parties. Delta expects to record roughly $350 million of other expenses in the December quarter. The revenue associated with these expenses is included in Delta's guidance for cargo and other revenue. Guidance

2 Forward Looking Statements Profit Sharing Delta’s employee profit sharing program for its ground and flight attendant employees pays 10% of the company’s adjusted annual pre - tax profit up to the prior year’s adjusted annual pre - tax profit and 20% above that amount (adjusted pretax profit for 2015 was $7.35 billion). Delta’s employee profit sharing program for its pilots pays 10% up to $2.5 billion in adjusted annual pre - tax profit and 20% above that amount. Profit sharing expense is accrued at a blended rate based on the company’s estimated profitability for the full year. Taxes Our December 2016 quarter results will reflect a 35% tax rate. There will be no material impact to cash as Delta’s net operating loss carryforwards will largely offset cash taxes. Share count Delta expects approximately 736 million diluted and approximately 732 million basic weighted average shares outstanding. Statements in this investor update that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections or strategies for the future, may be "forward - looking statements" as defined in the Private Securities Litigation Reform Act of 1995. All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectations, beliefs, intentions, projections and strategies reflected in or suggested by the forward - looking statements. These risks and uncertainties include, but are not limited to, the effects of terrorist attacks or geopolitical conflict; the cost of aircraft fuel; the impact of rebalancing our hedge portfol io, recording mark - to - market adjustments or posting collateral in connection with our fuel hedge contracts; the availability of aircraft fuel; the possible effects of accidents involving our aircraft; the restrictions that financial covenants in our fin anc ing agreements will have on our financial and business operations; labor issues; interruptions or disruptions in service at one o f our hub or gateway airports; disruptions or security breaches of our information technology infrastructure; our dependence on technology in our operations; the effects of weather, natural disasters and seasonality on our business; the effects of an extended disruption in services provided by third party regional carriers; failure or inability of insurance to cover a signi fic ant liability at Monroe’s Trainer refinery; the impact of environmental regulation on the Trainer refinery, including costs relat ed to renewable fuel standard regulations; our ability to retain management and key employees; competitive conditions in the airlin e industry; the effects of extensive government regulation on our business; the sensitivity of the airline industry to prolonge d periods of stagnant or weak economic conditions, including the effects of Brexit; and the effects of the rapid spread of contagious illnesses. Additional information concerning risks and uncertainties that could cause differences between actual results and forward - looking statements is contained in our Securities and Exchange Commission filings, including our Annual Report on Form 10 - K for the fiscal year ended December 31, 2015 and our Quarterly Report on Form 10 - Q for the quarterly period ended June 30, 2016. Caution should be taken not to place undue reliance on our forward - looking statements, which represent our views only as of January 4, 2017, and which we have no current intention to update. Non - GAAP Financial Measures Delta sometimes uses information ("non - GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non - GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The tables below show reconciliations of non - GAAP financial measures used in this release to the most directly comparable GAAP financial measures. Non - GAAP Reconciliations

3 Operating Margin, Adjusted and Operating Margin, Adjusted, Including Pilot Contract Impact Normalized We adjust for the following items to determine operating margin, adjusted and operating margin, adjusted, including pilot contract impact normalized for the reasons described below: Mark - to - market ("MTM") adjustments and settlements . MTM adjustments are defined as fair value changes recorded in periods other than the settlement period. Such fair value changes are not necessarily indicative of the actual settlement val ue of the underlying hedge in the contract settlement period. Settlements represent cash received or paid on hedge contracts settled during the period. These items adjust fuel expense to show the economic impact of hedging, including cash received or paid on hedge contracts during the period. Adjusting for these items allows investors to better understand and analyze our core operational performance in the period shown. Pilot contract impact, normalized . Delta’s new pilot contract was ratified on December 1, and the contract is retroactive to January 1, 2016. As a result, Delta will recognize $475 million in retroactive wages and other benefits in the December quarter. We have excluded the portion of the contract expense not related to the December quarter to allow investors to bette r understand and analyze the company's core operational performance in the period shown as if the pilot contract had been in effect as of January 1, 2016. (Projected) Three Months Ended December 31, 2016 Operating margin 10.4% - 11.1% Adjusted for: MTM adjustments and settlements 0.0% - (0.2)% Refinery sales 0.1% Operating margin, adjusted 10.5% - 11.0% Pilot contract impact, normalized 4.0% Operating margin, adjusted, including pilot contract impact, normalized 14.5% - 15.0%

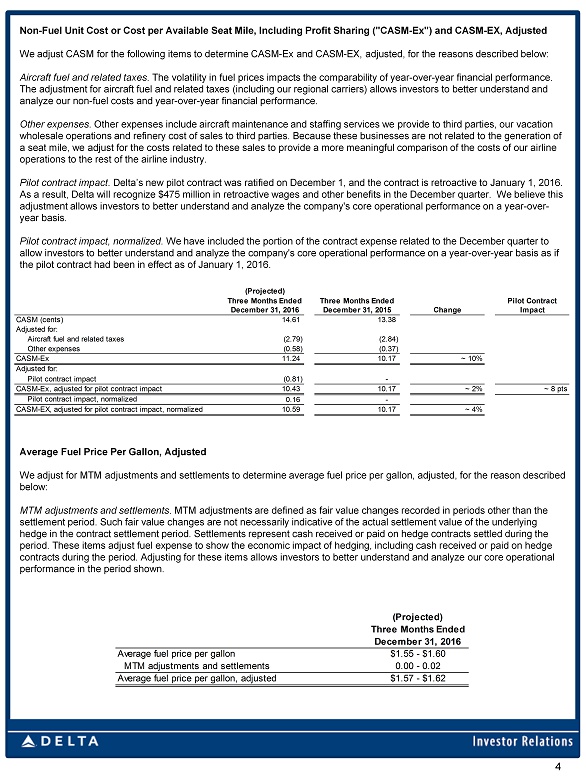

Non - Fuel Unit Cost or Cost per Available Seat Mile, Including Profit Sharing ("CASM - Ex") and CASM - EX, Adjusted We adjust CASM for the following items to determine CASM - Ex and CASM - EX, adjusted, for the reasons described below: Aircraft fuel and related taxes . The volatility in fuel prices impacts the comparability of year - over - year financial performance. The adjustment for aircraft fuel and related taxes (including our regional carriers) allows investors to better understand an d analyze our non - fuel costs and year - over - year financial performance. Other expenses . Other expenses include aircraft maintenance and staffing services we provide to third parties, our vacation wholesale operations and refinery cost of sales to third parties. Because these businesses are not related to the generation of a seat

mile, we adjust for the costs related to these sales to provide a more meaningful comparison of the costs of our airli ne operations to the rest of the airline industry. Pilot contract impact . Delta’s new pilot contract was ratified on December 1, and the contract is retroactive to January 1, 2016. As a result, Delta will recognize $475 million in retroactive wages and other benefits in the December quarter. We believe t his adjustment allows investors to better understand and analyze the company's core operational performance on a year - over - year basis. Pilot contract impact, normalized . We have included the portion of the contract expense related to the December quarter to allow investors to better understand and analyze the company's core operational performance on a year - over - year basis as if the pilot contract had been in effect as of January 1, 2016. Average Fuel Price Per Gallon, Adjusted We adjust for MTM adjustments and settlements to determine average fuel price per gallon, adjusted, for the reason described below: MTM adjustments and settlements . MTM adjustments are defined as fair value changes recorded in periods other than the settlement period. Such fair value changes are not necessarily indicative of the actual settlement value of the underlying hedge in the contract settlement period. Settlements represent cash received or paid on hedge contracts settled during the period. These items adjust fuel expense to show the economic impact of hedging, including cash received or paid on hedge contracts during the period. Adjusting for these items allows investors to better understand and analyze our core operational performance in the period shown. (Projected) Three Months Ended December 31, 2016 Average fuel price per gallon $1.55 - $1.60 MTM adjustments and settlements 0.00 - 0.02 Average fuel price per gallon, adjusted $1.57 - $1.62 4 (Projected) Three Months Ended Three Months Ended Pilot Contract December 31, 2016 December 31, 2015 Change Impact 14.61 13.38 (2.79) (2.84) (0.58) (0.37) 11.24 10.17 ~ 10% (0.81) - 10.43 10.17 ~ 2% ~ 8 pts 0.16 - CASM-EX, adjusted for pilot contract impact, normalized 10.59 10.17 ~ 4% Pilot contract impact, normalized Adjusted for: Pilot contract impact CASM-Ex, adjusted for pilot contract impact CASM (cents) Adjusted for: Aircraft fuel and related taxes Other expenses CASM-Ex