Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Marathon Petroleum Corp | mpc8-kjan3.htm |

Update on Strategic Actions to Enhance

Shareholder Value

January 3, 2017

Forward‐Looking Statements

This presentation contains forward-looking statements within the meaning of federal securities laws regarding Marathon Petroleum Corporation ("MPC") and MPLX LP ("MPLX").These forward-looking statements relate to,

among other things, expectations, estimates and projections concerning the business and operations of MPC and MPLX, including proposed strategic initiatives. You can identify forward-looking statements by words such

as “anticipate,“ "design," "evaluate," "expect," "forecast," "guidance," "intend," "opportunity," "plan," "predict," "potential," "strategy," "target," "could," "may," "should," "would," "will" or other similar expressions that convey

the uncertainty of future events or outcomes. Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the companies'

control and are difficult to predict. Factors that could cause MPC's actual results to differ materially from those implied in the forward-looking statements include: the time, costs and ability to obtain regulatory or other

approvals and consents and otherwise consummate the strategic initiatives discussed herein; the satisfaction or waiver of conditions in the agreements governing the strategic initiatives discussed herein; the ability to

achieve the strategic and other objectives related to the strategic initiatives discussed herein; the impact of adverse market conditions affecting MPC's and MPLX's midstream businesses; adverse changes in laws

including with respect to tax and regulatory matters; inability to agree with the MPLX conflicts committee with respect to the timing of and value attributed to assets identified for dropdown; risks described below relating to

MPLX; modifications to MPLX earnings and distribution growth objectives; continued/further volatility in and/or degradation of market and industry conditions; changes to MPC's capital budget; other risk factors inherent to

MPC's industry; and the factors set forth under the heading "Risk Factors" in MPC's Annual Report on Form 10-K for the year ended Dec. 31, 2015, filed with Securities and Exchange Commission (SEC). Factors that

could cause MPLX's actual results to differ materially from those implied in the forward-looking statements include: the time, costs and ability to obtain regulatory or other approvals and consents and otherwise

consummate the transactions discussed herein, the satisfaction or waiver of conditions in the agreements governing the transactions discussed herein; negative capital market conditions, including a persistence or

increase of the current yield on common units, which is higher than historical yields, adversely affecting MPLX's ability to meet its distribution growth guidance; the adequacy of MPLX's capital resources and liquidity,

including, but not limited to, availability of sufficient cash flow to pay distributions and access to debt to fund anticipated dropdowns on commercially reasonable terms, and the ability to successfully execute its business

plans and growth strategy; continued/further volatility in and/or degradation of market and industry conditions; changes to the expected construction costs and timing of projects; the suspension, reduction or termination of

MPC's obligations under MPLX's commercial agreements; modifications to earnings and distribution growth objectives; the level of support from MPC, including dropdowns, alternative financing arrangements, taking

equity units, and other methods of sponsor support, as a result of the capital allocation needs of the enterprise as a whole and its ability to provide support on commercially reasonable terms; changes to MPLX's capital

budget; other risk factors inherent to MPLX's industry; and the factors set forth under the heading "Risk Factors" in MPLX's Annual Report on Form 10-K for the year ended Dec. 31, 2015, and Quarterly Report on Form

10-Q for the quarter ended March 31, 2016, filed with the SEC. In addition, the forward-looking statements included herein could be affected by general domestic and international economic and political conditions.

Unpredictable or unknown factors not discussed here, in MPC's Form 10-K or in MPLX's Form 10-K or Form 10-Q could also have material adverse effects on forward-looking statements. Copies of MPC's Form 10-K are

available on the SEC website, MPC's website at http://ir.marathonpetroleum.com or by contacting MPC's Investor Relations office. Copies of MPLX's Form 10-K and Form 10-Q are available on the SEC website, MPLX's

website at http://ir.mplx.com or by contacting MPLX's Investor Relations office.

Non-GAAP Financial Measures

EBITDA and DCF coverage are non-GAAP financial measures provided in this presentation. DCF coverage ratio is the ratio of distributable cash flow attributable to GP and LP unitholders to total GP and LP distributions

declared. These measures should not be considered in isolation or as an alternative to GAAP financial measures. The EBITDA forecasts for the planned dropdowns were determined on an EBITDA-only basis. Information

related to the elements of net income, including tax and interest, and net cash provided by operating activities are not available and, therefore, reconciliations of these non-GAAP financial measures to the nearest GAAP

financial measures have not been provided.

Important Additional Information

MPC, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from MPC shareholders in connection with the matters to be considered at MPC’s 2017 Annual Meeting. MPC

intends to file a proxy statement with the SEC in connection with any such solicitation of proxies from MPC shareholders. MPC shareholders are encouraged to read any such proxy statement and accompanying white proxy card

when they become available as they will contain important information. Information regarding the ownership of MPC’s directors and executive officers in MPC shares, restricted shares and options is included in their SEC filings

on Forms 3, 4 and 5. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be

filed with the SEC in connection with MPC’s 2017 Annual Meeting. Information can also be found in MPC’s Annual Report on Form 10-K for the year ended Dec. 31, 2015, filed with the SEC, and Current Report on Form 8-K filed

with the SEC on Oct. 5, 2016. Shareholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by MPC with the SEC for no charge on the SEC

website, MPC’s website at http://ir.marathonpetroleum.com or by contacting MPC’s Investor Relations office.

Update on Strategic Actions to Enhance Shareholder Value

3

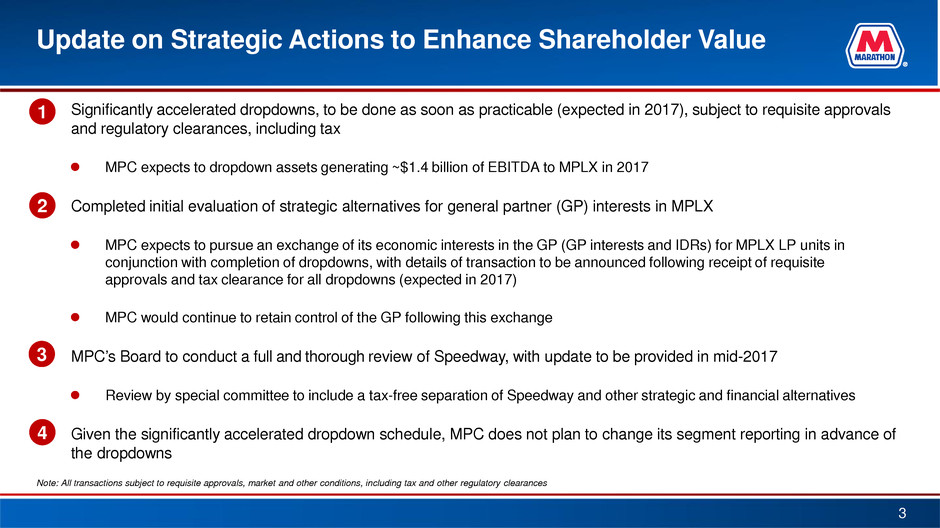

1) Significantly accelerated dropdowns, to be done as soon as practicable (expected in 2017), subject to requisite approvals

and regulatory clearances, including tax

MPC expects to dropdown assets generating ~$1.4 billion of EBITDA to MPLX in 2017

2) Completed initial evaluation of strategic alternatives for general partner (GP) interests in MPLX

MPC expects to pursue an exchange of its economic interests in the GP (GP interests and IDRs) for MPLX LP units in

conjunction with completion of dropdowns, with details of transaction to be announced following receipt of requisite

approvals and tax clearance for all dropdowns (expected in 2017)

MPC would continue to retain control of the GP following this exchange

3) MPC’s Board to conduct a full and thorough review of Speedway, with update to be provided in mid-2017

Review by special committee to include a tax-free separation of Speedway and other strategic and financial alternatives

4) Given the significantly accelerated dropdown schedule, MPC does not plan to change its segment reporting in advance of

the dropdowns

Note: All transactions subject to requisite approvals, market and other conditions, including tax and other regulatory clearances

MPC to Dropdown All ~$1.4 Billion MLP-Qualifying EBITDA to

MPLX As Soon As Practicable (Expected in 2017)

4

MPC expects to dropdown assets generating ~$1.4 billion of MLP-eligible annual EBITDA to MPLX as soon as practicable

(expected in 2017), subject to requisite approvals and regulatory clearances, including tax

A proposed transaction representing ~$250 million of this EBITDA is already under review by the conflicts committee of the

MPLX Board and the transaction is expected to be completed in the first quarter of 2017

Remaining assets generating ~$1.15 billion of annual EBITDA (including ~$600 million associated with fuels distribution) expected to be

dropped in 2017 subject to requisite approvals and regulatory clearances, including tax

– If tax clearance is delayed for fuels distribution, then ~$200 million of remaining MLP-qualifying EBITDA would be dropped no

later than the first quarter of 2018, with ~$600 million of fuels distribution EBITDA dropped following receipt of tax clearance

Expect valuation multiples consistent with recent industry precedents ranging from ~7.0x to ~9.0x EBITDA

Expect the partnership to finance the dropdown transactions with debt and equity in approximately equal proportions, with equity

financing to be funded through MPLX LP units issued to MPC at market price

Refining and Marketing segment expects continued top-tier refining gross margins following completion of the dropdowns

MPC expects its accelerated dropdown strategy to enhance shareholder value by providing significant cash

proceeds and substantially increasing its LP and GP distributions from MPLX

1

Note: All transactions subject to requisite approvals, market and other conditions, including tax and other regulatory clearances

All Dropdowns Expected to Be Done by End of 2017

5

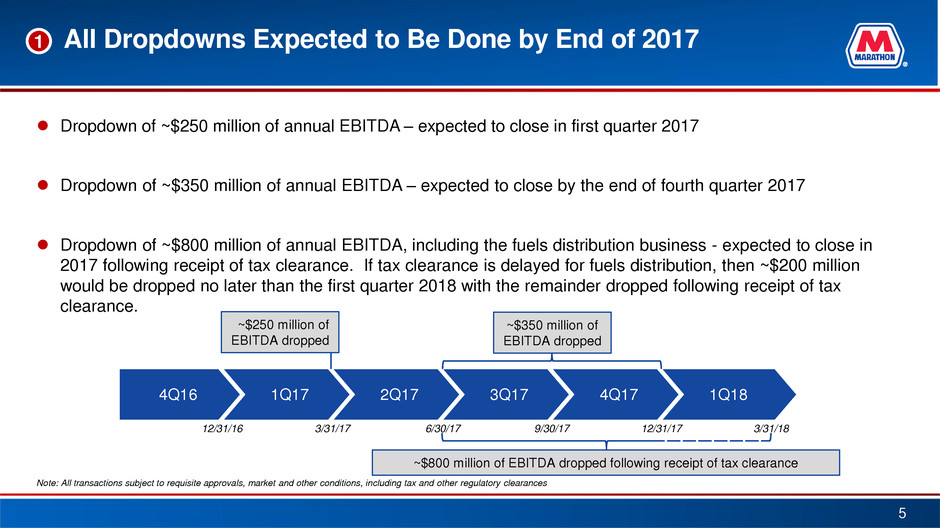

Dropdown of ~$250 million of annual EBITDA – expected to close in first quarter 2017

Dropdown of ~$350 million of annual EBITDA – expected to close by the end of fourth quarter 2017

Dropdown of ~$800 million of annual EBITDA, including the fuels distribution business - expected to close in

2017 following receipt of tax clearance. If tax clearance is delayed for fuels distribution, then ~$200 million

would be dropped no later than the first quarter 2018 with the remainder dropped following receipt of tax

clearance.

4Q16 1Q17 2Q17 3Q17 4Q17 1Q18

12/31/16 3/31/17 6/30/17 9/30/17 12/31/17 3/31/18

~$250 million of

EBITDA dropped

~$800 million of EBITDA dropped following receipt of tax clearance

~$350 million of

EBITDA dropped

1

Note: All transactions subject to requisite approvals, market and other conditions, including tax and other regulatory clearances

MPC Expects to Offer IDRs to MPLX in Exchange for

MPLX LP Units in 2017

6

With the assistance of independent financial advisors, MPC completed its initial evaluation of strategic

alternatives to highlight and capture the value of its general partner interests in MPLX while optimizing

MPLX’s cost of capital

Strategy expected to include an exchange of MPC’s economic interests in the GP for newly issued MPLX

LP units

– Provides tangible valuation marker for MPC’s GP interests via publicly traded MPLX LP units

– Exchanges GP/IDR cash flows for LP unit distributions

– Expected to reduce MPLX’s cost of capital

– Expected to enhance MPLX distribution growth

– MPC would continue to retain control of the GP following this exchange

To be undertaken in conjunction with completion of dropdowns, with details of transaction to be

announced following receipt of requisite approvals and tax clearance for all dropdowns (expected in 2017)

2

Note: All transactions subject to requisite approvals, market and other conditions, including tax and other regulatory clearances

Strategic Actions To Enhance Shareholder Value

Significant Cash to MPC for Return to Shareholders and Debt Paydown

7

1 2

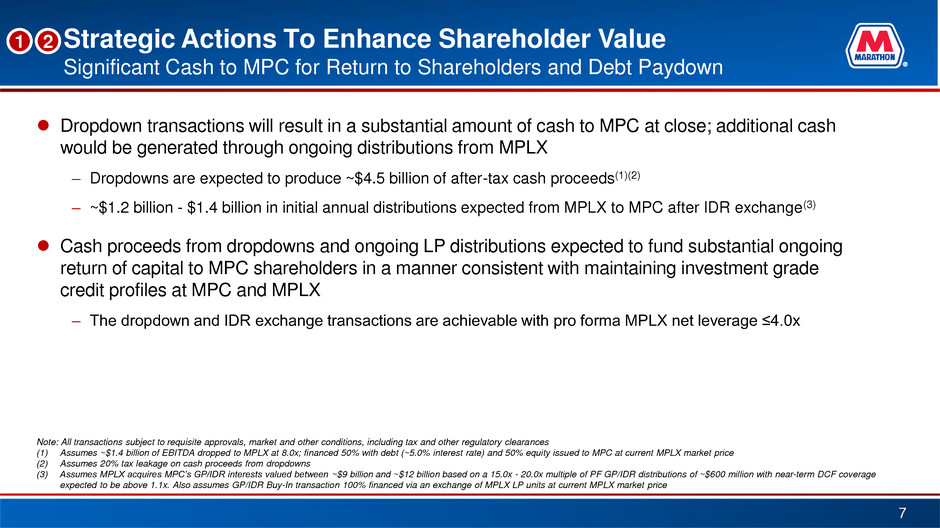

Dropdown transactions will result in a substantial amount of cash to MPC at close; additional cash

would be generated through ongoing distributions from MPLX

– Dropdowns are expected to produce ~$4.5 billion of after-tax cash proceeds(1)(2)

– ~$1.2 billion - $1.4 billion in initial annual distributions expected from MPLX to MPC after IDR exchange(3)

Cash proceeds from dropdowns and ongoing LP distributions expected to fund substantial ongoing

return of capital to MPC shareholders in a manner consistent with maintaining investment grade

credit profiles at MPC and MPLX

– The dropdown and IDR exchange transactions are achievable with pro forma MPLX net leverage ≤4.0x

Note: All transactions subject to requisite approvals, market and other conditions, including tax and other regulatory clearances

(1) Assumes ~$1.4 billion of EBITDA dropped to MPLX at 8.0x; financed 50% with debt (~5.0% interest rate) and 50% equity issued to MPC at current MPLX market price

(2) Assumes 20% tax leakage on cash proceeds from dropdowns

(3) Assumes MPLX acquires MPC’s GP/IDR interests valued between ~$9 billion and ~$12 billion based on a 15.0x - 20.0x multiple of PF GP/IDR distributions of ~$600 million with near-term DCF coverage

expected to be above 1.1x. Also assumes GP/IDR Buy-In transaction 100% financed via an exchange of MPLX LP units at current MPLX market price

The combination of dropdowns and GP/IDR buy-in is anticipated to lower MPLX’s cost of capital going forward

– Dropdowns enhance distribution growth

– GP/IDR buy-in removes IDR burden and lowers equity cost of capital

The strategic actions are projected to provide DCF accretion and allow MPLX to achieve its double-digit distribution growth

targets with near-term DCF coverage expected to be above 1.1x

– MPLX will have the ability to further increase distributions if market conditions support such actions

The strategic actions will simplify the MPLX structure and fully align incentives with MPC

– MPC will own the general partner and a majority of MPLX LP units, completely aligning interests towards continuing MPLX

distribution growth and managing MPLX to be competitive and attractively valued

Addition of ~$1.4 billion of EBITDA adds substantial stable cash flow to MPLX and greater visibility to distribution growth

Strategic Actions To Enhance Shareholder Value

Significant Value to MPLX

1 2

8

Note: All transactions subject to requisite approvals, market and other conditions, including tax and other regulatory clearances

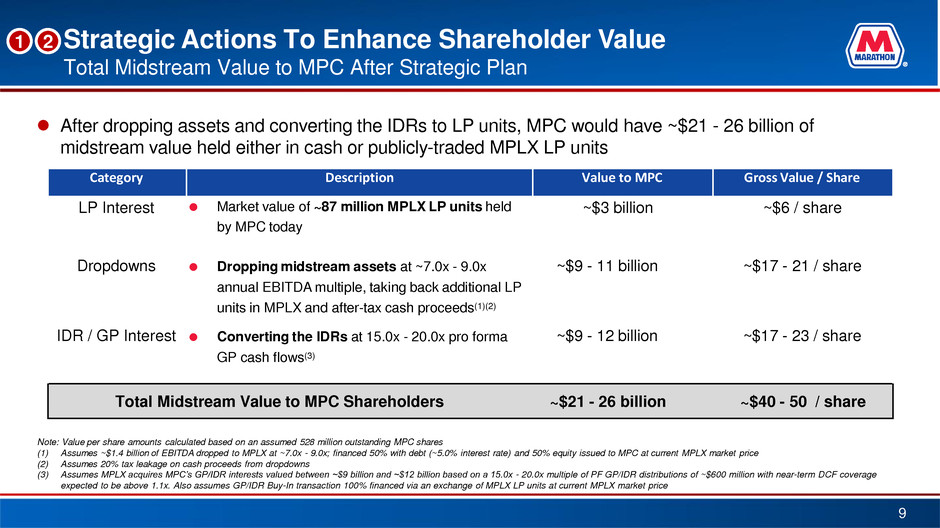

1 2 Strategic Actions To Enhance Shareholder Value

Total Midstream Value to MPC After Strategic Plan

Note: Value per share amounts calculated based on an assumed 528 million outstanding MPC shares

(1) Assumes ~$1.4 billion of EBITDA dropped to MPLX at ~7.0x - 9.0x; financed 50% with debt (~5.0% interest rate) and 50% equity issued to MPC at current MPLX market price

(2) Assumes 20% tax leakage on cash proceeds from dropdowns

(3) Assumes MPLX acquires MPC’s GP/IDR interests valued between ~$9 billion and ~$12 billion based on a 15.0x - 20.0x multiple of PF GP/IDR distributions of ~$600 million with near-term DCF coverage

expected to be above 1.1x. Also assumes GP/IDR Buy-In transaction 100% financed via an exchange of MPLX LP units at current MPLX market price

After dropping assets and converting the IDRs to LP units, MPC would have ~$21 - 26 billion of

midstream value held either in cash or publicly-traded MPLX LP units

Category Description Value to MPC Gross Value / Share

LP Interest Market value of ~87 million MPLX LP units held

by MPC today

~$3 billion ~$6 / share

Dropdowns Dropping midstream assets at ~7.0x - 9.0x

annual EBITDA multiple, taking back additional LP

units in MPLX and after-tax cash proceeds(1)(2)

~$9 - 11 billion ~$17 - 21 / share

IDR / GP Interest Converting the IDRs at 15.0x - 20.0x pro forma

GP cash flows(3)

~$9 - 12 billion ~$17 - 23 / share

Total Midstream Value to MPC Shareholders ~$21 - 26 billion ~$40 - 50 / share

9

MPC Will Conduct Full and Thorough Review of Speedway

In keeping with MPC’s practice of evaluating shareholder value creation, an MPC Board special

committee will conduct a full and thorough review of Speedway’s strategic and financial alternatives

– Review to include a tax-free separation of Speedway to shareholders and other strategic and financial alternatives

– Board special committee to lead review with the assistance of an independent financial advisor

– Expect to provide an update on the review by mid-2017

3

10

Consistent with Its Demonstrated Track Record, MPC Continues

Its Focus on Long-Term Value Creation

MPC and its Board of Directors continually analyze opportunities to enhance value and are confident that the MPC plan is the right course

Proven

Commitment to

Enhancing

Shareholder Value

– 2011 spinout from Marathon Oil

– Creation of MPLX

– Tripled stable cash flow(1)

– Over $10 billion returned to shareholders

– 179% Total Shareholder Return since 2011(2)

MPC’s Strategic

Plan Will Continue

to Deliver

Shareholder Value

– Significantly accelerated dropdowns: MPC expects to dropdown assets generating ~$1.4 billion of EBITDA to MPLX as

soon as practicable (expected in 2017) subject to regulatory clearances, including tax

– Completed initial evaluation of strategic alternatives for general partner (GP) interests in MPLX: MPC expects to pursue

an exchange of its economic interests in the GP (GP interests and IDRs) for MPLX LP units in conjunction with

completion of dropdowns, with details of transaction to be announced following receipt of requisite approvals and tax

clearance for all dropdowns (expected in 2017)

– MPC’s Board will conduct a full and thorough review of Speedway, including a tax-free separation and other strategic and

financial alternatives. Review to be led by a special committee of the Board with the assistance of an independent

financial advisor. Update on review expected to be provided by mid-2017

MPC and MPLX

Interests are

Aligned

– Increased and substantial MPLX LP holdings by MPC – greater than 50% pro forma for dropdowns and GP/IDR buy-in

– Growing stable cash flows through continued investment in midstream infrastructure, driven by a steady stream of MPLX

organic capex of $1.2 billion - $1.6 billion in 2017E

– Increasing distributions to MPLX LP unit holders with forecasted growth of 12% - 15% in 2017 and double-digit growth in

2018 driven by organic growth capital and MPC dropdowns

– Optimizing MPLX’s cost of capital enhances the partnership’s organic and M&A opportunities

(1) Based on 3Q 2016 LTM EBITDA as compared to 2011 EBITDA

(2) FACTSET as of December 30, 2016

11

Appendix

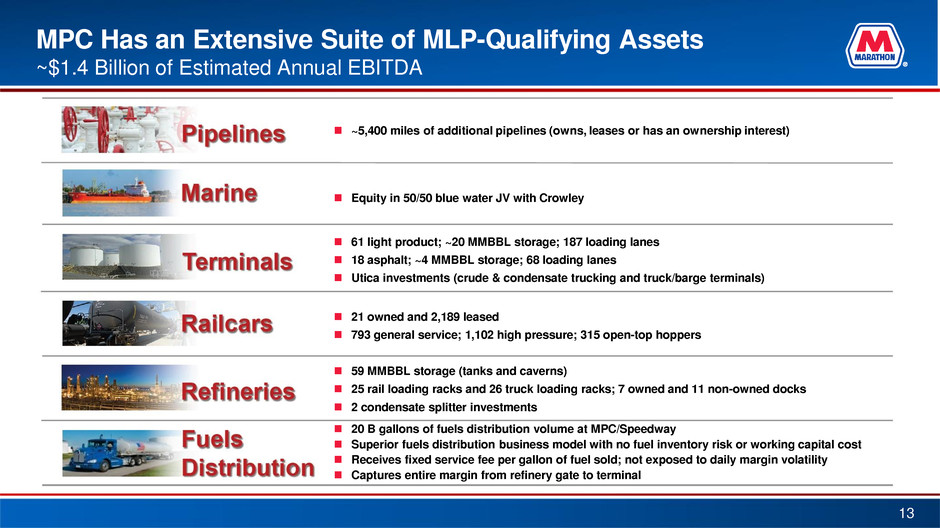

MPC Has an Extensive Suite of MLP-Qualifying Assets

~$1.4 Billion of Estimated Annual EBITDA

Equity in 50/50 blue water JV with Crowley

61 light product; ~20 MMBBL storage; 187 loading lanes

18 asphalt; ~4 MMBBL storage; 68 loading lanes

Utica investments (crude & condensate trucking and truck/barge terminals)

21 owned and 2,189 leased

793 general service; 1,102 high pressure; 315 open-top hoppers

59 MMBBL storage (tanks and caverns)

25 rail loading racks and 26 truck loading racks; 7 owned and 11 non-owned docks

2 condensate splitter investments

20 B gallons of fuels distribution volume at MPC/Speedway

Superior fuels distribution business model with no fuel inventory risk or working capital cost

Receives fixed service fee per gallon of fuel sold; not exposed to daily margin volatility

Captures entire margin from refinery gate to terminal

~5,400 miles of additional pipelines (owns, leases or has an ownership interest)

13