Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Holdings USA, Inc. | q316shusair.htm |

12.30.2016

SANTANDER HOLDINGS USA, INC.

Fixed Income Investor Presentation

Third Quarter 2016

2 Disclaimer

This presentation of Santander Holdings USA, Inc. (“SHUSA”) contains “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of SHUSA. Words such

as “may,” “could,” “should,” “looking forward,” “will,” “would,” “believe,” “expect,” “hope,” “anticipate,” “estimate,” “intend,” “plan,” “assume” or similar

expressions are intended to indicate forward-looking statements.

Although SHUSA believes that the expectations reflected in these forward-looking statements are reasonable as of the date on which the statements

are made, these statements are not guarantees of future performance and involve risks and uncertainties based on various factors and

assumptions, many of which are beyond SHUSA’s control. Among the factors that could cause SHUSA’s financial performance to differ materially

from that suggested by the forward-looking statements are: (1) the effects of regulation and policies of the Board of Governors of the Federal

Reserve System (the “Federal Reserve”), the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency and the

Consumer Financial Protection Bureau, including changes in trade, monetary and fiscal policies and laws, including interest rate policies of the

Federal Reserve, the failure to adhere to which could subject SHUSA to formal or informal regulatory compliance and enforcement actions; banking,

capital and liquidity, regulations and policies and the application and interpretations thereof by regulatory bodies, and the impact of changes in and

interpretations of generally accepted accounting principles in the United States of America; (2) the strength of the United States economy in general

and regional and local economies in which SHUSA conducts operations in particular, which may affect, among other things, the level of non-

performing assets, charge-offs, and provisions for credit losses; (3) the ability of certain European member countries to continue to service their debt

and the risk that a weakened European economy could negatively affect U.S.-based financial institutions, counterparties with which SHUSA does

business, as well as the stability of global financial markets; (4) inflation, interest rate, market and monetary fluctuations, which may, among other

things, reduce net interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and

secondary markets; (5) adverse movements and volatility in debt and equity capital markets and adverse changes in the securities markets,

including those related to the financial condition of significant issuers in SHUSA’s investment portfolio; (6) SHUSA’s ability to manage changes in the

value and quality of its assets, changing market conditions that may force management to alter the implementation or continuation of cost savings or

revenue enhancement strategies and the possibility that revenue enhancement initiatives may not be successful in the marketplace or may result in

unintended costs; (7) SHUSA's ability to grow revenue, manage expenses, attract and retain highly-skilled people and raise capital necessary to

achieve its business goals and comply with regulatory requirements and expectations; (8) SHUSA’s ability to timely develop competitive new

products and services in a changing environment that are responsive to the needs of SHUSA's customers and are profitable to SHUSA, the

acceptance of such products and services by customers, and the potential for new products and services to impose additional costs on SHUSA and

expose SHUSA to increased operational risk; (9) changes or potential changes to the competitive environment, including changes due to regulatory

and technological changes, the effects of industry consolidation and perceptions of SHUSA as a suitable service provider or counterparty; (10) the

ability of SHUSA and its third-party vendors to convert and maintain SHUSA’s data processing and related systems on a timely and acceptable

basis and within projected cost estimates; (11) SHUSA's ability to control operational risks, data security breach risks and outsourcing risks, and the

possibility of errors in quantitative models SHUSA uses to manage its business and the possibility that SHUSA's controls will prove insufficient, fail

or be circumvented; (12) the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, which is a significant

development for the industry, the full impact of which will not be known until the rule-making processes mandated by the legislation are complete,

although the impact has involved and will involve higher compliance costs that have affected and will affect SHUSA’s revenue and earnings

negatively; (13) SHUSA's ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that

meets regulatory expectations; (14) competitors of SHUSA that may have greater financial resources or lower costs, may innovate more effectively,

or may develop products and technology that enable those competitors to compete more successfully than SHUSA;

3 Disclaimer (cont.)

(15) acts of terrorism or domestic or foreign military conflicts; and acts of God, including natural disasters; (16) the outcome of ongoing tax audits by

federal, state and local income tax authorities that may require SHUSA to pay additional taxes or recover fewer overpayments compared to what

has been accrued or paid as of period-end; (17) adverse publicity, whether specific to SHUSA or regarding other industry participants or industry-

wide factors, or other reputational harm; and (18) SHUSA’s success in managing the risks involved in the foregoing.

Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this

presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco

Santander, S.A. (“Santander”), SHUSA, Santander Bank, N.A. (“Santander Bank” or “SBNA”), or Santander Consumer Holdings USA, Inc. (“SC”) in

any other securities or investments. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future

results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a

prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences,

and suitability of that investment. No offering of securities shall be made in the United States except pursuant to registration under the U.S.

Securities Act of 1933, as amended, or an exemption therefrom.

In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of

which is defined in this document, if utilized, may include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and

the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a

substitute for, our GAAP results, among others. We believe that this additional information and the reconciliations we provide may be useful to

investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to

which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information.

On February 18, 2014, the Federal Reserve issued the final rule implementing certain of the enhanced prudential standards mandated by Section

165 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Final Rule") to strengthen regulatory oversight of foreign banking

organizations ("FBOs"). Under the Final Rule, FBOs with over $50 billion of U.S. non-branch assets, including Santander, were required to

consolidate U.S. subsidiary activities under an intermediate holding company ("IHC"). Due to its U.S. non-branch total consolidated asset size,

Santander was subject to the Final Rule. As a result of this rule, Santander transferred substantially all of its equity interests in U.S. bank and non-

bank subsidiaries previously outside SHUSA to SHUSA, which became an IHC effective July 1, 2016. These subsidiaries included Santander

BanCorp, Banco Santander International (“BSI”), Santander Investment Services, Inc. (“SIS”), Santander Securities LLC (“SSLLC”), as well as

several other subsidiaries.

As these entities were and are solely owned and controlled by Santander prior to and after July 1, 2016, in accordance with Accounting Standards

Codification 805, the transaction has been accounted for under the common control guidance which requires SHUSA to recognize the assets and

liabilities transferred at their historical cost of the transferring entity at the date of the transfer. Additionally, as this transaction represents a change in

reporting entity, the guidance requires retrospective combination of the entities for all periods presented in the financial statements as if the

combination had been in effect since inception of common control. The entities transferred approximately $14.1 billion of assets and approximately

$11.8 billion of liabilities to SHUSA on July 1, 2016. The transfer added approximately $69.9 million and $68.8 million of net income to SHUSA for

the nine-month periods ended September 30, 2016 and 2015 after the financial statements have been recast to reflect the operations of the

commonly controlled entities for all periods presented as a change in reporting entity. Historical financial information in this presentation has

not been consistently recasted to reflect the above financial reporting requirements.

4

Santander

Bank

Santander

Consumer

USA

Santander

Puerto Rico

Banco

Santander

International

Santander

Investment

Securities

SHUSA is a bank holding company (“BHC”) headquartered in Boston, MA and is

wholly owned by Santander (NYSE: SAN)

Introduction

• SHUSA consists of:

• Well established banking franchises in

the Northeast and Puerto Rico

• A nationwide auto finance business

• A wholesale broker-dealer in New York

• International Private banking business

• Regulated by the Federal Reserve

• SEC registered1

12SHUSA’s SEC filings are accessible on the SEC website at www.sec.gov. Filings are also accessible through

SHUSA’s website at www.santanderus.com

5

Corporate Structure1

Santander Holdings USA, Inc.

$139.2BN Assets

Santander Bank,

N.A.

$85.5BN Assets

Santander

Consumer USA

Holdings Inc.

$38.7BN Assets

On July 1, 2016, SHUSA became the IHC for Santander’s U.S. operations

1Balances as of September 30, 2016

2Puerto Rico = includes Banco Santander Puerto Rico and SSLLC

“Approximately

58.9% ownership

Banco Santander, S.A.

Puerto Rico2

$5.3BN Assets

BSI

$7.2BN Assets

SIS

$1.4BN Assets

100% ownership

100% ownership

Added to SHUSA effective July 1, 2016

6

3Q16 Executive Summary1

Liquidity and

Funding

Capital

Balance Sheet

1Data as of 9/30/16 unless otherwise noted 4Liquidity Coverage Ratio

2Includes non controlling interest

3YTD 2016 includes $69.9MM in net income from the IHC entities consolidated on July 1, 2016

Earnings

Credit Quality

SHUSA 3Q16 net income $226MM2, YTD 2016 net income $611MM2,3

SHUSA 3Q16 net interest margin of 5.87%

In July 2016 SHUSA added $14.1BN in assets and $11.8BN in liabilities through

the consolidation of U.S. entities for the formation of the IHC

YTD 2016 SHUSA’s balance sheet has increased by $11BN as the IHC assets

were partially offset by lower assets at SBNA due to balance sheet optimization

SHUSA as a holding company has $4.0BN cash on hand

SHUSA’s LCR4 at end of 3Q16 is in excess of regulatory requirement

SC has $36.8BN in committed funding, of which $31.9BN was in use at 3Q16

Common Equity Tier 1 (CET1) 14.1%; 13.4% under U.S. Basel III fully phased-in

CET1 increased by 1.7% from 2Q16, primarily due to the IHC consolidation

SBNA’s non-performing loans (“NPLs”) and criticized balances have steadily

decreased since 1Q16, when they increased due to the energy finance portfolio

90 SC asset-backed securities (“ABS”) tranches totaling $7.1BN were upgraded

by Moody’s, S&P, and Fitch during 3Q16

SC delinquencies increased YoY primarily due to 2015 vintage loans

7 Significant Developments

IHC: On July 1, 2016, SHUSA completed the formation of the IHC by assuming ownership

of most U.S. entities formerly owned by Santander. The impact on SHUSA was:

SBNA Net Interest Margin (“NIM”) Improved from 2.19% at 4Q15 to 2.33% at 3Q16

Deposit repricing initiatives conducted in 2016 have reduced SBNA’s deposit cost by 8bps from

0.47% in 4Q15 to 0.39% in 3Q16

Through 3Q16 SBNA has terminated $3.1BN of legacy Federal Home Loan Bank (“FHLB”)

borrowings which had a weighted average rate of 3.93%

Moody’s downgrade: On October 18, 2016, Moody’s downgraded SHUSA’s long-term

debt rating from Baa2 to Baa3 and changed SHUSA’s outlook from negative to stable.

SBNA’s ratings were not affected.

Delayed Financial Statement Filings: See next slide for more information on the

delayed financial filings by SHUSA and SC

IHC Entity Impact BSI Puerto Rico SIS Other1 Total

Total Assets $7.2BN $5.3BN $1.4BN $0.2BN $14.1BN

Cash $3.6BN $1.0BN $1.0BN $5.6BN

Loans $3.4BN $4.0BN $7.4BN

Deposits $5.5BN $4.2BN $9.7BN

Equity $1.0BN $1.0BN $0.2BN $0.1BN $2.3BN

1Includes other small entities that were consolidated such as Santander Securities LLC

8 Delayed Financial Filings

In August 2016, SHUSA and SC disclosed1 that their 2Q16 Forms 10-Q would be delayed

as SC was working with its current and former independent registered public accountants

as well as the SEC to address certain accounting matters

The accounting matters primarily related to SC’s discount accretion and credit loss allowance

methodologies, and the related control considerations

On September 23, 2016, SC and SHUSA disclosed2 that they would be restating financial

disclosures for the full years 2013, 2014 and 2015, and 1Q16

Restatements would address the accounting matters cited in the August 2016 notices

SC provided preliminary restated results which showed no material impact from the restatements.

SC also provided preliminary 2Q16 results

On October 27, 2016, SC published final restated results and 2Q16 Form 10-Q3

Both the restated results and the 2Q16 Form 10-Q had immaterial changes to the preliminary

results provided on 9/23/16

On November 9, 2016 SC filed its 3Q16 Form 10-Q in a timely fashion

On December 7, 2016 SHUSA filed its restated results and the Form 10-Q for 2Q16.

On December 12, 2016 SHUSA filed the Form 10-Q for 3Q16

1SC Form 8-K filed 8/16/16 and SHUSA Form 8-K filed 8/23/16

2SC Form 8-K and SHUSA Form 8-K filed 9/23/16

3SC Form 8-K filed 10/27/16

9 Quarterly Profitability1

1Periods prior to 3Q16 have not been re-casted for the IHC consolidation

2 Net Income includes noncontrolling interest

3Q16 results reflect addition of IHC entities

4Q15 results reflect $4.5BN (pre-tax) goodwill impairment charge

Pre-Tax Pre-Provision Income/(Loss) ($MM)

Net Income/(Loss) ($MM)2

Net Interest Income ($MM)

Pre-Tax Income/(Loss) ($MM)

*3Q15 - excludes $96MM tax provision

1,264

(3,647)

1,032 985 1,022

-3,500

-2,500

-1,500

-500

500

1,500

3Q15 4Q15 1Q16 2Q16 3Q16

1,633 1,605 1,616 1,586 1,621

6.33%

6.12% 6.16%

6.06%

5.87%

0

500

1,000

1,500

2,000

3Q15 4Q15 1Q16 2Q16 3Q16

NII Net Interest Margin

327

(4,704)

150

388 334

(500)

(350)

(200)

(50)

100

250

400

3Q15 4Q15 1Q16 2Q16 3Q16

126

(3,665)

85

253 226 222*

(500)

(375)

(250)

(125)

-

125

250

3Q15 4Q15 1Q16 2Q16 3Q16

10

2

18%

11%

4%

7%

8%

8% 15%

5%

5%

3%

16%

Balance Sheet Overview (September 30, 2016)

9%

6%

4%

5%

4% 7%

6%

19%

13% 7%

18%

Investments

Auto Loans

2%

Cash

Non Interest-

Bearing

Demand

Deposits

Other Assets

C&I

CRE Residential

Mortgage

Other

Loans

Operating

Lease Assets

Goodwill

Home

Equity

Multi-Family

$139.2BN Assets

$116.8BN Liabilities

$22.4BN Equity

Interest-

Bearing

Demand

Deposits

Secured

Structured

Financings

Equity

Other

Liabilities

FHLB

Money

Market

Certificates

of Deposit

Savings

Revolving

Credit

Facilities

Other

Borrowings

Cash and Non-interest bearing DDA increases reflect IHC consolidation

Reduction in investments and FHLB due to SBNA balance sheet optimization

11

2

Balance Sheet Trends: Overview1

$131 $128 $131 $126

$139

ASSETS LIABILITIES & EQUITY

$ in Billions

Q316 balance sheet increase reflects the IHC consolidation in July 2016

$131 $128 $131

$126

$139

1Periods prior to 3Q16 have not been re-casted for the IHC consolidation

12

2

2

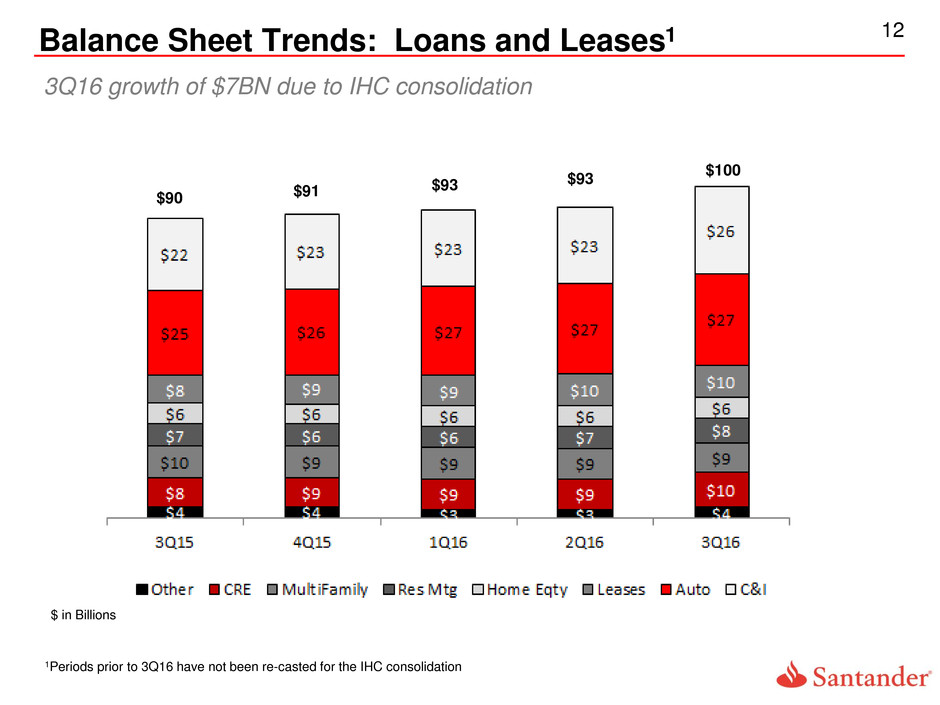

Balance Sheet Trends: Loans and Leases1

$90 $91

$93 $93

$100

$ in Billions

3Q16 growth of $7BN due to IHC consolidation

1Periods prior to 3Q16 have not been re-casted for the IHC consolidation

13

2

2

Balance Sheet Trends: Deposits1

$56 $56 $57 $56

$68

$ in Billions

3Q16 increase reflects $10BN from IHC consolidation as well as continued growth

in deposits at SBNA

1Periods prior to 3Q16 have not been re-casted for the IHC consolidation

14

2

2

$696

$619

$590

$515 $497 $513

$710

$687

$615

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Non-Performing Loans1 Criticized Balances2

Texas Ratio4 Annualized Net Charge off Ratio3

0.25%0.23% 0.26%

0.31%

0.20%

0.43%

0.15%0.12%

0.92%

0.43%0.41%0.36%

0.49%

0.36% 0.35% 0.36%

0.38%

0.39%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Santander Bank Large Banks**

SBNA: Asset Quality

$ MM

-12%

NPLs and Criticized Balances continued to contract after the increase in 1Q16

$ MM

Annualized NCO = Quarterly NCO*4

**Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC

14.3% 13.7% 13.1%

9.6%10.1% 9.3% 8.5% 7.9% 8.6%

10.3%10.7%10.8%

14.0%

17.3% 16.2% 15.1% 14.5% 13.9%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Santander Bank Large Banks**

1NPLs = Nonaccruing loans plus accruing loans 90+ DPD;

2Criticized = loans that are categorized as special mention, substandard, doubtful, or loss

33Q14 reflects charge offs relating to troubled debt restructuring (“TDR”)/NPL sale; excluding sale 3Q14 would have been 0.47%

4See Appendix for definition and non-GAAP measurement reconciliation of Texas Ratio

$2,054

$1,980 $1,972

$2,073

$2,171

$2,333

$2,626

$2,376 $2,337

4.08% 3.92% 3.78% 3.95%

4.09%

4.35%

4.81%

4.36% 4.42%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Criticized Balances Criticized Ratio

15

2

2

84.0%

90.6% 93.2%

111.3%114.6%

119.4%

106.5%

98.6% 100.2%

106.0%

120.0%118.6%120.6%115.3%113.2%110.6% 109.0% 110.4%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Santander Bank Large Banks**

Reserve Coverage (ALLL/NPL2)

1.16% 1.18% 1.17%

1.07%1.07%

1.17%1.21%1.21% 1.16%

1.29%1.26%1.28%1.31%1.34%

1.36%1.39% 1.27% 1.26%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Santander Bank Large Banks**

ALLL to Total Loans

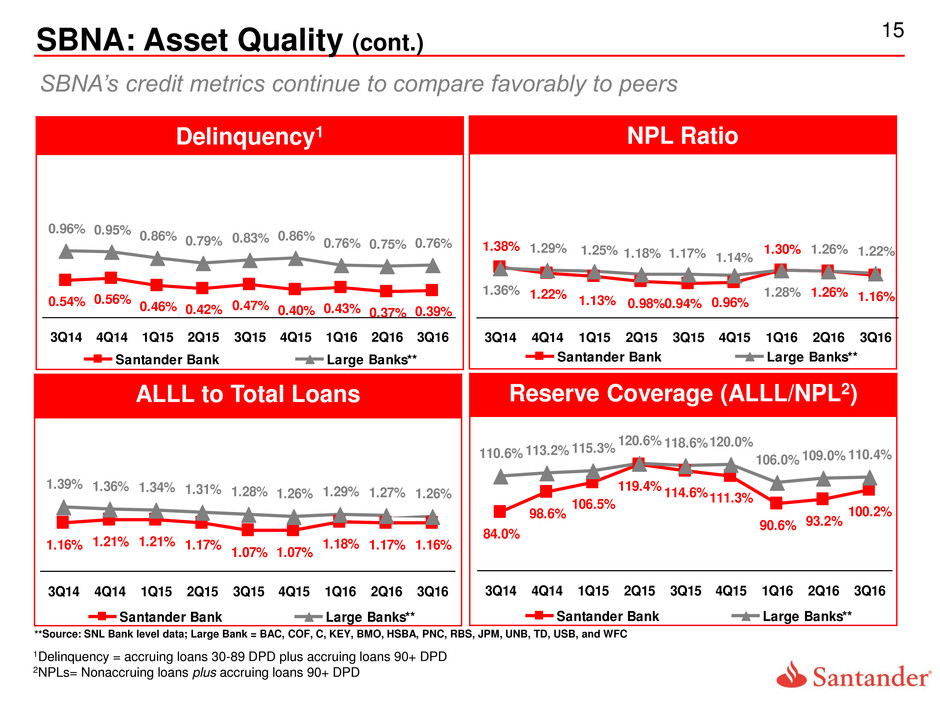

NPL Ratio Delinquency1

1.16%1.22% 1.13% 0.98%0.94% 0.96%

1.26%

1.30%1.38% 1.22%1.26%

1.36%

1.29% 1.25% 1.18% 1.17% 1.14%

1.28%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Santander Bank Large Banks**

0.54%

0.43% 0.37%0.40%

0.47%0.42%0.46%

0.56%

0.39%

0.76%

0.86%0.83%0.79%0.86%

0.95%0.96%

0.75% 0.76%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q 6

Santander Bank Large Banks**

SBNA: Asset Quality (cont.)

**Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC

1Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD

2NPLs= Nonaccruing loans plus accruing loans 90+ DPD

SBNA’s credit metrics continue to compare favorably to peers

16

2

2

SC: Asset Quality – Provisions and Reserves

3,436

177

144 34 (125)

(253)

3,413

3000

3100

3200

3300

3400

3500

3600

3700

3800

3900

Q2 2016 New

Volume

TDR

Migration

Performance

Adjustment

Qualitative

Reserve

Liquidations

& Other

Q3 2016

Q2 2016 to Q3 2016 ALLL Reserve Walk

($ in millions)

724

851

660

512

610

11.1%

11.9%

12.0%

12.6%

12.4%

10.0%

10.5%

11.0%

11.5%

12.0%

12.5%

13.0%

0

100

200

300

400

500

600

700

800

900

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Provision Expense and Allowance Ratio

($ in mill ions)

Provision for credit losses Allowance Ratio

Allowance to loans ratio decreased to 12.4% QoQ

Provision for credit losses decreased YoY primarily

driven by the recording of the provision for credit

losses on the personal loan portfolio in prior year

Excluding the impact of personal loans,

provision for credit losses decreased $8 million

YoY

QoQ allowance decreased $23 million

Liquidations and removal of qualitative adjustment

partly offset by new volume and TDR migration

1 TDR Migration – additional allowance coverage required for loans now classified as TDRs

17

8.1%

9.1%

6.9%

9.0% 9.2%

3.8%

4.4%

3.1%

4.2%

4.6%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Delinquency: Individually Acquired Retail Installment Contracts,

Held for Investment

31-60

61+

2

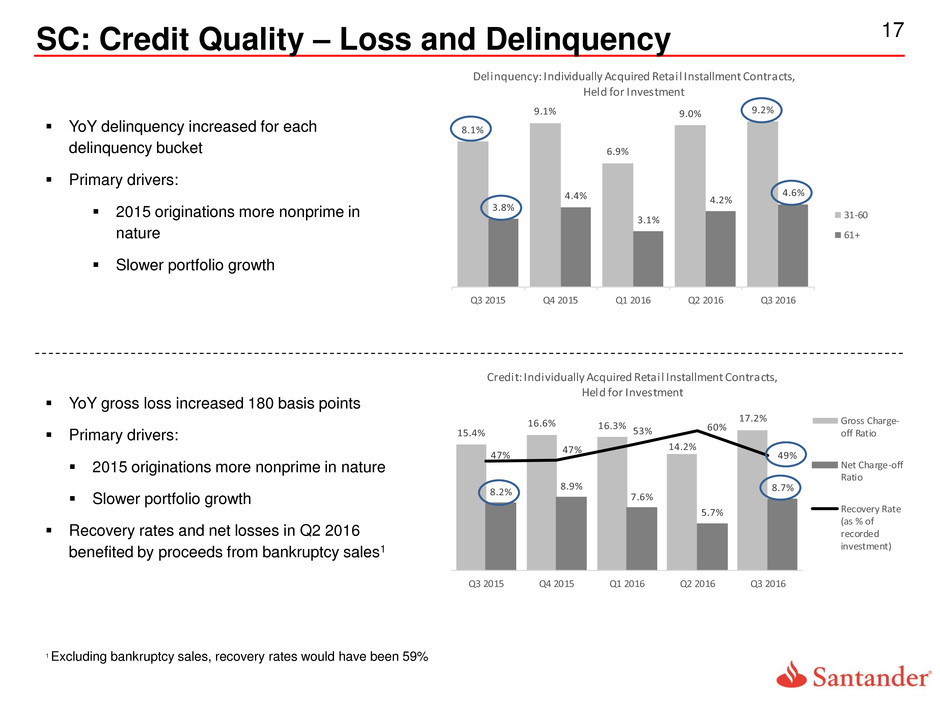

SC: Credit Quality – Loss and Delinquency

15.4%

16.6% 16.3%

14.2%

17.2%

8.2%

8.9%

7.6%

5.7%

8.7%

47%

47%

53% 60%

49%

0%

10%

20%

30%

40%

50%

60%

70%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Credit: Individually Acquired Retail Installment Contracts,

Held for Investment

Gross Charge-

off Ratio

Net Charge-off

Ratio

Recovery Rate

(as % of

recorded

investment)

YoY delinquency increased for each

delinquency bucket

Primary drivers:

2015 originations more nonprime in

nature

Slower portfolio growth

YoY gross loss increased 180 basis points

Primary drivers:

2015 originations more nonprime in nature

Slower portfolio growth

Recovery rates and net losses in Q2 2016

benefited by proceeds from bankruptcy sales1

1 Excluding bankruptcy sales, recovery rates would have been 59%

18

2

2017 2018 2019 2020 … 2025 … … 2036 Perp

Wholesale Funding Profile1

Trust

Pref

$150

Sr

Debt

4.625%

Sr

Debt

3.0%

Sr

Debt

3.45%

20 6 2017 2018 2019 Perp

4.8 2.4

10.8

8.3

8.8

8.8

12.4

12.4

Utilized

$31.9

SC ($BN)

Public Sec

Committed

FHLB

Bank Debt

HoldCo Debt

3rd Party Rev

Santander2

Trust

Pref

Pref

Stock

Sr

Debt

4.6%

Sr

Debt

3M+

145

REIT

Pref

12.2%

FHLB

0.6%

FHLB

0.7%

FHLB

0.8% $0.18

$2.7

$0.2

$4.2

Public Sec

$36.8

$0.6

$0.5

$0.22 $0.2

1As of September 30, 2016

2$0.3BN difference in Santander balance between SHUSA and SC charts reflects

$0.3BN facility between SHUSA and SC that is eliminated at the consolidated level

$46.8

$44.4

$1.0

Sr

Debt

2.65%

FHLB

1.7%

Private Amort.

SBNA ($BN, % yield)

SHUSA HOLDCO ($BN, % yield) SHUSA ($BN)

$1.1

Sr

Debt

4.5%

Debt

4.2%

$0.6

Private Amort.

3rd Party Rev

Santander2

Holding company funding will be driven by total loss-absorbing capacity (“TLAC”) and

liquidity risk management

$1.0

Sr

Debt

2.7%

FHLB

19

2

2

FRB Final TLAC Rule

The Federal Reserve Board (“FRB”) published its final rule for TLAC on December 15, 20161

The FRB TLAC rule will require SHUSA to meet the following:

TLAC requirement of 20.5% of risk-weighted assets (“RWA”) by January 1, 2019

Long term debt (“LTD”) requirement of 6.0%2 of RWA by January 1, 2019

• SHUSA, as an IHC under a multiple point of entry (“MPOE”) resolution strategy, can meet the LTD

requirement by issuing debt both externally and internally3

The final rule grandfathers debt issued prior to 12/31/2016 to qualify for LTD and TLAC

1The original FRB TLAC proposal was published on October 30, 2015

2The original FRB TLAC proposal required 7% of RWA for LTD

3TLAC proposal required that IHCs such as SHUSA could only issue debt internally to meet TLAC

Illustration

20

2

2

1Capital ratios calculated under the U.S. Basel III framework on a transitional basis

2Periods prior to 3Q16 have not been re-casted for the IHC consolidation

3Fully phased-in under the standardized approach - see SHUSA 3Q16 Form 10-Q

Increase in capital ratios from 2Q16 to 3Q16 primarily due to IHC consolidation

Under fully phased-in US Basel III rule,3 CET1 ratio as of 3Q16 was 13.4%

Capital Ratios1,2

Tier 1 Leverage

Tier 1 risk based

Common Equity Tier 1

Total Risk Based

12.1% 12.0% 11.9%

12.4%

14.1%

3Q15 4Q15 1Q16 2Q16 3Q16

11.9%

11.6% 11.5% 11.6%

12.5%

3Q15 4Q15 1Q16 2Q16 3Q16

13.4% 13.5% 13.4%

14.0%

15.7%

3Q15 4Q15 1Q16 2Q16 3Q16

15.3% 15.3% 15.3%

15.8%

17.6%

3Q15 4Q15 1Q16 2Q16 3Q16

21

2

2

SHUSA’s capital ratios remain at the top of peers

Capital Ratios Peer Comparison (as of 9/30/16)

CET1 Tier 1 Risk-Based Capital (“RBC”)

Total RBC Tier 1 Leverage

- - - - Peer Median

22

2

2

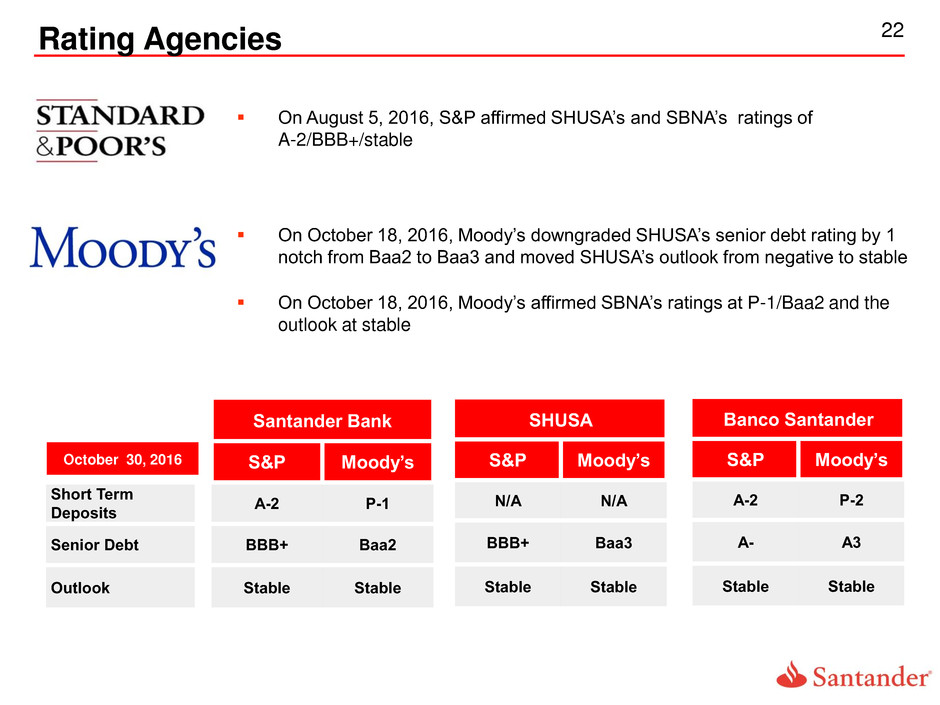

Rating Agencies

Santander Bank

Te S&P Moody’s

Short Term

Deposits

A-2 P-1

Senior Debt BBB+ Baa2

Outlook Stable Stable

SHUSA

S&P Moody’s

N/A N/A

BBB+ Baa3

Stable Stable

On August 5, 2016, S&P affirmed SHUSA’s and SBNA’s ratings of

A-2/BBB+/stable

On October 18, 2016, Moody’s downgraded SHUSA’s senior debt rating by 1

notch from Baa2 to Baa3 and moved SHUSA’s outlook from negative to stable

On October 18, 2016, Moody’s affirmed SBNA’s ratings at P-1/Baa2 and the

outlook at stable

October 30, 2016

Banco Santander

S&P Moody’s

A-2 P-2

A- A3

Stable Stable

Appendix

24

2

2

Santander U.S. Web site

SantanderUS.com

At-a-Glance

• Up-to-date key Santander US

information in one institutional

website

• 6 sections:

• About Us

• Structure and

governance

• Board of Directors

• Management

• Financial Services

• Investor and Shareholder

Relations (includes link to SEC

filings and fixed-income investor

presentations)

• Media Relations

• Communities

• Careers

• Links to U.S. business units

WWW.SANTANDERUS.COM

25

2

2

Consolidating Balance Sheet

(US $ millions) Bank SC Other

(1)

IHC Entities

(2)

SHUSA

Assets

Cash and cash equivalents 6,934$ 76$ (28) 4,848 11,830$

Investments 16,599 - 1 792 17,392

Loans 52,934 29,841 (488) 7,617 89,904

Less allowance for loan losses (616) (3,582) 476 (92) (3,814)

Total loans, net 52,318 26,259 (12) 7,525 86,090

Goodwill 3,403 74 967 11 4,455

Other assets 5,603 12,363 641 857 19,464

Total assets 84,857$ 38,772$ 1,569$ 14,033$ 139,231$

Liabilities and Stockholders' Equity

Deposits 61,724$ - (4,071) 10,051 67,704$

Borrowings and other debt obligations 8,404 31,800 4,126 274 44,604

Other liabilities 1,119 1,854 65 1,422 4,460

Total liabilities 71,247 33,654 120 11,747 116,768

Stock olders' equity including

noncontrolling interest 13,610 5,118 1,449 2,286 22,463

Total liabilities and stockholders' equity 84,857$ 38,772$ 1,569$ 14,033$ 139,231$

September 30, 2016

(1) Includes holding company, eliminations, IHC eliminations and purchase accounting marks related to SC consolidation

(2)The IHC entities are presented within "other" in the company's financial statement segment presentation due to immateriality

26 Consolidating Income Statement

(US $ Millions) Bank SC Other

(1)

IHC Entities

(3)

Interest income 541$ 1,302$ 40$ 88 1,971$

Interest expense (108) (207) (27) (8) (350)

Net interest income 433 1,095 13 80 1,621

Fees & other income/(expense) 248 389 (27) 118 728

Other non interest income - - - - -

Net revenue 681 1,484 (14) 198 2,349

G & A expense (539) (566) (39) (137) (1,281)

Other expenses (28) (4) (9) (5) (46)

Provision for credit losses 12 (610) (74) (16) (688)

Income/(loss) before taxes 126 304 (136) 40 334

Income tax (expense)/benefit (31) (90) 30 (17) (108)

Net income/(loss)

2

95$ 214$ (106)$ 23$ 226$

For the three-month period ended September 30, 2016

SHUSA

(1)Includes holding company activities, IHC eliminations, eliminations and purchase accounting marks related to SC consolidation.

(2) SHUSA net income includes non-controlling interest.

(3)The IHC entities are presented within "other" in the company's financial statement segment presentation due to immateriality

27

2

2

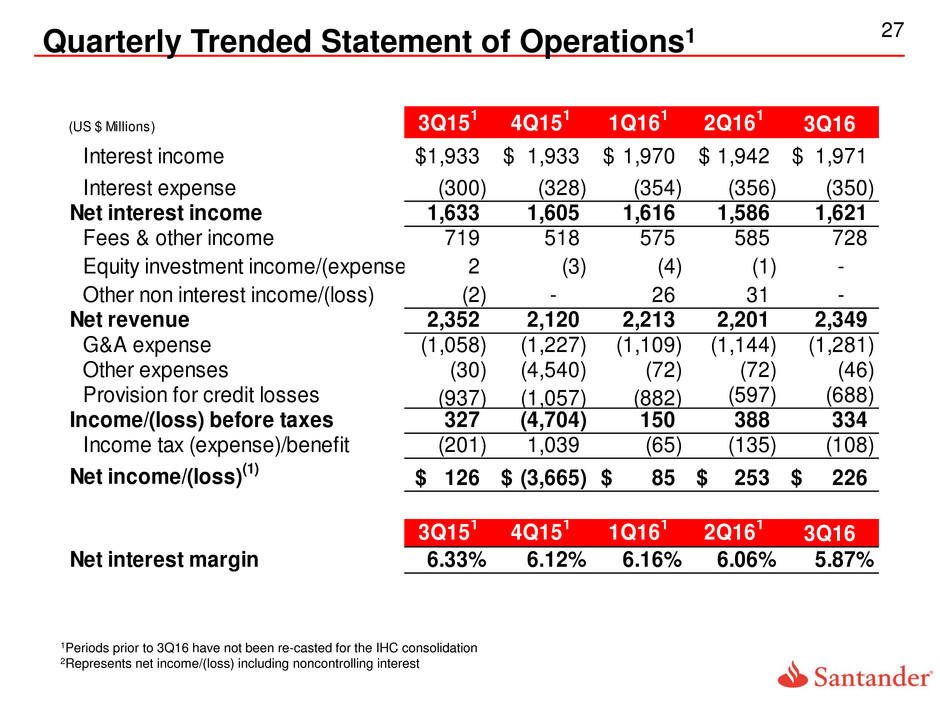

Quarterly Trended Statement of Operations1

1Periods prior to 3Q16 have not been re-casted for the IHC consolidation

2Represents net income/(loss) including noncontrolling interest

(US $ Millions) 3Q15

1 4Q151 1Q161 2Q161 3Q16

Interest income 1,933$ 1,933$ 1,970$ 1,942$ 1,971$

Interest expense (300) (328) (354) (356) (350)

Net interest income 1,633 1,605 1,616 1,586 1,621

Fees & other income 719 518 575 585 728

Equity investment income/(expense) 2 (3) (4) (1) -

Other non interest income/(loss) (2) - 26 31 -

Net revenue 2,352 2,120 2,213 2,201 2,349

G&A expense (1,058) (1,227) (1,109) (1,144) (1,281)

Other expenses (30) (4,540) (72) (72) (46)

Provision for credit losses (937) (1,057) (882) (597) (688)

Income/(loss) before taxes 327 (4,704) 150 388 334

Income tax (expense)/benefit (201) 1,039 (65) (135) (108)

Net income/(loss)(1) 126$ (3,665)$ 85$ 253$ 226$

3Q151 4Q151 1Q161 2Q161 3Q16

Net interest margin 6.33% 6.12% 6.16% 6.06% 5.87%

28

(US $ millions)

Average Yield/ Average Yield/ Average Yield/

Balance Rate Balance Rate Balance Rate

Deposits and investments 23,417$ 1.39% (1,202)$ -0.26% 24,619$ 1.65%

Loans 90,200 8.33% 494 -0.15% 89,706 8.48%

Allowance for loan losses (3,784) --- (764) --- (3,020) ---

Intercompany Investment 15 6.14% - --- 15 6.02%

Earning assets 109,848 7.14% (1,472) -0.06% 111,320 7.20%

Other assets 29,935 --- (2,760) --- 32,695 ---

TOTAL ASSETS 139,783$ 5.61% (4,232)$ 0.04% 144,015$ 5.57%

Interest-bearing demand deposits 10,978 0.23% (2,066) -0.24% 13,044 0.47%

Noninterest-bearing demand deposits 15,107 --- 2,236 --- 12,871 ---

Savings 6,002 0.22% (430) 0.04% 6,432 0.18%

Money market 25,199 0.50% 1,681 -0.05% 23,518 0.55%

Certificates of deposit 9,515 0.97% 97 0.06% 9,418 0.91%

Borrowed funds 45,948 2.47% (2,544) 0.55% 48,492 1.92%

Other liabilities 4,615 --- (23) --- 4,638 ---

Equity 22,419 --- (3,183) --- 25,602 ---

TOTAL LIABILITIES & SE 139,783$ 1.00% (4,232)$ 0.15% 144,015$ 0.85%

NET INTEREST MARGIN 5.87% -0.23% 6.10%

3Q16 Change 3Q15

2

2

Average Balance Sheet

Quarterly Averages

29

2

2

2016 CCAR Results

Capital

4Q15

Starting

Ratio

SHUSA1

Federal

Reserve2

Regulatory

Minimum

Severely Adverse Scenario

Stressed Capital Ratios

Minimum

CET1 ratio (%) 12.0% 10.6% 11.8% 4.5%

Tier 1 RBC ratio (%) 13.5% 11.8% 12.7% 6.0%

Total RBC ratio (%) 15.3% 13.3% 14.3% 8.0%

Tier 1 leverage ratio (%) 11.6% 9.2% 10.0% 4.0%

1Results calculated by SHUSA. SHUSA published its DFAST results via Form 8-K on 6/27/16

2DFAST Results calculated by the Federal Reserve and published on 6/24/16

SHUSA’s projected capital ratios, as calculated by both the Federal Reserve

and SHUSA, remain very strong and well above regulatory requirements

The Federal Reserve, while noting progress has been made by SHUSA since

the 2015 CCAR exercise, objected to SHUSA’s 2016 CCAR capital plan on

qualitative criteria

DFAST = Dodd Frank Act Stress Testing

CCAR = Comprehensive Capital Analysis and Review

30

2

2

2016 DFAST/CCAR Results – Projected Loan Losses

Loan Category

SHUSA1

Federal Reserve2

Total Losses – Severely Adverse 12.4% 8.2%

First Lien Mortgage 5.7% 3.8%

Junior Liens & HELOCs 3.4% 3.8%

Commercial and Industrial 2.9% 3.9%

Commercial Real Estate 2.3% 5.2%

Credit Cards 19.9% 15.6%

Other Consumer 34.0% 16.5%

Other Loans 1.1% 4.2%

SHUSA’s projected loss rates for the DFAST/CCAR exercise were more

conservative than the Federal Reserve’s calculations

1Results calculated by SHUSA. SHUSA published its DFAST results via Form 8-K on 6/27/16

2Results calculated by the Federal Reserve and published on 6/24/16

DFAST = Dodd Frank Act Stress Testing

CCAR = Comprehensive Capital Analysis and Review

31

2

2

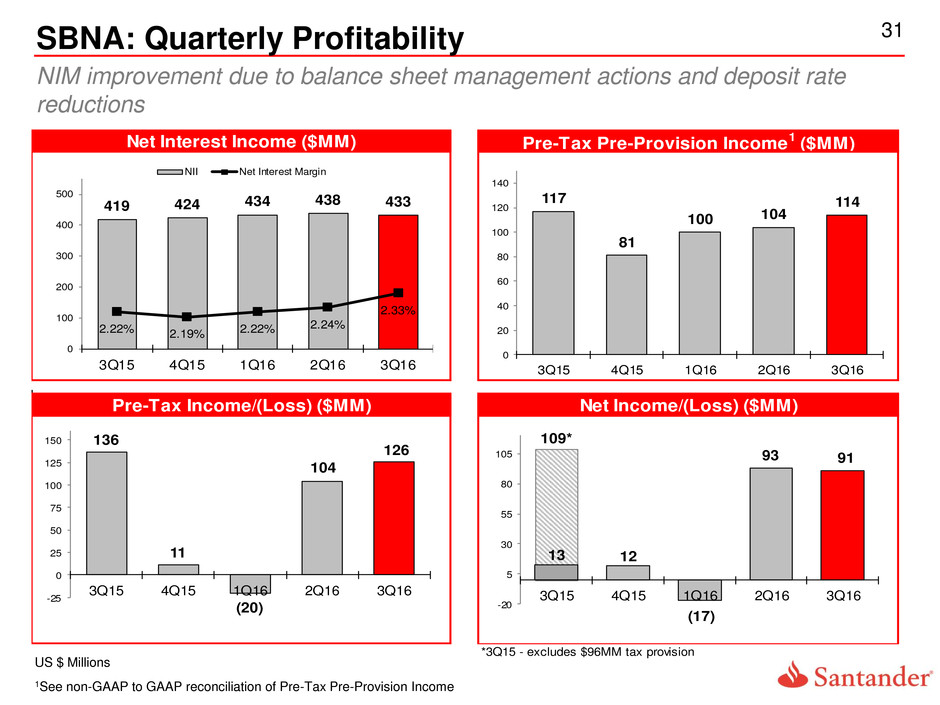

SBNA: Quarterly Profitability

US $ Millions

1See non-GAAP to GAAP reconciliation of Pre-Tax Pre-Provision Income

NIM improvement due to balance sheet management actions and deposit rate

reductions

*3Q15 - excludes $96MM tax provision

Net Interest Income ($MM) Pre-Tax Pre-Provision Income1 ($MM)

Pre-Tax Income/(Loss) ($MM) Net Income/(Loss) ($MM)

117

81

100 104

114

0

20

40

60

80

100

120

140

3Q15 4Q15 1Q16 2Q16 3Q16

419 424 434 438 433

2.22% 2.19% 2.22%

2.24%

2.33%

0

100

200

300

400

500

3Q15 4Q15 1Q16 2Q16 3Q16

NII Net Interest Margin

136

11

(20)

104

126

-25

0

25

50

75

100

125

150

3Q15 4Q15 1Q16 2Q16 3Q16

109*

12

(17)

93 91

13

-20

5

30

55

80

105

3Q15 4Q15 1Q16 2Q16 3Q16

32

2

2

SBNA: Quarterly Trended Statement of Operations

(US$ in Millions) 3Q15 4Q15 1Q16 2Q16 3Q16

Interest income 554$ 564$ 576$ 565$ 541$

Interest expense (135) (140) (142) (127) (108)

Net interest income 419 424 434 438 433

Fees & other income 261 276 227 240 248

Other non-interest (loss)/income (1) - 26 31 -

Net revenue 679 700 687 709 681

General & administrative expenses (544) (603) (537) (540) (539)

Other expenses (18) (16) (50) (65) (28)

Release of/(Provision for) credit losses 19 (70) (120) - 12

Income/(loss) before taxes 136 11 (20) 104 126

Income tax (expense)/benefit (123) 1 3 (11) (35)

Net income/(loss) 13$ 12$ (17)$ 93$ 91$

3Q15 4Q15 1Q16 2Q16 3Q16

Net interest margin 2.22% 2.19% 2.22% 2.24% 2.33%

33

2

2

SBNA: Quarterly Average Balance Sheet

Quarterly Averages

(In millions)

Average Yield/ Average Yield/ Average Yield/ Average Yield/

Balance Rate Balance Rate Balance Rate Balance Rate

Deposits and investments 22,018$ 1.32% 25,301$ 1.51% (3,283)$ -0.19% 24,058$ 1.68%

Loans 53,530 3.51% 54,560 3.49% (1,030) 0.02% 52,859 3.46%

Allowance for loan losses (633) --- (645) --- 12 --- (615) ---

Other assets 10,597 --- 10,873 --- (276) --- 11,287 ---

TOTAL ASSETS 85,512$ 2.54% 90,089$ 2.54% (4,577)$ 0.00% 87,589$ 2.55%

Interest-bearing demand deposits 9,780 0.24% 10,972 0.52% (1,192) -0.28% 11,523 0.49%

Noninterest-bearing demand deposits 11,439 --- 11,481 --- (42) --- 11,408 ---

Savings 4,099 0.12% 4,137 0.08% (38) 0.04% 3,969 0.12%

Money market 26,977 0.48% 26,493 0.49% 484 -0.01% 24,147 0.55%

Certificates of deposit 8,357 0.91% 8,777 0.93% (420) -0.02% 7,905 0.87%

Borrowed funds 9,438 2.06% 12,757 1.85% (3,319) 0.21% 13,520 2.05%

Other liabilities 1,791 --- 1,933 --- (142) --- 1,643 ---

Equity 13,631 --- 13,539 --- 92 --- 13,474 ---

TOTAL LIABILITIES & SE 85,512$ 0.50% 90,089$ 0.56% (4,577)$ -0.06% 87,589$ 0.62%

NET INTEREST MARGIN 2.33% 2.24% 0.09% 2.22%

3Q16 3Q152Q16 Change

34

2

2

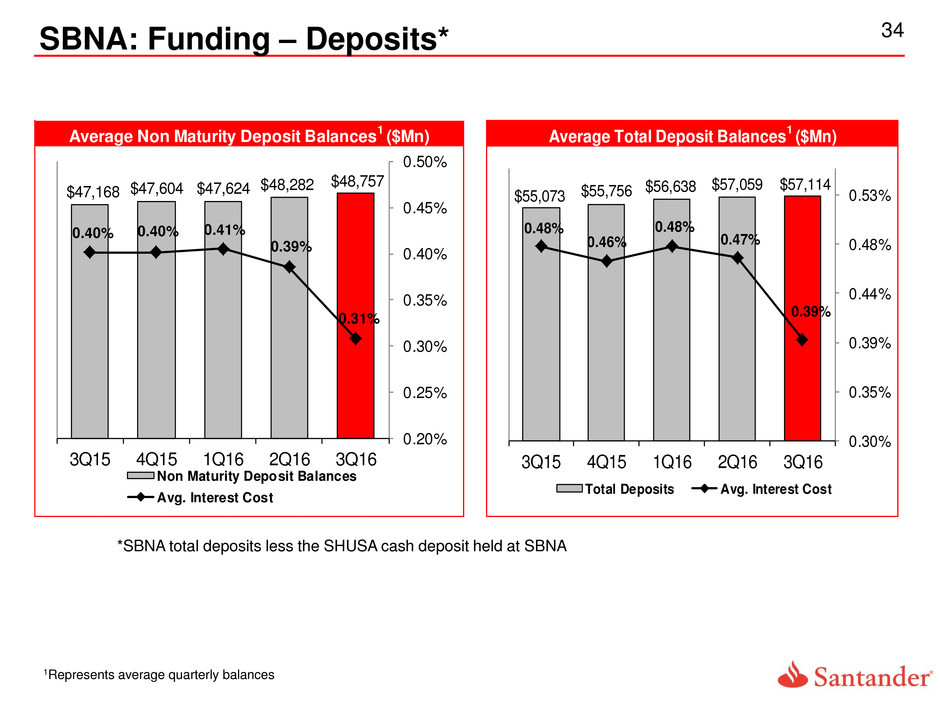

SBNA: Funding – Deposits*

1Represents average quarterly balances

*SBNA total deposits less the SHUSA cash deposit held at SBNA

Average Non Maturity Deposit Balances

1

($Mn)

$47,168 $47,604 $47,624 $48,282

$48,757

0.40% 0.40% 0.41%

0.39%

0.31%

0.20%

0.25%

0.30%

0.35%

0.40%

0.45%

0.50%

3Q15 4Q15 1Q16 2Q16 3Q16

Non Maturity Deposit Balances

Avg. Interest Cost

Average Total Deposit Balances

1

($Mn)

$55,073 $55,756

$56,638 $57,059 $57,114

0.48%

0.46%

0.48%

0.47%

0.39%

0.30%

0.35%

0.39%

0.44%

0.48%

0.53%

3Q15 4Q15 1Q16 2Q16 3Q16

Total Deposits Avg. Interest Cost

35

2

2

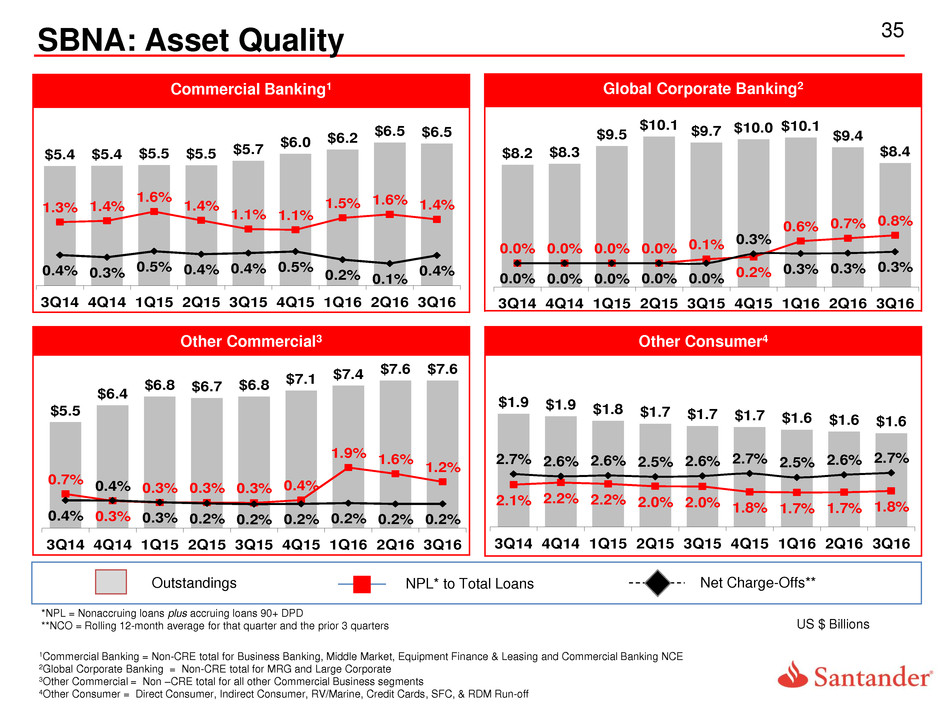

Global Corporate Banking2

1Commercial Banking = Non-CRE total for Business Banking, Middle Market, Equipment Finance & Leasing and Commercial Banking NCE

2Global Corporate Banking = Non-CRE total for MRG and Large Corporate

3Other Commercial = Non –CRE total for all other Commercial Business segments

4Other Consumer = Direct Consumer, Indirect Consumer, RV/Marine, Credit Cards, SFC, & RDM Run-off

Commercial Banking1

Other Consumer4 Other Commercial3

Outstandings NPL* to Total Loans Net Charge-Offs**

SBNA: Asset Quality

*NPL = Nonaccruing loans plus accruing loans 90+ DPD

**NCO = Rolling 12-month average for that quarter and the prior 3 quarters US $ Billions

$5.4 $5.4 $5.5 $5.5 $5.7

$6.0 $6.2

$6.5 $6.5

1.3% 1.4%

1.6%

1.4%

1.1% 1.1%

1.5% 1.6% 1.4%

0.4% 0.3% 0.5% 0.4% 0.4% 0.5% 0.2% 0.1%

0.4%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

$8.2 $8.3

$9.5

$10.1 $9.7 $10.0 $10.1 $9.4

$8.4

0.0% 0.0% 0.0% 0.0% 0.1%

0.2%

0.6% 0.7% 0.8%

0.0% 0.0% 0.0% 0.0% 0.0%

0.3%

0.3% 0.3% 0.3%

3Q 4 4Q14 1Q15 2Q15 3Q 5 4Q15 1Q16 2Q16 3Q16

$5.5

$6.4

$ .8 $6.7 $6.8

$7.1 $7.4

$7.6 $7.6

0.7%

0.3%

0.3% 0.3% 0.3% 0.4%

1.9% 1.6

1.2%

0.4%

0.4%

0.3% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

$1.9 $1.9 $1.8 $1.7 $1.7 $1.7 $1.6 $1.6 $1.6

2.1% 2.2% 2.2% 2.0% 2.0% 1.8% 1.7% 1.7% 1.8%

2 7 2 6 2 6 2 5 2 6 2.7 2.5% 2.6% 2.7%

3Q14 4Q14 Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

36

2

2

Santander Real Estate Capital Commercial Real Estate1

Home Equity Mortgages

Outstandings NPL* to Total Loans Net Charge-Offs**

SBNA: Asset Quality

*NPL = Nonaccruing loans plus accruing loans 90+ DPD

**NCO = Rolling 12-month average for that quarter and the prior 3 quarters

1Commercial Real Estate is comprised of the commercial real estate, continuing care retirement community and non-owner

occupied real estate secured commercial loans (SREC segment included in separate graph)

US $ Billions

$7.5

$7.0 $7.0 $6.8 $6.7 $6.5 $6.4 $6.6 $6.7

3.3% 3.3% 3.0% 2.9% 2.8% 2.7% 2.6% 2.4% 2.2%

1.2% 1.2% 1.3% 1.3%

0.3% 0.2% 0.2% 0.2% 0.1%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

$6.0 $6.0 $6.0 $6.0 $6.0 $6.0 $5.9 $5.9 $5.9

1.9% 1.9% 1.9% 1.8% 1.7% 1.8% 1.8% 1.7% 1.7%

0.4% 0.4% 0.3% 0.3% 0.3% 0.3% 0.3% 0.2% 0.2%

3Q 4 4Q14 Q15 2Q15 3Q 5 4Q15 Q16 2Q16 3Q16

$5.4 $5.6 $5.8

$5.9 $5.8 $6.0

$6.6 $6.6 $6.5

3.2%

2.2% 1.9%

1.3% 1.3% 1.3% 1.7% 1.6% 1.2%

0.7% 0.5% 0.2% 0.4% 0.1% 0.2% 0.2% 0.0% -0.1%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

$10.3 $10.0 $9.7 $9.7

$10.7 $10.5 $10.3 $10.1 $9.8

0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1%

0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

3Q 4 4Q14 1Q15 2Q15 3Q 5 4Q15 1Q16 2Q16 3Q16

37

2

2

SBNA: Capital Ratios

1Fully phased-in under the standardized approach - see SHUSA 3016 Form 10-Q

13.9% 13.8% 13.9%

14.9%

15.7%

3Q15 4Q15 1Q16 2Q16 3Q16

13.9% 13.8% 13.9%

14.9%

15.7%

3Q15 4Q15 1Q16 2Q16 3Q16

11.7% 11.5% 11.3% 11.4%

12.3%

3Q15 4Q15 1Q16 2Q16 3Q16

15.1% 15.1% 15.4%

16.2%

17.0%

3Q15 4Q15 1Q16 2Q16 3Q16

CET1 Tier 1 Leverage Ratio

Tier 1 RBC Ratio Total RBC Ratio

Beginning in 1Q15, capital ratios have been calculated under the U.S. Basel III

framework on a transition basis

Under fully phased-in US Basel III rule1, CET1 ratio as of 3Q16 was 15.3%

38

2

2

SC: Serviced For Others (“SFO”) Platform

$14,788 $15,047

$14,235

$13,034

$12,157

3Q15 4Q15 1Q16 2Q16 3Q16

$ in Millions

Flow Programs 1,348 1,081 860 659 794

CCART 788

Residual Sales 1,710

Recent decrease in total balance

related to lower prime

originations

Growth in SFO remains

dependent upon Chrysler Capital

Penetration

Finalizing a strategic agreement

with Santander1

Beneficial to SFO platform

Composition at 9/30/2016

RIC 75 %

Leases 19 %

RV/Marine 7 %

Total 100 %

SFO Balances

Flow programs continue to drive

asset sales

*Sales with retained servicing during period

1SC is finalizing a strategic agreement with Banco Santander to originate and flow prime and near-prime retail loan assets

39

2

2

SC: Credit Trends

RICs1,2

1RIC = Retail installment contract

2Held for investment; excludes assets held for sale

3.9

% 12.

2%

23.

8%

30.

4%

17.

1%

12.

6%

4.0

% 12.

2%

23.

4%

30.

9%

17.

3%

12.

2%

4.2

% 12

.6%

23.

2%

31.

0%

17.

1%

11.

9%

2.6

% 1

2.6

%

22.

9%

31.

2%

17.

4%

13.

3%

3.3

% 12

.4%

22.

2%

31.

1%

17.

2%

13.

8%

Commercial Unknown <540 540-599 600-639 >=640

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

40

2

2

Non-GAAP to GAAP Reconciliations1 $ Million 3Q15 4Q15 1Q16 2Q16 3Q16

SHUSA Pre-Tax Pre-Provision Income/(Loss)

Pre-tax income/(loss), as reported 327$ (4,704)$ 150$ 388$ 334$

Add back:

Provision for credit losses 937 1,057 882 597 688

Pre-Tax Pre-Provision Income/(Loss) 1,264$ (3,647)$ 1,032$ 985$ 1,022$

1Periods prior to 3Q16 have not been re-casted for the IHC consolidation

41

2

2

1

1Periods prior to 3Q16 have not been re-casted for the IHC consolidation

2Basel III ratios on a transition basis under the standardized approach starting in 2Q15

Non-GAAP to GAAP Reconciliations1,2

$ Millions 3Q15 4Q15 1Q16 2Q16 3Q16

CET1

Tier 1 Common 13,199$ 12,973$ 12,644$ 12,750$ 15,153$

Risk-Weighted Assets 109,173 108,455 106,446 106,446 107,310

Ratio 12.1% 12.0% 11.9% 12.4% 14.1%

Tier 1 Leverage

Tier 1 Capital 14,678$ 14,657$ 14,281$ 14,401$ 16,866$

123,129 126,636 123,964 124,498 135,155$

Ratio 11.9% 11.6% 11.5% 11.6% 12.5%

Tier 1 Risk-Based

Tier 1 Capital 14,678$ 14,657$ 14,281$ 14,401$ 16,866$

Risk-Weighted Assets 109,173 108,455 106,446 102,967 107,310$

Ratio 13.4% 13.5% 13.4% 14.0% 15.7%

Total Risk-Based

Risk-Based Capital 16,711$ 16,637$ 16,288$ 16,270$ 18,834$

Risk-Weighted Assets 109,173 108,455 106,446 102,967 107,310$

Ratio 15.3% 15.4% 15.3% 15.8% 17.6%

Average total assets for leverage capital

42

2

2

1

SBNA: Non-GAAP to GAAP Reconciliations1

$ Millions 3Q15 4Q15 1Q16 2Q16 3Q16

CET1

Tier 1 Common Capital 9,828$ 9,858$ 9,813$ 9,876$ 10,025$

Risk Weighted Assets 70,894 71,395 70,512 66,357 64,015

Ratio 13.9% 13.8% 13.9% 14.9% 15.7%

Tier 1 Leverage

Tier 1 Capital 9,828$ 9,858$ 9,813$ 9,876$ 10,025$

84,040 86,028 87,066 86,358 81,815

Ratio 11.7% 11.5% 11.3% 11.4% 12.3%

Tier 1 Risk Based

Tier 1 Capital 9,828$ 9,858$ 9,813$ 9,876$ 10,025$

Risk Weighted Assets 70,894 71,395 70,512 66,357 64,015

Ratio 13.9% 13.8% 13.9% 14.9% 15.7%

Total Risk Based

Risk Based Capital 10,734$ 10,776$ 10,827$ 10,771$ 10,874$

Risk Weighted Assets 70,894 71,395 70,512 66,357 64,015

Ratio 15.1% 15.1% 15.4% 16.2% 17.0%

Average total assets for leverage capital purposes

1Basel III ratios on a transition basis under the standardized approach starting in 2Q15

43 SBNA: Non-GAAP to GAAP Reconciliations

$ Millions 3Q15 4Q15 1Q16 2Q16 3Q16

Santander Bank Texas Ratio

Total Equity 13,416$ 13,326$ 13,456$ 13,576$ 13,610$

Less:

Goodwill and Other Intangibles (excluding MSRs) (3,717) (3,732) (3,723) (3,716) (3,681)

Preferred Stock - - - - -

Add: Allowance for loan losses 570 572 643 640 616

Total Equity and Loss Allowances for Texas Ratio 10,269$ 10,166$ 10,376$ 10,500$ 10,545$

Nonperforming Assets 536$ 550$ 747$ 748$ 648$

90+ DPD accruing 3 2 2 2 3

Accruing TDRs 268 323 364 364 356

Total Nonperforming Assets 807$ 875$ 1,113$ 1,114$ 1,007$

Texas Ratio 7.9% 8.6% 10.7% 10.6% 9.5%

44

2

2

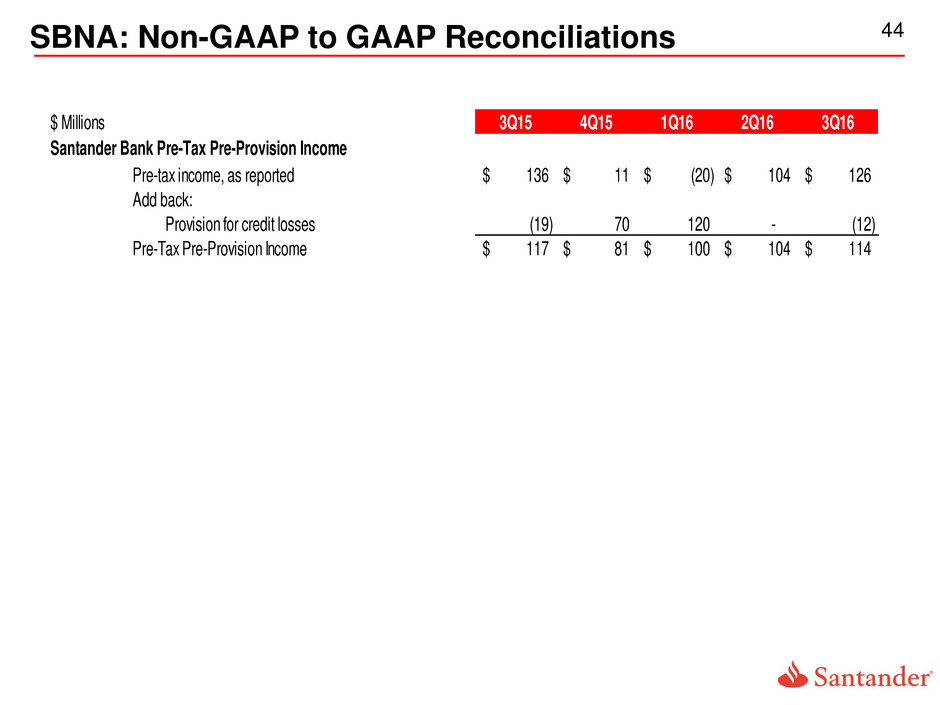

SBNA: Non-GAAP to GAAP Reconciliations

$ Millions 3Q15 4Q15 1Q16 2Q16 3Q16

Santander Bank Pre-Tax Pre-Provision Income

Pre-tax income, as reported 136$ 11$ (20)$ 104$ 126$

Add back:

Provision for credit losses (19) 70 120 - (12)

Pre-Tax Pre-Provision Income 117$ 81$ 100$ 104$ 114$