Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - EQUITY BANCSHARES INC | d315275dex991.htm |

| EX-10.2 - EX-10.2 - EQUITY BANCSHARES INC | d315275dex102.htm |

| EX-10.1 - EX-10.1 - EQUITY BANCSHARES INC | d315275dex101.htm |

| 8-K - FORM 8-K - EQUITY BANCSHARES INC | d315275d8k.htm |

| Exhibit 99.2

|

EQUITY BANCSHARES, INC.

|

|

Disclaimers

FORWARD-LOOKING STATEMENTS

The following information contains “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,”

“expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses, and similar variables. The foregoing list of factors is not exhaustive.

For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 17, 2016 and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included herein are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue.

NON-GAAP FINANCIAL MEASURES

This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding.

2

|

|

Experienced Management Team

BRAD ELLIOTT

Chairman & CEO

Founded Equity Bank in 2002

Served as Regional President of Sunflower Bank prior to forming Equity Bank More than 20 years of banking experience

GREG KOSSOVER

EVP, Chief Financial Officer

Has served as CFO since 2013 and as a Board Director since 2011 Previously served as CEO of Value Place, LLC, growing it to more than 150 locations in 25 states Banking experience includes treasurer of Western Financial Corporation, a publicly-held thrift holding company.

3

|

|

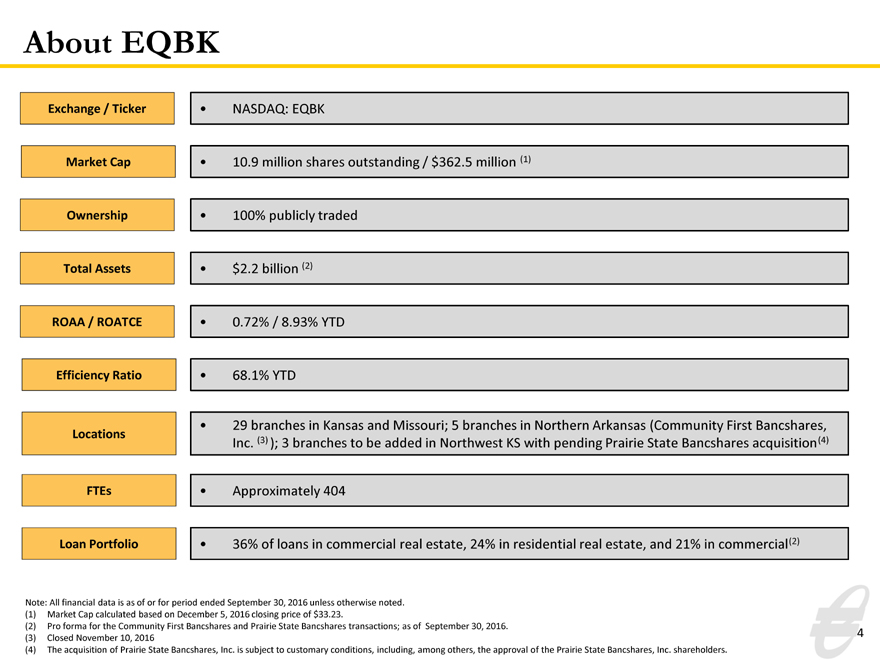

About EQBK

Exchange / Ticker NASDAQ: EQBK

Market Cap 10.9 million shares outstanding / $362.5 million (1)

Ownership 100% publicly traded

Total Assets $2.2 billion (2)

ROAA / ROATCE 0.72% / 8.93% YTD

Efficiency Ratio 68.1% YTD

29 branches in Kansas and Missouri; 5 branches in Northern Arkansas (Community First Bancshares,

Locations

Inc. (3) ); 3 branches to be added in Northwest KS with pending Prairie State Bancshares acquisition(4)

FTEs Approximately 404

Loan Portfolio 36% of loans in commercial real estate, 24% in residential real estate, and 21% in commercial(2)

Note: All financial data is as of or for period ended September 30, 2016 unless otherwise noted. (1) Market Cap calculated based on December 5, 2016 closing price of $33.23.

(2) Pro forma for the Community First Bancshares and Prairie State Bancshares transactions; as of September 30, 2016. (3) Closed November 10, 2016

(4) The acquisition of Prairie State Bancshares, Inc. is subject to customary conditions, including, among others, the approval of the Prairie State Bancshares, Inc. shareholders.

4

|

|

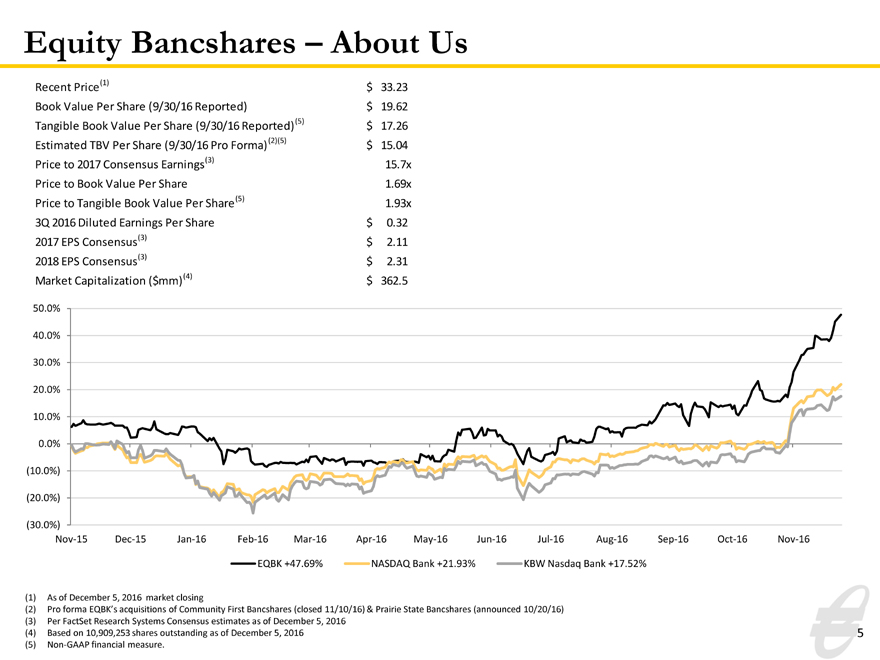

Equity Bancshares – About Us

Recent Price(1) $33.23

Book Value Per Share (9/30/16 Reported) $19.62

Tangible Book Value Per Share (9/30/16 Reported)(5) $17.26

Estimated TBV Per Share (9/30/16 Pro Forma) (2)(5) $15.04

Price to 2017 Consensus Earnings(3) 15.7x

Price to Book Value Per Share 1.69x

Price to Tangible Book Value Per Share(5) 1.93x

3Q 2016 Diluted Earnings Per Share $0.32

2017 EPS Consensus(3) $2.11

2018 EPS Consensus(3) $2.31

Market Capitalization ($mm)(4) $362.5

50.0% 40.0% 30.0% 20.0% 10.0%

0.0% (10.0%) (20.0%)

(30.0%)

Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16

EQBK +47.69% NASDAQ Bank +21.93% KBW Nasdaq Bank +17.52%

(1) As of December 5, 2016 market closing

(2) Pro forma EQBK’s acquisitions of Community First Bancshares (closed 11/10/16) & Prairie State Bancshares (announced 10/20/16)

(3) Per FactSet Research Systems Consensus estimates as of December 5, 2016

(4) Based on 10,909,253 shares outstanding as of December 5, 2016 5 (5) Non-GAAP financial measure.

5

|

|

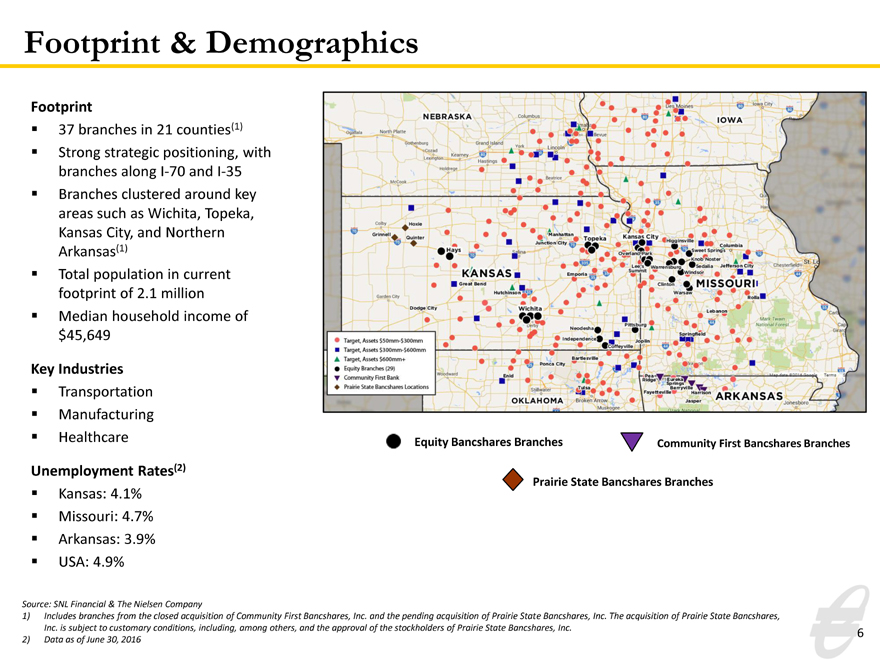

Footprint & Demographics

Footprint

37 branches in 21 counties(1)

Strong strategic positioning, with

branches along I-70 and I-35

Branches clustered around key

areas such as Wichita, Topeka,

Kansas City, and Northern

Arkansas(1)

Total population in current

footprint of 2.1 million

Median household income of

$45,649

Key Industries

Transportation

Manufacturing

Healthcare

Unemployment Rates(2)

Kansas: 4.1%

Missouri: 4.7%

Arkansas: 3.9%

USA: 4.9%

Equity Bancshares Branches Community First Bancshares Branches

Prairie State Bancshares Branches

Source: SNL Financial & The Nielsen Company

1) Includes branches from the closed acquisition of Community First Bancshares, Inc. and the pending acquisition of Prairie State Bancshares, Inc. The acquisition of Prairie State Bancshares, Inc. is subject to customary conditions, including, among others, and the approval of the stockholders of Prairie State Bancshares, Inc.

2) Data as of June 30, 2016

6

|

|

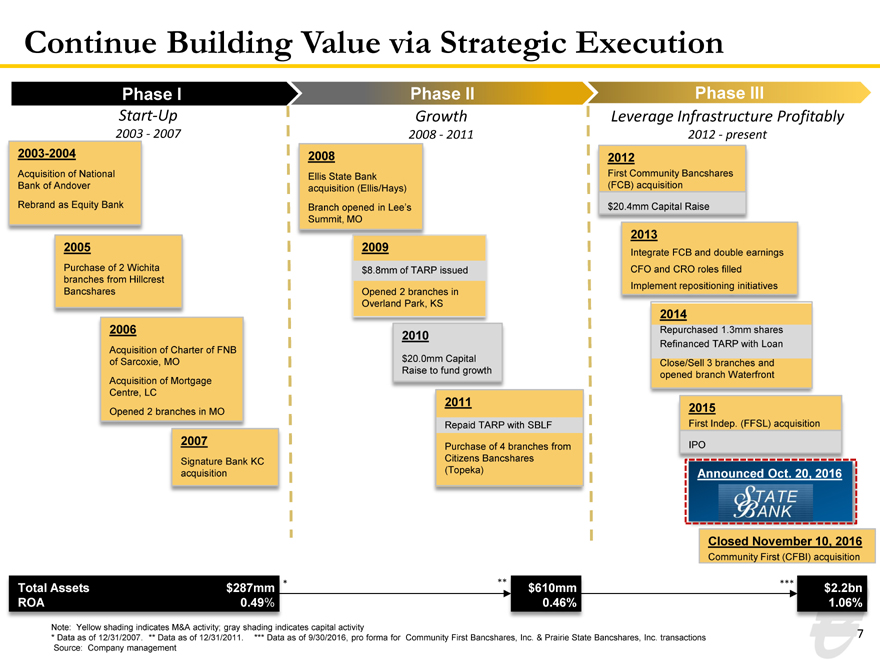

Continue Building Value via Strategic Execution

Phase I Phase II Phase III

Start-Up Growth Leverage Infrastructure Profitably

2003—2007 2008—2011 2012—present

2003-2004 2008 2012

Acquisition of National Ellis State Bank First Community Bancshares Bank of Andover acquisition (Ellis/Hays) (FCB) acquisition Rebrand as Equity Bank Branch opened in Lee’s $20.4mm Capital Raise Summit, MO

2013 2005

Integrate FCB and double earnings Purchase of 2 Wichita $8.8mm of TARP issued CFO and CRO roles filled branches from Hillcrest Implement repositioning initiatives Bancshares Opened 2 branches in Overland Park, KS

2014

2006 Repurchased 1.3mm shares

2010

Refinanced TARP with Loan Acquisition of Charter of FNB $20.0mm Capital of Sarcoxie, MO Raise to fund growth Close/Sell 3 branches and opened branch Waterfront Acquisition of Mortgage Centre, LC

Opened 2 branches in MO 2015

Repaid TARP with SBLF First Indep. (FFSL) acquisition

2007 IPO

Purchase of 4 branches from Signature Bank KC Citizens Bancshares acquisition (Topeka) Announced Oct. 20, 2016

Closed November 10, 2016

Community First (CFBI) acquisition

Total Assets $287mm * ** $610mm *** $2.2bn

ROA 0.49% 0.46% 1.06%

Note: Yellow shading indicates M&A activity; gray shading indicates capital activity

* Data as of 12/31/2007. ** Data as of 12/31/2011. *** Data as of 9/30/2016, pro forma for Community First Bancshares, Inc. & Prairie State Bancshares, Inc. transactions Source: Company management

7

|

|

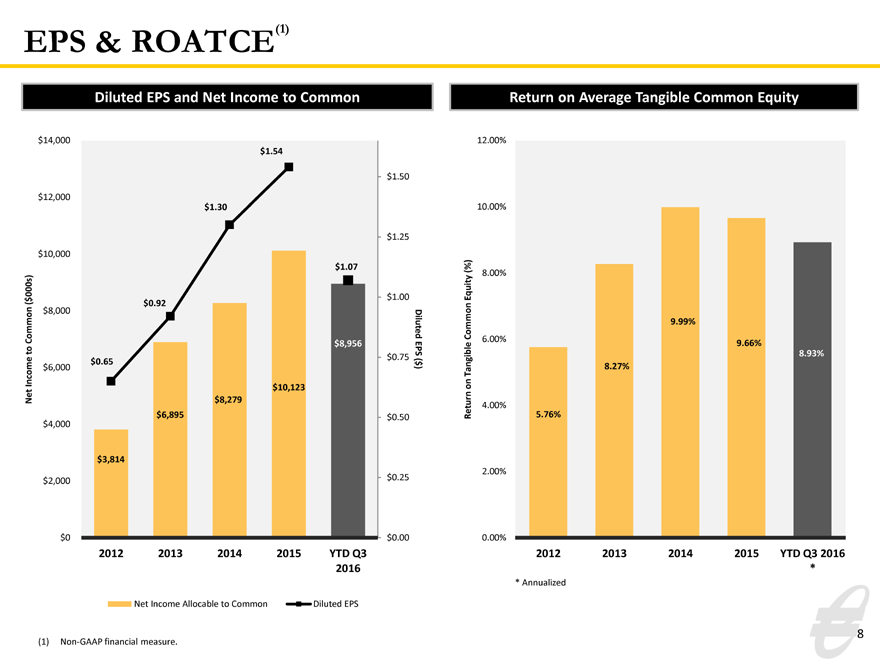

EPS & ROATCE(1)

Diluted EPS and Net Income to Common

$14,000 $1.54

$1.50

$12,000 $1.30

$1.25

$10,000 $1.07 000s) $ $1.00

( $0.92 $8,000 Diluted Common to $8,956 EPS $0.75 ( $0.65 $ Income $6,000) $10,123 Net $8,279 $6,895 $0.50 $4,000

$3,814

$2,000 $0.25

$0 $0.00

2012 2013 2014 2015 YTD Q3 2016

Net Income Allocable to Common Diluted EPS

Return on Average Tangible Common Equity

12.00%

10.00%

(%) Equity 8.00%

Common 9.99%

6.00% 9.66%

8.93% Tangible 8.27% on

4.00%

Return 5.76%

2.00%

0.00%

2012 2013 2014 2015 YTD Q3 2016 *

* Annualized

(1) Non-GAAP financial measure.

8

|

|

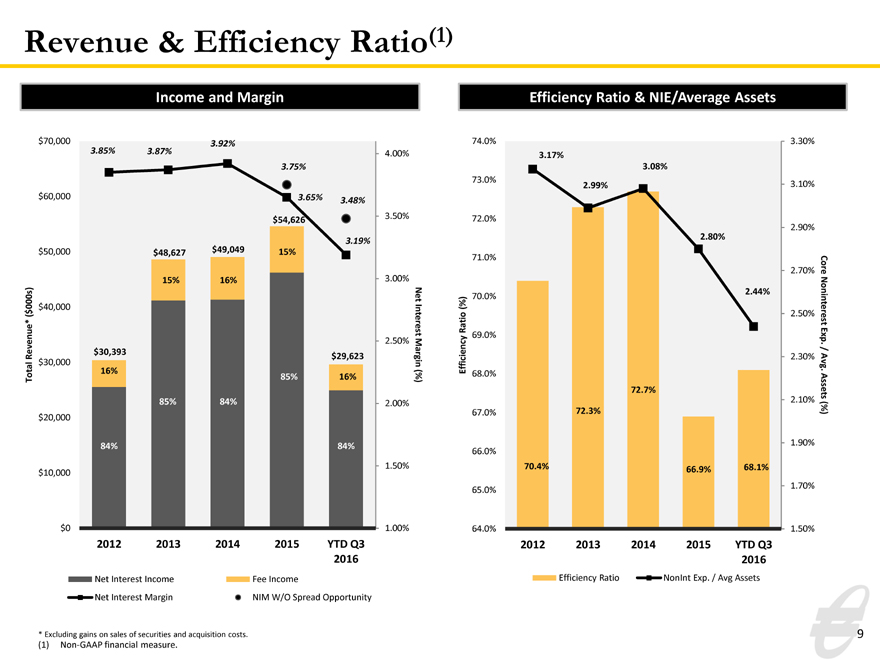

Revenue & Efficiency Ratio(1)

Income and Margin

$70,000 3.92%

3.85% 3.87% 4.00%

3.75%

$60,000 3.65%

3.48%

3.50% $54,626

3.19% $50,000 $48,627 $49,049 15%

15% 16% 3.00% Net 000s) $40,000 ( $ Interest

2.50% $30,393 Revenue* $29,623 $30,000 Margin 16% Total 85% 16% (%) 85% 84% 2.00% $20,000

84% 84%

$10,000 1.50%

$0 1.00%

2012 2013 2014 2015 YTD Q3 2016

Net Interest Income Fee Income

Net Interest Margin NIM W/O Spread Opportunity

Efficiency Ratio & NIE/Average Assets

74.0% 3.30%

3.17%

3.08%

73.0%

2.99% 3.10%

72.0%

2.90%

2.80%

71.0%

2.70% Core

2.44%

70.0%

(%)

2.50% Noninterest Ratio 69.0% Exp .

/

2.30% Avg Efficiency 68.0%.

72.7% Assets

2.10%

67.0% 72.3% (%)

1.90% 66.0%

70.4% 66.9% 68.1%

1.70% 65.0%

64.0% 1.50%

2012 2013 2014 2015 YTD Q3 2016

Efficiency Ratio NonInt Exp. / Avg Assets

* Excluding gains on sales of securities and acquisition costs.

(1) Non-GAAP financial measure.

9

|

|

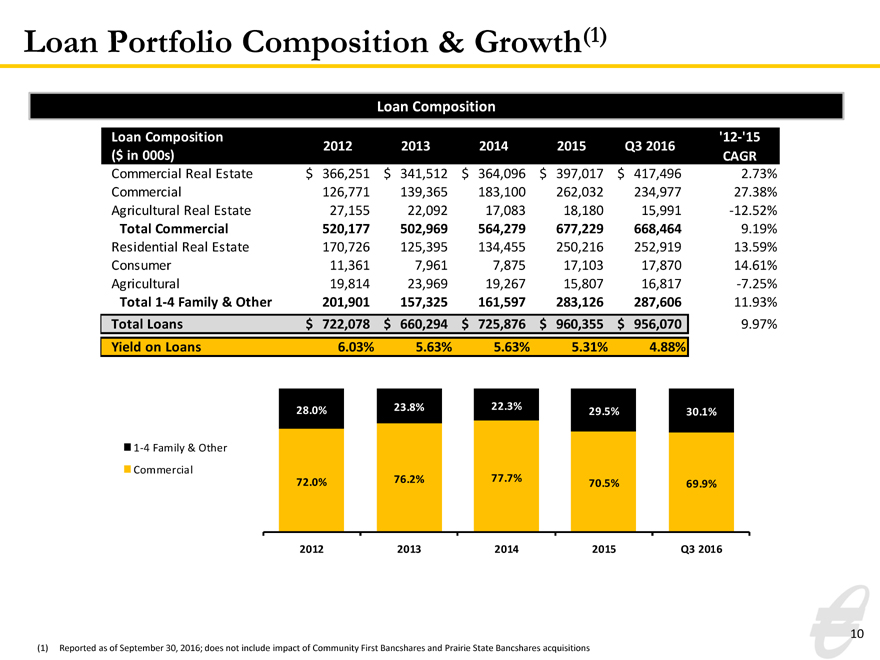

Loan Portfolio Composition & Growth(1)

Loan Composition

Loan Composition ‘12-‘15

2012201320142015Q3 2016

($ in 000s) CAGR

Commercial Real Estate $366,251$341,512$364,096$397,017$417,4962.73%

Commercial 126,771139,365183,100262,032234,97727.38%

Agricultural Real Estate 27,15522,09217,08318,18015,991-12.52%

Total Commercial 520,177502,969564,279677,229668,4649.19%

Residential Real Estate 170,726125,395134,455250,216252,91913.59%

Consumer 11,3617,9617,87517,10317,87014.61%

Agricultural 19,81423,96919,26715,80716,817-7.25%

Total 1-4 Family & Other 201,901157,325161,597283,126287,60611.93%

Total Loans $722,078$660,294$725,876$960,355$956,0709.97%

Yield on Loans 6.03%5.63%5.63%5.31%4.88%

28.0% 23.8%22.3%29.5%30.1%

1-4 Family & Other

Commercial

72.0% 76.2%77.7%70.5%69.9%

2012 201320142015Q3 2016

(1) Reported as of September 30, 2016; does not include impact of Community First Bancshares and Prairie State Bancshares acquisitions

10

|

|

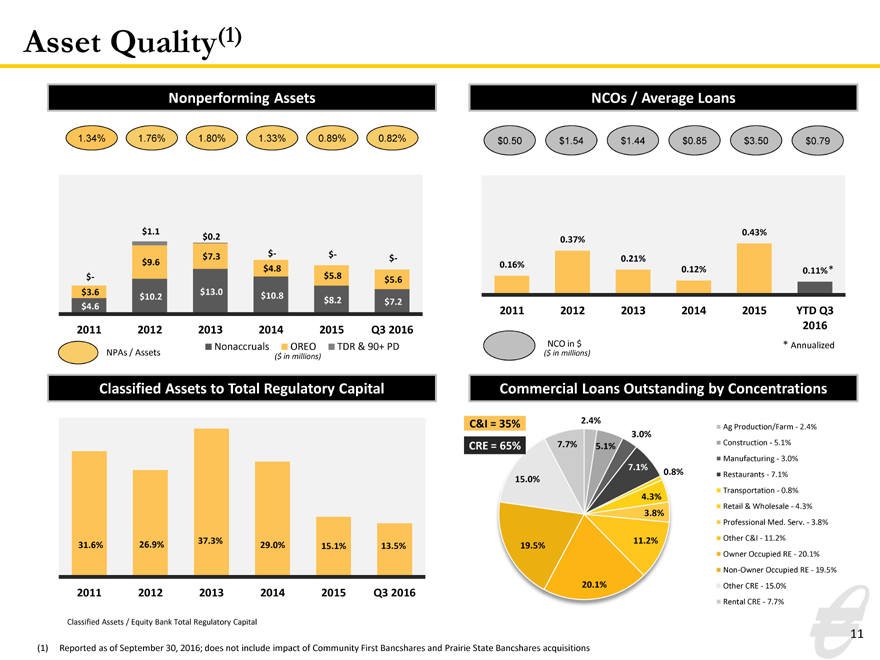

Asset Quality(1)

Nonperforming Assets

1.34% 1.76% 1.80% 1.33% 0.89% 0.82%

$1.1

$0.2

$7.3 $- $- $-

$9.6

$4.8 $5.8

$- $5.6

$3.6 $13.0 $10.2 $10.8

$8.2 $7.2

$4.6

2011 2012 2013 2014 2015 Q3 2016

Nonaccruals OREO TDR & 90+ PD

NPAs / Assets

($ in millions)

NCOs / Average Loans

$0.50 $1.54 $1.44 $0.85 $3.50 $0.79

0.37% 0.43%

0.21%

0.16%

0.12% 0.11% *

2011 2012 2013 2014 2015 YTD Q3 2016

NCO in $ * Annualized

($ in millions)

Classified Assets to Total Regulatory Capital

37.3%

31.6% 26.9% 29.0% 15.1% 13.5%

2011 2012 2013 2014 2015 Q3 2016

Classified Assets / Equity Bank Total Regulatory Capital

Commercial Loans Outstanding by Concentrations

C&I = 35% 2.4% Ag Production/Farm—2.4%

3.0%

CRE = 65% 7.7% 5.1% Construction—5.1%

Manufacturing—3.0%

7.1%

15.0% 0.8% Restaurants—7.1%

Transportation—0.8%

4.3%

3.8% Retail & Wholesale—4.3%

Professional Med. Serv.—3.8%

19.5% 11.2% Other C&I—11.2%

Owner Occupied RE—20.1%

Non-Owner Occupied RE—19.5%

20.1% Other CRE—15.0%

Rental CRE—7.7%

(1) Reported as of September 30, 2016; does not include impact of Community First Bancshares and Prairie State Bancshares acquisitions

11

|

|

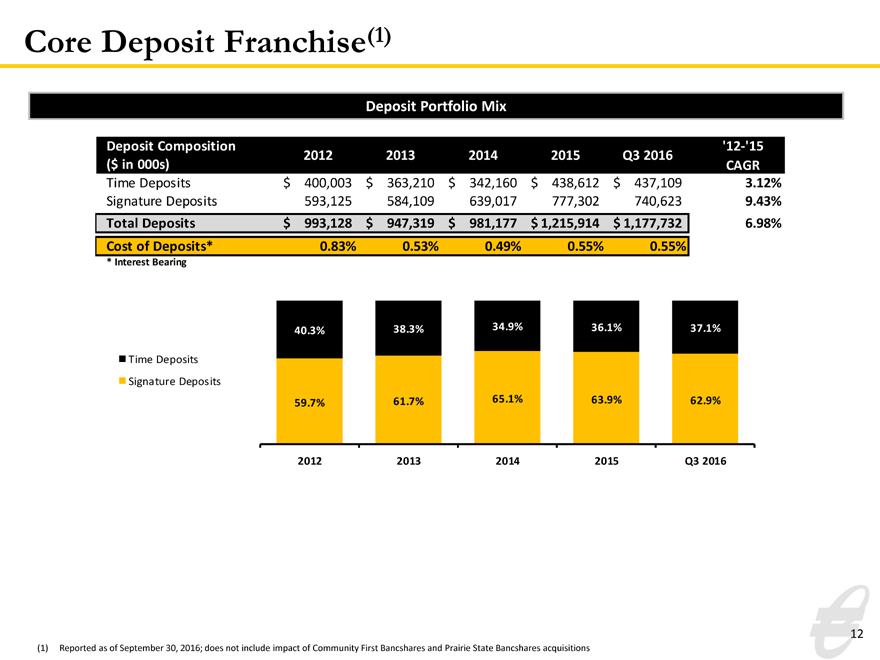

Core Deposit Franchise(1)

Deposit Portfolio Mix

Deposit Composition ’12-‘15

2012201320142015Q3 2016

($ in 000s) CAGR

Time Deposits $ 400,003$ 363,210$342,160$ 438,612$437,1093.12%

Signature Deposits 593,125584,109639,017777,302740,6239.43%

Total Deposits $ 993,128$ 947,319$981,177$ 1,215,914$1,177,7326.98%

Cost of Deposits* 0.83%0.53%0.49%0.55%0.55%

* Interest Bearing

40.3%38.3%34.9%36.1%37.1%

Time Deposits

Signature Deposits

59.7%61.7%65.1%63.9%62.9%

2012201320142015Q3 2016

(1) Reported as of September 30, 2016; does not include impact of Community First Bancshares and Prairie State Bancshares acquisitions

12

|

|

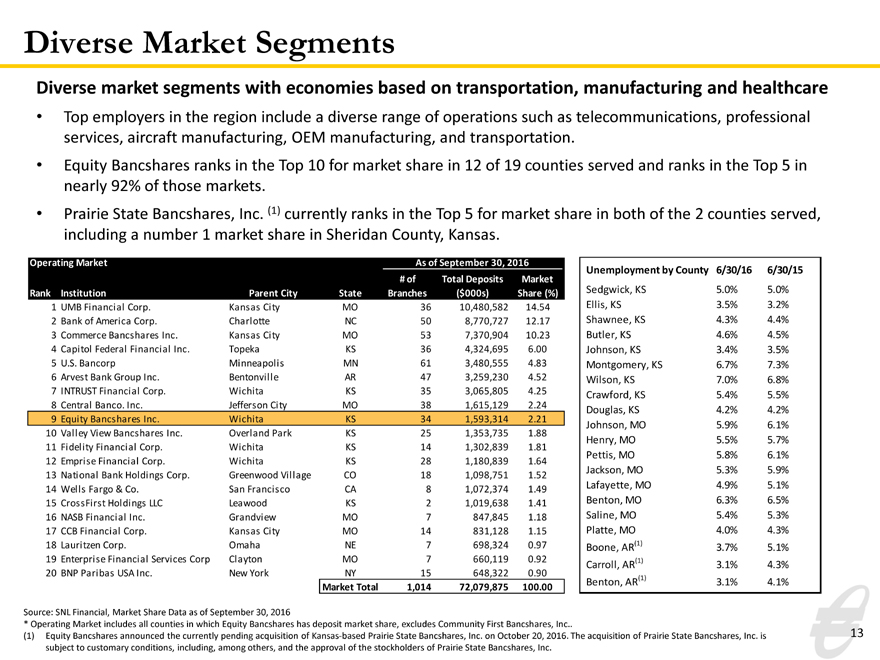

Diverse Market Segments

Diverse market segments with economies based on transportation, manufacturing and healthcare

• Top employers in the region include a diverse range of operations such as telecommunications, professional services, aircraft manufacturing, OEM manufacturing, and transportation.

• Equity Bancshares ranks in the Top 10 for market share in 12 of 19 counties served and ranks in the Top 5 in nearly 92% of those markets.

• Prairie State Bancshares, Inc. (1) currently ranks in the Top 5 for market share in both of the 2 counties served, including a number 1 market share in Sheridan County, Kansas.

Operating Market As of September 30, 2016

# ofTotal DepositsMarket

Rank Institution Parent CityStateBranches($000s)Share (%)

1 UMB Financial Corp. Kansas CityMO3610,480,58214.54

2 Bank of America Corp. CharlotteNC508,770,72712.17

3 Commerce Bancshares Inc. Kansas CityMO537,370,90410.23

4 Capitol Federal Financial Inc. TopekaKS364,324,6956.00

5 U.S. Bancorp MinneapolisMN613,480,5554.83

6 Arvest Bank Group Inc. BentonvilleAR473,259,2304.52

7 INTRUST Financial Corp. WichitaKS353,065,8054.25

8 Central Banco. Inc. Jefferson CityMO381,615,1292.24

9 Equity Bancshares Inc. WichitaKS341,593,3142.21

10 Valley View Bancshares Inc. Overland ParkKS251,353,7351.88

11 Fidelity Financial Corp. WichitaKS141,302,8391.81

12 Emprise Financial Corp. WichitaKS281,180,8391.64

13 National Bank Holdings Corp. Greenwood VillageCO181,098,7511.52

14 Wells Fargo & Co. San FranciscoCA81,072,3741.49

15 CrossFirst Holdings LLC LeawoodKS21,019,6381.41

16 NASB Financial Inc. GrandviewMO7847,8451.18

17 CCB Financial Corp. Kansas CityMO14831,1281.15

18 Lauritzen Corp. OmahaNE7698,3240.97

19 Enterprise Financial Services Corp ClaytonMO7660,1190.92

20 BNP Paribas USA Inc. New YorkNY15648,3220.90

Market Total1,01472,079,875100.00

Unemployment by County 6/30/16 6/30/15

Sedgwick, KS 5.0% 5.0%

Ellis, KS 3.5% 3.2%

Shawnee, KS 4.3% 4.4%

Butler, KS 4.6% 4.5%

Johnson, KS 3.4% 3.5%

Montgomery, KS 6.7% 7.3%

Wilson, KS 7.0% 6.8%

Crawford, KS 5.4% 5.5%

Douglas, KS 4.2% 4.2%

Johnson, MO 5.9% 6.1%

Henry, MO 5.5% 5.7%

Pettis, MO 5.8% 6.1%

Jackson, MO 5.3% 5.9%

Lafayette, MO 4.9% 5.1%

Benton, MO 6.3% 6.5%

Saline, MO 5.4% 5.3%

Platte, MO 4.0% 4.3%

Boone, AR(1) 3.7% 5.1%

Carroll, AR(1) 3.1% 4.3%

Benton, AR(1) 3.1% 4.1%

Source: SNL Financial, Market Share Data as of September 30, 2016

* Operating Market includes all counties in which Equity Bancshares has deposit market share, excludes Community First Bancshares, Inc

(1) Equity Bancshares announced the currently pending acquisition of Kansas-based Prairie State Bancshares, Inc. on October 20, 2016. The acquisition of Prairie State Bancshares, Inc. is subject to customary conditions, including, among others, and the approval of the stockholders of Prairie State Bancshares, Inc.

13

|

|

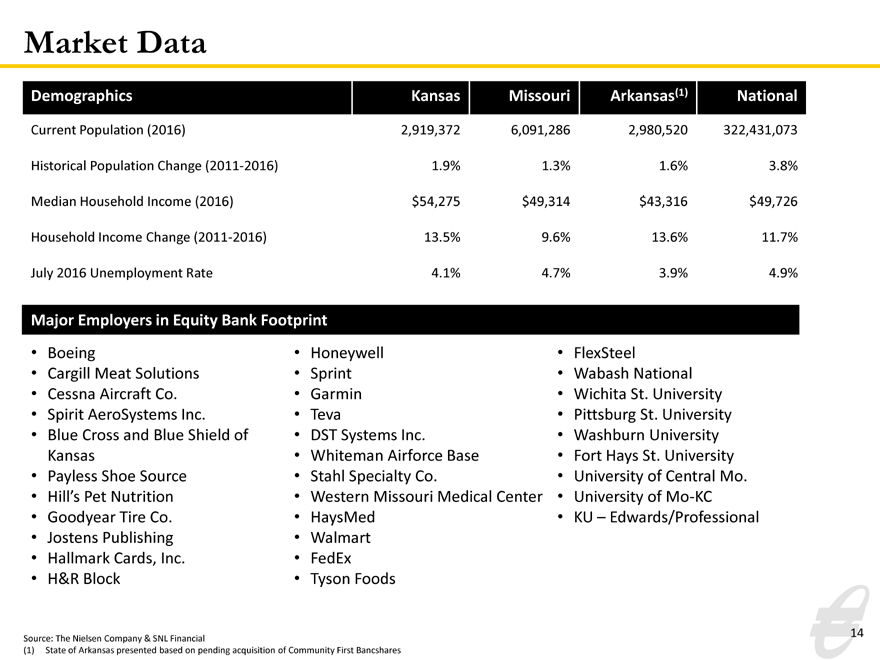

Market Data

Demographics Kansas MissouriArkansas(1)National

Current Population (2016) 2,919,372 6,091,2862,980,520322,431,073

Historical Population Change (2011-2016) 1.9% 1.3%1.6%3.8%

Median Household Income (2016) $54,275 $49,314$43,316$49,726

Household Income Change (2011-2016) 13.5% 9.6%13.6%11.7%

July 2016 Unemployment Rate 4.1% 4.7%3.9%4.9%

Major Employers in Equity Bank Footprint

• Boeing • Honeywell • FlexSteel

• Cargill Meat Solutions • Sprint • Wabash National

• Cessna Aircraft Co. • Garmin • Wichita St. University

• Spirit AeroSystems Inc. • Teva • Pittsburg St. University

• Blue Cross and Blue Shield of • DST Systems Inc. • Washburn University

Kansas • Whiteman Airforce Base • Fort Hays St. University

• Payless Shoe Source • Stahl Specialty Co. • University of Central Mo.

• Hill’s Pet Nutrition • Western Missouri Medical Center • University of Mo-KC

• Goodyear Tire Co. • HaysMed • KU – Edwards/Professional

• Jostens Publishing • Walmart

• Hallmark Cards, Inc. • FedEx

• H&R Block • Tyson Foods

Source: The Nielsen Company & SNL Financial

(1) State of Arkansas presented based on pending acquisition of Community First Bancshares

14

|

|

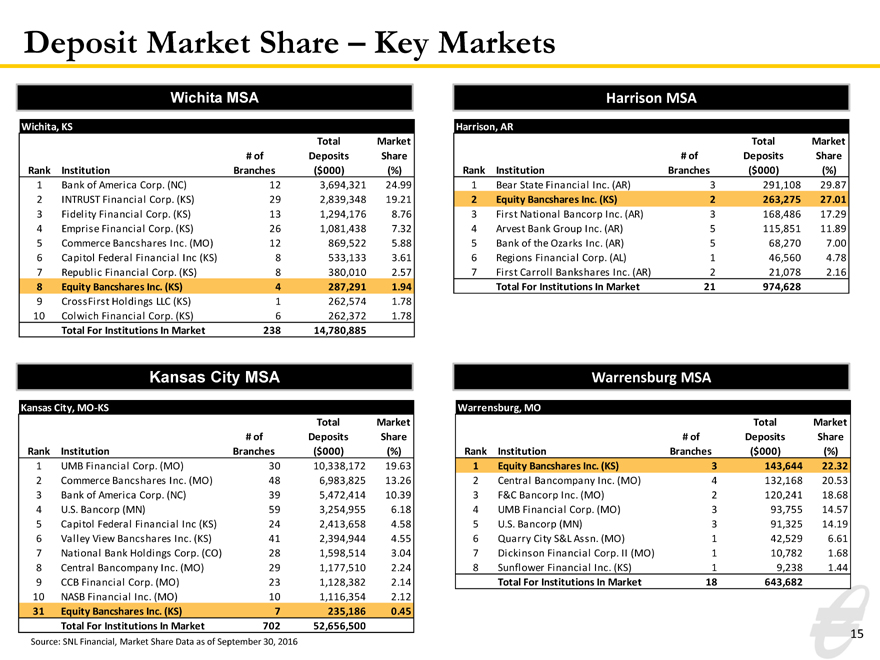

Deposit Market Share – Key Markets

Wichita MSA

Wichita, KS

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 Bank of America Corp. (NC) 123,694,32124.99

2 INTRUST Financial Corp. (KS) 292,839,34819.21

3 Fidelity Financial Corp. (KS) 131,294,1768.76

4 Emprise Financial Corp. (KS) 261,081,4387.32

5 Commerce Bancshares Inc. (MO) 12869,5225.88

6 Capitol Federal Financial Inc (KS) 8533,1333.61

7 Republic Financial Corp. (KS) 8380,0102.57

8 Equity Bancshares Inc. (KS) 4287,2911.94

9 CrossFirst Holdings LLC (KS) 1262,5741.78

10 Colwich Financial Corp. (KS) 6262,3721.78

Total For Institutions In Market 23814,780,885

Kansas City MSA

Kansas City, MO-KS

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 UMB Financial Corp. (MO) 3010,338,17219.63

2 Commerce Bancshares Inc. (MO) 486,983,82513.26

3 Bank of America Corp. (NC) 395,472,41410.39

4 U.S. Bancorp (MN) 593,254,9556.18

5 Capitol Federal Financial Inc (KS) 242,413,6584.58

6 Valley View Bancshares Inc. (KS) 412,394,9444.55

7 National Bank Holdings Corp. (CO) 281,598,5143.04

8 Central Bancompany Inc. (MO) 291,177,5102.24

9 CCB Financial Corp. (MO) 231,128,3822.14

10 NASB Financial Inc. (MO) 101,116,3542.12

31 Equity Bancshares Inc. (KS) 7235,1860.45

Total For Institutions In Market 70252,656,500

Source: SNL Financial, Market Share Data as of September 30, 2016

Harrison MSA

Harrison, AR

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 Bear State Financial Inc. (AR) 3291,10829.87

2 Equity Bancshares Inc. (KS) 2263,27527.01

3 First National Bancorp Inc. (AR) 3168,48617.29

4 Arvest Bank Group Inc. (AR) 5115,85111.89

5 Bank of the Ozarks Inc. (AR) 568,2707.00

6 Regions Financial Corp. (AL) 146,5604.78

7 First Carroll Bankshares Inc. (AR) 221,0782.16

Total For Institutions In Market 21974,628

Warrensburg MSA

Warrensburg, MO

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 Equity Bancshares Inc. (KS) 3143,64422.32

2 Central Bancompany Inc. (MO) 4132,16820.53

3 F&C Bancorp Inc. (MO) 2120,24118.68

4 UMB Financial Corp. (MO) 393,75514.57

5 U.S. Bancorp (MN) 391,32514.19

6 Quarry City S&L Assn. (MO) 142,5296.61

7 Dickinson Financial Corp. II (MO) 110,7821.68

8 Sunflower Financial Inc. (KS) 19,2381.44

Total For Institutions In Market 18643,682

15

|

|

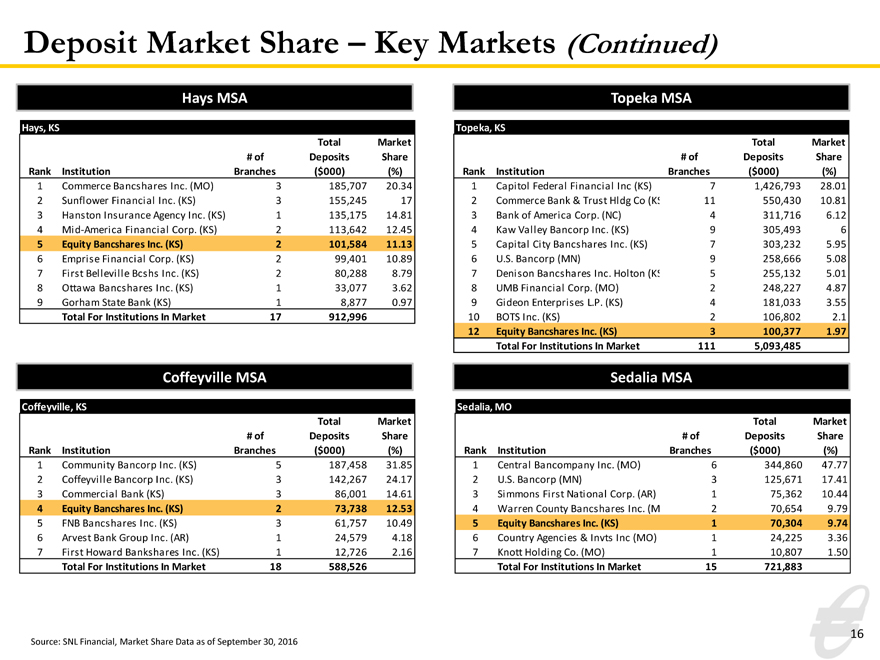

Deposit Market Share – Key Markets (Continued)

Hays MSA

Hays, KS

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 Commerce Bancshares Inc. (MO) 3185,70720.34

2 Sunflower Financial Inc. (KS) 3155,24517

3 Hanston Insurance Agency Inc. (KS) 1135,17514.81

4 Mid-America Financial Corp. (KS) 2113,64212.45

5 Equity Bancshares Inc. (KS) 2101,58411.13

6 Emprise Financial Corp. (KS) 299,40110.89

7 First Belleville Bcshs Inc. (KS) 280,2888.79

8 Ottawa Bancshares Inc. (KS) 133,0773.62

9 Gorham State Bank (KS) 18,8770.97

Total For Institutions In Market 17912,996

Coffeyville MSA

Coffeyville, KS

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 Community Bancorp Inc. (KS) 5187,45831.85

2 Coffeyville Bancorp Inc. (KS) 3142,26724.17

3 Commercial Bank (KS) 386,00114.61

4 Equity Bancshares Inc. (KS) 273,73812.53

5 FNB Bancshares Inc. (KS) 361,75710.49

6 Arvest Bank Group Inc. (AR) 124,5794.18

7 First Howard Bankshares Inc. (KS) 112,7262.16

Total For Institutions In Market 18588,526

Source: SNL Financial, Market Share Data as of September 30, 2016

Topeka MSA

Topeka, KS

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 Capitol Federal Financial Inc (KS) 71,426,79328.01

2 Commerce Bank & Trust Hldg Co (K 11550,43010.81

3 Bank of America Corp. (NC) 4311,7166.12

4 Kaw Valley Bancorp Inc. (KS) 9305,4936

5 Capital City Bancshares Inc. (KS) 7303,2325.95

6 U.S. Bancorp (MN) 9258,6665.08

7 Denison Bancshares Inc. Holton (K 5255,1325.01

8 UMB Financial Corp. (MO) 2248,2274.87

9 Gideon Enterprises L.P. (KS) 4181,0333.55

10 BOTS Inc. (KS) 2106,8022.1

12 Equity Bancshares Inc. (KS) 3100,3771.97

Total For Institutions In Market 1115,093,485

Sedalia MSA

Sedalia, MO

TotalMarket

# ofDepositsShare

Rank Institution Branches($000)(%)

1 Central Bancompany Inc. (MO) 6344,86047.77

2 U.S. Bancorp (MN) 3125,67117.41

3 Simmons First National Corp. (AR) 175,36210.44

4 Warren County Bancshares Inc. (M 270,6549.79

5 Equity Bancshares Inc. (KS) 170,3049.74

6 Country Agencies & Invts Inc (MO) 124,2253.36

7 Knott Holding Co. (MO) 110,8071.50

Total For Institutions In Market 15721,883

16

|

|

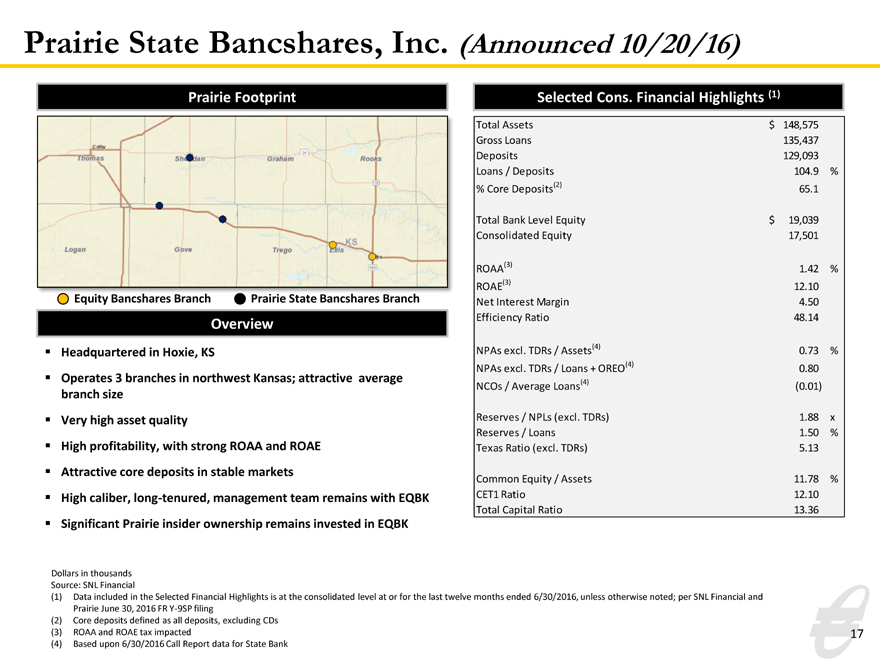

Prairie State Bancshares, Inc. (Announced 10/20/16)

Prairie Footprint

Equity Bancshares Branch Prairie State Bancshares Branch

Overview

Headquartered in Hoxie, KS

Operates 3 branches in northwest Kansas; attractive average branch size

Very high asset quality

High profitability, with strong ROAA and ROAE Attractive core deposits in stable markets

High caliber, long-tenured, management team remains with EQBK Significant Prairie insider ownership remains invested in EQBK

Dollars in thousands Source: SNL Financial

(1) Data included in the Selected Financial Highlights is at the consolidated level at or for the last twelve months ended 6/30/2016, unless otherwise noted; per SNL Financial and Prairie June 30, 2016 FR Y-9SP filing (2) Core deposits defined as all deposits, excluding CDs (3) ROAA and ROAE tax impacted (4) Based upon 6/30/2016 Call Report data for State Bank

Selected Cons. Financial Highlights (1)

Total Assets $148,575

Gross Loans 135,437

Deposits 129,093

Loans / Deposits 104.9%

% Core Deposits(2) 65.1

Total Bank Level Equity $19,039

Consolidated Equity 17,501

ROAA(3) 1.42%

ROAE(3) 12.10

Net Interest Margin 4.50

Efficiency Ratio 48.14

NPAs excl. TDRs / Assets(4) 0.73%

NPAs excl. TDRs / Loans + OREO(4) 0.80

NCOs / Average Loans(4) (0.01)

Reserves / NPLs (excl. TDRs) 1.88x

Reserves / Loans 1.50%

Texas Ratio (excl. TDRs) 5.13

Common Equity / Assets 11.78%

CET1 Ratio 12.10

Total Capital Ratio 13.36

17

|

|

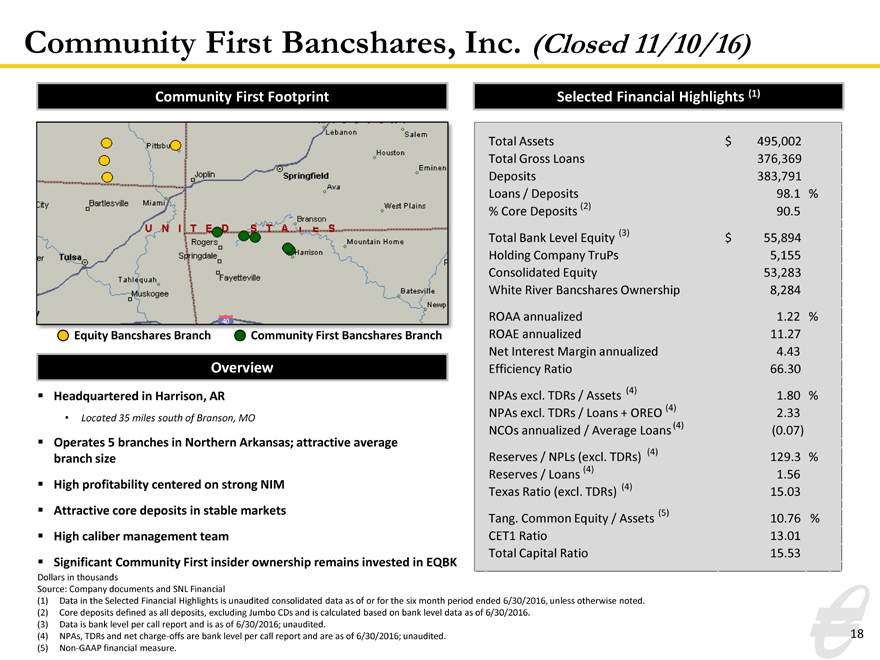

Community First Bancshares, Inc. (Closed 11/10/16)

Community First Footprint

Equity Bancshares Branch Community First Bancshares Branch

Overview

Headquartered in Harrison, AR

• Located 35 miles south of Branson, MO

Operates 5 branches in Northern Arkansas; attractive average branch size

High profitability centered on strong NIM Attractive core deposits in stable markets High caliber management team

Significant Community First insider ownership remains invested in EQBK

Dollars in thousands

Source: Company documents and SNL Financial

(1) Data in the Selected Financial Highlights is unaudited consolidated data as of or for the six month period ended 6/30/2016, unless otherwise noted. (2) Core deposits defined as all deposits, excluding Jumbo CDs and is calculated based on bank level data as of 6/30/2016.

(3) Data is bank level per call report and is as of 6/30/2016; unaudited.

(4) NPAs, TDRs and net charge-offs are bank level per call report and are as of 6/30/2016; unaudited. (5) Non-GAAP financial measure.

Selected Financial Highlights (1)

Total Assets $495,002

Total Gross Loans 376,369

Deposits 383,791

Loans / Deposits 98.1%

% Core Deposits (2) 90.5

Total Bank Level Equity (3) $55,894

Holding Company TruPs 5,155

Consolidated Equity 53,283

White River Bancshares Ownership 8,284

ROAA annualized 1.22%

ROAE annualized 11.27

Net Interest Margin annualized 4.43

Efficiency Ratio 66.30

NPAs excl. TDRs / Assets (4) 1.80%

NPAs excl. TDRs / Loans + OREO (4) 2.33

NCOs annualized / Average Loans (4) (0.07)

Reserves / NPLs (excl. TDRs) (4) 129.3%

Reserves / Loans (4) 1.56

Texas Ratio (excl. TDRs) (4) 15.03

Tang. Common Equity / Assets (5) 10.76%

CET1 Ratio 13.01

Total Capital Ratio 15.53

18

|

|

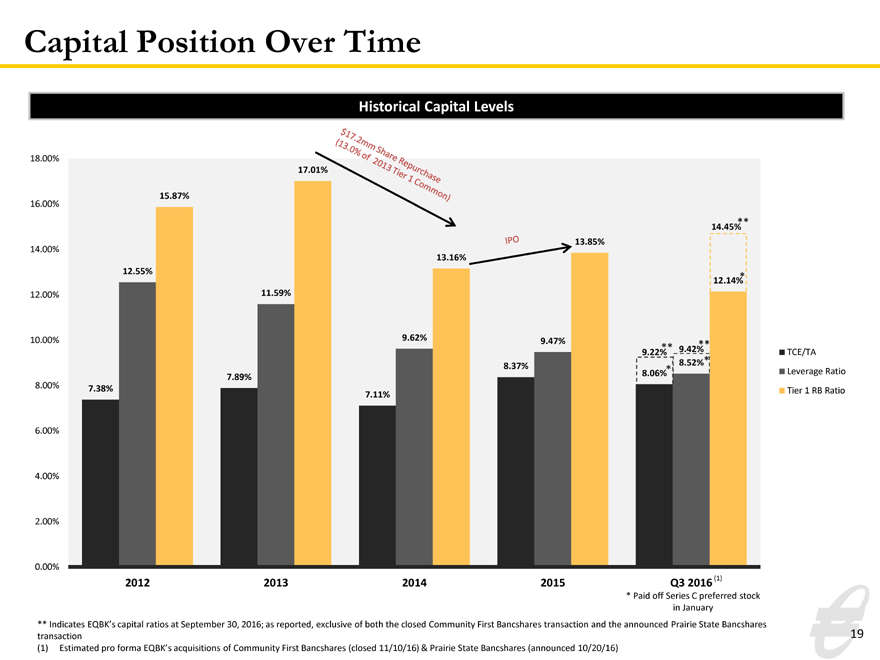

Capital Position Over Time

Historical Capital Levels

18.00%

17.01%

15.87%

16.00%

**

14.45%

14.00% 13.85%

13.16%

12.55%

12.14% *

12.00% 11.59%

10.00% 9.62% 9.47%

** **

9.22% 9.42% TCE/TA 8.52%* 8.37% *

8.06% Leverage Ratio

7.89%

8.00% 7.38%

Tier 1 RB Ratio

7.11%

6.00% 4.00% 2.00%

0.00%

2012 2013 2014 2015 Q3 2016(1)

* Paid off Series C preferred stock in January

** Indicates EQBK’s capital ratios at September 30, 2016; as reported, exclusive of both the closed Community First Bancshares transaction and the announced Prairie State Bancshares 19 transaction

(1) Estimated pro forma EQBK’s acquisitions of Community First Bancshares (closed 11/10/16) & Prairie State Bancshares (announced 10/20/16)

|

|

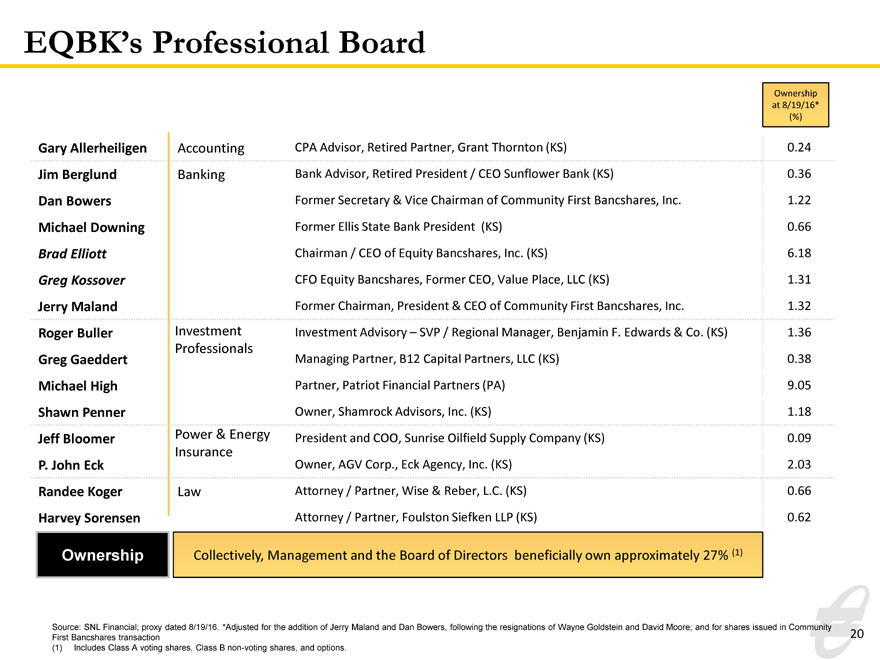

EQBK’s Professional Board

Ownership

at 8/19/16*

(%)

Gary Allerheiligen Accounting CPA Advisor, Retired Partner, Grant Thornton (KS)0.24

Jim Berglund Banking Bank Advisor, Retired President / CEO Sunflower Bank (KS)0.36

Dan Bowers Former Secretary & Vice Chairman of Community First Bancshares, Inc.1.22

Michael Downing Former Ellis State Bank President (KS)0.66

Brad Elliott Chairman / CEO of Equity Bancshares, Inc. (KS)6.18

Greg Kossover CFO Equity Bancshares, Former CEO, Value Place, LLC (KS)1.31

Jerry Maland Former Chairman, President & CEO of Community First Bancshares, Inc.1.32

Roger Buller Investment Investment Advisory – SVP / Regional Manager, Benjamin F. Edwards & Co. (KS)1.36

Professionals

Greg Gaeddert Managing Partner, B12 Capital Partners, LLC (KS)0.38

Michael High Partner, Patriot Financial Partners (PA)9.05

Shawn Penner Owner, Shamrock Advisors, Inc. (KS)1.18

Jeff Bloomer Power & Energy President and COO, Sunrise Oilfield Supply Company (KS)0.09

Insurance

P. John Eck Owner, AGV Corp., Eck Agency, Inc. (KS)2.03

Randee Koger Law Attorney / Partner, Wise & Reber, L.C. (KS)0.66

Harvey Sorensen Attorney / Partner, Foulston Siefken LLP (KS)0.62

Ownership Collectively, Management and the Board of Directors beneficially own approximately 27% (1)

Source: SNL Financial; proxy dated 8/19/16. *Adjusted for the addition of Jerry Maland and Dan Bowers, following the resignations of Wayne Goldstein and David Moore; and for shares issued in Community First Bancshares transaction (1) Includes Class A voting shares, Class B non-voting shares, and options.

20

|

|

Core Components of EQBK’s Story

Performance

Growth in Commercial Banking Franchise

Commercial banking customers (70% of loans) Manufacturing, transportation, business

Strong Operating Performance

Delivered earnings and EPS growth Above peer asset quality through cycles Leveraging infrastructure to achieve efficiencies

Proven M&A Acquirer and Integrator

Successful track record

Ability to integrate, operate and enhance revenue

Opportunity

Growth Oriented Business Plan

Focus on commercial banking

Continue organic and acquisition initiatives Leverage efficient, scalable infrastructure Enhance revenue through identified synergies Hire talented, entrepreneurial employees Continue offering sophisticated, improved and customized banking products

Market Opportunity

Numerous acquisition opportunities

Gathering low cost deposits and deploying into our growing target lending markets

Management Team & Board Strength

Large bank experience with community bank care

Success in attracting clients from larger banks Deep alignment with shareholders C-Suite and top-line managers have significant ownership Top-shelf credit culture

21