Attached files

| file | filename |

|---|---|

| EX-99.2 - UNAUDITED PRO FORMA COMBINED CONDENSED FINANICAL INFORMATION - CIRCOR INTERNATIONAL INC | ex-992unauditedproformacom.htm |

| EX-21.1 - CONSENT OF CROWE HORWATH LLP - CIRCOR INTERNATIONAL INC | ex-231consentofindependent.htm |

| 8-K/A - 8-K/A - CIRCOR INTERNATIONAL INC | a8-ka.htm |

EXHIBIT 99.1

Independent Auditors’ Report

Members

Downstream Holding, LLC and Subsidiaries

Sandy, Utah

Report on the Financial Statements

We have audited the accompanying consolidated financial statements of Downstream Holding, LLC and Subsidiaries which comprise the consolidated balance sheet as of June 30, 2016, and the related consolidated statements of income and comprehensive income, changes in members’ equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Downstream Holding, LLC and Subsidiaries as of June 30, 2016, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

/s/ Crowe Horwath LLP

Sherman Oaks, California

December 15, 2016

1

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

June 30, 2016

(Dollars in thousands)

ASSETS | ||||

CURRENT ASSETS: | ||||

Cash and cash equivalents | $ | 4,889 | ||

Accounts receivable (net of allowance for doubtful debts $531) | 27,386 | |||

Unbilled receivables | 14,281 | |||

Inventories | 14,706 | |||

Prepaid expenses and other current assets | 1,120 | |||

Total Current Assets | 62,382 | |||

PROPERTY, PLANT AND EQUIPMENT, NET | 15,164 | |||

OTHER ASSETS: | ||||

Intangibles, net | 7,238 | |||

Other assets | 288 | |||

TOTAL ASSETS | $ | 85,072 | ||

LIABILITIES AND MEMBERS’ EQUITY | ||||

CURRENT LIABILITIES: | ||||

Accounts payable | $ | 7,995 | ||

Accrued expenses | 6,616 | |||

Deferred revenue | 6,670 | |||

Income taxes payable | 7,815 | |||

Revolver | 6,162 | |||

Current portion of long-term debt | 1,433 | |||

Total Current Liabilities | 36,691 | |||

LONG-TERM DEBT | 25,132 | |||

DEFERRED INCOME TAXES | 9,145 | |||

TOTAL LIABILITIES | 70,968 | |||

COMMITMENTS AND CONTINGENCIES (NOTES 11 & 12) | ||||

MEMBERS’ EQUITY: | ||||

Contributed capital | 11,825 | |||

Accumulated other comprehensive loss | (614 | ) | ||

Retained earnings | 2,893 | |||

Total Members’ Equity | 14,104 | |||

TOTAL LIABILITIES AND MEMBERS’ EQUITY | $ | 85,072 | ||

2

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME AND COMPREHENSIVE INCOME

For the Fiscal Year Ended June 30, 2016

(Dollars in thousands)

Net sales | $ | 120,566 | ||

Cost of sales | 78,209 | |||

GROSS MARGIN | 42,357 | |||

Operating expenses | ||||

Selling, general and administrative expenses | 28,245 | |||

Management fees | 1,255 | |||

INCOME FROM CONTINUING OPERATIONS BEFORE OTHER EXPENSE AND TAXES | 12,857 | |||

Other expense (income): | ||||

Interest expense, net | 2,240 | |||

Other expense, net | 145 | |||

TOTAL OTHER EXPENSE, NET | 2,385 | |||

INCOME BEFORE INCOME TAXES | 10,472 | |||

Provision for income taxes | 3,214 | |||

INCOME FROM CONTINUING OPERATIONS | $ | 7,258 | ||

DISCONTINUED OPERATIONS (NOTE 4) | ||||

Gain from discontinued operations | 36 | |||

NET INCOME | $ | 7,294 | ||

Foreign currency translation loss, net of tax | (707 | ) | ||

COMPREHENSIVE INCOME | $ | 6,587 | ||

3

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN MEMBERS’ EQUITY

For the Fiscal Year Ended June 30, 2016

(Dollars in thousands)

Accumulated | |||||||||||||||

Other | Total | ||||||||||||||

Contributed | Comprehensive | Retained | Members’ | ||||||||||||

Capital | (Loss)/Income | Earnings | Equity | ||||||||||||

Balance at July 1, 2015 | $ | 10,000 | $ | 93 | $ | 29,599 | $ | 39,692 | |||||||

Net income | — | — | 7,294 | 7,294 | |||||||||||

Other comprehensive loss, net | — | (707 | ) | — | (707 | ) | |||||||||

Equity-based compensation | 1,825 | — | — | 1,825 | |||||||||||

Distributions | — | — | (34,000 | ) | (34,000 | ) | |||||||||

Balance at June 30, 2016 | $ | 11,825 | $ | (614 | ) | $ | 2,893 | $ | 14,104 | ||||||

4

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

For Fiscal Year Ended June 30, 2016

(Dollars in thousands)

Cash flows from operating activities | ||||||

Net income | $ | 7,294 | ||||

Adjustments to reconcile net income to net cash used in operating activities | ||||||

Depreciation and amortization | 3,458 | |||||

Amortization of deferred financing costs | 232 | |||||

Equity-based compensation | 1,825 | |||||

Gain on sale of business | (36 | ) | ||||

Deferred Income Taxes | (3,899 | ) | ||||

Provision for bad debts | 1,619 | |||||

Change in operating assets and liabilities: | ||||||

Accounts receivable | 1,790 | |||||

Unbilled receivables | (1,586 | ) | ||||

Inventories | (218 | ) | ||||

Prepaid expenses and other current assets | 949 | |||||

Accounts payable | (116 | ) | ||||

Accrued expenses | 721 | |||||

Accrued taxes | 5,626 | |||||

Deferred revenue | (4,230 | ) | ||||

Net cash provided by operating activities | 13,428 | |||||

Cash flows from investing activities | ||||||

Purchase of property and equipment | (1,060 | ) | ||||

Proceeds from sale of business | 7,000 | |||||

Net cash provided in investing activities | 5,939 | |||||

Cash flows from financing activities | ||||||

Borrowings from the Revolver and Bridge Loan | 7,474 | |||||

Payments on the Revolver and Bridge Loan | (16,002 | ) | ||||

Proceeds from long-term debt | 30,000 | |||||

Payments on long-term debt | (2,217 | ) | ||||

Deferred financing costs paid | (1,450 | ) | ||||

Distributions | (34,000 | ) | ||||

Net cash provided by financing activities | (16,195 | ) | ||||

Net increase in cash and cash equivalents | 3,172 | |||||

Effects of exchange rate changes on cash and cash equivalents | (931 | ) | ||||

Cash and cash equivalents at July 1, 2015 | 2,647 | |||||

Cash and cash equivalents at June 30, 2016 | $ | 4,889 | ||||

Supplemental disclosures of cash flow information | ||||||

Interest paid | $ | 1,805 | ||||

Taxes paid | $ | 1,925 | ||||

5

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

NOTE 1 - NATURE OF OPERATIONS

Downstream Holding, LLC, (“Downstream”) and its subsidiaries (hereinafter referred to collectively as the “Company”) is engaged in the business of designing, engineering, manufacturing and repairing of severe-service equipment for the petroleum refining industry. The Company was formed on May 18, 2015 and owns all issued and outstanding equity interests of TapcoEnpro Tracker, LLC (“TapcoEnpro”) and DeltaValve Tracker LLC (“DeltaValve”). TapcoEnpro Tracker LLC and DeltaValve Tracker LLC own all of the equity interest of Downstream Aggregator LLC. Downstream Aggregator LLC owns all of the equity interest of the operating entities - DeltaValve LLC, TapcoEnpro LLC, and TapcoEnpro UK Ltd.

The Company’s interest in Groquip Tracker, LLC and Groth Equipment Corporation of Lousiana was sold in April 2016 (see Note 5 for further details)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation: The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries as described in Note 1. All intercompany balances have been eliminated in consolidation. The operations of a former wholly-owned subsidiary, Groquip, are presented as discontinued operations within the consolidated statement income and comprehensive income.

Basis of Presentation: The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). These consolidated financial statements present the operations of the Company for the period from July 1, 2015 through June 30, 2016 (“the 2016 fiscal year”).

Use of Estimates: The preparation of consolidated financial statements in conformity with U.S. GAAP requires management of the Company to make estimates and assumptions that affect the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of sales and expenses during the reporting period. The Company routinely evaluates the estimates and assumptions related to the allowance for doubtful accounts, excess and obsolescence reserves for inventories, accrued warranty reserves, estimated total costs for ongoing long-term contracts accounted for under the percentage of completion method, the value of share-based awards, the valuation of identifiable intangible assets, and litigation and other loss contingencies. Actual results could differ from those estimates.

Cash and Cash Equivalents: The Company considers demand deposits at banks and highly liquid investments with a maturity of three months or less to be cash equivalents. The Company maintains funds on deposit with certain banks at times that exceed the federally insured limits in the United States of America. The Company has not experienced any losses of such deposits.

Accounts Receivable: Accounts receivable is carried at original invoice amount less an allowance for doubtful accounts. Credit is extended based on an evaluation of a customer’s financial condition. Generally, collateral is not required and payment terms vary by customer. The Company determines its allowance for doubtful accounts on a specific identification method which considers a number of factors, including the length of time accounts receivable are past due, the financial condition of a customer, the Company’s previous loss history, and the condition of the general economy. The Company writes off accounts receivable when deemed uncollectible, and payments subsequently received on such accounts receivable are recognized as a reduction in the allowance for doubtful accounts. The Company does not charge interest on past due accounts receivable.

Inventories: Inventories primarily consists of components, work in process and finished goods. Inventories acquired in the acquisition (Note 4) were recorded at fair value. The Company recorded a fair value adjustment of $1,908 to increase the value of the inventory over the cost basis. $1,344 of the fair value adjustment was amortized into cost of

6

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

goods sold in the consolidated statement of income and comprehensive income during the 2016 fiscal year. Subsequent to the acquisition, inventories are valued at the lower of cost or market, with cost principally determined by the LIFO (last in first out) method. Provisions are made to reduce excess and obsolete inventories to their estimated net realizable value. These provisions include determining the excess of current cost over stated LIFO.

Property and Equipment: Property and equipment acquired as a result of the acquisition (Note 4) are recorded at fair value. Property and equipment are stated at cost less accumulated amortization and depreciation. Depreciation and amortization are computed primarily on a straight-line basis over the estimated useful lives of the assets, or shorter of the estimated useful lives of the assets or lease term for leasehold improvements. When properties are retired or otherwise disposed of, the appropriate accounts are relieved of cost and accumulated depreciation, and any resulting gain or loss is recognized. Repairs, minor renewals, and betterments are expensed as incurred.

The Company reports depreciation of property, plant and equipment in cost of sales and selling, general and administrative expenses based on the nature of the underlying assets. Depreciation primarily related to equipment used in the production of inventory is recorded in cost of sales. Depreciation related to selling and administrative functions is reported in selling, general and administrative expenses.

The estimated useful lives of property and equipment are as follows:

Leasehold improvements | Shorter of useful life or lease term |

Auto | 5 years |

Buildings | 25-40 years |

Building improvements | 10 years |

Machinery and equipment | 5-10 years |

Office furniture and equipment | 3-7 years |

Business Combinations: We account for business combinations under the purchase method, and accordingly, the assets and liabilities of the acquired businesses are recorded at their estimated fair value on the acquisition date with the excess of the purchase price over their estimated fair value recorded as goodwill. If the estimated fair value of assets acquired exceeds the purchase price, a bargain purchase gain is recognized in the statement of income and comprehensive income. We determine acquisition related asset and liability fair values through established valuation techniques for industrial manufacturing companies and utilize third party valuation firms to assist in the valuation of certain tangible and intangible assets.

Evaluation of Impairment of Long-Lived and Indefinite- Lived Assets: Long-lived assets are reviewed for impairment when events or changes in circumstances indicate that their carrying value may not be recoverable. The Company periodically reviews the carrying value of long-lived assets, including property and equipment and identifiable amortizable intangible assets, for impairment whenever events or changes in business circumstances indicate that the carrying amount of an asset may not be fully recoverable. An impairment loss would be recognized if the undiscounted estimated future cash flows from the use of the asset are less than the carrying amount. Management of the Company determined that no impairment of long-lived assets exists as of June 30, 2016.

Management of the Company considers qualitative factors to determine whether the existence of events or circumstances lead to a determination that it is more likely than not that the fair value of indefinite-lived assets is less than their carrying amount. If, as the result of the qualitative assessment, management of the Company determines that the indefinite-lived asset may be impaired, management of the Company tests for impairment by comparing the fair value with the book value. Management of the Company determined that no impairment of indefinite-lived assets exists as of June 30, 2016.

7

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

Deferred Financing Costs: Deferred financing costs represent the costs incurred in connection with obtaining debt financing. The Company amortizes deferred financing costs on the effective interest rate method basis over the term of the related debt instruments. As of June 30, 2016, the Company has net deferred financing costs issuance costs of $1,218, included as a reduction of long-term debt. For the period from July 1, 2015 through June 30, 2016 the Company capitalized $1,450 of deferred financing costs and recognized amortization expense associated with deferred financing costs of $232, which also represents the total accumulated amortization as of June 30, 2016.

Accrued Warranty Reserves: The accrual for warranty reserves includes the expected costs of warranty obligations imposed by contract. Estimates are principally based on assumptions regarding the warranty costs based upon the Company’s historical experience with such claims. The Company records the accrual for warranty costs as a current liability if the anticipated settlement of those costs will be completed in the year subsequent to the consolidated financial statements; anticipated settlements beyond then are recorded as long-term liabilities, as applicable

Revenues and Costs on Construction Contracts: Revenues and costs on construction contracts are recognized on the percentage-of-completion method measured on the basis of costs incurred to estimated total costs for each contract. This method is used because management considers it to be the best available measure of progress towards completion on these contracts. Revenues and costs on contracts are subject to revision throughout the duration of the contracts, and any required adjustments are made in the period in which a revision becomes known. Estimated losses on contracts in progress are recognized in the period in which a loss becomes known.

The asset “Unbilled Receivables” represent revenues recognized in excess of the amounts billed for active projects. The liability “Deferred Revenue” represents billings in excess of revenues on active projects.

Revenue Recognition on Aftermarket Sales and Service: Revenues for aftermarket sales and service are primarily recognized as: products are shipped or as services are rendered; customers take ownership and assume risk of loss; collection of the related receivable is probable; persuasive evidence of an arrangement exists; and the sales price is fixed and determinable.

Equity-Based Compensation: The Company provides compensation benefits to certain key employees under an equity-based plan providing for employee unit options. Equity-based compensation is measured at the grant date based on the fair value of the award. The estimated fair values of the unit options, including the effect of estimated forfeitures, are expensed based on the performance measurements contained in the grants and which are being met by the performance of the Company.

Income Taxes: Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is recognized if the Company anticipates that it is more likely than not that we may not realize some or all of a deferred tax asset.

In accordance with the provisions of Financial Accounting Standards Board ("FASB") ASC Topic 740, Income Taxes, the Company initially recognizes the financial statement effect of a tax position when, based solely on its technical merits, it is more likely than not (a likelihood of greater than fifty percent) that the position will be sustained upon examination by the relevant taxing authority. Those tax positions failing to qualify for initial recognition are recognized in the first interim period in which they meet the more likely than not standard, are resolved through negotiation or litigation with the taxing authority, or upon expiration of the statute of limitations. De-recognition of a tax position that was previously recognized occurs when an entity subsequently determines that a tax position no longer meets the more likely than not threshold of being sustained.

8

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

If future results of operations exceed our current expectations, our existing tax valuation allowances may be adjusted, resulting in future tax benefits. Alternatively, if future results of operations are less than expected, future assessments may result in a determination that some or all of the deferred tax assets are not realizable. Consequently, we may need to establish additional tax valuation allowances for a portion or all of the gross deferred tax assets, which may have a material adverse effect on our results of operations.

The TapcoEnpro Tracker, LLC, DeltaValve Tracker, LLC, and Groquip Tracker, LLC entities of Downstream (refer to Note 1) all made elections to be taxed as corporations.

For more information related to our Income Taxes, see Note 17 of the consolidated financial statements.

Translation of Foreign Financial Statements: The financial statements of our UK based operating entity have been translated into U.S. dollars. The functional currency of the UK entity is its local currency, and foreign currency translation adjustments are recorded in other comprehensive income (loss) as a separate component of members’ equity. All assets and liabilities are translated at current rates of exchange in effect at the end of the period. Revenue and expenses are translated at the monthly average exchange rates for the period.

Comprehensive Income: Comprehensive income consists of net income and changes in unrealized gains and losses of the foreign currency translation adjustments related to revaluing the balance sheet and income statement of our UK based entity from its functional currency. Accumulated other comprehensive loss is presented as a separate component of members' equity.

Concentrations: As of June 30, 2016, two individual customers accounted for 16% and 10%, respectively, of the Company’s accounts receivable, and two individual vendors accounted for 8% and 6%, respectively, of the Company’s accounts payable. In addition, two individual customers accounted for 18% and 6%, respectively, of the Company’s revenues for the period from July 1, 2015 through June 30, 2016.

NOTE 3 - NEW ACCOUNTING STANDARDS

In August 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standard Update ("ASU") 2016-15, Classification of Certain Cash Receipts and Cash Payments. ASU 2016-15 reduces the existing diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows under Topic 230, Statement of Cash Flows, and other Topics. This ASU addresses eight specific cash flow issues with the objective of enhancing consistency in presentation and classification. The amendments in this ASU are effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted, including adoption in an interim period. We are currently evaluating the requirements of ASU 2016-15 and have not yet determined its impact on our consolidated financial statements.

In March 2016, the FASB issued ASU 2016-02, Leases. ASU 2016-02 outlines a model for lessees by recognizing lease-related assets and liabilities on the balance sheet. The amendments in this ASU are effective for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years. Early application is permitted for all entities. ASU 2016-02 requires a modified retrospective approach for all leases existing at, or entered into after, the date of initial application, with an option to elect to use certain transition relief. We are currently evaluating the requirements of ASU 2016-02 and have not yet determined its impact on our consolidated financial statements.

9

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, as part of its Simplification Initiative. The areas for simplification in this update involve several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The amendments in this ASU are effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early application is permitted for all entities. We are currently evaluating the requirements of ASU 2016-09 and have not yet determined its impact on our consolidated financial statements.

In July 2015, the FASB issued ASU 2015-11, Inventory. ASU 2015-11 more closely aligns the measurement of inventory in GAAP with the measurement of inventory in International Financial Reporting Standards (IFRS). The amendments in this Update require that an entity should measure inventory within the scope of this update at the lower of cost and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. ASU 2015-11 is effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. The amendments in this update should be applied prospectively with earlier application permitted as of the beginning of an interim or annual reporting period. We intend to adopt the standard prospectively after the effective date of January 1, 2017. We are currently evaluating the requirements of ASU 2015-11 and have not yet determined its impact on our consolidated financial statements.

In November 2015, the FASB issued ASU 2015-17, Balance Sheet Classification of Deferred Taxes, which amends existing guidance on income taxes to require the classification of all deferred tax assets and liabilities as non-current on the balance sheet. As permitted, the Company elected to early adopt this guidance effective June 30, 2016.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers. ASU 2014-09 outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and will replace most existing revenue recognition guidance in generally accepted accounting principles ("GAAP") when it becomes effective. ASU 2014-09 is effective for fiscal years and interim periods within those years beginning after December 15, 2017. Early adoption is permitted but not earlier than the original effective date of December 15, 2016. An entity should apply ASU 2014-09 either retrospectively to each prior reporting period presented or retrospectively with the cumulative effect of initially applying the ASU recognized as an adjustment to the opening balance of retained earnings at the date of initial application. In March, April and May 2016, the FASB issued additional updates to the new revenue standard relating to reporting revenue on a gross versus net basis, identifying performance obligations and licensing arrangements, and narrow-scope improvements and practical expedients, respectively. The Company is currently evaluating the requirements of ASU 2014-09 and has not yet selected its transition method or determined its impact on the consolidated financial statements.

NOTE 4 - ACQUISITION

On May 29, 2015, the Company via its wholly owned subsidiary Downstream Aggregator LLC acquired certain assets and assumed certain liabilities of Tapco International, Inc., Curtiss-Wright Flow Control (UK) Limited, and Curtiss-Wright Flow Control Service Corporation (collectively, the “Sellers”), which were engaged in the business of designing, engineering, manufacturing and repairing of severe-service equipment for the petroleum refining industry. The acquisition also included all of the outstanding shares of Groquip, which was engaged in the pressure relief valve distribution and repair business. Groquip was identified as a non-core business at the acquisition date and, as such, was classified as a discontinued operation effective on the date of the acquisition (Note 5).

The total purchase price of the acquisition was $28,700 which was paid in cash funded through capital contributions and debt borrowings. The purchase price and proceeds to the Sellers were reduced by an estimated working capital adjustment at closing of $5,212. The terms of the purchase agreement provided for a final working capital adjustment

10

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

which amounted to $4,751 and was paid to the Company by the Sellers in October 2015. The two working capital adjustments resulted in a net purchase price of $18,737.

All identifiable assets and liabilities were recorded at their acquisition date fair values. Because the fair value of net assets acquired exceed the purchase price, the Company recognized a gain on the bargain purchase totaling $46,372 at the time of the acquisition. Management believes that the bargain purchase can primarily be attributed to the Sellers’ desire to quickly divest of all of its holdings in the oil and gas industry. The fair value of identifiable assets and liabilities as of the purchase date was as follows:

The fair values of the assets and liabilities assumed approximated the following:

Consideration: | |||

Purchase price - cash, net of cash acquired of $7 | $ | 18,730 | |

Liabilities assumed: | |||

Accounts payable | 5,198 | ||

Accrued expenses | 4,536 | ||

Liabilities held for sale | 3,051 | ||

Deferred revenue | 11,430 | ||

Deferred income taxes | 503 | ||

Total consideration and liabilities assumed | 43,448 | ||

Assets acquired: | |||

Accounts receivable (face value $29,048) | 27,830 | ||

Unbilled revenue | 10,962 | ||

Inventories | 16,935 | ||

Other current assets | 142 | ||

Assets held for sale | 8,383 | ||

Property and equipment | 15,927 | ||

Intangible assets | 9,641 | ||

Identifiable assets acquired | 89,820 | ||

Gain on purchase of business | $ | 46,372 | |

The fair value of real estate was determined utilizing the market value approach. Property and equipment fair values were determined utilizing a fair value approach which included assumptions that would be made by market participants within the recognized principal or most advantageous market as if the market participants were valuing each identified asset on a piecemeal basis based on the asset’s highest and best use. The fair values of the identifiable intangible assets were estimated using an income approach. Under this method, an intangible asset’s fair value is equal to the present value of the incremental cash flows attributable solely to the intangible asset over its remaining useful life. The fair value of the assets held for sale was based on the fair value of Groquip, less the costs to sell the business (Note 5). The purchase price was paid in contemplation of Company’s customer relationships, assembled workforce and growth strategy for the business.

NOTE 5 - DISCONTINUED OPERATIONS

Groquip was identified as a non-core business at the acquisition date and, as such, was classified as a discontinued operation effective on the date of the acquisition (Note 4). On April 29, 2016, the stock of Groquip and its operations were sold for $7,404. The purchase price and proceeds to the Company were increased by an estimated working capital adjustment at closing of $107. As part of the agreement, $540 of cash proceeds were placed in escrow to cover

11

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

potential buyer claims against the Company related to the transaction. The terms of the escrow agreement provide for up to $252 to be released to the Company on April 29, 2017 and the remaining escrow to be released on October 29, 2017. Management believes the possibility of material buyer claims against the escrow fund is remote, therefore, the entire $540 is included in accounts receivable at June 30, 2016, of which $288 is long term. The Company incurred $1,188 of transaction expenses on the Groquip sale, which were included in gain from discontinued operations. The agreement requires both parties to agree upon a purchase price adjustment based upon a comparison of the estimated working capital at the close of the agreement and actual working capital at the close of the agreement. The terms of the purchase agreement provided for a purchase price adjustment of $213. This amount is included in accounts receivable at June 30, 2016.

Income statement information related to this operation for the period July 1, 2015 to June 30, 2016 is as follows:

Sales | $ | 13,426 | |

Cost of sales | 10,934 | ||

Gross margin | 2,492 | ||

Selling, general and administrative expenses | 2,969 | ||

Gain on sale of discontinued operation | 409 | ||

Pre-tax income related to discontinued operations | (68 | ) | |

Income tax benefit related to discontinued operations | 104 | ||

Gain from discontinued operations net of tax | $ | 36 | |

Operating and investing cash flows related to Groquip included in the statement of cash flows were cash provided from operations of $582 and cash used in investing purposes of $84 for the period July 1, 2015 through June 30, 2016.

Assets and liabilities disposed of in the sale transaction are as follows:

Assets | |||

Accounts receivable | $ | 2,488 | |

Inventory | 1,840 | ||

Property and equipment | 4,533 | ||

Intangible assets | 235 | ||

Total assets | 9,096 | ||

Liabilities | |||

Accounts payable | 1,035 | ||

Accrued expenses | 1,462 | ||

Accrued and deferred income taxes | 1,356 | ||

Total liabilities | $ | 3,853 | |

12

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

NOTE 6 - REVENUES AND BILLINGS ON UNCOMPLETED CONTRACTS

Revenues and billings on uncompleted contracts as of June 30 are as follows:

2016 | |||

Revenue on uncompleted contracts | 164,802 | ||

Total billings | 156,635 | ||

$ | 8,167 | ||

Included in the accompanying balance sheet under the following captions:

2016 | |||

Unbilled receivables (revenue in excess of billings) | 14,281 | ||

Deferred revenue (billings in excess of revenue) | 6,114 | ||

$ | 8,167 | ||

The balance sheet includes $556 of deferred revenue not associated with long-term contracts.

NOTE 7 - INVENTORIES

2016 | |||

Components | $ | 5,669 | |

Work-in-process | 4,500 | ||

Finished goods | 5,544 | ||

Reserves for excess and obsolete inventories | (833 | ) | |

LIFO reserve | (174 | ) | |

Inventories | $ | 14,706 | |

NOTE 8 - PROPERTY AND EQUIPMENT

Property and equipment consist of the following as of June 30,

2016 | |||

Land and buildings | $ | 7,300 | |

Machinery and equipment | 8,062 | ||

Leasehold improvements | 566 | ||

Office furniture and equipment | 456 | ||

Construction in progress | 568 | ||

16,952 | |||

Less accumulated depreciation and amortization | (1,788 | ) | |

Property and equipment, net | $ | 15,164 | |

Depreciation expense on property and equipment for the period was $1,552.

13

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

NOTE 9- INTANGIBLE ASSETS

Intangible assets consist of the following as of June 30:

2016 | ||||||||||

Gross | ||||||||||

carrying | Accumulated | |||||||||

amount | amortization | Useful Lives | ||||||||

Amortizable intangible assets: | ||||||||||

Customer lists | 3,301 | (1,192 | ) | 3.0 years | ||||||

Covenant not to compete | 2,763 | (599 | ) | 5.0 years | ||||||

Patents | 1,183 | (274 | ) | 4.7 years | ||||||

$ | 7,247 | $ | (2,065 | ) | ||||||

Non-amortized intangible assets: | ||||||||||

Trademarks and tradenames | $ | 2,056 | Indefinite | |||||||

Intangible assets were measured at fair value as of the acquisition date (Note 4) and are amortized using the straight-line method over their useful lives. The tradenames are indefinite lived intangible assets and are not subject to amortization. Amortization expense related to identifiable intangible assets was $1,906 for the period from July 1, 2015 through June 30, 2016, and was recorded in the accompanying consolidated statement of income and comprehensive income in selling, general and administrative expenses.

Estimated amortization expense for intangible assets recorded as of June 30, 2016 is as follows:

2017 | 1,906 | ||

2018 | 1,815 | ||

2019 | 806 | ||

2020 | 655 | ||

5,182 | |||

NOTE 10 - RELATED PARTY TRANSACTIONS

The Company pays an annual management fee, which is prepaid quarterly in the amount of $200 ($800 per year) plus expenses, to an affiliated entity of its owner in consideration for assistance with managing its operations and business. The affiliate may also charge the Company additional fees up to $200 per year based on Company performance. During the period from July 1, 2015 through June 30, 2016, the Company paid management fees totaling $1,329, of which $200 was included in prepaid expenses in the accompanying consolidated balance sheet as of June 30, 2016.

In connection with the sale of Groquip (Note 5), the affiliated entity also earned transaction fees of $74, of which all had been paid as of June 30, 2016. The Company recorded these transaction fees as part of the gain on sale of the business in discontinued operations for the period from July 1, 2015 through June 30, 2016.

The affiliate also earned fess for providing assistance to the Company for matters such as dividend issuance. The total of these other fees amount to $340 for the period from July 1, 2015 through June 30, 2016.

14

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

NOTE 11 - CONTINGENCIES

From time to time, the Company may experience litigation arising in the ordinary course of its business. These claims are evaluated for possible exposure by management of the Company. Management of the Company is not aware of any litigation as of June 30, 2016 that would require an accrual in the Company’s consolidated balance sheet.

NOTE 12 - OPERATING LEASE COMMITMENTS

The Company leases office and warehouse space, as well as certain facility and office equipment, under non-cancelable operating leases that expire on various dates through 2020 and include end of term renewal options. Under these real estate leases, the Company is required to pay its pro rata share of certain operating expenses and real estate taxes.

Lease expense for fiscal year 2016 was $670.

Minimum lease commitments under existing non-cancelable leases as of June 30 are as follows:

2017 | $ | 692 | ||

2018 | 296 | |||

2019 | 192 | |||

2020 | 112 | |||

$ | 1,292 | |||

NOTE 13 - ACCRUED WARRANTY RESERVES

The Company issues various types of product warranties under which the Company generally guarantees the performance of products delivered for a certain period of time or term. The reserve for product warranties includes the expected costs of warranty obligation imposed by contract. Estimates are principally based on historical claims experience. The expected long term portion of the warranty reserve is deemed to be immaterial.

The changes in accrued warranty reserves included as part of accrued expenses for the period from July 1, 2015 through June 30, 2016 were as follows:

Beginning Balance | $ | 784 | |

Provision for product warranty costs | 936 | ||

Product warranty claims paid | (647 | ) | |

Balance at June 30, 2016 | $ | 1,073 | |

NOTE 14 - REVOLVER AND LONG-TERM DEBT

Bridge Loan: On May 29, 2015, the Company entered into an agreement with a lender for a commitment of $45,000 in financing (“Bridge Loan”). The Company borrowed $14,641 on the Bridge Loan to fund the Acquisition (Note 3). The interest rate on the Bridge Loan was a variable rate based on the greater of prime rate margin plus 0.50% or libor margin plus 3.25%, as defined by the agreement. The Bridge Loan was paid in full on when the Company refinanced debt with a new lender in August 2015.

Credit Agreement: On June 30, 2015, the Company entered into a credit agreement with a lender that provides the Company with up to $60,000 in financing (the “Credit Agreement”). The Credit Agreement consists of a $48,000 revolving

15

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

credit facility (“Revolver”) and a $12,000 term loan (“Term Loan”). The Revolver and Term Loan represent first lien debt.

Revolver - The Revolver terminates on the earliest of June 29, 2020, or any earlier time upon which the obligations are accelerated and paid in full, as defined in the Credit Agreement. Funds borrowed under the Revolver are restricted to the amount available, as determined by the borrowing base defined in the Credit Agreement. The borrowing base under the Revolver is reduced by any outstanding letters of credit. The Company had $10,111 available under the Revolver as of June 30, 2016. Interest is payable monthly and is incurred at an interest rate equal to the base rate plus 1.75% or the eurodollar rate plus 2.75%, as defined by the Credit Agreement. The revolver is classified as current on the balance sheet as excess daily cash are automatically swept against the revolver.

As noted above, the Revolver includes provisions related to letters of credit that the Company requires in its normal course of business. The Company has outstanding letters of credit totaling $18,462 at June 30, 2016. The outstanding letters of credit expire through April 2019.

Term Loan - The Term Loan terminates on June 29, 2020. Principal payments of $358 on the Term Loan are due quarterly. Interest is due monthly and is incurred at an interest rate equal to the base rate plus 2.50% or the eurodollar rate plus 3.50%, as defined by the Credit Agreement.

Second Term Loan: On August 11, 2015, the Company entered into a term loan and security agreement with a lender that provides the Company with up to $11,000 in financing (“Second Term Loan”). The Company used the proceeds to pay the Bridge Loan in full. The Second Term Loan terminates on the earliest of August 11, 2020 or any earlier time upon which the obligations are accelerated, as defined in the Second Term Loan. On June 20, 2016, the Company amended the agreement and borrowed an additional $7,000 on the Second Term Loan. The Second Term Loan represents second lien debt. The Second Term Loans incurs interest at the eurodollar rate plus 10.50% with respect to eurodollar rate loan and at the base rate plus 8.25% with respect to domestic rate loans, as defined in the Second Term Loan. Interest is payable at the end of each month and as of June 30, 2016, interest was payable at 11.50%.

Both the first and second lien debt have an incremental repayment provision based on defined excess cash flow beginning with the fiscal year ended June 30, 2016. The Company must prepay the outstanding amount of the term loans in an amount equal to 25% of the excess cash flow for the first lien debt and 50% of the excess cash flow for the second lien debt, as defined in the Credit Agreement and Second Term Loan. There are no excess cash flow prepayments required as of June 30, 2016.

Amounts outstanding under the Credit Agreement and Second Term Loan are collateralized by substantially all assets of the Company. The approximate value of the assets collateralized is $41,121 as of June 30, 2016. The first lien debt holders having priority over the second lien debt holders. In connection with the Credit Agreement, the Company must meet certain financial and nonfinancial covenants. The Company was in compliance with all financial covenants as of June 30, 2016.

16

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

Long-term debt, exclusive of unamortized financing costs of $1,218, consists of the following as of June 30, 2016:

First Lien | Second Lien | Total | ||||||

Term loans | $12,000 | $18,000 | $30,000 | |||||

Less principal payments | (2,217 | ) | — | (2,217 | ) | |||

Less current portion of long-term debt | (1,433 | ) | — | (1,433 | ) | |||

Total | $8,350 | $18,000 | $26,350 | |||||

Revolver | $6,162 | |||||||

Maturities of long-term debt and the revolver for each fiscal year ending June 30 are as follows: | ||||||||

2017 | $1,433 | |||||||

2018 | 1,433 | |||||||

2019 | 1,433 | |||||||

2020 | 11,646 | |||||||

2021 | 18,000 | |||||||

$33,945 | ||||||||

NOTE 15 - BENEFIT PLAN

The Company maintains a 401(k) profit sharing plan (the “Plan”). The Plan is open to all full-time employees of the Company subject to certain age requirements. Participants of the Plan may elect to contribute a percentage of their salary, subject to ERISA limitations. The Company provides a matching contribution. The Company’s matching contributions are at the discretion of the Board of Directors of the Company. Contributions of $374 were made for the period from July 1, 2015 through June 30, 2016.

NOTE 16 - EQUITY-BASED COMPENSATION

The Company has an equity-based compensation plan (the “Plan”) which provides for the grant of non-qualified unit options to selected officers and directors of the Company and any of its subsidiaries. The Company has authorized 100,000 membership units of the Company for options to be awarded under the Plan. The compensation committee of the Board of Directors of the Company administers the Plan and has the authority to determine the recipients to whom awards will be made, the terms of the vesting and forfeiture, the amounts of the awards, and other terms.

The Company awarded incentive options to certain employees of the Company, which generally vest over a five-year period or upon change in control, as defined in the option award, with a maximum contractual term of 15 years. The fair value of unit options is estimated as of the date of grant using a Black-Scholes option pricing model. The estimated fair values of the unit options, including the effect of estimated forfeitures, are expensed based on the performance measurements contained in the grants and which are being met by the performance of the Company.

Compensation expense (net of estimated forfeitures) related to awards under the Plan for the period from July 1, 2015 through June 30, 2016 was $1,825. The total unrecognized compensation expense (net of estimated forfeitures) related to non-vested awards, as of June 30, 2016 is $1,850. The weighted average period over which the total unrecognized compensation cost is expected to be recognized is approximately 4 years.

17

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

If there are any modifications or cancellations of the underlying non-vested awards, the Company may be required to accelerate, increase, or cancel any remaining unearned compensation expense. Future compensation expense and unrecognized compensation expense may increase to the extent that additional equity awards are granted. In addition, there are certain exercise restrictions and provisions that could result in an adjustment to the exercise price. Such provisions would be triggered by a change in control or termination of the optionee prior to a change in control as defined by the option agreements.

The fair value of each option grant was estimated on the date of grant using the Black-Scholes option pricing model with the following key assumptions:

Expected term in years | 9.6 years | |

Risk free interest rate | 1.97% | |

Expected volatility | 46.85 | % |

Expected dividend yield | 0% | |

The expected term of the options is based on the expected future employee exercise behavior as the Company does not have sufficient historical transactions of its own. The risk-free interest rate is based on U.S. Treasury rates at date of grant with maturity dates approximating the expected option term at the grant date. Volatility is based on the historical volatility of peer public entities as the Company does not have sufficient historical transactions of its own shares on which to base expected volatility. The Company paid dividends from July 1, 2015 through June 2016 to its owners of record. Because the Company does not have a stated dividend policy, it is not practical to estimate the possibility of the payment of dividends in the future.

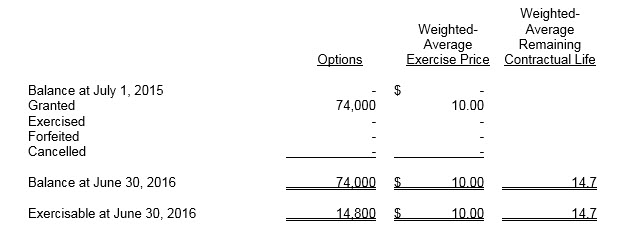

A summary of the activity in the Plan for the period from July 1, 2015 through June 30, 2016 is as follows:

18

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

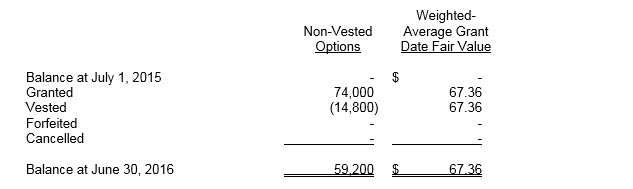

The weighted average fair value of non-vested options for the period from July 1, 2015 through June 30, 2016 is as follows:

NOTE 17 - PROVISION FOR INCOME TAXES

The differences between the income tax provision computed at the statutory federal income tax rate (35 percent) for the fiscal year ended June 30, 2016 are as follows:

Income before income taxes | $10,472 | |||||

Statutory federal income tax rate | 35.0 | % | $3,665 | |||

State income taxes, net of federal income tax benefit | 1.3 | % | 135 | |||

Foreign tax rate differential | 0.8 | % | 88 | |||

Manufacturing deduction | (2.8 | )% | (300 | ) | ||

Income not taxed at partnership level | (3.2 | )% | (340 | ) | ||

Other permanent | 1.5 | % | (34 | ) | ||

30.7 | % | $3,214 | ||||

19

DOWNSTREAM HOLDING, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2016

(Dollars in thousands)

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities at June 30, 2016 are as follows:

Deferred income tax liabilities | |||

Fixed assets | $(5,188) | ||

Accounts receivable | (332 | ) | |

Inventory | (2,540 | ) | |

Intangibles | (2,702 | ) | |

Other | (177 | ) | |

Total Deferred Income Tax Liabilities | $(10,939) | ||

Deferred income tax assets | |||

Accrued expenses | $1,013 | ||

Equity compensation | 650 | ||

Other | 131 | ||

$1,794 | |||

Net deferred income tax asset (liability) | $ | (9,145 | ) |

The provision for income taxes contain a deferred tax benefit of $3,850 and a current tax expense of $7,064.

ASC 740-10 prescribes that a company should use a more-likely-than-not recognition threshold based on the technical merits of the tax position taken. Tax positions that meet the “more-likely-than-not” recognition threshold should be measured as the largest amount of the tax benefits, determined on a cumulative probability basis, which is more likely than not to be realized upon ultimate settlement in the financial statements. We recognize interest and penalties related to income tax matters as a component of the provision for income taxes.

NOTE 18 - SUBSEQUENT EVENTS

The Company has evaluated subsequent events for potential recognition or disclosure through the date these consolidated financial statements were available to be issued.

On October 12, 2016, the Company, entered into an Agreement and Plan of Merger (the “Merger Agreement”) with CIRCOR International, Inc, a Delaware limited liability company (“CIRCOR”).

CIRCOR acquired all of the outstanding units of the Company for $210 million. CIRCOR designs, manufactures and markets flow control solutions and other highly engineered products and sub-systems for markets including oil & gas, power generation, industrial and aerospace & defense. CIRCOR has a diversified product portfolio with recognized, market-leading brands that fulfill its customers’ unique application needs.

20