Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RAYMOND JAMES FINANCIAL INC | a8-k_4q16shareholdersletter.htm |

(1) The Other segment includes the results of our principal capital and private equity activities as well as certain corporate overhead costs of RJF, including the interest costs on our public debt, and the acquisition and integration

costs associated with certain acquisitions.

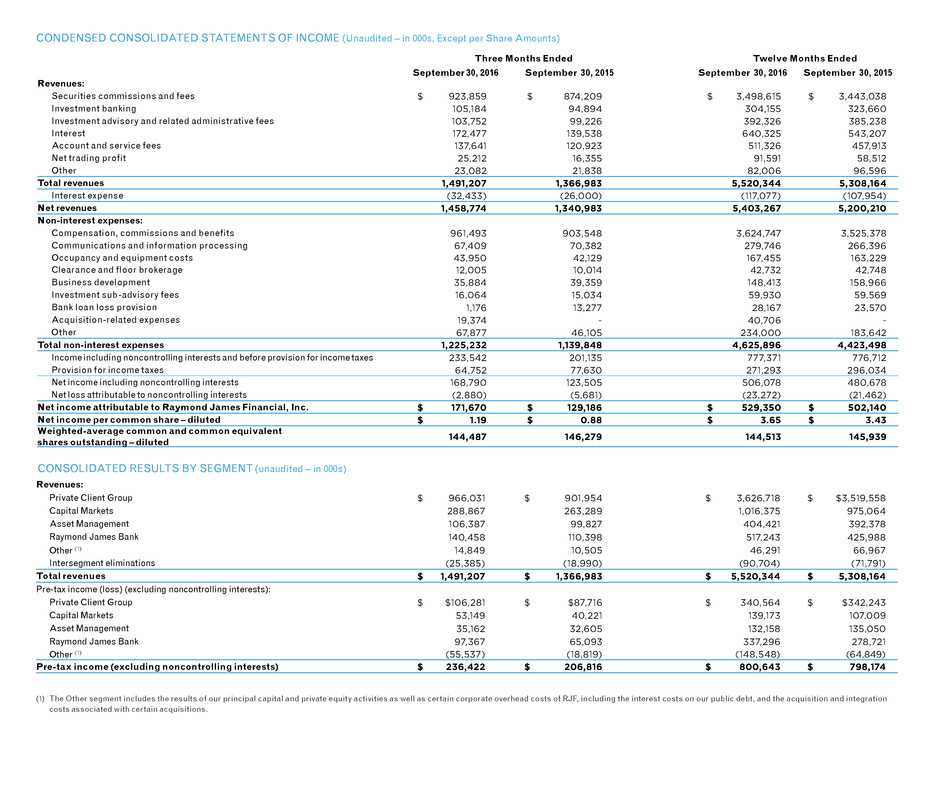

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts)

CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s)

Revenues:

Private Client Group $ 966,031 $ 901,954 $ 3,626,718 $ $3,519,558

Capital Markets 288,867 263,289 1,016,375 975,064

Asset Management 106,387 99,827 404,421 392,378

Raymond James Bank 140,458 110,398 517,243 425,988

Other (1) 14,849 10,505 46,291 66,967

Intersegment eliminations (25,385) (18,990) (90,704) (71,791)

Total revenues $ 1,491,207 $ 1,366,983 $ 5,520,344 $ 5,308,164

Pre-tax income (loss) (excluding noncontrolling interests):

Private Client Group $ $106,281 $ $87,716 $ 340,564 $ $342,243

Capital Markets 53,149 40,221 139,173 107,009

Asset Management 35,162 32,605 132,158 135,050

Raymond James Bank 97,367 65,093 337,296 278,721

Other (1) (55,537) (18,819) (148,548) (64,849)

Pre-tax income (excluding noncontrolling interests) $ 236,422 $ 206,816 $ 800,643 $ 798,174

Three Months Ended Twelve Months Ended

September 30, 2016 September 30, 2015 September 30, 2016 September 30, 2015

Revenues:

Securities commissions and fees $ 923,859 $ 874,209 $ 3,498,615 $ 3,443,038

Investment banking 105,184 94,894 304,155 323,660

Investment advisory and related administrative fees 103,752 99,226 392,326 385,238

Interest 172,477 139,538 640,325 543,207

Account and service fees 137,641 120,923 511,326 457,913

Net trading profit 25,212 16,355 91,591 58,512

Other 23,082 21,838 82,006 96,596

Total revenues 1,491,207 1,366,983 5,520,344 5,308,164

Interest expense (32,433) (26,000) (117,077) (107,954)

Net revenues 1,458,774 1,340,983 5,403,267 5,200,210

Non-interest expenses:

Compensation, commissions and benefits 961,493 903,548 3,624,747 3,525,378

Communications and information processing 67,409 70,382 279,746 266,396

Occupancy and equipment costs 43,950 42,129 167,455 163,229

Clearance and floor brokerage 12,005 10,014 42,732 42,748

Business development 35,884 39,359 148,413 158,966

Investment sub-advisory fees 16,064 15,034 59,930 59,569

Bank loan loss provision 1,176 13,277 28,167 23,570

Acquisition-related expenses 19,374 - 40,706 -

Other 67,877 46,105 234,000 183,642

Total non-interest expenses 1,225,232 1,139,848 4,625,896 4,423,498

Income including noncontrolling interests and before provision for income taxes 233,542 201,135 777,371 776,712

Provision for income taxes 64,752 77,630 271,293 296,034

Net income including noncontrolling interests 168,790 123,505 506,078 480,678

Net loss attributable to noncontrolling interests (2,880) (5,681) (23,272) (21,462)

Net income attributable to Raymond James Financial, Inc. $ 171,670 $ 129,186 $ 529,350 $ 502,140

Net income per common share – diluted $ 1.19 $ 0.88 $ 3.65 $ 3.43

Weighted-average common and common equivalent

shares outstanding – diluted 144,487 146,279 144,513 145,939

International Headquarters:

The Raymond James Financial Center

880 Carillon Parkway // St. Petersburg, FL 33716

800.248.8863 // raymondjames.com

©2016 Raymond James Financial

Raymond James® is a registered trademark of Raymond James Financial, Inc.

15-Fin-Rep-0018 KF 12/16

Stock Traded: NEW YORK STOCK EXCHANGE

Stock Symbol: RJF

corporate profile

Raymond James Financial, Inc. (NYSE: RJF) is a leading

diversified financial services company providing

private client, capital markets, asset management,

banking and other services to individuals, corporations

and municipalities. Its three principal wholly owned

broker/dealers, Raymond James & Associates, Raymond

James Financial Services and Raymond James Ltd.,

have approximately 7,100 financial advisors serving

in excess of 2.9 million client accounts in more than

2,800 locations throughout the United States, Canada

and overseas. Total client assets are approximately

$604 billion. Public since 1983, the firm has been listed

on the New York Stock Exchange since 1986 under the

symbol RJF. Additional information is available at

raymondjames.com.

2016

F O U R T H Q U A R T E R

CHANGE

GROWTH

OPPORTUNITY

HEADWINDS

REGULATION

EXPLORATION

UNPREDICTABILITY

INVESTING WISELY

LIVING WELL

MOBILITY

2

1 6

Dear Fellow Shareholders,

Obviously, news related to the election dominated the

fiscal fourth quarter. Economic data exhibited erratic

behavior, but annual GDP growth continued to average

around 2% during the year. While interest rate concerns

were the primary economic focus, essentially nothing

happened even though the majority of annual metrics

supported an increase, which is expected later this month.

At the same time, the Department of Labor’s (DOL)

proposed fiduciary rule engendered discussions at

financial firms with substantial private client businesses

like Raymond James. Unfortunately, the DOL hasn’t

provided enough details for firms to formulate solutions

and modify necessary support software. Moreover, the

combination of election and economic uncertainty for

firms and investors has dampened activity. These issues,

compounded by the amount of effort associated with two

acquisitions, have made this a difficult year. Nonetheless,

in retrospect, we would pronounce it successful as the

following financial results demonstrate.

Raymond James Financial generated record net revenues

and record net income in our fiscal fourth quarter ended

September 30, 2016. Quarterly net revenues of $1.46 billion

increased 9% over the prior year’s fiscal fourth quarter and

7% over the preceding quarter. Quarterly net income of

$171.7 million catapulted 33% over the prior year’s fiscal

fourth quarter and 37% over the preceding quarter,

achieving a new record despite absorbing $19.4 million of

acquisition-related expenses during the quarter. Record

quarterly results were fueled by record quarterly net

revenues in all four of our core operating segments as well

as record quarterly pre-tax income in the Private Client

Group segment, Capital Markets segment and Raymond

James Bank. Net income was also augmented by an

unusually low effective tax rate for the quarter of 27.4%,

which was driven mainly by favorable tax adjustments

associated with credits arising from the planned

divestitures of our remaining businesses in South America,

large nontaxable gains on the firm’s corporate-owned life

insurance portfolio and the favorable resolution of certain

state tax issues. The annualized return on equity for the

quarter was an outstanding 14.2%, and the pre-tax margin

on net revenues for the quarter was 16.2%, exceeding our

15-16% target.

In addition to generating excellent financial results

during the quarter, we also closed on two acquisitions –

Deutsche Bank Wealth Management’s US Private Client

Services unit (rebranded as “Alex. Brown,” a division of

Raymond James) and MacDougall, MacDougall & MacTier,

Inc. (“3Macs”), a Montreal-based Canadian broker/dealer

founded in 1849. Alex. Brown significantly expands our

presence in several attractive markets, particularly in the Mid-

Atlantic and Northeast as well as in the high net worth

segments. 3Macs bolsters our market position in Canada. The

retention of advisors from both transactions was tremendous,

with over 90% of Alex. Brown advisors and all of the 3Macs

advisors remaining with Raymond James thus far, resulting in

the addition of 265 Private Group financial advisors with

assets under administration of approximately $50 billion. We

are delighted to welcome these high-quality advisors and their

teams as well as their talented management leaders and

support staff to the Raymond James family! We don’t believe

that these acquisitions will materially impact net income in

fiscal 2017 as we experience the expenses associated with

integrating the businesses.

Turning to results of the individual segments, the Private

Client Group (PCG) produced record quarterly net revenues of

$963.3 million, up 7% compared to both the prior year’s fiscal

fourth quarter and the preceding quarter. Quarterly pre-tax

income of $106.3 million also reached a record, reflecting

significant growth of 21% on a year-over-year basis and 30% on

a sequential basis. The record results during the quarter were

primarily attributable to starting the period with higher assets

in fee-based accounts as well as increased fees earned on

client cash balances in the Raymond James Bank Deposit

Program. Private Client Group financial advisors increased by

550 over last year’s September to a record 7,146, and Private

Client Group assets under administration also reached a

record of $574.1 billion, a substantial 27% increase during the

same period. While these metrics were bolstered by the

aforementioned acquisitions, they still would have ended the

quarter at record levels excluding the benefit from those

acquisitions as the metrics were organically driven by best-in-

class financial advisor recruiting and retention results.

The Capital Markets (CM) segment also delivered record

quarterly results, with net revenues of $284.7 million increasing

10% over last year’s fiscal fourth quarter and 13% sequentially

from the June quarter. Pre-tax income of $53.1 million soared

32% over last year’s fiscal fourth quarter and 62% from the prior

quarter. Record quarterly results were lifted by a broad-based

improvement in investment banking revenues, which increased

11% over last year’s September quarter and 45% over the

preceding quarter, as well as strong institutional commissions

and net trading profits in the Fixed Income division. Raymond

James Tax Credit Funds also contributed substantial growth in

net revenues and pre-tax income.

The Asset Management segment generated record

quarterly net revenues of $106.4 million, up 7% over last year’s

fiscal fourth quarter and 5% over the preceding quarter.

Quarterly pre-tax income of $35.2 million increased 8% over

both the prior year’s fiscal fourth quarter and the preceding

SEPTEMBER 30,

2016

SEPTEMBER 30,

2015

Assets:

Cash and cash equivalents $1,650,452 $2,601,006

Assets segregated pursuant

to regulations and other

segregated assets

4,889,584 2,905,324

Securities purchased

under agreements to resell

and other collateralized

financings

470,222 474,144

Financial instruments 2,539,877 2,051,577

Receivables 4,505,124 3,447,319

Bank loans, net 15,210,735 12,988,021

Property & equipment, net 321,457 255,875

Other assets 2,006,282 1,744,766

Total assets $31,593,733 $26,468,032

Liabilities and equity:

Trading instruments sold

but not yet purchased 328,938 287,993

Securities sold under

agreements to repurchase 193,229 332,536

Payables 8,019,111 6,042,945

Bank deposits 14,262,547 11,919,881

Other debt 621,255 729,025

Senior notes payable 1,680,587 1,137,570

Other liabilities 1,338,150 1,231,984

Total liabilities $26,443,817 $21,681,934

Total equity attributable to

Raymond James Financial, Inc. 4,914,096 4,522,031

Noncontrolling interests 235,820 264,067

Total equity $5,149,916 $4,786,098

Total liabilities and equity $31,593,733 $26,468,032

CONDENSED CONSOLIDATED STATEMENTS

OF FINANCIAL CONDITION (Unaudited – in 000s)

RAYMOND JAMES FINANCIAL FOURTH QUARTER REPORT 2016

Sincerely,

Thomas A. James Paul C. Reilly

Chairman CEO

December 10, 2016

quarter. Results in the Asset Management segment continue

to benefit from growth in financial assets under management,

which ended the quarter at a record $77.0 billion, an increase

of 18% compared to September 2015 and 7% compared to

June 2016. The growth in financial assets under management

during the quarter was largely attributable to strong net

inflows in managed fee-based accounts in the Private Client

Group, market appreciation and the aforementioned

acquisitions, which added approximately $2 billion.

Raymond James Bank also had an excellent quarter, with

record quarterly net revenues of $133.7 million and record

quarterly pre-tax income of $97.4 million. Net revenues and

pre-tax income jumped 25% and 50%, respectively, over last

year’s fiscal fourth quarter. Net loans at Raymond James

Bank ended the quarter at a record $15.2 billion, reflecting

growth of 17% over September 2015 and 3% over the preceding

quarter. Importantly, the loan growth continues to be

supported by a focus on providing lending solutions to

strengthen client relationships in the PCG and CM segments.

The bank loan loss provision of $1.2 million for the quarter

was low relative to the net loan growth, as repayments of

criticized loans, particularly within the energy portfolio, offset

a portion of the provisions associated with net loan growth

and new downgrades during the quarter.

Total revenues in the Other segment were $14.8 million,

rising 41% compared to last year’s fiscal fourth quarter due to

higher interest earnings on firm cash balances, but down 14%

compared to the preceding quarter, which included a large

valuation gain attributable to private equity investments. The

pre-tax income in the Other segment was negatively impacted

by the aforementioned $19.4 million of acquisition-related

expenses as well as additional interest expense associated

with the successful senior notes issuance totaling $800 million

in aggregate principal amount, which closed on July 12.

The record fourth quarter results reported above

culminated in new records in annual results for fiscal 2016.

Net revenues increased 4% to $5.4 billion. Net income for

fiscal 2016 rose by 5% to $529 million. Diluted earnings per

share were $3.65, up from $3.43 last year, despite the difficult

market conditions earlier in the year. The annual after-tax

margin on net revenues was 9.8%. The annual return on

average equity was 11.3%, down slightly from last year’s

11.5% even though regulatory expenses have increased

dramatically during the year and we absorbed $41 million in

acquisition costs related to the Alex. Brown and 3Macs

transactions. On September 30, 2016, the book value per

share was $34.72, up from $31.68 last year.

There were several other notable accomplishments during

the quarter. In August, 11 Raymond James advisors were

named to the Forbes list of America’s Top Wealth Advisors,

and four Raymond James-affiliated advisors were named to

the Barron’s Top 100 Independent Wealth Advisors list. In

September, seven Raymond James-affiliated advisors were

named to the Financial Times “FT 401” list of top retirement

advisors. Finally, Raymond James Client Reporting was

named a winner in WealthManagement.com’s 2016 Industry

Awards during the quarter.

Although there were large support groups for both

presidential candidates, many voters didn’t appreciate the

choices with which they were presented. Moreover, they

were turned off by the process, which was largely non-issue

related and punctuated with a surfeit of vitriolic rhetoric.

Furthermore, Wall Street evidenced a lot of fear of a Trump

victory, as it concluded a major stock market decline would

ensue. Of course, we all now know that Hillary Clinton won

the highest vote total and Donald Trump is the president-

elect. Once again, market pundits’ prognostications were

also proven dead wrong as the market has risen

dramatically since.

In the cold light of the reaction to election results, it is

abundantly clear that the resultant legislative agenda was

considered positive by investors. In fact, prospects for the

enactment of a reduction in the corporate tax rate, a

replacement or substantial rewrite of Obamacare, a

material infrastructure spending bill, a reduction of

burdensome governmental regulation and perhaps

improved economic trade agreements suggest that the

outlook for faster rates of economic growth, increased

employment and higher stock prices is better. However,

knowledge of the tedious legislative process and the

complexities of the political process inform us to expect

that results will take time to achieve. In fact, not all the

expectations of the optimists will be realized even with the

Republicans controlling the administration, the House and

the Senate. Given the requirements of super-majorities to

enact some legislation and the absence of unanimity in

either party, compromises will be required.

Nonetheless, it is probable that some major changes will

be implemented. Those favorable changes will be magnified

by a number of economic factors that are already in place.

Growth in the United States, albeit slow and erratic, is

about to be joined by improved conditions globally. A return

to a slow introduction of interest rate increases will remove

uncertainty, restore the Fed’s capability to deal with the

next recession and not derail economic growth. The United

States is energy self-sufficient, and prices should remain at

reasonable levels as producers adjust production for price

changes. Inflation is still low but at more desirable levels.

The scenario above appears to be salubrious for the

financial services industry. A slow rise in interest rates will

benefit Raymond James as will an increased economic

growth rate that will spawn more earnings growth and

corporate demand for capital. Investors will be rewarded

with more capital gains, although buyers need to be

selective in light of the new highs in the U.S. equity markets.

We wish all of our clients, our employees, shareholders

and communities Happy Holidays, Merry Christmas and a

prosperous New Year!

Dear Fellow Shareholders,

Obviously, news related to the election dominated the

fiscal fourth quarter. Economic data exhibited erratic

behavior, but annual GDP growth continued to average

around 2% during the year. While interest rate concerns

were the primary economic focus, essentially nothing

happened even though the majority of annual metrics

supported an increase, which is expected later this month.

At the same time, the Department of Labor’s (DOL)

proposed fiduciary rule engendered discussions at

financial firms with substantial private client businesses

like Raymond James. Unfortunately, the DOL hasn’t

provided enough details for firms to formulate solutions

and modify necessary support software. Moreover, the

combination of election and economic uncertainty for

firms and investors has dampened activity. These issues,

compounded by the amount of effort associated with two

acquisitions, have made this a difficult year. Nonetheless,

in retrospect, we would pronounce it successful as the

following financial results demonstrate.

Raymond James Financial generated record net revenues

and record net income in our fiscal fourth quarter ended

September 30, 2016. Quarterly net revenues of $1.46 billion

increased 9% over the prior year’s fiscal fourth quarter and

7% over the preceding quarter. Quarterly net income of

$171.7 million catapulted 33% over the prior year’s fiscal

fourth quarter and 37% over the preceding quarter,

achieving a new record despite absorbing $19.4 million of

acquisition-related expenses during the quarter. Record

quarterly results were fueled by record quarterly net

revenues in all four of our core operating segments as well

as record quarterly pre-tax income in the Private Client

Group segment, Capital Markets segment and Raymond

James Bank. Net income was also augmented by an

unusually low effective tax rate for the quarter of 27.4%,

which was driven mainly by favorable tax adjustments

associated with credits arising from the planned

divestitures of our remaining businesses in South America,

large nontaxable gains on the firm’s corporate-owned life

insurance portfolio and the favorable resolution of certain

state tax issues. The annualized return on equity for the

quarter was an outstanding 14.2%, and the pre-tax margin

on net revenues for the quarter was 16.2%, exceeding our

15-16% target.

In addition to generating excellent financial results

during the quarter, we also closed on two acquisitions –

Deutsche Bank Wealth Management’s US Private Client

Services unit (rebranded as “Alex. Brown,” a division of

Raymond James) and MacDougall, MacDougall & MacTier,

Inc. (“3Macs”), a Montreal-based Canadian broker/dealer

founded in 1849. Alex. Brown significantly expands our

presence in several attractive markets, particularly in the Mid-

Atlantic and Northeast as well as in the high net worth

segments. 3Macs bolsters our market position in Canada. The

retention of advisors from both transactions was tremendous,

with over 90% of Alex. Brown advisors and all of the 3Macs

advisors remaining with Raymond James thus far, resulting in

the addition of 265 Private Group financial advisors with

assets under administration of approximately $50 billion. We

are delighted to welcome these high-quality advisors and their

teams as well as their talented management leaders and

support staff to the Raymond James family! We don’t believe

that these acquisitions will materially impact net income in

fiscal 2017 as we experience the expenses associated with

integrating the businesses.

Turning to results of the individual segments, the Private

Client Group (PCG) produced record quarterly net revenues of

$963.3 million, up 7% compared to both the prior year’s fiscal

fourth quarter and the preceding quarter. Quarterly pre-tax

income of $106.3 million also reached a record, reflecting

significant growth of 21% on a year-over-year basis and 30% on

a sequential basis. The record results during the quarter were

primarily attributable to starting the period with higher assets

in fee-based accounts as well as increased fees earned on

client cash balances in the Raymond James Bank Deposit

Program. Private Client Group financial advisors increased by

550 over last year’s September to a record 7,146, and Private

Client Group assets under administration also reached a

record of $574.1 billion, a substantial 27% increase during the

same period. While these metrics were bolstered by the

aforementioned acquisitions, they still would have ended the

quarter at record levels excluding the benefit from those

acquisitions as the metrics were organically driven by best-in-

class financial advisor recruiting and retention results.

The Capital Markets (CM) segment also delivered record

quarterly results, with net revenues of $284.7 million increasing

10% over last year’s fiscal fourth quarter and 13% sequentially

from the June quarter. Pre-tax income of $53.1 million soared

32% over last year’s fiscal fourth quarter and 62% from the prior

quarter. Record quarterly results were lifted by a broad-based

improvement in investment banking revenues, which increased

11% over last year’s September quarter and 45% over the

preceding quarter, as well as strong institutional commissions

and net trading profits in the Fixed Income division. Raymond

James Tax Credit Funds also contributed substantial growth in

net revenues and pre-tax income.

The Asset Management segment generated record

quarterly net revenues of $106.4 million, up 7% over last year’s

fiscal fourth quarter and 5% over the preceding quarter.

Quarterly pre-tax income of $35.2 million increased 8% over

both the prior year’s fiscal fourth quarter and the preceding

SEPTEMBER 30,

2016

SEPTEMBER 30,

2015

Assets:

Cash and cash equivalents $1,650,452 $2,601,006

Assets segregated pursuant

to regulations and other

segregated assets

4,889,584 2,905,324

Securities purchased

under agreements to resell

and other collateralized

financings

470,222 474,144

Financial instruments 2,539,877 2,051,577

Receivables 4,505,124 3,447,319

Bank loans, net 15,210,735 12,988,021

Property & equipment, net 321,457 255,875

Other assets 2,006,282 1,744,766

Total assets $31,593,733 $26,468,032

Liabilities and equity:

Trading instruments sold

but not yet purchased 328,938 287,993

Securities sold under

agreements to repurchase 193,229 332,536

Payables 8,019,111 6,042,945

Bank deposits 14,262,547 11,919,881

Other debt 621,255 729,025

Senior notes payable 1,680,587 1,137,570

Other liabilities 1,338,150 1,231,984

Total liabilities $26,443,817 $21,681,934

Total equity attributable to

Raymond James Financial, Inc. 4,914,096 4,522,031

Noncontrolling interests 235,820 264,067

Total equity $5,149,916 $4,786,098

Total liabilities and equity $31,593,733 $26,468,032

CONDENSED CONSOLIDATED STATEMENTS

OF FINANCIAL CONDITION (Unaudited – in 000s)

RAYMOND JAMES FINANCIAL FOURTH QUARTER REPORT 2016

Sincerely,

Thomas A. James Paul C. Reilly

Chairman CEO

December 10, 2016

quarter. Results in the Asset Management segment continue

to benefit from growth in financial assets under management,

which ended the quarter at a record $77.0 billion, an increase

of 18% compared to September 2015 and 7% compared to

June 2016. The growth in financial assets under management

during the quarter was largely attributable to strong net

inflows in managed fee-based accounts in the Private Client

Group, market appreciation and the aforementioned

acquisitions, which added approximately $2 billion.

Raymond James Bank also had an excellent quarter, with

record quarterly net revenues of $133.7 million and record

quarterly pre-tax income of $97.4 million. Net revenues and

pre-tax income jumped 25% and 50%, respectively, over last

year’s fiscal fourth quarter. Net loans at Raymond James

Bank ended the quarter at a record $15.2 billion, reflecting

growth of 17% over September 2015 and 3% over the preceding

quarter. Importantly, the loan growth continues to be

supported by a focus on providing lending solutions to

strengthen client relationships in the PCG and CM segments.

The bank loan loss provision of $1.2 million for the quarter

was low relative to the net loan growth, as repayments of

criticized loans, particularly within the energy portfolio, offset

a portion of the provisions associated with net loan growth

and new downgrades during the quarter.

Total revenues in the Other segment were $14.8 million,

rising 41% compared to last year’s fiscal fourth quarter due to

higher interest earnings on firm cash balances, but down 14%

compared to the preceding quarter, which included a large

valuation gain attributable to private equity investments. The

pre-tax income in the Other segment was negatively impacted

by the aforementioned $19.4 million of acquisition-related

expenses as well as additional interest expense associated

with the successful senior notes issuance totaling $800 million

in aggregate principal amount, which closed on July 12.

The record fourth quarter results reported above

culminated in new records in annual results for fiscal 2016.

Net revenues increased 4% to $5.4 billion. Net income for

fiscal 2016 rose by 5% to $529 million. Diluted earnings per

share were $3.65, up from $3.43 last year, despite the difficult

market conditions earlier in the year. The annual after-tax

margin on net revenues was 9.8%. The annual return on

average equity was 11.3%, down slightly from last year’s

11.5% even though regulatory expenses have increased

dramatically during the year and we absorbed $41 million in

acquisition costs related to the Alex. Brown and 3Macs

transactions. On September 30, 2016, the book value per

share was $34.72, up from $31.68 last year.

There were several other notable accomplishments during

the quarter. In August, 11 Raymond James advisors were

named to the Forbes list of America’s Top Wealth Advisors,

and four Raymond James-affiliated advisors were named to

the Barron’s Top 100 Independent Wealth Advisors list. In

September, seven Raymond James-affiliated advisors were

named to the Financial Times “FT 401” list of top retirement

advisors. Finally, Raymond James Client Reporting was

named a winner in WealthManagement.com’s 2016 Industry

Awards during the quarter.

Although there were large support groups for both

presidential candidates, many voters didn’t appreciate the

choices with which they were presented. Moreover, they

were turned off by the process, which was largely non-issue

related and punctuated with a surfeit of vitriolic rhetoric.

Furthermore, Wall Street evidenced a lot of fear of a Trump

victory, as it concluded a major stock market decline would

ensue. Of course, we all now know that Hillary Clinton won

the highest vote total and Donald Trump is the president-

elect. Once again, market pundits’ prognostications were

also proven dead wrong as the market has risen

dramatically since.

In the cold light of the reaction to election results, it is

abundantly clear that the resultant legislative agenda was

considered positive by investors. In fact, prospects for the

enactment of a reduction in the corporate tax rate, a

replacement or substantial rewrite of Obamacare, a

material infrastructure spending bill, a reduction of

burdensome governmental regulation and perhaps

improved economic trade agreements suggest that the

outlook for faster rates of economic growth, increased

employment and higher stock prices is better. However,

knowledge of the tedious legislative process and the

complexities of the political process inform us to expect

that results will take time to achieve. In fact, not all the

expectations of the optimists will be realized even with the

Republicans controlling the administration, the House and

the Senate. Given the requirements of super-majorities to

enact some legislation and the absence of unanimity in

either party, compromises will be required.

Nonetheless, it is probable that some major changes will

be implemented. Those favorable changes will be magnified

by a number of economic factors that are already in place.

Growth in the United States, albeit slow and erratic, is

about to be joined by improved conditions globally. A return

to a slow introduction of interest rate increases will remove

uncertainty, restore the Fed’s capability to deal with the

next recession and not derail economic growth. The United

States is energy self-sufficient, and prices should remain at

reasonable levels as producers adjust production for price

changes. Inflation is still low but at more desirable levels.

The scenario above appears to be salubrious for the

financial services industry. A slow rise in interest rates will

benefit Raymond James as will an increased economic

growth rate that will spawn more earnings growth and

corporate demand for capital. Investors will be rewarded

with more capital gains, although buyers need to be

selective in light of the new highs in the U.S. equity markets.

We wish all of our clients, our employees, shareholders

and communities Happy Holidays, Merry Christmas and a

prosperous New Year!

Dear Fellow Shareholders,

Obviously, news related to the election dominated the

fiscal fourth quarter. Economic data exhibited erratic

behavior, but annual GDP growth continued to average

around 2% during the year. While interest rate concerns

were the primary economic focus, essentially nothing

happened even though the majority of annual metrics

supported an increase, which is expected later this month.

At the same time, the Department of Labor’s (DOL)

proposed fiduciary rule engendered discussions at

financial firms with substantial private client businesses

like Raymond James. Unfortunately, the DOL hasn’t

provided enough details for firms to formulate solutions

and modify necessary support software. Moreover, the

combination of election and economic uncertainty for

firms and investors has dampened activity. These issues,

compounded by the amount of effort associated with two

acquisitions, have made this a difficult year. Nonetheless,

in retrospect, we would pronounce it successful as the

following financial results demonstrate.

Raymond James Financial generated record net revenues

and record net income in our fiscal fourth quarter ended

September 30, 2016. Quarterly net revenues of $1.46 billion

increased 9% over the prior year’s fiscal fourth quarter and

7% over the preceding quarter. Quarterly net income of

$171.7 million catapulted 33% over the prior year’s fiscal

fourth quarter and 37% over the preceding quarter,

achieving a new record despite absorbing $19.4 million of

acquisition-related expenses during the quarter. Record

quarterly results were fueled by record quarterly net

revenues in all four of our core operating segments as well

as record quarterly pre-tax income in the Private Client

Group segment, Capital Markets segment and Raymond

James Bank. Net income was also augmented by an

unusually low effective tax rate for the quarter of 27.4%,

which was driven mainly by favorable tax adjustments

associated with credits arising from the planned

divestitures of our remaining businesses in South America,

large nontaxable gains on the firm’s corporate-owned life

insurance portfolio and the favorable resolution of certain

state tax issues. The annualized return on equity for the

quarter was an outstanding 14.2%, and the pre-tax margin

on net revenues for the quarter was 16.2%, exceeding our

15-16% target.

In addition to generating excellent financial results

during the quarter, we also closed on two acquisitions –

Deutsche Bank Wealth Management’s US Private Client

Services unit (rebranded as “Alex. Brown,” a division of

Raymond James) and MacDougall, MacDougall & MacTier,

Inc. (“3Macs”), a Montreal-based Canadian broker/dealer

founded in 1849. Alex. Brown significantly expands our

presence in several attractive markets, particularly in the Mid-

Atlantic and Northeast as well as in the high net worth

segments. 3Macs bolsters our market position in Canada. The

retention of advisors from both transactions was tremendous,

with over 90% of Alex. Brown advisors and all of the 3Macs

advisors remaining with Raymond James thus far, resulting in

the addition of 265 Private Group financial advisors with

assets under administration of approximately $50 billion. We

are delighted to welcome these high-quality advisors and their

teams as well as their talented management leaders and

support staff to the Raymond James family! We don’t believe

that these acquisitions will materially impact net income in

fiscal 2017 as we experience the expenses associated with

integrating the businesses.

Turning to results of the individual segments, the Private

Client Group (PCG) produced record quarterly net revenues of

$963.3 million, up 7% compared to both the prior year’s fiscal

fourth quarter and the preceding quarter. Quarterly pre-tax

income of $106.3 million also reached a record, reflecting

significant growth of 21% on a year-over-year basis and 30% on

a sequential basis. The record results during the quarter were

primarily attributable to starting the period with higher assets

in fee-based accounts as well as increased fees earned on

client cash balances in the Raymond James Bank Deposit

Program. Private Client Group financial advisors increased by

550 over last year’s September to a record 7,146, and Private

Client Group assets under administration also reached a

record of $574.1 billion, a substantial 27% increase during the

same period. While these metrics were bolstered by the

aforementioned acquisitions, they still would have ended the

quarter at record levels excluding the benefit from those

acquisitions as the metrics were organically driven by best-in-

class financial advisor recruiting and retention results.

The Capital Markets (CM) segment also delivered record

quarterly results, with net revenues of $284.7 million increasing

10% over last year’s fiscal fourth quarter and 13% sequentially

from the June quarter. Pre-tax income of $53.1 million soared

32% over last year’s fiscal fourth quarter and 62% from the prior

quarter. Record quarterly results were lifted by a broad-based

improvement in investment banking revenues, which increased

11% over last year’s September quarter and 45% over the

preceding quarter, as well as strong institutional commissions

and net trading profits in the Fixed Income division. Raymond

James Tax Credit Funds also contributed substantial growth in

net revenues and pre-tax income.

The Asset Management segment generated record

quarterly net revenues of $106.4 million, up 7% over last year’s

fiscal fourth quarter and 5% over the preceding quarter.

Quarterly pre-tax income of $35.2 million increased 8% over

both the prior year’s fiscal fourth quarter and the preceding

SEPTEMBER 30,

2016

SEPTEMBER 30,

2015

Assets:

Cash and cash equivalents $1,650,452 $2,601,006

Assets segregated pursuant

to regulations and other

segregated assets

4,889,584 2,905,324

Securities purchased

under agreements to resell

and other collateralized

financings

470,222 474,144

Financial instruments 2,539,877 2,051,577

Receivables 4,505,124 3,447,319

Bank loans, net 15,210,735 12,988,021

Property & equipment, net 321,457 255,875

Other assets 2,006,282 1,744,766

Total assets $31,593,733 $26,468,032

Liabilities and equity:

Trading instruments sold

but not yet purchased 328,938 287,993

Securities sold under

agreements to repurchase 193,229 332,536

Payables 8,019,111 6,042,945

Bank deposits 14,262,547 11,919,881

Other debt 621,255 729,025

Senior notes payable 1,680,587 1,137,570

Other liabilities 1,338,150 1,231,984

Total liabilities $26,443,817 $21,681,934

Total equity attributable to

Raymond James Financial, Inc. 4,914,096 4,522,031

Noncontrolling interests 235,820 264,067

Total equity $5,149,916 $4,786,098

Total liabilities and equity $31,593,733 $26,468,032

CONDENSED CONSOLIDATED STATEMENTS

OF FINANCIAL CONDITION (Unaudited – in 000s)

RAYMOND JAMES FINANCIAL FOURTH QUARTER REPORT 2016

Sincerely,

Thomas A. James Paul C. Reilly

Chairman CEO

December 10, 2016

quarter. Results in the Asset Management segment continue

to benefit from growth in financial assets under management,

which ended the quarter at a record $77.0 billion, an increase

of 18% compared to September 2015 and 7% compared to

June 2016. The growth in financial assets under management

during the quarter was largely attributable to strong net

inflows in managed fee-based accounts in the Private Client

Group, market appreciation and the aforementioned

acquisitions, which added approximately $2 billion.

Raymond James Bank also had an excellent quarter, with

record quarterly net revenues of $133.7 million and record

quarterly pre-tax income of $97.4 million. Net revenues and

pre-tax income jumped 25% and 50%, respectively, over last

year’s fiscal fourth quarter. Net loans at Raymond James

Bank ended the quarter at a record $15.2 billion, reflecting

growth of 17% over September 2015 and 3% over the preceding

quarter. Importantly, the loan growth continues to be

supported by a focus on providing lending solutions to

strengthen client relationships in the PCG and CM segments.

The bank loan loss provision of $1.2 million for the quarter

was low relative to the net loan growth, as repayments of

criticized loans, particularly within the energy portfolio, offset

a portion of the provisions associated with net loan growth

and new downgrades during the quarter.

Total revenues in the Other segment were $14.8 million,

rising 41% compared to last year’s fiscal fourth quarter due to

higher interest earnings on firm cash balances, but down 14%

compared to the preceding quarter, which included a large

valuation gain attributable to private equity investments. The

pre-tax income in the Other segment was negatively impacted

by the aforementioned $19.4 million of acquisition-related

expenses as well as additional interest expense associated

with the successful senior notes issuance totaling $800 million

in aggregate principal amount, which closed on July 12.

The record fourth quarter results reported above

culminated in new records in annual results for fiscal 2016.

Net revenues increased 4% to $5.4 billion. Net income for

fiscal 2016 rose by 5% to $529 million. Diluted earnings per

share were $3.65, up from $3.43 last year, despite the difficult

market conditions earlier in the year. The annual after-tax

margin on net revenues was 9.8%. The annual return on

average equity was 11.3%, down slightly from last year’s

11.5% even though regulatory expenses have increased

dramatically during the year and we absorbed $41 million in

acquisition costs related to the Alex. Brown and 3Macs

transactions. On September 30, 2016, the book value per

share was $34.72, up from $31.68 last year.

There were several other notable accomplishments during

the quarter. In August, 11 Raymond James advisors were

named to the Forbes list of America’s Top Wealth Advisors,

and four Raymond James-affiliated advisors were named to

the Barron’s Top 100 Independent Wealth Advisors list. In

September, seven Raymond James-affiliated advisors were

named to the Financial Times “FT 401” list of top retirement

advisors. Finally, Raymond James Client Reporting was

named a winner in WealthManagement.com’s 2016 Industry

Awards during the quarter.

Although there were large support groups for both

presidential candidates, many voters didn’t appreciate the

choices with which they were presented. Moreover, they

were turned off by the process, which was largely non-issue

related and punctuated with a surfeit of vitriolic rhetoric.

Furthermore, Wall Street evidenced a lot of fear of a Trump

victory, as it concluded a major stock market decline would

ensue. Of course, we all now know that Hillary Clinton won

the highest vote total and Donald Trump is the president-

elect. Once again, market pundits’ prognostications were

also proven dead wrong as the market has risen

dramatically since.

In the cold light of the reaction to election results, it is

abundantly clear that the resultant legislative agenda was

considered positive by investors. In fact, prospects for the

enactment of a reduction in the corporate tax rate, a

replacement or substantial rewrite of Obamacare, a

material infrastructure spending bill, a reduction of

burdensome governmental regulation and perhaps

improved economic trade agreements suggest that the

outlook for faster rates of economic growth, increased

employment and higher stock prices is better. However,

knowledge of the tedious legislative process and the

complexities of the political process inform us to expect

that results will take time to achieve. In fact, not all the

expectations of the optimists will be realized even with the

Republicans controlling the administration, the House and

the Senate. Given the requirements of super-majorities to

enact some legislation and the absence of unanimity in

either party, compromises will be required.

Nonetheless, it is probable that some major changes will

be implemented. Those favorable changes will be magnified

by a number of economic factors that are already in place.

Growth in the United States, albeit slow and erratic, is

about to be joined by improved conditions globally. A return

to a slow introduction of interest rate increases will remove

uncertainty, restore the Fed’s capability to deal with the

next recession and not derail economic growth. The United

States is energy self-sufficient, and prices should remain at

reasonable levels as producers adjust production for price

changes. Inflation is still low but at more desirable levels.

The scenario above appears to be salubrious for the

financial services industry. A slow rise in interest rates will

benefit Raymond James as will an increased economic

growth rate that will spawn more earnings growth and

corporate demand for capital. Investors will be rewarded

with more capital gains, although buyers need to be

selective in light of the new highs in the U.S. equity markets.

We wish all of our clients, our employees, shareholders

and communities Happy Holidays, Merry Christmas and a

prosperous New Year!

(1) The Other segment includes the results of our principal capital and private equity activities as well as certain corporate overhead costs of RJF, including the interest costs on our public debt, and the acquisition and integration

costs associated with certain acquisitions.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts)

CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s)

Revenues:

Private Client Group $ 966,031 $ 901,954 $ 3,626,718 $ $3,519,558

Capital Markets 288,867 263,289 1,016,375 975,064

Asset Management 106,387 99,827 404,421 392,378

Raymond James Bank 140,458 110,398 517,243 425,988

Other (1) 14,849 10,505 46,291 66,967

Intersegment eliminations (25,385) (18,990) (90,704) (71,791)

Total revenues $ 1,491,207 $ 1,366,983 $ 5,520,344 $ 5,308,164

Pre-tax income (loss) (excluding noncontrolling interests):

Private Client Group $ $106,281 $ $87,716 $ 340,564 $ $342,243

Capital Markets 53,149 40,221 139,173 107,009

Asset Management 35,162 32,605 132,158 135,050

Raymond James Bank 97,367 65,093 337,296 278,721

Other (1) (55,537) (18,819) (148,548) (64,849)

Pre-tax income (excluding noncontrolling interests) $ 236,422 $ 206,816 $ 800,643 $ 798,174

Three Months Ended Twelve Months Ended

September 30, 2016 September 30, 2015 September 30, 2016 September 30, 2015

Revenues:

Securities commissions and fees $ 923,859 $ 874,209 $ 3,498,615 $ 3,443,038

Investment banking 105,184 94,894 304,155 323,660

Investment advisory and related administrative fees 103,752 99,226 392,326 385,238

Interest 172,477 139,538 640,325 543,207

Account and service fees 137,641 120,923 511,326 457,913

Net trading profit 25,212 16,355 91,591 58,512

Other 23,082 21,838 82,006 96,596

Total revenues 1,491,207 1,366,983 5,520,344 5,308,164

Interest expense (32,433) (26,000) (117,077) (107,954)

Net revenues 1,458,774 1,340,983 5,403,267 5,200,210

Non-interest expenses:

Compensation, commissions and benefits 961,493 903,548 3,624,747 3,525,378

Communications and information processing 67,409 70,382 279,746 266,396

Occupancy and equipment costs 43,950 42,129 167,455 163,229

Clearance and floor brokerage 12,005 10,014 42,732 42,748

Business development 35,884 39,359 148,413 158,966

Investment sub-advisory fees 16,064 15,034 59,930 59,569

Bank loan loss provision 1,176 13,277 28,167 23,570

Acquisition-related expenses 19,374 - 40,706 -

Other 67,877 46,105 234,000 183,642

Total non-interest expenses 1,225,232 1,139,848 4,625,896 4,423,498

Income including noncontrolling interests and before provision for income taxes 233,542 201,135 777,371 776,712

Provision for income taxes 64,752 77,630 271,293 296,034

Net income including noncontrolling interests 168,790 123,505 506,078 480,678

Net loss attributable to noncontrolling interests (2,880) (5,681) (23,272) (21,462)

Net income attributable to Raymond James Financial, Inc. $ 171,670 $ 129,186 $ 529,350 $ 502,140

Net income per common share – diluted $ 1.19 $ 0.88 $ 3.65 $ 3.43

Weighted-average common and common equivalent

shares outstanding – diluted 144,487 146,279 144,513 145,939

International Headquarters:

The Raymond James Financial Center

880 Carillon Parkway // St. Petersburg, FL 33716

800.248.8863 // raymondjames.com

©2016 Raymond James Financial

Raymond James® is a registered trademark of Raymond James Financial, Inc.

15-Fin-Rep-0018 KF 12/16

Stock Traded: NEW YORK STOCK EXCHANGE

Stock Symbol: RJF

corporate profile

Raymond James Financial, Inc. (NYSE: RJF) is a leading

diversified financial services company providing

private client, capital markets, asset management,

banking and other services to individuals, corporations

and municipalities. Its three principal wholly owned

broker/dealers, Raymond James & Associates, Raymond

James Financial Services and Raymond James Ltd.,

have approximately 7,100 financial advisors serving

in excess of 2.9 million client accounts in more than

2,800 locations throughout the United States, Canada

and overseas. Total client assets are approximately

$604 billion. Public since 1983, the firm has been listed

on the New York Stock Exchange since 1986 under the

symbol RJF. Additional information is available at

raymondjames.com.

2016

F O U R T H Q U A R T E R

CHANGE

GROWTH

OPPORTUNITY

HEADWINDS

REGULATION

EXPLORATION

UNPREDICTABILITY

INVESTING WISELY

LIVING WELL

MOBILITY

2

1 6

(1) The Other segment includes the results of our principal capital and private equity activities as well as certain corporate overhead costs of RJF, including the interest costs on our public debt, and the acquisition and integration

costs associated with certain acquisitions.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts)

CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s)

Revenues:

Private Client Group $ 966,031 $ 901,954 $ 3,626,718 $ $3,519,558

Capital Markets 288,867 263,289 1,016,375 975,064

Asset Management 106,387 99,827 404,421 392,378

Raymond James Bank 140,458 110,398 517,243 425,988

Other (1) 14,849 10,505 46,291 66,967

Intersegment eliminations (25,385) (18,990) (90,704) (71,791)

Total revenues $ 1,491,207 $ 1,366,983 $ 5,520,344 $ 5,308,164

Pre-tax income (loss) (excluding noncontrolling interests):

Private Client Group $ $106,281 $ $87,716 $ 340,564 $ $342,243

Capital Markets 53,149 40,221 139,173 107,009

Asset Management 35,162 32,605 132,158 135,050

Raymond James Bank 97,367 65,093 337,296 278,721

Other (1) (55,537) (18,819) (148,548) (64,849)

Pre-tax income (excluding noncontrolling interests) $ 236,422 $ 206,816 $ 800,643 $ 798,174

Three Months Ended Twelve Months Ended

September 30, 2016 September 30, 2015 September 30, 2016 September 30, 2015

Revenues:

Securities commissions and fees $ 923,859 $ 874,209 $ 3,498,615 $ 3,443,038

Investment banking 105,184 94,894 304,155 323,660

Investment advisory and related administrative fees 103,752 99,226 392,326 385,238

Interest 172,477 139,538 640,325 543,207

Account and service fees 137,641 120,923 511,326 457,913

Net trading profit 25,212 16,355 91,591 58,512

Other 23,082 21,838 82,006 96,596

Total revenues 1,491,207 1,366,983 5,520,344 5,308,164

Interest expense (32,433) (26,000) (117,077) (107,954)

Net revenues 1,458,774 1,340,983 5,403,267 5,200,210

Non-interest expenses:

Compensation, commissions and benefits 961,493 903,548 3,624,747 3,525,378

Communications and information processing 67,409 70,382 279,746 266,396

Occupancy and equipment costs 43,950 42,129 167,455 163,229

Clearance and floor brokerage 12,005 10,014 42,732 42,748

Business development 35,884 39,359 148,413 158,966

Investment sub-advisory fees 16,064 15,034 59,930 59,569

Bank loan loss provision 1,176 13,277 28,167 23,570

Acquisition-related expenses 19,374 - 40,706 -

Other 67,877 46,105 234,000 183,642

Total non-interest expenses 1,225,232 1,139,848 4,625,896 4,423,498

Income including noncontrolling interests and before provision for income taxes 233,542 201,135 777,371 776,712

Provision for income taxes 64,752 77,630 271,293 296,034

Net income including noncontrolling interests 168,790 123,505 506,078 480,678

Net loss attributable to noncontrolling interests (2,880) (5,681) (23,272) (21,462)

Net income attributable to Raymond James Financial, Inc. $ 171,670 $ 129,186 $ 529,350 $ 502,140

Net income per common share – diluted $ 1.19 $ 0.88 $ 3.65 $ 3.43

Weighted-average common and common equivalent

shares outstanding – diluted 144,487 146,279 144,513 145,939

International Headquarters:

The Raymond James Financial Center

880 Carillon Parkway // St. Petersburg, FL 33716

800.248.8863 // raymondjames.com

©2016 Raymond James Financial

Raymond James® is a registered trademark of Raymond James Financial, Inc.

15-Fin-Rep-0018 KF 12/16

Stock Traded: NEW YORK STOCK EXCHANGE

Stock Symbol: RJF

corporate profile

Raymond James Financial, Inc. (NYSE: RJF) is a leading

diversified financial services company providing

private client, capital markets, asset management,

banking and other services to individuals, corporations

and municipalities. Its three principal wholly owned

broker/dealers, Raymond James & Associates, Raymond

James Financial Services and Raymond James Ltd.,

have approximately 7,100 financial advisors serving

in excess of 2.9 million client accounts in more than

2,800 locations throughout the United States, Canada

and overseas. Total client assets are approximately

$604 billion. Public since 1983, the firm has been listed

on the New York Stock Exchange since 1986 under the

symbol RJF. Additional information is available at

raymondjames.com.

2016

F O U R T H Q U A R T E R

CHANGE

GROWTH

OPPORTUNITY

HEADWINDS

REGULATION

EXPLORATION

UNPREDICTABILITY

INVESTING WISELY

LIVING WELL

MOBILITY

2

1 6