Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Kleopatra Holdings 2 S.C.A. | d447312dex232.htm |

| EX-23.1 - EX-23.1 - Kleopatra Holdings 2 S.C.A. | d447312dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 21, 2016

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KLEOPATRA HOLDINGS 2 S.C.A.*

(Exact name of registrant as specified in its charter)

| Luxembourg (prior to migration) Delaware (after migration) |

3081 | N/A | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

46A, Avenue J.F. Kennedy

L-1855 Luxembourg

(+352) 26 428-1

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert B. Lence, Esq.

General Counsel

187 Danbury Road

Wilton, Connecticut 06897

(203) 423-4219

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Joshua N. Korff, P.C. William Burke Brian Hecht Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Richard Alsop Shearman & Sterling LLP 599 Lexington Avenue New York, New York 10022 (212) 848-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee | ||

| Common Stock, $0.001 par value per share |

$100,000,000 | $11,590 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) promulgated under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of any additional shares of common stock that the underwriters have the option to purchase. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| * | Prior to the completion of this offering contemplated hereby, the registrant will migrate to Delaware and continue to exist as a Delaware corporation by deregistering in Luxembourg and registering by way of continuation in Delaware and, in connection therewith, will change its corporate name to Klöckner Pentaplast Inc. |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated December 21, 2016

PRELIMINARY PROSPECTUS

Shares

KLEOPATRA HOLDINGS 2 S.C.A.

(to be renamed Klöckner Pentaplast Inc.)

Common Stock

This is the initial public offering of shares of common stock of Kleopatra Holdings 2 S.C.A. (to be renamed Klöckner Pentaplast Inc.). We are offering shares of our common stock in this offering.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to list the common stock on the New York Stock Exchange under the symbol “KP.”

After the completion of this offering, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. See “Principal Stockholders” and “Management.”

See “Risk Factors” on page 21 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from us at the initial price to the public less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , .

| Citigroup | Credit Suisse | Goldman, Sachs & Co. | ||

| BofA Merrill Lynch | Baird |

Jefferies |

Prospectus dated , .

Table of Contents

Table of Contents

Prospectus

| Page | ||||

| 1 | ||||

| 21 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

51 | |||

| 80 | ||||

| 98 | ||||

| 101 | ||||

| 106 | ||||

| 116 | ||||

| 118 | ||||

| 120 | ||||

| 124 | ||||

| 128 | ||||

| CERTAIN U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

130 | |||

| 134 | ||||

| 140 | ||||

| 140 | ||||

| 140 | ||||

| F-1 | ||||

Through and including , (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

MARKET, RANKING AND OTHER INDUSTRY DATA

This prospectus includes market share and industry information, which was obtained by us from industry publications, surveys and industry reports prepared by consultants, internal surveys and customer feedback. The market share and industry information sourced from third parties, which is used throughout this prospectus, has been accurately reproduced and, as far as we are aware and are able to ascertain from information published by relevant third parties, no facts have been omitted that would render the reproduced information inaccurate or misleading. These third party sources include information published by Smithers Information Ltd (“Smithers Pira”). We have also used data obtained from IHS Inc. (“CMAI Global/IHS”), formerly Chemical Market Associates, Inc. The aforementioned third party sources generally state that the information they contain has been obtained from sources believed to be reliable. However, these third party sources also state that the accuracy and completeness of such information is not guaranteed and that the projections they contain are based on significant assumptions. As we do not have access to the facts and assumptions underlying such market data, statistical information and economic indicators contained in these third party sources, we are unable to verify such information and cannot guarantee its accuracy or completeness. We also do not have access to the facts and assumptions underlying the projections made in these reports and various economic and other factors may cause actual results to differ from these projections.

In addition, certain information in this prospectus is not based on published data obtained from independent third parties, or extrapolations thereof, but are information and statements reflecting our best estimates based upon information obtained from trade and business organizations and associations, consultants and other contacts within the industries in which we operate, as well as information published by our competitors. Such information is based on the following: (i) in respect of our market position, information obtained from trade and business organizations and associations and other contacts within the industries in which we compete; (ii) in respect of industry trends, our senior management team’s business experience and experience in the industry and the local markets in which we operate; and (iii) in respect of the performance of our operations, our internal analysis of our own audited and unaudited information. We cannot assure you that any of the assumptions that we have made in compiling this data are accurate or correctly reflect our position in our markets.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own the trademarks, service marks and trade names that we use in connection with the operation of our business. Our trademarks include “Klöckner Pentaplast,” “Pentafood,” “Pentalabel,” “Pentapharm,” “BlisterPro,” “clikPET” and “kp i.center,” among others. Overall, we have 47 different trademarks. This prospectus may also contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the TM, SM, © and ® symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors, if any, to these trademarks, service marks, trade names and copyrights.

ii

Table of Contents

The following summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully. In particular, you should read the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes relating to those statements included elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Forward-Looking Statements.” Unless the context requires otherwise, references to the “Company,” “we,” “our” or “us” refer to Kleopatra Holdings 2 S.C.A. (or following its migration and continued existence in Delaware, Klöckner Pentaplast Inc.), the issuer of the common stock offered hereby and its consolidated subsidiaries, and the “Issuer” refers to Kleopatra Holdings 2 S.C.A. (or following its migration and continued existence in Delaware, Klöckner Pentaplast Inc.) alone. References to “fiscal” refer to our fiscal year ending September 30 of that year.

Company Overview

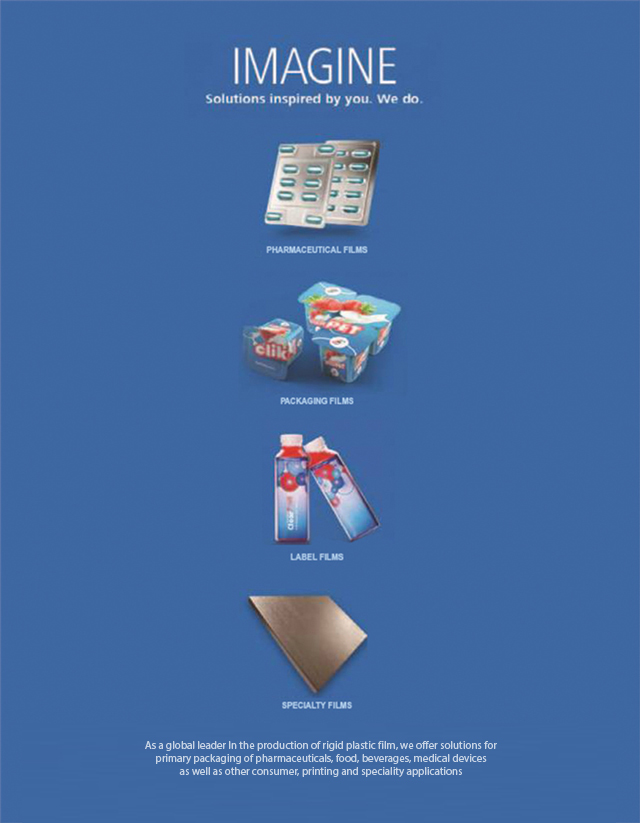

We are the leading global provider in the rigid plastic film industry with highly complementary capabilities in semi-rigid and flexible films used in packaging and other protective film applications. Our primary end-markets include pharmaceutical, medical devices, and food and beverage, as well as applications for other consumer and industrial products. We sell a wide range of custom rigid plastic films, including many proprietary solutions, which we believe provide mission-critical safety and security functions and enhance performance or drive end-user pull-through on the shelf. We have established ourselves as a leading supplier of rigid plastic films in the value chain for packaging, label and surface protection, among others, due to our expertise in compounding, formulation, calendering, extrusion, surface treatment and converting. We believe we are the leader in many of our end-markets, with approximately 75% of our fiscal 2016 net sales from end-markets where we hold a top 3 market position.

Within the markets we serve, we have one of the broadest product portfolios across a variety of polymers. Our manufacturing footprint across North America, South America, Europe and Asia Pacific allows us to serve our customers locally, offering customized solutions while maintaining the highest production standards. Starting with over 250 base formulations, we have created more than 4,800 customer-driven formulations. In fiscal 2016 alone we completed more than 1,400 formulation changes, of which over 350 were on single customer requests. The application of value-added secondary processes has resulted in a product suite of more than 17,000 SKUs. The size and scope of our existing material science capabilities allow us to remain a leader of innovation in the industry and meet and exceed the unique requirements of our customers for highly technical applications.

Our material science expertise relates to polyvinyl chloride (“PVC”) and polyethylene terephthalate (“PET”), which are two of the most important polymers in the rigid film industry. We complement our rigid film capabilities with semi-rigid and flexible films, manufactured from other polymers such as polyolefin (“PP”) and polystyrene (“PS”).

We are able to innovate and differentiate our products through our long-standing (50+ year history) technical expertise and know-how in developing formulations and customized products to meet customer needs. Our films are developed in close collaboration with our customers to meet their specific performance requirements to preserve, protect or otherwise enhance the value of their products and their manufacturing productivity. Typically, our products represent less than 5% of our customers’ total product cost.

We serve customers through four market-oriented segments: Pharma, Food & Consumer Packaging, Labels and Specialties. Our core end-markets have varying, yet complementary growth drivers and are generally non-cyclical in nature. In our Pharma segment, we benefit from the increasing need for innovative packaging

1

Table of Contents

solutions, the aging global population and increasing generic penetration. In our Labels segment, the drive to enhance and differentiate the look and appearance of consumer products has led to increased demand for the more vibrant and flexible packaging capabilities provided by shrink sleeve films. In addition to end-market specific drivers, we expect to benefit from positive macro trends such as a growing middle class in emerging markets and increasing spending on consumer and healthcare products.

We have a diverse mix of approximately 3,700 customers ranging from multinational companies to mid-size regional and local specialty companies. We enjoy long-term relationships with our customers and continue to serve 96% of our top 50 customers from 2012. In addition, each of our top 10 customers has been a customer for over 10 years, and no single customer represented more than 4% of fiscal 2016 revenue.

We believe that we are the only rigid plastic film manufacturer with a global operating platform complemented by local capabilities, evidenced by our 19 manufacturing facilities across North America, South America, Europe and Asia Pacific. As of September 30, 2016, including the Farmamak Acquisition (as described below), we had approximately 600,000 tons of capacity for calendering and extruding and approximately 110,000 additional tons of capacity for secondary processes such as laminating and coating. Our manufacturing footprint is supported by a global network of technical innovation engineers developing solutions in partnership with our commercial sales organization. Our global presence, capabilities and scale help ensure consistency and certainty of supply of our products.

We are led by our CEO, Wayne Hewett, formerly President and CEO of Arysta LifeScience, and CFO, R. Brent Jones, formerly interim CFO of Pall Corporation. We do business in approximately 80 countries worldwide, and our long tenured and well trained workforce of approximately 3,600 associates has an average tenure of more than a decade at the Company.

For fiscal 2016, net sales were $1,403 million, net loss was $11.6 million and Adjusted EBITDA was $242.9. Excluding the impact of foreign currency translation, net sales decreased by 0.5% and Adjusted EBITDA increased by 5.3%. For fiscal 2016, net cash provided by operating activities was $116.8 million and Adjusted Free Cash Flow was $86.4 million. For a reconciliation of Adjusted EBITDA and Adjusted Free Cash Flow to the closest comparable GAAP measures, see “—Summary Historical Consolidated Financial and Other Data.”

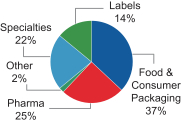

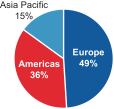

The charts below illustrate the breakdown of our net sales by segment and geography in fiscal 2016:

| Fiscal 2016 Net Sales Breakdown | ||

| Net Sales by Segment |

Net Sales by Geography | |

|

|

| |

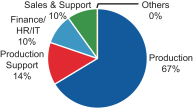

Our Products and Innovations

Our product portfolio includes diverse packaging film solutions such as rigid barrier films, shrink sleeve films for labels and specialty niche films for decorative surfaces, gift cards and other specialty printing and label

2

Table of Contents

applications. Our products play an integral role in the customer value chain by enhancing product graphics and protecting product integrity, food safety, UV protection, consumer health and, ultimately, brand reputation. For example, our specially formulated films for the pharmaceutical industry adhere to strict regulatory requirements set by the U.S. Food & Drug Administration (the “FDA”) and protect products against moisture, gas (e.g., oxygen) and UV rays, enabling maximum product efficacy and increased shelf life. Similarly, our highly engineered label films allow customers to cover the entire body of their product with high-resolution graphics and vibrant color, increasing product appeal while at the same time providing enhanced product protection through tamper evident features.

We believe our experience in the rigid films industry positions us to drive growth through our strong product innovation platform. Recent product launches include clikPET, an innovative yogurt packaging film that extends product shelf life, reduces waste and increases product convenience, and Luxury Vinyl Tile films, which deliver superior durability and wear resistance. We are building on the momentum from recent innovation successes by increasing our investment in research and development capabilities. In 2015, we opened our first kp i.center, a new front-end facility, to strengthen co-creation and collaboration with suppliers and customers. The kp i.center was created to decrease time-to-market and increase our hit-rate for new product innovations. We have also grown our Research & Development team to approximately 80 people as of December 7, 2016. In addition to creating new product formulations, our innovation team also supports customers seeking regulatory approval in high-value areas such as pharma and certain food applications, as well as improving product appearance in consumer products.

| Recent Innovations | ||

| clikPET |

Luxury Vinyl Tile films | |

|

|

| |

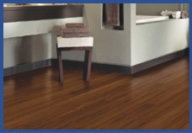

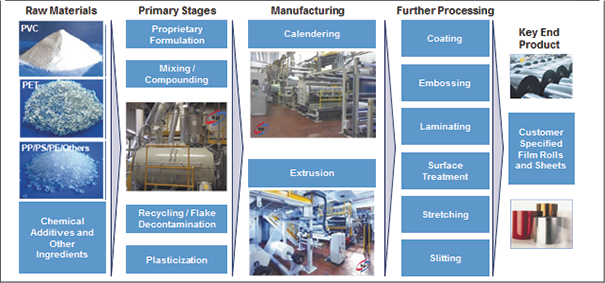

Our Differentiated Business Model

We manufacture rigid film from raw materials (e.g., resin, flakes and additives) and sell our products directly to brand owners and end packers, or to other companies for conversion into packaging or other products in accordance with customers’ and end-user specifications. Our sales to converters are often guided by our relationships with the ultimate brand owners who specify that converters use our film for the end products they manufacture.

3

Table of Contents

| kp Value Chain Overview |

|

|

|

|

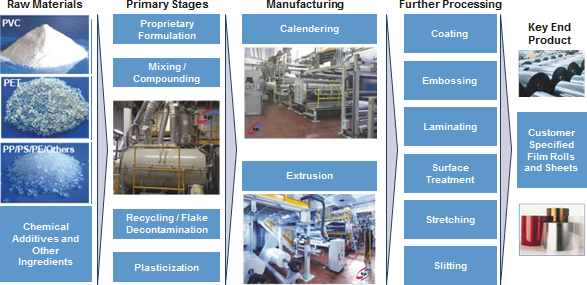

Manufacturing

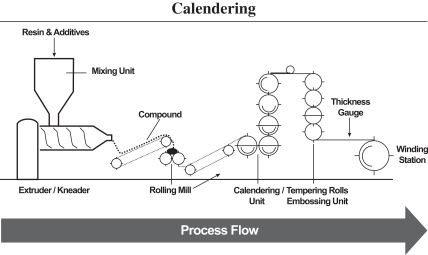

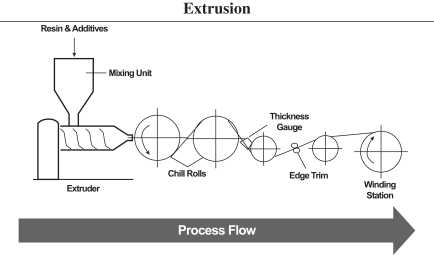

Nearly all of our film formulations are developed in-house. We believe our ability to create bespoke, customized film solutions is a key differentiator in the markets we serve. Our core production processes consist of calendering and extruding polymers, adding chemical additives as necessary and further processing to customer specifications. Our process includes complex mixing of various raw materials and ingredients to produce homogenous products. Calendering and extrusion are industrial scale processes to manufacture rigid plastic film using different types of polymers formulated to deliver various performance benefits. Our products are further customized to fit customer specifications through late stage differentiation techniques, as illustrated in the diagram below.

| Manufacturing Process Overview |

|

|

4

Table of Contents

Sales

We have a dedicated commercial team of approximately 340 associates, organized by our segments, across North America, Europe, Asia Pacific and South America. Our sales force works closely with our customers to create value added product solutions and to service our customers based on quality, timeliness of delivery and steadiness of supply. Our sales force is supported by a team of approximately 80 research and development personnel who we believe provide industry-leading support services directly to our customers. Our technical support team lowers overall costs for our customers by maximizing our customers’ machine uptime, throughput and yield. We believe our sales force and technical support teams are key differentiators of our “go-to-market” strategy.

5

Table of Contents

Segments

Our business operates through four segments: Pharma, Food & Consumer Packaging, Labels and Specialties. Each segment has a dedicated commercial and innovation team aligned by market to promote greater sales force effectiveness and customer focus.

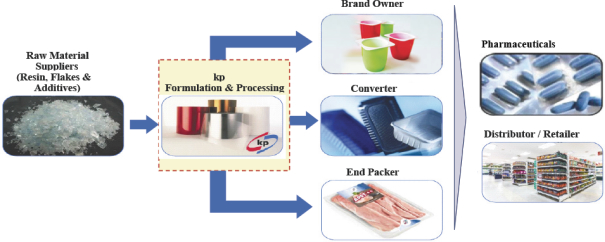

| End-Market Overview | ||||||||

| Pharma |

Food & Consumer |

Labels |

Specialties | |||||

| % of our Fiscal 2016 Net Sales |

• 25% |

• 37% |

• 14% |

• 22% | ||||

| Est. Market Growth | • 3-5% |

• 2-3% |

• 4-6% |

• 2-5% | ||||

| Applications | • Pharmaceuticals

• Medical devices |

• Food

• Dairy

• Consumer Products

|

• Bottles

• Bottle Caps

• Batteries |

• Decorative surfaces

• Card films (e.g. gift and ID)

• Stationery films

• Industrial & Construction | ||||

| Key Growth Drivers |

• Aging population in developed markets

• Drug safety/integrity

• Evolution of packaging solutions to extend product shelf life

• Expanding generic drug market

• Growing middle class in emerging markets

• Increase in capsule-based applications |

• Increased penetration of pre-packaged foods

• Increased food safety requirements

• Innovative packaging alternatives driven by market demand

• Secular trend to single serving and smaller food packs

• Millennial consumption habits (snacking)

• Strong growth in select sub- segments (yogurts) |

• Label conversion towards high margin shrink sleeve market

• Increasing demand for smart labels for safety and product tracking

• Shrink film continues to displace traditional flexible label alternatives

• Introduction of new polymer (polyolefin) |

• Diverse blend of global market exposures

• Attractive niche applications with superior performance characteristics relative to existing technology

• Surface protection for high value goods (flooring)

• Gift cards and ID card products expected to further proliferate worldwide | ||||

| Select Product Images |

|

|

|

| ||||

Pharma

We manufacture an extensive range of pharmaceutical packaging rigid films, including multi-layer barrier films for blister packaging as well as mono-layer barrier and multi-layer polymer films for sterile packaging of

6

Table of Contents

medical devices, such as surgical tools. As a result of strict regulatory specifications, our products and processes are required to be certified by various regulatory authorities, such as the FDA, as part of the initial drug approval process and are typically included in the drug master file. With an average overall certification process length of 6 to 12 months, we believe that these production requirements, along with our scale in the global market, create a significant competitive advantage.

Food & Consumer Packaging

Our Food & Consumer Packaging product portfolio consists mainly of mono-layer and multi-layer rigid films based on a wide variety of polymers. We produce films used in the packaging of fresh and pre-prepared foods, including sandwiches, salads, pasta, meat, cheese and fish. Our films are designed to provide heat resistance and specialized barrier properties to protect against moisture and oxygen and to improve the appearance, appeal and shelf life of packaged food products. Our rigid plastic films are also used by our global customers in a broad range of other packaging applications, including packaging for electronic components, cosmetics, household goods, personal care and lighting products.

Labels

We offer a broad range of label products for customers in the beverage and electronic battery end-markets. Our films are used for bottle wrap labels, tamper resistant closures, wine bottle capsules and battery wraps. With full color photographic images that wrap 360 degrees around containers, our customized products enhance the shelf appeal and marketability of the end product. In addition, our products can enhance the performance and functionality of the end product (such as UV protection in the case of full body shrink labels). We continue to introduce new products and build additional capacity to support this segment, with a focus on performance, differentiation and recyclability.

Specialties

We actively manage a portfolio of distinctive application solutions that require a high level of technical collaboration with our customers. For example, we produce a full portfolio of core and overlay films for specific card applications (such as gift cards). These solutions need to provide extended durability, increased security and greater design flexibility. Our film solutions for decorative flooring were developed in response to customer needs for wear resistance and superior durability in luxury vinyl tiles. Other application solutions apply to areas such as specialized printing and other decorative surfaces.

Industry and End-Markets

The packaging industry encompasses a wide variety of materials (plastic, glass, metal and paper) and applications (food and beverage, consumer, industrial and pharmaceutical). We estimate that the current size of the overall global packaging industry exceeds $850 billion, growing at approximately 3% annually.

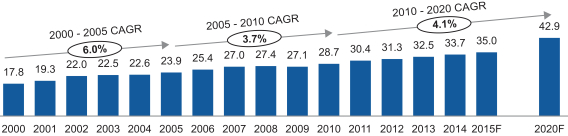

We primarily operate within the approximately $190 billion rigid plastic packaging segment of the wider packaging market, with complementary applications in attractive semi-rigid and flexible films for products such as shrink sleeve labels. According to Smithers Pira, the rigid plastic market, which includes rigid plastic films, is expected to grow between 2015 and 2020 at an approximately 4% compound annual growth rate (“CAGR”), which is above the global packaging industry. Growth in the rigid plastic market is driven by numerous factors which include increasing demand for light weight, re-sealable, convenient and portable packaging. The expanded market for packaged food in retail outlets is also driving increased demand for on-the-go packaging solutions, highly decorative and eye-catching packaging. Finally, the focus on food and drug safety and sustainability, with

7

Table of Contents

demographic changes through an aging and urbanizing population, is creating additional demand for our products, which is being further driven by the increasing need for innovation and customization through more complex packaging applications on a global scale.

| Global Rigid Plastics Industry (million tons) |

|

|

Source: Smithers Pira

Packaged goods utilizing PET and PVC, our primary base polymers, have seen consistent and stable growth in our largest developed markets. PET growth is expected to outpace PVC growth modestly as a result of selected areas of industry migration towards PET. Within developing economies, demand growth for PET-based and PVC-based packaging products is expected to grow at higher rates as the middle class grows and overall consumption of related goods increases. In our core end-markets, we expect volume growth in Pharma and Labels will outpace the broader global rigid plastics industry with growth rates of 3% to 5% and 4% to 6%, respectively, while Food & Consumer Packaging and Specialties are more likely to see volume growth of 2% to 5% annually, on average.

As a large global producer of rigid plastic films, we believe we hold a top 3 position in the majority of our end-markets across Europe and the Americas. We estimate that we are more than double the size of our nearest global competitor in terms of volume supplied. Our key competitors tend to focus on films based on a specific polymer, either PET or PVC, as well as specific end-markets.

We believe that we are the global leader in the PVC market. Our competitors that focus on PVC include Bilcare, Nan Ya, Tekni-Plex, Alfatherm and Perlen. While the PET market is more fragmented than the PVC market, over the last decade, we have established ourselves as a global leader in PET applications as well. Key competitors in the PET market include Octal and Hagner.

8

Table of Contents

We believe we enjoy market leading positions across a majority of our products across the end-markets and geographies we serve.

| Western Europe | North America | South America | ||||||

| Pharma | Mono | #1 | #1 | #1 | ||||

| Barrier | Top 3 | #1 | #1 | |||||

| Medical Devices | Top 3 | Top 3 | — | |||||

| Food & Consumer Packaging |

Multi-Layer | #1 | — | — | ||||

| Mono-Layer | Top 3 | Top 3 | Top 3 | |||||

| PP/PS | — | — | — | |||||

| Labels | Shrink Sleeve | Top 3 | Top 3 | — | ||||

| Roll Sleeve | Top 3 | #1 | — | |||||

| Battery | #1 | #1 | — | |||||

| Specialties | Cards | #1 | #1 | — | ||||

| Decorative Surfaces | Top 3 | — | — | |||||

| Tape | #1 | — | — |

Our Competitive Strengths

Market Leading Positions Across Key Geographies and End-Markets

We are the global leader in the rigid plastic film industry with highly complementary capabilities in semi-rigid and flexible films. Our market leadership is a function of our technical and material science capabilities, which allow us to provide customized solutions and services to customers. With $1.4 billion of net sales in fiscal 2016, we have 19 production sites servicing customers in approximately 80 countries and capacity of approximately 600,000 tons, we believe we are substantially larger than our nearest competitors in PVC and PET. We are the only rigid film manufacturer with in-house sales and manufacturing capabilities across North America, South America, Europe and Asia Pacific. We believe approximately 75% of our net sales comes from end-markets where we are a top 3 market leader.

Growing, Resilient End-Markets with Strong Secular Growth Drivers

We continue to benefit from a trend of increasing demand for rigid packaging in our segments. According to Smithers Pira, the rigid packaging market has experienced growth in 14 of the last 15 years. Currently, Smithers Pira projects that the market will grow at a CAGR of approximately 4% through 2020. Our business further benefits from trends in our core Pharma and Food & Consumer Packaging markets, in particular toward conversion from other packaging types to rigid film. Our success in capitalizing on this growing demand is a function of our ability to anticipate changing consumer preferences, such as trends towards light weighting, sustainability, smaller, more affordable and convenient product sizes and smart and aesthetically-pleasing packaging.

While organized as four segments, we operate in a number of distinct end-markets with varying yet complementary growth drivers. Our end-markets are generally non-cyclical in nature, and include pharmaceuticals, medical devices, food and beverage, fresh dairy, batteries, gift cards, decorative flooring, specialty printing and other consumer and industrial product categories. Our geographic footprint and end-market diversification has led to increased resilience, improved stability and limited cyclicality in our business.

9

Table of Contents

Leading Technical Expertise and Material Science Capabilities

Over our 50+ year history, we have developed industry-leading technical, manufacturing and material science capabilities that allow us to provide our customers with a broad range of proprietary film formulations, product solutions and services.

We have over 250 base formulations developed in-house through in-depth knowledge of chemistry and material interactions, and differentiated secondary processes of coating, embossing and laminating, which we use to create bespoke products for our customers, providing protection, durability, clarity and color, among other things. This unique expertise is evidenced through our product portfolio of more than 17,000 SKUs. Our manufacturing operations comply with the required regulatory certifications, and all of our sites and clean rooms are ISO 9001-14001 certified and approved by various food and drug agencies, such as the FDA and European Medicines Agency. These certifications are particularly important as we are a key supplier to the pharmaceutical and food end-markets.

Product quality, innovation, regulatory and customer certifications, delivery time and degree of customization create significant competitive advantages that we believe help us drive growth and profitability in our business.

Commitment to Innovation

We believe that we are an innovator and process leader in the rigid plastic films industry, and our business has historically benefitted from a strong technology platform. Our technological leadership is the result of our operational and engineering experience that we have built up over the past 50+ years, embedded process knowledge, product development efforts and efficient machinery base, a significant portion of which we custom engineer in-house.

To enhance our innovation efforts, within our 80 person Research and Development team we have (i) created a dedicated innovation team of approximately 40 associates and a VP of Innovation; (ii) hired dedicated product development directors for each segment; (iii) created a Chief Engineering Officer position; (iv) partnered with universities to bolster ongoing product development; and (v) opened a kp i.center for our Pharma segment. We believe these additional capabilities will enable us to maintain our competitive advantage as an innovation leader and drive growth throughout the organization.

Longstanding Relationships with a Diverse Global Customer Base

Our ability to provide bespoke products, meeting our customers’ stringent qualifications, has led to sticky and long-term relationships with a diverse customer base. Each of our top 10 customers has been our customer for over 10 years. Since 2012, we have retained 96% of our top 50 customers. In addition, we believe that we maintain the majority of most of our key customers’ wallet share.

Track Record of Growth and Cash Flow Generation

Excluding the impact of foreign currency translation, we have delivered consistent Adjusted EBITDA growth and margin improvement, which has translated into significant Adjusted Free Cash Flow generation and value creation for our stockholders. Over the past 4 years, our Adjusted EBITDA has increased at a CAGR of 2.5% and Adjusted EBITDA margins have increased by approximately 270 bps. Over the same period and excluding the impact of foreign currency translation, our Adjusted EBITDA has increased at a CAGR of 8.1% and Adjusted EBITDA margins have increased by 250 bps. In addition, our net loss went from $75.4 million for fiscal 2013 to $11.6 million for fiscal 2016. In our last three fiscal years, 2014 to 2016, we have successfully

10

Table of Contents

achieved operational and procurement savings of nearly $125 million, offsetting inflationary pressures while allowing us to continuously expand margins. In our operations, we have enhanced yields in our manufacturing process, lowered customer complaints, increased usage of non-virgin materials and optimized our operational headcount. In our procurement function, we have standardized our operations to drive savings and achieved additional indirect cost savings.

While growing our Adjusted EBITDA and expanding our margins, we have also demonstrated an ability to generate significant discretionary cash flow, with Adjusted Free Cash Flow of $86.4 million in fiscal 2016. This robust Adjusted Free Cash Flow enables us to make disciplined investments in organic growth initiatives and M&A. Our near-term capital expenditure projects have a high return threshold of over 20% internal rate of return and are primarily investments in capacity where we are operating at utilization of 90% or higher. For a reconciliation of Adjusted EBITDA and Adjusted Free Cash Flow to the closest comparable GAAP measures, see “—Summary Historical Consolidated Financial and Other Data.”

Proven Management Team Supported by a Long Tenured Production Team

We have a strong management team that has significant experience from blue chip, publicly listed, best-in-class global organizations. The company is led by our CEO and CFO. Our CEO, Wayne Hewett, who joined kp in September 2015, was formerly the President and CEO of Arysta LifeScience and led GE Momentive Performance Materials, and our CFO, R. Brent Jones, was formerly interim CFO of Pall Corporation. Our senior team is complemented by organizational continuity through a long tenured production team with deep process knowledge and on average over a decade of experience.

Our Strategies

We seek to continue to take advantage of our competitive strengths by pursuing the following business strategies to drive growth, expand our margins and generate significant Adjusted Free Cash Flow.

Enhance Commercial Initiatives to Grow Core Business

We have enjoyed significant continuity with our customers for many years. We believe we can expand these relationships by proactively marketing our full suite of solutions and addressing unmet customer needs. We believe there is additional volume upside from current customers through targeted actions and investments including key account management (“KAM”) (with a goal to increasing customer penetration), customer relations management (“CRM”) (realigned business units with dedicated sales teams equipped with enhanced technology tools and sales applications) and increased customer service personnel. We expect to continue to invest in and grow our sales team in order to support these initiatives.

Our current initiatives to accelerate further volume growth with both current and new customers include (i) a realignment of our salesforce by end-market to better understand customer needs, allowing us to prepare specific, tailored solutions; (ii) an increase in the size of our already industry-leading sales force, of approximately 340 sales and support employees by hiring approximately 20 additional sales staff; and (iii) changes in our sales force compensation with an increase in the variable component to focus on new customer wins and increased wallet share.

Accelerate Innovation in Response to Customer Needs

We have increased our focus on innovation in recent years in an effort to collaborate with and provide better solutions for our customers. We believe we can further drive net sales and Adjusted EBITDA growth through products originated in our stage-gate innovation process (i.e., products that are not yet in commercial

11

Table of Contents

production). We intend to open additional kp i.centers to continue to develop platforms in order to work with suppliers, customers and others in our ecosystem, such as universities, to develop new products and address the ongoing challenges our customers face.

Drive Continuous Operational Improvement

We believe we have established a solid framework based on Lean Six Sigma methodology to continuously improve our operational efficiency and effectiveness and offset the impact of inflation. Through this framework, we believe we can increase material efficiency, reduce procurement costs and improve quality.

In addition, we are reorganizing our people and processes into a global supply chain designed to take better advantage of scale in procurement and to shorten lead times, resulting in lower raw material costs and improved customer service.

Invest for Growth

We intend to make targeted investments to accelerate growth with attractive returns on capital. Our growth investments will be focused on (i) expansion of existing facilities such that we can take advantage of opportunities in our current markets; (ii) greenfield facilities that allow us to capitalize on regional demand where we do not have existing facilities or where we operate at or near optimal utilization; and (iii) investments in manufacturing equipment that continue to drive operational efficiencies within our manufacturing infrastructure.

Pursue Pipeline of Attractive Bolt-On M&A

In addition to our organic growth initiatives, we plan to pursue select M&A opportunities. We have a long history of M&A with over 20 acquisitions over our 50+ year history. We believe we are a natural consolidator in the fragmented rigid films industry and have demonstrated the ability to successfully integrate acquisitions and realize synergies. Our IT infrastructure and standardized global processes provide a stable environment to incorporate future acquisitions into our system. We believe that we have a clear acquisition strategy in place, targeting bolt-on acquisitions with significant synergies to drive long-term value creation for stockholders. To execute on our strategy, we have established an M&A-focused team to drive our strategic agenda following a recent period of internally-focused initiatives.

We intend to apply selective and disciplined acquisition criteria focused on: (i) acquisitions that consolidate our existing markets; (ii) acquisitions that offer geographic expansion in our existing business lines; (iii) acquisitions in attractive adjacencies, including licensing rights agreements; and (iv) acquisitions of new technologies, innovations or game-changing products. As part of this strategic agenda, we recently announced the acquisition of Farmamak, improving our market presence in Turkey and throughout the Middle East and enhancing our service capabilities in the region.

We believe that our track record of net sales growth and disciplined capital spending will enable us to generate excess Adjusted Free Cash Flow that can be re-deployed through accretive acquisitions that strengthen our core businesses and grow our company on a global basis.

Recent Developments

On October 31, 2016, we acquired Farmamak Ambalaj Maddeleri ve Ambalaj Makineleri Sanayi ve Tic. A.S. (“Farmamak”), a leading solutions provider for packaging solutions in the Turkish and European markets (the “Farmamak Acquisition”). Farmamak, located near Istanbul, Turkey, has approximately 55,000 tons of capacity across seven extrusion lines for PET, PP & PS as well as three PVC calender lines. Farmamak has multi-layer, lamination and metallization capabilities.

12

Table of Contents

In connection with the Farmamak Acquisition, we entered into an amendment to our existing credit agreement (the “First Amendment”), which provides for, among other things, an incremental term loan in an aggregate principal amount of €85 million. The proceeds from the incremental term loan were used, in part, to fund the Farmamak Acquisition, with the remainder to be used for working capital and general corporate purposes. For further information regarding our credit agreement and the incremental term loan, see “Description of Certain Indebtedness—Senior Secured Credit Facilities.”

Equity Sponsor

Strategic Value Partners, LLC (“SVPGlobal”) is a deep-value investment firm which was established in 2001 by Victor Khosla, with assets of approximately $4.9 billion across a hedge fund strategy and private equity vehicles. SVPGlobal has about 100 employees, including approximately 35 investment professionals, across its main offices in Greenwich (CT), London, Frankfurt and Tokyo. Its focus is on deep-value opportunities where it typically takes an active role in transactions. The team has also developed domain expertise in a select number of industries including infrastructure, power and industrials. SVPGlobal’s significant presence outside of the US as well as the extensive restructuring and operating experience of its professionals further support the firm’s investment approach and strategy.

Controlled Company

Following the consummation of this offering, approximately % of our outstanding common stock will be beneficially owned by Kleopatra Holdings 1 S.C.A. (“Kleopatra Holdings 1”), which is controlled by affiliates of SVPGlobal (or approximately % if the underwriters exercise their option to purchase additional shares in full). As a result, we will be a “controlled company” within the meaning of New York Stock Exchange corporate governance rules. For a discussion of the applicable limitations and risks that may result from our status as a controlled company, see “Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock—Following the offering, we will be classified as a “controlled company” and, as a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to stockholders of companies that are subject to such requirements.”

Risk Factors

An investment in our common stock involves a high degree of risk. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock. Among these important risks are the following:

| • | volatility in raw material prices utilized for our products or disruptions in the supply of raw materials may adversely impact our business; |

| • | global economic conditions, including sovereign debt and currency instability risks; |

| • | disruptions in the economy and the financial markets may adversely impact our business; |

| • | conducting operations in several different countries; |

| • | competition in our markets that could adversely affect our market position, sales and overall operations; |

| • | we are a “controlled company” within the meaning of New York Stock Exchange rules and, as a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. Accordingly, our stockholders will not have the same protections as stockholders of companies that are subject to such requirements. |

13

Table of Contents

Migration and Continued Existence as a Delaware Corporation

Prior to the completion of this offering, we will migrate to Delaware by de-registering as a Luxembourg partnership limited by shares (société en commandite par actions), organized and existing under the laws of the Grand Duchy of Luxembourg, and registering by continuation as a Delaware corporation, which will be effected through the filing of a certificate of incorporation and a certificate of conversion in Delaware.

Upon the effectiveness of the certificate of incorporation: (i) each issued and outstanding ordinary share and management share of the Luxembourg partnership limited by shares (société en commandite par actions) will be converted into one share of common stock of the Delaware corporation; and (ii) the Delaware corporation will effect a one-for- stock split with respect to its outstanding common stock. In connection with the migration and continued existence as a Delaware corporation, the name of the Company will be changed to “Klöckner Pentaplast Inc.” and its authorized capital stock will consist of shares of common stock, par value $0.001 per share, and shares of undesignated preferred stock, par value $0.001 per share. Following the migration, each outstanding option to purchase common shares and each share of restricted stock will relate to shares of common stock of the Delaware corporation and otherwise be adjusted appropriately to give effect to the stock split. In addition, following the migration, the TPECs (as defined herein) will no longer be outstanding.

Our Corporate Information

The Issuer of the common stock in this offering was originally incorporated as a Luxembourg partnership limited by shares (société en commandite par actions), organized and existing under the laws of the Grand Duchy of Luxembourg, in 2012 and will migrate to Delaware and continue to exist as a Delaware corporation prior to completion of this offering. Our business was founded in Montabaur, Germany in 1965.

Prior to our migration to Delaware, our principal executive offices are located at 46A, Avenue J.F. Kennedy, L-1855 Luxembourg. Our telephone number is (+352) 26 428-1. The address of our main website is www.kpfilms.com. We also have offices at 187 Danbury Road, Wilton, Connecticut 06897. The information contained on our website does not constitute a part of this prospectus.

14

Table of Contents

The Offering

| Issuer |

Kleopatra Holdings 2 S.C.A. (to be renamed Klöckner Pentaplast Inc.). |

| Common stock offered by us |

shares. |

| Underwriters’ option to purchase additional shares |

We have granted the underwriters a 30-day option to purchase up to an additional shares at the public offering price less underwriting discounts and commissions. |

| Common stock to be outstanding immediately after completion of this offering |

Immediately following the consummation of this offering, we will have shares of common stock outstanding, or shares, if the underwriters’ option to purchase additional shares is exercised in full. |

| Use of proceeds |

We estimate that the proceeds to us from this offering, after deducting estimated underwriting discounts and commissions and offering expenses payable by us, will be approximately $ million, assuming the shares offered by us are sold for $ per share, the midpoint of the price range set forth on the cover of this prospectus. |

| We intend to use the net proceeds from the sale of common stock by us in this offering to repay outstanding indebtedness and for general corporate purposes. For additional information, see “Use of Proceeds.” |

| Principal stockholders |

Upon completion of this offering, affiliates of SVPGlobal will beneficially own a controlling interest in us. We currently intend to avail ourselves of the controlled company exemption under the corporate governance rules of the New York Stock Exchange. |

| Dividend policy |

We currently expect to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness; therefore, we do not anticipate paying any cash dividends in the foreseeable future. For additional information, see “Dividend Policy.” |

| Proposed symbol for trading on the New York Stock Exchange |

“KP.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. See the “Risk Factors” section of this prospectus for a discussion of factors you should carefully consider before deciding to purchase shares of our common stock. |

15

Table of Contents

Unless otherwise indicated, all information in this prospectus:

| • | gives effect to the migration and continued existence as a Delaware corporation prior to the completion of this offering as described in “—Migration and Continued Existence as a Delaware Corporation”; |

| • | excludes shares of common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $ per share; |

| • | assumes no exercise by the underwriters of their option to purchase up to additional shares from us; and |

| • | assumes an initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus. |

16

Table of Contents

Summary Historical Consolidated Financial and Other Data

The following table presents our summary historical consolidated financial data and certain other financial data. The historical consolidated balance sheet data as of September 30, 2016 (“fiscal 2016”), September 30, 2015 (“fiscal 2015”) and September 30, 2014 (“fiscal 2014”), and the consolidated statement of operations data and consolidated statement of cash flows data for fiscal 2016, fiscal 2015 and fiscal 2014 have been derived from our historical audited consolidated financial statements, which are included in this prospectus. The consolidated balance sheet data as of fiscal 2014 are derived from our accounting records.

The historical consolidated financial data and other financial data presented below should be read in conjunction with our audited consolidated financial statements and the related notes thereto and our unaudited condensed consolidated financial statements and the related notes thereto, included elsewhere in this prospectus, and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical consolidated financial data may not be indicative of our future performance.

| Fiscal Year Ended September 30, | ||||||||||||

| (in thousands) | 2016 | 2015 | 2014 | |||||||||

| Net Sales |

$ | 1,403,454 | $ | 1,480,313 | $ | 1,620,807 | ||||||

| Cost of Sales |

1,102,414 | 1,193,595 | 1,311,635 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross Profit |

301,040 | 286,718 | 309,172 | |||||||||

| Selling, general and administrative expenses |

171,098 | 186,054 | 174,754 | |||||||||

| Other expenses, net |

28,194 | 10,856 | 12,853 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating Income |

101,748 | 89,808 | 121,565 | |||||||||

| Interest and other debt expense, net |

93,260 | 482,333 | 158,853 | |||||||||

| Foreign currency gains and (losses) on financing |

(12,492 | ) | (6,941 | ) | 4,725 | |||||||

|

|

|

|

|

|

|

|||||||

| Loss before income taxes and equity income of equity method investees |

(4,004 | ) | (399,466 | ) | (32,563 | ) | ||||||

| Income tax expense/(benefit) |

8,425 | (38,037 | ) | 19,407 | ||||||||

|

|

|

|

|

|

|

|||||||

| Loss before equity income of equity method investees |

(12,429 | ) | (361,429 | ) | (51,970 | ) | ||||||

| Equity income of equity method investees |

832 | 317 | 635 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Loss |

$ | (11,597 | ) | $ | (361,112 | ) | $ | (51,335 | ) | |||

| Fiscal Year Ended September 30, | ||||||||||||

| (in thousands) | 2016 | 2015 | 2014 | |||||||||

| Other Operating and Financial Data |

||||||||||||

| EBITDA(a) |

$ | 199,431 | $ | 195,723 | $ | 233,886 | ||||||

| Adjusted EBITDA(a) |

242,911 | 241,857 | 249,185 | |||||||||

| Free cash flow(b) |

64,803 | 86,868 | 52,979 | |||||||||

| Adjusted free cash flow(b) |

$ | 84,050 | $ | 96,443 | $ | 64,195 | ||||||

| As of September 30, | ||||||||||||

| (in thousands) | 2016 | 2015 | 2014 | |||||||||

| Consolidated Balance Sheet Data |

||||||||||||

| Cash |

$ | 116,008 | $ | 103,906 | $ | 149,522 | ||||||

| Total assets |

1,351,856 | 1,361,908 | 1,579,205 | |||||||||

| Total shareholders’ deficit |

468,107 | 461,737 | 154,212 | |||||||||

| Total liabilities |

1,819,963 | 1,823,645 | 1,733,417 | |||||||||

| (a) | EBITDA (non-GAAP measure) is calculated as net loss excluding equity income of equity method investees, income tax expense/(benefit), foreign currency gains and (losses) on financing, interest and other |

17

Table of Contents

| debt expense, net, depreciation and amortization and impairment charges. We believe EBITDA is a useful financial metric to assess operating performance before the impact of investing and financing transactions, income taxes and non-cash impairment charges. It also facilitates comparison between the Company and our competitors. We believe that EBITDA provides investors with a useful tool for assessing the comparability between periods because it eliminates interest expense related to financings and debt restructurings. |

| Adjusted EBITDA (non-GAAP measure) is our key performance indicator for operating results. Adjusted EBITDA is also the basis for performance evaluation under our current executive compensation programs. Adjusted EBITDA is calculated as EBITDA excluding restructuring costs, share-based compensation, IPO preparation costs and other items that we do not consider indicative of our operating performance. As such, the Company believes that Adjusted EBITDA provides investors with a useful tool for assessing the comparability of the core business between periods because it excludes certain items that do not reflect the ongoing performance of the Company’s business. |

| EBITDA and Adjusted EBITDA are not GAAP measures and the use of these measures has certain limitations. The Company’s presentation of EBITDA and Adjusted EBITDA may be different from the presentation used by other companies and therefore comparability may be limited. The terms EBITDA and Adjusted EBITDA are not defined under GAAP and EBITDA and Adjusted EBITDA are not measures of net income, operating income, operating performance or liquidity presented in accordance with GAAP. When assessing the Company’s operating performance, you should not consider this data in isolation, or as a substitute for the Company’s net income, operating income or any other operating performance measure that is calculated in accordance with GAAP. |

| A reconciliation of net loss, the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA for each of the respective periods is as follows: |

| Fiscal Year Ended September 30, | ||||||||||||

| (in thousands) | 2016 | 2015 | 2014 | |||||||||

| Net Loss |

$ | (11,597 | ) | $ | (361,112 | ) | $ | (51,335 | ) | |||

| Equity income of equity method investees |

(832 | ) | (317 | ) | (635 | ) | ||||||

| Income tax expense/(benefit) |

8,425 | (38,037 | ) | 19,407 | ||||||||

| Foreign currency losses/(gains) on financing |

12,492 | 6,941 | (4,725 | ) | ||||||||

| Interest and other debt expense, net |

93,260 | 482,333 | 158,853 | |||||||||

| Depreciation and amortization |

97,683 | 105,916 | 112,320 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

199,431 | 195,723 | 233,886 | |||||||||

|

|

|

|

|

|

|

|||||||

| Restructuring costs(1) |

17,078 | 7,882 | 9,936 | |||||||||

| Share-based compensation(2) |

8,527 | — | — | |||||||||

| IPO preparation costs(3) |

8,286 | 1,502 | — | |||||||||

| Other(4) |

9,589 | 36,750 | 5,364 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 242,911 | $ | 241,857 | $ | 249,185 | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | Consists of fees and expenses related to operational restructuring. |

| (2) | Share-based compensation relates to restricted stock granted to certain employees. |

| (3) | In 2016, these consist of the GAAP financial statement preparation, Sarbanes-Oxley compliance preparation and other preparation. |

| (4) | Other non-recurring adjustments primarily consist of transaction costs, refinancing costs, exceptional litigations and other special items. |

| (b) | Adjusted free cash flow (non-GAAP measure) is calculated as net cash provided by (used in) operating activities less capital expenditures and adjusted for certain income (expenses) and gains (losses) that we do not consider indicative of our normal business. As such, the Company believes that Adjusted Free Cash |

18

Table of Contents

| Flow will provide investors with a useful tool for assessing the comparability of cash generated from the core business between periods because it excludes other non-operating expense (income that does not relate to the ongoing performance of the Company’s assets). |

| Adjusted free cash flow is not a GAAP measure and the use of this measure has certain limitations. The Company’s presentation of Adjusted free cash flow may be different from the presentation used by other companies and therefore comparability may be limited. Adjusted free cash flow is used in addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the exclusion of GAAP financial measures. Management uses Adjusted free cash flow in tracking our business but compensates for the limitations when using this measure by looking at other GAAP measures, such as net cash provided (used in) by operating activities and net cash used in investing activities. In addition, we believe, securities analysts, investors and others frequently use Adjusted free cash flow in their evaluation of companies like ours. The term Adjusted free cash flow is not defined under GAAP and Adjusted free cash flow is not a measure of net cash provided (used in) by operating activities, operating performance or liquidity presented in accordance with GAAP. When assessing the Company’s operating performance or liquidity, you should not consider this data in isolation, or as a substitute for the Company’s net cash provided by (used in) operating activities, net cash used in investing activities or any other operating performance measure that is calculated in accordance with GAAP. |

| A reconciliation of net cash provided by (used in) operating activities, the most directly comparable GAAP measure, to Free Cash Flow for each of the respective periods is as follows: |

| Fiscal Year Ended September 30, | ||||||||||||

| (in thousands) | 2016 | 2015 | 2014 | |||||||||

| Cash flow from operations |

$ | 116,778 | $ | (367,678 | ) | $ | 106,505 | |||||

| Interests on subordinated shareholder loans |

11,706 | 441,188 | — | |||||||||

| Long-term incentive payments |

12,094 | 23,383 | — | |||||||||

| Withholding Tax |

— | 26,246 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted cash flow from operations |

140,578 | 123,139 | 106,505 | |||||||||

| Capital expenditures |

(75,775 | ) | (36,271 | ) | (53,526 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Free cash flow |

64,803 | 86,868 | 52,979 | |||||||||

| Restructuring costs(1) |

12,138 | 7,273 | 6,045 | |||||||||

| IPO preparation(2) |

3,088 | — | — | |||||||||

| Other(3) |

4,021 | 2,302 | 5,171 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted free cash flow |

$ | 84,050 | 96,443 | $ | 64,195 | |||||||

|

|

|

|

|

|

|

|||||||

| (1) | Consists of fees and expenses related to operational restructuring. |

| (2) | In 2016, these consist of the GAAP financial statement preparation, Sarbanes-Oxley compliance preparation and other preparation. |

| (3) | Other non-recurring adjustments primarily consist of transaction costs, refinancing costs, exceptional litigations and other special items. |

19

Table of Contents

| Fiscal Year Ended September 30,(1) | ||||||||||||

| (in thousands, other than percentages) | 2016 | 2015 | 2014 | |||||||||

| Net sales |

$ | 1,403,454 | $ | 1,480,313 | $ | 1,620,807 | ||||||

| Reported Growth |

(5.2 | )% | (8.7 | )% | 4.6 | % | ||||||

| FX Neutral Change |

(0.4 | )% | 0.7 | % | 4.8 | % | ||||||

| Gross profit |

301,040 | 286,718 | 309,172 | |||||||||

| Reported Growth |

5.0 | % | (7.3 | )% | 12.2 | % | ||||||

| FX Neutral Change |

10.0 | % | 0.7 | % | 12.7 | % | ||||||

| Operating income |

101,748 | 89,808 | 121,565 | |||||||||

| Reported Growth |

13.3 | % | (26.1 | )% | 60.3 | % | ||||||

| FX Neutral Change |

21.7 | % | (23.6 | )% | 63.5 | % | ||||||

| Adjusted EBITDA |

242,911 | 241,857 | 249,185 | |||||||||

| Reported Growth |

0.4 | % | (2.9 | )% | 10.4 | % | ||||||

| FX Neutral Change |

5.3 | % | 5.1 | % | 10.8 | % | ||||||

| (1) | The table above shows our reported growth and growth excluding foreign currency (“FX”) in net sales, gross profit, operating income, and Adjusted EBITDA growth on a consolidated level. Because of the impact of raw material costs on net sales, management focuses on gross profit rather than net sales to evaluate the operating performance of the segments. Adjusted EBITDA is our principal consolidated measure of profitability. |

| We have excluded the impact of fluctuations in foreign currency exchange rates by presenting the FX Neutral Change, which is a non-GAAP financial measure. We believe presenting the FX Neutral Change provides valuable supplemental information regarding our results of operations. We calculate the FX Neutral Change by converting our current period local currency financial information using the prior period foreign currency average exchange rates and comparing these adjusted amounts to our prior period reported results. This calculation may differ from similarly titled measures used by other companies and, accordingly, the FX Neutral Change is not meant to substitute for changes in recorded amounts presented in conformity with GAAP nor should such amounts be considered in isolation. |

20

Table of Contents

Investing in our common stock involves a number of risks. Before you purchase our common stock, you should carefully consider the risks described below and the other information contained in this prospectus, including our consolidated financial statements and accompanying notes. If any of the following risks actually occurs, our business, financial condition, results of operation or cash flows could be materially and adversely affected. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Relating to Our Business

We are impacted by volatility and uncertainty in raw material prices utilized for our products and disruptions in the supply of raw materials.

Cost of materials represent the single largest component of our operating costs and accounted for 52% of our net sales in fiscal 2016. The principal raw materials we use in our business are resins and additives. The price of resins and certain other raw materials is a function of many factors that are out of our control, including supply and demand, suppliers’ capacity utilization, industry and consumer sentiment and the price of crude oil, natural gas and other commodities. Our products are primarily based on PVC and PET, the prices of which often track the price of ethylene, which can be produced from materials derived from crude oil and natural gas, and is often affected by prices of those materials.

Similarly, if the availability of any of our raw materials is limited, we may be unable to produce some of our products in the quantities demanded by our customers, which could have an adverse effect on plant utilization and our sales of products requiring such raw materials. Furthermore, certain of our products are dependent on a limited or singled sourced raw material. Any supply interruption in limited or single sourced raw materials could materially harm our ability to manufacture our products until a new source of supply, if any, could be identified and qualified. We may be unable to find a sufficient alternative supply channel within a reasonable time or on commercially reasonable terms.

Our ability to pass on increases in the cost of raw materials to our customers is, to a large extent, dependent upon contractual terms with our existing customers and market conditions. The majority of our contacts do not have price escalation or cost pass through clauses and a pass on of an increase in the cost of raw materials can be achieved only through renegotiations. Our contracts that do include escalation or cost pass through clauses may not in all cases be effective to offset our increased costs and in almost all of these contracts there is a lag between the time we incur increased input costs and the time at which we are able to raise our prices. We also sell a substantial portion of our products based on purchase orders, in which pricing is based on market prices, and we seek to pass through raw material price increases by increasing the prices for our products. We may be unable to increase prices for our products if customers do not agree to a price increase, in particular in our markets where competition is intense.

We are exposed to global economic conditions, including sovereign debt and currency instability risks.

General global economic conditions and macroeconomic trends can affect overall demand for our products and the markets in which we operate. Beginning in 2008, a worldwide financial and economic downturn occurred that affected nearly all regions of the world and all business sectors. Ongoing struggles in Europe related to sovereign debt issues and currency instability, among other things, have contributed to a challenging economic environment. These sovereign debt issues and currency instability could become exacerbated, leading to a decline in the worldwide economy. Such a decline could adversely affect our business, financial condition and results of operations. Further, the announcement of the referendum on the United Kingdom’s membership in the European Union (the “EU”) (referred to as Brexit), advising for the exit of the U.K. from the EU caused significant volatility in global stock markets and currency exchange rate fluctuations that resulted in the

21

Table of Contents

strengthening of the U.S. dollar against foreign currencies in which we conduct business. The strengthening of the U.S. dollar relative to other currencies, as well as uncertainty in the global economy, has and may continue to adversely affect our business, financial condition or results of operations.

Disruptions in the economy and the financial markets may adversely impact our business.

Global market and economic conditions in the past several years have presented heightened volatility and risk perception. Disruptions in the overall economy and volatility in the financial markets could reduce consumer confidence, negatively affecting consumer spending, which could be harmful to our business, financial condition or results of operations. Furthermore, as our customers are often forced to reduce their prices during downturns, or to sell more lower priced items, many of our customers often seek to revise trade credit terms and aggressively negotiate prices. As a result, an economic slowdown may adversely affect our financial position and our cash flows.

Deterioration in economic conditions or disruptions in credit markets also pose a risk to our commercial relationships with our customers, suppliers and creditors. If economic conditions deteriorate significantly, or if our customers or raw material suppliers are not able to refinance their existing credit lines or otherwise are forced to cease doing business, our business would be materially adversely affected. The financial condition of some of our customers may expose us to credit risk. If our customers suffer financial difficulty, they may not pay us. In addition, if we are not able to secure working capital or other funding due to a lack of availability of credit, we may be unable to pay our suppliers who may cease doing business with us, which could affect our business, financial condition or results of operations.

We are exposed to the risk that the financial condition of our customers or suppliers or both could deteriorate.

Many economic and other factors are outside of our control, including but not limited to commercial credit availability. These factors also affect our customers who, in many cases, depend upon credit to finance their operations. If they are unable to secure financing, the financial condition of our customers could deteriorate and our customers could seek to change the terms on which we sell to them. In addition, we depend on suppliers based in numerous different countries for our raw materials and basic parts supplies. Should the financial condition of these suppliers deteriorate, or should suppliers cease operations, it may become more difficult for us to procure necessary supplies on favorable terms or at all. This could adversely affect our business, financial condition and results of operations.

We are exposed to risks related to conducting operations in many different countries.

A large portion of our manufacturing facilities are located outside of the U.S., as described in “Business—Our Strategies—Manufacturing and Operations.” In addition, we sell our products in over 80 countries. As a result, our business is subject to risks related to the differing legal, political, social and regulatory requirements and economic conditions of many jurisdictions. Risks inherent in international operations include the following:

| • | general economic, social or political conditions in the countries in which we operate; |

| • | compliance with a variety of laws and regulations in various jurisdictions may be burdensome; |

| • | inconsistent regulations, licensing and legal requirements may increase our cost of operations as we endeavor to comply with a myriad of laws that differ from one country to another in an unpredictable and adverse manner; |

| • | withholding taxes or other taxes or royalties on our income could be imposed or other restrictions on foreign trade or investment, including currency exchange controls could be adopted; |

| • | adverse changes in export duties, quotas and tariffs and difficulties in obtaining export licenses could occur; |

22

Table of Contents

| • | difficulty in enforcing intellectual property rights; |

| • | increase in transportation and other shipping costs; |

| • | staffing difficulties, national or regional labor strikes or other labor disputes; |

| • | imposition of price controls; and |

| • | difficulty in enforcing agreements and collecting receivables. |

Any of these and other factors could require us to change our current operational structure and could have a material adverse impact on our results of operations.

Significant competition in our markets may adversely affect our sales and overall operations.