Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - VALSPAR CORP | a10282016_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - VALSPAR CORP | a10282016_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - VALSPAR CORP | a1028201_ex31-1.htm |

| EX-24 - EXHIBIT 24 - VALSPAR CORP | a10282016_ex24.htm |

| EX-23.1 - EXHIBIT 23.1 - VALSPAR CORP | a10282016_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - VALSPAR CORP | a10282016_ex21-1.htm |

| EX-10.24 - EXHIBIT 10.24 - VALSPAR CORP | a10282016_ex10-24.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||

WASHINGTON, D.C. 20549 | ||

FORM 10-K | ||

(Mark One) | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 28, 2016 | |

or | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________________ to ___________________ | |

Commission File Number 1-3011 | ||

THE VALSPAR CORPORATION | ||||

(Exact name of registrant as specified in its charter) | ||||

Delaware | 36-2443580 | |||

(State of incorporation) | (I.R.S. Employer Identification No.) | |||

1101 South 3rd Street Minneapolis, Minnesota | 55415 | |||

(Address of principal executive offices) | (Zip Code) | |||

(612) 851-7000 | ||||

(Registrant’s telephone number, including area code) | ||||

Securities registered pursuant to Section 12(b) of the Act: | ||||

Title of Each Class | Name of Each Exchange on which Registered | |||

Common Stock, $0.50 Par Value | New York Stock Exchange | |||

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act). ☐Yes ☒ No

The aggregate market value of the voting stock held by persons other than officers, directors and more than 10% stockholders of the registrant as of April 29, 2016 was approximately $8.3 billion based on the closing sales price of $106.69 per share as reported on the New York Stock Exchange. As of December 13, 2016, 79,422,893 shares of Common Stock, $0.50 par value per share (net of 39,019,731 shares in treasury), were outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

Portions of The Valspar Corporation’s definitive 2017 Proxy Statement (the “Proxy Statement”), to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year ended October 28, 2016, are incorporated by reference into Part III to the extent described in this report.

The Valspar Corporation

Form 10-K

Table of Contents

Page | ||

PART I

ITEM 1 BUSINESS

BUSINESS & PRODUCT OVERVIEW

The Valspar Corporation (Valspar, the Company, we, us or our) is a global leader in the paints and coatings industry. We develop, manufacture and distribute a broad range of coatings, paints and related products, and operate our business in two reportable segments: Coatings and Paints. Our consolidated net sales in 2016 were $4,190.6 million. Net sales in the Coatings and Paints segments in 2016 were $2,388.1 million and $1,564.5 million, respectively. By providing high quality products with technologies that add superior value and performance, Valspar’s business has grown organically. Our global growth has also been fueled by the well-executed integration of acquisitions which have further expanded our scale, technology platforms and worldwide portfolio of respected brands.

Valspar is a Delaware corporation founded in 1806. Our principal executive offices are located at 1101 South 3rd Street, Minneapolis, Minnesota 55415, and our telephone number at that address is (612) 851-7000. Our corporate website address is www.valspar.com. The information on our website is not part of this filing.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, are made available free of charge on our website as soon as reasonably practicable after we electronically file such materials with, or furnish such materials to, the Securities and Exchange Commission. You may access these documents on the "Investors" page of our website referred to above.

Coatings Segment

Our Coatings segment includes our industrial product lines and our packaging product line. We offer a broad range of decorative and protective coatings for metal, wood and plastic, primarily for sale to original equipment manufacturing customers in Africa, Asia, Australia, Europe, North America and South America. Products within our Coatings segment include primers, top coats, varnishes, sprays, stains, fillers and other coatings used by customers in a wide range of manufacturing industries, including agricultural and construction equipment, appliances, building products, furniture, metal fabrication, metal packaging and transportation.

Our industrial product lines include general industrial, coil and wood coatings. Our general industrial product line provides customers a single source for powder, liquid and electrodeposition coatings technologies in a wide variety of industries, including agricultural and construction equipment, pipe, lawn and garden, appliance, transportation, and marine shipping containers. Our coil product line produces coatings that are applied to metal coils used to manufacture pre-engineered buildings and building components, other metal building and architectural products and appliances. Our wood product line supplies decorative and protective coatings for wood furniture, building products, cabinets and floors. We also provide color design and technical service to our customers. We supply our industrial products throughout the world.

Our packaging product line includes coatings for the interior and exterior of metal packaging containers, principally metal food containers and beverage cans. We also produce coatings for aerosol and paint cans, crowns for glass bottles, plastic packaging and bottle closures. We believe we are the world’s largest supplier of metal packaging coatings. We supply our packaging products throughout the world via a global manufacturing footprint in many major countries.

Paints Segment

Our Paints segment includes our consumer paints and automotive paint refinish product lines. We offer a wide variety of paints, primers, topcoats and aerosol spray paints through retailers, distribution networks and company-owned stores.

Our consumer paints product line comprises the largest part of our Paints segment. We offer a broad portfolio of interior and exterior decorative paints, stains, primers, varnishes and specialty decorative products, such as enamels, aerosols and faux finishes, used in both the do-it-yourself and professional markets. In the U.S. and Canada, we offer our branded products and private-label brands through more than 10,000 points of sale. The primary distribution channels for these products are home centers, hardware stores, distributors and independent dealers. In China, we sell branded consumer paints primarily through exclusive distribution to both exclusive and non-exclusive brand retailers. In Australia and New Zealand, we sell branded consumer paints through Valspar company-owned stores, big-box retail hardware and independent dealers. In the U.K. and Ireland, we sell branded products primarily through a large home center customer.

We develop highly customized merchandising and marketing support programs for our consumer paint customers, enabling them to differentiate their paint departments from their competitors’ through customer service, paint tinting technology, product and color selection assistance and in-store displays. Our primary brands include VALSPAR and CABOT in the U.S., HUARUN in

1

China, WATTYL, SOLVER, VALSPAR and PASCOL in Australia and New Zealand and VALSPAR and PLASTI-KOTE in the U.K. and Ireland.

Our automotive product line primarily includes refinish paints and body shop accessories sold through automotive refinish distributors, automotive supply retailers and body shops. We distribute these products under the DE BEER, MATRIX, VALSPAR, USC, PRO-SPRAY, OCTORAL and HOUSE OF KOLOR brands in many countries around the world.

Other and Administrative

In addition to the main product lines within our Coatings and Paints segments, we manufacture and sell specialty resins and colorants. The specialty resins and colorants are manufactured for internal use and for external sale to other coatings manufacturers. We also sell furniture protection plans and furniture care and repair products under the GUARDSMAN brand.

Proposed Merger with The Sherwin-Williams Company

On March 19, 2016, Valspar entered into an Agreement and Plan of Merger (the Merger Agreement) with The Sherwin-Williams Company (Sherwin-Williams) and Viking Merger Sub, Inc., a wholly-owned subsidiary of Sherwin-Williams (Merger Sub).

The Merger Agreement provides that, among other things and subject to the terms and conditions of the Merger Agreement, (1) Merger Sub will be merged with and into Valspar (the Merger), with Valspar surviving the Merger as a wholly-owned subsidiary of Sherwin-Williams, and (2) at the effective time of the Merger, each outstanding share of common stock of Valspar, par value $0.50 per share (Valspar common stock) (other than Valspar common stock held in treasury by Valspar, owned by a subsidiary of Valspar or owned by Sherwin-Williams or any of its wholly-owned subsidiaries, or shares with respect to which appraisal rights have been validly exercised and not lost in accordance with Delaware law) will be converted into the right to receive the Merger Consideration.

The Merger Consideration means $113.00 per share in cash, except that if Sherwin-Williams is required, in order to obtain the necessary antitrust approvals, to commit to any divestiture, license, hold separate, sale or other disposition of or with respect to assets, businesses or product lines of Valspar, Sherwin-Williams or their subsidiaries representing, in the aggregate, in excess of $650 million of Net Sales (as defined in the Merger Agreement), then the Merger Consideration will be $105.00 per share in cash.

The Merger Agreement contains certain termination rights, and we may be required to pay Sherwin-Williams a termination fee of $300 million.

For further information on the Merger Agreement, refer to the Merger Agreement, a copy of which was filed as Exhibit 2.1 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on March 21, 2016, and which is incorporated by reference herein.

On June 29, 2016, Valspar stockholders voted to adopt the Merger Agreement at a special meeting of stockholders held for that purpose. Completion of the Merger remains subject to certain closing conditions, including the expiration or termination of the applicable waiting period under the U.S. Hart-Scott-Rodino Antitrust Improvements Act and the receipt of regulatory approvals in certain other jurisdictions.

COMPETITION

All aspects of the coatings and paints business are highly competitive. Some of our competitors are larger and have greater financial resources than we have.

Competition in our Coatings segment is based on formulating products for specific customer applications, meeting customer delivery and application requirements, new technology offerings and pricing. As one of the world's largest industrial coatings manufacturers, we can provide coatings solutions globally and are committed to developing new technologies.

Competition in our Paints segment is based on factors such as consumer brand recognition, product quality, distribution and price. In this segment, we support our brand awareness through advertising and highly customized merchandising and marketing support programs provided to our customers.

RAW MATERIALS

We obtain raw materials from a number of suppliers. The raw materials are derived from petrochemicals, minerals and metals. Our most significant raw materials include solvents, titanium dioxide and epoxy and other resins. Historically, these materials have been generally available on the open market, with pricing and availability subject to fluctuation. Most of the raw materials used in production are purchased from outside sources. We have made, and plan to continue to make, supply arrangements to meet our current and future usage requirements. We manage sourcing of critical raw materials by establishing contracts, buying from multiple sources and identifying alternative or lower cost materials or technology, when possible. We have active initiatives to

2

find lower cost materials, reformulate products with lower cost and more environmentally friendly raw materials and qualify multiple and local sources of supply, including suppliers from Asia and other lower cost regions of the world.

INTELLECTUAL PROPERTY

Our practice is to seek patent protection for our products and manufacturing processes when appropriate. We also license some patented technology from third parties. Nevertheless, our business is not materially dependent upon licenses or similar rights or on any single patent or group of related patents. Although we believe our patent rights are valuable, our knowledge and trade secret information regarding our manufacturing processes and materials have also been important in maintaining our competitive position. We require certain employees to sign confidentiality agreements relating to proprietary information.

While we make efforts to protect our trade secret information, others may independently develop or otherwise acquire substantially equivalent proprietary information or techniques or inappropriately gain access to our proprietary technology or disclose this technology. Any of these factors could adversely impact the value of our proprietary trade secret information and harm our business.

SEASONALITY AND WORKING CAPITAL ITEMS

Our sales volume is traditionally lowest during the first quarter of the fiscal year (November, December and January), and highest in the third quarter of the fiscal year (May, June and July), primarily due to weather and the buying cycle in our Coatings and Paints segments. When sales are lowest, we build inventory, financed by internally generated funds and short-term debt facilities discussed in Note 9 of Notes to Consolidated Financial Statements.

SIGNIFICANT CUSTOMERS

In 2016, our sales to Lowe’s Companies, Inc. (Lowe's) exceeded 10% of consolidated net sales. Our ten largest customers accounted for approximately 31% of consolidated net sales. Our five largest customers in the Paints segment accounted for approximately 47% of our net sales in the segment. Our five largest customers in the Coatings segment accounted for approximately 19% of our net sales in the segment.

BACKLOG AND GOVERNMENT CONTRACTS

We have no significant backlog of orders and generally are able to fill orders on a current basis. No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the government.

RESEARCH AND DEVELOPMENT

Valspar’s technology innovation has enabled strong new product launches and a robust pipeline of coatings solutions that provide our customers with differentiated, competitively advantaged performance and are cost effective. The base technologies that support our products’ performance and applications have been developed and optimized over many years. Ongoing research and development efforts are focused on delivering the highest value, quality and performance for color and aesthetics, application productivity, in-service durability and environmental footprint and safety.

Valspar maintains a consistently strong investment in research and development, with approximately 1,100 technologists in a worldwide laboratory network, anchored by innovation centers in Minneapolis, MN and Guangzhou, China. Fiscal year 2016 investment was $139.3 million, or 3.3% of net sales, compared to $133.4 million or 3.0% for fiscal 2015 and $136.4 million or 2.9% in fiscal 2014.

ENVIRONMENTAL COMPLIANCE

We undertake to comply with applicable environmental regulations. Capital expenditures for this purpose were not material in fiscal 2016, and we do not expect such expenditures will be material in fiscal 2017.

EMPLOYEES

We employ approximately 11,100 people globally, approximately 360 of whom are subject to collective bargaining agreements in the U.S. We believe our relationship with our union employees is good.

FOREIGN OPERATIONS, EXPORT SALES AND BUSINESS SEGMENT INFORMATION

Our foreign operations are conducted primarily through majority-owned subsidiaries and, to a limited extent, through joint ventures. Revenues from foreign subsidiaries and operations comprised approximately 45% of our total consolidated net sales in 2016.

3

In addition to our manufacturing plants in the U.S., we have manufacturing plants in Australia, Brazil, Canada, China, Finland, France, Germany, India, Ireland, Italy, Malaysia, Mexico, The Netherlands, New Zealand, Poland, Singapore, South Africa, Switzerland, the United Kingdom and Vietnam. We also have joint ventures in Japan, South Africa, Switzerland and Vietnam and sales offices in other countries.

During fiscal 2016, export sales from the U.S. represented 3.4% of our net sales.

For additional financial information regarding our international operations and geographical areas, and our reportable business segments, see Note 15 in Notes to Consolidated Financial Statements.

ITEM 1A RISK FACTORS

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and any investment in us.

The proposed Merger may not be completed on a timely basis, or at all, and the failure to complete or delays in completing the Merger could adversely affect our business, financial results and stock price.

We can provide no assurance that the Merger will be consummated or consummated in the timeframe or manner currently anticipated. The Merger is subject to a number of conditions including the receipt of regulatory approvals, which are not within our control. There can be no assurance as to when, or if, the conditions to closing of the Merger will be satisfied or waived or that other events will not intervene to delay or result in the termination of the Merger.

Any delay in closing or a failure to close could have a negative impact on our business, financial results and stock price as well as our relationships with our customers, suppliers or employees, and a negative impact on our ability to pursue alternative strategic transactions and/or our ability to implement alternative business plans. If the Merger Agreement is terminated, we may be required to pay a termination fee of $300 million.

Our business and financial results could be adversely impacted during the pendency of the Merger.

The Merger may cause disruptions to our business or business relationships and create uncertainty surrounding our ongoing business operations, which could have an adverse impact on our financial condition, results of operations and cash flows, regardless of whether the Merger is completed, including as a result of the following (all of which could be exacerbated by a delay in completion of the Merger):

• | customers, suppliers or other parties with which we maintain business relationships may experience uncertainty prior to the closing of the Merger and seek alternative relationships with third parties or seek to terminate or re-negotiate their relationships with us; |

• | our employees may experience uncertainty about their future roles with us, which might adversely affect our ability to hire, retain and motivate key personnel and other employees; |

• | the Merger Agreement restricts us from engaging in certain actions without the consent of Sherwin-Williams, which could prevent us from pursuing opportunities that may arise prior to the consummation of the Merger; and |

• | the attention of our management may be directed to transaction-related considerations and may be diverted from the day-to-day operations of our business. |

In addition, we have incurred, and will continue to incur, significant costs, expenses, and fees for professional services and other transaction costs in connection with the Merger, and many of these fees and costs are payable by us regardless of whether or not the Merger is consummated.

Regulatory authorities may require divestitures in connection with the proposed Merger, which could result in Valspar stockholders receiving $105 per share instead of $113 per share as consideration in connection with completion of the Merger.

Following completion of the Merger, Valspar stockholders will receive as merger consideration $113 per share in cash, except that the merger consideration will be $105 per share in cash if Sherwin-Williams is required, in order to obtain the necessary regulatory approvals, to commit to any divestiture, license, hold separate, sale or other disposition of or with respect to assets, businesses or product lines of Valspar, Sherwin-Williams or their subsidiaries representing, in the aggregate, in excess of $650 million of net sales (as defined in the Merger Agreement). There can be no assurance as to whether regulatory authorities will not require such divestitures and accordingly there can be no assurance that Valspar stockholders will receive $113 per share in cash instead of $105 per share in cash.

4

Deterioration of economic conditions could harm our business.

Our business may be adversely affected by changes in national or global economic conditions, including inflation, interest rates, access to and the functioning of capital markets, consumer spending rates, energy availability and costs (including fuel surcharges) and the effects of governmental initiatives to manage economic conditions. Deterioration of national or global economic conditions may reduce demand for our products and overall growth of the paints and coatings industry.

Volatility in financial markets and the deterioration of national or global economic conditions could impact our operations as follows:

• | the financial stability of our customers and suppliers may be compromised, which could result in additional bad debts for us or non-performance by suppliers; |

• | it may become more costly or difficult to obtain financing to fund operations or investment opportunities, or to refinance our debt in the future; and |

• | the value of our investments in debt and equity securities may decline, including our assets held in pension plans. |

At various times, we utilize hedges and other derivative financial instruments to reduce our exposure to various interest rate risks, which qualify for hedge accounting for financial reporting purposes. Volatile fluctuations in market conditions could cause these instruments to become ineffective, which could require any gains or losses associated with these instruments to be reported in our earnings each period.

We have goodwill and intangible assets recorded on our balance sheet. We periodically evaluate the recoverability of the carrying value of our goodwill and intangible assets whenever events or changes in circumstances indicate that such value may not be recoverable. Impairment assessment involves judgment as to assumptions regarding future sales and cash flows and the impact of market conditions on those assumptions. Future events and changing market conditions may impact our assumptions and may result in changes in our estimates of future sales and cash flows that may result in us incurring substantial impairment charges, which would adversely affect our results of operations or financial condition.

Fluctuations in the availability and prices of raw materials could negatively impact our financial results.

We purchase the raw materials needed to manufacture our products from a number of suppliers. Most of our raw materials are derived from petroleum, minerals and metals. Under normal market conditions, these materials are generally available from one or more suppliers on the open market. From time to time, however, the availability and costs of raw materials may fluctuate significantly, which could impair our ability to procure necessary materials, or increase the cost of manufacturing our products. As a result, our raw material costs can be volatile, and we have experienced disruptions in supplies of certain raw materials at various times. These disruptions could affect our ability to manufacture products ordered by our customers, which could negatively impact sales.

When raw material costs increase, our profit margins are reduced unless and until we are able to pass along the increases to our customers through higher prices. If raw material costs increase and if we are unable to pass along, or are delayed in passing along, those increases to our customers, we will experience profit margin reductions.

Many of our customers are in cyclical industries, which may affect the demand for our products.

Many of our customers are in businesses or industries that are cyclical and sensitive to changes in general economic conditions. As a result, the demand for our products depends, in part, upon economic cycles affecting our customers' businesses or industries and general economic conditions. Downward economic cycles affecting the industries of our customers and the deterioration of global economic conditions may reduce our sales and profitability.

The industries in which we operate are highly competitive, and some of our competitors are larger than we are and may have greater financial resources than we do.

All aspects of the paints and coatings business are highly competitive. We face strong competitors in all areas of our business. Any increase in competition may cause us to lose market share or compel us to reduce prices to remain competitive, which could result in reduced margins for our products. Competitive pressures may not only impair our margins but may also impact our revenues and our growth. Many of our competitors are larger than we are and may have greater financial resources than we do. Competition with these companies could curtail price increases or require price reductions or increased spending on marketing, sales and research and development, any of which could adversely affect our results of operations.

5

Our larger competitors may have more resources to finance acquisitions or internal growth in this competitive environment, and may have more resources or capabilities to conduct business with large suppliers or large customers in our industry. Finally, many of our larger competitors operate businesses in addition to paints and coatings and so may be better able to compete during coatings industry downturns.

We have a significant amount of debt.

Our total long-term and short-term debt was $1,778.4 million at October 28, 2016. Our debt categorized as short-term was $221.4 million at October 28, 2016. Our level of debt may have important consequences. For example, it:

• | may require us to dedicate a material portion of our cash flows from operations to make payments on our indebtedness, thereby reducing our ability to fund working capital, capital expenditures or other general corporate purposes; |

• | could make us less attractive to prospective or existing customers or less able to fund potential acquisitions; and |

• | may limit our flexibility to adjust to changing business and market conditions and make us more vulnerable to a downturn in general economic conditions as compared to a competitor that may have less indebtedness. |

Global economic and capital market conditions may cause our access to capital to be more difficult in the future and/or costs to secure such capital more expensive.

We may need new or additional financing in the future to provide liquidity to conduct our operations, expand our business or refinance existing indebtedness. Any sustained weakness in general economic conditions and/or U.S. or global capital markets could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and we may also rely in the future, on access to financial markets as a source of liquidity for working capital requirements, acquisitions and general corporate purposes. Longer term volatility and continued disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation of financial institutions, reduced alternatives or failures of significant financial institutions could adversely affect our access to the liquidity needed for our businesses in the longer term. Such disruptions could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged.

Acquisitions are an important part of our growth strategy, and future acquisitions may not be available or successful.

Acquisitions have historically contributed significantly to the growth of our company. As part of our growth strategy, we intend to continue to pursue acquisitions of complementary businesses and products. If we are not able to identify and complete future acquisitions, our growth may be negatively affected. Even if we are successful in completing future acquisitions, we may experience:

• | difficulties in assimilating acquired companies and products into our existing business; |

• | delays in realizing the benefits from the acquired companies or products; |

• | difficulties due to lack of or limited prior experience in any new markets we may enter; |

• | unforeseen claims and liabilities, including unexpected environmental exposures or product liability; |

• | unforeseen adjustments, charges and write-offs; |

• | unexpected losses of customers of, or suppliers to, acquired businesses; |

• | difficulties in conforming the acquired business’ standards, processes, procedures and controls with our operations; |

• | variability in financial information arising from the application of purchase price accounting; |

• | difficulties in retaining key employees of the acquired businesses; and |

• | challenges arising from the increased geographic diversity and complexity of our operations. |

Any of these factors may make it more difficult to repay our debt or have an adverse effect on results of operations. In addition, an acquisition could materially impair our operating results by causing us to incur debt or requiring us to amortize acquisition-related costs or the cost of acquired assets.

6

We derive a substantial portion of our revenues from foreign markets, which subjects us to additional business risks.

We conduct a substantial portion of our business outside of the U.S. We currently have production facilities, research and development facilities and administrative and sales offices located outside the U.S., including facilities and offices located in Australia, Brazil, Canada, China, Finland, France, Germany, Greece, India, Indonesia, Ireland, Italy, Japan, Malaysia, Mexico, The Netherlands, New Zealand, Poland, Russia, Singapore, South Africa, South Korea, Spain, Switzerland, the United Arab Emirates, the United Kingdom and Vietnam. In 2016, revenues from products sold outside the U.S. accounted for approximately 45% of our consolidated net sales. Accordingly, the majority of our cash and cash equivalents are held by our foreign subsidiaries.

We expect sales in international markets to represent a significant portion of our consolidated net sales. Notwithstanding the benefits of geographic diversification, our ability to achieve and maintain profitable growth in international markets is subject to risks related to the differing legal, political, social and regulatory requirements and economic conditions of many jurisdictions. Risks inherent in international operations include the following:

• | agreements may be difficult to enforce, and receivables may be difficult to collect or have longer payment cycles; |

• | foreign countries may impose additional withholding taxes or otherwise tax our foreign income or adopt other restrictions on foreign trade or investment, including currency exchange controls; |

• | foreign operations may experience labor disputes and difficulties in attracting and retaining key employees; |

• | transportation and other shipping costs may increase; |

• | foreign governments may nationalize private enterprises; |

• | unexpected adverse changes may occur in export duties, quotas and tariffs and difficulties in obtaining export licenses; |

• | intellectual property rights may be more difficult to enforce; |

• | our business and profitability in a particular country could be affected by political or economic changes or terrorist activities and responses to such activities; |

• | unexpected adverse changes in foreign laws or regulatory requirements may occur; and |

• | compliance with a variety of foreign laws and regulations may be burdensome. |

Fluctuations in foreign currency exchange rates could affect our financial results.

We conduct business in various regions throughout the world and are subject to market risk due to changes in the exchange rate of foreign currencies in relation to our reporting currency, the U.S. dollar. The functional currencies of our foreign operations are generally the local currency in the corresponding country. Because our consolidated financial statements are presented in U.S. dollars, we translate revenues and expenses into U.S. dollars at the average exchange rate during each reporting period, as well as assets and liabilities into U.S. dollars at exchange rates in effect at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against other major currencies will affect our net revenues, operating income and the value of balance sheet items denominated in foreign currencies. We have not used derivative financial instruments to hedge our exposure to translation gains and losses. Fluctuations in foreign currency exchange rates, particularly the strengthening of the U.S. dollar against major currencies, could materially affect our financial results. At October 28, 2016, the regions where we have the largest exposure to our net sales, net income and financial position were China (CNY), Europe (EUR), Mexico (MXN), the UK (GBP), Australia (AUD), Brazil (BRL) and Canada (CAD).

We have certain key customers, and the loss of key customers could negatively affect our business.

Our relationships with certain key customers are important to us. From 2014 through 2016, sales to our largest customer exceeded 10% of our consolidated net sales. In 2016, our ten largest customers accounted for approximately 31% of our consolidated net sales. Our five largest customers in the Paints segment accounted for approximately 47% of our net sales in the segment. Our five largest customers in the Coatings segment accounted for approximately 19% of our net sales in the segment. Although we sell various types of products through various channels of distribution, we believe that the loss of a substantial portion of net sales to our largest customers could have a material adverse effect on us.

We have not typically entered into long-term contracts with our major customers for minimum purchase requirements. If any one of our key customers cease making purchases at historical levels, with little or no notice, we could experience a material adverse effect.

7

Our ability to innovate, develop, produce and market products that meet the demands of our customers could have a negative impact on our results of operations and financial condition.

Our business relies on continued global demand for our brands and products. To achieve business goals, we must develop and sell products that appeal to customers. This is dependent on a number of factors, including our ability to produce products that meet the quality, volume demands, performance and price expectations of our customers. Future growth will depend on our ability to continue to innovate our existing products and to develop and introduce new products that adapt to our customers' specific preferences. If we fail to keep pace with product innovation on a competitive basis or to predict market demands for our products, our business, financial condition and results of operations could be adversely affected.

In addition, our customers’ or consumers’ perceptions about the acceptability or potential environmental or health effects of certain substances could require us to invest additional amounts to develop products that exclude those substances. If we are unable to develop products that exclude those substances when and if required by our customers, we may experience reduced sales and profitability.

Supply disruptions, temporary plant and/or power outages, work stoppages, natural disasters and severe weather events could increase the cost of doing business or otherwise harm our operations, our customers and our suppliers. It is not always possible for us to predict the occurrence or consequence of any such events. However, such events could reduce demand for our products or make it difficult or impossible for us to receive raw materials from suppliers or to deliver products to customers.

If the reputation of our company or one or more of its key brands is damaged, it could harm our business.

Our reputation is one of the foundations of our relationships with key customers and other stakeholders. If we are unable to effectively manage real or perceived issues that negatively affect our reputation, our ability to conduct our business could be impaired, and our financial results could suffer. As we continue to invest in advertising and promotion for our key brands, our financial success is becoming more dependent on the success of our brands. The success of these brands could suffer if our marketing plans or product initiatives do not have the desired effect on a brand’s image, reputation or ability to attract customers. Further, our growth and results could be harmed if the reputation of our company or a key brand is damaged due to real or perceived quality issues, product recalls, regulatory enforcement or actions or customer claims and litigation.

Technology changes, and our ability to protect our technology, could affect our business.

Our product and application technology is supported by underlying chemistry that has been developed over many years. Ongoing research and development efforts focus on improving our internally developed and acquired technology and formulating changes to improve the performance, profitability and cost competitiveness of our products. If our competitors develop new technology, or if our customers’ technology requirements change, and we are not able to develop competitive technology, our business and financial results could suffer. Further, although we seek to protect our proprietary technology and information through confidentiality and trade secret protection programs and practices, patents, cybersecurity measures and other means, if we were unable to protect our material proprietary technology or information, our business and financial results could suffer.

Interruption, failure or compromise of our information systems could adversely affect our business.

We rely on information systems to run most aspects of our business, including sales and distribution of products, purchases of raw materials and supplies, accounting for purchase and sale transactions, manufacturing processes, billing and collections and managing data and records for employees and other parties. Our business may be adversely affected if these systems are interrupted, damaged or compromised or if they fail for any extended period of time due to user errors, programming errors, computer viruses, security breaches or other problems. Information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of cyber attackers. Although we strive to have appropriate security controls in place, prevention of security breaches cannot be assured, particularly as cyber threats continue to evolve. We may be required to expend additional resources to continue to enhance our security measures or to investigate and remediate any security vulnerabilities. In addition, third-party service providers manage a portion of our information systems, and we are subject to risk as a result of interruption, failure or security breaches of those systems. The consequences of these risks could adversely impact our results of operations and cash flows.

Numerous laws and regulations affect our business, and new laws or regulations, adverse decisions relating to our compliance with existing laws and regulations, or changes to these laws and regulations, could have a negative effect on our financial condition and results of operations.

We are subject to a wide variety of complex domestic and foreign laws and regulations, and legal compliance risks, including securities laws, tax laws, employment and pension-related laws, competition laws, U.S. and foreign export and trading laws and laws governing improper business practices. We are affected by new laws and regulations, and changes to existing laws and

8

regulations, including interpretations by courts and regulators. From time to time, our Company, our operations and the industries in which we operate are being reviewed or investigated by regulators, which could lead to enforcement actions or the assertion of private litigation claims and damages.

We are subject to tax laws and regulations in the United States and multiple foreign jurisdictions. We are affected by changes in tax laws and regulations, as well as changes in related interpretations and other tax guidance. In the ordinary course of our business, we are subject to examinations and investigations by various tax authorities. In addition to existing examinations and investigations, there could be additional examinations and investigations in the future, and existing examinations and investigations could be expanded.

We are subject to numerous laws and regulations that control the manufacturing, marketing, sale, use and disposal of our products. These laws and regulations include health, safety, product liability, environmental and labeling requirements applicable to our products and business.

Environmental laws and regulations control, among other things, the discharge of pollutants into the air and water, the handling, use, treatment, storage and clean-up of hazardous and non-hazardous wastes, the investigation and remediation of soil and groundwater affected by hazardous substances, or otherwise relating to environmental protection and various health and safety matters. These environmental laws and regulations impose strict, retroactive and joint and several liability for the costs of, and damages resulting from, cleaning up current sites, past spills, disposals and other releases of hazardous substances. Violations of these laws and regulations can also result in fines and penalties. We are currently undertaking remedial activities at a number of our facilities and properties and have received notices under the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, or analogous state laws, of liability or potential liability in connection with the disposal of material from our operations or former operations. Pursuant to health, safety, product liability and labeling laws and regulations, we have also been subject to various governmental enforcement actions and litigation by individuals relating to the sale or use of or exposure to our products or materials used or contained in our products, including claims for property damage or personal injury claimed to have been caused by our products or materials used or contained in our products.

We are subject to the risk that adverse decisions relating to our compliance with existing laws and regulations and new laws or regulations, or changes in existing laws or regulations or their interpretation could limit our ability to generate revenues, increase our compliance costs and expand our potential liability for enforcement actions by governmental authorities and litigation by individuals.

ITEM 1B UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2 PROPERTIES

Our principal offices are located in Minneapolis, Minnesota. Our North American manufacturing operations are conducted at 25 locations (21 owned; 4 leased) in the U.S., Canada and Mexico. The total combined square footage for our principal offices and manufacturing operations in North America is approximately 4,590,000. Asia Pacific manufacturing operations are conducted at 13 locations (11 owned; 2 leased) in Australia, China, Malaysia, New Zealand, Singapore and Vietnam, with a total combined square footage of approximately 2,310,000. European manufacturing operations are conducted at 15 locations (12 owned; 3 leased) in Finland, France, Germany, Ireland, Italy, The Netherlands, Poland, Switzerland and the United Kingdom, with a total combined square footage of approximately 1,702,000. In South America, we own two manufacturing facilities in Brazil with square footage of approximately 471,000. In India, we own one manufacturing facility with square footage of approximately 113,000. In South Africa, we own one manufacturing facility with square footage of approximately 89,000.

9

Shown below is a breakdown of the approximate square footage of principal facilities by region as of October 28, 2016:

Region | Approximate Square Footage Owned | Approximate Square Footage Leased | Total | |||

North America | 3,828,000 | 762,000 | 4,590,000 | |||

Asia Pacific | 2,235,000 | 75,000 | 2,310,000 | |||

Europe | 1,538,000 | 164,000 | 1,702,000 | |||

Other | 673,000 | — | 673,000 | |||

Total | 8,274,000 | 1,001,000 | 9,275,000 | |||

Set forth below is a breakdown of the approximate square footage of principal facilities by business segment:

Business Segment | Approximate Square Footage | |

Coatings | 5,384,000 | |

Paints | 3,114,000 | |

Other and Administrative | 777,000 | |

Total | 9,275,000 | |

We believe our properties are well maintained, in good operating condition and adequate for the purposes for which they are being used. Operating capacity of our manufacturing properties varies by product line, but additional production capacity is available for most product lines by increasing the number of days and/or shifts worked.

ITEM 3 LEGAL PROCEEDINGS

Environmental Matters

We are involved in various claims relating to environmental matters at a number of current and former plant sites and waste management sites. We engage or participate in remedial and other environmental compliance activities at certain of these sites. At other sites, we have been named as a potentially responsible party (PRP) under federal and state environmental laws for site remediation. We analyze each individual site, considering the number of parties involved, the level of our potential liability or contribution relative to the other parties, the nature and magnitude of the hazardous wastes involved, the method and extent of remediation, the potential insurance coverage, the estimated legal and consulting expense with respect to each site and the time period over which any costs would likely be incurred. Based on the above analysis, we estimate the clean-up costs and related claims for each site. The estimates are based in part on discussion with other PRPs, governmental agencies and engineering firms.

We accrue appropriate reserves for potential environmental liabilities when the amount of the costs that will be incurred can be reasonably determined. Accruals are reviewed and adjusted as additional information becomes available. While uncertainties exist with respect to the amounts and timing of our ultimate environmental liabilities, we believe it is neither probable nor reasonably possible that such liabilities, individually or in the aggregate, will have a material adverse effect on our financial condition, results of operations or cash flows.

Other Legal Matters

We are involved in a variety of legal claims and proceedings relating to personal injury, product liability, warranties, customer contracts, employment, trade practices, environmental and other legal matters that arise in the normal course of business. These claims and proceedings include cases where we are one of a number of defendants in proceedings alleging that the plaintiffs suffered injuries or contracted diseases from exposure to chemicals or other ingredients used in the production of some of our products or waste disposal. We are also subject to claims related to the performance of our products. We believe these claims and proceedings are in the ordinary course for a business of the type and size in which we are engaged. While we are unable to predict the ultimate outcome of these claims and proceedings, we believe it is neither probable nor reasonably possible that the costs and liabilities of such matters, individually or in the aggregate, will have a material adverse effect on our financial condition, results of operations or cash flows.

ITEM 4 MINE SAFETY DISCLOSURES

Not applicable.

10

PART II

ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is listed on the New York Stock Exchange under the trading symbol VAL. The table below sets forth the quarterly high and low market prices of our common stock for fiscal years 2016 and 2015 as quoted on the New York Stock Exchange.

Market Price (high/low) | |||

For the Fiscal Year | 2016 | 2015 | |

First Quarter | $85.27 - 71.99 | $88.36 - 80.97 | |

Second Quarter | $107.05 - 74.20 | $90.91 - 81.04 | |

Third Quarter | $108.64 - 105.90 | $88.17 - 78.66 | |

Fourth Quarter | $107.40 - 97.62 | $84.05 - 70.58 | |

The quarterly dividend declared November 17, 2016, to be paid on December 15, 2016 to common stockholders of record December 1, 2016, was increased to $0.37 per share. The table below sets forth the quarterly dividends paid for fiscal years 2016 and 2015.

Per Share Dividends | |||||||

For the Fiscal Year | 2016 | 2015 | |||||

First Quarter | $ | 0.33 | $ | 0.30 | |||

Second Quarter | $ | 0.33 | $ | 0.30 | |||

Third Quarter | $ | 0.33 | $ | 0.30 | |||

Fourth Quarter | $ | 0.33 | $ | 0.30 | |||

$ | 1.32 | $ | 1.20 | ||||

The number of record holders of our common stock at December 13, 2016 was 1,101.

ISSUER PURCHASES OF EQUITY SECURITIES

Period | Total Number of Shares Purchased1 | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs1 | Maximum Amount that May Yet be Purchased Under the Plans or Programs1 | |||||||

Repurchase program: | |||||||||||

7/30/16 - 8/26/16 | 0 | N/A | 0 | $ | 1,175,630 | ||||||

8/27/16 - 9/22/16 | 0 | N/A | 0 | $ | 1,175,630 | ||||||

9/23/16 - 10/28/16 | 0 | N/A | 0 | $ | 1,175,630 | ||||||

Other transactions2 | 1,020 | $ | 105.75 | ||||||||

1On November 21, 2014, the Board approved a share repurchase program, with no expiration date, authorizing us to purchase up to $1.5 billion of outstanding shares of our common stock. We repurchased a total of 221,060 shares in fiscal 2016.

2Our other transactions include our acquisition of our common stock in satisfaction of tax-payment obligations upon vesting of restricted stock.

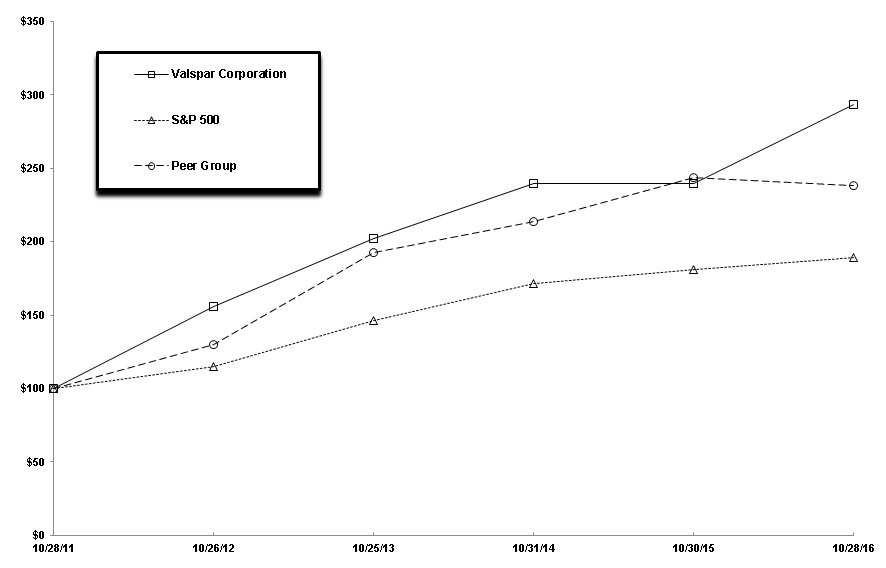

STOCK PERFORMANCE GRAPH

The following graph compares our cumulative total stockholder return for the last five fiscal years with the cumulative total return of the Standard & Poor’s 500 Stock Index and a peer group of companies selected by us on a line-of-business basis. The graph assumes the investment of $100 in our common stock, the S&P 500 Index and the peer group at the end of fiscal 2011 and the reinvestment of all dividends.

11

The companies selected to form the peer group index are: Akzo Nobel N.V.; Ferro Corporation; H.B. Fuller Company; Masco Corporation; Newell Rubbermaid Inc.; PPG Industries, Inc.; RPM International Inc.; and The Sherwin-Williams Company.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

Among The Valspar Corporation, a Peer Group and the S&P 500 Index

Cumulative Total Return | |||||||||||||||||||||||

Fiscal Year End | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||

Valspar | $ | 100 | $ | 156 | $ | 202 | $ | 240 | $ | 240 | $ | 294 | |||||||||||

Peer Group | $ | 100 | $ | 130 | $ | 193 | $ | 214 | $ | 244 | $ | 238 | |||||||||||

S&P 500 | $ | 100 | $ | 115 | $ | 147 | $ | 172 | $ | 181 | $ | 189 | |||||||||||

Assumes $100 invested on October 28, 2011 in our common stock, the Peer Group and the S&P 500 Index, including reinvestment of dividends.

EQUITY COMPENSATION PLANS

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans1 | ||||||

Equity compensation plans approved by security holders | 4,343,011 | $ | 41.01 | 4,105,254 | |||||

Equity compensation plans not approved by security holders | None | None | None | ||||||

Total | 4,343,011 | $ | 41.01 | 4,105,254 | |||||

1 | The number of securities remaining available for future issuance under equity compensation plans consists of shares issuable under the 2015 Omnibus Equity Plan, which was approved by the stockholders in February 2015. |

12

ITEM 6 SELECTED FINANCIAL DATA

The following selected financial data has been derived from our audited Consolidated Financial Statements and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and related Notes included elsewhere in this Form 10-K.

Fiscal Years | ||||||||||||||||||||

(Dollars in thousands, except per share amounts) | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

Operating Results | Net sales | $ | 4,190,552 | $ | 4,392,622 | $ | 4,625,624 | $ | 4,194,977 | $ | 4,106,888 | |||||||||

Cost and Expenses | ||||||||||||||||||||

Cost of sales | 2,654,968 | 2,841,233 | 3,086,578 | 2,836,919 | 2,753,184 | |||||||||||||||

Operating expenses | 1,006,545 | 951,403 | 979,137 | 865,634 | 871,434 | |||||||||||||||

Gain on sale of certain assets | — | 48,001 | — | — | — | |||||||||||||||

Income from operations | 529,039 | 647,987 | 559,909 | 492,424 | 482,270 | |||||||||||||||

Interest expense | 90,560 | 81,348 | 65,330 | 64,758 | 67,604 | |||||||||||||||

Other (income) expense – net | 3,960 | 2,838 | 2,697 | 3,871 | (2,558 | ) | ||||||||||||||

Income before income taxes | 434,519 | 563,801 | 491,882 | 423,795 | 417,224 | |||||||||||||||

Net income | 353,040 | 399,506 | 345,401 | 289,255 | 292,497 | |||||||||||||||

Net income as a percent of sales | 8.4 | % | 9.1 | % | 7.5 | % | 6.9 | % | 7.1 | % | ||||||||||

Return on average equity | 35.9 | % | 42.8 | % | 32.4 | % | 24.7 | % | 24.0 | % | ||||||||||

Per common share: | ||||||||||||||||||||

Net income – basic | $ | 4.47 | $ | 4.97 | $ | 4.13 | $ | 3.29 | $ | 3.20 | ||||||||||

Net income – diluted | 4.36 | 4.85 | 4.01 | 3.20 | 3.10 | |||||||||||||||

Dividends paid | 1.32 | 1.20 | 1.04 | 0.92 | 0.80 | |||||||||||||||

Financial Position | Total assets | $ | 4,314,550 | $ | 4,318,575 | $ | 4,033,951 | $ | 4,025,509 | $ | 3,626,836 | |||||||||

Working capital | 330,465 | 264,491 | (127,164 | ) | 99,717 | 422,405 | ||||||||||||||

Property, plant and equipment, net | 668,443 | 632,765 | 645,102 | 633,475 | 550,968 | |||||||||||||||

Long-term debt, net of current portion | 1,556,952 | 1,706,933 | 950,035 | 1,037,392 | 1,012,578 | |||||||||||||||

Stockholders’ equity | 1,113,423 | 855,009 | 1,011,091 | 1,122,550 | 1,223,523 | |||||||||||||||

Other Statistics | Property, plant and equipment expenditures | $ | 120,420 | $ | 97,126 | $ | 121,271 | $ | 116,749 | $ | 89,363 | |||||||||

Depreciation and amortization expense | 98,022 | 92,603 | 100,910 | 88,159 | 93,704 | |||||||||||||||

Research and development expense | 139,318 | 133,365 | 136,381 | 133,789 | 123,644 | |||||||||||||||

Total cash dividends | $ | 104,553 | $ | 96,890 | $ | 87,427 | $ | 81,189 | $ | 73,351 | ||||||||||

Average diluted common shares outstanding (000’s) | 81,020 | 82,447 | 86,046 | 90,526 | 94,380 | |||||||||||||||

Number of stockholders at year end | 1,105 | 1,201 | 1,219 | 1,290 | 1,365 | |||||||||||||||

Number of employees at year end | 11,083 | 11,130 | 10,513 | 10,702 | 9,755 | |||||||||||||||

Market price range – common stock: | ||||||||||||||||||||

High | $ | 108.64 | $ | 90.91 | $ | 82.26 | $ | 74.25 | $ | 59.81 | ||||||||||

Low | 71.99 | 70.58 | 66.94 | 55.17 | 33.17 | |||||||||||||||

Reference is made to the Notes to Consolidated Financial Statements for a summary of accounting policies and additional information.

13

ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Dollars in thousands, except per share amounts) |

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is intended to provide a reader of our financial statements with a narrative from the perspective of management on our financial condition, results of operations, liquidity and certain other factors that may affect our future results. Unless otherwise noted, transactions, trends and other factors significantly impacting our financial condition, results of operations and liquidity are discussed in order of magnitude. In addition, unless expressly stated otherwise, the comparisons presented in this MD&A refer to the same period in the prior year. Our MD&A is presented in six sections:

• | Overview |

• | Results of Operations |

• | Financial Condition |

• | Critical Accounting Estimates |

• | Off-Balance Sheet Arrangements |

• | Forward-Looking Statements |

Our MD&A should be read in conjunction with the Consolidated Financial Statements and related Notes included in Item 8, Financial Statements and Supplementary Data, of this Form 10-K.

OVERVIEW

Valspar is a global leader in the paints and coatings industry. We develop, manufacture and distribute a broad range of coatings, paints and related products and we operate our business in two reportable segments: Coatings and Paints. Our Coatings segment aggregates our industrial and packaging product lines. Our Paints segment aggregates our consumer paints and automotive refinish product lines. See Note 15 in Notes to Consolidated Financial Statements for further information on our reportable segments.

We operate in over 25 countries, and approximately 45% of our total net sales in 2016 were generated outside of the U.S. In the discussions of our operating results, we sometimes refer to the impact of changes in foreign currency exchange rates or the impact of foreign currency exchange rate fluctuations, which are references to the differences between the foreign currency exchange rates we use to translate international operating results from local currencies into U.S. dollars for reporting purposes. The impact of foreign currency exchange rate fluctuations is calculated as the difference between current period activity translated using the current period’s currency exchange rates and the comparable prior-year period’s currency exchange rates. We use this method to calculate the impact of changes in foreign currency exchange rates for all countries where the functional currency is not the U.S. dollar.

We have a 4-4-5 week accounting cycle with the fiscal year ending on the Friday on or immediately preceding October 31. Fiscal years 2016 and 2015 included 52 weeks while fiscal year 2014 included 53 weeks.

Our fundamental business objective is to create long-term value for our stockholders. We intend to accomplish this by:

• | Focusing on Customer Success by delivering coatings products and solutions that add value for our customers; |

• | Building Strong Brands and Distribution Partners by investing in brands that are well recognized in the markets in which we operate and building differentiated distribution networks in key markets; |

• | Developing Differentiated Technologies by investing in technologies that enhance our competitive position and add value for our customers; |

• | Driving Industry-Leading Innovation by developing unique products and services that differentiate us in the marketplace with our customers; and |

• | Attracting and Developing the Best People by creating a world class team with deep expertise and stockholder value orientation. |

In addition to creating value for our stockholders, we are committed to:

14

• | Adhering to our values, engaging in ethical business conduct and doing business with integrity; |

• | Improving the safety and reducing the environmental footprint of our business and the products we manufacture while also delivering solutions that enable our customers to meet their safety and environmental objectives; and |

• | Demonstrating our corporate citizenship by supporting the communities in which we work and live through volunteer efforts and philanthropy. |

Proposed Merger with The Sherwin-Williams Company

On March 19, 2016, Valspar entered into an Agreement and Plan of Merger (the Merger Agreement) with The Sherwin-Williams Company (Sherwin-Williams) and Viking Merger Sub, Inc., a wholly-owned subsidiary of Sherwin-Williams (Merger Sub).

The Merger Agreement provides that, among other things and subject to the terms and conditions of the Merger Agreement, (1) Merger Sub will be merged with and into Valspar (the Merger), with Valspar surviving the Merger as a wholly-owned subsidiary of Sherwin-Williams, and (2) at the effective time of the Merger, each outstanding share of common stock of Valspar, par value $0.50 per share (Valspar common stock) (other than Valspar common stock held in treasury by Valspar, owned by a subsidiary of Valspar or owned by Sherwin-Williams or any of its wholly-owned subsidiaries, or shares with respect to which appraisal rights have been validly exercised and not lost in accordance with Delaware law) will be converted into the right to receive the Merger Consideration.

The Merger Consideration means $113.00 per share in cash, except that if Sherwin-Williams is required, in order to obtain the necessary antitrust approvals, to commit to any divestiture, license, hold separate, sale or other disposition of or with respect to assets, businesses or product lines of Valspar, Sherwin-Williams or their subsidiaries representing, in the aggregate, in excess of $650 million of Net Sales (as defined in the Merger Agreement), then the Merger Consideration will be $105.00 per share in cash.

The Merger Agreement contains certain termination rights, and we may be required to pay Sherwin-Williams a termination fee of $300 million.

For further information on the Merger Agreement, refer to the Merger Agreement, a copy of which was filed as Exhibit 2.1 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on March 21, 2016, and which is incorporated by reference herein.

On June 29, 2016, Valspar stockholders voted to adopt the Merger Agreement at a special meeting of stockholders held for that purpose. Completion of the Merger remains subject to certain closing conditions, including the expiration or termination of the applicable waiting period under the U.S. Hart-Scott-Rodino Antitrust Improvements Act and the receipt of regulatory approvals in certain other jurisdictions.

The following discussion of results of operations and financial condition should be read in the context of this overview.

RESULTS OF OPERATIONS

Overview

Net sales in 2016 were $4,190,552 compared to $4,392,622 in 2015. The decline was primarily due to lower sales in our consumer paints product line, the impact of foreign currency exchange and lower sales in our general industrial product line. This decline was partially offset by the acquisition of the performance coating businesses of Quest Specialty Chemicals (Quest), which took place in the third quarter of 2015, and higher sales in our coil product line.

Foreign currency translation had a $128,600 negative impact on our net sales in 2016. The impact on earnings was partially mitigated by our management of operating activities at the local level, with underlying costs generally denominated in the same currency as sales. This foreign currency exchange impact reflects the strengthening of the U.S. dollar against many international currencies versus the prior year.

Our raw material costs were approximately 80% of our cost of goods sold in 2016 and 2015.

Gross profit as a percent of sales increased to 36.6% from 35.3% in the prior year driven by improved productivity and favorable cost/price comparison. Operating expenses as a percentage of net sales increased to 24.0% from 21.7% primarily due to higher employee-related costs and costs related to the proposed merger, partially offset by lower marketing expenses. Net income as a percent of sales of 8.4% declined from 9.1%. This decline was the result of higher operating expenses and a 2015 gain on sale of certain assets of a non-strategic specialty product offering, partially offset by a lower tax rate and improved gross margin.

15

Restructuring

Fiscal year 2016 restructuring expenses primarily relate to initiatives to improve our global cost structure by consolidating our manufacturing operations in the Paints segment and reducing non-manufacturing headcount in our Paints and Coatings segments. These initiatives included moving manufacturing of selected products in our consumer paints product line to a third party (continuation of an initiative started in 2015), consolidating three sites in our automotive product line as a result of the Quest acquisition and reducing headcount in our Australia and Europe regions. These restructuring activities resulted in pre-tax charges of $18,505 or $0.15 per diluted share after taxes in fiscal year 2016. Included in fiscal 2016 restructuring charges are pre-tax non-cash asset-related charges of $7,358. Asset-related charges include asset impairment charges as well as accelerated depreciation for assets with useful lives that have been shortened, accounted for in accordance with Accounting Standards Codification (ASC)Topic 360, Property, Plant and Equipment. We currently expect additional expenses of approximately $1,200 in fiscal year 2017 for these restructuring plans, primarily related to site clean-up costs, employment-related costs and accelerated depreciation. We currently estimate that upon their completion in fiscal year 2017, these actions will reduce annual costs by approximately $10,000, which is primarily due to lower employee-related costs and lower depreciation expense. We expect a portion of these savings, net of execution costs, will be achieved over the next year and the full annual benefit of these actions is expected in fiscal year 2018.

Restructuring charges in fiscal year 2015 included the following: (i) actions to close a manufacturing facility and other facilities in the Coatings segment to rationalize operations in the Australia region, (ii) actions to streamline and consolidate administrative operations in the Europe region and (iii) initiatives in the Paints segment to improve our North American cost structure through staffing reductions and actions to rationalize our manufacturing operations by moving certain manufacturing to a third party. These restructuring activities resulted in pre-tax charges of $21,569 or $0.18 per diluted share for fiscal year 2015, including pre-tax non-cash asset-related charges of $2,842. See Note 18 in Notes to Consolidated Financial Statements for further information on restructuring.

Financial Results 2016 vs. 2015

The following tables present selected financial data for the years ended October 28, 2016 and October 30, 2015.

Net Sales | 2016 | 2015 | % Change | |||||||

Coatings | $ | 2,388,133 | $ | 2,496,528 | (4.3 | )% | ||||

Paints | 1,564,531 | 1,661,186 | (5.8 | )% | ||||||

Other and Administrative | 237,888 | 234,908 | 1.3 | % | ||||||

Consolidated net sales | $ | 4,190,552 | $ | 4,392,622 | (4.6 | )% | ||||

• | Consolidated Net Sales – Consolidated net sales for the year decreased 4.6%, including a negative impact of 2.9% from foreign currency. Excluding foreign currency exchange, the decrease was driven by lower sales in our consumer paints product line, primarily in North America, and lower sales in our general industrial product line, partially offset by the acquisition of Quest and higher sales in our coil product line. |

• | Coatings Segment Net Sales – Our Coatings segment net sales for the year decreased 4.3%, including a negative impact of 3.6% from foreign currency. Excluding foreign currency exchange, the decrease was driven by lower sales in our general industrial product line offset by improved sales in our coil and wood product lines. |

• | Paints Segment Net Sales – Our Paints segment net sales for the year decreased 5.8%, including a negative impact of 2.1% from foreign currency. Excluding foreign currency exchange, the decrease was driven by lower sales in North America (primarily at Lowe's) and our Australia and Asia regions. This was partially offset by higher sales in our automotive refinish product line primarily due to the acquisition of Quest. |

Approximately $39,000 of the fiscal year 2016 decrease in sales was due to an adjustment in our product line offering at Lowe's, which impacted the first half of fiscal year 2016.

• | Other and Administrative Net Sales – The Other and Administrative category includes the following product lines: resins, furniture protection plans and colorants. Other and Administrative net sales increased 1.3%, including a negative impact of 1.0% from foreign currency. Excluding foreign currency exchange, the increased sales were primarily due to resins and furniture protection plans. |

16

Gross Profit | 2016 | 2015 | |||||

Consolidated gross profit | $ | 1,535,584 | $ | 1,551,389 | |||

As a percent of net sales | 36.6 | % | 35.3 | % | |||

• | Gross Profit – The gross profit rate for 2016 increased 1.3 percentage points compared to 2015. The increase in gross profit rate was primarily driven by improved productivity and favorable cost/price comparison, partially offset by the impact of lower volume on manufacturing cost. Productivity includes procurement and manufacturing efficiencies, product reformulations and benefits from previously completed restructuring actions. Cost/price comparison reflects the impact of market changes in raw material costs, offset by changes in product pricing and promotions. Restructuring charges of $9,906 or 0.2% of net sales and $14,007 or 0.3% of net sales were included in the 2016 and 2015 periods, respectively. |

Operating Expenses | 2016 | 2015 | |||||

Consolidated operating expenses1 | $ | 1,006,545 | $ | 951,403 | |||

As a percent of net sales | 24.0 | % | 21.7 | % | |||

1 | Includes research and development and selling, general and administrative costs. For breakout see Consolidated Statements of Operations. |

• | Consolidated Operating Expenses (dollars) – Consolidated operating expenses increased $55,142 or 5.8% including a favorable impact of 2.7% from foreign currency. Excluding foreign currency exchange, the increase was primarily due to higher employee-related costs, costs related to the proposed merger and the addition of Quest, partially offset by lower marketing expenses. 2016 included costs of $28,021 related to the proposed merger with The Sherwin-Williams Company. There were no costs related to the proposed merger in the prior year. Restructuring charges of $8,599 or 0.2% of net sales and $7,562 or 0.2% of net sales were included in the 2016 and 2015 periods, respectively. |

EBIT1 | 2016 | 2015 | |||||

Coatings | $ | 444,190 | $ | 483,649 | |||

As a percent of net sales | 18.6 | % | 19.4 | % | |||

Paints | 149,539 | 173,435 | |||||

As a percent of net sales | 9.6 | % | 10.4 | % | |||

Other and Administrative | (68,650 | ) | (11,935 | ) | |||

As a percent of net sales | (28.9 | )% | (5.1 | )% | |||

Consolidated EBIT | $ | 525,079 | $ | 645,149 | |||

As a percent of net sales | 12.5 | % | 14.7 | % | |||

1 | EBIT is defined as earnings before interest and taxes. |

• | Consolidated EBIT – EBIT for 2016 declined $120,070 or 18.6% or 2.2 percentage points as a percent of net sales from the prior year. 2015 EBIT included a pre-tax gain of $48,001 from the sale of certain assets of a non-strategic specialty product offering, recorded in the Coatings segment in the first quarter. 2016 EBIT declined due to higher employee-related costs, lower volumes and costs related to the proposed merger, partially offset by improved productivity. Restructuring charges were $18,505 or 0.4% of net sales, compared to $21,569 or 0.5% of net sales in fiscal year 2015. Foreign currency exchange had a negative impact on consolidated EBIT of $11,000 in 2016. |

• | Coatings Segment EBIT – EBIT as a percent of net sales declined 0.8 percentage points from the prior year. The decrease was primarily due to the gain on sale of certain assets in the prior period and higher employee-related costs, partially offset by improved productivity, favorable cost/price comparison and lower restructuring charges. Restructuring charges for the 2016 and 2015 periods were $581 or 0.0% of net sales and $9,574 or 0.4% of net sales, respectively. |

• | Paints Segment EBIT – EBIT as a percent of net sales decreased 0.8 percentage points from the prior year. The decrease was driven by the effect of lower volumes, impairment of a certain asset group in our consumer paints product line and higher restructuring charges, partially offset by improved productivity and favorable cost/price comparison. Restructuring charges for 2016 and 2015 periods were $16,239 or 1.0% of net sales and $11,913 or 0.7% of net sales, respectively. Acquisition-related charges of $5,320 or 0.3% were included in fiscal year 2015. |

• | Other and Administrative EBIT – Other and Administrative EBIT includes corporate expenses. EBIT as a percent of net sales decreased 23.8 percentage points from the prior year primarily due to costs related to the proposed merger and increased employee-related costs. |

17

Interest Expense | 2016 | 2015 | |||||

Consolidated interest expense | $ | 90,560 | $ | 81,348 | |||

• | Interest Expense – Interest expense increased in fiscal year 2016 primarily due to higher average debt levels, primarily from the Quest acquisition. |

Effective Tax Rate | 2016 | 2015 | |||

Effective tax rate | 18.8 | % | 29.1 | % | |

• | Effective Tax Rate – The lower 2016 effective tax rate was primarily due to the recognition of U.S. foreign tax credits, additional U.S. research and development credits, and the reversal of certain foreign valuation allowances. |

Net Income | 2016 | 2015 | % Change | |||||||

Consolidated net income | $ | 353,040 | $ | 399,506 | (11.6 | )% | ||||

Financial Results 2015 vs. 2014

The following tables present selected financial data for the years ended October 30, 2015 and October 31, 2014.

Net sales | 2015 | 2014 | % Change | |||||||

Coatings | $ | 2,496,528 | $ | 2,585,416 | (3.4 | )% | ||||

Paints | 1,661,186 | 1,806,051 | (8.0 | )% | ||||||

Other and Administrative | 234,908 | 234,157 | 0.3 | % | ||||||

Consolidated net sales | $ | 4,392,622 | $ | 4,625,624 | (5.0 | )% | ||||