Attached files

| file | filename |

|---|---|

| 8-K - ALASKA AIR GROUP FORM 8-K - ALASKA AIR GROUP, INC. | alaskaairgroup8-k12192016.htm |

| EX-99.2 - PRESS RELEASE - ALASKA AIR GROUP, INC. | alaskaairlinesenhancesmile.htm |

Investor Update: Delta Marketing & Codeshare Agreement

Safe harbor

This presentation may contain forward-looking statements subject to the safe harbor protection provided by Section

27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended,

and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known

and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated

by any forward-looking statements. For a comprehensive discussion of potential risk factors, see Item 1A of the

company's Annual Report on Form 10-K for the year ended December 31, 2015. Some of these risks include

competition, labor costs and relations, general economic conditions, increases in operating costs including fuel,

inability to meet cost reduction goals, seasonal fluctuations in our financial results, an aircraft accident, changes in

laws and regulations and risks inherent in the achievement of anticipated synergies and the timing thereof in

connection with the acquisition of Virgin America. All of the forward-looking statements are qualified in their entirety by

reference to the risk factors discussed therein. We operate in a continually changing business environment, and new

risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the

impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We

expressly disclaim any obligation to publicly update or revise any forward-looking statements after the date of this

report to conform them to actual results. Over time, our actual results, performance or achievements will likely differ

from the anticipated results, performance or achievements that are expressed or implied by our forward-looking

statements, and such differences might be significant and materially adverse.

2

Alaska’s marketing & codeshare agreement with Delta is

ending effective April 30th, 2017

3

Backdrop

Revenue and relevance of Delta marketing (“frequent flyer”) and codeshare

relationship had been steadily declining since late 2013

Both parties agreed to accelerated termination of codeshare agreement following

Alaska’s acquisition of Virgin America

Interline agreement remains in place

Impact to Alaska is estimated at $5-$10 million in 2017

Customer impact expected to be minimal, due to growth in Alaska’s own network

and ability to codeshare with other partners

Highlights

4

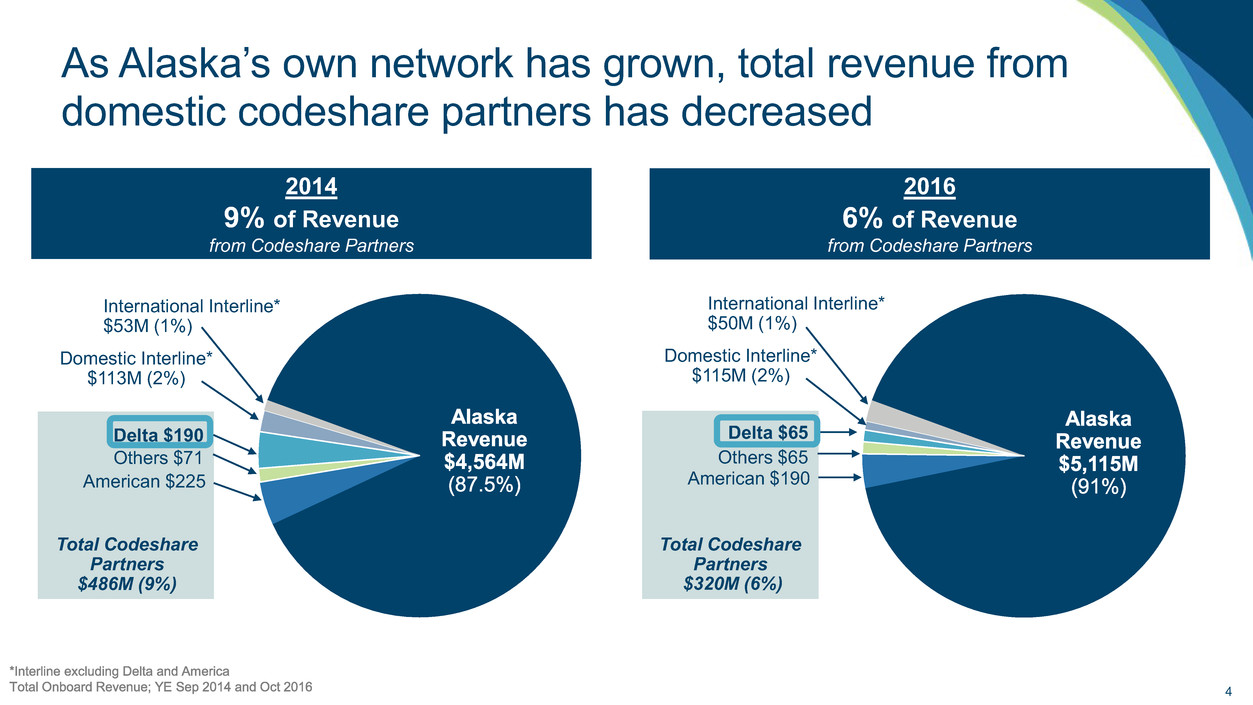

Total Codeshare

Partners

$320M (6%)

International Interline*

$50M (1%)

Domestic Interline*

$115M (2%)

American $190

Delta $65

Others $65

Total Codeshare

Partners

$486M (9%)

International Interline*

$53M (1%)

Domestic Interline*

$113M (2%)

American $225

Delta $190

Others $71

2014

9% of Revenue

from Codeshare Partners

2016

6% of Revenue

from Codeshare Partners

As Alaska’s own network has grown, total revenue from

domestic codeshare partners has decreased

5

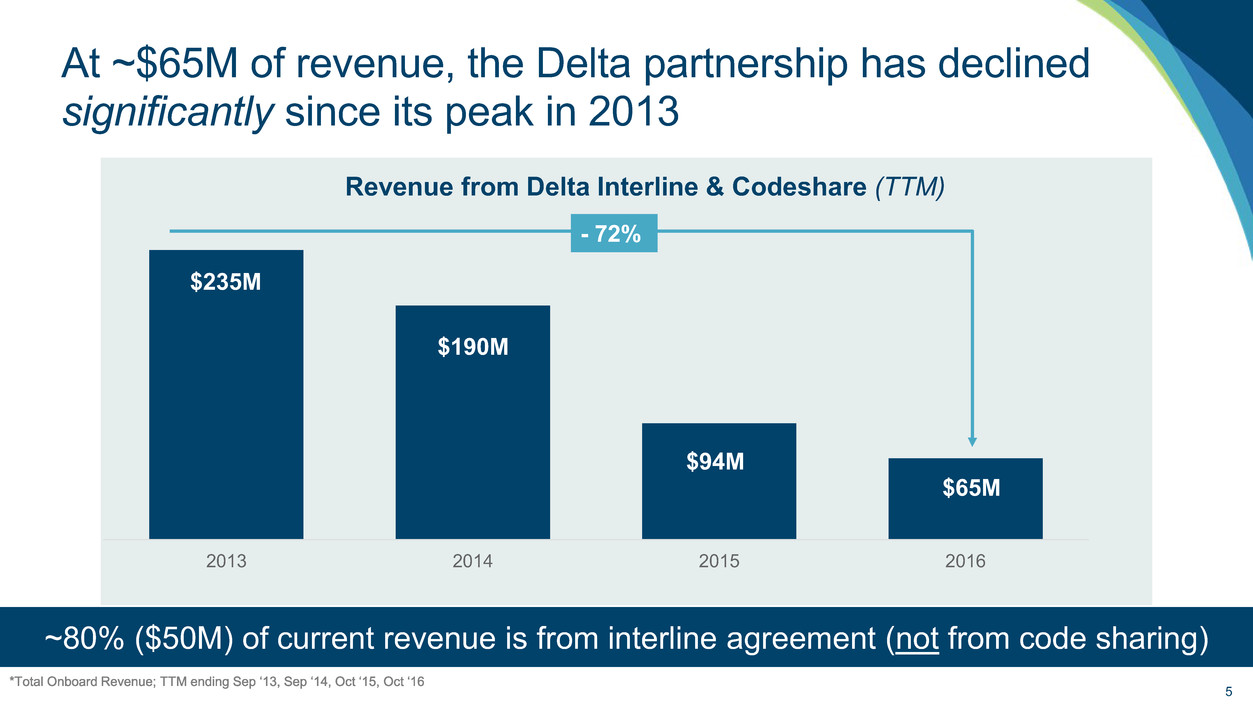

At ~$65M of revenue, the Delta partnership has declined

significantly since its peak in 2013

2013 2014 2015 2016

- 72%

Revenue from Delta Interline & Codeshare (TTM)

$65M

$235M

$190M

$94M

~80% ($50M) of current revenue is from interline agreement (not from code sharing)

6

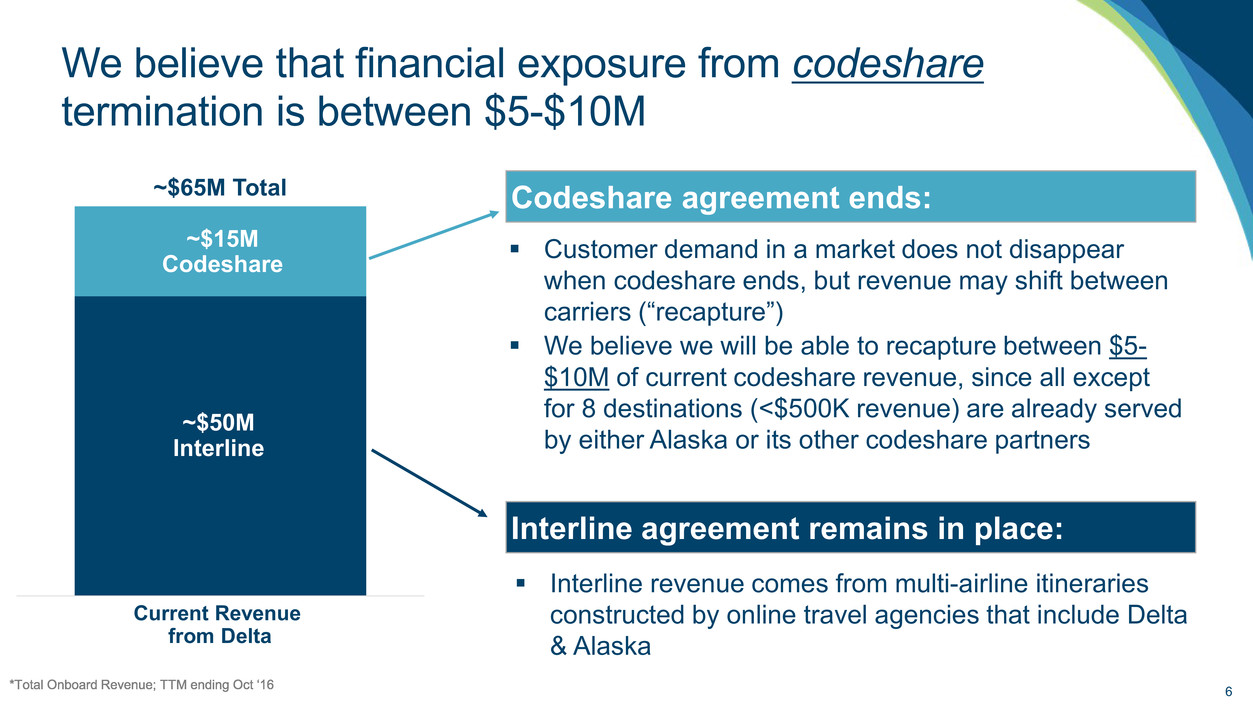

We believe that financial exposure from codeshare

termination is between $5-$10M

~$50M

Interline

Current Revenue

from Delta

Customer demand in a market does not disappear

when codeshare ends, but revenue may shift between

carriers (“recapture”)

We believe we will be able to recapture between $5-

$10M of current codeshare revenue, since all except

for 8 destinations (<$500K revenue) are already served

by either Alaska or its other codeshare partners

Codeshare agreement ends:

~$50M

Interline

~$15M

Codeshare

~$65M Total

Interline agreement remains in place:

Interline revenue comes from multi-airline itineraries

constructed by online travel agencies that include Delta

& Alaska

7

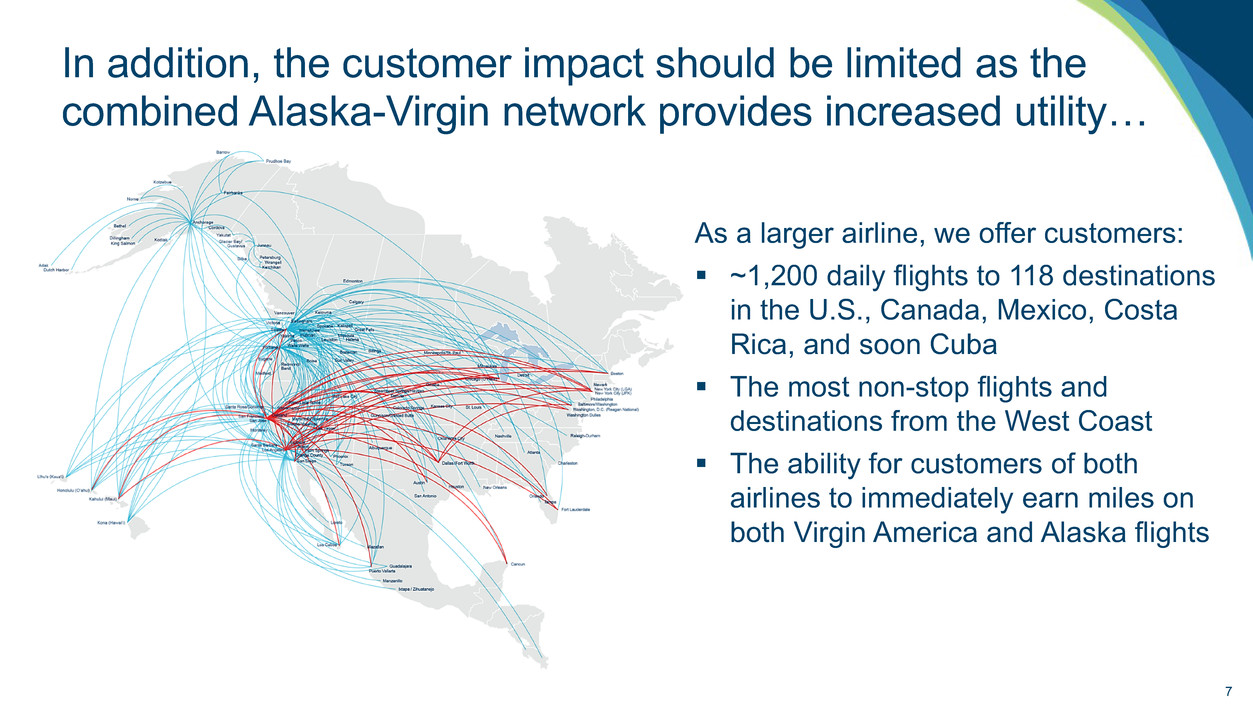

In addition, the customer impact should be limited as the

combined Alaska-Virgin network provides increased utility…

As a larger airline, we offer customers:

~1,200 daily flights to 118 destinations

in the U.S., Canada, Mexico, Costa

Rica, and soon Cuba

The most non-stop flights and

destinations from the West Coast

The ability for customers of both

airlines to immediately earn miles on

both Virgin America and Alaska flights

8

…and our other international partners have already

replaced the global utility Delta used to provide

Our global partner network offers access to more than 900 destinations worldwide