Attached files

Exhibit 10.4

EXECUTION VERSION

AMENDED AND RESTATED STOCK PURCHASE AGREEMENT

by and among

JELD-WEN HOLDING, INC.,

and

ONEX PARTNERS III LP

and

THE OTHER INVESTORS NAMED HEREIN

Dated as of July 29, 2011

TABLE OF CONTENTS

| Page | ||||||||

| ARTICLE I. DEFINITIONS |

1 | |||||||

| 1.1 | Certain Defined Terms |

1 | ||||||

| 1.2 | Index of Certain Other Definitions |

13 | ||||||

| 1.3 | Other Definitional and Interpretive Matters |

15 | ||||||

| ARTICLE II. AUTHORIZATION OF PREFERRED STOCK |

16 | |||||||

| 2.1 | Authorization of Preferred Stock |

16 | ||||||

| ARTICLE III. PURCHASE AND SALE OF PREFERRED STOCK AND BRIDGE NOTES |

16 | |||||||

| 3.1 | Issuance of Preferred Stock and Bridge Notes |

16 | ||||||

| ARTICLE IV. THE CLOSING | 17 | |||||||

| 4.1 | Closing |

17 | ||||||

| 4.2 | Payment of Purchase Price; Issuance of Shares and Bridge Notes |

17 | ||||||

| ARTICLE V. REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

20 | |||||||

| 5.1 | Organization and Good Standing |

20 | ||||||

| 5.2 | Power and Authorization; Enforceability |

21 | ||||||

| 5.3 | No Conflicts |

21 | ||||||

| 5.4 | Capitalization |

22 | ||||||

| 5.5 | Compliance with Laws |

23 | ||||||

| 5.6 | Litigation |

23 | ||||||

| 5.7 | Financial Statements; Undisclosed Liabilities |

23 | ||||||

| 5.8 | Absence of Certain Changes and Events |

24 | ||||||

| 5.9 | Real Property |

26 | ||||||

| 5.10 | Material Contracts |

27 | ||||||

| 5.11 | Insurance |

29 | ||||||

| 5.12 | Permits |

29 | ||||||

| 5.13 | Title to Assets |

29 | ||||||

| 5.14 | Intellectual Property |

30 | ||||||

| 5.15 | Labor Matters |

30 | ||||||

| 5.16 | Employee Benefits |

31 | ||||||

| 5.17 | Environmental Matters |

33 | ||||||

| 5.18 | Tax Matters |

35 | ||||||

| 5.19 | Products |

36 | ||||||

| 5.20 | Customers and Suppliers |

36 | ||||||

| 5.21 | Inventory |

37 | ||||||

| 5.22 | Affiliate Transactions |

37 | ||||||

| 5.23 | Books and Records |

37 | ||||||

| 5.24 | Absence of Certain Payments |

37 | ||||||

| 5.25 | Brokers |

37 | ||||||

i

TABLE OF CONTENTS

(continued)

| Page | ||||||||

| ARTICLE VI. REPRESENTATIONS AND WARRANTIES OF THE INVESTORS |

37 | |||||||

| 6.1 | Organization and Good Standing |

37 | ||||||

| 6.2 | Power and Authorization; Enforceability |

38 | ||||||

| 6.3 | No Brokers |

38 | ||||||

| 6.4 | Investment |

38 | ||||||

| 6.5 | Funding |

38 | ||||||

| ARTICLE VII. CERTAIN COVENANTS OF THE PARTIES |

38 | |||||||

| 7.1 | General |

38 | ||||||

| 7.2 | Conduct of Business by the Company |

39 | ||||||

| 7.3 | Hart-Scott-Rodino and other Antitrust Law Filings |

41 | ||||||

| 7.4 | Financial Statements |

42 | ||||||

| 7.5 | Exclusivity |

43 | ||||||

| 7.6 | Further Assurances |

43 | ||||||

| 7.7 | Public Announcements |

43 | ||||||

| 7.8 | Disclosure Supplements |

43 | ||||||

| 7.9 | Cash Proceeds |

43 | ||||||

| 7.10 | Information Rights |

44 | ||||||

| 7.11 | Intercompany Balances and Cash Management |

45 | ||||||

| 7.12 | Final Articles |

45 | ||||||

| 7.13 | Segregation of Non-Core Assets |

46 | ||||||

| 7.14 | Management Agreements |

46 | ||||||

| 7.15 | Indemnification of Directors and Officers |

46 | ||||||

| 7.16 | Use of Proceeds |

47 | ||||||

| ARTICLE VIII. CLOSING CONDITIONS |

47 | |||||||

| 8.1 | Conditions to Obligations of the Company |

47 | ||||||

| 8.2 | Conditions to Obligations of the Investors |

48 | ||||||

| ARTICLE IX. INDEMNIFICATION |

52 | |||||||

| 9.1 | Indemnification by the Company |

52 | ||||||

| 9.2 | Indemnification by Investor and Onex |

54 | ||||||

| 9.3 | Inter-Party Claims |

55 | ||||||

| 9.4 | Third Party Claims |

55 | ||||||

| 9.5 | Certain Limitations on Indemnification; Tax Treatment |

56 | ||||||

| 9.6 | Acknowledgment |

59 | ||||||

| 9.7 | Indemnification Gross-Up |

59 | ||||||

| 9.8 | Acknowledgment |

61 | ||||||

| ARTICLE X. TERMINATION |

62 | |||||||

| 10.1 | Termination of Agreement |

62 | ||||||

| 10.2 | Effect of Termination |

63 | ||||||

| ARTICLE XI. GENERAL PROVISIONS |

63 | |||||||

| 11.1 | Fees and Expenses |

63 | ||||||

| 11.2 | Notices |

63 | ||||||

ii

TABLE OF CONTENTS

(continued)

| Page | ||||||||

| 11.3 | Assignment and Benefit |

64 | ||||||

| 11.4 | Amendment, Modification and Waiver |

65 | ||||||

| 11.5 | Governing Law |

65 | ||||||

| 11.6 | Waiver of Jury Trial |

65 | ||||||

| 11.7 | Consent to Jurisdiction |

65 | ||||||

| 11.8 | Section Headings |

65 | ||||||

| 11.9 | Severability |

65 | ||||||

| 11.10 | Counterparts; Third-Party Beneficiaries |

66 | ||||||

| 11.11 | Entire Agreement |

66 | ||||||

| 11.12 | Specific Performance |

66 | ||||||

| EXHIBITS | ||

| Exhibit A | Form of Amended and Restated Articles of Incorporation | |

| Exhibit B | Form of Registration Rights Agreement | |

| Exhibit C | Form of Consulting Agreement | |

| Exhibit D | Form of Shareholders Agreement | |

| Exhibit E | Form of Amended and Restated Bylaws | |

| Exhibit F | Form of Bridge Note | |

| Exhibit G | Form of Opinion of Stoel Rives LLP | |

| Exhibit H | List of Non-Core Assets | |

| Exhibit I | Form of Second Amended and Restated Articles of Incorporation | |

| Exhibit J | July 2, 2011 Working Capital | |

| Exhibit K | Form of Escrow Agreement | |

iii

AMENDED AND RESTATED STOCK PURCHASE AGREEMENT

This AMENDED AND RESTATED STOCK PURCHASE AGREEMENT (this “Agreement”), dated as of July 29, 2011 (the “Effective Date”), is entered into by and among Onex Partners III LP, a Delaware limited partnership (“Onex”), Onex Advisor III LLC, Onex Partners III GP LP, Onex Partners III PV LP, Onex Partners III Select LP, Onex US Principals LP, Onex Corporation, Onex American Holdings II LLC, BP EI LLC, 1597257 Ontario Inc. (collectively with Onex, the “Investors”), and JELD-WEN Holding, inc., an Oregon corporation (the “Company”), and amends and restates, in its entirety, the Stock Purchase Agreement, dated as of May 4, 2011, by and among the parties named above (the “Prior Purchase Agreement”). Capitalized terms used in this Agreement without definition shall have the meaning given to such terms in Article I hereof.

RECITALS

WHEREAS, the Company wishes to issue and sell to the Investors and the Investors wish to purchase from the Company the Shares (as defined below) and the Bridge Notes (as defined below) on the terms and conditions and for the consideration set forth herein.

WHEREAS, the Company and the Investors desire to make certain representations, warranties, covenants and agreements in connection with this Agreement.

WHEREAS, the holders of a majority of the outstanding Common Shares have approved the Amended and Restated Articles.

NOW, THEREFORE, in consideration of the above premises and the mutual representations, warranties, covenants and agreements herein contained, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto (each a “Party” and collectively the “Parties”), intending to be legally bound, hereby agree as follows:

ARTICLE I.

DEFINITIONS

1.1 Certain Defined Terms. For purposes of this Agreement, the following terms shall have the following meanings:

“2009 Note Purchase Agreement” means the Amended, Restated and Consolidated Note Purchase Agreement, dated July 8, 2009, among JELD-WEN, inc., John Hancock Life Insurance Company, and the other Noteholders named therein.

“Accounting Standards” means accounting principles, methods, practices, categories, estimates, judgments and assumptions in accordance with GAAP as applied in the preparation of the balance sheet included in the Company Audited Financial Statements, consistently applied.

“Additional Investment Amount” means the amount of any Escrow Funds paid to the Company in accordance with Section 4.2(f) hereof.

“Affiliate” means, with respect to any Person, any other Person controlling, controlled by, or under common control with such Person. For purposes of this definition, “control,” when used with respect to any Person, means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have correlative meanings. Notwithstanding the foregoing, for purposes of this Agreement, neither the Company nor any of its Subsidiaries shall be considered an Affiliate of any Shareholder.

“Antitrust Authorities” means the United States Federal Trade Commission and the Antitrust Division of the United States Department of Justice, the attorneys general of the several states of the United States and any other domestic or foreign Governmental Body having jurisdiction with respect to the transactions contemplated hereby pursuant to applicable Antitrust Laws.

“Antitrust Laws” means the Sherman Act, the Clayton Act, the HSR Act, the Federal Trade Commission Act, in each case as amended, and all other competition, merger control, antitrust or similar Laws.

“Available Excess Non-Core Cash Proceeds” means, as of any date occurring after the Bridge Note Maturity Date, (a) the Aggregate Cash Proceeds (as defined in the Bridge Notes), but only taking into account amounts realized after the Bridge Note Maturity Date, minus (b) the aggregate amount of any Non-Core Asset Indemnification Payments (as defined in the Bridge Notes) made after the Bridge Note Maturity Date, minus (c) the amount of any Contingent Non-Core Asset Indemnification Payments as of such date, minus (d) the amount of Available Excess Non-Core Cash Proceeds used to satisfy any indemnification obligation of the Company Indemnified Parties under Article IX hereof prior to such date, minus (e) the amount of any dividends or distributions of Distributable Non-Core Assets/Proceeds (as defined in the Amended and Restated Articles) declared or made in cash prior to such date.

“Bridge Note” means a Convertible Promissory Note in the form attached as Exhibit F hereto.

“Bridge Note Maturity Date” means the stated maturity of the Bridge Notes, or if earlier, the date the entire amount of principal and interest of the Bridge Notes shall have been paid by the Company.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by Law to close.

“CERCLA” means the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. § 9601 et seq.

“Closing Date TTM EBITDA” means TTM EBITDA, as of the Closing Date.

“Closing Series A Investment Amount” means $600 million.

2

“Closing-Issued Shares” means a number of shares of Series A Preferred Stock equal to the quotient obtained by dividing the Closing Series A Investment Amount by the Estimated Per Share Price.

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Committee” has the meaning set forth in the Amended Bylaws.

“Common Share” means a share of Common Stock.

“Common Stock” means the Company’s common stock.

“Common Stock Value” means, as of any date, the aggregate proceeds that would be received in respect of each issued and outstanding share of Common Stock if the entire Indemnification Equity Value as of such date was distributed to the Company’s stockholders in accordance with Section C of Article IV of the Amended and Restated Articles.

“Company Disclosure Schedule” means the disclosure schedules of the Company attached to this Agreement and constituting a part hereof.

“Company Guarantee” means a direct or indirect guarantee by the Company or any of its Subsidiaries of any indebtedness of another Person of the nature referred to in clauses (a) through (g) of the definition of Consolidated Indebtedness, exclusive of the Suncadia Guarantees.

“Company Material Adverse Effect” means a material adverse effect on (i) the business, results of operations, assets, liabilities or financial condition of the Company and its Subsidiaries, taken as a whole, or (ii) the ability of the Company to consummate the transactions contemplated by this Agreement; provided, however, that “Company Material Adverse Effect” shall not include any event, occurrence, fact, condition, or change, directly or indirectly, resulting from or attributable to: (i) any changes, conditions or effects in the United States or foreign economies or securities or financial markets in general; (ii) changes, conditions or effects that generally affect the industries in which the Company and its Core Subsidiaries operate; (iii) any change, effect or circumstance resulting from an action expressly required by this Agreement; (iv) conditions caused by acts of terrorism or war (whether or not declared); or (v) any violation of a covenant in any credit facility of the Company and/or its Subsidiaries that will be refinanced at Closing that does not result in the lender accelerating the indebtedness (provided that the facts or circumstances giving rise to such violation may be considered in determining if there has been a Company Material Adverse Effect, subject to (i) - (iv) above); provided further, however, that any event, occurrence, fact, condition, or change referred to in clauses (i), (ii) or (iv) immediately above shall be taken into account in determining whether a Company Material Adverse Effect has occurred or could reasonably be expected to occur to the extent that such event, occurrence, fact, condition, or change has a disproportionate effect on the Company and its Core Subsidiaries compared to other participants in the industries in which the Company and its Core Subsidiaries conducts its businesses.

“Company Option” means an option, issued and outstanding, to purchase Common Shares pursuant to the Company Stock Option Plan.

3

“Company Stock Option Plan” means, collectively, the JELD-WEN HOLDING, inc. Stock Incentive Plan, dated September 29, 2010 (including all subsequent amendments or modifications).

“Company Transaction Expenses” means, without duplication, all out-of-pocket expenses (including all fees and expenses of counsel, accountants, financial advisors, investment bankers, experts and consultants) incurred through the Closing Date or as a result of the Closing by the Company or any of its Subsidiaries in connection with or related to the authorization, preparation, negotiation, execution and performance of this Agreement and the transactions contemplated hereby, including any fees, prepayment premiums, penalties or other amounts payable to lenders or agents in connection with the Refinancing, including the Make Whole Fees, in each case to the extent not paid prior to the Closing.

“Confidentiality Agreement” means that certain Confidentiality Agreement, dated April 23, 2010, between Onex Partners Manager LP and the Company.

“Consent” means any approval, consent, license, permit or other authorization (including any Governmental Authorization).

“Consolidated Adjusted EBITDA” means, for any period, as applied to the Consolidated Parties without duplication, Consolidated Net Income for such period as adjusted by the following (in each case, (x) to the extent deducted in the calculation of Consolidated Net Income for such period with respect to additions and (y) to the extent included in the calculation of Consolidated Net Income for such period with respect to subtractions):

(a) plus Consolidated Interest Expense and minus interest income;

(b) plus all expense for taxes based on Consolidated Net Income reported in accordance with GAAP and minus any increase to net income from a reduction in tax expenses based on Consolidated Net Income or from federal, state, local or foreign income tax benefits;

(c) plus depreciation, depletion and intangible or goodwill amortization expense;

(d) plus any loss from Discontinued Operations and minus any gain from Discontinued Operations;

(e) plus all non-cash charges (including, without limitation, (i) any non-cash Restructuring Charges, (ii) any non-cash losses realized on Dispositions, (iii) any non-cash asset and debt and equity investment impairments, (iv) any non-cash losses related to marking derivatives to market, (v) any non-cash losses related to foreign exchange transactions and translations, (vi) any non-cash non-recurring charges or non-cash extraordinary charges and (vii) any non-cash compensation expense in the form of Equity Interests) and minus all non-cash gains (including, without limitation, (i) any non-cash gains realized on Dispositions, (ii) any non-cash write-ups of asset and debt and equity investments, (iii) any non-cash gains related to marking derivatives to market, (iv) any non-cash gains related to foreign exchange transactions and translations and (v) any non-cash non-recurring items increasing Consolidated Net Income or non-cash extraordinary items increasing Consolidated Net Income);

4

(f) plus all cash non-recurring items decreasing Consolidated Net Income or cash extraordinary items decreasing Consolidated Net Income, in an aggregate amount not to exceed 10% of Consolidated Adjusted EBITDA for such period (calculated after giving effect to the adjustments in this definition of Consolidated Adjusted EBITDA) and minus all cash non-recurring or cash extraordinary items increasing Consolidated Net Income (including cash gains realized on Dispositions);

(g) plus all cash Restructuring Charges in an aggregate amount not to exceed 10% of Consolidated Adjusted EBITDA for such period (calculated after giving effect to the adjustments in this definition of Consolidated Adjusted EBITDA);

All capitalized terms used in this definition of Consolidated Adjusted EBITDA shall have the meanings set forth in the draft form of Credit Agreement attached as Annex A hereto, among JELD-WEN, inc., an Oregon corporation, JELD-WEN of Europe, B.V., a company organized under the laws of the Netherlands, each lender from time to time party thereto, and Bank of America, N.A., as Administrative Agent, Collateral Agent, Swing Line Lender and L/C Issuer.

“Consolidated Cash” means, as of any date, the consolidated cash and cash equivalents of the Company and its Subsidiaries, excluding cash held in escrow for the benefit of any third party and any other restricted cash to the extent the obligation secured by the applicable escrow or restriction is not included in Consolidated Indebtedness, calculated in accordance with GAAP as consistently applied by the Company.

“Consolidated Indebtedness” means, as of any date, the aggregate amount outstanding, on a consolidated basis and without duplication, of (a) all obligations of the Company or its Subsidiaries for borrowed money, (b) all obligations of the Company or its Subsidiaries evidenced by bonds, debentures, notes or other similar instruments or upon which interest charges are customarily paid, (c) all obligations of the Company or its Subsidiaries for the deferred purchase price of property or services, except current accounts payable arising in the ordinary course of business and not overdue beyond such period as is commercially reasonable for the business of the Company and its Subsidiaries, (d) all obligations of the Company or its Subsidiaries under conditional sale or other title retention agreements relating to property purchased by such Person and all capitalized lease obligations, (e) all payment obligations of the Company or its Subsidiaries on or for currency protection agreements, interest rate swap agreements or other agreements relating to derivatives based on the “mark to market” value of such agreements at the time of determination (it being understood that if the aggregate “mark to market” value is positive, such positive value will reduce the amount of Consolidated Indebtedness), (f) all obligations of the Company or its Subsidiaries for the reimbursement of any obligor on any letter of credit banker’s acceptance or similar credit transaction (other than any undrawn amount in respect of such letters of credit or similar credit transactions), (g) all obligations of the Company or its Subsidiaries or any third party secured by property or assets of the Company or its Subsidiaries (regardless of whether or not such Person is liable for repayment of such obligations), except for items described in clauses (i)-(iv) of the definition of Permitted Encumbrances, (h) all indebtedness of another Person of the nature referred to in clauses (a) through (g) above guaranteed directly or indirectly by the Company or any of its Subsidiaries solely to the extent any such guaranty has been called and not paid and (i) any amounts payable by the Company or any of its Subsidiaries under the PGA Contract in respect of the 2011

5

tournament. For purposes of this definition, any amount denominated other than in U.S. dollars shall be converted into U.S. dollars based on the applicable exchange rate on the Closing Date as reported by Wells Fargo.

“Contingent Non-Core Asset Indemnification Payments” means the aggregate amount, but without duplication, of potential liabilities of the Company and its Subsidiaries with respect to pending indemnity claims and claims of breaches of representations and warranties under its or their, as applicable, agreements for the sale of Non-Core Assets, giving effect to any contractual limitations on indemnification pursuant to the sale agreements (including maximum amounts and survival periods), indemnity deductibles, dedicated insurance (the cost of which was deducted in determining Net Cash Proceeds from the Sale of Non-Core Assets (as defined in the Bridge Notes)), waivers or other mechanisms limiting potential liability (including transfer of an entity with such a contingent liability from ownership by the Company or its subsidiaries with no continuing liability of the Company or its subsidiaries), but without consideration of the failure of any such claim to meet any procedural requirements for making indemnity claims under the applicable agreements, and excluding any potential indemnity claims or breaches of representations and warranties in respect of liabilities resulting solely from the affiliation of an entity holding Non-Core Assets with other Subsidiaries of the Company that are not Non-Core Assets.

“Contract” means any legally binding contract, lease or other property agreement, license, indenture, note, bond, agreement, permit, concession, franchise, commitment, purchase order, mortgage, partnership or joint venture agreement, instrument or other legally binding agreement.

“Core Subsidiaries” means those Subsidiaries of the Company other than those which own only Non-Core Assets.

“Disclosure Schedule” means the Company Disclosure Schedule or the Investor Disclosure Schedule, as the case may be.

“Encumbrance” means any mortgage, deed of trust, hypothecation, pledge, lien (statutory or otherwise), security interest, charge or encumbrance of any kind, whether voluntary or involuntary (including any conditional sale or other title retention agreement, any lease in the nature thereof and any agreement to give any security interest) and, with respect to capital stock, any option or other right to purchase or any restriction on voting or other rights.

“Enterprise Value” equals $1.7 billion.

“Environmental Law” means any applicable Law concerning protection or restoration of the environment and natural resources, protection of public or worker health and safety, or pollution, including Laws relating to the presence, use, production, generation, handling, transportation, treatment, storage, disposal, distribution, registration, labeling, testing, processing, discharge, release, threatened release, control, remediation or cleanup of any Hazardous Materials, and including any environmental transfer of ownership notification or approval statutes.

6

“Environmental Liabilities” means any liabilities, obligations, losses, claims, damages, penalties, fines, costs and expenses (including reasonable attorneys’ fees, engineering fees and other professional or expert fees) relating to or arising under Environmental Law, but excludes any capital expenditures budgeted and paid in the ordinary course of business. For purposes of this definition, capital expenditures to remedy violations of Environmental Laws pursuant to any notice of violation or any other similar enforcement action are not considered ordinary course expenditures.

“Environmental Permit” means any Governmental Authorization required under Environmental Laws necessary to operate the business of the Company and each of its Subsidiaries.

“Escrow Agent” means JP Morgan Chase Bank, N.A.

“Escrowed Series A Purchase Price” means $75 million.

“ESOP” means the JELD-WEN, inc., Employee Stock Ownership and Retirement Plan and Trust.

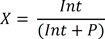

“Estimated Per Share Price” means a fraction, the numerator of which is the Estimated Common Equity Value and the denominator of which is the Estimated Total Common Shares Outstanding.

“Excess Debt Costs” means the excess, if any, of (x) the present value as of the date of issuance of the Notes, calculated using a discount rate of 10% per annum and semi-annual compounding, of all scheduled cash flows (including future principal and interest payments as positive amounts as well as the initial proceeds, net of any original issue discount, as a negative amount) related to the Notes through and including maturity, over (y) the present value as of the date of issuance of the Notes, calculated using a discount rate of 10% per annum and semi-annual compounding, of all cash flows (including future principal and interest payments as positive amounts as well as the initial proceeds, as a negative amount) related to notes (i) having a principal amount equal to the Notes, (ii) having no original issue discount, (iii) providing for semi-annual payments of interest at the rate of 13% per annum from the date of issuance of the Notes, and (iv) providing for payment of principal (and any unpaid interest) on the same maturity date as the Notes.

“Existing Loan Agreements” means (i) the Amended and Restated Credit Agreement, dated July 8, 2009, among JELD-WEN, inc., Bank of America, N.A., as Administrative Agent, Collateral Agent and L/C Issuer, and the Lenders named therein, (ii) the 2009 Note Purchase Agreement, (iii) the Amended and Restated Credit Agreement, dated as of July 8, 2009, between the Company and Wells Fargo Bank, National Association, and (iv) the Supplemental Agreement dated as of July 8, 2009 amending and restating the €200,000,000 Credit Agreement originally dated August 22, 2006, as amended by amendment agreements dated May 21, 2007 and April 10, 2008, between, among others, JELD-WEN, inc., JELD-WEN OF EUROPE, B.V., and NORDEA BANK AB (publ).

“Final Equity Value” means an amount equal to the sum of (a) the Final Common Equity Value and (b) the Series A Equity Value Increase.

7

“Former Non-Core Business” means any business not related to the manufacture, distribution and sale of doors and windows formerly conducted by the Company or any of its past or present Subsidiaries, or by any other Person in which the Company or any of its past or present Subsidiaries held or holds an equity interest. For avoidance of doubt, Former Non-Core Business does not include Suncadia, LLC, its Subsidiaries, or the businesses operated by such entities.

“GAAP” means United States generally accepted accounting principles as in effect at an applicable time.

“Governmental Authorization” means any approval, consent, license, permit or other authorization issued, granted, given or otherwise made available by or under the authority of any Governmental Body or pursuant to any Laws.

“Governmental Body” means the United States of America or any foreign nation or multi-national body, or any state, county, city, territory, possession or any political subdivision, court, department, commission, board, bureau, agency or other instrumentality of any of the foregoing.

“Hazardous Materials” means all substances, materials, mixtures or wastes that are regulated, classified or otherwise characterized as hazardous, toxic, dangerous, radioactive, a pollutant or contaminant, or words of similar meaning and effect, and including petroleum and fractions thereof, asbestos, polychlorinated biphenyls, noise, radiation or mold.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“Incremental Interest Costs” means the sum of (i) the aggregate cash interest accruing (whether or not paid) on the Notes from the date of issuance through the Closing Date and (ii) the amortization of any original issue discount on the Notes from the date of issuance through the Closing Date, calculated in accordance with the Accounting Standards.

“Indemnification Equity Value” means, as of any date, (a) the product of (i) 8.75 and (ii) TTM EBITDA, plus (b) Consolidated Cash, minus (C) Consolidated Indebtedness, minus (D) minority interests set forth on the Company’s month-end balance sheet most recently available prior to such date, in each case as of such date.

“Intellectual Property” means all of the following: (i) patents; (ii) trademarks, service marks, trade dress, trade names, corporate names, together with all goodwill associated with the foregoing; (iii) Internet domain names; (iv) copyrights, including copyrights in computer software; (v) registrations and applications for any of the foregoing; (vi) trade secrets; and (vii) all other intellectual property rights.

“Intercompany Account Balance” means any intercompany payable, receivable loan or reimbursable account between the Company and/or any Core Subsidiary on the one hand, and any Non-Core Subsidiary or any Non-Core Asset included within the Company or any Core Subsidiary on the other hand.

8

“Intercompany Nonreimbursable Cash Management Transaction” means any funding provided through capital contributions dividends, distributions or other similar methods not involving an obligation of repayment.

“Investor Disclosure Schedule” means the disclosure schedule of Investor attached to this Agreement and constituting a part hereof.

“Investor Percentage” means, with respect to each Investor, the percentage opposite such Investor’s name in Schedule I for the Shares and the Bridge Notes under the headings “Shares” and “Bridge Notes,” respectively. Onex may amend Schedule I at any time to adjust the percentage of any Investor upon written notice to the Company.

“Judgment” means any judgment, decision, order, decree, writ, injunction or ruling entered or issued by any Governmental Body.

“Knowledge” means the actual knowledge of (i) with respect to the Company and its Subsidiaries, Rod Wendt, Bob Turner, Ron Saxton, Barry Homrighaus, Neil Stuart, David Stork, Nigel Lapping, Jens Bach Mortensen and Bill Shaffner, and (ii) with respect to Investor, Anthony Munk, Philip Orsino, Adam Reinmann and Matthew Ross.

“Law” means the common law and any national, international, foreign, federal, state or local law, statute, ordinance, order, code, rule or regulation promulgated or issued by any Governmental Body.

“Liabilities” means any and all liabilities, debt, obligations, deficiencies, Taxes, penalties, fines, claims, causes of action or other losses, costs or expenses of any kind or nature whatsoever, whether asserted or unasserted, absolute or contingent, accrued or unaccrued, liquidated or unliquidated, and whether due or become due and regardless of when asserted.

“Make Whole Fees” means the prepayment fees payable on the Closing Date to holders of the notes issued by JELD-WEN, inc. pursuant to the 2009 Note Purchase Agreement.

“Material Impact” means any condition or event, occurrence or circumstance, or any related or similar conditions, events, occurrences or circumstances, that could reasonably be expected to result in (i) Liabilities of the Company or any of its Subsidiaries in excess of $4,000,000, (ii) any de minimis non-monetary restriction on the operations of the business of the Company or any of its Core Subsidiaries or on the ability of the Company to transfer any of the Non-Core Assets other than third party consents under agreements relating to the business operated using the Non-Core Assets, or (iii) a criminal Proceeding being brought against the Company or any of its Core Subsidiaries, or (iv) any Liability of the Company or any of its Subsidiaries for civil penalties in excess of $300,000 or criminal penalties.

“Negative Intercompany Balance” means, as of any date after the Closing Date, the sum of (a) the excess, if any, of (x) the aggregate amount of all Post-Closing Intercompany Account Balances owing from any Non-Core Subsidiary and Non-Core Asset included within the Company or any Core Subsidiary, on the one hand, to the Company and any Core Subsidiary on the other hand over (y) the aggregate amount of all Post-Closing Intercompany Account Balances owing from the Company or any Core Subsidiary, on the one hand, to any Non-Core

9

Subsidiary or Non-Core Asset included within the Company or any Core Subsidiary on the other hand and (b) the aggregate, net amount of all funding provided after the Closing Date by the Company or any Core Subsidiary, to any Non-Core Subsidiary or Non-Core Asset included within any Core Subsidiary via Intercompany Nonreimbursable Cash Movement Transactions.

“Non-Core Assets” means those assets listed on Exhibit H.

“Non-Core Subsidiary” means any Subsidiary of the Company that is not a Core Subsidiary.

“Notes Escrow” means any escrow established by the Company for purposes of holding, among other things, the proceeds of the issuance of the Notes prior to the Closing Date.

“Notes Escrow Fees” means all out-of-pocket fees and costs incurred by the Company related to the creation of the Notes Escrow, excluding any Incremental Interest Costs.

“Permitted Encumbrances” means (i) Encumbrances for Taxes and other governmental charges and assessments that are not yet due and payable, and Encumbrances for current Taxes and other charges and assessments of any Governmental Body that may thereafter be paid without penalty or that are being contested by appropriate proceedings, (ii) Encumbrances of landlords, lessors, carriers, warehousemen, mechanics and materialmen and other like Encumbrances arising in the ordinary course of business consistent with past practice, (iii) other Encumbrances or imperfections of title to or on real or personal property that are not material in amount and do not materially detract from the value of or materially impair the existing use of the property affected by such Encumbrance or imperfection, (iv) all local and other Laws, including building and zoning Laws, governing the use of real property generally in the enacting jurisdiction, (v) liens securing borrowing and other financing arrangements of the Company or its Subsidiaries (including letters of credit) to the extent set forth on Section 1.1(a) of the Company Disclosure Schedule, (vi) other matters disclosed on Section 1.1(a) of the Company Disclosure Schedule and (vii) purchase money security interest and similar liens outside of the United States.

“Permitted Non-Core Asset Sale” means a sale of Non-Core Assets for cash on terms (including the structure thereof) (a) that do not subject the Company to any Liability that is not limited to an amount that is no greater than the cash proceeds received in the sale of the relevant Non-Core Assets, other than de minimis obligations that will not affect the ongoing operations or business of the Company or any of the Core Subsidiaries, (b) that does not directly or indirectly in any manner involve the sale, assignment or transfer of any interest in any Intercompany Account Balance, whether or not for value and (c) if such sale involves the sale or transfer of the equity of any Non-Core Subsidiary, however structured (and including a sale of stock, a merger or other business combination transaction), provides for the full and unconditional release of the Company and the Core Subsidiaries from all Liability in respect of any Intercompany Account Balances with such Non-Core Subsidiary.

“Person” means an individual, corporation (including any non-profit corporation), general or limited partnership, limited liability company, joint venture, unincorporated organization, association, organization or other entity or form of business enterprise or Governmental Body.

10

“PGA Contract” shall mean the letter agreement, dated March 9, 2006, between JELD-WEN, inc. and PGA Tour, Inc., as amended January 1, 2008.

“Post-Closing Intercompany Account Balance” means an Intercompany Account Balance, determined by taking into account only transactions that occur after the Closing Date.

“Preferred Committee” has the meaning set forth in the Amended Bylaws.

“Refinancing” means those transactions described in Section 8.2(k) hereof.

“Representative” or “Representatives” means, with respect to a particular Person, any director, member, limited or general partner, officer, employee, agent, consultant, advisor or other representative of such Person, including outside legal counsel, accountants and financial advisors.

“Series A Equity Value Increase” means $575 million.

“Series A Initial Investment Amount” equals the sum of the Closing Series A Investment Amount and the Additional Investment Amount.

“Series A Preferred Share Amount” means the quotient obtained by dividing the Series A Initial Investment Amount by the Final Per Share Purchase Price.

“Shared Incremental Interest Costs” means 50% of the Incremental Interest Costs.

“Shareholders” means the shareholders of the Company as of immediately prior to the consummation of the Transaction.

“Shareholders Agreement” means the Shareholders Agreement in substantially the form attached hereto as Exhibit D.

“Specified Tax Attributes” means, without duplication:

(a) the amount of net operating losses carried forward by the Company or any of its Affiliates to the 2011 tax year or any later year from the 2010 tax year, as shown on the federal, state, local or foreign tax returns filed by the Company or any of its Affiliates for the year ended December 31, 2010;

(b) the amount of any loss or deduction claimed by the Company or any of its Affiliates with respect to prepayment fees, unamortized loan expenses, or other costs and expenses resulting from the repayment by or on behalf of the Company or any of its Affiliates of indebtedness in connection with the Refinancing;

(c) the amount of any tax credits claimed by the Company or any of its Affiliates after 2010 for foreign taxes paid in 2010 or prior years; and

(d) the present value, computed using a discount rate equal to the current yield for United States treasury obligations having a remaining life to maturity closest to the period of time over which the discount is being applied, of any loss or deduction, or reduction in income or gain, to the Company or any of its Affiliates arising (whether in the same or an earlier or later tax year, and whether in the same or another tax jurisdiction) in connection with, and as a consequence of, the recognition of income or gain or disallowance of loss, deduction, credit or carryback associated with any Specified Tax Claim.

11

“Specified Tax Claims” means, without duplication, claims arising out of, based upon or otherwise in respect of:

(a) the disallowance of any loss or deduction claimed by the Company or any of its Affiliates with respect to its investment in partnership interests and debt of Suncadia LLC; including, without limitation, the denial of any portion of any refund of its US federal income taxes for years to which losses generated by such losses or deductions were carried back;

(b) the recognition by the Company or any of its Affiliates of any income or gain attributable to the cancellation or reduction of the share of liabilities of Suncadia LLC included in the tax basis that the Company or any of its Affiliates has for its interest in Suncadia LLC or previously deducted by the Company or any of its Affiliates with respect to its investment in Suncadia LLC or otherwise arising from the disposition or abandonment of the interest of the Company or any of its Affiliates in Suncadia LLC;

(c) any additional income required to be recognized, or change in any deduction claimed, by the Company or any of its affiliates in connection or as a result of the distribution of the shares of stock of JW Timber Holdings to Richard Wendt on or about June 30, 2007;

(d) any change in tax treatment of the Company’s deduction of losses relating to its investment in Chileno Bay Development Partners, LLC;

(e) any change in the tax treatment of the June 29, 2007 sales by the Company of timberlands and of stock of JW Logging to JWTR LLC; and

(f) any adjustments to the amount of royalty income recognized by the Company or any of its Affiliates with respect to intellectual property used by foreign Affiliates of the Company.

“Subsidiary” means, with respect to any Person, any corporation, partnership, limited liability company, association or other business entity of which (i) if a corporation, a majority of the total voting power of shares of stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof, or (ii) if a partnership, limited liability company, association or other business entity, a majority of the partnership or other similar ownership interest thereof is at the time owned or controlled, directly or indirectly, by any Person or one or more Subsidiaries of that Person or a combination thereof; provided, however, that for purposes of Sections 5.1 - 5.20, Suncadia, LLC and its Subsidiaries shall not be considered Subsidiaries of the Company.

12

“Suncadia Guarantees” means, collectively, (i) the Amended and Restated Guaranty, dated as of July 8, 2009, by JELD-WEN, inc. in favor of U.S. Bank National Association as amended by the Amendment of Guaranty dated as of June 29, 2011 between JELD-WEN, inc. and U.S. Bank National Association, and (ii) the Guaranty, dated July 8, 2009, by JELD-WEN Holding inc. and the JELD-WEN subsidiaries named therein in favor of U.S. Bank National Association.

“Total Common Shares Outstanding” means the aggregate number of Common Shares outstanding immediately following Closing and, for avoidance of doubt, without giving effect to the purchase of Common Stock pursuant to the Tender Offer.

“TTM EBITDA” means, as of any date, Consolidated Adjusted EBITDA for the most recent twelve (12) full fiscal months ended at least 22 days prior to such date, adjusted to add back any Waiver Payments, Incremental Interest Costs, and Notes Escrow Fees incurred during such period and deducted in the calculation of Consolidated Adjusted EBITDA.

“Waiver Payments” means the aggregate fees and expenses paid or payable by the Company or its Subsidiaries to its lenders with respect to the Existing Loan Agreements to cause those lenders to waive any default existing prior to Closing.

“WARN Act” means the Worker Adjustment and Retraining Notification Act of 1988, as amended.

“Wholly-Owned” means 100% owned or 100% owned but for director qualifying shares.

“Working Capital” means the total current assets minus the total current liabilities of JELD-WEN, inc. and its consolidated subsidiaries from continuing operations, calculated using the accounting principles and methodologies used in the preparation of Exhibit J hereto; provided, that Working Capital shall be increased by the amount of any costs or expenses incurred by the Company in connection with the transactions contemplated by this Agreement prior to Closing, including the Incremental Interest Costs and the Notes Escrow Fees, and by the amount of any Waiver Payments.

1.2 Index of Certain Other Definitions. The following capitalized terms used in this Agreement have the meanings located in the corresponding section below.

| Term |

Section | |

| Acquisition Proposal | Section 7.5 | |

| Additional Shares | Section 9.5(g) | |

| Agreement | Introduction | |

| Amended and Restated Articles | Section 2.1 | |

| Amended Bylaws | Section 8.2(n) | |

| Annual Reports | Section 7.10(a) | |

| Auditor | Section 4.2(d) | |

| Closing | Section 4.1(b) | |

| Closing Date | Section 4.1(b) | |

| Closing Statement | Section 4.2(c) | |

13

| Term |

Section | |

| Company | Introduction | |

| Company Audited Financial Statements | Section 5.7(a) | |

| Company Indemnified Party | Section 9.2 | |

| Company Q1 Unaudited Financial Statements | Section 7.4(a) | |

| Company Transaction Documents | Section 5.2(a) | |

| Damages | Section 9.1(a) | |

| Deductible | Section 9.5(d) | |

| Deferred Tax Damages | Section 9.1(c) | |

| Determination Date | Section 4.2(d) | |

| Effective Date | Introduction | |

| Employee Benefit Plans | Section 5.16(a) | |

| ERISA | Section 5.16(a) | |

| Escrow Agreement | Section 4.2(b)(ii) | |

| Escrow Funds | Section 4.2(b)(ii) | |

| Estimated Closing Cash | Section 4.2(a) | |

| Estimated Closing Indebtedness | Section 4.2(a) | |

| Estimated Common Equity Value | Section 4.2(a) | |

| Estimated Company Transaction Expenses | Section 4.2(a) | |

| Estimated Excess Debt Costs | Section 4.2(a) | |

| Estimated Shared Incremental Interest Costs | Section 4.2(a) | |

| Estimated Total Common Shares Outstanding | Section 4.2(a) | |

| Final Articles | Section 2.1 | |

| Final Closing Cash | Section 4.2(d) | |

| Final Closing Indebtedness | Section 4.2(d) | |

| Final Closing Statement | Section 4.2(d) | |

| Final Common Equity Value | Section 4.2(d) | |

| Final Company Transaction Expenses | Section 4.2(d) | |

| Final Excess Debt Costs | Section 4.2(d) | |

| Final Shared Incremental Costs | Section 4.2(d) | |

| Final Per Share Purchase Price | Section 4.2(d) | |

| Final Total Common Shares Outstanding | Section 4.2(d) | |

| Financial Statements | Section 5.7(a) | |

| Indemnified Party | Section 9.3 | |

| Indemnifying Party | Section 9.3 | |

| Initial Bridge Principal Amount | Section 3.1 | |

| Insurance Policies | Section 5.11 | |

| Interim Balance Sheet | Section 5.7(c)(i) | |

| Investor Indemnified Party | Section 9.1(a) | |

| Investor Transaction Documents | Section 6.2(a) | |

| Investors | Introduction | |

| JELD-WEN, inc. Audited Financial Statements | Section 5.7(a) | |

| JELD-WEN, inc. Q1 Unaudited Financial Statements | Section 5.7(a) | |

| Leased Real Properties | Section 5.9(a) | |

| Material Contracts | Section 5.10 | |

14

| Term |

Section | |

| Monthly Financial Statements | Section 5.7(a) | |

| Monthly Reports | Section 7.10(a) | |

| Negotiation Period | Section 4.2(d) | |

| Notes | Section 8.2(k) | |

| Over-allotted Shares | Section 4.2(f)(v) | |

| Owned Real Properties | Section 5.9(a) | |

| Party/Parties | Recital | |

| Pre-Closing Cash Proceeds | Section 7.9 | |

| Pre-Closing Period | Section 7.2 | |

| Prior Purchase Agreement | Introduction | |

| Private Placement | Section 8.1(k) | |

| Proceeding | Section 5.6 | |

| Purchase | Section 3.1 | |

| Purchase Price | Section 3.1 | |

| Quarterly Reports | Section 7.10(a) | |

| Real Property | Section 5.9(a) | |

| Revolver | Section 8.2(k) | |

| Series A Preferred Stock | Section 2.1 | |

| Series B Preferred Stock | Section 2.1 | |

| Shares | Section 3.1 | |

| Shortfall Shares | Section 4.2(f)(v) | |

| Tax or Taxes | Section 5.18(k) | |

| Tax Return | Section 5.18(k) | |

| Tender Offer | Section 7.16 | |

| Third Party Claim | Section 9.4(a) | |

| Transaction | Section 4.1(a) | |

| Transaction Documents | Section 4.1(a) | |

| Unreviewed Company Q1 Unaudited Financial Statements | Section 5.7(a) | |

1.3 Other Definitional and Interpretive Matters.

(a) Except as otherwise provided or unless the context otherwise requires, whenever used in this Agreement, (i) any noun or pronoun shall be deemed to include the plural and the singular, (ii) the use of masculine pronouns shall include the feminine and neuter, (iii) the terms “include” and “including” shall be deemed to be followed by the phrase “without limitation,” (iv) the word “or” shall be inclusive and not exclusive, (v) all references to Sections refer to the Sections of this Agreement, all references to Schedules refer to the Schedules attached to or delivered with this Agreement, as appropriate, and all references to Exhibits refer to the Exhibits attached to this Agreement, each of which is made a part of this Agreement for all purposes, (vi) each reference to “herein” means a reference to “in this Agreement,” (vii) each reference to “$” or “dollars” shall be to United States dollars, (viii) each reference to “days” shall be to calendar days, (ix) each reference to any contract or agreement shall be to such contract or agreement as amended, supplemented, waived or otherwise modified from time to time, and (x) accounting terms which are not otherwise defined in this Agreement shall have the meanings

15

given to them under GAAP; provided, however, that to the extent that a definition of a term in this Agreement is inconsistent with the meaning of such term under GAAP, the definition set forth in this Agreement will control.

(b) The provisions of this Agreement shall be construed according to their fair meaning and neither for nor against any party hereto irrespective of which party caused such provisions to be drafted. Each of the parties hereto acknowledges that it has been represented by an attorney in connection with the preparation and execution of the Transaction Documents.

(c) Unless otherwise expressly provided herein, the measure of a period of one month or one year for purposes of this Agreement shall be that date of the following month or year corresponding to the starting date; provided, however, that if no corresponding date exists, the measure shall be that date of the following month or year corresponding to the next day following the starting date. For example, one month following February 18th is March 18th, and one month following March 31 is May 1.

ARTICLE II.

AUTHORIZATION OF PREFERRED STOCK

2.1 Authorization of Preferred Stock. Once all conditions to Closing set forth in Article VIII have been satisfied or waived, and prior to the Closing Date, the Company shall authorize and create preferred stock, consisting of 8,000,000 shares, of which 7,999,999 shares will be designated as its “Series A Convertible Preferred Stock” (the “Series A Preferred Stock”), and of which one (1) share will be designated will be designated as its “Series B Preferred Stock” (the “Series B Preferred Stock”). The terms, limitations and relative rights and preferences of the Series A Preferred Stock and the Series B Preferred Stock are set forth in the Company’s Amended and Restated Articles of Incorporation, the form of which is attached hereto as Exhibit A (the “Amended and Restated Articles”) and will ultimately be set forth in the Company’s Second Amended and Restated Articles of Incorporation after the Final Per Share Purchase Price and Series A Initial Investment Amount have been determined, the form of which is attached as Exhibit I (the “Final Articles”).

ARTICLE III.

PURCHASE AND SALE OF PREFERRED STOCK AND BRIDGE NOTES

3.1 Issuance of Preferred Stock and Bridge Notes. Subject to the terms and conditions set forth in this Agreement and in reliance upon the Company’s and the Investors’ representations set forth below, the Company shall issue and sell to each Investor, and each Investor shall purchase from the Company, such Investor’s Investor Percentage of (a) the Series A Preferred Share Amount of shares of Series A Preferred Stock for an aggregate purchase price of the Series A Initial Investment Amount (such purchased shares of Series A Preferred Stock, collectively, the “Shares”) and (b) $188,878,552 principal amount (the “Initial Bridge Principal Amount”) of Bridge Notes, with the Initial Bridge Principal Amount subject to reduction in accordance with Section 7.9 (the aggregate amount to be paid for the Shares, plus the Initial Bridge Principal Amount, “Purchase Price”). Such sale and purchase (the “Purchase”) shall be effected in accordance with Section 4.2 below by the Company (x) executing and delivering to each Investor duly executed stock certificates, duly registered in

16

its name, evidencing the Shares purchased by such Investor and (y) executing and delivering to each Investor duly executed Bridge Notes, duly registered in its name, evidencing the initial principal amount of Bridge Notes purchased by such Investor.

ARTICLE IV.

THE CLOSING

4.1 Closing.

(a) The Purchase and the other transactions contemplated by this Agreement are collectively referred to herein as the “Transaction,” and this Agreement and the Escrow Agreement, the Bridge Notes, the Registration Rights Agreement, the Shareholders Agreement, the Consulting Agreement, the Amended and Restated Articles and the Amended Bylaws are collectively referred to herein as the “Transaction Documents.”

(b) The closing of the Transaction (the “Closing”) shall take place at the offices of Kaye Scholer LLP, 425 Park Avenue, New York, NY 10022 at 9:00 A.M. on the later of (i) August 16, 2011 and (ii) second Business Day (the “Closing Date”) following the satisfaction or waiver of all conditions of the parties to consummate the transactions contemplated by this Agreement (other than the conditions with respect to actions the respective parties will take at the Closing itself), or at such other place or on such other date or time as is mutually agreed to by Investor and the Company.

4.2 Payment of Purchase Price; Issuance of Shares and Bridge Notes.

(a) By no later than three (3) Business Days prior to the Closing Date, the Company shall provide to the Investors a written statement setting forth its good faith estimate of Consolidated Cash, Consolidated Indebtedness, Total Common Shares Outstanding, Excess Debt Costs (if any), Shared Incremental Interest Costs and Company Transaction Expenses as of immediately following the Closing (and after giving pro forma effect thereto) (as set forth in such statement, the “Estimated Closing Cash,” “Estimated Closing Indebtedness,” “Estimated Total Common Shares Outstanding,” “Estimated Excess Debt Costs,” “Estimated Shared Incremental Interests Cost” and “Estimated Company Transaction Expenses,” respectively) together with a reasonably detailed calculation of Estimated Common Equity Value. For purposes hereof, the “Estimated Common Equity Value” means an amount equal to (i) Enterprise Value, plus (ii) Estimated Closing Cash, plus (iii) Estimated Shared Incremental Interest Costs, minus (iv) Estimated Closing Indebtedness, minus (v) Estimated Company Transaction Expenses, minus (vi) Estimated Excess Debt Costs, minus (vii) minority interests set forth on the Company’s month-end balance sheet most recently available prior to the Closing Date minus (viii) the Series A Equity Value Increase.

(b) At the Closing, each Investor shall:

(i) pay to the Company an amount equal to the product of such Investor’s Investor Percentage and the Closing Series A Investment Amount, by wire transfer in immediately available funds to an account or accounts specified in writing by the Company to the Investors not less than two (2) Business Days prior to the Closing and the Company shall deliver to each Investor certificates evidencing such Investor’s Investor Percentage of the Closing-Issued Shares, registered in the name of such Investor;

17

(ii) deposit such Investor’s Investor Percentage of the Escrowed Series A Purchase Price with the Escrow Agent pursuant to an escrow agreement in substantially the form of Exhibit K attached hereto (the “Escrow Agreement”). The funds held by the Escrow Agent pursuant to the Escrow Agreement (collectively, the “Escrow Funds”) shall be disbursed in accordance with Section 4.2(f); and

(iii) pay to the Company such Investor’s Investor Percentage of the Initial Bridge Principal Amount, by wire transfer in immediately available funds to an account or accounts specified in writing by the Company to the Investors not less than two (2) Business Days prior to the Closing and the Company shall deliver to each Investor a Bridge Note issued in the name of such Investor, in a principal amount equal to the portion of the Initial Bridge Principal Amount purchased by such Investor.

(c) Within five (5) Business Days following the Closing Date, the Company shall cause to be prepared and delivered to the Investors a statement of the Consolidated Cash, Consolidated Indebtedness, Excess Debt Costs, Shared Incremental Interest Costs, Total Common Shares Outstanding and Company Transaction Expenses as of immediately following the Closing (and after giving pro forma effect thereto), together with a reasonably detailed calculation thereof (the “Closing Statement”), certified by the chief financial officer of the Company.

(d) Upon delivery of the Closing Statement, the Company will provide the Investors and their advisors with access to the records and employees and representatives of the Company and its Subsidiaries, to the extent related to the Investors’ evaluation of the Closing Statement. The Investors shall have the right to review the Closing Statement and comment thereon and object thereto for a period of five (5) Business Days following the receipt of the Closing Statement, and the Company and the Investors shall endeavor in good faith to resolve any disagreement with respect to the determination of the Closing Statement for three (3) Business Days thereafter (the “Negotiation Period”). Any changes in the Closing Statement that are agreed to by the Company and the Investors shall be incorporated into the final closing statement of the Company and its Subsidiaries. In the event that the parties fail to agree on the Closing Statement or any element relevant thereto upon completion of the Negotiation Period, each of the Company, on the one hand, and the Investors, on the other hand, shall prepare separate written reports setting forth in detail the particulars of such disagreement and refer such reports to an independent accounting firm of recognized national standing, as may be mutually selected by the Company and the Investors (the “Auditor”), within two (2) Business Days after the Negotiation Period. The Auditor shall determine as promptly as practicable, but in any event within fifteen (15) days of the date on which such dispute is referred to the Auditor, whether the Closing Statement was prepared accurately and in accordance with the standards required hereby and (only with respect to the remaining disagreements submitted to the Auditor) whether and to what extent (if any) the Closing Statement requires adjustment. The fees, costs, and expenses of the Auditor shall be borne by the Company and the determination of the Auditor shall be final,

18

conclusive and binding on the parties. Promptly following the resolution of all disputed items (or, if there is no dispute, promptly after the parties reach agreement on the amounts set forth in the Closing Statement), the Closing Statement shall be updated to reflect all resolved items.

The final Closing Statement as determined in accordance with this Section shall be referred to hereinafter as the “Final Closing Statement.” The date on which the Final Closing Statement is determined in accordance with this Section is hereinafter referred to as the “Determination Date.” The amounts of Consolidated Cash, Consolidated Indebtedness, Excess Debt Costs, Shared Incremental Interest Costs, Total Common Shares Outstanding and Company Transaction Expenses finally determined in accordance with this Section 4.2 are hereinafter referred to as the “Final Closing Cash,” “Final Closing Indebtedness,” “Final Shared Incremental Interest Costs,” “Final Excess Debt Costs,” “Final Total Common Shares Outstanding” and “Final Company Transaction Expenses,” respectively. For purposes hereof, (a) the “Final Common Equity Value” means an amount equal to (i) Enterprise Value, plus (ii) Final Closing Cash, plus (iii) Final Shared Incremental Interest Costs minus (iv) Final Closing Indebtedness, minus (v) Final Company Transaction Expenses, minus (vi) Final Excess Debt Costs, minus (vii) minority interest reflected on the Company’s monthly balance sheet most recently available prior to the Closing Date minus (viii) the Series A Equity Value Increase, and (b) the “Final Per Share Purchase Price” means an amount equal to the quotient of (i) the Final Common Equity Value over (ii) the Final Total Common Shares Outstanding.

(e) Within five (5) Business Days following the Determination Date, the Company shall amend the terms of the Tender Offer such that the expiration of the Tender Offer shall occur no later than twenty-five (25) Business Days after the Determination Date, and shall take such actions as may be necessary so that the Tender Offer will be consummated, and Common Shares accepted for payment in connection therewith, on a date no later than twenty-five (25) Business Days after the Determination Date (assuming the concurrent release of the Escrow Funds as provided in Section 4.2(f) hereof).

(f) Promptly following the acceptance for payment of Common Shares in the Tender Offer:

(i) if shareholders have properly tendered shares equal to or in excess of the maximum number of shares that can be purchased in the Tender Offer, subject to Section 4.2(f)(v), the Company and Onex shall jointly instruct the Escrow Agent in writing to release the full amount of Escrow Funds to the Company.

(ii) If no shareholders of the Company have opted to participate in the Tender Offer, the Company and Onex shall jointly instruct the Escrow Agent in writing to return the full amount of Escrow Funds to the Investors, apportioned among the Investors in the same proportions as paid by each of the Investors pursuant to Section 4.2(b)(ii).

(iii) In all other cases, subject to Section 4.2(f)(v), the Company and Onex shall jointly instruct the Escrow Agent in writing to release (1) Escrow Funds to the Company in an amount equal to the amount by which the Company’s

19

payment obligations in respect of the acceptance of Common Shares in the Tender Offer exceeds $25 million, and (2) the remaining amount of the Escrow Funds to the Investors, apportioned among the Investors in the same proportions as paid by each of the Investors pursuant to Section 4.2(b)(ii).

(iv) Notwithstanding anything herein to the contrary, any release or payment of Escrow Funds by the Escrow Agent pursuant to Section 4.2(f)(i) or Section 4.2(f)(iii) shall be conditioned on (A) the verification by the Investors of the amounts and documentation of the Tender Offer, and (B) the concurrent issuance of all shares of Series A Preferred Stock by the Company required pursuant to this Section 4.2.

The Escrow Agreement shall provide that the Escrow Agent shall release the Escrow Funds in accordance with the provisions of this Section 4.2(f).

(v) If the Series A Preferred Share Amount exceeds the amount of Closing-Issued Shares (the amount of such excess, the “Shortfall Shares”), promptly following the acceptance for payment of Common Shares in the Tender Offer the Company shall issue to the Investors, in accordance with their respective Investor Percentages, an amount of Shares equal to the Shortfall Shares. If the amount of Closing-Issued Shares exceeds the Series A Preferred Share Amount (the amount of such excess, the “Over-allotted Shares”), promptly following the Tender Offer the applicable Investors shall return to the Company for cancellation the Over-allotted Shares (pro-rata for each Investor, based on such Investor’s Investor Percentage). Any Shortfall Shares shall be deemed to have been issued and held by the applicable Investors for all purposes as of the Closing Date and all Over-allotted Shares shall be deemed cancelled for all purposes as of the Closing Date.

(g) The obligations of Onex under this Agreement with respect to the other Investors shall be joint and several. The obligations of the Investors (other than Onex) under this Agreement shall be several and not joint.

ARTICLE V.

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as otherwise set forth in writing in appropriately corresponding sections of the Company Disclosure Schedule, the Company hereby represents and warrants to Investor:

5.1 Organization and Good Standing. The Company and each of its Subsidiaries are duly organized, validly existing and in good standing (if applicable) under the Laws of their respective jurisdictions of incorporation, formation or organization, as applicable, and have all necessary corporate, limited liability company or other power and authority, as the case may be, to carry on their business as presently conducted and to own and lease their respective assets and properties. The Company and each of its Subsidiaries are duly licensed or qualified to do business as a foreign corporation and are in good standing (if applicable) in each jurisdiction in which their respective ownership, or leasing of assets or properties, or the nature of their

20

activities requires such qualification, except where the failure to be so qualified would not, individually or in the aggregate, reasonably be expected to have a Company Material Adverse Effect. The Company and each of its Subsidiaries have made available to Investor correct and complete copies of the certificate of incorporation and bylaws (or other applicable organizational documents) for the Company and each of its Subsidiaries, as amended to date.

5.2 Power and Authorization; Enforceability.

(a) The Company has all requisite right, power, and authority to execute and deliver this Agreement and the other Transaction Documents to which it is, or is specified to be, a party (collectively, the “Company Transaction Documents”), to perform its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby. All necessary corporate action has been taken by the Company to authorize the execution, delivery and performance by the Company of this Agreement and each other Company Transaction Document, other than the Final Articles, for which shareholder approval has not yet been obtained. The Company has duly executed and delivered this Agreement and, at or prior to the Closing, will have duly executed and delivered each other Company Transaction Document.

(b) This Agreement is, and each other Company Transaction Document, when duly executed and delivered at Closing by the Company, will be, the legal, valid and binding obligations of the Company, enforceable against it in accordance with their respective terms, except as enforceability of such obligations may be limited by bankruptcy, insolvency, reorganization, moratorium and other similar Laws now or hereafter in effect relating to or limiting creditors’ rights generally and general principles of equity relating to the availability of specific performance and injunctive and other forms of equitable relief.

5.3 No Conflicts.

(a) Neither the execution, delivery or performance of this Agreement and the other Company Transaction Documents nor the consummation of the transactions contemplated hereby or thereby (with or without the passage of time or the giving of notice, or both) will:

(i) contravene, conflict with or result in a violation of (A) the certificate or articles of incorporation or bylaws (or other organizational documents) of the Company or any of its Subsidiaries or (B) any (1) Judgments or (2) Laws, in each case, binding upon or applicable to the Company or any of its Subsidiaries or by which they or any of their respective properties or assets are bound except in the case of clause (B) for violations that would not, individually or in the aggregate, reasonably be expected to have a Material Impact;

(ii) contravene, conflict with, result in a violation or breach of, constitute a default under, result in the modification, termination, acceleration or cancellation of, or give a right to modify, terminate, accelerate or cancel under, any of the terms or conditions of any Material Contract to which the Company is a party or by which it or any of its properties or assets are bound, any collective bargaining or other labor union agreement required to be set forth in Section 5.15 of the Company Disclosure Schedule or any Employee Benefit Plan;

21

(iii) result in the creation or imposition of any Encumbrance upon any of the assets of the Company or any of its Core Subsidiaries, other than Permitted Encumbrances; or

(iv) cause a loss or adverse modification of any Governmental Authorization required to be set forth in Section 5.12 of the Company Disclosure Schedule.

(b) Except for the filing of the Amended and Restated Articles with the Secretary of State of the state of Oregon, Section 5.3(b) of the Company Disclosure Schedule contains a complete and accurate list of each material Consent, registration, notification, filing or declaration of or with, any Governmental Body required to be given or made by the Company or any of its Subsidiaries in connection with the execution, delivery and performance of this Agreement and the other Company Transaction Documents, other than competition filings.

5.4 Capitalization.

(a) The authorized, issued and outstanding capital stock and other equity securities of the Company as of the date of this Agreement are fully and accurately set forth in Section 5.4(a) of the Company Disclosure Schedule. The Company has not granted any preemptive rights, rights of first offer or refusal, redemption or repurchase rights or other similar rights with respect to any of such capital stock or other equity securities of the Company and there are no offers, options, warrants, rights, agreements or commitments of any kind granted by the Company relating to the issuance, conversion, registration, voting, sale or transfer of capital stock or any other equity securities of the Company or obligating the Company to purchase or redeem any of such capital stock or other equity securities. The Common Shares and the Company Options constitute all of the issued and outstanding shares of capital stock or other equity interests of the Company, and all of such shares have been duly authorized and are validly issued and outstanding, fully paid and nonassessable. Immediately after giving effect to the Closing, but without giving effect to the Tender Offer, the authorized, issued and outstanding capital stock and other equity securities of the Company will be as set forth in Section 5.4(a) of the Company Disclosure Schedule as “Post Closing Capitalization,” subject to variances resulting from the Company making (i) required redemptions from the ESOP or its distributees after the date of this Agreement, and (ii) redemptions set forth in Section 5.4(a) of the Company Disclosure Schedule.

(b) All the outstanding capital stock and other equity securities of each of the Company’s Subsidiaries are owned of record or beneficially by the Company or one or more of its Subsidiaries. Neither the Company nor any of its Subsidiaries has granted any preemptive rights, rights of first offer or refusal, redemption or repurchase rights or other similar rights with respect to any of such capital stock or other equity securities of any of the Company’s Subsidiaries, and there are no offers, options, warrants, rights, agreements or commitments of any kind granted by any of the Company’s Subsidiaries relating to the issuance, conversion, registration, voting, sale or transfer of capital stock or any other equity securities of any of the Company’s Subsidiaries or obligating the Company or any of its Subsidiaries to purchase or redeem any of such capital stock or other equity securities. All of the issued and outstanding shares of capital stock of each of the Company’s Subsidiaries have been duly authorized and are

22

validly issued and outstanding, fully paid and nonassessable. Except as set forth on Section 5.4(b) of the Company Disclosure Schedule, neither the Company nor the Company’s Subsidiaries holds, directly or indirectly, any equity interest in any other Person (other than another Subsidiary of the Company). No equity securities of any Core Subsidiary are owned, directly or indirectly by, or are subject to any contractual or other right of, any Subsidiary of the Company that is not a Core Subsidiary.

5.5 Compliance with Laws. The business of the Company and each of its Subsidiaries, taken as a whole, currently is being, and for the past three (3) years has been, conducted in compliance with all applicable Laws and Governmental Authorizations, except to the extent any noncompliance, individually or in the aggregate, would not reasonably be expected to have a Material Impact. Neither the Company nor any of its Core Subsidiaries has received any written notice since January 1, 2010, order or other written communication from any Governmental Body of any alleged, actual or potential liability or violation of or failure to comply with any applicable Laws that could have had a Material Impact.

5.6 Litigation. Except for ordinary course of business product warranty claims and workers compensation claims, there are no claims, actions, investigations, suits or proceedings (each, a “Proceeding”) currently pending or, to the Knowledge of the Company, threatened which involve or affect the Company or any of its Subsidiaries, their businesses or assets which would reasonably be expected to have, individually or in the aggregate, a Material Impact. There are no unsatisfied Judgments against or adversely affecting the Company or any of its Subsidiaries or any of their respective businesses, properties or assets. There is no Proceeding pending, or to the Knowledge of the Company, threatened against the Company or any of its Core Subsidiaries seeking to prevent or delay the consummation of the transactions contemplated by this Agreement and the other Transaction Documents. There is no Proceeding currently pending, or, to the Knowledge of the Company, threatened, with respect to (x) any claim of property damage (other than customer claims made in connection with product warranty matters), personal injury or death, or any claim for injunctive relief in connection with any product manufactured or sold by the Company or any of its Subsidiaries, (y) any claim of unlawful employment discrimination by the Company or its Subsidiaries or (z) remediation of, or injury resulting from, Hazardous Materials.

5.7 Financial Statements; Undisclosed Liabilities.

(a) Financial Statements. Section 5.7(a) of the Company Disclosure Schedule includes: (i) the audited consolidated balance sheets of JELD-WEN, inc. and its Subsidiaries as of December 31, 2010 (including the notes thereto, if any), and the related audited consolidated statements of income, shareholders’ equity and cash flows for the fiscal year then ended, together with the report thereon of PriceWaterhouseCoopers LLP (the “JELD-WEN, inc. Audited Financial Statements”); (ii) the audited consolidated balance sheets of the Company and its Subsidiaries as of December 31, 2010 (including the notes thereto, if any), and the related audited consolidated statements of income, shareholders’ equity and cash flows for the fiscal year then ended, together with the unqualified report thereon of PriceWaterhouseCoopers LLP (the “Company Audited Financial Statements”); (iii) the unaudited financial statements of JELD-WEN, inc. and its Subsidiaries reviewed by PriceWaterhouseCoopers LLP for the three month period ending March 31, 2011 (the “JELD-WEN, inc. Q1 Unaudited Financial

23

Statements”); (iv) the unaudited financial statements of the Company and its Subsidiaries (not reviewed by PriceWaterhouseCoopers LLP) for the three month period ending March 31, 2011 (the “Unreviewed Company Q1 Unaudited Financial Statements”); and (v) monthly financial statements of the Company and its Subsidiaries as prepared by the Company’s management for its internal purposes for April 2011 through June 2011 (the “Monthly Financial Statements,” and together with the JELD-WEN, inc. Audited Financial Statements, the Company Audited Financial Statements, the JELD-WEN, inc. Q1 Unaudited Financial Statements and the Unreviewed Company Q1 Unaudited Financial Statements, the “Financial Statements”). The Financial Statements (including the notes thereto, if any) fairly present the consolidated financial condition, cash flows and results of operations of JELD-WEN, inc. and its Subsidiaries, or the Company and its Subsidiaries, as applicable, as at the date thereof and for the period therein referred to, present the Non-Core Subsidiaries as discontinued operations and have been prepared in accordance with GAAP, consistently applied, subject in the case of the Monthly Financial Statements to the absence of footnote disclosure and statements of cash flow, and presentation in a non-GAAP format.